Your recent searches

Your recent searches will appear here

Top searches

- Safety Data Sheets

- Annual Reports

- Shell Eco-marathon

Shell USA, INC. and Shell Midstream Partners, L.P. reached a definitive merger agreement

Jul 25, 2022

Houston - Shell USA, Inc. (“Shell USA”) and Shell Midstream Partners, L.P. (NYSE: SHLX) (“SHLX”) today announced they have executed a definitive agreement and plan of merger (the “Merger Agreement,” and the transactions contemplated thereby, collectively, the “Transaction”) pursuant to which Shell USA will acquire all of the common units representing limited partner interests in SHLX held by the public (the “Public Common Units”) at $15.85 per Public Common Unit in cash for a total value of approximately $1.96 billion. A subsidiary of Shell USA currently owns 269,457,304 SHLX common units, or approximately 68.5% of SHLX common units.

SHLX’s assets include interests in entities that own crude oil and refined products pipelines and terminals that serve as key infrastructure to transport onshore and offshore crude oil production to U.S. Gulf Coast and Midwest refining markets and deliver refined products from those markets to major demand centers, as well as storage tanks and financing receivables that are secured by pipelines, storage tanks, docks, truck and rail racks and other infrastructure used to stage and transport intermediate and finished products. Its assets also include interests in entities that own natural gas and refinery gas pipelines that transport offshore natural gas to market hubs and deliver refinery gas from refineries and plants to chemical sites along the U.S. Gulf Coast.

The Board of Directors of Shell Midstream Partners GP LLC, the general partner of SHLX (the “SHLX Board”), delegated to a conflicts committee of the SHLX Board (the “Conflicts Committee”), consisting solely of independent directors, the review, evaluation, negotiation and determination of whether to approve and to recommend that the SHLX Board approve the Transaction. The Conflicts Committee, after evaluating the Transaction in consultation with its independent legal and financial advisors, unanimously approved and recommended that the SHLX Board approve the Transaction. Following receipt of the recommendation of the Conflicts Committee, the SHLX Board reviewed the terms of the Transaction and the Merger Agreement, and unanimously approved the Transaction.

The Transaction is expected to close in the fourth quarter of 2022, subject to customary closing conditions. A subsidiary of Shell USA, as the holder of a majority of the outstanding SHLX common units, has delivered its consent to approve the Transaction concurrently with the execution of the Merger Agreement. As a result, SHLX has not solicited and is not soliciting approval of the Transaction by any other holders of SHLX common units.

Barclays Capital Inc. and Evercore Group L.L.C. acted as financial advisors to Shell USA; Baker Botts L.L.P. acted as Shell USA’s legal counsel, and Richards, Layton & Finger, PA acted as special Delaware counsel to Shell USA on the Transaction. Intrepid Partners, LLC acted as financial advisor to the Conflicts Committee and Gibson, Dunn & Crutcher LLP acted as the Conflicts Committee’s legal counsel on the Transaction.

Editor Note:

- In line with the International Accounting Standard (IAS) 7:17, for Shell this Transaction will be reflected as an outflow of cash of financing activities (CFFF). Should this full Transaction complete, the net debt of Shell will increase by up to the value of the Transaction, all else being equal.

Cautionary Note

The companies in which Shell plc directly and indirectly owns investments are separate legal entities. In this announcement, “Shell”, “Shell Group” and “Group” are sometimes used for convenience where references are made to Shell plc and its subsidiaries in general. Likewise, the words “we”, “us” and “our” are also used to refer to Shell plc and its subsidiaries in general or to those who work for them. These terms are also used where no useful purpose is served by identifying the particular entity or entities. ‘‘Subsidiaries’’, “Shell subsidiaries” and “Shell companies” as used in this announcement refer to entities over which Shell plc either directly or indirectly has control. Entities and unincorporated arrangements over which Shell has joint control are generally referred to as “joint ventures” and “joint operations”, respectively. “Joint ventures” and “joint operations” are collectively referred to as “joint arrangements”. Entities over which Shell has significant influence but neither control nor joint control are referred to as “associates”. The term “Shell interest” is used for convenience to indicate the direct and/or indirect ownership interest held by Shell in an entity or unincorporated joint arrangement, after exclusion of all third-party interest.

Forward-Looking Statements of Shell

This announcement contains forward-looking statements (within the meaning of the U.S. Private Securities Litigation Reform Act of 1995) concerning the statements related to the Transaction as described above. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. Forward-looking statements are statements of future expectations that are based on management’s current expectations and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in these statements. Forward-looking statements include, among other things, statements expressing management’s expectations, beliefs, estimates, forecasts, projections and assumptions. These forward-looking statements are identified by their use of terms and phrases such as “aim”, “ambition”, ‘‘anticipate’’, ‘‘believe’’, ‘‘could’’, ‘‘estimate’’, ‘‘expect’’, ‘‘goals’’, ‘‘intend’’, ‘‘may’’, “milestones”, ‘‘objectives’’, ‘‘outlook’’, ‘‘plan’’, ‘‘probably’’, ‘‘project’’, ‘‘risks’’, “schedule”, ‘‘seek’’, ‘‘should’’, ‘‘target’’, ‘‘will’’ and similar terms and phrases. There are a number of factors that could affect the future operations of Shell and could cause those results to differ materially from those expressed in the forward-looking statements included in this announcement, including (without limitation): (a) price fluctuations in crude oil and natural gas; (b) changes in demand for Shell’s products; (c) currency fluctuations; (d) drilling and production results; (e) reserves estimates; (f) loss of market share and industry competition; (g) environmental and physical risks; (h) risks associated with the identification of suitable potential acquisition properties and targets, and successful negotiation and completion of such transactions; (i) the risk of doing business in developing countries and countries subject to international sanctions; (j) legislative, judicial, fiscal and regulatory developments including regulatory measures addressing climate change; (k) economic and financial market conditions in various countries and regions; (l) political risks, including the risks of expropriation and renegotiation of the terms of contracts with governmental entities, delays or advancements in the approval of the Transaction; (m) risks associated with the impact of pandemics, such as the COVID-19 (coronavirus) outbreak; and (n) changes in trading conditions. All forward-looking statements contained in this announcement are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Readers should not place undue reliance on forward-looking statements. Additional risk factors that may affect future results are contained in Shell plc’s Form 20-F for the year ended December 31, 2021 (available at www.shell.com/investor and www.sec.gov ). These risk factors also expressly qualify all forward-looking statements contained in this announcement and should be considered by the reader. Each forward-looking statement speaks only as of the date of this announcement, July 25, 2022. Neither Shell plc nor any of its subsidiaries undertake any obligation to publicly update or revise any forward-looking statement as a result of new information, future events or other information. In light of these risks, results could differ materially from those stated, implied or inferred from the forward-looking statements contained in this announcement.

Shell’s net carbon footprint

Also, in this announcement we may refer to Shell’s “Net Carbon Footprint” or “Net Carbon Intensity”, which include Shell’s carbon emissions from the production of our energy products, our suppliers’ carbon emissions in supplying energy for that production and our customers’ carbon emissions associated with their use of the energy products we sell. Shell only controls its own emissions. The use of the term Shell’s “Net Carbon Footprint” or “Net Carbon Intensity” are for convenience only and not intended to suggest these emissions are those of Shell plc or its subsidiaries.

Shell’s net-Zero Emissions Target

Shell’s operating plan, outlook and budgets are forecasted for a ten-year period and are updated every year. They reflect the current economic environment and what we can reasonably expect to see over the next ten years. Accordingly, they reflect our Scope 1, Scope 2 and Net Carbon Footprint (NCF) targets over the next ten years. However, Shell’s operating plans cannot reflect our 2050 net-zero emissions target and 2035 NCF target, as these targets are currently outside our planning period. In the future, as society moves towards net-zero emissions, we expect Shell’s operating plans to reflect this movement. However, if society is not net zero in 2050, as of today, there would be significant risk that Shell may not meet this target.

Forward Looking Non-GAAP measures

This announcement may contain certain forward-looking non-GAAP measures such as cash capital expenditure and divestments. We are unable to provide a reconciliation of these forward-looking non-GAAP measures to the most comparable GAAP financial measures because certain information needed to reconcile those non-GAAP measures to the most comparable GAAP financial measures is dependent on future events some of which are outside the control of Shell, such as oil and gas prices, interest rates and exchange rates. Moreover, estimating such GAAP measures with the required precision necessary to provide a meaningful reconciliation is extremely difficult and could not be accomplished without unreasonable effort. Non-GAAP measures in respect of future periods which cannot be reconciled to the most comparable GAAP financial measure are calculated in a manner which is consistent with the accounting policies applied in Shell plc’s consolidated financial statements.

The contents of websites referred to in this announcement do not form part of this announcement.

We may have used certain terms, such as resources, in this announcement that the United States Securities and Exchange Commission (SEC) strictly prohibits us from including in our filings with the SEC. Investors are urged to consider closely the disclosure in our Form 20-F, File No 1-32575, available on the SEC website www.sec.gov .

Forward-Looking Statements of SHLX

This announcement includes various “forward-looking statements” within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. Forward-looking statements are statements of future expectations that are based on management’s current expectations and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in these statements. Forward-looking statements include, among other things, statements concerning management’s expectations, beliefs, estimates, forecasts, projections and assumptions. You can identify our forward-looking statements by words such as “anticipate,” “believe,” “estimate,” “budget,” “continue,” “potential,” “guidance,” “effort,” “expect,” “forecast,” “goals,” “objectives,” “outlook,” “intend,” “plan,” “predict,” “project,” “seek,” “target,” “begin,” “could,” “may,” “should” or “would” or other similar expressions that convey the uncertainty of future events or outcomes. In accordance with “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, these statements are accompanied by cautionary language identifying important factors, though not necessarily all such factors, which could cause future outcomes to differ materially from those set forth in forward-looking statements. In particular, expressed or implied statements concerning future actions, conditions or events, and statements concerning the Transaction or any other proposed transaction and the likelihood of a successful consummation of the Transaction or any other proposed transaction are forward-looking statements. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Future actions, conditions or events and future results of operations may differ materially from those expressed in these forward-looking statements. Many of the factors that will determine these results are beyond our ability to control or predict. Forward-looking statements speak only as of the date of this announcement, July 25, 2022, and we disclaim any obligation to update publicly or to revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. All forward-looking statements contained in this document are expressly qualified in their entirety by the cautionary statements contained or referred to in this paragraph. More information on these risks and other potential factors that could affect the Partnership’s financial results is included in the Partnership’s filings with the SEC, including in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Partnership’s most recently filed periodic reports on Form 10-K and Form 10-Q and subsequent filings (available at www.shellmidstreampartners.com and www.sec.gov ). If any of those risks occur, it could cause our actual results or the outcome of any particular event to differ materially from those contained in any forward-looking statement. Because of these risks and uncertainties, you should not place undue reliance on any forward-looking statement.

Important Information About the Proposed Transaction

SHLX will file with the SEC a Current Report on Form 8-K, which will contain, among other things, a copy of the Merger Agreement. In connection with the proposed Transaction, SHLX will prepare an information statement to be filed with the SEC that will provide additional important information concerning the proposed Transaction. When completed, a definitive information statement will be mailed to the SHLX unitholders. SHLX’S unitholders are strongly advised to read all relevant documents filed with the SEC, including SHLX’s information statement, because they will contain important information about the proposed transaction. SHLX’s unitholders will be able to obtain, without charge, a copy of the information statement (when available) and other relevant documents filed with the SEC from the SEC’s website at www.sec.gov . SHLX’s unitholders will also be able to obtain, without charge, a copy of the information statement and other documents relating to the proposed Transaction (when available) at www.shellmidstreampartners.com or at the contacts listed below.

Shell US Tweets

- Share this on Facebook

- Share this on Twitter

- Share this on LinkedIn

- Copy link to the clipboard

Shell online reporting suite 2022

- Reporting hub

Top searches

- Our journey to net zero

- Powering Progress strategy

- Respecting nature

Quick links

Consolidated Balance Sheet

- Download table (XLS, 15 kB)

Signed on behalf of the Board

/s/ Sinead Gorman

Sinead Gorman

Chief Financial Officer

March 8, 2023

You might also be interested in

Group results

More in Consolidated Financial Statements

- Note 11 – Goodwill and other intangible assets

- Note 12 – Property, plant and equipment

- Note 16 – Inventories

More in other sections

- Liquidity and capital resources

- Statement of cash flows

- Integrated Gas capital expenditure and portfolio

- Upstream capital expenditure and portfolio

- Compare to last year

- Chart generator

- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Technical Skills

- Strategy Resources

Shell Corporation

It is a dummy company that only exists on paper.

Mr. Arora is an experienced private equity investment professional, with experience working across multiple markets. Rohan has a focus in particular on consumer and business services transactions and operational growth. Rohan has also worked at Evercore, where he also spent time in private equity advisory.

Rohan holds a BA (Hons., Scholar) in Economics and Management from Oxford University.

Osman started his career as an investment banking analyst at Thomas Weisel Partners where he spent just over two years before moving into a growth equity investing role at Scale Venture Partners , focused on technology. He's currently a VP at KCK Group, the private equity arm of a middle eastern family office. Osman has a generalist industry focus on lower middle market growth equity and buyout transactions.

Osman holds a Bachelor of Science in Computer Science from the University of Southern California and a Master of Business Administration with concentrations in Finance, Entrepreneurship, and Economics from the University of Chicago Booth School of Business.

- What Is A Shell Corporation?

- How To Set Up A Shell Corporation

- Reasons To Legitimately Set Up A Shell Corporation

Ways That People Abuse Shell Companies

- Pros And Cons Of Shell Corporations

- Shell Corporations Examples

Panama Paper Leaks

Shell corporation faqs, what is a shell corporation.

A shell corporation is a dummy company that only exists on paper and does not have any actual operations or significant assets.

These businesses normally do not have any employees or a physical presence, but they do have bank accounts, ownership of some passive investments or assets, and certain intellectual properties ( IP ).

Often, such a business is used for illegal purposes like evading taxes, laundering money, or contraband sales. They may, however, sometimes be used legitimately to raise funds, for hostile takeovers , to hold certain specific assets or IP, etc.

It exists on paper and has no actual operations. It has no employees or assets and is hence termed as a ‘shell’ of an organization as it has nothing on the inside.

Shell companies may be used for any purposes, be it legitimate, from raising financing to tax avoidance and money laundering . They help to maintain the anonymity of the person behind such a business, which can thus help in protecting one’s personal assets.

Even though these firms often cause suspicion, such businesses are completely legal in most countries as long as they are used for legitimate purposes. These legitimate transactions can involve the sale of real estate or IP.

It can also be used as a part of a process called a reverse merger which allows a firm to go private without an initial public offering ( IPO ).

This involves a private company buying a majority stake in a public shell company. Then the private company swaps its shares for the public company and ends up being a subsidiary of the public company.

This process is completely legal and is allowed by the Securities and Exchange Commission (SEC) in the United States.

However, most such companies are associated with illegally reducing tax liabilities by creating these corporations in foreign countries like the Cayman Islands, Switzerland, Bermuda, etc.

Key Takeaways

A shell corporation is a dummy company that only exists on paper and does not have any actual operations or significant assets. These businesses normally do not have any employees or a physical presence.

They may be set up for legitimate uses like protecting assets and IPs and for hostile takeovers.

They, however, more often than not, are used in illicit activities like tax evasion, money laundering, hiding assets, or other illegal activities.

Examples of such firms being used for things like tax evasion can be seen in the case of the Panama Paper leaks back in 2016.

How to Set Up a Shell Corporation

Let's understand how these corporations are set up:

Shell companies should always be formally registered in the registrar of the country it is to be set up. In the US, shell corporations register with the US Securities and Exchanges Commission (SEC).

The shell companies are normally registered in places with tax benefits. It can be countries like the Cayman Islands, the British Virgin Islands, or Switzerland.

These companies must have registered agents who file all the necessary paperwork, pay the required taxes and fees, etc.

Shell companies should reveal a beneficial owner and, thus, are required to name a director. A beneficial owner is someone who exercises substantial control over the company, even though he/she may not have any power, considering the company only exists on paper.

To hide the owner’s identity, shell corporations are often registered as a subsidiary of another shell corporation. This means that the business is owned by another shell corporation, and further layers can be added. This creates a high level of secrecy.

Such a tactic is often used when these corporations are being used for illegal activities like money laundering, as it makes it difficult for law enforcement to employ anti-money laundering tactics against these firms due to the high level of secrecy.

Reasons to Legitimately Set Up a Shell Corporation

Shell companies can be used for legitimate purposes like real estate, investing in foreign markets, holding intellectual property, etc., and illegal activities like money laundering and fraud.

The most common aim of setting up such companies, however, is to reduce tax liabilities.

These companies are often set up in tax havens which are countries that offer such businesses minimal or no tax liability. To avoid taxes, a business may establish a shell corporation in a tax haven such as the Cayman Islands, Switzerland, or the British Virgin Islands, among others.

Normally, when a company is purchasing goods from a foreign firm, buying real estate, or investing in foreign markets, it may incur a large tax liability.

To avoid paying this significant tax duty, goods may be brought under these firms domiciled in a tax haven, allowing the business to avoid paying a hefty tax.

Similarly, high-earning individuals, due to progressive taxation, often have to pay a high tax.

As a result, such persons frequently establish themselves as shell corporations in these tax havens. They then funnel their income through shell companies to avoid the high taxes. This is known as tax evasion .

Legitimate uses

Some of the legitimate uses are:

- Real Estate: Shell corporations in the form of Limited Liability Corporations ( LLCs ) are often used to purchase a single piece of real estate as it helps in limiting the liability and dividing the profits. It helps in reducing taxation too.

- Holding intellectual property : Shell businesses are used by production companies to possess intellectual property and protect it from litigation or other forms of seizure.

- Hostile takeovers : A group of investors attempting a hostile takeover of a publicly-traded firm may form it to acquire control of the company if the hostile takeover is successful.

- Reverse mergers : Some private companies use it to go public using a technique called a reverse merger, which is swifter and less expensive than a typical IPO. It involves a private company buying a majority stake in a public shell company. Then the private company swaps its shares for the public company and ends up being a subsidiary of the public company.

- Investing in foreign markets: Forming such organizations in different countries allows companies to invest in the capital markets of those countries. Thus financial institutions can invest outside their domestic borders and reduce their tax liability too.

- Financing for startups: Before starting a new business, it can be used to gather and store funds, thus helping with funding for startups.

Despite the legal uses of Shell companies, most of such corporations are used for personal gain and to bypass the legal system.

In May 2012 alone, the SEC had to suspend the trading of 379 such inactive companies as they were vulnerable to being used for fraudulent activities.

Shell companies help in maintaining the anonymity of their owners. Due to the lack of transparency, these companies can mask their true ownership and are often used in conjunction with illicit activities.

Some ways that people often abuse the firms for illegal activities are as follows:

- Money Laundering: Money laundering is a process that allows criminals to hide illegal wealth and profits from crimes. Shell corporations are typically ideal for this because they are simple to register and conceal their true ownership. As a result, it is frequently utilized to hold this type of black money and pass it off as genuine business activities.

- Tax Evasion: The most common use of such corporations is to use them to avoid taxes. Wealthy individuals and businesses may hide their incomes and assets in shell corporations in a different country where the tax rates are lower. In this way, they reduce the tax they have to pay.

- Hiding Assets: During mergers and acquisitions for businesses and divorces or court cases for individuals, these companies may be used to conceal the actual net worth of these individuals by hiding assets. This is done to avoid losing the assets in litigation or having to share them after a divorce.

- Conducting illegal business: Due to the anonymous nature of such businesses, illegal businesses may use them to hide the identities of their actual owners. Such firms have historically been employed in criminal activities such as trafficking and terrorist activity since they cannot be traced back to their owners.

Pros and Cons of Shell Corporations

Some of the pros and cons are:

Everything You Need To Master M&A Modeling

To Help you Thrive in the Most Prestigious Jobs on Wall Street.

shell corporations Examples

An example of companies using shell corporations for legitimate reasons can be seen in the case of Sega Sammy Holdings . In June 2013, when Sega Sammy Holdings purchased the bankrupt Index Corporation , a shell corporation called Sega Dream Corporation was formed.

This corporation was used to transfer the valuable assets of the old firm, including the IP. Thus the liabilities of the old firm were left behind, and only the valuable assets of the firm were in possession of Sega.

Similarly, when Hilco purchased HMV Canada , a shell company by the name of Huk 10 was used to secure funds and minimize liabilities. Later on, HMV was sued by Huk 10 to get rid of liabilities and only be left with valuable assets.

A Panamanian law firm, Mossak Fonseca, saw a lot of clients leak back in 2016. Over 11.5 million of its clients and a list of 214,488 offshore entities that were created to evade taxes were leaked.

Titled 'Panama Paper,' the data was released by the German newspaper 'Süddeutsche Zeitung' under the title of 'Panama Papers on April 3rd, 2016, in which celebrities, businessmen, and famous personalities from dozens of countries were named.

The firm of Mossak Fonseca owned a network of over 214,000 tax havens. Even though such tax havens and shell establishments are legal, these entities were being used for illegal purposes like tax evasion, fraud, and the avoidance of international sanctions.

In 2018, the firm eventually had to terminate operations. But this was not before the names of high-profile individuals were associated with the scandal.

The main motive behind them is to maintain anonymity. So that it can not be traced back to certain individuals, and the assets or funds stored are stored in a different entity, thereby protecting them.

These firms can be used for both legitimate purposes, like real estate and holding IP, as well as illegal activities like money laundering . The most common aim of setting up such businesses, however, is to reduce tax liabilities.

An example of companies using Shell corporations for legitimate reasons can be seen in the case of Sega Sammy Holdings. In June 2013, when Sega Sammy Holdings purchased the bankrupt Index Corporation, Sega Dream Corporation was formed.

This shell corporation was used to transfer the valuable assets of the old firm, including the Intellectual properties. Thus the liabilities of the old firm were left behind, and only the valuable assets of the firm were in possession of Sega.

Shell companies as a concept are not illegal per se. If used for legitimate purposes like holding assets or storing funds, such companies are completely legal.

However, if these companies are used for illicit activities like funding trafficking or if they are involved in tax evasion, in those cases, these companies become illegal.

Establishing such shell companies leads to the main firm running the risk of coming under the scanner of organizations like the SEC , which may heavily penalize such firms.

Additionally, if it becomes public information that a company has such organizations under them, it may heavily damage its reputation.

Such businesses only exist on paper and have no real operations. Thus, if a business is registered but doesn't have major assets, any employees, or doesn't have regular business operations, it is likely a Shell Company.

Shell Companies are often registered in countries where the tax rates are lower, like the Cayman Islands, Switzerland, etc. Thus assets are often transferred to such companies, or resources are bought through these companies to avoid the high taxes in the firms' actual domestic company.

Everything You Need To Build Your Accounting Skills

To Help you Thrive in the Most Flexible Job in the World.

Researched and authored by Soumil De | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

- Associate Company

- Diversification

- Industry Life Cycle

- Risk Transfer

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

or Want to Sign up with your social account?

Located in Houston, Texas, Shell is an oil company that has approximately 22,000 employees across America. Considered as the nation’s largest natural gas producer and gasoline marketer, it is still a responsible brand that aims to meet the energy needs of society using methods that are economically, environmentally, and socially viable. Our designers made a presentation deck that highlights the company’s evolution, business strategy, commitment to sustainability, and statistics from the 2016 fiscal year.

In A Hurry? Give us a call

1.858.217.5144

OR GET YOUR FREE PRESENTATION DESIGN QUOTE NOW

Or fill out the form

Company Size None 1 2-10 10-100 100-1000 1000+

Trusted By 4,000 Clients Globally

24 Hour Global Coverage

Rush Projects

Project Overview

See other work we've created in your industry.

Our Design Process

When you work with us, getting your ideal slide designs will be easy thanks to our 4-step process. Each step is quality-controlled to ensure you’re getting the best presentation possible.

How To Reach A Genius

The Discovery Phase

You have an assigned Account Manager who is always there for you.

Kicking Off The Project

The Ideation Phase

This phase is dedicated to the collaborative development of concept and messaging through a Creative Call, and this is how we do it.

Ready. Set. Design!

The Design Phase

In this phase, our designers do the all-important job of visualizing your concepts and content into digestible layouts for your target audience.

Mission Complete

The Delivery Phase

With 100% of the project now in your hands, all that is left is to do is implement any final tweaks you may have and send it back your way.

Related Projects

See other work we’ve created in your industry.

Red Bull Lyft Chevron Delta Nike QuickenLoans SiriusXM Teletracking Hilton Fidelity Contact us for a design quote today

Are you ready to take your company’s PowerPoint presentation slides to the next level? Reach out to one of our presentation consultants to receive your free project quote today. Our trained staff can help assist you with all of your presentation needs.

- My View My View

- Following Following

- Saved Saved

Norway's wealth fund asks Shell for more climate policy details

- Medium Text

- Norway's wealth fund is Shell's 2nd largest shareholder

- Asks Shell to give more information on revised climate target

- Fund will not back climate resolution by other shareholders

Sign up here.

Reporting by Terje Solsvik; Editing by Louise Rasmussen and Mark Potter

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Sustainability Chevron

Asia-pacific real estate assets at 'high risk' from climate change, consultancy says.

Nearly one in ten properties owned by leading real estate investment trusts (REITs) in the Asia-Pacific region may be at "high risk" of damage from climate change, particularly in coastal regions, a report published on Wednesday showed.

Norway’s Wealth Fund Asks Shell for More Climate Disclosures (1)

By Laura Hurst

Norway’s $1.6 trillion wealth fund asked Shell Plc to disclose more information about its climate strategy, but stopped short of backing other investors’ push for the oil and gas giant to align itself with the Paris Climate Agreement.

Shell’s strategy “sufficiently retains the core components of a Paris-aligned transition plan” as well as the fund’s own expectations on climate change, Norges Bank Investment Management said in an update ahead of the energy giant’s annual general meeting on May 21.

The company’s plan has “evolved” under Chief Executive Officer Wael Sawan , NBIM added. “We have encouraged Shell to make additional ...

Learn more about Bloomberg Law or Log In to keep reading:

Learn about bloomberg law.

AI-powered legal analytics, workflow tools and premium legal & business news.

Already a subscriber?

Log in to keep reading or access research tools.

- Ann (Hoyt) Crosby

- Outside Lands Announces 2024 Lineups

- Beryl Williams

- Outside Lands announces early ticket release

- Martinez outrigger canoe club wins in New Zealand

- Ron Wheeler

- Bottlerock Napa Valley Announces Daily Lineup And Single Day Tickets

- Pearl Jam, Ed Sheeran, Stevie Nicks, and Maná to Headline BottleRock Napa Valley

- Rhea Bennett

- Cal Bears – ACC football schedule release

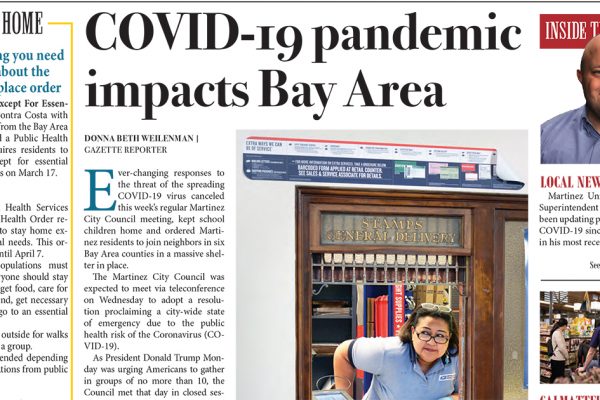

Shell sells Martinez Refinery to PBF, ending 104-year relationship with city

Equilon Enterprises, doing business as Shell Oil Products US, has agreed to sell the Martinez Shell Refinery to PBF Holding Company for $1 billion and other adjustments, the two companies announced Tuesday afternoon.

The refinery has been operating in Martinez under the Shell name since it was completed in 1915 as Shell’s first in the United States.

Both Shell and PBF said most of the refinery’s employees will be offered positions once its ownership changes hands. This includes Jeff Harris, named earlier this month as the Shell Martinez Refinery general manager to succeed the retiring Tom Rizzo effective June 17.

“Right now, our plan is to offer jobs to everybody at the refinery who is eligible to join us,” said Michael Karlovich, vice president of Corporate Communication at PBF Energy. “We’ll offer jobs to everyone that we can.”

He declined to provide additional details about who is qualified to stay. But he said PBF has “a high regard for the work force.”

The new owners also expect to continue the refinery’s community partnerships, he said.

Karlovich said PBF has a saying, “We have to earn the right to operate in the community host,” and recognized what he called Shell’s “robust relationships” and “impeccable reputation” for supporting Martinez Education Fund and its Run For Education and for supporting multiple other Martinez nonprofit organizations, activities and events.

Another area Karlovich addressed was safety. “We have the same dedication to safe, reliable operations,” he said. In addition, PBF will continue the refinery’s Community Advisory Panel, he said.

While rumors of the refinery’s sale have waxed and waned for some time, Karlovich said PBF began “off and on” talks in December 2018. “They became more earnest lately,” he said.

As far back as in 2016, a Reuters news article out of New York, citing three unnamed sources, said Royal Dutch Shell had retained Deutsche Bank to help find a buyer for the Martinez refinery as part of Shell’s divestment plan.

At the time, Mayor Rob Schroder said, “Martinez has been the home for Shell for 100 years. Generations of families have worked for the organizations.” He said his own family has three generations of Shell employees.

“At one time, Martinez was a company town,” he said. While the city has developed a more diverse economic base, it still depends on the refinery. “We have a close relationship with Shell management. It has a good reputation and a culture of safety,” he said.

A company statement at the time said most of its 700 employees as well as former workers live in Martinez. Active employees are given 18 hours of work time to commit to volunteer activities, that statement said, and have used that time to paint the library, build picnic tables, wired school computers and participate in the Run for Education and Martinez Community Appreciation Day.

Besides the $1 billion consideration, the sale price includes the value of the hydrocarbon inventory, crude supply and product offtake agreements as well as other adjustments, according to Tuesday’s announcement.

The transaction is for the sale of the refinery and adjacent truck rack and deep-water marine and product distribution terminals and product storage, but Shell’s branded fuel businesses, aviation terminal and area catalysts business won’t change hands.

The transaction is subject to conditions and regulatory approvals, and should be complete before the end of this year, the companies said in their statements.

“This divestment aligns with Shell’s strategy to reshape refining efforts towards a smaller, smarter refining portfolio focused on further integration with Shell trading hubs, Chemicals, and Marketing,” said the announcement..

“This deal is another step in our transformation to high-grade and optimize our portfolio to drive resilient returns,” said Shell Downstream Director John Abbott.

The sale also was announced on the Shell Refinery in Martinez Facebook page, which confirmed Shell told the local refinery Tuesday of the sale.

Shell and PBF will enter in crude and products agreements to supply branded businesses and customers with Shell fuels, the statement said.

The purchase increases PBF’s total throughput capacity to more than 1 million barrels a day, and its refining system a consolidated Nelson Complexity Index of 12.8, a calculation that compares the secondary conversion capacity of a petroleum refinery with the primary distillation capacity.

The local refinery was told of Shell’s divestment plans Tuesday as well, according to the Shell Refinery in Martinez Facebook page, which promised transparency with both employees and the community.

“The refinery has called Martinez home for the last 104 years and every day we work to minimize any impact to our neighbors,” the posting said, and provided the refinery’s environmental hotline, 925-313-3777 and off-work-hours number, 925-313-3601.

PBF Energy is one of the country’s largest independent refiners, with operations in California, Delaware Louisiana, New Jersey and Ohio. Like Shell, the company counts as its mission the operation of its campuses in “a safe, reliable and environmentally responsible manner, provide employees with a safe and rewarding workplace, become a positive influence in the communities where we do business and provide superior returns to our investors.”

PBF’s announcement said it and Shell have agreed to a joint exploration of building a proposed renewable diesel project to convert existing but idle Martinez refinery equipment into a renewable fuels production plant.

That endeavor is “forward-looking,” Karlovich said, but he promised the refinery’s new owners would share more information later, after PBF and Shell start their reviewing process.

Shell also will be underwriting direct and indirect turnaround costs and certain other capital expenses during the first quarter of 2020, according to PBF’s announcement.

“The acquisition of the high-complexity, dual-coking Martinez refinery is a significant strategic step for PBF as we expand our West Coast operations and increase our total throughput capacity to more than one million barrels per day,” said Tom Nimbley, PBF chairperson and its chief executive officer. “ Martinez is one of the most complex refineries in the country and a top-tier asset.

“We look forward to welcoming Martinez’s highly-motivated and professional workforce to the PBF family, and are committed to continuing their tradition of safe, reliable, environmentally responsible operations, as well as their outstanding community partnership.”

He, too, spoke of welcoming the Martinez refinery’s employees into his company, and promised to continue “their tradition of safe, reliable, environmentally responsible operations, as well as their outstanding community partnership.”

John Stevens is a member of Shell’s Community Advisory Panel (CAP). “At last night’s Shell CAP meeting, our members were not told of this, no doubt as it was not yet made public,” he said Tuesday.

“However, PBF is known to have its own CAP and be involved in local communities with volunteerism, philanthropy, and environmental stewardship as well as cultural arts and school programs,” he said.” It will be important for us to reach out to them to assure that these continue in Martinez.”

“Today was the first time I was contacted about the sale of Shell. I was made aware, as were many members of our community, through a communication sent by Shell.,” Martinez Unified School District Superintendent C.J. Cammack said Tuesday.

“Additionally, although I have not had a chance to speak with the individual, PBF contacted my office today in hopes of setting time to talk,” he said.

“Shell has been such an incredible partner for MUSD and all our students as well as our community has a whole. As superintendent, I am committed to nurturing that partnership with PBF to maintain an important relationship for our schools, our students, and our community,” he said.

The refinery is on 860 acres strategically placed in Northern California. It can convert 157,000 barrels of crude oil daily into multiple products and is a dual-coking plant.

According to Shell’s announcement, as the sale nears completion later this year, the refinery will remain committed to its Goal Zero safety program while supporting employees during the transition.

Harris has described the Martinez refinery as having “almost legendary status throughout Shell,” especially for its care of employees and community commitment.

You may also like:

Martinez News-Gazette March 20, 2020

Martinez News-Gazette February 28, 2020

Martinez News-Gazette Feb. 21, 2020

Martinez News-Gazette Feb. 14, 2020

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

- Resource Center

- Business Operations

- Trade Shows & Events

- Classifieds

- Advertising

- Feature Stories

- Buyers Guide

- Business Spotlights

PBF Energy Acquires Shell’s Martinez Refinery for $1.2 Billion, California

[Click image to enlarge]

Equilon Enterprises, doing business as Shell Oil Products US, has completed the $1.2 billion sale of the Martinez Refinery and associated logistics assets to PBF Energy’s subsidiary PBF Holding in California, US.

Crude supply and product offtake agreements were also part of the deal agreed by Shell and PBF.

With the completion of the deal, PBF Energy will expand its total throughput capacity to more than one million barrels per day (bpd).

In a statement, Shell stated: “Shell is very proud of the relationship we have built and maintained with the city and people of Martinez over the many years we’ve operated side-by-side with the Martinez community making several notable achievements on safety, reliability, performance, and community involvement.

“As we turn over ownership of the Martinez Refinery to PBF, we offer our many thanks to the City and community of Martinez for all they have done to support and partner with Shell and our employees over the last 100 years.”

MARTINEZ REFINERY PRODUCTION DETAILS

Located on an 860-acre site in the City of Martinez, 48km northeast of San Francisco, the refinery has a 157,000bpd refining capacity and a Nelson Complexity Index of 16.1.

The Martinez Refinery is said to be positioned strategically in Northern California for PBF Energy and offers operating and other synergies with the company’s Torrance Refinery in Southern California.

PBF’s Chairman and CEO Tom Nimbley said: “We welcome Martinez’s professional workforce to the PBF family.

“We are committed to maintaining the high operational standards of the refinery and, through continued safe, reliable and environmentally responsible operations, earning the privilege of being a respected member of the Martinez and Contra Costa County communities.

“The acquisition of Martinez is a significant strategic step for PBF as we expand our West Coast operations. Martinez is a top-tier asset, is a perfect complement to our existing assets and provides increased opportunities for PBF’s West Coast operations to deliver value.”

The deal comprised the sale of Shell’s on-site logistics assets, including a deepwater marine facility, product distribution terminals, and refinery crude and product storage facilities with an 8.8 million barrels of shell capacity.

PBF Energy and Shell have also agreed to go ahead with reviewing the feasibility of building a constructing a renewable diesel project at the refinery.

The existing idled equipment at the refinery would be repurposed to create a renewable fuels production plant.

Source: NS Energy

To stop by PBF’s website , CLICK HERE

To stop by Shell’s website , CLICK HERE

Be in-the-know when you’re on-the-go!

FREE eNews delivery service to your email twice-weekly. With a focus on lead-driven news, our news service will help you develop new business contacts on an on-going basis.

CLICK HERE to register your email address.

- Stay Informed - Register Now!

- Take Our Survey - Win Free Advertising!

Charitable Opportunities

LMB Photography

Home | Minerals Processing | Underground Mining | Surface Mining | Oil, Gas and Shale | Resource Center | Trade Shows & Events | Careers | Classifieds Powered by and © Mining Connection LLC. © 2009-2024 Mining Connection LLC. All rights reserved

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

IMAGES

VIDEO

COMMENTS

A selection of Shell plc investor presentations held in the current year and archived presentations since 2015. 2024. 2023. 2022. 2021. 2020. 2019. 2018. 2017. 2016.

In 2021, we re-based our dividend to $0.24 per share. We announced a share buyback programme of up to $3.5 billion, including $1.5 billion from the sale of our Permian business. The additional shareholder distributions from the Permian sale will eventually total $7 billion, with $5.5 billion distributed in the form of share buybacks in 2022.

Ben van Beurden, CEO of Royal Dutch Shell plc, and Jessica Uhl, CFO of Royal Dutch Shell plc, present Shell's strategy to accelerate its transformation into ...

Ben van Beurden (CEO, Shell plc) and Jessica Uhl (CFO, Shell plc) present the fourth quarter 2021 results.Welcome to Shell's official YouTube channel. Subscr...

For more than 100 years, Shell's people have provided much of what is needed for modern life: the energy to heat and light homes, the fuel for cars, trucks, ships and planes, the means to keep the world moving. Read Chair's message. Chief Executive Officer's review:

Our Chief Technology Officer oversees the development and deployment of new and differentiating technologies and innovations across Shell, seeking to align business and technology requirements throughout our technology maturation process. In 2020, research and development expenses were $907 million, compared with $962 million in 2019, and $986 ...

It's a project of Financial Ration Analysis, Complete Ratio Analysis on Engro Ltd. vs Fauji Fertilizer Company of three years (2011-2012, 2012-2013, 2013-2014). ... Royal Dutch Shell plc webcast presentation slides for the fourhd quarter and full year 2018 results.

The equivalent figure in the January 2021 report Decarbonising Road Freight: Getting into Gear was more than 70%. Shell intends to supply our road freight and aviation customers with the low-carbon biofuels they want and need. An important aim of our Powering Progress strategy is to transform refineries into energy and chemicals parks so that ...

The CEO and CFO hosted 2021 Strategy Day presentation webcasts which on February 11, 2021. The presentations set out Shell's strategy to accelerate its transformation into a provider of net-zero emissions energy products and services, powered by growth in customer-facing businesses.

Shell USA, Inc. ("Shell USA") and Shell Midstream Partners, L.P. (NYSE: SHLX) ("SHLX") today announced they have executed a definitive agreement and plan of merger (the "Merger Agreement," and the transactions contemplated thereby, collectively, the "Transaction") pursuant to which Shell USA will acquire all of the common units representing limited partner interests in SHLX ...

175,326. Total liabilities and equity. 443,024. 404,379. [A] Goodwill, previously presented under Intangible assets, is separately presented as from 2022. Prior period comparatives have been revised to conform with current year presentation. Signed on behalf of the Board. /s/ Sinead Gorman.

3. HISTORY The word Shell first appeared in 1891, as the trademark for kerosene shipped to the Far East by Marcus Samuel and Company. The word was elevated to corporate status in 1897, when Samuel formed the Shell Transport and Trading Company. The first logo in 1901 was a mussel shell, but by 1904 a scallop shell or pecten emblem had been introduced to give a visual representation of the ...

A shell corporation is a dummy company that only exists on paper and does not have any actual operations or significant assets. These businesses normally do not have any employees or a physical presence. They may be set up for legitimate uses like protecting assets and IPs and for hostile takeovers. They, however, more often than not, are used ...

Shell. Located in Houston, Texas, Shell is an oil company that has approximately 22,000 employees across America. Considered as the nation's largest natural gas producer and gasoline marketer, it is still a responsible brand that aims to meet the energy needs of society using methods that are economically, environmentally, and socially viable.

You can be a part of the future of energy. Together at Shell, we are transitioning to become a net-zero emissions business while providing the energy that people around the world need today. Working with experienced colleagues on this important challenge, you'll have the opportunity to develop the skills you need to grow, in an environment ...

Shell's updated energy transition strategy got the backing of 78% of shareholders at the company's annual general meeting on Tuesday. Only 19% voted for the climate resolution, filed by activist shareholder Follow This and 27 investors — including Amundi SA, Europe's largest asset manager — that jointly manage funds worth more than $4 ...

Equilon Enterprises LLC d/b/a Shell Oil Products US (Shell), a subsidiary of Royal Dutch Shell plc announced today that it has formally closed on the sale of Shell's Martinez Refinery in California to PBF Holding Company LLC (PBF), a subsidiary of PBF Energy, Inc., in exchange for $1.2 billion which includes the refinery and inventory. The deal also includes crude oil supply and product ...

The company, however, introduced a new "ambition" to cut overall emissions from oil products such as gasoline and jet fuel sold to customers by 15-20% by 2030 compared with 2021.

Norway's $1.6 trillion sovereign wealth fund urged Shell on Friday to give investors more information about its revised climate targets, but said it would not back a call by a group of 27 ...

Investors of oil and gas giant Shell voted Tuesday against a shareholder proposal wanting the company to disclose its plan to reduce its greenhouse gas emissions to meet the 2015 Paris Agreement's goals. The proposal, introduced by Amsterdam-based shareholder activist group Follow This on behalf of 27 investors, said Shell has not ...

The Energy Department bought 3.3 million barrels of sour oil from four companies to refill the Strategic Petroleum Reserve for an average price of $79.38 / bbl, below the maximum price of $79.99 it was willing to pay, according to a statement. Oil bought from Macquarie (1.5m bbl), Energy Transfer (700k bbl), Shell Trading (600k bbl) and ...

Norway's $1.6 trillion wealth fund asked Shell Plc to disclose more information about its climate strategy, but stopped short of backing other investors' push for the oil and gas giant to align itself with the Paris Climate Agreement. ... Norway's $1.6 trillion wealth fund asked -rte-company state="{"_id":"0000018f-86d9-de3b-adcf ...

Equilon Enterprises, doing business as Shell Oil Products US, has agreed to sell the Martinez Shell Refinery to PBF Holding Company for $1 billion and other adjustments, the two companies announced Tuesday afternoon. The refinery has been operating in Martinez under the Shell name since it was completed in 1915 as Shell's first in the United ...

Equilon Enterprises, doing business as Shell Oil Products US, has completed the $1.2 billion sale of the Martinez Refinery and associated logistics assets to PBF Energy's subsidiary PBF Holding in California, US. Crude supply and product offtake agreements were also part of the deal agreed by Shell and PBF.

May 6, 2024 at 6:02 AM PDT. Listen. 1:03. Shell Plc intends to exit shareholdings in its South African retail, transport and refining operations, Daily Maverick reported. The energy company made ...