- REALTOR® Store

- Fostering Consumer-Friendly Real Estate Marketplaces Local broker marketplaces ensure equity and transparency. Close

- Social Media

- Sales Tips & Techniques

- MLS & Online Listings

- Starting Your Career

- Being a Broker

- Being an Agent

- Condominiums

- Smart Growth

- Vacation, Resort, & 2nd Homes

- FHA Programs

- Home Inspections

- Arbitration & Dispute Resolution

- Fair Housing

- All Membership Benefits

- NAR REALTOR Benefits® Bringing you savings and unique offers on products and services just for REALTORS®. Close

- Directories Complete listing of state and local associations, MLSs, members, and more. Close

- Dues Information & Payment

- Become a Member As a member, you are the voice for NAR – it is your association and it exists to help you succeed. Close

- Logos and Trademark Rules Only members of NAR can call themselves a REALTOR®. Learn how to properly use the logo and terms. Close

- Your Membership Account Review your membership preferences and Code of Ethics training status. Close

- Highlights & News Get the latest top line research, news, and popular reports. Close

- Housing Statistics National, regional, and metro-market level housing statistics where data is available. Close

- Research Reports Research on a wide range of topics of interest to real estate practitioners. Close

- Presentation Slides Access recent presentations from NAR economists and researchers. Close

- State & Metro Area Data Affordability, economic, and buyer & seller profile data for areas in which you live and work. Close

- Commercial Research Analysis of commercial market sectors and commercial-focused issues and trends. Close

- Statistical News Release Schedule

- Advocacy Issues & News

- Federal Advocacy From its building located steps away from the U.S. Capitol, NAR advocates for you. Close

- REALTORS® Political Action Committee (RPAC) Promoting the election of pro-REALTOR® candidates across the United States. Close

- State & Local Advocacy Resources to foster and harness the grassroots strength of the REALTOR® Party. Close

- REALTOR® Party A powerful alliance working to protect and promote homeownership and property investment. Close

- Get Involved Now more than ever, it is critical for REALTORS® across America to come together and speak with one voice. Close

- All Education & Professional Development

- All NAR & Affiliate Courses Continuing education and specialty knowledge can help boost your salary and client base. Close

- Code of Ethics Training Fulfill your COE training requirement with free courses for new and existing members. Close

- Continuing Education (CE) Meet the continuing education (CE) requirement in state(s) where you hold a license. Close

- Designations & Certifications Acknowledging experience and expertise in various real estate specialties, awarded by NAR and its affiliates. Close

- Library & Archives Offering research services and thousands of print and digital resources. Close

- Commitment to Excellence (C2EX) Empowers REALTORS® to evaluate, enhance and showcase their highest levels of professionalism. Close

- NAR Academy at Columbia College Academic opportunities for certificates, associates, bachelor’s, and master’s degrees. Close

- Latest News

- NAR Newsroom Official news releases from NAR. Close

- REALTOR® Magazine Advancing best practices, bringing insight to trends, and providing timely decision-making tools. Close

- Blogs Commentary from NAR experts on technology, staging, placemaking, and real estate trends. Close

- Newsletters Stay informed on the most important real estate business news and business specialty updates. Close

- NAR NXT, The REALTOR® Experience

- REALTORS® Legislative Meetings

- AE Institute

- Leadership Week

- Sustainability Summit

- Mission, Vision, and Diversity & Inclusion

- Code of Ethics

- Leadership & Staff National, state & local leadership, staff directories, leadership opportunities, and more. Close

- Committee & Liaisons

- History Founded as the National Association of Real Estate Exchanges in 1908. Close

- Affiliated Organizations

- Strategic Plan NAR’s operating values, long-term goals, and DEI strategic plan. Close

- Governing Documents Code of Ethics, NAR's Constitution & Bylaws, and model bylaws for state & local associations. Close

- Awards & Grants Member recognition and special funding, including the REALTORS® Relief Foundation. Close

- NAR's Consumer Outreach

- Find a Member

- Browse All Directories

- Find an Office

- Find an Association

- NAR Group and Team Directory

- Committees and Directors

- Association Executive

- State & Local Volunteer Leader

- Buyer's Rep

- Senior Market

- Short Sales & Foreclosures

- Infographics

- First-Time Buyer

- Window to the Law

- Next Up: Commercial

- New AE Webinar & Video Series

- Drive With NAR

- Real Estate Today

- The Advocacy Scoop

- Center for REALTOR® Development

- Leading with Diversity

- Good Neighbor

- NAR HR Solutions

- Fostering Consumer-Friendly Real Estate Marketplaces Local broker marketplaces ensure equity and transparency.

- Marketing Social Media Sales Tips & Techniques MLS & Online Listings View More

- Being a Real Estate Professional Starting Your Career Being a Broker Being an Agent View More

- Residential Real Estate Condominiums Smart Growth Vacation, Resort, & 2nd Homes FHA Programs View More Home Inspections

- Legal Arbitration & Dispute Resolution Fair Housing Copyright View More

- Commercial Real Estate

- Right Tools, Right Now

- NAR REALTOR Benefits® Bringing you savings and unique offers on products and services just for REALTORS®.

- Directories Complete listing of state and local associations, MLSs, members, and more.

- Become a Member As a member, you are the voice for NAR – it is your association and it exists to help you succeed.

- Logos and Trademark Rules Only members of NAR can call themselves a REALTOR®. Learn how to properly use the logo and terms.

- Your Membership Account Review your membership preferences and Code of Ethics training status.

- Highlights & News Get the latest top line research, news, and popular reports.

- Housing Statistics National, regional, and metro-market level housing statistics where data is available.

- Research Reports Research on a wide range of topics of interest to real estate practitioners.

- Presentation Slides Access recent presentations from NAR economists and researchers.

- State & Metro Area Data Affordability, economic, and buyer & seller profile data for areas in which you live and work.

- Commercial Research Analysis of commercial market sectors and commercial-focused issues and trends.

- Federal Advocacy From its building located steps away from the U.S. Capitol, NAR advocates for you.

- REALTORS® Political Action Committee (RPAC) Promoting the election of pro-REALTOR® candidates across the United States.

- State & Local Advocacy Resources to foster and harness the grassroots strength of the REALTOR® Party.

- REALTOR® Party A powerful alliance working to protect and promote homeownership and property investment.

- Get Involved Now more than ever, it is critical for REALTORS® across America to come together and speak with one voice.

- All NAR & Affiliate Courses Continuing education and specialty knowledge can help boost your salary and client base.

- Code of Ethics Training Fulfill your COE training requirement with free courses for new and existing members.

- Continuing Education (CE) Meet the continuing education (CE) requirement in state(s) where you hold a license.

- Designations & Certifications Acknowledging experience and expertise in various real estate specialties, awarded by NAR and its affiliates.

- Library & Archives Offering research services and thousands of print and digital resources.

- Commitment to Excellence (C2EX) Empowers REALTORS® to evaluate, enhance and showcase their highest levels of professionalism.

- NAR Academy at Columbia College Academic opportunities for certificates, associates, bachelor’s, and master’s degrees.

- NAR Newsroom Official news releases from NAR.

- REALTOR® Magazine Advancing best practices, bringing insight to trends, and providing timely decision-making tools.

- Blogs Commentary from NAR experts on technology, staging, placemaking, and real estate trends.

- Newsletters Stay informed on the most important real estate business news and business specialty updates.

- Leadership & Staff National, state & local leadership, staff directories, leadership opportunities, and more.

- History Founded as the National Association of Real Estate Exchanges in 1908.

- Strategic Plan NAR’s operating values, long-term goals, and DEI strategic plan.

- Governing Documents Code of Ethics, NAR's Constitution & Bylaws, and model bylaws for state & local associations.

- Awards & Grants Member recognition and special funding, including the REALTORS® Relief Foundation.

- Top Directories Find a Member Browse All Directories Find an Office Find an Association NAR Group and Team Directory Committees and Directors

- By Role Broker Association Executive New Member Student Appraiser State & Local Volunteer Leader

- By Specialty Commercial Global Buyer's Rep Senior Market Short Sales & Foreclosures Land Green

- Multimedia Infographics Videos Quizzes

- Video Series First-Time Buyer Level Up Window to the Law Next Up: Commercial New AE Webinar & Video Series

- Podcasts Drive With NAR Real Estate Today The Advocacy Scoop Center for REALTOR® Development

- Programs Fair Housing Safety Leading with Diversity Good Neighbor NAR HR Solutions

- Establishing Your Business

Quick Takeaways

- Create your brand

- Build your technology platform

- Establish a lead generation funnel

Source: 8-Steps to Start a Real Estate Brokerage & Actually Make Money ( Kyle Handy , Oct. 27, 2021)

You’ve finally made the decision to open your own brokerage. What do you need to know? Learn the steps to make a successful transition from agent to owner.

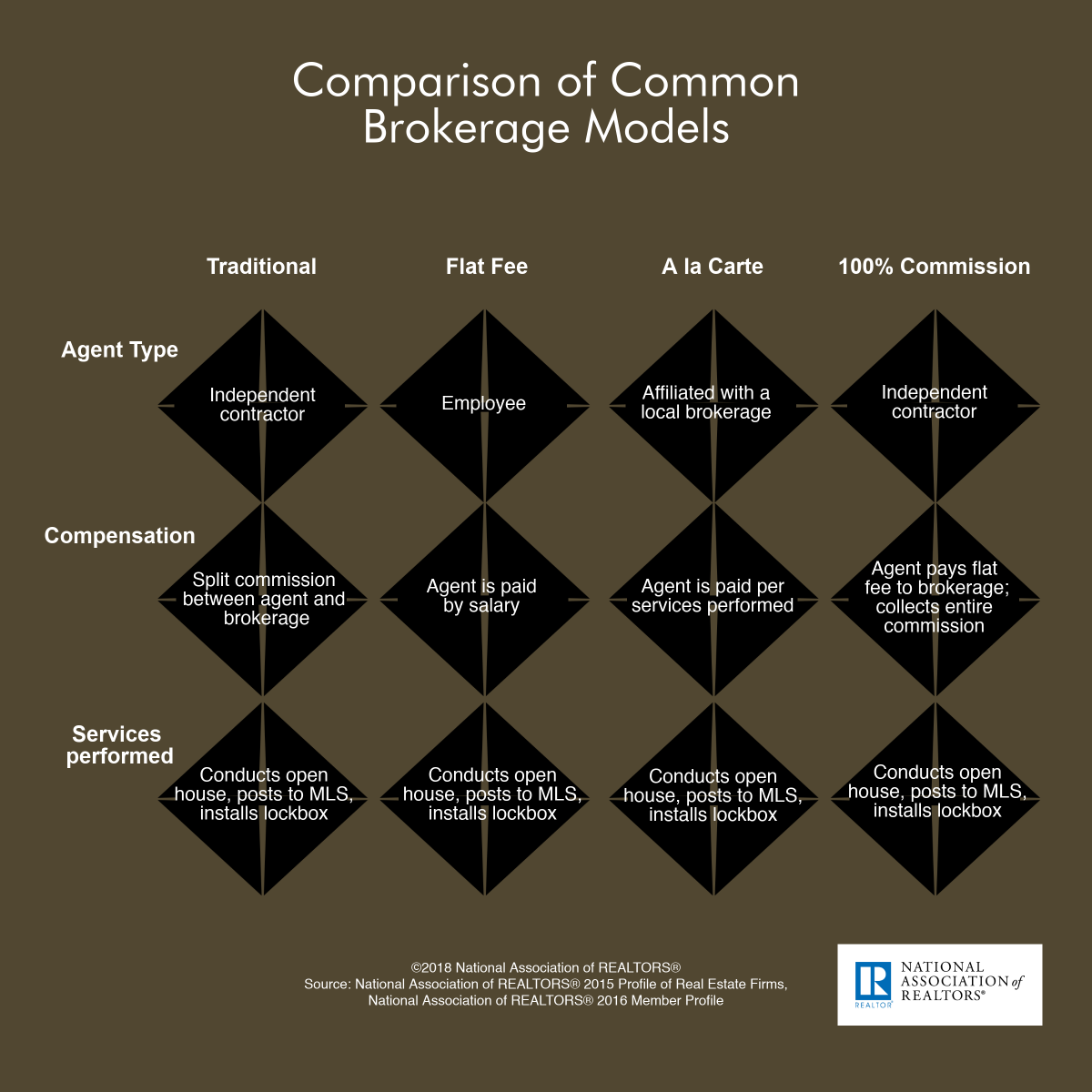

There are a variety of brokerage business models to choose from—traditional, flat fee, a la carte and 100% commission. Find out which model will work best for your brokerage. Writing a business plan allows you to create a detailed roadmap for your firm’s future and how you will achieve those plans. In your business plan, you should include financial planning, marketing strategies and hiring and personnel.

NAR has curated a list of useful websites providing more information to help you establish your new brokerage.

See References for more information.

Latest on this topic

Common Brokerage Models

Education: Management and Leadership

NAR Library & Archives has already done the research for you. References (formerly Field Guides) offer links to articles, eBooks, websites, statistics, and more to provide a comprehensive overview of perspectives. EBSCO articles ( E ) are available only to NAR members and require the member's nar.realtor login.

From the REALTOR® Store

Real Estate Brokerage Essentials® - Real Estate Brokerage Essentials®: Navigating Legal Risks and Managing a Successful Brokerage, Fourth Edition is the most comprehensive business tool for brokers to run their offices efficiently and minimize their risk for legal liability. This is a must have for all Brokers! (Item 126-359)

Broker to Broker: Management Lessons from America's Most Successful Real Estate Companies - Broker to Broker takes a unique approach to brokerage management by bringing you the ideas, strategies and lessons brokers and sales managers are implementing today. Compiled from the "For Brokers" section of REALTOR® Magazine it offers the best tips and advice on how to manage a residential real estate brokerage. (Item 141-60)

Sample Employee Manual for Brokers - Are you looking for assistance in developing an employee manual? NAR has a sample manual for you to tailor for your employees! (Item E126-155) Note: This employee manual is NOT intended to be used as a policy manual for independent contractors.

Striking Out on Your Own

5 Mistakes I Made Opening My Real Estate Brokerage ( Janis Benstock Real Estate Academy , May 25, 2023)

The best thing I ever did for the health of my brokerage was to ask for help by hiring a business strategist. It has saved me so much time on the learning curve and it’s difficult to even put a number on the return on my investment.

How to Start a Real Estate Brokerage ( TRUIC , May 11, 2023)

- Typical startup costs are:

- Real Estate Broker’s License - $1,500

- Office lease deposit - $2,000

- First month’s rent - $2,000

- Utilities, Telephone, Internet - $250 per month

- Office signage - $2,000

- Marketing expenses - $2,000 per month

- Employee expenses - (depends on the number of agents)

The 8-Step Guide to Starting a Real Estate Brokerage ( Fit Small Business , Mar. 30, 2023)

If you are a leader (a person who guides and communicates well with others), you have the first building block to being a successful broker. However, if you are the “bossy type” who likes to bark orders, tell others what to do, or believe that only your opinion counts, then being a broker is not for you.

Making the Transition From Top Producer to Broker-owner ( REALTOR® Magazine , May 4, 2021)

For other real estate practitioners thinking about making the transition from top producer to broker-owner, consider joining your local chamber of commerce. Get to know other professionals in your marketplace. Ask the chamber to support your office’s grand opening, which can help spread the word about your new brokerage and build those valuable relationships with members of the community.

How to Start a Real Estate Brokerage ( Placester )

Depending on the type of real estate brokerage you want to start, you’re looking at startup costs of at least $10,000. And that’s if you’re bootstrapping it and jumping in with the bare essentials. Thinking about opening up a brokerage under a franchise? Costs can easily hit $200,000, and that doesn’t include the ongoing fees you’ll be liable for like license renewals.

Creating a Business Plan and Choosing a Brokerage Model

7 Steps to Writing a Real Estate Business Plan (+ Worksheet) ( The Close , Apr. 17, 2023)

A killer business plan forces you to think through your goals and objectives, as well as your budget, so that you have a real chance of success right from the beginning. It keeps you realistic and establishes a way for you to clearly monitor and evaluate your success.

Creating a 2023 Real Estate Business Plan ( realtor.com® , Feb. 1, 2023)

The most important feature of the plan is that you are brutally honest with the inputs. If, for example, real estate is a part-time business for you, either by design or because your market is seasonal, recognize that this will affect all your metrics, top and bottom lines, and your expected outcomes. If, alternatively, your market is growing rapidly and you will need additional help to manage it and maintain an expected level of service, recognize that and the associated costs involved in recruiting, training. and managing new people.

What Are the Different Brokerage Models an Agent Can Choose From? ( PropStream , Jan. 4, 2023)

Taking a cue from popular subscription-based businesses in other industries (like Netflix and Spotify), subscription-based brokerages usually offer agents monthly or yearly service plans.

Agents can often choose from multiple pricing tiers based on their needs. For example, you might pay a base fee for using the brokerage as a storefront and co-working space (where you can meet clients) and a higher fee for additional access to marketing software, training, and other tools and resources.

National vs. Boutique vs. Virtual Brokerages: Which is Right for You? ( Aceable Agent , Jan. 20, 2023)

Virtual brokerages, also known as cloud brokerages, are online only with no physical location. Since most agents do the bulk of their work from a home office, a virtual brokerage makes a lot of sense. This this especially true for seasoned agents that have a large contact list and don’t need as much training.

The Ultimate Guide to Creating a Real Estate Business Plan + Free Template ( Placester )

The length of business plans vary, but they generally outline between one and five years. For our purposes, we’ve used a length of three years. Few agents are able to fully develop their business in only a year, while planning five years into the future can be very speculative. For most new agents, three years is a reasonable time frame for achieving a degree of financial success and establishing a viable career in the industry.

Most business plans fall into one of two common categories: traditional or lean startup. Traditional business plans are more common, use a standard structure, and encourage you to go into detail in each section. They tend to require more work upfront and can be dozens of pages long. Lean startup business plans are less common but still use a standard structure. They focus on summarizing only the most important points of the key elements of your plan. They can take as little as one hour to make and are typically only one page.

Useful Websites

U.S. Small Business Administration — This website should be the first stop for anyone wanting to start a business. Topics covered include startup basics, writing a business plan, financing, marketing, employment, and tax topics. This site also has special areas for women business owners, veterans, minorities, Native Americans and young entrepreneurs. You can also find a local SBA office for further assistance.

SCORE Association — SCORE, the nation’s largest network of volunteer, expert business mentors, is dedicated to helping small businesses get off the ground, grow and achieve their goals. Since 1964, we have provided education and mentorship to more than 11 million entrepreneurs.

Entrepreneur Magazine — From choosing a business structure to naming your business, this website highlights the nitty-gritty basics of business star-ups. How-to guides, online newsletters and a resource center of articles provide helpful information for your start-up.

Inc.com — Inc.'s website provides information on starting, growing, and leading your business.

America’s Small Business Development Centers ( SBDC) — America’s SBDC represents America’s nationwide network of Small Business Development Centers (SBDCs) – the most comprehensive small business assistance network in the United States and its territories. There are nearly 1,000 local centers available to provide no-cost business consulting and low-cost training to new and existing businesses. Small business owners and aspiring entrepreneurs can go to their local SBDCs for FREE face-to-face business consulting and at-cost training on a variety of topics.

Minority Business Development Agency - MBDA is an agency of the U.S. Department of Commerce that promotes the growth of minority-owned businesses through the mobilization and advancement of public and private sector programs, policy, and research.

National Association of Women Business Owners (NAWBO) — NAWBO is the only dues-based organization representing the interests of all women entrepreneurs across all industries; and with chapters across the country. With far-reaching clout and impact, NAWBO is a one-stop resource to propelling women business owners into greater economic, social and political spheres of power worldwide.

Books, eBooks & Other Resources

Ebooks.realtor.org.

The following eBooks and digital audiobooks are available to NAR members:

18 Steps for Starting Your Business (eBook)

The Accidental Startup (eBook)

Business Made Simple (Audiobook)

Business Plans Kit for Dummies (eBook)

Business Plans That Work: A Guide for Small Business (eBook)

The Complete Idiot's Guide to Starting Your Own Business (eBook)

The Fearless Woman's Guide to Starting a Business (Audiobook)

How to Write a Business Plan (eBook)

How to Write a Business Plan (EBSCO eBook)

Launching While Female (eBook)

The Real Estate Entrepreneur: Everything You Need to Know to Grow Your Own Brokerage (eBook)

Six Steps to Small Business Success (eBook)

Start a New Real Estate Brokerage, Economically! (eBook)

Starting a Business for Dummies (eBook)

Write Your Business Plan (eBook)

Your First Business Plan (eBook)

Books, Videos, Research Reports & More

As a member benefit, the following resources and more are available for loan through the NAR Library. Items will be mailed directly to you or made available for pickup at the REALTOR® Building in Chicago.

Real Estate Brokerage: A Management Guide (Chicago: Dearborn, 2004) HF 1375 C99 Ed. 6

Have an idea for a real estate topic? Send us your suggestions .

The inclusion of links on this page does not imply endorsement by the National Association of REALTORS®. NAR makes no representations about whether the content of any external sites which may be linked in this page complies with state or federal laws or regulations or with applicable NAR policies. These links are provided for your convenience only and you rely on them at your own risk.

Free Download

Real Estate Brokerage Business Plan Template

Download this free real estate brokerage business plan template, with pre-filled examples, to create your own plan..

Or plan with professional support in LivePlan. Save 50% today

Available formats:

What you get with this template

A complete business plan.

Text and financials are already filled out and ready for you to update.

- SBA-lender approved format

Your plan is formatted the way lenders and investors expect.

Edit to your needs

Download as a Word document and edit your business plan right away.

- Detailed instructions

Features clear and simple instructions from expert business plan writers.

All 100% free. We're here to help you succeed in business, no strings attached.

Get the most out of your business plan example

Follow these tips to quickly develop a working business plan from this sample.

1. Don't worry about finding an exact match

We have over 550 sample business plan templates . So, make sure the plan is a close match, but don't get hung up on the details.

Your business is unique and will differ from any example or template you come across. So, use this example as a starting point and customize it to your needs.

2. Remember it's just an example

Our sample business plans are examples of what one business owner did. That doesn't make them perfect or require you to cram your business idea to fit the plan structure.

Use the information, financials, and formatting for inspiration. It will speed up and guide the plan writing process.

3. Know why you're writing a business plan

To create a plan that fits your needs , you need to know what you intend to do with it.

Are you planning to use your plan to apply for a loan or pitch to investors? Then it's worth following the format from your chosen sample plan to ensure you cover all necessary information.

But, if you don't plan to share your plan with anyone outside of your business—you likely don't need everything.

More business planning resources

How to Create a Business Plan Presentation

Business Plan Template

10 Qualities of a Good Business Plan

Simple Business Plan Outline

How to Start a Business With No Money

Industry Business Planning Guides

How to Write a Business Plan for Investors

How to Write a Business Plan

Download your template now

Need to validate your idea, secure funding, or grow your business this template is for you..

- Fill-in-the-blank simplicity

- Expert tips & tricks

We care about your privacy. See our privacy policy .

Not ready to download right now? We'll email you the link so you can download it whenever you're ready.

Download as Docx

Download as PDF

Finish your business plan with confidence

Step-by-step guidance and world-class support from the #1 business planning software

From template to plan in 30 minutes

- Step-by-step guidance

- Crystal clear financials

- Expert advice at your fingertips

- Funding & lender ready formats

- PLUS all the tools to manage & grow

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

How to Start a Stock Brokerage Firm

Stock brokerage firms are a bridge between retail investors and public companies and allow smooth, fast trading of securities. They help create and maintain the secondary market and liquidity for investors and companies. Finally, they hold investments inside of retirement plans for individuals and companies.

Learn how to start your own Stock Brokerage Firm and whether it is the right fit for you.

Ready to form your LLC? Check out the Top LLC Formation Services .

Start a stock brokerage firm by following these 10 steps:

- Plan your Stock Brokerage Firm

- Form your Stock Brokerage Firm into a Legal Entity

- Register your Stock Brokerage Firm for Taxes

- Open a Business Bank Account & Credit Card

- Set up Accounting for your Stock Brokerage Firm

- Get the Necessary Permits & Licenses for your Stock Brokerage Firm

- Get Stock Brokerage Firm Insurance

- Define your Stock Brokerage Firm Brand

- Create your Stock Brokerage Firm Website

- Set up your Business Phone System

We have put together this simple guide to starting your stock brokerage firm. These steps will ensure that your new business is well planned out, registered properly and legally compliant.

Exploring your options? Check out other small business ideas .

STEP 1: Plan your business

A clear plan is essential for success as an entrepreneur. It will help you map out the specifics of your business and discover some unknowns. A few important topics to consider are:

What will you name your business?

- What are the startup and ongoing costs?

- Who is your target market?

How much can you charge customers?

Luckily we have done a lot of this research for you.

Choosing the right name is important and challenging. If you don’t already have a name in mind, visit our How to Name a Business guide or get help brainstorming a name with our Stock Brokerage Firm Name Generator

If you operate a sole proprietorship , you might want to operate under a business name other than your own name. Visit our DBA guide to learn more.

When registering a business name , we recommend researching your business name by checking:

- Your state's business records

- Federal and state trademark records

- Social media platforms

- Web domain availability .

It's very important to secure your domain name before someone else does.

Want some help naming your stock brokerage firm?

Business name generator, what are the costs involved in opening a stock brokerage firm.

Startup expenses vary, but FINRA will require at least $100,000, but may require up to $150,000 in capital reserves for your firm. Add to this the cost for state registration, consultants, salaries for your employees, and deposits for clearing firms, and you may find starting your own brokerage firm in your state can cost between $200,000 and $300,000 or more.

What are the ongoing expenses for a stock brokerage firm?

Ongoing expenses are mostly regulatory, including licensing and compliance training and testing (continuing education). However, there are also the normal office expenses, including utilities, paper and office supplies, and labor costs. In total, these costs can range from $2,000 to $5,000 per year for a very small firm, and typically cost up to 35% of total revenue for mid to large firms .

Who is the target market?

Preferred clients are high net worth or ultra high net worth clients. Minimum assets of $500,000 to $1 million are preferred. Poor clients are those with few or no assets to manage.

How does a stock brokerage firm make money?

This business makes money primarily by gathering assets under management (AUM). Brokerage firms typically charge a fee as a percentage of these assets. In addition to the fee, some brokerage firms also charge a flat fee per account.

A brokerage firm typically charges a fee against assets under management. For example, a broker-dealer may charge 2% of assets under management. On a client portfolio worth $100,000, this would amount to an annual fee of $2,000. Brokerages may also charge a flat fee for financial planning services. For example, a comprehensive financial plan can cost clients between $2,000 and $10,000. Modular financial plans can cost between $500, and $1,500.

Finally, a brokerage can charge clients a per-hour fee for consultations that fall outside of the normal scope of financial planning work. College planning would be an example of services that fall outside of conventional financial planning. While financial planning does recognize the role of planning for a child's education, usually this area is treated as supplemental to the core planning services, which include retirement planning.

In-depth college planning may involve researching schools, financial aid programs, helping parents set up 529 plans and alternative funding for college, researching grants and loans for parents and preparing a customized solution for their child.

How much profit can a stock brokerage firm make?

Average profit margins in the financial services industry hover around 14%, with some firms making as little as 5% and others, 40% or more. Ensemble firms average 20% profit margins.

How can you make your business more profitable?

Specialization can make a huge difference in income potential. Advisors and brokerage firms that cater to specific types of clients can charge more money. Another way brokerages can earn more is by specializing in specific types of investments and then charging more money for advice about those investments.

For example, an investment firm that specializes in precious metals and mining companies can gain a competitive advantage over others who only deal with more mainstream investments. Investors looking for these types of alternative investments are also usually more willing to pay more for specialized advice on these investments.

Want a more guided approach? Access TRUiC's free Small Business Startup Guide - a step-by-step course for turning your business idea into reality. Get started today!

STEP 2: Form a legal entity

The most common business structure types are the sole proprietorship , partnership , limited liability company (LLC) , and corporation .

Establishing a legal business entity such as an LLC or corporation protects you from being held personally liable if your stock brokerage firm is sued.

Form Your LLC

Read our Guide to Form Your Own LLC

Have a Professional Service Form your LLC for You

Two such reliable services:

You can form an LLC yourself and pay only the minimal state LLC costs or hire one of the Best LLC Services for a small, additional fee.

Recommended: You will need to elect a registered agent for your LLC. LLC formation packages usually include a free year of registered agent services . You can choose to hire a registered agent or act as your own.

STEP 3: Register for taxes

You will need to register for a variety of state and federal taxes before you can open for business.

In order to register for taxes you will need to apply for an EIN. It's really easy and free!

You can acquire your EIN through the IRS website . If you would like to learn more about EINs, read our article, What is an EIN?

There are specific state taxes that might apply to your business. Learn more about state sales tax and franchise taxes in our state sales tax guides.

STEP 4: Open a business bank account & credit card

Using dedicated business banking and credit accounts is essential for personal asset protection.

When your personal and business accounts are mixed, your personal assets (your home, car, and other valuables) are at risk in the event your business is sued. In business law, this is referred to as piercing your corporate veil .

Open a business bank account

Besides being a requirement when applying for business loans, opening a business bank account:

- Separates your personal assets from your company's assets, which is necessary for personal asset protection.

- Makes accounting and tax filing easier.

Recommended: Read our Best Banks for Small Business review to find the best national bank or credit union.

Get a business credit card

Getting a business credit card helps you:

- Separate personal and business expenses by putting your business' expenses all in one place.

- Build your company's credit history , which can be useful to raise money later on.

Recommended: Apply for an easy approval business credit card from BILL and build your business credit quickly.

STEP 5: Set up business accounting

Recording your various expenses and sources of income is critical to understanding the financial performance of your business. Keeping accurate and detailed accounts also greatly simplifies your annual tax filing.

Make LLC accounting easy with our LLC Expenses Cheat Sheet.

STEP 6: Obtain necessary permits and licenses

Failure to acquire necessary permits and licenses can result in hefty fines, or even cause your business to be shut down.

Federal Business Licensing Requirements

Guide to Broker-Dealer Registration

State & Local Business Licensing Requirements

Certain state permits and licenses may be needed to operate a stock brokerage firm. Learn more about licensing requirements in your state by visiting SBA’s reference to state licenses and permits .

Most businesses are required to collect sales tax on the goods or services they provide. To learn more about how sales tax will affect your business, read our article, Sales Tax for Small Businesses .

Certificate of Occupancy

A stock brokerage firm can be run out of a storefront. Businesses operating out of a physical location typically require a Certificate of Occupancy (CO). A CO confirms that all building codes, zoning laws and government regulations have been met.

- If you plan to lease office space :

- It is generally the landlord’s responsibility to obtain a CO.

- Before leasing, confirm that your landlord has or can obtain a valid CO that is applicable to a stock brokerage firm.

- After a major renovation, a new CO often needs to be issued. If your place of business will be renovated before opening, it is recommended to include language in your lease agreement stating that lease payments will not commence until a valid CO is issued.

- If you plan to purchase or build office space :

- You will be responsible for obtaining a valid CO from a local government authority.

- Review all building codes and zoning requirements for you business’ location to ensure your stock brokerage firm will be in compliance and able to obtain a CO.

STEP 7: Get business insurance

Just as with licenses and permits, your business needs insurance in order to operate safely and lawfully. Business Insurance protects your company’s financial wellbeing in the event of a covered loss.

There are several types of insurance policies created for different types of businesses with different risks. If you’re unsure of the types of risks that your business may face, begin with General Liability Insurance . This is the most common coverage that small businesses need, so it’s a great place to start for your business.

Another notable insurance policy that many businesses need is Workers’ Compensation Insurance . If your business will have employees, it’s a good chance that your state will require you to carry Workers' Compensation Coverage.

FInd out what types of insurance your Stock Brokerage Firm needs and how much it will cost you by reading our guide Business Insurance for Stock Brokerage Firm.

STEP 8: Define your brand

Your brand is what your company stands for, as well as how your business is perceived by the public. A strong brand will help your business stand out from competitors.

If you aren't feeling confident about designing your small business logo, then check out our Design Guides for Beginners , we'll give you helpful tips and advice for creating the best unique logo for your business.

Recommended : Get a logo using Truic's free logo Generator no email or sign up required, or use a Premium Logo Maker .

If you already have a logo, you can also add it to a QR code with our Free QR Code Generator . Choose from 13 QR code types to create a code for your business cards and publications, or to help spread awareness for your new website.

How to promote & market a stock brokerage firm

Marketing your business is usually done in stages. Since it’s almost impossible to start your own brokerage firm without having previously worked for another broker-dealer, most principals already come to their own business with a book of business. Marketing usually involves reaching out to existing clientele for referrals. However, compliance-approved marketing materials may also allow you to do targeted direct mail, online advertising, and email marketing.

How to keep customers coming back

Charge less in fees or offer more services than other firms. Since broker-dealers are prohibited from making explicit service or investment return claims, you must get creative in how you differentiate yourself. For example, you could offer potential customers free supplemental services that you used to charge money for. You could also give clients the option of a free concierge service, where they have greater access to you during off-hours.

STEP 9: Create your business website

After defining your brand and creating your logo the next step is to create a website for your business .

While creating a website is an essential step, some may fear that it’s out of their reach because they don’t have any website-building experience. While this may have been a reasonable fear back in 2015, web technology has seen huge advancements in the past few years that makes the lives of small business owners much simpler.

Here are the main reasons why you shouldn’t delay building your website:

- All legitimate businesses have websites - full stop. The size or industry of your business does not matter when it comes to getting your business online.

- Social media accounts like Facebook pages or LinkedIn business profiles are not a replacement for a business website that you own.

- Website builder tools like the GoDaddy Website Builder have made creating a basic website extremely simple. You don’t need to hire a web developer or designer to create a website that you can be proud of.

Recommended : Get started today using our recommended website builder or check out our review of the Best Website Builders .

Other popular website builders are: WordPress , WIX , Weebly , Squarespace , and Shopify .

STEP 10: Set up your business phone system

Getting a phone set up for your business is one of the best ways to help keep your personal life and business life separate and private. That’s not the only benefit; it also helps you make your business more automated, gives your business legitimacy, and makes it easier for potential customers to find and contact you.

There are many services available to entrepreneurs who want to set up a business phone system. We’ve reviewed the top companies and rated them based on price, features, and ease of use. Check out our review of the Best Business Phone Systems 2023 to find the best phone service for your small business.

Recommended Business Phone Service: Phone.com

Phone.com is our top choice for small business phone numbers because of all the features it offers for small businesses and it's fair pricing.

Is this Business Right For You?

This business is ideal for individuals who are good with math and finance, have a passion for helping others meet financial goals, and are good with money. This business may require long hours, especially in the early years of the business. And, while weekend and holidays are typically “non trading days,” many brokerage firm owners do work weekends completing paperwork or meeting with clients.

Want to know if you are cut out to be an entrepreneur?

Take our Entrepreneurship Quiz to find out!

Entrepreneurship Quiz

What happens during a typical day at a stock brokerage firm?

Day-to-day activities of a brokerage firm owner include contacting clients, overseeing employees, possibly managing special high net worth client funds, preparing financial plans for his book of business, meeting with compliance officers, approving marketing campaigns, meeting with internal and external wholesalers, and running financial analyses.

What are some skills and experiences that will help you build a successful stock brokerage firm?

You must be a Registered Investment Advisor before you can make any investment recommendations to clients. You also need to become a fiduciary for all investment accounts you manage. State exams may be part of this process, but most investment advisors are regulated at the federal level, directly under the Securities and Exchange Commission.

Knowledge of financial modeling, risk management, and investing is essential, as is portfolio management. Managerial experience is required by the Financial Industry Regulatory Authority (FINRA). If you do not have an experienced Principal on your management team, it’s unlikely your application for your own broker-dealer will be approved.

What is the growth potential for a stock brokerage firm?

Growth potential for a brokerage firm depends entirely on assets under management. Large firms, like Merrill Lynch hold trillions of dollars in assets. However, small firms may only hold several million. Brokerages are typically run by a manager with several brokers or investment advisors working for the firm.

TRUiC's YouTube Channel

For fun informative videos about starting a business visit the TRUiC YouTube Channel or subscribe to view later.

Take the Next Step

Find a business mentor.

One of the greatest resources an entrepreneur can have is quality mentorship. As you start planning your business, connect with a free business resource near you to get the help you need.

Having a support network in place to turn to during tough times is a major factor of success for new business owners.

Learn from other business owners

Want to learn more about starting a business from entrepreneurs themselves? Visit Startup Savant’s startup founder series to gain entrepreneurial insights, lessons, and advice from founders themselves.

Resources to Help Women in Business

There are many resources out there specifically for women entrepreneurs. We’ve gathered necessary and useful information to help you succeed both professionally and personally:

If you’re a woman looking for some guidance in entrepreneurship, check out this great new series Women in Business created by the women of our partner Startup Savant.

What are some insider tips for jump starting a stock brokerage firm?

Focus on a niche market and outcompete your competition by offering value-added services. It’s not enough anymore to advertise your investment services. Clients today expect full-service financial planning.

How and when to build a team

Building a team is never necessary, beyond your core admin team, but may be done when you outgrow your ability to service existing clients. A typical mid-sized brokerage firm will employ at least a dozen investment advisors. Even a small brokerage will need, at minimum, a compliance officer and possibly several principals with experience running a broker-dealer firm, and support staff to process paperwork and make appointments.

Useful Links

Industry opportunities.

- Schwab Franchise Opportunity

- Financial Industry Regulatory Authority

- National Association of Stockbrokers

Real World Examples

- Example of a Big Business

- Example of a Small Business

Further Reading

- Tips for Becoming a DIY Broker

- Pros & Cons of Starting This Business

Have a Question? Leave a Comment!

Real Estate | How To

8-step Guide to Starting a Real Estate Brokerage

Updated March 1, 2024

Updated Mar 1, 2024

Published March 30, 2023

Published Mar 30, 2023

REVIEWED BY: Gina Baker

WRITTEN BY: Theresa Landicho

This article is part of a larger series on How to Become a Real Estate Agent .

- 1. Determine if You’re Ready & Understand Your Why

- 2. Meet Your State’s Requirements

3. Conduct Market Research

- 4. Develop a Business Plan

5. Locate an Office Space for Your Team

- 6. Determine Your Staffing Needs & Hire a Strong Team

7. Market Your Brokerage

8. generate new business leads, bottom line.

If you are a self-starter with an incredible work ethic and can bring out the best in other real estate agents, you may be the perfect candidate for starting a real estate brokerage. You will be required to have real estate experience and complete additional training, and will also need to develop business plans, build a team, create your own brand, and organize finances. This will establish you as a broker-owner.

Before you read the eight steps of starting your own brokerage, make sure you’re up to the task by taking our quick quiz:

Are you ready to start your own real estate brokerage?

How many years have you been in the real estate industry.

Question 1 of 4

1 minute approx

How many real estate transactions have you completed?

Question 2 of 4

Do you have a business plan prepared that includes operations, finances, accounting, lead generation, and marketing?

Question 3 of 4

Are you a market expert?

Question 4 of 4

1. Determine if You’re Ready to Start a Brokerage & Understand Your Why

While opening a real estate office can be a rewarding experience in your career , real estate agents need to determine if they’re ready to embark on this journey and understand why they want to take on this next venture.

There are significant benefits to starting a real estate brokerage, but also there can be a lot of downsides if you’re not prepared.

Before weighing the pros and cons of starting a brokerage, agents should uncover their own personal motivations. Below are some questions real estate agents must ask themselves before starting an independent real estate brokerage:

- Are you a leader or a boss? Successful brokers are leaders who guide and communicate well, not bossy types who dominate and ignore others’ opinions. Leaders inspire trust and respect, fostering a productive and positive work environment.

- Do you need constant control? Brokers should allow agents freedom within legal and protocol boundaries, encouraging independent problem-solving without needing constant approval. This autonomy boosts agent confidence and fosters creativity in serving clients.

- Are you organized? Operating both front- and back-ends requires strong organization and systems for smooth business operations while allowing flexibility for agents. Effective organization also ensures that client needs are met promptly and efficiently.

- Do you have strong communication skills? Effective communication with agents, staff, clients, and peers is crucial for guidance, mentorship, and strategy sharing. Clear and open communication builds strong relationships and ensures everyone is aligned with the brokerage’s goals.

- Are you passionate about real estate? A successful brokerage demands time, effort, and passion for real estate to overcome challenges and setbacks. This passion is contagious, motivating your team and attracting clients who value your enthusiasm and commitment.

- Do you have a unique vision for your clients? In a competitive real estate market, having a unique value proposition is key to long-term success. Your vision should address specific client needs and market gaps, setting your brokerage apart from competitors.

- Could you achieve similar success by forming a team within another brokerage? Starting your own comes with financial and operational challenges. Agents seeking to focus on real estate with a team might find it more practical to join an existing brokerage, reducing overhead and operational complexities while focusing on client service and team dynamics.

When asking yourself these questions to understand your personal motivation to start a business, the reason behind why you want to start a real estate brokerage will be a guiding motivator to taking the first step.

2. Meet Your State’s Requirements for Starting a Real Estate Brokerage

An essential step in how to start a brokerage firm is ensuring you meet your state’s eligibility requirements. Typically, real estate agents who want to learn how to start a real estate brokerage must take additional classes, practice for a specific number of real estate hours, and pass the broker licensing exam. Education requirements range from 24 to 336 hours, depending on your state.

For example, California and New York have substantially different requirements for agents to get their brokerage licenses. See the differentiating factors between the two below:

Once you obtain your broker’s license, you must also comply with all state regulations regarding brokerages. For example, some states, like Nebraska and New Mexico, will require brokers to have a specific type of insurance or a physical office location. These requirements can change constantly, so all brokers must stay updated with the changes in their state laws.

Kaplan course demo (Source: YouTube )

Another way to stay current with changing state regulations is through continuing education courses. Brokers can take continuing education courses through online providers like Kaplan. It offers traditional learning, online learning, and self-paced course formats. Continuing education courses can be purchased in bundled packages or as individual courses, depending on how many credit hours you need.

Visit Kaplan

For specific information on broker licensing requirements in your state, visit our article How to Become a Real Estate Broker in 6 Steps .

Once you’ve pinpointed your motivator for starting your own real estate brokerage and completed licensing requirements, research your location and competition to evaluate the success rate of opening a brokerage in your desired area. Understand whether the area you’re located in is saturated with too many real estate brokerages and if there is enough housing demand to supply you with business to sustain your team.

To begin your research, agents can look at the data for the area they are interested in opening a real estate brokerage. Use Google or the National Association of Realtors directories to search for members or state and local associations.

It’s also necessary to evaluate if your brokerage will be able to cater to the chosen target market in your area. For example, you want to open a luxury real estate brokerage, but you discover the supply of luxury properties is limited in your area, which should cause you to reconsider your position. Understanding the target markets allows you to build your business and refine your marketing message.

Another consideration is the option between opening a franchise or an independent brokerage. Purchasing a franchise brokerage, like Keller Williams or Coldwell Banker, will give you pre-established features like branding, training, and marketing. However, buying a franchise can have starting costs of around $200,000.

The cheaper option is starting an independent brokerage. This will give you more control over your business, and you’ll be responsible for establishing your brand through advertising, marketing, and lead generation efforts. Although it will take longer for you to establish yourself in the community, and starting out will be tough, you will have complete autonomy over your business.

For more market insights, read through the following articles:

- 20 Most Crucial Real Estate Statistics in 2023

- 18 Essential Real Estate Lead Generation Statistics 2023

- 17 Vital Real Estate Marketing Statistics 2023

4. Develop a Real Estate Brokerage Business Plan

Developing a real estate business plan for your new brokerage is a crucial step to starting a real estate brokerage. This business plan will help you identify your goals, predict any challenges that may occur, and determine where the business opportunities are. This business plan will position your brokerage for long-term success and help you manage business growth. Here are a few important components you should take note of in how to open a real estate brokerage:

- A mission and vision statement: These statements outline your company’s purpose, values, and long-term goals.

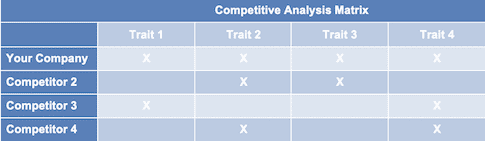

- Develop a SWOT analysis: SWOT stands for strengths, weaknesses, opportunities, and threats. The strengths and weaknesses are an internal assessment of your brokerage, while opportunities and threats take into account external factors.

- Identify your competitive advantage: It’s important to clearly outline why and how your business differs from the rest of the competition in your market.

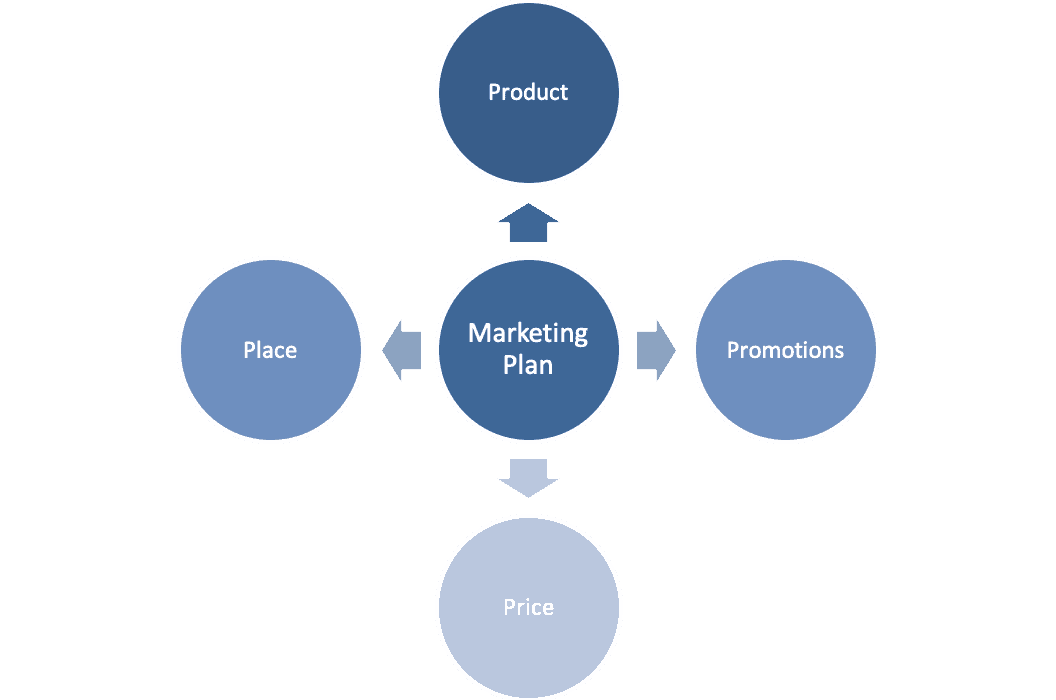

- Create a marketing and sales strategy: This outlines how you will attract clients and promote your business for financial growth.

- Identifying your niche: This will help you establish your expertise and draw attention from clients looking for someone who specializes in that niche.

The biggest difference between a real estate agent’s business plan versus a brokerage business plan is the expected finances of running a real estate brokerage. Outlining these financials clearly will help you align with your financial goals. Here is a breakdown of the expenses it’s essential to include in your plan:

For a deeper understanding of creating a real estate business plan, check out How to Write a Real Estate Business Plan: Elements, Examples & Free Template (+ Goal Calculator) . Agents can apply the same concept to their brokerage business as to their individual agent business.

When building a brokerage, brokers must decide whether they will have a brick-and-mortar office location or a virtual office. A physical office location makes it easier to develop a team culture and oversee your brokerage operations, whereas agents who choose a virtual office will save on overhead and office expenses. There are many pros and cons to each office type.

- Physical Office

- Virtual Office

Physical office space for your agents to work at or your clients to come to visit for meetings. Brick-and-mortar offices usually have reception areas, conference rooms, and other amenities to support the needs of agents and clients.

Some advantages and disadvantages of having a physical office:

Having a virtual office model allows agents to work remotely without a physical office space. Since you will not be providing your team with a physical space, your agents must have access to a suite of online tools and resources like virtual meeting software, document management systems, and online marketing platforms.

Some advantages and disadvantages of having a virtual office:

Ultimately, the decision to have a physical office or virtual office will depend on the type of brokerage you want to have and if you have the budget for it. You could consider a hybrid option with a smaller space or a space within a coworking building. Before finalizing your decision, make sure you’ve considered factors like location, size, costs, and amenities for each office option.

6. Determine Your Staffing Needs & Hire a Strong Team

As a brokerage owner, you must provide your team with careful planning, strategic recruiting, and ongoing support and training. Brokerage owners must give their team tools to support their individual agent’s business efforts, like access to lead generation software, customer relationship management (CRM) software , email, etc. With larger responsibilities, you must also build a team to delegate some of your responsibilities.

Some of the employee roles within a brokerage include the following positions:

- Real estate agents

- Listings manager

- Trainer/Development

- Transaction manager

- Administration

- Technical support

- Customer relationship management (CRM) system manager

Hiring New vs Experienced Real Estate Agents

Recruiting and retaining great agents will be the key to building a successful brokerage. Since real estate brokerages make money based on their agent’s deals, you want to make sure you have the right agents in place who will continuously contribute to your business income.

During the hiring process, consider factors like experience, skills, and fit with your business culture. You want to hire real estate agents for your team who share the same vision and value as your company. Some brokerages offer incentives to help hire and retain top talents, like increased commission splits, a team structure, training, and support from a dedicated admin.

Brokerage owners should consider whether they want to hire new talent or experienced agents. Here are some pros and cons of hiring new versus experienced agents:

Hiring Full-time vs Part-time Employees

Unlike real estate agents who are independent contractors, full-time employees work at least 40 hours per week. They receive benefits such as health insurance, paid time off, and retirement savings in compliance with state regulations.

Part-time employees may not have access to all these benefits. When hiring, consider your budget, needs, and growth plan. Full-time employees offer stability and commitment, ideal for roles requiring a high level of expertise. However, part-time employees can offer flexibility and cost savings, beneficial during growth phases.

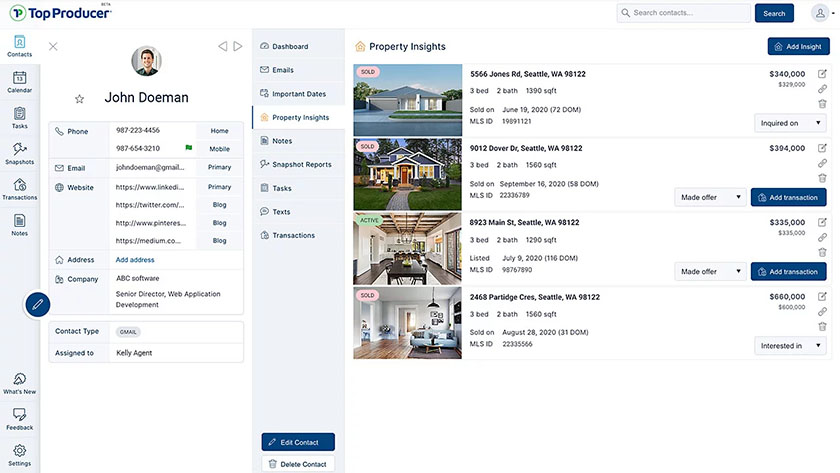

Real estate CRM (Source: Top Producer )

One solution to manage a team’s productivity is by implementing a robust customer relationship manager (CRM) like Top Producer. The platform helps agents connect with their leads through workflows and task reminders. The system also offers shared access to contacts, communication, and calendars so brokers and team leaders can view their team’s sales pipeline. Top Producer does have a real estate transaction management solution to help teams stay organized and store transactional information post-deal closure.

Visit Top Producer

Now that you have a brokerage name, an office, and team members, you want to market your brokerage so everyone is aware of your new business. Successful brokerage owners with a strong brand identity and great reputation can turn that into generating leads for their businesses. Agents should create a real estate marketing plan to help guide their marketing efforts and increase market awareness.

Below are some elements to effectively market your brokerage and increase your exposure:

- Develop a brand: To set your business apart from other brokerages in similar markets, brokerages should have their own brand identity. This includes having a creative brokerage name , defined logo, color scheme, and clear messaging that reflects your value and service offering.

- Build a website: Ensure a strong online presence with a website that highlights your brand, products, and services, catering to your target audience. A search engine-optimized website improves visibility, attracting prospective clients and potential agents.

- Leverage social media: Utilize platforms like Facebook, Twitter, and LinkedIn for exposure, ensuring your profiles reflect your brand. Share content and engage with prospective clients on these social media platforms .

- Network and collaborate: Attend local and industry events to grow your network and discuss your business. This helps in generating leads and brand exposure. Always bring business cards and follow up with contacts after the event.

- Invest in advertising: Use channels like online ads, billboards, and print mailers to generate sales leads. Ensure budget allocation toward effective mediums and track lead sources for optimal spending and a better understanding of where your leads come from.

- Provide excellent customer service: One of the best lead sources in real estate is through referral business . Make sure to always ask your clients for referrals. When you provide great customer service, your clients will want to share the same experience with their own personal networks.

Real estate postcards (Source: ProspectsPLUS! )

Marketing your new real estate business with a mix of branding, digital marketing, networking, and customer service will give your brand exposure and bring in new business. Use ProspectsPLUS! to execute timely mailers with their targeted mailing lists or by using your contacts. The platform has a campaign feature that allows you to send a series of mailers at set times, so you don’t have to remember to manually send them.

Visit ProspectsPLUS!

As a final step in learning how to start a real estate brokerage, you must provide sources of paid and organic leads to support your agents. This is especially important if you have new and inexperienced agents on your team who do not have an established sphere of influence.

Brokerages that provide leads or provide platforms that offer lead generation can have a larger commission split to the brokerage to help cover those costs. If you have an established CRM that can route and identify leads according to lead source, that will help you determine which splits to include for each closed deal.

Each lead generation tool has different pricing options that can be personalized to fit your budget and the needs of your agents. Most brokerages will tend to have multiple platforms that provide agents with leads. These lead generation tools provide a valuable supplement to your existing marketing and networking efforts:

Frequently Asked Questions (FAQs)

Is it hard to start your own brokerage.

Yes. Understanding how to start a brokerage reveals that it is challenging due to financial, regulatory, and market-related hurdles. It demands a profound real estate market knowledge, considerable upfront capital for startup costs, and a comprehensive business plan. Entrepreneurs embarking on this journey must navigate complex legal and regulatory frameworks that vary by state to ensure compliance. Additionally, establishing a reputation and building a client base in such a competitive industry requires dedication.

Are brokerage firms profitable?

Yes. Brokerage firms can be highly profitable, but their success depends on various factors such as market conditions, the firm’s business model, and operational efficiency. Profitability is influenced by the firm’s ability to generate consistent commission income, manage expenses, and adapt to changing market dynamics. Successful brokerages often have a strong client base, offer diverse services, and utilize technology effectively to maximize operational efficiency and client satisfaction.

Who is the richest real estate broker?

Pinpointing the richest real estate broker is challenging due to the private nature of individual wealth and the fluctuating real estate market. However, high-profile figures like Stephen Ross, founder of Related Companies, and Gary Keller, co-founder of Keller Williams Realty, are among the wealthiest individuals in the real estate industry. Their wealth is not solely from brokerage operations but also investments, development projects, and ownership stakes in various real estate ventures.

How to start your own brokerage can be tough and rewarding at the same time. By knowing what starting your own brokerage entails and carefully planning and executing strategies, real estate brokers can feel confident they have the tools to create long-term success in the real estate industry.

About the Author

Find Theresa On LinkedIn

Theresa Landicho

Esa is a real estate staff writer at Fit Small Business. In 2023, she was accredited as a licensed sales agent in the Philippines. Esa is knowledgeable about real estate, including topics on real estate education and real estate lead generation and marketing. She loves how vast the industry is, and that there’s always something to learn.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

Business Partner Magazine

Tips and advice for entrepreneurs, start-ups and SMEs

The Ultimate Guide on How to Start a Brokerage Business

October 17, 2019 by BPM Team

Click here to get this post in PDF

Too long to read? Enter your email to download this post as a PDF. We will also send you our best business tips every 2 weeks in our newsletter. You can unsubscribe anytime.

Have you ever wondered how brokerage firms are started?

Brokerage companies have played an important role in the economy for decades because they’ve allowed businesses to earn a lot of money. With a brokerage firm, investors can buy and sell stocks, exchange currencies, and invest in mutual funds.

Unlike most businesses, brokerage firms don’t require you to sell a product to find success. Providing that you are properly equipped, you’ll be able to earn income from commission thanks to your platform. This means that you need a certain amount of money before you can operate. If you need cash to get this done, it may be time to find out how title loans work .

Read on to learn more about how to start a brokerage business.

What Is a Brokerage Firm?

A brokerage company is where people go to buy and sell stocks. They act as the middleman between buyers and sellers, providing a universal platform where people can trade.

Brokerage companies typically earn compensation by charging a commission on transactions. For example, a transaction fee is charged whenever an investor buys a stock. This allows brokerage companies to continue operating while making investing convenient.

In the past, brokerage firms were only accessible by visiting the physical location. Today, almost all transactions take place via the internet through websites and applications. This makes trading more efficient, especially for those that day trade. Do you know the minimum deposit needed to start trading? Check fpmarkets minimum deposit for more info.

Creating a Plan

To start a brokerage firm, you’ll need to create a plan and stick with it. This guide will help you come up with a plan, but there are several things you need to consider before starting one.

One of the most important things is that you’ll need to save money beforehand so that you have enough to invest. Starting a brokerage firm will require you to get licenses and a facility before you can operate.

Office Space

You’ll need to look into real estate of the location that you’d like to have your office at. A startup brokerage firm will not require a large facility. Providing that you have an office large enough for several employees, you’ll be able to operate when you start.

Earning Income

Aside from thinking about where you’d like to go, you must decide who your target audience is. While all brokerage firms are for trading, some firms are better than others in certain areas.

If you’re someone that wants to create a firm for day traders , you’ll need to think about how you’ll attract new day traders and earn income. Day trading consists of buying and selling several times within a day. This can cost new traders a lot because of the commission fees, pushing them away from your firm.

You can offer flat rates for your service or various options for traders of all backgrounds. There are already numerous well-established brokerage firms, so you’ll need to please a wider audience.

B2Broker offers a variety of options for launching a brokerage with expert guidance and experience to help you every step of the way.

Establishing Your Firm

When you’ve purchased an office to operate out of and have decided how you’ll earn income, the next step is to establish your firm. One of the things that many people ask when wondering how to start a brokerage firm is how to get their name out in the public.

What you’ll need to do is reserve a name with the Financial Industry Regulatory Authority (FINRA). FINRA is responsible for regulating brokerage firms and exchange markets.

You’ll then have to get an accounting system that meets their requirements. Depending on how large your firm will be, you must meet a net capital requirement. This means that you need a certain amount of money before you can operate.

Getting Licensed

FINRA requires that brokerage firms have two managers for the firm. To get registered, you have to complete a background check and the firm must follow several security regulations.

“A FINRA Rule 3110(e) background check will investigate and verify the applicant’s good character, business reputation, financial background, and qualifications,” according to Tsion Chudnovsky , a professional license attorney at Chudnovsky Law. “FINRA utilizes fingerprint screening to verify criminal records. Some of the information about applicants will become publicly available through the FINRA BrokerCheck system.”

If you’re starting a small brokerage firm, you can apply to operate with a single registered manager. To do this, you’ll have to fill out a waiver request that can be found on FINRA’s website .

How to Be a Stockbroker

Becoming a stockbroker typically requires individuals to get a bachelor’s degree. The reason for this being that FINRA requires everyone within a firm to follow the same regulations in terms of understanding the market, no matter the position.

It’s common for those that are becoming stockbrokers to complete internships. This ensures that they’re aware of how brokerage firms operate, making it easier for them to get a stock broker’s license.

Stockbroker requirements typically consist of having a degree in finance or business, experience in the field, and passing tests relating to the market.

Stockbrokers are responsible for trading stocks for clients. They’re important when it comes to things like mutual funds because mutual funds are bought by investors that don’t want to manage their stocks.

The main goal of a stockbroker, in the case of mutual funds, is to buy and sell stocks in areas where they’ll earn their client’s money. They usually have a general return rate, giving clients a good idea of how much money they can expect to earn.

Start a Brokerage Business Today

If you’re interested in trading, you can make a living out of it by starting a brokerage business. Brokerage firms will allow you to earn passive income from traders as they buy and sell investments.

Learning how to start a brokerage firm is as simple as creating a plan, getting licensed, and following FINRA’s requirements. Providing that you have enough money to start, you can quickly open a brokerage firm and start earning money.

Browse our blog to receive more business advice to help you make smart investments.

You may also like: A Guide For Investment Methods

Image source: stock.adobe.com

[…] our wide variety of business services, you will be able to design your own business plan and be able to start your own brokerage in no time. From marketing strategies to CRM and innovative […]

We earn commissions if you shop through the links on this page.

Digital Marketing Agency

Business Partner Magazine provides business tips for small business owners (SME). We are your business partner helping you on your road to business success.

Have a look around the site to discover a wealth of business-focused content.

Here’s to your business success!

Item added to your cart

Here is a free business plan sample for a mortgage brokerage firm.

Embarking on a journey as a mortgage broker can be both exciting and daunting, especially if you're unsure about the first steps to take.

In the content that follows, we will present you with a comprehensive business plan tailored specifically for mortgage brokers.

As an aspiring entrepreneur in the financial sector, you're likely aware that a meticulously formulated business plan is crucial for laying the foundation of a successful practice. It serves as a roadmap, guiding you through the intricacies of the industry while setting clear objectives and strategies.

To streamline your planning process and get started on the right foot, feel free to utilize our mortgage broker business plan template. Our team of professionals is also on standby to provide a free review and fine-tuning of your plan.

How to draft a great business plan for your mortgage brokerage firm?

A good business plan for a mortgage broker must be tailored to the nuances of the mortgage industry.

To start, it's crucial to provide a comprehensive overview of the mortgage market. This includes up-to-date statistics and an analysis of emerging trends in the industry, similar to what we've included in our mortgage broker business plan template .

Your business plan should articulate your vision clearly. Define your target market (such as first-time homebuyers, property investors, or those refinancing) and your unique value proposition (expertise in specific loan types, personalized service, etc.).

Market analysis is a key component. You need to understand the competitive landscape, regulatory environment, and the needs and behaviors of potential clients.

For a mortgage broker, it's important to outline the range of mortgage products and services you plan to offer. Describe how these will cater to the diverse needs of your clientele, such as fixed-rate mortgages, adjustable-rate mortgages, government-backed loans, and refinancing options.

The operational plan should detail your brokerage's structure, including your office location, the technology you will use for loan processing, your network of lenders, and your approach to client consultations and application processing.

Compliance with financial regulations and maintaining a high standard of ethical practices should be emphasized in your plan.

Discuss your marketing and client acquisition strategies. How will you build trust and establish a reputation in the market? Consider your approach to networking, partnerships, online marketing, and customer service excellence.

Incorporating digital strategies, such as a professional website, online application tools, and a social media presence, is vital in the modern marketplace.

The financial section is critical. It should include your startup costs, revenue projections, operating expenses, and the point at which you expect to become profitable.

As a mortgage broker, understanding your commission structures and potential volume bonuses is essential for accurate financial forecasting. For assistance, you can refer to our financial forecast for a mortgage brokerage .

Compared to other business plans, a mortgage broker's plan must pay special attention to industry-specific regulations, the importance of building strong relationships with lenders, and strategies for maintaining a steady flow of clients.

A well-crafted business plan will not only help you clarify your strategies and goals but also serve as a tool to attract investors or secure lines of credit.

Lenders and investors will look for a thorough market analysis, realistic financial projections, and a clear plan for client engagement and compliance.

By presenting a detailed and substantiated business plan, you showcase your professionalism and dedication to the success of your brokerage.

To achieve these goals efficiently, you can fill out our mortgage broker business plan template .

A free example of business plan for a mortgage brokerage firm

Here, we will provide a concise and illustrative example of a business plan for a specific project.

This example aims to provide an overview of the essential components of a business plan. It is important to note that this version is only a summary. As it stands, this business plan is not sufficiently developed to support a profitability strategy or convince a bank to provide financing.

To be effective, the business plan should be significantly more detailed, including up-to-date market data, more persuasive arguments, a thorough market study, a three-year action plan, as well as detailed financial tables such as a projected income statement, projected balance sheet, cash flow budget, and break-even analysis.

All these elements have been thoroughly included by our experts in the business plan template they have designed for a mortgage broker .

Here, we will follow the same structure as in our business plan template.

Market Opportunity

Market data and figures.

The mortgage brokerage industry is a vital component of the real estate sector, facilitating a significant volume of home loans every year.