Student Debt - Essay Samples And Topic Ideas For Free

Student debt refers to the cumulative outstanding loans taken out to cover educational costs, which has become a significant issue, especially in the United States. Essays could delve into the causes and consequences of escalating student debt, its impact on economic mobility, and proposed solutions to alleviate the burden of student debt on individuals and society. We have collected a large number of free essay examples about Student Debt you can find at PapersOwl Website. You can use our samples for inspiration to write your own essay, research paper, or just to explore a new topic for yourself.

More than Stress Biological Effects of Student Debt

Introduction: ""Student debt is on the rise is a statement made by every article that examines student debt. Studies that consider the effects of student debt on college students have concluded that that those who take out loans and gain debt are affected negatively by the need to pay those debts and having to add that to their long list of responsibilities. Thus, the popular notion is that student loans make these students stressed and full of anxiety even leading […]

Decrease Student Debt as Step for the Future of America

America has always been known as one of the freest and most prosperous countries that exist in our modern world today. Freedom is the staple of our country and is what distinguishes us from other places in the world. We, as citizens in the United States, enjoy an incredibly vast array of rights and laws from which we benefit every day, even if we are not actively aware of it. There are so many reasons why we can take pride […]

Why College Matters

The price of attending college has risen dramatically over the past few decades, so much that it causes many second thoughts and doubts from young adults who preferred to attend. These doubts are mostly centered around the amount of student debt loan they might be burdened with. Americans now have 1.3 trillion in student debt, this is a crisis that many people have been said will be solved with free community and state college. State and community college should be […]

We will write an essay sample crafted to your needs.

Reflections on the Worth of College and Student Debt

The unemployment levels for high school and college graduates alike have reached record heights. This surfaces the hugely controversial argument: Is college worth it? With student debt crossing detrimental lines and acceptance rates at all-time lows, many people are starting to lean towards the negative side of this ongoing argument. Although college does teach more than just the basics for scholastic intelligence, my beliefs have started to stray towards the negative side as well. Unless you need a college education […]

Why College Tuition should be Free

There are so many reasons why college should be free for everyone. First there would be fewer people that would need to have government assistance. Also with free college education there would be smarter people making better decisions that could help solve our most difficult challenges. Students won’t graduate without a job and $ 30,000 student loan debt. Finally, most jobs in today's society ethier need some kind of degree, or technical training of some sort. This is why I […]

Is College Worth the Expense?

This paper will be debating whether the cost of college is worth the expense. There are several factors that go into debating whether you should attend college or not. The stress associated with financing college in the United States has raised a big red flag for many people. Not only can college put you in debt, but it can also cause you a lot of stress. As many people know college is very pricey. You can go several thousand dollars […]

The Economic Burden: Analyzing the Impact of Student Debt on Individuals and Society

Within the realm of higher education, a looming specter casts its shadow—a financial burden that not only burdens individuals but also reverberates throughout society. Student debt, an omnipresent reality for many, holds sway over both personal finances and broader economic structures. To truly grasp the extent of this issue, one must navigate the intricate network of factors that contribute to the economic weight of student loans. At the heart of this issue lies the individual experience, where the repercussions of […]

Breaking the Chains: Strategies for Addressing and Alleviating the Student Debt Crisis

In the labyrinth of higher education, a formidable specter haunts the dreams of countless students: the student debt crisis. Like chains forged from the weight of financial obligations, it binds aspirations and stifles progress, leaving a generation burdened with unprecedented economic strain. Yet, amid this daunting challenge, lies a tapestry of innovative strategies waiting to be woven, promising liberation from the shackles of debt. Central to any effective approach is a deep understanding of the crisis's roots. The soaring cost […]

The Double-Edged Sword of Student Loans in Higher Education

In the expansive domain of advanced learning, the terrain is profoundly influenced by the availability and ramifications of student loans, a fiscal apparatus crafted to bridge the chasm between aspiration and actuality for multitudes aspiring toward tertiary education. While student loans have unquestionably unlocked doors for myriad individuals who may otherwise have been unable to afford college, they also carry ramifications that reverberate through diverse facets of access, affordability, enrollment rates, scholastic achievement, and post-graduation outcomes. This discourse delves into […]

How to Write an Essay About Student Debt

Understanding the issue of student debt.

Before writing an essay about student debt, it's essential to understand the extent and implications of this issue. Student debt refers to the money borrowed to finance higher education, which can include tuition, room and board, and other related expenses. Begin your essay by outlining the current state of student debt, including the average amount of debt per student and the total debt nationwide. Discuss the factors that have contributed to the rise in student debt, such as the increasing cost of college tuition, changes in government funding for education, and the broader economic context. It's also important to understand the impact of student debt on individuals, including its effects on financial stability, career choices, and mental health.

Developing a Thesis Statement

A strong essay on student debt should be centered around a clear, concise thesis statement. This statement should present a specific viewpoint or argument about student debt. For example, you might explore the socioeconomic implications of student debt, analyze the effectiveness of current loan forgiveness programs, or argue for a particular policy solution to address the student debt crisis. Your thesis will guide the direction of your essay and provide a structured approach to your topic.

Gathering Supporting Evidence

To support your thesis, gather evidence from various sources, such as economic studies, government reports, and personal testimonies. This might include data on the long-term financial impact of student debt, analysis of the demographic disparities in student debt, or case studies of individuals or communities particularly affected by it. Use this evidence to support your thesis and build a persuasive argument. Be sure to consider different perspectives and address potential counterarguments.

Analyzing the Impact of Student Debt

Dedicate a section of your essay to analyzing the impact of student debt. Discuss how it affects individual choices and opportunities, including career decisions, homeownership, and family planning. Consider the broader economic and social implications, such as the potential for student debt to exacerbate income inequality or influence economic growth. Also, explore the psychological effects of carrying large amounts of debt over a prolonged period.

Concluding the Essay

Conclude your essay by summarizing the main points of your discussion and restating your thesis in light of the evidence provided. Your conclusion should tie together your analysis and emphasize the importance of addressing student debt as a significant issue facing society. You might also want to suggest areas for future research, policy changes, or action steps to mitigate the impact of student debt.

Reviewing and Refining Your Essay

After completing your essay, review and refine it for clarity and coherence. Ensure that your arguments are well-structured and supported by evidence. Check for grammatical accuracy and ensure that your essay flows logically from one point to the next. Consider seeking feedback from peers, educators, or financial experts to further improve your essay. A well-written essay on student debt will not only demonstrate your understanding of the issue but also your ability to engage with complex economic and social topics.

1. Tell Us Your Requirements

2. Pick your perfect writer

3. Get Your Paper and Pay

Hi! I'm Amy, your personal assistant!

Don't know where to start? Give me your paper requirements and I connect you to an academic expert.

short deadlines

100% Plagiarism-Free

Certified writers

Covering a story? Visit our page for journalists or call (773) 702-8360.

Top Stories

- UChicago to partner on $12 million NSF project to ‘decarbonize’ computing

- Researchers draw inspiration from ancient Alexandria to optimize quantum simulations

- Supply chain software startup FreshX takes first place at 2024 NVC

A smarter way to solve the student debt problem

Blanket loan forgiveness less effective than helping those who need it most, research suggests.

Editor’s Note: This piece was written by Constantine Yannelis, an assistant professor of finance at the University of Chicago Booth School of Business, and shared by Chicago Booth Review . The essay is based on testimony Yannelis submitted to the U.S. Senate Committee on Banking, Housing, and Urban Affairs’ Subcommittee on Economic Policy in April 2021.

Education is the single highest-return investment most Americans will make, so getting our system of higher-education finance right is fundamentally important for U.S. households and the economy.

A key point in the student-loan debate is that the outcomes of borrowers vary widely. Undeniably, a significant number of borrowers are struggling, and are sympathetic candidates for some kind of relief. Student-loan balances have surged over the past decades. According to the New York Fed, last year student loans had the highest delinquency rate of any form of household debt.

Most student borrowers end up as higher earners who do not have difficulties repaying their loans. A college education is, in the vast majority of cases in America, a ticket to success and a high-paying job. Of those who struggle to repay their loans, a large portion attended a relatively small number of institutions—predominantly for-profit colleges.

The core of the problem in the student-loan market lies in a misalignment of incentives for students, schools, and the government. This misalignment comes from the fact that borrowers use government loans to pay tuition to schools. If borrowers end up getting poor jobs, and they default on their loans, schools are not on the hook—taxpayers pay the costs. How do we address this incentive problem? There are many options, but one of the most commonly proposed solutions is universal loan forgiveness.

Various forms of blanket student-loan cancellation have been suggested, but all are extremely regressive, helping higher-income borrowers more than lower-income ones. This is primarily because people who go to college tend to earn more than those who do not go to college, and people who spend more on their college education—such as those who attend medical and law schools—tend to earn more than those who spend less on their college education, such as dropouts or associate’s degree holders.

My own research with Sylvain Catherine of the University of Pennsylvania demonstrates that most of the benefits of a universal-loan-cancellation policy in the United States would accrue to high-income individuals, those in the top 20 percent of the earnings distribution, who would receive six to eight times as much debt relief as individuals in the bottom 20 percent of the earnings distribution. These basic patterns are true for capped forgiveness policies that limit forgiveness up to $10,000 or $50,000 as well.

Another problem with capped student-loan forgiveness is that many struggling borrowers will still face difficulties. A small number of borrowers have large balances and low incomes. Policies forgiving $10,000 or $50,000 in debt will leave their significant problems unaddressed.

While income phaseouts—policies that limit or cut off relief for people above a certain income threshold—make forgiveness less regressive, they are blunt instruments and lead to many individuals who earn large amounts over their lives, such as medical residents and judicial clerks, receiving substantial loan forgiveness.

A fact that is often missed in the policy debate is that we already have a progressive student-loan forgiveness program, and that is income-driven repayment.

If policy makers want to make sure that funds get into the hands of borrowers at the bottom of the income distribution in a progressive way, blanket student-loan forgiveness does not accomplish this goal. Rather, the policy primarily benefits high earners.

While I am convinced from my own research that student-loan forgiveness is regressive, this is also the consensus of economists. The Initiative on Global Markets at Chicago Booth asked a panel of prominent economists to weigh in on this statement: “Having the government issue additional debt to pay off current outstanding loans would be net regressive.” The panel included economists from leading institutions from both the left and the right. The results of the survey were telling. Not a single economist disagreed with the idea that student-loan forgiveness is regressive. This is because the facts are clear—to borrow a phrase commonly used, “The science is settled”—student-loan forgiveness is a regressive policy that mostly benefits upper-income and upper-middle-class individuals.

Another facet of this policy issue is the effect of student-loan forgiveness on racial inequality. One of the most distressing failures of the federal loan program is the high default rates and significant loan burdens on Black borrowers. And student debt has been implicated as a contributor to the Black-white wealth gap. However, the data show that student debt is not a primary driver of the wealth gap, and student-loan forgiveness would make little progress closing the gap but at great expense. The average wealth of a white family is $171,000, while the average wealth of a Black family is $17,150. The racial wealth gap is thus approximately $153,850. According to our paper, which uses data from the Survey of Consumer Finances, and not taking into account the present value of the loan, the average white family holds $6,157 in student debt, while the average Black family holds $10,630. These numbers are unconditional on holding any student debt.

Thus, if all student loans were forgiven, the racial wealth gap would shrink from $153,850 to $149,377. The loan-cancellation policy would cost about $1.7 trillion and only shrink the racial wealth gap by about 3 percent. Surely there are much more effective ways to invest $1.7 trillion if the goal of policy makers is to close the racial wealth gap. For example, targeted, means-tested social-insurance programs are far more likely to benefit Black Americans relative to student-loan forgiveness. For most American families, their largest asset is their home, so increasing property values and homeownership among Black Americans would also likely do much more to close the racial wealth gap. Still, the racial income gap is the primary driver of the wealth gap; wealth is ultimately driven by earnings and workers’ skills—what economists call human capital. In sum, forgiving student-loan debt is a costly way to close a very small portion of the Black-white wealth gap.

How can we provide relief to borrowers who need it, while avoiding making large payments to well-off individuals? There are a number of policy options for legislators to consider. One is to bring back bankruptcy protection for student-loan borrowers.

Another option is expanding the use of income-driven repayment. A fact that is often missed in the policy debate is that we already have a progressive student-loan forgiveness program, and that is income-driven repayment (IDR). IDR plans link payments to income: borrowers typically pay 10–15 percent of their income above 150 percent of the federal poverty line. Depending on the plan, after 20 or 25 years, remaining balances are forgiven. Thus, if borrowers earn below 150 percent of the poverty line, as low-income individuals, they never pay anything, and the debt is forgiven. If borrowers earn low amounts above 150 percent of the poverty line, they make some payments and receive partial forgiveness. If borrowers earn a high income, they fully repay their loan. Put simply, higher-income people pay more and lower-income people pay less. IDR is thus a progressive policy.

IDR plans provide relief to struggling borrowers who face adverse life events or are otherwise unable to earn high incomes. There have been problems with the implementation of IDR plans in the U.S., but these are fixable, including through recent legislation. Many countries such as the United Kingdom and Australia successfully operate IDR programs that are administered through their respective tax authorities.

Beyond providing relief to borrowers, which is important, we could do more to fix technical problems and incentives. We could give servicers more tools to contact borrowers and inform them of repayment options such as IDR, and we could also incentivize servicers to sign more people up for an IDR plan. But while we may be able to make some technical fixes, servicers are not the root of the problem in the student-loan market: a small number of schools and programs account for a large portion of adverse outcomes.

To fix this, policy makers can also directly align the incentives for schools and borrowers. For example, Brazil, which has had similar problems with its student-loan program, recently gave schools skin in the game by requiring them to pay a fee based on dropout and default rates. This helped align the incentives of the schools and the student borrowers. Making revenues go directly to schools from IDR plans, or implementing income-share agreements in which individuals pay an uncapped portion of their income, could also help align the incentives of schools, students, and taxpayers.

Federal student loans are an important part of college financing and intergenerational mobility. The root of our student-loan crisis is a misalignment of incentives. Since the problem has been so slow moving and continuous, I like the analogy of a frog slowly boiling in a pot of water over a flame. Policies such as student-debt cancellation are not extinguishing the flame—they aren’t fixing the incentive problem. All they do is move the frog into a slightly cooler pot of water. And if we don’t fix the core of the problem, even if we forgive $50,000 of debt for current borrowers, balances will continue to grow, and we will be facing a similar crisis in 10 or 20 years.

Recommended stories

Why a 19th-century bank failure still matters

Household spending swings dramatically in reaction to coronavirus

Get more with UChicago News delivered to your inbox.

Related Topics

Latest news, class of 2024 learns ‘three little secrets to change the world’.

Convocation

Graduates reflect on their College journey: ‘We made it here together’

Class of 2024 reflects on how UChicago shaped their careers

Big Brains podcast: Learning to speak to whales using AI

Go 'Inside the Lab' at UChicago

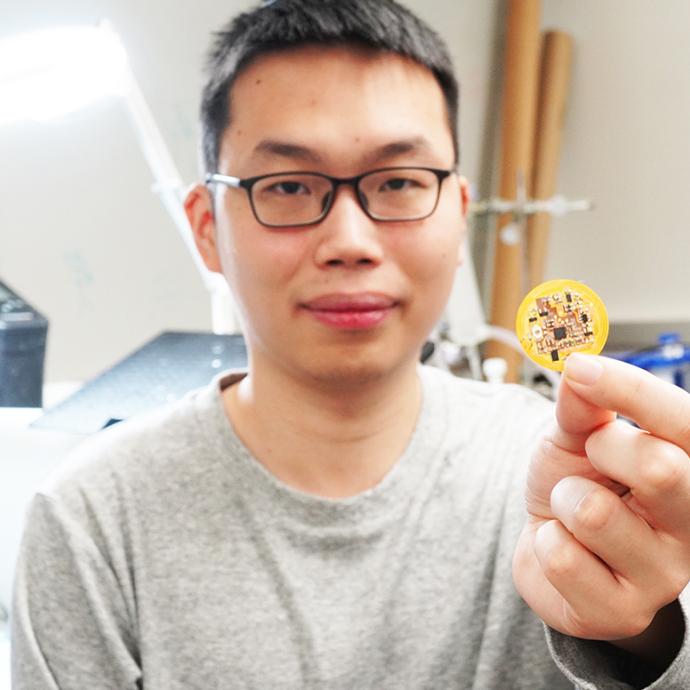

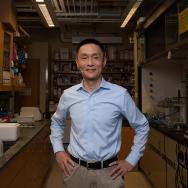

Explore labs through videos and Q and As with UChicago faculty, staff and students

Two scholars to receive honorary degrees at UChicago’s 2024 Convocation

Inside the Lab

He Lab: Using the science of RNA to feed the world

Around uchicago.

Around Campus

Rockefeller Chapel renovation to add beauty, functionality to historic landmark

Quantrell and PhD Teaching Awards

UChicago announces 2024 winners of Quantrell and PhD Teaching Awards

Campus News

Project to improve accessibility, sustainability of Main Quadrangles

National Academy of Sciences

Five UChicago faculty elected to National Academy of Sciences in 2024

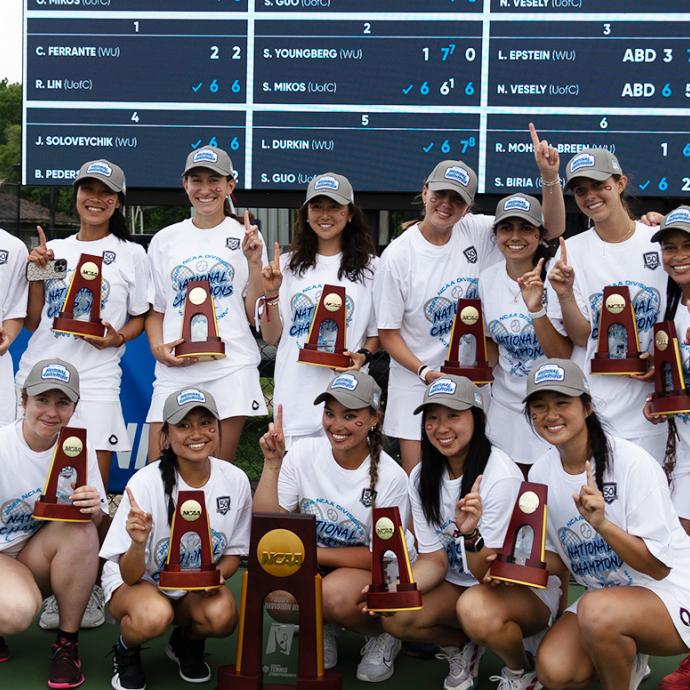

UChicago women’s tennis team wins first NCAA title

UChicago men’s tennis team storms back to win NCAA championship

Biological Sciences Division

“You have to be open minded, planning to reinvent yourself every five to seven years.”

UChicago Class Visits

Atop a Chilean mountain, undergraduate students make cutting-edge astronomical observations

- Entertainment

- Environment

- Information Science and Technology

- Social Issues

Home Essay Samples Life

Essay Samples on Student Loan Debt

Navigating the student debt crisis.

The student debt crisis in modern society is a pressing issue that has far-reaching consequences for individuals, families, and the broader economy. This essay delves into the complexities of the student debt crisis, examining its origins, the socio-economic implications it poses, the role of higher...

- Student Loan Debt

Why Student Loans Should be Forgiven: A Path to Economic Relief and Opportunity

The burden of student loans has become a pressing issue for countless individuals pursuing higher education. As tuition costs rise and the job market becomes increasingly competitive, many graduates find themselves weighed down by student debt. In this essay, we will explore the reasons why...

- Student Loans

Student Loan Debt: Looking for Ways to Manage Student Loans

Student loans are a pain for everyone involved. Many students are burdened with the weight of repayment, with their loans attractive large interests. Lenders are forced to find ways to recoup their monies, and are forced to shoulder the risk of bad loans on their...

Student Loan Debt Forgiveness as a Progressive or Conservative Concept

Introduction and Background The student debt crisis has never been more pertinent than at this moment. Student loans, currently at a whopping $1.6 trillion, have surpassed credit card and auto loans to be the largest source of household debt after mortgages (Walker, 2019). This level...

Reasoning Why College Should Not Be Free

A parent is their child’s first teacher and should remain their best teacher throughout their life. Parents only want the best for their children and help build their lives. From the first walk, the first failed test, the first time driving the car, to the...

- College Tuition

Stressed out with your paper?

Consider using writing assistance:

- 100% unique papers

- 3 hrs deadline option

Why College Should Be Free: Student Debt Crisis

When I was in second grade I had huge aspirations for my future. When I thought of who I would be when I became the age I am now, I envisioned myself doing big things, I thought I would be in some fancy school, studying...

Current Student Loan System in the US

Currently, about 18% of American adults are still repaying nearly $ 1.6 trillion in student loans. In the past ten years, the total student debt in the United States has increased by 107%. These figures reflect a series of problems in the current debt system...

Debt As A Sign That College Is Not For Everyone

“Carnevale says that for almost all majors, the best school for your major isn’t going to be a good investment.”(3). College can be very pricey and not the right choice for everyone. You have the choice to do as one pleases, but most jobs, in...

- College Education

Understanding Why College Is A Worth It

In 2019, the cost of college and college related debt are at an all-time high. Most people are willingly to stick to a regular nine to five job instead of going to college to actually get a degree. There are several reasons why they would...

Impact Of Student Loans On Student's Life And The Financial Value Of A Degree

Erin Velez, Melissa Cominole & Alexander Bentz (2019) Debt burden after college: the effect of student loan debt on graduates’ employment, additional schooling, family formation, and home ownership Articles core question- How does debt affect students' lives after earning their bachelors’ degree Research method Longitudinal...

- College Students

- Student Life

Student Loan Debt in 2020 is Now to Much

The democratic candidates for the 2020 presidential election have raised the issue of a student debt crisis that is striking young adults seeking higher education. Senator Warren and Senator Sanders are among these candidates who have brought the student debt issue that Americans hold to...

Here’s Your Crisis: Student Loan Debt Isn’t a Myth

These days, it is common knowledge that the university is luxurious. Most who attend college should take out student loans to even have enough money it. Although some agree with the scholar loan debt disaster is solely fictional, the pupil loan disaster needs to no...

Outstanding Student Loan Debt Will Likely Exceed $1 trillion - Student Debt Crisis

Multiple factors contribute to student debt. The growing problem of student debt has become more prominent and inspired many documentaries to investigate the cause and effect. One factor is the rate of the loan. Other factors include the emerging guidelines develops by the government. There...

Addressing the Student Loan Debt Crisis: An Analysis of its Impact on the Economy

When delving into the student loan debt crisis, one discovers that the total student loan debt in the United States amounts to a staggering $1.52 trillion. The average student borrower carries a debt of $31,172, and the duration to repay these loans can extend from...

The Effect of Student Loans on Post-Graduates

In modern-day society, a post-secondary degree is needed to compete for a well-paying job in the labour market. Higher education is viewed as a necessary long term financial investment to better oneself in their career, however, in reality, it is often a financial risk for...

- Bachelor's Degree

Benefits of Student Loans and Debt for Colleges and Students

In today's society, it is almost impossible to successfully achieve an education without some type of aid or student loans. Student loan debt is increasing, due to the total cost of universities increasing their tuition fees. Once students start to graduate, they have what is...

The Worth of Having Student Loans for a Better Job

Benjamin Franklin said, “An investment in knowledge pays the best interest.” Learning is one of the most powerful tools we have in our belt and we can definitely utilize schooling to help further us in our lives. As it can further our careers, it can...

- Cost of Education

The Abnormal Financial Load – A Problem Of College Education

A college education is not equitable something students can get in four forever; instead, it is also a quality of courage! Many Americans students are solicitation themselves, "Is pursuing a college position become the side?" College guardianship has almost sextupled since 1985, with the total...

Best topics on Student Loan Debt

1. Navigating the Student Debt Crisis

2. Why Student Loans Should be Forgiven: A Path to Economic Relief and Opportunity

3. Student Loan Debt: Looking for Ways to Manage Student Loans

4. Student Loan Debt Forgiveness as a Progressive or Conservative Concept

5. Reasoning Why College Should Not Be Free

6. Why College Should Be Free: Student Debt Crisis

7. Current Student Loan System in the US

8. Debt As A Sign That College Is Not For Everyone

9. Understanding Why College Is A Worth It

10. Impact Of Student Loans On Student’s Life And The Financial Value Of A Degree

11. Student Loan Debt in 2020 is Now to Much

12. Here’s Your Crisis: Student Loan Debt Isn’t a Myth

13. Outstanding Student Loan Debt Will Likely Exceed $1 trillion – Student Debt Crisis

14. Addressing the Student Loan Debt Crisis: An Analysis of its Impact on the Economy

15. The Effect of Student Loans on Post-Graduates

- Personality

- Perseverance

- Personal Experience

- Bad Memories

- Driving Age

Need writing help?

You can always rely on us no matter what type of paper you need

*No hidden charges

100% Unique Essays

Absolutely Confidential

Money Back Guarantee

By clicking “Send Essay”, you agree to our Terms of service and Privacy statement. We will occasionally send you account related emails

You can also get a UNIQUE essay on this or any other topic

Thank you! We’ll contact you as soon as possible.

Home / Essay Samples / Life / Personal Finance / Student Loan Debt

Student Loan Debt Essay Examples

Student loan crisis in america.

Since the wake of the Great Recession many people were affected are still struggling to make up their loses. Recession was the penuchle of the student loan debt crisis. The Crisis not only affects students and parents but lenders, employers, taxpayers and colleges. The Great...

The Cancellation of Student Loan Debt in the Us

Today, 44 million Americans, or one-eighth of the total population that is older than 18, have student loan debt2. On aggregate, student loan debt accounts for 1. 5 trillion of the national debt; however, this figure does not include private student loans which are not...

Student Loan Debt Issue in the Past and Today

One of the biggest decisions high school seniors have to make is whether to continue their academic careers and go off to college. Deciding where to go will certainly have an impact on the student’s life. In most cases, one of the biggest deciding factors...

The Crisis of Student Loan

The aspects of education loans.

In today's society, it is a norm and an expectation for students to pursue higher education after graduating from high school. Despite a college degree almost being deemed a prerequisite to adulthood, college tuition is on the rise, and a lot of students are left...

Free Colleges Would Resolve the Problem of Students Debt

“From the past years, student loan debt rose by 39%, reaching as much as $1.3 trillion”. If college was free, student loans/debt would be eliminated; the money used on tuition could easily be carried over to cover other costs such as a house, car, and...

An Urgent Need to Adress Student Loan Debt Crisis in America

The student loan crisis is the biggest issue effecting young adults in America. Many economists are suggesting that it may be the most devastating economic since the recession during the President Bush administration. A smaller segment of economists are concerned that the economic downside of...

Critical Reflection on Debt Cleanse by Jorge P. Newbery

I am rating “Debt Cleanse” by Jorge P. Newbery three out of four stars. “Debt Cleanse” is an exhaustive study, as the subtitle promises, on “How to Settle Your Unaffordable Debts for Pennies on the Dollar (And Not Pay Some at All)”. The author details...

How Students Deal with Student Loan Debt

College students have an unfair advantage when it comes to debt. A student can encounter debt from generational impulse buying. Parents can have poor buying habits and poor habits can be linked to family behavioral problems. Parents who overly exceed their financial resources will produce...

Review of the Book Debt Cleanse by Jorge P. Newbery

The premise of Debt Cleanse is that people often become overburdened with debt simply through ordinary living. They want to attend college, have a car to drive to work, or own a home. These perfectly reasonable desires generate student loans, vehicle loans, and mortgages. Or...

Trying to find an excellent essay sample but no results?

Don’t waste your time and get a professional writer to help!

You may also like

- Money Essays

- Heritage Essays

- Retirement Essays

- Legacy Essays

- Stock Market Essays

- Memories Essays

- Gratitude Essays

- Marriage Essays

- Inspiration Essays

- Values Essays

About Student Loan Debt

Student debt is a form of debt that is owed by an attending, formerly withdrawn, or graduated student to a lending institution, or to a financial institution.

Students who graduate with debt will feel the effects of their debt for years after they graduate because it is also a very “sticky” form of debt. You can escape other debt through bankruptcy, but it’s almost impossible to get out of your student debt without paying it in full. It can cause stress, anxiety and force people to delay important life events

samplius.com uses cookies to offer you the best service possible.By continuing we’ll assume you board with our cookie policy .--> -->