What is Cost Assignment?

Share This...

Cost assignment.

Cost assignment is the process of associating costs with cost objects, such as products, services, departments, or projects. It encompasses the identification, measurement, and allocation of both direct and indirect costs to ensure a comprehensive understanding of the resources consumed by various cost objects within an organization. Cost assignment is a crucial aspect of cost accounting and management accounting, as it helps organizations make informed decisions about pricing, resource allocation, budgeting, and performance evaluation.

There are two main components of cost assignment:

- Direct cost assignment: Direct costs are those costs that can be specifically traced or identified with a particular cost object. Examples of direct costs include direct materials, such as raw materials used in manufacturing a product, and direct labor, such as the wages paid to workers directly involved in producing a product or providing a service. Direct cost assignment involves linking these costs directly to the relevant cost objects, typically through invoices, timesheets, or other documentation.

- Indirect cost assignment (Cost allocation): Indirect costs, also known as overhead or shared costs, are those costs that cannot be directly traced to a specific cost object or are not economically feasible to trace directly. Examples of indirect costs include rent, utilities, depreciation, insurance, and administrative expenses. Since indirect costs cannot be assigned directly to cost objects, organizations use various cost allocation methods to distribute these costs in a systematic and rational manner. Some common cost allocation methods include direct allocation, step-down allocation, reciprocal allocation, and activity-based costing (ABC).

In summary, cost assignment is the process of associating both direct and indirect costs with cost objects, such as products, services, departments, or projects. It plays a critical role in cost accounting and management accounting by providing organizations with the necessary information to make informed decisions about pricing, resource allocation, budgeting, and performance evaluation.

Example of Cost Assignment

Let’s consider an example of cost assignment at a bakery called “BreadHeaven” that produces two types of bread: white bread and whole wheat bread.

BreadHeaven incurs various direct and indirect costs to produce the bread. Here’s how the company would assign these costs to the two types of bread:

- Direct cost assignment:

Direct costs can be specifically traced to each type of bread. In this case, the direct costs include:

- Direct materials: BreadHeaven purchases flour, yeast, salt, and other ingredients required to make the bread. The cost of these ingredients can be directly traced to each type of bread.

- Direct labor: BreadHeaven employs bakers who are directly involved in making the bread. The wages paid to these bakers can be directly traced to each type of bread based on the time spent working on each bread type.

For example, if BreadHeaven spent $2,000 on direct materials and $1,500 on direct labor for white bread, and $3,000 on direct materials and $2,500 on direct labor for whole wheat bread, these costs would be directly assigned to each bread type.

- Indirect cost assignment (Cost allocation):

Indirect costs, such as rent, utilities, equipment maintenance, and administrative expenses, cannot be directly traced to each type of bread. BreadHeaven uses a cost allocation method to assign these costs to the two types of bread.

Suppose the total indirect costs for the month are $6,000. BreadHeaven decides to use the number of loaves produced as the allocation base , as it believes that indirect costs are driven by the production volume. During the month, the bakery produces 3,000 loaves of white bread and 2,000 loaves of whole wheat bread, totaling 5,000 loaves.

The allocation rate per loaf is:

Allocation Rate = Total Indirect Costs / Total Loaves Allocation Rate = $6,000 / 5,000 loaves = $1.20 per loaf

BreadHeaven allocates the indirect costs to each type of bread using the allocation rate and the number of loaves produced:

- White bread: 3,000 loaves × $1.20 per loaf = $3,600

- Whole wheat bread: 2,000 loaves × $1.20 per loaf = $2,400

After completing the cost assignment, BreadHeaven can determine the total costs for each type of bread:

- White bread: $2,000 (direct materials) + $1,500 (direct labor) + $3,600 (indirect costs) = $7,100

- Whole wheat bread: $3,000 (direct materials) + $2,500 (direct labor) + $2,400 (indirect costs) = $7,900

By assigning both direct and indirect costs to each type of bread, BreadHeaven gains a better understanding of the full cost of producing each bread type, which can inform pricing decisions, resource allocation, and performance evaluation.

Other Posts You'll Like...

Understanding and Using Gross Profit Margin to Analyze Profitability

How to Use Profitability Ratios to Analyze Financial Statements

Basics of Using Performance Metrics to Analyze Financial Statements

Basics of Using Financial Statement Ratios to Analyze Financial Statements

TCP CPA Practice Questions Explained: Estimated Tax Payments

TCP CPA Practice Questions Explained: Non-Cash Property Donations

Helpful links.

- Learn to Study "Strategically"

- How to Pass a Failed CPA Exam

- Samples of SFCPA Study Tools

- SuperfastCPA Podcast

When More Study Time Isn’t the Answer: How Thomas Passed His CPA Exams

How Ekta Passed Her CPA 6 Months Faster Than She Planned

2024 CPA Exams F.A.Q.s Answered

How Jackie Got Re-Motivated by Simplifying Her CPA Study

The Study Tweaks That Turned Kevin’s CPA Journey Around

Helicopter Pilot to CPA: How Chase Passed His CPA Exams

Want to pass as fast as possible, ( and avoid failing sections ), watch one of our free "study hacks" trainings for a free walkthrough of the superfastcpa study methods that have helped so many candidates pass their sections faster and avoid failing scores....

Make Your Study Process Easier and more effective with SuperfastCPA

Take Your CPA Exams with Confidence

- Free "Study Hacks" Training

- SuperfastCPA PRO Course

- SuperfastCPA Review Notes

- SuperfastCPA Audio Notes

- SuperfastCPA Quizzes

Get Started

- Free "Study Hacks Training"

- Read Reviews of SuperfastCPA

- Busy Candidate's Guide to Passing

- Subscribe to the Podcast

- Purchase Now

- Nate's Story

- Interviews with SFCPA Customers

- Our Study Methods

- SuperfastCPA Reviews

- CPA Score Release Dates

- The "Best" CPA Review Course

- Do You Really Need the CPA License?

- 7 Habits of Successful Candidates

- "Deep Work" & CPA Study

Module 5: Job Order Costing

Introduction to accumulating and assigning costs, what you will learn to do: assign costs to jobs.

Financial and managerial accountants record costs of production in an account called Work in Process. The total of these direct materials, direct labor, and factory overhead costs equal the cost of producing the item.

In order to understand the accounting process, here is a quick review of how financial accountants record transactions:

Let’s take as simple an example as possible. Jackie Ma has decided to make high-end custom skateboards. She starts her business on July 1 by filing the proper forms with the state and then opening a checking account in the name of her new business, MaBoards. She transfers $150,000 from her retirement account into the business account and records it in a journal as follows:

For purposes of this ongoing example, we’ll ignore pennies and dollar signs, and we’ll also ignore selling, general, and administrative costs.

After Jackie writes the journal entry, she posts it to a ledger that currently has only two accounts: Checking Account, and Owner’s Capital.

Debits are entries on the left side of the account, and credits are entries on the right side.

Here is a quick review of debits and credits:

You can view the transcript for “Colin Dodds – Debit Credit Theory (Accounting Rap Song)” here (opens in new window) .

Also, this system of debits and credits is based on the following accounting equation:

Assets = Liabilities + Equity.

- Assets are resources that the company owns

- Liabilities are debts

- Equity is the amount of assets left over after all debts are paid

Let’s look at one more initial transaction before we dive into recording and accumulating direct costs such as materials and labor.

Jackie finds the perfect building for her new business; an old woodworking shop that has most of the equipment she will need. She writes a check from her new business account in the amount of $2,500 for July rent. Because she took managerial accounting in college, she determines this to be an indirect product expense, so she records it as Factory Overhead following a three-step process:

- Analyze transaction

Because her entire facility is devoted to production, she determines that the rent expense is factory overhead.

2. Journalize transaction using debits and credits

If she is using QuickBooks ® or other accounting software, when she enters the transaction into the system, the software will create the journal entry. In any case, whether she does it by hand or computer, the entry will look much like this:

3. Post to the ledger

Again, her computer software will post the journal entry to the ledger, but we will follow this example using a visual system accountants call T-accounts. The T-account is an abbreviated ledger. Click here to view a more detailed example of a ledger .

Jackie posts her journal entry to the ledger (T-accounts here).

She now has three accounts: Checking Account, Owner’s Capital, and Factory Overhead, and the company ledger looks like this:

In a retail business, rent, salaries, insurance, and other operating costs are categorized into accounts classified as expenses. In a manufacturing business, some costs are classified as product costs while others are classified as period costs (selling, general, and administrative).

We’ll treat factory overhead as an expense for now, which is ultimately a sub-category of Owner’s Equity, so our accounting equation now looks like this:

Assets = Liabilities + Owner’s Equity

147,500 = 150,000 – 2,500

Notice that debits offset credits and vice versa. The balance in the checking account is the original deposit of $150,000, less the check written for $2,500. Once the check clears, if Jackie checks her account online, she’ll see that her ledger balance and the balance the bank reports will be the same.

Here is a summary of the rules of debits and credits:

Assets = increased by a debit, decreased by a credit

Liabilities = increased by a credit, decreased by a debit

Owner’s Equity = increased by a credit, decreased by a debit

Revenues increase owner’s equity, therefore an individual revenue account is increased by a credit, decreased by a debit

Expenses decrease owner’s equity, therefore an individual expense account is increased by a debit, decreased by a credit

Here’s Colin Dodds’s Accounting Rap Song again to help you remember the rules of debits and credits:

Let’s continue to explore job costing now by using this accounting system to assign and accumulate direct and indirect costs for each project.

When you are done with this section, you will be able to:

- Record direct materials and direct labor for a job

- Record allocated manufacturing overhead

- Prepare a job cost record

Learning Activities

The learning activities for this section include the following:

- Reading: Direct Costs

- Self Check: Direct Costs

- Reading: Allocated Overhead

- Self Check: Allocated Overhead

- Reading: Subsidiary Ledgers and Records

- Self Check: Subsidiary Ledgers and Records

- Introduction to Accumulating and Assigning Costs. Authored by : Joseph Cooke. Provided by : Lumen Learning. License : CC BY: Attribution

- Colin Dodds - Debit Credit Theory (Accounting Rap Song). Authored by : Mr. Colin Dodds. Located at : https://youtu.be/j71Kmxv7smk . License : All Rights Reserved . License Terms : Standard YouTube License

- What the General Ledger Can Tell You About Your Business. Authored by : Mary Girsch-Bock. Located at : https://www.fool.com/the-blueprint/general-ledger/ . License : All Rights Reserved . License Terms : Standard YouTube License

Privacy Policy

- Contact sales

Start free trial

Project Cost Estimation: How to Estimate Project Cost

Good cost estimation is essential for project management success. Many costs can appear over the project management life cycle, and an accurate project cost estimation method can be the difference between a successful plan and a failed one. Project cost estimating, however, is easier said than done. Projects bring risks, and risks bring unexpected costs and cost management issues.

What Is Project Cost Estimation?

Project cost estimation is the process that takes direct costs, indirect costs and other types of project costs into account and calculates a budget that meets the financial commitment necessary for a successful project. To do this, project managers and project estimators use a cost breakdown structure to determine all the costs in a project.

Project cost estimation is critical for any type of project , from building a bridge to developing that new killer app. Everything costs money, so the clearer you are on the amount required, the more likely you and your project team will achieve your objective.

Project cost estimating is a critical step during the project planning phase because it helps project managers create a project budget that covers the project costs that are needed to achieve the goals and objectives of the project set forth by executives and project stakeholders.

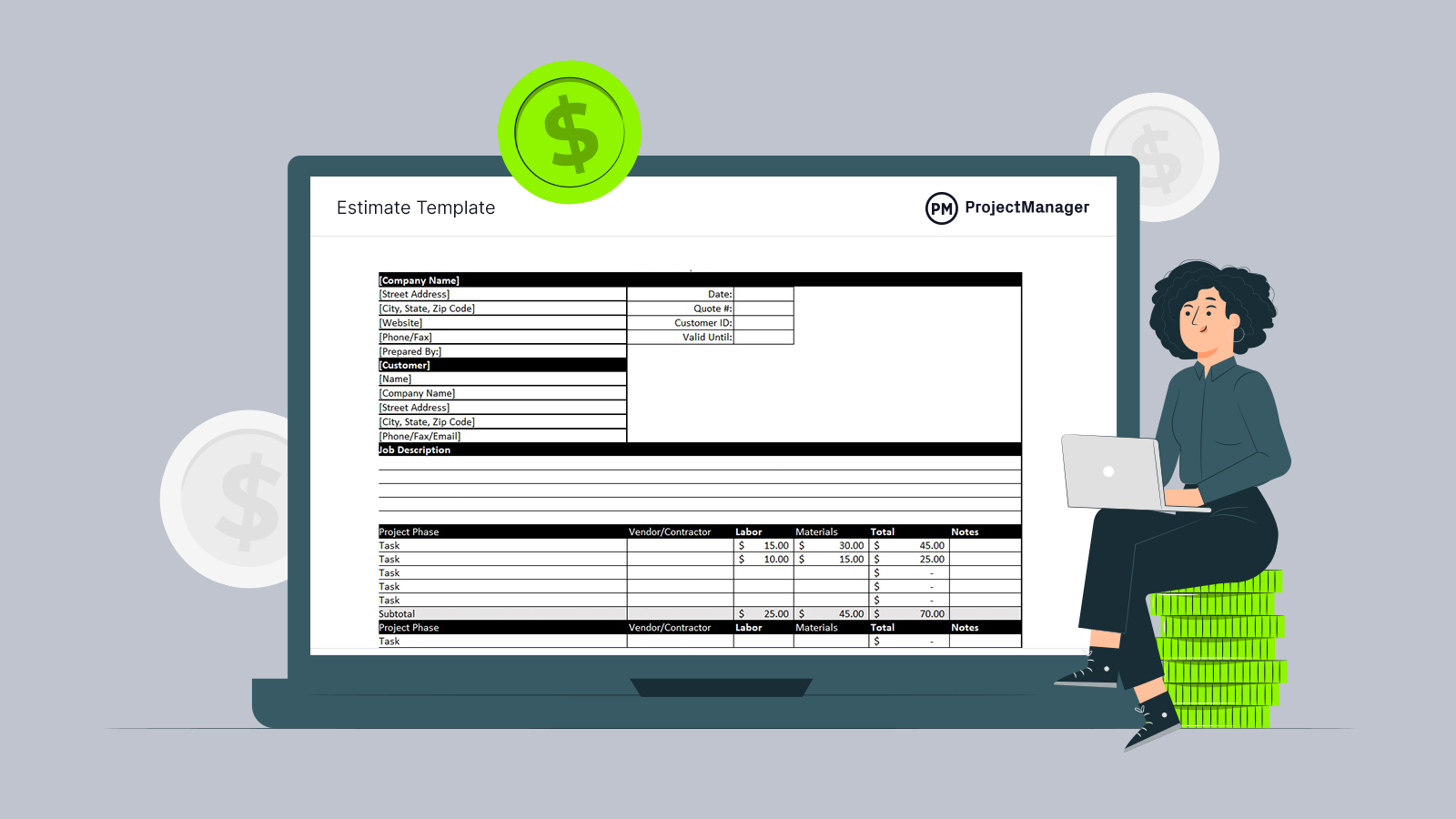

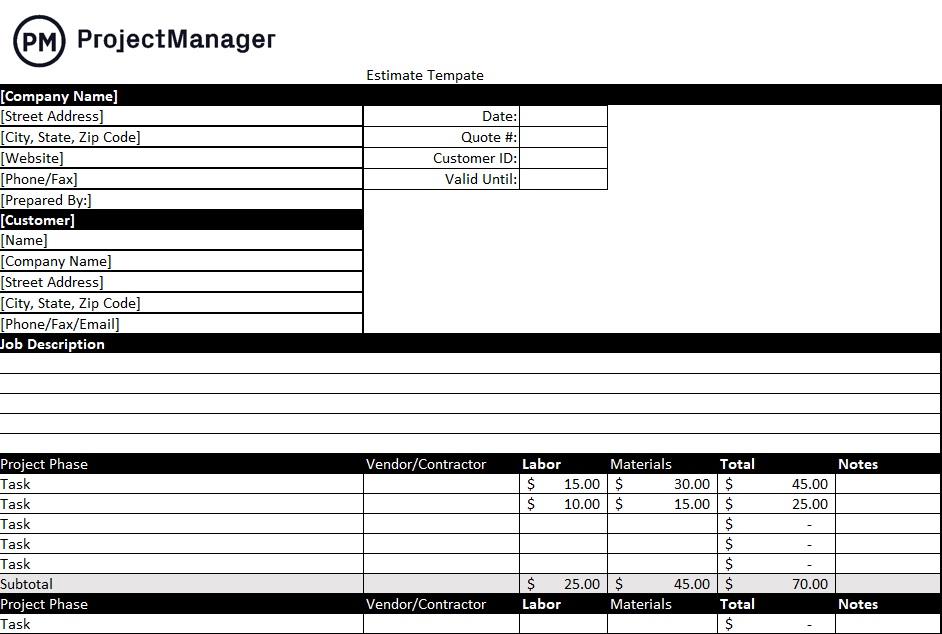

Get your free

Project Estimate Template

Use this free Project Estimate Template for Excel to manage your projects better.

What Is a Project Estimate?

A project estimate is the process of accurately forecasting the time, cost and resources required for a project. This is done by looking at historical data, getting information from the client and itemizing each resource and its duration of use in the project.

To create a project estimate, you should first define your project scope and then create a project cost breakdown structure, which allows you to pinpoint all of your different project costs for each stage of the project life cycle.

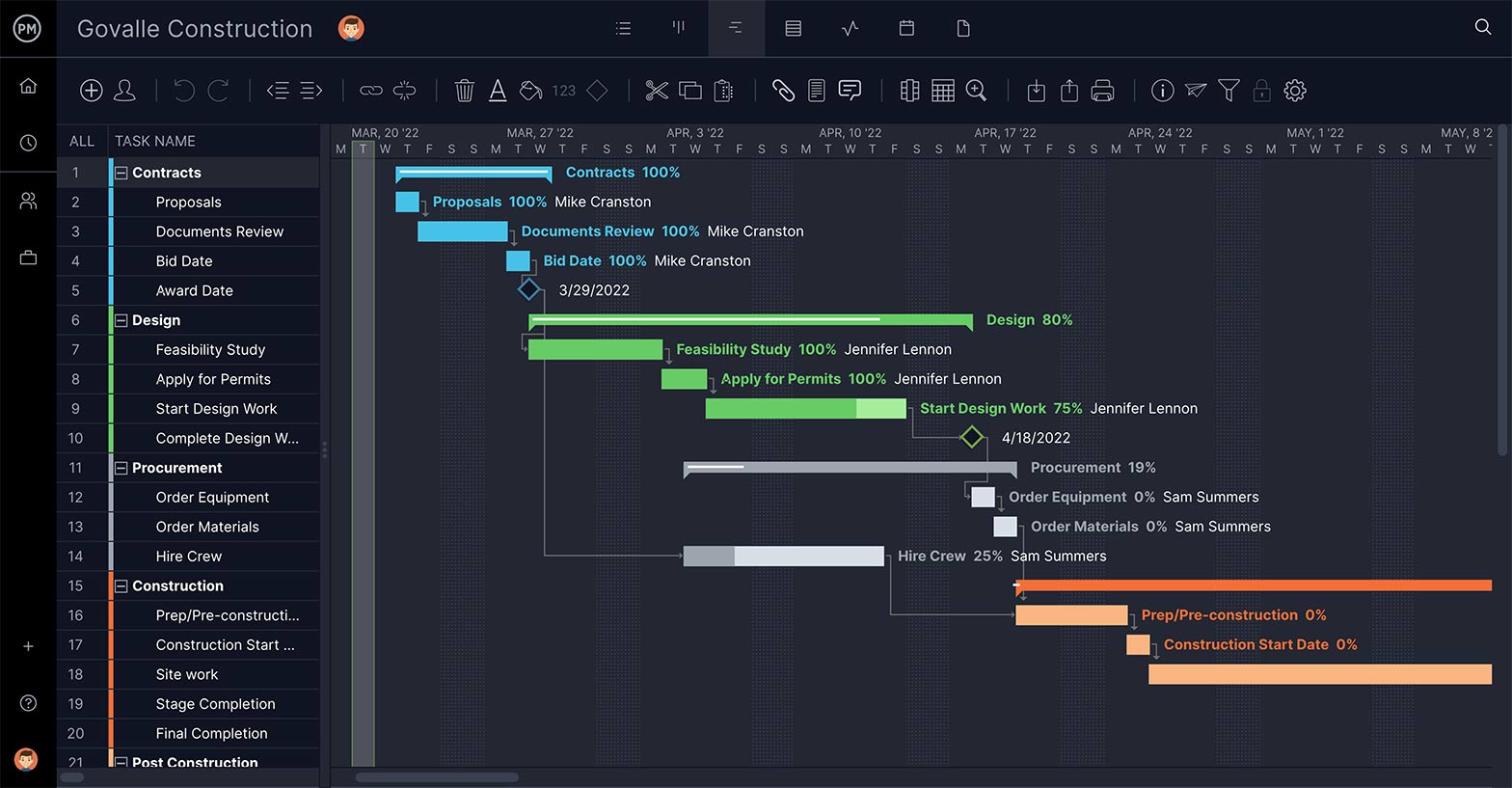

Project cost estimation is simplified with the help of project management software like ProjectManager . Add project budgets and planned costs for specific tasks and include labor rates for your team. When you build your plan on our Gantt chart, your estimated project costs will calculate automatically. Plus, as the project unfolds, you can track your costs in real time on our automated dashboard. Try it for free today.

What Is a Project Cost Breakdown Structure?

A cost breakdown structure (CBS) is a very important project costing tool that details the individual costs of a project on a document. Similar to a work breakdown structure (WBS) , it’s a hierarchical chart where each row represents a type of cost or item. This is done at the task level, which is called a bottom-up analysis.

Creating a cost breakdown structure might be time-consuming, but one that’s worth the effort in that the result is a more accurate estimate of costs than you’d get with a top-down approach, such as basing all your estimates on the costs of previous, similar projects.

Using a cost breakdown structure is an essential part of project cost management and resource management . By zeroing in on costs at the task level early during the project planning phase, you’re less likely to miss hidden costs that could come up later during the project execution stage and throw your project budget off.

Types of Project Costs

There are five main types of costs that make up your total project cost. Here’s a quick overview of these types of project costs and how to measure them.

- Direct costs: Direct costs are those that occur in a project and are attached to specific activities. These are generally costs that are easier to accurately estimate. They include raw materials, labor, supplies, etc.

- Indirect costs: Indirect costs in a project are those that are in support of the project, such as administrative fees. These can include everything from rent to salaries of the administrative staff to utilities, etc.

- Fixed costs: Fixed costs, as the name suggests, are those that don’t change throughout the life cycle of a project . Some examples of fixed costs include setup costs, rental costs, insurance premiums, property taxes, etc.

- Variable costs: Variable costs are costs that change due to the amount of work that’s done in the project and are variable in nature. These costs can include hourly labor wages, materials, fuel costs and so on.

- Sunk costs: In project cost estimating, when an investment has already been incurred and can’t be recovered it’s called a sunk cost or retrospective cost. Some examples of sunk costs include marketing, research, installation of new software, etc.

Free Project Cost Estimation Template

ProjectManager has free templates for every aspect of managing a project, including a free cost estimate template for Excel. It can be used for any project by simply replacing the items in the description column with those items that are relevant to your project.

This free cost estimate template has all the fields you’d need to fill in when estimating project costs. For example, there’s the description column followed by the vendor or subcontractor column and then there are columns to capture the labor and raw materials costs. These can be added together by line and then a total project cost can be calculated by the template.

Naturally, a cost estimate template is a static document. It’s handy in terms of collecting all your project costs and tracking them over the life cycle of the project. However, all that data must be manually added, which takes time and effort—two things that you don’t have in abundance when managing a project. Once you’re ready to streamline the cost estimate process you’ll find that there are many project management software solutions that can build budgets and track them in real time to keep you from overspending.

What Does a Project Estimator Do?

The project estimator or cost estimator, is tasked with figuring out the duration of the project in order to deliver it successfully. This includes determining the resources needed, including labor, materials, etc., which informs the project budget .

In order to do this, a project estimator must understand the project and its phases and be able to research the historical data of projects that were similar and executed in the past. Cost estimators also need to have a firm grasp of mathematical concepts.

Unlike a project manager , who’s responsible for the delivery and oversight of the project, a project estimator is focused on the direct and indirect costs associated with the project. Project estimators work closely with contractual professionals to develop accurate estimates, which are presented to project leaders.

Project Cost Estimation Techniques

All of these factors impact project cost estimation, making it difficult to come up with precise estimates. Luckily, there are cost estimating techniques that can help with developing a more accurate cost estimation.

Analogous Estimating

Seek the help of experts who have experience in similar projects, or use your own historical data. If you have access to relevant historical data, try analogous estimating, which can show precedents that help define what your future costs will be in the early stages of the project.

Parametric Estimating

There’s statistical modeling or parametric estimating , another cost estimation method that also uses historical data of key cost drivers and then calculates what those costs would be if the duration or another of the project is changed.

Bottom-Up Estimating

A more granular approach is bottom-up estimating, which uses estimates of individual tasks and then adds those up to determine the overall cost of the project. This cost-estimating method is even more detailed than parametric estimating and is used in complex projects with many variables such as software development or construction projects.

Three-Point Estimate

Another approach is the three-point estimate, which comes up with three scenarios: most likely, optimistic and pessimistic ranges. These are then put into an equation to develop an estimation.

Reserve Analysis

Reserve analysis determines how much contingency reserve must be allocated. This cost estimation method tries to wrangle uncertainty.

Cost of Quality

Cost of quality uses money spent during the project to avoid failures and money applied after the project to address failures. This can help fine-tune your overall project cost estimation. Plus, comparing bids from vendors can also help figure out costs.

Dynamic Project Costing Tools

Whenever you’re estimating costs, it helps to use online software to collect all of your project information. Project management software can be used in Congress with many of these techniques to help facilitate the process. Use online software to define your project teams, tasks and goals. Even manage your vendors and track costs as the project unfolds. We’ll show you how.

How to Estimate Project Costs in 10 Steps

The U.S. government has identified a 10-step process that results in reliable and valid cost estimates for project management . Those steps are outlined below.

- Define the cost estimate’s purpose: Determine the purpose of the cost estimate, the level of detail that is required, who receives the estimate and the overall scope of the estimate.

- Develop an estimating plan: Assemble a cost-estimating team and outline their estimation techniques. Develop a timeline , and determine who will do the independent cost estimate. Finally, create the team’s schedule.

- Define characteristics: Create a baseline description of the purpose, system and performance characteristics. This includes any technology implications, system configurations, schedules, strategies and relations to existing systems. Don’t forget support, security, risk items, testing and production, deployment and maintenance and any similar legacy systems.

- Determine cost estimating techniques: Define a work breakdown structure (WBS) and choose an estimating method that’s best suited for each element in the WBS. Cross-check for cost and schedule drivers; then create a checklist.

- Identify rules, assumptions and obtain data: Clearly define what’s included and excluded from the estimate and identify specific assumptions.

- Develop a point estimate: Develop a cost model by estimating each WBS element.

- Conduct a sensitivity analysis: Test the sensitivity of costs to changes in estimating input values and key assumptions, and determine key cost drivers.

- Conduct risk and uncertainty analysis: Determine the cost, schedule and technical risks inherent with each item on the WBS and how to manage them.

- Document the estimate and present it to management: Having documentation for each step in the cost estimate process keeps everyone on the same page with the cost estimate. Then you can brief the project stakeholders on cost estimates to get their approval.

- Update the cost estimate: Any changes to the cost estimate must be updated and reported . Also, perform a postmortem where you can document lessons learned.

Project Cost Estimation Example

Let’s take a moment to create a hypothetical project and run through a general cost estimate example to see how this process works. Construction cost estimation is straightforward so we’ll use a construction estimate example. This construction project will focus on the general requirements for cost estimation in project management.

Related: Construction Estimate Template

First, you’ll want to have a list describing the various elements needed to build your construction project. Gather all your construction project management documents such as plans, designs and specifications, blueprints and permits to find out cost data. In your documents, you’ll find administrative costs, financing costs, legal fees, engineering fees, insurance and other cost items.

Now it’s time to use a work breakdown structure (WBS) to identify all your construction project activities. Identify the labor costs, direct costs and indirect costs associated with every activity in your project schedule. There are various cost estimating techniques such as bottom-up estimating which allow contractors to estimate costs for each construction activity to create accurate proposals for the construction bidding process.

These costs are then added together for a line total, and those line totals are added together to determine your total project cost. Having a cost estimation template is a good tool to collect and track this information.

ProjectManager Helps With Project Cost Estimation

ProjectManager is a project management software that has features to help create a more accurate project cost estimate. Our Gantt chart can be used to help you track costs and expenditures for projects and tasks.

Estimate Costs of Specific Tasks

When estimating individual tasks, costs can also be collected and tracked on our online Gantt chart. Here you can add a column for the estimated costs, baseline cost and the actual costs to help you keep the project on budget once it’s been executed.

Our online Gantt chart can not only track tasks, but you can set it up to track materials and fixed costs associated with each project task and monitor the difference between budget and actual costs. All of this data is collected on one page.

Start by creating a project and then go to the Gantt view on ProjectManager. If you already have data, you can import it by clicking on the import button on the top right-hand side of the page. Or you can use this online Gantt chart to collect the data. It can be easily shared with team members and stakeholders when you’re ready to get input or approval.

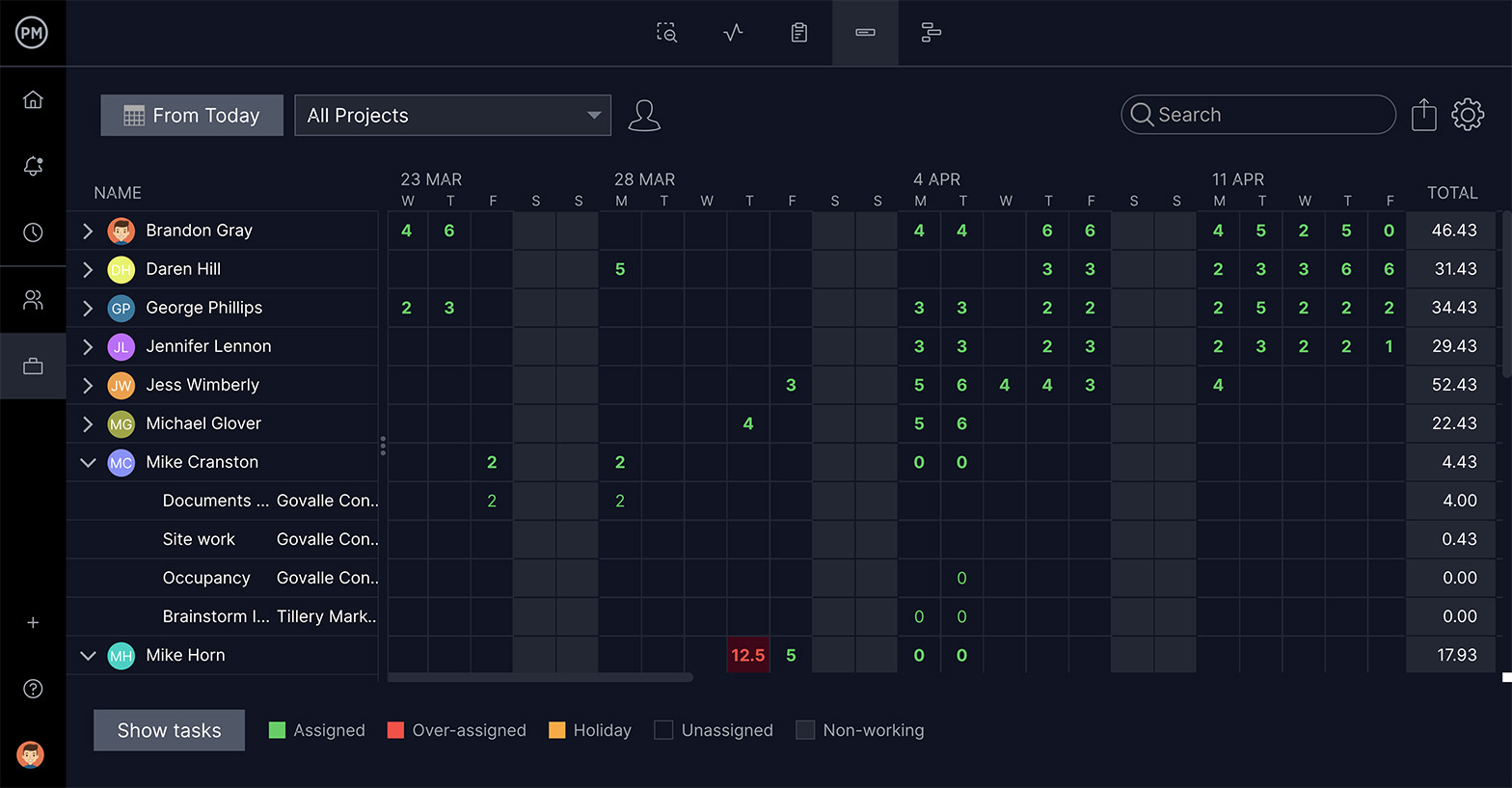

Estimate Costs of Resources

The resource management feature on ProjectManager is another tool that can help you achieve a more accurate project cost estimate. It offers a way to look at your costs through the workload across tasks and projects.

When planning a project with our resource management tool , you can account for employee schedules, equipment rentals, holidays and office space, among other factors that’ll impact your budget. Distributing project resources is one way to balance a budget.

Create a resource plan by scheduling the dates for planned resources, how long you’ll need them and the people who will be involved. That includes any equipment or site rentals. Break that down into the number of resources needed for each activity on a daily basis and you’ll be able to create a schedule with detailed resources, including duration and estimated costs.

FAQs About Project Cost Estimation

Here are some of the most frequently asked questions about project cost estimation online.

What Is Project Cost Analysis?

A project cost analysis is used to determine the costs and benefits associated with a project. It’s a process used to determine if the project is feasible.

What Is a Project Cost Breakdown?

A project cost breakdown is the process by which a project manager estimates what will need to be spent in order to deliver a project. A cost breakdown structure is used during the project cost estimating process to ensure all costs are accounted for.

Why Is Project Cost Estimation Important?

Cost estimation and cost management are an essential part of project management. The project manager is responsible for making the most accurate project budget possible by using a cost breakdown structure and project estimating techniques.

The project budget collects indirect costs and direct costs as it estimates the overall cost of delivering the project on time and meeting quality expectations. That means, whatever you’re going to need to make the project a success will be thought through during the cost estimation process.

Related Content

- Project Estimation Techniques: A Quick Guide

- Time Estimation in Project Management: Tips & Techniques

- Calculating Estimate at Completion (EAC)

- Parametric Estimating In Project Management

- What Is Job Costing? When to Use a Costing Sheet (Example Included)

When estimating costs on a project, you want to have the best tools to help you calculate a more accurate budget. ProjectManager is online project management software with online Gantt charts and resource management features that give you control over your project costs. See how ProjectManager can assist with your project cost estimation by taking this free 30-day trial today.

Deliver your projects on time and on budget

Start planning your projects.

Our Recommendations

- Best Small Business Loans for 2024

- Businessloans.com Review

- Biz2Credit Review

- SBG Funding Review

- Rapid Finance Review

- 26 Great Business Ideas for Entrepreneurs

- Startup Costs: How Much Cash Will You Need?

- How to Get a Bank Loan for Your Small Business

- Articles of Incorporation: What New Business Owners Should Know

- How to Choose the Best Legal Structure for Your Business

Small Business Resources

- Business Ideas

- Business Plans

- Startup Basics

- Startup Funding

- Franchising

- Success Stories

- Entrepreneurs

- The Best Credit Card Processors of 2024

- Clover Credit Card Processing Review

- Merchant One Review

- Stax Review

- How to Conduct a Market Analysis for Your Business

- Local Marketing Strategies for Success

- Tips for Hiring a Marketing Company

- Benefits of CRM Systems

- 10 Employee Recruitment Strategies for Success

- Sales & Marketing

- Social Media

- Best Business Phone Systems of 2024

- The Best PEOs of 2024

- RingCentral Review

- Nextiva Review

- Ooma Review

- Guide to Developing a Training Program for New Employees

- How Does 401(k) Matching Work for Employers?

- Why You Need to Create a Fantastic Workplace Culture

- 16 Cool Job Perks That Keep Employees Happy

- 7 Project Management Styles

- Women in Business

- Personal Growth

- Best Accounting Software and Invoice Generators of 2024

- Best Payroll Services for 2024

- Best POS Systems for 2024

- Best CRM Software of 2024

- Best Call Centers and Answering Services for Busineses for 2024

- Salesforce vs. HubSpot: Which CRM Is Right for Your Business?

- Rippling vs Gusto: An In-Depth Comparison

- RingCentral vs. Ooma Comparison

- Choosing a Business Phone System: A Buyer’s Guide

- Equipment Leasing: A Guide for Business Owners

- HR Solutions

- Financial Solutions

- Marketing Solutions

- Security Solutions

- Retail Solutions

- SMB Solutions

What Is Cost Allocation?

Table of Contents

Entrepreneurs, small business owners and managers need accurate, timely financial data to run their operations. Specifically, understanding and connecting costs to items or departments helps them create budgets, develop strategies and make the best business decisions for their organizations. This is where cost allocation comes in. Detailed cost allocation reports help businesses ensure they’re charging enough to cover expenses and make a profit.

While a detailed cost allocation report may not be vital for extremely small businesses, more complex businesses require cost allocation to optimize profitability and productivity.

What is cost allocation?

Cost allocation is the process of identifying and assigning costs to business objects, such as products, projects, departments or individual company branches. Business owners use cost allocation to calculate profitability. Costs are separated or allocated, into different categories based on the business area they impact. These amounts are then used in accounting reports .

For example, say you’re a small clothing manufacturer. Your product line’s cost allocation would include materials, shipping and labor costs. It would also include a portion of the operation’s overhead costs. Calculating these costs consistently helps business leaders determine if profits from sales are higher than the costs of producing the product line. If not, it can help the owner pinpoint where to raise prices or cut expenses .

For a larger company, cost allocation is applied to each department or business location . Many companies also use cost allocation to determine annual bonuses for each area.

Types of costs

If you’re starting a business , the cost allocation process is relatively straightforward. However, larger businesses have many more costs that can be divided into two primary categories: direct and indirect costs:

- Purchased inventory

- Materials used to make inventory

- Direct labor costs for employees who make inventory

- Payroll for those who work in operations

- Manufacturing overhead, including rent, insurance and utilities costs

- Other overhead costs, including expenses that support the company but aren’t directly related to production, such as marketing and human resources

What is a cost driver?

A cost driver is a variable that affects business costs, such as the number of invoices issued, employee hours worked or units of electricity used. Unlike cost objects, such as units produced or departments, a cost driver reflects the reason for the incurred cost amounts.

How to allocate costs

While cost objects vary by business type, the cost allocation process is the same regardless of what your company produces. Here are the steps involved.

1. Identify your business’s cost objects.

Determine the cost objects to which you want to allocate costs, such as units of production, number of employees or departments. Remember that anything within your business that generates an expense is a cost object. Review each product line, project and department to ensure you’ve gathered all cost objects for which you must allocate costs.

2. Create a cost pool.

Next, create a detailed list of all business costs. Categories should cover utilities, business insurance policies, rent and any other expenses your business incurs.

3. Choose the best cost allocation method for your needs.

After identifying your business’s cost objects and creating a cost pool, you must choose a cost allocation method. Several methods exist, including the following standard ones:

- Direct materials cost method: This cost allocation method assumes all products have the same allocation base and variable rate.

- Direct labor cost method: This cost allocation method is most helpful if labor costs can be allocated to one product or if expenses vary directly with labor costs.

- High/low method. This cost allocation method is best if you have more than one cost driver and each driver has different fixed or variable rates.

- Step-up or step-down method: With this cost allocation method, departments are first ranked and then the cost of services is allocated from one service department to another in a series of steps.

- Full absorption costing (FAC): This cost allocation method combines direct material and direct labor costs with a predetermined FAC rate based on company historical data or industry standards.

- Variable costing: Consider this cost allocation method if your business has many variable cost allocations (costs that vary by quantity) and uses significant direct labor.

4. Allocate costs.

Now that you’ve listed cost objects, created a cost pool and chosen a cost allocation method, you’re ready to allocate costs.

Here’s a cost allocation example to help you visualize the process:

Dave owns a business that manufactures eyeglasses. In January, Dave’s overhead costs totaled $5,000. In the same month, he produced 3,000 eyeglasses with $2 in direct labor per product. Direct materials for each pair of eyeglasses totaled $5. Here’s what cost allocation would look like for Dave: Direct costs: $5 direct materials + $2 direct labor = $7 direct costs per pair Indirect costs: Overhead allocation: $5,000 ÷ 3,000 pairs = $1.66 overhead costs per pair Direct costs: $7 per pair + Indirect costs: $1.66 per pair Total cost: $8.66 per pair

As you can see, cost allocation helps Dave determine how much he must charge wholesale for each pair of eyeglasses to make a profit. Larger companies would apply this same process to each department and product to ensure sufficient sales goals.

5. Review and adjust cost allocations.

Cost allocations are never static. To be meaningful, they must be monitored and adjusted constantly as circumstances change.

What are the benefits of cost allocation?

Accurate, regular cost allocation can bring your business the following benefits:

- Helps you run your business: The information you glean from cost allocation reports helps you perform vital functions like preparing income tax returns and creating financial reports for investors, creditors and regulators.

- Informs business decisions: Cost allocation is an excellent business decision tool that can help you monitor productivity and justify expenses. Cost allocation gives a detailed overview of how your business expenses are used. From this perspective, you can determine which products and services are profitable and which departments are most productive.

- Helps produce accurate business reports: Tax accounting, financial accounting and management accounting all require some kind of cost allocation. This information is the foundation of accurate business reports.

- Can reveal accurate production costs: Knowing what it costs to create a product, including all expenses allocated to it, is essential to making good pricing decisions and allocating resources efficiently.

- Helps you evaluate staff: Cost allocation can help you assess the performance of different departments and staff members. If a department is not profitable, staff productivity may need improvement.

Common cost allocation mistakes

To get the most from cost allocation, avoid these common mistakes:

- Equal or inflexible allocation : Cost allocation is not as simple as allocating any given cost over different product lines or departments. Some cost objects require more time, expense or labor than others, for example.

- Missing costs: Costing is meaningless if it doesn’t include all expenses. Don’t forget costs, such as overhead, time spent and intangible expenses.

- Failing to adjust as needed: Costs and priorities in business are changing constantly. Be sure your cost allocations are monitored and adjusted to meet your information needs.

- Not considering fluctuating revenue with indirect costs: If your business is seasonal or fluctuates over time, it’s important to account for that when allocating costs.

Cost allocation and your business

Even if you operate a very small business, it’s essential to properly allocate your expenses. Otherwise, you could make all-too-common mistakes, such as charging too little for your product or spending too much on overhead. Whether you choose to start allocating costs on your own with software or with the help of a professional small business accountant , cost allocation is a process no business owner can afford to overlook.

Dachondra Cason contributed to this article.

Building Better Businesses

Insights on business strategy and culture, right to your inbox. Part of the business.com network.

- Book a Speaker

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vivamus convallis sem tellus, vitae egestas felis vestibule ut.

Error message details.

Reuse Permissions

Request permission to republish or redistribute SHRM content and materials.

Managing International Assignments

International assignment management is one of the hardest areas for HR professionals to master—and one of the most costly. The expense of a three-year international assignment can cost millions, yet many organizations fail to get it right. Despite their significant investments in international assignments, companies still report a 42 percent failure rate in these assignments. 1

With so much at risk, global organizations must invest in upfront and ongoing programs that will make international assignments successful. Selecting the right person, preparing the expatriate (expat) and the family, measuring the employee's performance from afar, and repatriating the individual at the end of an assignment require a well-planned, well-managed program. Knowing what to expect from start to finish as well as having some tools to work with can help minimize the risk.

Business Case

As more companies expand globally, they are also increasing international assignments and relying on expatriates to manage their global operations. According to KPMG's 2021 Global Assignment Policies and Practices Survey, all responding multinational organizations offered long-term assignments (typically one to five years), 88 percent offered short-term assignments (typically defined as less than 12 months), and 69 percent offered permanent transfer/indefinite length.

Managing tax and tax compliance, cost containment and managing exceptions remain the three principal challenges in long-term assignment management according to a 2020 Mercer report. 2

Identifying the Need for International Assignment

Typical reasons for an international assignment include the following:

- Filling a need in an existing operation.

- Transferring technology or knowledge to a worksite (or to a client's worksite).

- Developing an individual's career through challenging tasks in an international setting.

- Analyzing the market to see whether the company's products or services will attract clients and users.

- Launching a new product or service.

The goal of the international assignment will determine the assignment's length and help identify potential candidates. See Structuring Expatriate Assignments and the Value of Secondment and Develop Future Leaders with Rotational Programs .

Selection Process

Determining the purpose and goals for an international assignment will help guide the selection process. A technical person may be best suited for transferring technology, whereas a sales executive may be most effective launching a new product or service.

Traditionally, organizations have relied on technical, job-related skills as the main criteria for selecting candidates for overseas assignments, but assessing global mindset is equally, if not more, important for successful assignments. This is especially true given that international assignments are increasingly key components of leadership and employee development.

To a great extent, the success of every expatriate in achieving the company's goals in the host country hinges on that person's ability to influence individuals, groups and organizations that have a different cultural perspective.

Interviews with senior executives from various industries, sponsored by the Worldwide ERC Foundation, reveal that in the compressed time frame of an international assignment, expatriates have little opportunity to learn as they go, so they must be prepared before they arrive. Therefore, employers must ensure that the screening process for potential expatriates includes an assessment of their global mindset.

The research points to three major attributes of successful expatriates:

- Intellectual capital. Knowledge, skills, understanding and cognitive complexity.

- Psychological capital. The ability to function successfully in the host country through internal acceptance of different cultures and a strong desire to learn from new experiences.

- Social capital. The ability to build trusting relationships with local stakeholders, whether they are employees, supply chain partners or customers.

According to Global HR Consultant Caroline Kersten, it is generally understood that global leadership differs significantly from domestic leadership and that, as a result, expatriates need to be equipped with competencies that will help them succeed in an international environment. Commonly accepted global leadership competencies, for both male and female global leaders, include cultural awareness, open-mindedness and flexibility.

In particular, expatriates need to possess a number of vital characteristics to perform successfully on assignment. Among the necessary traits are the following:

- Confidence and self-reliance: independence; perseverance; work ethic.

- Flexibility and problem-solving skills: resilience; adaptability; ability to deal with ambiguity.

- Tolerance and interpersonal skills: social sensitivity; observational capability; listening skills; communication skills.

- Skill at handling and initiating change: personal drivers and anchors; willingness to take risks.

Trends in international assignment show an increase in the younger generation's interest and placement in global assignments. Experts also call for a need to increase female expatriates due to the expected leadership shortage and the value employers find in mixed gender leadership teams. See Viewpoint: How to Break Through the 'Mobility Ceiling' .

Employers can elicit relevant information on assignment successes and challenges by means of targeted interview questions with career expatriates, such as the following:

- How many expatriate assignments have you completed?

- What are the main reasons why you chose to accept your previous expatriate assignments?

- What difficulties did you experience adjusting to previous international assignments? How did you overcome them?

- On your last assignment, what factors made your adjustment to the new environment easier?

- What experiences made interacting with the locals easier?

- Please describe what success or failure means to you when referring to an expatriate assignment.

- Was the success or failure of your assignments measured by your employers? If so, how did they measure it?

- During your last international assignment, do you recall when you realized your situation was a success or a failure? How did you come to that determination?

- Why do you wish to be assigned an international position?

Securing Visas

Once an individual is chosen for an assignment, the organization needs to move quickly to secure the necessary visas. Requirements and processing times vary by country. Employers should start by contacting the host country's consulate or embassy for information on visa requirements. See Websites of U.S. Embassies, Consulates, and Diplomatic Missions .

Following is a list of generic visa types that may be required depending on the nature of business to be conducted in a particular country:

- A work permit authorizes paid employment in a country.

- A work visa authorizes entry into a country to take up paid employment.

- A dependent visa permits family members to accompany or join employees in the country of assignment.

- A multiple-entry visa permits multiple entries into a country.

Preparing for the Assignment

An international assignment agreement that outlines the specifics of the assignment and documents agreement by the employer and the expatriate is necessary. Topics typically covered include:

- Location of the assignment.

- Length of the assignment, including renewal and trial periods, if offered.

- Costs paid by the company (e.g., assignment preparation costs, moving costs for household goods, airfare, housing, school costs, transportation costs while in country, home country visits and security).

- Base salary and any incentives or allowances offered.

- Employee's responsibilities and goals.

- Employment taxes.

- Steps to take in the event the assignment is not working for either the employee or the employer.

- Repatriation.

- Safety and security measures (e.g., emergency evacuation procedures, hazards).

Expatriates may find the reality of foreign housing very different from expectations, particularly in host locations considered to be hardship assignments. Expats will find—depending on the degree of difficulty, hardship or danger—that housing options can range from spacious accommodations in a luxury apartment building to company compounds with dogs and armed guards. See Workers Deal with Affordable Housing Shortages in Dubai and Cairo .

Expats may also have to contend with more mundane housing challenges, such as shortages of suitable housing, faulty structures and unreliable utility services. Analyses of local conditions are available from a variety of sources. For example, Mercer produces Location Evaluation Reports, available for a fee, that evaluate levels of hardship for 14 factors, including housing, in more than 135 locations.

Although many employers acknowledge the necessity for thorough preparation, they often associate this element solely with the assignee, forgetting the other key parties involved in an assignment such as the employee's family, work team and manager.

The expatriate

Consider these points in relation to the assignee:

- Does the employee have a solid grasp of the job to be done and the goals established for that position?

- Does the employee understand the compensation and benefits package?

- Has the employee had access to cultural training and language instruction, no matter how similar the host culture may be?

- Is the employee receiving relocation assistance in connection with the physical move?

- Is there a contact person to whom the employee can go not only in an emergency but also to avoid becoming "out of sight, out of mind"?

- If necessary to accomplish the assigned job duties, has the employee undergone training to get up to speed?

- Has the assignee undergone an assessment of readiness?

To help the expatriate succeed, organizations are advised to invest in cross-cultural training before the relocation. The benefits of receiving such training are that it: 3

- Prepares the individual/family mentally for the move.

- Removes some of the unknown.

- Increases self-awareness and cross-cultural understanding.

- Provides the opportunity to address questions and anxieties in a supportive environment.

- Motivates and excites.

- Reduces stress and provides coping strategies.

- Eases the settling-in process.

- Reduces the chances of relocation failure.

See Helping Expatriate Employees Deal with Culture Shock .

As society has shifted from single- to dual-income households, the priorities of potential expatriates have evolved, as have the policies organizations use to entice employees to assignment locations. In the past, from the candidate's point of view, compensation was the most significant component of the expatriate package. Today more emphasis is on enabling an expatriate's spouse to work. Partner dissatisfaction is a significant contributor to assignment failure. See UAE: Expat Husbands Get New Work Opportunities .

When it comes to international relocation, most organizations deal with children as an afterthought. Factoring employees' children into the relocation equation is key to a successful assignment. Studies show that transferee children who have a difficult time adjusting to the assignment contribute to early returns and unsuccessful completion of international assignments, just as maladjusted spouses do. From school selection to training to repatriation, HR can do a number of things to smooth the transition for children.

Both partners and children must be prepared for relocation abroad. Employers should consider the following:

- Have they been included in discussions about the host location and what they can expect? Foreign context and culture may be more difficult for accompanying family because they will not be participating in the "more secure" environment of the worksite. Does the family have suitable personal characteristics to successfully address the rigors of an international life?

- In addition to dual-career issues, other common concerns include aging parents left behind in the home country and special needs for a child's education. Has the company allowed a forum for the family to discuss these concerns?

The work team

Whether the new expatriate will supervise the existing work team, be a peer, replace a local national or fill a newly created position, has the existing work team been briefed? Plans for a formal introduction of the new expatriate should reflect local culture and may require more research and planning as well as input from the local work team.

The manager/team leader

Questions organization need to consider include the following: Does the manager have the employee's file on hand (e.g., regarding increases, performance evaluations, promotions and problems)? Have the manager and employee engaged in in-depth conversations about the job, the manager's expectations and the employee's expectations?

Mentors play an important role in enhancing a high-performing employee's productivity and in guiding his or her career. In a traditional mentoring relationship, a junior executive has ongoing face-to-face meetings with a senior executive at the corporation to learn the ropes, set goals and gain advice on how to better perform his or her job.

Before technological advances, mentoring programs were limited to those leaders who had the time and experience within the organization's walls to impart advice to a few select people worth that investment. Technology has eliminated those constraints. Today, maintaining a long-distance mentoring relationship through e-mail, telephone and videoconferencing is much easier. And that technology means an employer is not confined to its corporate halls when considering mentor-mentee matches.

The organization

If the company is starting to send more employees abroad, it has to reassess its administrative capabilities. Can existing systems handle complicated tasks, such as currency exchanges and split payrolls, not to mention the additional financial burden of paying allowances, incentives and so on? Often, international assignment leads to outsourcing for global expertise. Payroll, tax, employment law, contractual obligations, among others, warrant an investment in sound professional advice.

Employment Laws

Four major U.S. employment laws have some application abroad for U.S. citizens working in U.S.-based multinationals:

- Title VII of the Civil Rights Act.

- The Age Discrimination in Employment Act (ADEA).

- The Americans with Disabilities Act (ADA).

- The Uniformed Services Employment and Reemployment Rights Act (USERRA).

Title VII, the ADEA and the ADA are the more far-reaching among these, covering all U.S. citizens who are either:

- Employed outside the United States by a U.S. firm.

- Employed outside the United States by a company under the control of a U.S. firm.

USERRA's extraterritoriality applies to veterans and reservists working overseas for the federal government or a firm under U.S. control. See Do laws like the Fair Labor Standards Act and the Family and Medical Leave Act apply to U.S. citizens working in several other countries?

Employers must also be certain to comply with both local employment law in the countries in which they manage assignments and requirements for corporate presence in those countries. See Where can I find international employment law and culture information?

Compensation

Companies take one of the following approaches to establish base salaries for expatriates:

- The home-country-based approach. The objective of a home-based compensation program is to equalize the employee to a standard of living enjoyed in his or her home country. Under this commonly used approach, the employee's base salary is broken down into four general categories: taxes, housing, goods and services, and discretionary income.

- The host-country-based approach. With this approach, the expatriate employee's compensation is based on local national rates. Many companies continue to cover the employee in its defined contribution or defined benefit pension schemes and provide housing allowances.

- The headquarters-based approach. This approach assumes that all assignees, regardless of location, are in one country (i.e., a U.S. company pays all assignees a U.S.-based salary, regardless of geography).

- Balance sheet approach. In this scenario, the compensation is calculated using the home-country-based approach with all allowances, deductions and reimbursements. After the net salary has been determined, it is then converted to the host country's currency. Since one of the primary goals of an international compensation management program is to maintain the expatriate's current standard of living, developing an equitable and functional compensation plan that combines balance and flexibility is extremely challenging for multinational companies. To this end, many companies adopt a balance sheet approach. This approach guarantees that employees in international assignments maintain the same standard of living they enjoyed in their home country. A worksheet lists the costs of major expenses in the home and host countries, and any differences are used to increase or decrease the compensation to keep it in balance.

Some companies also allow expatriates to split payment of their salaries between the host country's and the home country's currencies. The expatriate receives money in the host country's currency for expenses but keeps a percentage of it in the home country currency to safeguard against wild currency fluctuations in either country.

As for handling expatriates taxes, organizations usually take one of four approaches:

- The employee is responsible for his or her own taxes.

- The employer determines tax reimbursement on a case-by-case basis.

- The employer pays the difference between taxes paid in the United States and the host country.

- The employer withholds U.S. taxes and pays foreign taxes.

To prevent an expatriate employee from suffering excess taxation of income by both the U.S. and host countries, many multinational companies implement either a tax equalization or a tax reduction policy for employees on international assignments. Additionally, the United States has entered into bilateral international social security agreements with numerous countries, referred to as "totalization agreements," which allow for an exemption of the social security tax in either the home or host country for defined periods of time.

A more thorough discussion of compensation and tax practices for employees on international assignment can be found in SHRM's Designing Global Compensation Systems toolkit.

How do we handle taxes for expatriates?

Can employers pay employees in other countries on the corporate home-country payroll?

Measuring Expatriates' Performance

Failed international assignments can be extremely costly to an organization. There is no universal approach to measuring an expatriate's performance given that specifics related to the job, country, culture and other variables will need to be considered. Employers must identify and communicate clear job expectations and performance indicators very early on in the assignment. A consistent and detailed assessment of an expatriate employee's performance, as well as appraisal of the operation as a whole, is critical to the success of an international assignment. Issues such as the criteria for and timing of performance reviews, raises and bonuses should be discussed and agreed on before the employees are selected and placed on international assignments.

Employees on foreign assignments face a number of issues that domestic employees do not. According to a 2020 Mercer report 4 , difficulty adjusting to the host country, poor candidate selection and spouse or partner's unhappiness are the top three reasons international assignments fail. Obviously, retention of international assignees poses a significant challenge to employers.

Upon completion of an international assignment, retaining the employee in the home country workplace is also challenging. Unfortunately, many employers fail to track retention data of repatriated employees and could benefit from collecting this information and making adjustments to reduce the turnover of employees returning to their home country.

Safety and Security

When faced with accident, injury, sudden illness, a disease outbreak or politically unstable conditions in which personal safety is at risk, expatriate employees and their dependents may require evacuation to the home country or to a third location. To be prepared, HR should have an evacuation plan in place that the expatriate can share with friends, extended family and colleagues both at home and abroad. See Viewpoint: Optimizing Global Mobility's Emergency Response Plans .

Many companies ban travel outside the country in the following circumstances:

- When a travel advisory is issued by the World Health Organization, Centers for Disease Control and Prevention, International SOS or a government agency.

- When a widespread outbreak of a specific disease occurs or if the risk is deemed too high for employees and their well-being is in jeopardy.

- If the country is undergoing civil unrest or war or if an act of terrorism has occurred.

- If local management makes the decision.

- If the employee makes the decision.

Once employees are in place, the decision to evacuate assignees and dependents from a host location is contingent on local conditions and input from either internal sources (local managers, headquarters staff, HR and the assignee) or external sources (an external security or medical firm) or both. In some cases, each host country has its own set of evacuation procedures.

Decision-makers should consider all available and credible advice and initially transport dependents and nonessential personnel out of the host country by the most expeditious form of travel.

Navigating International Crises

How can an organization ensure the safety and security of expatriates and other employees in high-risk areas?

The Disaster Assistance Improvement Program (DAIP)

Repatriation

Ideally, the repatriation process begins before the expatriate leaves his or her home country and continues throughout the international assignment by addressing the following issues.

Career planning. Many managers are responsible for resolving difficult problems abroad and expect that a well-done job will result in promotion on return, regardless of whether the employer had made such a promise. This possibly unfounded assumption can be avoided by straightforward career planning that should occur in advance of the employee's accepting the international assignment. Employees need to know what impact the expatriate assignment will have on their overall advancement in the home office and that the international assignment fits in their career path.

Mentoring. The expatriate should be assigned a home-office mentor. Mentors are responsible for keeping expatriates informed on developments within the company, for keeping the expatriates' names in circulation in the office (to help avoid the out-of-sight, out-of-mind phenomenon) and for seeing to it that expatriates are included in important meetings. Mentors can also assist the expatriate in identifying how the overseas experience can best be used on return. Optimum results are achieved when the mentor role is part of the mentor's formal job duties.

Communication. An effective global communication plan will help expatriates feel connected to the home office and will alert them to changes that occur while they are away. The Internet, e-mail and intranets are inexpensive and easy ways to bring expatriates into the loop and virtual meeting software is readily available for all employers to engage with global employees. In addition, organizations should encourage home-office employees to keep in touch with peers on overseas assignments. Employee newsletters that feature global news and expatriate assignments are also encouraged.

Home visits. Most companies provide expatriates with trips home. Although such trips are intended primarily for personal visits, scheduling time for the expatriate to visit the home office is an effective method of increasing the expatriate's visibility. Having expatriates attend a few important meetings or make a presentation on their international assignment is also a good way to keep them informed and connected.

Preparation to return home. The expatriate should receive plenty of advance notice (some experts recommend up to one year) of when the international assignment will end. This notice will allow the employee time to prepare the family and to prepare for a new position in the home office. Once the employee is notified of the assignment's end, the HR department should begin working with the expatriate to identify suitable positions in the home office. The expatriate should provide the HR department with an updated resume that reflects the duties of the overseas assignment. The employee's overall career plan should be included in discussions with the HR professional.

Interviews. In addition to home leave, organizations may need to provide trips for the employee to interview with prospective managers. The face-to-face interview will allow the expatriate to elaborate on skills and responsibilities obtained while overseas and will help the prospective manager determine if the employee is a good fit. Finding the right position for the expatriate is crucial to retaining the employee. Repatriates who feel that their new skills and knowledge are underutilized may grow frustrated and leave the employer.

Ongoing recognition of contributions. An employer can recognize and appreciate the repatriates' efforts in several ways, including the following:

- Hosting a reception for repatriates to help them reconnect and meet new personnel.

- Soliciting repatriates' help in preparing other employees for expatriation.

- Asking repatriates to deliver a presentation or prepare a report on their overseas assignment.

- Including repatriates on a global task force and asking them for a global perspective on business issues.

Measuring ROI on expatriate assignments can be cumbersome and imprecise. The investment costs of international assignments can vary dramatically and can be difficult to determine. The largest expatriate costs include overall remuneration, housing, cost-of-living allowances (which sometimes include private schooling costs for children) and physical relocation (the movement to the host country of the employee, the employee's possessions and, often, the employee's family).

But wide variations exist in housing expenses. For example, housing costs are sky-high in Tokyo and London, whereas Australia's housing costs are moderate. Another significant cost of expatriate assignments involves smoothing out differences in pay and benefits between one country and another. Such cost differences can be steep and can vary based on factors such as exchange rates (which can be quite volatile) and international tax concerns (which can be extremely complex).

Once an organization has determined the costs of a particular assignment, the second part of the ROI challenge is calculating the return. Although it is relatively straightforward to quantify the value of fixing a production line in Puerto Rico or of implementing an enterprise software application in Asia, the challenge of quantifying the value of providing future executives with cross-cultural perspectives and international leadership experience can be intimidating.

Once an organization determines the key drivers of its expatriate program, HR can begin to define objectives and assess return that can be useful in guiding employees and in making decisions about the costs they incur as expatriates. Different objectives require different levels and lengths of tracking. Leadership development involves a much longer-term value proposition and should include a thorough repatriation plan. By contrast, the ROI of an international assignment that plugs a skills gap is not negatively affected if the expatriate bolts after successfully completing the engagement.

Additional Resources

International Assignment Management: Expatriate Policy and Procedure

Introduction to the Global Human Resources Discipline

1Mulkeen, D. (2017, February 20). How to reduce the risk of international assignment failure. Communicaid. Retrieved from https://www.communicaid.com/cross-cultural-training/blog/reducing-risk-international-assignment-failure/

2Mercer. (2020). Worldwide Survey of International Assignment Policies and Practices. Retrieved from https://mobilityexchange.mercer.com/international-assignments-survey .

3Dickmann, M., & Baruch, Y. (2011). Global careers. New York: Routledge.

4Mercer. (2020). Worldwide Survey of International Assignment Policies and Practices. Retrieved from https://mobilityexchange.mercer.com/international-assignments-survey

Related Articles

A 4-Day Workweek? AI-Fueled Efficiencies Could Make It Happen

The proliferation of artificial intelligence in the workplace, and the ensuing expected increase in productivity and efficiency, could help usher in the four-day workweek, some experts predict.

How One Company Uses Digital Tools to Boost Employee Well-Being

Learn how Marsh McLennan successfully boosts staff well-being with digital tools, improving productivity and work satisfaction for more than 20,000 employees.

Employers Want New Grads with AI Experience, Knowledge

A vast majority of U.S. professionals say students entering the workforce should have experience using AI and be prepared to use it in the workplace, and they expect higher education to play a critical role in that preparation.

HR Daily Newsletter

New, trends and analysis, as well as breaking news alerts, to help HR professionals do their jobs better each business day.

Success title

Success caption

Understanding Global Assignment Costs

By LaQuita Morrison, GMS

Confidence in the U.S. economy is rising, and with it, the number of companies seeking to establish, strengthen or expand their global positions is increasing. Often, this involves expatriating talent to fill key positions in other countries. Some companies will also provide global assignment opportunities to expand their employees’ knowledge and skills.

Whether your company is well versed or new to managing global assignments, the cost of them can be daunting. However, when appropriately managed, global assignments can positively impact a company’s global business goals.

Sending an employee and a family of three on a three-year global assignment could cost in excess of USD $1 million. So, it’s not surprising that many global companies believe traditional overseas assignments are cost-prohibitive. Some companies have reduced, frozen or even eliminated their global assignment programs. However, to remain competitive, companies still need to place the best talent at the appropriate locations, and often that talent isn’t available without a global transfer. This is when the proper management and oversight of relocation costs becomes imperative.

Understanding the Costs

If you’re planning global assignments, there are ways to scale back costs without compromising operations or impacting employee productivity. Finding that balance between employee support and cost management to successfully oversee global assignments is a challenge, but it can be done. Below is a list of some of the expenses associated with a global assignment:

- Candidate Assessment – Conducted by the company to determine if the employee is the right candidate for the global assignment.

- Pre-Decision Assessment – Aligns the individual needs of the employee and the employee’s family with the business goals of the assignment.

- Immigration – Obtaining the appropriate documentation for the assignment. The reason for the assignment will dictate the appropriate visa type.

- Tax Implications – Determining the tax implications of the assignment and responsibilities of both the company and the employee.

- Tax Assistance – Providing the employee with tax assistance, which could include consultation; preparation (for both home and host countries); filing (for both home and host countries); tax equalization.

- Host Country Housing – Providing reasonable and customary rent and utility costs for the employee’s housing in the host country according to regional guidelines based on family size and location.

- Cost-of-Living Allowance (COLA) – An allowance or differential paid to the employee for similar goods and services in the host location that they have in the home location based on family size and salary. Intended to cover costs to purchase host country goods and services over those from the home country.

- Transportation – An allowance for a car for the duration of the assignment, the amount of which may vary by location and family size.

- Hardship – An allowance paid in addition to salary and COLA for assignments in locations designated as a hardship for the employee based on factors that include potential violence, incidence of disease, medical care quality, geographic isolation and availability of goods and services.

- Miscellaneous Expense Allowance – One-time payment made, separate from base salary, intended to cover expenses not expressly covered in the Letter of Understanding, like renter’s insurance, obtaining a new driver’s license, immunizations, taxis, etc.

- Cultural/Language Training – Provided to the employee and the family to assist in understanding the host country culture and language.

- Home Finding and Destination Services – Locating housing in the host country, as well as registering with local authorities and setting up accounts.

- Departure Services – Home sale, property management, lease termination, etc.

- Global Household Goods – Transporting (via land, air and/or sea) or storing household goods and personal effects.

- Temporary Living – Fully furnished housing at the destination location.

- Repatriation – Return of the employee to the home country following assignment completion.

To learn more about managing global assignment costs, download our free guide.

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

- Share with Email

Insights + Resources

How much is the average relocation package in 2024, gross-up: a guide to employer-paid relocation tax assistance, what is an executive relocation package, how to build an effective hr communication strategy.

- school Campus Bookshelves

- menu_book Bookshelves

- perm_media Learning Objects

- login Login

- how_to_reg Request Instructor Account

- hub Instructor Commons

Margin Size

- Download Page (PDF)

- Download Full Book (PDF)

- Periodic Table

- Physics Constants

- Scientific Calculator

- Reference & Cite

- Tools expand_more

- Readability

selected template will load here

This action is not available.

10.19: Assignment- Production and Costs

- Last updated

- Save as PDF

- Page ID 60725

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

In this module you learned that cost functions are derived from production functions and that the marginal cost curve is the inverse of the marginal product curve. Work through this problem to demonstrate those findings.

Production Function:

1. Using the production function, compute the figures for marginal product using the definition given earlier in this module. Draw a graph of the marginal product curve using the numbers you computed.