- Oil and Gas Careers

- Educational Videos

30 Oil and Gas Interview Questions and Answers

On this page, you will find the most common technical oil and gas interview questions.

We will skip over basic questions such as “Tell me about yourself?” or “Why should we hire you and not someone else” and instead will focus on more specific questions directly related to the oil and gas industry.

Whether you are a recent graduate or an experienced professional, by familiarizing yourself with these questions and answers, you will be able to make sure your interview goes as smoothly as possible.

In addition to questions that we will discuss today, depending on the position you are applying you may also be asked questions about specific operating systems, software, or hardware used in your role.

Questions may also focus on safety procedures and regulations, production processes, project management skills, and more.

Related: Working for Oil and Gas Operator vs Oilfield Service Company

Oil and Gas Interview Questions and Answers

1. what is the difference between upstream, midstream, and downstream oil and gas sectors.

- Upstream deals with the exploration and production of hydrocarbons

- Midstream deals with the transportation and storage

- Downstream deals with the refining of crude oil

2. What is the difference between sour and sweet crude oil?

Sour crude contains hydrogen sulfide (H2S) while sweet oil doesn’t. Usually, oil with H2S content above 0.5% is considered to be sour.

3. What are some examples of enhanced oil recovery (EOR)?

Thermal recovery – for example, steam injection in SAGD

Chemical flooding – injecting surfactants or polymers to decrease surface tension

Gas injection – using natural gas or carbon dioxide to lower the viscosity of the oil and increase its mobility

Microbial injection – using bacteria to increase production efficiency

4. What are the most popular artificial lift methods?

Sucker rod pump – downhole plunger is used to displace oil to the surface. The surface engine provides energy to the rod attached to the plunger.

Gas lift – this method involves pumping compressed gas to decrease hydrostatic pressure in the well and allow hydrocarbons to flow more easily to the surface.

An electric submersible pump (ESP) – is a downhole centrifugal pump powered by electricity from the surface and usually used on higher-rate wells.

Hydraulic pump – this method works by pumping pressurized fluid from the surface to supply energy to the pump downhole.

Progressive cavity pump (PCP) – downhole stator and rotor create a cavity that draws oil to the surface. The engine is located at the surface and the mechanical force is transferred by a rotating rod.

5. What is the composition of crude oil?

- Paraffins/Alkanes ( ~25%) –

- Naphthenes/Cycloalkanes (~45%)

- Aromatics (20%)

Related: 30 Short Examples of Oil and Gas Resume Objectives

6. What are some of the properties used to describe reservoir rock?

Porosity – the amount of void space available in the rock between the rock particles in comparison to the total volume of the rock.

Permeability – describes how easily the fluids can flow through the rock.

Rock Compressibility – describes how the rock volume is affected by changes in pressure.

Fluid Saturation – the volume of a particular fluid in comparison to the total pore volume.

Wettability – describes how the fluids behave on the surface of the rock.

7. What is the API gravity of crude oil and how it is calculated?

API stands for American Petroleum Institute and it is used to demonstrate how the density of crude oil compares to the density of water.

API Gravity = (141.5/SG) -131.5

Specific Gravity (SG) = density of oil/density of water

8. What are the casing and cementing?

Casing involves running a steel pipe into the well to prevent hole collapse, allow more well control, and isolate high and low-pressure zones.

Cementing involves filling the space between the casing pipe and the walls of the drilled hole with cement to stabilize the wellbore and prevent the formation fluids from contaminating groundwater.

9. What are the 3 types of reservoir recovery?

- Primary – conventional oil recovery driven by reservoir pressure

- Secondary – injecting water or gas to increase reservoir pressure and push hydrocarbons toward the producing well

- Tertiary (Enhanced Oil Recovery) – injecting chemicals or increasing reservoir temperature to decrease oil viscosity and increase sweeping efficiency

10. What is the difference between enhanced oil recovery and hydraulic fracturing?

Hydraulic fracturing is usually done right after the well is drilled and is used to create fractures in tight formations such as shale to create additional pathways for hydrocarbons to flow toward the wellbore.

Enhanced oil recovery on the other hand is usually performed on older wells by injecting chemicals or increasing temperature to change the oil properties and make it more mobile.

Related: What do Production Engineers do in the Oil and Gas Industry?

11. What is gas flaring and why it is performed?

Gas flaring is burning natural gas released during oil extraction or refining processes. It is performed to dispose of small volumes of unwanted natural gas that cannot be economically shipped to the refinery or used on location.

12. What are the main factors affecting oil prices?

- Production costs – how much it costs to get the oil out of the ground

- Transportation costs – the price of oil depends on where the oil is located and how easy it is to get it to the consumer

- Type of oil – sweet lighter oil will be sold at a premium in comparison to heavier sour oil

- Supply and demand – high demand and low supply will drive the price of oil up

- M arket speculation – fears and rumors can move the price of oil in both directions

13. What is pipeline pigging?

Pipeline pigging is the process of using a pig to inspect, clean or repair a pipeline. The pigs are usually pushed down the pipeline by the energy of the fluid flowing through the pipeline.

Pigs come in various shapes and sizes depending on the job requirements but in most cases, they have cylindrical shapes. They are made of soft, durable materials such as rubber, plastic, or foam.

14. How is natural gas formed?

Natural gas is formed deep underground from the decomposition of organic matter such as dead plants and animals.

It is a very slow process and it takes millions of years for natural gas to form this way because organic matter needs to be buried and slowly pushed deeper and deeper underground until the right conditions are met.

There under high temperatures and pressure, this organic matter is slowly converted into natural gas.

15. What are some examples of how natural gas is used?

- Cooking food

- Heating water

- Generating electricity

- Transportation

- Chemical synthesis

- Welding metals

- Making fertilizers

- Hydrogen generation

Related: 6 Oil and Gas Cover Letter Examples for Fresh Graduates

16. What is coal bed methane?

Coal bed methane or CBM is a natural gas trapped in underground coal deposits. Methane is either trapped as free gas, dissolved in water, or adsorbed into coal.

17. What are some examples of well logging and why it is performed?

Gamma-ray logging – used to detect natural radiation emitted by the formation. This can be used to distinguish between different reservoir rocks and determine reservoir thickness

Sonic logging – used to measure how fast the sound travels through the formation. This can be used to calculate porosity and the type of rocks in the formation.

Spontaneous potential logging – used to determine the porosity of the formation.

Caliper logging – used to measure the size of the hole.

Resistivity logging – performed to determine the resistivity of the formation rock.

Density logging – used in determining the porosity of the formation.

Neutron logging – performed by emitting neutrons from the tool and then determining how they interact with a formation.

18. What is MWD?

Measurement while drilling (MWD) is used to get real-time information about wellbore trajectory as well as other downhole data.

This data is sent via pressure pulses to the surface where it is received by surface transducers.

19. What are methane gas hydrates?

Methane gas hydrates are formed when methane is combined with water at low temperatures and high pressure. The methane molecules don’t chemically react with water to create gas hydrates but instead are bonded to the water with hydrogen bonds.

After gas hydrate is formed it can stay relatively stable even at temperatures above freezing point.

20. What is H2S and why it is so dangerous?

Hydrogen sulfide is a colorless toxic gas that smells like rotten eggs at low concentrations (0.1 ppm). It is highly toxic and can be lethal even in small quantities (>500 ppm), making it extremely dangerous. It acts by paralyzing the respiratory system.

H2S is also a very flammable gas and can damage metals by allowing hydrogen to diffuse into the metal and making it weaker and easier to break.

Read: Working In the Oilfield | Requirements, Entry Level Jobs and Work Conditions

21. What are the main ways to transport crude oil?

- Oil Tankers

22. What Is the difference between Brent and WTI crude oil?

WTI is a light sweet crude oil that comes from the oilfields in the US and is stored at Cushing, Oklahoma

Brent is a bit heavier and slightly sourer and comes from various fields in the North Sea

23. What are some examples of how oil is extracted from the oil sands?

Surface mining – is done by using large trucks that load oil sand and transport it to facilities where it undergoes processing to separate the oil from sand by heating it up with water.

Steam Assisted Gravity Drainage (SAGD) – an in-situ oil sand recovery method that involves drilling two wells just a few meters apart from each other. One of the wells is used for steam injection and the other one is for oil production.

Cold Heavy Oil Production With Sand (CHOPS) – this method is similar to conventional horizontal well drilling operations with the only difference being that sand filters are not installed and sand is allowed to flow into the wellbore along with heavy oil.

Cyclic Steam Stimulation (CSS) – steam is injected into the well for a long period of time to heat up the formation. After the steam injection is stopped, the well is put on production.

Vapor Extraction (VAPEX) – similar to SAGD but instead of steam various solvents, and liquid natural gas are injected into the upper well to dissolve bitumen and allow it to flow into the lower well.

24. What are the 3 types of permeability?

Absolute permeability – describes how a single fluid flows through the reservoir rock. This assumes that there is only one type of fluid in the reservoir.

Effective permeability – describes the flow of a particular fluid in the rock when there is another fluid present. For example, describing how oil flows through the rock when there are both oil and water in the reservoir.

Relative permeability – describes the ratio between effective permeability and absolute permeability.

25. What are some examples of chemicals used in hydraulic fracturing?

Friction reducers – used to lower the pumping pressures

Gelling agents – used to increase the viscosity of the fracturing fluid to improve its sand-carrying capacity.

Breakers – used to break down the gel and prevent formation damage

Biocides – used to get rid of the bacteria in the fracturing fluid that can potentially create unwanted by-products like H2S and damage the formation and equipment.

Non-emulsifiers – help to prevent emulsion between frac and formation fluids

Acids – pumped before the frac to prepare the perforations and formation for the frac

Don’t miss: Cover Letter Examples for Drilling, Production, Reservoir, and Completion Engineers

26. What is LNG?

LNG is a natural gas (methane) that is compressed and cooled to transform it into a liquid form. By compressing natural gas its volume can be decreased by up to 600 times.

27. What is Hydraulic Fracturing?

Fracturing basically means creating small pathways in the formation that allow hydrocarbons like oil and gas to flow more easily into the wellbore.

This is achieved by injecting large volumes of fluid and sand under pressure into the formation to break the rock and create high permeability fractures. Fracturing is often performed in tight formations such as shale that have extremely low permeability.

28. What is the purpose of an oil refinery?

Oil refineries are used to process crude oil into useful products like fuel, lubricants, and petrochemicals. The refining process includes various methods such as fractional distillation, hydro-treating, and catalytic cracking.

29. What are OPEC and OPEC+?

OPEC stands for the Organization of the Petroleum Exporting Countries, a cartel of 13 nations that control significant portions of global crude oil production. OPEC+ is a union of OPEC and non-OPEC countries such as Russia and Mexico, that work together to manage global crude oil supply and control prices.

30. What is a blowout preventer?

A blowout preventer (BOP) is a safety device used to prevent an uncontrolled release of hydrocarbons during drilling and intervention operations. Most BOPs usually have metal-type rams that either seal around the pipe in the well or cut it and hold it in place until it can be safely removed after the well is under control.

Four most common types of rams used:

Pipe Rams – seal around the pipe preventing the well fluids from coming to the surface.

Blind Rams – seal the wellbore when there is no pipe in the well.

Shear Rams – cut through the pipe and fully seal the wellbore.

Slip Rams – prevent the pipe from falling into the well or being pushed upward by the well pressure.

Read next: 4 Types of Petroleum Engineers

Related Articles

What frac sand haulers do and how to become one, what is an afe (authorization for expenditure) in oil and gas, what is directional drilling in oil and gas, latest articles, where do petroleum engineers work, is working in integrated oil and gas companies a good career path.

Find out how the oil and gas industry works. Learn the skills required to work in the exploration, development, and production of crude oil or natural gas.

Contact us: [email protected]

© Copyright - OilandGasOverview.com

- Privacy Policy

- Terms of Use

Use Our Resources and Tools to Get Started With Your Preparation!

McKinsey Digital / BCG Platinion: Oil & Gas Upstream Technology

This is an interviewer-led case based on a real-life project . This case could be seen across a range of consultancies and is well-suited to test candidates aiming for more operations and technology-based roles (I.e. BCG Platinion, McKinsey Digital , etc).

The case involves IT process improvements as well as an efficient resource (employee) re-allocation/re-organization .

Do not attempt this case if you are applying for a generalist role.

====================================================

Scoring Criteria: Use the following grading system for each skill area:

a. Structured Thinking (Frameworking):

1 = Lacked a coherent structure

5 = Pinpointed the appropriate issue, segmented it into a complete set of non-overlapping components (e.g., MECE), presented a plan to tackle the case, and offered valuable insights.

b. Numeracy/Math:

1 = Committed numerous errors and required assistance in setting up equations

5 = Performed calculations accurately and with confidence, identified implications, designed a clear and efficient approach, and demonstrated exceptional speed.

c. Judgement and Insights (Charts & Exhibits): 1 = Missed basic insights 5 = Connected findings to develop practical recommendations, made reasonable hypotheses, shared impressive insights, and flagged far-reaching implications. 1 = Overlooked fundamental insights

5 = Linked observations to devise actionable recommendations, formulated plausible hypotheses, conveyed strong, objective-driven insights, and highlighted impact.

d. Case Leadership (unless interviewer-led):

1 = Frequently disoriented and dependent on guidance

5 = Advanced autonomously and maintained focus on the question and the client's objective.

e. Creativity:

1 = Had difficulty generating original ideas

5 = Offered a variety of strong and diverse ideas, tailored to the industry and business context.

f. Presence:

1 = Not client-ready

5 = Exhibited professionalism, charisma, enthusiasm, and self-assurance.

g. Communication:

1 = Unclear and disorganized

5 = Demonstrated active listening, spoke precisely, and communicated concisely.

h. Synthesis (Final Recommendation):

1 = Failed to provide a coherent and well-founded recommendation

5 = Justified recommendation with key considerations, potential risks, and subsequent steps to address those risks.

During the Interview: As the candidate progresses through the case, take notes on their performance in each skill area. Be prepared to provide feedback at the end of the interview.

Post-Interview: After the interview, grade the candidate's performance in each skill area based on your notes and the scoring criteria. Share the scores and any specific feedback with the candidate to help them understand their level of readiness for the actual interview.

Improvement: Encourage the candidate to focus on areas where their performance was weak and provide guidance on how they can improve in those areas.

Case Prompt

[PLEASE NOTE: This is a technically difficult case and should only be completed by those coming in as a Technology specialist, i.e. recruiting for McKinsey Digital, BCG Platinion, etc.]

Our client is a multinational oil and gas company. While they are vertically integrated and have upstream, midstream, and downstream divisions, they have recently been experiencing competitivity issues in the upstream gas division , which brings in $1B in profits annually .

Our client’s upstream division has offices in Australia and Indonesia . Their work is highly dependent on their IT systems , as they have to constantly monitor wells and pipes (pressure, hydrocarbon count, fluid makeup, etc.)

The upstream division has two large legacies of IT systems that are primarily used for downstream operations but have been modified for upstream purposes.

These systems are managed by a central team in the US which is responsible for all IT issues across the business. They triage issues/enhancements and then manage development teams in India and Finland who complete the work.

Overview of all exhibits

I. Process Improvement - Part 1: Understanding Competitivity Issues

An important part of the case is that the interviewee must understand what is meant by “competitivity issues”.

In the client’s case, unit costs are quite high and their workers are not getting things done as quickly as competitors . This means the client has to hire many employees and pay a lot of contracting hours to do twice as much as other firms. The competitivity issues do not involve loss of clients, but rather process inefficiencies.

The root cause is that our client’s processes and supporting systems, such as software and technology, are very complex and old by industry standards.

A good candidate should recognize the following:

- It’s likely problematic that a system designed and intended for one part of the business has been converted – it is likely, not fit for purpose

- There are likely significant inefficiencies from the separation of users and managers of this IT system (i.e. users in the Pacific, and managers in the US)

- There are also likely added inefficiencies from the separation of developers (India and Finland)

I. Process Improvement - Part 2: Understanding the Process

Note for interviewer.

If the candidate asks about the process for raising/resolving issues/enhancements to the IT systems , you may state the following:

Like any IT system, these two systems are supported by an IT department. Users of the system submit issues and change requests and look to the IT department to resolve them.

The current process is as follows: any office would submit change requests into a central system, which is then prioritized and organized by US-based IT business analysts. These tickets then go to India for development, then back to the US analysts for testing, then back to the office that originally submitted the ticket for acceptance testing.

- This entire process takes about 8 weeks

- All of these change requests are submitted through an IT system and handled in an excel document

The candidate should note some of the following:

- 8 weeks is far too long to resolve issues – an Agile process would take 2-3 weeks

- This process is very lengthy and clearly has too many hand-offs , increasing both delays and the likelihood of poor solutions

- The US probably does not have the best idea as to which enhancements/changes are actually the most important, as they’re not close to our client’s needs – the work is outsourced to them

- The US office is likely a chokepoint with a lot of delays as they have competing priorities from across the companies

- The client is split across three different time zones , so any communications or clarifications generally add an extra day

- Excel is a poor method for handling IT tickets – there are numerous issues in regards to change tracking, simultaneous access, reporting, and management

I. Process Improvement - Part 3: Solutions

Prompt the candidate to suggest solutions.

The candidate should recommend any of the following:

- The client could look into replacing the current IT systems (with upstream-specific ones)

- The client should invest in a ticket management/tracking system such a Jira or ServiceNow

- Processes should be streamlined so that the US as a middleman is cut

- Required resources could be brought onshore to Indonesia/Australia

- It’s odd that testing goes back to the US, it should be done in India in parallel with development or by the office that raised the issue/enhancement

II. Colocation

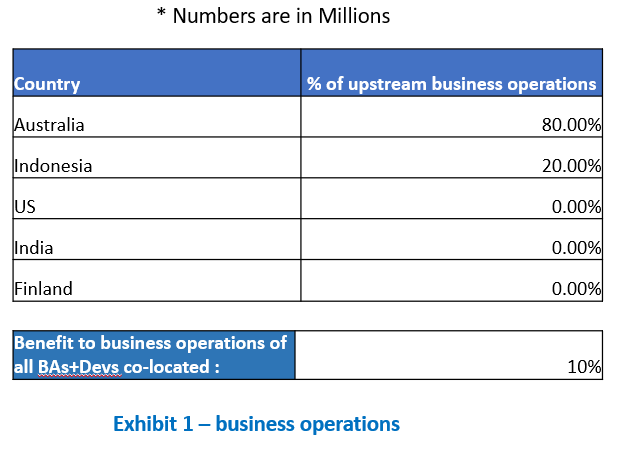

Provide the candidate with Exhibit 1 .

Exhibit 1 lists where our client’s employees are, and the percent of upstream business operations attributed to each office . IT resources are currently located in the US (Business analysts) as well as Finland and India (Developers). If the candidate needs clarification, you can tell them that, if IT resources were co-located, we would increase that location’s business operation profits by 10%.

The candidate should calculate the business impact of co-location in Australia and Indonesia respectively.

If they don’t opt to do this, prompt them.

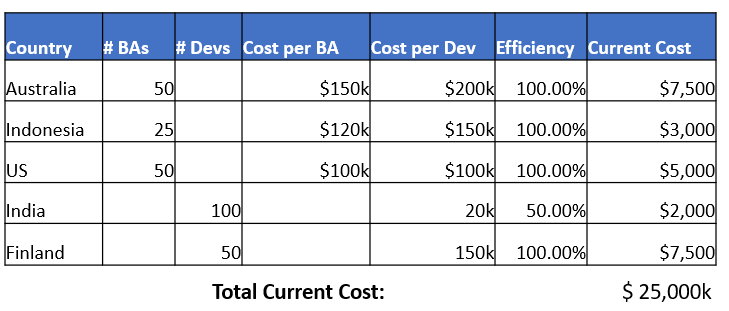

Provide the candidate with Exhibit 2 .

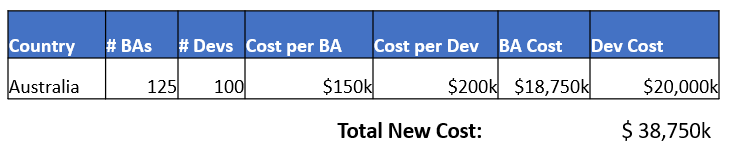

The candidate should run with the hypothesis that all resources should be co-located in Australia , given the huge impact to the business’ bottom line. Encourage this thinking.

The candidate should note that there is an annual co-location benefit of $80 million for Australia and $20M for Indonesia. A good candidate would then want to consider the cost of re-location (in terms of paying workers potentially higher salaries, moving costs, etc.)

Exhibit 2 provides a breakdown of where the client’s IT employees are currently located as well as their salaries (we can assume these are the primary costs to consider).

The candidate should opt to calculate the existing costs of the current system, as well as the costs of the newly proposed system. (A good candidate will realize that only half of the current # of developers are needed to replace the India contingent, given they are 50% as productive.)

Current Cost Calculations

Future Cost Calculations

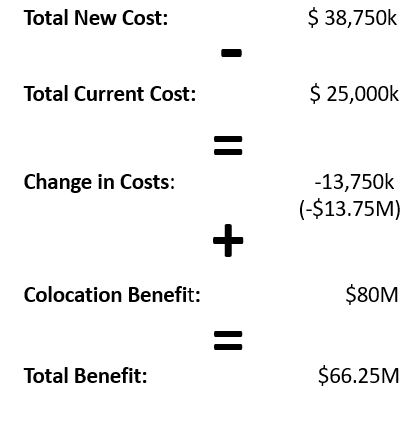

Net colocation benefit

The candidate should take the calculated difference of current vs. new locations (-$13.75M) and subtract it against the colocation benefits of $80M to determine that the net colocation benefit is $66.25 million.

III. Conclusion

Recommendation

The candidate should come to the conclusion that the client needs to colocate the business analysts and developers in Australia. While this will cost $13.75M more in added employee wages, there will be a colocation bonus of $80 million, resulting in a $66.25 million net benefit.

There are risks in the client’s ability to find qualified employees in Australia and to effectively conduct knowledge transfer. In particular, there are risks that the transition period would be both long and difficult.

The client should gain a better understanding of the Australian IT market to determine if the required skillsets exist. They should evaluate whether hiring locally or bringing in offshore developers is a better approach. Additionally, they should prepare a transition plan that ensures a smooth handover in both system knowledge and business processes.

Format and content scope of BCG Platinion technical case

Future profit calculation question, adkar model.

A highly coveted model for change management, it underscores the reality that changes can only prosper when employees actively engage in them.

Public Value Strategic Triangle

The Strategic Public Value Triangle is a conceptual framework developed by Prof. Mark H. Moore to guide public managers in creating public value.

The Cynefin Framework

The Cynefin Framework offers a model to make sense of different problem domains and determine approaches based on their level of complexity and uncertainty.

Herzbergs 2-Factor Theory

Herzbergs 2-factor-theory, also known as the two-factor theory or motivation-hygiene theory, was developed in the 1950s by Frederick Herzberg.

Kotter Change Management Model

The 8-Step Model serves as a roadmap to guide organizations through change initiatives. Learn about each step and how it can help to transform your business.

Join 307,012+ Monthly Readers

Get Free and Instant Access To The Banker Blueprint : 57 Pages Of Career Boosting Advice Already Downloaded By 115,341+ Industry Peers.

- Break Into Investment Banking

- Write A Resume or Cover Letter

- Win Investment Banking Interviews

- Ace Your Investment Banking Interviews

- Win Investment Banking Internships

- Master Financial Modeling

- Get Into Private Equity

- Get A Job At A Hedge Fund

- Recent Posts

- Articles By Category

From Oil & Gas Investment Banking to Energy Hedge Fund: How to Make the Leap and Dominate Your Case Studies

If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking . Thanks for visiting!

So, what does it really take to dominate case studies and stock pitches in hedge fund interviews?

And how can you move from a specific industry group in investment banking (oil & gas) to a hedge fund or private equity firm with a similar focus?

The answer, as it turns out, is “Modeling out ultra-deep water contracts on a ship-by-ship basis and taking into account multiple scenarios for revenue, expenses, and utilization rates.”

And if you have no idea what that sentence means but want to move to an industry-specific fund, it’s a good thing you’ve stumbled across this article.

Here’s what we’re going to cover in this in-depth interview:

- What it’s like working in an oil & gas investment banking group , and what types of deals you’ll be working on.

- How easy or difficult it is to move into private equity firms or hedge funds afterward, coming from a specialized background .

- The real way to tackle case studies, and the top mistakes to avoid – and why you never hear other people mention this part.

- What it’s like working at an energy-focused hedge fund and how it compares to banking.

Banker Begins: The Origin Story

Q: Let’s get started with your “origin story,” since it’s an interesting one.

A: Sure. I came from more of a “mixed” background than other people, and had worked full-time at a Big 4 firm (in restructuring / distressed M&A) and had completed a few internships before that.

So I was not coming into oil & gas investment banking as a bright-eyed and eager undergraduate or MBA student.

I was a lateral hire and joined the energy team of a top bulge bracket bank, originally planning to transition over to the industrials group since I didn’t want to focus on such a specialized sector.

Q: But seeing as how you stayed in the group and then moved to the energy fund, I’m guessing that you changed your mind?

A: Yeah, pretty much. It turned out that I actually enjoyed the work and got a lot more exposure to modeling and deals than other people on my team.

Originally, they were planning to put me on oilfield services deals and work with companies there – but that was shifted around and I ended up working mostly with exploration & production (E&P) companies instead and doing a lot of M&A deals, while other people on the team focused on capital markets deals .

If you’re not familiar with the industry, E&P companies are the most “different” since you use completely different metrics and valuation methodologies (NAV) when analyzing them , whereas oilfield services companies and a few others are closer to “normal” companies.

I also got to travel a lot as a result of all these deals, and that was a great experience as well.

Q: So I just heard you say a lot of positive things about your experience in this group.

I’m disappointed that you didn’t have a crazy VP or MD who forced you out… do you really have no dramatic stories?

A: Hah, funny that you mention that. I didn’t see anything quite as dramatic as a VP punching his fist through a car door window, but the office politics got to me after a while.

In banking, you always get penalized for saying that someone sucks or isn’t good at their job – and if you piss off the wrong people, you’re in trouble regardless of how much you contribute.

They like to claim that they punish you because you’re not a “team player,” but here’s what really happens:

- They hire people who don’t know what they’re doing , in the interest of “paying back favors” or “bringing a greater perspective” to the team or things like that…

- And then, those people turn out to be horrible at doing the job.

- And then when you bring up their poor performance, you get penalized.

So that’s why I decided to start exploring “strategic alternatives” – I liked the work itself and the industry focus, but couldn’t deal with the politics.

Whither the Buy-Side?

Q: So how did you go about recruiting for buy-side roles once you decided that you were set on moving in that direction?

A: I interviewed very sparingly, for a couple reasons:

- I didn’t want to just hop somewhere else for the sake of moving somewhere else – for the same reason that you have to be careful of the “rebound” phase right after a relationship ends. Yes, it might feel good at the time, but in the long-term it’s not great for you.

- I was only interested in fairly large energy-focused PE firms and hedge funds, and only in very specific sectors within those.

- I didn’t want word to get out that I was thinking of moving elsewhere.

Several headhunters actually reached out to me, and I just focused on opportunities that they presented.

This wouldn’t work as well if you’re at a middle-market or regional boutique bank and you don’t have as much visibility with headhunters – you’d have to be more proactive.

Q: That all makes a lot of sense, but I want to circle back to one of the points you raised about energy-specific funds…

I was under the impression that there aren’t too many PE firms and hedge funds that focus on investing in E&P companies due to commodity price volatility. Is that not the case?

A: That’s not entirely true. It is true that traditional leveraged buyouts are less common in the space for the reasons you mentioned: if oil or gas prices plunge, your returns could be obliterated.

But there are energy teams at the biggest private equity firms and hedge funds , and there are even a few large firms that are dedicated to energy:

- Riverstone – $22 billion fund focused on energy and power

- First Reserve – $23 billion PE fund focused on energy and infrastructure

- EnCap – $18 billion PE fund focused on the oil & gas sector

And the list goes on. So they’re out there, but you’re right that traditional LBOs are less common.

Q: So if traditional buyouts are less common, how exactly do these types of firms invest?

A: Their strategy is basically “Acquire lots of acreage and resources, and then resell them to other companies once these resources have proven somewhat viable.”

So they might acquire a piece of land, drill enough to get energy production to the level where it’s good enough to sell, and then go and sell the asset to a diversified energy company like Exxon-Mobil or an E&P-focused company.

Asset sales and divestitures are extremely common in the energy sector because it’s very expensive and time-consuming to actually go out and find new resources yourself – so acquiring reserves that have already been proven to some extent tends to be more cost-effective.

There are several firms that have become well-known for this style of investing, including Cordillera Energy Partners (1-3).

Other examples include HK (Petrohawk and now Halcon Resources) and Oasis.

Q: Great, thanks for explaining that one.

Everything you’re describing here sounds very specialized – do you think it’s harder to move to a generalist role on the buy-side after working in an oil & gas banking group?

A: Yes, it’s harder to move to a generalist role, but it can be done. My group, for example, had guys who moved to the Carlyle tech team, the TPG generalist team, and the Fortress generalist team.

But I think it’s much harder to move from a generalist role into an energy role than to do the reverse – there’s a lot of specialized lingo and modeling and valuation are very different, so you really need to know your stuff to work in this industry.

Q: Thanks for clarifying that.

I know you’ve also been through our Oil & Gas Modeling course – after working in the field for a few years now, would you say that it’s actually accurate / helpful?

A: Definitely, it’s great if you’re new to the field and need a crash course on how energy is different.

There are some things I would do differently – for example, typically you build a Net Asset Value (NAV) model for a company first , and then create the financial statements based on that.

You might also create a NAV for each individual asset a company owns, but obviously you can’t do that if the company doesn’t disclose the information in its filings.

And, of course, in real life when working on real deals you might use more detailed / specific assumptions.

But it’s great for learning about how accounting differs, how to work with reserves and production numbers, and how financial statements, valuation, and modeling differ.

The Recruiting Process

Q: Thanks, I’m glad it was helpful.

You mentioned before how headhunters contacted you about opportunities – what was the recruiting process like?

A: Sure. At the firm I ultimately accepted an offer with, here’s what happened:

- The headhunter reached out and wouldn’t even give me the name of the fund (typical), but claimed they were “rapidly growing their energy team.”

- First Round Headhunter “Interview”: Before the headhunter would even set me up with a real interview, I had to “interview” with him/her first because of my random background – even though I had a lot of deal experience.

- Second Round Interview: I spoke with 2 PMs on the phone – this interview was quite technical and they grilled me on my knowledge of oil & gas.

- Third Round Interview: I completed a case study on an E&P company that also had midstream (transportation pipeline) and downstream (distribution and refinery) assets.

- Fourth Round Interview: I met the Group Head and a few other analysts in the group. This was less technical and they focused on my “fit” with the group and whether or not I would like working on their team. They asked a few more general questions about investment ideas and how I thought about the investing process.

- Several days pass: Get used to this part.

- Yet Another Case Study: They gave me another modeling exercise, this time focused on an offshore drilling company . I didn’t have as much experience in that sector, but I was able to figure out enough to do a decent job with it.

I was also interviewing with a PE firm at the same time, but I received the hedge fund offer quickly so I didn’t continue talks with the PE firm.

Q: Thanks for describing the process in that level of detail. We’re going to jump back into what you had to complete for these case studies in a bit, but I wanted to ask a more general question first…

What were the key obstacles you faced in the recruiting process, and how did you stand out against other candidates?

A: Surprisingly, the biggest obstacle I faced was that I went to a “non-target” school and hadn’t followed the typical investment banking career path , from a private high school to the Ivy League to a bulge-bracket bank.

I wish I were joking, but this still came up repeatedly even years and years after I had finished undergraduate.

Headhunters are still a lot more hesitant to deal with you because they assume that if you didn’t go to a top school, you might be horrible or you might embarrass them in interviews.

So you have to be VERY selective in choosing who you work with, and go the extra mile to show them that your deal experience and technical / modeling skills are exceptional.

In terms of standing out, it’s what I just mentioned: proving that you can hit the ground running and immediately add value and contribute to getting deals and investments done by pointing to what you’ve done in the past.

You also must be extremely specific with what you want – pick an industry, geography, and firm type and size, and stick with those criteria.

You might think that my own criteria were too specific – “Large-cap E&P-focused energy hedge funds or PE firms” (I also added geography to that mix).

But that specificity actually helped because headhunters were much more likely to respond and introduce me to the right opportunities. If I had walked in there and said, “I want to work in PE!” they would have just tossed aside my resume and put it in a stack with everyone else’s.

Q: That’s a great point. You can never be too specific in the recruiting process.

What else were they looking for in interviews?

A: The will grill you on industry-specific concepts and see if you understand the nuances and are actually enthusiastic about learning more and reading up on it every day.

- They asked me how I’d look up and verify information on individual well reserves .

- They asked if I understood how intangible drilling costs would affect DD&A and the financial statements.

- They asked how you could verify management estimates / sanity-check projections with limited information.

Q: OK, so it sounds like you really need to know the specific industry in these interviews…

But what about the more generic questions? Did they ask you to pitch a stock or explain how you think about investing?

A: Yes – and with that type of discussion, it is super-helpful to have a personal account that you trade and have traded for a long-time to show evidence that you’re passionate about investing.

No, you can’t really do much investing when working at a bank because lots of securities will be restricted – but you can come up with ideas and act on them before you start working. And you need to do that to prove your interest and commitment.

Having proof of what you’ve done is also good – if you claim to have earned impressive returns, some places will actually ask you for a screenshot or account statement or something like that to verify. Anyone can walk in and claim 200% returns, but few people can back it up with evidence and explain how they did it.

In interviews, it’s also common to get questions on companies that you know nothing about and have never worked with before.

So they might say, “General Electric vs. Honeywell – which one would you invest in and why?”

Do not give an actual answer right away. Instead, you want to talk about the criteria that you’d need to make a decision and how you’d go about gathering the data.

So you might ask, for example:

- What markets are the companies in, and what’s their position in them? Are the markets growing or shrinking? How is the competition doing?

- What drives the company’s revenue and expenses? What do their historical and projected growth and margins look like?

- How are they valued vs. the peer companies? Could anything drive their valuation higher or lower?

Case Studies 101

Q: And I’m guessing that all of those questions are also important to address in case studies as well.

You mentioned receiving two case studies, one on an E&P-focused company and one on an offshore drilling company.

What exactly did you have to do for both these case studies and what was the format?

A: Sure… the basic format was:

“Here’s Company X, currently trading at such and such per share. Should we invest in it? And if so, why, and at what price? And if not, why not, and at what price would it be a good investment?”

The most common mistakes:

- Failing to properly explain your assumptions – for oil & gas, for example, you need a very strong view on where commodity prices are heading and you need to be able to back that up in your discussion.

- Not being granular enough – if you’re projecting revenue as a percentage growth rate, for example, that won’t be enough detail to satisfy them unless it is a very quick, time-pressured case study where they tell you to do that.

- Not making a decision one way or the other – you can’t say, “Well, maybe…” in investing. You have to reach a firm Yes / No decision.

So let me start with how I approached the first case study, on the E&P company.

Step 1 was breaking it down into the different regions they operated in, and projecting how many wells they would construct in each region.

Then, I created a type curve / single well model for an “average” well in each region, and then I applied different risking to each of the specific areas – so if one area was more proven, maybe it would get an 80% reserve credit vs. another area that was less proven that would have received a 60% reserve credit.

Next, I split the production into different categories based on the Proved vs. Probable vs. Possible categories in each of those regions.

Once all that is in place, you estimate the annual production each year, project how much it declines by as the reserves run out, calculate the expenses associated with each well, and sum up everything over the entire region.

Then, you discount all the after-tax cash flows to find the net present value of the reserves in each region, add those up, and then add in other assets such as midstream (transportation) and downstream (refining) and make the normal balance sheet adjustments to calculate NAV and NAV per Share.

So at the end of this analysis, you’ve calculated a range of values for NAV per Share and you can compare that range to the company’s current share price to determine whether it’s overvalued, undervalued, or valued appropriately.

That range is based on different cases for commodity prices and perhaps different assumptions for long-term production decline rates, among other factors.

Q: OK, so you just mentioned what sounded like a very complex exercise here.

And you actually sent me the Excel model you used, so I see how complex it is.

How can you possibly build something this granular in the span of only a few hours? It would take days to replicate the model you used.

A: That’s true, and it really depends on the nature of the case study and how much time they give you.

If you don’t have that much time, simplify and focus on the key drivers rather than going into a ton of granular detail.

So maybe instead of splitting out all the wells by region or reserve type, you just model 1 or 2 separate locations in your NAV and combine that with production multiples for some areas, acreage multiples for other areas, and something as simple as an EBITDA multiple for the other segments like midstream.

The most important thing with these case studies is to show them that you understand how to break down and analyze a company’s operations, even if you don’t have enough time to do it in extreme detail.

It’s also very important to include scenarios in a case study like this – whenever you’re dealing with commodity prices (oil, gas, mining, etc.) – because they make a huge impact on the implied valuation and your investment recommendations may be completely different depending on commodity prices.

But you don’t need the extreme amount of detail I went through – if you’re under time pressure, simplify, don’t create as many granular projections, and show them that you’ve at least thought about different scenarios.

Q: I think a second major problem, though, is where to find all this information.

Companies don’t exactly break out everything you’ve described in their annual filings .

A: Sometimes yes, sometimes no.

It’s true that you may have to go beyond the filings at times and look at investor presentations, equity research, and so on – and it’s actually a good idea to review all of those just to check your own numbers and see if you’re coming up with ranges that make sense.

Many oil & gas companies do actually disclose reserves, wells drilled, and production by location, but you’re right that they may not include 100% of what you need.

So a lot of it does depend on the company and how much they’ve chosen to disclose – the company I valued gave a lot of information in their filings and I found more via a recent investor presentation and equity research.

Q: OK, I see. So do the best you can with the information you have available, but if it’s not there, don’t kill yourself trying to get the numbers.

What about the second case study on the offshore drilling company?

A: Sure… that one was a little more straightforward and it’s also easier to explain.

The format was similar: “Here’s an offshore drilling company, currently trading at $X Per Share. Should we invest?” So once again, you need to determine whether it’s overvalued, undervalued, or valued appropriately.

I split it into the ultra-deep water (UDW) , deep water (DW) , and jack-up segments, and determined a “day rate” (i.e. how much money each type of ship makes per day), a utilization rate, and daily expenses for each category, all based on what was in the company’s most recent filings.

Then I used the company’s “fleet status report,” a supplementary document that lists all the rigs and the categories for each one, to calculate yearly revenue and expenses on a per-rig basis.

It was not terribly complicated: you simply take the daily revenue and expenses and multiply by the days in the year, maybe factoring in inflation over time as well.

I also used scenarios for this one and included Base, Downside, and Upside cases. The expense profile was the same in each case (reflecting reality), but the daily revenue and utilization rates were slightly higher in the Upside case and lower in the Base and Downside cases.

Then, I created a DCF analysis that pulled in revenue and expenses from this buildup and went through the normal steps of projecting and discounting the cash flows and the Terminal Value at the end.

Q: That sounds too easy. Are you sure this was a real case study, or are you just making stuff up now?

A: Hah, good one…

It was definitely more straightforward. But there were a few tricky parts:

- Getting the CapEx correct and splitting it into Maintenance vs. Growth CapEx – since some of the rigs had yet to be completed. So the earlier years were more CapEx-heavy, and in the later years the spending moved more toward Maintenance CapEx.

- Factoring in planned asset sales – yes, you need to include these in a DCF. They only existed in a few early years, but if a company mentions that it plans to sell a specific asset in its filings, you need to include it and reflect the cash inflow.

- Properly constructing and defending my assumptions – a few other candidates attempted to complete this case study, but made much simpler assumptions for revenue growth or did not take into account factors like the completion of new rigs, the higher upfront CapEx, and so on.

Q: So let me stop you right there – how would you defend something like the numbers you used for your different cases here?

A: I mostly based them on the company’s historical numbers. So for the Base Case, I looked at the Daily Rate over the most recent quarter.

And then for the Downside and Upside cases, I looked at historical data further back and used the general range that the rate was in over time to get those.

You don’t want a super-wide range for these or the analysis doesn’t mean much; my numbers were about 10-15% different in each case.

On the Job and the Future

Q: Great, thanks for describing these case studies in such detail. I think everyone but the hardcore oil & gas geeks has had enough by now, so let’s move on…

Any thoughts on your new job at the hedge fund so far?

A: Admittedly, I haven’t been here that long yet, so don’t take my views as “the inside scoop from a seasoned industry veteran.”

But my main impression is that it’s far less structured than banking.

That’s quite challenging because it’s easy to find yourself sitting around and doing nothing but surfing the web… when in reality, you need to be generating investment ideas .

If you’re not constantly thinking of new ideas, looking into opportunities, and doing research and due diligence yourself, you’ll never make it here.

It’s not like banking where they just give you tasks and you have to execute everything.

For more on this topic, see the article on the hedge fund career path .

Q: But it sounds like you like it more, despite the added challenges?

A: I like getting to dig into companies and understand what makes them tick.

Let’s say you come up with a long / short equity idea… you could go and call up investor relations for that company, meet with management, or even fly out to their headquarters and do a deep dive on everything you want to know about.

So it’s different from banking where you often just go with what the client wants to see and don’t do as much critical thinking.

Q: Any downsides so far?

A: Not really, though I do miss the team environment you get in banking .

You don’t really see that as much here – you’re flying solo a lot of the time and don’t necessarily collaborate with others as much.

On the other hand, that also means that I get to avoid the office politics that were driving me crazy as well.

I have no plans to leave anytime soon, as I really like the industry and enjoy working with these types of companies.

Q: Awesome! Thanks for such an in-depth interview.

A: My pleasure.

About the Author

Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street . In his spare time, he enjoys lifting weights, running, traveling, obsessively watching TV shows, and defeating Sauron.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Read below or Add a comment

49 thoughts on “ From Oil & Gas Investment Banking to Energy Hedge Fund: How to Make the Leap and Dominate Your Case Studies ”

What is the likelihood of someone in oil and gas IB going to a non energy fund like a typical long/short equity HF?

Not very likely because energy is very specialized (perception more than reality sometimes, but recruiters only care about perception).

Would going back to school for an MBA help at all?

Not unless you somehow get non-energy work experience via the MBA such as from a pre-MBA internship

Great article – I would be interested in getting in touch with the interviewee to have a brief chat about the discussed opportunities.

Please let me know if there is any option to do that.

Thanks and best,

I can ask, but this interview was conducted years ago, so he may or may not be responsive.

Nice! Quick question though, if i want to get into oil and gas investment banking post MBA, is geography an issue? i.e should my search for jobs be in Houston or I can get into the field from DC..this will have a tremendous effect on the business school i choose to attend as I am considering schools based on areas I think i can get a job afterwards. Thanks

Geography matters, yes. You can still get in coming from DC, but your chances will be better if you’re in Houston or closer to Houston.

Hi Brian: I am looking for opportunities in municipal finance, investment banking and equity capital markets to create and deliver long-term value to clients involved in the shale play. What investment banking firms in the northeast are active in this area. Thanks, Mike

I am not 100% sure and I’ll leave readers to answer your query.

Do you think that the energy industry (specifically oil & gas) is slowly dying out? I have read that the resource extraction will top by 2017 and will be declining afterwards. Moreover, new energy sources, such as solar, are rising. So, would not it be a bit shortsighted to get into such an industry for a 20-year old graduate like me.

No. People always say energy is “dying,” and then it always comes back. Commodity prices fluctuate, but conventional energy will be around for a *very* long time to come.

Solar energy is not going to power an airplane (or most other methods of transportation ) anytime soon…

Hi Brian/Nicole,

How about mining hedge fund/private equity? Can anyone here give some names?

These links maybe useful: http://www.resourcecapitalfunds.com/about.asp http://www.greenstoneresources.com/ http://www.arc-fund.com/ http://www.miningprivateequity.com/

I am really interested in Oil & Gas investment banking. But as I understand, the deals in the sector mainly go through the Houston offices. Is it equally beneficial in the long run if I want to start in an NYC Oil & Gas BB office? I feel the NYC networking experience is critical in the first two years of your career. Will that have a negative impact on my experience in terms of how much I learn and how good my exit opportunities are? Thanks a lot for your help.

It depends on where you want to end up. If you want to end up in NY, I’d probably start out in NY. In regards to how much you can learn, it depends on the team and your firm. By starting out in a particular city, you’re more likely to stay in that region unless you can pull off in-person trips or interview entirely via video conference (unlikely for the traditional exit opportunities). Plenty of analysts elsewhere get into mega-funds – it’s just that they go to the offices in their region rather than NY. One legitimate difference is that there are more exit opportunities in New York just because it’s the biggest financial center – but then there’s also more competition. https://mergersandinquisitions.com/investment-banking-new-york-california/

Thanks a lot Nicole. I think I am just a little worried that the deal flow in the NYC offices might not be as great as Houston. But at the same time, the amount you learn as an analyst also depends on how practive you are on the job and the kind of attitude you have. Perhaps I can start in NYC hopefully and see where it takes me.

Thank you so much for your help. I really appreciate it.

Yes. In terms of the deal flow, I can’t comment though I’d imagine it depends on the firm you’ll be working for too.

Hi, great article! Is it possible to get into these energy funds with experience as a financial analyst from a large oil&gas company (eg. Exxon, Shell, BP etc)? Thanks.

I believe so, you’ll just have to have a great pitch and articulate why you want to move and how you can add value.

Thanks for the interview Brian. As an energy professional looking to shift my career towards the corporate development/M&A areas this was really informative. It’s interesting to see how energy is viewed from a PE/Banking perspective. Cheers and thanks for the site!

Thanks for your comment!

Does anyone have any insight on moving from energy specific pe to more general/different industry pe? How conceivable is energy pe then b school then pe in a different industry?

I think you can still move to other industries even though your industry knowledge is different because the basic modeling/analytical skills are transferable. I’d suggest you to start networking a lot within the PE community by attending industry events if you haven’t already been doing so. Readers may have more insights on this front. Getting an MBA is useful in PE, regardless of whether you want to switch industries or not, because pedigree is valued https://mergersandinquisitions.com/private-equity-recruiting/

GREAT POST!

I am an analyst in energy equity research…so the valuation process described here actually resonates with me:)

If possible, I would like to know the guest’s view on moving from energy equity research to an energy hedge fund, as opposed to moving from banking. Is it a similar process? Would it be more difficult just because you get more prestige coming from banking?

Thanks! It is a similar process, but probably easier from banking since the perception is that it’s more demanding / prestigious, even if that’s not really true. But plenty of ER associates do move from ER to HFs, and the process is similar.

Thanks for the writeup! I come from an oilfield services group myself and was surprised that they lumped E&P opportunities together with the oilfield services. Always thought there was a distinct breakdown between up mid and down stream.

Thanks! Yeah, usually there is more of a distinction between the two. But some funds will focus on opportunities from upstream to downstream within energy.

Great article.

Where does the coverage/execution divide lie in a specialized group like O&G? Have heard many different answers to the topic in general. Would be grateful for your input (or even the interviewee’s…).

Many thanks.

I don’t think there’s a universal split and a lot of it depends on the bank/location, but in general the roles are probably blended together more because it’s so specialized. This article didn’t really cover O&G groups at banks in detail, but that one will be coming up later this year in a separate interview on natural resources groups.

OK, thanks. Look forward to it.

But most of energy / natural resources PEs and HFs are located in Houston…

Most, but not all. Some are in NY, London, and other places.

Thanks Brian for sharing yet another interesting and exciting post. Thoroughly enjoyed reading the interview. I have had some investment banking background and have recently joined a physical soft commodities firm as a trader. The nature of the role requires one to be able to negotiate purchase contracts, plan for shipments and understanding the futures market for hedging. The skills required are not nearly as technical compared to what you will encounter in investment banking so my question is how do I position myself for a role in the hedge funds? Is investment banking the main route to secure roles in hedge funds?

Thanks! If you’re at a commodities trading firm, it will be tough to move into a traditional long/short equity HF because they usually want people with corporate finance backgrounds. However, you could have a good shot at a global macro fund because they want people who know commodities really well, so I would probably aim for those types of funds with your background.

Thanks for this article.

Is it possible to move from Oil & Gas/Natural resources (London) to commodities trading firm (paper or physical)? What is your opinion about such opportunities (Energy PE/HF) in London, are there much opportunities? Anything you think I should look out for?

I’m going to start my 2024 summer in a BB (BofA), hopefully in their NR group.

We covered some of those points in the article on commodity hedge funds: https://mergersandinquisitions.com/commodity-hedge-funds/

In theory, you can move from a NR group to a trading firm, but you’re better off starting in S&T. I can’t comment on energy PE firms or hedge funds in London, as I haven’t looked at the space in a long time.

Great article Brian! I have a quick question though, do you think energy corporate banking would be a good career? And what would the comps like for energy corporate banking?

In addition, is it always the case that corporate bankers switch to leveraged finance after a few years?

Thanks! Yes, energy corporate finance or banking could be good… some of those companies are huge and massively profitable and pay a lot. Not sure about what’s really comparable to it.

I don’t think corporate bankers “always” switch to LevFin, but it is one possible path.

Thank you for the post! Definitely informative, and for an energy nerd like me, I always enjoy a healthy discussion of drilling, NAVs, well production decline curves, etc.

With regard to the offshore drilling company case, when projecting revenues, how do you go about forecasting Base, Upside, and Downside cases when it comes to dayrates as these can change fairly significantly over time (previous contract dayrate vs. new contract dayrate, as seen on the fleet status reports) — more specifically, do you try to figure “demand” in as well, or solely look at historical data to get a range? Apologies for the long-winded question — just trying to get a better idea of how to model this sort of stuff!

Thanks! Not 100% certain of that one, but basically I think he focused on historical data and used that range, which was easier in this case because it wasn’t a very wide range. And then I think he looked at some estimates in the fleet status report and an investor presentation, and adjusted them up or down for the next 1-2 years based on how close the historical forecasts were to actuals.

Got it — gotta love those investor presentations! Appreciate the message, thanks again!

Great Interview. Would it be possible to share the model he sent you so we can see how complex it it?

Thanks! I asked, but he said no because it’s too personally identifying – I would have to remove names, change around all the numbers, formatting, etc. If I have time to do so in the future I may go back and do that.

Amazing article. I have a 3rd round case interview with a top E&P focused hedge fund coming up, so I’ve been researching all over. This article was particularly helpful and the first one to explain in great detail certain of the complex considerations required to impress the PMs. I’m curious if you were ever able to clean the model to share, or if you know of anyone or any service that could offer a couple hours of paid consulting services to answer questions about the nuances of E&P modeling. Thanks, again for the interview. Look forward to hearing from you soon.

Regards, Adam

I see you already signed up, but the entire NAV Model is in the Oil & Gas course as the second case study on Ultra Petroleum. We don’t offer consulting services, but you’re free to ask any questions about your model or stock pitch for the hedge fund interview on the site, either in the comments or via email.

thanks for the interview. great details and insights.

Thanks for reading!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Top 20 Oil & Gas Interview Questions & Answers (2024 Update)

Here are Oil and Gas interview questions and answers for freshers as well as experienced candidates to get their dream job.

1) What are the different categories of Oil found worldwide?

There are about 161 different types of Oil found worldwide. The different categories of Oil found worldwide is classified into different types of crude oil like Brent, Dubai Crude, West Texas, Intermediate, etc. Classification is done according to their sulphur content.

Free PDF Download: Oil and Gas Interview Questions and Answers

2) Explain what is OPEC?

Organization of Petroleum Exporting Countries is also known as OPEC.

3) What is the purpose of forming OPEC?

4) who are the members of opec currently.

- Saudi Arabia

5) On what basis Crude Oil prices are determined?

Crude oil is a commodity, and the prices depend on the demand and supply.

6) Who controls or decides the Oil prices?

OPEC does not decide the crude oil prices, though it influence the market prices. It is following exchange market that decides global crude oil prices

- New York Mercantile Exchange ( NYMEX)

- International Petroleum Exchange in London (IPE)

- Singapore International Monetary Exchange (SIMEX)

7) How U.S dollar contribute to the rising Oil prices?

On the world market, oil is priced in U.S dollars. So, when dollar becomes weaker, foreign currency becomes stronger, which means foreign countries can buy more oil at same amount of money. As people in other countries start buying more, demand rises, and it drives up the price in dollars, which again influence the price of oil in the global market.

8) Explain how much do you pay for a gallon of regular gasoline?

On a regular gallon of gasoline, you will pay about

- Crude Oil: About 67% of what you pay goes to the cost of crude oil

- Refining costs and profits: About 14%

- Distribution, Marketing and Retail costs and profits: 8%

9) Mention what is the amount of ethanol present in gasoline?

Approximately about 10% -15 % of ethanol is present per gallon of gasoline, and it is denoted by E10.

10) Explain what is PowerShares DB Energy Fund?

In the energy commodities, this fund is the most rounded investment in the energy commodities. This fund is invested in the energy futures contract like heating oil, Brent crude oil, RBOB gasoline and natural gas.

11) What are the factors that decide the retail price of Gasoline?

The gasoline retail price is determined by following factors

- Transportation costs

- Location (Urban/ Rural)

- Average volume pumped

- Competitive mix ( Concentration of major oil companies and independent marketers)

12) What are the taxes you have to pay on your gasoline?

There are State taxes and Federal taxes that is levied on your gasoline, though taxes changes from one state to another. You are paying approx. 23% of state taxes per gallon of your gasoline that may vary to 40% depending upon the state. While, federal government excise tax is about 18 percent per gallon.

13) Mention what are the factors that can fluctuate in gasoline price?

The factors that can fluctuate the gasoline price are

- Changes to the price of crude oil

- Major supply disruption in any area of the country

- Increased consumer demand

- Expected or unexpected outages of any refinery

- Activity on the commodities market

14) Who analyse and does research of the Oil and Natural gas supply in U.S?

EIA (Energy Information Administration) is an independent agency of the United States Department of Energy, which gives all the weekly detail or data of the supply of oil and natural gas in U.S. It schedules weekly publications known as WEEKLY PETROLEUM STATUS REPORT and THE WEEK IN PETROLEUM.

15) Explain how many gallons of gasoline does one barrel of oil can be made?

From one barrel (42 gallons) U. S refineries make about 19 gallons of motor gasoline. The residue yields other refined products such as distillate and residual fuel oil.

16) Which states are among the high paying price for gasoline?

Some of the states that are paying more price for gasoline other than other states are

• California • New York • Alaska • Connecticut • Michigan • Pennsylvania • Indiana • Maine

17) Explain how much do oil companies make on each dollar you spend on gas?

Oil and natural gas industry make 8.6% for every dollar of sales.

18) Mention what are the requirements for importing natural gas, oil and petroleum into the U.S?

For importing petroleum or petroleum products to U.S, you don’t need a license to import these items, but you need to file a form called EIA814 with the EIA (Energy Information Administration).

19) What is API gravity?

API means American Petroleum Institute; it is the main association for the oil and natural gas industry in U.S. The API denotes about 400 corporations in the petroleum industry and helps to set the standard for production, refinement and distribution of petroleum product.

20) How API is calculated?

API is nothing but the ratio of its density compare to other substance like water to check the standard of the oil. The formula to check API is

API gravity = (141.5/ Specific Gravity) – 131.5

You Might Like:

34 Comments

Thanks so much for u contribution.

I leanrt alot. Thnaks

THANK U FOR THIS

good questions & answers.

*how find out if your land has oil? *how find out if your has gold? *how to know if your land has californium 252?

Ver helpful oil and gas field. Electrical technical questions and answers.very thank.you sir

Is very well Question

Very good basic information

Thank you to the creator that I got a good grade on Science of Oil Thank You

This topics is very important and very good information to daily….very. Nice

I need to have more skills

Thanx for your indeemed works !!!!

I would love to join

Thanks for providing those information.please if you don’t mind just provide information about the chemistry.or Lab

Thank you for this. It’ll help me.

Thank you so much. please share technical questions on onshore civil and mep works

Thanks a lot careerguru99.com

Thank a lot for sharing detail information,please operational and control process

Thank you so much

More power to your elbow. I appreciate the wonderful knowledge u impact. May Allah increase u in knowledge. Thanks.

Thanks for sharing this knowledge to us.

This was helpful

thank you for sharing your knowledge whit us.

Thank you very much.

I find so many contradictory comments on crude oil production. Can someone confirm the following points:

World crude oil production 2021 stated about 88.4 million bpd – true or false ? OPEC+ just renegotiated UAE needs by increasing production by 1.63 bpd – true or false ?

If the above is true, this increase represents an increase of about 1.85% – true or false

I would be grateful for a profession unambiguous answer

Very nice question and creative to help us to know more about our industries.

Thanks for this information I need more skill in this field I well join this field need skill

Thanks for sharing this best information especially again for us fresh graduate

This is very important information.

Thanks to sharing with us that information.

Very insightful. Thank you!

I benefit lot with this thanks.

I’d need more of this questions and answers as a fresh graduate, I’ve dreamed to work in the oil and gas sector…

Useful information, thanks

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

We and our partners use cookies to give you the best online experience, including to personalize content, advertising, and web analytics. You can reject cookies by changing your browser settings. To learn more about the cookies we use see our Cookie Policy .

- Supply Chains

- Manufacturing

- Transportation

- Warehouse Operations

- Rail Logistics

- Ports & Terminals

- Road Traffic

- Passenger Terminals

- Business Processes

- Asset Management

- Social Processes

- Why simulation

- AnyLogic Timeline

- Artificial Intelligence

- Digital Twin

- Enterprise Simulation

- Get started

- White papers

Case studies

- Training and events

- AnyLogic Conference

- Documentation

- For academia

- Academic articles

- Clients & Testimonials

- --> Supply Chains

- --> Manufacturing

- --> Transportation

- --> Warehouse Operations

- --> Rail Logistics

- --> Oil & Gas

- --> Ports & Terminals

- --> Road Traffic

- --> Passenger Terminals

- --> Healthcare

- --> Business Processes

- --> Asset Management

- --> Marketing

- --> Social Processes

- --> Defense

Drilling Rig Digital Twin and Well Construction Optimization

Transocean is a Swiss offshore drilling company that provides rig-based well construction services worldwide. The company is one of the largest contractors in its sector and has offices in 20 countries. It operates a fleet of versatile, mobile, offshore units comprised of midwater, deep water, ultra-deep water, and harsh environment floaters. The company decided to build a digital twin of its well construction processes to enable prediction and advanced planning capabilities with the aim of optimizing operations across its fleet.

Resource Optimization in the Oil and Gas Industry Project Management

YPF is the largest oil and gas company in Argentina. YPF was aiming to reduce its costs associated with oil wells’ maintenance downtime and equipment breakdown. The analysis showed that the root cause of inefficiencies was the lack of a robust maintenance scheduling process. YPF approached Simcastia to develop a scheduling tool to streamline asset management at all YPF facilities.

Oil Well Modeling and Optimization Using AnyLogic Fluid Library

Canada is the third largest country to have oil reserves. However, most of the oil is in oil sand – the mixture of sand, oil, and water – which has to be heated up with steam to emit the oil. It is costly to maintain such a distribution system, and outages may lead to disruptions in steam injection and oil production. Stream Systems company applied AnyLogic simulation modeling to optimize expenditures and capture production lags.

Simulation and Optimization of Sand Transportation for Fracking Operations

Fracking is the process of cracking rocks using a combination of sand and water at high pressure to release trapped gas. Tecpetrol needed to optimize sand transportation for their fracking operations from various warehouses. They could do this best using a simulation model with a parameter variation experiment and then a simulation experiment. In the first 8 months of implementing this model, Eurystic saved an estimated $500,000.

Simulation Based Digital Twin for Well Construction Process Optimization

Transocean is one of the largest offshore drilling companies that provides rig-based well construction services worldwide. Offshore oil and gas well construction is a complex process that takes a considerable amount of time. It demands certain sequences of both manual and semi-automated operations carried out in unison, as safely and efficiently as possible. Different kinds of equipment are usually created and operated independently. However, at the rig, all technical units are integrated. Any kind of delay in machinery increases the critical time path, which reduces the efficiency of the...

Oil Pipeline Network Design: Finding Bottlenecks and Choosing the Right Policies

One of the largest oil and gas pipeline operators in North America was delivering oil to a client that was not always able to accept the incoming batches. The operator was challenged to quantify the system impacts of deferred downstream deliveries. They also needed to determine whether the existing tankage at upstream oil terminals would be adequate to store the deferred batches.

Identifying Inefficient Oil Wells through Oil Extraction Process Simulation

One of the largest oil and gas companies faced financial inefficiency from depleting deposits: approximately 20% of the deposits yielded little if any profit. In order to maintain a strong performance in a context of high uncertainty, the company had to make operational decisions about whether they should shut down or retain their marginally profitable wells, and whether it made sense to repair breakages.

Simulation Modeling of an Offshore Offloading System for an Arctic Oil and Gas Condensate Field

The Novoportovskoye oil and gas condensate field is located in the Yamal peninsula and owned by the fourth-largest oil production company in Russia. Oil from the field is transferred via 100km pipeline to the sea terminal at Cape Kamenny, where it is loaded into arctic cargo tanks for further transportation. The main issues in planning tanker transportation in an arctic region are the harsh ice environment and difficult sea conditions.

Modeling and Optimization of a Maritime Transport System for an Offshore Oil Platform