Root out friction in every digital experience, super-charge conversion rates, and optimize digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re are saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Explore the platform powering Experience Management

- Free Account

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Employee Exit Interviews

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

- Market Research

- Artificial Intelligence

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results, live in Salt Lake City.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

- Experience Management

- Brand Experience

- Brand Perception Surveys

See how Qualtrics Strategic Brand works

The complete guide to brand perception surveys.

7 min read Who owns your brand? Your marketing team? Your public relations staff? Your CEO? In a very real sense, your customers own your brand. It is what they think it is. It promises what they say it promises.

What does a brand perception survey do?

Brand perception surveys help you understand how your brand is perceived in the mind of customers, prospects, employees, and other stakeholders. They paint a picture of the mental real estate your brand owns and how it compares to that of your competitors’ brands.

At a very simple level, a brand is just an idea connected to your product. For example:

- Simple + Computer = Apple

- Cola + Youth = Pepsi

- Rebel + Motorcycle = Harley Davidson

- Pictures + Temporary = SnapChat

Do you know how many customers recall or recognize your brand name and logo ? Use our free brand awareness survey template to find out.

Why are brand perception surveys important?

Brand perception can be formed over time through different customer experiences . A customer’s personal experience with your product or service can spread throughout a market and solidify a positive or negative reputation among those who may know nothing about your company at all.

Brand perception surveys hold a key position in promoting positive brand equity – the value premium a brand brings to a business. Businesses want to maintain high levels of brand equity as this can have a knock-on effect on sales and profits.

As customers have ‘ownership’ over the brand’s image in their minds, it’s important that businesses can influence this. To do this, you first need to measure brand perception regularly, track it over time, and identify what drives improvements.

A brand perception survey is a painless and cost-effective way to measure your customer’s views on your brand. It’s regularly employed by brand managers as it provides more flexibility than in-person workshops: surveys can be completed in the target audience’s own time.

Best Practices : Discover how to increase response rates in your brand perception surveys.

Questions to ask in a brand perception survey

There are 4 core human factors that lead to brand affinity:

- Cognitive – the concepts that a consumer associates with your brand

- Emotional – the feelings that a consumer associates with your brand

- Language – how a consumer describes your brand

- Action – the experiences a consumer has with your brand

When you design your brand perception survey, focus on these 4 key areas that will help you understand the cognitive, emotional, language, and action factors of your brand. The following sections will describe each area and provide some example questions to start you off.

These questions should draw out the associations that consumers connect to your brand. You can start off with open-ended questions and then tighten using multi or single-select lists.

Example questions :

- Open-ended question: When you think of [your brand], what comes to mind first?

- List question: Which of the following words describe [your brand]?

- Positive to negative scale question: Of the words you selected, how do you feel about each?

These questions should attempt to identify the feelings connected to your brand, and if those draw them closer to the brand or pull them away.

- Open-ended question: What kind of feelings do you experience when you think of [your brand]?

- List question: How would you describe your level of emotional attachment to [your brand]?

- List question: When you think of [your brand], how do you feel?

These questions teach you how consumers internalize and understand your brand by asking how they would describe it to others.

- Open-ended question: Which three words would you use to describe [your brand]?

- Open-ended question: How would you describe [your brand] to a friend?

- List question: Which words would you use to describe [your brand]?

These questions should answer how positive or negative a consumer’s previous experience has been with your brand.

- Open-ended question: How would you describe your last experience with [your brand]?

- List question: Which best describe your last experience with [your brand]?

- Scale question: On a scale of 1-10, how likely are you to recommend to a friend or colleague?

Who should you send your brand perception survey to?

Try to take into consideration who the best audience for your survey is. The kinds of insights you can draw from your survey will depend largely on who you invite to participate. For example, if your brand is about comfortable maternity-wear, you may choose to survey one (or more) of three different audiences:

- You may want to get a wide pool of responses from different backgrounds indiscriminately, including expecting mothers, new mothers, partners, friends, and family. This could provide a 360-degree perspective that gives very general insights.

- Alternatively, you could focus on expecting mothers, then women thinking of having a child, etc. in a segment-by-segment approach , sorted in order of product market relevance. Your customer perceptions will then be from very focused, but relevant markets.

- You might also choose to send your survey to people from each possible stage of the customer journey . This focuses on audiences with greater involvement and brand affinity, shown by increased sales activity. In our maternity wear business example, the survey could be given to:

- Non-customers that have no knowledge of your brand

- New customers who have experienced it for the first time

- Current customers have the experience of purchasing a product

- Long-term repeat customers that enjoy using your brand

- Former customers that did not enjoy using your brand

In this way, you would gain customer perceptions from different perspectives along the customer sales cycle, helping you focus on process and product improvements.

Each of these three approaches provides unique and valuable insights.

Getting started with a brand perception study

Brand perception surveys have three main outcomes:

- Understand the impact of your marketing campaigns on brand perception.

- Resolve the gap between the brand qualities you want to portray and how the customer actually feels.

- Identify areas for improvement based on customer perceptions.

Tracking and managing these three stages can be hard to do without an intuitive solution.

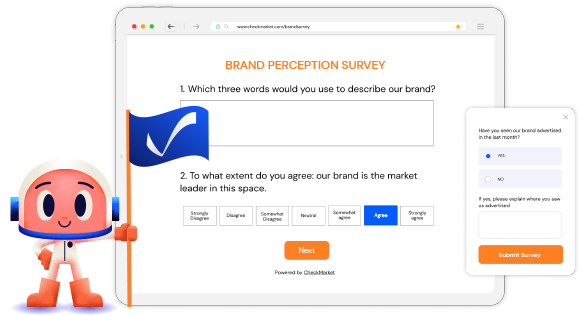

The Qualtrics Brand Perception Study is a solution that gives a 360-degree understanding of how effective your marketing and messaging is. It’s an all-in-one product that helps you:

- Understand if your product experience is aligned with your brand values .

- Track how well consumers are accepting the ideas you try to associate with your brand. The ideas they associate with your brand help determine their affinity towards it.

- Measure how your brand is positioned against relative competitors.

Watch a video about the Qualtrics Brand Perception Study

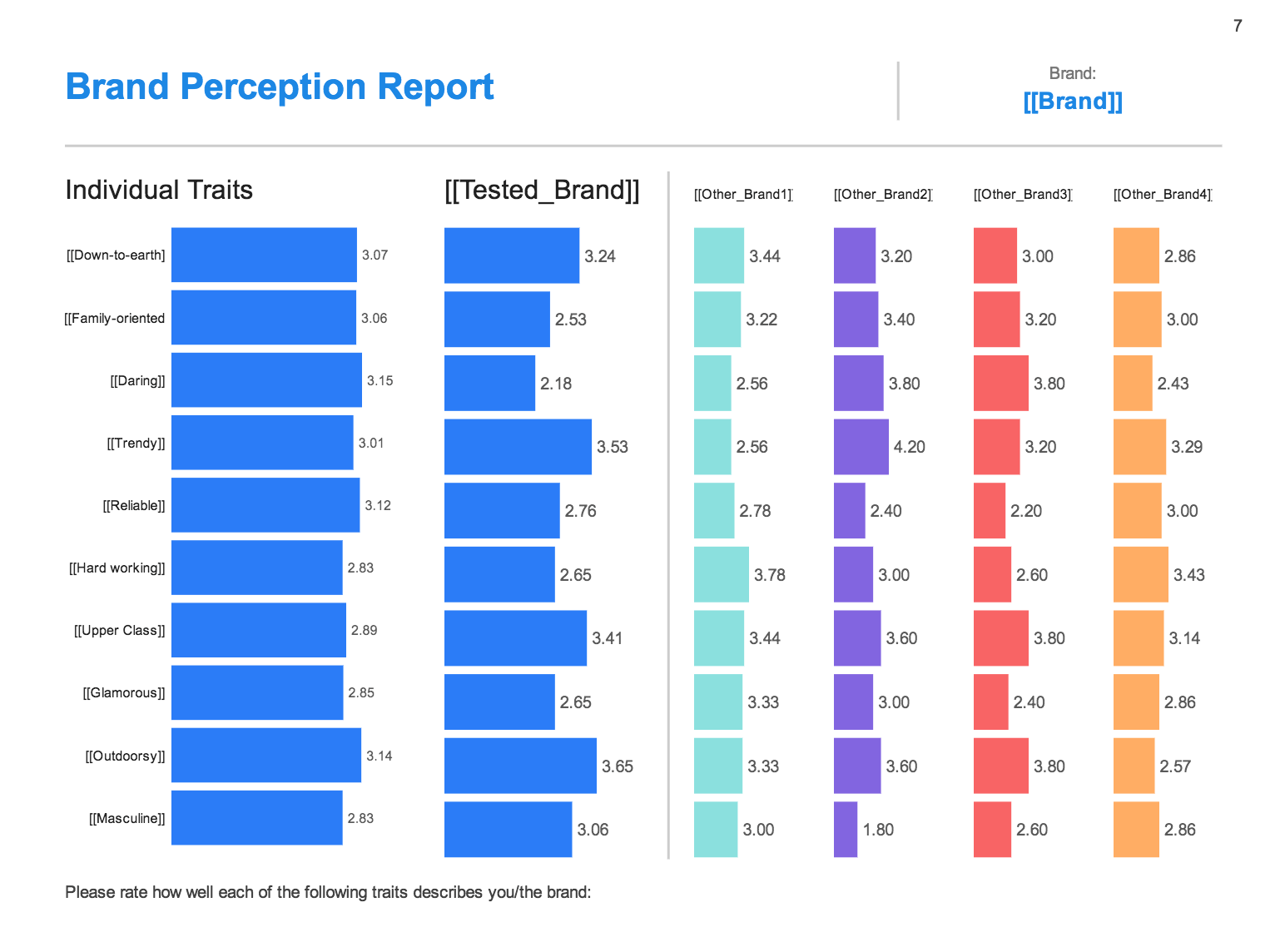

Prebuilt reports, like below, show you instant analysis of your data, so you can spend more time delivering results.

Over time, results can be monitored and compared to see how your brand perception changes across different audiences.

Better understand the health of your brand with our free brand awareness survey template

Related resources

Brand Perception

Brand Sentiment 18 min read

Brand intelligence 12 min read, brand recall 10 min read, brand image 10 min read, brand identity 12 min read, brand perception 11 min read, request demo.

Ready to learn more about Qualtrics?

- Jan 16, 2021

9 Key Brand Research Questions To Ask

Updated: Apr 5

There are 9 key brand research questions to ask that are vitally important to keep track whether the brand is seen in a positive light in the market. This is crucial for businesses or websites in ensuring they have a good brand name as it encapsulates the personality, values, goals and image that make the brand recognisable to the public.

In this post we will explore these key 9 brand research questions and the reasons why they should be used, which fall within the 5 levels of the brand research funnel below:

1. Brand awareness

2. familiarity, 3. consideration, 5. advocacy, other brand research question topics to include.

[Disclosure: This post contains affiliate links, meaning we get a commission if you decide to make a purchase through these links at no additional cost to you.]

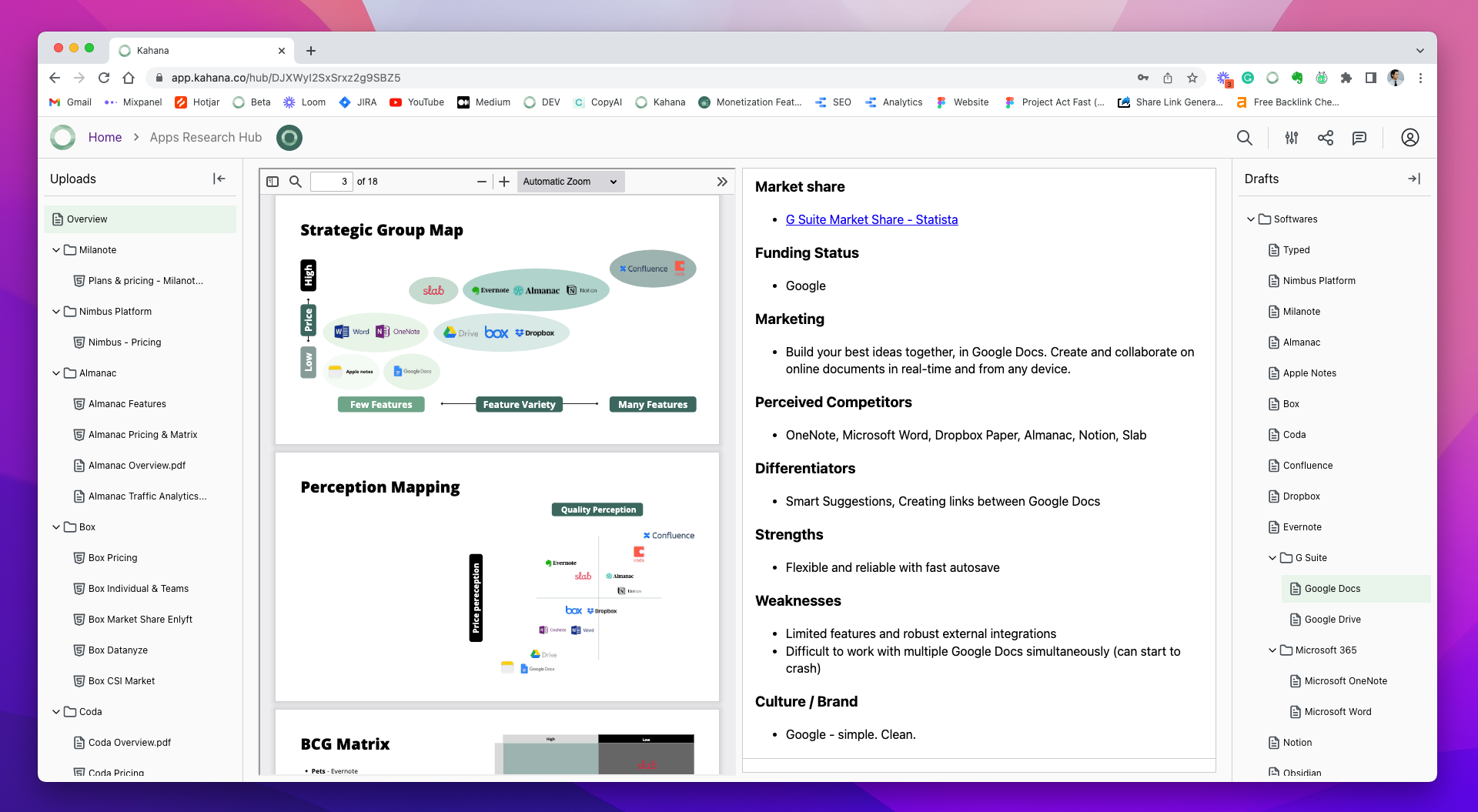

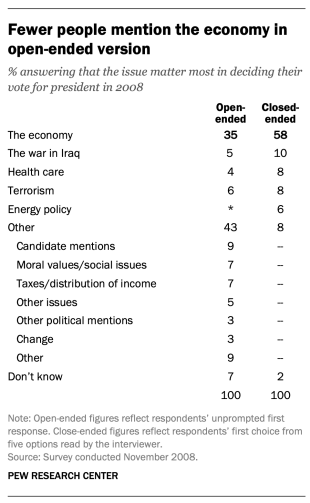

The table above shows the 9 key brand research questions to ask respondents.

The top 9 brand research questions shown above fit within the brand research funnel to help measure different key metrics. The brand research funnel gives you an instant snapshot of conversion from awareness to users or advocates of the brand. Below is an explanation of how these 9 questions fit within the 5 levels of the brand research funnel and their importance in brand research .

There are 3 types of brand awareness questions below that cover spontaneous and prompted mentions to make up total awareness amongst your audience of brands within a category.

1: Top of mind awareness

This helps to gage which brands in a particular category that the target audience are aware of spontaneously. In this case the first brand that comes to mind for that market or sector. This is important to see how your brand does when people are unprompted and is an important part of brand recall .

Q. Please think about online banks that provide everyday financial services such as current accounts, savings accounts, mortgages and loans. Which online bank comes to mind first?

2: Total spontaneous awareness

This measure’s all the spontaneous brand mentions including the first top of mind mention as well. As mentioned above this is a good judge of success for a brand to see how they stand out within their category.

Q. Which other comparison sites are you aware of?

3: Prompted awareness

This is when a brand list is either read out or listed in a survey for participants to select brands, they are aware of that they have not already mentioned in the spontaneous awareness questions.

Q. You may have mentioned several of these already, but please indicate which of the following computer brands you know, even if it is only the name.

The familiarity question helps to see how good is the awareness of brands of those participants who answered they know the brand from it being merely a label they heard of to something that is more meaningful and part of their consideration set for purchase.

Q. How familiar are you with each of these brands as mobile phone providers?

It’s important to be in the consideration set of 3 or 4 brands in members of the target audience who are serious about buying that product or service type. It often takes that number of brands for many purchase decisions. This question will allow you to understand if your brand is part of that consideration set from those participants aware of the brand.

Q. Which brands would you consider when buying a large household appliance?

It’s also interesting to see which is the most preferred by the target audience even if they have not purchased the product or service before.

Q. Which of these BRANDS do you most prefer?

When asking participants about usage of brands it’s best to keep it within a timeframe such as past month, 3 months, 6 months or in the past year. The usage question will allow you to understand how brands compare in the market and the relative market share. It’s a very useful measure to hold to supplement the existing sales data you have.

Q. Thinking about your own home, which of the following brands do you currently have/use in your household? This could be for any type of domestic appliance?

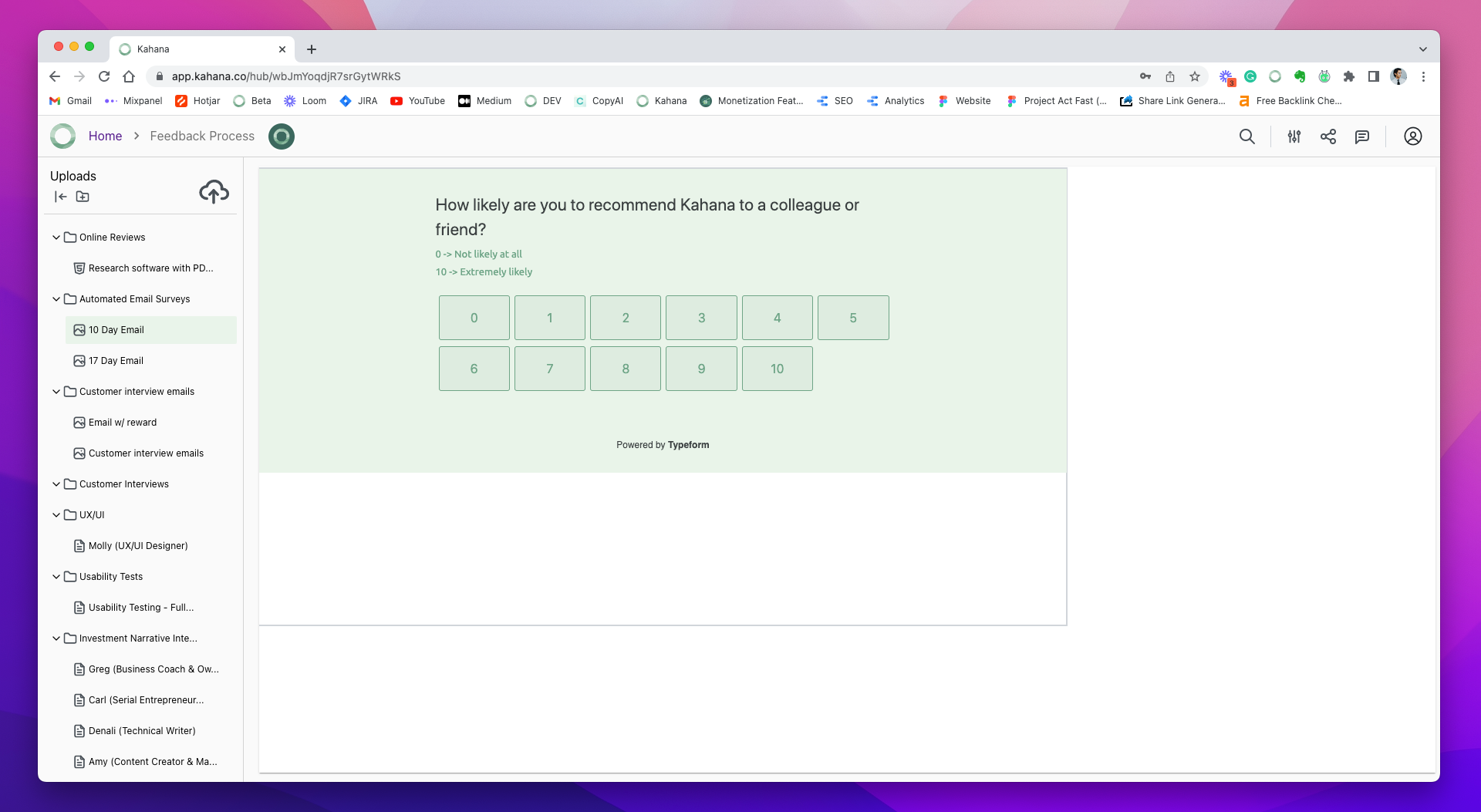

Either overall customer satisfaction or likelihood to recommend questions (NPS) on a scale of 0 to 10 will help you to understand how well your brand is delivering on your promises. Those that give a score of 9 or 10 are likely to be advocates of the brand in raising awareness or to consider purchasing in the future. So, this ties in with the other measures in the funnel.

LIKELIHOOD TO RECOMMEND

Q. On a scale of 0 to 10 with 0 being not at all to 10 being extremely likely, how likely are you to recommend BRAND X OR WEBSITE to friends or family?

OVERALL SATISFACTION

Q. Thinking about your overall experiences with BRAND X in the last 3 months, on a scale of 0 to 10 with 0 being not at all satisfied to 10 being extremely satisfied, how satisfied are you with BRAND X?

There are many other topics that can be covered in brand research and these include:

Channel of purchase

You can draw on important intelligence of the channel strategies of your competitors from where they bought the brand from and the brands used.

Behaviour in making the purchase decision

Find out what people were thinking in the lead up of the purchase, so did they seek advice from others, search for information online or looked at products instore. These are vital insights to gain an understanding of where your brand should be most noticeable in order to positively influence the purchase.

Switching patterns

This can serve as an early warning system of likely defection of customers when monitoring this on a regular basis. Possible questions for this would be around - do they intend on staying loyal to the brand? Or whether they are likely to change their purchase behaviour?

Profiling the audience

To get the latest understanding of their target audience many profiling questions are asked around demographics, attitudes and behaviour and is often linked to the segmentation profiles of a business.

Advertising awareness

So long as the sponsor of the research is not disclosed, you can ask questions around what advertising they remember seeing for a particular category? Do they remember the message of the ad? What brand was is it for? What was the source of the advertising? These advertising research questions help to establish how effective any recent brand advertising campaigns were.

Brand image

Brand image otherwise known as Brand association is normally asked towards the latter part of the survey to help ascertain whether the brand’s values are being positively associated with it or not. This is often a list of brand attribute statements on a 5-point agreement scale. It’s best a have a maximum of 10 statements to help avoid respondent fatigue .

Brand research helps to refine marketing strategies whether you’re at the start of your brand’s journey or in the middle to ensure the brand’s personality is positively conveyed and instantly recognisable amongst your target audience. It’s best to use brand research to monitor your brand’s progress over time to ensure you can efficiently and strategically move against your competitors and foresee any possible market trends by conducting brand analysis from the data that was gathered.

RELATED POSTS BELOW ABOUT BRANDING AND ONLINE SURVEYS

Brand Touchpoints: Definition, Importance, Examples

Brand Value: Definition, Importance & How Is It Measured

Brand Recognition: Definition, Importance & More You Should Know

Brand Association: Definition, Types, Examples & More

Brand Promise Explained With Examples

Brand Essence: Definition, Importance, Examples & More

Brand Perception: Definition, Measurement, Examples & How To Improve I t

Brand Equity: Definition, Importance, Examples & Much More

5 Best Survey Maker Platforms To Consider Using

Market Research Online Surveys In 6 Easy Steps

How To Do A Survey: Top 10 Tips

Market Research Online: Benefits, Methods & Tools

Conversational Forms: Discover What So Good About Them

Top 5 Website Survey Questions About Usability

Type Of Customer Feedback Questions To Ask

#AnparResearch #9brandresearchquestions

- BRAND PERFORMANCE

Related Posts

Brand Touchpoints: Definition | Importance | Examples

Brand Analysis: Definition, Importance & How To Use It

Brand Recall: A Guide To All You Need To Know

Cookie consent

We use our own and third-party cookies to show you more relevant content based on your browsing and navigation history. Please accept or manage your cookie settings below. Here's our cookie policy

- Form Builder Signups and orders

- Survey maker Research and feedback

- Quiz Maker Trivia and product match

- Find Customers Generate more leads

- Get Feedback Discover ways to improve

- Do research Uncover trends and ideas

- Marketers Forms for marketing teams

- Product Forms for product teams

- HR Forms for HR teams

- Customer success Forms for customer success teams

- Business Forms for general business

- Form templates

- Survey templates

- Quiz templates

- Poll templates

- Order forms

- Feedback forms

- Satisfaction surveys

- Application forms

- Feedback surveys

- Evaluation forms

- Request forms

- Signup forms

- Business surveys

- Marketing surveys

- Report forms

- Customer feedback form

- Registration form

- Branding questionnaire

- 360 feedback

- Lead generation

- Contact form

- Signup sheet

- Help center Find quick answers

- Contact us Speak to someone

- Our blog Get inspired

- Our community Share and learn

- Our guides Tips and how-to

- Updates News and announcements

- Brand Our guidelines

- Partners Browse or join

- Careers Join our team

- → 20 essential brand perception survey ...

20 essential brand perception survey questions + template

Brand perception survey questions help you gauge the strengths and weaknesses of your brand’s image. Discover what to ask on your next brand perception survey.

Latest posts on Tips

Typeform | 04.2024

Typeform | 03.2024

When you hear the brand name Apple, what comes to mind? Cutting-edge, sleek, and top-of-the-line are just a few of the words and phrases commonly associated with the tech giant. From soccer moms to business execs, many people share the same sentiments about this brand because of the work it's put into its brand perception.

Brand perception is (surprise, surprise) how your audience perceives your brand, which can influence their purchasing decisions and, ultimately, your business’s success or failure. And, like any great marketing endeavor, fine-tuning your brand perception takes solid market research .

To start crafting your survey , check out these brand perception survey questions that won’t just tell you who you are now but what your brand can be.

1. What’s your age/gender/location/etc.?

Measures: Audience research

Understanding your audience's demographics helps you tailor your marketing strategies to specific groups and identifies the customer segments most interested in your brand. Demographic survey questions allow you to craft laser-focused campaigns that resonate with specific groups, ensuring your message hits the mark and doesn't get lost in the noise.

2. Have you heard of our brand before?

Measures: Brand awareness

Before you get into the meat of your survey, you should probably ask whether your participant even knows who you are.

This question is fundamental in assessing the extent of brand awareness and visibility. It provides a baseline understanding of how well your audience recognizes your brand and serves as a starting point to gauge the effectiveness of your marketing efforts.

3. How did you first learn about our brand?

Asking survey participants how they first heard about your brand sheds some much-needed light on your marketing landscape. It not only reveals the most successful first-touch channels but also uncovers the dark corners that need a little extra illumination.

This question provides vital insights for refining your marketing strategies, directing resources to the most effective channels, and fine-tuning your approach to enhance brand discovery and engagement.

4. Can you name our main competitors in the industry?

Measures: Competitor awareness

It’s not enough to know whether your audience is familiar with your brand—to fully assess the level of brand awareness, you should also ask whether they’re familiar with your competitors.

This insight is essential in understanding where you stand in relation to your competitors. Armed with this knowledge, you can craft marketing strategies that emphasize your unique selling points, differentiate your brand, and communicate your strengths in a way that resonates with your audience and strengthens your market position.

5. What do you believe sets us apart from competitors?

Measures: Brand differentiation

Every brand has a unique selling point that sets it apart from the competition, but it’s not always obvious. Asking your audience what they believe are your brand’s unique qualities not only sheds light on the competition from their perspective but helps you understand what potential customers value as distinctive.

With this knowledge, you can position your brand more effectively in the market by aligning your messaging and strategies with the attributes that matter most to your target audience.

6. How likely are you to purchase from our brand within the next six months?

Measures: Purchase intent

Inquiring about how likely your survey participants are to purchase from you not only measures the immediate sales potential but also offers valuable insights into the likelihood of conversion and the effectiveness of your marketing strategies.

This question helps you identify potential customers on the cusp of making a decision, allowing you to tailor your efforts to nurture those prospects and secure future sales.

7. Do you believe our products or services are priced fairly?

Measures: Price perception

You might believe your offerings are worth a million bucks, but your brand’s premium price tags may turn off your target audience. Asking survey respondents to rate the value of your products or services for the price provides a direct line to understanding how customers perceive your value proposition.

With this data, you can gauge whether your pricing aligns with customer expectations and whether you need to make adjustments to maintain competitiveness.

8. Have you ever used our products/services before?

Measures: Usage and interaction

Just because they’ve heard about your brand doesn’t mean they’ve already made their merry way through your sales funnel.

Asking this question is essential because it helps you determine the level of consumer interaction with your brand. Responses to this question let you know whether survey participants have engaged with your products or services or if they’ve hit a snag along the customer journey.

9. How would you rate the quality and reliability of our products/services?

Measures: Quality and reliability

Having survey participants rate the quality and reliability of your offerings is a linchpin in safeguarding and enhancing your brand reputation. It offers valuable feedback from customers about your brand's strengths and weaknesses.

By addressing any shortcomings and amplifying strengths, you can maintain and elevate your reputation to build trust and loyalty among your audience.

10. How likely are you to continue using our products or services in the future?

Measures: Brand loyalty

Attracting new customers is only half the battle when it comes to building a successful brand—you need to keep those customers coming back for more. This brand perception survey question directly gauges brand loyalty and the depth of the customer relationship.

It offers a clear indication of whether your customers are not only satisfied with but also committed to your brand, reflecting their potential for repeat business. Knowing how likely your customers are to continue using your products or services provides valuable insights for retention strategies and can help forecast the long-term sustainability and growth of your brand.

11. How would you rate our customer service?

Measures: Customer service and support

With scathing Yelp reviews and rampant social media sharing, nothing can ruin a brand faster than poor customer service. Inquiring about yours is pivotal for assessing how effectively your brand meets customer needs and, in turn, gauging overall customer satisfaction. It acts as a direct feedback mechanism, shedding light on the critical touchpoints of the customer journey.

By understanding and addressing the quality of your customer service, you can enhance the overall customer experience, foster loyalty, and ensure your brand remains aligned with customer expectations.

12. How likely are you to recommend our brand to a friend or colleague?

Measures: Word-of-mouth marketing

Asking how likely your customers are to recommend your brand offers a glimpse into the potential for organic growth and word-of-mouth marketing.

When customers are willing to recommend your brand, they essentially become voluntary brand advocates. Their positive sentiment and endorsement can cause a powerful ripple effect as satisfied customers actively promote your products or services to their networks. It's a testament to their trust and affinity for your brand, which can translate into increased visibility, customer acquisition, and long-term success.

13. How would you describe our brand in three words?

Measures: Brand association

Questions like, “How would you describe our brand in three words?,” “How would you describe our brand to a friend?,” or “What words or phrases come to mind when you think of our brand?” are great for understanding which core attributes and characteristics resonate most with your audience.

This condensed feedback is a gold mine of information because it reveals the top-of-mind associations people have with your brand. You can use these descriptors to inform and shape your brand messaging, ensuring it aligns with the attributes that matter most to your audience.

14. Do you feel our brand’s messaging aligns with your values and needs?

Measures: Brand messaging

Just like a game of telephone, the underlying meaning behind a marketing campaign can often get lost in translation.

Asking your audience whether or not they feel your messaging aligns with their values serves as a vital checkpoint in understanding the harmony between your brand's messaging and your customers' expectations. It's not enough for brand messages merely to inform; they should also resonate with the values and needs of the intended audience.

The response to this question can unveil whether your messaging strikes the right chord and whether customers perceive your brand as a solution that aligns with their values and requirements.

15. How do you perceive our brand’s online presence (websites, social media, etc.)?

Measures: Online presence and perception

Knowing how your audience views and interacts with your online persona is necessary in today’s digital age—after all, your brand’s online presence is the first point of contact for many consumers.

Their perception of your website, social media profiles, and other online assets can significantly impact their overall brand perception. Feedback on this aspect is indispensable for staying relevant and competitive in the online arena, as it allows you to make necessary improvements to align your digital strategy with your audience's ever-evolving needs and preferences.

16. How effective is our brand when communicating with customers?

Measures: Brand communication

This brand perception survey question is your hotline to find out if your brand is an eloquent storyteller or if it's muttering incoherent gibberish.

In today's world, effective communication is a must for building lasting relationships with your audience. Responses to this question may be your cue to fine-tune your communication strategy, ensuring it's not just speaking but truly engaging with your customers.

17. Have you noticed any changes in our brand offerings over time?

Measures: Brand evolution

Like a fine wine, your brand should evolve over time—but it’s crucial to keep a pulse on how your audience perceives those changes. Are they readily embracing the changes or struggling to connect the dots?

This question is your barometer, helping you understand how well your brand navigates through evolving market dynamics and customer tastes. It's all about ensuring your brand remains in sync with ever-changing market conditions and customer preferences.

18. Have you ever provided feedback to our brand? If so, what was your experience?

Measures: Customer feedback

Asking customers about their experiences by providing feedback on your brand is instrumental in gauging your brand’s responsiveness and commitment to improvement.

The responses to this question can tell you if you’re hearing customers’ suggestions or concerns and acting on their insights. Customer feedback is crucial for driving meaningful changes within your brand. While we can’t implement those changes for you, our customer survey feedback tool makes it easy for customers to share their thoughts and feelings with your brand.

19. What's your overall impression of our brand?

Measures: Overall brand impression

One of the final questions in your brand perception survey should cover participants' overall impression of your brand. It's a condensed yet crucial question that’ll provide a snapshot of your audience's general sentiment and perception.

20. Is there anything else you'd like to share about your perception of our brand?

Measures: Qualitative data

While structured questions serve as the backbone of a brand perception survey, wrapping up with an open-ended query lets customers express their thoughts and feelings in their own words.

This question captures the nuances, unique experiences, and unexpected insights that structured questions can miss. It allows customers to:

Raise concerns

Share personal stories

Highlight exceptional encounters

Offer suggestions and ideas

This qualitative data can be a treasure trove for understanding the subtle aspects of brand perception, offering valuable context that can lead to improvements, innovation, and enhanced customer satisfaction.

What is a brand perception survey?

Brand perception surveys are powerful tools that give insight into how current customers, potential customers, and the public perceive your brand—think of it as a mirror reflecting your brand’s image in the eyes of your audience.

This survey typically consists of a series of questions aimed at assessing various aspects of the brand, such as:

How recognizable it is (awareness)

What people think of it (reputation)

How customers would rate it (quality)

How helpful it is to customers (customer service)

The magic of brand perception surveys lies in their ability to provide a clear, data-driven understanding of your brand's strengths and weaknesses. They help you uncover areas where your brand excels and pinpoint areas of improvement, allowing you to tailor strategies to address any issues that may be tarnishing your brand’s reputation.

By aligning your brand with your target audience's perceptions and expectations, a well-executed brand perception survey can lead to increased customer loyalty, stronger market positioning, and, ultimately, greater business success.

How to run a brand perception survey

Leave the cookie cutter in the kitchen if you want to put together a successful brand perception survey.

Your brand's unique audience and goals will affect how you format your questions, distribute your survey, and analyze the data you collect. Here’s a quick guide to making the most of your brand perception survey:

Know what questions to ask

If you’re looking to gauge how your social media presence is fairing, you probably don’t need to be asking 20 questions about the usability of your product. Crafting the right set of questions is the cornerstone of running a successful brand perception survey, but it depends on your goals.

Start by defining the specific insights you aim to gather. What aspects of your brand perception are most critical? These could include brand awareness, reputation, product quality, customer service, or any other attributes relevant to your brand.

Once you've identified your objectives, design a series of clear, concise, and well-structured questions that align with those objectives. Open-ended questions can provide in-depth insights, while closed-ended questions with rating scales can offer quantitative data you can quickly analyze. Strike a balance between the two to gain a comprehensive understanding of your brand's perception.

Determine the best method to run your survey

The survey method you choose significantly impacts the quality and quantity of responses you receive.

There are several effective brand perception survey methods to choose from, including:

Online surveys: Administered through web-based platforms, these are cost-effective and can reach a broad audience.

Email questionnaires: Distributed via email, these surveys are convenient for reaching a specific customer base or email list.

Phone interviews: This method provides a personal touch but may be more time-intensive.

In-person surveys: Face-to-face interviews with respondents are often best for detailed or targeted research.

Social media surveys: Utilize social platforms to engage with your audience and gather feedback.

Mail-in surveys: Physical surveys sent through traditional mail may be more suitable for specific demographics or areas.

In-app surveys: Surveys integrated into mobile apps are ideal for businesses with a mobile app user base.

SMS surveys: Text message surveys are convenient for reaching a mobile-focused audience.

Mystery shopping surveys: Use undercover shoppers to evaluate the customer experience and gather feedback.

Your choice should align with your target audience's preferences and accessibility. For example, if your brand caters to a tech-savvy, online-focused audience, an online survey may be the most efficient choice. Conversely, if your audience is less tech-oriented, you may have better luck with phone interviews or in-person surveys.

Additionally, consider factors like the cost, time, and available resources for survey administration. Online surveys are often cost-effective and allow for quick data collection and analysis, while in-person surveys may require more significant time and budget commitments. Choose wisely!

Tailor your questions to each specific audience

To make the most of your research, it's crucial to tailor your brand perception survey questions to suit each specific audience within your brand's ecosystem. Your target audience, existing customers, cart abandoners, and other segments all hold unique perspectives and concerns.

You may need to create multiple surveys that cater to each audience segment. For example:

Surveys sent to your target audience should gauge initial brand awareness and the factors influencing their purchasing decisions.

Surveys targeting existing customers may inquire about their satisfaction levels, brand loyalty, and likelihood of referring your brand to others.

Survey questions for cart abandoners should focus on pinpointing the obstacles that stopped them from completing the purchase, like price perception.

Customized questions create a personalized and relevant survey experience for each group, increasing the likelihood of meaningful, actionable feedback.

If you don’t have your audience segmented, that’s OK—you can use conditional logic with Typeform’s form builder so your respondents are only presented with the questions that are relevant to them.

Impress with Typeform

Brand perception surveys require minimum effort but can result in maximum payout. Whether you’re a legacy brand looking to dial in your marketing messaging or a startup gathering customer data for your first big advertising campaign, Typeform lets you create beautiful surveys that are customizable, on-brand, and more engaging than your typical online questionnaire.

Need a jumping-off point? Try adding your own spin on our brand perception survey template —we make it easy with over 1 million icons, videos, and photos to choose from (or you can upload your own).

About the author

We're Typeform - a team on a mission to transform data collection by bringing you refreshingly different forms.

Liked that? Check these out:

Remote working statistics for CEOs vs. employees: an unexpected finding

COVID-19 has transformed the way we work. But what's been the impact? This infographic has the answers, thanks to input from thousands of workers around the world.

Teresa Lee | 12.2020

3 ways personalized surveys can boost form conversions

Survey personalization can go a long way in building trust with your audience, creating a more streamlined and relevant experience, and earning engagement. Learn more about adding survey personalization to your strategies.

5 landing page tests to run on your website from day one

You’ve got visitors, and now you need to turn them into customers. It start with knowing their needs. Here’s five tests you should be running on your landing pages.

Jessica Thiefels | 03.2019

Read the practical framework for leveling up your social media team.

- · Brandwatch Academy

- Forrester Wave

Brandwatch Consumer Research

Formerly the Falcon suite

Formerly Paladin

Published September 1 st 2016

Building a Brand Research Strategy: How to Analyze Your Brand

Brand research assists with the creation, development, and strengthening of brands. Using a variety of methods, researchers can uncover a range of insights.

Undertaking brand research will help to uncover the health of your brand. A business’s potential can be maximized by identifying threats and opportunities.

You can understand if your customers are aligned with your values. The position you occupy in the in the marketplace is important too, as is the health of your competitors.

What is brand research?

Brand research assists with the creation, development, and ongoing management and strengthening of brands.

Analysis can be carried out to understand the landscape and develop a launch strategy. Brand research can also be conducted after launch to assist in the development of brand assets.

For more established businesses, brand research can be used periodically, or continually, to track consumers awarenes, perceptions, and experience.

You might like

How to increase your brand affinity: discover your brand personality.

Clearly defining your brand personality can increase brand affinity, and that's good news for the future. Find out how to build these better relationships.

Brand research methods

As with any research, the most robust methodology will include information taken from multiple sources. Some will be easier or cheaper to obtain than others, but investing wisely means you will develop a more detailed picture of the landscape and reduce the possibilities for bias that are inherent in any form of research.

The good old fashioned survey is still a great source of consumer views on brands and product categories, and can be useful regardless of what development stage the brand is at.

You can conduct surveys in person, by telephone or online. Each has its own set of biases that researchers have to be aware of.

Surveys can provide the quantitative insights for brand research, understanding consumer views on a larger scale. SurveyMonkey is probably the most well known and popular online survey software.

Workshops and focus groups

Bringing different types of people, from customers to employees, into a workshop can bring some qualitative insights into the research mix. Asking open-ended questions allows you to gain deeper perceptions, opinions and emotional responses to your brand, product or service.

Twitter recently launched a service that turns 12,000 users into a quick research panel, allowing brands to gauge what a cross section of consumers thinks of a campaign or product. The service can be used before or during campaigns, offering focus group insights at speed and without using the same level of resources.

Any customer facing employee should have some insight into what prospects and customers think of your brand. Salespeople, account managers, shop assistants and customer service representatives will all have stories from the front line that can add to the qualitative research.

Social Intelligence

Social intelligence offers a unique blend of research. Used well, it can offer a mix of the qualitative and quantitative. The organic nature of conversations reduces response bias found in surveys while the volume of conversations means that you are not limited to a specific set of questions. You simply need to devise the methodology to best answer the questions you’d like answered while also being able to find aspects of the conversation you hadn’t anticipated.

While collecting social media metrics for campaign monitoring has long been a popular use case, deeper business insights can also be found. Even brands at pre-launch or relatively new or small brands with lower volumes of conversation can gain insights by looking at broad topics and types of conversation. Segmenting the data using tags and categories is vital for highlighting relevant information in your data.

Ways to conduct brand research

With surveys and focus groups you can obviously just ask people the questions, although you need to design the questions to reduce bias where possible and keep them open ended. With social intelligence, you also have to design your methodology. One advantage is that you may come across insights you hadn’t previously considered.

Below are some topics and themes that you may wish to track, but the list is not exhaustive. There may be brand or industry specific insights you wish to search for.

Competitive analysis

Whether you are launching a new brand or are an established player, understanding the current landscape is vital. Undertaking competitive analysis can give insights to help you position and improve your offering.

With social intelligence, you can uncover the strengths and weaknesses of the competition, understand their unique selling point in the eyes of the customer, and get an overview of the level of competition among different markets and demographics by measuring share of voice .

Brand awareness

Are people aware of your brand and are they able to recall it unprompted? Focus groups are best for measuring brand awareness , but surveys and social intelligence can also be used to understand the level of fame your brand has achieved.

Brand perception

Measuring brand awareness will tell you if people know your brand, but measuring brand perception will tell you what those people think of the brand. What does the brand represent for consumers? What do they think of its products and services? How does this perception compare with competing brands?

Brand associations

Following on from brand perception, you can discover and measure brand associations consumers have when thinking about your business. If you are a luxury brand, you need to know that you are maintaining that exclusivity and admiration. If you aim at the opposite end of the market, do people associate your brand with savings and economy or cheap, inferior products?

Sentiment and satisfaction

Sentiment analysis in social intelligence platforms can provide a quick overview of public opinion on any topic. A human analysis of the data can surface more nuanced emotions, such as joy, humor, frustration, anger, and so on. Working through the data you can understand if customers are satisfied or frustrated and why, helping you address any issues.

Shopping experience

Whether your shopfront is brick-and-mortar or e-commerce, understanding perceptions of your shopping experience is also valuable. Average shopping cart abandonment rate for e-commerce stores is 68% . While shoppers don’t tend to abandon carts in physical stores, experiences can still be improved through data led approaches.

General brand research tips

- Don’t be afraid to ask simple questions. Often you can find that by asking simple questions people open up and explain in greater detail.

- Seek emotional and rational responses. There are different reasons why someone chooses one brand over another. Trying to uncover a mix of the two will help your brand research.

- Don’t start with assumptions or bring your own views into the research. Facilitate the conversation to discover true insights, don’t lead the conversation to where you expect it to go.

- Think about the best presentation methods. Present your findings well, with methodology and key findings first, followed by clearly presented data and qualitative insights.

There is no one way to create the perfect brand research strategy. The best method will use a mix of data sources, developing a tailored approach to suit your brand and industry. Some of the findings may be great, and others may be painful. The painful ones can often be the best as they lead to opportunities to improve.

Content Writer

Share this post

Brandwatch bulletin.

Offering up analysis and data on everything from the events of the day to the latest consumer trends. Subscribe to keep your finger on the world’s pulse.

New: Consumer Research

Harness the power of digital consumer intelligence.

Consumer Research gives you access to deep consumer insights from 100 million online sources and over 1.4 trillion posts.

More in marketing

20 social media holidays to celebrate this may.

By Yasmin Pierre Apr 10

The Ultimate Guide to Competitor Analysis

By Ksenia Newton Apr 5

How to Market Your Sustainability as a Brand in 2024

By Emily Smith Mar 18

The Swift Effect: What Brands Can Learn from Taylor Swift

By Emily Smith Feb 29

We value your privacy

We use cookies to improve your experience and give you personalized content. Do you agree to our cookie policy?

By using our site you agree to our use of cookies — I Agree

Falcon.io is now part of Brandwatch. You're in the right place!

Existing customer? Log in to access your existing Falcon products and data via the login menu on the top right of the page. New customer? You'll find the former Falcon products under 'Social Media Management' if you go to 'Our Suite' in the navigation.

Paladin is now Influence. You're in the right place!

Brandwatch acquired Paladin in March 2022. It's now called Influence, which is part of Brandwatch's Social Media Management solution. Want to access your Paladin account? Use the login menu at the top right corner.

- Market Research

- Survey best practices

- Tips & tricks

- 13 Important Questions to Ask on Br ...

13 Important Questions to Ask on Brand Perception Surveys

Surveys are simple yet powerful tools that can provide valuable insight into your brand.

What is your business doing right? Where are pain points that have room for improvement? How satisfied are your employee s? What do your customers think about your brand?

Brand perception in the eyes of your customers is a critical piece of your marketing equation. While engineered customer personas certainly hold merit as you’re planning the next marketing campaign, the best way to measure brand perception is straight from the customer.

What is a Brand Perception Survey?

The purpose of a brand perception survey is to understand how your customers, prospects, stakeholders, and employees perceive your brand.

Think of some popular brands and the immediate association you have with them. For example, when you think of TikTok, you probably think of a young audience, short videos, and dancing.

But brand perception goes even deeper. Do customers trust your brand , or did they have a bad experience that makes them immediately feel a negative reaction whenever they think about your company? Do prospects already know what kind of goods or services you offer? Does your business have a memorable name? A recognizable logo?

In 2019, Doritos demonstrated just how confident it was in its brand perception and identity when it launched an “anti-ad” campaign with no logo and no brand name in order to appeal to a Gen Z audience. The company claimed the iconic triangle shape of their chips and branded colors were enough to still be recognizable even without traditional advertising. And they were right.

But Doritos probably wouldn’t have taken that bold leap without plenty of outreach and surveys to gauge their customers’ perception of their brand first.

How Do You Test Brand Perception?

The concept of brand perception can be tricky to nail down, since a precise measurement is impossible to take, and opinions of your brand will vary from person to person.

Companies rely on brand perception surveys to achieve three primary outcomes:

- To understand how past, present, and future marketing campaigns impacted (or need to impact) overall brand perception

- To identify and minimize the gap between qualities the brand wants to portray, and how the customer actually feels about the brand.

- To find opportunities for improvement based on customer experiences and perceptions.

In order to get a somewhat accurate pulse of consumer perception of your brand, your survey should focus on these four factors:

1. Cognitive

Cognitive questions uncover concepts and associations that a customer connects with your brand. The Doritos example using a triangle and branded colors is a prime illustration of cognitive brand perception.

Open-ended questions and multiple-choice word lists can be especially helpful to determine what connections are being made with your brand.

2. Emotional

These types of questions will help you to gauge the emotional connection a customer feels with your brand. Measuring your customers’ emotions can be a subtle way of analyzing their brand loyalty and trust in your company as well.

Scale questions, such as “rank on a scale from 1-10,” and open-ended questions often provide the best insights on how customers feel about your brand, and whether that pulls them closer to your brand or pushes them farther away.

3. Descriptive

What kind of language do customers use when describing your brand to others? Is it positive, negative, or neutral?

Focusing on the language and descriptions your customers are using can help future marketing campaigns to either build up and reinforce positive perceptions using the same type of language, or try to redirect your customers’ word choice and perception by presenting alternative vocabulary.

Open-ended questions are usually best for this category, so customers can tell you exactly what words they’re using rather than selecting from predetermined choices.

4. Action-Based Experiences

Asking your customers about their positive and negative experiences is particularly effective when it comes to learning more about the performance of your customer service team and the functionality of your ecommerce shopping experience.

While multiple choice and scale questions are a quick way to analyze overall satisfaction in your company’s services, it’s a good idea to have at least one open-ended question at the end of the survey where customers can elaborate on why they gave the score they did.

After all, a brand perception survey isn’t going to be helpful if you don’t know the reason a customer is upset about their experience.

13 Brand Perception Survey Questions You Should Be Asking

You have several options when it comes to determining the best audience for a brand perception survey.

If you’re interested in obtaining data on a segmented portion of your audience, such as first-time customers or prospects who have heard of your brand but not committed to a purchase yet, then you can limit your questions to a specifically targeted demographic.

But if your goal is to get an all-encompassing view of your brand as a whole, you can send tailored brand perception surveys out to employees, vendors, business partners, stakeholders, new customers, long-term repeat customers, former customers, leads, focus groups, and anyone else you feel might be able to offer valuable insight.

Brand perception survey questions to ask customers:

- Are you familiar with our products/services? If so, how did you discover our brand?

- How would you describe our products to a friend?

- When you think of our brand, what comes to mind?

- If you had to describe our brand in three words, what would they be?

- How likely are you to recommend our brand to your friends?

- How would you describe your last experience with our brand?

Brand perception survey questions to ask employees:

- What did you know about the company before you applied for a position here?

- What factors made you want to work for us?

- What makes you happy about working here?

- If you could change one thing about the company, what would it be and why?

Brand perception survey questions to ask prospects and leads:

- How did you become aware of our brand and the products/services we offer?

- What have you heard (both positive and negative) about our brand?

- What was your first impression when you interacted with our company for the first time?

How Do You Write a Brand Perception Survey?

The good news – you don’t have start from scratch and waste time staring at the ominous blank page, wondering where to begin. Survey templates are an accessible asset available to help you, offering brand survey examples you can build from.

But before you dive into the templates, start by taking a step-by-step approach and developing a strategy.

First, identify the goals you want to achieve with your brand perception survey. What is the ideal response rate you’re looking for? How will your results impact your marketing goals? What factors about your brand are you specifically hoping to identify (i.e. customer service, brand recognition, online shopping experience)?

Next, consider your audience. Are you sending one survey out to a segmented population? Or will you need to create several difference versions of your brand perception survey for employees, customers, leads, et cetera?

Then, create your list of questions that fit the needs of both your survey objectives and the audience you’re targeting.

Some factors you should be mindful of when creating your survey:

- Time: If you want to maintain an average-to-high response rate , try to keep your survey relatively short. People are less likely to complete the survey if it takes too long.

- Complexity: Simple is better when it comes to surveys. Don’t overwhelm your audience with complicated instructions and questions that don’t make sense.

- Anonymity: Some respondents, especially if you’re sending out surveys for employees and stakeholders, may not complete the survey if they’re concerned about negative consequences for less-than-favorable answers.

- Question Types: Open-ended questions are a fantastic way to gain valuable insight in your customers’ own words, but they take more time and effort to answer. Vary the types of questions you’re asking in the survey to keep your respondents engaged.

When done correctly with a targeted, strategic approach, brand perception surveys can be a powerful tool to help your business represent the qualities you value.

Are you ready to create your brand perception survey? Sign up for FREE and get started!

- Survey best practices (63)

- Market Research (62)

- Tips & tricks (52)

- Product updates (40)

- Company news (22)

- Customer Experience (19)

- Net Promoter Score (16)

- Employee Experience (16)

- Survey analysis (9)

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

- (855) 776-7763

All Products

BIGContacts CRM

Survey Maker

ProProfs.com

- Get Started Free

Want insights that improve experience & conversions?

Capture customer feedback to improve customer experience & grow conversions.

100+ Market Research Questions to Ask Your Customers

Babu Jayaram

Head of Customer Success - ProProfs

Review Board Member

Babu Jayaram brings over 20 years of experience in sales and customer service to his role on the Qualaroo Advisory Board. With a profound understanding of sales and conversion strategies, ... Read more

Babu Jayaram brings over 20 years of experience in sales and customer service to his role on the Qualaroo Advisory Board. With a profound understanding of sales and conversion strategies, Babu is committed to delivering exceptional results and fostering robust customer relationships. His expertise extends beyond mere management, including adept handling of support tickets, overseeing internal and customer-facing knowledge bases, and training support teams across diverse industries to ensure exceptional service delivery. Read less

Author & Editor at ProProfs

Shivani Dubey specializes in crafting engaging narratives and exploring Customer Experience Management intricacies. She writes on vital topics like customer feedback, emerging UX and CX trends, and sentiment analysis.

Asking the right market research questions can help you understand your target customers and map their behavior and preferences.

But what does it actually mean?

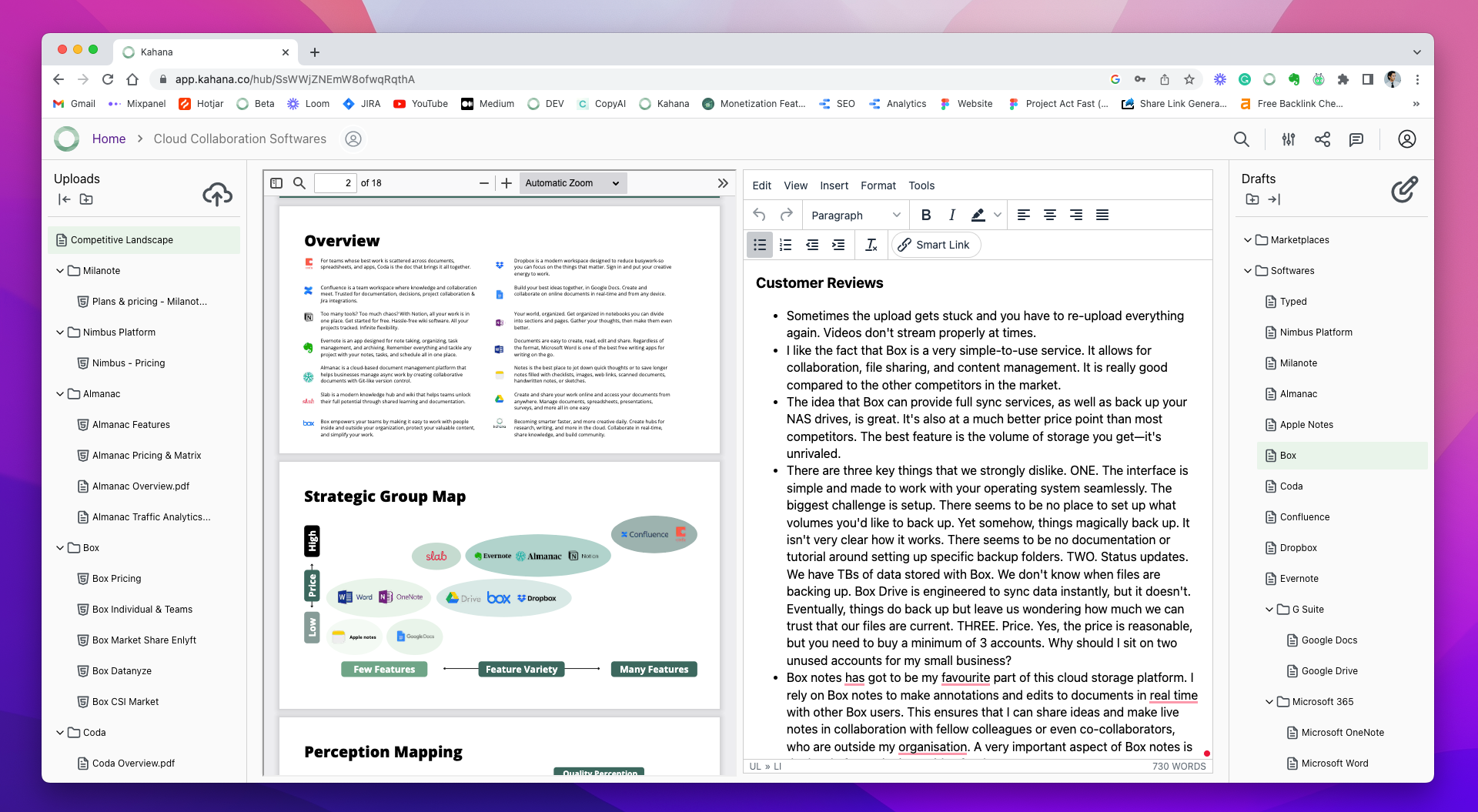

Let’s look at a sample from a market research survey report for mapping brand awareness:

From this simple Q&A report, you can:

- Visualize the proportions of demographic segments among your audience.

- Measure how your brand is performing in comparison to others.

- Pick the top preferred brand among the customers, explore what makes it stand out, and apply the same techniques to your brand.

- See how your target market perceives brand advertisements and promotional efforts.

Now imagine if this type of data set is available for different aspects of your business – product development, marketing campaigns, optimization plans, and more.

That’s what market research does for you.

With the evolution of customer interaction points and constantly changing market trends, more and more businesses are fueling efforts to do in-depth market research, as evidenced by the steady increase in the revenue of the market research industry worldwide.

Market research can help you develop essential business strategies and maintain a competitive advantage over other brands to increase conversions and customer base.

And it all starts with asking the right questions to the right audience.

That’s why we have created this collection of 100+ market research questions to ask your target market. Each question aims to uncover a specific attribute about your customers. You can use a combination of these customer research survey questions, interviews, and othe marketing questionnaires for customers.

We have also added key tips to help you write your own effective market analysis questions if the needed.

100+ Great Market Research Questions to Ask Your Customers

The main challenge while designing and conducting research is – “What questions should I ask in my customer research survey?

That’s why we have a carefully curated list of market research questions to help you get started.

To Explore New Product Opportunities

- What was your first reaction to the product?

- Would you purchase this product if it were available today?

- What feature would you like to see on the website/product?

- Which feature do you think will help improve the product experience for you?

- Of these four options, what’s the next thing you think we should build?

- What’s the one feature we can add that would make our product indispensable for you?

- Would implementing [this feature] increase the usability of the [product name]?

- Please let us know how we can further improve this feature.

- What problem would you like to solve with our product?

To Collect Feedback on Existing Products

- Have you heard of [product name or category] before?

- How would you feel if [product name] was no longer available?

- How disappointed would you be if you could no longer use [Product/feature name?]

- How often do you use [product name]?

- How long have you been using [product name] for?

- When was the last time you used [product name]?

- Please rate the following product features according to their importance to you.

- According to you, In which area is this product/service lacking the most? Specify below.

- How does the product run after the update?

- Rate our product based on the following aspects:

- Have you faced any problems with the product? Specify below.

- What feature did you expect but not find?

- How are you planning to use [product or service]?

- How satisfied are you with the product?

To Segment the Target Market

Please specify your age.

- Please specify your gender.

- Select your highest level of education.

- What is your current occupation?

- What is your monthly household income?

- What is your current marital status?

- What is the name of your company?

- Where is your company’s headquarters located?

- Please specify the number of employees that work in your company.

- What is your job title?

- In which location do you work?

- Which activity do you prefer in your free time?

- Which other physical activities do you take part in?

- Where is your dream holiday destination?

- Please rate the following as per their priority in your life – Family, work, and social life?

- Are you happy with your current work-life balance?

- Do you describe yourself as an optimist or a pessimist?

- How often do you give to charity?

- How do you travel to work?

- How do you do your Holiday shopping?

To Conduct a Competition Analysis

- Which product/service would you consider as an alternative to ours?

- Rate our competitor based on the following:

- Have you seen any website/product/app with a similar feature?

- How would you compare our products to our competitors?

- Why did you choose to use our [product] over other options?

- Compared to our competitors, is our product quality better, worse, or about the same?

- Which other options did you consider before choosing [product name]?

- Please list the top three things that persuaded you to use us rather than a competitor.

- According to you, which brand best fits each of the following traits.

To Gauge Brand Awareness

- [Your brand name] Have you heard of the brand before?

- How do you feel about this brand?

- How did you hear about us?

- Describe [brand name] in one sentence.

- If yes, please tell us what you like the most about [your brand name]?

- If no, please specify the reason.

- How likely are you to purchase a product from this company again?

- If yes, where have you seen or heard about our brand recently? (Select all that apply)

- Do you currently use the product of this brand?

- Have you purchased from this brand before?

- Of all the brands offering similar products, which do you feel is the best brand?

- Please specify what makes it the best brand for you in the category.

- Which of the following products have you tried? (Select all that apply)

- On a scale of 1 to 10, how likely would you recommend this brand to a friend or colleague?

To Map Customers’ Preferences

- Have you ever boycotted a brand? If so, which brand and why?

- What influences your purchase decision more – price or quality of the item?

- How many hours do you spend on social media like Facebook, Instagram, etc.?

- How do you do your monthly grocery shopping – online or through outlets?

- How do you search for the products you want to buy?

- Rate the factors that affect your buying decision for [product].

- What persuaded you to purchase from us?

- How likely are you to purchase a product from us again?

- Please rate the following aspects of our product based on their importance to you.

- What is the most important value our product offers to you?

- Which of the following features do you use least?

- How well does the product meet your needs?

To Map Customers’ Reservations

- Is there anything preventing you from purchasing at this point?

- What’s preventing you from starting a trial?

- Do you have any questions before you complete your purchase?

- What is the main reason you’re canceling your account?

- What are your main reasons for leaving?

- What was your biggest fear or concern about purchasing from us?

- What is the problem that the product/service helped to solve for you?

- What problems did you encounter while using our [product]?

- How easy did we make it to solve your problem?

- What is your greatest concern about [product]?

- Have you started using other similar products? If yes, what made you choose that product?

To Perform Pricing Analysis

- Would you purchase the product at [price]

- According to you, what should be the ideal price of the [product name]?

- Is our product pricing clear?

- According to you, what is the ideal price range for the product?

To Collect Feedback on Website Copy

- Please rate the website based on the following aspects:

- How well does the website meet your needs?

- Was the information easy to find?

- Was the information clearly presented?

- What other information should we provide on our website?

- How can we make the site easier to use?

- What could we do to make this site more useful?

- Is there anything on this site that doesn’t work the way you expected it to?

- How easy was it to find the information you were looking for?

- Have feedback or an idea? Leave it here!

- Help us make the product better. Please leave your feedback.

To Assess Website/Product Usability

- Are you satisfied with the website layout?

- What features do you think are missing on our website?

- What features do you not like on our website?

- Was our website navigation simple and user-friendly?

- How much time did it take to find what you were looking for on our website?

- Was it easy to find the products you are looking for?

- Was the payment process convenient?

To Uncover Market Trends and Industry Insights

- Did you purchase our product out of peer influence or individual preference?

- How do you form your opinion about our product?

- Do you follow trends of the product, or do you prefer to go with what you know?

- Do discounts or incentives impact your decision-making process?

Market Research Survey Templates

One of the easiest ways to conduct market research is to use survey templates. They can help you save time and effort in creating your own market research surveys.

There are many types of market research survey templates available, depending on your objectives and target audience. Some of the most popular ones are:

- Demographic Templates: These templates help you segment your customers based on their location. It can help you tailor your marketing strategies and offers to different customer groups.

- Consumer Behavior Templates: These templates help you keep your pulse on your target market.

Industry Insights Templates: These templates help you get detailed information about your target industry and business.

Breakdown of Different Market Research Questions

The answer choices in a market research survey question can significantly impact the quality and reliability of the response data you collect from the audience.

Some answer types help categorize the audience, while others measure their satisfaction or agreement.

So, before listing the customer research survey questions to ask your target audience, let’s understand their types:

Multiple Choice

A multiple-choice question type lets users select more than one answer from the given options. These questions are great for collecting multiple data sets using the same question and gauging people’s preferences, opinions, and suggestions .

Single Choice

In a single-choice question, the respondent can select only one answer from the given options. This question type is great for:

- Segregating the users.

- Prioritizing product updates based on user consensus.

- Disqualifying irrelevant respondents by placing the question at the start of your customer research survey.

Matrix Match

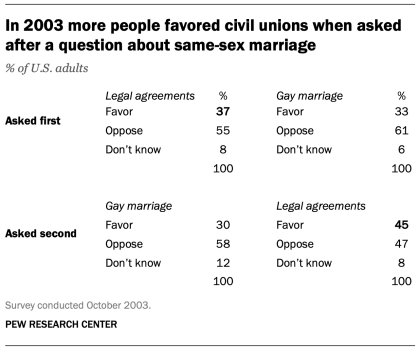

A matrix matching grid can combine multiple market research questions into one to make the survey shorter . There is only one condition – the individual questions should have the same response anchors as shown in the image below:

The questions are arranged in rows while the answer options occupy the grid columns.

Ranking Question

A ranking question can help map customers’ preferences and set priorities for product development . This question type asks the respondent to arrange the given options in their decreasing/increasing preference.

Dichotomous

A dichotomous question poses a simple yes or no scenario to the respondent. These question types can help disqualify irrelevant people from the survey and categorize the users into two groups .

Likert Scale

Likert scale market research questions can help you measure the extent of respondents’ agreement/disagreement with the given statement . The answer options are arranged from positive to negative sentiments or vice-versa, with the neutral option in the middle.

There are two types of Likert scales: 5-point and 7-point .

Open-ended market questions let you explore the respondents’ minds without adding any restrictions to the answer . This question type is followed by a blank space for the respondent to add a free-text response.

You can add an open-ended question as a follow-up after the first question to explore the reasons for the customer’s previous answer. It also lets you collect more in-depth information about their issues, pain points, and delights.

Tools like Qualaroo offer tons of different question types for your surveys. Just pick the question and match its answer option type from the drop-down. To make it more effective, you can add branching to the survey.

How to Write Your Marketing Research Questions

It’s imperative to have a dedicated repository of market research questions for your surveys. But nothing’s better than crafting your questions.

For this, you need to sit with your team and discuss what information you require from the customers. It lets you analyze and document how much data you already have in your system, which can help set the market research scope.

We have listed some questions you need to ask yourself before asking market research questions to your potential customers or target market:

Audience Segmentation Questions

Audience segmentation questions help to size up your target market and provide a granular view of the audience . Not all customers are equal, and audience segmentation makes it possible to focus on each group individually to address their issues, fears, and expectations.

Here’s what you need to know before you start writing customer research survey questions to understand your audience:

- Do we understand the demographics of the new market we are trying to target? (Age, location, ethnicity, education, company, annual income, etc.)

- What are the locations that drive the most customers to our business? How are these locations different from others?

- What are the interests, preferences, and fears of people from our new target market? Have we addressed these situations for our current customer base?

- What are the psychographics attributes of the current customers and potential market? Are we targeting these in our campaigns?

- What are the most popular engagement channels for our customers? Which channels drive the most traffic to our website?

- Do we have enough data to perform value segmentation to separate high-value customers from low-value customers?

- How often do these high-value customers make a purchase?

Product-Based Market Research Questions

Product-based market research questions can produce precious insights to channel into your product development and optimization strategies . You can see how changing technology affects customers’ behavior, what new features they want to see in your product, and how they perceive your products and services over the competition.

Start by gathering information about the following:

- How does our product compare to the competition based on the features?

- What products do our competitors offer?

- What new features do customers want to see in our products? Do we have a product roadmap to deliver these updates?

- What unique solutions do our products offer? What is the value proposition that reflects this offering?

- Does our product incorporate the latest technological advancements?

- What channels do we use to collect product feedback from our users?

- What are customers’ preferences while choosing our products over competitors?

Pricing Market Research Questions

Pricing analysis can help you make your product more affordable to different customer segments while maintaining the desired gross margin. It also lets you restructure the pricing tiers to provide features depending on the customers’ requirements and company size .

Watch: (1/5) Supercharge Your Revenue With Data-Driven Pricing

Your sales and marketing team can help you hone in on the market research questions to ask your customers for running pricing analysis:

- Do the customers ever complain about the difficulty in finding the pricing information?

- What is the pricing structure of our competitors for the same products? What features do they include for a specific price?

- How do customers find our pricing when compared to the competitors?

- Do our products provide value for money to the customers? Does the sales pitch reflect this point?

- Can we restructure the pricing, and how will it affect the revenue?

- Are there any customer segments that have high-value potential but find the current pricing unaffordable? What are the plans for such customers?

- Are we in a situation to offer a basic free plan to encourage customers to try our product before upgrading?

- What promotions can we run to attract more customers?

- Should we target customers based on income, company size, or type of solution to set our product prices?

Brand Reputation Market Research Questions

A brand reputation questionnaire for marketing research gives you information on how well your target market knows about your brand. You can uncover previously unidentified channels to increase brand awareness and find potential customers to promote your brand .

Start by gauging what customers are saying about your brand:

- Which channels receive mentions of our brand? Are these posts positive or negative?

- Do we have a system in place to analyze and monitor these reviews and posts?