How Costco's Unique Business Model Resulted In Global Success

Table of contents, here’s what you’ll learn from costco’s strategy study:.

- How developing a radically different business model can lead to an industry breakthrough.

- How global expansion can be safely explored when you’re at your very best.

- How to accompany a business model innovation with policies that create a cohesive strategy.

- How managing your competitive advantage requires the evolution of your strategic approach.

- How to respond to market trends without killing your strategic advantage.

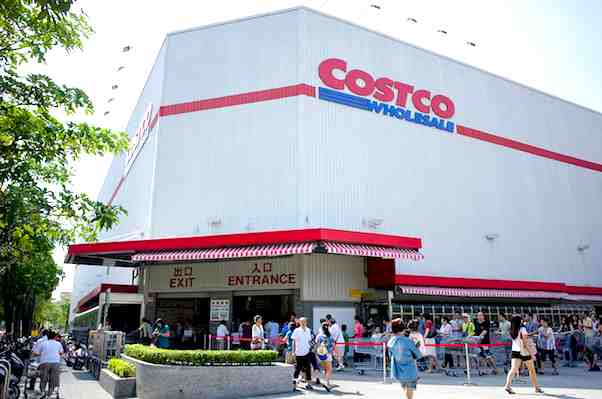

Costco is the third biggest retail player in the world - behind only Walmart and Amazon. Yet there is something very unusual about the retail giant. Costco makes way less money per a sold product compared to other retail stores.

The company’s average gross profit margin was only around 12% in 2022 . That’s way lower than your average retailer gross margin which ranges from 20% all the way to 50% for department stores. E.g. Walmart’s average margin in 2022 was 24.4% . In fact, Costco even loses about $40 million a year on their $5 roasted chickens alone.

It also doesn’t have nearly as many stores as other big retailers, yet it outperforms everyone but Walmart. Costco has “only” 838 stores around the world, while Walmart has 10,593 retail stores in 2022 , Schwarz Group, the group that owns Lidl and Kaufland, has 13,500 stores , Kroger owns nearly 2,800 stores , and Target owns 1,948 stores .

After all, the company boasts:

- $222.7 billion net sales in 2022

- 314,000+ employees 273,000 employees

- Stores in 13 countries

- 120.9 million worldwide members

- A 93% membership renewal rate in the U.S. and Canada and an 90% renewal rate worldwide

Members - that’s Costco’s secret. Their warehouse retail stores are membership-only and that’s the foundation of their extremely successful business model.

Costco’s story is a masterclass of thinking outside the box and creating win-win scenarios which satisfy customers and employees while achieving the company’s business goals.

{{cta('fd46c809-bb8d-49c6-828e-a5f17d1471b4')}}

A warehouse club: the birth of a disruptive business model

Costco’s story begins with Price Club which was founded in 1976 by Sol Price and his son Robert Price. The store introduced a brand new concept - a retail warehouse club . In order to shop there, you had to be a member.

At first, Price Club was limited exclusively to business members, who could purchase a wide range of supplies and wholesale items. But after a while, it opened up its membership to employees of local businesses, non-profit organizations, and government.

One of the people who were instrumental in fine-tuning the new warehouse club concept was Jim Sinegal , the executive vice-president of merchandising, distribution, and marketing. He was previously employed by Sol Price and was familiar with the Price Club business model.

Seven years after the first Price Club store, Sinegal used his expertise to co-found Costco Wholesale with Jeff Brotman, and together they opened the first warehouse in Seattle, Washington in 1983.

In 1993, Costco and Price Club agreed to merge operations since Costco's business model and size were similar to those of Price Club, which made the merger more natural for both companies.

Costco has transformed the retail world as the world's first membership warehouse club for the wider public which accepted non-business members. While the idea of charging people to shop in your store seemed very bold and was not followed by any of the retail giants, it proved to be the right move. It allowed Costco more efficient buying and operating practices while giving the members access to unmatched savings.

Costco’s operating philosophy has always been simple:

Keep costs down and pass the savings on to our members.

People loved the concept, which resulted in Costco’s stunning rise. By the end of 1984, 200,000 people held Costco memberships and Costco soon became the first company ever to grow from zero to $3 billion in sales in less than six years since its inception.

The annual membership of Costco’s first Seattle store back in 1983 was $25. The cost of a membership nowadays starts from $60, which is around the same as it was back in 1983 once adjusted to inflation.

The merger between Price Club and Costco created the world's most successful warehouse club . In 1999 the name of the company was changed to Costco Wholesale Corporation and remained as such until this day.

Key takeaway #1: A radically different business model is a preposterously effective business strategy

Costco’s radically different business model was a disruptive innovation in the retail industry.

It created a constant flow of revenue that offered unmatched flexibility that was returned back to its customers. It’s important to note, though, that:

- Costco tested the model with a small circle before it proved successful. It didn’t go into full launch mode without validation .

- The model is not different for the sake of being different. It included an advantage (e.g. the fixed revenue stream) and a way to turn that advantage into increased customer value (e.g. unbeatable low prices). It was meaningfully different .

The different business model created a second, unique to Costco, profit model. The company faces the same challenges as any other retail, but its second profit model gives it the flexibility to challenge the conventional way of the industry (like having much lower profit margins). In other words, it offers an unfair advantage like every great strategy.

How Costco safely started its global strategy

Before Costco's international expansion, there was quite some doubt whether the innovative Costco retailing strategies would result in success outside the United States.

There are plenty of failure stories indicating that advantages aren’t easily transferred geographically:

- Target's exit from Canada in 2015

- Tesco's shutdown of its U.S. Fresh and Easy chain

- Walmart's store closings in Brazil in 2016

Being successful in the global market is not a given even for the biggest retail players.

However, Costco's expansion, which began in 2013, succeeded in ways that Target, Walmart, and Tesco failed to do. By January 2023 , Costco was present in 14 countries outside the US and Puerto Rico.

Costco membership sign ups in the first 8 to 12 weeks of a new store opening overseas are generally 10 times greater than at Costco store openings in the United States. Additionally, the company’s international membership renewal rate was 90% at the end of its 2022 fiscal year.

While many other retail chains open international locations as a defensive strategy in order to shore up declining sales, Costco isn't compensating for domestic weakness. Costco's international expansion came in the middle of high profits in the U.S. market, allowing the company to focus on a long-term international strategy and to test if its business model would be well-received in other markets.

And talk about great reception! In 2017, before Costco opened its doors in Iceland, one out of eight Icelanders had already signed up for membership. On the opening day, search-and-rescue teams were deployed to manage the crowds.

Perhaps even more impressive is Costco’s opening of its first store in mainland China in Shanghai in 2019. On an opening day, 139,000 people got their Costco membership. The store even had to close early on the first day due to traffic jams caused by crowds of shoppers and three-hour wait times just to park .

Key takeaway #2: A global expansion attempt as a growth experiment

Costco’s strategic plan was carefully formed before it was executed.

And the approach had a few critical traits that helped it to succeed where other retail giants failed:

- Costco tested the waters beforehand . Again, validation, then action. Before opening its first store, the company enabled its potential customers to subscribe ahead of time, giving a feel of the potential demand.

- Costco expanded when its US profits were still rising. That enabled it to take a long-term stance, in case the attempt wasn’t fruitful initially.

Costco’s business model innovation was market agnostic. The retail giant could transfer the advantages of its innovative approach to any market whose fundamental working principles were the same as the US market.

Now let’s see what exactly makes Costco’s business model so successful.

Understanding Costco’s business model

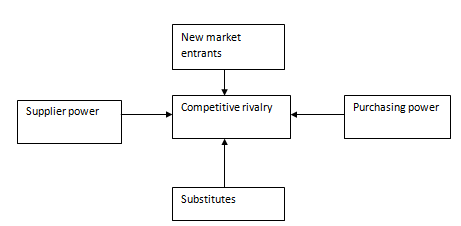

Costco’s strategy remains at its core a cost leadership approach.

Costco’s mission is “to continually provide members with quality goods and services at the lowest possible prices.”

This mission statement is directly linked to its business model and strategy. It emphasizes quality and cost leadership , which are two factors that top consumer’s priority charts. While they might seem mutually exclusive, Costco is known for both.

Costco is primarily a big-box store. Such stores achieve economies of scale by focusing on large sales volumes and are meant to be a one-stop shop for customers. Establishments like Costco took “the one-stop shop” a bit further and don’t offer just groceries and store products, but also a food court, optical services, gas stations, tire garages, or photo processing services.

Big-box stores typically carry items in extra-large sizes and lure customers with the promise of saving by buying in bulk . Costco is no exception - real bargains can be had by purchasing bulk non-perishable items or items with long shelf life.

As a result, Costco’s generic strategy is cost leadership.

This strategy entails maintaining the lowest prices possible and is used by many retail giants. However, Costco’s strategy incorporates the warehouse club membership business model, which differentiates it from other retailers and enables Costco to offer lower prices than its competitors.

Costco is so effective because its revenue is broadly divided into two streams:

- Product sales , which is revenue from all the sales of goods and services through all Costco’s channels.

- Membership fees , which is revenue from Gold Star, Business and Executive memberships to customers worldwide.

This is a very basic overview of Costco’s general business model. Now let’s go into more details and look at some specific elements - starting with the core of the business model, Costco’s membership.

Costco’s membership: the competitive advantage of Costco’s business model

As said, Costco uses a membership-only warehouse club business model , which means consumers pay a membership fee to access the low-cost products available at Costco stores.

Each member is entitled to issue a free supplementary card to someone living in the same household or to a fellow staff member working in the same company. Non-members may accompany members, but only members are allowed to purchase products in stores. In 2020, Costco had a total of 58.1 million paid members and 105.5 million cardholders .

Costco has two tiers of membership – basic and executive plans for consumers and businesses. Basic plans cost $60 per year, while Executive plans cost $120 per year.

Executive members get an annual 2% cashback on their purchases (up to $1,000 per year). This makes executive membership an enticing offer for people who often shop at Costco and there’s plenty of them. In fact, 45% of members pay $120 for the Gold Star Executive membership.

These membership fees actually represent the majority of Costco's operating profit. Yes, Costco makes most of its money by selling access to affordable products and not by selling those products.

In 2019, Costco made $4.2 billion from membership fees , an increase of 9% from the previous year. Its entire net income for the year was $5.8 billion.

Costco’s membership is also a powerful play on the human psyche. Once a customer pays the membership fee, it treats it like a sunk cost. The investment has been made and now it is time to get value from it. Because of that, customers will make additional trips to Costco to make sure they get value from their investment.

While other retailers need to worry that a decline in same-store sales will lead to collapsing profits, Costco doesn’t really face this problem. Its profits are mostly dependent on its memberships, which are getting renewed on an extremely high basis (93% in the US and 90% internationally).

Obviously, such high renewal rates aren’t a coincidence. Costco does reinvest the membership fees into low prices for customers and by doing so ensures that everyone wins. We’ll talk more about product prices later on, but now let’s see what kind of people Costco wants for its members.

Target market: suburban homeowners

From the very beginning, Costco targeted relatively affluent and college-educated customers who would understand the value of membership.

A typical Costco shopper is an upper-middle or upper socioeconomic class and has an income of about $93,000 a year.

But if Costco employs a cost leadership strategy, why does it target relatively wealthy people? Well, while all shoppers like a bargain, Costco’s customers also have the means to buy in bulk, which is the only way one can buy most products Costco stocks.

While the price of an individual product generally is the lowest around, shoppers usually have to buy at least a three-pack, which means that the average transaction total is quite high.

That also explains why the vast majority of Costco stores are located in affluent suburban areas both in the U.S. and around the world. It’s hard to make the most of a Costco membership if you’re renting a small flat as it takes a lot of space to store bulk purchases. That’s why a typical shopper is a suburban homeowner.

Speaking of buying and selling in bulk - that is also an important part of Costco’s business model.

Bulk purchasing

Product quality is a crucial aspect that Costco focuses on for driving growth and maintaining customer loyalty.

Instead of selling a hundred thousand different products as most other retailers, Costco’s merchandise is limited to under 4,000 items (for comparison, Walmart sells over 142,000 SKUs in each of its supercenters). This allows Costco’s procurement team to rigorously screen each product in order to provide the best quality and the best price to members. Each item Costco sells is meticulously selected . As a result, consumers don’t suffer from choice paralysis and can always rely on Costco for selling quality products.

Because of the lower number of options, each option has a higher perceived quality and is more likely to sell, which allows Costco to order more stock and thus lower the product’s price. Remember that Costco is selling most products in bulk packaging, so shoppers can’t buy just one cereal box but have to get 5 or them - which complements Costco’s ordering model.

By selling products in bulk Costco entices customers to buy large quantities of items. The perception of getting a deal often negates the fact that one may not even need all the products. Customers believe they're saving more money by spending more money , which leads them to spend more in the long run.

According to Perfect Price’s research from 2015 , customers spend by far the most money per shopping trip when visiting Costco compared to other retailers.

Here are the top 10 stores where customers spend the most per shopping trip:

- Costco, $136

- Sam’s Club, $81 (similar membership model)

- Target, $62

- Stop & Shop, $56

- Wal-Mart, $55

- Meijer, $54

- Whole Foods, $54

- Trader Joe’s, $50

- Kroger, $50

There’s another part of Costco’s business model we haven’t mentioned yet that makes big purchases less risky.

Costco’s refund policy is essentially a promise for a risk-free investment

Costco has a very liberal return policy where customers can return almost anything they have purchased at any time. Even their membership.

On Costco’s website it says:

“We are committed to providing quality and value on the products we sell with a risk-free 100% satisfaction guarantee on both your membership and merchandise. ”

Having such a liberal return policy is almost necessary if you want to entice shoppers to try new products which they can only buy in bulk. If you know you can return anything if you don’t like the first product in the box of ten, you’ll be much more inclined to buy something new.

And yes, members can also claim a refund on their memberships at any time if they are not satisfied with the service, which means anyone can try shopping at Costco risk-free.

There was even a case of a woman who successfully returned a Christmas tree 10 days after Christmas because the tree was dead.

Efficient inventory management and warehouse design

From a logistics standpoint, Costco is one of the most efficient retailers in the world. This is because of two factors: inventory management and warehouse design.

Costco uses its warehouse-style stores as retail and storage spaces in one . It utilizes cross-docking, which means that products from a supplier or a manufacturing plant are distributed directly to the retail chain with marginal to no handling or storage time, which reduces inventory management costs and storage space costs.

Costco also displays goods in their shipping pallets, instead of arranging individual items on shelves, which further reduces inventory costs.

Costco’s warehouses are strategically designed to make restocking as easy as possible . Warehouse design allows forklifts to restock the store, which also makes it easier to rotate seasonal products and enables the treasure-hunt experience. This purposeful design saves both time and costs.

The combination of impeccable inventory management and warehouse design also allows Costco to utilize the just-in-time stocking principle , which is a management strategy that has a company receive goods as close as possible to when they are actually needed.

Once you combine everything mentioned thus far in this chapter, you can see why Costco can cut prices even lower and pass on the savings to their members, thus attracting more membership sign-ups and directly increasing their bottom line.

However, their store design serves yet another purpose.

“Costco doesn’t use any fancy decor or lighting, instead, they make sure that their store resembles a warehouse with exposed beams, pallets, and simple metal shelving,” says Mark Ortiz, a marketing expert and founder of Reviewing This. “This is smart because it tricks the consumer into believing that they are purchasing goods at low prices . Logically, you would think, less money spent on decor equals less overhead cost equals the opportunity to lower your prices.”

The warehouse design is a part of “the Costco Experience”, which Costco is famous for, which shouldn’t be neglected when talking about their business model. Let’s see what the famed experience is all about.

The Costco experience and Costco culture

Shopping at Costco is often called “The Costco experience”.

As offering superior customer experience is the key to customer loyalty, Costco does its best to be an experience in itself. By putting customers first in every choice and innovation, Costco continues to build its loyal customer base

Consumers go crazy for a deal, and Costco has designed its entire strategy around this core tenet. A good deal “feels like winning,” says Bob Nelson, the senior vice president of financial planning and investor relations at Costco. And Costco would like their members to feel like they’re always winning, even if this means resisting the urge to raise prices and increase profits.

James Sinegal, Costco’s co-founder and former CEO, once talked about how once Costco was selling Calvin Klein men’s jeans for $29.99 a pair. The pants were selling faster than Costco could stock them, and when he bought another shipment for $22.99 per pair, it was ultra-tempting to charge more. However, Costco stayed true to their philosophy of passing the savings to their members and sold the jeans for $22.99 per pair.

Making sure that the customers get the best deal at Costco is an integral part of Costco’s culture.

Besides providing an exceptional shopping experience, Costco is also famous for an employee-focused organizational culture, which we’ll explore later.

The combination of cost, generous return policy, and satisfied employees resulted in a shopping experience that many customers get addicted to.

It was believed at the company that culture is not the most important thing, but the only way forward . Costco saw promoting its core values as the only recipe for success. Maintaining integrity, passion, motivation, and customer trust is what enables Costco to outdo its competitors.

Shopping features aside, there is something more to Costco that cultivates such a loyal customer base.

"Costco relaxes my soul," says John, the founder of the I love Costco blog.

"I do love that everyone at Costco appears to be relaxed humans," says Ellinger. "I love overhearing a weird personal conversation between two employees unloading a box and knowing that Costco is a safe space for people to just be people."

Costco also has great food courts which drive visits on their own. And they offer amazing deals, which are even losing them money in some cases.

We already mentioned the $5 roasted chicken, but there’s also the famous hot dog and soda combo for $1.50. It still costs the same as in 1985 when it was introduced and that is a big part of its almost mythical status among Costco’s members. Yes, Costco could make a lot of money by raising the price, but it’s much more valuable if they let it serve as a reminder of Costco culture every time a customer decides to grab a hot dog after a shopping trip.

All this helped the company build an outstanding image among its customers and it’s apparent that it leads to more sales year after year.

Key takeaway #3: Reap the benefits of a business model innovation with a cohesive strategy

Costco’s business model isn’t an isolated difference from its competitors, but one of many distinctly different policies, approaches, and benefits that create a cohesive corporate strategy.

Otherwise, any one of its competitors could duplicate the business model and reap the benefits for itself, rendering Costco competitively exposed. Here some policies that tie well with Costco’s innovative business model:

- Customer filtering. Costco’s subscription model discourages low-income customer groups from becoming members, like students and small household tenants. That ensures a larger average spend per shopping trip.

- Supplier independence. Since Costco makes most of its profits from its membership fees and has a more exclusive customer base, it doesn’t need a big variety of products. As a result, it can be more picky with its product and supplier selection, increasing its negotiating leverage.

- A loyal culture. Costco has one of the most supportive cultures in the business world. It pays its employees above average, provides rare benefits and powerful leadership initiatives. That’s why it enjoys a triple retention rate than the industry average (90%) and increased productivity. Also, customers feel employee loyalty by having a pleasurable experience while buying.

- A cheap design. Maintaining an industrial decoration keeps operating costs at lower levels and the “I’m getting a bargain” feeling at higher levels.

But does Costco’s strategy produce results? How successful has its business model been during the last few years? We’ll let the numbers do the talking.

Recommended reading: What is Strategic Analysis? 8 Best Strategic Analysis Tools + Examples

How Costco’s corporate strategy evolves leading to constant expansion

Costco pricing strategy - lower margins, lower prices, high value.

Offering quality products at the lowest prices is as much a part of Costco’s business model as the result of it.

According to Craig Jelinek, Costco's CEO and Director:

"Costco is able to offer lower prices and better values by eliminating virtually all the frills and costs historically associated with conventional wholesalers and retailers, including salespeople, fancy buildings, delivery, billing and accounts receivable. We run a tight operation with extremely low overhead which enables us to pass on dramatic savings to our members."

Unlike most other retailers, Costco’s membership model allows them to focus on strategies for making products cheaper for customers , rather than trying to increase revenue by finding ways to make customers pay more.

Because of its limited range of products, Costco can stay committed to delivering high-quality items at the lowest prices. Because of its efficient inventory management system and constant revenue from membership fees, Costco can keep its gross profit margins lower than most other retailers. Low margins result in cheaper products as Costco passes the savings to their members.

Kirkland Signature: one of the most trusted private-label brands

When it comes to affordable yet quality products, Costco’s own private-label brand, Kirkland Signature, deserves its own chapter.

In 1995 Costco began the Kirkland Signature. Its mission was to create an item of the same or better quality than the leading brand at a lower price and do so by controlling every element of the item’s creation , including packaging and transportation.

Costco claims that Kirkland Signature products are high-quality goods at simply excellent prices and openly invites customers to compare any Kirkland Signature product with its brand-name counterpart. The store’s return policy basically guarantees Kirkland’s quality.

Costco prices Kirkland Signature items according to its philosophy and that’s why they are always cheaper than their brand-name equivalents, often by more than 20%.

It’s no surprise that nowadays Kirkland products account for roughly 25% of Costco’s sales and shoppers can find them in virtually any category, from groceries to household products and clothing.

"I am not sure there is another [private-label] brand that has established this level of trust," says Timothy Campbell, a senior analyst at Kantar Consulting.

The success of Kirkland Signature is possible because of Costco’s business model as they have direct contact with lots of manufacturers and their members trust them that they will only choose and offer quality products.

In return, Kirkland Signature has become one of the top reasons that customers are so loyal to Costco. Creating such a strong store brand shows that Costco cares about its customers and wants them to have great products at a great price.

A lot of Kirkland products are actually manufactured under a private label by name-brands just for Costco.

Select varieties of Kirkland Signature Coffee are actually roasted by Starbucks Coffee Company, Kirkland Signature dry dog and cat foods are made by Diamond Pet Food and Craig Jelinek, Costco’s CEO, said in an interview that Kirkland Signature Batteries are made by Duracell.

There are many other examples and in each case, Kirkland products are cheaper than their brand-name counterparts.

The treasure hunt experience

If you’ve ever spoken with a Costco member, you’ve probably heard them brag about their latest find at our warehouse. Costco calls those products treasure hunt items , and they’re offered in various departments throughout the year.

They’re there to make the customers feel the thrill of discovery . The aisles at Costco aren’t labeled, which tempts shoppers to walk down each one. That makes them more likely to encounter what Costco calls its “treasures.”

“Treasures” make up 25% of Costco’s inventory and they are items that make shopping an adventure. When customers turn the corner they might suddenly find the luxury “surprise” of the week. It’s often something one would expect in upscale department stores, but certainly not in Costco. Surprises like Waterford Crystal, Coach handbags, Omega watches, Andrew Marc, Calvin Klein, Adidas, Chanel, Prada handbags and many more are offered at incredibly low prices. Other treasures include electronics, appliances and other less frequently purchased finds at extremely good prices. These products appear on Costco’s shelves one day, but are gone the next.

That uncertainty creates a sense of urgency , and means that Costco shoppers don't just buy a pack of gum on impulse - they buy an 80" 3D television or a whole box of fine wine.

The company refers to this strategy as “treasure hunting,” in which Costco shoppers must navigate through the entire warehouse in search of exciting deals and unbelievable bargains. And they know some of the things they can find as they receive a pamphlet filled with coupons and irresistible deals as soon as they walk into the warehouse.

Every Costco warehouse is purposely designed with the necessities at the back of the store, meaning customers have to walk through the rotating items and sales to get their most-needed products and groceries.

The treasure hunt atmosphere is also a safeguard against online competitors as customers have to go into a Costco store to see what is new and exciting.

One would think that unlabeled isles, rotating inventory and purposely longer shopping trips would bother customers, but in the case of Costco, it’s quite the opposite. It’s all a part of the famed Costco experience and members enjoy it as they feel that’s how they get the most value for their membership. Instead of a run-of-the-mill grocery trip, Costco becomes an adventure that loyal customers are obsessed with.

Setting up the adventure is made possible by Costco’s inventory management and warehouse design which enables the store to quickly and efficiently rotate merchandise and allows them to grab the best deals their procurement team can find.

The treasure hunt experience is once again something that is enabled by Costco’s business model and at the same time a part of it. It’s also another factor that contributes to Costco’s extremely high customer retention rate.

Customer loyalty

Most consumers take pride in being a Costco member and the company’s high level of customer loyalty is no secret.

The emphasis Costco places on excellent customer experience and the value to their members results in an extremely high membership renewal rate - 93% in the US and Canada and 90% on the global market .

Costco’s number of cardholders has also been steadily growing - there were 76.4 million cardholders in 2014 and the number rose to 120.9 million cardholders in 2022. Around 66.9 million of them are paying members as each member gets an additional card for their household. These numbers are what makes Costco’s customer retention rate even more impressive.

But Costco’s members aren’t just loyal, some of them are obsessed with the Costco experience. There are websites and blogs solely devoted to people talking about the warehouse. Some of them, like Costco Insider , have huge followings as they review recent deals at the store.

A blog dedicated to the Costco experience

This stable base of members who are making repeat purchases throughout the year is the result of Costco’s business model. There’s another very interesting thing Costco does or rather doesn’t do, in order to keep their profits higher and prices lower.

No advertising

Costco spends next to nothing on advertising and has no official advertising budget. It does send targeted emails to prospective members, email coupons and offers to existing members, but that’s negligible. Considering the huge sums of money most retailers spent to bring customers into their stores, that’s a really unorthodox approach.

How can Costco completely shun traditional advertising and still be successful? There are two reasons.

First, Costco has a product that sells itself . The membership offers great value to those who shop regularly at Costco, and because they’re excited about the deals they get, they spread the word.

Costco’s focus on customer satisfaction helped them create a strong brand and nowadays it’s safe to say that their reputation precedes them and that most of their target market has at least heard of Costco.

Second, spending on marketing to get existing members to shop more wouldn't really help Costco’s bottom line as membership fees are the real driver of profits. You might think that spending heavily to gain more members would make sense, but when you look at the numbers it actually doesn’t.

Spending just 0.5% of its revenue on marketing would wipe out 17% of the company's operating profit. If Costco was to spend 2% of revenue on advertising, as Target does, it would erase nearly 70% of their operating profit. The number of new members they’d get couldn’t possibly cover that loss, so it’s just not worth it.

Costco’s membership model allows them to focus on improving every aspect of the experience that leads to customer loyalty and inevitable word-of-mouth recommendations instead of spending on traditional marketing campaigns. This is one of the company’s core strengths as almost no other retailer can afford to pretty much ignore advertising.

Instead of investing in ads, Costco invests in something that much more directly impacts their members’ experience - their employees.

Higher wages and great employee benefits

Costco is often recognized as being much more employee-focused than other Fortune 500 companies. By offering higher wages and top-notch health benefits, the company has created a workplace culture that attracts positive, high-energy, talented employees.

Costco’s objective is to have motivated employees and reduce the employee turnover rate. And it succeeded as Costco's annual employee turnover is 13% while the industry turnover is believed to be well above 20% annually. The company also cultivates most of its leaders through internal leadership development, which presents an opportunity for professional growth and development.

Costco fosters a culture that is built on employee empowerment. It invests in its employees in order to improve operations and drive profits. Employees are recognized as an asset for the company as they are the ones driving the competitive advantage in the physical retail landscape. Costco doesn’t only provide them with good wages and health benefits but also promotes cultural diversity and inclusion.

This inclusive organizational culture and HRM practices have resulted in extreme popularity along with a strong social image - driving more and more loyal customers into the stores.

Apart from that, the focus of Costco has been on a company culture that promotes constructive criticism, and the philosophy has been ‘leading from the floor’, which means there’s much less micromanagement than in many other similar jobs.

Of course one of the biggest draws is a higher wage, so let’s take a closer look at it.

In early 2019, Costco raised its minimum hourly pay to $15. Its average hourly pay in 2019 was about $17.60 an hour, compared to about $10.88 on average for retailers, according to Payscale. When you add healthcare benefits, you get arguably the best job package in the retail sector.

According to Forbes surveys, Costco is consistently among the 5 top employees on America’s Best Large Employers chart. In 2017, it was even ranked as #1, and in 2021, it is ranked as #4.

How can Costco afford these higher wages and great benefits? Once again, it’s all thanks to its business model. In fact, Costco always had a much higher revenue per employee than other big retailers.

The average Costco employee generates nearly triple the revenue produced by the average Wal-Mart and Target employee and the latest results show, Costco is ranked #1 for revenue per employer in the retail sector, the wholesale industry as well as the general market!

Highly paid, motivated and happy employees help customers enjoy a consistently good shopping experience . That plays a large part when it comes to membership renewal and ensures that Costco’s customers keep coming back. In the end, that’s what matters the most.

Key takeaway #4: Expand your competitive advantages to evolve your strategy

Complacency is a giant killer in the business world.

Large enterprises that rest on their laurels, don’t evolve their strategies, and manage their competitive advantage die.

Costco’s strategy is constantly adapting to market changes. The company keeps finding new ways to take advantage of its unique business model and the policies surrounding it. Here is the list of the policies that no Costco competitor could benefit from implementing isolated:

- Offering premium product options with the lowest market prices.

- Spend zero on advertising and promoting its sales and special offers.

- Offer a treasure-hunt-like experience.

Other policies like its employee extensive support are repeatable but work exceptionally well for Costco.

Recommended reading: The 7 Best Business Strategy Examples I've Ever Seen

Why Costco’s growth strategy doesn’t follow the norm

Costco is a shining example of how very successful an innovative business model can be and how it can create an environment where everybody wins.

Almost everything we discussed in this study is thought-thru and purposeful innovation - from Costco’s membership model to its warehouse store design.

Despite its success (or because of it?) Costco never stopped evolving. It expanded its offering to services such as gas stations, pharmacies, beauty salons and travel agencies which generated about 16% of the company’s $166 billion in revenue in 2020.

It added a food court and if it weren't considered a retailer, Costco would be #14 on the list of the largest pizza chains in the U.S in 2018. They cannot be easily implemented by e-commerce giants like Amazon and as such make Costco more “future-proof” than many other retailers.

Let’s take a look at two interesting examples of how Costco evolved some aspects of its business and how it implemented its growth strategy.

The art of free samples

Free samples in stores are anything new or groundbreaking, but there’s no brand that’s as strongly associated with them as Costco.

The company took the promotional activity to the next level and people have been known to tour the sample tables at Costco stores for a free lunch, acquired piecemeal. There are even personal finance and food bloggers who’ve encouraged the practice .

There are shopper blogs about favorite sample options, and some say the samples are their main reason for coming into the store.

Of course, free samples boost sales of certain products (in some cases even up to 2,000% ), but Costco knows that they also can make the store a fun place to be .

Consider this - Penn Jillette, from the famous magic act Penn & Teller, has even taken his dates to Costco to enjoy free samples on more than one occasion. And he’s surely not the only one.

However, samples don’t just make Costco’s store more appealing, they operate on a more subconscious level as well. As author Robert Cialdini writes in his best-selling book Influence, the Psychology of Persuasion : “One of the most potent of the weapons of influence around us is the rule for reciprocation. The rule says that we should try to repay, in kind, what another person has provided us.”

This means that customers feel a stronger urge to buy something after they sample it and that creates a potent combination for Costco. Even if people come to their stores because trying samples is fun, a variety of psychological mechanisms kick in, compelling them to buy more products over a longer period of time.

The curious case of Costco and e-commerce

Costco actually entered the e-commerce world in 1998 , which shows that they were again quick to evolve and try something new. However, online shopping never became a substantial part of its business model.

As for most other companies, the COVID-19 pandemic changed that to a certain extent. Costco’s e-commerce sales grew by 10% in 2022 .

Costco definitely upped their e-commerce game and also started selling their products via Instacart, which had to hire 300,000 new staff to accommodate the surge in shopping delivery.

Costco now also offers same-day delivery service to its customers located within a 20 minute vicinity.

While Costco evolved its e-commerce activities, it hadn’t quite recreated the unique in-store experience online. And the interesting thing is, perhaps it doesn’t need to.

Costco’s online margins aren’t as good as their in-store sales and even as foot traffic slowed at some of its competitors, Costco saw their members spending more in stores during the pandemic. That’s why the company opened 16 new warehouses even in 2020.

“Ultimately, we still want our members to come into the warehouse,” CFO Richard Galanti said during a December 2020 earnings call . “When they come in, they see the items and they are more likely to buy some of those items.”

When you think about it, it’s apparent why Costco is more resistant to the rising e-commerce threat. Their members give them a stable income and treat their fees as a cost that makes them come to the store. Costco entices them with the services they offer and the treasure hunting experience which can’t really be replicated. Customers genuinely enjoy being there and they buy in bulk, which means they don’t have to visit the store that often if they don’t want to.

So in the case of e-commerce, it’s not that Costco wouldn’t be willing to further evolve, it just doesn’t make a lot of business sense for them at that very moment.

This already shows that there are some unusual strengths when it comes to Costco’s business model, which means it’s high time to look at Costco’s SWOT analysis.

Key takeaway #5: Study a market trend meticulously to understand how you fit in it

Costco is unlike any other retail player.

Naturally, its business is affected by market trends, but not in the same way as its competitors. Costco’s business model compels its members to go to the store to make their purchases. If Costco tried to make its online experience something like offline, it would kill its advantage.

The company would end up slowly transitioning to a more conventional retail player, lose its competitive advantage, and eventually die.

Instead, it uses its online presence in a complementary way that supports its offline experience and invites members back to the store.

Where initiatives like free samples have a big impact on buying behavior.

Recommended reading: Internal Analysis: What is it & How to conduct one

Costco’s SWOT analysis

While there’s certainly a lot to love when it comes to Costco and its business model, there are always things that could be improved. As the SWOT analysis is going to recap a lot of what you already read in this study.

Membership business model

Costco’s membership fees enable Costco to better predict their income, cut prices and ensure customers have an incentive to shop at the store.

Loyal customer base

Membership card renewal rates of 91% in the US and 88% worldwide show that Costco has an extremely loyal customer base in an industry where it’s very easy to switch brands and retailers.

Low prices, high quality

Costco’s strategy of stocking high-quality items, which are sold in bulk-size at low-profit margins entices their target customers to become Costco members and to buy more products during their shopping trip. Their own Kirkland Signature brand is also a result of Costco’s philosophy to offer the highest quality products at the lowest price.

Selling in bulk

Costco can keep their margins low because they sell more of the same product compared to other retailers. It significantly increases how much money customers spend during one trip to Costco.

Low operation costs

Costco’s inventory management, warehouse store design and selling in bulk directly from transport pallets keep overhead costs low.

Passing savings to customers

Costco is not reliant on making huge profit margins in sales and can therefore pass the savings to customers, which encourages loyalty and entices new members.

Costco doesn’t rely on ads to sell their products and doesn’t need to spend huge amounts of money on ad campaigns, which allows them to keep their prices lower than their competitors. Their strong brand name and word of mouth are enough to bring in new members.

High paying retail jobs with generous benefits

Costco takes care of their employees which translates into a better customer experience for their members. Satisfied and motivated employees do a better job and are less likely to leave which results in a low turnover rate.

Flexible inventory

Costco rotates their inventory faster than other retailers which enables them to make the most out of the best deals on the market (e.g. by buying the surplus stock at the lowest prices) and create a treasure hunting experience.

Eco-friendly

Costco’s eco-friendly approach focuses on four main objectives:

- Creating proper waste management systems

- Significantly reducing their carbon footprint

- Changing how they package designs

- Improving energy management systems in warehouses

This is important for eco-conscious shoppers, which a lot of their target customers are.

Limited product selection

While this is a plus for some, it’s indisputable that Costco offers much fewer choices than other retailers and that customers often can’t find more “exotic” products. Therefore, Costco is unable to attract a wider customer base, who want a bigger selection of products in smaller quantities.

Cumbersome transportation and storage

Buying in bulk can be very difficult for people living in cities and storing these products can be tough if a customer doesn’t own a house.

Aging customer base

Costco has an aging problem . It is mostly attributed to its lack of digital advertising and limited e-commerce. A lot of younger people prefer a quick shopping experience or an online shopping spree, which is not something Costco is known for.

Long lines at the checkout

That’s the biggest complaint of Costco members, which Costco is trying to address with self-service lanes at selected locations.

Wasted food

As consumers are becoming more eco-conscious, it’s starting to bother them that a lot of food from Costco goes uneaten as there’s just too much of it in the one big package the store offers.

Opportunities

Online presence and e-commerce

Although we said Costco might not need e-commerce as much as other retailers, it’s still an opportunity they can explore to attract new members and increase their revenue.

Social media

Costco could tap into new markets by using social media and social advertising for a fraction of the cost of traditional advertising. Currently, they have 0 tweets on their Twitter accounts and are lacking behind the competition on Facebook.

Global expansion

Costco has shown it can successfully enter new markets, which is an opportunity to expand further. China especially represents a huge opportunity after the success of Costco’s first Shanghai store.

Reputational damage

Costco relies on its strong brand name more than other retailers and therefore has to retain a strong reputation. Product recalls can seriously damage Costco’s image of a store that provides quality items. Instances such as a rotisserie chicken salad recall in November 2015 due to the outbreak of E. Coli toxin where 19 people were infected make Costco less attractive to potential members.

Data security

Costco gathers and hands over its customers’ and employees’ information to a third-party cloud service for safekeeping. In an era where people are more and more conscious of cybersecurity, any incident can create a major problem for the company.

Competition and digitalization

A lot of Costco’s competitors are ahead of them when it comes to e-commerce and digital services. While this might not be a problem yet it does represent a threat in the long run if Costco doesn’t evolve and starts losing younger potential members to their competitors.

Why is Costco so successful?

Costco has been so successful because it introduced a new business model, accompanied it with a cohesive strategy, and managed its competitive advantage cautiously.

It’s a company with strong leadership and a powerful culture.

Costco’s unwavering commitment to doing what they feel is the right thing for their members, their employees, their suppliers, and their communities have created a Costco culture and a strong brand with an impressive social image. That’s quite an achievement for a retail company that primarily employs a cost leadership strategy.

Growth by the numbers

As a result, a lot of customers are crazy about Costco. They love the company and have fun going to their stores. It’s not just a shopping trip, it’s a Costco experience - an adventure where members look forward to what treasures they might find.

- For Small Business

Inside the Costco Empire: How a Unique Business Model Created the Ultimate Shopping Destination

- April 21, 2024

- by Tom Wells

As a savvy shopper and student of the retail industry, I‘ve long been fascinated by Costco‘s singular business model. No company in the world does quite what Costco does, and none do it nearly as well. With a fanatically loyal customer base, an unmatched value proposition, and a growth story for the ages, Costco is the retailer that every other retailer wants to be. But how did a nondescript warehouse store hawking bulk-sized mayonnaise jars become an international juggernaut with over $200 billion in sales? Let‘s pull back the curtain on Costco‘s winning strategy.

Membership Mastery

The core of the Costco way is its membership model. Costco is really two businesses in one—a membership club and a discount retailer. The basic Gold Star membership costs $60 per year and grants access to all Costco locations and the Costco.com site. An Executive membership, at $120 per year, offers additional benefits like 2% cashback on Costco purchases and discounts on services like check printing and identity protection. Business memberships are available at both tiers with additional perks.

Costco makes the vast majority of its profits on membership fees, not retail sales. While margins on product sales are razor thin, membership fees flow almost entirely to the bottom line. Membership fee income topped $3.9 billion in 2022, compared to total company profit of $5.8 billion ( Costco 2022 Annual Report ). In other words, membership fees account for more than two thirds of Costco‘s profit in a typical year. No wonder Costco execs call memberships "the most important thing we do."

Costco‘s renewal rates are the envy of the industry—over 90% in the U.S. and Canada ( Costco Q4 2022 Earnings Call ). The membership model creates stickiness and loyalty that traditional retailers can only dream of. Once a customer pays for a membership, they are invested in getting their money‘s worth by shopping at Costco as much as possible. The more they shop, the more value they perceive in their membership. It‘s a virtuous flywheel that competitors have found impossible to match.

Demographic Dominance

So who are these devoted Costco members? Costco‘s core customer base is surprisingly upscale. The average Costco member is college educated, owns a home and earns over $100,000 per year ( Numerator Intelligence ). Nearly a third have annual incomes over $150,000.

Source: Numerator Intelligence

This highly desirable demographic is attracted to Costco‘s unique mix of quality and value. Walk into any Costco and you‘ll see BMWs and Mercedes sprinkled throughout the parking lot. Where else can you pick up a Prada handbag along with a pallet of paper towels?

Costco knows its customers and caters to their preferences. You won‘t find many bargain basement brands at Costco. Instead, the merchandising skews heavily towards premium brands, organic foods, and high-end electronics and appliances. "Costco is a curator of quality," says Timothy Campbell, a senior analyst at Kantar Retail. Costco is pickier about what it sells than any other store.

The Kirkland Powerhouse

Perhaps nothing exemplifies Costco‘s quality-first approach better than its Kirkland Signature private label. Kirkland Signature is a powerhouse in its own right, with annual sales of over $50 billion. That‘s bigger than the total revenue of Kraft-Heinz, Colgate, or Mattel ( CNN ).

But Kirkland Signature is no ordinary store brand. Costco goes to extraordinary lengths to make KS products as good or better than national brands at a fraction of the price. It partners directly with many of the world‘s top manufacturers to create Kirkland products. For example, Kirkland Signature batteries are made by Duracell, KS vodka is made by Grey Goose, and KS golf balls are made by Titleist ( MoneyWise ). This unmatched combination of quality and value has earned Kirkland a fiercely loyal following. Over 30% of Costco members say they shop at Costco specifically for the Kirkland brand ( CNN ).

As a longtime Costco member, I can personally attest to the lure of Kirkland. Why buy Oreos when the Kirkland cookies taste just as good (maybe better) at half the price? Kirkland products are the main reason my annual Costco journeys have steadily increased from a few visits to over 30 per year. I challenge anyone to do a blind taste test between Kirkland and national brand products. You‘ll be shocked how many "ties" you wind up with. With Kirkland Signature, Costco has achieved the holy grail of retail—a private brand customers are actually proud to buy.

Efficiency Obsession

Private label quality is just one way Costco keeps costs down and passes value to the customer. Costco‘s entire business model is built around ruthless efficiency. As a frequent shopper, I‘m always struck by the Spartan nature of Costco warehouses. There are no window displays, mannequins, or fancy fixtures. 60 percent of merchandise is still on the pallet it was shipped on. The sales floor does double duty as storage space—excess inventory is simply stacked on steel racks above the shopping floor.

This bare-bones approach enables Costco to achieve incredible sales per square foot, inventory turnover, and labor productivity. Costco captures over $1,600 of sales per square foot, nearly double that of Walmart or Target ( Retail Dive ). Inventory turns over before Costco has to pay suppliers, creating "float" that Costco can invest. And with a self-service model, Costco generates over $700,000 of sales per employee, again multiples higher than competitors ( Cascadia Strategy ).

All these efficiencies add up to cold, hard cash. As one retail analyst put it to me, "Costco basically mints money." Costco‘s gross margins of around 13% are less than half that of Walmart or Target ( Costco 2022 Annual Report ). But its steady membership fee income and rock-bottom costs mean Costco‘s profit margins and return on equity are consistently higher than other large retailers.

A Winning Formula

Put it all together and you have a business model that prints cash as reliably as the U.S. Mint. Over the last decade, Costco‘s sales have grown at a 8% compound annual growth rate while profits have increased a whopping 12% per year ( Costco 2022 Annual Report ).

Source: Costco 2022 Annual Report

This phenomenal growth isn‘t due to complex financial engineering or unsustainable expansion. It‘s the product of a simple business model executed to perfection, year after year. By relentlessly focusing on quality, value, and efficiency, Costco makes its members happy and generates boatloads of cash in the process. It forgoes short-term profits to build long-term value. In an era of retailers chasing the latest fads, Costco‘s consistency is its greatest strength.

Not that Costco is resting on its laurels. To keep growing, Costco will need to attract the next generation of shoppers. E-commerce remains an opportunity and a challenge—Costco.com is growing rapidly but only represents about 7% of sales ( Costco Q4 2022 Earnings Call ). Capturing younger, digital natives without cannibalizing store sales will require deft management. International markets, with just 16% of locations today, offer another avenue for growth.

But Costco isn‘t about to abandon a formula that has served it so well for so long. "If we keep our eye on the ball: keep prices down, keep providing good value and quality to our members, and keep paying our employees better, we think we have a pretty good future ahead of us," says CEO Craig Jelinek ( Cascadia Strategy ). I couldn‘t agree more. As retail continues to evolve at a breakneck pace, Costco‘s future appears as solid as that 20-pound turkey in my oversized shopping cart.

Brought to you by:

Costco Wholesale Corporation: Market Expansion and Global Strategy

By: Chansoo Park, Vipin Viswanathan, Raadhika Gopinath, Sara Parveen, Mary Furey

In 2015, Costco Wholesale Corporation (Costco) was ranked as one of the world's largest global retailers based on sales revenue, second only to Walmart Inc. It had successfully expanded into eight…

- Length: 15 page(s)

- Publication Date: Feb 21, 2019

- Discipline: Strategy

- Product #: W19041-PDF-ENG

What's included:

- Teaching Note

- Educator Copy

$4.95 per student

degree granting course

$8.95 per student

non-degree granting course

Get access to this material, plus much more with a free Educator Account:

- Access to world-famous HBS cases

- Up to 60% off materials for your students

- Resources for teaching online

- Tips and reviews from other Educators

Already registered? Sign in

- Student Registration

- Non-Academic Registration

- Included Materials

In 2015, Costco Wholesale Corporation (Costco) was ranked as one of the world's largest global retailers based on sales revenue, second only to Walmart Inc. It had successfully expanded into eight international markets: Canada, Japan, South Korea, Spain, Mexico, Taiwan, Australia, and the United Kingdom, managing to grow despite the turbulent economic conditions prevalent in these countries. Costco challenged stereotypes and employed unconventional business strategies to position itself as a leading transnational retailer. Costco's business model was crucial to the company's financial success and expansion over the years. Key company success factors included its membership-based operating model, its focus on low-cost efficiencies, the perceived quality and value of the Kirkland Signature brand, and its philosophy of rewarding human capital. However, as Costco made plans to expand its operations, it faced challenges due to intensified competition in the global retail industry and policies and regulations in local markets that restricted big box retailers. In this context of uncertain international markets, which markets should it enter next? What was the best entry method for each individual market?

Chansoo Park and Vipin Viswanathan and Raadhika Gopinath and Mary Furey are affiliated with Memorial University of Newfoundland.

Learning Objectives

This case is suitable for an undergraduate- or graduate-level business course on strategic management, global strategy, international business, or international marketing. The case examines Costco's international expansions and highlights key success factors in each market, enabling students to analyze and determine appropriate modes of entry based upon the challenges presented in various countries. After working through the case and assignment questions, students will be able to do the following: Describe the global retail business industry. Examine and evaluate the effectiveness of Costco's international business strategies in eight markets and its global expansion strategies. Evaluate Costco's entry mode into each of the eight markets. Examine Costco's key success factors and strategic challenges in the eight markets.

Feb 21, 2019 (Revised: Sep 3, 2019)

Discipline:

Ivey Publishing

W19041-PDF-ENG

We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More . By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

The Leading Source of Insights On Business Model Strategy & Tech Business Models

Business Strategy Lessons From Costco Business Model

Costco’s strategy can be summarized as primarily a selection of high-quality items sold in bulk in warehouses around the US and Canada, with a substantial part of its business focused on selling merchandise at a low-profit margin. Costco also uses a single-step distribution strategy to sell its inventory before it gets paid to suppliers. Costco generated almost $242.29 billion in revenue in 2023, of which $4.58 billion came from 71 million paid members.

Table of Contents

History of Costco

Here is the story of how this retail behemoth carved out its own niche in what is an extremely competitive market.

Back then, consumers paid $25 annually to purchase bulk products at discount prices in a basic, warehouse-like environment.

Price Club expanded to 94 locations across North America and by 1992, reported revenue of $6.6 billion and profit of $134 million .

The original Price Club store in a converted airplane hangar in San Diego, California, still operates to this day under the Costco banner.

Costco is founded

The first store opened in Seattle in 1983, and by the end of 1986, it boasted 17 locations, 1.3 million members, and 3,740 employees.

The subsequent company became known as PriceCostco, but consumers with a Price Club membership could shop at Costco and vice versa. Around this time, the first locations were opened in the United Kingdom and then in South Korea.

In 1994, Sol and Robert Price left the company to start PriceSmart, a warehouse chain for the Central American and Caribbean markets.

Three years later, PriceCostco became Costco Companies, Inc., and all remaining Price Club stores were rebranded.

The company also introduced its Executive Membership where members could earn a 2% reward on eligible purchases and access additional benefits.

Existing Costco locations retain many of the characteristics of Price Club stores.

Each warehouse is sparsely decorated, but the company has remained committed to low prices and also pays its employees an attractive wage.

Costco business model at a glance

Costco’s business model and business strategy can be summarized as a selection of high-quality items sold in bulk-sized warehouses around the US and Canada.

With a substantial part of its business focused on selling merchandise at a low-profit margin, Costco also had 65.8 million members in 2022.

Which generated $4.22 billion in revenue for the company in 2022.

Membership revenue has been consistently increasing over the last few years.

Costco also uses a single-step distribution strategy that allows it to sell its inventory even before it gets paid to suppliers.

Just like ALDI tries to keep its prices as low as possible, Costco managed to do so by deliberately lowering its profit margin to pass those savings to consumers.

Indeed, Costco wants to be recognized in the minds of its consumer as high-quality, low-priced stuff that you can purchase in bulk.

A few other interesting aspects of the Costco business model make it unique and make its value proposition compelling.

A glimpse at Costo’s business model few key ingredients

The value proposition of the Costco business model is quite strong. The company offers low prices to its members with a limited selection of nationally-branded and private-label products in a wide range of merchandise categories.

While those items will produce high sales volumes, they will also be driven by fast inventory turnover .

Costco offers merchandise in a few key categories:

- Foods which comprise dry foods, packaged foods, and groceries

- Sundries which comprise snack foods , candy, alcoholic and non-alcoholic beverages, and cleaning supplies

- Hardlines, which comprise major appliances, electronics, health and beauty aids, hardware, and garden and patio

- Fresh Foods comprising meat, produce, deli, and bakery

- Softlines comprising apparel and small appliances

- Ancillary, which comprises gas stations and pharmacy

Let’s see the critical ingredients of Costco’s business model and business strategy success, starting from how the company manages its inventory .

High inventory turnover: the key is cross-docking and single-step distribution channels

Costco generally sells inventory even before they’ve paid it. As pointed out in its annual report:

We buy most of our merchandise directly from manufacturers and route it to cross-docking consolidation points (depots) or directly to our warehouses. Our depots receive large shipments from manufacturers and quickly ship these goods to individual warehouses. This process creates freight volume and handling efficiencies, eliminating many costs associated with traditional multiple-step distribution channels .

The key ingredient to Costco’s ability to move merchandise efficiently from manufacturers to its warehouses allows the company to sell its inventory quickly.

Indeed, thanks to its memberships, Costco knows it will sell most of its inventory pretty quickly. Thus, inventory losses (shrinkage) are well below typical retail operations.

Indeed, where in a typical retail operation, there is a multiple-step distribution channel where the retailer has to move the merchandise from the manufacturer to a warehouse and then again to a retail store where it gets sold.

Costo warehouses are stores themselves. Thus, when moved the merchandising there, it gets sold quickly.

Another critical aspect is that when the merchandise arrives in bulk at Costco warehouses, they don’t need many repackaging or complex and expansive operations.

Rather the merchandise gets sold directly in bulk.

Ancillary businesses: leverage on tight margin merchandise and goods to sell primary merchandising

Ancillary businesses within or next to our warehouses provide expanded products and services, encouraging members to shop more frequently. These businesses include our gas stations, pharmacy, optical dispensing centers, food courts, and hearing-aid centers. We sell gasoline in all countries except Korea and France, with the number of warehouses with gas stations varying significantly by country. We operated 536, 508, and 472 gas stations at the end of 2017, 2016, and 2015, respectively.

One might wonder why to sell an item with a minimal profit margin like gasoline. And the answer is simple. Gas allows Costco to attract people to its warehouses.

Going to Costco is an “experience” all its way down.

From purchasing gas to stocking the car of merchandise.

The two primary ancillary businesses Costco leverages to bring as many customers back to its warehouses are gasoline and pharmacy.

Limit merchandising selection: better vendors’ agreements and payments with low prices and high quality

Our strategy is to provide our members with a broad range of high-quality merchandise at prices we believe are consistently lower than elsewhere. We seek to limit items to fast-selling models, sizes, and colors. We carry an average of approximately 3,800 active stock keeping units (SKUs) per warehouse in our core warehouse business, significantly less than other broadline retailers. Many consumable products are offered for sale in case, carton, or multiple-pack quantities only.

It’s quite counterintuitive to think of as a strength the limitation in merchandising.

Whereas other large players like Walmart and Amazon praise themselves for making available any merchandise.

Costco, like ALDI , does the opposite and praises itself for limited stock selection.

This allows Costco to get better vendor agreements, and Costco customers might be happier to have less.

Still, higher quality merchandise becomes way more accessible for Costco to manage that merchandising, which in comparison, lowers its operational burden.

Online commerce to offer what’s not available in the warehouses

Online businesses provide our members additional products and services, many not found in our warehouses. Net sales for our online business were approximately 4% of our total net sales in 2017 and 2016, respectively, and 3% in 2015.

Even though Costco doesn’t focus on online sales, it uses it to provide products and services that might not be available in its warehouses. This is a privilege that members enjoy.

Comparable sales growth as a primary business metric

Costco focuses relentlessly on sales growth by looking at a simple yet effective metric: comparable sales growth .

This is defined as sales from warehouses open for more than one year, including remodels, relocations, and expansions, as well as online sales related to e-commerce websites operating for more than one year.

The power of the membership model to create a stable revenue stream that enhances profitability

If you want to enjoy the Costco experience, there is no way out than to become a member. Indeed, t he member renewal rate was 90% in the U.S. and Canada and 87% worldwide in 2017 .

Usually, those renewals happen within six months following their renewal date. Memberships comprise four main categories

- Goldstar and Goldstar executive

- business, and business executive, including add-ons

Memberships have been growing at a steady rate over the years:

With almost 66 million paid members in 2022, most of them representing a good chunk of US households, membership fees increased over the years.

Why is this revenue model so interesting? For a few reasons:

- with a membership model , Cosco can pass part of the saving on the merchandise to its members

- at the same time, those members will spend more, and they will get more savings

- Costco will enjoy higher revenue growth , and a stable revenue stream represented by its members

- that revenue stream can get invested to grow Costo even further

- while it will allow Costco to lower its prices further while keeping a high quality for its members

The membership revenue stream – also though it represents only about 2.26% of Costco net sales yet carries high-profit margins.

Thus, on the one hand, Costco runs its primary business on tight margins, while it relies on fifty million members (and growing) that represent a stable revenue stream for Costco business in the long run.

Bulk sizes make it easier to cross-dock while Costco sells more and members save more

Another key ingredient that it is essential to remark on about Costco’s business model and business strategy is how it sells merchandise in bulk and in larger quantities compared to other retail stores.

This has a simple yet powerful logic:

- Costco gets better prices from manufacturers as it buys larger quantities

- it also sells more of that merchandise compared to traditional retailers

- at the same time, members get lower prices at higher convenience

Summarizing Costco’s main business drivers

A few key drivers that Cosco leverages for its future success are:

- increasing shopping frequency from new and existing members and the amount they spend on each visit (so-called average ticket)

- growing comparable sales by making available to Costco members the right merchandise at the right prices

- provide quality goods and services at competitive prices

- being perceived as a “pricing authority” (low-price and high-quality merchandise)

- leverage on ancillary businesses to grow the sales of primary merchandise that carries higher profit margins (take the gasoline business, which draws members to Costco warehouses)

- keep growing Costco warehouses

- membership format as an integral part Cosco’s business model and business strategy with high profitability and a constant revenue stream

Business lessons you can apply to your company

- On top of your primary revenue stream, build a membership base: You can offer members exclusive advantages and offers in exchange for a small annual fee. This overtime will also enhance the sales in other areas of your business as members will be willing to buy more at a more reasonable price.

- Sell larger quantities at a lower price: if you sell a physical good or an intangible service, you can sell them at higher volumes for a more reasonable price. This will deliver more value to your customers while allowing you to get more sales.

- Provide ancillary goods or services to sustain the sales of primary goods or services: we all like to discuss optimizing our business operations. However, you need to lose money on something else to make money. In a way, this is a variation of the razor and blade business strategy . On the one hand, you sell a service where you don’t make money; on the other, you sell a complementary good or service with high margins. This strategy can be applied pretty much to any business. For instance, imagine a digital agency selling a website design at a meager price by making no profit on that. It will sell complementary digital marketing services that instead have a high-profit margin.

- Use a single-step distribution strategy : distribution is crucial to any business’s success. Rather than make it complicated, try to simplify it to reduce the number of steps a service or product takes before it gets to the final consumers.

Key Highlights

- Business Model : Costco’s business model revolves around offering a selection of high-quality items in bulk-sized quantities through warehouse-style stores. The company focuses on selling merchandise at low-profit margins and relies heavily on its membership model for revenue.

- History : Costco’s roots trace back to Price Club, founded in 1976 as a warehouse store catering to business customers. Costco was founded in 1983 by Jeffrey H. Brotman and James D. Sinegal, following a similar warehouse-style approach.

- Merger : Price Club and Costco merged in 1993, creating a natural fit due to their similar business models. The merged entity became PriceCostco, later rebranded as Costco Companies, Inc.

- Kirkland Signature : Costco introduced its private label brand , Kirkland Signature, in 1995. This brand has become highly successful, accounting for a significant portion of the company’s sales.

- Inventory Management : Costco employs a single-step distribution strategy that allows it to move merchandise efficiently from manufacturers to warehouses. Cross-docking consolidation points play a key role in this process.

- Limited Merchandise Selection : Costco limits its merchandise selection to fast-selling models, sizes, and colors. This strategy helps the company negotiate better vendor agreements and manage its inventory more effectively.

- Ancillary Businesses : Costco leverages ancillary businesses like gas stations and pharmacies to attract more customers to its warehouses, enhancing the overall shopping experience.

- Membership Model : Membership is central to Costco’s strategy . Members pay an annual fee to access the store, and the high membership renewal rate provides a stable revenue stream for the company.

- Bulk Sizes and Value Proposition : Selling items in bulk quantities allows Costco to negotiate better prices with manufacturers and offer cost savings to its members. The company focuses on providing high-quality products at lower prices.

- Comparable Sales Growth : Costco’s primary business metric is comparable sales growth , which measures sales from warehouses open for more than a year. This metric reflects the company’s success in attracting and retaining customers.

- Online Commerce : While Costco’s primary focus is on its physical warehouses, it also uses online commerce to offer products and services that may not be available in-store.

- Expansion and Membership Growth : Costco’s strategy includes ongoing expansion, increasing membership base, and enhancing shopping frequency and spending per visit.

Business Model Recap

Related visual stories.

Costco Business Model

Costco SWOT Analysis

Who Owns Costco

Wholesale Business Model

Costco Financials

Costco Employees

Costco Members

Costco Membership Revenue

Costco Revenue per Member

More Resources

About The Author

Gennaro Cuofano

Leave a reply cancel reply, discover more from fourweekmba.

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

- 70+ Business Models

- Airbnb Business Model

- Amazon Business Model

- Apple Business Model

- Google Business Model

- Facebook [Meta] Business Model

- Microsoft Business Model

- Netflix Business Model

- Uber Business Model

Costco Business Model Explained: The Things That Led to Its Success

- Key Takeaways

Growth and Development

- Costco Business Model Explained - How Does It Work?

Costco Business Strategy

Client filtering, a loyal culture.

- Suppliers' Independence

Cheap Designs

Membership fees, merchandise sales volume, ecommerce offers, home programs, auto sales program, key partners, financial performance, customer segments, costco travel, concierge service, costco optical, costco insurance, food service, audiobook app.

- Costco's Customer Relations

Costco Marketing Mix

Future plans, opportunities.

- Sam's Club

- Question: What Are Costco's Strategy Elements?

Question: Does Costco Operate a Unique Business Model?

- Question: What's Costco's Competitive Strategy?

Bottom Line