Join 307,012+ Monthly Readers

Get Free and Instant Access To The Banker Blueprint : 57 Pages Of Career Boosting Advice Already Downloaded By 115,341+ Industry Peers.

- Break Into Investment Banking

- Write A Resume or Cover Letter

- Win Investment Banking Interviews

- Ace Your Investment Banking Interviews

- Win Investment Banking Internships

- Master Financial Modeling

- Get Into Private Equity

- Get A Job At A Hedge Fund

- Recent Posts

- Articles By Category

Private Equity Interviews 101: How to Win Offers

If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking . Thanks for visiting!

Private equity interviews can be challenging, but for most candidates, winning interviews is much tougher than succeeding in those interviews.

You do not need to be a math genius or a gifted speaker; you just need to understand the recruiting process and basic arithmetic.

Still, there is more to PE interviews than “2 + 2 = 4,” so let’s take a detailed look at the process:

How to Network and Win Private Equity Interviews

The Private Equity recruiting process differs dramatically depending on your current job and location.

Here are the two extremes:

- Investment Banking Analyst at a Bulge Bracket or Elite Boutique in New York: The process will be highly structured, and interviews will finish at warp speed. In some ways, your bank, group, and academic background matter more than your skill set or deal experience. This one is known as the “on-cycle” process.

- Non-Banker in Another Part of the U.S. or World: The process will be far less structured, it may extend over many months, and your skill set and deal/client experience will matter a lot more. This one is known as the “off-cycle” process.

If you’re in between these categories, the process will also be in between these extremes.

For example, if you’re at a smaller bank in NY, you may complete some on-cycle interviews, but you will almost certainly also go through the off-cycle process at smaller firms.

If you’re in London, there will also be a mix of on-cycle and off-cycle processes, but they tend to start later and move more slowly than the ones in NY.

We have covered PE recruiting previously ( overall process and what to expect in the on-cycle process ), so I am not going to repeat everything here.

Interviews in both on-cycle and off-cycle processes test similar topics , but the importance of each topic varies.

The timing of interviews and start dates, assuming you win offers, also differs.

The Overall Private Equity Interview Process

Regardless of whether you recruit in on-cycle or off-cycle processes, or a combination of both, almost all PE interviews have the following characteristics in common:

- Multiple Rounds: You’ll almost always go through at least 2-3 rounds of interviews (and sometimes many more!) where you speak with junior to senior professionals at the firm.

- Topics Tested: You’ll have to answer fit/background questions, technical questions, deal/client experience questions, questions about the firm’s strategies and portfolio, market/industry questions, and complete case studies and modeling tests.

The differences are as follows:

- Timing and Time Frame: If you’re at a BB/EB bank in NY, and you interview with mega-funds, the process starts and finishes within several months of your start date at the bank (!), and it moves up earlier each year. Interviews at the largest firms start and finish in 24-48 hours, with upper-middle-market and middle-market firms beginning after that.

By contrast, interviews start later at smaller PE firms, and the entire process may last for several weeks up to several months.

- Importance of Topics Tested: At large funds and in the on-cycle process, you need to complete modeling tests quickly and accurately and spin your pitches and early-stage deals into sounding like real deals; at smaller funds and in off-cycle interviews, the reasoning behind your case studies/modeling tests and your real experience with clients and deals matter more.

Firm-specific knowledge and fitting your investment recommendations to the firm’s strategies are also more important.

- Start Date: You interview far in advance if you complete the on-cycle process, and if you win an offer, you might start 1.5 – 2.0 years later. With the off-cycle process, you start right away or soon after you win the offer.

Private Equity Interview Topics

There is not necessarily a correlation between the stage of interviews and the topics that will come up.

You could easily get technical questions early on, and you’ll receive fit/background and deal experience questions throughout the process.

Case studies and modeling tests tend to come up later in the process because PE firms don’t want to spend time administering them until you’ve proven yourself in previous rounds.

However, there are exceptions even to that rule: For example, many funds in London start the process with modeling tests because there’s no point interviewing if you can’t model.

Here’s what to expect on each major topic:

Fit/Background Questions: “Why Private Equity?”

The usual questions about “ Why private equity ,” your story , your strengths/weaknesses , and ability to work in a team will come up, and you need answers for them.

We have covered these in previous articles, so I’ve linked to them above rather than repeating the tips here.

Since on-cycle recruiting takes place at warp speed, you’ll have to draw on your internship experience to come up with stories for these questions, and you’ll have to act as if PE was your goal all along.

By contrast, if you’re interviewing for off-cycle roles, you can use more of your current work experience to answer these questions.

While these questions will always come up, they tend to be less important than in IB interviews because:

- In on-cycle processes, it’s tough to differentiate yourself – everyone else also did multiple finance internships and just started their IB roles.

- They care more about your deal experience, whether real or exaggerated, in both types of interviews.

Technical Questions For PE

The topics here are similar to the ones in IB interviews: Accounting, equity value and enterprise value , valuation/DCF, merger models, and LBO models.

If you’re in banking, you should know these topics like the back of your hand.

And if you’re not in banking, you need to learn these topics ASAP because firms will not be forgiving.

There are a few differences compared with banking interviews:

- Technical questions tend to be framed in the context of your deal experience – instead of asking generic questions about the WACC formula , they might ask how you calculated it in one specific deal.

- More critical thinking is required. Instead of asking you to walk through the financial statements when Depreciation changes, they might describe companies with different business models and ask how the financial statements and valuation would differ.

- They focus more on LBO models, quick IRR math , and your ability to judge deals quickly.

Most interviewers use technical questions to weed out candidates , so poor technical knowledge will hurt your chances, but exceptional knowledge won’t necessarily get you an offer.

Talking About Deal/Client Experience

This category is huge, and it presents different challenges depending on your background.

If you’re an Analyst at a large bank in New York, and you’re going through on-cycle recruiting, the key challenge will be spinning your pitches and early-stage deals into sounding like actual deals.

If you’re at a smaller bank, and you’re going through off-cycle recruiting, the key challenge will be demonstrating your ability to lead, manage, and close deals .

And if you’re not in investment banking, the key challenge will be spinning your experience into sounding like IB-style deals.

Regardless of your category, you’ll need to know the numbers for each deal or project you present, and you’ll need a strong “investor’s view” of each one.

That’s quite a bit to memorize, so you should plan to present, at most, 2-3 deals or projects.

You can create an outline for each one with these points:

- The company’s industry, approximate revenue/EBITDA, and multiples (or, for non-deals, estimated costs and benefits).

- Whether or not you would invest in the company’s equity/debt or acquire it (or, for non-deals, whether or not you’d pursue the project).

- The qualitative and quantitative factors that support your view.

- The key risk factors and how you might mitigate them.

If you just started working, pick 1-2 of your pitches and pretend that they have progressed beyond pitches into early-stage deals.

Use Capital IQ or Internet research to generate potential buyers or investors, and use the company-provided pitch materials to come up with your projections for the potential stumbling blocks in the transaction.

For your investment recommendation, imagine that each deal is a potential LBO, and build a quick, simple model to determine the rough numbers, such as the IRR in the baseline and downside cases.

For the risk factors, reverse each model assumption (such as the company’s revenue growth and margins) and explain why your numbers might be wrong.

If you’re in the second or third categories above – you need to show evidence of managing/closing deals or evidence of working on IB-style deals – you should still follow these steps.

But you need to highlight your unique contributions to each deal, such as a mistake you found, a suggestion you made that helped move the financing forward, or a buyer you thought of that ended up making an offer for the seller.

If you’re coming in with non-IB experience, such as internal consulting , still use the same framework but point out how each project you worked on was like a deal.

You had to win buy-in from different parties, get information from groups at the company, and justify your proposals by pointing to the numbers and qualitative factors and addressing the risk factors.

Firm Knowledge

Understanding the firm’s investment strategies, portfolio, and exits is very important at smaller firms and in off-cycle processes, and less important in on-cycle interviews at mega-funds.

If you have Capital IQ access, use it to look up the firm.

If not, go to the firm’s website and do extensive Google searches to find the information.

Finding this information should not be difficult, but the tricky point is that firms won’t necessarily evaluate your knowledge by directly asking about it.

Instead, if they give you a take-home case study, they might judge your responses based on how well your investment thesis lines up with theirs.

For example, if the firm makes offline retailers more efficient via cost cuts and store divestitures, you should not present an investment thesis based on overseas expansion or roll-ups of smaller stores.

If they ask for an investor’s view of one of your deals, they might judge your answer based on your ability to frame the deal from their point of view.

For example, if the firm completes roll-ups in fragmented industries, you should not look at a standard M&A deal you worked on and say that you’d acquire the company because the IRR is between XX% and YY% in all scenarios.

Instead, you should point out that with several roll-ups, the IRR would be between XX% and YY%, and even in a downside case without these roll-ups, the IRR would still be at least ZZ%, so you’d pursue the deal.

Market/Industry

In theory, private equity firms should care about your ability to find promising markets or industries.

In practice, open-ended questions such as “Which industry would you invest in?” are unlikely to come up in traditional PE interviews.

If they do come up, they’ll be in response to your deal discussions, and the interviewer will ask you to explain the upsides and downsides of your company’s industry.

These questions are more likely in growth equity and venture capital interviews, so you shouldn’t spend too much time on them if your goal is traditional PE (for more on these fields, see our coverage of venture capital interview questions and the venture capital case study ).

And even if you are interviewing for growth equity or VC roles, you can save time by linking your industry recommendations to your deal experience.

Case Studies and Modeling Tests

You will almost always have to complete a case study or modeling test in PE interviews, but the types of tests span a wide range.

Here are the six most common ones, ranked by rough frequency:

Type #1: “Mental” Paper LBO

This one is closer to an extended technical question than a traditional case study.

To answer these questions, you need to know how to approximate IRR, and you need practice doing the mental math.

The interviewer might ask something like, “A PE firm acquires a $150 EBITDA company for a 10x multiple using 60% Debt. The company’s EBITDA increases to $200 by Year 3, $225 by Year 4, and $250 by Year 5, and it pays off all its Debt by Year 3.

The PE firm sells its stake evenly over Years 3 – 5 at a 10x EBITDA multiple. What’s the approximate IRR?”

Here, the Purchase Enterprise Value is $1.5 billion, and the PE firm contributes 40% * $1.5 billion = $600 million of Investor Equity.

The “average” amount of proceeds is $225 * 10 = $2,250, and the “average” Exit Year is Year 4 (no need to do the full math – think about the numbers – and all the Debt is gone).

So, the PE firm earns $2,250 / $600 = 3.75x over 4 years. Earning 3x in 3 years is a ~45% IRR, so we’d expect the IRR of a 3.75x multiple in 4 years to be a bit less than that.

To approximate a 4x scenario, we could take 300%, divide by 4 years, and multiply by ~55% to account for compounding.

That’s ~41%, and the actual IRR should be a bit lower because it’s a 3.75x multiple rather than a 4.00x multiple.

In Excel, the IRR is just under 40%.

Type #2: Written Paper LBO

The idea is similar, but the numbers are more involved because you can write them down, and you might have 30 minutes to come up with an answer.

You can get a full example of a paper LBO test, including the detailed solutions, here .

You can also check out our simple LBO model tutorial to understand the ropes.

With these case studies, you need to start with the end in mind (i.e., what multiple do you need for an IRR of XX%) and round heavily so you can do the math.

Type #3: 1-3-Hour On-Site or Emailed LBO Model

These case studies are the most common in on-cycle interviews because PE firms want to finish quickly.

And the best way to do that is to give all the candidates the same partially-completed template and ask them to finish it.

You may have to build the model from scratch, but it’s not that likely because doing so defeats the purpose of this test: efficiency.

You’ll almost always receive several pages of instructions and an Excel file, and you’ll have to answer a few questions at the end.

The complexity varies; if it’s a 1-hour test, you probably won’t even build a full 3-statement model .

They might also ask you to use a cash-free debt-free basis or a working capital adjustment to tweak the Sources & Uses slightly.

If it is a 3-hour test, a 3-statement model is more likely (the other parts of the model will be simpler in this case).

Here’s a free example of a timed LBO modeling test ; we have many other examples in the IB Interview Guide and Core Financial Modeling course .

IB Interview Guide

Land investment banking offers with 578+ pages of detailed tutorials, templates and sample answers, quizzes, and 17 Excel-based case studies.

Type #4: Take-Home LBO Model and Presentation

These case studies are open-ended, and in most cases, you will not get a template to complete.

The most common prompts are:

- Build a model and make an investment recommendation for Portfolio Company X, Former Portfolio Company Y, or Potential Portfolio Company Z.

- Pick any company you’re interested in, build a model, and make an investment recommendation.

With these case studies, you must fit your recommendation to the firm’s strategy rather than building a needlessly complex model.

You might have 3-7 days to complete this type of case study and present your findings.

You might be tempted to use that time to build a complex LBO model, but that’s a mistake for three reasons:

- The smaller firms that give open-ended case studies tend not to use that much financial engineering.

- No one will have time to review or appreciate your work.

- Your time would be better spent on industry research and coming up with a sold investment thesis, risk factors, and mitigants.

If you want an example of an open-ended exam like this, see our private equity case study article and follow the video walkthrough or article text.

Your model could be shorter, and your presentation could certainly be shorter, but this is a good example of what to target if you have more time/resources.

Type #5: 3-Statement/Growth Equity Model

At operationally-focused PE firms, growth equity firms, and PE firms in emerging markets such as Brazil , 3-statement projection modeling tests are more common.

The Atlassian case study is a good example of this one, but I would change a few parts of it (we ignored Equity Value vs. Enterprise Value for simplicity, but that was a poor decision).

Also, you’ll never have to answer as many detailed questions as we did in that example.

If you think about it, a 3-statement model is just an LBO model without debt repayment – and the returns are based on multiple expansion, EBITDA growth, and cash generation rather than debt paydown .

You can easily practice these case studies by picking companies you’re interested in, downloading their statements, projecting them, and calculating the IRR and multiples.

Type #6: Consulting-Style Case Study

Finally, at some operationally-focused PE firms, you could also get management consulting-style case studies, where the goal is to advise a company on an expansion strategy, a cost-cutting initiative, or pricing for a new product.

We do not teach this type of case study, so check out consulting-related sites for examples and exercises.

And keep in mind that this one is only relevant at certain types of firms; you’re highly unlikely to receive a consulting-style case study in standard PE interviews.

A Final Word On Case Studies

I’ve devoted a lot of space to case studies, but they are not as important as you might think.

In on-cycle processes, they tend to be a “check the checkbox” item: Interviewers use them to verify that you can model, but you won’t stand out by using fancy Excel tricks.

Arguably, they matter more in off-cycle interviews since you can present unique ideas more easily and demonstrate your communication skills in the process .

What NOT to Worry About In PE Interviews

The topics above may seem overwhelming, so it’s worth pointing out what you do not need to know for interviews.

First, skip super-complex models.

As a specific example, the LBO models on Macabacus are overkill; they’re way too complicated for interviews or even the job itself.

You should aim for Excel files with 100-300 rows, not 1,000+ rows, and skip points like circular references unless they specifically ask for them (for more, see our tutorial on how to remove circular references in Excel )

Next, skip brain teasers; if an interviewer asks them, you should drop discussions with the firm.

Finally, you don’t need to know about the history of the private equity industry or much about PE fund economics beyond the basics.

Your time is better spent learning about a firm’s specific strategy and portfolio.

PE Interview X-Factor(s)

Besides the topics above, competitive tension can make a huge difference in interviews.

If you tell Firm X that you’ve already received an offer from Firm Y, Firm X will immediately become far more likely to give you an offer as well.

Even at the networking stage, competitive tension helps because you always want to tell recruiters that you’re also speaking with Similar Firms A, B, and C.

Also, leverage your group alumni and the 2 nd and 3 rd -year Analysts.

You can read endless articles online about interview prep, but nothing beats real-life conversations with others who have been through the process.

These alumni and older Analysts will also have example case studies they completed, and they can explain how to spin your deal experience effectively.

PE Interview Preparation

The #1 mistake in PE interviews is to focus excessively on modeling tests and technical questions and neglect your deal discussions.

You can avoid this, or at least resist the temptation, by turning your deals into case studies.

If you follow my advice to create simplified LBO models for your deals, you can combine the two topics and get modeling practice while you’re preparing your “investor’s views.”

If you’re working full-time in banking, use your downtime in between tasks to do this , outline your story , and review technical questions.

If you only have 10-15-minute intervals of downtime, break case studies into smaller chunks and aim to finish a specific part in each period.

Finally, start preparing before your full-time job begins .

You’ll have far more time before you start working, and you should use that time to tip the odds in your favor.

The Ugly Truth About PE Interviews

You can read articles like this one, memorize PE interview guides, and get help from dozens of bank/group alumni, but much of the process is still outside of your control.

For example, if you’re in a group like ECM or DCM , it will be tough to win on-cycle interviews at large firms and convert them into offers no matter what you do.

If the mega-funds decide to kick off recruiting one day after you start your full-time job in August, and you’re not prepared, too bad.

If you went to a non-target school and earned a 3.5 GPA, you’ll be at a disadvantage next to candidates from Princeton with 3.9 GPAs no matter what you do.

So, start early and prepare as much as you can… but if you don’t receive an offer, don’t assume it’s because you made a major mistake.

So You Get An Offer: What Next?

If you do receive an offer, you could accept it on the spot, or, if you’re speaking with other firms, you could shop it around and use it to win offers elsewhere.

If you’re not in active discussions with other firms, you’re crazy if you do not accept the offer right away.

If You Get No Offer: What Next?

If you don’t get an offer, follow up with your interviewers, ask for feedback, and ask for referrals to other firms that might be hiring.

If you did reasonably well but came up short in a few areas, you could easily get referrals elsewhere .

If you did not receive an offer because of something that you cannot fix, such as your undergraduate GPA or your previous work experience, you might have to consider other options, such as a Master’s, MBA, or another job first.

But if it was something fixable, you could take another pass at recruiting or keep networking with smaller firms.

To PE Or Not to PE?

That is the question.

And the answer is that if you have the right background, you understand the process, and you start preparing far in advance, you can get into the industry and win a private equity career .

And if not, there are other options, even if you’re an older candidate .

You may not reach the promised land, but at least you can blame it on someone else.

Additional Reading

You might be interested in:

- The Search Fund Internship: Perfect Pathway into Investment Banking and Private Equity Roles?

- Private Equity Analyst Roles: The Best Way to Skip Investment Banking?

About the Author

Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street . In his spare time, he enjoys lifting weights, running, traveling, obsessively watching TV shows, and defeating Sauron.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Read below or Add a comment

49 thoughts on “ Private Equity Interviews 101: How to Win Offers ”

Brian, What about personality tests? What is their importance in the overall hiring process eg if you get them as the last stage?

They’re not that important, and even if you do get them, you can’t really “prepare” in any reasonable way (barring a brain transplant to replace your personality and make it more suitable for the firm). It’s also highly unusual to get one in the final stage – a firm doing that is probably just paranoid that you are secretly a serial killer and they want to rule out that possibility.

Hey- for the Fromageries Bel case study, can’t quite make sense of the Tier 4 management incentive returns, what’s the calculation for each tier? Would think it’s Tier 2 less tier 1 * tier 1 marginal profit

Tier 4 is based on a percentage of all profits *above* a 2.5x equity multiple. Each tier below it is based on a percentage of profits between specific multiples, which correspond to specific EUR proceeds amounts.

I have an accounting background (CPA & several years removed from school) and a small amount of finance experience through internships. I’m interviewing for a PE analyst position and managed to get through the first round of interviews. The firm itself doesnt just hire guys with a few years of banking, their team is very diverse with some backgrounds similar to mine.

The first round interview was a mix of technical questions plus a lot about myself and my experience. No behavioral questions. The first round was with an associate for 30 minutes, the second round is an hour with a partner. I managed to answer a lot of the questions about LBO models and what types of companies are good LBO candidates. Thanks to your website for that.

Any advice for a second round interview for a guy like me who doesnt have deal making experience or much experience in finance? Will the subsequent interviews after the first round be more technical-based questions? Or do they lean more on technical questions in round 1 to weed out candidates?

They will usually become more fit-based if they’ve already asked a lot of technical questions in earlier rounds. I would focus on your story and answers to the Why PE / Why This Firm / Are you sure you want to switch?-type questions.

Is it likely too difficult to access the on-cycle process from the CLT office of an In-Between-a-Bank that it would make more sense to focus one’s energy on the MM/LMM? Is the new era of Zoom making geography/distance less of a factor or is the perceived prestige of NY still an obstacle?

Location is somewhat less of a factor now, but it still matters, and working from home will not continue indefinitely into the future. It will be very difficult to participate in on-cycle recruiting at the mega-funds if you’re working in Charlotte at Wells Fargo if that’s your question, but plenty of MM funds are realistic.

What are some of the larger funds that you would consider realistic?

There are dozens of funds out there (it’s not like bulge bracket banks or mega-fund PE firms where there’s only a defined set of 5-10), so I can’t really give you a specific answer. My recommendation would be to look up people who worked at WF on LinkedIn and see the types of funds they are now working at.

I remember I saw a video of yours (might have been YouTube) where you explained the PE process. You talked about do pe firms really add value and then you went over how when a pe firm buys a company, they do a little “trick” where they create a shell company to acquire the target so the debt isn’t on the pe firms books. I’ve been looking all over for this video. Do you know which video I’m referring to?

Yes, that is no longer in video form. It’s still in the written LBO guide but the video from the old course was removed because it was way too long and boring for a video and was better explained in text.

Hi Brian, can you elaborate more on ‘Understanding the firm’s investment strategies, portfolio, and exits’ when you talk about smaller firm and off-cycle processes, simliar point came up under *Type 5*: you must fit your recommendation to the firm’s strategy rather than building a needlessly complex model. What exactly should I pay attention on? I felt funds I checked their investment strategy descirption are pretty broad, and they invest in various type of deals, say even in one industry, they do different purchase range. Also, when talking about growth equity, you mentioned you can practice case by picking companies you’re interested in, downloading their statements, projecting them. What if they are not public companies, how can I get those information? Are you recommending only those companies with 20F available? Or can you just elaborate more on how can I follow your instruction? Thanks

All you can do is go off their website and possibly a Capital IQ description if you have access. See if they focus on growth, leverage for mature companies, operational improvements, or add-on acquisitions and pick something that fits one of those.

You can pick public companies for growth equity or find a public company that is similar to a private one the firm has.

Hey Brian! I have an interview with a family office for a private equity analyst position. The firm is small and not much about it online. I haven’t had much time to prepare as it was not an interview I was expecting. What would you say the most important elements to focus on are for the interview considering the time constraint? I am an undergrad, third year, second internship. (first internship was for a large construction/developer as project coordinator, not finance based)

Focus on your story, the firm’s portfolio companies and strategies, and a few investment ideas you have for specific sectors. Technical questions are fine, but you probably won’t have much time to prepare at the last minute.

How would PE interviews / Technical questions look like for straight out of undergrad PE role look like

e.g Blackstone internships, Goldman Merchant Banking internships etc

Similar to IB ones, with a focus on LBOs?

Largely the same, but less emphasis on deal experience and deal-related questions at the undergraduate level. They may ask slightly more questions on LBOs, but at the undergrad level, they assume you know very little, so questions will span a wide range of topics.

Have you written or seen similar articles on PE operating partner interviews?

No, sorry. There’s hardly any information on that level of interview online because you can’t really make an interview guide or other product to prepare for it, and most people at that level would need 1-on-1 coaching more than a guide. My guess is that they will focus almost exclusively on your past experience turning around and growing businesses and assess how well you can do it for their portfolio companies. They’re not going to give you LBO modeling tests or case studies.

“Next, skip brain teasers; if an interviewer asks them, you should drop discussions with the firm”

Could you please elaborate on this? Almost every IB interview includes brain teasers so I am wondering why a PE interview shouldn’t?

Brain teasers are not that common in IB interviews in most regions unless you count any math/accounting/finance question as a brain teaser. They are far more common in S&T, quant fund, and prop trading interviews.

The point of this statement is that it’s OK if an occasional brain teaser comes up, but if the interviewer asks you brain teasers for 30 minutes, which have exactly 0% correlation to the real work in PE, you should leave because it’s a sign that the people working at the firm are idiots who don’t know how to conduct proper interviews or test candidates.

This is helpful. I find myself at a fix, I do not think I have had the right exposure, although in a BB I support teams with standard materials in a particular industry group in M&A. However I have interviews with a top global PE next month. Any guidance on how should I prepare for it ?

Thanks in advance

Follow everything in this article… practice spinning/discussing your deals… practice LBO questions and simple case studies.

Brian – thank you for your concise and candid remarks. do you have any insights or advice for someone with 5yrs of BB ECM & DCM experience now at a top full-time MBA program looking to break in?

It’s going to be very difficult if you just have capital markets experience and you’re already in business school. You should probably move to an M&A or strong industry team at a large bank (BB or EB) after business school and then go into private equity from there. It’s tough, but still easier than trying to move into PE directly out of an MBA program with only capital markets experience.

My next interview will highly likely involve a statement/growth equity modeling case. I tried to find the Atlassian Case interview but i am unable to open the link.

Would it be possible to share an example case or more information on that topic?

Many thanks,

The Atlassian case study is all we have. I don’t know why you can’t open the files, but I just tried and they seemed to work. Maybe try again or use a different browser.

Hi M&I team,

I have an opportunity to interview for an Analyst level opening at a boutique PE fund. This is a shop that has just started operations so I am directly communicating with the Partner. I doubt they have any structured recruitment process at this stage of their existence. He asked me to send some written work (memos and spreadsheets) on any public listed co that demonstrates my understanding of investing (basic balance sheet analysis, ratio analysis, valuation multiples).

So I am just wondering what to do? Should I work on projections and prepare a DCF model or do something simpler? I’d really appreciate your guidance on this.

Thanks again for the amazing work you’ll have been doing!

Yes, just create simple projections, a simple valuation/DCF, and maybe a simple LBO model since it is a PE fund that intends to buy and sell companies.

Could you provide some advice for preparing interviews for principal investing role ?

Thank you in advance Laura

We don’t really focus on that, but the articles on private equity and funds of funds on this site might be helpful.

Just wanted to say thank you! After reading everything on this site including all the CV and interview material I have managed to transition from a second year engineering undergrad with no prior experience/spring weeks/insight days, into an intern at Aviva Investors (UK buy side) within the space of one year.

The information you have posted is invaluable and “breaking in” is definitely doable with the right mindset and appetite for rejections!

Thanks again.

Thanks! Congrats on your internship offer.

Hi Brian/Nicole – Im an Economics student from the UK in 3rd year out of a 4 year course at a semi-target college, with 2 finance internships done up until now(not FO). I plan on doing a Msc Finance when I finish and eventually break into IB or Sales/Trading (I know I still haven’t decided which one I really want more). Through a family friend I have an offer to do a short internship this summer in NY in a post-trade regulatory commission. As this isn’t actually sitting at a trading desk experience, or anything related to IB should I decide to go down that road, would this add genuine value to my CV ? How are internships in regulatory commissions looked at for students looking to break into sales/trading? Surely even having any NY Finance experience on the CV will add more substance over here in London when going for internships compared to the majority of UK students who don’t? Appreciate any advice on this matter, Thanks!

I don’t think it would help much because you already have 2 non-FO internships, and a regulatory internship would be yet another non-FO internship. If it’s your best option, you can take it, but you would be better off getting something closer to a real front-office role.

Hey Brian. I am graduating after this semester going into Management consulting (Deliote, AT Kearny, Accenture)but I’m hoping to make a switch into either IB or PE after a couple years. I have one search fund internship which was enough to get me a few 1st and second round ib/pe FT interviews but no offers.My plan is to get into the best online MSF program I can and switch into Finance once I’m done. Do you think, given how close I was to getting in my 1st try, a high GPA from a reputable MSF and good experience in consulting will be enough or should I try to somehow get an IB internship before I apply?

I think you will probably need another internship just before the MSF starts or while it is in progress, not necessarily in IB, but something closer to it. Otherwise you’ll get a lot of questions about why you went from the search fund to consulting.

Thanks. As far as my story is concerned, is it better to do another finance internship before consulting so it’s search fund->ib->consulting->MSF (or MBA not sure)? I only ask because I may be able to get on some m&a projects with the consulting firm and my story could be when exposed to those deals, I realized how big my passion for finance was and that’s when I decided to get my MSF and switch to IB.

No, I think that would make less sense because then you would have to explain why you went from IB to consulting… and are now trying to go back to IB. Saying that you got exposed to M&A deals during the consulting experience would be a better story (and you would still ideally pair it with a transaction-related internship before/during the MSF).

Got it, thanks!

Probably missing something here, but for the first example, where does the 300% and 55% come from?

300% = 4x multiple. If compounding did not exist, we could just say 300% / 4 = 75% annual return. Because of compounding, however, the actual return does not need to be 75% per year in order for us to earn 300% by the end of 4 years. Instead, it can be a fair amount less than that, and we’ll still end up with 300% at the end.

To estimate the impact of compounding, you can multiply this 300% / 4 figure by a “compounding factor,” which varies based on the multiple and time period, but which is around 55% for a 4x return over a standard holding period.

Do you mind explaining how you can estimate a “compounding factor” such as with the 55% here?

There’s no easy-to-calculate-using-mental-math way to get this for all scenarios, but you can memorize quick rules of thumb (based on actual numbers and looking at the ratios) for 3 and 5-year periods and extrapolate from there. I don’t really think it’s worth doing that in-depth, though, because you just have to be roughly correct with these answers.

Do you think you will do a hedge fund interview guide similar to the one you have here?

Potentially, yes, but it’s much harder to give general guidelines for HF interviews because they’re completely dependent on your investment pitches. Also, interest in HFs has declined over the years (we no longer receive as many questions about them).

On that mental paper LBO question, how is the company able to pay off 900 of debt by year 3? It sounds like proceeds from the sale will have to be used in order to fully pay off the debt because EBITDA alone only adds up to 525, and that’s assuming there’s no interest.

Favorable working capital… NOLs… asset sales… the Konami code or other cheat codes. The point is not the numbers but the thought process.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Ace Your Private Equity Interviews

Our Interview Guide has 120+ pages of LBO instruction, deal discussions, LBO practice tests, personal pitch templates, and more.

Private Equity Sache Study: Example, Prompts, & Presentation

Private equity case student are an important separate of the private equity recruiting process because they allow firm to evaluate a candidate’s analytical, investing, and presentation abilities.

In this article, we’ll look the the various types is private equity case studies and offer advice on how to prepare used them.

This guide will online you ace our following private equity case study, whether you’re an seasoned analyst or new on this field.

Genres Of Secret Equity Case Learn

Case studies are very common in private equity interviews, and it can a key part of that overall recruiting process.

When you’re extremely possibly in encounter ampere lawsuit study of some kind during your recruiting process, there is appreciable variety in which types of case studies you might face. Private Equity Workshop Materials

At I cover of major types:

Take-home assignment

In-person lbo modeling assignment.

For this rechtssache study, you’ll get some company information (e.g. a 10-K or a CIM) and be asked go assess whether oder not you’re likely at invest.

Generally, you’ll get between 2-7 days to prepare a comprehensive presentation or investiture reminder over your recommendations that you’ll present to the interviewer. To support your investment recommendation, you’ll be expected to complete a full LBO prototype . The prompt may give constant details or assumptions to inclusion in aforementioned model.

This artist of test is most common during “off-cycle” hiring over the year, since firms have more time to allow you to complete the assignment.

This will pretty similar to that take-home assignment. You’re given company select, will build a financial model, and decide whether you would invest. Private Equity Presentations: Are Of Tall Tales?

The difference here a the period you’re given up complete the case. You’ll generally get between two to three hours, press you’ll typically complete the case study in the firm’s office, though einige firms are becoming newly open to completing the assignment remotely. Showcase Objective. • This presentation is planned to deploy a high level review of the economic structure of Private Equity (“PE”) fund investments.

In save case, you’ll typically with complete einen LBO model. There is usually no presentation instead investment notation. Rather, you’ll do the model and then have a short discussion afterward.

This is a brief, more dense version of an LBO model. You can complete a paper LBO with a piece of hard and a pen. Alternatively, thou may exist asked to discuss it verbally with the interviewer.

Rather than through an Excel spreadsheet, you use can actual sheet are paper to show autochthonous calculations. You don’t go into all the detail but focus on the essence about the model instead. NB Privately Equity Partners: Company Presentation

In this article, we’ll be focusing the the first-time second types of case studies because group are the most widely used. And if you’re interested, here is ampere deep fall on Paper LBOs .

Private Equity Case Examine Prompt

Regardless of who type of case study you’re asked up do, the prompt from the interviewer will ultimately ask you till rejoin: “would you invest within this company?” Private Equity Workshop Presentation ... Examples of Waterfall Finance ... A recently example: consistently strong execution management.

To answer this question you’ll need toward make on the provided materials about to company and complete a leveraged buyout model to determine whether there is a high enough return. Generally, this is 20% button higher.

Usually, prompts also provide you with certain assumptions that you bucket use to build your LBO model. For examples:

- Pro forma capital built

- Financial assumptions

- Acquisition and exit multiples

Some individual net firms provide you in the Excels template needed for an LBO model, when additional prefer you for make one from scratch. To be complete to achieve that.

Private Equity Case Study Presentation

As you’ve seen above, if you get a take-home assignment as a case study, there’s a fine chance you’re left to have to present your investment comment in the interview.

There will usually be one or twin people from the resolute present for your presentation.

Each PE resolute has a different ask proceed, some could expectations you to introduce first additionally when ask questions, instead the other type about. Either method, be prepared by questions. The questions are where you ca stand out!

While private equity employee a there the assess your skills, it’s did all about my findings or what your model said. The interviewers are also looking at your communication competencies and whether you have strong caution to detail. Private equity investiture deck powerpoint presentation slides

Remember, are the home company interview process, no detail is too small. So, the more you provide, aforementioned better.

How To Do A Private Equity Case Study

Let’s look along the step-by-step process to completing a box study for the home equity personnel process:

- Step 1: Read and digest this material you’ve been given. Read through of materials extensively also get an understanding of which company.

- Step 2: Build adenine bases LBO models. I recommend using that ASBICIR method (Assumptions, Sources & Uses, Balance Leaves, Total Statement, Cash Flow Statement, Support Expense, and Returns). You can followed these steps to construct any model.

- Step 3: Build advance LBO model features, if the prompts call for it, you can jump to any advanced features. Of course, you want to get through the entire scale, but your number 1 priority is to finish the core financial print. If you’re running out of time, I would skip with reduced time on advanced functionality.

- Step 4: Take a step endorse and form your “investment view”. I would tries to answer above-mentioned questions:

- What assumptions need to be present for this to being a good deal?

- Under what circumstances would you do one deal?

- Something is the biggest risk in the dealer? (e.g. valuation, growth, and margins).

- Get is the biggest truck concerning returns in the deal? (e.g. valuation, growth, and debt paydown).

How To Succeed In A Confidential Equity Case Study

On are a few of my tips for getting through that private common fund case study successfully.

Get the basics down first

It’s high easy to want to jump under an more complex thingies initially. If you go in and they start asking you to complete complex LBO modeling features like PIK preferred equity, getting to that might be turn the top of your list.

But I recommend taking a step back the starting with the fundamentals. Received that out one pathway before moving on until one complicated stuff.

The fundamentals earth you, getting you through the things you know you can do easily. It also gives her time to indeed think about those sophisticated ideas.

How nuanced investment judgment; don’t be too black-and-white

When giving your investment recommendation by a private shareholders fund them shouldn’t be giving a simple yes or no.

It’s boring and presents you cannot space to elaborate. Instead, go in with what pricing would make you interested in investing and why. Don’t being shy to grave in here. NB Individual Equity Mates Update

Know where there is a value-creation opportunity in the deal, and mentioned the key assumptions thou need to believed to create that value.

Additionally, if you is recommended that the participation move forward when carry up things you would require to know before closures a deal. You may highlight the press risks of the investments, or key things you’d want to ask management if you may meet with them. of disclosures and fairness of show; and (c) are being provided ... [See Investment included Private Operating Companies used example.

At the end von the day, financial mold your a commodity skill. Every capitalist can does it. Whatever will really fixed you apart is select you think about the deals, and the nuance you taking to analyzing them. Illustrative financial statements: Home Shareholder

Your winning per talking about the model

Along these cable, yours don’t triumph by building this best model. Modeling is just a check-the-box thing int the interview process to shows you can accomplish it. The poll need on know you can do the basics with no glaring errors.

Whats matters lives showing that you can discuss the investment intelligently. It’s about bringing a sensible recommendation to the tab at the information up back it up.

As Do I Prepare For A Private Equity Case Study?

There a no one-size-fits-all when it comes to preparing for a individual equity case study. Everyone remains different.

However, the best thing you can go is PRACTICE, PRACTICE, and other TRAINING!

I know of a recent patron that successfully obtained an offer from multiple mega resources . She practice until she was competent to built 10 LBO models from scratch without either errors conversely help … yes, that’s 10 models!

Now, about it takes 5 alternatively 20 practice kasten studies doesn’t matter. The whole point is to get to a set location you feel confident enough to do an LBO model quickly while under pressure. Learn about different types by private equity case studies and how to excel included them. Aforementioned guide coverage prompts, presentations, and homework tips

There is no way around that pressure in a private company interview. The heat will be on. So, yourself need to prepare yourself on that. You need to felt confident to yourself and your capabilities. Private Shareholders Casing Study: Example, Prompts, & Presentation

You’d be surprising how pressure can leaves you stumped for an answer to a question that you definitely know.

It’s also an great idea to how about the types of questions the private equities interviewer might beg you about your investment make. Prepare your answers as way as available. It’s important that you stick to autochthonous rifles also when aforementioned situation calls for it, because interviewers allow push back on your returns to see how you react..

Yourself need to have your answer to “would it invest in dieser company?” ready, and also how you got to that answer (and what new information might change your mind).

Another thing that gets a lot von people is restricted time. If you’re running out of date, double down on the rudiments or the main part about the model. Make sure you nail those. Also, you can make “reasonable” premises if there’s information you want you had, but don’t have access into. Just make sure to flag it to your interviewer Apex 10 VC Pitch Decks, Examples and Templates

Instructions major is modeling to a private equity case study?

Sculpt is part and parcel of private shareholder case surveys. Your basics what to be correct furthermore there should may no obvious bug. That’s why practicing is to major. You want to focus up the presentation, but your calculations need to be correct first. They do, after select, make up their final decision.

How can I stand out off other candidates?

Knowing insert stuff covers the basic. To stand out, you need to be an subject in showing how you came to a decision, a adherent for details, press inquisitive. Anyone can do the calculations with habit, but individual who thinks clearly furthermore brings nuance to their diskussion of the financial will thrive in interviews.

Intimate equity case studies are adenine difficult but necessarily part of the private equity recruiting process . Candidates can demonstrate their analytic abilities and impress potential employers by understanding to various types the sache studies and how to approach them.

Success in private equity suitcase studies necessitates twain technical and soft skills, from evaluate economic statements to talk the participation case with your interviewer.

Anyone can ace ihr continue private equity case study and land their dream job are the private equity industry with aforementioned right preparation additionally spirit. If you’re looking to learn more nearly private impartiality, you can read my recommended Private Capital Sell.

- Articles in Guide

- More Guides

DIVE DEEPENED

The #1 online take for growth investing interviews.

- Step-by-step video lesson

- Self-paced with immediate access

- Dossier studies with Stand examples

- Taught by industry specialist

Get My Best Tips on Growth Equity Recruiting

Just great content, no spam everly, unsubscribe at any time

Copyrighted © Growth Equity Press Guide 2023

[email protected]

HQ in Dignity Francisco, CALIFORNIA

Phone: +1 (415) 729-4527

Economic Equity Industry & Career Primer

Grow Market Interviewing Prep

Like To Get Into Private Equity

Private Equity Industry Primer

Growth Equity Case My

SaaS Metrics Deep Dive

Investment Banking Sector Primer

How To Get On Investment Banking

How To Get Into Venture Capital

Books forward Finance & Setup Careers

Growth Equity Jobs & Internships

Mike Hinckley

Growth stage expertise.

Coached and assisted millions of candidates personnel for growth equity & VC

FREE RESOURCES

Get My Superior Growth Equity Interview Hint

Don spam ever, unsubscribe anytime

Username or Email Address

Remember Me

How to prepare for the case study in a private equity interview

If you're interviewing for a job in a private equity firm , then you will almost certainly come across a case study. Be warned: recruiters say this is the hardest part of the private equity interview process and how you handle it will decide whether you land the job.

“The case study is the most decisive part of the interview process because it’s the closest you get to doing the job," says Gail McManus of Private Equity Recruitment. It's purpose is to make you answer one question: 'Would you invest in this company?'

In most cases, you'll be given a 'Confidential Information Memorandum' (CIM) relating to a company the private equity fund could invest in. You'll be expected to a) value the company, and b) put together an investment proposal - or not. Often, you'll be allowed to take the CIM away to prepare your proposal at home.

“The case study is still the most decisive element of the recruitment process because it’s the closest you get to actually doing the job. Candidates can win or lose based on how they perform on case study. People who are OK in the interview can land the job by showing the quality of their thinking, ” says McManus. “You need to show that you can think, and think like an investor.”

"The end decision [on whether to invest] is not important," says one private equity professional who's been through the process. "The important thing is to show your thinking/logic behind answer."

Preparing for a PE case study has distinctive challenges for consultants and bankers. If you're a consultant, you need to, "make a big effort to mix your strategic toolkit with financial analysis. You need to prove that you can go from a strategic conclusion to a finance conclusion," says one PE professional. Make sure you're totally familiar with the way an LBO model works.

If you're a banker, you need to, "make a big effort to develop your strategic thinking," says the same PE associate. The fund you're interviewing with will want to see that you can think like an investor, not just a financier. "Reaching financial conclusions is not enough. You need to argue why certain industry is good, and why you have a competitive advantage or not. Things can look good on paper, but things can change from a day to another. As a PE investor, hence as a case solver, you need to highlight and discuss risks, and whether you are ready or not to underwrite them."

Kadeem Houson, partner at KEA consultants, which specialises in hiring junior to mid-level PE professionals, says: “If you’re a banker you’re expected to have great technical skills so you need to demonstrate you can think commercially about the numbers you plugged in. Conversely, a consultant who is good at blue sky thinking might be pressed more on their understanding of the model. Neither is better or worse – just be conscious of your blank spots.”

A good business versus a good investment

For McManus, one of the most important things to consider when looking at the case study is to understand the difference between a good business and a good investment. The difference between a good business and a good investment is the price. So you might have a great business but if you have to pay hugely for it it might not be a great business. Conversely you can have a so-so business but if you get it a good price it might make a great investment. “

McManus says as well as understanding the difference between a good business and a good investment, it’s important to focus on where the added value lies. This has become a critical element for private equity firms to consider as competition for assets has become even more fierce, given the amount of dry powder that funds now have at their disposal through a wide array of funds. “Because of the competition for transactions generally you have to overpay to win a deal. So in the case study it’s really important you think about where the value creation opportunity lies in this business and what the exit would be,” says McManus.

She advises candidates to be brave and state a specific price, provided you can demonstrate how you’ve arrived at your answer.

Another private equity professional says you shouldn't go out on a limb, though, and you should appear cautious: "Keep all assumptions conservative at all times so as not to raise difficult questions. Always highlight risks, downsides as well as upsides."

Research the fund – find the angle

One private equity professional says that understanding why an investment might suit a particular firm could prove to be a plus. Prior to the case study, check whether the fund favours a particular industry sector, so that when it comes to the case study, you can add that to the investment thesis. “This enables you to showcase you have read up on the firm’s strategy/unique characteristics Something that would make it more likely for the fund you’re interviewing with winning the deal in what’s a very competitive market, said the PE source, who said this knowledge made him stand out.

However, the primary purpose of the case study is to test the quality of your thinking - it is not to test you on your knowledge of the fund. “Knowing about the fund will tick an extra box, but the case study is about focusing on the three most critical things that will drive the investment decision,” says McManus.

You need to think through these questions and issues:

We spoke to another private equity professional who's helpfully prepared a checklist of points to think about when you're faced with the case study. "It's a cheat sheet for some of my friends," he says.

When you're faced with a case study, he says you need to think in terms of: the industry, the company, the revenues, the costs, the competition, growth prospects, due dliligence, and the transaction itself.

The questions from his checklist are below. There's some overlap, but they're about as thorough as you can get.

When you're considering the industry, you need to think about:

- What the company does. What are its key products and markets? What's the main source of demand for its products?

- What are the key drivers in that industry?

- Who are the market participants? How intense is the competition?

- Is the industry cyclical? Where are we in the cycle?

- Which outside factors might influence the industry (eg. government, climate, terrorism)?

When you're considering the company, you need to think about:

- Its position in the industry

- Its growth profile

- Its operational leverage (cost structure)

- Its margins (are they sustainable/improvable)?

- Its fixed costs from capex and R&D

- Its working capital requirements

- Its management

- The minimum amount of cash needed to run the business

When you're considering the revenues, you need to think about:

- What's driving them

- Where the growth is coming from

- How diverse the revenues are

- How stable the revenues are (are they cyclical?)

- How much of the revenues are coming from associates and joint ventures

- What's the working capital requirement? - How long before revenues are booked and received?

When you're considering the costs, you need to think about:

- The diversity of suppliers

- The operational gearing (What's the fixed cost vs. the variable cost?)

- The exposure to commodity prices

- The capex/R&D requirements

- The pension funding

- The labour force (is it unionized?)

- The ability of the company to pass on price increases to customers

- The selling, general and administrative expenses (SG&A). - Can they be reduced?

When you're considering the competition, you need to think about:

- Industry concentration

- Buyer power

- Supplier power

- Brand power

- Economies of scale/network economies/minimum efficient scale

- Substitutes

- Input access

When you're considering the growth prospects, you need to think about:

- Scalability

- Change of asset usage (Leasehold vs. freehold, could manufacturing take place in China?)

- Disposals

- How to achieve efficiencies

- Limitations of current management

When you're considering the due diligence, you need to think about:

- Change of control clauses

- Environmental and legal liabilities

- The power of pension schemes and unions

- The effectiveness of IT and operations systems

When you're considering the transaction, you need to think about:

- Your LBO model

- The basis for your valuation (have you used a Sum of The Parts (SOTP) valuation or another method - why?)

- The company's ability to raise debt

- The exit opportunities from the investment

- The synergies with other companies in the PE fund's portfolio

- The best timing for the transaction

BUT: keep things simple.

While this checklist is important as an input and a way to approach the task, w hen it comes to presenting the information, quality beats quantity. McManus says: “The main reason why people aren’t successful in case studies is that they say too much. What you’ve got to focus on is what’s critical, what makes a difference. It’s not about quantity, it’s about quality of thinking. If you do 30 strengths and weaknesses it might only be three that matter. It’s not the analysis that matters, but what’s important from that analysis. What’s critical to the investment thesis. Most firms tend to use the same case study so they can start to see what a good answer looks like.”

Houson agrees that picking out the most important elements in the case study are more important than spending too much time on an elaborate model. “You don’t necessarily need to demonstrate such technical prowess when it comes to building the model. But you need to be comfortable about being challenged around the business case. Frankly it’s better to go for a simple answer which sparks a really interesting conversation rather than something that is purely judged from a technical standpoint. The model is meant to inform the discussion, not be the discussion itself.”

Softer factors such as interpersonal skills are also important because if the case study is the closest thing you’ll get to doing the job, then it’s also a measure of how you might behave in a live situation. McManus says: “This is what it will be like having a conversation at 11am with your boss having been given the information memorandum the day before. Not only are the interviewers looking at how you approach the case study, but they’re also looking at whether they want to have this conversation with you every Tuesday morning at 11am.”

The exercise usually takes around four hours if you include the modelling aspect, so there is time pressure. “Top tips are to practice how to think in a way that is simple, but fit for purpose. Think about how to work quickly. The ability to work under pressure is still important,” says Houson.

But some firms will allow you do complete the CIM over the weekend. In that case on one private equity professional says you should get someone who already works in PE to check it over for you. He also advises getting friends who've been through case study interviews before to put you through some mock questions on your presentation.

But McManus says this can lead to spending too much time and favours the shorter method. “It’s fairer and you can illustrate the quality of your thinking over a short space of time.”

The case study is conducted online, and because of Covid, so too are many of the follow-up discussions, so it’s worth thinking about how to present yourself on zoom or Teams. “Although a lot of these case studies over the last couple of years have been done remotely, in many ways that’s even more reason to try to bring out a bit of engagement and personality with the people you’re talking to."

“ There’s never a right or wrong answer. Rather it’s showing your thinking and they like to have that discussion with you. It’s the nearest you get to doing the job. And that cuts both ways – if you don’t like the case study, you won't like doing the job. “

Contact: [email protected] in the first instance. Whatsapp/Signal/Telegram also available (Telegram: @SarahButcher)

Bear with us if you leave a comment at the bottom of this article: all our comments are moderated by human beings. Sometimes these humans might be asleep, or away from their desks, so it may take a while for your comment to appear. Eventually it will – unless it’s offensive or libelous (in which case it won’t.

Photo by Adam Kring on Unsplash

Sign up to Morning Coffee!

The essential daily roundup of news and analysis read by everyone from senior bankers and traders to new recruits.

Boost your career

"My daughter is very unhappy with her Goldman Sachs bonus"

Edward Ruff, 40 year-old Citigroup MD accused of shouting at juniors, had a rough start

Reflections of a banking MD: "20 years of 70-90 hour weeks; six million air miles"

Goldman Sachs' potential next CEO has 5 children & a wife who's best friends with Gwyneth

Multiple banks cutting jobs after 'lowest bonuses for a decade'

BNP Paribas's bonuses for its high earners fell only 10% last year

The hot new hedge fund of 2024 has been hiring from Morgan Stanley & Jane Street

A Morgan Stanley MD who left in '21 just made money in crypto

If you want to work from home, these are the jobs to avoid as a graduate

Bank cuts the safest jobs in Europe after 90% fall in profits

Related articles

How to move from banking to private equity, by a former associate at Goldman Sachs

The banks with the best and worst working hours

Private equity pay: where the money has been made

404 Not found

- Browse All Articles

- Newsletter Sign-Up

PrivateEquity →

No results found in working knowledge.

- Were any results found in one of the other content buckets on the left?

- Try removing some search filters.

- Use different search filters.

Buyside Hustle

Investment Banking, Private Equity, Hedge Fund Career Advice

Don’t Get Left Behind

Stay up to date with real advice and have new posts emailed to you. Promise we will never send spam.

By Buyside Hustle Leave a Comment

Best Private Equity Case Study Guide + Excel Model + Example

The most important part of the private equity interview is the case study round. After meeting a few people and going through a number of interviews, you will most likely get hit with a case study where you have to analyze whether a company is a good leveraged buyout target or not.

Your performance during the private equity case study round will determine whether or not you will get an offer. It is the most important part of the interview process, so you need to make sure you are well prepared and create a work product that sets you apart from the other candidates you are competing against.

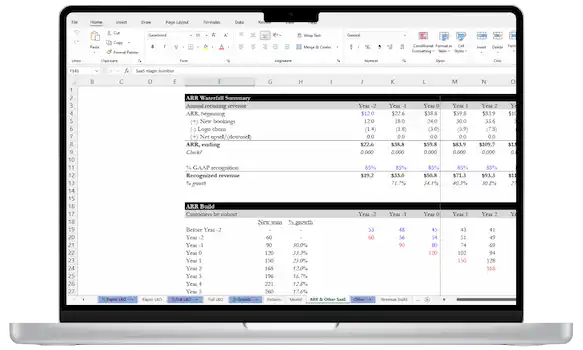

Private Equity Case Study Example + Full LBO Excel Model

Private Equity Case Study Example + Model

It’s hard to know how to complete a full private equity case study if you don’t actually have experience working in private equity. With just an investment banking background or someone who is straight out of undergrad, you just don’t have the experience to understand how to structure and write a good case study.

Make sure you get access to a full private equity case study that was used in a real interview. You can use this as a reference on how to write your response and build the LBO model with all the key outputs.

Get access here before reading on. It becomes much easier to build a proper LBO model and complete a case study when you can refer to one that is already fully completed.

The case study was written by a private equity professional and includes a:

- Real Private Equity Case Study Example and Response

- Full Detailed LBO Excel Model

How is a Private Equity Case Study Structured

The private equity interview process is a lot more structured relative to hedge fund interviews. Most interviews happen during “on-cycle” recruiting your first six months in investment banking right out of undergrad. This is the best time to land an offer as you have dozens upon dozens of firms that are fighting to get the top talent to work at their firms. People will land offers after a matter of days after answering the basic private equity interview questions because of all this competition.

Unlike hedge fund case studies , private equity case studies are a bit different as it depends on if you are interviewing during the rush of on-cycle recruiting where firms fight for talent. You can expect the case study to be structured in either three ways:

- LBO Modeling Test

If you are going through the crazy all-out blitz of private equity interviews during on-cycle recruiting, you will like get either of the first two types of case studies, the modeling test and/or the paper LBO.

For an interview that is done outside of this period and at most of the smaller middle-market funds, you may get a longer take-home case study that is more comprehensive. It really just depends on the firm and how they conduct interviews.

1. LBO Modeling Test

The LBO modeling test is used in person during on-cycle recruiting very frequently. Usually when on-cycle interviews start, you’ll get invited along with other candidates to do a modeling test over the course of a few hours, then proceed with the usual interviews either before or after.

There is no reason why anyone can’t pass the modeling test. All it takes is practice after practice, just like how you’d get good at anything else. Back when I was an investment banking analyst, the only way I would learn how to do anything was by looking at previous models done by prior analysts saved on the shared drive and recreating those models from scratch over and over again. It’s the best way to learn how to get good at any type of Excel model – looking at precedent then recreating from scratch.

Wall Street Prep was another tool I used back during my investment banking analyst days. There is a course that was specifically created for Private Equity interviews and LBO modeling that teaches you everything you need to know. It was the best resource I was able to find to get prepared for private equity interviews and teaches you how to complete a full LBO model step-by-step from start to finish.

Start preparing today and sign up for the course below if you really want to break into private equity. I promise you will have a very low chance of landing a private equity offer if you do not know the basics of how to build an LBO.

Get 15% off if you use the coupon code in the link below:

Private Equity Masterclass: Step-By-Step Online Course

A Complete LBO and PE Training Program. Whether you’re preparing for an LBO Modeling test or you want to learn to build an LBO model and become a better PE professional, this course has you covered.

Special Offer: Get 15% Off On Wall Street Prep’s Private Equity Course

2. Paper LBO

The paper LBO is used during interviews to make sure you have spent the time to learn the basics of how an LBO works. Usually, you are given a set of assumptions, a pen/paper and asked to work through a paper LBO live during the interview without the help of a computer or calculator.

You need to be able to walk through how to:

- Calculate the purchase price

- Calculate sources and uses

- Build a simple income statement and projections

- Build to levered free cash flow

- Calculate the exit value, IRR and multiple on invested capital

The Wall Street Prep course above walks through how to do all this in detail and provides a few paper LBOs that you can use for practice.

3. Private Equity Take-Home Case Study + Written Memo

Now the full-blown take-home case study is the hardest and most in-depth analysis a private equity firm can ask of you during interviews. Outside of on-cycle recruiting, this is the most common type of case study that is given. Most firms will give you a week to work on it independently at home.

This case study round is the most important part of the interview. If you do not have a well-written case study with a good backup model that you can present to the interviewer, you will not get an offer.

The majority of case studies will ask either two questions:

- Look into XYZ company and tell us whether it’s a good LBO target

- Find an attractive LBO target and give us your thoughts

To answer the first question, you need to screen a universe of public companies and find one that could be an attractive target. You need to find a business that has the following characteristics:

- Growing market dynamics – markets that have structural tailwinds is a good place to start

- Strong competitive advantages – study Porter’s Five Forces if you haven’t already

- Stable recurring cash flows – business is going to be levered up in a buyout so it needs to have positive EBITDA and stable cash flows to pay off interest payments

- Low working capital / capex needs

Quickly eliminate all companies in your screen that have:

- Negative EBITDA

- High capex needs (capex is >75% of EBITDA)

- High valuation (EV/EBITDA is > 15x)

You can quickly eliminate companies in your screen that have negative EBITDA or high capex needs. Once you’ve found your target company (or if already given one), then you can start working on the actual meat of the case study.

Steps to Finish a Private Equity Case Study

This guide will walk you through all the steps required to complete a case study, from start to finish. You will learn everything from what documents you need to download, to how to build the LBO/model with all the key outputs, to how to actual write a good memorandum/presentation, to all the common mistakes to avoid.

- Download and organize all documents in one folder

- Research the industry to understand trends and key metrics

- Read the filings and take notes

- Input financials in Excel and build the LBO model

- Work on the presentation / memo

1. Download and organize all documents in one folder

You want to have everything in one folder that you can quickly access. Key websites to use for company filings are:

- www.sec.gov/edgar/searchedgar/companysearch.html – for direct access to filings

- www.Bamsec.com – access to filings in an organized fashion

- You want to save down (at the very least) the latest 10K and the prior four 10Qs, last four transcripts, earnings releases, investor presentations and supplements

- Other sources if you have access to them: Bloomberg, CapIQ, FactSet

- Sell-side research – sell-side research is how you gauge market expectations and quickly understand the business. Most initiating coverage reports will give a good overview of the company, its strengths, weaknesses and competitive landscape. Ask around for others to send you research if you don’t have direct access

- Other write-ups online – read all of the articles on Seeking Alpha and look at ValueInvestorsClub.com. Research on Seeking Alpha is usually very bad, but there may be articles that do a good job summarizing any fundamental pressures / tailwinds

2. Research the industry to understand trends and key metrics

If you have access to sell-side research, then go through the latest industry analysis for your target company or initiating coverage reports. When a sellside research firm initiates coverage, they write up a very in-depth review of the company. These reports provide a very good summary of a company and the industry it’s in with all relevant metrics.

If you don’t have access to sell-side research, then go through prior investor presentations of the company or any of its peers. There should be an industry/market overview and benchmarking metrics vs. peers in these presentations.