Join 307,012+ Monthly Readers

Get Free and Instant Access To The Banker Blueprint : 57 Pages Of Career Boosting Advice Already Downloaded By 115,341+ Industry Peers.

- Break Into Investment Banking

- Write A Resume or Cover Letter

- Win Investment Banking Interviews

- Ace Your Investment Banking Interviews

- Win Investment Banking Internships

- Master Financial Modeling

- Get Into Private Equity

- Get A Job At A Hedge Fund

- Recent Posts

- Articles By Category

Big 4 Transaction Services: Pathway to Private Equity, or Just a Small Improvement Over Audit?

If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking . Thanks for visiting!

At some point, almost everyone “becomes interested” in Big 4 Transaction Services (TS) teams:

- Auditors fantasize about escaping from a boring, repetitive grind and moving into a higher-paying job with more interesting work.

- Aspiring investment bankers think about their Plan B options and wonder if a Big 4 job offer might be a good pathway into IB.

- Corporate finance professionals want to escape their repetitive work and assume that anything related to deals will be an improvement.

- And career changers figure that Big 4 firms might offer easier pathways into higher-paying jobs in finance, consulting, and related fields.

I could go on, but you get the idea.

The point is, everyone debates the merits of these jobs, but there’s still a lot of confusion over what “Transaction Services” means.

We’ll delve into all these points in this article, but let’s start with the basic definition:

The Transaction Services Job Description

Transaction Services Definition: Transaction Services (TS) teams at Big 4 and other accounting firms advise on specific aspects of M&A transactions, such as financial due diligence and the valuation of intangible assets, and they help buyers assess the financial risk of deals; when TS teams advise sellers, they confirm financial results and business trends to potential buyers.

The TS group may also be called “Transaction Advisory Services” (TAS), among other names.

At the large accounting firms, such as the Big 4 , Transaction Services is usually split into different sub-groups:

- Valuations and Appraisals

- Financial Due Diligence (FDD)

- Corporate Finance (may be a separate group)

- Integration Services

- “Business Recovery Services” or Restructuring (may be a separate group)

We will focus on groups #1 and #2 (Valuations and Financial Due Diligence) here.

Corporate Finance and Restructuring are quite different and don’t fit the TS definition above, and the Integration Services group is smaller and has less readily available information.

We did publish an interview about Big 4 Restructuring a long time ago, so refer to that for more details.

We’ve been using the name “Big 4 Transaction Services,” but many non-Big 4 firms and business valuation firms offer these services as well; examples include RSM, BDO, Grant Thornton, Moss Adams, and CLA.

The nature of Transaction Services roles differs heavily based on region .

In Europe, for example, TS teams analyze both historical financial information and forecasts.

But in the U.S., TS teams can analyze only past results due to regulatory differences.

As a result, you gain more exposure to actual financial modeling in European TS roles, and the exit opportunities are better.

Big 4 Transaction Services vs. Investment Banking

Professionals in TS groups work on deals differently than investment bankers.

M&A investment bankers execute the entire deal process from start to finish, including finding and contacting potential buyers and sellers, marketing the company, and negotiating the purchase agreement.

By contrast, Big 4 TS teams:

- Work on only one specific part of the deal (e.g., when a potential buyer is conducting due diligence, or when a deal is closing and the buyer needs to integrate the company and re-value the seller’s Balance Sheet ).

- Are paid on an hourly basis with fees that are not linked to the deal closing successfully.

- Earn fees per engagement somewhere in the $200K – $800K USD range , which is less than what investment banks earn even on “small deals” (but the collection probability is also much higher).

The exceptions here are the Corporate Finance and Restructuring teams at Big 4 firms, but they’re often considered separate from Transaction Services (see below).

Valuation vs. Financial Due Diligence vs. Integration Services vs. Corporate Finance vs. Restructuring

There are many groups within or around “Transaction Services,” so it’s worth explaining how they differ.

The Valuation, Financial Due Diligence, and Integration Services teams all advise on specific aspects of deals and get paid for specific projects, so they fit the definition above.

The Valuation group, similar to business valuation firms , usually works on tasks like purchase price allocation , re-valuing sellers’ assets and liabilities in M&A deals, Goodwill impairment testing, and the valuation of financial assets.

If you’re in the group, you’ll learn far more about valuation than the average banker, but you won’t get much exposure to entire deal processes or other types of modeling.

The Financial Due Diligence (FDD) group digs into companies’ financial statements to highlight trends and identify “red flags” before buyers complete M&A deals.

For example, they might determine the key revenue drivers over the past few years, figure out the company’s cash conversion cycle , determine whether or not the provided EBITDA figures are accurate, and find the company’s “true debt” levels (including hidden and off-Balance Sheet items).

Something like operating leverage could also be a focal point, and they could dig into metrics such as Days Sales Outstanding .

They might also calculate the most common liquidity ratios , including the current ratio , quick ratio , and cash ratio , and make adjustments to determine their true values and the key trends over time.

Quality of Earnings (QoE) reports to assess a company’s recurring earnings and the validity of its accounting policies are also common.

The FDD team typically does this work during the bidding phase of an M&A deal, when potential buyers have access to the seller’s data room.

Finally, the Integration Services team assists with the post-merger integration process when the buyer and seller’s financials, taxes, reporting, and other systems must line up.

In contrast to these three groups, the Corporate Finance and Restructuring teams are much closer to investment banking.

The Corporate Finance team at most Big 4 firms is an internal investment bank that executes entire M&A deals from beginning to end.

The experience is more relevant for IB/PE roles, but these CF teams also tend to work on smaller deals than the FDD teams.

If the TS team works on due diligence for $1 billion deals, the CF team might execute deals in the $100 million – $200 million range.

So, the CF team is more like a middle market or boutique investment bank .

The Restructuring team is a cross between Restructuring investment banking and turnaround consulting , so please see those articles for more.

Also, take a look at our past coverage of Big 4 restructuring in the U.S. and Europe .

Recruiting: How to Join a Big 4 Transaction Services Group

Some Transaction Services groups hire candidates directly out of undergraduate or MBA programs, but internal hires from other groups, such as audit, tend to be more common.

On-campus recruiting, when it happens, usually takes place at the top ~10 schools in the country for accounting, which are different from the “target schools” for investment banking.

For example, in the U.S., the list might include universities like Notre Dame, the University of Illinois at Urbana-Champaign, UT Austin, BYU, Michigan (Ann Arbor), and others in that tier.

There is some overlap with the top schools for IB recruiting, but relatively few students from the Ivy League and equivalent schools end up in these roles.

An accounting degree helps, but it’s not necessary if you’ve had enough relevant work experience, and you already have the required Excel, accounting, and analytical skills.

The CA or CPA certifications can help if you’re moving into TS from another full-time job; accountants take these credentials more seriously than bankers (but again, it’s region-dependent).

If you want to move from audit to Transaction Services , hiring usually occurs after tax season each year.

However, you may need to network for around a year to get to know everyone in the TS group and maximize your chances.

So, you might be looking at 2-3 years to move from audit to TS.

If you want to improve your chances, involve yourself in the audits of acquisitive companies or ones with complex issues around revenue recognition, stock-based compensation, or intangible assets.

Transaction Services Interview Questions

If you network your way into the interview process, you can expect a few rounds of interviews with behavioral/fit and technical questions, potentially a case study or Excel test, and then a final-round interview with the Partners.

The interview questions are very similar to investment banking interview questions , but they’ll focus more on accounting and valuation and less on topics like LBO modeling.

For example, expect questions about what the Change in Working Capital means, EBIT vs. EBITDA vs. Net Income , and “accountant only” topics like trial balances and how to walk through events using debits and credits rather than financial statement changes.

The case study or Excel test could involve almost anything, so here are a few examples and practice exercises:

- Excel Database Functions

- Excel Practice Test for Interviews with INDIRECT, MATCH, and SUMIFS

- INDEX/MATCH Tutorial

- 3-Statement Modeling Case Study (30 Minutes)

The Transaction Services “Work Product”

It’s difficult to find real examples of the reports that TS teams write because there’s no disclosure requirement.

I managed to find one short, partially redacted example, which you can access below:

- Taylor Torrington and Associates – Financial Due Diligence Report (PDF)

Just like an investment bank can advise the buyer or the seller in an M&A deal, a TS team can also advise either party.

If the seller hires the TS team, the deliverable is usually a “vendor due diligence” (VDD) report that makes it easier for potential buyers to analyze the seller’s business before placing a bid.

If the buyer hires the TS team, the output is usually a “due diligence report” based on the seller’s data or a review of the seller’s existing VDD report, where one TS team challenges the conclusions and adjustments of another TS team.

Besides the tasks mentioned above – analysis of revenue drivers, normalization of metrics like EBITDA and EPS, Working Capital and cash conversion cycle analysis, and determination of “true debt” levels – a few others include:

- Detailed revenue analysis , broken down by customer, channel, geography, and product.

- Customer contract analysis , including any onerous or hidden terms.

- Trial balance analysis to detect shenanigans in the underlying debits and credits.

- Lease analysis , where the team estimates the ongoing costs and rental increases from existing leases and the ones that need to be renewed.

- Revenue and EBITDA bridges that demonstrate how both metrics have changed based on products, channels, and customers.

- Budgeted vs. actual numbers to judge the accuracy of management’s past forecasts.

- Inventory analysis , including aging, inventory by product, average levels, and provisions.

- Review of financial forecasts (outside the U.S.) to determine whether they’re completely fictional or somewhat believable.

Professionals in the TS / FDD teams may also interview management about everything above, and they’ll write a detailed report with their findings at the end of the process.

If you’re in the valuation team, your work tasks will be similar to the ones covered in the business valuation firms article, with a focus on numbers rather than written reports.

What Do You Do as an Associate, Manager, Director, and Partner?

The hierarchy in Transaction Services differs a bit from the ones in investment banking and private equity careers , and the general shape looks like this:

- Associate or “Consultant” – The entry-level role, where you do a lot of data and financial analysis (~2 years for a promotion from here).

- Senior Associate or “Senior Consultant” – The next level up; similar work, but you get the more interesting bits (~3 years for a promotion).

- Manager – You lead the Associates and review their work to write the reports (~3 years for a promotion).

- Senior Manager – You lead the Managers, perform reviews, and delegate work to everyone else (~3-6 years for a promotion)

- Director / VP – You do final reviews of the FDD and valuation reports and start managing client relationships (promotion time is highly variable).

- Partner – This one is divided into Junior Partner and Equity Partner roles, and your job at this level is to win new clients and more business from existing clients.

If you perform very well, you might reach the Partner level in 10-15 years.

But don’t be fooled: it’s not necessarily “easier” to reach the top than in investment banking because the turnover is also lower .

In particular, it’s difficult to get promoted beyond the Manager level because few people leave the job at that stage, and you need to start showing evidence of your ability to generate revenue to advance.

Transaction Services Salary, Hours, and Lifestyle

Let’s start with the hours and lifestyle since those are easier to describe: expect to work around 50-60 hours per week .

There are occasional late nights and weekend work, but nothing like the frantic nature of investment banking.

In normal, non-pandemic times, you might also have to travel to client sites occasionally, but far less than the travel schedule required in management consulting.

Before giving the compensation ranges, it’s important to explain the Transaction Services business model.

The fees from TS engagements are lower than audit fees, but the margins on the engagements are higher .

Many deals are staffed with a Partner or Director, a Senior Manager, and 2-3 Managers and Associates.

If an engagement takes a few professionals a month to complete, and it results in $300K in fees, that’s a very healthy profit for the firm.

The budget for each engagement is 100% negotiable with the client, and in some cases, firms end up billing clients less if a deal falls through – because of relationships and the desire to win future work.

These factors explain why total compensation (salary + year-end bonus) is higher than audit compensation but lower than investment banking salaries :

- Associate: $80K – $100K Base + Up to 30% bonus ($100K – $130K total)

- Senior Associate: $115K – $145K Base + Up to 30% bonus ($150K – $190K total)

- Manager: $150K – $190K Base + Up to 30% bonus ($200K – $250K total)

- Senior Manager: $190K – $220K Base + Up to 30% bonus ($250K – $290K total)

- Director / VP: $220K – $300K Base + Up to 30% bonus ($290K – $390K total)

- Partner: $600K – $2 million+ in total compensation (if profits for the Equity Partners that own part of the firm are also counted)

NOTE: Compensation figures as of 2022.

The average total compensation for a Partner is probably just above $1 million, depending on bonus levels and profit share in the year.

There are cost-of-living adjustments, so expect lower compensation if you’re in a cheaper location outside major financial centers.

For all positions except Partner, the base salary comprises the bulk of the total compensation; the year-end bonus might be a max of 30% of your base salary.

Often, the best way to increase your earnings is to switch to a different firm and negotiate for a higher salary and bonus.

Promotion Within Transaction Services Groups

You might now be thinking, “Well, the pay is lower than IB or PE pay, but I can just grind it out until the Partner level and earn a lot!”

Not so fast: 1-2% of new hires might eventually become Junior Partners.

And even fewer will make it to the Equity Partner level, where total compensation moves over $1 million due to ownership in the firm.

To reach those levels, you need to generate millions of dollars in revenue each year.

An average assignment could be worth something in the low-hundreds-of-thousands range, so that requirement translates into 10-20 signed engagements each year.

So, it’s arguably even more difficult than what a Managing Director in investment banking does because an MD can close a large deal or two and earn their pay.

Juggling dozens of clients and potential clients and trying to win assignments from them requires more multi-tasking and constant attention.

Oh, and if you do not advance to the Partner level, your exit opportunities are fine, but not spectacular:

Transaction Services Exit Opportunities

The top question here is “Can I get into private equity ? I’m dreaming of private equity. Can I break into Blackstone or KKR directly from a Big 4 TS team?”

And the answer is “No, probably not .”

Some people do move from TS into private equity, but this usually happens:

- Outside the U.S.

- At smaller/startup funds.

- If you’ve worked with highly relevant clients, such as PE firms executing deals and bolt-on acquisitions .

The issue with moving directly into private equity is that you don’t gain experience working on entire deals from start to finish in TS.

It makes more sense to use a TS role as a springboard into investment banking or the internal IB team (“Corporate Finance”) at the Big 4 firm, and then move into PE from there.

Other exit opportunities depend on how long you’ve been working in the TS group:

- 1-3 Years: It’s possible to win IB roles, but more so at boutique and middle market firms; FP&A roles in corporate finance , corporate development jobs , and certain consulting roles are also plausible.

- 4-6 Years: You could get into corporate development , but investment banking gets more difficult at this stage because you’ll be over-qualified for Analyst roles. Corporate finance is still an option.

- Past 6 Years: At this stage, you should just stay and make a run for a Partner-level role. If you want to leave, maybe move to a client and perform their valuations and due diligence in-house.

Is a Big 4 Transaction Services Team Right for You?

Overall, Transaction Services jobs are “OK.”

In terms of Plan B options for winning IB/PE roles, my view is that corporate banking and even independent business valuation firms come out ahead.

The main problem is that TS is an indirect/lengthy way to break into the industry because:

- You usually need to join another Big 4 group, such as audit, and work there for a few years…

- …and then move into TS, work there for a few years…

- …and then move into IB.

- And there’s still no guarantee of winning this IB role because it depends on your region, clients, and the hiring market at the time.

Big 4 TS teams make the most sense if:

- You want to stay in the industry and work at a Big 4 firm for the long-term;

- You want to get into corporate development or win a related corporate role without doing IB first; or

- You’re in a region like Europe, where it’s somewhat easier to move into IB/PE due to the skillset differences.

Longer-term, there is also some risk of commoditization and automation because reviewing a company’s historical financial information is not exactly rocket science.

Yes, humans will always need to be involved, but with more advanced technology, lower headcounts could potentially support client engagements.

That said, the Transaction Services group beats audit in terms of pay, work, and exit opportunities.

So, if you’re bored to tears in your audit role and itching to do something different, TS is a good place to start.

If you liked this article, you might be interested in reading

- The Corporate Finance Analyst: Promising Career Path, or “Plan B” if Investment Banking Doesn’t Work Out?

- The Full Guide to Lateral Hiring in Investment Banking

- Corporate Development Careers: The Definitive Guide

About the Author

Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street . In his spare time, he enjoys lifting weights, running, traveling, obsessively watching TV shows, and defeating Sauron.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Read below or Add a comment

63 thoughts on “ Big 4 Transaction Services: Pathway to Private Equity, or Just a Small Improvement Over Audit? ”

Hi Brian, thank you so much for the insightful articles. I noticed you mentioned big 4 corporate finance a bit here, do you have an article that provide more insights over the big 4 corporate finance? (e.g. difference between IB, how to break into it, qualifications, exit opportunities). I am currently in audit and looking for a change. Appreciate your help!

We don’t have anything on Big 4 CF vs. IB, specifically. But there are a few other articles on Big 4 groups if you do a search:

https://mergersandinquisitions.com/?s=big+4

Some are much older, but I don’t think too much changes over time other than the salary/bonus levels. I’ll see if we can cover this topic in the future.

Hey brian can you tell me what is the percentage chance of winning IB Analyst role from Big 4 TAS/TS? Is it too difficult to convert from Big 4 to IB? And what percentage of the chances are very good win IB analyst role from Big4 TAS/TS?

I can’t give you an exact percentage because I don’t know how many Big 4 professionals apply for IB Analyst roles, but I would say it’s “doable but not necessarily easy.” The problem is that many people take these Big 4 roles with the aim of moving into IB eventually, and lateral hiring for IB roles comes and goes in waves based on market conditions and deal activity. So you’re up against a lot of competition and not-very-consistent open spots at banks. If you put in enough effort over a long enough period, you should be able to find something, but it might be at a smaller bank.

These salary numbers are laughably off…managers aren’t taking home 250k, and seniors aren’t doing 190k lol. all these pay ranges need to drop down level outside of partner. Also, seniors get a max bonus of maybe 12%, it’s a formula at most Big 4. A&M is the only firm that is paying above big 4 and it’s just a sell side shop.

The original version of this article from ~2 years ago had lower numbers, but then people left comments saying they were too low, at least in the U.S. So we increased them based on these comments.

Since 2022 was a terrible year for most finance firms, including banks and the Big 4, bonuses are now lower and below the ones here. And outside the U.S., I don’t think they were ever close to these figures.

The point here is that salaries and bonuses sometimes change slowly over a long period (2010 – 2019) and sometimes very quickly in a short period (2020 – 2022). We will probably revisit this topic and update the ranges later this year or just eliminate them altogether. Keeping track of Big 4 salaries/bonuses each year adds exactly $0 to my revenue, given that it’s not at all the core focus of this site, so it is not very high on the priority list.

Do you know what an associate salary range would be at a non big 4 firm?

Traditionally, non-Big 4 firms paid around 20% less than the Big 4 firms, but the last data point I have is from 4-5 years ago, so I’m not sure currently. I would imagine that there is still a discount, but no idea if it’s closer to 10%, 30%, or something else now.

Do exit options between Valuation and FDD differ?

Maybe a little, but the difference is very small vs. working in a completely different group or firm type. Valuation is arguably better for the types of exit opportunities discussed on this site because it’s closer to what bankers do; FDD requires more in-depth accounting knowledge, but that’s less important in banking vs. understanding the story and spinning the company correctly.

Hi Brian Thanks for this amazing article I am 33 years old started working as an associate in accounting& payroll services in PwC about 14 months ago, now I got an offer from Deloitte as an associate in TS with little higher salary. Do you see it’s better to move to TS in Deloitte or stay in Accounting in PwC considering that I don’t have a big experience in accounting and I am looking for which is better in the future. Thank you

I would move to TS at Deloitte because the work is more interesting, the salary is higher, the exit opportunities are better, and you’ll learn about accounting in either one. And the brand/reputation is the same level.

Brian – I am a long-time follower of your website / content, great work. Your TS Compensation numbers are a bit outdated. I thought I’d share the new Big 4 base compensation numbers with you and your followers (bonus various and is generally up to a max of 30%): Associate ($80k – $102k), Senior Associate ($117k – $145k), Manager ($156k – $188k), Senior Manager ($186k – $216k), Director ($216k – $301k). Partners ($600k – $2M) – most partners sit at $1.XXM.

Thanks, updated.

Hi Mr.Brian. For starters, immensely thankful for coming up with this article. Quite insightful and exhaustive. Truly helpful for professionals who have just started our careers in the finance domain.

Question: I am a 27 year old engineer male, passed cfa level 1, with 2.8 years work ex at Morningstar, Senior Research Associate. Now having done my MBA in finance, I in my last semester right now, i have accepted an offer from Grant Thornton India, Strategy and Transactions team. Basis my profile, can you enlighten me about what i can expect in this role and what are my exit opportunities. Also how should i go about my career from here on, if my finally wish to land up in one of the below 5 roles and, whether it possible at all to transition to these: 1. equity research 2. credit analyst 3. private equity 4. venture capital 5. corporate finance

This article is old but covers the Big 4 TS in India:

https://mergersandinquisitions.com/india-big-4-transaction-services/

Salaries have probably changed over time, but the points about the work, careers, exit opportunities, etc., are similar/the same.

Can you please comment on whether research analyst/associate jobs, be it in PE, IB etc. offer 401K contributions and match as part of the compensation package? I think 401k is a very important part of a job offer for me.

I believe they do, at least at the large banks, but I do not have the details on these packages, as people rarely report them along with salary and bonus figures.

Is working in FDD or in Valuation better to break into corporate development

I don’t think there is a huge difference, but valuation is probably better (slightly) because much of the work in corporate development involves analyzing and valuing target companies to estimate how much your firm might pay for them. FDD skills can still be useful, but more at the stage when your company is already serious about making the acquisition, which doesn’t happen that often vs. doing a high-level target search.

Great article.

Just to add, CF team at b4 regional office.

In UK, pay is significantly lower than described, esp for first 2 years.

Of our small team, 80% are internal hires from audit (usually high performers with 1-3 years exp) and 20% external hires at assistant manager level

Broadly looking more into direct graduate hires, 3 new coming this year w/ now summer internships too for CF specifically within TAS at regional offices.

CF is pretty much how you describe, operates like a MM

Thanks for adding that.

Thanks for the article, Brian – feels like you’ve got an article for almost every question on my mind! I’m heading for a globally top 10 ranked MBA in Europe later this year, after working in a big 4 valuation team (back office for US clients). I didn’t work directly in the IB team, but I have been through the same trainings, have modelled LBOs, made decks for deals and have done due diligence valuation work for tons of PE/VC portcos.

How would you rate my chances of making it into the PE/VC arena? I do lack the end-to-end deal experience, but I am willing to put in the elbow grease if there’s even a 5% shot. Also, keeping in mind that the job markets I will target will be European.

I think you have a fairly good shot if you have this type of relevant experience (even if it wasn’t officially “working on deals”). The biggest issue will probably be that there are fewer MBA-level roles in Europe in general, so they’re arguably more competitive to win. But you should have as good a chance as anyone outside of former IB/PE professionals who are just going back into the field (no idea why they bothered with MBAs to begin with).

Enjoy your work on here. Thanks for all the perspectives and data points. Have a quick point on comp ranges listed here. I have been a senior associate/senior consultant at two of the Big 4 firms in deals consulting over the last three years and my base salary alone across both firms (~$165k) is at the upper end of what you have listed for Senior Manager, and I know from discussions with other senior associate/senior consultant peers, that they are being paid similarly. Just wanted to point this out for you.

Thanks. We update the salaries in these articles periodically, usually once every few years once they’ve changed enough to justify an update.

Recently graduated from a target Canadian school, previous internships include LMM PE and a top MM IB. For poor health and familial reasons, I wasn’t able to participate in IB recruiting, and signed with Big 4 M&A Tax Advisory. I was hoping to find my way back to IB after getting my CPA a year or two down the line, and was wondering if you had any insight into a viable path, or potential opportunities that I might have access to with these credentials. Thanks so much.

The best approach here is to move into a more relevant group at the Big 4 firm (valuation, the internal bank, etc.) and then use that to lateral into an IB role. Another option might be to join the valuation/transaction team at a smaller/independent firm and move in. Another degree, MBA, etc., is unnecessary with that type of experience.

This is the first time, I am interacting with B4. Actually, I am from India NCR region. I am B-tech graduate in Electronics and Communication and working in Transaction Services as a senior trade processor for Deutsche Bank in BPO sector since 2016. Now I m pursuing MBA in Finance. Please suggest me how can I look my upcoming future in IB. And Kindly suggest what steps should I take in upcoming times.

OK, so the market in India is completely different, and most IB recruiting only takes place at the top IIMs. So I would read this article before you do anything else:

https://mergersandinquisitions.com/investment-banking-india/

Hi Brian, I am a recent grad from semi target and just started working at Big 4 business valuations group a few months ago. However, I came across an opportunity at BB in leveraged lending group (in their corporate banking/credit division). Which role do you think has better chance of transitioning to IB?

The leveraged lending group, easily. People move from corporate banking into investment banking fairly often.

Excellent article, thank you. Can you recommend a source that would sort the specific services by industry deal type/experience? I’m looking for financial due diligence and valuation on a merger project, specifically in the direct hire executive recruitment space. Finding CPA and CFA firms that have supported M&A in this world is challenging. Plenty of staffing…endless…but the direct hire search side is very different. Nevertheless, thanks for the article.

Sorry, I cannot. This site focuses on careers in these fields, not the services that different providers offer, so we don’t track this information.

Hi Brian – thanks for the article. I have 3 years experience in transactional banking (sales of treasury products like trade finance, cash management…) at a big bank looking to transition to structure/project/infrastructure finance at a BB. I have an opportunity to join a big 4 in their infrastructure deals advisory practice and tasks would be financial modelling (buy side modelling not acting as an advisor on the deals), risk analysis, business cases etc with most clients seemingly in the public sector. Would spending 1-2 years there be a good stepping stone to project/structured finance at a BB? Or maybe 1-2 years there -> M7 MBA -> BB? I’m based in Canada and open to relocate to US/UK if easier.

Yes. I think you might need a top MBA just because 4-5 years of experience is pushing it in terms of being able to join a large bank as an Analyst. The US and UK are much better for IB recruiting than Canada for a host of reasons (more positions, higher turnover, more exit opportunities), so I would recommend relocating if possible.

Hi Brian, Is the PwC edge program which provides rotations across PwC deals functions a good starting point in my career? Can it lead to Investment banking roles in the Middle East?

Not familiar with it, but if it gives you rotations in some of the groups mentioned in this article, sure. It is more common to move from the Big 4 into IB in the EMEA region.

Thanks for the article, TAS seems intersting with more normal working hours and i’m in ‘late to the game career switcher’ group

Currently passed cfa lvl 2 and hopefully this meant something on big 4 TAS

Regarding Valuation vs FDD division, which one is more suitable to cfa based person from non accounting background?

And which one have better working hours?

FDD is probably more directly relevant to the CFA, but they’re quite similar. Not sure about work hour differences.

Hi Buds, I’ve worked both in Valuation and FDD as an Associate in a Big 4 TAS for around 2 years. Not yet a CFA myself but I agree with Brian that CFA is more useful in FDD. As to working hours, I think there are other factors that come to play such as the number and size of engagements you handle. But based on my experience, FDD usually involves more analyses compared to Valuation where at times it’s more of a plug and play.

Hi Brian. Currently in my third year of TAS in Chicago where I’ve done both FDD and Management/Operational consulting projects for a wide range of clients (ranging from F500 to $10M manufacturing companies). Interested in making a move to sell-side IB and have a great network to lean on to potentially make this happen. My only hesitation is that I’ve already received my non-target MBA during my 4 years of school (due to being on scholarship for D1 basketball & coming into school with a semesters worth of AP credits – it was that or double major at the time), and I’m wondering if this hurts me. I know my options are probably more limited to smaller boutiques / regional banks if anything, but wanted to hear your thoughts on feasibility of this move / if it makes sense to you.

Realize it’s not a traditional path by any means, but I have relevant skills/experience now (from both FDD/QofE projects and consulting engagements) and am hoping it’s not too late for me to break in. Also, been reading a lot on how COVID has caused a lot of turnover in IB, so wondering if this would help my chances or if you’ve also heard this. Thanks a lot for any advice/input!

It may hurt you a bit at the large banks because they won’t necessarily know what to do with you, but smaller firms might be more open to it. It’s usually very difficult to get in via a non-target MBA, but you’re an exception since you have directly relevant experience. Yes, turnover is definitely higher in IB now because work-from-home has made everyone depressed. I think you should just start networking with a variety of different banks and see what turns up.

Hi Brian, this article seems to focus more on TAS from an experienced associate/auditor POV but it looks like in recent years, this space has been opened up to undergraduate students. As a student who was only able to get an FDD internship for my junior internship, what would you recommend as next steps? Should I accept a FT and try to get an M7/T10 MBA after a couple of years? Recruit for a boutique IB firm for FT? I’m pretty fixed on getting my MBA though so I’m not sure what would look better. Try recruiting for FT CB at a BB? Any advice would help!

Accept a FT offer and then try to move into IB as a lateral hire. I don’t really think you need an MBA to transition into IB if you have that type of experience. Only do it if networking / lateral recruiting does not work.

Hey Brian, This summer, I’ll be working at a Big 4 firm in their Business Tax Consulting division, where I’ll be working exclusively with Financial Services companies. I will be applying to IB summer internships next year. Do you think this Big 4 internship is relevant enough for IB or should I look for more relevant internships? I’m in London if that helps and already had an investment banking spring week, along with a consulting one and asset management one. Thanks!

It’s good enough.

I am currently doing federal tax at big 4 for a year now. I want to move into TS valuation and modeling. What do you think is the chance? Thanks!

It’s possible, but you need to start far in advance and network extensively to get in. See: https://mergersandinquisitions.com/big-4-transaction-advisory-services-corporate-development-financial-institution/

Would you advise doing a traineeship at big 4 TS in Europe. Here i will work at 4 different TS departmemts during 2 years.

Or would you recommend to go for a PE or CF boutique directly if possible?

What are your goals? If you want to do IB, go to a PE or CF boutique. If you want to stay in the Big 4, do the Big 4 TS traineeship.

Insightful article as always. I’ve been a long time reader and you articles have helped me to secure 2 offers from Big 4 Advisory/Transaction services. However, these 2 roles are quite different and I’m not sure which offer to accept, so I would appreciate if you could give me some insights in terms of the career prospects and exit opportunities. Some details of the roles below:

1. Deloitte: Associate – M&A Group (Commercial Strategy & Research) – Financial Advisory – 50% Strategy/consulting projects for corporates, 50% on M&A deals, mostly pre-deal commercial due diligence

2. EY: Strategy and Transactions – Valuation modelling and economics – Mostly modelling work on asset valuation. ~60% time working with audits, rest of the time works on deals, litigation etc.

As you can see, these two positions are quite different in nature and it may lead to a very different career path down the road. So I was hoping to learn what would be the prospects and exit ops for each respectively.

Thanks, and I look forward to hearing back from you.

Thanks. The second one is probably better because you’ll at least be doing some modeling work there. The first one sounds very qualitative, and you may not get “credit” for deal experience there. 60% of your time spent on audits isn’t great, but at least you’ll be able to point to some exposure to valuation and modeling for specific clients.

I see – what about exits to corporate development? Would the first one provide good exit opportunities to corp dev? I quite like the first one as the work seemed more interesting but I’m not sure what kind of exits it would provide.

Potentially, yes, but it’s hard to say because the description sounds vague. But I don’t think there’s a huge difference between them, at least not based on the descriptions.

Brian – what do you recommend if a candidate has too much non finance experience (eg. 10 yrs of accounting + auditing) if they should leave out those experience off the resume if applying for the analyst/associate level opening at PE?

Potentially, yes, but you do still have to list a university and graduation date. I think you could get away with leaving out the oldest ~5 years of experience and maybe just add a line that says you started out in audit and moved into some other group at your firm.

Thanks for your insightful article. I Would like to receive your opinion, I did 6 years in banking in treasury, capital markets, Murex projects, and derivatives analysis, then I did 3 years of equity research and finally 3 years in consulting in Europe at functional corporate banking activities such as capital markets, Murex and cash management. I got a master at non target school in corporate finance a few years ago. I Would like to get a job in transactions service, corporate development, M&A, corporate finance or even sales and trading, do you think I still have a change and In which field may I improve the opportunity to get interviews and job in Europe? Additionally I am around 40 years, I appreciatte your ideas and help

I think it will be difficult to move into any of those at this stage without an MBA. Maybe transaction services or corporate development, but you have a long work history that might be difficult to summarize/explain.

Not sure if this exists in the US but other parts of the world also have a dedicated modelling team which sit close to the valuation team. Except their main deliverable is a model for clients to use or auditing a model created by a client. This can range from valuation modelling, project finance modelling, operational modelling to really random pieces of work like HR payroll modelling – so experience can vary vastly and dictate what future exit opps you may get. Generally this team can place quite well into analyst positions at MM/Boutique IB, small PE funds, decent sized Infra PE funds, equity research and corporate development

Thanks for adding that. Yes, a dedicated modeling team that does real financial modeling can also place well in those roles. Regulations in the U.S. limit how much teams can advise on projections.

Not sure if this is true outside of the UK, but equity research is a pretty common exit too, not just from big4 TS but big4 ACAs in general.

Thanks for adding that. Yes, TS to equity research is possible as well, but it’s probably more common in Europe for similar reasons (more focus on projected financials).

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Learn Valuation and Financial Modeling

Get a crash course on accounting, 3-statement modeling, valuation, and M&A and LBO modeling with 10+ global case studies.

Loading Results

No Match Found

M&A transformation

We help clients transform their business through deals that realize strategic goals, capture value, and deliver growth.

Growing stronger through mergers, acquisitions, divestitures, and alliances

Deals present unparalleled opportunities for faster growth, stronger capabilities, and dramatic transformation. At PwC’s Strategy&, we offer integrated consulting and transaction advisory services from strategy through execution and value capture — bringing the most relevant capabilities, perspectives, and insights to your biggest M&A transformations. Our global network of deals professionals is over 15,000 strong, and teams seamlessly with our clients across their entire M&A agenda, blending the capabilities of a strategy, transaction advisory, and management consulting firm. Together, we help clients along the deals journey to capture value and sustain profitable growth.

How we can help you

Acquisitions, divestitures, deals strategy, capital markets, private equity, crisis and restructuring.

Our integrated teams draw from strategy, operations, valuation, diligence, IT, transformation, tax, and capital markets to help clients enter into the right deal, and close with speed and certainty, while unlocking hidden value from a merger or acquisition. Working with the broader PwC network, we help clients navigate the many opportunities and interdependencies associated with complex, large, and cross-border M&A deals.

Service offerings include:

- Screening, evaluating, and accessing acquisition targets, including capabilities fit

- Determining the appropriate price for the target

- Closing the deal

- Developing the future strategy and operating model of the combined entity

- Integrating both organizations

- Realizing post-deal value creation

- Managing people aspects and supporting cultural integration

Divestitures play — or should play — a key role in many companies’ growth strategy. With the rise in shareholder activism and focus on portfolio realignment, more and more companies are divesting assets to move toward stronger positions in the future. Divestitures can be a primary lever to better align your company’s portfolio with your value proposition and distinctive capabilities system.

While divestitures can be more complex than typical acquisitions, they provide opportunities to increase the overall value of your remaining business portfolio. We help clients with rigorous diligence and clear strategic vision so they can determine the right assets to divest, the right transaction structure, and the right timing to make a move."

- Determining the business to be divested and the best structure

- Identifying buyers that would benefit from the business to be divested, given their capabilities fit with the target

- Understanding tax implications and advantages

- Addressing stranded costs

- Negotiating the price and conditions for the deal

- Preparations for closing and keeping the business running

- Managing post-deal service agreements

Alliances have become pervasive in the very fabric of how business is conducted, and they will continue to grow in size, power, and influence. Indeed, borrowing capabilities via an alliance instead of building or buying them through acquisitions has become a proven way to strengthen a company’s set of capabilities. We help clients select the right partner or structure and develop a rigorous approach to manage alliances, creating real collaboration with a string of interconnected relationships that allow them to outperform the competition.

- Defining the vision and developing an explicit alliance strategy

- Identifying the critical capabilities that need to be strengthened via the acquisition

- Formulating the alliances, by screening and evaluating priority partners

- Negotiating and implementing alliances

- Setting the governance for the alliance and institutionalizing alliance capabilities

- Renewing the alliance portfolio

Seizing opportunity depends not only on developing the right strategic vision, but also moving it forward with agility and speed. Working closely with PwC Corporate Finance LLC,* we help you do both, integrating strategic perspective and execution insights throughout a deal. From assessing the potential impact of changes in your industry landscape, to helping you navigate complexity, we uncover opportunities for you to capture more value while keeping you on track to achieve your strategic goals.

- Creating deal strategy

- Assessing industry dynamics

- Optimizing the portfolio

- Serving as lead advisor

- Providing independent advice on valuation

- Developing capital structure and financing options

- Accelerating corporate goals, with end-to-end value optimization

- Helping clients fluidly navigate tax and accounting complexity

- Advancing private equity portfolio performance

A deep knowledge of capital raising and regulatory processes and a global network of professionals enables us to work with clients in the US and in principal capital markets around the world. We help you identify new ways to access capital or focus investment where it matters most. Our independent professionals equip you with the objective, unbiased guidance that you need so that you can make decisions for growing your business.

- Equity offerings, with initial public offerings and secondary offerings in the equity capital markets including reverse merger, master limited partnership, and REIT structures

- Debt offerings, with registered and exempt debt offerings including both investment-grade and high-yield

- Spinoff transactions, with separation and registration of public shares for a pro rata distribution to shareholders

- Capital structure, capital raising, and capital alternatives

- Financial structuring

- Strategic planning

- Complex accounting and reporting issues

- Independent view on investment bank and equity research analyst selection, pricing, valuation, and equity raising process

With the ability to both formulate an acquisition strategy and translate it seamlessly into detailed value improvement levers and initiatives, we help clients in the private equity space with their deals and operations improvement needs. We deliver integrated insights and effect change with the speed that private equity needs, from pre-deal analysis, through post-acquisition restructuring strategies, to advising on the right exit strategy to maximize value capture.

- Commercial due diligence

- Restructuring and turnarounds

- Exit strategy

Your business is unlike anyone else’s. That’s why our cross-functional professionals help create a unique, holistic, and strategic view of your organization and its path forward, no matter the issue at hand. From bankruptcy to liquidity constraints to underperforming businesses, our coordinated perspectives evaluate strategic and financial alternatives to get you building value for the future with speed and confidence.

We help clients find the right runway to a speedy recovery with solutions for a range of needs, from turnaround and restructuring plans to optimized exit strategies.

- Corporate reorganizations

- Evaluation of liquidity positions

- Advice on operating efficiency and margin enhancement

Case studies

Consumer goods, industrial products, financial services, transformative merger and divestiture redefines industry structure.

Strategy& assisted with the strategic assessment, pre-close planning, and post-close execution of one of the largest consumer goods deals in history, helping the client plan a simultaneous acquisition and asset sale involving two other companies. This included the establishment of complex contract manufacturing relationships, preparation for critical Day 1 transitions of field-sales execution and information management, and alignment of strategic priorities behind two brands. Our work positioned the client as number two in the industry and ensured the stand-up of a third-party competitor that was essential to clear antitrust.

Talk to one of our specialists about how we can help you

Digital acquisition accelerates omni-channel strategy

Strategy& helped a leading U.S. retailer in the due diligence, pre-close planning, and post-close execution of an online, pure play e-retailer to accelerate the client’s position in omni-channel retailing. This included evaluation of complex demand drivers such as the impact of creating tax nexus for the online player, multiple revenue synergy plays, as well as supply chain and back office integration opportunities. The successful execution of the acquisition enabled the client to first maintain a multi-website model, with a pure-play extended assortment and shop your local store formats, before ultimately bringing the entire digital model together into one of the strongest offerings in its category.

Simultaneous global merger, operating model redefinition, and REIT conversion creates massive shareholder value

Strategy& assisted a leading B2B information services provider in the largest global acquisition in its history, while simultaneously transforming the core business model for efficiency and effectiveness, and ensuring that a recently adopted REIT structure was not impaired by either move. Key levers included consolidation of operations; migration to shared, outsourced services; and a restructuring of key processes such as order to cash. The combined benefits generated more than $300 million in recurring benefits for a $4 billion global corporation.

Preparation for spin-out to create two focused Fortune 500 players in financial services and education

Strategy& helped a leading financial services client in preparing for an announced spin-out to form two separate, focused businesses. Efforts included application of our Fit for Growth methodology to ensure each entity would carry forward with an optimal cost structure and capabilities essential to perform in its market, as well as detailed financial work to prepare for legal and financial separation. The transformative separation plan was ultimately executed through a private sale of one of the divisions to a leading private equity firm.

What CEOs are thinking about

Peter Gassmann

Global Leader of Strategy&, Strategy&

Natalya Lim

Partner, Eurasia Advisory Leader, Strategy&

Kağan Karamanoglu

Partner, Strategy&

© 2022 - 2024 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

- Privacy statement

- Cookies info

- Legal disclaimer

- About site provider

Get Active in Our Amazing Community of Over 453,000 Peers!

Case study transaction services.

First time user as i am looking for some help!

I've managed to land an interview with KPMG for a role in transaction services as an Assistant manager. I was hoping if anyone has any advice on what to expect for the case study? I've had a read through on the forum but it's the level of detail on what to prepare myself for.

I have an understanding of key metrics and how to calculate them but i've never used them in a case scenario. This is my first attempt so i'm quite new to the whole process!

If anybody is able to help or shed some light on what to expect that would be much appreciated! The role itself is due dilligence so i would expect to see a heavy valuation sort of scenario.

Overview of answers

- Date ascending

- Date descending

Based on the description, it may be closer to the PE / IB M&A interview that is much more technical and detailed in the financial part. Usually, they give you much more time to prepare and do the valuation on paper / excel. Depending on the company you'll need to:

- Find the relevant information in P&L, Balance sheet, CF statement

- Do the simplified valuation using NPV: calculate cash flows and make assumptions about growth rate and discount rate

- Do the valuation using comps - you'll have to explain which comps you will use and why

- Do the valuation of the synergies

- Play with different scenarios (e.g. how the stock-price will change if the deal terms leak into media, or how should the companies behave in a bidding process)

There are two types of frameworks you may use:

- Commercial due-diligence of the target company

- Synergies calculation of two merging companies

Note also that it can be a mix of both.

1. For Due Diligence you can use the following structure:

- Growth rates

- Profitability

- Distribution channels

Competition

- Market shares of competitors and their segments (see the next point)

- Concentration / fragmentation (Fragmented market with lots of small players is less mature and easier to enter from a scratch. Concentrated market is hard to enter but has potential acquisition targets)

- Unit economics of the players (Margins, relative cost position)

- Key capabilities of the players (e.g. suppliers, assets, IP, etc)

- Unit economics (Margins, costs) in current or target markets

- Product mix

- Key capabilities

Feasibility of exit (in case of a PE company) :

- Exit multiples

- Existence of buyers

2. For Synergies Calculation you can use the following structure:

- Revenue synergies - here you calculate the synergies in price and quantity (depending on the case it may be new geographies, new products, new distribution channels, bigger share on shelves crosselling opportunities, etc.)

- Cost synergies - typically you use a value chain structure tailored to the industry (e.g. supply-production-distribution-marketing-after sales support)

- Financial synergies - working capital, capital structure, tax

- Risks - major risks that can decrease the synergies (tip: don't underestimate the merging companies culture factor)

- Total synergies potential in $, adjusted by risk (probability of failure)

Professional writers make college lives’ easier for students, since they ensure that the ordered research papers are completed and submitted on time, without the constant involvement of the student themselves, nor a high amount of money. Custom research writing has a lot to itself in terms of style, and professional writers are experts in that field. The best research paper services employ writers that can assist students in the best possible affordable manner. This makes their lives easier, which is what we want. https://samuraipaper.com/research-papers-writing-services/

https://samuraipaper.com/research-papers-writing-services

Related Cases

Deloitte Case: Footloose

MBB Final Round Case - Smart Education

Bain 1st round case – blissottica, bcg case style - online groceries [new], bain case style - growth offensive at chemcorp [new], related companies.

Related Case Interview Basics article(s)

Preparation for case studies.

Learn how to best prepare for case interviews at the world's largest consulting firms. In our Case Interview Basics, you will find everything you need!

Similar Questions

Accenture strategy or ey (not parthenon), difficult offer decision ey, what are the exit opportunities for you if you work at ey in the strategy and transformation service line (not eyp).

- Select category

- General Feedback

- Case Interview Preparation

- Technical Problems

The New Equation

Forward Now: Real-time business insights

Tech Effect

Shared success benefits

Loading Results

No Match Found

PwC case studies

Examples of how a community of solvers brings together the strengths of people and technology to build trust and deliver sustainable outcomes — bringing The New Equation to life.

Featured - 3 items

Wpp reimagines it to foster agility and creativity.

Enterprise agility shifts IT from order-taker to decision maker.

Helping the YMCA of GNY meet new community needs

Responding to change and expanding their reach and ability to support.

Baker Hughes is working toward net zero at scale

Learn how PwC helped Baker Hughes accelerate their net zero strategy.

A brighter future for medicine with healthcare technology

A collaboration between OSIC, PwC and Microsoft is helping patients, providers and researchers fight a rare disease.

{{filterContent.facetedTitle}}

- {{v.tagsTitle}}

{{item.title}}

- {{filterContent.dataService.numberHits}} {{filterContent.dataService.numberHits == 1 ? 'result' : 'results'}}

- {{vf.elipsedTagsTitle}}

- 0" ng-click="filterContent.reset()" class="reset-filters"> {{filterContent.resetFiltersLabel}}

{{item.publishDate}}

{{item.text}}

Explore further

Vice Chair, Consulting Solutions Co-Leader, PwC US

Thank you for your interest in PwC

We have received your information. Should you need to refer back to this submission in the future, please use reference number "refID" .

Required fields are marked with an asterisk( * )

Please correct the errors and send your information again.

By submitting your email address, you acknowledge that you have read the Privacy Statement and that you consent to our processing data in accordance with the Privacy Statement (including international transfers). If you change your mind at any time about wishing to receive the information from us, you can send us an email message using the Contact Us page.

© 2017 - 2024 PwC. All rights reserved. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. Each member firm is a separate legal entity. Please see www.pwc.com/structure for further details.

- Privacy Shield

- Cookies info

- Terms and conditions

- Site provider

- Do Not Sell My Personal Information

The PwC Case Interview (Including Strategy&) – A Complete Guide

- Last Updated January, 2024

PwC is an accounting firm with a huge consulting arm. Its consulting business is as large as those of Bain, BCG, and McKinsey combined. If you’re interested in landing a job in the consulting industry, it’s a great firm to apply to because its business combines strategy consulting (Strategy&) as well as business transformation/implementation (PwC).

If you want to know more about PwC consulting and Strategy&, you’re in the right place! In this article, we’ll discuss:

- An overview of PwC Consulting and Strategy&.

- The PwC recruitment process.

- The PwC case interview.

- The behavioral/fit interview.

- The PwC group case.

- The PwC individual presentation.

- Our 5 tips for preparing for PwC and Strategy& interviews.

Let’s get started!

PwC Consulting and Strategy& - An Overview

The pwc group case, the pwc recruitment process, the pwc individual presentation, the pwc case interview (including strategy&).

5 Tips for Preparing for PwC and Strategy& Interview

The PwC Behavioral Interview

PwC Consulting and Strategy & - An Overview

5 Tips for Preparing for PwC and Strategy & Interview

PwC employs over a quarter of a million people in 155 countries worldwide. Its operations are divided into two parts: Trust Solutions and Consulting Solutions. Trust Solutions focuses on its accounting and tax services. PwC Consulting Solutions help a broad spectrum of clients navigate complex business issues by leveraging PwC’s significant experience and range of capabilities.

Client case studies include:

- helping TransRe adopt an enterprise resource planning system to collect and manage data, offering insight and improved decision-making.

- supporting Chipotle to implement a loyalty program to improve customer relationships, build loyalty, and drive business growth.

- providing pro bono consulting to charity The Trevor Project to strengthen its technological capabilities and optimize its volunteer recruitment process.

How does PwC Consulting differ from Strategy&?

In 2014, PwC acquired Booz & Co., the commercial arm of consulting firm Booz Allen Hamilton, and renamed it Strategy&. While PwC Consulting focuses on typical management consulting cases and implementation projects, Strategy& specializes in strategy consulting.

Set up by PwC to attempt to compete with McKinsey, Bain, and BCG, Strategy& has over 3,000 consultants helping businesses shape their future strategies. Strategy& focuses on creating competitive advantage by “developing corporate and business unit strategies and building differentiating capabilities that outperform the competition.” ( Source: PwC )

Implementation of those strategies is handed over to PwC consulting teams. If you join PwC’s management consulting team you will, “help clients translate strategy into execution, closing the gap between ideas and outcomes, to transform the organization and achieve tangible business results.” (Source: PwC)

Like most other Big 4 firms (EY, Deloitte, and KPMG), the PwC recruitment process has multiple stages:

Stage 1: The PwC Application

For entry-level recruitment, the first stage of the PwC process is to submit an application form for the particular roles you’re interested in. You can search for your school’s application deadline on PwC’s interactive campus map. If you can’t find your school or have recently graduated, you should submit by their September deadline. You’ll be asked to pick your top 2 preferred office locations and you’ll need to submit a resume.

To learn more about how to write a stellar consulting resume, read Consulting Resume: Everything You Need to Know .

Stage 2: The PwC Online Test

A few hours after you’ve submitted your application, PwC will send you an assessment to complete via email. You have to complete the online test within 3 calendar days so it’s worth thinking about that when applying. The PwC online test is a series of games-based assessments to measure cognitive ability, behavioral preferences, and verbal and numerical reasoning.

Learn more by reading PwC Online Test .

Stage 3: The PwC Interview

If you successfully pass the online test, PwC will invite you to a series of interviews. These will include a case interview and behavioral interview and may include a group case and an individual presentation. The first of these interviews is sometimes conducted as a video interview where you’ll record your answers to a range of questions and case studies. Group interviews have traditionally been part of the recruiting process for sophomore consulting internship candidates and select other groups. It’s a good idea to clarify with your recruiting contact what types of interviews you’ll have.

In the past, the bulk of the remaining interviews, group, or individual activities took place during an assessment day. However, for 2021-22 recruitment, PwC US is moving to virtual interviewing. For Consulting Services, you’ll face two virtual, live interviews back-to-back. If you move forward in the process, there may be a final additional interview.

Nail the case & fit interview with strategies from former MBB Interviewers that have helped 89.6% of our clients pass the case interview.

The case interview process is similar for both PwC Consulting Services and Strategy&. The case interviews are both candidate-led, which means you’ll be responsible for deciding what analysis you want to do and what the approach should be.

The PwC case interviews for Consulting Services applicants typically focus on profit optimization, cost optimization, and market sizing. For example, a recent candidate was asked to “Run me through a market sizing estimate of the iPhone market in Asia.”

For a breakdown of precisely what each of these types is, read Case Interview Types: Master Common Ones Before Your Interview .

The PwC Strategy& case interview includes more strategy-focused cases (such as make-vs-buy decisions, new product introduction, M&A, etc.), but how you tackle a case interview is the same no matter which area you’re applying for.

Following this 4-step model gives you the best chance for success:

- Understand the question . Make sure you understand what it is you’re being asked to do. Repeat back to the interviewing team what exactly you think the task is so they can correct you if necessary.

- Create a structured approach to the problem . Analyze what data you’ve been given and identify areas where you need more information about the client’s problem. Use a business framework to explore the case further or, better yet, create one of your own that’s specific to the issues in your case.

- Ask relevant questions and analyze the problem . Begin to share the assumptions you’re making about the case and ask the interviewing team questions about areas where you’re uncertain or need more data to inform your judgments.

- Effectively communicate your recommendation . Walk the interviewing team through your recommendation(s), explaining how you used the data provided to back up your recommendations. Make sure you call out any assumptions made or any risks associated with the action you’re proposing.

The fit or behavioral interview is a way for interviewers to figure out how well candidates would work within the firm’s culture and how they’d be in front of clients. Interviewers want to feel that they could work well with you if you were part of their team and that you’d represent the firm effectively on client projects.

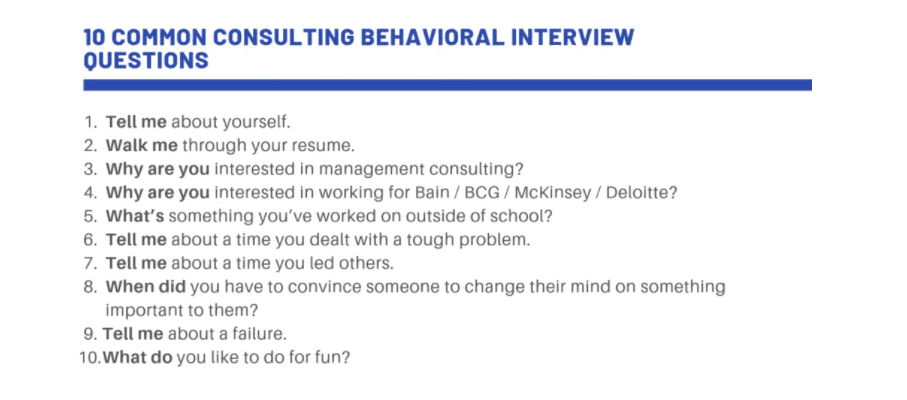

While the exact questions will differ between firms, here are ten common questions asked in behavioral interviews:

PwC's Core Values

PwC has 5 core values that define its culture and approach:

- Act with integrity

- Make a difference

- Work together

- Reimagine the possible

It’s important to ensure that when answering interview questions, you keep these values in mind. For example, if the interviewer asks you to tell them more about yourself or what you do for fun, pick stories that show where you’ve made a difference, challenged the status quo, or tried something new.

If you’re interviewing for several different firms, it’s important to tailor your responses to each individual firm. Try not to rely on stock answers about why management consulting is the role for you. Many other candidates will also be waxing lyrical about working with the best people, on the most interesting projects, for the most exciting clients.

Try researching cases the firm has recently been involved in and explain why they’re interesting to you. Or look into work the firm does regarding corporate social responsibility and talk about how it aligns with your values.

The Best Answers to PwC Behavioral Interview Questions Are Stories

Frame your examples as stories. Stories engage interviewers even after a long day interviewing dozens of candidates. While you want to remain professional, it’s ok to talk with emotion as you share your stories. Interviewers want to see humans, not robots! One of PwC’s core values is ‘Care’ so interviewers want to know what’s important to you and more about the things that make you you.

Make sure you also reflect on your own learning from the examples you want to share in your interview. You’ll likely be asked about how you work in a team, how you handle conflict, and how you overcome failure. Using a model like the ASTAR(E) framework helps you remember to share the effect that going through that experience had on you and how it’s changed how you would approach things in the future.

For the Strategy& interview specifically, it’s worth noting that you may face more behavioral questions than you expect. PwC is keen to check that you’re not just using Strategy& as an MBB backup and wants to make sure you’re a great fit for the firm.

To learn more about acing the behavioral interview, read The Consulting Fit Interview: What to Say, What NOT to Say .

PwC has traditionally used a group case as part of its recruiting process during the assessment day for some applicants (most frequently, undergraduate sophomores applying for internships). A typical group case experience involves you working within a small group to solve a business case.

Interviewers assess both analytical and behavioral competencies as you work in your team to solve the case. This means you have 2 roles during a group case. First, you need to contribute to solving the case — providing analysis, making logical assumptions and judgments, and offering insight to shape the overall recommendation you present to the client.

Secondly, you need to showcase how well you can work within a team — offering an opinion, demonstrating active listening, summarizing and building on others’ points of view, and leading the team towards consensus.

Recent interviewees have not had a group case as part of their PwC interview process. This is likely due to Covid restrictions, so make sure you are ready for a group case in the event PwC reintroduces them. If you want more help on preparing for a group case interview, read This Is What You Need to Know to Pass Your Group Case Interview .

As part of the recruitment process, you may be asked to prepare an individual presentation. This comes in the form of a written case presentation. Unlike other firms, PwC releases the information you’ll need to prepare your recommendation 48 hours in advance of the interview.

Using the information provided, you’ll have to prepare a PowerPoint presentation showing your analysis of the data, explaining any assumptions you’ve made, and detailing your client recommendations.

On the day of the interview, you’ll spend 15–30 minutes presenting your findings and then 15–30 minutes taking questions on them from the interviewing team.

Bain and BCG commonly request a written case, so this may feel familiar if you’ve interviewed for them. For more information on preparing for a written case interview, check out Written Case Interviews – Everything You Need To Know .

5 Tips for Preparing for PwC and Strategy& Interviews

Now you’re clear on the different elements that make up the PwC interviews, here are our top 5 tips for acing them:

1. Research

Make sure you do your research before your PwC or Strategy& interview. Understand what it is about the firm that appeals to you, what type of case work they’re involved in, and how else they get involved in the community.

It can sometimes be helpful to figure out what a company isn’t as much as what it is. So compare PwC to other firms and note the differences and why PwC still appeals. Learn their core values and what a typical day would involve as an analyst, or the specific role you’re applying for.

Ensure you also know as much as possible about the format for the interview. Are you expected to complete several tasks or just one? How much time will you have? Will you have a single interviewer or multiple? Company websites often describe the people they’re looking for to join their team — those will be the attributes you’ll be assessed against, so make sure you’re clear on what they are.

2. Prepare and Practice

Once you’ve done all your research, start your preparation. Use case interview examples to practice your casing skills. The linked page includes several PwC case examples as well as ones from other consulting firms. Make sure you feel confident in your case interview math skills too.

For your behavioral interview, make sure you’ve prepared answers to typical questions such as “Tell me about yourself” and “How would you manage a challenging team member?” Make sure your answers follow the ASTAR(E) framework and that you’ve tailored them to show off how you meet the PwC core values. You can practice answering these questions with a friend or coach until you feel confident in your responses.

3. Follow a Structure

Consulting firms are looking for structured thinkers who can solve a wide variety of business problems. Show your structured problem-solving skills by creating a framework that identifies the key issues you want to address in the case and use this framework to keep your progress in the case on track. Building your answers around a framework can help ensure you cover all the important points succinctly and confidently.

4. Explain Your Approach and Any Assumptions

Remember your math teacher always used to tell you to show your work? Well, it’s the same during consulting interviews. If you’re using data or solving math problems during your PwC case interview and you end up with an incorrect answer, it’s important to gain as much credit as possible.

Maybe you just made a small error in your calculation but your assumptions and approach were sound. The interviewer will never know that unless you walk them through the steps you take as you’re solving the case. Make sure you talk aloud as you’re putting together the pieces of the case and ensure you clearly state any assumptions you’ve made as you present your final recommendation. By making your assumptions clear, you‘ll allow your interviewer to guide you if you get off-track.

5. Communicate Confidently

In the PwC case interview, once you’ve decided on a recommendation, make sure you communicate your thoughts confidently. While interviewers are obviously interested in your analytical skills, business acumen, and logical approach, they also care about how you’re going to appear in front of clients. They need you to be able to effectively communicate your thoughts and respond appropriately to questions and feedback.

This is also true of the behavioral interview, where your interviewers also care about how you’ll fit within their team and what it’d be like to work long hours on a project with you. They’ll expect you to talk with passion about things you care about, offer thoughtful or interesting stories in response to questions, and seem friendly, competent, and approachable.

– – – – –

In this article, we’ve covered:

- The difference between PwC Consulting and Strategy&.

- The stages of the PwC recruiting process.

- What you need to know about the PwC case interview, behavioral interview, group interview, and individual presentation.

- 5 tips for success in PwC interviews.

Still have questions?

- Our Ultimate Guide to Case Interview Prep .

- PwC Psychometric Assessment .

- The Big 4: How Do They Fit Into the Consulting Industry

- Group Case Interview .

- Written Case Interview .

Help with Case Study Interview Prep