- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, how often should a business plan be updated, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.

- For established companies, a business plan can help keep the executive team focused on and working toward the company's short- and long-term objectives.

- There is no single format that a business plan must follow, but there are certain key elements that most companies will want to include.

Investopedia / Ryan Oakley

Any new business should have a business plan in place prior to beginning operations. In fact, banks and venture capital firms often want to see a business plan before they'll consider making a loan or providing capital to new businesses.

Even if a business isn't looking to raise additional money, a business plan can help it focus on its goals. A 2017 Harvard Business Review article reported that, "Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs."

Ideally, a business plan should be reviewed and updated periodically to reflect any goals that have been achieved or that may have changed. An established business that has decided to move in a new direction might create an entirely new business plan for itself.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. These include being able to think through ideas before investing too much money in them and highlighting any potential obstacles to success. A company might also share its business plan with trusted outsiders to get their objective feedback. In addition, a business plan can help keep a company's executive team on the same page about strategic action items and priorities.

Business plans, even among competitors in the same industry, are rarely identical. However, they often have some of the same basic elements, as we describe below.

While it's a good idea to provide as much detail as necessary, it's also important that a business plan be concise enough to hold a reader's attention to the end.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, it's best to fit the basic information into a 15- to 25-page document. Other crucial elements that take up a lot of space—such as applications for patents—can be referenced in the main document and attached as appendices.

These are some of the most common elements in many business plans:

- Executive summary: This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services: Here, the company should describe the products and services it offers or plans to introduce. That might include details on pricing, product lifespan, and unique benefits to the consumer. Other factors that could go into this section include production and manufacturing processes, any relevant patents the company may have, as well as proprietary technology . Information about research and development (R&D) can also be included here.

- Market analysis: A company needs to have a good handle on the current state of its industry and the existing competition. This section should explain where the company fits in, what types of customers it plans to target, and how easy or difficult it may be to take market share from incumbents.

- Marketing strategy: This section can describe how the company plans to attract and keep customers, including any anticipated advertising and marketing campaigns. It should also describe the distribution channel or channels it will use to get its products or services to consumers.

- Financial plans and projections: Established businesses can include financial statements, balance sheets, and other relevant financial information. New businesses can provide financial targets and estimates for the first few years. Your plan might also include any funding requests you're making.

The best business plans aren't generic ones created from easily accessed templates. A company should aim to entice readers with a plan that demonstrates its uniqueness and potential for success.

2 Types of Business Plans

Business plans can take many forms, but they are sometimes divided into two basic categories: traditional and lean startup. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These plans tend to be much longer than lean startup plans and contain considerably more detail. As a result they require more work on the part of the business, but they can also be more persuasive (and reassuring) to potential investors.

- Lean startup business plans : These use an abbreviated structure that highlights key elements. These business plans are short—as short as one page—and provide only the most basic detail. If a company wants to use this kind of plan, it should be prepared to provide more detail if an investor or a lender requests it.

Why Do Business Plans Fail?

A business plan is not a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections to begin with. Markets and the overall economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All of this calls for building some flexibility into your plan, so you can pivot to a new course if needed.

How frequently a business plan needs to be revised will depend on the nature of the business. A well-established business might want to review its plan once a year and make changes if necessary. A new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is an option when a company prefers to give a quick explanation of its business. For example, a brand-new company may feel that it doesn't have a lot of information to provide yet.

Sections can include: a value proposition ; the company's major activities and advantages; resources such as staff, intellectual property, and capital; a list of partnerships; customer segments; and revenue sources.

A business plan can be useful to companies of all kinds. But as a company grows and the world around it changes, so too should its business plan. So don't think of your business plan as carved in granite but as a living document designed to evolve with your business.

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

U.S. Small Business Administration. " Write Your Business Plan ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How to Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Business Plan, Step by Step

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

What is a business plan?

1. write an executive summary, 2. describe your company, 3. state your business goals, 4. describe your products and services, 5. do your market research, 6. outline your marketing and sales plan, 7. perform a business financial analysis, 8. make financial projections, 9. summarize how your company operates, 10. add any additional information to an appendix, business plan tips and resources.

A business plan outlines your business’s financial goals and explains how you’ll achieve them over the next three to five years. Here’s a step-by-step guide to writing a business plan that will offer a strong, detailed road map for your business.

ZenBusiness

A business plan is a document that explains what your business does, how it makes money and who its customers are. Internally, writing a business plan should help you clarify your vision and organize your operations. Externally, you can share it with potential lenders and investors to show them you’re on the right track.

Business plans are living documents; it’s OK for them to change over time. Startups may update their business plans often as they figure out who their customers are and what products and services fit them best. Mature companies might only revisit their business plan every few years. Regardless of your business’s age, brush up this document before you apply for a business loan .

» Need help writing? Learn about the best business plan software .

This is your elevator pitch. It should include a mission statement, a brief description of the products or services your business offers and a broad summary of your financial growth plans.

Though the executive summary is the first thing your investors will read, it can be easier to write it last. That way, you can highlight information you’ve identified while writing other sections that go into more detail.

» MORE: How to write an executive summary in 6 steps

Next up is your company description. This should contain basic information like:

Your business’s registered name.

Address of your business location .

Names of key people in the business. Make sure to highlight unique skills or technical expertise among members of your team.

Your company description should also define your business structure — such as a sole proprietorship, partnership or corporation — and include the percent ownership that each owner has and the extent of each owner’s involvement in the company.

Lastly, write a little about the history of your company and the nature of your business now. This prepares the reader to learn about your goals in the next section.

» MORE: How to write a company overview for a business plan

The third part of a business plan is an objective statement. This section spells out what you’d like to accomplish, both in the near term and over the coming years.

If you’re looking for a business loan or outside investment, you can use this section to explain how the financing will help your business grow and how you plan to achieve those growth targets. The key is to provide a clear explanation of the opportunity your business presents to the lender.

For example, if your business is launching a second product line, you might explain how the loan will help your company launch that new product and how much you think sales will increase over the next three years as a result.

» MORE: How to write a successful business plan for a loan

In this section, go into detail about the products or services you offer or plan to offer.

You should include the following:

An explanation of how your product or service works.

The pricing model for your product or service.

The typical customers you serve.

Your supply chain and order fulfillment strategy.

You can also discuss current or pending trademarks and patents associated with your product or service.

Lenders and investors will want to know what sets your product apart from your competition. In your market analysis section , explain who your competitors are. Discuss what they do well, and point out what you can do better. If you’re serving a different or underserved market, explain that.

Here, you can address how you plan to persuade customers to buy your products or services, or how you will develop customer loyalty that will lead to repeat business.

Include details about your sales and distribution strategies, including the costs involved in selling each product .

» MORE: R e a d our complete guide to small business marketing

If you’re a startup, you may not have much information on your business financials yet. However, if you’re an existing business, you’ll want to include income or profit-and-loss statements, a balance sheet that lists your assets and debts, and a cash flow statement that shows how cash comes into and goes out of the company.

Accounting software may be able to generate these reports for you. It may also help you calculate metrics such as:

Net profit margin: the percentage of revenue you keep as net income.

Current ratio: the measurement of your liquidity and ability to repay debts.

Accounts receivable turnover ratio: a measurement of how frequently you collect on receivables per year.

This is a great place to include charts and graphs that make it easy for those reading your plan to understand the financial health of your business.

This is a critical part of your business plan if you’re seeking financing or investors. It outlines how your business will generate enough profit to repay the loan or how you will earn a decent return for investors.

Here, you’ll provide your business’s monthly or quarterly sales, expenses and profit estimates over at least a three-year period — with the future numbers assuming you’ve obtained a new loan.

Accuracy is key, so carefully analyze your past financial statements before giving projections. Your goals may be aggressive, but they should also be realistic.

NerdWallet’s picks for setting up your business finances:

The best business checking accounts .

The best business credit cards .

The best accounting software .

Before the end of your business plan, summarize how your business is structured and outline each team’s responsibilities. This will help your readers understand who performs each of the functions you’ve described above — making and selling your products or services — and how much each of those functions cost.

If any of your employees have exceptional skills, you may want to include their resumes to help explain the competitive advantage they give you.

Finally, attach any supporting information or additional materials that you couldn’t fit in elsewhere. That might include:

Licenses and permits.

Equipment leases.

Bank statements.

Details of your personal and business credit history, if you’re seeking financing.

If the appendix is long, you may want to consider adding a table of contents at the beginning of this section.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Here are some tips to write a detailed, convincing business plan:

Avoid over-optimism: If you’re applying for a business bank loan or professional investment, someone will be reading your business plan closely. Providing unreasonable sales estimates can hurt your chances of approval.

Proofread: Spelling, punctuation and grammatical errors can jump off the page and turn off lenders and prospective investors. If writing and editing aren't your strong suit, you may want to hire a professional business plan writer, copy editor or proofreader.

Use free resources: SCORE is a nonprofit association that offers a large network of volunteer business mentors and experts who can help you write or edit your business plan. The U.S. Small Business Administration’s Small Business Development Centers , which provide free business consulting and help with business plan development, can also be a resource.

On a similar note...

Find small-business financing

Compare multiple lenders that fit your business

What is a Business Plan? Definition, Tips, and Templates

Published: June 07, 2023

In an era where more than 20% of small enterprises fail in their first year, having a clear, defined, and well-thought-out business plan is a crucial first step for setting up a business for long-term success.

Business plans are a required tool for all entrepreneurs, business owners, business acquirers, and even business school students. But … what exactly is a business plan?

In this post, we'll explain what a business plan is, the reasons why you'd need one, identify different types of business plans, and what you should include in yours.

What is a business plan?

A business plan is a documented strategy for a business that highlights its goals and its plans for achieving them. It outlines a company's go-to-market plan, financial projections, market research, business purpose, and mission statement. Key staff who are responsible for achieving the goals may also be included in the business plan along with a timeline.

The business plan is an undeniably critical component to getting any company off the ground. It's key to securing financing, documenting your business model, outlining your financial projections, and turning that nugget of a business idea into a reality.

What is a business plan used for?

The purpose of a business plan is three-fold: It summarizes the organization’s strategy in order to execute it long term, secures financing from investors, and helps forecast future business demands.

Business Plan Template [ Download Now ]

Working on your business plan? Try using our Business Plan Template . Pre-filled with the sections a great business plan needs, the template will give aspiring entrepreneurs a feel for what a business plan is, what should be in it, and how it can be used to establish and grow a business from the ground up.

Purposes of a Business Plan

Chances are, someone drafting a business plan will be doing so for one or more of the following reasons:

1. Securing financing from investors.

Since its contents revolve around how businesses succeed, break even, and turn a profit, a business plan is used as a tool for sourcing capital. This document is an entrepreneur's way of showing potential investors or lenders how their capital will be put to work and how it will help the business thrive.

All banks, investors, and venture capital firms will want to see a business plan before handing over their money, and investors typically expect a 10% ROI or more from the capital they invest in a business.

Therefore, these investors need to know if — and when — they'll be making their money back (and then some). Additionally, they'll want to read about the process and strategy for how the business will reach those financial goals, which is where the context provided by sales, marketing, and operations plans come into play.

2. Documenting a company's strategy and goals.

A business plan should leave no stone unturned.

Business plans can span dozens or even hundreds of pages, affording their drafters the opportunity to explain what a business' goals are and how the business will achieve them.

To show potential investors that they've addressed every question and thought through every possible scenario, entrepreneurs should thoroughly explain their marketing, sales, and operations strategies — from acquiring a physical location for the business to explaining a tactical approach for marketing penetration.

These explanations should ultimately lead to a business' break-even point supported by a sales forecast and financial projections, with the business plan writer being able to speak to the why behind anything outlined in the plan.

.webp)

Free Business Plan Template

The essential document for starting a business -- custom built for your needs.

- Outline your idea.

- Pitch to investors.

- Secure funding.

- Get to work!

You're all set!

Click this link to access this resource at any time.

Free Business Plan [Template]

Fill out the form to access your free business plan., 3. legitimizing a business idea..

Everyone's got a great idea for a company — until they put pen to paper and realize that it's not exactly feasible.

A business plan is an aspiring entrepreneur's way to prove that a business idea is actually worth pursuing.

As entrepreneurs document their go-to-market process, capital needs, and expected return on investment, entrepreneurs likely come across a few hiccups that will make them second guess their strategies and metrics — and that's exactly what the business plan is for.

It ensures an entrepreneur's ducks are in a row before bringing their business idea to the world and reassures the readers that whoever wrote the plan is serious about the idea, having put hours into thinking of the business idea, fleshing out growth tactics, and calculating financial projections.

4. Getting an A in your business class.

Speaking from personal experience, there's a chance you're here to get business plan ideas for your Business 101 class project.

If that's the case, might we suggest checking out this post on How to Write a Business Plan — providing a section-by-section guide on creating your plan?

What does a business plan need to include?

- Business Plan Subtitle

- Executive Summary

- Company Description

- The Business Opportunity

- Competitive Analysis

- Target Market

- Marketing Plan

- Financial Summary

- Funding Requirements

1. Business Plan Subtitle

Every great business plan starts with a captivating title and subtitle. You’ll want to make it clear that the document is, in fact, a business plan, but the subtitle can help tell the story of your business in just a short sentence.

2. Executive Summary

Although this is the last part of the business plan that you’ll write, it’s the first section (and maybe the only section) that stakeholders will read. The executive summary of a business plan sets the stage for the rest of the document. It includes your company’s mission or vision statement, value proposition, and long-term goals.

3. Company Description

This brief part of your business plan will detail your business name, years in operation, key offerings, and positioning statement. You might even add core values or a short history of the company. The company description’s role in a business plan is to introduce your business to the reader in a compelling and concise way.

4. The Business Opportunity

The business opportunity should convince investors that your organization meets the needs of the market in a way that no other company can. This section explains the specific problem your business solves within the marketplace and how it solves them. It will include your value proposition as well as some high-level information about your target market.

5. Competitive Analysis

Just about every industry has more than one player in the market. Even if your business owns the majority of the market share in your industry or your business concept is the first of its kind, you still have competition. In the competitive analysis section, you’ll take an objective look at the industry landscape to determine where your business fits. A SWOT analysis is an organized way to format this section.

6. Target Market

Who are the core customers of your business and why? The target market portion of your business plan outlines this in detail. The target market should explain the demographics, psychographics, behavioristics, and geographics of the ideal customer.

7. Marketing Plan

Marketing is expansive, and it’ll be tempting to cover every type of marketing possible, but a brief overview of how you’ll market your unique value proposition to your target audience, followed by a tactical plan will suffice.

Think broadly and narrow down from there: Will you focus on a slow-and-steady play where you make an upfront investment in organic customer acquisition? Or will you generate lots of quick customers using a pay-to-play advertising strategy? This kind of information should guide the marketing plan section of your business plan.

8. Financial Summary

Money doesn’t grow on trees and even the most digital, sustainable businesses have expenses. Outlining a financial summary of where your business is currently and where you’d like it to be in the future will substantiate this section. Consider including any monetary information that will give potential investors a glimpse into the financial health of your business. Assets, liabilities, expenses, debt, investments, revenue, and more are all useful adds here.

So, you’ve outlined some great goals, the business opportunity is valid, and the industry is ready for what you have to offer. Who’s responsible for turning all this high-level talk into results? The "team" section of your business plan answers that question by providing an overview of the roles responsible for each goal. Don’t worry if you don’t have every team member on board yet, knowing what roles to hire for is helpful as you seek funding from investors.

10. Funding Requirements

Remember that one of the goals of a business plan is to secure funding from investors, so you’ll need to include funding requirements you’d like them to fulfill. The amount your business needs, for what reasons, and for how long will meet the requirement for this section.

Types of Business Plans

- Startup Business Plan

- Feasibility Business Plan

- Internal Business Plan

- Strategic Business Plan

- Business Acquisition Plan

- Business Repositioning Plan

- Expansion or Growth Business Plan

There’s no one size fits all business plan as there are several types of businesses in the market today. From startups with just one founder to historic household names that need to stay competitive, every type of business needs a business plan that’s tailored to its needs. Below are a few of the most common types of business plans.

For even more examples, check out these sample business plans to help you write your own .

1. Startup Business Plan

As one of the most common types of business plans, a startup business plan is for new business ideas. This plan lays the foundation for the eventual success of a business.

The biggest challenge with the startup business plan is that it’s written completely from scratch. Startup business plans often reference existing industry data. They also explain unique business strategies and go-to-market plans.

Because startup business plans expand on an original idea, the contents will vary by the top priority goals.

For example, say a startup is looking for funding. If capital is a priority, this business plan might focus more on financial projections than marketing or company culture.

2. Feasibility Business Plan

This type of business plan focuses on a single essential aspect of the business — the product or service. It may be part of a startup business plan or a standalone plan for an existing organization. This comprehensive plan may include:

- A detailed product description

- Market analysis

- Technology needs

- Production needs

- Financial sources

- Production operations

According to CBInsights research, 35% of startups fail because of a lack of market need. Another 10% fail because of mistimed products.

Some businesses will complete a feasibility study to explore ideas and narrow product plans to the best choice. They conduct these studies before completing the feasibility business plan. Then the feasibility plan centers on that one product or service.

3. Internal Business Plan

Internal business plans help leaders communicate company goals, strategy, and performance. This helps the business align and work toward objectives more effectively.

Besides the typical elements in a startup business plan, an internal business plan may also include:

- Department-specific budgets

- Target demographic analysis

- Market size and share of voice analysis

- Action plans

- Sustainability plans

Most external-facing business plans focus on raising capital and support for a business. But an internal business plan helps keep the business mission consistent in the face of change.

4. Strategic Business Plan

Strategic business plans focus on long-term objectives for your business. They usually cover the first three to five years of operations. This is different from the typical startup business plan which focuses on the first one to three years. The audience for this plan is also primarily internal stakeholders.

These types of business plans may include:

- Relevant data and analysis

- Assessments of company resources

- Vision and mission statements

It's important to remember that, while many businesses create a strategic plan before launching, some business owners just jump in. So, this business plan can add value by outlining how your business plans to reach specific goals. This type of planning can also help a business anticipate future challenges.

5. Business Acquisition Plan

Investors use business plans to acquire existing businesses, too — not just new businesses.

A business acquisition plan may include costs, schedules, or management requirements. This data will come from an acquisition strategy.

A business plan for an existing company will explain:

- How an acquisition will change its operating model

- What will stay the same under new ownership

- Why things will change or stay the same

- Acquisition planning documentation

- Timelines for acquisition

Additionally, the business plan should speak to the current state of the business and why it's up for sale.

For example, if someone is purchasing a failing business, the business plan should explain why the business is being purchased. It should also include:

- What the new owner will do to turn the business around

- Historic business metrics

- Sales projections after the acquisition

- Justification for those projections

6. Business Repositioning Plan

.webp?width=650&height=450&name=businessplan_6%20(1).webp)

When a business wants to avoid acquisition, reposition its brand, or try something new, CEOs or owners will develop a business repositioning plan.

This plan will:

- Acknowledge the current state of the company.

- State a vision for the future of the company.

- Explain why the business needs to reposition itself.

- Outline a process for how the company will adjust.

Companies planning for a business reposition often do so — proactively or retroactively — due to a shift in market trends and customer needs.

For example, shoe brand AllBirds plans to refocus its brand on core customers and shift its go-to-market strategy. These decisions are a reaction to lackluster sales following product changes and other missteps.

7. Expansion or Growth Business Plan

When your business is ready to expand, a growth business plan creates a useful structure for reaching specific targets.

For example, a successful business expanding into another location can use a growth business plan. This is because it may also mean the business needs to focus on a new target market or generate more capital.

This type of plan usually covers the next year or two of growth. It often references current sales, revenue, and successes. It may also include:

- SWOT analysis

- Growth opportunity studies

- Financial goals and plans

- Marketing plans

- Capability planning

These types of business plans will vary by business, but they can help businesses quickly rally around new priorities to drive growth.

Getting Started With Your Business Plan

At the end of the day, a business plan is simply an explanation of a business idea and why it will be successful. The more detail and thought you put into it, the more successful your plan — and the business it outlines — will be.

When writing your business plan, you’ll benefit from extensive research, feedback from your team or board of directors, and a solid template to organize your thoughts. If you need one of these, download HubSpot's Free Business Plan Template below to get started.

Editor's note: This post was originally published in August 2020 and has been updated for comprehensiveness.

Don't forget to share this post!

Related articles.

24 of My Favorite Sample Business Plans & Examples For Your Inspiration

![business plan in management meaning How to Write a Powerful Executive Summary [+4 Top Examples]](https://blog.hubspot.com/hubfs/executive-summary-example_5.webp)

How to Write a Powerful Executive Summary [+4 Top Examples]

19 Best Sample Business Plans & Examples to Help You Write Your Own

Maximizing Your Social Media Strategy: The Top Aggregator Tools to Use

The Content Aggregator Guide for 2023

![business plan in management meaning 7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]](https://blog.hubspot.com/hubfs/gantt-chart-example.jpg)

7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]

![business plan in management meaning The 8 Best Free Flowchart Templates [+ Examples]](https://blog.hubspot.com/hubfs/flowchart%20templates.jpg)

The 8 Best Free Flowchart Templates [+ Examples]

16 Best Screen Recorders to Use for Collaboration

The 25 Best Google Chrome Extensions for SEO

Professional Invoice Design: 28 Samples & Templates to Inspire You

2 Essential Templates For Starting Your Business

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

Plan Smarter, Grow Faster:

25% Off Annual Plans! Save Now

0 results have been found for “”

Return to blog home

What Is a Business Plan? Definition and Planning Essentials Explained

Posted february 21, 2022 by kody wirth.

What is a business plan? It’s the roadmap for your business. The outline of your goals, objectives, and the steps you’ll take to get there. It describes the structure of your organization, how it operates, as well as the financial expectations and actual performance.

A business plan can help you explore ideas, successfully start a business, manage operations, and pursue growth. In short, a business plan is a lot of different things. It’s more than just a stack of paper and can be one of your most effective tools as a business owner.

Let’s explore the basics of business planning, the structure of a traditional plan, your planning options, and how you can use your plan to succeed.

What is a business plan?

A business plan is a document that explains how your business operates. It summarizes your business structure, objectives, milestones, and financial performance. Again, it’s a guide that helps you, and anyone else, better understand how your business will succeed.

Why do you need a business plan?

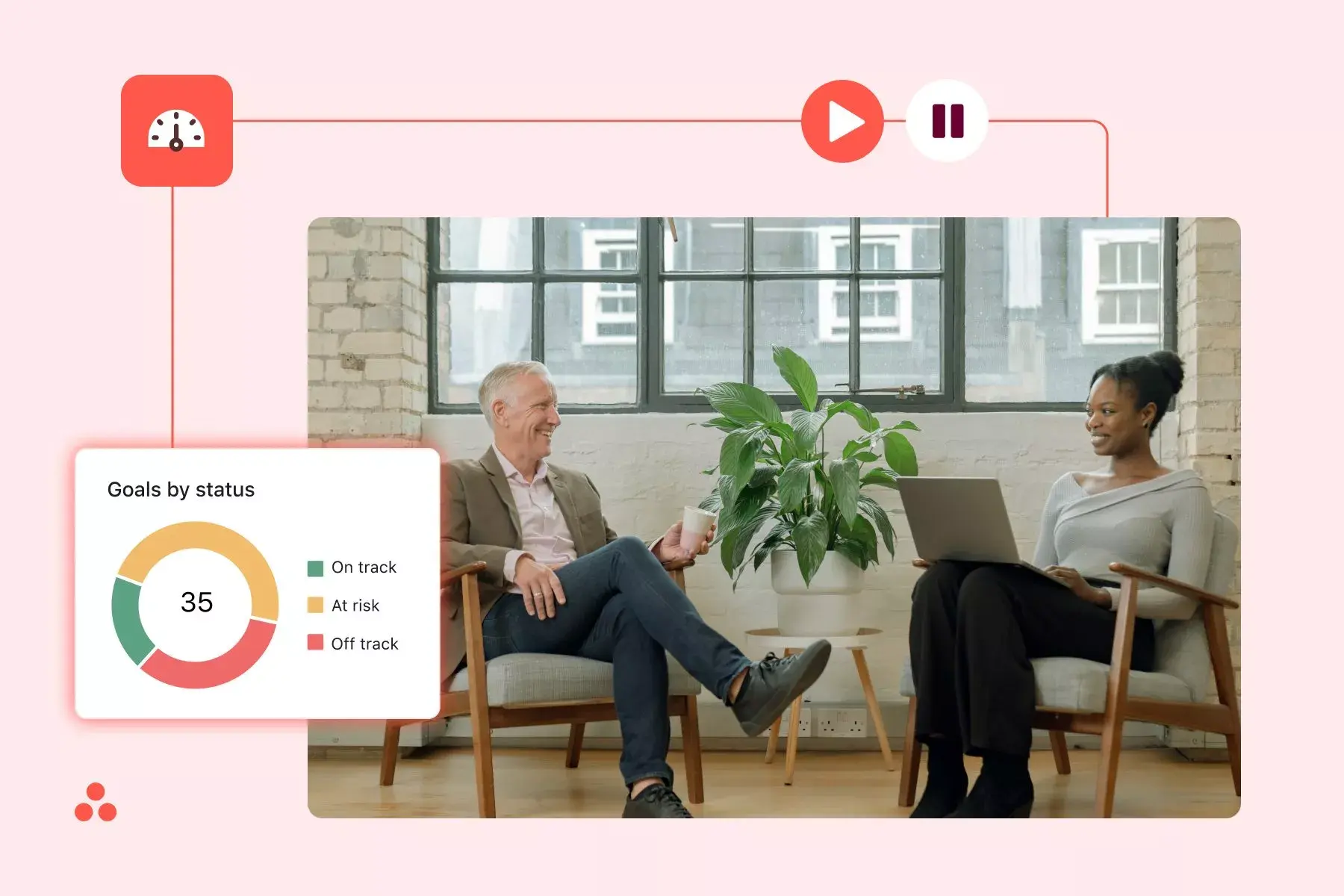

The primary purpose of a business plan is to help you understand the direction of your business and the steps it will take to get there. Having a solid business plan can help you grow up to 30% faster and according to our own 2021 Small Business research working on a business plan increases confidence regarding business health—even in the midst of a crisis.

These benefits are directly connected to how writing a business plan makes you more informed and better prepares you for entrepreneurship. It helps you reduce risk and avoid pursuing potentially poor ideas. You’ll also be able to more easily uncover your business’s potential. By regularly returning to your plan you can understand what parts of your strategy are working and those that are not.

That just scratches the surface for why having a plan is valuable. Check out our full write-up for fifteen more reasons why you need a business plan .

What can you do with your plan?

So what can you do with a business plan once you’ve created it? It can be all too easy to write a plan and just let it be. Here are just a few ways you can leverage your plan to benefit your business.

Test an idea

Writing a plan isn’t just for those that are ready to start a business. It’s just as valuable for those that have an idea and want to determine if it’s actually possible or not. By writing a plan to explore the validity of an idea, you are working through the process of understanding what it would take to be successful.

The market and competitive research alone can tell you a lot about your idea. Is the marketplace too crowded? Is the solution you have in mind not really needed? Add in the exploration of milestones, potential expenses, and the sales needed to attain profitability and you can paint a pretty clear picture of the potential of your business.

Document your strategy and goals

For those starting or managing a business understanding where you’re going and how you’re going to get there are vital. Writing your plan helps you do that. It ensures that you are considering all aspects of your business, know what milestones you need to hit, and can effectively make adjustments if that doesn’t happen.

With a plan in place, you’ll have an idea of where you want your business to go as well as how you’ve performed in the past. This alone better prepares you to take on challenges, review what you’ve done before, and make the right adjustments.

Pursue funding

Even if you do not intend to pursue funding right away, having a business plan will prepare you for it. It will ensure that you have all of the information necessary to submit a loan application and pitch to investors. So, rather than scrambling to gather documentation and write a cohesive plan once it’s relevant, you can instead keep your plan up-to-date and attempt to attain funding. Just add a use of funds report to your financial plan and you’ll be ready to go.

The benefits of having a plan don’t stop there. You can then use your business plan to help you manage the funding you receive. You’ll not only be able to easily track and forecast how you’ll use your funds but easily report on how it’s been used.

Better manage your business

A solid business plan isn’t meant to be something you do once and forget about. Instead, it should be a useful tool that you can regularly use to analyze performance, make strategic decisions, and anticipate future scenarios. It’s a document that you should regularly update and adjust as you go to better fit the actual state of your business.

Doing so makes it easier to understand what’s working and what’s not. It helps you understand if you’re truly reaching your goals or if you need to make further adjustments. Having your plan in place makes that process quicker, more informative, and leaves you with far more time to actually spend running your business.

What should your business plan include?

The content and structure of your business plan should include anything that will help you use it effectively. That being said, there are some key elements that you should cover and that investors will expect to see.

Executive summary

The executive summary is a simple overview of your business and your overall plan. It should serve as a standalone document that provides enough detail for anyone—including yourself, team members, or investors—to fully understand your business strategy. Make sure to cover the problem you’re solving, a description of your product or service, your target market, organizational structure, a financial summary, and any necessary funding requirements.

This will be the first part of your plan but it’s easiest to write it after you’ve created your full plan.

Products & Services

When describing your products or services, you need to start by outlining the problem you’re solving and why what you offer is valuable. This is where you’ll also address current competition in the market and any competitive advantages your products or services bring to the table. Lastly, be sure to outline the steps or milestones that you’ll need to hit to successfully launch your business. If you’ve already hit some initial milestones, like taking pre-orders or early funding, be sure to include it here to further prove the validity of your business.

Market analysis

A market analysis is a qualitative and quantitative assessment of the current market you’re entering or competing in. It helps you understand the overall state and potential of the industry, who your ideal customers are, the positioning of your competition, and how you intend to position your own business. This helps you better explore the long-term trends of the market, what challenges to expect, and how you will need to initially introduce and even price your products or services.

Check out our full guide for how to conduct a market analysis in just four easy steps .

Marketing & sales

Here you detail how you intend to reach your target market. This includes your sales activities, general pricing plan, and the beginnings of your marketing strategy. If you have any branding elements, sample marketing campaigns, or messaging available—this is the place to add it.

Additionally, it may be wise to include a SWOT analysis that demonstrates your business or specific product/service position. This will showcase how you intend to leverage sales and marketing channels to deal with competitive threats and take advantage of any opportunities.

Check out our full write-up to learn how to create a cohesive marketing strategy for your business.

Organization & management

This section addresses the legal structure of your business, your current team, and any gaps that need to be filled. Depending on your business type and longevity, you’ll also need to include your location, ownership information, and business history. Basically, add any information that helps explain your organizational structure and how you operate. This section is particularly important for pitching to investors but should be included even if attempted funding is not in your immediate future.

Financial projections

Possibly the most important piece of your plan, your financials section is vital for showcasing the viability of your business. It also helps you establish a baseline to measure against and makes it easier to make ongoing strategic decisions as your business grows. This may seem complex on the surface, but it can be far easier than you think.

Focus on building solid forecasts, keep your categories simple, and lean on assumptions. You can always return to this section to add more details and refine your financial statements as you operate.

Here are the statements you should include in your financial plan:

- Sales and revenue projections

- Profit and loss statement

- Cash flow statement

- Balance sheet

The appendix is where you add additional detail, documentation, or extended notes that support the other sections of your plan. Don’t worry about adding this section at first and only add documentation that you think will be beneficial for anyone reading your plan.

Types of business plans explained

While all business plans cover similar categories, the style and function fully depend on how you intend to use your plan. So, to get the most out of your plan, it’s best to find a format that suits your needs. Here are a few common business plan types worth considering.

Traditional business plan

The tried-and-true traditional business plan is a formal document meant to be used for external purposes. Typically this is the type of plan you’ll need when applying for funding or pitching to investors. It can also be used when training or hiring employees, working with vendors, or any other situation where the full details of your business must be understood by another individual.

This type of business plan follows the outline above and can be anywhere from 10-50 pages depending on the amount of detail included, the complexity of your business, and what you include in your appendix. We recommend only starting with this business plan format if you plan to immediately pursue funding and already have a solid handle on your business information.

Business model canvas

The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

The structure ditches a linear structure in favor of a cell-based template. It encourages you to build connections between every element of your business. It’s faster to write out and update, and much easier for you, your team, and anyone else to visualize your business operations. This is really best for those exploring their business idea for the first time, but keep in mind that it can be difficult to actually validate your idea this way as well as adapt it into a full plan.

One-page business plan

The true middle ground between the business model canvas and a traditional business plan is the one-page business plan. This format is a simplified version of the traditional plan that focuses on the core aspects of your business. It basically serves as a beefed-up pitch document and can be finished as quickly as the business model canvas.

By starting with a one-page plan, you give yourself a minimal document to build from. You’ll typically stick with bullet points and single sentences making it much easier to elaborate or expand sections into a longer-form business plan. This plan type is useful for those exploring ideas, needing to validate their business model, or who need an internal plan to help them run and manage their business.

Now, the option that we here at LivePlan recommend is the Lean Plan . This is less of a specific document type and more of a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, test, review, refine, and take action based on performance.

It holds all of the benefits of the single-page plan, including the potential to complete it in as little as 27-minutes . However, it’s even easier to convert into a full plan thanks to how heavily it’s tied to your financials. The overall goal of Lean Planning isn’t to just produce documents that you use once and shelve. Instead, the Lean Planning process helps you build a healthier company that thrives in times of growth and stable through times of crisis.

It’s faster, keeps your plan concise, and ensures that your plan is always up-to-date.

Try the LivePlan Method for Lean Business Planning

Now that you know the basics of business planning, it’s time to get started. Again we recommend leveraging a Lean Plan for a faster, easier, and far more useful planning process.

To get familiar with the Lean Plan format, you can download our free Lean Plan template . However, if you want to elevate your ability to create and use your lean plan even further, you may want to explore LivePlan.

It features step-by-step guidance that ensures you cover everything necessary while reducing the time spent on formatting and presenting. You’ll also gain access to financial forecasting tools that propel you through the process. Finally, it will transform your plan into a management tool that will help you easily compare your forecasts to your actual results.

Check out how LivePlan streamlines Lean Planning by downloading our Kickstart Your Business ebook .

Like this post? Share with a friend!

Posted in Business Plan Writing

Join over 1 million entrepreneurs who found success with liveplan, like this content sign up to receive more.

Subscribe for tips and guidance to help you grow a better, smarter business.

You're all set!

Exciting business insights and growth strategies will be coming your way each month.

We care about your privacy. See our privacy policy .

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

Writing the Organization and Management Section of Your Business Plan

What is the organization and management section in a business plan.

- What to Put in the Organization and Management Section

Organization

The management team, helpful tips to write this section, frequently asked questions (faqs).

vm / E+ / Getty Images

Every business plan needs an organization and management section. This document will help you convey your vision for how your business will be structured. Here's how to write a good one.

Key Takeaways

- This section of your business plan details your corporate structure.

- It should explain the hierarchy of management, including details about the owners, the board of directors, and any professional partners.

- The point of this section is to clarify who will be in charge of each aspect of your business, as well as how those individuals will help the business succeed.

The organization and management section of your business plan should summarize information about your business structure and team. It usually comes after the market analysis section in a business plan . It's especially important to include this section if you have a partnership or a multi-member limited liability company (LLC). However, if you're starting a home business or are writing a business plan for one that's already operating, and you're the only person involved, then you don't need to include this section.

What To Put in the Organization and Management Section

You can separate the two terms to better understand how to write this section of the business plan.

The "organization" in this section refers to how your business is structured and the people involved. "Management" refers to the responsibilities different managers have and what those individuals bring to the company.

In the opening of the section, you want to give a summary of your management team, including size, composition, and a bit about each member's experience.

For example, you might write something like "Our management team of five has more than 20 years of experience in the industry."

The organization section sets up the hierarchy of the people involved in your business. It's often set up in a chart form. If you have a partnership or multi-member LLC, this is where you indicate who is president or CEO, the CFO, director of marketing, and any other roles you have in your business. If you're a single-person home business, this becomes easy as you're the only one on the chart.

Technically, this part of the plan is about owner members, but if you plan to outsource work or hire a virtual assistant, you can include them here, as well. For example, you might have a freelance webmaster, marketing assistant, and copywriter. You might even have a virtual assistant whose job it is to work with your other freelancers. These people aren't owners but have significant duties in your business.

Some common types of business structures include sole proprietorships, partnerships, LLCs, and corporations.

Sole Proprietorship

This type of business isn't a separate entity. Instead, business assets and liabilities are entwined with your personal finances. You're the sole person in charge, and you won't be allowed to sell stock or bring in new owners. If you don't register as any other kind of business, you'll automatically be considered a sole proprietorship.

Partnership

Partnerships can be either limited (LP) or limited liability (LLP). LPs have one general partner who takes on the bulk of the liability for the company, while all other partner owners have limited liability (and limited control over the business). LLPs are like an LP without a general partner; all partners have limited liability from debts as well as the actions of other partners.

Limited Liability Company

A limited liability company (LLC) combines elements of partnership and corporate structures. Your personal liability is limited, and profits are passed through to your personal returns.

Corporation

There are many variations of corporate structure that an organization might choose. These include C corps, which allow companies to issue stock shares, pay corporate taxes (rather than passing profits through to personal returns), and offer the highest level of personal protection from business activities. There are also nonprofit corporations, which are similar to C corps, but they don't seek profits and don't pay state or federal income taxes.

This section highlights what you and the others involved in the running of your business bring to the table. This not only includes owners and managers but also your board of directors (if you have one) and support professionals. Start by indicating your business structure, and then list the team members.

Owner/Manager/Members

Provide the following information on each owner/manager/member:

- Percentage of ownership (LLC, corporation, etc.)

- Extent of involvement (active or silent partner)

- Type of ownership (stock options, general partner, etc.)

- Position in the business (CEO, CFO, etc.)

- Duties and responsibilities

- Educational background

- Experience or skills that are relevant to the business and the duties

- Past employment

- Skills will benefit the business

- Awards and recognition

- Compensation (how paid)

- How each person's skills and experience will complement you and each other

Board of Directors

A board of directors is another part of your management team. If you don't have a board of directors, you don't need this information. This section provides much of the same information as in the ownership and management team sub-section.

- Position (if there are positions)

- Involvement with the company

Even a one-person business could benefit from a small group of other business owners providing feedback, support, and accountability as an advisory board.

Support Professionals

Especially if you're seeking funding, let potential investors know you're on the ball with a lawyer, accountant, and other professionals that are involved in your business. This is the place to list any freelancers or contractors you're using. Like the other sections, you'll want to include:

- Background information such as education or certificates

- Services provided to your business

- Relationship information (retainer, as-needed, regular, etc.)

- Skills and experience making them ideal for the work you need

- Anything else that makes them stand out as quality professionals (awards, etc.)

Writing a business plan seems like an overwhelming activity, especially if you're starting a small, one-person business. But writing a business plan can be fairly simple.

Like other parts of the business plan, this is a section you'll want to update if you have team member changes, or if you and your team members receive any additional training, awards, or other resume changes that benefit the business.

Because it highlights the skills and experience you and your team offer, it can be a great resource to refer to when seeking publicity and marketing opportunities. You can refer to it when creating your media kit or pitching for publicity.

Why are organization and management important to a business plan?

The point of this section is to clarify who's in charge of what. This document can clarify these roles for yourself, as well as investors and employees.

What should you cover in the organization and management section of a business plan?

The organization and management section should explain the chain of command , roles, and responsibilities. It should also explain a bit about what makes each person particularly well-suited to take charge of their area of the business.

Want to read more content like this? Sign up for The Balance’s newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning!

Small Business Administration. " Write Your Business Plan ."

City of Eagle, Idaho. " Step 2—Write Your Business Plan ."

Small Business Administration. " Choose a Business Structure ."

How to Write the Management Team Section of a Business Plan + Examples

Written by Dave Lavinsky

Over the last 20+ years, we’ve written business plans for over 4,000 companies and hundreds of thousands of others have used the best business plan template and our other business planning materials.

From this vast experience, we’ve gained valuable insights on how to write a business plan effectively , specifically in the management section.

What is a Management Team Business Plan?

A management team business plan is a section in a comprehensive business plan that introduces and highlights the key members of the company’s management team. This part provides essential details about the individuals responsible for leading and running the business, including their backgrounds, skills, and experience.

It’s crucial for potential investors and stakeholders to evaluate the management team’s competence and qualifications, as a strong team can instill confidence in the company’s ability to succeed.

Why is the Management Team Section of a Business Plan Important?

Your management team plan has 3 goals:

- To prove to you that you have the right team to execute on the opportunity you have defined, and if not, to identify who you must hire to round out your current team

- To convince lenders and investors (e.g., angel investors, venture capitalists) to fund your company (if needed)

- To document how your Board (if applicable) can best help your team succeed

What to Include in Your Management Team Section

There are two key elements to include in your management team business plan as follows:

Management Team Members

For each key member of your team, document their name, title, and background.

Their backgrounds are most important in telling you and investors they are qualified to execute. Describe what positions each member has held in the past and what they accomplished in those positions. For example, if your VP of Sales was formerly the VP of Sales for another company in which they grew sales from zero to $10 million, that would be an important and compelling accomplishment to document.

Importantly, try to relate your team members’ past job experience with what you need them to accomplish at your company. For example, if a former high school principal was on your team, you could state that their vast experience working with both teenagers and their parents will help them succeed in their current position (particularly if the current position required them to work with both customer segments).

This is true for a management team for a small business, a medium-sized or large business.

Management Team Gaps

In this section, detail if your management team currently has any gaps or missing individuals. Not having a complete team at the time you develop your business plan. But, you must show your plan to complete your team.

As such, describe what positions are missing and who will fill the positions. For example, if you know you need to hire a VP of Marketing, state this. Further, state the job description of this person. For example, you might say that this hire will have 10 years of experience managing a marketing team, establishing new accounts, working with social media marketing, have startup experience, etc.

To give you a “checklist” of the employees you might want to include in your Management Team Members and/or Gaps sections, below are the most common management titles at a growing startup (note that many are specific to tech startups):

- Founder, CEO, and/or President

- Chief Operating Officer

- Chief Financial Officer

- VP of Sales

- VP of Marketing

- VP of Web Development and/or Engineering

- UX Designer/Manager

- Product Manager

- Digital Marketing Manager

- Business Development Manager

- Account Management/Customer Service Manager

- Sales Managers/Sales Staff

- Board Members

If you have a Board of Directors or Board of Advisors, you would include the bios of the members of your board in this section.

A Board of Directors is a paid group of individuals who help guide your company. Typically startups do not have such a board until they raise VC funding.

If your company is not at this stage, consider forming a Board of Advisors. Such a board is ideal particularly if your team is missing expertise and/or experience in certain areas. An advisory board includes 2 to 8 individuals who act as mentors to your business. Usually, you meet with them monthly or quarterly and they help answer questions and provide strategic guidance. You typically do not pay advisory board members with cash, but offering them options in your company is a best practice as it allows you to attract better board members and better motivate them.

Management Team Business Plan Example

Below are examples of how to include your management section in your business plan.

Key Team Members

Jim Smith, Founder & CEO

Jim has 15 years of experience in online software development, having co-founded two previous successful online businesses. His first company specialized in developing workflow automation software for government agencies and was sold to a public company in 2003. Jim’s second company developed a mobile app for parents to manage their children’s activities, which was sold to a large public company in 2014. Jim has a B.S. in computer science from MIT and an M.B.A from the University of Chicago

Bill Jones, COO

Bill has 20 years of sales and business development experience from working with several startups that he helped grow into large businesses. He has a B.S. in mechanical engineering from M.I.T., where he also played Division I lacrosse for four years.

We currently have no gaps in our management team, but we plan to expand our team by hiring a Vice President of Marketing to be responsible for all digital marketing efforts.

Vance Williamson, Founder & CEO

Prior to founding GoDoIt, Vance was the CIO of a major corporation with more than 100 retail locations. He oversaw all IT initiatives including software development, sales technology, mobile apps for customers and employees, security systems, customer databases/CRM platforms, etc. He has a B.S in computer science and an MBA in operations management from UCLA.

We currently have two gaps in our Management Team:

A VP of Sales with 10 years of experience managing sales teams, overseeing sales processes, working with manufacturers, establishing new accounts, working with digital marketing/advertising agencies to build brand awareness, etc.

In addition, we need to hire a VP of Marketing with experience creating online marketing campaigns that attract new customers to our site.

How to Finish Your Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Click here to finish your business plan today.

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success.

Click here to see how Growthink’s professional business plan consulting services can create your business plan for you.

Other Resources for Writing Your Business Plan

- How to Write an Executive Summary

- How to Expertly Write the Company Description in Your Business Plan

- How to Write the Market Analysis Section of a Business Plan

- The Customer Analysis Section of Your Business Plan

- Completing the Competitive Analysis Section of Your Business Plan

- Financial Assumptions and Your Business Plan

- How to Create Financial Projections for Your Business Plan

- Everything You Need to Know about the Business Plan Appendix

- Business Plan Conclusion: Summary & Recap

Other Helpful Business Plan Articles & Templates

Management Plan: Definition, Benefits & How To Create One?

“A goal without a plan is just a wish.”

In any business, you may have multiple operations running at any given time.

It’s necessary to stay on track with all these operations and the management of a firm plays a pivotal role in making sure they are carried out smoothly.

Managers need to be two steps ahead and prepare for any possible threats and anticipate upcoming changes.

For this a management plan needs to be in place, without it, you become vulnerable to changing trends that can threaten our business.

Management plans will help address a variety of issues, not just during the initial phases of an operation but throughout its execution.

Simply put, a management plan ensures that everything operates smoothly.

The good news is that setting up a management plan will help you optimize all your processes.

The bad news? Creating a management plan usually trips most managers. But that’s why we’re here to not let you fall into the same traps that most managers get themselves into.

Read on and soon you’ll become a management plan expert…

What is a Management Plan? (Definition)

A management plan is a comprehensive plan that provides the objectives of any given project, clearly defines roles and responsibilities, and more to make sure it’s a success!

Your management plan is a resource that everyone in the firm can use for better guidance.

It is a blueprint for the way your organization runs, both day-to-day and over the long term.

A management plan generally outlines:

- the aims and objectives of a firm — what are we trying to achieve?

- the strategies used to meet the objectives — how will we achieve it?

- the methods used to measure performance — how will we know if we are achieving it?

No matter the size of your organization, the core intent of your management plan will be to ensure that the organization is running as effectively as possible.

Let’s dive a little deeper and get to know management plans better…

Benefits Of A Management Plan

To make sure that an organization is working smoothly, a lot of processes need to be handled simultaneously.

If you leave everything for the last minute, hoping that it all works out when the problems arise, you’d be in deep waters.

So to keep up with daily tasks, manage emergencies as they arise, and to not let projects slip through, you need a management plan.

There are a lot of benefits of having a management plan in place, some of them are:

- Defines roles and responsibilities so everyone knows what’s expected of them : Employees need to know who their reporting managers are, who they should consult and go to in case of any need of information. They also need to be aware of the limits of their work, when they need a sign-off from some authority, and when they don’t. All of this can be easily done with the use of a management plan.

- Allocates Tasks : A management plan also divides the work within an organization in reasonable and feasible ways, so that everyone is not only achieving their goals but also doing them in a way that doesn’t burn them out.

- Increases accountability : When tasks and duties are determined, people can be easily accounted for. If daily tasks are not being attained within the allocated time, then the internal team is failing whereas if the CSR activities are not being conducted, then it’s the management who’s failing.

- Creates an effective timeline: A management plan creates a timeline that ensures that bills are being paid on time, staff members are where they’re supposed to be to provide the organization’s services, funding proposals get written and submitted, problems are quickly dealt with, and as a result, the organization functions effectively.

- It helps the organization define itself: The management plan establishes a solid plan that aligns with the organization’s mission and philosophy. This helps the organization to never forget about its core beliefs and communicate this with clarity to its staff, its customers, and the community as a whole.

Read more: What Is Change Management And How To Cope With It?

How To Create A Sound Management Plan? (With Steps)

Step 1. executive summary .

An executive summary is how you start your management plan.

It offers a brief overview of all the key components of the management plan. Be as concise as possible and keep your main points in mind as you write the summary.

Not every point needs to be included here but you need to ensure that the major ones are covered briefly. This summary should easily be understood and comprehended by people even if they don’t visit the entirety of the management plan.

Step 2. Vision Statement

The next step is to mention your vision statement . The vision statement is intended as a guide to help the organization make decisions that align with its philosophy and declared set of goals.

Vision statements are often confused with mission statements, but they generally serve long-term purposes whereas mission is more myopic.

Step 3. Mission Statement

The mission statement is a clear statement of what your organization does and how it will be managed. The mission statement describes:

- purpose of the facility — what is our business?

- why does it exist — what is our underlying philosophy?

- what it has to offer — what services or products do we provide?

- who will use it — what is our target group?

This helps to ensure that your team is committed to the mission. Both the vision and mission reflect the aspirations of the stakeholders.

Step 4. Goals

Once the mission and vision statement has been established, the next step is to work out how to achieve it. It is vital to identify the goals that will help you get to your mission. Goals reflect what you aim to achieve and give direction to your organization.

Goals are usually broad statements that have no time frames.

Step 5. Key Performance Areas

Key performance areas (KPA) focus on general areas of operation within an organization, where the desired outcome is required over the period of the management plan’s execution.

There are many key performance areas in your organization, you need to mention them all separately. Some of these KPAs are:

- Administration

- Human Resources

Create a separate section for each one of them and mention what tasks are expected of them to attain your goals.

Step 6. Mention Policies & Procedures

You need certain policies and procedures in place, to formalize the operations across your organization.

This helps to create consistency and a cohesive environment. You can include working hours, dress codes, leaves, and more, depending on the needs and size of your organization, take your time to define policies.

Step 7. Future Considerations

Every business is at a constant threat of surprises. Thus, you need to base all certain future projections on these unknown problems. For example:

- What resources will be required to remain competitive in a technological sense?

- What building extensions, modifications, or upgrades to your facility will be required in the future?

Step 8. Revisit Your Plan

Your management plan needs to be super-professional and free of any errors as it is a representation of what your organization stands for.

Check for any typos, ask someone else to take a look and proofread it. Make sure that each owner gets a copy. They may send you edits and revisions too. Consider all these carefully and create a powerful, full-proof management plan.

This way you’ll be prepared for unprecedented times and your employees can be ready for what’s expected of them.

Creating a management plan without an intuitive and robust tool can be overbearing on any person.

Gone are the days of boring management plans, today we want something enticing and informative. How can you do that?

Bit.ai is the answer! Let us tell you more…

Create Your Management Plan The Right Way With Bit.ai

Bit.ai is a new age online document collaboration tool that helps anyone create an awesome management plan or any other document, in minutes.

Take a look at some of the many wonderful Bit features:

Real-Time Collaboration: When working on a document as comprehensive as a management plan, it’s obvious that you’ll be working with a team. At such times, it’s more important than ever to have a seamless collaboration experience! Bit facilitates exactly that with its real-time collaboration feature that lets you work on the same document together, comment to exchange ideas and chat on the side.

Smart Workspaces: On Bit.ai, you can create as many workspaces as you want around different teams and communicate in a much better way. For example, once the management plan is created, you can send the document to other owners for approval. And after their approval, you can send it to all the departments within a few clicks!

Media Integrations: No more hopping from one app to the other in search of information, Bit.ai integrates with over 100+ popular applications (YouTube, Typeform, LucidChart, Spotify, Google Drive, etc.) to help teams weave information in their management plan beyond just text and images.

Sleek Editor: Creating a management plan requires constant revisions and edits, with Bit’s minimal document editor, you can write your management plan without the distraction of unnecessary buttons and tabs. And given its simple design, you won’t have to spend hours creating your report.