- Join the AMA

- Find learning by topic

- Free learning resources for members

- Certification

- Training for teams

- Why learn with the AMA?

- Marketing News

- Academic Journals

- Guides & eBooks

- Marketing Job Board

- Academic Job Board

- AMA Foundation

- Diversity, Equity and Inclusion

- Collegiate Resources

- Awards and Scholarships

- Sponsorship Opportunities

- Strategic Partnerships

We noticed that you are using Internet Explorer 11 or older that is not support any longer. Please consider using an alternative such as Microsoft Edge, Chrome, or Firefox.

Exploring New Research on Marketing in the Healthcare Sector

Hayoung Cheon and Nah Lee

As the world faces a pandemic of a magnitude not witnessed for over 100 years, we are reminded of healthcare’s fundamental role in our interconnected world. Marketing as a discipline has not lived up to its potential contributions to this important aspect of our lives. The Journal of Marketing Special Issue on “ Marketing in the Healthcare Sector ” is dedicated to promoting research on healthcare marketing. Thirteen scholars from across the marketing discipline shared their views on unanswered questions facing marketing in the healthcare sector during a special session at the 2020 AMA Summer Academic Conference. A summary and video clip of their individual presentations follows.

Leonard Berry | University Distinguished Professor of Marketing, M.B. Zale Chair in Retailing and Marketing Leadership, Mays Business School, Texas A&M University

Underuse of Palliative Care and Hospice Services

One of healthcare’s most important jobs is to help people with advanced illnesses live as comfortably as possible until they die. Yet, many patients do not die how they wish, which is to be as pain-free as possible and at home surrounded by family. Two services are available in the U.S. for patients with advanced illness— palliative care and hospice . Both services provide comfort care (such as pain control) and emotional support for patients and their families.

However, palliative care and hospice services are grossly underutilized in the U.S. About 60% of patients who could benefit from palliative care do not receive it and 25% of hospice patients die within three days of enrollment even though insurance covers it for six months. How can marketing help improve the utilization of these valuable services that can help people live better at the end of life?

Poverty and Health

Another important topic is the impact of social determinants on health. Factors such as quality of housing and education, income levels, physical activity, and social support are far more influential in overall health and length of life than medical care. For example, life expectancy in a low-income Chicago area drops 16 years compared to an affluent neighborhood. Poverty’s links to health may seem an impossibly big and complex topic for marketing academics to tackle, but research teams can break this big puzzle into manageable pieces and make extraordinary contributions. Consider, for example, the opportunity for marketing to reimagine housing for low-income people such as being done in designing “purpose-built communities” such as Villages of East Lake in Atlanta, GA. Think of “purpose-built communities” as a complex new product to serve the needs of its customers and other stakeholders. We in marketing have the expertise to make these “products” much better.

Punam Keller | Senior Associate Dean of Innovation and Growth, Charles Henry Jones Third Century Professor of Management, Tuck School of Business, Dartmouth University

Ecosystem goal: The Role of Business and Marketing in the BIG Picture

Multiple factors determine health outcomes. As the current pandemic shows, health outcomes are the result of interactions across global and social elements, technology, governments, and organizations. Thus, to tackle health problems, marketing should work more with the parties that it has not done so very often in the past. For example, collaborative work with global organizations such as WHO, WTO, and COP can be advantageous.

Individual Behavioral Goal: Message-Behavior Tailoring Using Technology and AI

Switching the focus from the ecosystem level to the individual level, marketing should note that technology can be readily adapted to encourage behavioral changes that promote better health outcomes. For example, smartphones can be powerful if combined with tailored messages alerting patients when to take their medications. We can study the efficacy of the types of text messages across segments of patients to understand which types of message are most successful at promoting positive behavioral changes.

Irina Kozlenkova | Assistant Professor of Marketing, University of Virginia

Mitigating the Effects of Physician Turnover through Relationships

Relationships have an important role in healthcare marketing. Among many players in the healthcare ecosystem (which includes payers, purchasers, suppliers/distributors, and regulators), the physician-patient relationship is central to healthcare and is also related to other entities in the ecosystem.

One problem that has not been understood well is mitigating the effects of physician turnover. In 2017, healthcare jobs experienced 21% turnover, which is second only to the hospitality sector’s turnover rate. It is costly to replace health professionals ($100,000 to replace a registered nurse, $1,000,000 to replace a physician) and doing so negatively affects patients and organizations. It has been shown that typical retention initiatives that work in other industries do not work well in healthcare.

Relational mitigation strategies may be key to mitigating the negative impact of turnovers. We conducted qualitative interviews with employees from all levels of a big healthcare organization (from high level executives, physicians, nurses, to receptionists) and a patient survey, which we later matched with turnover data and patient health data. The data revealed a big variance between various departments in terms of staff structure – some had consistent structures, while others were more ad-hoc. We learned that it is important to pay attention not only to physician turnover, but also to other parties (RNs, MAs, PAs). Continuity of care with the other parties improves patient outcomes, such as retention by 45–75%. While often the most attention is paid to the central relationship between a physician and a patient, we found that to many patients, their relationships with other members of the healthcare team (e.g., nurses, medical assistants) were as or more important as the relationship with their physician. Proactive communication with recommendations for a replacement of a leaving party has also been shown to improve outcomes (41–91%).

Off-Labeling Prescribing

Another important problem to address is off-label prescribing. It is legal in many countries to prescribe drugs for conditions for which they have not been approved. This is a very common practice (over 20% of prescriptions are off-label), yet patients are often unaware of it because doctors are not required to tell them. Since drugs are used for conditions for which they have not been tested and approved, it can be risky, and sometimes deadly. Some populations (e.g., children, pregnant women) may disproportionally receive off-label prescriptions. Research shows that over 70% of off-label uses have little to no scientific support.

Two important research questions surrounding this issue are how to regulate off-label prescribing without stifling innovation and understanding how physicians make off-label prescribing decisions. Our preliminary research findings from a field conjoint study, matched with the actual prescription data, show that physicians are more likely to prescribe an off-label drug when they are similar to the patient (in gender or experiencing the same “issue”) and when they have more experience in the specialty. Also, higher prices of the approved drug tend to diminish the use of the cheaper off-label drug.

Cait Lamberton | Alberto I. Duran Distinguished Presidential Professor in Marketing, Wharton School of Business, University of Pennsylvania

Micro: Biases Specific to Care Choices?

While we have done quite a lot of work to show that well-established biases exist in healthcare (as they do in any context), we also have a lot to learn about specific biases that may arise in healthcare choice making. One example is anti-community bias. Health outcomes are superior closer to home, given that closer-to-home facilities offer better accessibility and a closer relationship with doctors. With no other information, patients seem to prefer to stay close to home. However, when given a choice, patients tend to reject community hospitals in favor of more distant university-based hospitals, which do not necessarily lead to better outcomes for many standard procedures. Moreover, in rural areas (where 20% of the U.S. population resides) such biases may have long-lasting negative effects, as we see the increasing closures of community hospitals in rural areas. Given this tension between rural and community hospitals versus urban and university-based hospitals, understanding how patients make choices weighing different factors across these two types of hospitals and contemplating how and when marketing should tip the scales become crucial.

Macro: Satisfaction (with Healthcare)?

At the macro-level, marketing can focus on hospital satisfaction measurement. HCAHPS (Hospital Consumer Assessment of Healthcare Providers and Systems) measures patient experience including communication, pain management, and the quietness of the hospital environment. It is a widely used measure, freely available and, more importantly offers a huge opportunity to conduct interesting research. For example, an interesting area of research is the difference in the mode of delivery where more positive responses are attained through mobile devices than through computers. Researchers can also investigate the role of pain and the way it may be framed to help consumers deal with it in the most healthy manner, what types of advertising work well for healthcare facilities and providers, and how we can more accurately capture patient satisfaction as fully-conceptualized, and likely to be rooted in different, healthcare-specific experiences like empathy and respect for dignity, than might drive satisfaction with other goods and services.

John Lynch | University of Colorado Distinguished Professor, University of Colorado-Boulder

Health Care System Infomediaries

Healthcare expenses have experienced a six-fold increase in inflation-adjusted dollars since 1970. One major factor contributing to this increase is the absence of consumer price sensitivity. Insurers, the payers of this expense, cap the maximum out-of-pocket costs for the consumer. Even when patients are paying, they are often willing to pay all they can for a few more months of expected life. Furthermore, prices are opaque, even to doctors. This means that doctors do not know how much patients will be charged for a given procedure. They view it as impossible to know because it is dependent on insurance and not their job to know. How can marketing help incorporate price sensitivity in healthcare? Can we design pricing infomediary models to help doctors be better price shoppers for their patients?

Health Privacy & Quality of Care

Another interesting topic is health privacy and quality of care. HIPPA regulations govern the uses and disclosures of personal health information. Patients have rights over their health information and can authorize certain health records to be disclosed. How many consumers know who has what records and how does this affect the transmission of health history information that could benefit care?

Utilizing health data is analogous to the literature on customer identification in advertising, pricing, and personalized recommendations. Sharing information has benefits, but there are also risks of exploitation. Can we develop models for patient ownership and sharing of personal health information that promote better health outcomes?

Detelina Marinova | Sam Walton Distinguished Professor of Marketing, University of Missouri

Physician-Patient Digital Communications for Improved Health Outcomes

Provider-patient interactions are crucial in healthcare and we see a shift of the mode of communication from in-person to digital platforms, especially during the pandemic. However, research has just started to address digital communication in healthcare. Digital communication can be beneficial because it reduces office visits, which can improve efficiency. However, it can also increase physician workload in other ways and digital communication bears a risk of miscommunication. Thus, it is important to understand why and under what conditions digital communication between patients and providers contributes to patient compliance, engagement, and improved health outcomes.

Managing Frontline Interactions for Patient Well-Being and Hospital Revenue

Hospital spending constitutes 30% of national health expenditures, yet it is challenging to deliver high quality and cost-efficient health outcomes. With this tension, there are trade-off s between hospital revenue and patient well-being. One crucial aspect affecting both hospital spending and health outcomes is frontline interactions, which includes proactive actions by physicians and nurses and reactive actions by staffs. These often shape patients’ behavioral approach to medical conditions and treatments, thereby influencing the patients’ well-being. Moreover, it can be either a revenue source or a high-cost factor for hospitals. Therefore, one potential research question is how proactive and reactive actions of frontline agents contribute to or alleviate the trade-offs from the dual-emphasis on hospital revenues and patient well-being.

Vikas Mittal | J. Hugh Liedtke Professor of Marketing, Jones Graduate School of Business, Rice University

Health Care & Marketing

Conducting successful research in healthcare has a few issues that are uncommon in other sectors. First, problem-solving and practical relevance is critical in healthcare. Collaborators in health systems may not be interested in laborious “theory.” Hence, it is important to focus on relevant problems with basic rigor rather than thin-slicing or engaging in complicated quantitative analyses.

Second, research modesty is important for successful collaboration. A marketing perspective can contribute to solving healthcare problems, which is a much better approach than trying to solve a marketing problem with healthcare only as a “context.” For example, problem-oriented research questions may be: 1. How can a pharmacy chain manage its segmentation in different locations? and 2. How can nursing homes improve employee retention to improve healthcare outcomes?

Third, it is important to learn the differences in process as well as in incentive structures. In healthcare, grants are more critical than publications, so learning how to contribute to the grant-writing process is vital. Regarding publications, in medical journals, authorship and authorship order follow a pre-defined structure. Lastly, data privacy and data integrity issues are paramount and often university-level permissions are needed, which can be time-consuming.

Despite the unique characteristics of the field, there are many marketing research opportunities to gain a deeper understanding of medical and healthcare problems and teaching opportunities for training health professionals for rewarding careers.

Maura Scott | Madeline Duncan Rolland Professor of Marketing, Florida State University

Stigma and Vulnerability in Healthcare: Solutions through Technology?!

Stigmatized consumers experience a distinct healthcare journey relative to other consumers. Stigmatization can aversely influence the quality of care that patients receive from healthcare providers. Stigmatization in healthcare can limit patients’ willingness to engage in their treatment, thereby potentially further harming their health outcomes. Sources of stigma include certain patients’ characteristics such as race, ethnicity, and body type. Some diseases may be stigmatized based on the perceptions of visibility, controllability, permanence, or contagion associated with the disease. Vulnerable populations (e.g., underrepresented minority groups) may face these two sources of stigmatization at the same time, further affecting their well-being. Identifying interventions that help encourage stigmatized patients overcome the reluctance to engage in their healthcare (e.g., via online healthcare communities) is crucial. More research should identify policies that create an inclusive, equitable, and accessible healthcare system.

Technology in Healthcare: Tensions and Solutions

One potential way to tackle low engagement from stigmatized patients is to leverage relevant technology in healthcare. There are concerns and tensions to consider when developing such solutions. First, technology can reduce stigmatization because it can reduce human interaction; however, technology programmed with inherent bias could increase stigmatization. Second, technology could lower costs and increase accessibility for vulnerable patients. Yet, income level can make a difference in healthcare service quality, for example by separating ‘premium’ in-person service for the wealthy, which might lead back to the current status quo. Third, technology can influence patients’ anxiety levels, which suggests the need for healthcare interventions to help reduce anxiety triggered by technology. More research is needed to identify how to leverage technology in healthcare to increase accessibility and inclusivity of high quality, low-cost healthcare for all patients.

Steven Shugan | McKethan-Matherly Eminent Scholar Chair and Professor, Warrington College of Business, University of Florida

Changes in Healthcare Markets

Marketing can address several interesting issues in changing healthcare markets. Service mix has been addressed in recent work, highlighting the fact that services offered by non-profit hospitals differ from those offered by for-profit hospitals. More research on service mix is needed. Websites hosted by hospitals and other healthcare providers can serve multiple roles—information provision (education) and selling (referrals). Research on multiple role healthcare websites would be valuable. New product launches are also an interesting problem in healthcare, with many new devices facing complications when being brought to market because of licensing issues and multiple players (including regulators, competitors with patents and courts).

Block-chain is a new encryption technology that may enable the storage of sensitive healthcare data. Marketing research can address the interaction of these databases with multiple parties also with privacy concerns. The interaction of these databases with consumers is a typical marketing communications issue. Artificial intelligence also has made its way into healthcare integration, from reading x-rays to making diagnoses, yet the AI-consumer interface is a marketing issue with many unanswered questions.

Other changes in healthcare markets that merit further research include the effect of changes in government regulation of the healthcare industry, the impact of for-profit entry in the existing market, and the implications of declining patient co-pays. Marketing communication in a heavily regulated environment with both business-to-business and business-to-consumer issues provides many research topics.

Healthcare Data Sources

There are many publicly available data sources in healthcare. Links for these data sources appear in the attached slide. Many of these datasets can be integrated based on geography (e.g., zip codes, FIPS, states, counties, etc.). My slides indicate many sources of free healthcare data. I and coauthors have also purchased data from American Hospital Directory and combined that data with data from free sources.

Jagdip Singh | AT&T Professor, Case Western Reserve University

Frontlines in Hyper-Markets

The pandemic has underscored the importance of getting ahead of the healthcare curve in uncertain and fast-changing healthcare markets. Research opportunities lie in the study of “outside-in” and “inside-out” frontline capabilities in healthcare organizations for demand anticipation and response agility that yield effective outcomes. These capabilities require an integration of ground-level experience with data-based analytics at speed. Several research contributions in Marketing can be useful to facilitate understanding of these capabilities including adaptive foresight, strategic flexibility, velocity and marketing excellence. Some potential ways to seed research is to leverage public data such as ‘Red Dawn’ emails or data from wearable-sensor technology.

Temporary Organizing for Public Health

The uncertain nature of healthcare markets can sometimes stem from public health and humanitarian crises such as climate change, war, disease, migration, and other conflicts. Many different organizations, such as the Red Cross, NGOs, and Doctors Without Borders, come together to address these crises. The challenges involved collaboration, coalition, and conflict in temporary meta-organizations to yield effective outcomes. Several research contributions in Marketing can be useful to facilitate understanding of these challenges including cause-driven marketing, mega-marketing and temporary marketing organizations. Potential for funding projects and data comes from Gates Foundation grants, Business Roundtable priorities, and community data.

Hari Sridhar | Joe B. Foster’56 Chair in Business Leadership Professor of Marketing, Mays Business School, Texas A&M University

Marketing in the Healthcare Sector: Improving Cancer Outreach Effectiveness

Marketing research in the healthcare sector can complement and embellish medical research. It is important to recognize that not all patients are created equal. We can leverage more than 60 years of marketing research on customer needs and the latest developments in machine learning. Using predictive models, we can also demonstrate the social and financial impact of healthcare interventions. Doing so can help the field of marketing become a value-added support arm to healthcare.

In our study 1 of cancer outreach effectiveness, we use patient data and predictive models to improve returns on cancer outreach efforts. Only 4-8% of the general population undergoes regular cancer screening, despite massive spending on preventive outreach campaigns. In an National Institute of Health (NIH) supported study in partnership with UT-Southwestern, we conduct a large scale randomized field experiment to study how cancer screening visits are impacted by different types of cancer outreach efforts. Using a smorgasbord of variables concatenated from medical histories, geographical information, and the outreach program CRM data, we apply causal forests to estimate the causal effect of outreach efforts for every individual patient. We find that patient response to cancer screening varies dramatically across the population, enabling the dream of personalized outreach programs. By targeting the right people with the right intervention, we show that cancer outreach programs can save money and improve yield (over 74% in returns) in preventive cancer screening. Can marketing save lives and money? Our answer is a resounding yes.

It is also critical to understand the innards of the healthcare value chain and move beyond just the study of patient-physician and patient-facility interfaces. Other marketing scholars are now addressing issues surrounding multiple players in designing care facilities and improving quality of care, the complexities of hospital purchasing contracts, and the impact of regulatory interventions on payment disclosures. The field is ripe with other relevant questions and we are merely scratching the surface.

Featured in JM Webinar: https://www.ama.org/events/webinar/jm-webinar-series-insights-for-managers/

S Sriram | Professor of Marketing, University of Michigan, Ann Arbor

Technology has the potential to have a significant impact on the healthcare ecosystem. More importantly, the impact is likely to be felt by all stakeholders in the ecosystem. I consider two examples here.

The Internet of Health Things

In recent years, there has been a considerable increase in the use of wearable devices and apps by consumers, who use these devices for monitoring various markers of physiological and psychological well being. Broadly, these hardware devices and software applications come under the realm of Internet of Things (IoT). Do these devices, which are supposed to monitor health actually lead to better health outcomes and well being? Extant literature has documented mixed results because of several reasons. First, purchasing a device or downloading an app does not necessarily translate into repeat usage. Researchers have documented that consumers routinely lose interest after a few months. Second, even in instances where interest does not wane over time, routinely monitoring markers of health can lead to excessive obsession, which can be detrimental to overall well being. Third, even if we can establish a positive effect of these devices on health outcomes and overall well-being using observational data, one needs to be careful to control for patient self-selection – purchasers of these devices are likely to be different from those who chose not to purchase them.

The effect of these devices and apps can extend beyond patients. In this regard, how an individual’s health monitoring efforts can benefit other stakeholders in the whole ecosystem can be studied. For example, providers might see the reduced hospital readmission rate as shown in some literature and can potentially ensure adherence to medication taken outside hospitals. Drug manufacturers can increase the speed of drug development faster with regularly monitored data, as opposed to relying on self-reported measures. Of course, the downside is that such regular monitoring can be intrusive and raise concerns about loss of privacy. A careful quantification of the benefits of monitoring patient health information can help in assessing whether the benefits of sharing consumer data outweigh the risks associated with the violation of privacy.

Telemedicine

Although the idea of telemedicine has been around for a few years, COVID-19 has made it a reality for many consumers of healthcare. The promise of telemedicine lies in its potential to relax wealth, accessibility, time, and skills constraints. This, in turn, can democratize healthcare. However, there are several important questions that need to be answered in order to assess whether and how this promise is realized. First, is the actual and perceived quality of a telemedicine service as good as in-person visits? Are there any particular risks of misdiagnosis from telemedicine? Second, the benefits delivered by telemedicine might not be evenly distributed across different stakeholders. For example, what benefits do patients and other stakeholders such as providers, payers, and telemedicine platforms derive from the new mode of healthcare delivery? How are these benefits distributed among the various stakeholders? How does the relaxation of the aforementioned constraints benefit patients? Does the benefit vary across patients’ socioeconomic status? Lastly, one can study the challenges that telemedicine might face in building a stable platform.

Richard Staelin | Gregory Mario and Jeremy Mario Professor of Business Administration, Fuqua School of Business, Duke University

Patient Experience Questions

Patient experience data has been collected for decades. However, until recently, most of these data came from standard surveys given to patients after they received treatment. Over the last few years free-form texts, such as reviews, have become increasing available. This new source of input from the patients may provide additional information to more traditional “rating-only” surveys. Do patient reviews of doctors differ substantially from customer reviews in other sectors? Do these reviews provide new information over the standard surveys?

There may be distinct segments of patients that vary in terms of their ability to judge the quality of service received. What is the size of the sophisticated market segment and can it influence the behavior of medical professionals? It would also be interesting to understand whether patients’ view of the quality of care differs across venues of service (e.g., emergency room, hospital, clinic). How is the perceived quality different from the objective quality measures currently used by medical practitioners?

Organizational Reaction to Patient Experience Data

Patient experience data are relevant to hospital management and insurance companies. Do they pay more attention to some databases over others depending on the source? How much should they weigh patient experience data compared to objective or clinical measures of quality? What are the profit implications for the hospital/company? The reaction of the medical staff is also a critical factor in understanding the impact of patient feedback data. Are providers receptive to such feedback by the patients and, if so, do their ability to adapt to feedback depend on the type of information? For example, patient feedback may be regarding bedside manners, receiving faulty advice, or being overcharged. Medical professionals may try to improve bedside manners and avoid billing mistakes, but it may be very difficult (or costly) to alter diagnostic practices.

Learn more about the Journal of Marketing Special Issue on “ Marketing in the Healthcare Sector ” and note that for those interested, submissions must be made between July 1, 2021 and November 1, 2021.

Doctoral student at University of Michigan

Doctoral Student at Duke University

By continuing to use this site, you accept the use of cookies, pixels and other technology that allows us to understand our users better and offer you tailored content. You can learn more about our privacy policy here

- Pollfish School

- Market Research

- Survey Guides

- Get started

How to Conduct Healthcare Market Research Like a Pro

Healthcare market research is essential to providing optimal patient care, which is much needed in an industry hailed as people-centric , especially in a world rife with a pandemic.

Market research allows healthcare industry professionals to gain a deep understanding of the needs and behaviors of their patients — the kind they otherwise wouldn’t have. Additionally, it allows practice providers to expand their patient network, and increase their patient retention rates by helping them provide products and services tailor-made to the needs of their patients.

This article expounds on how to conduct healthcare market research for healthcare market researchers.

Defining Healthcare Market Research

Market research is the process of researching the viability of a new product or service through both primary and secondary sources. Primary sources use techniques like in-depth interviews, focus groups, and ethnographic studies to understand how products are used, how they can be improved, and how they can be streamlined.

Secondary sources involve a wide variety of research that has already been conducted such as statistics publications, scientific journal articles, and market research articles.

Healthcare market research applies the concept of market research to the healthcare industry. Instead of gauging how products are used, healthcare industry professionals use market research to learn about how their services can better benefit patients (and how they can reach and retain more patients).

The Importance of Conducting Healthcare Market Research

While the healthcare industry relies on services and products to keep patients healthy, market research specific to this industry is seldom conducted.

Healthcare market research needs to be prioritized because it creates a path to better care, and this is what the healthcare industry is fundamentally all about. The best way for healthcare providers to succeed in the industry is to form a clear understanding of this target market through market research methodologies.

Gaining access to the proper research can be a gateway to building a strong reputation, attracting more patients, garnering good reviews, and being a community go-to. As you learn more about your patients’ wants and needs, your quality of care will increase and you’ll build patient trust.

The Makeup of Healthcare Market Research

When conducting healthcare market research, you’ll need to conduct both primary and secondary research for a holistic market research campaign. Combining these methods yields powerful insights with the potential to transform patient care.

Primary Healthcare Market Research

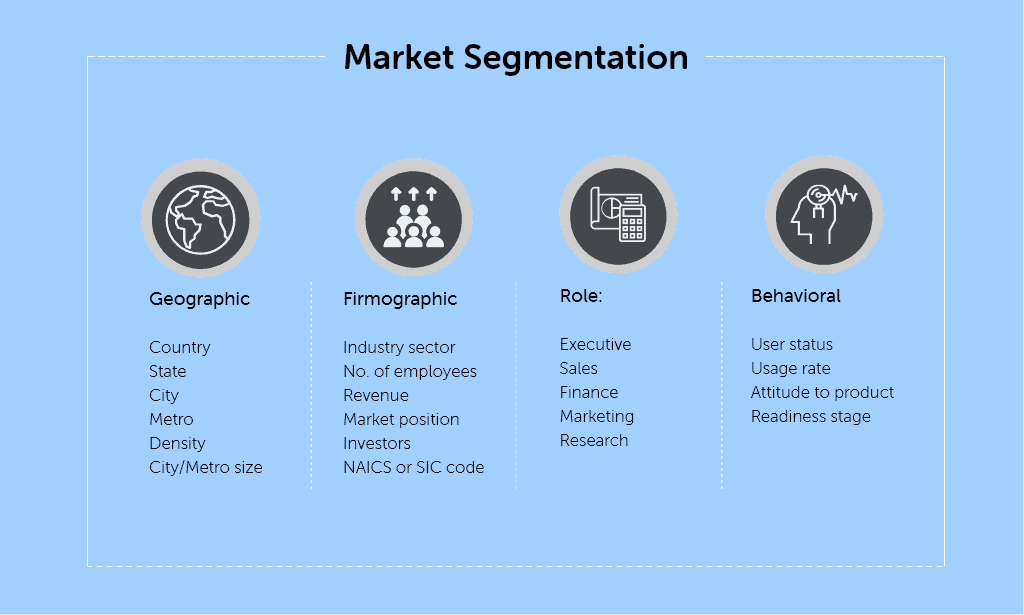

Primary market research in the healthcare industry involves communicating directly to existing or potential patients. You do this to learn about your target market, which gives you the ability to perform market segmentation. Dividing your patient base into narrow market segments allows you to address a specific sector of your target audience.

You can conduct primary research using these methods:

- Surveys include questionnaires and screeners that you can deploy to your target market via an online survey tool.

- A 3-minute survey will yield more responses than a 5-minute survey, so try to get the information you need in as few questions as possible.

- With online surveys, you can reach a specific segment of your target audience while saving time and maximizing responses.

- In-depth interviews are one-on-one interviews that can happen over the phone or in person.

- Time estimates range from 20 minutes to over an hour.

- This intimacy and time-frame allow the researcher to get detailed feedback, as healthcare can be a sensitive topic.

- Personal interviews make it easy to gather information without privacy concerns. An average study might interview 10-50 participants.

- Ethnographies are field studies that use observation and interviews to study how people use products, interact with technology, and find/use services.

- Ethnographic research allows the researcher to record behavior in addition to participant feedback.

- It can be performed in-person or by software.

- While recall methods rely on participant’s memories, this real-time observational method is more reliable.

- Customer journey mapping can be integrated into this technique to see how patients interact with a healthcare provider’s website and how they locate services from providers through phone referrals or word of mouth.

- Focus groups are a great technique for healthcare market research, especially when a product or service is new.

- The group-brainstorming format stimulates ideas and feedback that you might not be able to get out of an individual.

- A great healthcare marketing research method is a hybrid of focus groups and ethnography studies.

- This lets you observe your consumers in their natural setting before bringing them together for a brainstorming session.

Secondary market research is the process of gathering already published data. You can speed up this process by purchasing high-quality market research reports. They provide in-depth data, statistics, and results that reveal areas and topics that need to be explored through primary research.

Here are some secondary market research sources for the healthcare industry:

- Published market research reports are a great source of information. The healthcare market research section of marketresearch.com is a great place to get started.

- Consumer reports and industry reports are a perfect starting point for researching target markets and trends. Visit Statista for reliable reports relevant to the healthcare industry.

- Healthcare provider websites , i.e., those of your competitors are often a natural starting point for market research. You can find relevant annual reports, presentations made for investors, and other information that shows you where you’re positioned in your field and what areas you need to focus on with your primary market research.

- NCBI is full of secondary research information pertaining to patient care.

- UpToDate is a medical resource providing clinical decision support that’s been proven to improve patient care .

- BMC Health Services Research offers a collection of journal articles on topics relating to healthcare practices like policy, the health workforce, health services research methodology, protocol, and more.

- Census data can also be helpful in exploring demographic information.

Tips for Healthcare Market Research Surveys

Healthcare market research surveys are nothing without responses. Follow these tips to boost your response rates:

- Target Your Population: Choose a target population relevant to your survey goals. If this population is hard to reach, consider using software to find survey takers who meet your criteria.

- Prioritize Question Clarity: Keep your questions simple with the least number of steps possible. The easier your survey, the more responses you’ll get.

- Shoot for between 5 and 15 minutes. You can make it even more manageable by using skip logic to let respondents only answer the questions most relevant to them.

- Offer Incentives: you can boost your survey response rate by offering extrinsic survey incentives like discounts, coupons, gift cards, or even cash rewards.

Healthcare Market Research Use Cases

The above techniques are only helpful if you know how to use them, so let’s dive into use cases. Here are some ways you can use healthcare market research to expand the reach and improve the overall patient experience:

- Evaluate healthcare access: you can investigate benefits and barriers to healthcare among groups with limited access (for example, low-income and senior citizens). You can target populations in rural areas and inner cities for the best results.

- Improve business operations: this gauges the effectiveness of your business processes. It allows you to discover where you need more support and where systems could use some tweaking.

- Healthcare feedback questionnaire: this survey helps you find out if your patients are satisfied with their care if they were taken care of in a timely manner and if their needs were met.

- Women’s health research: This allows you to monitor the healthcare female patients received, which includes their opinions, concerns and fears. This is especially important for gynecologists and those who provide health services targeted at women.

- Healthy lifestyle programs: This divulges whether patients are interested in secondary health programs such as health and wellness classes, smoking addiction aid, stress relief, weight management, mental health support, pain management, etc.

- Teen health survey: this gives teens a confidential place to provide info on teen health habits, tobacco, drug, and alcohol abuse, bullying, and family issues. You can use this info to tailor-make special programs to aid your teen patients.

Upgrade your Patient Care with Healthcare Market Research

Healthcare market research can help you understand your patients and what they need to feel healthy and happy with their patient care. Staying on top of your healthcare practice isn’t limited to the day-to-day — it also involves the need to monitor patient satisfaction to keep your practice’s online perception in check. Surveys can come to your rescue on this matter.

Healthcare market research is important, but it shouldn’t take time away from patient care. That’s why you need a robust online survey platform to aid your in healthcare market research efforts . With an online survey platform, you can collect the data you need to better your practice . Plus, online surveys are one of the only kinds of primary market research where you don’t have to meet with someone in person (making them pandemic-proof). They’re the best way to listen to your patients’ needs and improve your practice accordingly.

Frequently asked questions

What is healthcare market research.

Healthcare market research is research that helps healthcare industry professionals understand the needs of their patients, expand their patient network, and increase their patient retention rates.

Why should you conduct healthcare market research?

Healthcare market research is important because using it to guide your practice improves patient care, strengthens your practice’s reputation, attracts patients, garners good reviews and establishes your practice as a trusted one in your community.

What are some primary healthcare market research methods?

For primary healthcare research, use surveys via an online survey tool, focus groups, phone calls and ethnographic (field) research.

What are some secondary healthcare market research resources?

For secondary healthcare market research, look for resources like published market research reports, consumer reports and industry reports, healthcare provider websites (like your competitors), NCBI for patient care research, UpToDate for clinical decision support, BMC Health Services Research for healthcare best practices and census data for exploring your demographic information.

What are some tips for healthcare market research surveys?

For the best healthcare market research surveys, target your population well, prioritize question clarity, keep your survey length to a minimum and offer incentives to up your survey participation.

Do you want to distribute your survey? Pollfish offers you access to millions of targeted consumers to get survey responses from $0.95 per complete. Launch your survey today.

Privacy Preference Center

Privacy preferences.

Marketing in healthcare: Improving the consumer experience

Healthcare consumers have never been more empowered than they are today. The COVID-19 pandemic forced healthcare providers to adapt quickly to continue delivering patient care, including by pivoting to digital care. Seemingly overnight, telehealth went from an industry sidenote to the primary means of seeing noncritical patients. 1 For more, see Oleg Bestsennyy, Greg Gilbert, Alex Harris, and Jennifer Rost, “ Telehealth: A quarter-trillion-dollar post-COVID-19 reality? ,” McKinsey, July 9, 2021. Healthcare consumers also saw global retailers, grocery store chains, and other disrupters demonstrate how convenient it can be to order your health products online for delivery or curbside pickup.

Consumers increasingly expect transparent, predictable, and mobile-friendly experiences, but most healthcare organizations have failed to keep up. Although healthcare providers have more options for how to spend limited marketing budgets, many have chosen to stick with the familiar traditional- and digital-marketing channels—such as billboards and ads on television, on the radio, and in magazines—and with a one-size-fits-all digital presence.

Today, health systems have the same aspirations as companies in any industry: to engender long-term relationships with their consumers. 2 For more on how leaders are thinking about brand loyalty, see Lidiya Chapple, Oren Eizenman, and Jamie Wilkie, “ Winning in loyalty ,” McKinsey, August 2, 2022. Consumer goods, retail, and e-commerce leaders set the original bar and continue to push it higher today. 3 For more, see “ E-commerce: At the center of profitable growth in consumer goods ,” McKinsey, July 5, 2022. A 2021 McKinsey survey of more than 3,000 US healthcare consumers found that satisfied patients are 28 percent less likely to switch providers. 4 McKinsey 2021 CX Provider Journey Pulse, a 15-minute patient experience survey conducted across 3,311 respondents in three US metro areas (Dallas–Fort Worth, Detroit, and Tampa Bay).

Healthcare providers that are ready to rethink their marketing approach to grow and maintain continuity of care—or work to gain back what’s been lost in recent years—have their work cut out for them. In this article, we describe three priorities for progress: align the C-suite, build capabilities methodically through carefully chosen use cases and quick wins, and measure what works. In our experience, healthcare providers that implemented changes focused on improving the consumer experience—including through marketing efforts—saw their revenue increase by up to 20 percent over five years, while costs to serve decreased by up to 30 percent.

Providers that can bring it all together can achieve lofty marketing ambitions. One regional healthcare provider that stood up an agile marketing team as part of its digital transformation prioritized increasing the share of new patients who schedule appointments digitally instead of over the phone or in person. The provider was able to build a backlog of more than 300 test ideas representing a wide variety of goals and priorities, from improving online scheduling to optimizing content on specific pages. The team prioritized half of those tests to launch in a period of only 12 months, yielding an impressive test success rate of about 50 percent. When successful tests were scaled, the healthcare provider tripled the number of new patients from digital channels, compared with before the transformation.

Align the C-suite

The chief marketing officer (CMO) is a well-established member of healthcare providers’ C-suite. However, the CMO requires active involvement from the leaders of other functions to deliver modern marketing efforts. These leaders include, most crucially, the chief technology officer (CTO) or chief digital officer (CDO), chief information officer (CIO), and chief financial officer (CFO).

Only when the C-suite is aligned on the importance of marketing to drive growth and continuity of care (and what it takes to do so) will the CMO have the permission and support required to effect change beyond their immediate influence. This moves the CMO role away from basic brand and communication activities that characterize marketing at most healthcare organizations today. These traditional- and digital-marketing activities depend on mass, undefined channels—such as television, newspapers, broadcast emails, and a generic website—that reach all consumers with the same messaging. This style of marketing also often fails to include a compelling call to action, such as “schedule your health visit today,” that encourages healthcare consumers to reach back out to the organization to make an appointment or speak to a specialist about their needs.

To make the leap to more sophisticated marketing capabilities, CMOs could start by defining priority use cases by both financial and nonfinancial returns on investment—from costs to improved health outcomes. The CMO could then work with the CTO or CDO to validate the technical feasibility, with the CIO to assess operational challenges and risks, and with the CFO to calculate the financial ROI. The true power of this cross-functional collaboration can be seen in organizations that, for example, have worked in concert to design and build a single source of truth for consumer data, which is critical to enabling use cases related to advanced marketing capabilities, such as personalization.

Many organizations outside of healthcare—and increasingly within healthcare—have adopted agile marketing to drive high-velocity testing across digital- and traditional-marketing channels. 5 For more, see David Edelman, Jason Heller, and Steven Spittaels, “ Agile marketing: A step-by-step guide ,” McKinsey, November 9, 2016. Speed to market requires quick handoffs, cross-functional collaboration, and enterprise-wide transparency. For example, a healthcare provider could focus on improving its new-patient appointment cancellation rate by A/B testing appointment reminders to determine what works best in terms of number of touchpoints, messaging, and cadence.

The test brief—a standard feature of agile marketing typically reviewed by leads from marketing, finance, and technology—can help align the CMO, CFO, and CTO and enable them to compile a more persuasive case for the CEO and other company leaders. A test brief is a document with codified creative, technical, and measurement details for an agile marketing test. It provides the organization with the details it needs to quantify the number of days (or sometimes hours) necessary to launch a test, as well as to estimate the effort required to design, create, build, and deploy it.

Build sophisticated capabilities by choosing use cases wisely

Today, most healthcare providers have critical capability gaps that stand in the way of mounting an end-to-end, personalized consumer journey:

- A disjointed consumer experience and lack of personalization . Multichannel consumer touchpoints can lead to fragmented, impersonal experiences because of the lack of integration between consumer data and omnichannel engagement platforms.

- Siloed systems . Silos result in a limited ability to track current and potential consumers across channels and devices, as well as no organization-wide access to consumer data tracking tools.

- A lack of consumer-centric data. A lack of data leads to channels without access to a real-time, 360-degree view of consumer care needs and to clinical data that is not augmented with nonclinical data.

The theme of these challenges is fragmented information. Marketers increasingly require hands-on, real-time access to technology. Next-level healthcare marketing is built on a robust, integrated technology stack—and reaching full maturity in marketing-technology capabilities is not a short-term undertaking. No marketing function operates with an unlimited budget, meaning the marketing team will need to prioritize use cases that can build the department’s muscle and momentum.

In our experience, patient scheduling tends to be a priority growth lever for healthcare providers and systems. This makes sense considering that being able to easily schedule an appointment is a critical step in the consumer healthcare journey. Use cases that improve scheduling would thus rise to the top of the priority list and the budgeting conversation. For other providers, use cases could include better patient communication management to facilitate follow-up care.

Reliable collaboration between the marketing and technology teams is paramount to achieving seamless healthcare consumer journeys.

Given that these marketing touchpoints span the entire healthcare consumer experience, from learning about a provider to scheduling a visit and receiving care and follow-up care, reliable collaboration between the marketing and technology teams is paramount to achieving seamless healthcare consumer journeys (exhibit). And to deliver it, an integrated technology stack (across both digital and traditional channels) is essential.

Measure what works

Marketers use the term “attribution” to describe the process of measuring the effects of marketing efforts and the rate at which they convert consumers to achieve desired consumer outcomes. Consumer outcomes are not the only measure of ROI; the ultimate goal is an improved patient experience and potentially improved health outcomes. But attribution can serve as a crucial indicator. A simple example would be analyzing the click-through rates of marketing emails to determine what messaging is most effective. Attribution analysis is a critical component of measuring the financial ROI of spending on digital marketing in healthcare—and most providers and systems today are early in the process of building out their marketing-attribution capabilities. As a result, the CFO and CMO are often misaligned on what works, which can greatly affect marketing’s budget allocation.

Common marketing-attribution methods and their application to healthcare

Three attribution tools in particular can help healthcare providers effectively measure what works.

Marketing mix modeling. Regression analysis can help marketers understand the specific effects of every interaction with healthcare consumers. It uses historical data to estimate the effects of a particular marketing tactic—such as a radio ad or a personalized email—on patient appointment volume. This method can be used to measure tactics in both traditional marketing channels (such as TV and radio) and digital channels (such as paid search and paid social).

This method does have a few limitations, however, including limited measurement granularity, given that it mostly evaluates media effectiveness at a high level for annual or monthly budget allocation. However, A/B testing can be instrumental in improving revenue forecasting with better estimations of revenue and ROI.

Anonymized data. Anonymized data processing can encrypt personal identifying information (PII) or protected health information (PHI) to protect healthcare consumer information while still enabling marketers to send personalized messages, run longitudinal analyses, and port data securely across technology platforms. For example, digital healthcare platforms can encrypt the individual data fields in a healthcare consumer’s record while still sharing journey-specific marketing communications.

Encryption is vital to healthcare providers’ ability to communicate with healthcare consumers and their families based on their own treatment journey and needs. It also transforms the experience of consumers by enabling them to share their data privately and receive offline support outside of the clinical setting. There are limits, of course, to the personalization that is available, and it requires rigorous testing to be compliant with industry regulations. Encryption at scale is also a massive undertaking that requires a robust core data infrastructure and operations that enable speed, accuracy, and security. Few providers today encrypt PII as part of processing anonymized consumer data, and the few that are doing so are not currently using it to drive personalized consumer experiences.

A/B testing. The A/B (or incrementality) testing method is one of the most popular and well-known marketing tactics. By measuring the difference made by discrete details, such as the performance of an email when the audience is addressed as “healthcare professionals” versus “doctors,” A/B testing can offer marketers an abundance of information about consumer conversion and sales—and which conversions would not have happened without the marketing campaign.

The A/B testing methodology is widely adopted because its results are accurate and easy to understand, and they don’t require complex analytics capabilities. However, many healthcare providers don’t employ the methodology well or at all. Those that can do it well can see outsize bottom-line impact. One healthcare provider, for example, embarked on an end-to-end consumer transformation journey and deployed more than 100 agile digital A/B tests to optimize patient experience across its locations. In one such initiative, the team improved its conversion rate by 0.15 percentage points—or $2.4 million in scaled revenue impact—by personalizing and targeting communications to different healthcare consumer segments.

Successful attribution is founded on the cross-departmental collaboration modeled and facilitated by the C-suite. Specifically, attribution requires marketing and IT to partner closely to, for example, provide marketing the ability to connect how individual digital channels (such as paid media or the provider’s website) are driving new patient appointments booked via phone calls or online.

Industry regulations require that healthcare data be anonymized, but that does not preclude it from being measured. (For more on three of the most ubiquitous marketing-attribution methods that meet the industry’s criteria for healthcare consumer data, see sidebar, “Common marketing-attribution methods and their application to healthcare.”)

It’s not surprising that healthcare providers increasingly see marketing as a growth driver. Modern technology, approaches, and collaborative structures can help CMOs pivot the perception and performance of the marketing function away from being a cost center and toward measurable bottom-line gains while improving the healthcare consumer experience.

Adam Broitman is a partner in McKinsey’s New York office, where Michelle Jimenez is a senior expert. Julie Lowrie is a partner in the Atlanta office.

The authors wish to thank Jessica Buchter, Jenny Cordina, and Eli Stein for their contributions to this article.

Explore a career with us

Related articles.

Telehealth: A quarter-trillion-dollar post-COVID-19 reality?

How ‘Care at Home’ ecosystems can reshape the way health systems envision patient care

The role of personalization in the care journey: An example of patient engagement to reduce readmissions

Healthcare Market Research: 10+ Trends & Real-Life Examples in '24

Figure 1. Popularity of the keyword “healthcare market research” on Google search engine between 2017-2023

Research shows that there are four major areas that patients care most about but are still dissatisfied with 1 :

- obtaining coverage

- understanding benefits

- finding care

- managing care costs.

Market research is crucial for healthcare companies to address consumer dissatisfaction in these areas. By understanding consumer experiences and expectations through market research, businesses can improve these journeys, enhancing overall satisfaction and trust in healthcare services. This approach can lead to tailored solutions that effectively meet consumer needs and streamline their healthcare experiences.

This article explains the benefits of conducting healthcare market research, core market research solutions, and some real-life examples.

If you are looking for a market research software , check out our vendor guide and a list of top providers.

Why should healthcare providers conduct market research?

1- improve healthcare operations and services.

Market research gathers essential feedback from physicians, frontline clinicians, and patients, guiding healthcare providers in making changes that are seen as beneficial enhancements rather than impersonal or disruptive. This patient and employee input is vital for tailoring healthcare services to actual needs and expectations, leading to better patient outcomes and more efficient healthcare delivery.

2- Understand patient satisfaction & sentiment

Market research is crucial in healthcare to understand patient satisfaction and sentiment. The American Customer Satisfaction Index in 2023 rated hospitals 74 out of 100, highlighting the need for improvement. 2 Market research provides critical insights into patient experiences, identifying areas needing enhancement and guiding healthcare providers in implementing changes that truly resonate with patients. This research is key to elevating patient satisfaction levels and ensuring that healthcare services align more closely with patient expectations and needs.

To learn more about the applications of sentiment analysis in healthcare , check out our article.

3- Develop new products

With more than 75% of health consumers expecting more accessible, personalized care, market research is invaluable in guiding the development of new healthcare products and services. 3 This research helps in understanding patient preferences and emerging health trends, ensuring that new offerings are well-tailored to meet the specific needs of patients.

For more on personalized care , feel free to check out our comprehensive article.

4- Evaluate access to healthcare

Given that research shows one-third of adults have chronic conditions requiring regular healthcare, it’s crucial for providers to understand and improve access to medical services. 4 Medical market research practices can highlight barriers to access, such as geographic, financial, or informational challenges, and guide providers in making their services more accessible and inclusive for all patient groups.

Emerging trends in healthcare services

1- generative ai & digital transformation.

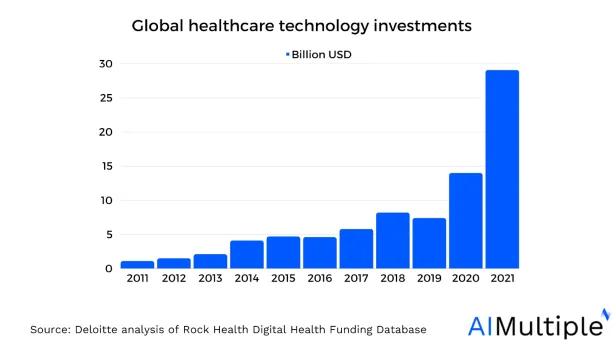

Source: Deloitte 5

Generative AI is significantly impacting the digital transformation in healthcare, fundamentally changing how data is processed and utilized. Its proficiency in handling unstructured medical data is leading to more efficient and accurate clinical operations. AI technology in healthcare enhances patient care and streamlines administrative tasks, marking a vital shift towards more advanced, data-driven healthcare services.

If interested, check out our article on generative AI in healthcare .

You can also check out the AI use cases in the healthcare industry .

If interested, you can also watch the video below:

2- Mergers & acquisitions (M&A)

Mergers and acquisitions (M&A) is an emerging trend in the healthcare industry and it refers to the process of healthcare organizations joining forces or one entity acquiring another. This trend in healthcare is driven by objectives such as improving service quality, expanding patient access to care, and achieving cost efficiencies. Through M&A, healthcare providers can pool resources, share expertise, and enhance their capabilities to deliver more comprehensive and integrated care to their patients.

3- Wearable medical products

Wearables are revolutionizing patient monitoring and health management. These devices, ranging from fitness trackers to advanced medical wearables, enable continuous health monitoring, personalized care, and data-driven treatment approaches.

4- Remote healthcare services & medical devices

The concept of medical devices has broadened beyond traditional large-scale machinery to include everyday items like smartwatches, capable of gathering vital medical data. This trend complements the growing preference for virtual healthcare, evidenced by 50% having attended a virtual medical appointment in the last year. 6 These developments reflect an evolving healthcare landscape where technology enables continuous health monitoring and convenient access to medical services, reshaping how healthcare is delivered and experienced.

If interested, you can also watch the video about a mobile clinic:

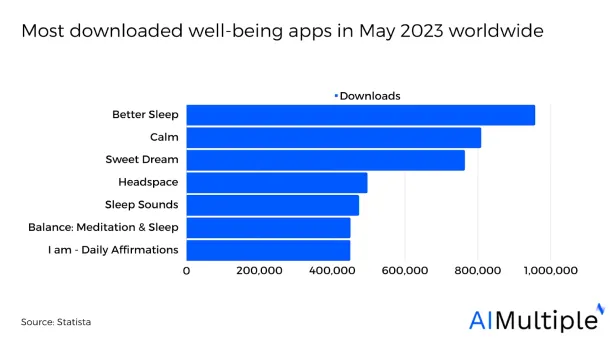

5- Healthcare & well-being mobile apps

Survey across 19 countries shows that 85% of individuals state that their mental health is as important as their physical health. 7 Besides, one in four individuals experience mental illness during their lifetime. 8 Well-being apps are a cheap and accessible way of helping people to deal with these issues especially for those who cannot receive proper treatment.

Source:Statista 9

6- Cybersecurity developments

As healthcare increasingly adopts digital technologies, cybersecurity has become paramount. Research shows that more than 50% of customers express concerns about the security vulnerabilities of their smartphones and smart home devices, and 40% worry about data security on smartwatches and fitness trackers. 10 This trend underscores the need for robust cybersecurity measures to protect sensitive health data collected and transmitted by these devices, ensuring patient privacy and trust in digital healthcare solutions.

For a more comprehensive view on cybersecurity in healthcare , check out our article.

Essential methods for conducting healthcare market research

Online surveys.

Online surveys in healthcare market research are a versatile and efficient way to gather large amounts of data. They can be designed to capture both qualitative and quantitative information, allowing researchers to understand diverse aspects such as patient satisfaction, treatment effectiveness, and public health trends.

a) Qualitative research

Qualitative research in healthcare delves into the depth and complexity of patients’ experiences, beliefs, and motivations. This approach often provides rich, detailed data that help understand the ‘why’ behind patient behaviors and preferences.

b) Quantitative research

Quantitative research in healthcare focuses on numerical data to quantify behaviors, opinions, and other variables related to health and medicine. This method is crucial for statistical analysis, providing clear, objective data that can inform policy decisions and clinical practices.

If interested, here is our data-driven list of survey participant recruitment services and survey tools .

Focus groups

They involve small, diverse groups of people discussing specific health-related topics, guided by a skilled moderator. This setting is particularly effective in understanding the varied perspectives of patients, caregivers, and healthcare professionals on new treatments, health policies, or service delivery.

In depth interviews

Conducted one-on-one, these interviews allow for a comprehensive exploration of sensitive or complex topics, such as patient experiences with chronic illness, decision-making processes in treatment, or perceptions of healthcare quality.

5 real-life examples of market research in healthcare industry

Ai4healthcro.

AI4HealthCro, a collaborative initiative in Croatia, stands as a testament to the transformative power of AI in healthcare. 11 This consortium is pioneering AI solutions with ambitious goals: dramatically reducing healthcare costs by an estimated €212.4 billion, saving a substantial number of lives, up to 403,000, and significantly increasing operational efficiency by freeing thousands of man hours annually.

Apple collaboration with Zimmet Biomet

Zimmer Biomet’s collaboration with Apple, resulting in the mymobility™ app and accompanying clinical study, exemplifies how market research in healthcare can drive product development. 12 This initiative leverages Apple Watch and iPhone technology to enhance patient care for knee and hip replacements, demonstrating a response to market demands for more integrated and personalized healthcare solutions. The mymobility app aims to improve patient outcomes and reduce healthcare costs, illustrating the potential of market research in identifying patient needs and fostering innovative healthcare solutions.

Advanced – NHS Cyber Attack

The ransomware attack on Advanced, an NHS IT provider, highlights the critical need for robust cybersecurity measures and market research in healthcare. 13 Hackers took control of systems, posing potential data theft risks. The attack disrupted services like patient check-in and NHS 111, with recovery expected to take weeks. Healthcare companies need to ensure and understand evolving cyber threats and develop effective strategies to protect sensitive patient data and healthcare services. Market research can guide healthcare providers in implementing the latest cybersecurity solutions, ensuring resilience against such attacks.

Roni Jamesmeyer, senior healthcare manager at Five9, focuses on AI solutions like ChatGPT for ambulance services and highlights the importance of understanding customer needs through market research. 14 The findings from their FOI request to NHS Ambulance Trusts reveal a low usage of AI, despite its potential to manage high call volumes and improve patient routing. This underscores the need for comprehensive market research to educate and inform healthcare leaders about AI’s benefits, ensuring technology adoption aligns with actual service requirements and patient care needs.

Apple Health

Source: Apple 15

Apple’s collaboration with the medical community, as part of its health ecosystem, highlights the importance of market research in healthcare innovation. 16 Through ResearchKit and the Research app, Apple enables large-scale participant recruitment for studies, advancing scientific discovery. Tools like Health Records on iPhone strengthen the physician-patient relationship by providing meaningful health data. Apple’s partnerships in various health studies, such as those focusing on women’s health, heart health, and hearing, demonstrate how market research can drive significant advancements in public health and personalized care.

If interested, check out our data-driven list of market research tools .

You can reach out if you need help in market research:

External Links

- 1. “ Driving growth through consumer centricity in healthcare “. McKinsey. March 14, 2023. Retrieved December 13,2023.

- 2. “ Gold-standard benchmarks for quality care “. American Customer Satisfaction Index. Retrieved December 13,2023.

- 3. “ 2023 Global Health Care Outlook “. Deloitte. Retrieved December 13,2023.

- 4. “ 2023 Global Health Care Outlook “. Deloitte. Retrieved December 13,2023.

- 5. “ Trends in healthcare tech investments “. Deloitte. Retrieved December 13,2023.

- 6. “ 2022 Connectivity and Mobile Trends Survey “. Deloitte. Retrieved December 13,2023.

- 7. “ In sickness and in health: How health is perceived around the world ” McKinsey . July 21, 2022. Retrieved December 13, 2023.

- 8. “ 2023 Global Health Care Outlook “. Deloitte. Retrieved December 13,2023.

- 9. “ Leading health and meditation apps worldwide in May 2023, by downloads “. Statista. Retrieved December 13,2023.

- 10. “ 2022 Connectivity and Mobile Trends Survey “. Deloitte. Retrieved December 13,2023.

- 11. AI4HealthCro . Retrieved December 13,2023.

- 12. “ Zimmer Biomet and Apple Collaborate to Launch Major Clinical Study Detailing Patient Experience and Improving Joint Replacement Journey “ . Zimmer Biomet. October 15, 2018. Retrieved December 13,2023.

- 13. “ NHS IT supplier held to ransom by hackers “ . BBC. August 11, 2022. Retrieved December 13,2023.

- 14. “ Unlocking the power of AI for improved ambulance services “ . Healthcare. November 19, 2023. Retrieved December 13,2023.

- 15. “ How Apple is empowering people with their health information “ . Apple. July 20, 2022. Retrieved December 13,2023.

- 16. “ How Apple is empowering people with their health information “ . Apple. July 20, 2022. Retrieved December 13,2023.

Cem has been the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per similarWeb) including 60% of Fortune 500 every month. Cem's work has been cited by leading global publications including Business Insider , Forbes, Washington Post , global firms like Deloitte , HPE, NGOs like World Economic Forum and supranational organizations like European Commission . You can see more reputable companies and media that referenced AIMultiple. Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised businesses on their enterprise software, automation, cloud, AI / ML and other technology related decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization. He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider . Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

To stay up-to-date on B2B tech & accelerate your enterprise:

Next to Read

Pharma market research: 10+ trends & real-life examples in '24, top 4 qualtrics competitors & alternatives in 2024, b2b marketing survey: an in-depth guide in 2024.

Your email address will not be published. All fields are required.

Related research

Top 6 Market Research Software in 2024

11 Online Survey Challenges in 2024

- Skip to content.

- Jump to Page Footer.

Webinar: Foreign Investment in 2024

Discover the secrets to prospecting and selecting relevant investors, and unlock the potential of international funding opportunities. Our expert speakers provide invaluable insights on engaging with investors, creating an international investment strategy, and navigating term sheet negotiations.

A brief guide: Healthcare market research tactics

Healthtech startups offer unique challenges when it comes to scoping out their markets. The healthcare industry is notoriously complex, and most ventures will run into regulatory and reimbursement barriers when bringing their products to market. However, a little market research know-how will do wonders for easing your growing pains.

What is healthcare market research?

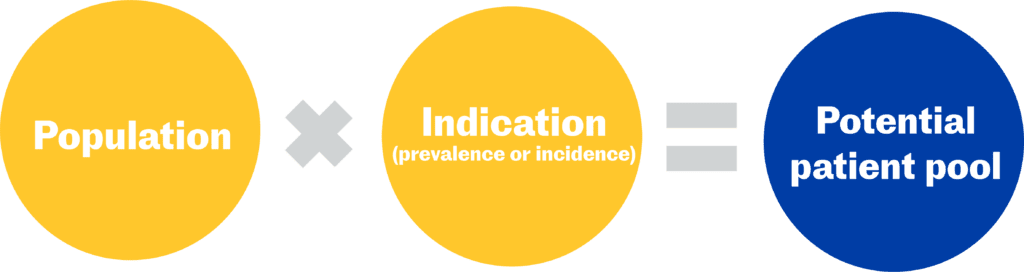

Unlike traditional market research , healthcare market research uses epidemiology and medical data to size your market. Healthcare market research focuses on the latest health trends and examines factors like patient comfort and education to identify market opportunities and penetration. It also accounts for healthcare’s unique customer landscape, where patient pools drive the overall market size, and where healthcare providers (HCPs) can influence product sales more than consumers. Healthcare market research provides an understanding of the number of potential patients that could be treated with your product, which products HCPs prefer to treat them with, and the accessibility of the market.

Primary vs. secondary research approach

What questions can secondary healthcare market research answer.

This guide will highlight several reputable free resources and tips to help you conduct secondary healthcare market research. The public resources identified in this guide can be used to:

- Estimate your patient pool

- Define potential reimbursement

- Map the competitive landscape

- Identify technological trends

Key secondary resources for healthcare market research

While there are many general market research resources available for the U.S . and Canada , these public resources can help you to understand the potential market for your therapy by providing in-depth, healthcare-specific data on epidemiology, patient demographics, healthcare spending, and more.

Calculating your market size/penetration

Using epidemiological data and patient demographics provided by resources like WHO and expenditure data from CIHI, HCUP or OECD, you will be able to directly size your market or estimate market penetration. However, if you cannot locate the information you are looking for, you can estimate your patient pool by crossing population data with prevalence or incidence data sourced from academic journals, or expand your research into other free databases .

Mapping the competitive landscape

If you want to understand where your therapeutic market is headed, it is important to research your competitors. A public competitor’s annual report can offer a wealth of information beyond their revenue. Many corporations break their financial statements into geography, brand or therapeutic levels and accompany their data with commentary and analyses. This information can illustrate useful market trends, such as which geographies are experiencing the fastest growth or which technological trends are expected to transform the market. Of course, even the most spartan annual reports can be used to puzzle out market growth through year-over-year calculations , or estimate market size simply by adding up the annual revenue of the other players.

Emerging startups should keep an eye on their competitors’ annual reports and press releases, especially since mergers and acquisitions can signal landscape upheavals or major technological trends. Due to the technological and regulatory barriers inherent to healthcare, fragmented markets are rare and any change in the landscape can have a far-reaching impact.

International resources

For ventures that are interested in marketing their products outside of the U.S. or Canada, market research can be more difficult. Resources like OECD and WHO provide important high-level health data, but other websites can help you understand international healthcare systems . If you are interested in the European market, many countries host extensive government healthcare databases. The National Health Service (NHS) and Destatis offer rich data sources on procedural volumes, epidemiology, and healthcare policies in England and the European Union, which you can use to build your market model.

Case study: Partnering with major players in drug development

Case study: building personas and developing a value proposition, sign up for our monthly startup resources newsletter about building high-growth companies..

- Enter your email *

You may unsubscribe at any time. To find out more, please visit our Privacy Policy .

How to conduct market research for healthcare

Find out how to conduct market research for healthcare so that you can provide better care and improved services for your patients.

Understanding healthcare market research

- Why is healthcare marketing research

Examples of healthcare market research

- How to make health market research

How to do healthcare and medical market research in 8 steps

- Tips for an effective healthcare market research

Market research shouldn’t only be done by what you’d consider typical commercial business. As it’s largely about people and what they want and need, other organizations—from governments to the healthcare industry—would definitely benefit from it.

Your local family doctor or nearest hospital will most likely not give you a survey with your prescription on your way out, but there are certainly ways in which the healthcare industry can gather valuable information about its ‘target audience’.

In this guide we’ll highlight why market research is so important for the healthcare sector, how you can use it to improve your health systems and how to conduct your research in a way that’ll give you actionable insights.