- Learning Center

- Trading Account

How to Create a Commodity Trading Business Plan

The roadmap to your commodity trading plan.

Commodity trading, like any other form of investing, can make or break your financial future. If you're new to commodity trading, it's important to realize that, unlike other forms of investing, there's little regulation on commodity trading and no clear path that most traders follow in their careers.

Commodity trading can be complex, but it doesn't have to be difficult. If you start with the right plan that lays out your strategies and goals, you'll have the structure you need to learn from your mistakes and continue towards success in the industry.

What is Commodity Trading?

Invest right, invest now.

Open a FREE* Demat + Trading account and enjoy

Zero commission* on Mutual Funds and IPO

₹20* per order on Equity, F&O, Commodity and Currency

Enter your mobile number to continue

*By signing up you agree to our Terms and Conditions

The two most common ways to trade commodities are futures and options contracts. When you trade futures, you agree to buy or sell a commodity for delivery in the future. The commodity trading time in India is from 9 AM to 11:3 PM.

Define Your Goals

Your commodity trading plan should be based on your specific goals. Perhaps you want to trade for income or to speculate on price movements. Maybe you want to hedge your physical holdings or trade for capital gains. Define your goals before starting to trade to develop a plan that fits those objectives.

Next, assess your personality type: Do you like taking risks? Are you interested in analyzing supply and demand fundamentals? Do you prefer to use technical analysis techniques? Once again, this step is about defining what suits your trading style best. Finally, analyze the time commitment: If time is an issue, opt for less frequent trades instead of day-trading .

Develop Your Strategy

Now that you know what a commodity trading plan is and why you need one, it's time to develop your strategy. Here are a few steps to get you started:

- Figure out what commodities you want to trade. Research and identify which commodities fit your trading style and risk tolerance.

- Decide how you're going to trade. There are a few different ways to trade commodities, so make sure you choose the method that best suits your needs. If you're an active trader who likes to take high risks and place many trades, then day trading may be right for you. If you have more capital or prefer slower-paced trades with less risk, then maybe investing in futures contracts would be better for you.

- Define your expectations. What do you hope to achieve by starting this new business? How much money do you want to earn? By when? What kind of trader do you want to be? Day Trader? Swing Trader? Part-time Trader? Long-Term Trader? Day traders typically hold positions from 30 minutes to three days, while swing traders hold positions from three days up to six months. No matter the trader you decide to be, make sure you define your expectations before moving forward!

Find the Right Commodity Broker

Not all commodity brokers are created equal. To find the right one for you, do your research and ask around. Make sure to look at their track record, fees, and the products they offer. Once you've found a few brokers that seem promising, open up a demo trading account with each one and test them out.

See which one you're most comfortable with before making a decision. As far as which commodities to trade, it depends on what your goals are. For example, if you want stability but don't want exposure to the price fluctuations of gold or silver, trading agricultural commodities like corn or wheat may be more suitable for you.

If you want more risk exposure but also want exposure to gold or silver (or other precious metals), then trading these commodities may be better suited for your needs.

Develop a Risk Management Strategy

A well-defined risk management strategy is critical to the success of any commodity trading plan. There are a variety of risks inherent in trading commodities, so it's important to identify the ones that pose the biggest threat to your success and develop a plan to mitigate them. It is recommended to start with your ability to maintain liquidity.

If you can't meet margin calls or pay off debts as they come due, you could be forced into bankruptcy. Second on my list would be market risk, which includes exposure to changes in prices and volatility of commodities markets as well as interest rates for borrowing money (the cost).

Third is transaction costs, which refer to commissions and the spread between the buy and sell price you'll incur when executing trades.

Set Up Your Commodity Trading Account

Before starting trading commodities, you need to set up a commodity trading account . This account will be used to hold your funds and will be where you execute your trades.

To set up an account, you'll need a broker that offers commodity trading. You'll then need to open an account and deposit funds. Once your account is funded, you're ready to start trading.

Start to Trade

When you first start trading commodities, it's important to have a plan in place. This plan will be your roadmap, guiding you through the market and helping you make decisions along the way. What do you want from this trade? What kind of risk can you take? How much money are you looking to invest? How long are you willing to hold on before selling?

These are all questions that should be answered before making any moves. It may seem like a lot of work at first, but once you have a system in place, it will become easier each time.

Now that you know the steps in creating a commodity trading plan, it's time to start. Remember that your plan will evolve as you gain experience and learn more about the markets.

The important thing is to get started and stay disciplined. A well-thought-out trading plan can give you the structure and discipline you need to succeed in the commodities markets.

Explore More Fundamentals

It should be noted that there is no special software required to use these templates. All business plans come in Microsoft Word and Microsoft Excel format. Each business plan features:

- Excecutive Summary

- Company and Financing Summary

- Products and Services Overview

- Strategic Analysis with current research!

- Marketing Plan

- Personnel Plan

- 3 Year Advanced Financial Plan

- Expanded Financial Plan with Monthly Financials

- Loan Amortization and ROI Tools

- FREE PowerPoint Presentation for Banks, Investors, or Grant Companies!

1.0 Executive Summary

The purpose of this business plan is to raise $5,000,000 for the development of a commodities trading firm while showcasing the expected financials and operations over the next three years. The Commodities Trading Inc. (“the Company”) is a New York based corporation that will actively trade hard commodities and currencies among the many exchanges within the United States and abroad. The Company was founded in 2008 by John Doe.

1.1 Products and Services

The primary revenue center for the business will come from the direct trading of commodities including corn, oil, precious metals, and currencies on a day to day basis. The Company, through its established relationships with commodities brokers, will be able to amplify its returns through the use of significant leverage for the commodities purchased using the firm’s capital. The business expects that it will use 1:5 leverage on all commodities trades executed by the Company. The Company’s secondary stream of income will be derived from interest generated on capital held from short sales that are used in conjunction with the Company’s trading operations. Interest income will generate approximately 30% of the Commodities Trading Firm’s aggregate revenue. The third section of the business plan will further describe the investment management services offered by the Commodities Trading Firm.

1.2 The Financing

At this time, the Company is seeking to raise $5,000,000 for the development of the Commodity Trading Firm’s operations. Mr. Doe is seeking to sell a 75% ownership interest in the business in exchange for this capital. 90% of the invested capital will be used for direct investments into the firm’s commodity trading operations.

1.3 Mission Statement

Management’s mission is to develop the Commodities Trading Firm into a middle market investment company that specializes in trading specific agricultural, oil, and precious metal commodities with the intent to realize small, but continuous profits on a daily basis.

1.4 Mangement Team

The Company was founded by John Doe. Mr. Doe has more than 10 years of experience in the commodities trading industry. Through his expertise, he will be able to bring the operations of the business to profitability within its first year of operations.

1.5 Sales Forecasts

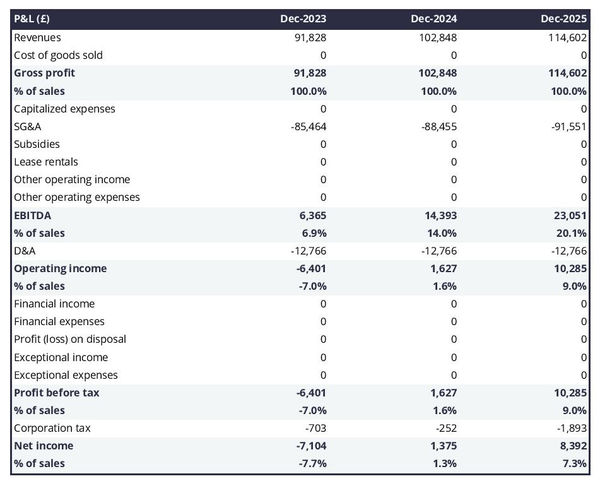

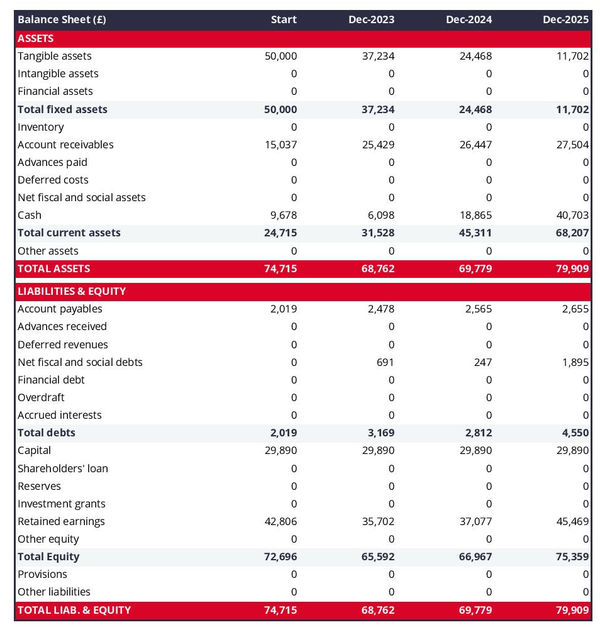

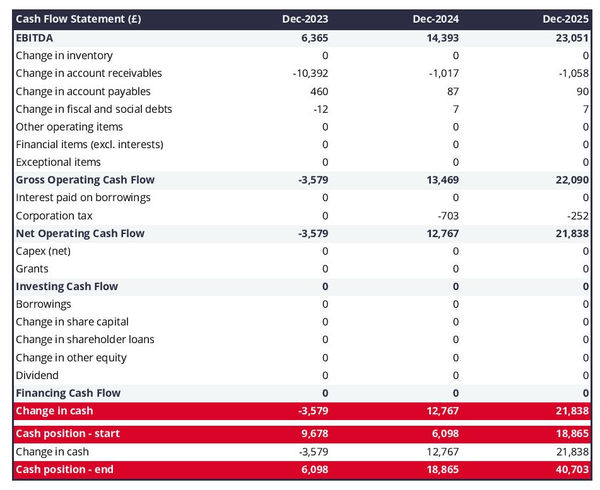

Mr. Doe expects a strong rate of growth at the start of operations. Below are the expected financials over the next three years.

1.6 Expansion Plan

The Company will to undergo an aggressive expansion after the successful completion of the initial capital raising period. As the laws that govern investment pools for commodities trading are different than those for general securities dealers/traders, the business may be able to solicit capital from the general public in a similar capacity to that of a registered investment advisory. Mr. Doe is currently investigating how the business can expand once trading operations commence.

2.0 Company and Financing Summary

2.1 Registered Name and Corporate Structure

Commodities Trading Firm, Inc. The Company is registered as a corporation in the State of New York.

2.2 Required Funds

At this time, the Commodities Trading Firm requires $5,000,000 of equity funds. Below is a breakdown of how these funds will be used:

2.3 Investor Equity

At this time, Mr. Doe is seeking to sell a 75% interest in the Commodities Trading Firm in exchange for the capital sought in this business plan. Please reference the Company’s private placement memorandum regarding more information regarding the Company’s fee and ownership structure.

2.4 Management Equity

John Doe currently owns 100% of the Commodities Trading Firm, Inc.

2.5 Exit Strategy

Management has planned for two possible exit strategies that would yield significant capital appreciation for the Company’s Management Team and Investors. First, the business could be sold in its entirety to a third party entity. At this point, Management would most likely leave the Company to pursue other ventures. The second exit strategy would be to engage a secondary capital raising that would allow Management and Investors to cash out a portion of the equity built into the business while concurrently providing the firm with more capital for trading. This exit strategy would still require that Management operate the firm on a day to day basis, so in actuality it is only a partial exit strategy. However, by raising a secondary or tertiary round of capital, the business could easily expand to become a much larger trading firm after the third year of operations.

3.0 Products and Services

As stated in the executive summary, the business intends to actively trade contracts, swaps, and options related to commodities including agricultural commodities, oil, precious metals, and currencies. The Company, prior to the onset of operations, will develop brokerage relationships with major commodities brokers that will place and manage trades on behalf of the Company. The business will specially select brokers that can offer the commodities trading firm prime brokerage capabilities which include expanded leverage for the Company’s investments. As discussed earlier, the Company intends to use conservative 1:5 leverage for most of its trades. However, most exchanges permit the use of 1:20 leverage for certain commodities. Currency trading can often provide leverage of 1:50 and up to 1:100 leverage depending on the type of trade. Management will only use larger amounts of leverage when the underlying commodities have been properly hedged using counteracting options. One of the primary strategies that the Commodities Trading Firm intends to engage will be delta neutral trading, which will allow the business to actively purchase options while currently hedging the values of the Company’s commodity portfolios. Delta neutral trading allows the firm to generate revenues on commodities (these types of trades are available on all commodities) trading simply through the volatility of the underlying positions. With the pace of inflation increasing significantly in the last year, Management sees a significant opportunity to develop substantial profit streams through volatility style trading rather than attempting to determine the direction of any given market.

4.0 Strategic and Market Analysis

4.1 Economic Outlook

This section of the analysis will detail the economic climate, the commodities trading industry, the customer profile, and the competition that the business will face as it progresses through its business operations. Currently, the economic market condition in the United States is in recession. This slowdown in the economy has also greatly impacted real estate sales, which has halted to historical lows. Many economists expect that this recession will continue until mid-2009, at which point the economy will begin a prolonged recovery period. Inflation is somewhat of a concern for the Company. As the inflation rate decreases, the purchasing power parity of the American dollar decreases in relation to other currencies. This may pose a risk to the Company should rampant inflation, much like the inflation experienced in the late 1970s, occur again. This event would significant weaken the Company’s ability to borrow funds (should the need arise), but it could also severely impact the gross margins of the business. After the business begins to trade in excess of $20,000,000 per year in revenues, the business may solicit a currency based investment bank to hedge against inflationary risks. This risk has been faced by many companies over the last five years as the value of the Euro/Yuan/Yen has appreciated significantly in its relation to the American dollar.

4.2 Industry Analysis

The financial services sector has become one of the fastest growing business segments in the U.S. economy. Computerized technologies allow financial firms to operate advisory and brokerage services anywhere in the country. In previous decades, most financial firms needed to be within a close proximity to Wall Street in order to provide their clients the highest level of service. This is no longer the case as a firm can access almost every facet of the financial markets through Internet connections and specialized trading and investment management software. With these advances, several new firms have been created to address the needs of people in rural and suburban areas. Within the United States, there are approximately 2,000 companies that independently trade futures and commodities contracts with the intent to generate a profit. Each year, these firms aggregately generate more than $25 billion of revenue while concurrently providing $10 billion of payrolls (including bonuses). More than 60,000 people are employed by the industry.

4.3 Customer Profile

As the Company intends to operate its trading operations via the free trading markets within the US and internationally, the Company will not directly have “customers.” In a sense, the customers of this firm are its investors as the Company is trying to develop a wealth and income creating vehicle for them and the Senior Management Team. However, and in the future, the Company may expand its capital base by soliciting additional investments from the general public. In this instance, the Company would need to register itself as a CTA firm with the Commodities and Futures Trading Commission. At this time, it is unclear as to what requirements would be needed in order for an individual to invest with the commodities trading firm as they differ substantially from other private investment vehicles such as hedge funds and private equity groups.

4.4 Competitive Analysis

This is one of the sections of the business plan that you must write completely on your own. The key to writing a strong competitive analysis is that you do your research on the local competition. Find out who your competitors are by searching online directories and searching in your local Yellow Pages. If there are a number of competitors in the same industry (meaning that it is not feasible to describe each one) then showcase the number of businesses that compete with you, and why your business will provide customers with service/products that are of better quality or less expensive than your competition.

5.0 Marketing Plan

As the Commodities Trading Firm intends to primarily trade for its own account, the marketing required by the business will be absolutely minimal. Mr. Doe’s marketing campaigns will primarily consist of familiarizing the Company’s brand name with other commodities traders and brokerages so that future joint ventures and investments can be made in the future. As discussed earlier, there is the possibility that the business may be able to solicit capital from the general public. In that instance, the Company will engage marketing strategies discussed below.

5.1 Marketing Objectives

• Develop ongoing relationships with commodities brokerages within the United States and abroad.

• Develop an informative website if the Company decides to solicit capital from the general public.

5.2 Marketing Strategies

Foremost, the Company will develop ongoing prime brokerage relationships with several commodities brokerages throughout the United States, Europe, and Asia. This will ensure that the Company can amplify its returns through leverage offered by these firms. Mr. Doe will distribute information, via an information packet, to these firms informing them that the Commodities Trading Firm is in business, its capitalization, and what types of trades the company most frequently engages. In regards to raising capital from the general public, the Company will develop an informative website showcasing the operations of the firm, Mr. Doe’s experience as a trader, proper investment disclosures, and relevant contact information. The website may also feature functionality so that investors can log in and track the performance of their account. If this website is built, the Company will hire an internet marketing firm to properly rank the site via search engine optimization and pay per click strategies.

5.3 Pricing

In this section, describe the pricing of your services and products. You should provide as much information as possible about your pricing as possible in this section. However, if you have hundreds of items, condense your product list categorically. This section of the business plan should not span more than 1 page.

6.0 Organizational Plan and Personnel Summary

6.1 Corporate Organization

6.2 Organizational Budget

6.3 Management Biographies

In this section of the business plan, you should write a two to four paragraph biography about your work experience, your education, and your skill set. For each owner or key employee, you should provide a brief biography in this section.

7.0 Financial Plan

7.1 Underlying Assumptions

• The Commodities Trading Firm will have an annual revenue growth rate of 19% per year.

• The Founder will acquire $5,000,000 of equity funds to develop the business.

• The Company will earn a compounded annual return of 17% on its commodities portfolio.

7.2 Sensitivity Analysis

The Company’s revenues are not sensitive to changes in the general economy. The Commodities Trading Firm will use a number of trading strategies to ensure that the business can generate profits despite increases or decreases in the value of any commodity. As such, the business should have no issues with top line income despite inflationary pressures or downward pricing pressure on specific commodities.

7.3 Source of Funds

7.4 General Assumptions

7.5 Profit and Loss Statements

7.6 Cash Flow Analysis

7.7 Balance Sheet

7.8 General Assumptions

7.9 Business Ratios

Expanded Profit and Loss Statements

Expanded Cash Flow Analysis

Trading Business Plan Template

Written by Dave Lavinsky

Trading Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their trading companies.

If you’re unfamiliar with creating a trading business plan, you may think creating one will be a time-consuming and frustrating process. For most entrepreneurs it is, but for you, it won’t be since we’re here to help. We have the experience, resources, and knowledge to help you create a great plan.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write a trading business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is a Trading Business Plan?

A business plan provides a snapshot of your trading company as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for a Trading Company

If you’re looking to start a trading company or grow your existing company, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your trading business to improve your chances of success. Your business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Trading Companies

With regards to funding, the main sources of funding for a trading company are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for trading companies.

Finish Your Business Plan Today!

How to write a business plan for a trading company.

If you want to start a trading business or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your trading business plan.

Executive Summary

Your executive summary provides an introduction to your trading business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of trading company you are running and the status. For example, are you a startup, do you have a trading business that you would like to grow, or are you operating a chain of trading companies?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overview of the trading industry.

- Discuss the type of trading business you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail what type of trading business you are operating.

For example, you might specialize in one of the following types of trading businesses:

- Retail trading business: This type of business sells merchandise directly to consumers.

- Wholesale trading business: This type of business sells merchandise to other businesses.

- General merchandise trading business: This type of business sells a wide variety of products.

- Specialized trading business: This type of business sells one specific type of product.

In addition to explaining the type of trading business you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of customers served, the number of products sold, and reaching $X amount in revenue, etc.

- Your legal business Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the trading industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the trading industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section:

- How big is the trading industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your trading business? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, schools, families, and corporations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of trading business you operate. Clearly, individuals would respond to different marketing promotions than corporations, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Trading Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other trading businesses.

Indirect competitors are other options that customers have to purchase from that aren’t directly competing with your product or service. This includes other types of retailers or wholesalers, re-sellers, and dropshippers. You need to mention such competition as well.

For each such competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of customers do they serve?

- What type of trading business are they?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you make it easier for customers to acquire your product or service?

- Will you offer products or services that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a trading company, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type of trading company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you sell jewelry, clothing, or household goods?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your plan, you are presenting the products and/or services you offer and their prices.

Place : Place refers to the site of your trading company. Document where your company is situated and mention how the site will impact your success. For example, is your trading business located in a busy retail district, a business district, a standalone facility, or purely online? Discuss how your site might be the ideal location for your customers.

Promotions : The final part of your trading marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your trading business, including answering calls, scheduling shipments, ordering inventory, and collecting payments, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to acquire your Xth customer, or when you hope to reach $X in revenue. It could also be when you expect to expand your trading business to a new city.

Management Team

To demonstrate your trading business’ potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing trading businesses. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing a trading business.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you charge per item or per pound and will you offer discounts for bulk orders? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your trading business, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and traders don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a trading business:

- Cost of equipment and supplies

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your facility location lease or a list of your suppliers.

Writing a business plan for your trading business is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will understand the trading industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful trading business.

Trading Business Plan Template FAQs

What is the easiest way to complete my trading business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily write your trading business plan.

How Do You Start a Trading Business?

Starting a trading business is easy with these 14 steps:

- Choose the Name for Your Trading Business

- Create Your Trading Business Plan (use a trading business plan template or a forex trading plan template)

- Choose the Legal Structure for Your Trading Business

- Secure Startup Funding for Trading Business (If Needed)

- Secure a Location for Your Business

- Register Your Trading Business with the IRS

- Open a Business Bank Account

- Get a Business Credit Card

- Get the Required Business Licenses and Permits

- Get Business Insurance for Your Trading Business

- Buy or Lease the Right Trading Business Equipment

- Develop Your Trading Business Marketing Materials

- Purchase and Setup the Software Needed to Run Your Trading Business

- Open for Business

What is a Trading Business?

There are several types of trading businesses:

- Retail trading business- sells merchandise directly to consumers

- Wholesale trading business- sells merchandise to other businesses

- General merchandise trading business- sells a wide variety of products

- Specialized trading business- sells one specific type of product

Don’t you wish there was a faster, easier way to finish your Trading business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how Growthink’s business plan advisors can give you a winning business plan.

Other Helpful Business Plan Articles & Templates

- Search Search Please fill out this field.

- Assets & Markets

- Commodities

How to Start a Commodity Brokerage Firm

:max_bytes(150000):strip_icc():format(webp)/image0-MichaelBoyle-30f78c37d3174fe298f9407f0b5413e2.jpeg)

Westend61 / Getty Images

Starting a commodity brokerage firm might seem like a lofty task, but knowing the proper steps and what's required before you embark on such a venture can save you a lot of time and headaches.

Commodity brokerage firms are known as "introducing brokers" (IB) in the futures sector. There are many IBs registered with the National Futures Association (NFA). Some firms may have only one person, while others have many people and branch offices. Chicago is the hub for commodity brokerage firms, while Florida, Texas, California and New York are other busy places for IBs.

Registration Requirements

To become an IB, the first thing you must do is sit for and pass the Series 3 Exam if you are not a current broker and registered as an IB with the NFA. There must be at least one associated person (AP, usually a broker) listed with the firm. If you plan on being a one-person entity, you must become an AP. There are costs you must pay to register, along with regulatory paperwork to complete.

One vital step in the process of opening a firm is going into an agreement with a futures commission merchant (FCM). There must be a signed agreement between an IB and an FCM before you can register and do business with the public. An FCM will execute and clear the trades, handle client funds, provide back-office support, and in many cases, guarantee your firm, which is why will be choosy when it comes to forming an agreement with any IB.

IB Business Plan

A business plan is crucial to any start-up firm. You will need to have an office opened and ready to conduct business. You must decide on how you plan on bringing clients on to earn enough money to sustain the business. Initial earnings provide a base to build upon. A plan to raise equity and pursue clients is the most vital aspect of starting your business. Some common routes are to pay for advertising, conduct seminars, and approach friends and family for business and support.

Before you land your first client, you need to be educated in trading in the commodity futures markets. Some brokers focus on one market or one sector of the market, but successful brokers can make trades in every market on the futures exchanges around the U.S.

Some clients make their own trading choices, while others will rely solely on your advice. The more skilled you become at commodities trading, the more likely you will retain clients and grow your brokerage. If you lose money trading commodities, and your clients rely on your advice, you will be fighting an uphill battle to succeed and might want to look for another venture.

To summarize, to open an IB firm, you will need to pass the Series 3 Exam and arrange for all proper registrations with the NFA. You will need to choose and agree to terms with an FCM for clearing trades and handling the accounting and client statements. You will need to prepare a clear business plan that includes projected costs and earnings. Spell out how you plan on opening new accounts and growing your firm. If you plan on making trading recommendations for your clients , make sure you have a solid trading plan and a good track record in trading before you venture into managing money for clients.

Final Thought on Starting Your Own IB Firm

Starting an IB firm can be a lucrative venture. Still, it takes years to learn the trading business and the ins and outs of each commodity futures contract listed on U.S. exchanges. At times, it is best to work with another IB with more experience. You may be able to work as an apprentice before starting out on your own. There is always a risk when you start a new venture; without it, there can be little reward. The best commodities traders know risk vs. reward better than many others because of the high volatility of the raw material markets. Starting an IB firm is the first risk of many that you will have to take.

CME Group. " The Complete IB Handbook ," Page 3.

National Futures Association. " Proficiency Requirements ."

National Futures Association. " Registration Rules ," Rule 204.

National Futures Association. " Guaranteed IB Requirements ."

Markets Home

Market data home.

Real-time market data

Market Data on Google Analytics Hub

CME DATAMINE:

THE SOURCE FOR HISTORICAL DATA

Services Home

Clearing Advisories

Uncleared margin rules

Insights Home

Subscribe to Research

Get our latest economic research delivered to your email inbox.

The world's most valuable exchange brand

Education Home

Step Into Commodities: Trading Challenge

New to Futures?

Course Overview

"He who fails to plan is planning to fail" -Winston Churchill

Traders who win consistently treat trading as a business. While there is no guarantee that you will make money, developing a trading plan is crucial if you want to become consistently successful and thrive in the trading game. Every trader—no matter your experience—needs a plan.

Why are you here?

- You want to know what constitutes a trading plan

- You realize you need a trading plan

- You want to be successful at futures trading

You’re in the right place for any those objectives. At the end of this course, you’ll understand why you need a trading plan and how to build one to support your success as a futures trader.

What is a trading plan?

A trading plan is a business plan for your trading career. Like any business plan, a trading plan is a working document in which you make assumptions about projected costs, revenues, and business conditions. Some of your assumptions may be right, some will surely be wrong. You wouldn't start a business without a business plan, so why would you start trading without a trading plan?

The real value in writing a trading plan is that it forces you to think about every part of your trading business, including confronting your strengths and weaknesses, and formulating reasonable expectations.

Any solid trading plan consists of the following five components. There are no shortcuts to developing a trading plan that will support your objectives. Take the time now to think about each of these components thoroughly and you will thank yourself later.

- Methodology

- Risk Management

- Trading Strategies

Related Courses

CME Group is the world’s leading derivatives marketplace. The company is comprised of four Designated Contract Markets (DCMs). Further information on each exchange's rules and product listings can be found by clicking on the links to CME , CBOT , NYMEX and COMEX .

© 2024 CME Group Inc. All rights reserved.

Disclaimer | Privacy Notice | Cookie Notice | Terms of Use | Data Terms of Use | Modern Slavery Act Transparency Statement | Report a Security Concern

Friday, February 16, 2024

Essential steps to launching a commodity brokerage business, table of contents.

- Understanding the Commodity Market

- Developing a Business Plan

- Obtaining Necessary Licenses and Permits

- Setting Up a Brokerage Office

- Hiring Staff and Building a Team

- Building Relationships with Clients and Suppliers

- Marketing and Promoting Your Business

1. Understanding the Commodity Market

Before starting a commodity brokerage business, it's crucial to have a solid understanding of how the commodity market operates. Research different commodities, market trends, and trading strategies to be successful in this industry.

2. Developing a Business Plan

Create a detailed business plan that outlines your goals, target market, pricing strategy, and financial projections. A well-thought-out business plan will help guide your decisions and attract investors if needed.

Starting a commodity brokerage business requires careful planning and preparation. A well-thought-out business plan can help guide you through the process and increase your chances of success. Here are some key steps to consider when developing a business plan for your commodity brokerage business:

1. Define Your Business Model

Before you can start trading commodities, you need to determine your business model. Will you focus on a specific type of commodity or offer a wide range of options to your clients? Will you provide full-service brokerage services or specialize in online trading? Understanding your business model will help you identify your target market and set your business apart from the competition.

2. Conduct Market Research

Research is key to understanding the commodity market and identifying potential opportunities. Take the time to study industry trends, competitor analysis, and customer preferences. This information will help you tailor your services to meet the needs of your target market and develop a competitive strategy.

3. Develop a Marketing Plan

Once you have a clear understanding of your target market and competition, you can start developing a marketing plan. Consider how you will reach potential clients, whether through digital marketing, networking events, or partnerships with other businesses. Your marketing plan should outline your unique selling propositions and strategies for attracting and retaining clients.

4. Establish Your Operations

As a commodity brokerage business, you will need to establish operational processes to manage trades, handle client inquiries, and comply with regulatory requirements. Consider how you will handle account management, risk management, and compliance to ensure smooth operations and client satisfaction.

5. Set Financial Goals and Budgets

Finally, it's essential to set financial goals and budgets to guide your business growth. Consider how much capital you need to start and run your business, as well as your revenue targets and profitability goals. Regularly monitor your financial performance and adjust your strategies as needed to ensure long-term success.

By following these steps and developing a comprehensive business plan, you can increase your chances of starting a successful commodity brokerage business. Good luck!

3. Obtaining Necessary Licenses and Permits

Commodity brokerage businesses require specific licenses and permits to operate legally. Research the requirements in your area and obtain the necessary documentation to avoid legal issues.

4. Setting Up a Brokerage Office

Choose a suitable location for your brokerage office and set up the necessary infrastructure, including trading platforms and communication systems. Make sure your office meets all regulatory requirements and is conducive to conducting business efficiently.

5. Hiring Staff and Building a Team

Recruit experienced brokers, analysts, and support staff to build a competent team that can provide exceptional service to your clients. Training and development programs can help employees stay updated on market trends and regulations.

6. Building Relationships with Clients and Suppliers

Networking is key to the success of a commodity brokerage business. Build strong relationships with clients and suppliers to expand your network and attract new business opportunities. Provide excellent customer service to retain existing clients and attract referrals.

7. Marketing and Promoting Your Business

Develop a marketing strategy to promote your commodity brokerage business and attract new clients. Utilize online and offline channels, such as social media, industry events, and advertising, to raise awareness about your services and expertise in the market.

Key Takeaways

- Understand the commodity market and trading strategies

- Develop a comprehensive business plan

- Obtain necessary licenses and permits

- Set up a brokerage office with the right infrastructure

- Build a competent team and invest in employee training

- Focus on building relationships with clients and suppliers

- Implement a strategic marketing plan to promote your business

Frequently Asked Questions

No comments:

Post a comment.

- The Commodity Trading Game Plan

- learn to trade futures

- free trading education

- futures trading strategies

- stop loss order

- trading game plan

- commodity risk management

Article Index

- Timing is Everything in Commodity Trading

- Options, Futures, or Both?

- Commodity Trading Risk Management

- Option Selling Risk Management

- 10% Rule in Futures Trading

- Position Sizing and Stop Loss Orders

- The Bottom Line

A New Look at an Old Futures Trading Topic

There are an unlimited number of ways to skin a cat, and trading is no different. Despite your futures trading strategy, risk tolerance or trading capital, having a plan is one of the most important components of achieving success in these treacherous commodity markets. However, we believe that the most important characteristic of a profitable futures and options trader is the ability to adapt to ever-changing market conditions. Assuming this, it seems logical to infer that a commodity trading plan should be established; nevertheless, just as rules are meant to be broken, futures trading plans should be flexible to accommodate altering environments and new events. The premise of properly planning a commodity trade is similar in nature to a business plan. It is a relatively detailed outline of the structure of the futures and options speculation and the contingency plan, or plans, should the market go against the trade. Once again, I believe that trading plans should not necessarily be set in stone; behaving as if they are could lead to financial peril. There are two primary components of a commodity trading plan: price prediction and risk management. Price prediction is simply the method used to signal the direction and timing of trade execution. This may involve fundamental or technical analysis, or both. Risk management specifies when to cut losses, when and how to adjust a position, or better yet when to take profits.

Commodity Futures Price Speculation (Hopefully Prediction)

The only way to make profitable futures and options trades is to buy low and sell high. This is true whether you are trading derivatives, or baseball cards. Although it is a simple concept in theory, in practice, it is much more difficult to implement than one may think. In order to successfully buy something at a low price and sell it at a higher price, the trader must first be accurate in his speculation.

Determining an opinion on where commodity market prices could, or should, go is only half the battle. Once you have done your homework in both fundamental and technical analysis, you must be able to construct a prospective commodity trade that will be profitable if you are correct and hopefully relatively painless if you are wrong.

Commodity Trading Books by Carley Garner

What people are saying about our futures and options trading books, decarley trading youtube feed, follow carley on twitter, commodity futures and options site tags.

- Business Plan for Investors

Bank/SBA Business Plan

- Operational/Strategic Planning Services

- L1 Visa Business Plan

- E1 Treaty Trader Visa Business Plan

- E2 Treaty Investor Visa Business Plan

- EB-1 Business Plan

- EB-2 NIW Business Plan

- EB-5 Business Plan

- Innovator Founder Visa Business Plan

- Start-Up Visa Business Plan

- Expansion Worker Visa Business Plan

- Manitoba MPNP Visa Business Plan

- Nova Scotia NSNP Visa Business Plan

- British Columbia BC PNP Visa Business Plan

- Self-Employed Visa Business Plan

- OINP Entrepreneur Stream Business Plan

- LMIA Owner Operator Business Plan

- ICT Work Permit Business Plan

- LMIA Mobility Program – C11 Entrepreneur Business Plan

- USMCA (ex-NAFTA) Business Plan

- Franchise Business Plan

- Landlord business plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Cannabis business plan

- Ecommerce business plan

- Online boutique business plan

- Mobile application business plan

- Daycare business plan

- Restaurant business plan

- Food delivery business plan

- Real estate business plan

- Business Continuity Plan

- Pitch Deck Consulting Services

- Financial Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Examples

Trading Business Plan

MAR.12, 2024

According to a report, 13% of day traders maintain consistent profitability over six months, and a mere 1% succeed over five years. This is primarily due to inadequate planning and undercapitalization. A well-crafted trading business plan can help you avoid these pitfalls, and this article will guide you.

In this article, you’ll learn:

- The current trends and growth forecasts in the stock trading industry

- A breakdown of the costs involved in starting a trading company

- The key components of a trading business plan (with a trading business plan example)

- Strategies for securing funding and overcoming the barriers to entry

By the end of this article, you’ll understand what it takes to create a business plan for an investment company , positioning your trading business for long-term success in this lucrative but highly competitive industry.

Pros and Cons of Trading Company

Let’s explore the pros and cons associated with running a trading company before diving into the specifics of a trading site business plan. Understanding them will help you make informed decisions:

- Potential for significant profits.

- Flexibility in terms of time and location.

- Opportunity for continuous learning and skill development.

- High risk due to market volatility.

- Emotional stress and psychological pressure.

- Requirement for constant vigilance and discipline.

Trading Industry Trends

Industry size and growth forecast.

According to a report , the global stock trading and investing applications market size was at around $37.27 billion in 2022 and projects to grow at a CAGR of 18.3% from 2023 to 2030 (Source: Grand View Research). The following factors drive this growth:

- Increasing internet penetration

- Rising disposable income

- Growing awareness of investment opportunities.

(Image Source: Grand View Research)

The Services

As per our private equity firm business plan , a stock trading business offers various services, including:

- Facilitating Trades on behalf of clients

- Algorithmic trading services to automatically execute trades

- Market Insights (research reports, market analysis, and economic forecasts)

- Technical and Fundamental Analysis (price charts, historical data, and company fundamentals)

- Investment Recommendations

- Seminars and Webinars

- Online Courses

- Demo Accounts

- Portfolio Diversification

- Stop-Loss Orders

- Hedging Strategies

- Direct Market Access (DMA)

- Global Market Access

- Trading Platforms

- Mobile Apps

- High-Frequency Trading (HFT)

- Legal and Compliance Services

- Educate clients about Risk Disclosure

How Much Does It Cost to Start a Trading Company

According to Starter Story, you can expect to spend an average of $12,272 for a stock trading business. Some key startup costs include:

How Much Can You Earn from a Trading Business?

Earnings in the trading business can vary significantly and depend heavily on:

- Trading strategy and approach

- Market conditions and volatility

- Risk management techniques

- Capital allocation and leverage

While specific income figures are difficult to predict due to these factors. However, here are some statistics showing the earning potential of a stock trading business:

- According to Investopedia, only around 5% to 20% of day traders consistently make money.

- According to Indeed Salaries, the average base salary for a stock trader in the U.S. is $80,086 per year.

- 72% of day traders ended the year with financial losses, according to FINRA.

- Among proprietary traders, only 16% were profitable, with just 3% earning over $50,000. (Source: Quantified Strategies)

What Barriers to Entry Are There to Start a Trading Company

Barriers to entry into the stock trading business include:

- Regulatory Requirements: Obtaining necessary licenses and registrations from governing bodies like the SEC and FINRA is a complex and time-consuming process.

- Capital Requirements: Trading activities require significant capital to manage risks and leverage opportunities, which can be a substantial challenge for new or small firms.

- Technological Expertise: Developing or acquiring sophisticated trading platforms, algorithms, and data analysis tools is costly and requires specialized expertise.

- Market Knowledge and Experience: Gaining in-depth knowledge and practical experience in the complex and dynamic financial markets takes years of dedicated study.

- Competitive Landscape: Breaking into the highly competitive trading industry dominated by established firms and well-funded proprietary trading desks is challenging for new entrants.

You can overcome these barriers by developing unique strategies, leveraging innovative technologies, and offering competitive and specialized services to differentiate yourself in the market. Do check our financial advisor business plan to learn more.

Creating a Trading Business Plan

A well-researched stock trading business plan is crucial to start a trading business. A general trading company business plan is a comprehensive document that defines your goals, strategies, and the steps needed to achieve them. It helps you stay organized and focused and increases your chances of securing funding if you plan to seek investors or loans.

Steps to Write a Trading Business Plan

You can use a business plan template for a trading company or follow these steps to prepare a business plan for a personal trading business:

Step 1: Define Your Goals and Investment Objectives

Step 2: Conduct Market Research

Step 3: Develop Your Trading Strategy

Step 4: Establish Your Business Structure

Step 5: Develop a Financial Plan

Step 6: Outline Your Operational Procedures

Step 7: Create a Marketing and Growth Strategy

Step 8: Implement Risk Management

Step 9: Create an Exit Strategy

What to Include in Your Trading Business Plan

Executive summary, company overview.

- Market Analysis

- Trading Strategy and Risk Management

- Operations and Technology

- Financial Projections

- Management and Organization

- Appendices (e.g., research, charts, legal documents)

Here’s an online trading business plan sample of ABC Trading:

ABC Trading, a recently established stock trading firm, provides online trading services to individuals and institutional investors. Key highlights of our business include:

- Vision – Becoming a leading online trading platform with a wide range of trading products and services.

- Values – Our core focus is innovation, excellence, integrity, and customer satisfaction.

- Target market – Tech-savvy and risk-tolerant investors looking for alternative ways to invest their money and diversify their portfolios.

- Revenue model – Commissions and fees for each trade, as well as subscription fees for premium features and services.

- Financial goal – Break even in the second year of operation and generate a net profit of $1.2 million in the third year.

ABC Trading is seeking $500,000 seed funding to launch its platform, acquire customers, and expand its team.

Company Name: ABC Trading

Founding Date: January 2024

Location: Delaware, USA

Registration: Limited Liability Company (LLC) in the state of New York

Regulated By: Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA)

Our team comprises seasoned professionals with diverse finance, mathematics, computer science, and engineering backgrounds.

Marketing Plan

Marketing Strategy: We aim to leverage online channels, such as social media, blogs, podcasts, webinars, and email newsletters, to create awareness, generate leads, and convert prospects into customers.

Marketing Objectives:

- Reach 100,000 potential customers in the first year of operation

- Achieve a 10% conversion rate from leads to customers

- Retain 80% of customers in the first year and increase customer lifetime value by 20% in the second year

The customer profile of ABC Trading includes the following characteristics:

- Age: 25-65 years old

- Gender: Male and female

- Income: Above $100,000 per year

- Education: Bachelor’s degree or higher

- Occupation: Professionals, entrepreneurs, executives, or retirees

- Location: US or international

- Trading experience: Intermediate to advanced

- Trading goals: Income generation, capital appreciation, risk diversification, or portfolio optimization

- Trading preferences: Stocks, options, or both

- Trading style: Technical, trend following, or volatility trading

- Trading frequency: Daily, weekly, or monthly

- Trading risk: Low, medium, or high

Marketing Tactics:

- Create and distribute engaging and informative content on social media platforms

- Offer free trials, discounts, referrals, and loyalty programs

- Collect and analyze customer feedback and data to improve and personalize the customer experience

- Partner with influencers, experts, and media outlets in the trading and finance niche

Marketing Budget:

We will allocate $10,000 for our marketing campaign, which we will use for the following purposes:

Operations Plan

ABC Trading’s operations plan ensures the smooth and efficient functioning of the company’s platform and services and compliance with the relevant laws and regulations.

Operation Objectives:

- Maintain a 99% uptime and availability of the company’s platform and services

- Ensure the security and privacy of the company’s and customers’ data and funds

- Provide timely and professional customer support and service

Operation Tactics:

- Use cloud-based servers and services

- Implement encryption, authentication, and backup systems

- Hire and train qualified and experienced customer service representatives and technicians

- Monitor and update the company’s platform and services regularly

- Follow the best practices and standards of the industry and adhere to the applicable laws and regulations

Operation Standards:

- Test and verify the quality and reliability of the company’s platform and services before launching and after updating

- Document and report any issues, errors, or incidents that occur on the company’s platform or services

- Resolve any customer complaints or disputes in a timely and fair manner

- Maintain a record of the company’s operations activities and performance

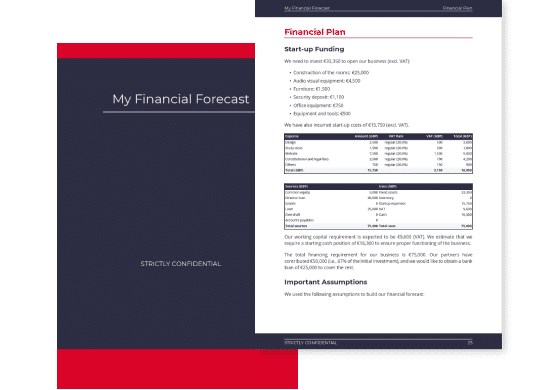

Financial Plan

ABC Trading’s financial plan is to provide a realistic and detailed projection of the company’s income, expenses, and cash flow for the next three years, as well as the key financial indicators and assumptions that support the projection.

Financial Objectives:

- Achieve a positive cash flow in the second year of operation.

- Reach a break-even point in the second year of operation.

- Generate a net profit of $1.2 million in the third year of operation.

- Maintain a healthy financial ratio of current assets to current liabilities of at least 2:1.

Financial Assumptions:

- Launch its platform and services in the first quarter of 2024

- Acquire 10,000 customers in the first year, 20,000 customers in the second year, and 30,000 customers in the third year

- Average revenue per customer will be $50 per month, based on the average number and size of trades and the subscription fees

- Average operating expense per customer will be $10 per month, based on the average cost of salaries, rent, utilities, marketing, and legal fees

- Pay a 25% tax rate on its net income

- Reinvest 50% of its net income into the company’s growth and development

Projected Income Statement:

Projected Cash Flow Statement

Projected Balance Sheet

Fund a Trading Company

To successfully establish and operate a trading company, raising funds to finance daily operations and business expansion is crucial. There are different ways with their advantages and disadvantages:

1. Self-funding (Bootstrapping)

Self-funding, also known as bootstrapping, is when the founder or owner of the trading company uses their own personal savings, family business ideas , assets, or income to finance the business. This is the most common and simplest way to fund a trading company, especially in the early stages.

- Complete ownership and control

- Flexibility in decision-making

- Potential for higher long-term returns

- Limited access to capital

- Personal financial risk

- Slower growth potential

2. Debt Financing

Debt financing involves borrowing money from lenders, such as banks, credit unions, or microfinance institutions, to fund the trading company’s operations. The borrowed funds must be repaid with interest over a specified period.

- Retain ownership and control

- Potential tax benefits from interest deductions

- Disciplined approach due to repayment obligations

- Debt burden and interest payments

- Collateral requirements and personal guarantees

- Difficulty in securing financing for startups

3. Angel Investors

Angel investors are wealthy individuals who invest their own money into early-stage or high-potential trading companies in exchange for equity or convertible debt. Angel investors typically provide smaller funding than venture capitalists and offer mentorship, guidance, and access to their network.

- Access to capital and industry expertise

- Potential for additional mentorship and guidance

- Lower risk compared to traditional investors

- Dilution of ownership and control

- Potential for conflicting visions and expectations

- Limited resources compared to larger investors

4. Venture Capital (VC) Funding

Venture capital firms are professional investment firms that provide capital to high-growth startups in exchange for equity ownership. They typically invest large sums of money and are active in the company’s management and strategic direction.

- Access to substantial capital for growth

- Expertise and industry connections from the VC firm

- Validation and credibility for the business

- Significant dilution of ownership and control

- Intense pressure for rapid growth and return on investment

Depending on your business model, goals, and needs, you may also consider other options, such as grants, subsidies, partnerships, etc. Ensure to check for relevant documents, like the hedge fund private placement memorandum . The best way to fund your trading company is the one that suits your situation and preferences.

OGSCapital: Your Strategic Partner for Business Success

At OGSCapital, we specialize in professional business plans that empower startups, established companies, and visionary entrepreneurs. With over 15 years of experience, our seasoned team combines financial acumen, industry insights, and strategic thinking to craft comprehensive plans tailored to your unique vision. Whether you’re seeking funding, launching a new venture, or optimizing your existing business, we’ve got you covered.

If you have any further questions regarding how to write a business plan for your trading business, feel free to contact us. Our team at OGSCapital is here to support you on your entrepreneurial journey. You can also check our hedge fund business plan sample here.

Download Trading Business Plan Template in PDF

Frequently Asked Questions

What does a trading business include?

A trading business involves trading stocks and other financial instruments under a legal business structure. It includes:

- Market analysis

- Trading strategy

- Risk management

How does a trading company work?

A stock trading company facilitates the buying and selling of stocks (shares) on behalf of investors. These companies operate within stock exchanges, executing trades based on specific trading strategies.

OGSCapital’s team has assisted thousands of entrepreneurs with top-rate business plan development, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

Add comment

E-mail is already registered on the site. Please use the Login form or enter another .

You entered an incorrect username or password

Comments (0)

mentioned in the press:

Search the site:

OGScapital website is not supported for your current browser. Please use:

The future of commodity trading

The commodity trading industry has enjoyed an upward trend over the past five years. While all industries go through multiyear cycles of peaks and troughs, the industry’s prospects look excellent for the years ahead.

Indeed, commodity trading is on the cusp of the next normal. The energy transition now under way is an economic and physical transformation that cuts across and integrates the various global food, energy, and materials systems. From a commodity trading standpoint, this transformation will increase structural volatility, disrupt trade flows to open new arbitrages, redefine what it means to be a commodity, and fundamentally alter commercial relationships. All these developments will create unique opportunities and challenges for new and incumbent players alike.

In this article, we explore the trends underpinning commodity trading value pools, discuss five success factors and their potential implementation, and present our perspective on the three business models that could develop over time.

What is the status of the industry?

Commodity trading value pools have grown substantially, almost doubling from $27 billion in 2018 to an estimated $52 billion of EBIT in 2021 (Exhibit 1). The majority of this growth was fueled by EBIT from oil trading, which were estimated to have increased by more than 90 percent to $18 billion during this period. Power and gas trading was just behind, rising from $7 billion to $13 billion. These value pools maintained their upward trajectory in 2022. The market will likely attract new entrants that enhance competition, and our analysis suggests that its overall value will continue to grow.

We identified four developments that contributed to this rapid growth and will have an impact in the years to come.

The energy transition is structurally resetting volatility and the value of flexibility across assets and demand

While significant economic and environmental benefits could be captured from decarbonization, the inconsistency of incentives, bottlenecks in the value chain, and current geopolitical turbulence have clouded the supply and demand picture. Annual investments in traditional hydrocarbons have dropped by 50 percent since 2013, but the level of funds committed to the energy transition—approximately $700 billion in 2021, about one-third the $2 trillion needed in 2022—will likely not be sufficient to prevent the emergence of sustained bottlenecks.

Without significantly building out the underlying supply chain, our analysis projects potential supply imbalances (Exhibit 2). For example, lithium and nickel have a high probability of supply constraints by 2030, particularly in the Further Acceleration and Achieved Commitments scenarios discussed in McKinsey’s Global Energy Perspective 2022 . 1 “ Global Energy Perspective 2022 ,” McKinsey, April 26, 2022. Similarly, in Germany and Italy alone, the land space currently occupied by renewable-energy sources (RES) would need to double by 2030. 2 Based on data from the Global Wind Atlas and on McKinsey analysis. These supply gaps are also being observed outside the power space: continued feedstock supply constraints—combined with increasing demand from refineries on the back of regulations favorable to second-generation biofuel feedstocks—have increased used cooking oil (UCO) prices by 90 percent in the past 18 months. 3 Based on data from Argus Media and on McKinsey analysis.

The increased susceptibility of markets to both short- and long-term volatility and boom-and-bust cycles will likely increase the value of maintaining prompt inventory to deploy in response to a market dislocation. Over the past two years, markets have experienced historic spikes caused by COVID-19, severe weather, geopolitical events, and macroeconomic uncertainty. These fluctuations have been most apparent in the energy sector, but other commodities have also been affected. For example, because producers of agricultural goods and metals use energy as an input, volatile prices have upended the economics of production and led to shutdowns. The historical volatility of US natural-gas prices (as measured by Henry Hub natural-gas spot prices) jumped from a low of 25 percent in the third quarter of 2021 to 179 percent just six months later. European gas prices (as measured by Dutch title transfer facility prices) increased from less than €10 per megawatt-hour (MWh) in the second quarter of 2020 to more than €330 per MWh in the second quarter of 2022. This spike has led fertilizer companies to halt Europe-based production and exports. From a commodity trader’s perspective, profitability is determined by a combination of price levels and price volatility (Exhibit 3).

Given these expectations of higher volatility, flexible capacity to respond to changing market conditions will become more critical from both balancing and economic standpoints. Our analysis indicates that achieving a global electrical supply based on 70 percent intermittent penetration in 2050 would require an embedded flexible capacity of 2.5 times at 25 percent penetration. Players could capture considerable economic value by optimizing flexible assets, which could account for more than 60 percent of the overall commodity trading value pool.

However, estimating the value of this flexibility based on forecasts is challenging—especially when physical assets are subject to operational, regulatory, or environmental constraints. For instance, most business cases for flexible assets do not factor in the occurrence of extreme market scenarios that are likely to occur over their 30-year lifespan, thereby underestimating the potential economic rent.

Moreover, the energy transition has priced environmental impact into the supply curve, which will have implications for market volatility. A reordering of asset values and cross-commodity relationships would more strongly intertwine the price volatility of traditional commodities with that of new green commodities—and vice versa.

Given these expectations of higher volatility, flexible capacity to respond to changing market conditions will become more critical from both balancing and economic standpoints.

Trade flow disruptions and potentially increasing regionalization

The flow of global commodities remains vulnerable to potential disruption from one-off events.

The COVID-19 pandemic is a case in point: the precipitous drop in demand for oil and the corresponding decline in seaborne crude-oil-pricing benchmarks, such as Dubai Fateh, saw charter rates for very large crude carriers (VLCCs) trade at $150,000 to $200,000 a day in the first quarter and second quarter of 2020, with tankers anchored off the coasts of major import centers to provide floating storage.

Recent events have kick-started a reordering of global flows, and the geographical distribution of relevant and competitive assets makes a reversion to pre-2021 levels unlikely in the foreseeable future. In energy, the reduction in Russian supplies to Europe and its allies has led the European Union to rely on imports sourced or rerouted from longer distances, such as Latin America, the Middle East, the United States, and West Africa. Conversely, Russia is exporting higher volumes farther afield, including to China and India. As a result, ships will likely spend more time at sea, and freight optimization could have a greater impact on margins. For example, shipping costs have risen dramatically since the first quarter of 2021: Baltic dirty, Baltic clean, and liquefied natural gas (LNG) tanker rates have increased by approximately 228 percent, 195 percent, and 266 percent, respectively (Exhibit 4).