Ultimate Letter

Letter For Everyone

7 Samples Of Application For Opening Bank Account

Need to open a new savings bank account? We are giving you test application letters to the bank office chief for opening a financial balance for yourself, your children, your mom, your dad, kin, your better half, or some other relatives of your loved ones. The financial balance can be opened for a solitary individual or a joint ledger like you, your girl, and your child.

So, in this article, I am going to give 7 samples of application for opening bank account . So, see below the samples…

Table of Contents

Documents Required To Open A Bank Account:

If you do not have a bank account yet and you also want to open a new saving bank account, then you may also need to write a letter to the bank manager to open a new bank account.

To open a new bank account, you can write a letter to bank manager requesting him to open a new saving account in your name in his branch. With this, you can use the facilities of that bank

Before writing the application letter for opening a savings account with the bank, you have to collect all the vital and important documents for opening a new personal bank account. For those who want to open their bank account for the first time, the below-mentioned documents are required.

- After filling out the bank account opening form, it has to be signed.

- Opening an account with a bank also requires someone who signs your account opening form as the introduction.

- Copy of your Aadhar Card and Address Proof document.

- Copy of your PAN card.

- Your 2 passport size photographs.

After collecting all these documents you will have to write a letter to open a savings account in the bank.

Mr. Branch Manager

[Name Of The Bank]

[Branch Address]

Subject: Application For Opening A Bank Account

It is a humble request that I [Your Name] open a savings account in your bank and I can take advantage of the facility of your bank, so it is requested that open my new account. For which I will be forever grateful to you.

Yours Faithfully.

[Your Name]

[Your Address]

[Mobile Number]

[Signature]

Download Application For Opening A Bank Account In MS Word File

The Branch Manager

[Address Of The Bank]

Subject: Application For A Opening Bank Account

Humble request that I [Your Name] need to open a new account in your bank. So that I can take advantage of the facilities of the bank. I have attached all the required documents with the application form for opening the account . Please kindly pay attention to my application and help me to open my account at the earliest.

So I kindly request you to open the account. For which I will always be grateful to you.

[Bank Name]

I kindly request that I [Your Name] want to open an account at your bank.

Therefore, you are requested to open a bank account at your bank in my name. For this, I will be forever grateful to you.

Download Application For Opening A Savings Account In MS Word File

List Of Official Letter

Branch Manager

Subject: Application For Bank Account Opening

With this letter, I would like to request you to open a new savings account with your bank so that I can avail the facilities of the bank. My name is [Your Name] am a resident of [Your City] and [State] . I am enclosing the vital and important documents and address proof along with the account opening form.

I formally request you to provide a savings account in your branch in the name of [Candidate Name] . Please let me know at the provided number if anything is required.

I am waiting for your favorable reply.

Download Application For Opening Savings Account In MS Word File

The Bank Manager,

Subject: Application For Opening Young Kid Saving Account

I formally request you to open a young kid savings account for my 11-year-old daughter, [Name] , at [Name Of The Bank and Branch] . I declare myself as her sole source of income.

Attached with this application are the details of my account and a copy of my required documents, along with a copy of my pension book . If any documents are missing for this procedure, please let me know at the provided number.

Download Application For Opening Bank Account In MS Word File

I have read a lot about your bank’s success and customer service from my friends and on social media. It creates interest, so I also want to open a savings account in your bank, and I also want to enjoy your customer service.

I hope you will process my application for account opening as soon as possible.

Yours truly,

Subject: Application For Opening New Savings Bank Account

I hope you are doing well. I want to open an account in this bank . The type of account should be saved because the primary purpose of opening this account is that I am trying to save some money.

I have another account but could not manage to save the money. I have also been through your savings account benefits and like them the most. I have attached all required documents with this letter to open the account.

I hope you will proceed with my application as soon as possible. Again, I would be very thankful to you.

Q. How do I write a letter to open a bank account?

A. To open a bank account an application letter from your bank you might demand face to face at a bank office from one of the investors, by a call to the bank, and contingent upon the monetary foundation, through their web-based stage.

Q. Can I access my account information online?

A. You might have the option to really look at balances, move cash, get proclamations and take care of bills on the web. In the event that you don’t have simple admittance to a branch, online banking can be entirely important. Ensure you know your internet banking liabilities and ensure the occasion somebody falsely eliminates your assets through web-based administrations.

Q. What Is The Application For Opening A Bank Account?

A. Savings Account Opening Form means the standardized application form prescribed by the Management Company to be duly filled by the investors at the time of opening an account with the Fund.

Q. Can I apply for a bank account online?

A. You can start the cycle with only your portable number, and records, and by finishing up a structure. It should be in every way possible helpfully by means of our online entryway, permitting you to try not to need to genuinely go to the bank.

Bank Account Opening Letter For Individuals & Companies

A “Request Letter to Bank for Opening a Current Account” is a formal letter written to a bank when an individual or organization wants to open a new current account with the bank. The letter serves as a formal request for the bank to open an account and should be written professionally and politely. The letter should include the name and contact information of the person or organization making the request and any relevant identification or documentation that the bank requires. This may include personal identification such as a government-issued ID, proof of address, and other relevant documentation such as a business registration certificate for a company. The letter should also clearly state the purpose of the account, whether it is for personal use or business operation. It should also specify any specific requirements or preferences the account holder has, such as a desired account number or the need for online banking access. It is also important to mention any initial deposit the account holder plans to make. The letter should be addressed to the appropriate person or department at the bank, such as the account opening department. It should be signed by the person or authorized organisation representative who is making the request. Including a self-addressed stamped envelope for the bank’s reply is also advisable. In conclusion, a Request Letter to Bank for Opening a Current Account is an important document that should be written professionally. It should provide all the necessary information to the bank, including the purpose of the account, identification, and any specific requirements or preferences. By following these guidelines, the account holder can successfully open a current account with the bank.

TEMPLATE (Letter by Individual / Sole Proprietor)

Date : _________

From: (Name of the Applicant) (Full Address) (Contact No.)

To: The Branch Manager (Name of the Bank) (Name of the Branch) (Address)

Sub .: Application for opening of a current account.

Dear Sir/Madam,

I am writing to express my interest in opening a current account with your bank at (Name of the Branch). I am a resident of (Locality) and currently operate a (type of business) business under the name of (Name of the business). Our business has an annual turnover of around INR ___________to __________lakhs.

I have filled out and signed the necessary application forms, which I have enclosed with this letter. I have also requested for a cheque book and online banking facilities for the account. I am committed to maintaining a sufficient balance in the account to honor any cheques issued, in order to avoid any inconvenience to the bank or the parties involved. I am willing to comply with all the rules and regulations set by the bank for customers with a current account.

As proof of identification and address, I have enclosed copies of the relevant documents. I have also included an introductory letter from an existing customer of your bank.

I would appreciate it if you could approve my application for opening a current account with your bank. Thank you for your time and consideration.

Sincerely, (Signature) (Name of the Applicant) Encl.: As above

TEMPLATE (Letter by a Company)

Date: __ ______ To: The Branch Manager (Bank’s Name) (Branch’s Name) (Address) Sub .: Application for opening of a current account for the company. Dear Sir/Madam, I am writing on behalf of our company, (Company Name) Limited, to apply for the opening of a current account with your bank at (Branch’s Name) branch. Our Board of Directors has passed a resolution in their meeting held on (Date) to open the account for our company. Enclosed with this letter, you will find the necessary documents for opening the current account, including (1) A completed application form as prescribed by your bank, (2) A certified copy of the board resolution for account opening, (3) Specimen signatures of the authorized signatories, (4) ID proofs of the authorized signatories, and (5) Introductory letters from 2 existing customers of your bank. We anticipate transactions amounting to INR per month and expect this amount to increase as our sales grow. We will make an initial deposit of INR when the account is opened. We would greatly appreciate it if you could open the account as soon as possible and inform us of the confirmation. We are committed to abiding by all the rules governing the current account. Thank you for your time and consideration. Sincerely, (Signature) (Name of the Authorized Officer) (Designation, Department) Encl.: A/a

Read More: Application For New Passbook To The Bank Manager

Similar Posts

Indefinite Leave Letter for Work Due to Sickness

An indefinite leave letter for work because of sickness is a serious request from an employee. They need time off from their job because they’re not well. This kind of letter is used when a person’s sickness needs long-term care. It means they can’t know exactly when they’ll be back at work. In this letter,…

Stop Pension After Death Letter To Bank Manager

A “Stop Pension After Death Letter” is a formal document that informs a bank manager to stop disbursing pension payments to a deceased individual. This letter serves as a notice to the bank that the pensioner has passed away and that their pension payments should be discontinued. The letter should include the pensioner’s personal information,…

Sample Letter To Reduce Hours At Work

Sample Letter to reduce hours at work, is a written request from an employee to their employer, asking for a reduction in the number of hours they are scheduled to work each week. This letter can be written for various reasons, such as health concerns, caregiving responsibilities, pursuing education, or simply needing more work-life balance….

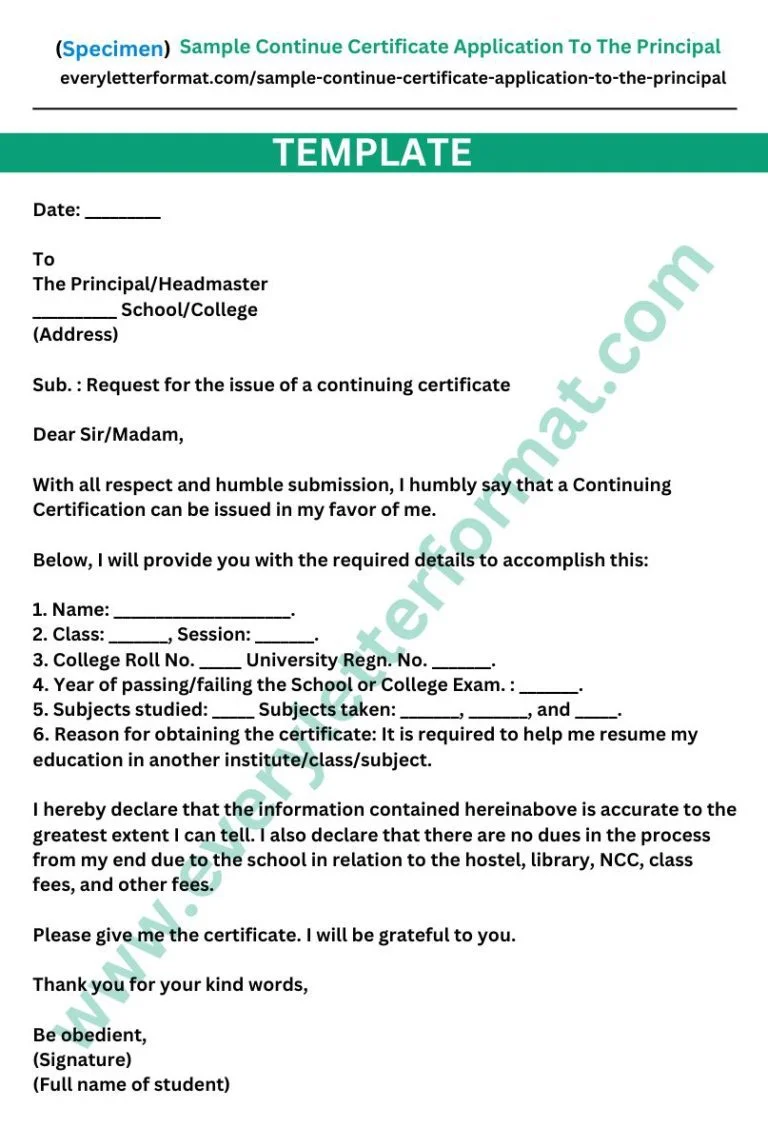

Sample Continue Certificate Application To The Principal

A continuation certificate is issued to students from an educational institution. It demonstrates the ongoing nature of an individual’s training in the institute. To get the certificate, the student must apply to the institution’s director for a continuing certificate. A continuation certificate could be required when changing the subject, taking an additional course, or transferring…

Sample Letter To Attorney Regarding Case

It is vital to monitor your legal matters that are pending before a court of law or in other legal venues. Sometimes the lawyer will fail to inform you about the situation; this could result in a problem under certain conditions. Send a letter to your lawyer inquiring about the case’s status, or send an…

Address Change Letter to Bank of Company Business

An “Address Change Letter to Bank of Company Business” is a written notification sent by a company to its bank, informing the bank of a change in the company’s address. The letter serves as an official request to update the bank’s records with the new information and to ensure that all future communications and transactions…

Bank Account Opening Letter: How To Write It Right!

As someone who has navigated the sometimes confusing world of banking, I want to share with you a straightforward guide on how to write a bank account opening letter.

Key Takeaways

- Understand the importance and purpose of a bank account opening letter.

- Follow a step-by-step guide to write an effective letter.

- Utilize a customizable template for your convenience.

- Learn tips for ensuring your letter meets bank requirements.

- Discover how to personalize your letter for different situations.

Whether you’re a student stepping into the world of finance, a professional looking to manage your earnings, or simply someone wanting to organize your financial life, this guide is for you.

I’ll walk you through each step, from understanding the purpose of this letter to crafting one that meets your unique needs.

Understanding the Purpose of a Bank Account Opening Letter

Before diving into the writing process, it’s crucial to understand what a bank account opening letter is and why it’s important.

Essentially, this letter is a formal request to a bank for opening a new account in your name.

Trending Now: Find Out Why!

It’s a critical step in establishing a relationship with your bank and lays the groundwork for your financial management.

Why Write a Bank Account Opening Letter?

- Formalizes Your Request : It’s a professional way to communicate with the bank.

- Provides Necessary Information : The letter includes all the details the bank needs.

- Serves as a Personal Record : Keeps a record of your banking intentions and requirements.

Step-by-Step Guide to Writing the Letter

Step 1: collect necessary information.

Before you start writing, gather all the information you’ll need. This includes:

- Your personal details (name, address, contact information).

- The type of account you want to open (savings, checking, etc.).

- Any specific features or services you require.

Step 2: Choose the Right Format

A bank account opening letter should be formal and concise. Use a standard business letter format:

- Your Address

- Bank’s Address

- Salutation (e.g., Dear [Bank Manager’s Name])

Step 3: Write the Body of the Letter

In the first paragraph, state your purpose clearly – opening a new account. In the following paragraphs, provide your personal information and specify the type of account you wish to open.

Step 4: Close the Letter

Conclude with a polite request for the bank to process your application and provide any necessary instructions for the next steps.

Step 5: Proofread and Sign

Always proofread your letter for errors. A well-written, error-free letter reflects your seriousness. Don’t forget to sign the letter.

Customizable Template

[Your Name] [Your Address] [City, State, Zip]

[Bank’s Name] [Bank’s Address] [City, State, Zip]

Dear [Bank Manager’s Name],

I am writing to formally request the opening of a [type of account] account at your esteemed bank. I have chosen [Bank’s Name] due to its reputation for excellent customer service and innovative banking solutions.

My personal details are as follows:

- Name: [Your Full Name]

- Address: [Your Address]

- Contact Information: [Your Phone Number and Email Address]

I am interested in opening a [type of account, e.g., savings/checking] account. [Mention any specific features or services you require, if any].

I am looking forward to a prompt and favorable response. Please let me know if there are any forms I need to complete or any further information you require.

Thank you for your time and assistance.

Sincerely, [Your Signature (if sending a hard copy)] [Your Typed Name]

Tips for an Effective Letter

- Be Clear and Concise : Avoid unnecessary details.

- Personalize Your Letter : Tailor the letter to reflect your specific needs and circumstances.

- Double-Check Bank Requirements : Ensure you include all necessary information.

- Professional Tone : Maintain a formal and respectful tone throughout the letter.

Personalizing Your Letter for Different Situations

- For Students : Mention your student status as some banks offer special accounts for students.

- For Business Owners : Specify the nature of your business and any specific business banking needs.

Writing a bank account opening letter might seem daunting at first, but with the right guidance, it’s quite straightforward.

Use this guide and template to create a letter that clearly communicates your needs to the bank.

Remember, a well-crafted letter can make your banking experience smoother and more efficient.

Comment Request

I’d love to hear about your experiences or any additional tips you might have regarding writing a bank account opening letter. Please share your thoughts in the comments below!

Frequently Asked Questions (FAQs)

Q: What is a bank account opening letter?

Answer : A bank account opening letter is a formal document sent to a bank by an individual or a company to request the opening of a new bank account.

It outlines the type of account being requested and may include details such as personal information, the initial deposit, and any specific features or services the applicant wishes to include.

Q: Who needs to write a bank account opening letter?

Answer : A bank account opening letter is typically written by individuals or businesses that intend to establish a new banking relationship. This is more common in corporate banking, where formal requests are necessary to initiate the account creation process.

Q: What information should be included in a bank account opening letter?

Answer : The letter should include the applicant’s full name, address, and contact information, the date, the bank’s name, and branch information. It should clearly state the purpose of the letter, the type of account to be opened, any specific services required, personal identification details, and any accompanying documents.

Q: Can I send a bank account opening letter via email?

Answer : Yes, many banks now accept electronic communication for account opening requests. However, it’s essential to confirm with the specific bank if they accept account opening requests via email and understand their process for electronic submissions.

Q: How formal should the bank account opening letter be?

Answer : The bank account opening letter should be formal and professional. It’s an official request and serves as part of your financial records. Use a formal tone and proper salutations, and close the letter respectfully.

Q: Do I need to include personal identification documents with my bank account opening letter?

Answer : Yes, banks usually require proof of identification and address to open an account. It is advisable to mention in your letter that you have enclosed the necessary documents and list them for clarity.

Q: How do I follow up after sending a bank account opening letter?

Answer : If you do not receive a response within a week or two, you can follow up with a phone call or visit the bank in person. Always keep a copy of your letter and documents sent for your records.

Q: What if I make a mistake in my bank account opening letter?

Answer : If you realize there’s a mistake after sending the letter, contact the bank as soon as possible to correct it. You can do this via phone, email, or a follow-up letter, depending on the bank’s preferred communication method.

Related Articles

Loan repayment letter sample: free & effective, sample letter to bank for name change after marriage, request letter for cancelling auto debit: the simple way, sample letter informing change of email address to bank: free & effective, sample letter for cheque book request, sample letter to creditors unable to pay due to death, leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Start typing and press enter to search

12+ Bank Account Opening Letter Format – Writing Tips, Examples

- Letter Format

- February 1, 2024

- Application Letters , Bank Letters , Legal Letters

Bank Account Opening Letter Format : Bank account opening letters are formal letters that an individual or a company writes to a bank to request the opening of a new bank account . A well-written bank account opening letter can ensure that the account opening process is smooth and hassle-free . In this article, we will discuss the Bank Account Opening Letter Format and essential components of a Bank Account Opening Letter.

- Bank Account Transfer to Another Branch Letter Format

- NOC Letter Format for Bank

- Bank Account Closing Letter Format

- Request Letter to Bank for Open Current Account Format

Bank Account Opening Letter Format Writing Tips

Content in this article

- Sender’s Information : The Bank letter should start with the sender’s information, including their name, address, phone number, and email address. This information is important as it enables the bank to contact the sender for any queries or clarifications.

- Date : The date should be mentioned below the sender’s information. It is crucial to include the date as it helps in record-keeping and tracking the timeline of the account opening process.

- Bank’s Information : Next, the letter should include the bank’s information, such as the bank’s name, address, and contact details. This information will help the bank to identify the recipient of the letter and ensure that it reaches the right person.

- Salutation : The letter should start with a formal salutation, such as “Dear Sir/Madam,” or “To Whom It May Concern.” This helps establish a respectful tone for the letter.

- Introduction : The introduction should state the reason for writing the letter, which is to request the opening of a new bank account. The introduction should be concise and clear.

- Type of Account : The letter should mention the type of account that the sender wishes to open, such as a savings account, current account, or fixed deposit account.

- Required Documents : The letter should mention the necessary documents required to open the account, such as identity proof, address proof, and income proof. The sender should attach these documents along with the letter.

- Signatures : The letter should end with the sender’s signature and date. This indicates that the sender has provided accurate and complete information and agrees to the bank’s terms and conditions.

Template 1: Email Format about Bank Account Opening Letter

Here is the Email Template about Bank Account Opening Letter Format

Subject: Request for Opening a Bank Account

Dear Sir/Madam,

I am writing to request the opening of a new bank account with your esteemed bank. Please find attached all the necessary documents, including my identity proof, address proof, and income proof, as required by your bank.

I would like to open a [type of account] account with your bank, and I have enclosed a check for the initial deposit amount of $[Amount].

I request you to kindly provide me with the necessary information and guidelines to complete the account opening process. Please let me know if any further information or documentation is required from my end.

I would appreciate your prompt assistance in this matter.

Thank you for your time and consideration.

[Your Name] [Your Address] [City, State, Zip Code] [Phone Number] [Email Address]

Template 2: Personal Bank Account Opening Letter Format

Here is the Template about Bank Account Opening Letter Format

[Your Name] [Your Address] [City, State, Zip Code] [Phone Number] [Email Address] [Date]

[Bank Name] [Bank Address] [City, State, Zip Code]

I am writing to request the opening of a personal account with your bank. I have attached all the required documents, including my identity proof, address proof, and income proof.

I would like to open a savings account with your bank, and I have enclosed a check for the initial deposit of $[Amount].

If you need any further information or clarification, please do not hesitate to contact me.

[Your Name and Signature] [Date]

Template 3: Business Bank Account Opening Letter Format

[Your Company Name] [Your Address] [City, State, Zip Code] [Phone Number] [Email Address] [Date]

I am writing to request the opening of a business account with your bank. I have attached all the required documents, including my identity proof, address proof, and income proof.

Our company is a [type of business], and we require a current account to manage our financial transactions.

Template 4: Fixed Deposit Bank Account Opening Letter Format

I am writing to request the opening of a fixed deposit account with your bank. I have attached all the required documents, including my identity proof, address proof, and income proof.

I would like to deposit $[Amount] for a period of [Number] months. Please let me know the interest rate and any other details required to complete the account opening process.

A well-written Bank Account Opening Letter Format should include the sender’s information , date, bank’s information, salutation, introduction, type of account, required documents, and signatures . By following Bank Account Opening Letter Format, individuals and companies can ensure that their account opening request is processed efficiently and effectively .

Related Posts

25+ Complaint Letter Format Class 11 – Email Template, Tips, Samples

15+ Business Letter Format Class 12 – Explore Writing Tips, Examples

21+ Black Money Complaint Letter Format, How to Write, Examples

20+ Comp Off Leave Letter – Check Meaning, How to Apply, Email Ideas

11+ Authorized Signatory Letter Format – Templates, Writing Tips

20+ Authorization Letter Format for ICEGATE Registration – Examples

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Name *

Email *

Add Comment

Save my name, email, and website in this browser for the next time I comment.

Post Comment

Application Letter for Opening Bank Account (With Samples)

Opening a bank account is an important step in managing your finances. A bank account allows you to safely deposit your money, make payments, avail of loans and credit cards, and reap the benefits of interest.

Banks usually require you to submit an application form to open an account. Along with the form, you need to provide identity proof, address proof, photographs, and other KYC documents.

If you are applying in person at a bank branch, the process is straightforward. However, sometimes banks may ask you to submit a written application letter for opening a new account. This is especially true if you are mailing your account opening documents or applying through an intermediary.

Writing an application letter to the bank manager will make the process faster and increase your chances of approval. Read on to learn how to write an application for opening a bank account along with sample letters for different scenarios.

How to Write an Application to Open a Bank Account?

Follow these steps to draft an effective application letter to open a bank account:

1. Add the Date and Your Contact Details

Begin the letter by mentioning the date at the top. Below this, provide your complete name, address, phone number, and email id.

Adding your contact information at the beginning establishes your identity. It also allows the bank to get in touch in case they need any clarifications.

2. Use the Correct Salutation

The next step is to address the letter to the relevant person using an appropriate salutation. For account opening applications, this would be:

- To, The Branch Manager

- Dear Sir/Madam

Make sure to mention the bank’s name and branch address below the salutation. Getting these small details right increases the letter’s formality.

3. State Your Purpose Clearly

In the first paragraph itself, state the purpose of your letter – that you want to open an account. Mention the type of account you want to open – savings, current, salary, etc.

Your purpose needs to be clear so the reader immediately knows that it is an account opening application letter.

4. Provide Necessary Personal Details

The next section should cover your personal details like full name, date of birth, contact number, marital status, spouse’s name (if married), nationality, etc.

Provide your permanent and current residential address. Also, attach proof of identity and address like an Aadhaar card photocopy, lease agreement, etc.

These details will help the bank verify your identity and eligibility for opening the account.

5. Share Your Occupation Details

This section should cover details related to your work. Mention your educational qualifications, employment status, organization name and address, monthly income, etc.

If you are self-employed, provide details of your business. Retired individuals must state their former occupation and pension amount.

Occupation details are necessary for the bank to gauge your financial standing. It also helps them offer suitable products and services.

6. Explain Why You Need the Account

Briefly explain the purpose and benefits of opening this bank account. For example – you may need it to receive your salary, make transactions for your business, pay college fees, apply for loans, save tax by investing, etc.

Giving a genuine reason tailored to your profile and needs increases the chances of approval.

7. Request for Swift Action

Politely request the bank manager to process your application and open the account at the earliest. You can mention that you have provided all the necessary documents. Also, express gratitude for their assistance.

A humble and sincere request creates a positive impression in the reader’s mind.

8. Say Thanks

Conclude the letter by thanking the bank manager for considering your request.

Leave a space below your signature to write your full name.

This shows etiquette and professionalism even in formal communication.

7+ Sample Application Letters for Opening Bank Account

Here are sample application letters for different situations when you may need to open a new bank account:

1. Letter for Opening Bank Account

To, The Branch Manager, Bank of Baroda, C Block, XYZ Road, Mumbai

Date: dd/mm/yy

Subject: Account opening letter

Respected Sir/Madam,

I wish to open a savings account in your branch. My name is John Doe and I am a businessman based out of Mumbai. I own a fleet of 5 goods carriers that transport cargo across the state.

I am 35 years old and unmarried. My permanent address is Flat 201, Hill View Apartments, XYZ Road, Mumbai which is also my place of birth. However, presently I am residing at Happy Homes, XYX Lane, Mumbai.

I have recently started my transport business and require a bank account to manage the company’s finances efficiently. Kindly open a savings account so I may start depositing the capital and operating revenue. Having an account with your reputed bank will be very beneficial for my new venture.

I have attached all the necessary KYC documents like identity proof, address proof, photographs, etc. I hope you will process the account opening application at the earliest so I can start using it for business transactions. Looking forward to a long association with your bank.

Thank you for your assistance.

Yours faithfully, [Signature] John Doe

2. Application for Account Opening in Bank

To, The Branch Manager, Bank of India, D Block, XYZ Road, Bengaluru

Subject: Application for opening a current account

Dear Sir/Madam,

I am writing this letter to request you to open a current account in your branch. I am Viral Desai working at Zillion Technologies Pvt Ltd as a Software Developer for the past 5 years. I am planning to start my own IT consulting and services business soon.

For smooth operations of the business, I need a dedicated current account to manage cash flows efficiently. My office will be located near your bank branch, hence it will be very convenient to maintain an account with you.

Here are some of my key details:

Full Name: Viral Mahesh Desai Address: Flat 502, ABC Apartments, PQR Road, Bengaluru Date of Birth: 25/08/1991 Mobile No: 9876543210 Email: [email protected] Aadhaar No: xxxxxxxxxxxx

Kindly process my request at the earliest so I can start using the account. I have provided all the required documents and hope to hear from you soon. Looking forward to a fruitful association with your bank.

Yours sincerely, [Signature] Viral Desai

3. Bank Account Open Application

To, The Branch Manager, Bank of Maharashtra, E Block, XYZ Road, Kolkata

Subject: Application for opening a savings bank account

I wish to open a savings account with your bank branch. I am Varun Gupta, 25 years old, working as a Computer Science Engineer at Zomato. I have been employed here for 4 years now and earn Rs. 50,000 per month.

Recently, I have started some side freelancing work in web development. This brings me an additional income of around Rs. 15,000 – Rs. 20,000 per month. I wish to open this savings account to deposit this income separately.

Having this account with your reputed bank will help me efficiently manage and grow my hard-earned money. I reside at ABC sector 8, near Hanuman Mandir, Kolkata. You will find attached the photocopies of my KYC documents.

Kindly open the savings account at the earliest so I can start using it for banking transactions. I look forward to a long, fruitful relationship with your bank. Thank you for your time and assistance.

Yours sincerely, [Signature] Varun Gupta

4. Bank Account Opening Request Letter

To, The Branch Manager, Canara Bank, F Block, XYZ Road, Agra

Subject: Request for opening a minor’s savings account

I wish to open a minor savings account in your branch for my daughter, Siya Gupta. She is 10 years old and currently studying in Class 5 at DPS School, Agra.

I want to open this account so I can start saving for her future education needs. I am aware that your bank offers excellent interest rates and facilities for children’s savings accounts.

We reside at ABC Colony, Near Post Office, Agra. You will find attached Siya’s birth certificate, address proof, photographs, and other documents for KYC verification.

Kindly open her account as soon as possible so I can start depositing funds monthly towards her future. I assure you all account operations will be handled responsibly. Looking forward to associating with your esteemed bank.

Thank you for your consideration.

Yours faithfully, [Signature] Rahul Gupta

5. Letter for Account Opening in Bank

To, The Branch Manager, Central Bank of India, G Block, XYZ Road, Jaipur

Subject: Request for opening a salary account

I wish to open a salary account with your bank. I, Raj Malhotra, have recently joined Infosys Ltd as a Software Engineer Trainee. As per company policy, I need to open a salary account with the Central Bank of India to start receiving my monthly salary.

Please find attached the account opening forms duly filled along with self-attested copies of my PAN card, Aadhaar card, passport, and Infosys offer letter. I shall be obliged if you could expedite the process and open my salary account at the earliest.

Opening an account with your bank will allow smooth disbursal of my salary and provide me access to other benefits like internet banking, mobile banking, locker facility, etc. I look forward to a long fruitful association with your bank.

Thank you for your assistance in this matter.

Sincerely, [Signature] Raj Malhotra

6. Application to Open Bank Account

To, The Branch Manager, Indian Bank, H Block, XYZ Road, Chennai

Subject: Application for opening a PPF Account

I wish to open a Public Provident Fund (PPF) account with your bank. I am Veena Goswami, 35 years old, working as an Accountant at RST Enterprises since 2010. I earn a gross monthly income of Rs. 50,000.

I want to start investing for my retirement by opening a PPF account. Being a reputed nationalized bank, Indian Bank is ideal for my long-term investment needs.

Please find enclosed documents like KYC, PAN card, address proof, passport-size photographs, etc. for account opening formalities. It will be highly appreciated if you could expedite the process and open my PPF account so I can begin investing.

I assure you all contributions will be made regularly as per PPF rules. Thank you for your assistance. I look forward to a fruitful association with your bank.

Regards, [Signature] Veena Goswami

7. Bank Account Opening Letter Format

To, The Branch Manager, State Bank of India, J Block, XYZ Road, Varanasi

Subject: Fixed deposit account opening request

I am writing this letter to request you to open a fixed deposit (FD) account in your branch. I am Ramesh Kumar, aged 45 years, working as a Marketing Manager at TeleTech Solutions Pvt Ltd since 2015.

I wish to open an FD account to invest my savings for better returns. Being one of India’s largest PSU banks, SBI offers very attractive interest rates on fixed deposits. I wish to deposit Rs. 5 lakhs for a 3-year tenure in the FD account.

Please find attached the duly filled FD account opening forms along with KYC documents and photographs for processing. It will be highly appreciated if you could expedite the process so I can deposit the funds soon. I assure you of maintaining the required account balance as per guidelines.

Thank you for your assistance in this matter. I look forward to a smooth account opening process and great returns on my FD investment.

Regards, [Signature] Ramesh Kumar

So these were some sample application letters for opening different types of bank accounts. Simply tweak them as per your profile and requirements while applying. Do remember to provide the necessary supporting documents for fast approval. A well-drafted application letter is key to a hassle-free account opening process.

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Search This Blog

Search letters formats here, sample request letter to bank for opening current account.

.png)

submit your comments here

The format seems good enough. I have written to bank for opening of the account and submitted other documents. :)

Thanks a lot for the format of letter.

Thank you! Your letters are written well and very knowledgeable for students like me. I'm learning.

Thanks dear such a good written may Allah bless you

Awesome. This is good.

Post a Comment

Leave your comments and queries here. We will try to get back to you.

- Search Search Please fill out this field.

- Banking Basics

Letter To Close Bank Accounts

Other ways to close your account, tips for a successful account closure, the bottom line, frequently asked questions (faqs).

Sometimes an old-fashioned letter is the best way to get the job done. To close a bank account, you might be required to mail your request in a traditional letter or submit it in person at a bank branch. There's no need to wait on hold or in a line, explain yourself to customer service, and hope that the account is closed expeditiously—you can just send the letter and be done with it. Even if a letter isn’t required, using one creates a paper trail that may give you peace of mind, should any errors or complications arise.

Use the text below as a template and fill in the information between brackets (“[“ and “]”) as necessary. See the tips below the letter for more details and other easy ways to close an account.

Sample Account Closing Letter

[Today's Date]

To whom it may concern,

Please close the account(s) listed below. Please send any remaining funds in those accounts by check to the address below, and reject any further requests for transactions in these accounts.

Checking Account: [Account Number]

Savings Account: [Account Number]

Money Market Account: [Account Number]

Other Account: [Account Number]

Please provide written confirmation that the accounts are closed.

If you have any questions, please contact me at the phone number below.

[Account Owner's Original Signature]

[Account Owner’s Printed Name]

[Mailing Address]

[Phone Number]

There might be easier ways to close your account. If you don’t want to print, sign, and mail a letter, try a higher-tech or more personal approach. In some cases, banks may prefer one of these methods over a letter. Check your bank's website to see what steps they recommend taking.

Submit an Online Request

Online banks allow you to transfer all of your funds out and request a closure online. It can be as easy as clicking “Close Account.” Other banks require you to write a request to customer service while you’re logged in to your account.

Call Customer Service

A quick phone call might also do the trick. If you’ve got a few minutes, just call customer service and ask to close your account. Be prepared for a few attempts at keeping your business, which you can firmly (but politely) decline.

In many cases, submitting a written, online, or over-the-phone request is all you need to do to close an account. However, you can take extra steps to ensure the process goes as smoothly as possible. Before you finalize your account closure, review these optional steps and special scenarios.

Make Sure You're Done

Before closing your account, double-check to make sure there are no outstanding checks or automatic payments scheduled to hit your account. Change your direct deposit instructions to your new account, and wait to see that the update has taken place before you close an account.

Empty It Yourself

It is usually best to empty your bank account before you send the letter to close it. In most cases, transferring the funds yourself will get the money in your hands more quickly than if you wait for the bank to process your request.

There are several free and easy ways to send funds to yourself electronically, including basic bank-to-bank transfers . Apps and non-bank services for sending money can also do the job.

If you do it yourself, you’ll know exactly when and where to expect the money. The alternative is to wait for a check in the mail (which you’ll have to deposit before you can withdraw and spend the money). Be careful not to empty your old account too soon if there are pending fees or charges. A fee or charge that you can't cover could complicate and delay the process.

Be Direct, But Polite

To close your bank account , you just need to make the request (whether it’s in writing or by clicking a button). The wording isn't the most important thing. It’s not necessary to instruct them to do it “promptly” or “immediately” because they will do it as soon as possible anyway.

Banks do not drag their feet on these things until somebody notices and applies pressure. Just make it easy for the person who opens your letter (tell them exactly what to do and where to send the money), and it’s more likely to get done quickly and accurately. If you have complaints about the bank or its services, send that feedback separately and wait until after your account is closed.

Download Statements or Transactions

Once you close your account, you may lose access to your account history. Someday, you may wish you had a record of an important transaction. Download several years’ worth of statements before you close your account—just in case. Alternatively, download your transactions into a software program that stores the information for you.

You May Need To Provide an Original Signature

You may be required to sign your letter with ink, rather than with an e-signature or stamp, depending on bank policy. If a bank asks for a written letter, a component of that requirement may include a real signature in order to authorize the account closure.

Use Wire Transfers or Cashier's Checks in Time-Sensitive Situations

If you really need the money to move immediately and be available for spending, send the money to your new account by wire transfer . Alternatively, get a cashier's check , which will cost a bit less and still provide "cleared" funds.

Changes of Address Can Delay the Process

If you’re closing the account because you’ve moved, be aware that bank policies typically only allow them to send funds to your address of record (the address they currently have on file at the bank). Address changes followed by check requests could potentially raise a red flag—they could worry an identity thief is attempting to steal your money. If the bank questions the legitimacy of the transfer, you may have to wait longer for your money, or you may have to do additional paperwork and get your request notarized .

Ask your bank what is required to mail a check to a new address (better yet, get the money out yourself, as described above).

If you use a credit union, you might not need to close your account just because you've moved. Many credit unions participate in shared branching, which allows you to use a different credit union's branches (with thousands of locations available to you nationwide). You might eventually need an account at a local institution for more complex needs—or you might be just fine using your old account.

Use an App To Deposit the Check

If the bank sends a check for the leftover money in the closed account, you'll need to deposit that check somewhere—and many people these days hardly ever deal with paper checks. The easiest way to make that deposit is with your new bank's mobile app (if available).

Verify the Closure

Don’t just assume your instructions will be followed. Double-check by logging in to your account or calling the bank to ensure that your account is closed. Sometimes instructions get lost, or something needs to be done before you can close the account. If you’re not aware of problems that arise, you risk having inactivity charges or low balance fees charged to your account. They might not be your fault, but it’s easier to clean everything up while it’s fresh in your mind.

While not always required, using a hand-signed letter to request an account closure is an easy way to add an extra layer of financial protection. If any complications or errors occur during the process, you have handwritten and dated proof of key details like what exactly you requested, when you requested it, and where any remaining funds were supposed to go—just remember to keep a copy for yourself.

If the process does go awry at some point, make sure to reach out as soon as you notice the discrepancies. Be direct in your conversations with customer service, but don't burn bridges. Rude comments won't speed up the process, only clear communication will.

If you still have questions about the process, you can read more about what to do before you change banks or closing a joint checking account .

Which bank has the highest interest rate on savings accounts?

Some of the banks with the highest interest rates on savings accounts include Sallie Mae Bank, Affirm, and ConnectOne.

How do you remove a bank account from Google Pay?

To delete a bank account from your Google Pay app , tap your photo, then tap "bank account," and select the account you want to delete. Tap the three dots to bring up the option to remove the bank account.

How do you transfer money to another bank account?

There are many ways to transfer money to another bank account. You can directly transfer the money to another account via ACH transfer . You can use a payment app like Venmo. You can use a money order or personal check. You can also withdraw the cash and physically bring it to your new bank, but that may be unnecessarily burdensome when so many digital options exist.

BBVA. " Closing a Checking Account ."

Consumer Financial Protection Bureau (CFPB). " Can I Close My Account Whenever I Want? "

Capital One. " How to Close a Bank Account ."

First National Bank of Moose Lake. " Account Closing Letter ."

Bank of America. " International Wire Transfers ."

Capital One. " What Is a Cashier's Check and How Do You Use It? "

CO-OP Financial Services. " CO-OP Shared Branch ."

:max_bytes(150000):strip_icc():format(webp)/ScreenShot2020-06-24at12.24.57PM-da686b9735da4f35b4635703253e7ed0.png)

Application for Closing Bank Account

Sometimes you have got to close your bank account for various reasons. You need to draft an application for closing bank account properly. Along with it, you need to attach a few important documents as well. This article let us learn how to write an application for closing bank account, the guidelines to be followed and a few sample letters to understand the topic in depth.

To close your bank account, you must write an application letter to the manager of your respective bank branch. Along with the application, you must also include/attach the documentation required to shut your account, such as a passbook, chequebook, ATM card (debit/credit), identity proof and so on. It is also important to mention the reason for closing your bank account.

A person’s bank account might be closed for a variety of reasons. Some common causes include difficulties maintaining several accounts, inadequate response or service, unnecessarily charged fees, personal or financial troubles, the death of a family member, an untrustworthy online service, or an inability to maintain a minimum balance.

Guidelines to follow before Closing your Bank Account

- It is critical to double-check your account balance before closing it.

- Check your balance and then write a cheque to withdraw your money.

- Before requesting closure, ensure that all of your transactions and bank-related operations have been completed.

- Using an ATM card may result in less than 500 remaining. Hence, use a cheque whenever emptying the money in your bank account.

- Deposit or destroy a blank chequebook and ATM card for security and personal reasons.

- Confirm that your account has been closed.

Format for Application for Closing Bank Account

The Branch manager

Bank Address

Subject: Application to Close Bank Account

Body of the letter: Mention the reason for closing the bank account, also mention the required bank details such as account number, member ID, passbook, identity proof, etc.

Complimentary Closing

Sender’s Name

Application for Closing Bank Account Samples

Sample 1 – letter for closing current account.

The Branch Manager

State Bank of India

SV Road Branch

12 th October 2022

Subject: Request for Closing Current Account

Respected Sir/Madam,

My name is Ramesh Pawar and I am holding a Current Account in your bank. I would like to close my account because I am having difficulties in maintaining multiple bank accounts. Along with this letter, I am submitting the account passbook and my identity confirmation. Please perform the necessary and begin the closing procedure as soon as feasible.

Thanking you.

Yours Sincerely,

Ramesh Pawar

(Attach original passbook and identity copy)

Explore More Sample Letters

- Leave Letter

- Letter to Uncle Thanking him for Birthday Gift

- Joining Letter After Leave

- Invitation Letter for Chief Guest

- Letter to Editor Format

- Consent Letter

- Complaint Letter Format

- Authorization Letter

- Application for Bank Statement

- Apology Letter Format

- Paternity Leave Application

- Salary Increment Letter

- Permission Letter Format

- Enquiry Letter

- Cheque Book Request Letter

- Application For Character Certificate

- Name Change Request Letter Sample

- Internship Request Letter

- Application For Migration Certificate

- NOC Application Format

- Application For ATM Card

- DD Cancellation Letter

Sample 2 – Letter for Closing Savings Account

Dhana Lakshmi Bank

MG Road Branch

18 th April 2022

Subject: Request for Closing Savings Account

Dear Sir/Madam,

My name is Rahul Tripathi and I have a savings bank account with you. XXXXXXXXXXXXXXX is my account number. I haven’t used my account in a long time and don’t need it right now.

As a result, I respectfully recommend that you close this bank account. I’ve attached all of the paperwork needed to close the bank account. If you can complete this in less time, I will be eternally thankful.

Yours truly,

Rahul Tripathi

Sample 3 – Letter for Closing Account Due to Excessive Charges

3 rd July 2022

Subject: Request for Closing my Bank Account

I’m requesting that you close my current account via this application since I’ve seen that unnecessary and excessive costs are being deducted from it over the past few days. Despite the fact that I have not engaged in any unusual transactions. My account information is as follows:

Account Holder’s Name:

Account No.:

Aadhar Card No.:

Registered Email:

Registered Mobile:

Along with my application, I will be returning my passbook, chequebook, and ATM cards. As a result, please accept my application and begin the process of terminating my account.

Kapil Dhuria

Sample 4 – Letter for Closing Account Due to Personal Reasons

Union Bank of India

Noida Branch

30 th September 2021

My name is Sakshi Malik, and I have a savings account at your branch with account number 1147693627569. Because I am relocating to Mumbai for personal reasons, I would like to liquidate my savings account and take the money. I would appreciate it if you could please terminate my account as soon as possible because I will be travelling next week.

For your convenience, I have enclosed the bank passbook, identity, and address evidence.

Yours faithfully,

Sakshi Malik

Frequently Asked Questions

Q1. What documentation is needed to close a bank account?

Answer. All account information, including account holder name, address, account number, associated mobile number, signature, original passbook and original chequebook (if issued). Your Identification Proof (Aadhar Card, Voter ID Card, Electricity Bill, etc.), Address Proof (Aadhar Card, Voter ID Card), and Debit Card / Credit Card are also required (if issued).

Q2. What is the average time it takes to close a bank account?

Answer. It is entirely dependent on your bank. Request that your bank manager performs this activity as soon as feasible. However, it just takes five to 10 days. However, in some government banks, this process can take up to two months.

Q3. Can a bank reinstate a previously closed account?

Answer. Yes, you can reopen a bank account that has been closed. However, whether you can reopen the bank account relies on the bank in specific situations.

Customize your course in 30 seconds

Which class are you in.

Letter Writing

- Letter to School Principal from Parent

- ATM Card Missing Letter Format

- Application for Quarter Allotment

- Change of Address Letter to Bank

- Name Change Letter to Bank

- Application for School Teacher Job

- Parents Teacher Meeting Format

- Application to Branch Manager

- Request Letter for School Admission

- No Due Certificate From Bank

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Download the App

SemiOffice.Com

Your Office Partner

Company Bank Account Opening Request Letter to Bank

Want to open a company account in a bank? Sample request letter to the bank for opening a company bank account or business bank account . We also suggest you give a clue to the bank if your account is huge. Like you will have big deals with this account etc. But don’t write any business or company secret to the bank. Nowadays, account opening for a company is not an issue. Most of the banks are looking for company accounts with maximum balance & facilities.

Request Letter to Open a Business Account

I request you to please open a current business account for our Company in the name of “title of account”. I hope for a great business relationship. I will be grateful to you.

Sincerely Yours,

Your Name, Designation

Company Account Opening Request Letter to Branch Manager

Dear Branch Manager,

I am writing to request for the opening of our company business account in your prestigious bank. We are a registered firm, and we will provide all the documents you need for account opening. I will be grateful for your priority services for us.

Request Letter to Bank for Company Account

The Branch Manager

Subject: Company Bank Account Opening Request Letter

Dear Sir or Madam,

This is to request you to open a company account in your branch of New York City. We are going to start business operation in New York City form November. Our Company has an outstanding reputation, and massive turnover. Therefore, please facilitate our account in the name of “SemiOffice” in your branch as soon as possible. We will provide all the information and documents that you may require to open this account.

Looking for Your Favorable Reply,

Regional Manager Finance

Company Bank Account Opening Letter

We are very pleased to inform you, and your bank that we have started a new company named “OBTC.” Our head office is located in your branch area. We expect a huge turnover for our solar products to increase awareness and cost-effective solutions for the residents. I already have my bank accounts in your branch, and I will be pleased to open our company account in your bank branch under the title of OBTC. Later I will also prefer to maintain our employee accounts in your branch. For now, I request you to please open our company account; a duly filled account opening form is attached, including references of the account holders. I will be highly obliged.

Thanking you,

Zahid Nawaz

Company Bank Account Opening Letter Format

The bank employee writes this letter for the clients to open their company bank accounts with all the letter requirements and standard patterns for a company bank account.

The Branch Manager,

Dear Sir, It is certified that I am running a company with ABC Company’s name, which deals with manufacturing confectionery items. I am the sole owner of such a company. I have been operating ABC company since (Date). The Company’s office landline no is (number here). Kindly open my Allied Business Account in your prestigious bank. Below is a brief detail of my Company:

NAME: ABC COMPANY Proprietor: Muhammad Umair NTN NO: 3410133626657

Share this:

Author: david beckham.

I am a content creator and entrepreneur. I am a university graduate with a business degree, and I started writing content for students first and later for working professionals. Now we are adding a lot more content for businesses. We provide free content for our visitors, and your support is a smile for us. View all posts by David Beckham

3 thoughts on “Company Bank Account Opening Request Letter to Bank”

Thanks for helping us

Letter to Tax Commissioner requesting new tax clearance certificate

check it here: https://semioffice.com/request-letters/requesting-a-new-tax-clearance-certificate/

Please Ask Questions? Cancel reply

- GK for competitive exams

- General Awareness for Bank Exams

- Current Affairs

- Govt Schemes

- Financial Awareness

- Computer GK

- Social Issues

- General Knowledge for Kids

- Letter For Closing Bank Account: Check Format and Samples

- Casual Leave Application: Check Format & Samples

- Ledger | Meaning, Format, Example and Balancing of Accounts

- Profit and Loss Appropriation Account : Journal Entries & Format

- PROFIT AND LOSS APPROPRIATION ACCOUNT

- Permanent Account Number (PAN) : Full Form, Format, Eligibility & Types

- Software Testing - Bank Domain Application Testing

- How to Write Job Application Letter? (with Samples)

- Accounting Treatment of Consumable Items: Stationery and Sports Material

- How to write a Business Letter? | Steps and Format

- Adjustment of Sale of Goods on Sale or Return Basis in Final Accounts (Financial Statements)

- Income and Expenditure Account Format

- Adjustment of Goods given as Charity or Free Sample in Final Accounts (Financial Statements)

- Adjustment of Interest on Loan in Final Accounts (Financial Statements)

- Adjustment of Interest on Deposits in Final Accounts (Financial Statements)

- Adjustment of Goods in Transit in Final Accounts (Financial Statements)

- Adjustment of Prepaid Expenses in Final Accounts (Financial Statements)

- Adjustment of Bad Debts in Final Accounts (Financial Statements)

- Regular Expressions to validate Loan Account Number (LAN)

Application for Closing Bank Account: Format and Samples Letter

Closing a bank account may seem like a daunting task, but with the right approach, it can be a straightforward process. In this blog, we’ll explore the essential steps and provide a sample letter template to guide you through writing a formal letter for closing your bank account. Whether you’re switching banks or simplifying your finances, we’ve got you covered with practical tips and a clear, concise letter format to help you navigate the account closure process with ease.

Table of Content

Application for Closing Bank Account

Steps to write a letter to close a bank account, standard format of an account closing letter, guidelines to follow before closing your bank account, bank account closing letter format.

- [Your Name]

- [Your Address]

- [City, State, Zip Code]

- [Your Email Address]

- [Your Phone Number]

- [Bank Name]

- [Bank Address]

Subject: Request for Account Closure

Dear [Bank Name] Manager,

I, [Your Name], hold a Savings Account with your bank. Due to some personal circumstances, I am unable to maintain the account and would like to close it.

Please find the account passbook enclosed with this letter. I kindly request you to initiate the account closure process at the earliest convenience.

Thank you for your assistance in this matter.

- Enquiry Letter : Format and Example

Writing a letter to close a bank account is a straightforward process. Here are the steps you can follow:

- Address the Letter: Begin by addressing the bank manager or appropriate authority with the correct salutation, such as “Dear [Bank Name] Manager.”

- State Your Intent: Clearly state your intention to close your bank account due to personal reasons. Mention the type of account you hold (e.g., savings account) for clarity.

- Provide Necessary Details: Include essential account information, such as your account number, to ensure accurate identification of the account to be closed.

- Request Action: Politely request the bank to initiate the account closure process. If applicable, mention any accompanying documents, like an enclosed passbook, to facilitate the process.

- Express Gratitude: Conclude the letter by thanking the bank for their services and cooperation. Provide your contact information for any further communication or clarification.

- Letter to Principal, Format And Samples

- How To Write a Recommendation Letter (With Examples)

[Your Name] [Your Address] [City, State, Zip Code] [Your Email Address] [Your Phone Number] [Date]

[Bank Name] [Bank Address] [City, State, Zip Code]

I am writing to formally request the closure of my [Type of Account] account with your institution. The details of my account are as follows:

Account Holder Name: [Your Name] Account Number: [Your Account Number]

I kindly request that you proceed with the necessary steps to close this account and provide confirmation of closure at your earliest convenience.

Please ensure that any remaining balance in the account is transferred to my linked account or issued to me in the form of a cashier’s check.

Thank you for your prompt attention to this matter. Should you require any further information or clarification, please do not hesitate to contact me at the above-mentioned contact details.

Sincerely, [Your Name]

Before closing your bank account, consider the following guidelines:

- Review Account Activity: Check for any pending transactions, outstanding checks, or automatic payments linked to your account. Ensure that all transactions are completed and there are no pending balances.

- Update Direct Deposits and Automatic Payments: Notify any companies or institutions that deposit funds directly into your account or make automatic withdrawals. Provide them with your new account information if necessary.

- Transfer Funds: Transfer any remaining funds from your current account to your new account or withdraw cash if needed. Ensure that your account balance is sufficient to cover any outstanding checks or payments.

- Cancel Automatic Transfers: Cancel any recurring transfers between your accounts to avoid unexpected transactions after closure.

- Return Bank Items: Return unused checks, debit cards, and any other bank-related items to the bank.

- Check for Fees: Review your bank’s account closure policies and check for any associated fees or penalties for closing your account.

- Notify the Bank: Contact your bank to inform them of your intention to close your account. Follow their procedures for account closure, which may include submitting a written request or visiting a branch in person.

- Obtain Confirmation: Request written confirmation of the account closure from the bank for your records.

- Update Contact Information: Provide your new contact information to the bank to ensure that you receive any final statements or correspondence.

- Monitor Account Activity: Continue to monitor your account for any final transactions or fees that may occur after closure. Keep records of the closure process for future reference.

Sample 1 – Current Account Closing Letter:

Subject: Closure of Current Account (Account Number: [Your Account Number])

I am writing to request the closure of my current account (Account Number: [Your Account Number]) with your bank. Due to personal reasons, I have decided to consolidate my banking activities and close this account.

I kindly request you to initiate the necessary steps to close the account and provide confirmation of closure at your earliest convenience. Please ensure that any remaining balance in the account is transferred to my linked account or issued to me in the form of a cashier’s check.

Thank you for your prompt attention to this matter.

Sample 2 – Letter to Bank Manager for Closing Account:

[Bank Manager’s Name] [Bank Name] [Bank Address] [City, State, Zip Code]

Dear [Bank Manager’s Name],

I am writing to formally request the closure of my savings account (Account Number: [Your Account Number]) with your esteemed bank. Due to personal circumstances, I have decided to terminate my banking relationship with your institution.

I kindly request you to initiate the necessary steps to close the account and provide confirmation of closure at your earliest convenience. Please advise me of any outstanding balances or procedures required to complete the closure process.

Thank you for your cooperation in this matter.

Sample 3 – Request Letter for Bank Account Closure:

Subject: Request for Bank Account Closure

Dear Sir/Madam,

I am writing to formally request the closure of my bank account (Account Number: [Your Account Number]) with your esteemed bank. Due to personal reasons, I have decided to discontinue my banking services with your institution.

I kindly request you to initiate the necessary steps to close the account and provide written confirmation of closure at your earliest convenience. Please ensure that any remaining balance in the account is transferred to my linked account or issued to me in the form of a cashier’s check.

- Thank You Letters : Purpose, Format, Sample, and Example

- Difference between Formal and Informal Letter

- Welcome Letters : Purpose, Format, Sample, and Example

FAQs on letter for closing bank account

How do i write a letter to close my bank account.

To write a letter, start with a formal salutation, state your intention clearly, provide your account details, and request closure and confirmation.

How do I close my bank account?

You can close your bank account by visiting the bank in person, submitting a written request, or sometimes through online banking platforms, following the bank’s specific procedures.

What is the right wording for closing a bank account?

The right wording includes a polite request for closure, clear identification of your account, and a request for confirmation of closure, ensuring clarity and formality.

How do I write a letter to terminate an account?

Write a formal letter addressing the bank manager, state your intention to terminate the account, provide necessary account details, and request closure and confirmation.

Sample letter to close current bank account and transfer funds?

“Dear [Bank Manager], I am writing to request the closure of my current account [Account Number] and transfer the remaining funds to [New Account Details]. Please confirm the closure at your earliest convenience.”

How do I write a letter to close my SBI bank account?

Start with a formal salutation, state your intention clearly, provide your SBI account details, and request closure and confirmation in a polite and professional manner.

How to write a bank account closure letter to the customer?

Address the customer formally, state that their account will be closed per their request, provide any necessary instructions or information, and thank them for their patronage in a courteous manner.

Please Login to comment...

Similar reads.

- General Knowledge

- SSC/Banking

Improve your Coding Skills with Practice

What kind of Experience do you want to share?

- Letter Writing

- Formal Letter Writing In English

- Application for Bank Statement

Application for Bank Statement - Format and Sample Letters

In today’s world, where money has become the factor that decides the fate of anything and everything, it is very vital that individuals equip themselves with financial independence and financial literacy. Having a lot of money and not knowing what to do with it or stashing it away in your cupboard lockers is of no use. On the other hand, if individuals know how to invest and save the money they earn, they could live a much more financially secure life. This article will give you a glimpse of how banking promotes the effective use of money, the ways to choose the right bank and the means to invest in, and sample application letters requesting bank statements.

Table of Contents

Who can have a bank account – things you need to know before you start your bank account, choosing your banking partner, sample 1 – bank statement request letter for it returns, sample 2 – application for account statement for loan application, sample 3 – letter requesting bank statement for scholarship.

- FAQs on Bank Statement Request Letter Format

Anyone is allowed to have a bank account. The Reserve Bank of India has given provisions for children and adults to have bank accounts. Children below the age of ten are eligible to have joint accounts, which can be changed into independent accounts once they complete eighteen years of age.

Should I have money to open a bank account? To this question, the answer is no. Not all banks insist on depositing money into your bank account the moment you start it. Many banks provide the option of a zero balance account. There are a few documents, however, that you should keep handy when you are at a bank to open your account. Most banks demand an address proof and identity proof for verification. The Aadhaar card is one compulsory proof demanded by all banks owing to the country’s rules and regulations. Other documents include ration card, voter’s identity card, passport, driving license, pan card, etc., for identification proof; and electricity bill, telephone bill, gas bill, etc., for address proof. The most important thing you need to take care of when starting a bank account is that you fill in all the right details in a legible manner.

To choose a bank, you should first decide what kind of account you want. Once you know the type of account you want to open, you can identify the bank by filtering out a few factors. Check for banks which do not charge much; check if there are any hidden fees, annual fees or transfer fees; check for cashing limits, digital banking policies, interest rates and also your convenience. If you are able to find a bank that offers you the best options and suits your financial needs, you can go forward with that one.

Sample Letters of Request for Bank Statement

Here are some sample letters of request for bank statements for your better understanding and reference.

The Branch Manager

State Bank of India

Chennai – 600045

Subject: Request for bank statement for IT return filing

As I have to file my income tax returns for the financial year 2020-2021, I request you to provide me with the bank statement from the 1st of April, 2020 to the 31st of March, 2021 for the savings bank account. I have enclosed herewith the account number and a copy of the passbook for your reference. Kindly do the needful.

Account number:

Thanking you

Yours faithfully,

Soumia Thomas

The Bank Manager

Union Bank of India

Uttar Pradesh

Pin Code – 110096

Subject: Request for bank account statement for personal loan application

I hold an account with the account number (mention your account number) at your bank, and I require a bank statement for the past six months (13/11/2020 to 13/05/2021) to provide as proof to apply for a personal loan. Kindly do the needful and provide me with my bank account statement at the earliest.

Thank you in advance.

Yours sincerely,

Shankar Nethran

Central Bank of India

New Washermanpet Extension

Chennai – 600054

Subject: Request for bank account statement for scholarship

I am Stephen Ruben, and I hold an account with the account number (mention your account number) at your bank. I require the bank statement for the last six months in order to apply for a scholarship abroad.

It would be of great help if you could kindly do the needful and issue me my bank statement at the earliest. You can mail it to [email protected].

Stephen Ruben

Frequently Asked Questions on Bank Statement Request Letter Format

For what reasons can you request for a bank statement.

People request for a bank statement for purposes such as loan application, scholarship, IT return filing, visa application, for higher education and to provide proof for various transactions.

How do I write a request for a bank statement to the branch manager?

I hold an account with the account number (provide your account number correctly) at your bank, and I require a bank statement for the past six months (the dates for which you require the bank statement) to provide as proof (state reason for request of bank statement). Kindly do the needful and provide me with my bank account statement at the earliest.

Leave a Comment Cancel reply

Your Mobile number and Email id will not be published. Required fields are marked *

Request OTP on Voice Call

Post My Comment

Register with BYJU'S & Download Free PDFs

Register with byju's & watch live videos.

Application for Bank Account Transfer – 11+ Samples, Formatting Tips, and FAQs