How Much Does it Cost to Start a Business?

8 min. read

Updated April 25, 2024

What will it cost to start your business? This is a key question for anyone thinking about starting out on their own. You’ll want to spend some time figuring this out so you know how much money you need to raise and whether you can afford to get your business off the ground.

Most importantly, you’ll want to figure out how much cash you’re going to need in the bank to keep your business afloat as you grow your sales during the early days of your business.

Typical startup costs can vary depending on whether you’re operating a brick-and-mortar store, online store, or service operation . However, a common theme is that launching a successful business requires preparation.

And while you may not know exactly what those expenses will be, you can and should begin researching and estimating what it will cost to start your business.

- How to determine your startup costs

Like when developing your business plan , or forecasting your initial sales, it’s a mixture of market research , testing , and informed guessing. Looking at your competitors is a good starting point. Once you feel your initial estimates are in the ballpark, you can start to get more specific by making these three simple lists.

1. Startup expenses

These are expenses that happen before you launch and start bringing in any revenue. Here are some examples:

- Permits and Licenses: Every business needs a license to operate, just like a driver needs one to drive. Costs vary depending on industry and location.

- Legal Fees: Getting your business structure set up (sole proprietorship, LLC, etc.) might involve consulting a lawyer and at least will involve the basic business formation fees.

- Insurance: Accidents happen, and insurance protects your business from unforeseen bumps.

- Marketing and Branding: The ways to spread the word about your product or service. They could involve creating a website, creating business cards, or promoting social media.

- Office Supplies : Pens, paperclips, that all-important stapler – the essentials to keep your business humming.

- Rent/Lease: If you need to rent space for your business before you start selling, include those expenses in your list as well.

2. Startup assets

Next, calculate the total you need to spend on assets to get your business off the ground. Assets are larger purchases that have long-term value. They’re typically significant items that you could resell later if you needed or wanted to.

Here are a few examples:

- Equipment: Think ovens for a bakery, cameras for a photography business, or computers for a tech startup.

- Inventory: If you’re selling products, you’ll need to stock up before opening your doors (or your online store).

- Furniture and Decorations: Desks, chairs, that comfy couch in the waiting room – creating a functional and inviting workspace might involve some upfront investment.

- Vehicles: If your business requires a vehicle to deliver your product or service, be sure to account for that purchase here.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

Why separate assets and expenses?

There’s a reason that you should separate costs into assets and expenses. Expenses are deductible against income, so they reduce taxable income. Assets, on the other hand, are not deductible against income.

By initially separating the two, you potentially save yourself money on taxes. Additionally, by accurately accounting for expenses, you can avoid overstating your assets on the balance sheet. While typically having more assets is a better look, having assets that are useless or unfounded only bloats your books and potentially makes them inaccurate.

Listing these out separately is good practice when starting a business and leads into the final piece to consider when determining startup costs.

3. Operating Expenses

Finally, figure out what it’s going to cost to keep your doors open until sales can cover expenses. Create a list that estimates monthly expenses, such as:

- Payroll (including your own salary)

- Marketing and advertising

- Loan payments

- Insurance premiums

- Office supplies

- Professional services

- Travel costs

- Shipping and distribution

Then, based on your revenue forecasts , calculate how many months it will take before your sales can cover all those monthly expenses. Multiply that number of months by your monthly operating expenses to determine how much you’re going to need to cover operating expenses as your business starts.

This number is often called “ cash runway ” and is a critical number – you need enough cash to fund those early red ink months. This number is how much cash you need to have in your checking account when you open your doors for business.

Calculating how much startup cash you need

To figure out how much money you need to start your business, add the asset purchases, startup expenses, and operating expenses over your cash runway period. This is your total startup costs, and it’s better to overestimate than underestimate these costs.

It often makes sense to invest the time to build a slightly more detailed starting costs calculation. Assuming you start making some sales and those sales grow over time, your revenue will be able to help pay for some of your operating expenses. Ideally, your sales contribute more and more over time until you become profitable.

To do a more detailed calculation, you’ll want to invest the time in a detailed financial forecast where you can experiment with different scenarios. If you do this, you’ll be able to see how much it will cost to start your business with different revenue growth rates. You’ll also be able to experiment with different funding scenarios and what your business would look like with different types of loans.

- Funding Starting Costs

You can cover starting costs on your own, or through a combination of loans and investments.

Many entrepreneurs decide they want to raise more cash than they need so they’ll have money left over for contingencies. While that makes good sense when you can do it, it is difficult to explain that to investors. Outside investors don’t want to give you more money than you need, because it’s their money.

You may see experts who recommend having anywhere from six months to a year’s worth of expenses covered, with your starting cash. That’s nice in concept and would be great for peace of mind, but it’s rarely practical. And it interferes with your estimates and dilutes their value.

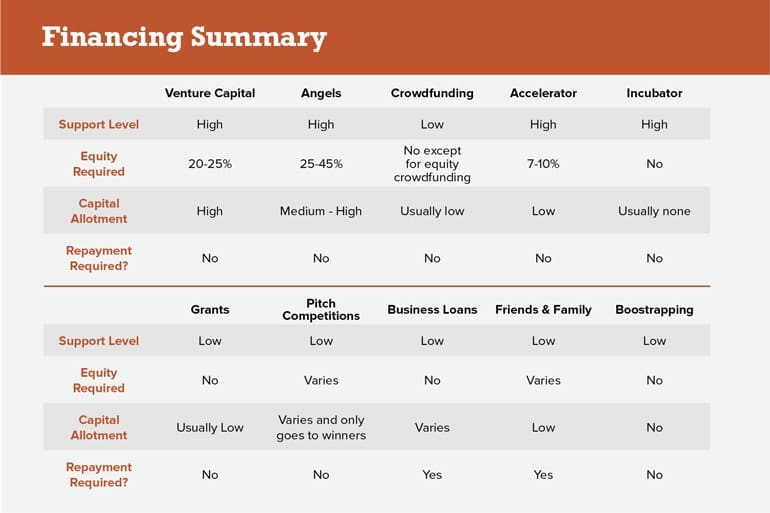

Of course, startup financing isn’t technically part of the starting costs estimate. But in the real world, to get started, you need to estimate the starting costs and determine what startup financing will be necessary to cover them. The type of financing you pursue may alter your startup or ongoing costs in a given period, so it’s important to consider this upfront.

Here are common financing options to consider:

- Investment : What you or someone else puts into the company. It ends up as paid-in capital in the balance sheet . This is the classic concept of business investment, taking ownership in a company, risking money in the hope of gaining money later.

- Accounts payable : Debts that are outstanding or need to be paid after a certain time according to your balance sheet. Generally, this means credit-card debt. This number becomes the starting balance of your balance sheet.

- Current borrowing : Standard debt, borrowing from banks, Small Business Administration , or other current borrowing.

- Other current liabilities : Additional liabilities that don’t have interest charges. This is where you put loans from founders, family members, or friends. We aren’t recommending interest-free loans for financing, by the way, but when they happen, this is where they go.

- Long-term liabilities : Long-term debt or long-term loans.

- Other considerations for estimating startup costs

Pre-launch versus normal operations

With our definition of starting costs, the launch date is the defining point. Rent and payroll expenses before launch are considered startup expenses. The same expenses after launch are considered operating or ongoing expenses.

Many companies also incur some payroll expenses before launch because they need to hire people to train before launch, develop their website, stock shelves, and so forth.

Further Reading: How to calculate the hourly cost of an employee

The same defining point affects assets as well. For example, amounts in inventory purchased before launch and available at launch are included in starting assets. Inventory purchased after launch will affect cash flow , and the balance sheet; but isn’t considered part of the starting costs.

So, be sure to accurately define the cutoff for startup costs and operating expenses. Again, by outlining everything within specific categories, this transition should be simple and easy to keep track of.

Your launch month will likely be the start of your business’s fiscal year

The establishment of a standard fiscal year plays a role in your analysis. U.S. tax code allows most businesses to manage taxes based on a fiscal year, which can be any series of 12 months, not necessarily January through December.

It can be convenient to establish the fiscal year as starting the same month that the business launches. In this case, the startup costs and startup funding match the fiscal year—and they happen in the time before the launch and beginning of the first operational fiscal year. The pre-launch transactions are reported as a separate tax year, even if they occur in just a few months, or even one month. So the last month of the pre-launch period is also the last month of the fiscal year.

- Aim for long-term success by estimating startup costs

Make sure you’ve considered every aspect of your business and included related costs. You’ll have a better chance at securing loans, attracting investors, estimating profits, and understanding the cash runway of your business.

The more accurately you layout startup costs and make adjustments as you incur them, the more accurate vision you’ll have for the immediate future of your business.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

.png?format=auto)

Table of Contents

Related Articles

5 Min. Read

How Much Should You Personally Cover for Startup Costs?

4 Min. Read

3 Steps to Figure Out How Much Money You Need to Start a Business

2 Min. Read

The Top 5 Hidden Costs of Starting a Business

4 Things You Won’t Regret Spending Money on When Starting Your Business

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Calculate Startup Costs for Small Businesses

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

When you’re writing your business plan , you’ll need an accurate estimate of what it will cost for you to start your business so you can decide how to manage your funding and expenses.

Accurately estimating your startup costs can be tricky, but this guide will help you understand your initial costs and how you can plan for them.

First we’ll look at some of the most common startup expenses to get you started:

Common business expenses

The first step is to make a list of all the purchases you’ll need to make in order to start operating.

Categorize your list into expenses that are one-time purchases and those that will be ongoing payments, since both will factor into your calculations.

Here are some of the most common expenses in both categories:

One-time expenses

Necessary equipment like a cash registers, machinery, or vehicles

Incorporation fees

Permits and licenses, such as city, county, and state licensing, or those related to your specific industry

Computer or technology equipment

Down payment for your office or store

Initial business cards

Initial inventory

Initial office supplies

Technology, such as computers, tablets, or printers

Office or business furniture

Ongoing expenses

Business taxes

Your rent or mortgage payment

Accounting services

Legal services

Business insurance

Payroll and employee benefits

Your salary and benefits

Operating expenses, such as bags in retail

Office supplies, such as pens and paper

Website hosting and maintenance

Travel if your business will require it, including gas

Utilities like electric, gas, water, phone, and internet

Marketing materials

Ongoing inventory

Ongoing office supplies

Loan or credit payments

Next, you’ll also need to determine which of your ongoing expenses are fixed costs, and which are variable costs. Fixed expenses you can plan for exactly, but for variable expenses, your costs will change each time.

Here are some common expenses in each category:

Fixed expenses

Lease or mortgage

Administrative costs

Variable expenses

When planning for your startup, you need to only consider items that are essential in the beginning, rather than optional items you can invest in later when your business revenue can help offset the cost.

Don’t forget to research additional necessary expenses in your industry. Other professionals in your field or websites about your type of business can help you determine what is essential.

>> MORE: Best budgeting software for businesses

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

How to calculate startup costs for your small business

Use your list from above to complete the next steps:

1. Research

After you’ve made a list of your expenses, it’s time to research. You’ll need to estimate the cost of each item on your list for an accurate estimate.

When researching, don’t forget to do some bargain hunting. You’ll want to minimize expenses as much as possible without sacrificing quality for big-ticket items. This will mean that your research will include equipment capabilities, reviews, maintenance costs, and warranties.

Your one-time expenses and fixed ongoing expenses should have specific costs you can estimate fairly accurately.

For variable ongoing expenses, you may have to do some extra research and make some broad guesses. For example, you won’t know what your ongoing inventory costs will be until you’re operational, but if you factor in a bit of cushion on these expenses, you can ensure you’ll have enough funding to cover these expenses.

2. Expense totals

You’ll need to total your one-time expenses, so that you know exactly what just opening the business will cost, but that isn’t all. You’ll also need to factor in several months’ worth of ongoing expenses.

While your business will be able to cover these expenses once it is operational, it may take time before it can generate enough sales to cover these costs, much less make a profit.

Generally speaking, it’s a smart idea to count on covering six-12 months of business expenses up front while your business is growing. While you can factor sales growth and business revenue into the payment for these costs to lessen the upfront burden, it’s generally safer to make calculations on the assumption that your business won’t be able to contribute, since you won’t be able to accurately forecast sales until you’re operational.

You may also find that some expenses will increase as your business grows, such as marketing, inventory, or payroll, so you’ll want to factor in some extra cushion for growing needs.

4. Total startup costs

Once you have all these figures, you can total your expenses to estimate your startup costs fairly accurately.

Yes, it’s probably a large number, especially if you plan to factor in a cushion for the first few months to a year of operation, but there are many funding options for new business owners.

Once your business begins operating or you begin making purchases for your business, you may find additional needs you left out of your estimates or that some expenses are lower than you planned. You’ll need to keep adjusting your plan as you learn more through the process of starting your business.

This article originally appeared on JustBusiness, a subsidiary of NerdWallet.

On a similar note...

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai Pitch Deck Generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

- WHY UPMETRICS?

Customer Success Stories

Business Plan Course

Small Business Tools

Strategic Planning Templates

E-books, Guides & More

How to Calculate Business Startup Costs

Starting a business from scratch takes a lot out of you, even before you begin operating—whether it’s about selecting a revenue model, securing startup funding, or estimating startup costs.

I already knew it was challenging for entrepreneurs to calculate the startup costs accurately.

However, when I turned up to my computer, researching this article, I discovered so many challenges new business owners face while estimating startup costs that I had overlooked or didn’t pay much attention to earlier.

Thousands of startups close down every single year. 38% of them fail solely because they underestimated their startup costs and ran out of cash. You can’t ignore something like that, can you?

That said, I’m ready to pour my research into the article to help you calculate your business startup costs .

So, you’re ready to begin? Let’s dive right in.

Key Takeaways

- Startup costs are the expenses a startup must bear in the process of starting a new business, while operational costs are the expenses that are incurred during daily operations.

- Different types of business structures, such as sole proprietorships, partnerships, and corporations, have different costs.

- Business insurance, formation fees, licensing and permits, and marketing are some of the most common business startup costs.

- A modern financial forecasting tool is the most efficient method for calculating startup costs.

How much does it cost to start a business?

Startup costs for a small business depend on various factors like business model, location, industry, and scale of operations. Although it’s tough to estimate precisely, Guidant Financial’s 2023 survey reported that the average cost of starting a small business falls between $50K and $1 million .

You must consider the industry, business category, working capital requirements, and other common expenses associated with the business for the accurate estimation of startup costs.

Let’s kickstart this guide by discussing the common startup expenses to consider while starting a new venture.

Common Business Startup Costs to Consider

It is a typical list of expected business startup costs with rough cost estimates you must plan for while starting a new business. Your actual startup costs will entirely depend on your business category and the industry you serve.

Following are some of the most common startup costs to consider:

1. Equipment and tools

It’s no surprise we’re starting the list with equipment and tools. There’s no way a business can operate without the necessary equipment. The equipment costs may range from $10,000 to $120,000 . However, these costs will entirely depend on the business type and equipment requirements.

For instance, starting a food truck would require financing a food truck and expensive kitchen equipment, while starting a small daycare would only require purchasing a few play area equipment.

Here are the average equipment costs for some of the popular business types:

- Restaurant and food trucks: $24,000 to $120,000+

- Small Bakery: $6,000 to $8,000

- Clothing line: $2,000 to $15,000+

- Construction: $10,000 to $50,000

- Law firm: $5,000 to $25,000+

- Barbershop: $1,000 to $2,000

2. Incorporation fees

The first thing you should do is choose a business entity when you plan to form a new business. The most common and preferred business structure types include sole proprietorship, partnership, corporation, and LLC.

The business incorporation or filing fees can range from $50 to $725 in the United States depending on your industry, the state you operate in, and the business structure you choose.

However, the average incorporation fee is $300 in the majority of the states in the US. You may contact your secretary of state’s website to learn more about the filing fees or process for the articles of incorporation or articles of organization.

3. Business licensing and permits

Operating any small business requires specific licenses and permits depending on the industry compliance and regulations. For instance, a trucking company requires a USDOT number, heavy vehicle use tax, and others, while a restaurant may need licenses like food safety and liquor licenses to operate.

Similar to different filing fees for other business structures, the business licensing and permit fees vary depending on the business industry and regulatory compliance. You can expect to spend between $1,000 to $5,000 for your licensing and permitting requirements.

4. Office or retail space

If you’re starting a small business that can be operated from home like a home bakery or an online clothing store, you may not have to worry about office space costs.

But if it’s not the case, paying for an office or a retail space would make up a sizable portion of your fixed expenses, no matter whether you rent or buy the place.

Based on our research, you should spend around $100 to $1200 per employee monthly on your workspace.

However, the actual office space expense will entirely depend on your location and the type of space you’re using.

5. Legal and professional fees

Professional and legal fees may sound like an additional expense while starting up with limited resources, but it’s essential to ensure compliance with regulations and maintain accurate financial records.

You may choose legal assistance for business licensing, EIN registration, and legal paperwork, a business consultant for market research and strategic planning, and an accountant for bookkeeping and tax planning.

You can hire these professional consultants on an hourly basis; their services typically cost around $40 to $150 per hour. You should spend around $2,000 to $10,000 per year on professional and legal fees.

6. Inventory

Retail, wholesale, distribution, and manufacturing—if your small business falls under any of the mentioned categories, you need an inventory to operate your business. Finding the ideal inventory size to carry can be challenging when entering a new marketplace.

You want to attract more and more customers and make sales in your early days. However, you can’t also risk having too much inventory since it can increase spoilage.

Consider allocating 15% to 25% of your budget to inventory, depending on your industry. You will eventually learn more about inventory management once your business starts operating and making sales.

7. Marketing and advertising

Although it’s an optional expense, marketing is something worth investing in. Your marketing expenses may include physical materials like sign boards, banners, hoarding, paid social media advertising and search ads, or money paid to marketing agencies or consultants.

It is suggested to keep your advertising and promotion costs under 10% of your budget. If you’re working on a really tight budget, there’s no need to spend big bucks on marketing or hire fancy consultants or agencies.

With social media being a free marketing platform, over 47% of small business owners run their marketing efforts themselves, and you can do it, too.

8. Website development

A business website is like an online office where customers can contact you, learn more about your offerings, and seek assistance.

When building a website, make sure it looks professional, is easy to navigate, and displays the relevant information about your product and service offerings, as well as the contact information.

You can either develop a business website using website builders like Wix and Squarespace or hire a developer to do it for you.

Creating a website can range between $1,000 to $10,000 when you hire a developer, whereas you can do it on your own with website builders by spending around 40 dollars a month.

9. Business Insurance

Like you have a house, car, and health insurance, you need business insurance to ensure your business remains intact in troublesome and inevitable times, be it a natural disaster or a customer filing a lawsuit against your business.

The level of security and type of business insurance your business will require depends entirely on your business, industry, and the number of employees you have. For instance, a big-scale manufacturing company with over a thousand employees would require much stronger insurance compared to a home bakery.

Some of the must-have business insurance types include:

- General liability insurance—for all online, offline, and home-based businesses.

- Worker’s compensation insurance—for businesses with 1 or more employees.

- Professional liability insurance—for businesses offering consulting services.

You must expect to spend approximately $500 to $1500 annually on business insurance.

10. Payroll

Payroll is undoubtedly one of the major business expenses most businesses incur. However, there’s no denying how crucial it is to hire quality employees to make your business thrive.

Of course, payroll expenses are employee salaries, but there’s more to it. Your payroll expenses may also include:

- Incentive or bonus

- Commissions

- Paid time off

- Overtime pay

- Travel allowance

- Other benefits

Most businesses spend around 20% to 50% of their monthly budget on payroll. It can be more or less for your business depending on your business and the number of employees you have.

11. Office furniture and supplies

Those planning to have a traditional nine-to-five corporate workplace, be ready to spend some severe bucks on office furniture and office supplies.

When you operate from a corporate workspace, you need a desk, chair, telephone extension, computer, computer programs like accounting software, and, of course, a coffee machine or two.

The cost of furniture and supplies depends solely on your employee strength and the size of the office. However, it’s recommended to keep your furniture and supply costs to 10% of your total startup costs.

12. Utilities

No matter whether you plan to rent or purchase a workspace, you are bound to pay utility bills that include electricity, gas, water, internet, and phone bills for your office.

Unlike other fixed costs, it’s hard to estimate utility expenses, but the average cost of utilities for commercial buildings is $2.10 per square foot , according to a report by Iota Communications .

Besides the electricity, internet, and phone bills, the utility expenses may also incur the HVAC unit installation costs. This heating and cooling system will add a few additional thousand dollars to your startup expenses.

13. Business taxes

How much you’d spend on business taxes will depend on your business entity, tax-deductible expenses, and revenue. Since it’s hard to predict your revenue, estimating the exact amount to allocate for tax preparation may feel a bit challenging.

Under US federal law, corporations pay a flat 21% corporate income tax . If you’re a pass-through entity(a legal entity that passes all its income on to the owners), the business income or losses will pass through to your personal taxes.

However, you, as a pass-through entity, can claim a 20% deduction on income before paying taxes.

14. Other expenses

Since you’ve reached this section, you must already have a clear understanding of all the expected startup costs, whether they are one-time or recurring expenses.

Here, we will discuss the other costs most small business owners tend to miss or overlook while estimating the startup costs— research expenses and borrowing costs .

Capital is required for starting a business, and equity financing and debt financing are considered to be the most preferred ways to acquire the initial working capital.

Equity financing, however, does not apply to most small businesses since it requires stock issuance. So, securing a small business loan seems to be the most likely source of debt financing for small business owners.

Research expenses, on the other hand, are the expenses incurred even before you started operating, spent on conducting a careful industry analysis and market research.

When calculating your startup costs, make sure to include these two as well.

Since we have already discussed common business expenses, let’s move on discussing calculating the startup costs.

How to Calculate the Costs of Starting a Business

There are various ways to calculate the cost of starting a business. Still, drafting a business plan remains the best way to estimate startup costs.

The financial forecasting section of your plan provides three to five-year projections of revenue, profit, and expense.

The other resources for estimating startup costs include using Upmetrics’ startup costs worksheet or calculator . These resources will help you estimate the initial investment required and determine how much capital or financing you’ll need.

Know that many of the common business expenses we discussed earlier are recurring, with some of them being one-time expenses.

Be sure to categorize them and calculate the recurring expenses on a monthly, quarterly, and annual basis. In contrast, consider expenses like incorporation fees and equipment financing one-time costs.

Sounds like a lot to digest? Get a business planning software like Upmetrics and calculate startup costs in minutes with AI-powered financial forecasting .

Save hours estimating startup costs with Upmetrics

Estimate costs, forecast financials, and prepare a business plan all in one place

Plans starting from $7/month

Calculating Startup Costs for Your Small Business

Does your business fall under one of these categories? Excellent. We have startup cost guides for all the business categories listed below. Get a cost estimate for starting the business you plan to launch.

How to Reduce Your Business Startup Costs

Starting a business means being prepared to bear some non-negotiable expenses; there’s no other way around. However, sound research and thoughtful planning can help you save on high-ticket purchases—ultimately reducing your startup costs.

For instance, hiring professional business plan writers can be expensive for a business owner on a tight budget to create a business plan, so they can opt for a business planning software like Upmetrics to draft a business plan at a much lesser cost.

It was just an example, here are a few tips to help you reduce your business startup costs.

1. Create a business plan

It doesn’t make sense. Isn’t it another business expense? How will it reduce costs? Some of you must be having this line of questioning in your mind, but let us clear it up for you.

Brainstorming and listing all the important business costs, and estimating your total startup costs is challenging. Missing out on some critical expenses tends to happen. However, creating a comprehensive business plan makes things easier.

An AI-powered tool like Upmetrics makes sure you don’t miss out on any critical information and helps you properly estimate your startup costs.

Remember, accurate estimation of startup costs is your first step to reducing them.

2. Start small

You don’t need everything or a perfect business setup when you are not making any sales, forget about the business profits. Start small with limited resources and grow your business as it grows financially.

For instance, instead of having a big fancy office for your startup, start with a remote team or a co-working space until you raise capital or gather the necessary resources.

One way of doing that would be listing all the major high-ticket expenses and researching competitive alternatives for them.

3. Lease instead of purchasing

Of course, having your own office or a retail space feels good, but not at the cost of more than 70% of your budget for starting a business. Prefer leasing the place instead of purchasing.

It will leave you with enough working capital or cash to efficiently manage your business operations and handle the other non-negotiable costs.

Furthermore, there’s no guarantee your storefront will find success at the very first location; you may have to relocate if things don’t work out. The further process will be more straightforward with leasing, whereas the same won’t be the case when you own the place.

4. Buy used equipment, tools, or furniture

Since you’re looking for ways to reduce costs and save money, there’s no way for you to have brand-new business equipment, tools, and furniture. You can look for used equipment, tools, and furniture on online selling sites like eBay and Etsy.

Be sure to thoroughly check the equipment before purchasing to avoid any future restoration or repair costs.

5. Funding and business credit card

Now that you have a long list of capital expenditures, you will need financing or funding to manage all these costs. You can’t simply do it all on your own, can you?

It won’t reduce the startup costs but will help you get resources to manage them. Your funding options include debt and equity financing. You may apply for a business loan, reach out to angel investors, or apply for business grants to secure the initial investment for your business.

With limited debt financing options, it could be tough to get through. Applying for a business credit card can be a more accessible alternative to a business loan. You can easily qualify for it while also gaining a higher credit limit than your personal credit card.

Make sure you’re not totally relying on it or taking out more than you can repay. This can negatively impact your credit score, making it harder for you to secure business loans in the future.

And, the final section leads us to our conclusion!

And there you have it. We hope now you have a better understanding of startup cost calculation. What’s next? It’s time to estimate the actual costs of starting a business, be it a bakery, restaurant, or hot shot trucking, and start budgeting.

Get your hands on the modern and AI-powered business planning solution, Upmetrics—and create precise startup cost projections in minutes, just like that.

Frequently Asked Questions

What is the average cost to start a small business.

It is a question with a broad scope for the answer since you can start a business with an initial investment of $100, $1,000, and up to a million dollars or even more. However, the startup and first-year operational expenses fall somewhere between $30,000 to $40,000.

How do you calculate startup costs?

The most easy-to-use method to calculate startup costs is to create a business plan. It’s easier than ever to calculate your startup costs using a tool like Upmetrics.

Simply head to the financial forecasting feature, get AI suggestions to list your startup and organizational costs, add remaining costs, and let it make the automated calculations for you.

What are business startup costs?

Business startup costs are expenses incurred when starting a new business. These can be your marketing costs, payroll expenses, or any other costs involved. These can either be recurring or one-time costs.

For instance, your advertising costs are recurring, whereas incorporation fees are a one-time expense. Although there can be some common startup expenses, the value or costs for them may not be the same for two different businesses.

What is the difference between startup costs and operational expenses?

Startup costs are the expenses small businesses incur when starting a new business, whereas operational expenses are those incurred during normal day-to-day business operations.

For instance, equipment financing can be considered a startup cost, whereas inventory or marketing costs can be your operational expenses.

What are the examples of start-up costs?

The following can be considered as a few examples of startup costs:

- Equipment costs

- Inventory expenses

- Business licenses and permits

- Marketing and advertising expenses

- Payroll expenses

- And others.

About the Author

Vinay Kevadiya

Vinay Kevadiya is the founder and CEO of Upmetrics, the #1 business planning software. His ultimate goal with Upmetrics is to revolutionize how entrepreneurs create, manage, and execute their business plans. He enjoys sharing his insights on business planning and other relevant topics through his articles and blog posts. Read more

Popular Templates

- 212 best farm names

Business Startup Costs: The Ultimate Guide (2024)

September 14, 2022

More people are thinking about starting a business than ever before. In fact, nearly 5.4 million businesses were started in 2021, so how much does it cost to start a business?

The answer is different for every business, but many small business owners spend less than $5,000 on startup costs. We’ve talked to a ton of small business owners about how to start a business and we’re going to share what we’ve learned from them.

We’ll break down the business startup costs into upfront costs, one-time costs, and recurring expenses for each type of business. Let’s look at how we classified each type of cost.

Typical business startup costs

We’ve broken down the startup costs into fixed costs and variable costs. We’ll discuss each below.

Fixed Costs

Fixed costs are business costs that do not change as sales increase. The following items are common startup costs that are fixed costs:

- Office Space (Recurring) : This includes both rent and utilities. Most small business owners start with home office space and deduct the percentage of space from their taxes as a small business cost.

- Legal Fees (Upfront) : These are recurring costs that you have to pay to run a business legally, which usually include business formation, business licensing, and other professional fees to comply with regulations.

- Software Costs (Upfront and Ongoing) : These business startup costs include payment processors, websites, CRM, accounting software, and more. You can find some that would be one-time costs, but most are recurring charges.

- Equipment Costs (Upfront) : This includes machinery, vehicles, and other costs to meet the mission critical aspects of the business.

- Insurance Costs (Upfront and Ongoing) : If your business requires insurance, make sure to keep it continuous. If it doesn’t, you may want to consider it anyway.

As time goes on, some businesses may find that a few fixed costs only remain fixed up to a certain volume. After that, they might see a drastic increase to add more volume and then it will become a fixed cost again. Adding a second service truck is one of the typical costs that work like this.

The other type of small business startup costs are variable costs, which we’ll discuss next.

Variable Costs

There are business costs that vary based on the volume the business does. These startup costs are called variable costs. Common startup costs in this category include:

- Shipping Costs (Variable Expense): Shipping costs are included in variable costs because you only pay for them if you order materials or ship products to a customer.

- Marketing Costs (Ongoing Costs) : The Small Business Administration suggests spending approximately 8% of desired revenue on marketing. The advertising costs seem to be one of the defining factors as to whether a business succeeds long term.

- Material Costs (Varies): The time and materials that go into offering a product or service will affect your revenue.

- Supplies and Packaging Costs: Items you use for running the business must be considered early in the game. This startup cost may include computers, cleaning supplies, business cards, packaging for products, and other items that help your business.

- Wages: Most wages will vary with the amount of business you have. You have to pay employees for their time regardless, but you’ll schedule less hours when you have less business.

- Unexpected Costs: You should always leave a little wiggle room for unforeseen events. I’d suggest at least a 10% slush fund for unexpected startup costs and operating costs.

- Other Costs: This is a catch all for spending you can forecast, but are not sure which cost categories to include them in.

Now that you know the costs we’ll be analyzing, let’s look at the average start-up costs for businesses.

How much does it cost to start a business?

I broke down the average costs of starting a business into four different classifications:

- Low Cost: start a business with a shoestring budget and figure out the ongoing expenses along the way.

- Average Cost: start a business with the money to cover the first year of organizational expenses.

- High Cost: business owners interested in the startup costs to guarantee they stay in business for five years.

- Franchise: business owners who want to buy a franchise.

H ow much does it cost to start a small business?

According to the Small Business Administration , one out of every four businesses start with less than $5,000, and over half of small businesses have startup costs of under $25,000. But the median is just over $24,000, and the weighted average would be between $72,000 and $276,000.

How much does it cost to start an online business?

Online businesses are normally some of the lowest in cost to start. You can start most of them for under $1,000 without any educational expenses.They require a computer, internet, business licensing, and some software. Businesses in this category might include:

- E-commerce stores

- Graphic design

- YouTube content creators

- Virtual assistants

- Marketing agencies

- Software developers

When people ask “how much does it cost to start a business online?” search results will normally provide answers about ecommerce stores. We’ll discuss those next.

How much does it cost to start a t-shirt business?

T-shirt companies are fairly easy to start. For example, you can start with a $30 Shopify, some design software, and a print-on-demand provider. If you really want to make money on it, you have to get good at SEO and marketing, which will increase your costs.

Check out our interview with the owner of Urbanity to learn more:

How much does it cost to start a landscaping business?

We’ve interviewed multiple business owners who have started landscaping companies. It’s one of the easiest types of businesses to start. You can even start a business for as little as $300.

The table below shows the breakdown of the business expenses a small business owner should expect when starting a landscaping business.

Check out our most recent YouTube video with a small business owner who started Plan-It Vision with only $300:

How much does it cost to start an eyelash business?

An eyelash business is one of the most commonly searched small businesses. To get started, you may need to go to cosmetology school. Many states require school , but some do not. If you haven’t already gone to cosmetology school, starting a small business will cost more than $20,000.

Most eyelash small businesses run as a combination of brick and mortar business and traveling to their client’s location. We’ve provided you with estimates of how much to expect startup expenses to cost based on the assumption you haven’t already gone to cosmetology school.

Subtract $20,000 from any of these numbers if you have already gone to school. I included legal fees and insurance costs in the low cost startup funding because you don’t want your new business to be slapped with a major fine for operating illegally.

H ow much does it cost to start a cleaning business?

Cleaning businesses are great for startups. You can even start your own business for as low as $300 if you just buy the cleaning supplies. Almost all the costs are variable expenses.

However, you should get the business license and the insurance as soon as possible if you decide to get them after you get started. The ultra low cost way assumes you rent any equipment after booking a job that needs equipment.

Check out our interview with Christopher Mondragon below or sign up for our cleaning business course that covers pricing, business credit, Chris’s marketing scripts, and automation templates:

H ow much does it cost to start a jewelry business?

Many people enjoy doing arts and crafts like making jewelry. You can start a business out of this fun hobby for less than $100 and build your business as you grow. Premade findings are typically more economical, but creativity is often the joy of this type of business owner, so you might want to make your own pieces.

If you are trying to make gold and silver jewelry, you can expect the cost to be much higher. A troy ounce of gold varies based on market conditions, but has been between $1,000 and $2,000 over the last 15 years. It will only make about five to 16 rings, and you still have to have the tools to melt it.

H ow much does it cost to start a storage unit business?

The answer to this isn’t particularly clear cut. If you are wanting to buy storage units that are selling people’s stuff to recoup the costs, you should plan to bring at least $500 to the auction. Then, hope you find a gem and recoup your investment.

If you are talking about building storage units and renting them out, you’ll need to:

- Buy land (acres range from $1,600 to millions, with an average of $12K over the continental U.S.

- Build storage space for $25 to $45 per square foot.

- Run the property for $2 to $4 per square foot of operating expenses.

Check out Love to Know’s blog for more detailed information.

H ow much does it cost to start a food truck business?

You might be able to start a food truck for as low as $10K, but I’d expect to spend more like $20K to get started. You’ll probably need around $156K to make it through the first year and around $670,000 to make it through the first five years.

If you figure out a winning recipe, it can lead to a million dollar business, though.

Check out our video below to find out how Saied Samaiel makes more than $600K per year with his food truck:

H ow much does it cost to start a dropshipping business?

The cost of starting a dropshipping business can vary dramatically because you may have to design a product and purchase inventory. If you are using print-on-demand with dropshipping, it is often fairly cheap.

Expect to spend at least $80 getting started, but if you are sourcing materials and manufacturing, it could be more than $30,000 to make your products. Through the course of a year, you might spend up to $180,000.

Check out our interview with Casey about how he created and dropships Shed Defender:

How much does it cost to start a candle business?

You can start a candle business for less than $200. The materials and a Shopify account are all you need to get started. The numbers below are from our interview with Jazmin who started the company in 2020 and is making more than $150K per year.

Check out our interview below:

How much does it cost to start a towing business?

A towing business can be started for under $10,000. It has special licensing requirements that raise the cost and most people don’t own a tow truck. You can typically make around $100,000 per truck––if you do it right.

Check out our interview with a towing company business owner to learn more:

How much does it cost to start a painting business?

You should expect to spend $5,000+ to start a painting business because you’ll need a contractor’s license in most states to start a painting business. Contractors’ licenses have financial requirements that make them more expensive. States may require:

- Background checks

- Surety bonds

- Multiple years of experience

- Licensing exams

How much does it cost to start a detailing business?

You can start a mobile detailing business for as little as $300, but you should probably expect the annual costs to approach $53K to really grow. That includes licensing, insurance, a vehicle, upgrading your website, and spending $2K per month on marketing. Check out the breakdown below:

H ow much does it cost to start a trucking business?

Trucking businesses will normally cost around $10,000 to start in-state or $20,000 for interstate operations, but you can expect to spend $100K to $250K per year to run a trucking business.

Make sure the truck you buy is less than 10 years old because most companies require a newer vehicle when hiring you to haul their products.

Check out our interview with Mikael Sant. He averages $75K a month running Sant Lines LLC:

How much does it cost to start a taxi business?

Taxis are a dying business in most places. The business structure is antiquated. You have to register with your city’s transit authority, hire dispatch, and buy a bunch of taxis. We’ve provided an estimate for starting with five taxis running 24 hours a day.

If you already have a car, you can start driving for Uber or Lyft. All you have to do is get a business license, pass a background check, and have a current car inspection. You can run a successful business fairly easily. The startup costs for this kind of business is around $300.

How much does it cost to start a laundromat business?

Starting a laundromat can cost nearly $1 million to get started and about twice that over the first five years. The building, equipment, and utilities are most of the cost.

Check out our interview with Justin Pike of Ferndale Laundry:

How much does it cost to start a photography business?

You can start a photography business for as little as $500, which includes the price of the camera, a website, online photo gallery, and Adobe Photography Suite.

If you want to upgrade to a higher end business with better equipment and a good marketing budget, you should expect to spend around $45,000 the first year. It’s even higher if you want a good studio, however.

Check out our interview with a couple that started their own photography company:

How much does it cost to start a handyman business?

Most places require handymen to be licensed contractors, so you can get started for as low as $2,750 without risking violating laws, but you can expect to spend around $40,000 during the first year if you really want to do it right.

Check out our interview with Caleb to find out how he makes $125K per truck:

How much does it cost to start a soap business?

Soap businesses are fairly inexpensive to start. You could start making soap for under $100 and build from there. Successful business owners will spend nearly $70K in their first year of business to make around $200K. Check out the TruIC blog for the steps to start a soap business.

Small Business Owners Funding Resources

Now that you know the costs associated with starting a business, check out some of our resources for finding funding.

- Business Credit : Check out our preferred lending partners to get small business loans or a business credit card.

- Business Hub : Learn how to start a business entity, get insurance, and estimate a company’s revenue in our hub .

- Small Business Administration : Get information from the SBA on grants, loans, and local business resources.

- Evaluate Funding Options : Whether you are using a personal savings account or looking for alternative funding methods, check out our funding blog .

What Type of Business Will You Start?

We’ve covered the typical expenses associated with the costs of starting a business. Now it’s time to examine your personal expenses and cash flow to cover the filing fee and other business costs.

Make sure to follow our YouTube channel and blog for more great information on how to start a business.

Which business do you think is a worthwhile investment? How will you manage the financial implications of starting a new business?

80% of businesses fail... Learn how not to.

Learn from business failures and successes in 5 min or less. The stories, frameworks, and tactics that will make you a 10x better founder.

Brandon Boushy

Related articles

How to Hire Employees (in 7 Simple Steps)

- How to prepare to hire people

- How to create a job description

- How to screen applicants

- How to conduct an interview (and what not to do)

- How to provide a job offer

- How to onboard employees

- How to improve your employee retention

Step 1. How to prepare for the hiring process

- Establish what positions you need to hire.

- Get an employer identification number (if you don't already have one).

- Create an employee handbook.

- Establish employee benefits.

- Implement a payroll system.

- Purchase workers’ compensation insurance.

- Get workplace posters.

Establish what positions you need to hire

- Should you hire hourly vs salary employees?

- Can you hire independent contractors or freelancers?

- Is it reasonable to expect one person to have all the specialized skills you need?

- What software are you consistently using?

- What is your company culture like? What type of person will fit well in it?

- Does the employee need to be on-premises, or can you hire remote employees?

Each industry has different challenges

- Logistical

Get an employer identification number (EIN)

Create an employee handbook

What to include in a handbook.

- Mission statement, company culture, and values

- Information required by an HR professional and legal professional

- Paid time off, benefits, and non-discrimination policies

- Obligations and rights of employees

- The company's expectations of employees

- Commitments the company makes to employees

- Link to the full company policies (I once had to review thousands of pages for an employer regarding complex legal requirements. Major corporations and franchises have a policy for almost everything. If you have contacts within major corporations, ask their HR and legal departments how they handle it.)

Establish employee benefits

- Paid time off

- Remote work options

- Paid leave to care for kids and aging parents

- Great insurance and 20 days of PTO per year

- No benefits

Implement a payroll system

Purchase workers’ compensation insurance, get workplace posters.

Step 2. How to create a job description

- Company Information: Tell people about your company. It helps you find the right candidates.

- Job Title: Include the official title the new employee will have.

- Salary: Many job boards will autofill this information if you don't include it.

- Job Description : Be clear about the activities the new employee will perform.

- Essential Abilities : What skills and software should qualified candidates know before starting?

- Preferred Qualifications: Give examples of experiences that an ideal candidate would have but aren't essential candidate's skills.

- Metrics : How you will measure the performance of the new hire.

- Why Choose You : The right candidate will make your company better than it currently is. Work to convince them that what they get from the deal is worth it; otherwise, you get deadbeats who just want to do a job and leave when they clock out.

- Locations: Where is the job located? If you want job seekers from a specific location, include it in the description.

- Be transparent. You don't want to waste your time or anyone else's. Build it based on search engine optimization best practices.

- Write your job descriptions using Search Engine Optimization best practices .

- When comparing employee and business desires, employees want to work from home at a rate three times higher than business owners want to allow. If you can, allow remote work. Jessica specifically said:

Step 3. How to find employees to hire

- New hire referral programs

- Social media

Try referral programs

- Four times more likely to be offered the job.

- Five percent more likely to accept the job offer.

- Nearly twice as likely to stay for over four years.

Post on social media

Don't forget to post on all the standard job boards

Work with recruiters.

- Performing a background check

- Reporting to each state's labor department

- Withholding taxes

- Workers’ compensation

- Paying the Social Security Administration

Step 4. How to screen applicants

Step 5. How to conduct an interview (and what not to do)

Starting the interview

- Good questions to ask

- Illegal questions to ask

- Arrive early : 15–30 minutes early likely means they believe if you're not early, you are late.

- Arrive on time : 15 minutes early to two minutes late means they believe in being on time.

- Arrive late : If you are waiting on them, they likely have a diva mindset. They might view their time as more important than yours. I'd thank them for coming out, but I don't appreciate the "fashionably late" mentality.

Ask good questions

- Our weekends.

- Where the industry is going.

- Our interests.

- Where the company is going.

- How we can create a mutually beneficial scenario.

Ask open-ended questions, but make them meaningful

Congratulations you get to deal with the labor board.

- Marital status

- Sexual orientation

- Transportation (except for a reliable way to get to work)

- Health conditions

Step 6. How to hire the right employees

- Title : You should have this match the title on the job description.

- Start Date : The first day of work is when the employee starts the job.

- Pay: Specify the amount and payment frequency. Make sure it is over minimum wage.

- Type of employment : Specify whether the offer is hourly, full-time, part-time, contract and duration, or for an independent contractor.

- Benefits: List any additional compensation like PTO, health care, etc.

- Intellectual property (IP) guidelines : Specify how intellectual property is used. Who owns it, how can previous IP can be used in the company services? These are mostly in tech-related concepts.

- Non-compete agreement (if applicable): Use these sparingly. Unless the employee has enough information to destroy your company by selling it to a competitor, you probably don't need these. Here's a non-compete template .

- Non-disclosure agreement (if applicable): Use a Form to prevent sharing insider information. Disclosing this information could be a violation of security laws. It also can harm the company. These are fairly standard practice.

Step 7. What to do after hiring employees

- W-4 form : Employee fills this out to specify how to withhold taxes. A W-9 is for tax purposes for independent contractors. These are necessary to calculate payroll taxes and income tax and send employment taxes to the federal government.

- E-Verify system : Verify employee eligibility in the U.S. without any paper.

- State tax withholding form: If your state has an income tax , you'll need to provide employees your state's tax agency form.

- Direct deposit form : You'll need to provide a direct deposit form to know how to pay an employee.

- E-Verify system : This is not a form but a way to verify employee eligibility in the U.S.

Bonus Step: How to improve your employee retention

- Improve your benefits package.

- Recruit staff.

- Add transparency to the steps of the hiring process.

- Perform exit surveys.

Friendly Reminder About Hiring

Frequently asked questions about hiring, how to hire 1099 employees.

- Prepare to hire people. (You won’t need to do tax deductions.)

- Create a job description.

- Find applicants.

- Screen job hunters.

- Interview potential candidates.

- Offer the best candidate a job.

- Onboard employee. (You’ll use a W-9 instead of a W-4.)

How to hire your first employees

- Establish what you need to hire employees to do.

- Get an EIN if you don’t already have one.

- Establish a benefits package.

- Get a payroll provider.

- Purchase workers’ compensation.

- Follow the rest of our guide.

How to hire employees for a startup

- Prepare to hire people. (Consult a lawyer about alternative forms of payment.)

- Create a job description. (Make sure to include information about the alternative payments.)

- Find applicants with diverse backgrounds.

- Interview potential candidates and make sure they understand the pay. Have a lawyer advise you regarding communications if you plan to offer pay in stock (because you can’t ask about their finances).

- Onboard the employee.

How to hire diverse employees

- Go to college job fairs.

- Use TikTok to find employees.

- Ask minority influencers to help you find candidates.

How to hire part-time employees

- People spend time getting ready for work, going to the location, and going home. Let them choose how they want to get their hours. They might prefer six 4-hour days or three 8-hour days, and with a little creativity, you can work with that either way.

- Make sure to keep their shifts consistent. Unless you are paying them $5K per month for part time work, they need a second job.

- The quality of employees is equal to the quality of treatment. They know you are hiring part time to avoid benefits. Be nice. Seriously. Low-paying jobs tend to be customer-facing. That means they deal with rude people all day long. Treat them well. Otherwise, they’ll run away like an ostrich.

How to hire temporary employees

How to hire good employees.

- Industry-leading pay : Just disclosing your pay for each position improves your success. In Colorado , job postings dropped by 8.2% while the participation rate increased by 1.5%. If you really want to lead your industry in pay, the average 1-bedroom is $1,326 per month and people have to make three times that ($3,978 or $24.86 per hour). I know that sounds crazy, but at those wages, you’ll be getting much better candidates. Even $2 over the median pay will normally lead to better employees.

- Generous time off : People have lives. They have stuff come up. We all know we don’t own our employees, but sometimes we get so focused on our own problems we forget to be compassionate about others. If you fall into this category, it’s your responsibility to train yourself to be more compassionate. It’s hard. I struggle with it every day, but we have to try to be good to those around us. Don’t make them beg for time off.

- Remote work when possible : Many positions don’t require people to be in the same space. If they can work from home, let them. You just need systems that make it easy to do so. The additional costs should be made up by better efficiency.

- Don’t skimp on benefits : Let people choose the benefits that are right for them. With medical insurance, don’t offer minimum wage employees plans with $10K deductibles. They are unusable.

How to hire international employees

How to hire remote employees

What part of the hiring process do you find most challenging.

How to Start an $80M/Year Construction Company

Have you ever wondered how to start a construction company but hesitated because you don’t have business experience or a previous business failed?

Marc Rousso knows what it’s like. His real estate business failed during the 2009 recession and left him owing the bank $2.5 million after liquidating everything. But within seven years, he grew JayMarc Homes into a construction company that makes $80 million annually, and he’s already paid off all the debt from his prior business.

We combine his insight with industry research to share everything you need to know to get into contracting (even if you have no money to invest).

How to start a construction company

We’ll cover each of the following topics. Read from start to finish or click any link to jump to the step you need help navigating right now.

- Learn about the construction industry.

- Decide how to start your own construction company.

- Write a construction company business plan.

- Choose a construction company name.

- Learn how to open a construction company.

- Set up your construction business finances.

- Establish safety protocols.

- Get equipment and supplies.

- Hire employees.

- Consider how to grow a construction business.

- Document your own business processes.

Step 1. Learn about the construction industry

- How much do construction companies make? According to IBISWorld Report 23 , the average company makes around $696K in revenue, but JayMarc Homes makes approximately $ 80 million per year.

- How much do construction company owners make? The profit margin for construction work is 3.4% before taxes, which means that the average small business owner makes approximately $23,664 in profit plus any salary they take from contracting.

- How many construction companies are in the U.S.? There are over 3.8 million construction companies in the United States, with an average of 2.63 employees.

- What is the most profitable construction niche? Land developers have the most profitable niche with an average pre-tax margin of 17%, followed by remodeling and excavation at 7.2%. Check out the table below for other segments' profit margins.

- How to start a construction company with no experience: Starting a construction company with no experience may be a challenge. The average home requires 22 subcontractors to build a house, so you’ll need lots of basic knowledge and soft skills to manage a contracting company without experience.

- How to start a construction company with no money: You can always book jobs and then rent the equipment needed to complete the job. Reinvest the profits into the business to reduce your costs over time.

- How much does it cost to start a construction company? Marc started his contracting business with around $15K. But other construction companies have started with much less. In fact, the VP Homes CEO entered the construction industry with $80 of tools and is now making $1.2 million per year.

- What skills do I need to own a construction business? You must understand building materials, each subcontracting field, and safety requirements. You might also need certifications depending on your niche.

Pro Tip: Subscribe to construction industry publications and local industry publications to keep updated on trends in your industry. Check out some of the popular industry organizations .

Case Study: JayMarc Homes

JayMarc Homes focuses on building custom homes. It was their second construction business after a company closure. They currently make about $80 million in revenue annually with a 10% profit margin, but Marc warned:

[su_quote] In any 10 years, you’ll probably have a 5% year, 10% year, 17% year, and 27% year. It all depends on the economy. [/su_quote]

Check out our interview with Marc below:

Next, you'll want to decide how to start a construction company.

Step 2. Decide how to start your own construction company

People who want to start contracting and construction companies have two main options:

- General contracting

- Subcontracting

Find out more about how to start a construction company as each of these types of contractors.

What is a general contractor?

A general contractor is the primary contact between a property owner and the construction project. Their role includes:

- Creating and managing the construction budget

- Hiring, managing, and paying subcontractors

- Working with the architect to implement and revise design specifications

- Maintaining project schedule and timing

- Scheduling inspections

- Making payments to vendors and specialty contractors

- Collecting and tracking lien waivers

- Managing post-construction issues with warranties and payments

How to start a general contracting business

Starting a general contracting business will normally require some or all of the following:

- time in the field

- education in the field

- passing an exam

- background checks

- security bonds

Find your state’s licensing requirements for how to start a small construction business as a general contractor .

What is a subcontractor?

Subcontracting businesses are normally construction services focused on specific trades like HVAC, plumbing, electrical, roofing, carpentry, or other fields with specialized construction equipment or tools. The bigger specialty contractors may also compete as general contractors.

For instance, when I worked at Honeywell, we would compete for both HVAC and general construction work when bidding on government contracts for new federal, state, and local projects.

There are plenty of business ideas in the construction industry to consider. Check out our courses here . The cleaning business, pressure washing, and flooring courses will all guide you toward success in the construction industry.

Once you've decided whether you want to be a general contractor or a subcontractor, you'll want a business plan to guide you through the process of how to start a construction company and succeed.

Step 3. Write a construction company business plan

You’ll need a construction business plan to be successful.

A solid business plan includes:

- Contracting insurance information

- Competitive analysis

- Construction equipment list

- Financial projections

- Location details

- Licenses and permits

- Marketing plan

- Money-making strategies

Pro Tip: Our business plan guide walks you through writing a business plan and includes a free template for getting your business plan in order.

We can't discuss how to start a construction company without discussing choosing a business name…

Step 4. Choose a construction company name

Choosing a name can be exciting! Consider the following tips when choosing a construction business name:

- Add your details: JayMarc Homes communicates what field the business entity is in, though it could also be a real estate business.

- Easy and clear: JayMarc Homes might be changed to JayMark by potential customers. When it comes to getting a website, I would buy both domains, just in case.

- Location: Construction companies can rank higher in search results with a business name that includes the city name.

- Branding: A new construction company will have other branding elements. How will they tie in with your new business name?

Pro Tip: Try out our construction business name generator . Find a name that ensures your business’s future success and click on it to buy the domain.

Next, we’ll discuss how to start a contracting business legally.

Step 5. How to open a construction company

After writing a business plan, you’ll need to establish a legal structure. While some businesses can get away without creating a business entity, it is legally necessary for a local construction company.

Building companies should consult with a business lawyer to make sure they comply with all the laws that govern small construction companies in their area.

Your new construction builder will likely need assorted licenses, permits, insurance, and tax forms. Find out what you’ll need from the Small Business Administration (SBA) and Municode Library .

Business structure for construction companies

Construction companies need to create a separate legal entity to keep company property and personal assets separate. Most construction companies will form one of the following structures through their state’s Secretary of State website:

- S-Corporation: Best for high-earning companies that want to lower business owner taxes. A limited number of stockholders, provides personal liability protection, requires business owners to receive a salary (and optional dividends), no double taxation.

- C-Corporation: Best for companies trying to change the world. Unlimited stockholders, provides personal liability protection, high compliance costs, and double taxation. Business owners can earn money through multiple income streams with different tax codes.

- Limited Liability Company: Best for companies that want to separate business entities from personal assets. Provides limited liability, pass-through income, and no double taxation.

Pro Tip: To learn more about business structures, check out our blog on 11 structure options .

You’ll also want to get your business licensed. Some states let you do it all at once. Don’t forget to grab an employer identification number (sometimes called a federal tax ID) from the IRS . It’s used for payroll and business taxes when starting a contracting business.

What licenses are needed to start a construction business?

A successful construction business will need different business licenses depending on your location and business plan. There are main categories of business licenses for a contractor business: general contractor’s license or subcontractor license. Check with local industry associations and the state and local government for more information.

Next, you'll need to thing about finances as you learn how to start a construction company.

Step 6. Set up your construction business finances

Financial management is an essential part of how to start your own construction business. Once you arrive at this step, you should already know your budget, but let’s look at how to:

- Get a business bank account

- Get small business insurance.

- Secure funding

- Create a pricing structure

Business bank account

To run a successful business, you need to open a business bank account because you need to separate your business and personal finances and assets. Business bank accounts can be either online or from brick-and-mortar (legacy) banks and credit unions.

Online banks tend to have better offers, but they might not have as broad a range of business credit card accounts and service offerings as the legacy banking system. If credit accounts or making cash deposits are important to you, go with the legacy banks. Learn more from our business bank account guide .

Get business insurance

You’ll want to get business insurance, including:

- General liability insurance: Covers against customer injuries

- Property insurance: Protects the business owner from expenses due to property damage

- Workers compensation insurance: Pays employees for lost wages and medical bills when they get hurt