- A/B Monadic Test

- A/B Pre-Roll Test

- Key Driver Analysis

- Multiple Implicit

- Penalty Reward

- Price Sensitivity

- Segmentation

- Single Implicit

- Category Exploration

- Competitive Landscape

- Consumer Segmentation

- Innovation & Renovation

- Product Portfolio

- Marketing Creatives

- Advertising

- Shelf Optimization

- Performance Monitoring

- Better Brand Health Tracking

- Ad Tracking

- Trend Tracking

- Satisfaction Tracking

- AI Insights

- Case Studies

quantilope is the Consumer Intelligence Platform for all end-to-end research needs

How To Determine Sample Size for Quantitative Research

This blog post looks at how large a sample size should be for reliable, usable market research findings.

Table of Contents:

What is sample size , why do you need to determine sample size , variables that impact sample size.

- Determining sample size

The sample size of a quantitative study is the number of people who complete questionnaires in a research project. It is a representative sample of the target audience in which you are interested.

Back to Table of Contents

You need to determine how big of a sample size you need so that you can be sure the quantitative data you get from a survey is reflective of your target population as a whole - and so that the decisions you make based on the research have a firm foundation. Too big a sample and a project can be needlessly expensive and time-consuming. Too small a sample size, and you risk interviewing the wrong respondents - meaning ultimately you miss out on valuable insights.

There are a few variables to be aware of before working out the right sample size for your project.

Population size

The subject matter of your research will determine who your respondents are - chocolate eaters, dentists, homeowners, drivers, people who work in IT, etc. For your respective group of interest, the total of this target group (i.e. the number of chocolate eaters/homeowners/drivers that exist in the general population) will guide how many respondents you need to interview for reliable results in that field.

Ideally, you would use a random sample of people who fit within the group of people you’re interested in. Some of these people are easy to get hold of, while others aren‘t as easy. Some represent smaller groups of people in the population, so a small sample is inevitable. For example, if you’re interviewing chocolate eaters aged 5-99 you’ll have a larger sample size - and a much easier time sampling the population - than if you’re interviewing healthcare professionals who specialize in a niche branch of medicine.

Confidence interval (margin of error)

Confidence intervals, otherwise known as the margin of error, indicate the reliability of statistics that have been calculated by research; in other words, how certain you can be that the statistics are close to what they would be if it were possible to interview the entire population of the people you’re researching.

Confidence intervals are helpful since it would be impossible to interview all chocolate eaters in the US. However, statistics and research enable you to take a sample of that group and achieve results that reflect their opinions as a total population. Before starting a research project, you can decide how large a margin of error you will allow between the mean number of your sample and the mean number of its total population. The confidence interval is expressed as +/- a number, indicating the margin of error on either side of your statistic. For example, if 35% of chocolate eaters say that they eat chocolate for breakfast and your margin of error is 5, you’ll know that if you had asked the entire population, 30-40% of people would admit to eating chocolate at that time of day.

Confidence level

The confidence level indicates how probable it is that if you were to repeat your study multiple times with a random sample, you would get the same statistics and they would fall within the confidence interval every time.

In the example above, if you were to repeat the chocolate study over and over, you would have a certain level of confidence that those eating chocolate for breakfast would always fall within the 30-40% parameters. Most research studies have confidence intervals of 90% confident, 95% confident, or 99% confident. The number you choose will depend on whether you are happy to accept a broadly accurate set of data or whether the nature of your study demands one that is almost completely reliable.

Standard deviation

Standard deviation represents how much the results will vary from the mean number and from each other. A high standard deviation means that there is a wide range of responses to your research questions, while a low standard deviation indicates that responses are more similar to each other, clustered around the mean number. A standard deviation of 0.5 is a safe level to pick to ensure that the sample size is large enough.

Population variability

If you already know anything about your target audience, you should have a feel for the degree to which their opinions vary. If you’re interviewing the entire population of a city, without any other criteria, their views are going to be wildly diverse so you’ll want to sample a high number of residents. If you’re honing in on a sample of chocolate breakfast eaters - there’s probably a limited number of reasons why that’s their meal of choice, so you can feel confident with a much smaller sample.

Project scope

The scope and objectives of the research will have an influence on how big the sample is. If the project aims to evaluate four different pieces of stimulus (an advert, a concept, a website, etc.) and each respondent is giving feedback on a single piece, then a higher number of respondents will need to be interviewed than if each respondent were evaluating all four; the same would be true when looking for reads on four different sub-audiences vs. not needing any sub-group data cuts.

Determining a good sample size for quantitative research

Sample size, as we’ve seen, is an important factor to consider in market research projects. Getting the sample size right will result in research findings you can use confidently when translating them into action. So now that you’ve thought about the subject of your research, the population that you’d like to interview, and how confident you want to be with the findings, how do you calculate the appropriate sample size?

There are many factors that can go into determining the sample size for a study, including z-scores, standard deviations, confidence levels, and margins of error. The great thing about quantilope is that your research consultants and data scientists are the experts in helping you land on the right target so you can focus on the actual study and the findings.

To learn more about determining sample size for quantitative research, get in touch below:

Get in touch to learn more about quantitative sample sizes!

Related posts, quantilope & wire webinar: solving the research dilemma with ai, a full year of better brand health tracking in the soda category, non-probability sampling: when and how to use it effectively, survey results: how to analyze data and report on findings.

Skip navigation

World Leaders in Research-Based User Experience

How many participants for quantitative usability studies: a summary of sample-size recommendations.

July 25, 2021 2021-07-25

- Email article

- Share on LinkedIn

- Share on Twitter

In This Article:

Introduction, the intuition behind the 40-participants guideline: why you need 40 participants, the assumptions behind the 40-participant guideline, when you may get away with fewer participants, what if your metric is continuous.

The exact number of participants required for quantitative usability testing can vary. Apparently contradictory recommendations (ranging from 20 to 30 to 40 or more) often confuse new quantitative UX researchers. (In fact, we’ve recommended different numbers over the years.)

Where do these recommendations come from and how many participants do you really need? This is an important question. If you test with too few , your results may not be statistically reliable . If you test with too many, you’re essentially throwing your money away. We want to strike the perfect balance — collecting enough data points to be confident in our results, but not so many that we’re wasting precious research funding.

In most cases, we recommend 40 participants for quantitative studies. If you don’t really care about the reasoning behind that number, you can stop reading here. Read on if you do want to know where that number comes from, when to use a different number, and why you may have seen different recommendations.

Since this is a common confusion, let’s clarify: there are two kinds of studies, qualitative and quantitative. Qual aims at insights, not numbers , so statistical significance doesn’t come into play. In contrast, quant does focus on collecting UX metrics , so we need to ensure that these numbers are correct. And the key point: this article is about quant, not qual . ( Qualitative studies only need a small number of users , but that’s not what we’re discussing here.)

When we conduct quantitative usability studies, we’re collecting UX metrics — numbers that represent some aspect of the user experience.

For example, we might want to know what percentage of our users are able to book a hotel room on Expedia, a travel-booking site. We won’t be able to ask every Expedia user to try to book a hotel room. Instead, we will run a study in which will ask a subset of our target population of Expedia users to make a reservation.

Then, we’ll count how many participants in that study are able to complete the task and we’ll use that percentage to estimate the percentage of our population. Of course, what we get from the study is not going to be exactly the same as our population success rate (there is always going to be some amount of measurement error), but we hope that it will be close enough.

When the number of people we include in the study is small, the percentage from the study will be unlikely to predict the success rate of the whole population — that number will simply be too noisy.

As another example, image you want to figure out the average daily temperature in Berlin, Germany during the summer. You decide to estimate that average by looking only at three random daily temperatures. Those three days probably will not give you a very accurate number, will they? This is the problem with small samples for quantitative studies.

In a quantitative usability study, to get a reasonably trustworthy prediction for the behavior of your overall population, you need around 40 data points. There are nuances depending on how much risk you are willing to take and what exactly you are trying to measure.

The 40-participant recommendation comes from a calculation . That calculation estimates the minimum number of users needed to produce a reasonable prediction of your population behavior based on one study. It has specific assumptions, but it will work for many quantitative usability studies .

If you don’t care about statistics, you can stop reading at this point (or jump directly to the conclusion ). Otherwise, if you’re curious about the nuances behind this recommendation, keep reading.

In statistical terms, the 40-participant guideline comes from a very specific situation, which may or may not apply to your particular scenario. It assumes that you have a considerable user population (over 500 people) and that the following are true:

- You want to estimate a binary metric such as success rate or conversion rate based on a study with a sample of your user population.

- You aim for a 15% margin of error — namely, you want your true score (e.g., the success rate or conversion rate for your whole population) to be within 15% of the observed score (the percentage you obtained from your study).

- You want to take very little risk of being wrong in this prediction (that is, you will use a confidence level of 95% for computing your margin of error).

If all the above are true, it turns out that you can calculate the number of participants you need for your study, and it is 39. We round it up to 40 — hence the above recommendation. (These estimates are often rounded up by a few participants. First, rounding up makes the numbers more memorable. Second, slight overrecruiting helps if something goes wrong with one or two participants and their data has to be removed. For example, you may discover during the study that you accidentally recruited an unrepresentative user or a cheater.)

It is possible to need fewer participants if the last two of the assumptions above are not true. Specifically, if you are:

- Willing to have a margin of error that is bigger than 15%

- Willing to take a larger risk

Willing to Have a Margin of Error Bigger than 15%

The margin of error tells you how much you can expect your overall population rate to vary as a function of the observed score. Any time you collect a metric you should compute a margin of error (or, equivalently, a confidence interval). In other words, if in your Expedia study, 70% of your study participants were able to book a room and your margin of error was 15%, it means that your whole-population completion rate (the true score) is 70% ± 15% — that is, it could be anywhere from 55% to 85%.

That range is 30% wide and it represents the precision of your estimate; it could, however, be the case that in some situations you don’t care if it’s a little wider and your margin of error is bigger (for example, if you want to be able to say that most people can use a certain feature of your UI). We don’t recommend going for margins of error bigger than 20% because your confidence interval for the true score will be quite wide and unlikely to be useful.

Willing to Take a Larger Risk

A 95% confidence level means that your margin of error computations will be wrong only 5% of the time. It is the gold standard for published academic research. However, most UX researchers work in applied research, not academic research. For practical purposes, you may be willing to take a little bit more risk.

(Taking more risk is cheaper and is a good idea if the risks of a somewhat unreliable result won’t be catastrophic. However, bear in mind that UX teams often use quantitative usability testing to inform prioritization and resource allocation, so unreliable data may be quite problematic.)

If you are willing to drop the confidence level to 90%, then a margin of error of 15% will require 28 users and a margin of error of 20% will require 15 users . Again, you may consider rounding these up for many good reasons (for example, you may end up having to remove some of your trials when you clean up the data). This is the origin of the 30-user guideline that you may have encountered elsewhere — that recommendation accepts more risk.

This table shows the number of participants needed for different confidence levels and desired margins of error for binary metrics. The lower the confidence level, the riskier the study. The bigger the margin of error, the lower your precision and the less useful the numbers will be.

If your metric is continuous or can be treated as continuous (e.g., task time, satisfaction or other types of rating, SUS score ), the formula for the number of participants will depend on an additional factor: the variability of your target population. (It will also depend, like for binary metrics, on the desired margin of error and the confidence level used). That is something that you could estimate separately for your population by running a pilot study.

Of course, a pilot study to estimate the standard deviation is quite expensive and it will itself involve a fairly large number of participants. On the other hand, in most quantitative usability studies, there are several metrics involved and usually at least one of them is binary. Therefore, we recommend using that binary metric as a constraint in deciding the number of users. In other words, if you are collecting success, task time, and satisfaction, then you can simply say I want a 15% margin of error for success at a 90% or 95% confidence level (and recruit 30 or 40 users respectively). That will usually result in good margins of error for the other metrics involved.

If, however, you collect only continuous metrics (this is unusual) and you cannot afford to estimate the standard deviation of your population, you must first settle on a desired value for your margin of error. Of course, your desired value will depend on what you are measuring and the range for a task. We usually recommend using as a desired value 15% or 20% of the mean — in other words, if your task time is around 1 minute, you would like a margin of error no bigger than 0.15–0.20 minutes (9 to 12 seconds); if your task time is around 10 minutes, your margin of error should be no bigger than 1.5–2 minutes.

Next, you can use Jakob Nielsen’s estimate of variability for website- and intranet-related continuous metrics . That estimate is 52% of the mean . In other words, if the mean task time is 1 min, your estimated standard deviation is 0.52 x 1 min = 0.52 minutes. If the mean task time is 10 minutes, then your estimated standard deviation will be 0.52 x 10 min = 5.2 minutes. With that supplementary assumption, you would need 47 users for a 15% margin of error at 95% confidence level, 33 users for a 15% margin of error at 90% confidence level, 26 users for a 20% margin of error at 95% confidence level and 19 users for a 20% margin of error at 90% confidence level. (Note that a 15% margin of error of 1 minute translates into 0.15 minutes — that is, 9 seconds.)

This table shows the required number of participants needed for a study involving continuous metrics such as time on task or satisfaction. Different numbers of participants are appropriate for different confidence levels and desired margins of error.

In general, the number of users can be determined using the following formula:

The variables in that formula are:

- K is a constant (1.96 for 95% confidence level or 1.645 for 90% confidence level)

- s is your standard deviation as a proportion of the mean

- m is your desired margin of error, also expressed as a proportion of the mean (0.15 corresponding to 15% or 0.20 corresponding to 20%)

If you estimate your standard deviation as a 52% (or 0.52) of the mean, then you can use the formula below:

Even though there are many different recommendations for sample sizes in quantitative usability testing, they are all consistent with each other — they simply make slightly different assumptions. We think the 40-user guideline is the simplest and the most likely to lead to good results — namely, a relatively small margin of error with a high confidence level.

However, you may settle for a lower number of users (around 30) if you want to take slightly more risk that your findings will not represent the behavior of your user population and thus decrease your confidence level to 90%. Moreover, if you also have tolerance for a larger margin of error, you can drop the number of users to 20 or even fewer, but that is generally a lot riskier.

An acceptable strategy (especially if you are on a tight budget and mostly interested in continuous metrics such as task time and satisfaction) is to start with as many users as you can comfortably afford — say, 20–25 users. Once you’ve collected your data from these users, calculate your margins of error and determine if they are tight enough for your purposes. If they are too wide, then consider adding more users. This approach, however, requires that you work fast: you’ll need to do your analysis in a matter of a few days in order to be able to run the extra participants very soon after the first batch. Otherwise, you risk compromising the validity of your study.

Choose the right sample size for your situation to ensure you’ll optimize your quantitative study: collecting just enough data, but not too much.

Jeff Sauro, James Lewis. 2016. Quantifying the User Experience: Practical Statistics for User Research . Elsevier.

Related Courses

How to interpret ux numbers: statistics for ux.

When research data should be trusted; what statistics to use when

Measuring UX and ROI

Use metrics from quantitative research to demonstrate value

Remote User Research

Collect insights without leaving your desk

Related Topics

- Research Methods Research Methods

Learn More:

How to Present UX Research Results Responsibly

Caleb Sponheim · 3 min

Card Sorting: Why & When

Samhita Tankala · 3 min

Measurement Error in UX Research

Related Articles:

Why You Cannot Trust Numbers from Qualitative Usability Studies

Raluca Budiu · 9 min

10 Survey Challenges and How to Avoid Them

Tanner Kohler · 15 min

Quantitative UX: Glossary

Raluca Budiu · 8 min

CASTLE Framework for Productivity/Workplace Applications

Page Laubheimer · 8 min

Confounding Variables in Quantitative Studies

Caleb Sponheim · 5 min

Should You Run a Survey?

Maddie Brown · 6 min

tools4dev Practical tools for international development

How to choose a sample size (for the statistically challenged)

One of the most common questions I get asked by people doing surveys in international development is “how big should my sample size be?”. While there are many sample size calculators and statistical guides available, those who never did statistics at university (or have forgotten it all) may find them intimidating or difficult to use.

If this sounds like you, then keep reading. This guide will explain how to choose a sample size for a basic survey without any of the complicated formulas. For more easy rules of thumb regarding sample sizes for other situations, I highly recommend Sample size: A rough guide by Ronán Conroy and The Survey Research Handbook by Pamela Alreck and Robert Settle.

This article is a short introduction to the topic for a more in-depth coverage of the topic consider enrolling in the free online course offered by University of Florida .

This advice is for:

- Basic surveys such as feedback forms, needs assessments, opinion surveys, etc. conducted as part of a program.

- Surveys that use random sampling.

This advice is NOT for:

- Research studies conducted by universities, research firms, etc.

- Complex or very large surveys, such as national household surveys.

- Surveys to compare between an intervention and control group or before and after a program (for this situation Sample size: A rough guide ).

- Surveys that use non-random sampling, or a special type of sampling such as cluster or stratified sampling (for these situations see Sample size: A rough guide and the UN guidelines on household surveys ).

- Surveys where you plan to use fancy statistics to analyse the results, such as multivariate analysis (if you know how to do such fancy statistics then you should already know how to choose a sample size).

The minimum sample size is 100

Most statisticians agree that the minimum sample size to get any kind of meaningful result is 100. If your population is less than 100 then you really need to survey all of them.

A good maximum sample size is usually 10% as long as it does not exceed 1000

A good maximum sample size is usually around 10% of the population, as long as this does not exceed 1000. For example, in a population of 5000, 10% would be 500. In a population of 200,000, 10% would be 20,000. This exceeds 1000, so in this case the maximum would be 1000.

Even in a population of 200,000, sampling 1000 people will normally give a fairly accurate result. Sampling more than 1000 people won’t add much to the accuracy given the extra time and money it would cost.

Choose a number between the minimum and maximum depending on the situation

Suppose that you want to survey students at a school which has 6000 pupils enrolled. The minimum sample would be 100. This would give you a rough, but still useful, idea about their opinions. The maximum sample would be 600, which would give you a fairly accurate idea about their opinions.

Choose a number closer to the minimum if:

- You have limited time and money.

- You only need a rough estimate of the results.

- You don’t plan to divide the sample into different groups during the analysis, or you only plan to use a few large subgroups (e.g. males / females).

- You think most people will give similar answers.

- The decisions that will be made based on the results do not have significant consequences.

Choose a number closer to the maximum if:

- You have the time and money to do it.

- It is very important to get accurate results.

- You plan to divide the sample into many different groups during the analysis (e.g. different age groups, socio-economic levels, etc).

- You think people are likely to give very different answers.

- The decisions that will be made based on the results of the survey are important, expensive or have serious consequences.

In practice most people normally want the results to be as accurate as possible, so the limiting factor is usually time and money. In the example above, if you had the time and money to survey all 600 students then that will give you a fairly accurate result. If you don’t have enough time or money then just choose the largest number that you can manage, as long as it’s more than 100.

If you would like to learn more about Survey Data Collection consider taking the free course offered by University of Michigan and University of Maryland. Enroll here.

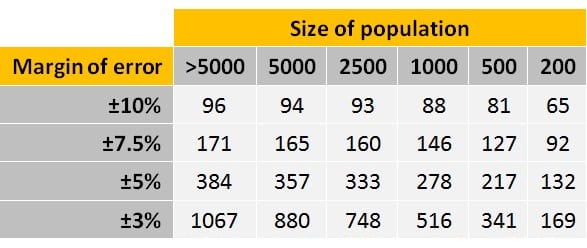

If you want to be a bit more scientific then use this table

While the previous rules of thumb are perfectly acceptable for most basic surveys, sometimes you need to sound more “scientific” in order to be taken seriously. In that case you can use the following table. Simply choose the column that most closely matches your population size. Then choose the row that matches the level of error you’re willing to accept in the results.

You will see on this table that the smallest samples are still around 100, and the biggest sample (for a population of more than 5000) is still around 1000. The same general principles apply as before – if you plan to divide the results into lots of sub-groups, or the decisions to be made are very important, you should pick a bigger sample.

Note: This table can only be used for basic surveys to measure what proportion of the population have a particular characteristic (e.g. what proportion of farmers are using fertiliser, what proportion of women believe myths about family planning, etc). It can’t be used if you are trying to compare two groups (e.g. control versus intervention) or two points in time (e.g. baseline and endline surveys). See Sample size: A rough guide for other tables that can be used in these cases.

Relax and stop worrying about the formulas

It’s a dirty little secret among statisticians that sample size formulas often require you to have information in advance that you don’t normally have. For example, you typically need to know (in numerical terms) how much the answers in the survey are likely to vary between individuals (if you knew that in advance then you wouldn’t be doing a survey!).

So even though it’s theoretically possible to calculate a sample size using a formula, in many cases experts still end up relying rules of thumb plus a good deal of common sense and pragmatism. That means you shouldn’t worry too much if you can’t use fancy maths to choose your sample size – you’re in good company.

Once you’ve chosen a sample size, don’t forget to write good survey questions , design the survey form properly and pre-test and pilot your questionnaire .

Photo by James Cridland

Tags Monitoring & Evaluation

About Piroska Bisits Bullen

Related Articles

What can international development learn from tech start-ups?

13 May 2021

Social Enterprise Business Plan Template

12 May 2021

How to write an M&E framework – Free video tutorial & templates

10 September 2017

Ready to level up your insights?

Get ready to streamline, scale and supercharge your research. Fill out this form to request a demo of the InsightHub platform and discover the difference insights empowerment can make. A member of our team will reach out within two working days.

Cost effective insights that scale

Quality insight doesn't need to cost the earth. Our flexible approach helps you make the most of research budgets and build an agile solution that works for you. Fill out this form to request a call back from our team to explore our pricing options.

- What is InsightHub?

- Data Collection

- Data Analysis

- Data Activation

- Research Templates

- Information Security

- Our Expert Services

- Support & Education

- Consultative Services

- Insight Delivery

- Research Methods

- Sectors We Work With

- Meet the team

- Advisory Board

- Press & Media

- Book a Demo

- Request Pricing

Embark on a new adventure. Join Camp InsightHub, our free demo platform, to discover the future of research.

Read a brief overview of the agile research platform enabling brands to inform decisions at speed in this PDF.

InsightHub on the Blog

- Surveys, Video and the Changing Face of Agile Research

- Building a Research Technology Stack for Better Insights

- The Importance of Delegation in Managing Insight Activities

- Common Insight Platform Pitfalls (and How to Avoid Them)

- Support and Education

- Insight Delivery Services

Our services drive operational and strategic success in challenging environments. Find out how.

Close Connections bring stakeholders and customers together for candid, human conversations.

Services on the Blog

- Closing the Client-Agency Divide in Market Research

- How to Speed Up Fieldwork Without Compromising Quality

- Practical Ways to Support Real-Time Decision Making

- Developing a Question Oriented, Not Answer Oriented Culture

- Meet the Team

The FlexMR credentials deck provides a brief introduction to the team, our approach to research and previous work.

We are the insights empowerment company. Our framework addresses the major pressures insight teams face.

Latest News

- Insight as Art Shortlisted for AURA Innovation Award

- FlexMR Launch Video Close Connection Programme

- VideoMR Analysis Tool Added to InsightHub

- FlexMR Makes Shortlist for Quirks Research Supplier Award

- Latest Posts

- Strategic Thinking

- Technology & Trends

- Practical Application

- Insights Empowerment

- View Full Blog Archives

Discover how to build close customer connections to better support real-time decision making.

What is a market research and insights playbook, plus discover why should your team consider building one.

Featured Posts

- Five Strategies for Turning Insight into Action

- How to Design Surveys that Ask the Right Questions

- Scaling Creative Qual for Rich Customer Insight

- How to Measure Brand Awareness: The Complete Guide

- All Resources

- Client Stories

- Whitepapers

- Events & Webinars

- The Open Ideas Panel

- InsightHub Help Centre

- FlexMR Client Network

The insights empowerment readiness calculator measures your progress in building an insight-led culture.

The MRX Lab podcast explores new and novel ideas from the insights industry in 10 minutes or less.

Featured Stories

- Specsavers Informs Key Marketing Decisions with InsightHub

- The Coventry Panel Helps Maintain Award Winning CX

- Isagenix Customer Community Steers New Product Launch

- Curo Engage Residents with InsightHub Community

- Tech & Trends /

- Research Methods /

The Quantitative Research Sample Size Calculator

Chris martin, market research room 101: round 2.

On Thursday 9th May 2024, Team Russell and Team Hudson duelled in a panel debate modelled off the po...

Sophie Grieve-Williams

- Insights Empowerment (29)

- Practical Application (170)

- Research Methods (283)

- Strategic Thinking (191)

- Survey Templates (7)

- Tech & Trends (387)

We may love our in-depth qualitative research tools, but we know the value of integrating both qual and quant methods. That’s why we have built our DIY quantitative research sample size calculator. From some basic information, this tool displays the recommended sample size required for your research to be statistically significant.

Use the calculator to work out how many people you need to complete your survey or poll to be confident in the accuracy of your results.

Not sure what values to use? This brief guide explains the terms used in our sample size calculator, in addition to providing recommended values for optimum results.

Sample Size: Your sample size is the amount of consumers in your target population that you will be researching. This calculator provides a recommended sample size – i.e. the minimum amount of consumers you need to research for your results to be statistically significant within your defined parameters.

Population Size: The population size is the approximate amount of consumers in the group that you want to research. For example, if you want to understand the internet usage habits of the entire UK population, your population would be all UK consumers ( 64.6 million at the latest estimate).

Confidence Level: A confidence level is defined as the statistical probability that the value of a parameter falls within a specified range of values. Therefore a confidence level of N% means you can be N% sure that your results contain the true mean average of the designated population.

In market research, the most commonly used confidence level is 95%. A higher confidence level indicates a higher probability that your results are accurate, but increasing it can dramatically increase the required sample size. Finding a balance between confidence and an achievable research goal is crucial.

In this calculation, each confidence level is translated to a z-score. A z-score is a statistical method for rescaling data that helps researchers draw comparisons easier. The following table details the z-score generated from each confidence level:

Margin of Error: The margin of error is the maximum acceptable difference in results between the population and sample. On a basic level, if a poll were to ask 1,000 people if they drive a car and 70% of people were to answer yes – a margin of error of +/- 5% would indicate that in the total population, between 66.5% and 73.5% would answer in the same way.

The smaller the margin of error, the more representative of the total population the results will be. However, decreasing the margin of error will also result in a sharp increase in sample size. We recommend using a 5% margin of error as standard, which should never be increased above 10%.

The DIY Sample Size Calculation

Want to work out your required sample size by hand? Our free calculator uses the following equation. Simply follow the steps below to work out how many research participants you need to complete your research.

S = (z 2 (d(1 - d))/ e 2 ) / 1 + (z 2 (d(1 - d)) / e 2 )

S = sample size | P = population size | z = z-score | e = margin of error | d = standard deviation

Please note that our calculator assumes a standard deviation of 0.5. Use the manual equation to change the standard deviation.

Now that you have calculated the recommended amount of participants required to make your results statistically significant, the next step is to invite participants. In our experience, a typical panel based survey will yield a 15%-20% response rate without an incentive, but approximately a 30% response rate when a relevant incentive is offered. There are a multitude of factors that can affect survey response rate, from length to design, acessibility to relevance.

However, by using an estimate of 30% survey completion and the minimum sample provided by our calculator, it is possible to work out how many consumers you'll need to reach. For example, if you need to reach a minimum sample of 1,000 consumers - you'll need to invite approximately 3,334 consumers within your target population (S (1 - 0.7) .

What are your top tips for improving survey response rates? Let us know in the comments below and start a discussion.

About FlexMR

We are The Insights Empowerment Company. We help research, product and marketing teams drive informed decisions with efficient, scalable & impactful insight.

About Chris Martin

Chris is an experienced executive and marketing strategist in the insight and technology sectors. He also hosts our MRX Lab podcast.

Stay up to date

You might also like....

On Thursday 9th May 2024, Team Russell and Team Hudson duelled in a panel debate modelled off the popular TV show Room 101. This mock-gameshow-style panel, hosted by Keen as Mustard Marketing's Lucy D...

Delivering AI Powered Qual at Scale...

It’s safe to say artificial intelligence, and more specifically generative AI, has had a transformative impact on the market research sector. From the contentious emergence of synthetic participants t...

How to Use Digital Ethnography and ...

In one way or another, we’ve all encountered social media spaces. Whether you’ve had a Facebook account since it first landed on the internet, created different accounts to keep up with relatives duri...

IMAGES

VIDEO

COMMENTS

It is the ability of the test to detect a difference in the sample, when it exists in the target population. Calculated as 1-Beta. The greater the power, the larger the required sample size will be. A value between 80%-90% is usually used. Relationship between non-exposed/exposed groups in the sample.

This study aims to further inform researchers and health practitioners interested in quantitative research, so as to improve their knowledge of sample size calculation. ... Allowing for an MoE of 5% and a confidence level of 95%, the minimum sample size is 195.9. The recommended sample size can be set at 245, so as to allow for a 20% ...

The sample size for a study needs to be estimated at the time the study is proposed; too large a sample is unnecessary and unethical, and too small a sample is unscientific and also unethical. The necessary sample size can be calculated, using statistical software, based on certain assumptions. If no assumptions can be made, then an arbitrary ...

An absolute minimum of 200 samples are required for Pearson Correlation analysis (Guilford, 1954). Also, a pre-testing and/or pilot study demands a smaller sample size than a main study. Sample ...

You need to determine how big of a sample size you need so that you can be sure the quantitative data you get from a survey is reflective of your target population as a whole - and so that the decisions you make based on the research have a firm foundation. Too big a sample and a project can be needlessly expensive and time-consuming.

In a quantitative usability study, to get a reasonably trustworthy prediction for the behavior of your overall population, you need around 40 data points. There are nuances depending on how much risk you are willing to take and what exactly you are trying to measure. The 40-participant recommendation comes from a calculation.

In a recent overview, Lakens (2021) listed six types of general approaches to justify sample size in quantitative empirical studies: (a) measure entire population, (b) resource constraints, (c) a priori power analysis, (d) accuracy, (e) heuristics, and (f) no justification. For the first approach, no quantitative justification is necessary, and ...

3.3. Analysis of sample size. As described in Section 2.6, the minimum, maximum, average, and trimmed averages were tabulated based on a variety of groupings.For each use of trimmed averages, the Excel TRIMMEAN function was used, first with a value of 0.1 and then with a value of 0.2, meaning that first 10 % and then 20 % of outlier values (equally taken from minimum and maximum values) were ...

A good sample size justification in qualitative research is based on 1) an identification of the populations, including any sub-populations, 2) an estimate of the number of codes in the (sub-)population, 3) the probability a code is encountered in an information source, and 4) the sampling strategy that is used.

Sample size policy for qualitative studies using in-depth interviews. Arch Sex Behav (2012) 41:1319-1320 Boddy CR. Sample size for qualitative research. Qualitative Market Research: An International Journal, Vol. 19 Issue: 4, pp.426-432 Mason, M. (2010, August). Sample size and saturation in PhD studies using qualitative interviews.

However, in some fields of study, such as pharmacology or biological research, a minimum of five per group is recommended and considered acceptable by academic journals in the field. 4 Recommendations for minimum sample sizes for clinical studies suggest having at least 100 in each group. 40 However, recent advances in sample size calculation ...

sample size for quantitative research works. For this purpose usually we will need to know . ... T o determine the minimum sample size for in nite populations, and the proportion of the .

Minimum sample size / group Maximum sample size / group; Group comparison (ANOVA) = (10 / k) + 1 ... This calculator, which provides automated power analysis for variance components (VC) quantitative trait locus (QTL) linkage and association tests in sibships, and other common tests, is significantly effective especially for genetics studies ...

Sciences Gates. The minimum sample size for using SPSS is 30 according to Sekaran book. However, for using SEM analysis, you will need at least 80 responses for PLS or 100-150 for AMOS.

quantitative research. This paper only examines sample size considerations in quantitative ... Factors that influence sample sizes Sufficient sample size is the minimum number of participants required to identify a statistically significant difference if a difference truly exists. Statistical significance does not mean clinical significance ...

A good maximum sample size is usually around 10% of the population, as long as this does not exceed 1000. For example, in a population of 5000, 10% would be 500. In a population of 200,000, 10% would be 20,000. This exceeds 1000, so in this case the maximum would be 1000. Even in a population of 200,000, sampling 1000 people will normally give ...

In order to make up for a rough estimate of 20.0% of non-response rate, the minimum sample size requirement is calculated to be 254 patients (i.e. 203/0.8) by estimating the sample size based on the EPV 50, and is calculated to be 375 patients (i.e. 300/0.8) by estimating the sample size based on the formula n = 100 + 50i.

That's why we have built our DIY quantitative research sample size calculator. From some basic information, this tool displays the recommended sample size required for your research to be statistically significant. ... For example, if you need to reach a minimum sample of 1,000 consumers - you'll need to invite approximately 3,334 consumers ...

The Sampling Issues in Quantitative Research Ali DELİCE* Abstract A concern for generalization dominates quantitative research. For generalizability and re-peatability, identification of sample size is essential. The present study investigates 90 qu-alitative master's theses submitted for the Primary and Secondary School Science and

Finally, the question remains, what is the minimum sample size for a quantitative instrument validation study? ... Although the similar nature of the studies might justify using similar sample sizes, additional research is needed to verify sample sizes in correlational studies. Second, these suggested sample size values are based on outlier ...

Finally, the question remains, what is the minimum sample size for a quantitative instrument validation study? ... Although the similar nature of the studies might justify using similar sample sizes, additional research is needed to verify sample sizes in correlational studies. Second, these suggested sample size values are based on outlier ...

When determining sample size for qualitative versus quantitative studies, consider the sampling strategy you'll use, as it significantly impacts sample size. In qualitative research, purposive ...

Determining the sample sizes involve resource and statistical issues. Usually, researchers regard 100 participants as the minimum sample size when the population is large. However, In most studies ...

An appropriate sample renders the research more efficient: Data generated are reliable, resource investment is as limited as possible, while conforming to ethical principles. The use of sample size calculation directly influences research findings. Very small samples undermine the internal and external validity of a study.