How adidas is owning the digital transformation game

3 ways adidas is reinventing itself for the digital age.

On March 19, 2021, Adidas outlined a new 5-year growth plan dubbed “Own the Game.” The goal? Double online sales to €9 billion by 2025 while boosting profit margins and working towards climate neutrality.

Critical to this endeavor is Adidas’ embrace of digital technology and automation. According to a blog post outlining the “ Own the Game ” strategy, “the company's digital transformation is driven by investments of more than € 1 billion until 2025. Core processes across the entire value chain will be digitalized: from the creation process with 3D design capabilities, via the sourcing of its products to selling it to customers and consumers. In 2025, the vast majority of adidas’ sales will be generated with products that were created and sold digitally. To achieve this, the company will expand its data and technology expertise internally and increase the size of its tech team. In 2021 alone, adidas will hire more than 1,000 tech and digital talents. The company is also investing into the new ERP system S/4HANA.”

According to additional reports , the S/4HANA will be fully integrated with AWS. Not only will the deployment of SAP on AWS streamline the company’s global supply chain, inventory, and merchandising operations, it will enable the company to leverage machine learning techniques to deliver personalized customer experiences such as product and fit recommendations. They also hope to use the technologies to create digital twins of products to help accelerate and increase the efficiency of the product development process.

Via a 2021 statement, Markus Rautert, senior VP, technology enablement at Adidas AG, explained, “We want to drive innovation across our business, which includes everything from how we design our products to how we engage with the consumers who buy them. By committing to cloud infrastructure, we have the scalability and elasticity we need to handle the seasonality of our business during peak demand, and support the projected growth in our e-commerce business in the years to come. Deploying SAP environments on AWS isn’t just about transforming our technology, it’s about transforming business opportunities and using AWS’s wide range of cloud capabilities to create efficiencies and bring us closer to consumers.”

adidas sews a data mesh

By decentralizing and democratizing enterprise data, data mesh architecture has emerged as a powerful enabler of digital transformation. With this in mind, adidas too has transitioned from a monolithic, centralized data architecture to a data mesh.

As adidas’ Director Platform Engineering, Javier Pelayo, exclaims in a recent blog post that outlines how they successfully implemented a data mesh (which we highly recommend you read , “ We can proudly say that adidas has been successful in the Microservices journey; definitely, applying the same concepts to democratise the access to the data was a clear field of investment.

Also, to complete the context, we implemented a Data Streaming strategy based on Kafka that was following the main principles:

- Domain-oriented decentralized data ownership and architecture

- Self-serve data infrastructure as a platform”

Welcome to Ozworld

Like many retailers looking to target younger generations of consumers, adidas is diving headfirst into the Metaverse. Phase one began in late 2021 when the launched and sold their first NFTs, the total sales of which amounted to over $22 million .

Phase two began in April of 2022 with the launch of Ozworld, the world’s first personality based, AI generated avatar creation platform, to help promote its OZWEEGO series of physical footwear. In short, after completing a highly designed, interactive questionnaire, Ozworld’s AI generates an individualized adidas-branded Avatar that can be downloaded and used across the web.

To celebrate the launch of Ozworld, they also co-hosted an online event at Tencent Music Entertainment Group’s virtual music festival TMELAND. Using their Ozworld Avatars, users could attend a “concert” featuring Jay Park and MC Jin as well as socialize with friends and walk a virtual catwalk to show off their avatars.

Advancing the sustainability blockchain

Over the past decade, adidas has emerged as a pioneer of sustainability. In addition to increasing the use of recycled materials in their products, the company has also vowed to reduce GHG emissions across its entire value chain by 30% by 2030.

Quantifying the environmental impact of a single garment is an incredibly difficult process. Organizations must look at everything from where the product was made, material waste and how the original raw materials were sourced, amongst a few dozen more variables.

In order to overcome these challenges, adidas partnered with TrusTrace to more effectively aggregate and leverage material traceability data. According to TrusTrace’s website , “adidas chose Certified Material Compliance and they've integrated their systems with TrusTrace, ensuring seamless data flow between PLM, Purchase Order System, and Supplier Management systems. Besides automated data flows, the integrations also ensure data quality, as the data is continually updated, capturing last minute changes to designs or purchase orders. adidas and the TrusTrace Business Services team also worked in tandem to onboard hundreds of suppliers and get them familiar with how to share documentation on TrusTrace within the first months.”

Upcoming Events

All access: low code 2024.

April 16 - 17, 2024 Free PEX Network Webinar Series

AI Tech Stack Masters Exchange

April 17 - 19, 2024 The Georgian Terrace | Atlanta, GA

Insights into action: Methodologies for data strategy success

25 April, 2024 Online

Chief AI Officer USA Exchange

May 01 - 02 Le Méridien Hotel, Fort Lauderdale, Florida

All Access: AI in PEX 2024

May 07 - 08, 2024 Free PEX Network Webinar Series

24th Annual Shared Services & Outsourcing Week Europe 2024

14 - 16 May, 2024 Estoril Congress Centre, Lisbon, Portugal

Subscribe to our Free Newsletter

Insights from the world’s foremost thought leaders delivered to your inbox.

Latest Webinars

Using ai to improve master data processes.

2024-05-30 11:00 AM - 12:00 PM EDT

2024-04-25 11:00 AM - 12:00 PM EDT

Unlocking Business Value through AI-Powered Document Processing

2023-02-23 11:00 AM - 11:45 AM EST

RECOMMENDED

FIND CONTENT BY TYPE

- White Papers

Intelligent Automation Network COMMUNITY

- Advertise With Us

- Artificial Intelligence Universe

- Become a Member Today

- Cookie Policy

- User Agreement

- AIIA.net App

- AIIA Partners

- Intelligent Automation Showcase

- 2023 Editorial Calendar

- Webinar Series

ADVERTISE WITH US

Reach RPA, intelligent automation and digital transformation professionals through cost-effective marketing opportunities to deliver your message, position yourself as a thought leader, and introduce new products, techniques and strategies to the market.

JOIN THE Intelligent Automation Network COMMUNITY

Join IAN today and interact with a vibrant network of professionals, keeping up to date with the industry by accessing our wealth of articles, videos, live conferences and more.

Intelligent Automation Network, a division of IQPC

Careers With IQPC | Contact Us | About Us | Cookie Policy

Become a Member today!

PLEASE ENTER YOUR EMAIL TO JOIN FOR FREE

Already an IQPC Community Member? Sign in Here or Forgot Password Sign up now and get FREE access to our extensive library of reports, infographics, whitepapers, webinars and online events from the world’s foremost thought leaders.

We respect your privacy, by clicking 'Subscribe' you will receive our e-newsletter, including information on Podcasts, Webinars, event discounts, online learning opportunities and agree to our User Agreement. You have the right to object. For further information on how we process and monitor your personal data click here . You can unsubscribe at any time.

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

How Consumer Insights and Digital Have Led to Adidas’ Growth

Sponsor Content from Google.

In today’s connected world, it’s essential for brands to think consumer-first. But how does a brand get to the point where that thinking is not only embraced, but also put into action across the company?

At Adidas, it all starts with digital.

“Digital is one of our core strategic priorities. We have ambitious goals that we’ve set until 2020,” says Joseph Godsey, Global Head of Digital Brand Commerce at Adidas. “We want to create a consumer experience that is premium, connected and personalized. We will measure ourselves rigorously in how the various digital touchpoints come to life across those three dimensions, and we believe they will be core to reaching our overarching targets for sales, consumer experience net promoter score, and ultimately engagement and lifetime value.”

- Time Is of The Essence: How Leading Marketers Match Messages to the Right Moments

- How Leading Marketers Get Time on Their Side

- How Leading Marketers Get Ahead in Today’s Data-Driven World

- Is Your Marketing in the Right Place but at the Wrong Time?

- Trust, Transparency and Value-How Google Is Working to Improve Online Advertising for Everyone

Data-Driven Growth in a Digital World That digital focus helped Adidas reshape its strategy for today’s mobile, more empowered consumer . The brand embraces data and technology as a way to be faster and smarter in a world where marketers are competing for consumer attention in the moment. And as consumer behavior evolves and new devices and channels come into play, Adidas is ready to flex to stay in the game.

“With the right approach to data and technology, you can continuously monitor the pulse of the consumer and how they respond,” Godsey says. “This could be through testing new ideas to launching campaigns and experiences through rigorous A/B testing frameworks and using data to decide how you proceed.”

“Data and tech are helping us grow at our current pace,” Godsey says. “We’re using data to better understand our consumer and their wants and needs. And we’re using technology to enable our end-to-end business to create the best experience for our consumers — and ultimately build a relationship we can grow in the long term.”

Making Consumer Connections Digital information also helps Adidas tell more relevant stories . “The best stories come from consumer insights. And these insights often come from data,” says Kelly Olmstead, VP Brand Activation for North America at Adidas. “We’re constantly working to understand our consumers better, and data leads us to insights that deliver stories that are richer and more relevant to our consumers.”

“I think that’s the key; the more info we have, the more likely we are to be relevant and meaningful,” Olmstead says. More than that, the brand uses digital insights to know which stories work when it matters most. “We use data to ensure that the stories we’re telling are resonating — in real time.”

And if the digital information shows that something is not connecting with consumers, the brand can react appropriately and adapt its plans. “More than ever before, data is fueling our marketing efforts,” she adds.

Connecting Teams Part of Adidas’ investment in a digital transformation was the brand’s use of extensive consumer research not only to inform its marketing strategy and storytelling, but also to uncover new, efficient ways of working so it could continue to build better experiences and products — faster. That led to creating the right environment for teams.

Now brand, media and digital teams are organized to center around creating a better consumer experience. This consumer-first thinking allows Adidas to use consumer insights as the starting point for creating new processes and models of working that help Adidas bring capabilities to consumers faster.

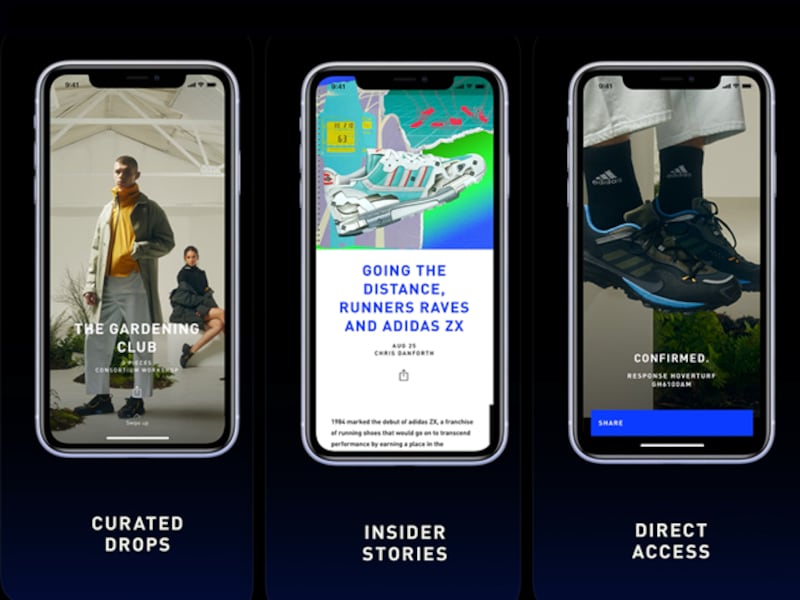

One example of this consumer-centric model was the launch of the new Adidas app. “We used extensive consumer testing throughout the iterations of app development, but we also intentionally launched it in the U.S. before every feature and capability was developed,” Godsey says. “We wanted to get it in the hands of the consumers and use their feedback to prioritize what we did next. They were very powerful in what they shared back, and it greatly shaped how we’ve evolved the app experience since then.”

Follow the Insights You can’t be relevant and timely without insights into what your consumers care about and where they spend their time. And you can’t achieve growth if you don’t take risks or adapt to our changing world. “As an organization, we openly talk about the importance of taking risks and the important role innovation plays in everyday work,” Godsey says. “We’re better at both when we’re using data and insights.”

“Taking risks, testing new ideas and innovation require data — early and often.”

To read more about how leading brands use consumer insights to improve marketing, download research from Bain & Company in partnership with Google.

- S&P Dow Jones Indices

- S&P Global Market Intelligence

- S&P Global Mobility

- S&P Global Commodity Insights

- S&P Global Ratings

- S&P Global Sustainable1

- Investor Relations Overview

- Investor Presentations

- Investor Fact Book

- News Releases

- Quarterly Earnings

- SEC Filings & Reports

- Executive Committee

- Corporate Governance

- Merger Information

- Stock & Dividends

- Shareholder Services

- Contact Investor Relations

- Email Subscription Center

- Media Center

Big bet on digital technology helps Adidas stay fit amid pandemic

Japan M&A By the Numbers: Q4 2023

Essential IR Insights Newsletter Fall - 2023

A Corporation Clearly Pinpoints Activist Investor Activity

2023 Big Picture: US Consumer Survey Results

- 6 Aug, 2020

- Author Gautam Naik

- Theme Retail & Consumer Products

The millions of euros that Adidas AG has spent over the last three years on digital technology enabled the company to weather the COVID-19 storm in the first half of 2020, a strategy it now wants to bolster with more investments.

"Digital is and will continue to be our most important commercial and brand driver," said Kasper Rorsted, CEO of Adidas, in an Aug. 6 earnings call with analysts. "We leveraged our entire digital ecosystem in order to nearly double e-commerce sales in the second quarter."

Had it not been for that 93% leap in quarterly e-commerce sales, Adidas would have published far worse results than the wider-than expected loss and 34% decline in sales it reported for the three months ending June 30. Online sales accounted for more than one-third of revenue during the quarter. The German company now expects its digital push to continue.

"At the beginning of 2017, we made it a strategic priority for the company and named our dot-com [channel] the most important store in the world," said Rorsted. "And since then, we have built a strong digital foundation ... [which] allowed us to cope with the spike in the first half and raise our e-commerce target to more than €4 billion" for 2020. That is a 33% jump from the €3 billion in e-commerce sales reported in 2019.

Adidas' rivals, notably Nike Inc., have jumped on the same opportunity. Nike recently announced plans to further intensify its online business, with expectations that e-commerce sales from its own channels, combined with key retail partners, could account for 50% of overall sales in the foreseeable future. In fiscal 2020, Nike's digital sales reached $5.5 billion, up from $3.8 billion in fiscal 2019. Digital sales in fiscal 2018 were $2.8 billion.

One of the key digital strategies that big shoe companies have embarked on is customization. Nike uses its online customization platform, NIKE BY YOU, to build long-term relationships with consumers and thereby increase sales. Consumers who customize their Nike shoes can pay a premium of 30% to 50% and are more likely to be repeat customers.

Adidas similarly used a combination of apps, video and social media to sell more clothes and shoes via online channels. Its Creators Club program allows users to track their runs and workouts using apps to collect points and get exclusive rewards. These members account for more than 6% of online sales, according to Adidas.

The company's digital transformation goes beyond online sales. It is using digital technology to market products, glean consumer insights to determine shifts in trends and improve its logistical capabilities. For example, at the end of 2019, Adidas began using its "SpeedFactory" concept in Asia, an approach that shortens design and production times in response to customer needs.

"To be clear, digital is more than just e-commerce," Rorsted said. "As part of our digital transformation, we launched our first-ever rapid creation product pack last month. In just under 48 hours, teams created a 3D-rendered product based on the latest consumer research data. ... Launched in July, [the creation pack] performed very well as the tropical [colors] match current consumer tastes, as we had inferred from our data."

In the last two months, as physical showrooms closed, Adidas wanted to continue to engage with its wholesale partners. So it used a "digital showroom tool" that combines three-dimensional video previews and augmented reality to bring its products to life in a virtual setting. Adidas said it had seen a 10-fold increase in the number of wholesale partners using the tool.

"And I think that's where big companies have a huge advantage over the smaller ones," said Rorsted. "We have the capability to invest with more than 200 IT people overnight into our digital space, and accelerate a number of development projects that smaller companies cannot do."

Adidas' shares closed Aug. 6 up 1.9% at €244.30.

- Gautam Naik

- Retail & Consumer Products

Product details

Teaching and learning

Time period, geographical setting, featured company.

The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

News & Analysis

- Professional Exclusives

- The News in Brief

- Sustainability

- Direct-to-Consumer

- Global Markets

- Fashion Week

- Workplace & Talent

- Entrepreneurship

- Financial Markets

- Newsletters

- Case Studies

- Masterclasses

- Special Editions

- The State of Fashion

- Read Careers Advice

- BoF Professional

- BoF Careers

- BoF Insights

- Our Journalism

- Work With Us

- Read daily fashion news

- Download special reports

- Sign up for essential email briefings

- Follow topics of interest

- Receive event invitations

- Create job alerts

Inside Adidas’ Billion-Dollar Digital Transformation

For Adidas, there’s no doubt the future is digital.

The German sports giant is investing more than $1 billion to transform its business from design to delivery by the middle of the decade. The effort is central to the company’s ambitions to reignite slowing growth and position itself as a pacesetter in a new era of tech-enabled retail.

By 2025, Adidas expects the “vast majority” of its sales to come from products that were created and sold digitally, according to an ambitious growth strategy outlined in March. It’s planning to digitise across the value chain, moving to design more of its products in 3D, sell to retail partners without them ever having to see a physical sample and quickly get products in front of shoppers on digital channels it controls — and which feed it back valuable data.

“We have some great lofty goals for 2025,” Chris Murphy, vice president of digital activation for Adidas North America, told BoF.

ADVERTISEMENT

As the company seeks to get faster, smarter and more agile, it’s also aiming to more than double the shoppers signed up for its membership program. That would not only give Adidas stronger relationships with its customers but also let it harvest data directly from them.

The company is working hard to catch up to Nike, which in recent years has acquired a handful of data-centric technology firms and remodelled its business around selling directly to shoppers through its own stores, e-commerce and apps such as SNKRS.

“The key for these big brands is can they build a really strong network of apps and direct customer relationships? Because these are businesses which traditionally have relied to a very large extent on selling via third parties,” said Simon Irwin, an analyst at Credit Suisse. “With the whole move to [direct-to-consumer selling], that is all changing dramatically, and clearly Nike is miles in the lead.”

Adidas could use a boost. After a stretch of blazing growth through 2017, its performance has cooled and it’s still recovering its footing from the pandemic. In 2020, the company’s sales fell to €19.8 billion ($22.3 billion), down 14 percent in currency-neutral terms from the prior year. Sales rebounded in 2021, but the company recently trimmed its forecast for the year , citing struggles in China and supply chain snarls.

Adidas is seeking to sell investors on a long-term promise “to significantly increase sales and profitability as well as gain market share,” as it said in its growth plan. It’s targeting an average of eight percent to 10 percent growth per year on a currency-neutral basis through 2025. Digital sales, which Adidas is looking to double, will be crucial.

How Adidas is Going Digital

The change Adidas envisions is arguably more evolution than transformation. At its stores, for instance, the company has been expanding digital touchpoints, said LaNiece Douglas, the company’s vice president of retail for North America. Smart mirrors currently give shoppers information on products they’re holding, and so-called “endless aisle” kiosks let them shop online for products or sizes not available in the store. Soon the company will also enable self-checkout through its app.

On the operations side, the company is scaling its use of 3D design, which allows designers to develop and revise products faster using detailed digital renderings, eliminating the need for physical samples that are usually shipped from factories in Asia. More than €5 billion of Adidas’ sales already come from products created with 3D design, Adidas’ head of global operations Martin Shankland said at the company’s investor day in March. If the company hits its 2025 targets, that number will grow substantially in the coming years.

It may just be the price of staying competitive at this point, though. While brands of all sorts still rely heavily on physical sampling, a number are increasingly using 3D in its place, including Nike, Under Armour, Saucony and more, according to Matt Priest, president and chief executive of Footwear Distributors and Retailers of America, an industry trade group.

“It’s turning into table stakes,” Priest said.

Transformation isn’t always easy either. In 2015, Adidas launched a high-profile project to help it respond faster to customer demand in key markets with high-tech “Speedfactories.” But it shut down the two manufacturing locations it built in Germany and the US in 2019. At the time, Adidas said it made more sense for the company to take what it had learned and upgrade its supplier base in Asia, where most of its production is concentrated.

Irwin said he sees the new digital investments as fundamentally different.

“That was always fairly speculative,” he said of the Speedfactories, noting that near-shoring production was impossible to scale. But digitising operations is “just basic business in terms of what most of these companies need to do,” Irwin said.

Getting Smarter with Data

Where Adidas’ investments could give it an edge, analysts say, is by helping to fuel its membership programme and apps. Membership lets Adidas build deeper relationships with its best customers, and the more members it has, the more data it’s able to collect from them.

Data lets companies make better decisions and more accurate predictions — if they’re able to effectively analyse it and put it to use. To help on that front, the company is planning to hire more than 1,000 data and technology workers this year.

“We’re looking at infusing data right into our buying, our planning process, our operations process,” said Douglas.

Adidas already uses data to inform decisions such as the local assortment at its stores, down to the colour choices. It wants to be able to sift data from its e-commerce and apps on what’s selling or where there are gaps in its assortment, feed that to its design team to rapidly conceive new products with 3D tools and quickly test those products in the market.

Member data is only growing more valuable given the changes occurring in online privacy. Murphy pointed to Apple’s update in April that now forces apps to ask permission to track a user’s activity. Apps dependent on that data to target ads, such as Facebook and Snapchat, have felt the impact .

“It’s important to grow your internal database and have an understanding of who your consumers are, instead of relying on outside parties to tell you that,” Murphy said.

Nike reported more than 300 million members in its most recent fiscal year. Adidas is trailing but has still attracted 220 million members since launching its programme in 2018, Murphy said. In 2020, the company also relaunched its Confirmed app, where it releases its most hyped products, after shuttering a previous version a few years earlier. This year, it expanded it across Europe.

Adidas anticipates big returns from its digital bet. In 2020 its total e-commerce sales already surpassed €4 billion — more than a quarter of the company’s sales — up significantly from the prior year after the pandemic supercharged online shopping. In 2025, according to its growth plan, it’s targeting between €8 billion and €9 billion in online sales. By that time, it plans to have around 500 million members.

“If you dig into the figures that Adidas is mentioning for membership, for example, or that Nike is mentioning for apps — the SNKRS app or the Nike app — this draws literally millions of consumers and makes them come back,” said Erwan Rambourg, an analyst at HSBC. “I think it is a competitive advantage.”

Recommended Articles:

The New Normal: Digital Is Set For a Step Change

Adidas and Allbirds Join Forces to Try to Create the World’s Lowest Carbon Footprint Sports Shoe

Inside Nike’s Radical Direct-to-Consumer Strategy

Marc Bain is Technology Correspondent at The Business of Fashion. He is based in New York and drives BoF’s coverage of technology and innovation, from start-ups to Big Tech.

- Digitisation

© 2024 The Business of Fashion. All rights reserved. For more information read our Terms & Conditions

BoF Masterclass | How to Turn Data Into Meaningful Customer Connections

Join us for a BoF Professional Masterclass that explores the topic in our latest Case Study, “How to Turn Data Into Meaningful Customer Connections.”

The New Backlash Against Social Media, Explained

Social networks are being blamed for the worrying decline in young people’s mental health. Brands may not think about the matter much, but they’re part of the content stream that keeps them hooked.

How Coach Used Data to Make Its Tabby Bag a Hit

After the bag initially proved popular with Gen-Z consumers, the brand used a mix of hard numbers and qualitative data – including “shopalongs” with young customers – to make the most of its accessory’s viral moment.

Using AI to Create Customer-Centric Business Strategies

At The Business of Fashion’s Professional Summit in New York last week, Sona Abaryan, partner and global retail and luxury sector lead at tech-enabled data science firm Ekimetrics, shared how businesses can more effectively leverage AI-driven insights on consumer behaviour to achieve a customer-centric strategic approach.

Subscribe to the BoF Daily Digest

The essential daily round-up of fashion news, analysis, and breaking news alerts.

Our newsletters may include 3rd-party advertising, by subscribing you agree to the Terms and Conditions & Privacy Policy .

Our Products

- BoF Insights Opens in new window

Adidas doubled down on e-commerce through consumer marketing, product launches and prioritized supply chain management in 2020. Adidas said this focus was reflected in e-commerce sales growth accelerating to triple-digit rates during several months in 2020, and remaining at elevated levels even as retail stores reopened.

Adidas is targeting online sales of up to 9 billion euros or $10.7 billion a year by 2025 with an operating profit margin of 12-14 percent, up from the 11.3 percent achieved in 2019 before the coronavirus crisis knocked sales and profitability, Reuters reported.

The company has reopened 95 percent of its retail stores after coronavirus lockdowns, it said earlier on Wednesday. Adidas forecast sales growth rate in the mid-to-high teens, rising to as much as 30 percent in greater China, the rest of Asia and Latin America, in 2021.

Nike, the world’s biggest sportswear brand, said people have logged on to its workout and store apps en masse, driving significantly higher online sales over the past year.

Adidas will invest more than 1 billion euros in the company’s digital transformation and aims to make nine out of 10 products more sustainable by 2025, using more recycled and biodegradable materials.

CEO Kasper Rorsted said e-commerce will account for more than 40 percent of the industry’s sales by 2025, with online growing three times faster than offline, adding that more than 70 percent of consumers say sustainability is an important consideration when making a purchase.

Fourth-quarter sales rose by a currency-neutral 1 percent to 5.55 billion euros ($6.59 billion) while operating profit slipped slightly to 225 million euros.

About half of its stores were closed in Europe in the period, but online sales grew 43 percent.

Rival Puma last month said it expects the financial impact from lockdowns to last well into the second quarter but that pandemic-driven growth in running should support a strong improvement after that.

As part of the new strategy, Adidas will manage greater China as a separate market from the rest of Asia and it has integrated Europe, Russia and emerging markets into a new Europe, Middle East and Africa (EMEA) region.

Net income from operations is projected to rise to between 1.25 billion and 1.45 billion euros in 2021, up from 429 million euros in 2020 but still below the 1.9 billion euros in 2019.

Adidas expects a hit of about 250 million euros to operating profit from costs to make its struggling Reebok brand a standalone company, with a third of that in 2022 but none in 2023, before a planned sale or spin-off of the business.

Marketing and point-of-sale expenses declined 15 percent to € 2.573 billion (2019: € 3.042 billion) as Adidas took on a disciplined approach regarding physical marketing activities, while keeping up digital marketing investments to support its e-commerce business.

As a percentage of sales, marketing and point-of-sale expenses were almost flat at 13 percent (2019: 12.9 percent). Operating overhead expenses decreased 2 percent to €6.656 billion (2019: €6.80 billion). Adidas posted lower expenses for travel and IT projects, which offset increased logistics costs resulting from the exceptional growth in e-commerce.

Digital plans

Adidas’ own-retail stores will be digitized with fully-fledged omnichannel capabilities. The focus on increasing digitalization will be expanded to the company’s wholesale partners to ensure a seamless experience for the consumer across all touchpoints.

Adidas plans to invest around € 1 billion more into the brand in 2025 compared to 2021. By 2025, the digital transformation of the company will have been driven forward with investments amounting to over € 1 billion as well.

The company’s digital transformation is driven by investments of more than € 1 billion until 2025. Core processes across the entire value chain will be digitalized: from the creation process with 3D design capabilities, via the sourcing of its products to selling it to customers and consumers.

In 2025, the vast majority of adidas’ sales will be generated with products that were created and sold digitally. The company will expand its data and technology expertise internally and increase the size of its tech team. In 2021 alone, Adidas will hire more than 1,000 tech and digital talents. The company is also investing into the new ERP system S/4HANA from SAP.

Baburajan Kizhakedath

LEAVE A REPLY

Log in to leave a comment

News website for AI, Security, Cloud, Network, CIO, Digital, Devices, Gaming, Software, VC funding, Technology, Crypto, Mobility.

- Partnership

- Terms of Use

- Privacy Policy

Take-Two Interactive Cuts Sales Forecasts Following Weak Gaming Demand

We use cookies to improve your experience on our site. Cookies enable you to enjoy certain features, social sharing functionality and to tailor messages and display ads to your interests (on our site, and others). Cookies and Matomo also help us understand how our site is being used. Find out more in our cookie statement .

- Annual Report 2020

- Annual Report 2019

- Annual Report 2018

- Annual Report 2017

Topics filter

- Executive and Supervisory Board

Sustainability

- Corporate Governance

- Sourcing & Supply Chain

- No filter selected.

- en At a Glance

- At a Glance Financial Highlights 2020

- At a Glance 2020 Stories

- 2020 Stories The #hometeam movement

- 2020 Stories Our sustainability initiatives

- 2020 Stories Product highlights

- 2020 Stories Creating lasting change

- At a Glance About this Report

- en To our Shareholders

- To our Shareholders Letter from the CEO

- To our Shareholders Executive Board

- To our Shareholders Supervisory Board

- To our Shareholders Supervisory Board Report

- To our Shareholders Declaration on Corporate Governace

- To our Shareholders Compensation Report

- Compensation Report Board Compensation

- Compensation Report Supervisory Board Compensation

- To our Shareholders Our Share

- en Group Management Report – Our Company

- Group Management Report – Our Company Strategy

- Group Management Report – Our Company Global Brands

- Group Management Report – Our Company Global Sales

- Group Management Report – Our Company Global Operations

- Group Management Report – Our Company Our People

- Our People Attraction and retention of talents

- Our People Role Model Leadership

- Our People Diversity and Inclusion

- Our People Work-life- and health management

- Our People Learning and performance

- Our People Employee population

- Group Management Report – Our Company Sustainability

- Sustainability Our Approach

- Sustainability Our Progress

- Sustainability Environmental Impacts

- Sustainability Social Impacts

- Sustainability Supply Chain

- Group Management Report – Our Company Non-Financial Statement

- en Group Management Report – Financial Review

- Group Management Report – Financial Review Internal Management System

- Group Management Report – Financial Review Business Performance

- Business Performance Economic and Sector Development

- Business Performance Income Statement

- Business Performance Statement of Financial Position and Statement of Cash Flows

- Business Performance Treasury

- Business Performance Financial Statements and Management Report of adidas AG

- Business Performance Disclosures persuant to German Commercial Code

- Group Management Report – Financial Review Business Performance by Segment

- Business Performance by Segment Europe

- Business Performance by Segment North America

- Business Performance by Segment Asia-Pacific

- Business Performance by Segment Russia/CIS

- Business Performance by Segment Latin America

- Business Performance by Segment Emerging Markets

- Group Management Report – Financial Review Outlook

- Group Management Report – Financial Review Risk and Opportunity Report

- Risk and Opportunity Report Illustration of Risks

- Risk and Opportunity Report Illustration of Opportunities

- Group Management Report – Financial Review Management Assessment

- en Consolidated Financial Statements

- Consolidated Financial Statements Consolidated Statement of Financial Position

- Consolidated Financial Statements Consolidated Income Statement

- Consolidated Financial Statements Consolidated Statement of Comprehensive Income

- Consolidated Financial Statements Consolidated Statement of Changes in Equity

- Consolidated Financial Statements Consolidated Statement of Cash Flows

- Consolidated Financial Statements Notes

- Notes General Information

- General Information 01 » General

- General Information 02 » Summary of Significant Accounting Policies

- General Information 03 » Discontinued Operations

- General Information 04 » First-Time Consolidation/Disposal of Subsidiaries as well as Assets and Liabilities

- Notes Notes to the Consolidated Statement of Financial Position

- Notes to the Consolidated Statement of Financial Position 05 » Cash and Cash Equivalents

- Notes to the Consolidated Statement of Financial Position 06 » Short-Term Financial Assets

- Notes to the Consolidated Statement of Financial Position 07 » Accounts Receivable

- Notes to the Consolidated Statement of Financial Position 08 » Other Current Financial Assets

- Notes to the Consolidated Statement of Financial Position 09 » Inventories

- Notes to the Consolidated Statement of Financial Position 10 » Other Current Assets

- Notes to the Consolidated Statement of Financial Position 11 » Property, Plant and Equipment

- Notes to the Consolidated Statement of Financial Position 12 » Right-of-Use Assets

- Notes to the Consolidated Statement of Financial Position 13 » Goodwill

- Notes to the Consolidated Statement of Financial Position 14 » Trademarks and other Intangible Assets

- Notes to the Consolidated Statement of Financial Position 15 » Long-Term Financial Assets

- Notes to the Consolidated Statement of Financial Position 16 » Other Non-Current Financial Assets

- Notes to the Consolidated Statement of Financial Position 17 » Other Non-Current Assets

- Notes to the Consolidated Statement of Financial Position 18 » Borrowings and Credit Lines

- Notes to the Consolidated Statement of Financial Position 19 » Other Current Financial Liabilities

- Notes to the Consolidated Statement of Financial Position 20 » Other Provisions

- Notes to the Consolidated Statement of Financial Position 21 » Lease Liabilities

- Notes to the Consolidated Statement of Financial Position 22 » Accrued Liabilities

- Notes to the Consolidated Statement of Financial Position 23 » Other Current Liabilities

- Notes to the Consolidated Statement of Financial Position 24 » Other Non-Current Financial Liabilities

- Notes to the Consolidated Statement of Financial Position 25 » Pensions and Similar Obligations

- Notes to the Consolidated Statement of Financial Position 26 » Other Non-Current Liabilities

- Notes to the Consolidated Statement of Financial Position 27 » Shareholders’ Equity

- Notes to the Consolidated Statement of Financial Position 28 » Share-Based Payment

- Notes to the Consolidated Statement of Financial Position 29 » Non-Controlling Interests

- Notes to the Consolidated Statement of Financial Position 30 » Financial Instruments

- Notes Notes to the Consolidated Income Statement

- Notes to the Consolidated Income Statement 31 » Other Operating Income

- Notes to the Consolidated Income Statement 32 » Other Operating Expenses

- Notes to the Consolidated Income Statement 33 » Cost by Nature

- Notes to the Consolidated Income Statement 34 » Financial Income/Financial Expenses

- Notes to the Consolidated Income Statement 35 » Hyperinflation

- Notes to the Consolidated Income Statement 36 » Income Taxes

- Notes to the Consolidated Income Statement 37 » Earnings per Share

- Notes Additional Information

- Additional Information 38 » Segmental Information

- Additional Information 39 » Additional Cash Flow Information

- Additional Information 40 » Other Financial Commitments and Contingencies

- Additional Information 41 » Related Party Disclosures

- Additional Information 42 » Other Information

- Additional Information 43 » Information relating to the German Corporate Governance Code

- Additional Information 44 » Events after the Balance Sheet Date

- Consolidated Financial Statements Shareholdings

- Consolidated Financial Statements Responsibility Statement

- Consolidated Financial Statements Independent Auditor’s Report

- Consolidated Financial Statements Limited Assurance Report

- en Additional Information

- Additional Information Ten-Year Overview

- Additional Information Declaration of Support

- Additional Information GRI Standard Content Index

- Additional Information Financial Calendar

- Compare to last year

With sport playing an increasingly important role in more and more peoples’ lives, both on and off the field of play, we operate in a highly attractive industry. Based on our deep understanding of our consumer and the authenticity of the adidas brand, we push the boundaries of products, experiences and services. We do so according to our strategy, which allows us to fully capitalize on the acceleration of favorable long-term structural trends.

Review of strategy: ‘Creating the New’

‘Creating the New’ was our strategy for the period from 2015 to 2020. Our ambition to drive top- and bottom-line growth by significantly increasing brand desirability was at the core of ‘Creating the New’ – a strategy that proved to be very successful.

We were firmly on track to deliver on our 2020 financial ambition, having raised our targets twice during the strategic cycle. This is reflected by the company’s results for the period from 2015 to 2019, prior to the coronavirus pandemic:

- Net sales: Currency-neutral net sales increased at a rate of 12% per annum on average between 2015 and 2019, in line with our ambition from March 2018 of between 10% and 12% between 2015 and 2020 (initial ambition from March 2015 was high-single-digit growth).

- Operating margin: Reached a level of 11.3% in 2019, in line with our ambition from March 2018 of up to 11.5% by 2020 (initial ambition from March 2015 was around 10%).

- Net income from continuing operations: Grew at a rate of 28% per annum on average between 2015 and 2019, ahead of our ambition from March 2018 of between 22% and 24% between 2015 and 2020 (initial ambition from March 2015 was around 15%).

Ultimately, the financial ambitions for 2020 were not met due to the impact of the global coronavirus pandemic. Aside from financials, we executed on the three strategic choices of ‘Creating the New’ as introduced in March 2015 – Speed, Cities, and Open Source – all the way to the finish line of the strategic cycle. As a result, we not only established new iconic product franchises, such as Ultraboost and NMD, but also built and scaled innovative capabilities, many of which did not previously exist in our industry. These include the groundbreaking partnerships with Parley for the Oceans and Carbon, the creative collaborations with Kanye West, Pharrell Williams and Beyoncé, the shortening of lead times through speed-enabled ranges, and the creation of end-to-end consumer ecosystems in global megacities.

The execution of our Creating the New ‘Acceleration Plan’, which was introduced in March 2017, yielded the profitability turnaround of Reebok and the divestiture of CCM Hockey, the significant strengthening of adidas’ positioning in North America, the relentless standardization of processes under ONE adidas, and the successful digital transformation of our company. The latter resulted in overproportionate growth in the company’s e-com business, which generated more than € 4 billion in net sales in 2020 – more than twice the initial ambition from March 2015.

The many achievements resulting from these initiatives form the foundation upon which we have built our new strategy for the period until 2025, grounded in our purpose, mission, and attitude.

Our purpose: Through sport, we have the power to change lives

We will always strive to expand the limits of human possibilities, to include and unite people in sport and to create a more sustainable world.

Our mission: To be the best sports brand in the world

We are the best when we are the credible, inclusive, and sustainable leader with a first or second position regarding market share in each strategic category in the long term.

Our attitude: Impossible is nothing

We are rebellious optimists driven by action, with a desire to shape a better future together. We see the world of sport and culture with possibility where others only see the impossible.

New strategy ‘Own the Game’ for the period until 2025

‘Own the Game’ is our strategy that guides us through to 2025 – a plan rooted in sport. Sport is adidas’ past, present and future. ‘Own the Game’ puts the consumer at the heart of everything we do and is brought to life by our people. Our strategic focus is on increasing brand credibility, elevating the experience for our consumer and pushing the boundaries in sustainability. The execution of our strategy is enabled by a mindset of innovation across all dimensions of our business as well as our digital transformation. We own the game and will drive significant growth.

Our new strategy ‘Own the Game’

Our consumers are at the heart of ‘Own the Game’. Consumers drive structural trends in our industry through their preferences and behaviors. They strive to live active and healthy lives, they wish to blend sport and lifestyle, and they are digital by default as well as sustainable by conviction. ‘Own the Game’ will be ready to capture those consumer-driven opportunities and carve out new ones for their benefit. In 2025, ‘Own the Game’ will not only have delivered overproportionate growth for adidas, but also deepened relationships with our consumer, as we continue to actively live our purpose ‘through sport, we have the power to change lives.’

Credibility

We are a leading brand thanks to our credibility in both sport and culture. To continue to excite our consumers with innovative concepts that support our mission, we will sharpen our brand, refine our product offering and leverage partnerships to further enhance our credibility with consumers.

To grow long-term relationships with our consumer, we excite and empower them by creating personalized experiences in both digital and physical spaces. With this in mind, we will accelerate our transformation into a direct-to-consumer-led (DTC-led) business built around membership.

Our commitment to sustainability is truly holistic and deeply embedded into how we have done business for over two decades. Its rooted in our purpose that, through sport, we have the power to change lives. As we continue to pioneer in sustainability, we will move from strong stand-alone initiatives to a scaled and comprehensive sustainability program.

To successfully deliver on our five-year strategy, we will support our people to truly own the game. We will make sure we have the relevant capabilities to tackle our business needs and seize opportunities as we attract, grow and retain talent. We will ensure there is a level playing field for all as we continue our diversity and inclusion journey. Furthermore, we will leverage our unique workplace that has the consumer at the heart of everything we do.

- Sport: We will focus on the most important sport categories: Football, Training, Running, and Outdoor. Football is the biggest sport in terms of viewership, while Running, Training, and Outdoor are the biggest participation sports. Our products in these categories are built for sport and worn for sport.

- Lifestyle: To tap into the biggest commercial opportunity for our brand, we will sharpen our brand architecture by introducing a new consumer proposition called Sportswear. These products are born from sport and worn for style. At the same time, we will extend Originals, which is inspired by sport and worn on the street, into the premium segment through top-quality manufacturing processes and materials.

- Women: We will execute on a cross-category plan to achieve product excellence and elevate the women’s experience through our membership program to become her indispensable sports brand. Our goal is to grow currency-neutral net sales for our Women’s business at a mid-teens rate per annum on average until 2025, thereby significantly increasing the Women’s share of our overall business.

- Partnerships: We will amplify our credibility through our partnerships by leveraging their power, authenticity, and reach. We will expand our portfolio of partners, which already includes Beyoncé, Kanye West, Stella McCartney and Pharrell Williams, all of whom will continue to play a significant role in wowing our consumer on the lifestyle side. Likewise, we will continue to leverage our partnerships with the biggest symbols in sport, be it with teams like Bayern Munich or Real Madrid, athletes like Lionel Messi or Mikaela Shiffrin, or events like the Boston and Berlin Marathons.

- Membership: With the launch of our membership program in 2018, we laid the foundation for offering personalized experiences to our most valuable consumers. We are now ready to take this to the next level with the goal of increasing our member base to around 500 million by 2025. Through membership, we reward engagement and purchasing activity by offering exclusive hype products, access to launches and special events, and more.

- DTC-led: E-com continues to be our most important store. Both adidas.com and the adidas app will see enhancements across the entire consumer journey. By 2025, our e-com business is expected to account for between € 8 billion and € 9 billion of our company’s net sales. While e-com is the pinnacle of our retail strategy, our physical stores will continue to play a crucial role in creating a physical and emotional connection with our brand. Retail formats will be digitized with fully-fledged omnichannel capabilities. The DTC business, comprising our e-com as well as our physical stores, is projected to account for around half of the company’s net sales by 2025. We will also continue to leverage our strong relationships with strictly selected wholesale partners and ‘win-with-the-winners’ to ensure a holistic experience for the consumer no matter the point of sale.

- Key Cities: We are building on our Key Cities portfolio of London, Los Angeles, New York, Paris, Shanghai and Tokyo, by adding Mexico City, Berlin, Moscow, Dubai, Beijing and Seoul. These cities represent the beating heart of our global consumer experience and exert influence on the rest of the world, while at the same time offering commercial opportunities as urbanization continues.

- Strategic markets: We will double down on Greater China, North America and EMEA to bring exciting consumer experiences to life, pursuing a tailored approach that appeals to local trends. Our ambition is to gain market share in all three strategic markets.

- What we offer: We keep pushing the boundaries of our sustainable offering, so that our consumer will be able to choose from a uniquely comprehensive range. By 2025, nine out of ten of our articles will be sustainable. How we will do this revolves around how we expand and innovate our 3-loops: made from recycled materials, made to be remade, or made with natural and renewable materials. We define products as sustainable when they show environmental benefits versus conventional products due to the materials used or their respective production technologies.

- What we do: We are committed to reducing the CO 2 footprint of our product offerings as we work to reach climate neutrality by 2050. We will achieve this through initiatives such as driving zero-carbon within our own operations and promoting environmental programs along our entire value chain in close cooperation with our suppliers.

- What we say: We will be vocal about our efforts that focus on creating low-impact products that are made to be remade. To guide our consumer to make more sustainable choices, we will also simplify our labelling strategy and scale up our product takeback program.

Innovation and Digital

Two enablers will set us up for success. The first is applying a mindset of deep and broad innovation across all dimensions of our business. The second is using the speed and agility of Digital throughout our entire value chain. These enablers will be particularly powerful when it comes to executing on the three strategic focus areas – Credibility, Experience, and Sustainability – that support us in intensifying our focus on the consumer and driving growth.

Financial ambition for 2025

‘Own the Game’ is designed to yield growth in terms of revenue, profitability and cash generation, which in turn creates long-term value for our shareholders. Therefore, we are focused on rigorously driving execution and managing all of the factors under our control, which will enable us to:

- Achieve top-line growth above industry average: We aim to increase currency-neutral revenue at a rate of between 8% and 10% per annum on average in the four-year period between 2021 and 2025.

- Further expand both gross and operating margin: We expect to expand our gross margin to a level of between 53% and 55% and our operating margin to a level of between 12% and 14% by 2025.

- Grow our bottom-line sustainably: We plan to grow our net income from continuing operations by an average of between 16% and 18% per annum in the four-year period between 2021 and 2025.

- Invest into future organic growth: We are committed to reinvesting between 3% and 4% of net sales into our business by means of annual capital expenditure.

- Deliver attractive cash return to shareholders: Based on the material growth in terms of revenue and profitability, we will generate substantial cumulative free cash flow until 2025. The majority of it – between € 8 billion and € 9 billion – will be made available and distributed to shareholders through a consistent dividend pay-out in a range between 30% and 50% of net income from continuing operations, complemented by share buybacks.

Given the prevailing uncertainties related to the further development of the coronavirus pandemic, our financial ambition for 2025 has 2021 – rather than 2020 – as a baseline. However, this does not apply to the strategy as such, which will be executed throughout the entire five-year strategic cycle.

As a global leader in our industry with a strong strategy in place, we are very well positioned for the years ahead.

Parley for the Oceans

Parley for the Oceans is an environmental organization and global collaboration network. Founded in 2012, Parley aims to raise awareness for the beauty and fragility of the oceans, and to inspire and empower diverse groups such as pacesetting companies, brands, organizations, governments, artists, designers, scientists, innovators and environmentalists in the exploration of new ways of creating, thinking and living on our finite, blue planet.

Would you like to know more about our e-commerce business?

Here’s What Brands can Learn from Nike & Adidas’ Digital Disruption Amidst COVID-19

Examining the increasingly digital, personalized sportswear market .

As with many retail sectors, the 2020-21 sportswear faced some unprecedented changes due to COVID-19 — both from customers and the market at large.

For starters, COVID’s impact can be seen in changing consumer values. On a surface level, demand for athleisure increased. The pandemic forced stay-at-home orders and work-from-home set-ups that naturally led people to ditch the buttons and collars in favor of comfort. And this comfort frequently manifested in athleisure — what with its multi-purpose functionality and often sleek vibe.

Another value that the pandemic shone a bright light on has been health consciousness. Sensitivity to health matters has, of course, been heightened to unprecedented degrees. As such, consumer interest in at-home workout options has grown — as has the desire for sustainably produced materials.

Beyond the customer, sportswear companies have seen firsthand the benefits of relying on flexible supply channels. COVID can thus be seen as a sort of wake-up call: In an uncertain world, the ability to adapt to market uncertainties is invaluable.

And perhaps no market adjustment is quite as stark as the adoption of digital channels. As we’ll discuss below, sportswear companies like Nike, Adidas, and Lululemon have all pivoted their operations (at times, quite dramatically) to build up their eCommerce and digital marketing avenues. They were undoubtedly headed in this direction prior to 2020, but COVID has expedited the process out of necessity.

So these, in a nutshell, are the biggest transformations seen in the 2021 sportswear market. But now we face the question: what will the sportswear market look like through 2022 and beyond? And what exactly are those big-name brands doing to stay ahead?

The future will be defined by the success of DTC eCommerce

Perhaps most prominent to the individual buyer, direct-to-consumer (DTC) channels are unquestionably becoming the new normal.

More and more of the sportswear market is “cutting out the middleman,” so to speak, relying on their eCommerce capabilities instead of physical stores and third-party vendors. In fact, Nike, Adidas, Puma, and Under Armor all saw DTC account for a greater share of their 2021 sales than in 2019. (Adidas, at the front of the pack, now attributes over 40 percent of sales to DTC; that number is expected to surpass 50 percent by 2025).

Apart from the convenience of shortening the supply chain, DTC channels benefit these retailers by embracing new-age technological capabilities. Specifically, access to user data — both on individuals and demographic groups — enables smarter recommendations and product assortments. In other words, DTC opens the door to a newfound level of personalization.

What this means, from a big picture lens, is a vastly improved user experience from a number of angles. One of these angles is customer relationship building — DTC eCommerce literally gives you direct access to communicate with consumers (and, in turn, fulfill their desires/assuage their pain points). Another angle: Strategically targeted product deals, rewards and promotions, and loyalty programs.

Now when we pair this tech-minded DTC movement with the current commitment to sustainable production, we get something that every company craves: A brand image that breeds customer loyalty.

The cutting-edge user experience that DTC channels enable is essentially a long-term marketing technique. Greater experience cultivates brand loyalty which, in turn, spawns a greater ROI per customer in the long term.

Success stories: How Nike, Adidas, & Co. are thriving in unprecedented times

Let’s ask: What do these tectonic shifts in the sportswear market mean for the big name brands out there?

Well, for Nike, they meant a quick resurgence after the initial early-Covid-induced dip in sales. With a newfound commitment to online channels, Nike’s sales through those channels ballooned by over 80 percent over the summer of 2020! To be fair, Nike was already trending in this digital direction; pre-Covid projections were that 30 percent of revenue would be digital by 2023.

That number, though, has already been eclipsed. With such substantial returns, we can only expect Nike to dig deeper into this gold mine. Specifically, Nike has used (and will likely continue to use) digital channels to offer exclusive, custom products (namely, shoes). One particularly notable pricing strategy Nike employed was making their at-home workout platform entirely free. The result was increased accessibility, bringing in over 50 million new users who became loyal, paying customers of Nike retail products. But more importantly, this gave Nike access to these new users’ data; with this data, the sportswear giant could then optimize prices to be as competitive and lucrative as possible .

As mentioned above, Adidas has put an industry-leading premium on eCommerce sales. But they’ve also done the extra leg by investing more in digital marketing. One striking development is their newfound interest in hosting ads on Snapchat . Over the past few years, Adidas has committed more and more ad spending to this social media channel — thanks to an ROI boost of over 50 percent in European markets. Whether or not Snapchat marketing continues to be so effective long-term may be uncertain, but it’s safe to expect sportswear giants to keep expanding their creative digital advertising.

Otherwise, Adidas’ 2020 financial review cites pricing flexibility as a major factor in weathering the Covid-induced storm. In their own words, they “exploit growth opportunities… according to market realities.” Thus: By committing to dynamic pricing and extensive market analysis, Adidas puts itself in a position to optimize its profitability with respect to its competitors.

Another big winner in athleisure has been Lululemon, whose revenue from DTC channels now accounts for 49% of the total sales . This despite years of downswing with their in-store sales. CEO Calvin MacDonald credits this recent growth to their timely adaptation of DTC eCommerce avenues… As well as their acquisition of Mirror. The on-demand personal fitness app adds a new dimension to Lululemon, providing a timely offering that’s engaged a whole new user base — much like Nike did. And much like Nike, this new app channel has equipped Lululemon with deeper customer data with which to optimize prices.

Looking ahead: Sportswear and retail at large depend on strong market intelligence

Whether it’s DTC channels, digital commerce, or sustainable production, embracing the new isn’t just about following trends.

These strategies have allowed companies like Nike to strategically grab a hold of rising markets, even through a pandemic. With at-home life gaining prominence, Nike and Co. quickly seized the newfound athleisure demand. As running, biking, and virtual fitness gain steam, so too do Nike and Co. fill the gap. And as target demographics — most notably, female buyers and the Chinese market — contribute to more and more sportswear sales, Nike and Co. are adapting to offer them exactly what they want.

The takeaway here is that these brands have not only adapted to market changes, but they’ve taken advantage of these changes to win over new segments of opportunity. They’ve adjusted to fluctuations in real-time with everything from their marketing priorities to pricing models.

Their success through a global recession is as powerful evidence as any of the merit of real-time, across-the-board market intelligence. So if you want to know how your brand can use such data-driven insights to inch ahead of the competition, book a free demo to chat it over!

Related posts

Retail Strategy

An In-Depth Data Analysis of Macy’s and Kohl’s Retail Competitiveness

Market Comparison Between Two Premier Retail Giants In the original report, Intelligence Node compared two of the largest departmental stores in the US- Macy’s & Kohl’s. Both these retailers have…

A Tour of Intelligence Node’s New Office

Last month, the Intelligence Node team moved to a bigger, swankier office after an impressive year and some major growth spurt. We put in a lot of thought into the…

Pricing Strategy

How to set fashion prices that fit

As fashion gets faster and more global, it’s also getting more complex and competitive. Many apparel retailers and brands struggle with decisions about which numbers to put on their price…

Popular Posts

- All You Need to Know About the Amazon Pricing Strategy in 2024

- The Retailer’s Guide to Price Optimization – How to Optimize Prices

- The Price Monitoring Software for Accurate Competitor Price Tracking

- Competitive Pricing Strategy – See How Products Are Priced

- 5 of the Best Penetration Pricing Examples

Latest Posts

- Driving Growth: Intelligence Node’s Accurate Digital Shelf Analytics

- Intelligence Node Partners With Kroger, Expanding to Serve Marketplace Clients

- Influencing Choices: How Online Product Visibility is Evolving in Retail

- 8 Digital Shopper Secrets to Understand the Modern Consumer

- The 2024 Consumer Behavior Trends : 40 Stats for Retail Success

- Artificial Intelligence (13)

- Big Data (9)

- Company Culture (3)

- Competitive pricing (7)

- Consumer Behavior (24)

- Covid-19 (5)

- Culture (3)

- Digital Shelf (10)

- Ecommerce (29)

- Fashion (1)

- Fashion Trend (3)

- Future Retail (16)

- Marketing Strategy (11)

- Merchandising (15)

- Price Intelligence (11)

- Pricing Strategy (58)

- Product Pricing (11)

- Retail Analytics (4)

- Retail Business (9)

- Retail Pricing (2)

- Retail Sales (8)

- Retail Strategy (12)

- Retail Trends (12)

- Seasonal Sales (8)

- Supply Chain (9)

Maximizing Your Presence through Advanced Digital Shelf Analytics

- Press Releases

- Images and Media

- At ISPO Munich

- At OutDoor by ISPO

- Press Contact

- Français (Home)

- Spanish (Home)

- Sustainability

- Connective Consultancy

- 50 years of tomorrow

- Advertise on ISPO.com

- Exhibition areas

- List of exhibitors

- Exhibitor Statements

- Opening hours

- Directions & Accomodation

- Application

- Participation opportunities

- Services around the trade fair appearance

- Trader & Exhibitor Statements

- Exhibitor shop

- Directions & Visa

- Exhibitor Manual

- ISPO Academy International conferences and trainings for your edge of knowledge

- Events All events at a glance

- Innovation Labs

- ISPO Award Our quality seal for outstanding products

- Judging & Criteria

- Application Process

- Awardees ISPO Textrends Fall/Winter

- Awardees ISPO Textrends Spring/Summer

- ISPO Collaborators Club We connect brands with consumer experts

- Urban Culture

- Sports Business

- Heroes & Athletes

- Product reviews

- Watersports

- More topics

- ISPO Munich

- About All about the ISPO Collaborators Club

- For business members Benefits and successes

Digitalization in the Sports Business: How Adidas Is Driving Development

This feature is only available when corresponding consent is given. Please read the details and accept the service to enable rating function.

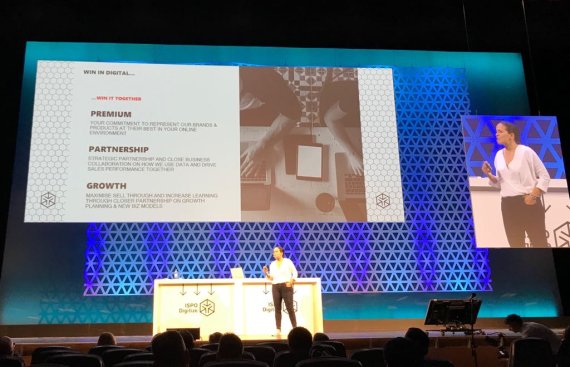

With its “Creating the New” strategy, Adidas is driving the digital transformation forward. However, many retailers fear that they will fall by the wayside at the sporting goods giant’s high speed. At the ISPO Digitize Summit, Roland Auschel and Jacqueline Smith-Dubendorfer explained how Adidas aims to win the race together with its retail partners.

- Trends This Is the Tuesday at ISPO Munich Online

- Products Buying sports glasses with open eyes

- Markets Highlights of the ISPO Re.Start Days in pictures

- All about Digitalization

The early out of the German national soccer team at the World Cup in Russia isn’t to Adidas’ liking, as Roland Auschel, Chief Sales Officer and member of the executive board, implies. He and Jacqueline Smith-Dubendorfer actually wanted to hold their keynote at the ISPO Digitize Summit in Munich in jerseys: him in DFB garb, her in Swiss colors. “But after yesterday’s game I scrapped that idea,” said Auschel with a wink.

As a representative of a global sporting goods giant, Auschel is convinced that despite Germany’s elimination “we are still going to see a fantastic World Cup in Russia.” For Adidas, the World Cup plays a major role not just because of the millions in sales of soccer jerseys and balls, but also because it’s meant to push the digital transformation that the Herzogenaurach-based company has devoted itself to one step further.

Adidas gathering important intelligence at the 2018 World Cup

Such was the case during the group match between Germany and Sweden (2:1) when the Adidas app was advertised on the advertising boards in the stadium for the first time, Auschel reports: “The number of downloads increased by 14 percent as a result.” Adidas wants to draw important conclusions for its digital platforms and e-commerce from the data obtained during the World Cup in Russia. More data means better user appeal, which means more sales – that’s how the basic formula can be summed up.

Adidas is investing several millions of euros into digitalization, aiming to be everywhere consumers are. It’s therefore more of a vision than a strategy that everyone at the company is sworn to. “Digitalization as a whole isn’t schedulable,” Roland Auschel makes clear in his speech, “but the individual digital steps are.”

Digitalization as a cycle race

Direct sales on the company’s own e-commerce platforms are expected to generate four billion euros in sales by 2020 – a huge increase. During her lecture in the ICM Jacqueline Smith-Dubendorfer, Vice President of Digital Partner Commerce, presented how these goals are to be reached and compared digitalization with a cycle race. “Let's go to the head of the peloton together. Only together can we win the race,” the manager said.

That Adidas, as a global player with roughly 57,000 employees, views itself as a star of this cycling team is needless to say. But on the difficult stages, Adidas needs a lot of helpers. “Collaborations like those with Zalando or SportScheck are important and valuable,” emphasized Smith-Dubendorfer.

Three prerequisites for Adidas partners

To be successful, the question must be answered together: “How can we maximize customer satisfaction on- and offline?” Smith-Dubendorfer presented three prerequisites for a partnership with Adidas:

Commitment to Adidas and its associated brands.

A close strategic partnership when generating and utilizing data.

Growth through optimizing existing structures and adapting new business fields.

Smith-Dubendorfer chose clear words in her lecture and – to stick with the imagery of the cycle race – made clear: Not everyone still pedaling along at the moment will reach the finish line.

Specialty sports retailers have to ask themselves unpleasant questions, the manager said. “Do you want to win the digital race? Then you have to ask yourself if you can really keep up the pace. Do you have the right people to survive? Is your IT infrastructure ready for the new era?” the Adidas representative asked the auditorium. “We are ready to communicate with our partners.”

- Mountain sports

- Water sports

- Winter sports

- OutDoor by ISPO

- Transformation

- Challenges of a CEO

- Trade fairs

- Find the Balance

- Use ISPO.com for marketing

- Individual consultancy

- Contact the editorial team

- Deutschland

- Asia, Australia & New Zealand

- Europe, Middle East & Africa

- United States & Canada

- Latinoamérica

Google Multi-Platform Case Study: adidas

adidas had two goals when it partnered with Carat for their All-In campaign: become the loudest sports apparel brand in digital and get teens to see adidas as a leader in performance and style. By placing ads across all digital platforms, adidas channel views jumped 26x and doubled its subscribers. Plus, by using mobile, they were able to reach four million additional people.

Become the loudest sports apparel brand in digital

Place adidas in the minds of American teens as a leader in performance and style

Carat and adidas worked with Google to extend their video brand messages to digital

Placed adidas video across all digital platforms

Drove awareness with 100% YouTube takeovers across all digital screens

1400%+ lift in brand response conversions

adidas channel views jumped 26x and subscribers doubled

The "All-In" video was viewed more that 2 million times in the U.S.

Others are viewing

Marketers who view this are also viewing

Understanding consumers' local search behavior

Mobile path to purchase: five key findings, secrets behind 3 of the most-watched youtube ads, the ai handbook: resources and tools for marketers, land rover finds success with engagement ads, ehealth boosts brand awareness with google display ads, others are viewing looking for something else, complete login.

To explore this content and receive communications from Google, please sign in with an existing Google account.

- Adidas Digital Transformation

Social Media Adidas

Chief digital officer (cdo), social media chief digital officer (cdo).

- External Digitalization

Digital Unit external

Digital business model (value proposition), sports products and digital offers in the field of sports, digital accelerators, digital incubators, digital startups, digital hubs, additional information – apps.

- Internal Digitalization

Digital Unit internal

- Digital Strategy

- Digital Governance

- Digital Architecture

- Digital Processes

- Digital Organization

Digital Platform

Digital tools, posts regarding adidas, posts regarding fashiontech.

Digitalization is changing the demands that customers and suppliers, but also the market itself, place on the company. External digitalization is about how the company presents itself to the outside world and how it deals with these new requirements in order to be able to continue to operate successfully in the market.

This is about answering the questions:

- How can I design my product range to inspire the customer? (Raise Net Promoter Score )

- How can I bring my products to market as quickly as possible? (Go-to-Market strategy)

Describes own companies, which deal intensively with the topic digitization and promote this topic. Digital Unit external and Digital Unit internal cannot always be clearly separated from each other.

A business model describes how a company creates value, communicates that value and records it as revenue. Digitalization creates entirely new ways in which a company can create value that can be integrated into existing business models. Value proposition is the core of the business model , as it determines the benefits a company can offer its customers. Existing companies must therefore review their business models (in particular value proposition) and determine whether a new approach created by digitization should be used to increase the benefits for the customer.

Accelerators are institutions which support companies, e.g. through consulting, training or personnel, so that they can develop as quickly as possible. Normally these are startups that are helped by Accelerators. In this cooperation, a company already established on the market is supported, which faces new challenges or has to grow into the digital transformation . More about Accelerators can be found here in the glossary: Accelerator .

Incubators are facilities that create optimal conditions for a company to develop fully. Incubators are also usually associated with startups. In this context, incubators create optimal conditions for successfully integrating the changes associated with digitization into an existing company. You can find out more about incubators here in the glossary: Incubator .

Digital startups of the corporate . More about Startups can be found here in the glossary: Startup .

Digital Hubs are outsourced premises of a company in which innovations are dedicated to the topic of digitization. By means of other work processes and unfastened corporate structures, the networking of internal and external expertise is intended to create digital innovations that drive the company forward. You can find out more about Digital Hub here in the glossary: Digital Hub .

Apps of the corporate . More about Apps can be found here in the glossary: App .

Adidas offers App users a free advantage program called “Creators Club” . App users can earn points through training, which they can then use in the Creators Club to receive special offers. Special offers are for example Limited-Product-Editions or access to exclusive events.

Refers to the digitization of internal company structures and processes. Here, the digitization of the company's own product and service chain is at the forefront.

- How can I increase my productivity through even more digital processes ?

- How can I achieve faster results through even more digitalisation in the company?

Describes internal company departments or even a direct subsidiary that deals intensively with the topic of digitization and drives it forward. Digital Unit external and Digital Unit internal cannot always be clearly separated from each other.