Fitness Industry Statistics 2021-2028 [Market Research]

To better understand the current state of the fitness industry and the future of fitness, we researched and analyzed hundreds of studies on each individual segment and compiled them into an overview of 15+ fitness industry statistics.

Top Fitness Industry Statistics 2021

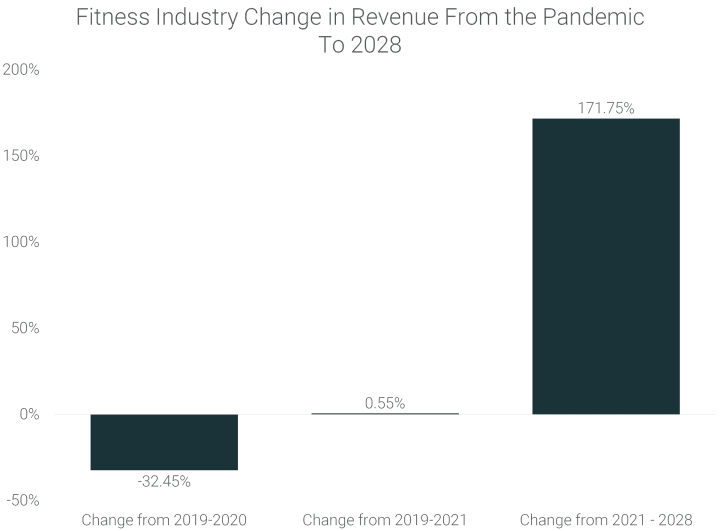

- The fitness industry experienced a 32.45% decline in revenue during 2020 but is projected to rebound to 0.55% pre-pandemic levels by the end of 2021

- Worth nearly 160 billion in 2021, the fitness industry is expected to grow 171.75% to 434.74 billion USD by 2028

- The industries hit the hardest by the pandemic were the gym, health club, and boutique fitness studio industries

- They declined up to 58.30% in the first year of the pandemic

- In 2021, they are projected to still be down 22.5% from their pre-pandemic revenue levels in 2019

- Meanwhile, online/digital fitness, fitness apps, fitness equipment, and fitness tracker markets all experienced significant growth due to the pandemic

- Experiencing a revenue growth of 40.61% in 2020

- Projected to be up 66.32% by the end of 2021, in comparison to their pre-pandemic levels

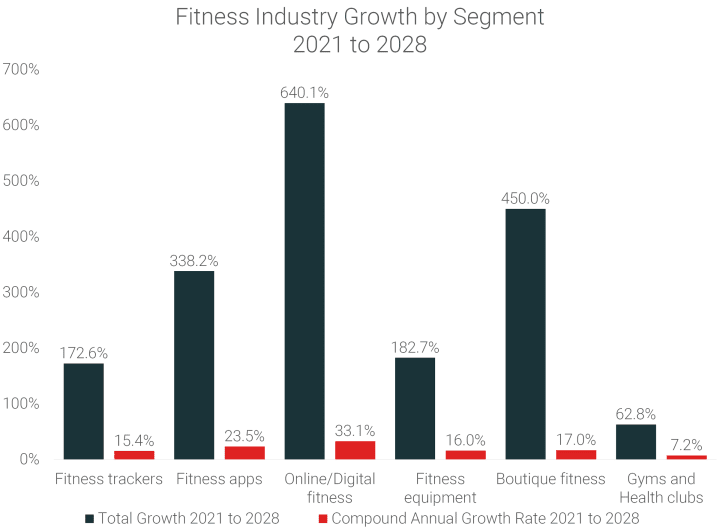

- From 2021 to 2028, the online/digital fitness industry is projected to have the highest growth rate of 33.10% per year

- The industry with the lowest compound annual growth rate (CAGR) is the gym industry, growing at a rate of 7.21% per year

The research and data provided come from hundreds of hours spent researching and analyzing data on the different segments within the fitness industry. Specifically, the data is referencing research from:

- 77 Gym Membership Statistics, Facts, and Trends [2020/2021]

- 200+ Gym Industry Statistics 2021 [Global Analysis]

- 45+ Boutique Fitness Statistics 2021 [Research Review]

- 90+ Fitness Equipment Statistics 2021/2022 [Research Review]

- 40+ Online Fitness Statistics for 2021/2022 [Research Review]

- 100+ Fitness App Statistics 2021/2022 [Research Review]

- 50+ Wearable Fitness Tracker Statistics 2021

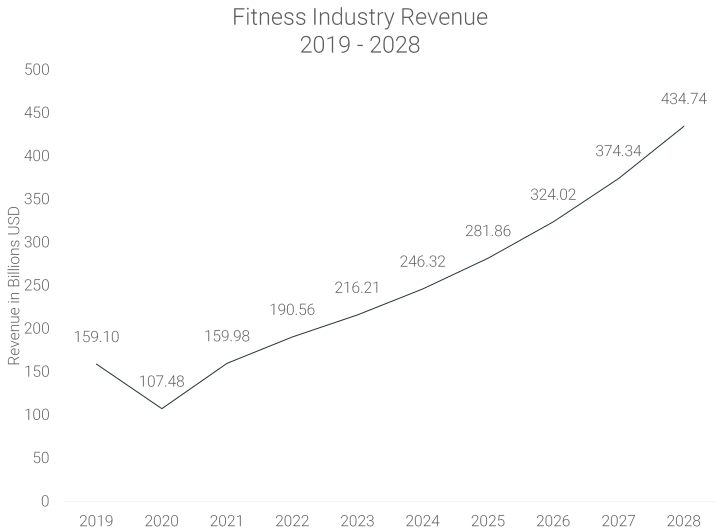

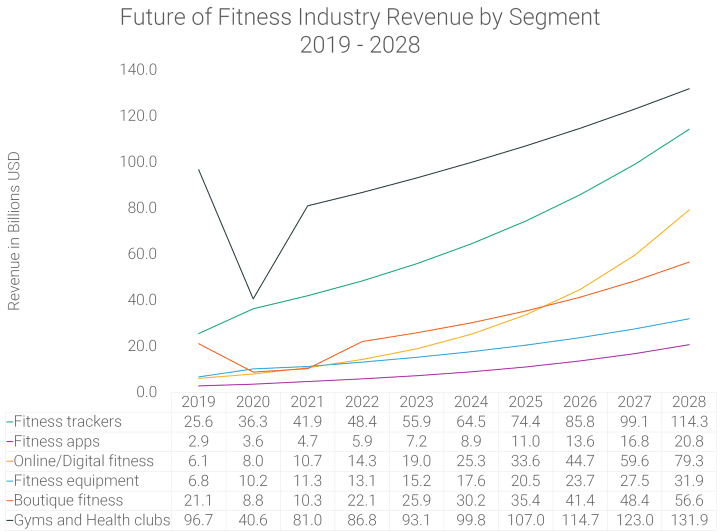

Fitness industry revenue: 2019 - 2028

As of 2019, the Fitness Industry was worth approximately 159.10 billion, hitting a peak before experiencing a 32.45% decline in 2020.

It is projected that the industry will rebound to its pre-pandemic levels by the end of 2021, to an approximate revenue of 159.98 billion USD, and continue growing to 190.56 billion in 2022.

Projections estimate that the industry will reach a revenue of 434.74 billion by 2028, growing 171.75% from 2021.

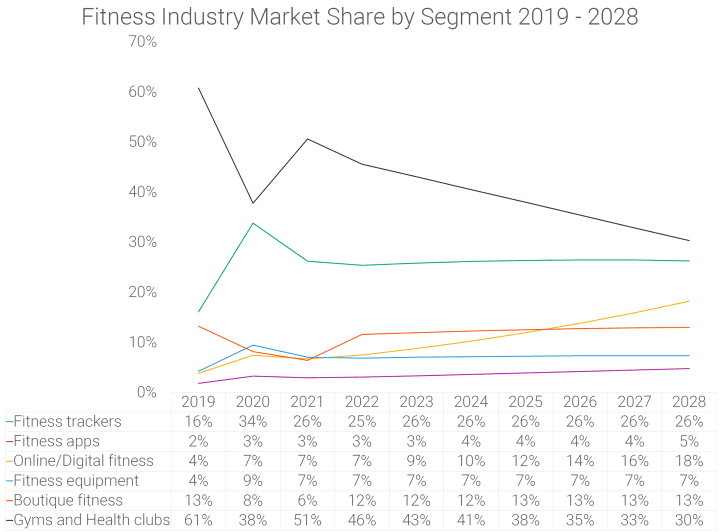

Pandemics impact on segments of the fitness industry market

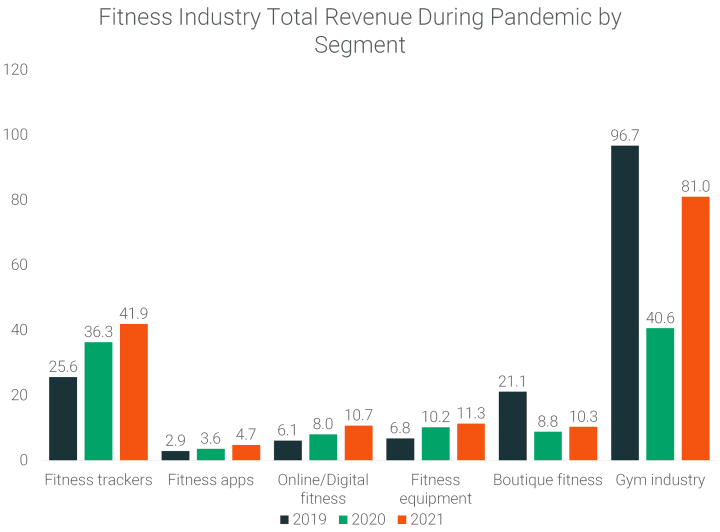

With the gym industry’s greater than 50% decline in revenue in 2020, it was the first time that gyms didn’t make up more than half of the fitness industry’s revenue. That’s because the other segments combined for 54.03% of the total market revenue.

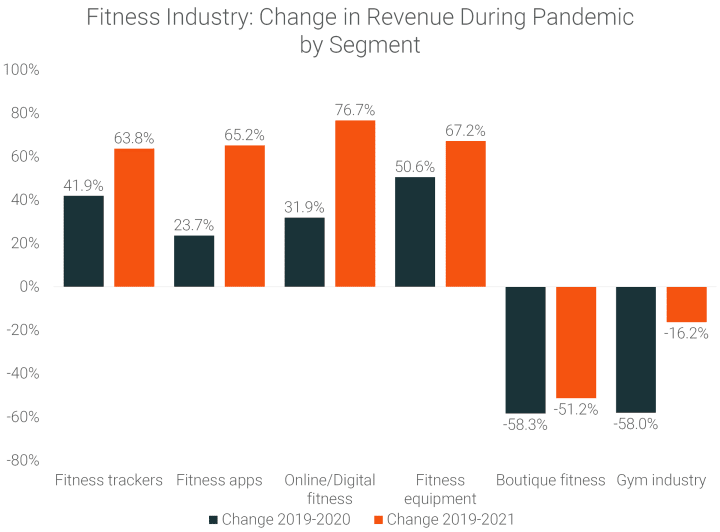

The fitness equipment industry saw the greatest growth during the first year of the pandemic - increasing 50.6% from 6.8 billion in 2019 to 10.2 billion in 2020.

While the industry with the greatest growth over the course of the entire pandemic is the online/digital fitness industry. Supplying on-demand, live-streamed, and pre-recorded fitness content online exploded by 76.7% from 6.1 billion in 2019 to 10.7 billion by the end of 2021.

The other segments experiencing growth were wearable fitness trackers (up 63.8% from 2019 - 2021) and fitness apps (up 65.2% from 2019 - 2021).

Meanwhile, the boutique fitness industry has experienced the greatest decline, dropping 58.3% in 2020 and still down 51.2% by the end of 2021.

Future of the fitness industry by segment 2019 - 2028

The gym industry has long been the major pillar of the fitness industry, accounting for 61% of the industry’s revenue as of 2019 (96.7 billion in revenue).

With other segments in the industry experiencing growth, it is expected that the gym industry will only account for 30% of the fitness industry’s revenue by 2028 (131.9 billion in revenue).

The two major segments taking up more of the market share are:

- Fitness trackers - Expected to go from 16% market share in 2019 (25.6 billion in revenue) to 26% in 2028 (114.3 billion in revenue)

- Online/digital fitness - Expected to go from 4% market share in 2019 (6.1 billion in revenue) to 18% market share in 2028 (79.3 billion in revenue)

The two segments with the lowest market shares in 2021 and 2028 are:

- Fitness apps - Expected to go from 3% market share in 2021 (4.7 billion) to 5% in 2028 (20.8 billion)

- Fitness equipment - Expected to go from 7% market share in 2021 (11.3 billion) to 7% in 2028 (31.9 billion)

Fitness industry growth 2021 to 2028

The fastest-growing segment in the fitness industry is the online/digital fitness industry. Revenue generated around delivering live-streamed, on-demand, and pre-recorded fitness content is expected to grow 33.1% each year, for a total growth of 640.1% from 2021 to 2028.

Fitness apps have the second-highest CAGR (compound annual growth rate) at 23.5%, expecting to grow 338.2% over the 7 year period.

Meanwhile, the segment expecting the second-highest overall growth over the 7 year period is boutique fitness, expecting to grow 450% from 2021 to 2028.

The COVID-19 pandemic has directly affected the fitness industry in 2020 as many gyms and fitness centers were forced to shut down operations to reduce the spread of the virus. The fitness industry suffered a huge decline in revenue, but is expected to start to recover in 2021 and the succeeding years as people put more emphasis on their health and well-being.

About RunRepeat

RunRepeat hosts an extensive collection of athletic shoe reviews . Here, you can find unbiased shoe reviews, so you won’t have to spend too much time deciding whether a pair of shoes is the right fit for you. We ensure they are unbiased by a) buying shoes with our own money b) testing the shoes ourselves c) cutting the shoes in half in the lab and showcasing the results of all the lab tests we do.

Aside from our collection of running shoes , trainers , and sneakers , you can also check out our shoe guides to learn more about the different types of shoes and their unique features.

Use of content

- If you want to know more about the fitness industry statistics, you are more than welcome to reach out to Nick Rizzo at [email protected]. He’s also available to do interviews.

- Feel free to use data found in this article on any online publication. We only request that you link back to this original source.

- Sports & Recreation ›

Sports & Fitness

Fitness industry in the United States - statistics & facts

How many americans participate in sports and outdoor activities, the rise of efitness in the u.s., key insights.

Detailed statistics

Number of U.S. health clubs & fitness centers 2008-2022

Most used gyms in the U.S. as of April 2022

Fitness club employment in the United States 2012-2023

Editor’s Picks Current statistics on this topic

Gym, health & fitness club industry revenue in the United States 2010-2023

Health & fitness club companies by revenue in the United States 2021

Sports Participation

Further recommended statistics

- Premium Statistic U.S. health club industry revenue 2000-2020

- Premium Statistic Fitness club industry value added in the U.S. 2021

- Premium Statistic Health & fitness club companies by revenue in the United States 2021

- Premium Statistic Health clubs ranked by number of facilities in the U.S. 2021

U.S. health club industry revenue 2000-2020

Revenue of the health club industry in the United States from 2000 to 2020 (in billion U.S. dollars)

Fitness club industry value added in the U.S. 2021

Economic impact of the fitness industry in the United States in 2021 (in billion U.S. dollars)

Health & fitness club companies by revenue in the United States 2021

Leading health club industry companies in the United States in 2021, by revenue (in million U.S. dollars)

Health clubs ranked by number of facilities in the U.S. 2021

Leading health club industry companies in the United States in 2021, by number of facilities

- Premium Statistic Number of U.S. health clubs & fitness centers 2008-2022

- Premium Statistic U.S. states with the most fitness centers 2021

- Premium Statistic Most used gyms in the U.S. as of April 2022

- Premium Statistic Health club membership rate in metro areas in the U.S. as of April 2022

- Premium Statistic Share of gym visits in the U.S. in Q1 2023, by chain

- Premium Statistic Number of LA Fitness locations in the U.S. 2023, by state

Number of U.S. health clubs & fitness centers 2008-2022

Number of health clubs in the United States from 2008 to 2022

U.S. states with the most fitness centers 2021

Number of health clubs in the United States in 2021, by state

Most popular gyms in the United States as of April 2022

Health club membership rate in metro areas in the U.S. as of April 2022

Gym penetration rate in selected metro areas in the United States as of April 2022

Share of gym visits in the U.S. in Q1 2023, by chain

Share of visits to fitness chains in the United States in the 1st quarter of 2023, by chain

Number of LA Fitness locations in the U.S. 2023, by state

Number of LA Fitness gyms in the United States as of April 2023, by state

- Premium Statistic Fitness industry enterprises in the United States 2023

- Basic Statistic Fitness club employment in the United States 2012-2023

- Premium Statistic Key figures on personal trainers in the U.S. 2023

Fitness industry enterprises in the United States 2023

Number of fitness industry businesses in the United States from 2012 to 2023

Number of employees in the gym, health and fitness club industry in the United States from 2012 to 2021, with a forecast for 2023

Key figures on personal trainers in the U.S. 2023

Key figures on the personal trainers industry in the United States in 2023

Fitness participation

- Basic Statistic Percentage of U.S. population engaged in sports and exercise per day 2010-2022

- Basic Statistic Hours per day spent on leisure and sports in the U.S. by employment status 2022

- Premium Statistic Most popular sports activities in the U.S. 2024

- Premium Statistic Most popular outdoor activities in the U.S. 2022

- Basic Statistic Participation rate in outdoor sports 2021, by age group

- Premium Statistic Types of sports / activities high-income household members participated in the U.S.

Percentage of U.S. population engaged in sports and exercise per day 2010-2022

Average percentage of the population engaged in sports, exercise, and recreation per day in the United States from 2010 to 2022

Hours per day spent on leisure and sports in the U.S. by employment status 2022

Average hours per day spent on leisure and sports in the United States from 2009 to 2022, by employment status

Most popular sports activities in the U.S. 2024

Most popular sports activities in the U.S. as of March 2024

Most popular outdoor activities in the U.S. 2022

Leading outdoor activities in the United States in 2022, by number of participants (in millions)

Participation rate in outdoor sports 2021, by age group

Participation rate in outdoor sports in the United States in 2021, by age group

Types of sports / activities high-income household members participated in the U.S.

Types of sports / activities rich Americans regularly participated in in the United States in 2022

Fitness equipment

- Premium Statistic Revenue of the sports equipment industry in the U.S. 2018-2028

- Premium Statistic Wholesale sales (consumer segment) of home gyms in the U.S. 2007-2023

- Premium Statistic Sports equipment market revenue in the U.S. from 2018 to 2028, by product type

- Premium Statistic Most common home fitness equipment in the U.S. as of April 2022

- Premium Statistic Most common brand of treadmill in the United States as of April 2022

- Premium Statistic Most common reasons for not owning fitness gear at home in the U.S. as of April 2022

Revenue of the sports equipment industry in the U.S. 2018-2028

Revenue of the sports equipment industry in the United States from 2018 to 2024, with a forecast to 2028 (in billion U.S. dollars)

Wholesale sales (consumer segment) of home gyms in the U.S. 2007-2023

Wholesale sales of home gyms for consumers in the United States from 2007 to 2023 (in million U.S. dollars)

Sports equipment market revenue in the U.S. from 2018 to 2028, by product type

Sports equipment market revenue in the United States from 2018 to 2028, by product type (in billion U.S. dollars)

Most common home fitness equipment in the U.S. as of April 2022

Most popular home exercise equipment among users in the United States as of April 2022

Most common brand of treadmill in the United States as of April 2022

Most common brand of treadmill owned in the United States as of April 2022

Most common reasons for not owning fitness gear at home in the U.S. as of April 2022

Most common reasons for not owning fitness equipment at home in the United States as of April 2022

Fitness apps & wearables

- Premium Statistic Most downloaded health and fitness apps U.S. 2022

- Premium Statistic U.S. download share of health and fitness apps 2022, by subcategory

- Premium Statistic U.S. leading health and fitness apps search keywords 2022

- Premium Statistic Health and fitness apps usage in the U.S. 2022

- Premium Statistic Wearables and connected fitness equipment market size in the U.S. 2026

- Premium Statistic U.S. digital health and fitness market revenues 2019-2026, by segment

Most downloaded health and fitness apps U.S. 2022

Leading health and fitness apps in the United States in 2022, by downloads (in millions)

U.S. download share of health and fitness apps 2022, by subcategory

Most downloaded health and fitness app subcategories in the United States from January to October 2022

U.S. leading health and fitness apps search keywords 2022

Most used health and fitness app keywords in the United States from January to October 2022

Health and fitness apps usage in the U.S. 2022

Usage reach of health and fitness apps in the United States in 2019 and 2022

Wearables and connected fitness equipment market size in the U.S. 2026

Wearables and connected fitness equipment market size in the United States in 2019, 2022, and 2026 (in billion U.S. dollars)

U.S. digital health and fitness market revenues 2019-2026, by segment

Revenues of digital health and fitness mobile apps, connected equipment, and wearable devices in the United States in 2019, 2022 and 2026 (in billion U.S. dollars)

- Premium Statistic Revenue forecast for the eServices market by segment in United States until 2030

- Premium Statistic Online revenue forecast for the eServices Fitness market in United States until 2024

- Premium Statistic Number of users in the eServices Fitness market in United States until 2024

- Premium Statistic Penetration rate for the eServices Fitness market in United States until 2024

Revenue forecast for the eServices market by segment in United States until 2030

Online revenue forecast for the eServices market by segment in United States from 2023 to 2030 (in million U.S. dollars)

Online revenue forecast for the eServices Fitness market in United States until 2024

Online revenue forecast for the eServices Fitness market in United States from 2017 to 2024 (in million U.S. dollars)

Number of users in the eServices Fitness market in United States until 2024

Forecast for the number of online users in the eServices Fitness market in United States from 2017 to 2024 (in million)

Penetration rate for the eServices Fitness market in United States until 2024

Online penetration rate forecast for the eServices Fitness market in United States from 2017 to 2024

Further reports

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Gym, Health & Fitness Clubs in the US - Market Size, Industry Analysis, Trends and Forecasts (2024-2029)

Instant access to hundreds of data points and trends.

- Market estimates from

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

100% money back guarantee

Industry statistics and trends.

Access all data and statistics with purchase. View purchase options.

Gym, Health & Fitness Clubs in the US

Industry Revenue

Total value and annual change from . Includes 5-year outlook.

Access the 5-year outlook with purchase. View purchase options

Trends and Insights

Market size is projected to over the next five years.

Market share concentration for the Gym, Health & Fitness Clubs industry in the US is , which means the top four companies generate of industry revenue.

The average concentration in the sector in the United States is .

Products & Services Segmentation

Industry revenue broken down by key product and services lines.

Ready to keep reading?

Unlock the full report for instant access to 30+ charts and tables paired with detailed analysis..

Or contact us for multi-user and corporate license options

Table of Contents

About this industry, industry definition, what's included in this industry, industry code, related industries, domestic industries, competitors, complementors, international industries, performance, key takeaways, revenue highlights, employment highlights, business highlights, profit highlights, current performance.

What's driving current industry performance in the Gym, Health & Fitness Clubs in the US industry?

What's driving the Gym, Health & Fitness Clubs in the US industry outlook?

What influences volatility in the Gym, Health & Fitness Clubs in the US industry?

- Industry Volatility vs. Revenue Growth Matrix

What determines the industry life cycle stage in the Gym, Health & Fitness Clubs in the US industry?

- Industry Life Cycle Matrix

Products and Markets

Products and services.

- Products and Services Segmentation

How are the Gym, Health & Fitness Clubs in the US industry's products and services performing?

What are innovations in the Gym, Health & Fitness Clubs in the US industry's products and services?

Major Markets

- Major Market Segmentation

What influences demand in the Gym, Health & Fitness Clubs in the US industry?

International Trade

- Industry Concentration of Imports by Country

- Industry Concentration of Exports by Country

- Industry Trade Balance by Country

What are the import trends in the Gym, Health & Fitness Clubs in the US industry?

What are the export trends in the Gym, Health & Fitness Clubs in the US industry?

Geographic Breakdown

Business locations.

- Share of Total Industry Establishments by Region ( )

Data Tables

- Number of Establishments by Region ( )

- Share of Establishments vs. Population of Each Region

What regions are businesses in the Gym, Health & Fitness Clubs in the US industry located?

Competitive Forces

Concentration.

- Combined Market Share of the Four Largest Companies in This Industry ( )

- Share of Total Enterprises by Employment Size

What impacts market share in the Gym, Health & Fitness Clubs in the US industry?

Barriers to Entry

What challenges do potential entrants in the Gym, Health & Fitness Clubs in the US industry?

Substitutes

What are substitutes in the Gym, Health & Fitness Clubs in the US industry?

Buyer and Supplier Power

- Upstream Buyers and Downstream Suppliers in the Gym, Health & Fitness Clubs in the US industry

What power do buyers and suppliers have over the Gym, Health & Fitness Clubs industry in the US?

Market Share

Top companies by market share:

- Market share

- Profit Margin

Company Snapshots

Company details, summary, charts and analysis available for

Company Details

- Total revenue

- Total operating income

- Total employees

- Industry market share

Company Summary

- Description

- Brands and trading names

- Other industries

What's influencing the company's performance?

External Environment

External drivers.

What demographic and macroeconomic factors impact the Gym, Health & Fitness Clubs in the US industry?

Regulation and Policy

What regulations impact the Gym, Health & Fitness Clubs in the US industry?

What assistance is available to the Gym, Health & Fitness Clubs in the US industry?

Financial Benchmarks

Cost structure.

- Share of Economy vs. Investment Matrix

- Depreciation

What trends impact cost in the Gym, Health & Fitness Clubs in the US industry?

Financial Ratios

- 3-4 Industry Multiples (2018-2023)

- 15-20 Income Statement Line Items (2018-2023)

- 20-30 Balance Sheet Line Items (2018-2023)

- 7-10 Liquidity Ratios (2018-2023)

- 1-5 Coverage Ratios (2018-2023)

- 3-4 Leverage Ratios (2018-2023)

- 3-5 Operating Ratios (2018-2023)

- 5 Cash Flow and Debt Service Ratios (2018-2023)

- 1 Tax Structure Ratio (2018-2023)

Data tables

- IVA/Revenue ( )

- Imports/Demand ( )

- Exports/Revenue ( )

- Revenue per Employee ( )

- Wages/Revenue ( )

- Employees per Establishment ( )

- Average Wage ( )

Key Statistics

Industry data.

Including values and annual change:

- Revenue ( )

- Establishments ( )

- Enterprises ( )

- Employment ( )

- Exports ( )

- Imports ( )

Frequently Asked Questions

What is the market size of the gym, health & fitness clubs industry in the us.

The market size of the Gym, Health & Fitness Clubs industry in the US is measured at in .

How fast is the Gym, Health & Fitness Clubs in the US market projected to grow in the future?

Over the next five years, the Gym, Health & Fitness Clubs in the US market is expected to . See purchase options to view the full report and get access to IBISWorld's forecast for the Gym, Health & Fitness Clubs in the US from up to .

What factors are influencing the Gym, Health & Fitness Clubs industry in the US market trends?

Key drivers of the Gym, Health & Fitness Clubs in the US market include .

What are the main product lines for the Gym, Health & Fitness Clubs in the US market?

The Gym, Health & Fitness Clubs in the US market offers products and services including .

Which companies are the largest players in the Gym, Health & Fitness Clubs industry in the US?

Top companies in the Gym, Health & Fitness Clubs industry in the US, based on the revenue generated within the industry, includes .

How many people are employed in the Gym, Health & Fitness Clubs industry in the US?

The Gym, Health & Fitness Clubs industry in the US has employees in United States in .

How concentrated is the Gym, Health & Fitness Clubs market in the United States?

Market share concentration is for the Gym, Health & Fitness Clubs industry in the US, with the top four companies generating of market revenue in United States in . The level of competition is overall, but is highest among smaller industry players.

Methodology

Where does ibisworld source its data.

IBISWorld is a world-leading provider of business information, with reports on 5,000+ industries in Australia, New Zealand, North America, Europe and China. Our expert industry analysts start with official, verified and publicly available sources of data to build an accurate picture of each industry.

Each industry report incorporates data and research from government databases, industry-specific sources, industry contacts, and IBISWorld's proprietary database of statistics and analysis to provide balanced, independent and accurate insights.

IBISWorld prides itself on being a trusted, independent source of data, with over 50 years of experience building and maintaining rich datasets and forecasting tools.

To learn more about specific data sources used by IBISWorld's analysts globally, including how industry data forecasts are produced, visit our Help Center.

Deeper industry insights drive better business outcomes. See for yourself with your report or membership purchase.

Discover how 30+ pages of industry data and analysis can give you the edge you need..

Sweating for the fitness consumer

Fitness is a “Yes, and” industry. While other goods and services compete intensely for a finite number of consumer purchases, fitness consumers continue to use a widening array of services, tools, and solutions to help them look, feel, and function better. 1 McKinsey identified wellness as “the next trillion-dollar market” in 2012. For more, see Putney Cloos, Sherina Ebrahim, Tracey Griffin, and Warren Teichner, “ Healthy, wealthy and (maybe) wise: The emerging trillion-dollar market for health and wellness ,” May 1, 2012. Our research shows that the market for health and wellness products and services is growing by 5 to 10 percent per year, depending on the region. An even more fragmented market of complementary solutions is filling the white space around new movements, activity measurement, experiences, and more.

The COVID-19 pandemic, which forced large swaths of the global population to isolate with members of their households (and their devices), has spurred the shift toward personalized at-home workouts and made overall wellness even more salient. Indeed, 40 percent of the general population surveyed now consider wellness a top priority in daily life . The growing number of fitness choices—exact counts are difficult to find, but fitness-tech apps raised a record-breaking $2 billion from investors in 2020 2 Fitness Tech Report 2020 , SportsTechX, sportstechx.com. —now seek to serve this need in increasingly diverse ways. Prior to the pandemic, the same consumer may have complemented their health club membership with a smartwatch, a social-fitness app, an at-home workout solution, and occasional boutique studio sessions with friends. As vaccines roll out globally, the question is what will happen to the fitness consumer—if their use of at-home solutions and equipment will keep them away from the gym or if they will rush back.

The answer appears to be something in between. The fitness industry is shifting from surviving the COVID-19 crisis to looking for ways to thrive in the next normal, building consumer relationships that last and grow. Providers of solutions and services for fitness practices both inside and outside the home will need to reassess their value propositions, articulate their roles in consumers’ fitness routines, and commit to an approach that will win over the right consumers for them. Specifically, providers of on-site fitness solutions should consider a more hybrid approach that keeps consumers figuratively and digitally connected; makers of in-home tools and equipment should lean into the normalization of DIY fitness; and, of course, data security should be prioritized with such a high level of connectivity. Success will accrue to those that earn consumers’ trust and a place in their fitness routines.

Nowhere to go but looking to move

The COVID-19 crisis has elevated consumers’ awareness of the importance of health and wellness, with 68 percent of survey respondents reporting that they prioritized their health more after the onset of the pandemic. Exercise is also the most commonly reported tool for relieving stress: 65 percent of gymgoers surveyed reported using exercise as stress relief. 3 The COVID era fitness consumer , IHRSA, October 2020, ihrsa.org. The share of these consumers who reported using mobile apps to fulfill health and fitness goals accordingly increased from about 50 percent before the COVID-19 outbreak to 75 percent in June 2020. 4 Jonathan Harrop, “3 predictions for the health & fitness mobile app market,” Business of Apps, June 15, 2020, businessofapps.com. Our surveys throughout the pandemic consistently found consumers exercising at home and spending on technology solutions. For example, one McKinsey survey shows that monthly consumer spending on connected fitness equipment increased by 5 percent and spending for paid apps rose about 10 percent. A little more than 10 percent of the American general population have also set up home gyms or have accessed fitness resources online during the pandemic. Of the online exercisers, 70 percent intend to maintain or increase their use of online fitness even after the pandemic abates.

Despite this experimentation, 50 percent of consumers from one survey were less happy with their pandemic-era routines than they were with what they had before. Of these consumers, about half said their at-home workouts were not intense enough, that their at-home fitness regimens were less consistent, and that they struggled to find motivation. Indeed, 95 percent of prepandemic fitness club members reported missing at least one element of working out at the gym, 5 The COVID era fitness consumer , IHRSA, October 2020, ihrsa.org. and more than 60 percent of Americans who exercise regularly say they will likely prefer a mix of working out at a gym or studio and at home in the future. 6 Rachel King, “Most Americans plan to continue at-home workouts even once gyms fully reopen,” Fortune , August 17, 2020, fortune.com.

As vaccines roll out and pandemic restrictions ease, we have observed consumers return to gyms and studios in those markets while continuing to use alternatives to the gym. In short, consumers are finding ways to continue to take part in fitness, and industry participants will need to figure out how best to serve consumers who now use a portfolio of options.

Attracting and retaining fitness consumers for the long term

The local gym is not dead, and at-home solutions are here to stay. This should be good news for the industry even though the breadth and quality of competitive offerings has increased; our experience with drivers of membership churn shows that nothing helps drive retention more than sustained visits and workouts. For example, someone may have left too late from work to go to the gym but can do 30 minutes on their spin bike that night (for our segmentation of fitness consumers, see infographic, “Fitness consumer archetypes”).

On-site fitness: From in-person to hybrid

The pandemic has forced the $97 billion global health club industry to change its operations to limit person-to-person interaction. 7 For more on the state of the health club industry, see page 24 of 2020 IHRSA Global Report , IHRSA, June 2020, ihras.org. However, we believe that there is hope for traditional gyms and studios: 30 percent of US customers went to the gym or studio at least once in the first two weeks of February 2021, and 70 percent of fitness consumers report missing their gym as much as they miss family and friends. For fully vaccinated consumers, 35 percent went to the gym, 8 McKinsey US Consumer Sentiment Survey, May 2021. an improvement over gyms’ prepandemic market penetration of about 25 percent in the United States. As economies reopen, gyms and studios should reexamine their value propositions and place them in the context of consumers’ portfolio approach to fitness, particularly embracing their potential as third places—community hubs—where members can focus on themselves.

Reaching wellness enthusiasts, researcher-experimenters, and traditionalists can be important for gyms and studios. Wellness enthusiasts are likely to return; traditionalists who have not yet developed new habits may reincorporate gyms and studios into their routines once they feel safe. Similarly, researcher-experimenters are likely to be enticed by the variety of new options.

Crucially, gyms and studios should cultivate communities to help meet consumers’ psychological need for belonging and mutual support. Community types can vary, from ones built around leaders or experts—instructors—to supportive or competitive groups, but our research shows that they all make members feel that they are taking time for themselves. For instance, one UK gym started a virtual running club—with social media support—to foster a sense of togetherness and positive competition during the pandemic.

In addition to defining the optimal community type for the values of a club and its members, gyms and studios should clarify their value propositions for their target consumers—and, if necessary, adapt them. One opportunity area may be in reviewing floor-space utilization and productivity in a similar manner to a traditional retailer. For instance, if a gym’s members have shifted to doing independent cardiovascular exercise outside the gym, decision makers can change the gym’s layout and reallocate space accordingly. One large chain of gyms brought members outside the gym with outdoor-class experiences and launched its own streaming service for classes on demand, a reflection of the trend of many gyms’ reallocation of floor space.

To fit into consumers’ portfolios of fitness habits, gyms and studios could consider ways to partner with providers of complementary offerings. Depending on their value propositions and goals, a gym and a fitness tracker may be good partners. Even prepandemic, a fitness studio chain successfully partnered with an indoor-cycling chain using their shared value proposition of live performance tracking to motivate members. With the ongoing expansion of fit-tech capabilities, traditional on-site fitness players may have opportunities to offer data and performance tracking in innovative areas such as power measured by someone’s output in watts. To fulfill some members’ desire for connection and self-expression—consider wellness enthusiasts whose identities are built around fitness—gyms and studios can design spaces to facilitate community engagement or provide visually appealing spaces for social media posts. One cycle club has used a mural to fuel social media engagement.

Clubs can also redesign memberships and pricing to offer more flexibility for members who are now exercising in multiple ways and to optimize retention and average revenue per user. Not only did the pandemic force some competitors to close, reshaping demand and price tolerances, but it also pushed the remaining gyms and studios to offer hybrid memberships that opened the door to expanded models of price accessibility. Going forward, the fitness industry can adapt traditional pricing analysis to optimize their pricing—identifying value, matching offers to consumer segments, and timing discounts. Like many other industries, fitness businesses should commit the resources required to regularly pilot new pricing strategies and expand their offerings across the in-gym and at-home ecosystem. 9 For more on building new businesses, see “ Bringing the start-up in-house with Leap by McKinsey .”

Unfortunately, the economic shock of the pandemic resulted in more than a million lost jobs by the end of 2020. 10 Melissa Rodriguez, “U.S. fitness industry revenue dropped 58% in 2020,” IHRSA, February 25, 2021, ihrsa.org. Gyms and studios can reinforce the confidence of their staff by communicating their value propositions and staff’s roles in fulfilling those visions. Gyms and studios can also support staff in their work using technology to gather data and curate fitness resources for consumers in a fragmented market.

At the same time, gyms and studios can adjust the size of their geographic and real-estate footprint and consider opportunities to expand or contract in different areas based on their performance. Over time, M&A opportunities will emerge.

In-home and DIY fitness: From alternative to standard

Outside of gyms and studios, digital-enabled solutions have evolved from low-cost alternatives and add-ons to stand-alone offerings that are a regular part of consumers’ lives. These kinds of solutions offer convenience and personalization that can appeal to wellness enthusiasts and researcher-experimenters alike.

However, the market for in-home and DIY fitness solutions and equipment will be competitive. This is a sector that has attracted many entrepreneurs and investors, and the number of good and emerging solutions is rapidly expanding. Furthermore, with more consumers returning to the gym as economies reopen, the growth in new users for in-home equipment may slow. To prepare themselves, connected-equipment manufacturers should plan for a partial rebalancing of their customer base back toward commercial businesses and evaluate the potential returns of special equipment offerings targeted at specific consumer segments. For instance, researcher-experimenters may love connected equipment that integrates a wide variety of brand-new, high-quality content at reasonable prices, but traditionalists may seek simple analog equipment that is well made.

As with gyms and studios, solutions that have a community component can bring people together. Downloads and use of fitness and health apps grew during the pandemic, but the people seem to be the real draw. During the first few weeks of lockdown—March 9–24, 2020—overall downloads of health and fitness apps grew 27 percent, but apps that include a community component saw four times as many downloads. 11 Airnow Data Market Intelligence, Airnow Data, accessed March 17, 2021, airnowdata.com. One lesson for providers of health and fitness apps is to design and position their apps as facilitators and gateways to fitness-minded communities. Indeed, apps that enable digital streaming for live classes, sometimes involving sought-after instructors who acknowledge individual students by name, can replicate some of the sense of community people might get from an in-person group-exercise class. Large tech companies have already begun to provide their own offerings that are more like fitness ecosystems that include class curation and fitness tracking. To prepare for a time when more consumers return to gyms and studios, app providers should strengthen their user communities to keep users coming back.

An increasing need for data security

Connected-equipment manufacturers and digital fitness players need to remain vigilant in protecting themselves and their consumers. One large wearables company was compromised in a ransomware attack in July 2020 that shut down its ecosystem for users, requiring days to recover. More recently, another connected-fitness-solution provider was found to have an exposed API that would allow hackers to gain access to customer data. The potential for sensitive-information leaks or outright ransom attacks is proving a very real risk that can blindside an unprepared industry player, and data security should be a priority for companies that control consumer data. Indeed, a data breach is also a breach of trust and can jeopardize relationships with consumers.

The COVID-19 pandemic has scrambled fitness consumers’ habits, and the next phase in recovery is a prime opportunity for industry participants to reset. Selecting a target consumer segment and updating value propositions to better align with their wants and needs and responding to industry developments will help industry participants survive and thrive in the new normal.

Eric Falardeau is a partner in McKinsey’s Montréal office, John Glynn is a consultant in the Toronto office, and Olga Ostromecka is a consultant in the Wrocław office.

The authors wish to thank Sabine Becker, Tamara Charm, Anna Pione, Warren Teichner, and Alexander Thiel for their contributions to this article.

Explore a career with us

Related articles.

Feeling good: The future of the $1.5 trillion wellness market

Wellness worldwide: Consumer insights from four countries

Looking ahead in US consumer health: An interview with Scott Melville

You are using an outdated browser. Please upgrade your browser to improve your experience.

Market Research Consumer Goods Market Research Consumer Goods & Retailing Market Research Consumer Services Market Research Fitness Centers & Health Clubs Market Research

Fitness Centers & Health Clubs Market Research Reports & Industry Analysis

Fitness centers & health clubs industry research & market reports, refine your search, 2024 fitness evaluation and personal fitness training services global market size & growth report with updated recession risk impact.

May 04, 2024 | Published by: Kentley Insights | USD 295

... Report covers market size, revenue, growth, and share across 4 global regions (The Americas, Europe, Asia & Oceania, Africa & Middle East), 22 subregions, and 195 countries. Figures are from 2012 through 2023, with forecasts ... Read More

2024 Recreational, Fitness & Health Training Programs Global Market Size & Growth Report with Updated Recession Risk Impact

... market size, revenue, growth, and share across 4 global regions (The Americas, Europe, Asia & Oceania, Africa & Middle East), 22 subregions, and 195 countries. Figures are from 2012 through 2023, with forecasts for 2024 ... Read More

2024 Fitness and Recreational Sports Center Services Global Market Size & Growth Report with Updated Recession Risk Impact

2024 fitness and recreational sports center memberships global market size & growth report with updated recession risk impact, 2024 fitness and recreational sports center admissions global market size & growth report with updated recession risk impact, 2024 gyms and fitness centers global market size & growth report with updated recession risk forecasts.

May 02, 2024 | Published by: Kentley Insights | USD 295

... share across 4 global regions, 22 subregions, and 195 countries. Historical data is from 2012 through 2023, with forecasts for 2024 and 2027. The historical data utilizes in-depth survey results from companies in the Gyms ... Read More

Gyms and Fitness Centers - 2024 U.S. Market Research Report with Updated Recession Risk Forecasts

... of the industry in the United States with over 100+ data sets covering 2015-2028. This Kentley Insights report is full of industry insights including historical and forecasted market size, revenue and industry breakdowns by product ... Read More

Stationary Bicycle

May 01, 2024 | Published by: Global Industry Analysts | USD 5,600

... growing at a CAGR of 4.4% over the period 2023-2030. Recumbent Stationary Bicycle, one of the segments analyzed in the report, is expected to record 4.2% CAGR and reach US$526.4 Million by the end of ... Read More

Gym Management Software

May 01, 2024 | Published by: Global Industry Analysts | USD 5,450

... Million by 2030, growing at a CAGR of 9.5% over the period 2023-2030. Cloud Deployment, one of the segments analyzed in the report, is expected to record 9.3% CAGR and reach US$264.8 Million by the ... Read More

Gyms and Fitness Centres in Australia - Industry Market Research Report

May 01, 2024 | Published by: IBISWorld | USD 795

... centres and gymnasiums, and provide a range of fitness and exercise services. This report covers the scope, size, disposition and growth of the industry including the key sensitivities and success factors. Also included are five ... Read More

Global Pools & Spas

May 01, 2024 | Published by: Freedonia Focus Reports | USD 1,100

... pools and spas. Major world regions include North America, Western Europe, Asia/Pacific, and all other regions. To illustrate historical trends, world, product, and regional (including product segments) in use, and world and regional sales are ... Read More

Weight Management

May 01, 2024 | Published by: Global Industry Analysts | USD 4,950

... growing at a CAGR of 7.4% over the analysis period 2023-2030. Diet-based Weight Management, one of the segments analyzed in the report, is expected to record a 7.5% CAGR and reach US$187.5 Billion by the ... Read More

Fitness Centers

Apr 22, 2024 | Published by: First Research, Inc. | USD 129

... Group, Gold's Gym, LA Fitness, Life Time Fitness, Planet Fitness, and 24 Hour Fitness (all based in the US), along with Fitness First and Virgin Active (both based in the UK), Konami Sports Club (Japan), ... Read More

Gyms & Fitness Centres in Ireland - Industry Market Research Report

Apr 19, 2024 | Published by: IBISWorld | USD 820

... 0.3% to €177.2 million over the five years through 2023, including forecast growth of 9% in the current year. Membership levels in recent years have been aided by public health initiatives that have shed light ... Read More

Cryotherapy Market Size, Trends, Analysis, and Outlook By Therapy (Cryosurgery, Icepack Therapy, Chamber Therapy), By Device (Cryogun, Cryo Probes, Gas Cylinders, Localized Cryotherapy Devices, Cryochambers & Cryosaunas, Others), By Application (Medical, Surgical Applications, Pain Management, Beauty and Wellness, Fitness, Cold Storage, Others), By End-User (Hospitals and Specialty Clinics, Cryotherapy Centers, Spas and Fitness Centers, Others), by Country, Segment, and Companies, 2024-2032

Apr 16, 2024 | Published by: VPA Research | USD 3,980

... Management, Beauty and Wellness, Fitness, Cold Storage, Others), By End-User (Hospitals and Specialty Clinics, Cryotherapy Centers, Spas and Fitness Centers, Others), by Country, Segment, and Companies, 2024-2032 The global Cryotherapy market size is poised to ... Read More

Weight Management Market Report by Diet (Functional Beverages, Functional Food, Dietary Supplements), Equipment (Fitness Equipment, Surgical Equipment), Service (Health Clubs, Consultation Services, Online Weight Loss Services), and Region 2024-2032

Apr 08, 2024 | Published by: IMARC Services Pvt. Ltd. | USD 3,899

... size reached US$ 534.5 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 864.0 Billion by 2032, exhibiting a growth rate (CAGR) of 5.3% during 2024-2032. The market is primarily driven ... Read More

Indian Sports and Fitness Goods Market Report by Product Type (Balls, Fitness Goods, Adventure Sports, Golf Goods, and Other Goods), Fitness Goods (Cardiovascular Training Goods, Strength Training Goods), Cardiovascular Training Goods (Treadmills, Stationary Bikes, Rowing Machines, Ellipticals, and Others), End-Use (Health Clubs/Gyms, Home Consumers, Hotels and Corporate Offices, Hospitals, Medical Centers and Public Institutions, and Others), and Region 2024-2032

Apr 08, 2024 | Published by: IMARC Services Pvt. Ltd. | USD 2,699

... Rowing Machines, Ellipticals, and Others), End-Use (Health Clubs/Gyms, Home Consumers, Hotels and Corporate Offices, Hospitals, Medical Centers and Public Institutions, and Others), and Region 2024-2032 The Indian sports and fitness goods market size reached US$ ... Read More

Personal Trainers in the US - Industry Market Research Report

Apr 04, 2024 | Published by: IBISWorld | USD 1,095

... centers, while the other segment is in-house operations, tailoring workouts and regiments to the individual client and their needs at home. This industry derives its demand from downstream consumer groups. The group with the highest ... Read More

Gyms & Fitness Centres in the UK - Industry Market Research Report

Apr 02, 2024 | Published by: IBISWorld | USD 825

... be low-market, mid-market and high-market based on their membership fees and the facilities they offer. Despite the presence of several large players, there are still many small independent gyms operating across the UK. Operators in ... Read More

Gym, Health & Fitness Clubs in Canada - Industry Market Research Report

Apr 01, 2024 | Published by: IBISWorld | USD 875

... consumer trends and the proliferation of public health campaigns. With an increasing rate of adult obesity, the Public Health Agency of Canada (PHAC) has stressed adherence to fitness and healthy lifestyle choices. According to the ... Read More

Aqua Gym Equipment

Apr 01, 2024 | Published by: Global Industry Analysts | USD 4,950

... Million by 2030, growing at a CAGR of 3.5% over the period 2023-2030. Machines & Equipment, one of the segments analyzed in the report, is expected to record 3.4% CAGR and reach US$434.3 Million by ... Read More

Personal Trainers & Fitness Classes (UK) - Industry Report

Apr 01, 2024 | Published by: Plimsoll Publishing Ltd. | USD 400

... comprehensive individual analysis on the top 120 companies, including BEACH BODY STUDIO LTD, DEFINE FITNESS LTD and FITNESS AGENTS LTD. This report covers activities such as personal, training, health, gym, fitness and includes a wealth ... Read More

Health & Fitness Clubs (UK) - Industry Report

... on the top 410 companies, including AB SALUTE GYM LAKESIDE LTD, ALIVE FITNESS AND NATURAL HEALTH LTD and ASPIRE SPORTS HEALTH & FITNESS LTD. This report covers activities such as gym, fitness, health club, spa, ... Read More

Health Spas (UK) - Industry Report

... BARNES HEALTH & FITNESS LTD, BRISTOL HOTSPRING LTD and CHAMPNEYS SPRINGS LTD. This report covers activities such as spa, massage, health spa, nmea2000, sauna and includes a wealth of information on the financial trends over ... Read More

Fitness Equipment (UK) - Industry Report

... BESTGYMEQUIPMENT LTD, CRANLEA HUMAN PERFORMANCE LTD and FENLAND LEISURE PRODUCTS LTD. This report covers activities such as fitness equipment, gym equipment, treadmills, fitness, treadmill and includes a wealth of information on the financial trends over ... Read More

< prev 1 2 3 4 5 6 7 8 9 10 next >

Filter your search

- Africa (11)

- Europe (41)

- Global (163)

- Middle East (13)

- North America (56)

- Oceania (15)

- South America (15)

Research Assistance

Join Alert Me Now!

Start new browse.

- Consumer Goods

- Food & Beverage

- Heavy Industry

- Life Sciences

- Marketing & Market Research

- Public Sector

- Service Industries

- Technology & Media

- Company Reports

- Reports by Country

- View all Market Areas

- View all Publishers

- $495 All Access

- All Kentley Insights Reports

- Apparel & Footwear Manufacturing

- Auto & Transportation Equipment Manufacturing

- Beverage & Tobacco Manufacturing

- Chemical Manufacturing

- Computer & Electronic Products Manufacturing

- Electrical Equipment, Appliances & Components Manufacturing

- Fabricated Metal Manufacturing

- Food Manufacturing

- Furniture & Cabinets Manufacturing

- Machinery & Industrial Manufacturing

- Medical & Miscellaneous Manufacturing

- Mineral Products Manufacturing

- Paper, Pulp, Paperboard & Printing Manufacturing

- Petroleum & Coal Products Manufacturing

- Plastics & Rubber Products Manufacturing

- Primary Metal Manufacturing

- Textile Manufacturing

- Wood Product Manufacturing

- Auto & Motor Vehicles Retail

- Building & Garden Supply Retailers

- Ecommerce & Non-store Retail

- Electronics & Appliance Retailers

- Fashion & Clothing Retailers

- General Merchandisers

- Grocery, Food & Beverage Retailers

- Health & Beauty Retailers

- Home & Furniture Retailers

- Other Retailers

- Sporting Goods, Hobby & Media Retailers

- Accommodation, Restaurants, and Food

- Air Travel, Freight, & Travel Arrangements

- Arts, Entertainment, & Recreation

- Business & Facilities Support Services

- Care Facilities & Social Services

- Communication, Online, & Technology Services

- Energy & Utilities

- Financial Services

- Ground Transportation

- Health Care

- Media, Broadcasting, & Publishing

- Personal Services

- Professional, Engineering & Consulting Services

- Real Estate, Rental, & Leasing

- Religious, Civic, Social & Professional Orgs

- Repair & Maintenance Services

- Trucking, Warehousing, and Logistics

- Waste Management & Remediation

- Water Transportation & Services

- Antiques, Art, Collectibles & Used Goods

- Auto Products

- Auto Parts & Accessories

- Boats and Other Vehicles

- Clothing & Accessories

- Computers & Electronics

- Energy & Fuels

- Fabrics & Materials

- Farm Supplies

- Food & Groceries

- Health & Beauty

- Home Improvement

- Jewelry & Watches

- Lawn & Garden

- Mobile Homes

- Office Supplies

- Other Retail Products

- Personal Goods

- Print & Digital Media

- Sporting Goods & Outdoor

- Accommodation

- Advertising, Marketing & Public Relations

- Architecture & Civil Engineering

- Auto Repair & Maintenance

- Building Services

- Death Services

- Employment Services

- Entertainment, Activites, Media & Print

- Equipment Maintenance & Repair

- Finance & Banking

- Food & Beverage – Immediate Consumption

- Graphic, Industrial and Other Design Services

- Home Goods Rental, Maintenance & Repair

- Industrial Equipment Rental, Repair & Maintenance

- Laundry & Garments

- Logistics & Warehousing

- Movie, Video & Audio Production

- Online & IT Services

- Other Services

- Personal Care

- Real Estate

- Research & Intellectual Property

- Social Services & Care

- Software, Hardware & Data

- Sports & Outdoor Activities

- Testing Services

- Transportation

- Utilities & Waste

- Global Wholesale Market Size & Growth Reports

- Free Reports

- Small Business Ideas

- Fastest Growing Service Industries

- Fastest Growing Manufacturing Industries

- Fastest Growing Retail Industries

- The Most Profitable Industries

- Highest Inflation Industries

- Top Benchmarks

About Kentley Insights

- All Access Membership

- 100% Guarantee

- Privacy Policy

- Member Login

Gyms and Fitness Centers – 2024 U.S. Market Research Report

Published: May 2024 Updated Recession Statistics & Forecasts

This 78-page industry market research report is an in-depth analysis of the $41.9 billion gyms and fitness centers industry in the United States. The market research report utilizes the most extensive set of business surveys as the foundation for over 100 market research data sets with extensive historical data (2015-2023), statistics, trend analysis, and forecasts for 2024 & the next 5 years.

The report includes market size, growth, sales & cost trends, industry dynamics, operating expenses for 26 categories, profitability, employee productivity, 10 financial ratios, 31 balance sheet metrics, extensive statistics by state and Metropolitan Statistical Area (MSAs), workforce composition statistics, market share for top 50 companies, inflation, payroll and pay range data on 46 jobs, product line breakdown, industry data sets segmented by business size, concentration, and business structure, and much more.

Report Format

Industry Definition

Industry scope & services, select market research report statistics.

NUMBER OF COMPANIES In 2023, there were 31,268 companies in the industry Download for historicals and forecasts of companies & locations

MARKET GROWTH The 5-year annual growth rate averaged 4.1% Download the report for more historical, annual and forecasted growth rates

MARKET SHARE The top 4 companies have 19.1% market share The report has more market share statistics

REVENUE PER LOCATION In 2023, the avg. sales per location was $1.1 million Download now for historical and forecasted revenue per company

INFLATION & PRICING Over the past 5 years, inflation averaged 2% This report has historicals, 4 years of monthly data, and 2024 & 5-year forecasts

EMPLOYEE PRODUCTIVITY Revenue per employee is $55,983 Download now for more employee metrics

OPERATING EXPENSE BENCHMARKS 2.5% of expenses is spent on professional services Download this market research report for 24 other categories

PAY BENCHMARKS In 2023, avg. pay per employee was $16,079 The report has extensive pay statistics

ORGANIZATIONAL BENCHMARKS 0.8% of employees are in business ops & finance Download for 25 other organizational categories

Download a Sample Report

Data & Methodology

Key questions answered in this market research report.

How do professionals use this report? Professionals utilize this report for industry research, market sizing and evaluation, forecasting, strategic planning, sales & marketing strategy, due diligence, valuations, benchmarking, streamlining, and other analyses.

What is the market size of the gyms and fitness centers industry? This report covers the historical industry market size (2015-2023), and forecasts for 2024 and the next 5 years. This report also includes market share of the top 50 companies.

What is the outlook for the industry? This report has over a dozen market forecasts (2024 & 5 years) on total sales, companies, employees, productivity, inflation, compensation, operating expense, and others.

What industry analysis/data exists for the industry? This report covers over 100+ data sets on the gyms and fitness centers industry. Take a look at the table of contents below to see the breadth of analysis and data on the industry.

What segmentations are there on the gyms and fitness centers industry? This report segments the industry many ways including by business size, concentration (Top 50 companies), business structure, state, MSAs, and product lines.

What are the financial metrics for the industry? This report covers many financial metrics for the industry including profitability, growth, opex / revenue, 31 balance sheet items organized by liabilities, assets, and equity, and 10 financial metrics including return on sales, asset turnover, liability ratio, and net worth ratio.

What are important benchmarks for the gyms and fitness centers industry? Some of the most important benchmarks for the industry include market share, sales growth, employee productivity, operating expense breakdown, product line breakdown, span of control, and organizational composition. This report includes all of them and many more.

Report & Industry Details

NAICS Code: 713940

Number of Pages: 78

Format: PDF

Price: $295

Support Contact : Email us at [email protected] or call us at 1-800-613-3611

Related Market Research Reports:

Table of Contents

Page 1-2 – Report Overview & Table of Contents

Page 3 – Industry Overview – Methodology – Industry Definition & Examples

Page 4 – Industry Snapshot – Revenue & Growth

Page 5 – Industry Snapshot – Costs & Profitability

Section One REVENUE & GROWTH BENCHMARKS

Page 7 – Industry Growth Details – Industry Revenues – Companies – Locations – 2015-2023 Historical Figures – Forecasts for 2024 and the Next 5 Years

Page 8 – Growth Benchmarks – Revenues per Company – Revenues per Location – Locations per Company – 2015-2023 Historical Figures – Forecasts for 2024 and the Next 5 Years

Page 9 – Breakdown of Product Lines – Percentage of Revenue from Product Lines

Page 10 – BCG Income vs. Revenue Growth Matrix – Service Subsectors vs. Industry

Page 11 – Total Revenue by Industry Segments – Concentration (Top 4, next 4, next 12, next 30 largest companies) – Business Size (1-4 employees, 5-9 employees, 10-19, 20-49, 50-99, 100-249, 250+) – Business Structure (C-Corporations, S-Corporations, Partnerships, Sole Proprietorships) – Franchise Segments – Industry Average

Page 12 – Total Revenue per State – Revenue per State and State Rankings

Page 13 – Sales per Capita by State – Sales per Capita and State Rankings

Page 14-17 – Revenue per Metropolitan Statistical Area

Page 18-21 – Revenue per Capita per Metropolitan Statistical Area

Page – 22 Revenue per Company by Industry Segment – Concentration, Business Size, & Business Structure

Page – 23 Revenue per Location by Industry Segment – Concentration, Size, Structure, & Franchise

Page – 24 Revenue per Location by State – Revenue per Location and State Rankings

Page – 25-28 Revenue per Location per MSA

Page – 29 Industry Segmentation by Business Size – Segments include 1-4 employees, 5-9 employees, 10-19, 20-49, 50-99, 100-249, 250+ employees – Revenue, Companies, Locations, Employees & Payroll – Absolute Figures & % of Industry

Page – 30 Industry Consolidation Analysis – By Business Size Segments – Revenue, Companies, Locations & Employees – 2018 vs. 2023 by Business Size

Page – 31 Industry Consolidation Benchmarks – Revenue per Company, Location & Employee – 2018 vs. 2023 by Business Size

Page – 32 Industry Segmentation by Top 50 Companies – Segments include top 4, next 4, next 12, next 30, and top 50 companies by revenue – Revenue, Locations, Employees & Payroll – Absolute Figures & % of Industry

Page – 33 Sector Concentration Benchmarks – % of Sector Revenue from the Top 50 Companies – 12 Sectors

Page – 34 Industry Segmentation by Business Structure – Revenue, Companies, Locations, Employees & Payroll – Absolute Figures & % of Industry

Page – 35 Pricing & Inflation – Annual Inflation – Indexed to 2006 – 2015-2023 historicals, 2023 & 5-yr forecasts – Monthly Inflation Figures for the Past 4 Years

Page – 36 Service Subsector Growth – Revenue and 5-Year CAGR – 12 Subsectors

Page – 37 Service Subsector Analysis – Revenue per Company – Revenue per Location – 12 Subsectors

Page – 38 Service Subsector Analysis – Revenue per Employee – Payroll per Employee

SECTION TWO COST & FINANCIAL ANALYSIS

Page – 40 Profitability & Financial Ratio Analysis – Percent of Companies that are Profitable – Average Net Income as a Percent of Revenue – Financial Ratios – 10 ratios, such as Total Asset Turnover, Assets to Liabilities, Return on Net Worth, Solvency Ratio

Page – 41 Balance Sheet Benchmarks – Assets and Liabilities indexed to industry revenue at 100 – Current & Non-Current Assets: Cash, Notes & Accounts Receivable, Allowance for Bad Debts, Inventories, Treasuries & Securities, Other Current Assets, Loans to Shareholders / Mortgage, Other Investments, Depreciable Assets, Accumulated Depreciation, Land, Intangible Assets (Amortizable), Accumulated Amortization, Other Assets – Short-term, Long-term Liabilities, & Net Worth: Accounts Payable, Mortgages, Notes, Bonds due in less than 1 Yr., Other Current Liabilities, Loans from Shareholders, Mortgages, Notes, Bonds > 1 Yr., Other Liabilities, Capital Stock, Additional Paid-in Capital, Retained Earnings, Cost of Treasury Stock

Page – 42 Operating Expenses – Industry Operating Expenses – Industry Revenue vs. Operating Expense Growth – Operating Expense as a Percent of Revenue – 2015-2023 Historical Figures – Forecasts for 2024 and the Next 5 Years

Page 43 – Operating Expenses by Company & Location – Operating Expenses per Company – Operating Expenses per Location – Revenue vs. Expenses Growth per Location – 2015-2023 Historical Figures – Forecasts for 2024 and the Next 5 Years

Page – 44 Operating Expense Detail – Employee Expenses: Annual Payroll, Health Insurance, Defined Benefit Pension Plans, Defined Contribution Plans, Other Fringe Benefits, Contract Labor Costs, Incl. Temporary Help – Property Expenses: Lease and Rent for Buildings, Offices, Stores, Repairs and Maintenance to Buildings, Purchased Electricity, Purchased Fuels (except motor fuels), Water, Sewer, Refuse, Other Utility Payments – Equipment Expenses: Expensed Equipment: Lease and Rent for Machinery and Equip., Repairs, Maint. to Machinery and Equip., Depreciation and Amortization Charges, Other Materials, Parts, and Supplies – IT Expenses: Data Processing & Other Computer Services: Communication Services: Expensed Purchases of Software – Miscellaneous Expenses: Advertising and Promotional Services, Professional and Technical Services, Taxes and License Fees

Page 45 – Productivity & Industry Employment – Revenue per Employee – Total Industry Employees – Employees per Company – 2015-2023 Historical Figures – Forecasts for 2024 and the Next 5 Years

Page – 46 Employee Productivity by Segments – Revenue per Employee – Concentration, Business Size, Structure & Franchise

Page – 47 Employee Productivity by State – Revenue per Employee and State Rankings

Page – 48-51 Employee Productivity per MSA – Revenue per Employee

Page – 52 Industry Payroll – Payroll per Employee – Payroll per Company – Payroll per Location – 2015-2023 Historical Figures – Forecasts for 2024 and the Next 5 Years

Page – 53 Workforce Composition Benchmarks – 26 Job Categories – Management & Finance – Sales & Marketing – Technology, Engineering, Science – Service, Support & Training – Operations – Percent of Industry Employees

Page – 54 Job Categorization Pay Ranges – 26 Job Categories – Management & Finance – Sales, Service & Marketing – Operations – Pay Bands – Bottom 10% & 25%, Mean, Top 25% & 10% – Pay Bands (10%, 25%, Mean, 75%, 90%)

Page – 55 Top 20 Jobs Breakdown – Percent of Total Employees by Job – Rank Ordered by Top 20 Job Categories

Page – 56 Pay Ranges of Top 20 Jobs – Pay Bands (10%, 25%, Mean, 75%, 90%)

Page – 57 Payroll per Company by Segments – Concentration, Business Size, & Business Structure

Page – 58 Payroll per Location by Segments – Concentration, Business Size, Structure, & Franchise

Page – 59 Payroll per Employee by Segments – Concentration, Business Size, Structure, & Franchise

Page – 60 Payroll per Employee by State – Payroll per Employee – State Rankings

Page – 61-64 Payroll per Employee per MSA

Page – 65 Employees per Company by Segments – Concentration, Business Size, & Business Structure

Page – 66 Employees per Company by Segments – Concentration, Business Size, Structure, & Franchise

Page – 67 Total Employment by State – Number of Employees and State Rankings

Page – 68 Population to Every Employee by State – Number of Residents to Industry Employee – State Rankings

Page – 69-72 Total Employment per MSA

Page – 73 Locations per Company by Segments – Concentration, Business Size, & Business Structure

Page – 74-77 Locations per MSA

Product Lines Analyzed

Industry jobs analyzed, states covered, metropolitan statistical areas (msas) covered.

Abilene, TX Akron, OH Albany, GA Albany, OR Albany-Schenectady-Troy, NY Albuquerque, NM Alexandria, LA Allentown-Bethlehem-Easton, PA-NJ Altoona, PA Amarillo, TX Ames, IA Anchorage, AK Ann Arbor, MI Anniston-Oxford-Jacksonville, AL Appleton, WI Asheville, NC Athens-Clarke County, GA Atlanta-Sandy Springs-Roswell, GA Atlantic City-Hammonton, NJ Auburn-Opelika, AL Augusta-Richmond County, GA-SC Austin-Round Rock, TX Bakersfield, CA Baltimore-Columbia-Towson, MD Bangor, ME Barnstable Town, MA Baton Rouge, LA Battle Creek, MI Bay City, MI Beaumont-Port Arthur, TX Beckley, WV Bellingham, WA Bend-Redmond, OR Billings, MT Binghamton, NY Birmingham-Hoover, AL Bismarck, ND Blacksburg-Christiansburg-Radford, VA Bloomington, IL Bloomington, IN Bloomsburg-Berwick, PA Boise City, ID Boston-Cambridge-Newton, MA-NH Boulder, CO Bowling Green, KY Bremerton-Silverdale, WA Bridgeport-Stamford-Norwalk, CT Brownsville-Harlingen, TX Brunswick, GA Buffalo-Cheektowaga-Niagara Falls, NY Burlington, NC Burlington-South Burlington, VT California-Lexington Park, MD Canton-Massillon, OH Cape Coral-Fort Myers, FL Cape Girardeau, MO-IL Carbondale-Marion, IL Carson City, NV Casper, WY Cedar Rapids, IA Chambersburg-Waynesboro, PA Champaign-Urbana, IL Charleston, WV Charleston-North Charleston, SC Charlotte-Concord-Gastonia, NC-SC Charlottesville, VA Chattanooga, TN-GA Cheyenne, WY Chicago-Naperville-Elgin, IL-IN-WI Chico, CA Cincinnati, OH-KY-IN Clarksville, TN-KY Cleveland, TN Cleveland-Elyria, OH Coeur d’Alene, ID College Station-Bryan, TX Colorado Springs, CO Columbia, MO Columbia, SC Columbus, GA-AL Columbus, IN Columbus, OH Corpus Christi, TX Corvallis, OR Crestview-Fort Walton Beach-Destin, FL Cumberland, MD-WV Dallas-Fort Worth-Arlington, TX Dalton, GA Danville, IL Daphne-Fairhope-Foley, AL Davenport-Moline-Rock Island, IA-IL Dayton, OH Decatur, AL Decatur, IL Deltona-Daytona Beach-Ormond Beach, FL Denver-Aurora-Lakewood, CO

Des Moines-West Des Moines, IA Detroit-Warren-Dearborn, MI Dothan, AL Dover, DE Dubuque, IA Duluth, MN-WI Durham-Chapel Hill, NC East Stroudsburg, PA Eau Claire, WI El Centro, CA Elizabethtown-Fort Knox, KY Elkhart-Goshen, IN Elmira, NY El Paso, TX Enid, OK Erie, PA Eugene, OR Evansville, IN-KY Fairbanks, AK Fargo, ND-MN Farmington, NM Fayetteville, NC Fayetteville-Springdale-Rogers, AR-MO Flagstaff, AZ Flint, MI Florence, SC Florence-Muscle Shoals, AL Fond du Lac, WI Fort Collins, CO Fort Smith, AR-OK Fort Wayne, IN Fresno, CA Gadsden, AL Gainesville, FL Gainesville, GA Gettysburg, PA Glens Falls, NY Goldsboro, NC Grand Forks, ND-MN Grand Island, NE Grand Junction, CO Grand Rapids-Wyoming, MI Grants Pass, OR Great Falls, MT Greeley, CO Green Bay, WI Greensboro-High Point, NC Greenville, NC Greenville-Anderson-Mauldin, SC Gulfport-Biloxi-Pascagoula, MS Hagerstown-Martinsburg, MD-WV Hammond, LA Hanford-Corcoran, CA Harrisburg-Carlisle, PA Harrisonburg, VA Hartford-West Hartford-East Hartford, CT Hattiesburg, MS Hickory-Lenoir-Morganton, NC Hilton Head Island-Bluffton-Beaufort, SC Hinesville, GA Homosassa Springs, FL Hot Springs, AR Houma-Thibodaux, LA Houston-The Woodlands-Sugar Land, TX Huntington-Ashland, WV-KY-OH Huntsville, AL Idaho Falls, ID Indianapolis-Carmel-Anderson, IN Iowa City, IA Ithaca, NY Jackson, MI Jackson, MS Jackson, TN Jacksonville, FL Jacksonville, NC Janesville-Beloit, WI Jefferson City, MO Johnson City, TN Johnstown, PA Jonesboro, AR Joplin, MO Kahului-Wailuku-Lahaina, HI Kalamazoo-Portage, MI Kankakee, IL Kansas City, MO-KS Kennewick-Richland, WA Killeen-Temple, TX Kingsport-Bristol-Bristol, TN-VA Kingston, NY Knoxville, TN Kokomo, IN La Crosse-Onalaska, WI-MN Lafayette, LA Lafayette-West Lafayette, IN Lake Charles, LA Lake Havasu City-Kingman, AZ Lakeland-Winter Haven, FL Lancaster, PA Lansing-East Lansing, MI

Laredo, TX Las Cruces, NM Las Vegas-Henderson-Paradise, NV Lawrence, KS Lawton, OK Lebanon, PA Lewiston, ID-WA Lewiston-Auburn, ME Lexington-Fayette, KY Lima, OH Lincoln, NE Little Rock-North Little Rock-Conway, AR Logan, UT-ID Longview, TX Longview, WA Los Angeles-Long Beach-Anaheim, CA Louisville/Jefferson County, KY-IN Lubbock, TX Lynchburg, VA Macon-Bibb County, GA Madera, CA Madison, WI Manchester-Nashua, NH Manhattan, KS Mankato-North Mankato, MN Mansfield, OH McAllen-Edinburg-Mission, TX Medford, OR Memphis, TN-MS-AR Merced, CA Miami-Fort Lauderdale-West Palm Beach, FL Michigan City-La Porte, IN Midland, MI Midland, TX Milwaukee-Waukesha-West Allis, WI Minneapolis-St. Paul-Bloomington, MN-WI Missoula, MT Mobile, AL Modesto, CA Monroe, LA Monroe, MI Montgomery, AL Morgantown, WV Morristown, TN Mount Vernon-Anacortes, WA Muncie, IN Muskegon, MI Myrtle Beach-Conway-North Myrtle Beach, SC-NC Napa, CA Naples-Immokalee-Marco Island, FL Nashville-Davidson–Murfreesboro–Franklin, TN New Bern, NC New Haven-Milford, CT New Orleans-Metairie, LA New York-Newark-Jersey City, NY-NJ-PA Niles-Benton Harbor, MI North Port-Sarasota-Bradenton, FL Norwich-New London, CT Ocala, FL Ocean City, NJ Odessa, TX Ogden-Clearfield, UT Oklahoma City, OK Olympia-Tumwater, WA Omaha-Council Bluffs, NE-IA Orlando-Kissimmee-Sanford, FL Oshkosh-Neenah, WI Owensboro, KY Oxnard-Thousand Oaks-Ventura, CA Palm Bay-Melbourne-Titusville, FL Panama City, FL Parkersburg-Vienna, WV Pensacola-Ferry Pass-Brent, FL Peoria, IL Philadelphia-Camden-Wilmington, PA-NJ-DE-MD Phoenix-Mesa-Scottsdale, AZ Pine Bluff, AR Pittsburgh, PA Pittsfield, MA Pocatello, ID Portland-South Portland, ME Portland-Vancouver-Hillsboro, OR-WA Port St. Lucie, FL Prescott, AZ Providence-Warwick, RI-MA Provo-Orem, UT Pueblo, CO Punta Gorda, FL Racine, WI Raleigh, NC Rapid City, SD Reading, PA Redding, CA Reno, NV

Richmond, VA Riverside-San Bernardino-Ontario, CA Roanoke, VA Rochester, MN Rochester, NY Rockford, IL Rocky Mount, NC Rome, GA Sacramento–Roseville–Arden-Arcade, CA Saginaw, MI St. Cloud, MN St. George, UT St. Joseph, MO-KS St. Louis, MO-IL Salem, OR Salinas, CA Salisbury, MD-DE Salt Lake City, UT San Angelo, TX San Antonio-New Braunfels, TX San Diego-Carlsbad, CA San Francisco-Oakland-Hayward, CA San Jose-Sunnyvale-Santa Clara, CA San Luis Obispo-Paso Robles-Arroyo Grande, CA Santa Cruz-Watsonville, CA Santa Fe, NM Santa Maria-Santa Barbara, CA Santa Rosa, CA Savannah, GA Scranton–Wilkes-Barre–Hazleton, PA Seattle-Tacoma-Bellevue, WA Sebastian-Vero Beach, FL Sebring, FL Sheboygan, WI Sherman-Denison, TX Shreveport-Bossier City, LA Sierra Vista-Douglas, AZ Sioux City, IA-NE-SD Sioux Falls, SD South Bend-Mishawaka, IN-MI Spartanburg, SC Spokane-Spokane Valley, WA Springfield, IL Springfield, MA Springfield, MO Springfield, OH State College, PA Staunton-Waynesboro, VA Stockton-Lodi, CA Sumter, SC Syracuse, NY Tallahassee, FL Tampa-St. Petersburg-Clearwater, FL Terre Haute, IN Texarkana, TX-AR The Villages, FL Toledo, OH Topeka, KS Trenton, NJ Tucson, AZ Tulsa, OK Tuscaloosa, AL Tyler, TX Urban Honolulu, HI Utica-Rome, NY Valdosta, GA Vallejo-Fairfield, CA Victoria, TX Vineland-Bridgeton, NJ Virginia Beach-Norfolk-Newport News, VA-NC Visalia-Porterville, CA Waco, TX Walla Walla, WA Warner Robins, GA Washington-Arlington-Alexandria, DC-VA-MD-WV Waterloo-Cedar Falls, IA Watertown-Fort Drum, NY Wausau, WI Weirton-Steubenville, WV-OH Wenatchee, WA Wheeling, WV-OH Wichita, KS Wichita Falls, TX Williamsport, PA Wilmington, NC Winchester, VA-WV Winston-Salem, NC Worcester, MA-CT Yakima, WA York-Hanover, PA Youngstown-Warren-Boardman, OH-PA Yuba City, CA Yuma, AZ

Kentley Insights is the leader in data-rich market research with coverage of over 1200 industries and 2000 product lines. All the top consulting firms, banks, accounting firms, private equity firms, and many of the Fortune 1000 depend on Kentley Insights for their in-depth market research needs.

100% MoneyBack Satisfaction Guaranteed

If you purchase the 2024 Gyms and Fitness Centers Market Research Report on KentleyInsights.com and you don’t find $295 worth of value in the report, just let us know what it was missing, and we’ll give you a 100% refund . We stand by our reports and want to make your purchase as effortless as possible.

Fitness Tracker Market Size & Share Analysis - Growth Trends & Forecasts (2024 - 2029)

The Report Covers Global Fitness Tracker Market Technology & Share by Brand and it is Segmented by Product Type (Fitness Band, Smart Watches, and Others), By Sales Channel (Offline and Online), By Wearing Type (Hand Wear, Leg Wear, Head Wear, and Others), By Application (Heart Rate Monitoring, Sleep Measurement, Glucose Measurement, and Others), and Geography (North America, Europe, Asia-Pacific, Middle East, and Africa, and South America).

- Fitness Tracker Market Size

Need a report that reflects how COVID-19 has impacted this market and its growth?

Fitness Tracker Market Analysis

The fitness tracker market is projected to register a CAGR of 15.7% during the forecast period (2022-2027).

During the COVID-19 pandemic, the demand for fitness tracker products has been seen increasing due to a lot of consumption and usage of these devices to monitor heart rate and oxygen levels in the body during the pandemic. This raise in adoption has resulted in increased research and development activities in the fitness tracker segment by the key players in this market. Furthermore, the demand for these fitness trackers has increased as these gadgets are also helpful in detecting COVID-19 cases in advance. For instance, according to a study conducted by Stanford University in California in 2021, smartwatches from Apple, Gramin, and Fitbit help detect Covid-19 cases before they show signs, among asymptomatic patients. Moreover, the Covid-19 pandemic has majorly increased awareness about these devices. The increased adoption has led to the rise in device development & innovation as more market players race in to deliver the growing demand and capture a higher market share. For instance, in August 2020, Fitbit Inc. launched Sense, an advanced smartwatch that features an ECG monitor, skin temperature sensor, stress management, sleep monitor, SpO2 levels monitor, built-in GPS, period tracker, and 20+ exercise modes. Thus, COVID-19 has a significant impact on the target market.

Certain factors which have contributed to the growth of the market include rising awareness among people on health, rising prevalence of cardiovascular diseases (CVD) and obesity, and growing penetration of the internet and smartphones among others. Many people are focusing on their health and are engaged in physical activities such as walking, running, cycling, and other recreational activities. Physical activity has been shown to aid in the prevention and management of non-communicable diseases such as heart disease, stroke, diabetes, and a variety of malignancies. It also aids in the prevention of hypertension, the maintenance of healthy body weight, and the enhancement of mental health, quality of life, and overall well-being.