- Applying to Uni

- Apprenticeships

- Health & Relationships

- Money & Finance

Personal Statements

- Postgraduate

- U.S Universities

University Interviews

- Vocational Qualifications

- Accommodation

- Budgeting, Money & Finance

- Health & Relationships

- Jobs & Careers

- Socialising

Studying Abroad

- Studying & Revision

- Technology

- University & College Admissions

Guide to GCSE Results Day

Finding a job after school or college

Retaking GCSEs

In this section

Choosing GCSE Subjects

Post-GCSE Options

GCSE Work Experience

GCSE Revision Tips

Why take an Apprenticeship?

Applying for an Apprenticeship

Apprenticeships Interviews

Apprenticeship Wage

Engineering Apprenticeships

What is an Apprenticeship?

Choosing an Apprenticeship

Real Life Apprentices

Degree Apprenticeships

Higher Apprenticeships

A Level Results Day 2024

AS Levels 2024

Clearing Guide 2024

Applying to University

SQA Results Day Guide 2024

BTEC Results Day Guide

Vocational Qualifications Guide

Sixth Form or College

International Baccalaureate

Post 18 options

Finding a Job

Should I take a Gap Year?

Travel Planning

Volunteering

Gap Year Guide

Gap Year Blogs

Applying to Oxbridge

Applying to US Universities

Choosing a Degree

Choosing a University or College

Personal Statement Editing and Review Service

Guide to Freshers' Week

Student Guides

Student Cooking

Student Blogs

- Top Rated Personal Statements

Personal Statement Examples

Writing Your Personal Statement

- Postgraduate Personal Statements

- International Student Personal Statements

- Gap Year Personal Statements

Personal Statement Length Checker

Personal Statement Examples By University

Personal Statement Changes 2025

Personal Statement Template

Job Interviews

Types of Postgraduate Course

Writing a Postgraduate Personal Statement

Postgraduate Funding

Postgraduate Study

Internships

Choosing A College

Ivy League Universities

Common App Essay Examples

Universal College Application Guide

How To Write A College Admissions Essay

College Rankings

Admissions Tests

Fees & Funding

Scholarships

Budgeting For College

Online Degree

Platinum Express Editing and Review Service

Gold Editing and Review Service

Silver Express Editing and Review Service

UCAS Personal Statement Editing and Review Service

Oxbridge Personal Statement Editing and Review Service

Postgraduate Personal Statement Editing and Review Service

You are here

- Mature Student Personal Statements

- Personal Statements By University

- Accountancy and Finance Personal Statements

- Actuarial Science Personal Statements

- American Studies Personal Statements

- Anthropology Personal Statements

- Archaeology Personal Statements

- Architecture Personal Statements

- Art and Design Personal Statements

- Biochemistry Personal Statements

- Bioengineering Personal Statements

- Biology Personal Statements

- Biomedical Science Personal Statements

- Biotechnology Personal Statements

- Business Management Personal Statement Examples

- Business Personal Statements

- Catering and Food Personal Statements

- Chemistry Personal Statements

- Classics Personal Statements

- Computer Science Personal Statements

- Computing and IT Personal Statements

- Criminology Personal Statements

- Dance Personal Statements

- Dentistry Personal Statements

- Design Personal Statements

- Dietetics Personal Statements

- Drama Personal Statements

- Economics Personal Statement Examples

- Education Personal Statements

- Engineering Personal Statement Examples

- English Personal Statements

- Environment Personal Statements

- Environmental Science Personal Statements

- Event Management Personal Statements

- Fashion Personal Statements

- Film Personal Statements

- Finance Personal Statements

- Forensic Science Personal Statements

- Geography Personal Statements

- Geology Personal Statements

- Health Sciences Personal Statements

- History Personal Statements

- History of Art Personal Statements

- Hotel Management Personal Statements

- International Relations Personal Statements

- International Studies Personal Statements

- Islamic Studies Personal Statements

- Japanese Studies Personal Statements

- Journalism Personal Statements

- Land Economy Personal Statements

- Languages Personal Statements

- Law Personal Statement Examples

- Linguistics Personal Statements

- Management Personal Statements

- Marketing Personal Statements

- Mathematics Personal Statements

- Media Personal Statements

- Medicine Personal Statement Examples

- Midwifery Personal Statements

- Music Personal Statements

- Music Technology Personal Statements

- Natural Sciences Personal Statements

- Neuroscience Personal Statements

- Nursing Personal Statements

- Occupational Therapy Personal Statements

- Osteopathy Personal Statements

- Oxbridge Personal Statements

- Pharmacy Personal Statements

- Philosophy Personal Statements

- Photography Personal Statements

- Physics Personal Statements

- Physiology Personal Statements

- Physiotherapy Personal Statements

- Politics Personal Statements

- Psychology Personal Statement Examples

- Radiography Personal Statements

- Religious Studies Personal Statements

- Social Work Personal Statements

- Sociology Personal Statements

- Sports & Leisure Personal Statements

- Sports Science Personal Statements

- Surveying Personal Statements

- Teacher Training Personal Statements

- Theology Personal Statements

- Travel and Tourism Personal Statements

- Urban Planning Personal Statements

- Veterinary Science Personal Statements

- Zoology Personal Statements

- Personal Statement Editing Service

- Personal Statement Writing Guide

- Submit Your Personal Statement

- Personal Statement Questions 2025

- Personal Statement Changes 2024

Finance Personal Statement Examples

- Search Search Please fill out this field.

- Financial Planning

What Is a Personal Financial Statement?

:max_bytes(150000):strip_icc():format(webp)/IMG_0031-a6116af31d5a4783a969390cd325367c.jpg)

- Definition and Examples

How Does a Personal Financial Statement Work?

Do i need a personal financial statement.

Xavier Lorenzo / Getty Images

A personal financial statement is a physical snapshot of your assets compared to your liabilities. It gives you a real-time view of your wealth and helps you assess your current financial situation. While it's beneficial for your own financial growth, lenders may ask for a personal financial statement if you’re applying for a loan

Key Takeaways

- A personal financial statement is a document that lists all your assets, liabilities, and resulting net worth.

- Personal financial statements can be used by individuals and businesses.

- A personal financial statement is important because it shows you if you’re building wealth, and can play a critical role in helping you get approved for loans.

- The most efficient way to keep your personal financial statement up-to-date is to use budgeting software that tracks your net worth for you.

Definition and Examples of a Personal Financial Statement

A personal financial statement is a physical snapshot of your assets compared to your liabilities . It gives you a real-time view of your wealth and helps you assess your current financial situation. While it's beneficial for your own financial growth, lenders may ask for a personal financial statement if you’re applying for a loan

But what are assets and liabilities? Your assets refer to all items you can easily convert to cash, including:

- Bank accounts

- Retirement accounts

- Investment balances

- Real estate

- Personal property with significant value, such as rare art collections, coin collections, antiques, and jewelry

Your liabilities refer to all the debt you owe. They can be:

- Student loans

- Credit card debt

- Car and boat loans

- Loans where you’re the co-signer

- Unpaid taxes

- Medical debt

If your total assets are higher than your liabilities, your personal financial statement reflects a positive net worth . This is a sign that you’re building wealth and signals to lenders that you may be a trustworthy borrower.

If your liabilities are higher than your assets, however, you have a negative net worth. This signals you may be living paycheck to paycheck or spending more than you earn, and you could be seen as a high-risk borrower to lenders.

If you are in a committed partnership or married and share assets, you and your partner can combine assets and liabilities to create a joint personal financial statement.

Suppose you have $200,000 worth of assets. This includes your house, a bank account, and a retirement account. Now let’s say you have $130,000 in liabilities. This includes your mortgage, some student loans , and credit card debt. In this case, your net worth is $70,000.

Here’s an example of how your personal financial statement may look in spreadsheet form:

The Balance

Your personal financial statement will be a lot more complex if you’re creating one for your business. For small business owners, the Small Business Administration (SBA) has a sample personal financial statement you can use as a guide.

Wealth is not defined by the income you accumulate, but by your net worth. A personal financial statement is important because it shows if your net worth is improving or decaying over time. It sheds light on your entire financial picture so you can see if you’re moving closer or farther away from your goals .

For example, suppose your financial goal is to retire early . You’ve officially paid off your debt (minus your mortgage), but you’re not sure how close you are to reaching your retirement goals. You decide to create a personal financial statement to see where you stand.

Below is a guide to how you would fill out your personal financial statement, using the above example.

Step 1: List All Your Assets

Most assets have a clear dollar value (i.e., you can look in your bank account and see what your balance is). But some assets—such as your car, home, or an art collection—may require an appraisal first.

If you’re creating a personal financial statement for a lender, it’s important to be as accurate as possible (and get an appraisal if you’re unsure of the amount). But if it’s just for your own personal records, an educated guess may be fine. This may look like:

- $600,000 in your home

- $150,000 in your 401(k)

- $125,000 in your investment account

- $40,000 in your checking and savings accounts

- $30,000 in your traditional IRA

- $5,000 for your car

Total assets = $950,000

Anything you rent does not count as an asset because you don’t own it. So if you rent a house or lease a car, leave it off your personal financial statement.

Step 2: List All Your Debt

Your debts are your liabilities. In this example, we’ve stated you’ve paid off all your debt except your mortgage, so that’s the only thing listed here.

- $300,000 on your mortgage

Total liabilities = $300,000

If you pay your credit card bill off in full every month, it’s not considered debt, so don’t include it on your personal financial statement.

Step 3: Subtract the Two Numbers To Get Your Net Worth

In this example, when you subtract the assets from your liabilities, you see that your total net worth is $650,000.

Now, suppose you know you need $1.2 million to reach financial freedom and retire early. Your personal financial statement would show that you’re $550,000 away from your goal. You could then update it again next month to track your progress, and make changes to your spending and saving as needed.

Personal financial statements help individuals understand the overall state of their personal or business finances, and calculate their net worth. They can also be used as a tool when applying for credit such as a mortgage, personal loan, or business loan . To get a snapshot of your financial health, it’s a good idea to create a personal financial statement.

Even if you have a positive net worth, it is not guaranteed you will receive a loan you apply for. Credit history and past debts are also taken into consideration by lenders.

The biggest drawback of personal financial statements is that it’s a frozen snapshot of your financial health at any given time. For it to have a positive impact, you have to update it regularly.

The good news is that there are many online tools you can use to automate your personal financial statement. Two popular options include:

- You Need a Budget (YNAB) : This is a personal finance software with strong financial budgeting features that can automatically track your assets and liabilities for you. As you earn income and pay off debt, your net worth updates in real time.

- Personal Capital : This tool for tracking your net worth acts as more of a wealth management tool, praised for helping you track and optimize investments and spot ways to diversify and manage risk. It connects with more than 14,000 financial institutions and provides a moving snapshot of your net worth.

Clearview Credit Union. " What Is a Personal Financial Statement? " Accessed Oct. 28, 2021.

Personal Capital. " Our Mission: We Transform Financial Lives Through Technology and People ." Accessed Oct. 28, 2021.

- Search Search Please fill out this field.

Personal Cash Flow Statement

Personal balance sheet, bringing them together, the bottom line.

- Personal Finance

- Budgeting & Savings

Evaluating Your Personal Financial Statement

Tips to help with budget planning and figuring your net worth

:max_bytes(150000):strip_icc():format(webp)/Office2-EbonyHoward-8b4ada1233ed44aca6ef78c46069435d.jpg)

Many individuals look at their bank and credit card statements and are surprised by how much they've spent. One simple method of accounting for income and expenditures is to keep personal financial statements just like the ones used by corporations. Financial statements provide you with an indication of your financial condition and can help with budget planning. There are two types of personal financial statements: the personal cash flow statement and the personal balance sheet .

Key Takeaways

- You can create your own personal financial statements to help with budget planning and to set goals for increasing your net worth.

- Two types of personal financial statements are the personal cash flow statement and the personal balance sheet.

- The personal cash flow statement measures your cash inflows or money you earn and your cash outflows or money you spend. This determines if you have a positive or negative net cash flow.

- A personal balance sheet summarizes your assets and liabilities to calculate your net worth.

A personal cash flow statement measures your cash inflows and outflows to show you your net cash flow for a specific period. Cash inflows generally include:

- Interest from savings accounts

- Dividends from investments

- Capital gains from the sale of financial securities like stocks and bonds

Cash inflow can also include money received from the sale of assets like houses or cars. Your cash inflow essentially consists of anything that brings in money.

Cash outflow represents all your expenses regardless of size. Cash outflows include these types of costs:

- Rent or mortgage payments

- Utility bills

- Entertainment, such as books, movie tickets, and restaurant meals

The purpose of determining your cash inflows and outflows is to find your net cash flow. Your net cash flow is simply the result of subtracting your outflow from your inflow. A positive net cash flow means that you earned more than you spent and you have some money left over from that period. A negative net cash flow shows that you spent more money than you brought in.

A balance sheet is another type of personal financial statement. A personal balance sheet provides an overall snapshot of your wealth at a specific period in time. It's a summary of your assets or what you own and your liabilities or what you owe. It results in your net worth : your assets minus liabilities.

Your Assets

Assets can be classified into three categories:

- Liquid Assets: These are things you own that can easily be sold or turned into cash without losing value. They include checking accounts, money market accounts, savings accounts, and cash. Some people include certificates of deposit (CDs) in this category but the problem with CDs is that most of them charge an early withdrawal fee, causing your investment to lose a little value.

- Large Assets: Large assets include houses, cars, boats, artwork, and furniture. Make sure to use the market value of these items when you're creating a personal balance sheet . You can use recent sales prices of similar items if it's difficult to find a market value.

- Investments: Investments include bonds, stocks, CDs, mutual funds , and real estate. You should record investments at their current market values as well.

Your Liabilities

Liabilities are what you owe. They include current bills, payments still owed on some assets like cars and houses, credit card balances , and other loans.

The "debt avalanche" and the "debt snowball" are two popular methods for paying off liabilities such as credit card debt.

Your Net Worth

Your net worth is the difference between what you own and what you owe. This figure is your measure of wealth because it represents what you own after everything you owe has been paid off. You owe more than you own if you have a negative net worth.

You can increase your net worth by increasing your assets or decreasing your liabilities. You can increase assets by increasing your cash or increasing the value of any asset you own. Just make sure that you don't increase your liabilities along with your assets.

Your assets will increase if you buy a house but your liabilities will also increase if you take out a mortgage on that house. Increasing your net worth through an asset increase will only work if the increase in assets is greater than the increase in liabilities. The same goes for trying to decrease your liabilities. A decrease in what you owe has to be greater than a reduction in assets.

Personal financial statements give you the tools to monitor your spending and increase your net worth. They're not just two separate pieces of information. They work together.

Your net cash flow from the cash flow statement can help you in your quest to increase your net worth. You can apply the money to acquiring assets or paying off liabilities if you have a positive net cash flow in a given period. Applying your net cash flow toward your net worth is a great way to increase assets without increasing liabilities or to decrease liabilities without increasing assets.

What Are Some Examples of Non-Liquid Assets?

Non-liquid assets are those that you can't sell or dispose of quickly if you need cash. Real estate, automobiles, artwork, and jewelry are all non-liquid assets. They can also lose value in the sales process. You might purchase your home for $350,000 and then have to sell it for only $300,000 if you find yourself in an emergency where you have to liquidate assets as quickly as possible to raise cash.

How Much Does the Average American Spend a Year?

The U.S. Bureau of Labor Statistics reported in September 2023 that average annual expenditures per household were $72,967 in 2022. This was up 9% from the year before. Average income before taxes increased only 7.5% during the same timeframe.

How Much Money Should I Have in Savings?

It's been said that you should save six months' worth of living expenses tucked away but the U.S. Securities and Exchange Commission puts a slightly different spin on that. It says you should have six months' worth of income saved. That works out to $30,000 if you earn $60,000 a year.

The SEC also suggests that you might want to consider paying off your high-interest credit card debt to amass some savings rather than invest your money, hoping to earn some. You might find that the amount you're saving on interest is more than a safe investment such as a money market or mutual fund would pay you in a given period.

Approach your finances like a financial advisor during your annual review . If you have a negative cash flow or you want to increase positive net cash flow, the only way to do it is to assess your spending habits and adjust them as necessary. You'll be well on your way to greater financial security if you use your personal financial statements to become more aware of your spending habits and your net worth.

Cornell Law School Legal Information Institute. " Liquid Asset ."

U.S. Bureau of Labor Statistics. " Consumer Expenditures—2022 ."

U.S. Securities and Exchange Commission. " Financial Navigating in the Current Economy: Ten Things to Consider Before You Make Investing Decisions ."

:max_bytes(150000):strip_icc():format(webp)/0-banksavings-951dc516fac84b50a6b6032cceacbcc3.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

How to Create a Personal Financial Statement + [Free Template and Sample]

This post may contain affiliate links, which helps us to continue providing relevant content and we receive a small commission at no cost to you. As an Amazon Associate, I earn from qualifying purchases. Please read the full disclosure here .

Do you want to create a personal financial statement, but aren’t sure where to start?

According to Mint.com , over 65% of people have no clue how they spent money last month. So, you can probably be pretty sure even less know how their personal finance situation.

With rising costs for essentials like housing and education due to inflation, there is no better time to get an accurate picture of your current situation today.

If you’re wondering how your finances measure up, a Personal Financial Statement can be an invaluable tool in helping you understand where you stand financially and prepare for changes ahead.

This article will walk through creating a sample personal financial statement template with examples of what this document might look like based on your situation.

A personal financial statement isn’t just for your loan applications anymore, it’s an opportunity for transparency in your finances too!

What is a personal financial statement?

A personal financial statement is a document that summarizes your assets, liabilities, and net worth. A PFS can help you understand your financial health so you can make informed decisions about your money.

A personal financial statement template will typically include three sections:

- Assets: This section will list all of the money and property you own.

- Liabilities: This section will list all of the money you owe.

- Net Worth: This section will calculate your net worth by subtracting your total liabilities from your total assets.

Your personal financial statement should be updated on a regular basis, typically once a year. This will help you track your progress and make sure you’re on track to reach your financial goals.

What are the benefits of creating a personal financial statement?

There are many great benefits of a personal financial statement.

By creating a personal financial statement, you can see at a glance how much money you have coming in, going out, and what your net worth is. This information can be extremely helpful in making financial decisions and setting goals.

Benefit #1 – Understand Your Financial Situation

This is why you must spend the extra couple of minutes to create a personal financial statement form.

Most importantly, you get a better understanding of your financial situation. This includes seeing where your money is going each month and how much debt you have.

What we call around here at Money Bliss – the 1000-foot look from above. The outsider’s perspective of what is going on with your finances.

Benefit #2 – Helps you track your progress

When it comes to personal finance, one of the best things you can do is keep track of your progress.

Tracking your progress should be important to you! By seeing everything laid out in front of you, it becomes much easier to make informed financial decisions that will help improve your overall financial picture.

Benefit # 3- Find some areas of improvement

Since a personal financial statement is a document that summarizes your income, expenses, assets, and liabilities in one place it helps you see the financial big picture. Thus, spotting areas for improvement are easier.

For example, if you see that you are spending too much money on non-essential items, you can make changes to improve your financial health.

Benefit #4 – Useful Tool to Set Goals

Next, it can help you set goals. Once you see where you stand financially, you can set goals for paying off debt or saving more money each month.

This aids you to make better financial decisions by providing a clear picture of your financial situation.

Benefit #5 – Snapshot to help you stay motivated

Creating a personal financial statement can be incredibly helpful in staying motivated to save money and achieve your financial goals. Seeing your progress in black and white (or, more accurately, green and red) can be a strong motivator to keep going.

Using a personal finance statement is especially helpful if you’re working towards paying off debt or saving for a specific goal. It can be difficult to stay motivated when you’re not seeing progress, but seeing the numbers going down (or up) can give you the boost you need to keep going.

Benefit #6 – Monitor your financial health

Creating a personal financial statement can help you monitor your financial health and make informed decisions about your spending and saving habits.

- If you see that your expenses are consistently exceeding your income, for example, you may need to make some changes to ensure that you are able to meet your long-term financial goals.

- Easier to spot opportunities to save money or invest in assets that will grow in value over time.

Monitoring your financial health on a regular basis can help you avoid debt problems and keep track of your progress toward financial goals.

What are the types of personal financial statements?

A personal financial statement is a form or spreadsheet detailing a person’s overall financial health. This statement is typically used to apply for business loans or other forms of financing. There are two types of personal financial statements:

- The first type is the balance sheet, which lists a person’s assets and liabilities.

- The second type is the income statement, which details a person’s income and expenses.

The balance sheet provides an overview of a person’s financial situation at a particular point in time, while the income statement shows how much money a person has coming in and going out over a period of time.

Both types of statements are important in helping lenders evaluate a borrower’s ability to repay a loan. As well as for you to monitor your personal situation.

What are the components of a personal financial statement?

A personal financial statement is not just a document that shows how much money you have in your bank account. It also includes other important components to show a well-rounded picture.

Most people know that a personal finance statement includes income, assets, and liabilities. But did you know there are actually four main components of a personal financial statement?

A personal financial statement varies from a traditional balance sheet that is used for a company.

Your income is everything you earn in a year from all sources, including your job, investments, alimony, and more.

You should list all of your sources of income on your personal financial statement so you have a clear picture of what you’re bringing in each month.

- Include all sources of income, even if they are irregular or one-time payments.

- List after-tax income.

- If you are married or have a partner, include their income as well.

- Update your income regularly to reflect any changes (e.g., new job, raise, bonus).

This will help you make informed decisions about your spending and saving.

This is the money you spend each month on things like your mortgage or rent, car payments, groceries, and other necessary expenses.

Here are over 100 personal budget categories for various expenses.

Assets are everything you own like your home equity or the value of your car and can use to pay your debts. This includes cash, savings, investments, property, and possessions.

Calculate your total assets by adding up the value of all your cash, savings, investments, property, and possessions.

So, is a car an asset ? Well it depends if there is a loan against it.

Liabilities

Your liabilities are everything you owe money on. This includes, but is not limited to:

- Student loans

- Credit card debt

- Any other personal loans

Your liabilities also include any money you may owe in taxes.

How to create a personal financial statement – Part 1

There are a few key things you need to know in order to create a personal financial statement.

The first part includes what is needed for your net worth – assets and liabilities. The second part includes your current income, expenditures, and savings.

We will show you next how to collect all of this information, then you can start to work on creating a personal financial statement.

Step #1 – Determine your current assets and business profit

The first is your current assets. Your assets are everything you own and can use to pay your debts. This includes your savings, your home equity, and any investments you have. You will need to know the value of all of these things in order to create an accurate personal finance statement.

To determine the value of your assets, start by looking at your savings. This can be any money you have in the bank, including checking, savings, and money market accounts. Add up the total balance of all these accounts to get your total savings.

Next, determine the value of your home equity. This is the difference between what your home is worth and how much you still owe on it. To calculate this, look up the current value of your home and subtract any outstanding mortgage or other loan balances from it. This will give you an estimate of how much equity you have in your home.

Finally, add up the values of any investments you have. These can include stocks, bonds, mutual funds, and other types of investment accounts. Once you have all these values totaled up, this will give you an estimate of your current assets.

Step #2 – Determine your current liabilities

Your current liabilities are all of the debts and financial obligations that you currently have.

This can include things like credit card debt, car loans, student loans, and any other type of loan that you are currently paying off.

To get an accurate picture of your current liabilities, you will need to gather up all of your bills and statements so that you can see exactly how much you owe.

Step #3 – Determine your net worth

Your net worth is your assets – your savings, your home equity, and your stocks and investments – minus your liabilities. To calculate it, simply subtract your total liabilities from your total assets. This will give you your net worth.

Your net worth is a good indicator of your financial health.

It can help you make decisions about saving and investing, and it can also be a useful tool for budgeting. If you want to improve your financial health, focus on increasing your net worth by saving more money and investing in assets that will grow in value over time.

Your goal is to double your liquid net worth quickly.

How to create a personal financial statement – Part 2

Now, you have developed your next worth statement. The next step in creating a personal financial statement is to determine your monthly cash flow of money or annual cash flow.

This second part includes your current income, expenditures, and savings.

Step #1 – Determine your monthly income

Firstly, you will need your income flow section. This could come from your pay stubs, or if you are self-employed, your profit and loss statements.

Your monthly income includes all money that you earn in a month, including salary, wages, tips, commissions, child support, alimony, and any other regular payments that you receive.

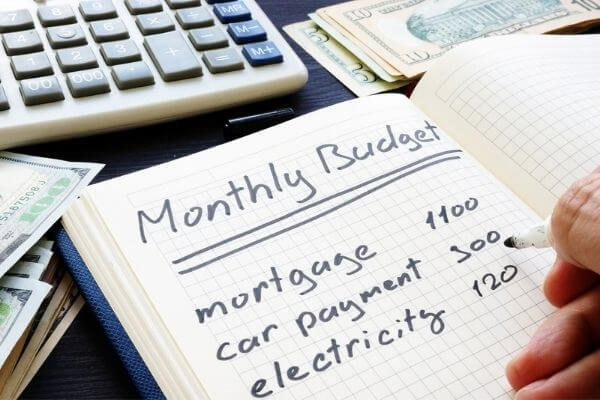

Step #2 – Determine your monthly expenses

The next piece is to determine your monthly expenses. This includes things like your mortgage or rent, car payments, credit card bills, and any other regular expenses. You’ll also want to factor in occasional expenses, like doctor’s appointments or annual membership fees.

Your expenses can be divided into two categories: fixed and variable.

Fixed expenses are those that remain the same each month, such as rent or mortgage payments, car insurance, and minimum credit card payments. Variable expenses change from month to month and can include items such as groceries, utility bills, entertainment, and clothing.

Step #3 – Determine your monthly savings

Typically, most advice will leave out monthly savings. However, this. is a critical piece to learning how to FI – financial independence.

Once you have both your income and expense information, you can begin to calculate your monthly savings. To do this, simply take your total income and subtract your total expenses. The remaining amount is what you have available to save each month.

Maybe you just calculated this and realize you have a negative number (meaning you spend more than you earn each month), then you will need to make some changes in order to improve your financial situation.

It is important to note that a personal financial statement is not static.

Your income and expenses can change from month-to-month, so it is important to recalculate your statement on a regular basis. Additionally, as you begin to save more money each month, the amount available for savings will increase as well.

How to use a personal finance statement template

A personal financial statement is a snapshot of your financial health at a given point in time. It lists your assets, liabilities, and net worth so you can see the big picture of your finances.

You can use a personal finance statement template to track your progress over time and make changes to improve your financial health.

Here’s how to use a personal finance statement template:

- Enter your information into the template. This includes details about your income, expenses, debts, and assets.

- Review your numbers and calculate your net worth. This is the difference between your total assets and total liabilities.

- Watch for comparisons. Compare your net worth from one period to another to track your progress over time.

- Make tweaks. Make changes in areas where you want to improve, such as increasing savings or paying down debt.

- Repeat steps 1-4 periodically . Then you can see how well you’re doing and make necessary changes

How to interpret a personal finance statement

A personal financial statement is a document that shows your current financial health. It lists your assets and liabilities, giving you a clear picture of your net worth.

- Positive net worth means you have more assets than debt.

- Negative net worth means you have more debt than assets.

Your personal financial statement will help you to set financial goals and track your progress over time. For example, if you want to become debt-free within five years, you can use your statement to create a budget and track your progress each year.

If you have a negative net worth, don’t panic! You can improve your financial health by paying off debts and building up your savings.

Creating a budget will help you make the most of your income and make headway on your financial goals.

How to use a personal financial statement to make financial decisions?

This is the important piece of becoming a millionaire.

A personal financial statement can help you see where your money is going each month and make changes to ensure that you are saving enough for your future goals.

Way #1 – Look at your current financial situation

Your personal financial statement is a record of your income and expenses over a period of time. This information can be used to make financial decisions, such as whether to save money or invest in a new business venture.

If you are looking to save money, you will want to compare your total income to your total expenses. If your expenses are greater than your income, you will need to find ways to reduce your spending. You may also want to consider investing in a savings account or retirement fund.

If you are looking to invest in a new business venture, you will want to assess your current financial situation. You will need to determine how much money you can afford to invest and whether or not the venture is likely to be successful.

Doing this analysis before making any decisions can help you avoid making costly mistakes.

Way #2 – Determine your financial goals

There are a few key things to keep in mind when you’re determining your financial goals.

First, you need to think about your short-term and long-term goals.

- Your short-term goals might include things like saving up for a down payment on a house or car or paying off high-interest debt.

- Your long-term goals might include things like saving for retirement or sending your kids to college.

Once you’ve determined your goals, you need to think about how much money you’ll need to reach them. This is where a personal financial statement can come in handy.

This information can help you figure out how much money you have available to put towards your financial goals.

Once you have an idea of how much money you need to reach your financial goals, the next step is to develop a plan for how you’re going to save that money. This might involve setting up a budget and sticking to it, investing in a specific savings account or investment account, or taking advantage of employer matching programs if they’re available.

Making smart financial decisions is important for achieving both your short-term and long-term goals. A personal financial statement can help you determine how much money you need to reach your goals, and develop a plan for saving that money.

Way #3 – Make a budget

Your personal financial statement can be a helpful tool when you’re trying to make a budget. This document lists your income and expenses and can give you a clear picture of your financial situation.

To use your personal financial statement to make a budget:

- Look at your overall income and expenses. This will give you an idea of where your money is going each month.

- What are Necessary Expenses? Determine which expenses are necessary and which ones you can cut back on.

- Prioritize your List. Make a list of your monthly income and expenses, with the necessary expenses first. And drop the expenses at the bottom of the list.

- How Much is Left? Determine how much money you have left over each month after paying for necessities. This is the money you can use for savings or other goals.

- Adjust your budget as needed based on changes in your income or expenses.

Way #4 – Invest in yourself

There are a lot of things you can do to invest in yourself, but one of the smartest things you can do is to invest in your personal finance education.

In fact, one of the popular millionaire quotes from Warren Buffet is :

Invest in yourself as much as possible. Warren Buffet

Investing in yourself is one of the smartest things you can do.

Way #5 – Stay disciplined

Making financial decisions can be difficult, but if you have a personal financial statement, it can help you stay disciplined.

A personal financial statement is a document that shows your income, expenses, and assets. It can help you track your spending and see where you can save money. That my friend is black and white information.

Making financial decisions can be difficult, but if you have a personal financial statement, it can help you stay disciplined and on track.

What are some common mistakes to avoid when creating a personal finance statement?

There are many common mistakes people make when creating a personal financial statement. This can lead to an inaccurate picture of your financial situation and make it difficult to make informed decisions about your finances.

Any of these common mistakes can also lead to problems down the road because you will be unable to meet your financial obligations.

- Not including all sources of income

- Not including all debts and expenses

- Forgetting to track new sources of income

- Overstating or understating expenses

- Not properly categorizing expenses

- Forgetting to update (or review) the statement regularly

- Not tracking progress over time

- Too scared to seek professional help if needed.

By avoiding these common mistakes, you can create a personal financial statement that accurately reflects your financial situation and helps you make better decisions about your money.

How often should a personal finance statement be updated?

You should update your personal finance statement at least once a year.

However, you may want to update it more frequently if you have significant changes in your income or expenses. For example, you may want to update your personal finance statement after you get a raise or buy a new car.

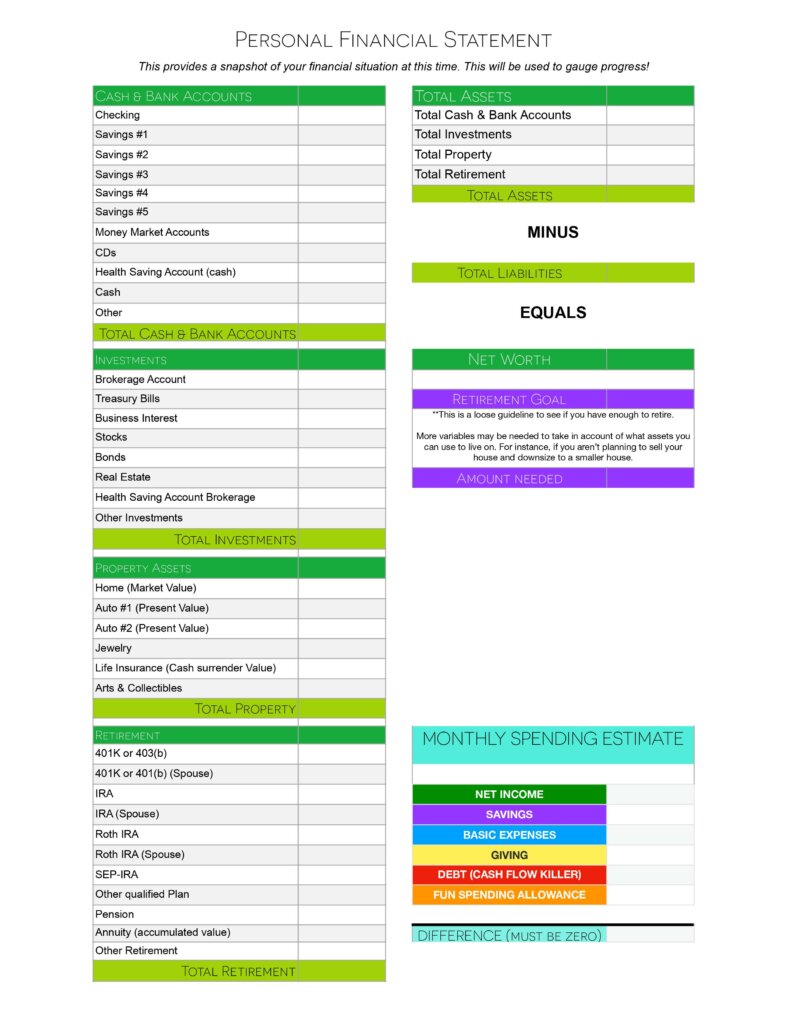

A Personal Financial Statement Template Example

A personal financial statement is a document that summarizes your financial health.

It includes information about your income, expenses, debts, and assets. This information can be used to make informed decisions about your finances.

There are many personal finance statement templates available online. Some banks and financial institutions offer their own templates. You can also find templates in our free resource library. Once you find a template you like, you can download it and fill it out with your own information.

When filling out a personal financial statement template, be sure to include accurate and up-to-date information.

This will give you the most accurate picture of your financial health. Review your statements regularly to track your progress and make changes as needed.

Time to Create A Sample Personal Financial Statement

When creating a personal financial statement, it is important to include all sources of income, not just your salary. This includes any freelance work, investments, or other forms of passive income. Additionally, make sure to include any government benefits or assistance you receive.

Excluding all sources of income will give you an inaccurate picture of your financial situation and make it difficult to create a realistic budget.

This is something you need to spend dedicated time doing to create a personal financial statement worksheet.

Over time, this wealth management tool will help you to become the next millionaire.

Know someone else that needs this, too? Then, please share!!

Did the post resonate with you?

More importantly, did I answer the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not just welcomed; they’re an integral part of our community. Let’s continue the conversation and explore how these ideas align with your journey towards Money Bliss.

There was a template offer that popped up when I first visited the page and then it disappeared. Could you please send me the spreadsheet?

You can go here to subscribe to our email list: https://moneybliss.org/email-subscribe/

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Original text

Why All Small Business Owners Need a Personal Financial Statement

Running a small business is exhilarating, demanding and often a blur of financial uncertainty. While most entrepreneurs focus on their business’s bottom line and keep their financial statements current, they often neglect to document their personal finances. That’s wrong. Every small business owner needs to create a personal financial statement (PFS), which serves as a personal balance sheet, documenting your assets, liabilities and net worth.

When do you need a personal financial statement?

Many small business owners may need a loan or other outside financing as they grow their companies. That usually requires providing a lot of documentation to the lender. But lenders don’t only want to see your business finances. Most require a personal financial statement as well.

If you decide to pledge personal assets as collateral, lenders definitely want to know the details about those assets. Financial institutions may wish to conduct a fiscal health evaluation of your personal finances so they can assess how well you manage money. For instance, if you have few assets and a lot of outstanding debt, it can indicate you would have trouble repaying a loan.

Are you thinking of buying an existing business or a franchise? The business owner, broker and/or franchisor will ask for a PFS as evidence that you’re financially able to purchase the business or franchise.

If you plan to rent a commercial office, retail space, or other types of business space, the landlord will likely request a personal financial statement before approving your lease.

As you can see, there are numerous reasons you need a PFS. It’s smart to prepare yours now (and keep it updated) so it will be ready when needed.

Personal financial statements are financial snapshots offering numerous benefits.

Beyond simply tracking your assets and liabilities, a PFS offers several vital benefits for entrepreneurs. Creating your PFS is like getting a checkup, except the result is a fiscal health evaluation rather than a physical one.

Some of the benefits of preparing a personal financial statement (sometimes called a personal financial summary):

- Securing funding: As we already noted, when seeking loans for business expansion, new equipment or company vehicles, lenders rely on your PFS to assess your creditworthiness and ability to repay. A strong PFS significantly increases your chances of securing favorable loan terms and interest rates.

- Understanding your net worth: Your PFS provides a clear picture of your overall financial standing, including your assets (cash, investments, property) and liabilities (debt, loans, mortgages). Seeing a comprehensive view helps you make informed decisions about investments, savings goals and risk management.

- Making prudent financial decisions: With a clear understanding of your income, expenses and debt obligations, you can make informed choices about spending, investments and financial planning. Your PFS empowers you to avoid impulsive decisions and build a solid financial foundation.

- Monitoring progress and adapting: Regularly reviewing your PFS allows you to track your progress toward your financial goals and identify areas for improvement. This ongoing review process enables you to pivot, adapt, and adjust your strategies as your business and personal circumstances evolve.

What's included in a personal financial statement?

A typical PFS is divided into two main sections—assets and liabilities.

List of assets

- Current Assets include cash, checking and savings accounts, certificates of deposit, short-term investments and accounts receivable.

- Investment Assets include stocks, bonds, mutual funds and retirement accounts (IRAs, 401(k)s).

- Fixed Assets include real estate holdings and personal property, such as jewelry, cars and other items of significant value (art collection, first editions of books, etc.)

List of liabilities

- Current Liabilities include credit card debt, outstanding bills and short-term loans.

- Long-term Liabilities include mortgages, car loans, student loans and personal loans.

Do not include business assets or liabilities in your personal financial statement.

Creating your financial snapshot

You don’t need to be a financial wizard to create a PFS. Here’s how:

- Gather your documents: Collect bank statements, investment account statements, loan documents and receipts for major purchases.

- Choose a format: You can use an online template, spreadsheet or pen and paper. Choose the best format for you and ensure consistency for future updates.

- List your assets: Identify and value all your assets using current market values for investments and real estate.

- List your liabilities: Include all your debts, noting the remaining balances and interest rates.

- Calculate your net worth: Subtract your total liabilities from your assets to determine your net worth. While this is part of your overall personal balance sheet, you should keep this calculation as a separate net worth statement.

- Review and update regularly: Your PFS is not static. Update it regularly, ideally quarterly, to reflect changes in your financial situation.

When creating your personal financial statement, it’s critical to be honest and accurate. This wealth assessment is for your own benefit to help you (and lenders) make informed decisions. No one is judging you.

A PFS helps you take ownership of your personal finances and equips you with the knowledge and confidence to navigate the challenges and reap the rewards of entrepreneurship. A healthy business rests on a solid personal financial foundation.

If navigating financial statements feels overwhelming, consider consulting with a financial advisor, accountant or SCORE mentor .

National Bankers Association Foundation

The National Bankers Association Foundation’s mission is to eliminate the racial wealth gap by ensuring underserved communities have fair access to transformative financial education, services, and resources. To accomplish this, we support the work of Minority Depository Institutions (MDIs) through our four strategic pillars, which include: Financial Education, Entrepreneurship and Small Business, Research and Impact, and Collaboration and Capacity Building.

Copyright © 2024 SCORE Association, SCORE.org

Funded, in part, through a Cooperative Agreement with the U.S. Small Business Administration. All opinions, and/or recommendations expressed herein are those of the author(s) and do not necessarily reflect the views of the SBA.

Financial Tips, Guides & Know-Hows

Home > Finance > Personal Financial Statement: Definition, Uses, And Example

Personal Financial Statement: Definition, Uses, And Example

Published: January 7, 2024

Learn about the definition, uses, and example of a personal financial statement in the world of finance. Understand its importance and impact on your financial planning.

- Definition starting with P

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more )

Understanding Personal Financial Statements

When it comes to managing your finances, having a clear understanding of your financial position is essential. This is where personal financial statements come into play. In this article, we’ll explore the definition, uses, and provide an example of a personal financial statement.

Key Takeaways:

- Personal financial statements provide a snapshot of an individual’s financial position.

- These statements are useful for assessing one’s net worth, cash flow, and financial health.

A personal financial statement is a document that summarizes an individual’s financial situation, including their assets, liabilities, income, and expenses. It provides a comprehensive overview of one’s financial health and can be an invaluable tool for making informed financial decisions.

Let’s delve deeper into the various components of a personal financial statement:

Assets refer to items of financial value that an individual owns. This can include cash, savings accounts, investments, real estate, vehicles, and personal belongings. In the personal financial statement, these assets are listed at their current market value. By calculating the total value of assets, one can determine their net worth.

Liabilities

Liabilities encompass the debts and obligations that an individual owes. This can include credit card debt, mortgages, student loans, car loans, and any other outstanding debts. Similar to assets, liabilities are also listed in the personal financial statement, giving a clear picture of one’s overall financial obligations.

Income and Expenses

The personal financial statement also includes an individual’s income and expenses. Income refers to all sources of money inflow, such as salary, rental income, investments, or any other forms of income. Expenses, on the other hand, encompass all the money outflows, including rent/mortgage payments, utilities, groceries, transportation costs, and other personal expenses. By analyzing this section, one can assess their cash flow and determine if they are living within their means.

Uses of Personal Financial Statements:

- Assessing net worth: By calculating the total value of assets and subtracting liabilities, one can determine their net worth.

- Evaluating financial health: Personal financial statements provide a holistic view of an individual’s financial health, helping identify areas for improvement.

- Applying for loans: Lenders often require personal financial statements when assessing an individual’s creditworthiness.

- Planning for the future: These statements serve as a foundation for setting financial goals and creating a budget.

Example of a personal financial statement:

Let’s take a look at a simple example of a personal financial statement:

Personal Financial Statement of John Doe

- Cash: $10,000

- Savings Account: $20,000

- Investments: $50,000

- Real Estate: $150,000

- Total Assets: $230,000

- Mortgage: $100,000

- Student Loans: $20,000

- Credit Card Debt: $5,000

- Total Liabilities: $125,000

- Salary: $60,000

- Rental Income: $12,000

- Total Income: $72,000

- Monthly Rent/Mortgage: $1,500

- Utilities: $200

- Groceries: $400

- Transportation: $300

- Total Expenses: $2,400

In this example, John Doe’s net worth is calculated by subtracting his liabilities ($125,000) from his assets ($230,000), resulting in a net worth of $105,000. His monthly cash flow can also be determined by subtracting expenses ($2,400) from income ($6,000), resulting in a positive cash flow of $3,600.

Personal financial statements are crucial for managing your finances effectively. By regularly updating and analyzing your personal financial statement, you can gain valuable insights into your financial standing and make informed decisions to achieve your financial goals. Whether you’re applying for a loan, evaluating your financial health, or simply aiming to improve your financial well-being, personal financial statements are an essential tool in your financial toolkit.

20 Quick Tips To Saving Your Way To A Million Dollars

Our Review on The Credit One Credit Card

What Is The Difference Between Secured Card And Unsecured Card

What You Can Do To Support Small Businesses Freely

Latest articles.

Navigating Crypto Frontiers: Understanding Market Capitalization as the North Star

Written By:

Financial Literacy Matters: Here’s How to Boost Yours

Unlocking Potential: How In-Person Tutoring Can Help Your Child Thrive

Understanding XRP’s Role in the Future of Money Transfers

Navigating Post-Accident Challenges with Automobile Accident Lawyers

Related post.

By: • Finance

Please accept our Privacy Policy.

We uses cookies to improve your experience and to show you personalized ads. Please review our privacy policy by clicking here .

- https://livewell.com/finance/personal-financial-statement-definition-uses-and-example/

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

How to Write a Strong Personal Statement

- Ruth Gotian

- Ushma S. Neill

A few adjustments can get your application noticed.

Whether applying for a summer internship, a professional development opportunity, such as a Fulbright, an executive MBA program, or a senior leadership development course, a personal statement threads the ideas of your CV, and is longer and has a different tone and purpose than a traditional cover letter. A few adjustments to your personal statement can get your application noticed by the reviewer.

- Make sure you’re writing what they want to hear. Most organizations that offer a fellowship or internship are using the experience as a pipeline: It’s smart to spend 10 weeks and $15,000 on someone before committing five years and $300,000. Rarely are the organizations being charitable or altruistic, so align your stated goals with theirs

- Know when to bury the lead, and when to get to the point. It’s hard to paint a picture and explain your motivations in 200 words, but if you have two pages, give the reader a story arc or ease into your point by setting the scene.

- Recognize that the reviewer will be reading your statement subjectively, meaning you’re being assessed on unknowable criteria. Most people on evaluation committees are reading for whether or not you’re interesting. Stated differently, do they want to go out to dinner with you to hear more? Write it so that the person reading it wants to hear more.

- Address the elephant in the room (if there is one). Maybe your grades weren’t great in core courses, or perhaps you’ve never worked in the field you’re applying to. Make sure to address the deficiency rather than hoping the reader ignores it because they won’t. A few sentences suffice. Deficiencies do not need to be the cornerstone of the application.

At multiple points in your life, you will need to take action to transition from where you are to where you want to be. This process is layered and time-consuming, and getting yourself to stand out among the masses is an arduous but not impossible task. Having a polished resume that explains what you’ve done is the common first step. But, when an application asks for it, a personal statement can add color and depth to your list of accomplishments. It moves you from a one-dimensional indistinguishable candidate to someone with drive, interest, and nuance.

- Ruth Gotian is the chief learning officer and associate professor of education in anesthesiology at Weill Cornell Medicine in New York City, and the author of The Success Factor and Financial Times Guide to Mentoring . She was named the #1 emerging management thinker by Thinkers50. You can access her free list of conversation starters and test your mentoring impact . RuthGotian

- Ushma S. Neill is the Vice President, Scientific Education & Training at Memorial Sloan Kettering Cancer Center in New York City. She runs several summer internships and is involved with the NYC Marshall Scholar Selection Committee. ushmaneill

Partner Center

Sample Personal Statement Finance (MIT Sloan)

by Talha Omer, MBA, M.Eng., Harvard & Cornell Grad

In personal statement samples by field | personal statements samples by university.

Here is the personal statement of an applicant who got admitted to MIT Sloan’s Masters in Finance program . For personal statement, Sloan poses several questions to applicants, which the admissions committee expects to be answered in an essay form. MIT provides these personal statement prompts to encourage students to self-reflect and then to share their insights with the program.

The following essays are an example of a compelling story and reflect the original voice and personality of the applicant. Get inspiration from them and try to incorporate their strengths into your own personal statement.

In this Article

Personal Statement Prompt 1

Personal statement prompt 2, personal statement prompt 3.

Please discuss past academic and professional experiences and accomplishments that will help you succeed in the Master of Finance program. Include achievements in finance, math, statistics, and computer sciences, as applicable.

As an ardent finance student, I have always sought opportunities to develop a solid grounding in the subject.

During my undergraduate, I successfully co-founded a philanthropic long/short Impact Investment Hedge Fund, “Australian Students Asset Management” (ASAM). The fund secured firms like Goldman Sachs to provide pro-bono services and mentorship. In addition, I developed a proprietary ESG algorithm to identify investment opportunities per our social development mandate. As a result, our investments have consistently outperformed our benchmark. Furthermore, I attended two courses at LSE on Alternative Investments and Financial Risk with “A” grades. This involved in-depth exploration of topics like Monte Carlo, Bootstrapping, Financial Modelling and Stratification.

As an Associate at PwC, I created PwC’s first fully automated valuation process. This consisted of using industry-specific valuation templates using Python and VBA for data scraping. This solution saw significant savings for the firm and is now used by PwC throughout the world.

As an analyst with Barclays Capital, a Global Quantitative Hedge Fund, I gained exposure to arbitrage trading strategies by implementing statistical principles like mean reversion, volatility trends and co-integration in Python. This helped me develop successful trading algorithms yielding a highly desirable annualized return of 33%.

Describe your short-term and long-term professional goals. How will our MFin degree help you achieve these goals?

My short-term goal is to return to Australia and establish my own quantitative “for-profit” hedge fund. I will utilize my previous experience co-founding the philanthropic hedge fund, ASAM, to that effect. My long-term goal is to expand this hedge fund’s operations overseas and invest in the North American markets, as they present significant growth opportunities.

At MIT, I am eager to research the implications of current trends in institutional capital flows. This detailed exploration will enhance my understanding of the potential risks of passive investing and provide an edge in building trust with future investors.

As an Analyst at Barclays Capital, I developed event-driven and relative-value trading algorithms using Python. With the MFin, I will create an advanced, intuitive approach to data science problems, enabling the manipulation of alternative data sets to automate trading decisions and executions. The Advanced Analytics and Data Science courses and Analytics Certificate are especially exciting as they will allow me to understand shallow models and train deep neural networks in an economic context. I also hope to improve my technical skills around asset pricing and general dimension reduction techniques and ensemble methods which are critical to forming accurately priced derivatives.

Please share personal qualities that will enable you to contribute to the advancement of our mission.

THE MISSION

The mission of the MIT Sloan School of Management is to develop principled, innovative leaders who improve the world and generate ideas that advance management practice.

I believe success as a Leader requires one to have a passion for taking the initiative, thinking outside the box and persevering in adversity.

These traits have always been integral to my personal and professional pursuits, including my recent experience as a special education teacher in San Pedro, a rural village in Costa Rica. I was required to develop creative methods to overcome the language barrier and constructed visual aids from cardboard pieces to make block numbers. In addition, the school had a dire need for wheelchairs, so I devised a cost-effective design to repurpose old bicycles into wheelchairs that we implemented as a team. My commitment to improving the world through innovation will allow me to contribute actively to MIT’s mission.

Furthermore, my extensive involvement in boxing has enabled me to develop perseverance and increased focus in facing challenges. My first loss was devastating, and I considered giving up the sport, as my goal had been to maintain a perfect record. Ultimately, increasing training intensity, dance classes and the strong support from my team allowed me to win my next match and achieve the Most Improved Fighter award by the Sydney Boxing League.

WANT MORE AMAZING ARTICLES ON GRAD SCHOOL PERSONAL STATEMENTS?

- 100+ Outstanding Examples of Personal Statements

- The Ultimate Guide to Writing a Winning Personal Statement

- Common Pitfalls to Avoid in Your Personal Statement

- Writing a Killer Opening Paragraph for Your Personal Statement

- Ideal Length for a Graduate School Personal Statement

- 100 Inspiring Quotes to Jumpstart Your Personal Statement

Sample Personal Statement for Masters in International Business

Sample Personal Statement for Masters in International Business My journey began amidst the kaleidoscope of Qatar's landscapes, setting the stage for a life attuned to cultural nuances. Transitioning to Riyadh in my teens, I absorbed a mosaic of traditions, sparking a...

Sample Personal Statement for Family Medicine Residency

Personal Statement Prompt: A personal letter is required. We are looking for mature, enthusiastic physicians who bring with them a broad range of life experiences, are committed to providing excellent patient care, and can embrace the depth and breadth of experiences...

Harvard Personal Statement Example

In this article, I will be providing a sample grad school personal statement for Harvard University. This example aims to show how prospective applicants like you can seamlessly weave your passion, skills, and relevant experiences into a compelling narrative. In...

[2024] 4 Law School Personal Statement Examples from Top Programs

In this article, I will discuss 4 law school personal statement samples. These statements have been written by successful applicants who gained admission to prestigious US Law schools like Yale, Harvard, and Stanford. The purpose of these examples is to demonstrate...

Sample Personal Statement Cybersecurity

In this article, I will be providing a sample grad school personal statement in the field of cybersecurity. This sample was written by an applicant who got admitted into George Mason, Northeastern and Arizona State University. This example aims to show how prospective...

WANT AMAZING ARTICLES ON GRAD SCHOOL PERSONAL STATEMENTS?

- 100+ Personal Statement Templates

- Accountancy

- Business Studies

- Organisational Behaviour

- Human Resource Management

- Entrepreneurship

- Provisions in Accounting - Meaning, Accounting Treatment, and Example

- Three Golden Rules of Accounting - Types, Examples & more

- Income & Expenditure Account: Accounting Treatment

- Reserves in Accounting: Meaning, Accounting Treatment, Importance, and Example

- Accounting : Purpose, Importance, Types & Careers

- Types Of Bank Account In India: Details & Benefits

- Difference between Accounting and Accountancy

- Accrued Expenses : Meaning, Examples and Accounting Treatment

- Conservatism Concept : Uses, Importance & Examples

- Branch Accounting : Types, Advantages & Examples

- Tax Accounting : Work, Principles, Purpose, Types, Methods & Calculation

- Consistency Concept : Examples, Importance, Uses & Impact

- Managerial Accounting : Works, Scope, Importance & Types

- Matching Concept in Accounting: Work, Examples, Use & Benefits

- Objectivity Concept in Accounting : Work, Importance & Examples

- Difference between Historical Cost Accounting and Fair Value Accounting

- Types and Users of Accounting Information

- Difference between Accounts Receivable and Accounts Payable

- Difference between Accounting Concept and Accounting Convention

Personal Account in Accounting: Rule, Types & Examples

What are personal accounts.

Personal accounts refer to those financial accounts that belong to individuals, organizations, or entities with whom financial transactions are carried out. The personal accounts track the individuals’ assets, liabilities, expenses, and revenue. Thus, individuals can manage their finances, monitor their financial health, and prepare their financial statements using these personal accounts. Typically, personal accounts can be related to natural persons such as Rajesh’s account, and Suresh’s account, to artificial persons such as partnership firms, corporate bodies, companies, and associations of persons.

Key Takeaways:

Personal accounts are financial accounts of individuals, organizations, or entities with whom an entity has financial transactions. There are three types of personal accounts: natural, representative, and artificial. The golden rule of accounting for personal accounts says Debit the receiver and Credit the giver.

Table of Content

Types of Personal Accounts

Personal accounts and golden rules of accounting.

- Example of Personal Accounts

Personal Accounts – FAQs

Personal accounts are ledger accounts of individuals or organizations that have direct financial transactions with your business. They are divided into three main categories: Natural, Artificial and Representative.

1. Natural Personal Account: This type of personal account refers to human beings (individuals or persons) such as customers, dealers, owners or employees of the business. For example: a capital account of an individual or business, creditors account, debtors account, drawings account, salary payable account, accounts receivable and accounts payable , etc.

2. Artificial Personal Account: Apart from individuals or persons, separate legal entities or bodies that have financial transactions are clubbed under the artificial personal account. These accounts belong to those legal entities which are distinct from their members or owners. For example: corporations, government bodies, banks, cooperatives, hospitals, partnerships, associations and trusts, etc.

3. Representative Personal Account: This personal account is a representative of the individuals or organizations, i.e., accounts belongs to groups or categories rather than specific individuals. In this personal account, transactions belong to preceding or succeeding year. For example: an employee’s due salary from last year, rent a company paid in advance for the succeeding year can be accounted under this personal account.

Personal accounts are required to monitor individual transactions and keep precise records of business transactions with specific parties. They are frequently used in combination with general ledger accounts to simplify recording as well as analyzing financial transactions. The golden rule of accounting is applicable to personal accounts as well.

DEBIT the receiver; CREDIT the giver.

Suppose, a natural or artificial entity makes a donation to a business, it is an cash inflow for the business. Here, the receiver account (natural or artificial entity) must be debited while the business receiving the donation must be credited in the journal entry. Suppose, goods sold to Ramesh is a financial transaction. Here, Ramesh (a natural personal account) is debited and the business who gives the goods to Ramesh have to be credited.

Examples of Personal Accounts

There are multiple personal accounts available. Some of them can be listed as:

1. Customers’ Accounts Receivable (Debtors): These accounts track the amounts owed to the business by its customers for goods or services sold on credit.

2. Suppliers’ Accounts Payable (Creditors): These accounts track the amounts owed by the business to its suppliers for goods or services purchased on credit.

3. Employees’ Accounts: These accounts track the amounts owed to or owed by employees for salaries, wages, bonuses, or other employment-related transactions.

4. Loan Accounts: These accounts track the amounts owed to or owed by the business for loans received or extended, such as bank loans, mortgages, or lines of credit.

5. Capital Accounts: These accounts track the amounts invested by the business owners or shareholders in the business, representing their ownership interests.

6. Partners’ Accounts: These accounts track the amounts invested by individual partners in a partnership, as well as their share of profits or losses.

7. Vendors’ Accounts Receivable: These accounts track the amounts owed to the business by vendors or suppliers for goods or services sold on credit.

Personal accounts are those financial accounts who represent either individuals, entities or groups of individuals or entities. In journal and ledger accounts, these personal accounts are either credited or debited depending on the golden rules of accounting. A personal account is a general ledger account that relates to individuals. Individuals are natural persons, while companies, firms, associations, and so on are artificial persons. When firm A receives money or credit from another business or individual, it becomes the recipient. In the event of a personal account, the other business or individual who contributes to it takes over as the giver. Creditor accounts are a form of personal account.

How is personal account different from other forms of accounts in accounting?

Personal accounts refer to individuals, entities, or organizations, with whom an organization performs financial transactions, whereas real accounts correspond to tangible assets, liabilities, or equity, and nominal accounts record revenues, expenses, gains, and losses. Personal accounts emphasize on particular individuals engaged in transactions rather than general classifications of financial properties.

How do the personal account impact the preparation of financial statements?

Personal accounts contribute to the preparation of financial statements by giving precise information about transactions involving particular individuals or organizations. This information helps to create income statements, balance sheets, and cash flow statements, that allow stakeholders to examine the organization’s financial health and position.

Do personal accounts involve both internal and external transactions?

Yes, personal accounts involve both external and internal transactions. For example, the customers, suppliers and creditors are part of external transactions while employees or owners are part of the internal transactions. Further, proprietorships and partnerships are also included in personal account where there is a combination of both personal and business finances.

Please Login to comment...

Similar reads, improve your coding skills with practice.

What kind of Experience do you want to share?

What are paper bank statement fees?

- Cost of paper statements

Avoiding paper statement fees

Benefits of electronic statements, paper bank statement fees: what you need to know.

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate banking products to write unbiased product reviews.

- Many banks charge you a few dollars per month for mailing paper bank statements to your home.

- You can avoid paper statement fees by opting for paperless statements online.

- If you don't like banking online, paper statements could be worth the cost.

A bank statement is a document that shows your account activity. One statement shows the activity over a "statement period," which is typically one month.

Banks are required to provide bank statements to customers for checking and savings accounts for any period in which an electronic funds transfer was made. So if you swiped your debit card, made an ATM withdrawal, or paid a bill from your account, you should receive a statement.

For many years, banks would print and mail monthly bank statements to every customer.

In an effort to reduce costs and paper waste, many financial institutions have stopped sending paper statements in favor of electronic statements — or else charging customers a small fee if they still want to receive a physical copy each month.

How much are paper statement fees?