Powerd By SAG INFOTECH

We Would Like To Send You Push Notifications.

Notifications can be turned of anytime from browser settings

- 0141-4072000 (90 line)

- [email protected]

- GST Income Tax TDS MCA LCNC Payroll

GST Impact on Financial Statements’ Transactions & Various Accounts

Since July 2017, the One Nation One tax i.e. Goods and Services Tax (GST) has been introduced in India. Apparently, it looks simplified; however, the entire accounting mechanism has been overhauled. Nevertheless, the concept of GST has its own advantages in the long run.

As Per the Indian Accounting Standards

- State-based Registration and Consequent Accounting Mechanism (Person who is liable for registration subject to section 22 of the CGST Act)

- Supplies in the absence of Consideration ( Schedule I of the CGST ACt specifies those activities that are to be categorised as supply without consideration

- Excise Duty is to be included in revenue as it’s production-based taxation.

- And Sales Tax along with VAT also is not included in the revenue as it is imposed at the time of the sales. However, GST is called a destination-based tax that is imposed at the point of the supply.

- Specific Rules: These provisions have impacted directly on business accounting such as Composite Supply, Works Contract etc.

- Mode of GST: All the transactions of the supply shall be subject to 2 kinds of levies CGST for Union and SGST for State government) and levied tax is also shared between 2 entities. The Union Government and the State Government.

- Central Goods and Services Tax (CGST)

- State Goods and Services Tax (SGST)

- Integrated Goods and Services Tax (IGST)

- Compensation Cess

Every Business has 2 Types of Transactions:

- Inward Supply (Purchase) that is auto-populated in GSTR 2A

Maintaining of Accounts of the Business Entities Excepting Composite Tax Payer

The normal taxpayer has to maintain the following accounts that have to be maintained and kept by a normal taxpayer under the GST mechanism.

- Input CGST A/c

- Input IGST A/c

- Input SGST A/c

- Output SGST A/c

- Output CGST A/c

- GST Payable A/c

- Output IGST A/c

- Input and output Cess (If in case applicable)

Illustration of Business Transaction as Per GST Regime

- Inward Supplies ( Intra or Inter state)

- Outward supplies ( Intra or Inter state)

- Refunds in the Case of the Export of Goods & Services

- Set Off of ITC Against Out Tax Liability

- Reverse Charge Transactions

Intra State implies transaction within the same state or the Union Territory Inter-State implies Transactions outside the state or Union Territory

Under the GST Mechanism, the Expenses can be Subdivided Into the Below-Mentioned Categories

- Expenses on which the ITC NOT availed

- Expenses on which the ITC availed

- Expenses on which nil GST has been charged by the supplier as below the threshold

- Expenses on which GST paid on RCM

- Expenses on which GST is not leviable

- Expenses with zero-rated GST

Records that are Required to be Maintained Under the GST

- Stock records

- ITC availed

- Tax Invoice

- Inward & the outward supply of the goods/ services

- Debit note/ credit notes

- Bill of Supply

- Receipt/ Payment/ Refund voucher

Effect of the GST Transactions on the Financial Statements

Check points that will help you in relation to how the effects of Goods and Services Tax for transactions on the financial statements:

Reconciling/Matching Outward & Inward Supply

- Reconciling the Outward and the Inward Supply with the GST Invoices, the Debit Note / Credit note/ the documents issued during FY and so on.

- Reconciling your Turnover with 26 AS

- Reconciling of the Turnover with the GST TDS(If in case applicable)

Check the Eligibility of the ITC Considering Section 16 that is Read with the Rules

- Checking the eligibility of the Input Tax Credit under section 16 and Rule 36

- Reverse the ITC if not covered under the eligibility criteria

- Record it in the financial statement as the current liability

- However, if the payment has been made in the subsequent time period then re-avail the ITC up to the September 2021 Return for the Financial Year 20-21

Concept of Reverse Charge Mechanism

- Reviewing the financial statements for the FY 2020-21 identifying expenses subject to the RCM as per the Sec 9(3)

- Discharging RCM liability through the GSTR 3B or/and DRC 03

- Discharging the GST liability under the Reverse Charge Mechanism along with the interest if it is not paid and also availing of the Input Tax Credit in the subsequent returns

- Record GST payable as Current Liability and ITC receivable as the Current Assets.

Reconciling/Matching the Balances of Cash and Credit Ledger

- Reconciling Financial BOA with the Cash and the Credit Ledger of the GSTN portal

- Recording Current assets(Cash) and the Credit balance that is reflected in the GST portal

- Further reviewing of the GST TDS that is receivable if any and recording it as current assets.

Benefit of Input Tax Credit Wrongly Availed

- ITC that is wrongly availed of the inputs that are covered under section 17(5) of the CGST Act

- ITC that is wrongly availed and not complying with the provisions of Rule 36(4)

- ITC that is not reversed taking into consideration Rule 42/43

- Discharging the Interest on reversal if the same has not been utilized

- Recording it as Current Liability in the Financial Statements.

Benefit of Input Tax Credit Not Availed

- Identify the income that is accrued as per the Income Tax but is not liable to the GST in a period in which it has not been accrued taking into consideration the time of supply provisions.

- For the purpose of future reference, preparing a reconciliation between the outward supply as per the Income Tax and the GST for future reference.

- Discharging of the GST liability in the subsequent period as per the time of the supply of provisions.

Income Accrued as Per I-T Act But is Not Liable Considering GST Act

- Identify the income that has been accrued as per Income Tax Act, but not subject to GST

- Reconciling between Outward supply as per Income Tax and GST for the future reference

- Discharging the GST liability in the later period as per the provision of time of supply

Advance Received for Services Only (Not Including Goods)

- The amount has been received but no invoice has been raised against the supply of services.

- Reviewing the bank statements for the receipts against which no invoice has been raised.

- According to section 12 of the CGST Act (Time of the Supply), the GST is payable on the advance receipt.

- The advance receipt had been reflected in the return for a period of the receipt but the same is not applicable for goods as per the notification

- Discharging of the GST liability along with the due interest at the time of the advance

- GST paid on Advance recorded as Current Assets in the financial statements.

Disclaimer:- "All the information given is from credible and authentic resources and has been published after moderation. Any change in detail or information other than fact must be considered a human error. The blog we write is to provide updated information. You can raise any query on matters related to blog content. Also, note that we don’t provide any type of consultancy so we are sorry for being unable to reply to consultancy queries. Also, we do mention that our replies are solely on a practical basis and we advise you to cross verify with professional authorities for a fact check."

Was this page helpful to you?

Leave a comment

Cancel reply.

Your email address will not be published. Required fields are marked *

Follow Us on Google News

Latest posts.

Orrisa HC: GST Officer Can Open Web Portal for e-Filing If Assessee Fulfilled All Dues

Bombay High Court Deletes Order Against Wife When the Alleged Investment Was Done by Her Husband

Mumbai ITAT: Employees Need to Prove TDS Deduction While Making Deposit to Company

CBDT Sets a Deadline for Pending Income Tax Refunds Approval

New offer for tax experts, huge discount on tax software.

Promo code: FEB15 -->

Best Offer for Tax Professionals

Upto 20% discount on tax software.

Select Product *

Mega Offer - Upto 20% Off On Genius, ROC/XBRL, Payroll, CA Portal

Fill form for a demo.

AI Summary to Minimize your effort

AS 21 Consolidated Financial Statements

Updated on : May 17th, 2021

AS 21 Consolidated Financial Statements should be applied in preparing and presenting consolidated financial statements for a group of enterprises under the sole control of a parent enterprise.

Applicability of AS 21 Consolidated Financial Statements

This standard must be applied when accounting for investment in subsidiaries in a separate financial statement of the parent.

It is to be noted that while preparing a consolidated financial statement, other standards also stay relevant in a similar manner as for standalone statements.

This accounting standard doesn’t deal with:

- Accounting methods for amalgamations and effects on consolidation, which includes goodwill which arises on an amalgamation

- Accounting for investments in JVs (joint ventures)

- Accounting for investments in associates

Presentation of Consolidated Financial Statements

A parent company presenting its consolidated financial statements must present these statements along with its standalone financial statements.

The users of financial statements of a parent company are typically concerned with and are required to be educated about, the results of operations and financial position of not only the company itself but also of that group together.

This requirement is served by offering the users of financial statements –

- Standalone financial statements of a parent; and

- Consolidated financial statements that provide financial information about the business group as that of a lone enterprise without respect to the legal restrictions of the distinct legal entities

Scope of Consolidated Financial Statements

A parent company that presents its consolidated financial statements must consolidate all of its subsidiaries, foreign as well as domestic. Where a company doesn’t have any subsidiary, however, has associates and/or joint ventures such company also needs to prepare consolidated financial statements as per Accounting Standard 23 – Accounting for Associates in Consolidated Financial Statements and Accounting Standard 27 – Financial Reporting of Interests in JVs respectively.

Exclusion of Subsidiaries

A Subsidiary must be excluded from the consolidation when:

- control is planned to be temporary since the subsidiary was taken over and was held exclusively for disposal in the near future, or

- the subsidiary is operating under severe long-standing restrictions that considerably impair the subsidiary’s ability to transfer funds to its parent

In a consolidated financial statement, investments in such subsidiaries must be accounted for as per AS 13 – Accounting for Investments. Reasons for which a subsidiary isn’t included in the consolidation must be disclosed in such consolidated financial statements.

Consolidation Procedures

While preparing a consolidated financial statement, the parent company’s financial statements and its subsidiaries must be combined line by line by totaling together similar items such as assets, liabilities, income, and expenses.

For consolidating financial statements in a way to present financial information about a group as that of a lone enterprise, the below-motioned steps must be taken:

- Eliminate the cost to the parent of its investment made in each of its subsidiaries and such parent’s equity portion of each of its subsidiaries, at the date when the investment in such subsidiaries are made

- any additional cost to the parent company of the investment in the subsidiary over the parent company’s share of the equity of subsidiary, at the date on which the investment in such subsidiary is done, must be shown as goodwill for recognizing as the asset in its consolidated financial statements

- when the cost to the parent of the investment in the subsidiary is lower than the parent company’s share of the equity of subsidiary, a date on which the investment in such subsidiary is done, the difference must be treated as the capital reserve in its consolidated financial statements

- a portion of minority interests in net income of the consolidated subsidiary for reporting period must be recognized and adjusted against income of the group for arriving at the net income which is attributable to owners of such parent company; and

- a portion of minority interests in net assets of the consolidated subsidiaries must be recognized and provided for in consolidated balance sheet distinctly from the equity and liabilities of the parent company.

- amount of equity which is attributable to the minorities at the date on which such investment in the subsidiary is done; and

- minorities’ share of the movements in equity from the date the relationship of parent-subsidiary came in to force

- Where carrying investment amount in a subsidiary is different from the cost, such carrying amount is to be considered for the above calculations.

Accounting for Investments in the Subsidiaries in Separate Financial Statement of the Parent

In a parent company’s separate financial statements, the investments made in subsidiaries must be accounted for as per AS 13 – Accounting for Investments.

Disclosures in the Financial Statements

Following disclosures must be made w.r.t. AS 21 Consolidated Financial Statements:

- in the consolidated financial statements the list of all the subsidiaries of the parent company which includes the name, country of residence or incorporation, the share of ownership interest and, in case different, the share of voting power held

- In case the consolidation of a particular subsidiary hasn’t been made according to the grounds permissible in the accounting standard, reasons for which such subsidiary isn’t included in the consolidation must be disclosed in such consolidated financial statements

- type of relationship between a parent and its subsidiary, whether direct control or indirect control through the subsidiaries

- effect of acquisition and disposal of the subsidiaries on the financial position at the date of reporting results for the reporting period and on corresponding amounts for the preceding period; and

- Name of the subsidiary(s) of which reporting date(s) is different

Major Differences between AS 21 and Ind AS 110

Quick Summary

Was this summary helpful.

Clear offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. Clear serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India.

Efiling Income Tax Returns(ITR) is made easy with Clear platform. Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing.

CAs, experts and businesses can get GST ready with Clear GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. Clear can also help you in getting your business registered for Goods & Services Tax Law.

Save taxes with Clear by investing in tax saving mutual funds (ELSS) online. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Download Black by ClearTax App to file returns from your mobile phone.

Cleartax is a product by Defmacro Software Pvt. Ltd.

Company Policy Terms of use

Data Center

SSL Certified Site

128-bit encryption

Home » Blog » Ind AS Schedule III Checklist | Presentation & Disclosure of Expenses in the Financial Statements

Ind AS Schedule III Checklist | Presentation & Disclosure of Expenses in the Financial Statements

- Blog | News | Account & Audit |

- Last Updated on 26 July, 2023

Recent Posts

Blog, News, Insolvency and Bankruptcy Code

Appeal Against NCLAT’s Order Remanding Approved RP to NCLT Rejected as AA Passed Order Violating Sec. 419(3) of Co(s) Act | SC

Blog, News, FEMA & Banking

Secured Creditor’s Action Under SARFAESI Act Abates References to AAIFR, Including Appellant Co.’s SICA Reference | HC

Latest from taxmann.

In an ever-evolving world of business and finance, the accurate and transparent presentation of financial information is of paramount importance. As companies adapt to the dynamic landscape and follow the Indian Accounting Standards (Ind AS) Schedule III, meticulous attention to the disclosure and presentation of expenses in financial statements becomes crucial. The presentation of expenses not only reflects a company’s financial performance but also demonstrates its commitment to accountability and adherence to the highest standards of financial reporting. This discussion aims to explore the key aspects of the Ind AS Schedule III checklist concerning the presentation and disclosure of expenses, providing a comprehensive guide for companies to effectively communicate their financial performance to stakeholders while ensuring compliance with the laws and regulations.

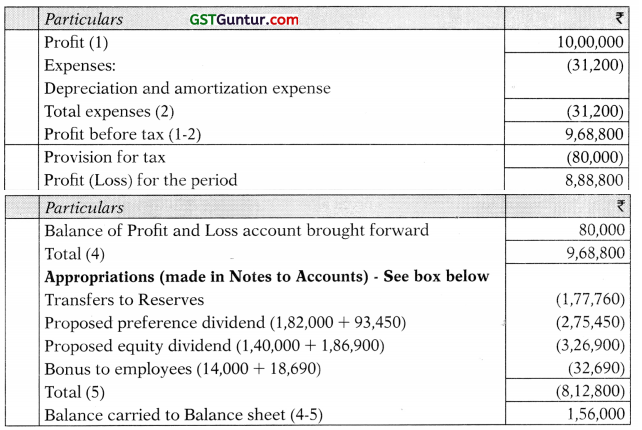

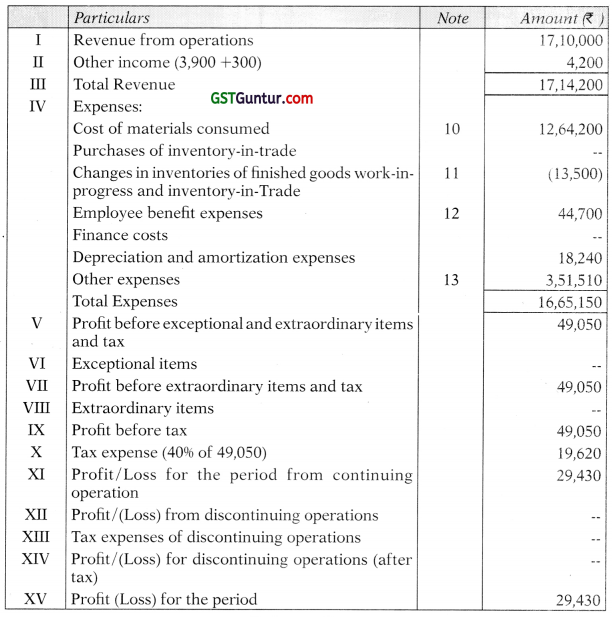

I. Whether the company has disclosed the aggregate of expenses in the face of the statement of Profit & Loss in the following manner:

a) Cost of materials consumed

b) Purchases of Stock-in-Trade

c) Changes in inventories of finished goods, work in progress, and stock in trade

d) Employee benefits expense

e) Finance costs

f) Depreciation and amortization expense

g) Other expenses

II. Whether the manufacturing company has classified raw materials, packing materials, purchased intermediates, and components consumed in the manufacturing activity under the cost of material consumed

III. Has the company excluded the internally manufactured intermediates and components from the cost of material consumed

IV. Whether the company has disclosed internally manufactured components that are sold without further processing under Finished Products

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

One thought on “Ind AS Schedule III Checklist | Presentation & Disclosure of Expenses in the Financial Statements”

This checklist for Ind AS Schedule III is extremely helpful in ensuring accurate and compliant financial reporting information. This is a valuable resource for financial professionals and businesses facing complex reporting requirements. Thank you for providing such a useful tool.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

PREVIOUS POST

To subscribe to our weekly newsletter please log in/register on Taxmann.com

Latest books.

R.K. Jain's Customs Tariff of India | Set of 2 Volumes

R.K. Jain's Customs Law Manual | 2023-24 | Set of 2 Volumes

R.K. Jain's GST Law Manual | 2023-24

R.K. Jain's GST Tariff of India | 2023-24

Everything on Tax and Corporate Laws of India

Author: Taxmann

- Font and size that's easy to read and remain consistent across all imprint and digital publications are applied

Everything you need on Tax & Corporate Laws. Authentic Databases, Books, Journals, Practice Modules, Exam Platforms, and More.

- Express Delivery | Secured Payment

- Free Shipping in India on order(s) above ₹500

- Missed call number +91 8688939939

- Virtual Books & Journals

- About Company

- Media Coverage

- Budget 2022-23

- Business & Support

- Sell with Taxmann

- Locate Dealers

- Locate Representatives

- CD Key Activation

- Privacy Policy

- Return Policy

- Payment Terms

Simplified: Concept of Deferred Tax and Its Presentation in Financial Statements

Introduction.

Deferred tax is an accounting concept that recognizes the difference between the tax expense reported in a company's financial statements and the actual taxes payable to the tax authorities. It arises due to timing differences in recognizing revenue and expenses for financial reporting purposes versus tax purposes. This article aims to simplify the concept of deferred tax and explain its presentation in financial statements.

Understanding Deferred Tax

Deferred tax arises from temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and their tax bases. These differences can be either taxable temporary differences or deductible temporary differences.

Taxable temporary differences result in higher taxable income in future periods when the carrying amount of an asset or liability exceeds its tax base. On the other hand, deductible temporary differences lead to lower taxable income in future periods when the tax base exceeds the carrying amount.

The key idea behind deferred tax is that these temporary differences will reverse over time and result in either future tax payments or tax benefits. Therefore, recognizing deferred tax allows for more accurate reporting of a company's financial performance and position.

Presentation in Financial Statements

Deferred tax is presented as a separate line item in the balance sheet and income statement of a company's financial statements. It is classified as a non-current asset or liability, depending on whether it represents a future tax benefit or obligation.

Balance Sheet Presentation

On the balance sheet, deferred tax assets and deferred tax liabilities are presented separately. A deferred tax asset represents a future tax benefit resulting from deductible temporary differences or unused tax losses or credits. It is classified as a non-current asset because it is expected to be realized beyond one year.

Conversely, a deferred tax liability represents a future tax obligation resulting from taxable temporary differences. It is also classified as a non-current liability because it is expected to be settled beyond one year.

Income Statement Presentation

Deferred tax is also reflected in the income statement. The tax expense reported in the income statement includes both the current tax expense, which is the actual tax payable based on the current year's taxable income, and the deferred tax expense or benefit.

The deferred tax expense or benefit is determined by considering the changes in deferred tax assets and liabilities during the year. If there is an increase in deferred tax assets or a decrease in deferred tax liabilities, it results in a deferred tax benefit that reduces the overall tax expense. Conversely, if there is a decrease in deferred tax assets or an increase in deferred tax liabilities, it leads to a deferred tax expense that increases the overall tax expense.

In conclusion, deferred tax is a concept that recognizes timing differences between financial reporting and tax reporting. It ensures that a company's financial statements accurately reflect the future tax consequences of these temporary differences. By presenting deferred tax as a separate line item in the balance sheet and income statement, stakeholders can gain insights into a company's tax obligations and benefits. Understanding the concept of deferred tax and its presentation in financial statements is essential for investors, analysts, and other users of financial information.

Suggestions

GST on Co-operative Housing Societies or Resident Welfare Associations CLCSS Credit-Linked Capital Subsidy Scheme GST Rate HSN Code for Aluminium and Articles thereof - Chapter 76

Related Blog Posts

Plight of Online Gaming Platforms – Assessment Under GST

Other Metal Machines - GST Rates HSN Code 8463

What is the procedure to reject the e-Way Bills?

Is Exporting Goods & Services upon payment of IGST a better option?

Featured Posts

Quick Links

Looking for a billing software.

- Submit Post

- Union Budget 2024

- CA, CS, CMA

A pocket guide on Presentation of Financial Statements (IAS 1/ Ind AS 1)

Financial statements:

♦ The presentation of financial statements is governed by both IAS 1 (International Accounting Standard 1) and Ind AS 1 (Indian Accounting Standard 1). The standards are comparable in many ways, however, there are some variances in the presentation criteria.

♦The objective of financial statements is to provide information about the financial position (Assets, Liabilities & Equity), financial performance (Income, Expenses including gains and Losses), and cash flows (Including cash equivalents) of an entity that is useful to a wide range of users in making economic decisions.

♦ Both standards require that financial statements should be prepared on the basis of the accrual principle, which means that transactions are recognized when they occur, rather than when cash is received or paid except for cash flow statements which need to be prepared based on cash principle.

Page Contents

- Components of Financial Statements:

- Key Principles:

- II. Balance sheet – Statement of financial position:

III. Statement of profit or loss and other comprehensive income:

1. statement of profit or loss:, 2. statement of other comprehensive income (oci):.

- IV. Statement of Cash Flows (IAS 7/INDAS 7):

V. Statement of Changes in Equity:

- VI. Notes to the Financial Statements:

VII. Third Balance sheet/Re-statement:

Difference between ias 1 and indas 1:, components of financial statements :.

A complete set of financial statements comprises:

1. A statement of financial position

2. A statement of profit or loss and other comprehensive income

3. A statement of changes in equity

4. A statement of cash flows

5. Notes : Significant accounting policies, judgments, assumptions, and other explanatory notes must be disclosed

6. Re-Statement/3rd Balance sheet : The balance sheet as at the beginning of the preceding period if there is a retrospective change in the accounting policy or reclassification or restatement.

Key Principles:

1. True and fair presentation and compliance with IND AS :

- Financial statements are required to be presented fairly as set out in the framework and in accordance with IND AS/IFRS and are required to comply with all the requirements of IND AS/IFRS.

- True and fair view = Compliance with applicable IND AS’s/IFRS + Additional disclosures when necessary.

2. Going concern:

- An entity neither has any intention nor has any necessity to curtail its business operations in foreseeable future. The firm will continue its operations for the next 12 months period.

- Financial statements are required to be prepared on a going concern basis (unless the entity is in liquidation or has ceased trading or there is an indication that the entity is not a going concern). Management shall make an assessment of an entity’s ability to continue as a going concern at the end of the accounting period. If material uncertainties exist on its ability to continue as a going concern, those uncertainties shall be disclosed.

3. Accrual basis of accounting:

- Recognize and record the items of revenue and expenditure as and when it is earned or incurred irrespective of the fact that when cash has been received or paid out respectively.

- Financial statements are prepared on an accrual basis (except cash flow information) to inform users not only about past transactions but also about future transactions.

4. Consistency:

- The same set of accounting principles, accounting policies, and accounting methods are followed from one accounting period to another accounting period.

- The standard requires the presentation and classification of items in financial statements to be consistent from one period to another unless:

♦ Change will result in a more appropriate presentation due to a change in entity operations or another presentation would be more appropriate having regard to criteria for selection and application of accounting policies in IND AS/IAS-8.

♦ Change required by an IND AS or IFRS standard/law .

5. Materiality:

- An entity shall present separately: Each material class of similar items shall be presented separately in the financial statements. Items of a dissimilar nature or function shall be presented separately unless they are immaterial.

- Financial statements should disclose all the items and facts which can influence the decisions taken by the users/readers of the financial statements.

6. Offsetting:

- Offsetting of assets and liabilities or income and expenses is not permitted unless required or permitted by other IND AS/IFRS.

- Offsetting is permitted when it reflects the substance of the transaction.

- Examples of offsetting :

a. Revenue recognized is after offsetting trade discounts and volume rebates. The same is allowed by IND AS/IFRS.

b. Gains/losses from the sale of non-current assets with a net of the selling expenses for the same.

c. Reporting a provisional loss net of third-party reimbursement.

7. Frequency of Reporting:

- As per IND AS 1, a complete set of financial statements should be presented at least annually. If not, then additional disclosures are required.

- When there is a change at the end of the reporting period and presents for a period longer or shorter than 1 year, an entity should disclose:

♦ Reason for using a longer or shorter period

♦ The fact that the amounts presented in the financials are not entirely comparable

8. Comparative Information:

- At least 1 year of comparative information.

- The information must be presented for the current and previous reporting period for all amounts reported in the financial statements.

- Narrative and descriptive comparative information is also required, to understand the current period’s financial statements.

- 3rd Balance sheet as at the beginning of the preceding period if there is a retrospective change in accounting policy or reclassification or restatement.

Structure and content:

I. IDENTIFICATION OF THE FINANCIAL STATEMENTS : Financial statements must be clearly identified and distinguished from other information in the same published document. The following information shall be displayed to facilitate understanding:

- Name of the reporting entity

- Whether financial statements relate to an individual entity or a group of entities

- Reporting date and reporting period

- Presentation Currency

- Level of rounding used

II. Balance sheet – Statement of financial position:

a. IND AS 1/IFRS 1 specifies that the following items, as a minimum, are presented on the face of the balance sheet. There is no prescribed order or format in which items are to be presented.

- Assets : Property, plant and equipment; investment property; intangible assets; financial assets; investments accounted for using the equity method; biological assets; deferred tax assets; current tax assets; inventories; trade and other receivables; and cash and cash equivalents

- Equity : Issued capital and reserves attributable to the parent’s owners; and non-controlling interest

- Liabilities : Deferred tax liabilities; current tax liabilities; financial liabilities; provisions; and trade and other payables

- Assets and liabilities held for sale : The total of assets classified as held for sale and assets included in disposal groups classified as held for sale; and liabilities included in disposal groups classified as held for sale in accordance with Ind AS/IFRS 105, ‘non-current assets held for sale and discontinued operations.

b. Present additional line items, headings, and subtotals when such presentation is relevant on the face of the balance sheet.

c. Present Current and Non-Current items separately

d. Deferred tax asset/liability shall be classified as Non-Current

e. Presentation

♦ Current / Noncurrent

♦ Liquidity

f. Distinction of Current / Non-Current:

Classification of asset

Classification of liability

- Report = Expenses incurred & Revenue earned

- The expenses are classified in the statement of profit and loss based on the nature of the expense.

- Line items within other comprehensive income are required to be categorized into two categories:

♦ Those that could subsequently be reclassified to profit or loss

♦ Those that cannot be re-classified to profit or loss.

- The statement of other comprehensive income represents a company’s change in equity during a specific period from transactions and events that are typically Unrealized (non-cash) gains and losses. When the gains and losses crystallize into cash (Realized), they are usually reflected on the income statement and removed from other comprehensive income.

- Other comprehensive income provides additional detail to the balance sheet’s equity section, which identifies the change in stockholder’s equity beyond the net income listed on an income statement. The statement provides details of entries in the OCI account.

- Some of the transactions included in other comprehensive income are revenue, expenses, losses and gains not realized in the income statement. The reason a company has not realized those transactions is that they have not yet been completed, such as a sale of an investment (preventing a company from paying dividends to its shareholders with the gains), but its value has changed since the acquisition.

IV. Statement of Cash Flows (IAS 7/INDAS 7):

This statement provides information about an entity’s cash inflows and outflows during the period, categorized into operating, investing, and financing activities. Please refer to my article dated 23rd March 2023.

- Total comprehensive income for the period, showing separately amounts attributable to owners of the parent and to non-controlling interests.

- For each component of equity, the effects of retrospective application/restatement are recognized in accordance with INDAS/IAS 8.

- For each component in equity, a reconciliation between the carrying amount at the beginning and end of the period, separately disclosing each change.

- Amount of dividends recognized as distributions to owners during the period in this statement or disclosed in the notes.

- Analysis of each item of OCI (alternatively to be disclosed in the notes).

VI. Notes to the Financial Statements:

Notes should contain

- A statement of compliance with IFRS/IND AS.

- A summary of significant accounting policies, estimates, assumptions, and judgments must be disclosed.

- Supporting information for the numbers presented in the financial statements, and other disclosures/additional information useful to users understanding / decision-making to be presented.

An entity shall present a third balance sheet as at the beginning of the preceding period in addition to the minimum comparative financial statements required if:

♦ It applies an accounting policy retrospectively makes a retrospective restatement of items in its financial statements, or reclassifies items in its financial statements; and

♦ The retrospective application, retrospective restatement, or reclassification has a material effect on the information in the balance sheet at the beginning of the preceding period.

- Ind AS 1 requires entities to present a statement of profit or loss and other comprehensive income, while IAS 1 allows entities to present comprehensive income in either a single statement or two separate statements.

- IAS 1 requires an entity to present an analysis of expenses recognized in profit or loss using a classification based on either their nature or their function within the equity. Ind AS 1 requires only nature-wise classification of expenses.

- IAS 1 permits the periodicity, for example, of 52 weeks for the preparation of financial statements. However, Ind AS 1 does not permit it.

- For materiality and disaggregation requirements, Ind AS 1 includes the words ‘except where required by law’.

- « Previous Article

- Next Article »

Name: Kirankumar.G

Qualification: cma, company: societe generale, location: bangalore, karnataka, india, member since: 02 jul 2019 | total posts: 4, my published posts, join taxguru’s network for latest updates on income tax, gst, company law, corporate laws and other related subjects..

- Join Our whatsApp Channel

- Join Our Telegram Group

Leave a Comment

Your email address will not be published. Required fields are marked *

Post Comment

Notice: It seems you have Javascript disabled in your Browser. In order to submit a comment to this post, please write this code along with your comment: 599219c736128dc3dcb3371b6bc3a736

Subscribe to Our Daily Newsletter

Latest posts.

AO seeking to reassess completed assessment without incriminating material is untenable: Delhi HC

Penalty u/s. 54(1)(2) not imposable when assessment is based on best judgement assessment: Allahabad HC

Traffic Hindrance Not Grounds to Refuse Permission for Political Rallies: Madras HC

HC Directs Submission of Section 80 Representation for GST Dues Installment Request

Denial of Sections 80G & 12A Registration: Kerala HC directs reconsideration of Application

Refund of 4% SAD cannot be denied for trivial procedural requirement

No coercive action on Congress till Lok Sabha polls: I-T dept to SC

GST: Personal Hearing Obligation exists despite petitioner’s Failure to Request

Madras HC Quashes GST Registration Cancellation Order- Non Filing of Returns

Madras HC Dismisses Writ Petition: Bank Account Dispute Unsuitable for Article 226

Featured posts.

Representation on deficiency in GST Portal functioning

GST recommends Extension of GSTR-1 due date to 12th April 2024

For Tax Filing – Analyze the Old and New Tax Regime

Auto-populate HSN-wise summary from e-Invoices into Table 12 of GSTR-1

Advisory on Reset and Re-filing of GSTR-3B of some taxpayers

CBDT Clarifies on Misleading Reports on HRA Claims

Financial Year end GST Checkpoints

Representation on Incorrect/Delay In Submitting Application U/S 12A(1)(ac)

Statutory and Tax Compliance Calendar for April 2024

TDS Deduction under Old vs New Tax Regime & Budget 2023 Impact

KPMG Personalization

- How companies communicate financial performance is changing

IFRS 18 aims to deliver more consistent, comparable and transparent information

- Share Share close

- Download How companies communicate financial performance is changing pdf Opens in a new window

- 1000 Save this article to my library

- Go to bottom of page

- Home ›

- Insights ›

Global IFRS Institute

A more structured income statement

MPMs – Disclosed and subject to audit

Greater disaggregation of information

- Next steps

The way companies communicate their financial performance is set to change.

Responding to investor calls for more relevant information, IFRS 18 Presentation and Disclosure in Financial Statements 1 will enable companies to tell their story better through their financial statements. Investors will also benefit from greater consistency of presentation in the income and cash flow statements, and more disaggregated information.

So what does this mean for companies’ financial reporting? Essentially, companies’ net profit will not change. What will change is how they present their results on the face of the income statement and disclose information in the notes to the financial statements. This includes disclosure of certain ‘non-GAAP’ measures – management performance measures (MPMs) – which will now form part of the audited financial statements.

IFRS 18 marks a step towards more connected reporting. Financial statements that include relevant and consistent information will afford users better information on companies’ financial performance.

IFRS 18 brings three categories of income and expenses, two income statement subtotals and one single note on management performance measures. These, combined with enhanced disaggregation guidance, set the stage for better and more consistent information for users – and will affect all companies.

Gabriela Kegalj KPMG global IFRS presentation leader

Under current IFRS ® Accounting Standards, companies use different formats to present their results, making it difficult for investors to compare financial performance across companies.

IFRS 18 promotes a more structured income statement, as set out below. In particular, it introduces a newly defined ‘operating profit’ subtotal and a requirement for all income and expenses to be allocated between three new distinct categories based on a company’s main business activities.

All companies are required to report the newly defined ‘operating profit’ subtotal – an important measure for investors’ understanding of a company’s operating results – i.e. investing and financing activities are specifically excluded. This means that the results of equity-accounted investees are no longer part of operating profit and are presented in the ‘investing’ category.

IFRS 18 also requires companies to analyse their operating expenses directly on the face of the income statement – either by nature, by function or using a mixed presentation. Under the new standard, this presentation provides a ‘useful structured summary’ of those expenses. If any items are presented by function on the face of the income statement (e.g. cost of sales), then a company provides more detailed disclosures about their nature.

Companies often use ‘non-GAAP’ information to explain their financial performance because it allows them to tell their own story and provides investors with useful insight into a company’s performance.

IFRS 18 now requires some of these ‘non-GAAP’ measures to be reported in the financial statements. It introduces a narrow definition for MPMs 2 , requiring them to be:

- a subtotal of income and expenses;

- used in public communications outside the financial statements; and

- reflective of management’s view of financial performance.

For each MPM presented, companies will need to explain in a single note to the financial statements why the measure provides useful information, how it is calculated and reconcile it to an amount determined under IFRS Accounting Standards.

To provide investors with better insight into financial performance, the new standard includes enhanced guidance on how companies group information in the financial statements. This includes guidance on whether information is included in the primary financial statements or is further disaggregated in the notes.

Companies are discouraged from labelling items as ‘other’ and will now be required to disclose more information if they continue to do so.

Now is the time to get ready to report under the new standard, which is effective from 1 January 2027 and applies retrospectively. It is available for early adoption.

- Assess the impacts on your financial statements.

- Communicate the impacts with investors.

- Consider how the new requirements impact financial reporting systems and processes.

- Monitor any changes in the local reporting landscape.

Our high-level guide, available shortly, will help you understand the new accounting standard and assess the impacts for your company. And look out for our First Impressions publication, which will provide more information on the new standard, including our detailed insight and illustrative examples.

1 IFRS 18 replaces IAS 1 Presentation of Financial Statements .

2 IFRS 18 defines management performance measures (MPMs); these measures are currently commonly known as non-GAAP measures, alternative performance measures (APMs) or key performance indicators (KPIs).

© 2024 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

The IFRS Foundation is a not-for-profit, public interest organisation established to develop high-quality, understandable, enforceable and globally accepted accounting and sustainability disclosure standards.

Our Standards are developed by our two standard-setting boards, the International Accounting Standards Board (IASB) and International Sustainability Standards Board (ISSB).

About the IFRS Foundation

Ifrs foundation governance, stay updated.

IFRS Accounting Standards are developed by the International Accounting Standards Board (IASB). The IASB is an independent standard-setting body within the IFRS Foundation.

IFRS Accounting Standards are, in effect, a global accounting language—companies in more than 140 jurisdictions are required to use them when reporting on their financial health. The IASB is supported by technical staff and a range of advisory bodies.

IFRS Accounting

Standards and frameworks, using the standards, project work, products and services.

IFRS Sustainability Disclosure Standards are developed by the International Sustainability Standards Board (ISSB). The ISSB is an independent standard-setting body within the IFRS Foundation.

IFRS Sustainability Standards are developed to enhance investor-company dialogue so that investors receive decision-useful, globally comparable sustainability-related disclosures that meet their information needs. The ISSB is supported by technical staff and a range of advisory bodies.

IFRS Sustainability

Education, membership and licensing, new ifrs accounting standard will aid investor analysis of companies’ financial performance.

You need to Sign in to use this feature

The International Accounting Standards Board (IASB) today completed its work to improve the usefulness of information presented and disclosed in financial statements. The new Standard, IFRS 18 Presentation and Disclosure in Financial Statements , will give investors more transparent and comparable information about companies’ financial performance, thereby enabling better investment decisions. It will affect all companies using IFRS Accounting Standards.

IFRS 18 introduces three sets of new requirements to improve companies’ reporting of financial performance and give investors a better basis for analysing and comparing companies:

Improved comparability in the statement of profit or loss (income statement)

Currently there is no specified structure for the income statement. Companies choose their own subtotals to include. Often companies report an operating profit but the way operating profit is calculated varies from company to company, reducing comparability. 1

IFRS 18 introduces three defined categories for income and expenses—operating, investing and financing—to improve the structure of the income statement, and requires all companies to provide new defined subtotals, including operating profit. The improved structure and new subtotals will give investors a consistent starting point for analysing companies’ performance and make it easier to compare companies.

Enhanced transparency of management-defined performance measures

Many companies provide company-specific measures, often referred to as alternative performance measures. Investors find this information useful. However, most companies don’t currently provide enough information to enable investors to understand how these measures are calculated and how they relate to the required measures in the income statement.

IFRS 18 therefore requires companies to disclose explanations of those company-specific measures that are related to the income statement, referred to as management-defined performance measures. The new requirements will improve the discipline and transparency of management-defined performance measures, and make them subject to audit.

More useful grouping of information in the financial statements

Investor analysis of companies’ performance is hampered if the information provided by companies is too summarised or too detailed. IFRS 18 sets out enhanced guidance on how to organise information and whether to provide it in the primary financial statements 2 or in the notes. The changes are expected to provide more detailed and useful information. IFRS 18 also requires companies to provide more transparency about operating expenses, helping investors to find and understand the information they need.

Andreas Barckow, IASB Chair, said:

IFRS 18 represents the most significant change to companies’ presentation of financial performance since IFRS Accounting Standards were introduced more than 20 years ago. It will give investors better information about companies’ financial performance and consistent anchor points for their analysis.

IFRS 18 is effective for annual reporting periods beginning on or after 1 January 2027, but companies can apply it earlier. Changes in companies’ reporting resulting from IFRS 18 will depend on their current reporting practices and IT systems.

IFRS 18 replaces IAS 1 Presentation of Financial Statements . It carries forward many requirements from IAS 1 unchanged. IFRS 18 is the culmination of the IASB’s Primary Financial Statements project.

Access the Standard

IFRS 18, the Illustrative Examples and the Basis for Conclusions are available to IFRS Digital subscribers. You can purchase an IFRS Digital Subscription or a PDF version of the Standard from our web shop.

- IFRS 18 Presentation and Disclosure in Financial Statements

- Basis for Conclusions —explanation of the IASB’s considerations in developing the requirements in IFRS 18

- Illustrative Examples —worked examples for aspects of IFRS 18, including flowcharts relating to key requirements in IFRS 18

Access the supporting materials

Support to implement IFRS 18 will be available via the IFRS 18 implementation webpage .

The following documents, along with IFRS 18, are available from the completed project page :

- Short video of IASB Chair Andreas Barckow summarising the new requirements

- One-page quick view of IFRS 18

- Project Summary —overview of the project in non-technical language

- Effects Analysis —description of the likely benefits and costs of IFRS 18

- Feedback Statement —summary of feedback on proposals and the IASB’s response to feedback

- Reference materials —comparison table of requirements in IAS 1 and IFRS 18 showing changes to each paragraph of IAS 1

Watch Andreas Barckow explain the new requirements to improve companies’ financial performance reporting.

1 An IASB study of 100 companies showed that over 60 reported a figure for operating profit, using at least nine different ways to calculate it.

2 The primary financial statements consist of the statement of profit or loss (income statement); statement presenting comprehensive income; statement of financial position (balance sheet); statement of changes in equity; and statement of cash flows.

Related information

IFRS Accounting Standards Navigator

Supporting implementation for IFRS 18

Primary Financial Statements project

Followable tags

Your action was not processed, please try again later

Related news

Translated versions of this story.

Brazilian Portuguese translation

French translation

Japanese translation

Simplified Chinese translation

Spanish translation

Your privacy

IFRS Foundation cookies

We use cookies on ifrs.org to ensure the best user experience possible. For example, cookies allow us to manage registrations, meaning you can watch meetings and submit comment letters. Cookies that tell us how often certain content is accessed help us create better, more informative content for users.

We do not use cookies for advertising, and do not pass any individual data to third parties.

Some cookies are essential to the functioning of the site. Other cookies are optional. If you accept all cookies now you can always revisit your choice on our privacy policy page.

Cookie preferences

Essential cookies, always active.

Essential cookies are required for the website to function, and therefore cannot be switched off. They include managing registrations.

Analytics cookies

We use analytics cookies to generate aggregated information about the usage of our website. This helps guide our content strategy to provide better, more informative content for our users. It also helps us ensure that the website is functioning correctly and that it is available as widely as possible. None of this information can be tracked to individual users.

Preference cookies

Preference cookies allow us to offer additional functionality to improve the user experience on the site. Examples include choosing to stay logged in for longer than one session, or following specific content.

Share this page

- IFRS and Corporate Reporting

IASB publishes IFRS 18 Presentation and Disclosure in Financial Statements

- Required categories and sub-totals in the statement of profit or loss: items of income and expense will be classified into operating, financing, investing, income tax or discontinued operations categories. This classification will depend on a combination of an assessment of the entity’s main business activities and certain accounting policy choices.

- Required sub-totals in the statement of profit or loss: based on an entity’s application of the classification requirements as described in #1, certain sub-totals will be required to be presented in financial statements, such as operating profit. The operating profit sub-total is now defined in IFRS 18.

- Labelling, aggregation and disaggregation: expanded requirements for labelling, aggregation and disaggregation of information in financial statements.

- Narrow scope changes to the statement of cash flows: revised requirements for how the statement of cash flow will be presented, including the classification of interest and dividend cash flows.

- Management-defined performance measures: the requirement for certain entities to include ‘management-defined performance measures’ (i.e. alternative performance measures, ‘non-GAAP measures’, etc.) in their financial statement notes, with reconciliations to the nearest IFRS-compliant sub-total. For example, ‘adjusted profit or loss’ reconciled to profit or loss.

- Popular Courses

- GST Live Course

- More classes

- More Courses

Understanding IND AS 1: Presentation of Financial Statements

Introduction

The Indian Accounting Standards (IND AS) were introduced in India in 2015, to bring greater transparency and consistency to financial reporting. One of the key standards is IND AS 1 - Presentation of Financial Statements. This standard sets out the principles and requirements for the presentation of financial statements, which are the primary means of communicating financial information to users.

Overview of IND AS 1

Scope of IND AS 1

IND AS 1 applies to all entities that prepare financial statements in accordance with IND AS. The standard sets out the requirements for the presentation of financial statements, including the balance sheet, income statement, statement of changes in equity, and statement of cash flows. It also specifies the minimum requirements for disclosures in the notes to the financial statements.

Purpose of IND AS 1

- The purpose of IND AS 1 - Presentation of Financial Statements is to ensure that financial statements provide information that is relevant, reliable, comparable, and understandable to users. This standard sets out the principles and requirements for the presentation of financial statements, which are the primary means of communicating financial information to users.

- IND AS 1 establishes the minimum requirements for the presentation of financial statements, including the balance sheet, income statement, statement of changes in equity, and statement of cash flows. It also specifies the minimum requirements for disclosures in the notes to the financial statements.

- By setting out the principles and requirements for the presentation of financial statements, IND AS 1 ensures that financial statements provide a fair and accurate representation of an entity's financial position, performance, and cash flows. This helps users to make informed decisions about the entity's financial health and prospects, and promotes transparency and accountability in financial reporting.

Key principles of IND AS 1

- Accrual Accounting: IND AS 1 requires entities to use the accrual basis of accounting to recognize revenue and expenses in the financial statements. Accrual accounting recognizes revenues and expenses when they are earned or incurred, regardless of when cash is received or paid. This provides a more accurate picture of an entity's financial performance and position.

- Going Concern Assumption: IND AS 1 assumes that an entity will continue to operate for the foreseeable future, unless there is evidence to the contrary. This allows financial statements to be prepared on a basis that assumes the entity will continue to operate, which is important for making meaningful financial projections and evaluating an entity's long-term viability.

- Consistency of Presentation: IND AS 1 requires entities to present financial statements in a consistent manner from one period to the next. This includes using consistent accounting policies, formats, and classifications. This principle ensures that users can compare an entity's financial performance and position over time and make informed decisions based on this information.

- Materiality: IND AS 1 requires entities to consider the materiality of information when presenting financial statements. Materiality refers to the significance of information in the context of the financial statements as a whole. This principle ensures that financial statements focus on information that is relevant and useful to users.

- Fair Presentation: IND AS 1 requires entities to present financial statements fairly, which means that the financial statements must be free from material misstatements and errors. Fair presentation also requires entities to provide adequate disclosures in the notes to the financial statements, which helps to ensure that users have a complete understanding of the financial statements.

Requirements of IND AS 1

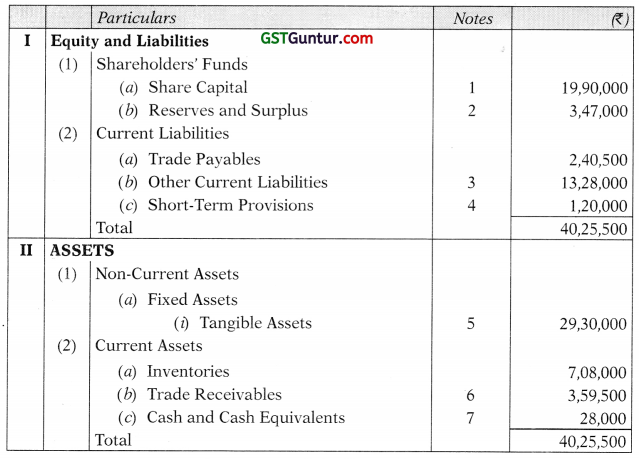

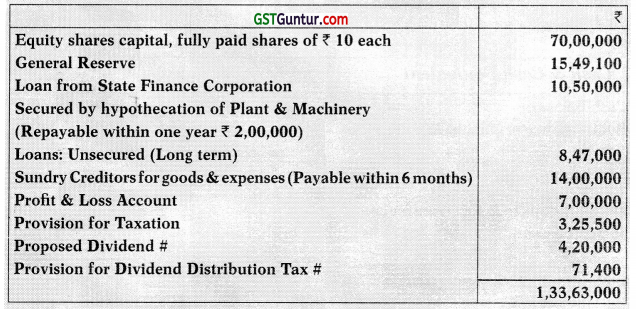

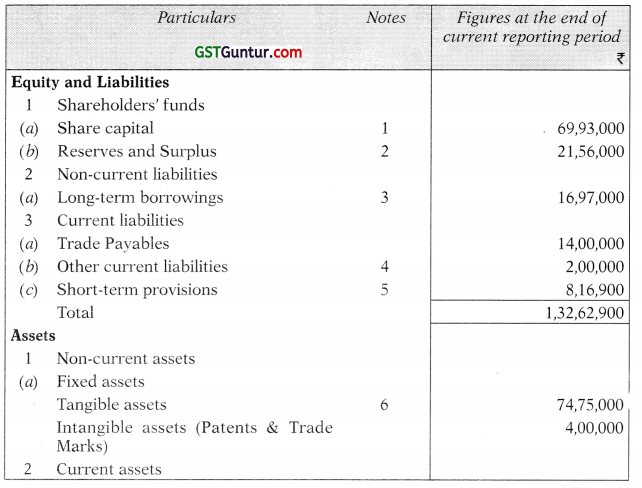

Balance sheet.

When preparing a balance sheet in accordance with IND AS, there are certain key requirements that must be met. Here is a guide to drafting a balance sheet in compliance with IND AS:

- Asset Classification: Assets should be classified as current or non-current. Current assets are those that are expected to be realized or consumed within 12 months, while non-current assets are those that are expected to be held for more than 12 months.

- Liability Classification: Liabilities should be classified as current or non-current. Current liabilities are those that are expected to be settled within 12 months, while non-current liabilities are those that are expected to be settled after more than 12 months.

- Equity: Equity should be presented separately on the balance sheet, and should include any reserves or accumulated profits. The components of equity should be clearly disclosed, including any changes in equity during the reporting period.

- Valuation: Assets and liabilities should be valued at fair value, unless the standard specifically requires a different valuation basis. Fair value is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants.

- Off-Balance Sheet Items: Off-balance sheet items should be disclosed in the notes to the financial statements. This includes any contingent liabilities or assets that may have an impact on the financial position of the entity.

- Comparative Figures: The balance sheet should include comparative figures for the previous reporting period, unless this is not practicable.

- Disclosure: The balance sheet should include adequate disclosures to enable users to understand the financial position of the entity. This includes details of significant accounting policies, estimates and judgments, and any material events or transactions that have occurred during the reporting period.

Income statement

When preparing an income statement in accordance with IND AS, there are certain key requirements that must be met. Here is a guide to drafting an income statement in compliance with IND AS:

- Revenue Recognition: Revenue should be recognized when it is earned, and it should be measured at the fair value of the consideration received or receivable.

- Cost of Sales: The cost of sales should be recognized as an expense in the same period as the related revenue is recognized.

- Operating Expenses: Operating expenses should be recognized in the period in which they are incurred, and should be classified by nature (e.g. selling and distribution expenses, administrative expenses, etc.).

- Finance Costs: Finance costs should be recognized in the period in which they are incurred, and should include interest expense on borrowings and other financing costs.

- Income Taxes: Income tax expense should be recognized in the period in which the related income is recognized, using the applicable tax rate.

- Earnings per Share: Earnings per share should be disclosed on the income statement, calculated using the weighted average number of shares outstanding during the reporting period.

- Comparative Figures: The income statement should include comparative figures for the previous reporting period, unless this is not practicable.

- Disclosure: The income statement should include adequate disclosures to enable users to understand the entity's financial performance. This includes details of significant accounting policies, estimates and judgments, and any material events or transactions that have occurred during the reporting period.

Statement of changes in equity

When preparing a statement of changes in equity in accordance with IND AS, there are certain key requirements that must be met. Here is a guide to drafting a statement of changes in equity in compliance with IND AS:

- Opening Balance: The statement should begin with the opening balance of equity at the beginning of the reporting period.

- Changes in Equity: The statement should include all changes in equity during the reporting period, including the effects of any adjustments or corrections made during the period.

- Comprehensive Income: The statement should disclose the components of comprehensive income for the reporting period, including any items of income or expense that are recognized directly in equity.

- Dividends: The statement should disclose any dividends or other distributions made during the reporting period.

- Share-Based Payments: The statement should disclose the effects of any share-based payment transactions during the reporting period.

- Reconciliation: The statement should include a reconciliation between the opening and closing balances of each component of equity, including share capital, share premium, retained earnings, and any other reserves.

- Comparative Figures: The statement should include comparative figures for the previous reporting period, unless this is not practicable.

- Disclosure: The statement should include adequate disclosures to enable users to understand the changes in equity during the reporting period. This includes details of significant accounting policies, estimates and judgments, and any material events or transactions that have occurred during the reporting period.

Statement of cash flows

When preparing a statement of cash flows in accordance with IND AS, there are certain key requirements that must be met. Here is a guide to drafting a statement of cash flows in compliance with IND AS:

- Operating Activities: The statement should begin with the net cash inflow or outflow from operating activities, which should be prepared using the indirect method.

- Investing Activities: The statement should disclose the net cash inflow or outflow from investing activities, which includes cash flows related to the acquisition and disposal of long-term assets, investments, and other financial instruments.

- Financing Activities: The statement should disclose the net cash inflow or outflow from financing activities, which includes cash flows related to the issuance and repayment of debt, equity instruments, and other financing activities.

- Reconciliation: The statement should include a reconciliation between the opening and closing balances of cash and cash equivalents, which should include the effects of exchange rate changes.

- Non-Cash Transactions: The statement should disclose any significant non-cash transactions that have affected the entity's financial position during the reporting period, such as the issuance of shares in exchange for assets or the conversion of debt into equity.

- Disclosure: The statement should include adequate disclosures to enable users to understand the entity's cash flows during the reporting period. This includes details of significant accounting policies, estimates and judgments, and any material events or transactions that have occurred during the reporting period.

Other Comprehensive Income

Other Comprehensive Income (OCI) is a reporting category in financial statements that reflects gains and losses that are not recognized in the income statement. OCI includes items that affect the financial position of a company but are not part of its normal operations. These gains and losses are usually recognized directly in equity, bypassing the income statement.

The concept of OCI is important because it allows for a more comprehensive view of a company's financial performance and position. Here are some of the items that are commonly included in OCI:

- Unrealized Gains or Losses on Available-for-Sale Securities: Companies must record any changes in the fair value of securities they hold as available for sale. These changes are recorded directly in OCI, rather than in the income statement.

- Foreign Currency Translation Adjustments: Companies that operate internationally must account for exchange rate fluctuations. OCI is used to record gains and losses that arise from these fluctuations.

- Changes in the Fair Value of Derivatives: Companies that use derivatives such as futures, options, or swaps to hedge their exposure to market risks must record any changes in the fair value of these derivatives in OCI.

- Pension Plan Gains and Losses: Companies that offer defined benefit pension plans must record any gains or losses that arise from changes in the value of plan assets or from changes in actuarial assumptions in OCI.

- Revaluation Surplus: Companies that revalue their fixed assets to reflect changes in their market value must record any resulting gains or losses in OCI.

While these items do not impact the company's bottom line, they can have a significant impact on its financial position. By recording these items in OCI, investors and analysts can get a more complete picture of the company's financial performance and position. Companies are required to disclose the items included in OCI in the notes to their financial statements, along with any tax implications of these items.

Disclosures required by IND AS

IND AS 1 requires companies to provide certain disclosures in their financial statements to ensure that users of the financial statements have a clear understanding of the company's financial position, performance, and cash flows. Here are some of the key disclosures required under IND AS 1:

- Statement of compliance: The financial statements should include a statement that they have been prepared in accordance with the requirements of IND AS.

- Significant accounting policies: The financial statements should disclose the significant accounting policies that have been used in preparing the financial statements, including any changes in those policies.

- Judgments and estimates: The financial statements should disclose any significant judgments and estimates made in the preparation of the financial statements, including the methods used to determine these estimates.

- Materiality: The financial statements should disclose any items that are considered to be material to the financial statements, either individually or in aggregate.

- Going concern: If the company's ability to continue as a going concern is in doubt, the financial statements should disclose this fact and provide any related information.

- Events after the reporting period: The financial statements should disclose any events that have occurred after the reporting period but before the financial statements are authorized for issue.

- Related party transactions: The financial statements should disclose any related party transactions that have occurred during the reporting period, including the nature of the relationship and the amounts involved.

- Segment reporting: If the company operates in multiple segments, the financial statements should disclose information about those segments, including revenue, profit or loss, assets, and liabilities.

- Earnings per share: If the company has issued equity instruments, the financial statements should disclose the earnings per share for the reporting period.

- Share capital: The financial statements should disclose information about the company's share capital, including the number of shares issued, their par value, and any changes in share capital during the reporting period.

- Cash flows: The financial statements should disclose information about the company's cash flows, including the net cash flow from operating, investing, and financing activities.

- Contingent liabilities: The financial statements should disclose any contingent liabilities, including the nature of the contingency, the likelihood of it being resolved, and the potential financial impact on the company.

These are some of the key disclosures required under IND AS 1. Companies must also provide any additional disclosures that are necessary to ensure that the financial statements provide a true and fair view of the company's financial position, performance, and cash flows.

Guidance notes on IND AS-1

The Institute of Chartered Accountants of India (ICAI) has issued a guidance note on IND AS 1, which provides additional guidance to companies in complying with the standard. The guidance note aims to provide clarity on certain aspects of IND AS 1 and help companies in preparing their financial statements.

The guidance note covers several areas such as the presentation of financial statements, the use of estimates, and the preparation of interim financial statements. It also provides examples and illustrations to help companies better understand the requirements of the standard.

One of the key aspects covered in the guidance note is the presentation of financial statements. The note provides guidance on the presentation of assets, liabilities, equity, revenue, expenses, and cash flows. It also provides guidance on the classification of items as current or non-current, the presentation of related party disclosures, and the use of fair value measurements.

Another area covered in the guidance note is the use of estimates. The note provides guidance on the use of estimates in the preparation of financial statements, including the estimation of useful lives of assets, the assessment of impairment, and the calculation of provisions.

The guidance note also provides guidance on the preparation of interim financial statements, which are financial statements prepared for a period shorter than a full financial year. The note covers the presentation of interim financial statements, the disclosure requirements for interim financial statements, and the use of estimates in the preparation of interim financial statements.

In conclusion, the guidance note on IND AS 1 provides additional guidance and clarification to companies in complying with the standard. The note covers several areas, including the presentation of financial statements, the use of estimates, and the preparation of interim financial statements. Companies can use this guidance to ensure that their financial statements comply with the requirements of IND AS 1.

IND AS 1 sets out the overall framework for financial reporting under Indian Accounting Standards (IND AS) and establishes guidelines for the preparation and presentation of financial statements. The standard provides guidance on the selection of accounting policies, the treatment of changes in accounting policies, and the presentation of comparative information in financial statements.

IND AS 1 also sets out the requirements for the presentation of financial statements, including the minimum components that must be included in the statement of financial position, the statement of profit and loss, and the statement of changes in equity. The standard also requires the disclosure of additional information in the notes to the financial statements to provide a complete understanding of the financial position and performance of the entity.

Overall, IND AS 1 plays a crucial role in enhancing transparency and consistency in financial reporting, which ultimately leads to more informed decision-making by users of financial statements. It is important for companies to comply with IND AS 1 and ensure that their financial statements are presented fairly and accurately in accordance with the standard.

Published by

CA Sanat Pyne (F.C.A. & M.COM) Category Corporate Law Report

Related Articles

Popular articles.

- Cash Transaction Limits under Income Tax Act

- 70 GST Checkpoints for Financial Year End - March 2024

- GST: Action Points of Closing of FY 2023-24

- Differentiating TDS on Rent: Section 194IB vs 195 of IT Act, 1961

- EPFO's Latest: Automatic PF Transfer for Job Switcher

- A Deep Understanding of GST Department's Guidelines on Summons

- Issuance of notice in Form GST ASMT-10

- Navigating the Labyrinth of GST Notices: A Detailed Guide on Show Cause Notices

Trending Online Classes

Live class on Bonus & Gratuity(with recording)

GST Live Certification Course (39th Batch) - April 2024 (Weekend Batch) (With Certificate)

"Live class on Python for Financial Analysis: Unlocking Efficiency in Accounting and Finance"

CCI Articles

You can also submit your article by sending to [email protected]

Browse by Category

- Corporate Law

- Info Technology

- Shares & Stock

- Professional Resource

- Union Budget

- Miscellaneous

Whatsapp Groups

Login at caclubindia, caclubindia.

India's largest network for finance professionals

Alternatively, you can log in using:

Presentation of Financial Statements – CA Inter Accounts Study Material

Presentation of Financial Statements – CA Inter Accounts Study Material is designed strictly as per the latest syllabus and exam pattern.

Presentation of Financial Statements – CA Inter Accounts Study Material

Presentation of Items In Schedule III – Division I

Question 1. (i) Vasudha Ltd. provides following information: Raw Material stock holding period: 3.5 months Work-in-progress holding period: 1 month Finished goods holding period: 4.5 months Debtors collection period: 6 months You are required to compute the operating cycle of Vasudha Ltd. What would happen if the trade payables of the company are paid in 14 months-whether these should be classified as current or non-current liability?