Hacking the Case Interview

Have an upcoming valuation case interview and don’t know how to prepare? We have you covered!

In this article, we’ll cover what a valuation case interview is, a step-by-step guide to solve any valuation case, and a comprehensive review of the major valuation methodologies.

If you’re looking for a step-by-step shortcut to learn case interviews quickly, enroll in our case interview course . These insider strategies from a former Bain interviewer helped 30,000+ land consulting offers while saving hundreds of hours of prep time.

What is a Valuation Case Interview?

A valuation case interview is a type of interview commonly used in management consulting and finance to assess a candidate's analytical, quantitative, and problem-solving skills.

In a valuation case interview, candidates are presented with a business scenario that involves determining the value of a company, an asset, or an investment opportunity.

The candidate is expected to use financial modeling, data analysis, and critical thinking to arrive at an appropriate valuation.

The case typically involves evaluating various factors such as financial statements, market trends, industry benchmarks, growth projections, and relevant economic indicators.

Candidates may be asked to perform calculations, create financial models, and provide a well-reasoned recommendation based on their analysis.

Valuation case interviews not only assess a candidate's ability to perform financial analysis but also evaluate their communication skills, as candidates are required to explain their thought process, assumptions, and findings to the interviewer.

These interviews are common in fields like investment banking, private equity, consulting, and corporate finance, where accurate valuation is crucial for decision-making.

How to Solve a Valuation Case Interview

There are eight major steps in a valuation case interview. Although these are the major steps, know that each valuation case interview can be slightly different.

Depending on your interviewer, they may spend more time on certain steps than others. They may also choose to skip certain steps that they feel are unnecessary for the discussion.

1. Understand the objective

This foundational step involves clarifying the scope of the valuation and its purpose within the context of the case.

Whether you are valuing a company, a project, an asset, or something else, it's crucial to define precisely what is being valued and the reasons behind the valuation.

This understanding serves as a guiding beacon for the rest of your analysis, helping you tailor your approach and focus on the most relevant data and methodologies.

A clear grasp of the valuation objective demonstrates your ability to extract critical information from the case prompt and ensures that your subsequent analysis is aligned with the intended outcome.

By establishing a solid foundation in this step, you set the stage for a well-structured and insightful valuation analysis that addresses the core challenges presented in the case.

2. Gather information

Once you've comprehended the valuation objective, you need to identify the key factors and variables that will influence your analysis.

This may include financial statements, industry benchmarks, market trends, growth projections, and more. Efficient data collection demonstrates your research skills and your ability to pinpoint the essential components driving the valuation.

As you accumulate data, you'll start forming an initial understanding of the company's financial health, competitive landscape, and potential risks.

This knowledge will be invaluable as you move forward to apply appropriate valuation methods.

3. Select a valuation method

The next step involves selecting the appropriate valuation method based on the nature of the business and the available data.

Common valuation methods include:

- Market Capitalization : Values the company based on its current stock price multiplied by the total number of outstanding shares.

- Discounted Cash Flow (DCF) Analysis : Calculates the present value of future cash flows generated by the company.

- Comparable Company Analysis (CCA) : Compares the company's financial metrics to similar publicly traded companies to estimate its value (e.g., using an earnings, revenue, EBITDA multiple)

- Precedent Transaction Analysis (PTA) : Examines the valuation multiples of similar companies based on their historical transactions.

- Book Value : Calculates the company's net worth by subtracting its liabilities from its assets.

- Liquidation Value : Estimates the value of the company's assets if it were to be liquidated.

- Replacement Cost : Determines the cost to replace the company's assets with equivalent new assets.

- Asset-based Approach : Calculates the company's value based on the fair market value of its assets.

Each method has its strengths and limitations, and your choice should align with the company's characteristics and the information you've gathered.

For instance, if you're valuing a stable and mature company with reliable cash flows, Discounted Cash Flow (DCF) might be suitable.

On the other hand, if market data for similar companies is readily available, Comparable Company Analysis (CCA) could be more relevant.

This step showcases your analytical acumen and ability to tailor your approach to the specific case. By justifying your method selection with clear reasoning, you'll demonstrate your expertise in translating theoretical concepts into practical decision-making tools.

4. Perform financial analysis and calculate the valuation

Afterwards, you'll apply the chosen valuation method to the company's financial data and industry benchmarks. This is where your quantitative skills come to the forefront.

For example, for a Discounted Cash Flow (DCF) analysis, you'll forecast the company's future cash flows, apply a discount rate to account for the time value of money, and calculate the present value of those cash flows.

As another example, for a Comparable Company Analysis (CCA), you'll identify publicly traded companies similar to the target company, gather their financial ratios, and apply those ratios to the target company's financial data.

This step showcases your ability to handle complex calculations and interpret financial metrics.

Precision, attention to detail, and a solid understanding of financial concepts are crucial to ensure accurate results that form the basis of your valuation.

5. Perform sensitivity analysis

Once you've derived your valuation estimate, it's crucial to assess its sensitivity to changes in key assumptions.

This step demonstrates your understanding of the potential risks and uncertainties that can impact the valuation.

By tweaking variables like growth rates, discount rates, or terminal values, you can gauge how different scenarios might influence the valuation outcome. This showcases your ability to think beyond the numbers and consider the broader business context.

It's a reflection of your analytical rigor and strategic mindset, as you'll be able to discuss how changes in market conditions, competitive dynamics, or industry trends could affect the valuation result.

Sensitivity analysis reveals your ability to anticipate challenges and make more informed decisions under various circumstances, a skill highly valued in consulting and financial roles.

6. Check reasonableness

It's essential to perform a reasonableness check on your calculated valuation.

This step involves using your business intuition and understanding of industry norms to ensure that the valuation result aligns with the reality of the company's performance and market conditions.

By comparing your valuation estimate to comparable companies' valuations, recent transactions, or industry benchmarks, you can identify any glaring discrepancies that might indicate errors in your assumptions or calculations.

Additionally, considering qualitative factors such as the company's competitive landscape, growth potential, and economic trends helps ensure that your valuation aligns with logical expectations.

Demonstrating your ability to critically evaluate your results and validate them against real-world context showcases your analytical rigor and ability to provide practical insights, both of which are highly valued in consulting and finance roles.

7. Present your findings

In the final step of solving a valuation case interview, you’ll present your findings.

It's crucial to effectively communicate your findings to the interviewer. Clear and concise communication is a key skill in consulting and other professional fields.

Begin by summarizing the key details of the case, including the company's background, the valuation method used, and the main assumptions made.

Present your calculated valuation and the reasoning behind it, highlighting the critical drivers that influenced the outcome.

Articulate any potential limitations or uncertainties in your analysis to show your awareness of the inherent complexities in valuation.

Delivering a well-structured and confident summary of your findings not only showcases your technical skills but also your capacity to translate insights into actionable recommendations, a quality highly valued in consulting roles.

8. Consider strategic implications

It can be helpful to go beyond just presenting your findings and talk through what the potential strategic implications are.

This is your opportunity to showcase your understanding of the broader business context and your capability to translate numerical findings into actionable insights.

Discuss how your valuation aligns with the company's current market position, growth prospects, and competitive landscape.

Highlight any potential areas of concern, such as overvaluation or undervaluation, and suggest strategies to address these issues.

Whether it's recommending expansion into new markets, optimizing operational efficiency, or considering potential mergers and acquisitions, your recommendations should be well-founded, innovative, and tailored to the company's unique circumstances.

This step allows you to demonstrate your ability to think strategically and provide value beyond numbers, qualities highly sought after in consulting and financial roles.

In addition to valuation case interviews, we also have additional step-by-step guides to: market entry case interviews , growth strategy case interviews , M&A case interviews , pricing case interviews , operations case interviews , marketing case interviews , and private equity case interviews .

Valuation Case Interview Examples

Valuation case interview example #1.

Your client, a private equity firm, is interested in investing in a technology startup. They have approached you to perform a valuation analysis of the startup. The startup operates in the e-commerce sector and has developed a cutting-edge platform that connects local artisans with customers seeking unique handmade products.

Your task is to determine the valuation of the startup using appropriate valuation methods and provide recommendations based on your analysis.

How to solve : The startup operates an e-commerce platform that connects local artisans with customers looking for unique handmade products. The platform aims to showcase artisanal craftsmanship and provide a marketplace for these products.

The startup provides the following financial information for the past year:

- Annual Gross Merchandise Value (GMV): $5 million

- Projected GMV Growth Rate: 25%

- Operating Expenses: $2 million

- Net Income: $1 million

- Estimated Discount Rate: 15%

We will use the Discounted Cash Flow (DCF) method and the Market Multiple method to determine the valuation of the startup.

After doing the analysis, suppose we get:

- DCF Valuation: $8.2 million

- Market Multiple Valuation: $7.5 million

Assess the reasonableness of the blended valuation estimate by comparing it with recent acquisitions or investments in the e-commerce sector.

Discuss the impact of variations in growth rates, discount rates, and key assumptions on the valuation. Highlight potential scenarios that could affect the valuation range.

Recommend a valuation range of $7.5 million to $8.2 million for the startup. Emphasize the startup's unique value proposition in connecting artisans with customers and the potential for growth in the e-commerce market.

Valuation Case Interview Example #2

Your client is a technology startup that is seeking investment from venture capitalists. They are looking to raise funds to expand their product line and market presence. As a consultant, your task is to perform a valuation analysis of the startup and recommend a valuation range for their company

How to solve : The startup is a technology company that has developed a cutting-edge software solution for streamlining supply chain operations. They provide real-time visibility into inventory levels, order status, and production schedules, helping companies optimize their supply chain efficiency.

- Annual Revenue: $2.5 million

- Projected Revenue Growth Rate: 30%

- Operating Expenses: $1.2 million

- Net Income: $800,000

- Estimated Discount Rate: 20%

We will use both the Discounted Cash Flow (DCF) method and the Comparable Company Analysis (CCA) method to determine the valuation of the startup.

- DCF Valuation: $6.8 million

- CCA Valuation: $7.5 million

Discuss the impact of changes in growth rates, discount rates, and key assumptions on the valuation. Highlight potential scenarios that could influence the valuation range.

Recommend a valuation range of $6.8 million to $7.5 million for the startup. Emphasize that the negotiation process with potential investors should consider the company's unique technology, growth prospects, and competitive landscape.

Valuation Case Interview Example #3

Your client is a manufacturing company interested in acquiring a competitor in the same industry. They have asked you to conduct a valuation of the target company to guide their acquisition strategy. The target company produces similar products and has a strong distribution network.

Your task is to determine the valuation of the target company and provide a recommendation for an offer price.

How to solve : The client, a manufacturing company, seeks to acquire a competitor with a similar product line and a robust distribution network. This acquisition would expand their market share and potentially provide operational synergies.

Collect financial data for both the client company and the target company:

- Client Company Revenue: $100 million

- Target Company Revenue: $60 million

- EBITDA Margin (both companies): 15%

- Industry Multiples: Average EV/EBITDA multiple of 8

We will use the Comparable Company Analysis (CCA) method and the precedent transaction method.

- Comparable Company Analysis Valuation: $72 million

- Precedent Transaction Valuation: $68 million

Discuss the sensitivity of the valuation to changes in EBITDA margin and industry multiples, as well as potential impacts on the acquisition strategy.

Recommend a valuation of $70.4 million for the target company. Emphasize that the acquisition aligns with the client's growth strategy and provides access to a stronger distribution network.

Recommended Case Interview Resources

Here are the resources we recommend to learn the most robust, effective case interview strategies in the least time-consuming way:

- Comprehensive Case Interview Course (our #1 recommendation): The only resource you need. Whether you have no business background, rusty math skills, or are short on time, this step-by-step course will transform you into a top 1% caser that lands multiple consulting offers.

- Hacking the Case Interview Book (available on Amazon): Perfect for beginners that are short on time. Transform yourself from a stressed-out case interview newbie to a confident intermediate in under a week. Some readers finish this book in a day and can already tackle tough cases.

- The Ultimate Case Interview Workbook (available on Amazon): Perfect for intermediates struggling with frameworks, case math, or generating business insights. No need to find a case partner – these drills, practice problems, and full-length cases can all be done by yourself.

- Case Interview Coaching : Personalized, one-on-one coaching with former consulting interviewers

- Behavioral & Fit Interview Course : Be prepared for 98% of behavioral and fit questions in just a few hours. We'll teach you exactly how to draft answers that will impress your interviewer

- Resume Review & Editing : Transform your resume into one that will get you multiple interviews

Land Multiple Consulting Offers

Complete, step-by-step case interview course. 30,000+ happy customers.

Company Valuation Using Discounted Cash Flow

Leading provider of teaching materials for management education

This module explains how to use discounted cash flow (DCF) to value a company and explores different DCF approaches to valuation.

6 Topics in This Module

Introduction.

The introduction begins with the bestselling Harvard Business Review article “What’s It Worth? A General Manager’s Guide to Valuation." The article first describes the limitations of the standard WACC approach of the DCF valuation of companies. As an alternative, the article recommends the APV, real options, and equity cash flow methods as better suited for valuing operations, opportunities, and ownership claims, respectively. The first supplement, “Note on Cash Flow Valuation Methods: Comparison of WACC, FTE, CCF and APV Approaches,” covers the same material at greater length and uses a capstone example to compare and contrast the various methods. The second note, "Valuation Methods and Discount Rate Issues: A Comprehensive Example," reviews the various valuation methods and uses a simple example to demonstrate the consistency of each method's results under similar assumptions.

WACC-Based DCF and Market Multiples

This section compares DCF valuation using WACC to the market multiples approaches. Mercury Athletic: Valuing the Opportunity , a brief case, uses the potential acquisition of a footwear subsidiary to teach students DCF valuation using WACC and compares the results with those drawn from market multiples approaches. The alternative case, Healthineers: A Strategic IPO , covers the valuation of a subsidiary of Siemens. In addition to valuing the subsidiary by DCF and market multiple methods, students are also asked to do a sum-of-parts valuation of the diversified firm. The supplementary technical note, "Corporate Valuation and Market Multiples," reviews the market multiples method of valuation and its limitations.

Adjusted Present Value

In Valuation of AirThread Connections , students must value a potential acquisition, a regional cellular provider, with the WACC-based DCF method and with APV. They must choose which method to use when the capital structure is stable and when it is changing, and estimate the effect of capital structure changes on assumptions in determining beta and the cost of capital. The alternative case, Seagate Technology Buyout , is a two-session case that concerns a leveraged buyout (LBO) of the disk drive operations of Seagate. Students are asked to perform both WACC-based DCF and APV valuations of the target (including estimating the cost of capital from comparables) and address the impact of financing decisions on value. The supplementary article, “Using APV: A Better Tool for Valuing Operations,” describes an APV analysis using a hypothetical company.

Capital Cash Flow

In Berkshire Partners: Bidding for Carter’s , Berkshire Partners is making a bid and deciding on a financial structure for an LBO of a leading producer of children’s apparel. Berkshire’s financial team uses CCF to calculate the value of William Carter Co. The students are also asked to consider how value is created in the private equity world. "Note on Capital Cash Flow Valuation," the supplemental reading, walks students through the mechanics of the calculation.

Equity Cash Flow

In Acova Radiateurs , students must value a takeover candidate for an LBO in an international setting. The teaching note provides one- and two-day teaching plans, as well as ECF and CCF valuations of Acova. The alternative, The Hertz Corporation (A) , is a more difficult case, examining the LBO of Hertz in 2005. Students are asked to locate the sources of value in the deal, in operations, and in the financing and deal structures. While the case itself lacks detailed financial projections, both the teaching note and an electronic spreadsheet include sample projections. The supplement, "Note on Valuing Equity Cash Flows," is for advanced students. It teaches the mechanics and examines the biases and shortcomings of the ECF method.

Comprehensive Simulation

The following simulation can be used as a capstone for this module. It gives students the opportunity to use different valuation approaches. In Finance Simulation: M&A in Wine Country , students play the role of the CEO at one of three publicly traded wine producers, evaluating merger and acquisition opportunities among the three companies. WACC-based DCF, APV, and market multiples are some of the methods at their disposal to work up bids and negotiate deals.

1 hour, 30 minutes

About this module

Valuation is a key skill for managers. This module focuses on using DCF to value a company. The materials cover different approaches, including DCF using weighted average cost of capital (WACC), adjusted present value (APV), capital cash flow (CCF), and equity cash flow (ECF), as well as sum-of-the-parts valuation. Students can explore how valuations using DCF compare with valuations using market multiples. The module also includes comprehensive simulations that instructors can use as capstone exercises.

Learning Objectives

Understand why managers use DCF to value companies

Learn how to construct a discounted cash flow valuation

Appreciate the issues that arise in determining an appropriate discount rate

Explore different approaches to discounted cash flow valuations, including WACC-based DCF, APV, capital cash flow, and equity cash flow

Understand how a valuation using DCF compares to a valuation using market multiples

Practice valuations using the appropriate DCF methodology

We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More . By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

Use Our Resources and Tools to Get Started With Your Preparation!

Valuation cases usually require estimating the price of a firm, patent, or service in the market .

This type of case can either be a subset of an M&A case, in which you need to know a company's worth before purchasing, or a standalone case (rare). For instance, “How much is Pfizer worth today?” In strategy consulting, these questions are rather rarely seen. However, cases where you do need to valuate something usually start with “ How much would you pay for… ”

The most common methods of valuating are the Discounted Cash Flow (DCF) and the industry multiple method

As these are still case studies meant to fit in an interview round, the interviewer will very likely not ask you to perform an exact and comprehensive valuation analysis. Instead, you may be required to estimate the worth of a product, patent, or a service. You may also have to judge if an offered price is reasonable.

Discounted Cash Flow method

The first valuation method is the Discounted Cash Flow method. This method shows how much money you would have in your savings account at a certain interest rate in order to provide you with the same annual cash flow generated by the company that is being evaluated. Here, you simply divide projected annual cash flows by a discounted rate (or interest rate). Of course, the discount rate of your savings account will be much lower than that of an investment in a company. This is so because the risk you take putting your money in a savings account is much lower than the risk of investing in a company.

Industry multiple method

The DCF method is limited since it does not take into account additional dimensions other than money (unless you quantify those dimensions into the future cash flows).

Football teams, for instance, are often overvalued compared to their generated returns. For such cases, there is another method called the industry multiple method.

This method allows you to valuate a firm by using a metric known to this company and multiplying it by the associated industry multiple. This can be done for similar players in the industry to assess their relative valuations using benchmarking .

An example of a multiple ratio is the price-to-book ratio (P/B). This multiple is the ratio of the actual firm valuation (based for example on M&A deals) and the book value of the same firm (value of its assets, which can be found in the balance sheet ). If a firm’s assets added up to 200 million, and it was sold for 100 million, the ratio is 0.5 (100 million/200 million). Do this for a set of representative industry players, take the average and you get the average industry multiple. Finally, you multiply the industry multiple with the value of the assets.

Other commonly used ratios are the price-earnings ratio (P/E ratio or PER) and the EBITDA ratio.

Since you will not be required to calculate the value of an investment on too high a level of detail, it is not necessary to learn values for different interest rates or industry multiples by heart. However, to give you an idea about orders of magnitude:

- A good guess for an industry multiple is EBITDA*10.

- Good guesses for interest rates would range from 3% (inflation) to up to 20% for highly speculative investments.

Key takeaways

- Use the Discounted Cash Flow (DCF) method to valuate a firm based solely on its expected profits.

- Use the industry multiple method to double-check if the DCF valuation is reasonable. Sometimes other aspects need to be factored in like brand value, customer loyalty, liabilities, etc.

- There are several types of industry multiples to choose from. For more precise valuation, choose more types of industry multiples.

Related Cases

EY-Parthenon Case: Nachhaltiges Geschäftsmodell

FTI-Andersch AG Case: Funkstille – Kommunikationstechnik in der Krise

Mazars Case: Prüfung der Carvermietungen GmbH

Smart meters.

Caribbean Island – MBB Final Round

Breaking News: FINCAD is now Numerix. LEARN MORE

- Worldwide View all content

- AMAPAC Americas + Asia Pacific

- EMEA Europe, Middle East + Africa

Get Started

Get the latest updates and news from FINCAD. Subscribe and never miss a post!

If you are evaluating valuation and risk solutions, I would encourage you to check out the vendor’s case studies. While items like brochures, product demos, and website content are useful in helping you understand solution offerings, a good case study will give you valuable insight into real-world use cases and results of the system you might be considering.

If the vendor has a healthy library of case studies available—even better. You should be able to pinpoint at least a couple that will give you a good idea of how other firms solved the same challenges you face.

At FINCAD, we provide numerous case studies to our clients and prospects. Since we offer different solutions to both buy- and sell-side institutions, we provide a diverse set of case studies that showcase how clients are using our solutions to overcome their biggest valuation and risk challenges. Below are a five popular FINCAD case studies showing how different firm types are getting results with our solutions. Hopefully one (or more) will resonate with you.

1. Mitsubishi UFJ Financial Group (MUFG) Case Study

Industry : Bank holding and financial services company

Business Objective: Adopt an accurate, efficient solution for CVA reporting, necessary to meeting Basel III requirements

Requirements: MUFG required a CVA provider that not only offered the right technology, but also a complete service for handling the regulatory reporting process from beginning to end.

Results: Using FINCAD, MUFG simplified Basel III CVA reporting, saving considerable time by outsourcing the process to FINCAD’s Professional Services team. Read more about MUFG .

2. Arca Vita Case Study

Industry: Life insurer

Business Objectives: Introduce powerful analytics libraries, model structured bonds and perform scenario analysis

Requirements: Arca Vita required an easy-to-use and highly reliable software solution that could easily integrate with Excel and other existing systems.

Results: Arca Vita gained flexible curve-building, the ability to constantly monitor portfolios, and perform detailed ALM and scenario analysis. Read more about Arca Vita .

3. KPMG South Africa Case Study

Industry: Audit, tax and advisory services

Business Objective: Accelerate derivative valuations for banking and corporate clients

Requirements: KPMG required an Excel-based valuation and risk solution backed by a trusted provider that could help them perform timely valuations of complex derivatives.

Results: Leveraging FINCAD’s fast and accurate audit valuation and validation results, KPMG has been able to significantly reduce modeling and computation time, and reliance on internal development resources. Read more about KPMG .

4. First Swedish National Pension Fund Case Study

Industry: Pension fund

Business Objective: Gain access to a powerful analytics library for pricing bonds and yields, able to integrate with an existing investment management application

Requirements: First Swedish National Pension Fund required an analytics library for generating bond and yield calculations. The firm also wanted a solution with a robust development toolkit to help developers build out the application.

Results: First Swedish National Pension Fund accelerated accurate bond pricing and yield calculations, and boosted efficiency through using FINCAD’s prebuilt market conventions. Read more about First Swedish National Pension Fund .

5. Frame Financial Case Study

Industry: FinTech provider of pricing and risk analytics solutions

Business Objective: Provide a key client, Kensington Capital Advisors, and other firms with a solution offering flexible deployment and custom work flows integrated with fast and sophisticated pricing and risk analytics

Requirements: Frame Financial sought a valuation tool providing powerful analytics and flexible architecture for ease of custom solution development.

Results: Using FINCAD, Frame Financial was able to effectively meet the demands of client, Kensington Capital Advisors, giving them the ability to price and analyze diverse portfolios together within a single platform. Read more about Frame Financial .

Interested in reading more FINCAD case studies? Check out our full case study library .

Financial Valuation Workbook: Step-by-Step Exercises and Tests to Help You Master Financial Valuation, 3rd Edition by James R. Hitchner, Michael J. Mard

Get full access to Financial Valuation Workbook: Step-by-Step Exercises and Tests to Help You Master Financial Valuation, 3rd Edition and 60K+ other titles, with a free 10-day trial of O'Reilly.

There are also live events, courses curated by job role, and more.

Valuation Case Study Exercises: Solutions and Explanations

EXERCISE 1 : Which of the following is the as of date for valuation?

a. Anytime within one year

b. As of a single point in time

c. As of a single point in time or six months later

d. Date that the report is signed

ANSWER: b. As of a single point in time

The valuation date is always as of a single point in time, typically a day. Valuation of a business is a dynamic, not static, exercise. Values can change constantly, such that a value today may be very different from the value a year from now or even just a few months from now. In the estate tax area, valuations are as of the date of death or six months later. However, this is only for estate tax. The date that the analyst signs the report usually does not coincide with the as of date. The signature date is most often after the valuation date.

EXERCISE 2: This is a detailed report per SSVS No. 1. What other types of reports are allowed under SSVS No. 1?

1. Summary report

2. Calculation report

3. Oral report

EXERCISE 3: The purpose of the valuation of LEGGO is to assist management in internal planning. What other purposes are there?

ANSWER: Valuations are used for a variety of purposes, including estate tax, income tax, gift tax, ESOPs (employee stock ownership plans), marital dissolution, buying companies, selling companies, shareholder oppression cases, dissenting rights cases, financial reporting, reorganization and bankruptcy, minority stockholder ...

Get Financial Valuation Workbook: Step-by-Step Exercises and Tests to Help You Master Financial Valuation, 3rd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.

Don’t leave empty-handed

Get Mark Richards’s Software Architecture Patterns ebook to better understand how to design components—and how they should interact.

It’s yours, free.

Check it out now on O’Reilly

Dive in for free with a 10-day trial of the O’Reilly learning platform—then explore all the other resources our members count on to build skills and solve problems every day.

Valuation: the key to mergers and acquisitions

- Estimates and segmentation

- Profitability

- Competitive interaction

Example: Steel Producer Acquisition

Identify the problem, build a problem driven structure, lead the analysis and provide a recommendation.

Valuations are estimates of how much a company will be worth to a prospective buyer . The most important use for valuations in consulting interviews is in cases dealing with mergers and acquisitions . In order to weigh up our options in such scenarios, we need to be able to compare the potential gains or losses associated with various options - and this means we need to make valuations!

All the best resources in one place!

Risky business.

An important point to note straight off the bat is that valuations can only ever be estimates rather than absolute values. Because valuation fundamentally involves making predictions about the future, there will always be an element of uncertainly or risk . We address these sources of risk in some detail - as well as drilling down into many of the other issues here in more depth - in our full length lesson on valuation in the MCC Academy . Here, though, we will have to confine our briefer discussion to the more immediate nuts and bolts of how valuations are made.

We'll explore the theory around valuation through a reasonably straightforward case study which hinges on your valuing a company .

Let's say your interviewer gives you the following case prompt:

"Our client is a steel producer who wants to expand by acquiring their competitor. The competitor offers to sell their plant for $1M. Should our client accept the deal at this price or not?"

Working through this case will provide a great introduction to valuation!

As always, your first step in tackling a case should be to correctly identify the problem . This is quite straightforward given this case prompt. In order to work out whether the client should be willing to pay the $1m asking price, we ultimately need to work out what the steel producer is worth to them . That is, we have to establish the value of this second steel plant to our client, to see whether it is worth paying $1m for .

Varieties of value

This might seem simple enough - however, we have not quite narrowed down the specific problem to be addressed yet. There is an extra layer of complexity to consider when identifying the problem in the case dealing with valuation.

Prep the right way

This is because there is not one single "value" concept for us to reach for. Instead, the word "value" can refer to several distinct quantities, all of which might be of interest in different contexts. These various varieties of value can be somewhat bamboozling at first, as some are radically distinct from other, whilst some are subsets of one another,. We need to be clear exactly which kind of value we are trying to calculate!

In this case study, what we are interested in is the value which acquiring this second steel producer will offer for our specific client. This quantity is referred to as the Asset Value or the Total Enterprise Value (TEV) .

It's all relative...

Note that this value is inherently relative to a particular buyer and will be different for different individuals. In our case, the value of the steel producer will likely be very different for our client, whom is already involved in the industry, to the value which might be derived from a buyer with no existing interests in steel. What we are calculating here is the price which it makes sense for a certain individual to pay for the asset in question .

Now we know exactly which kind of value we are trying to figure out, it's time to get on and figure out how we are going to get to an answer. This means structuring our approach to the problem .

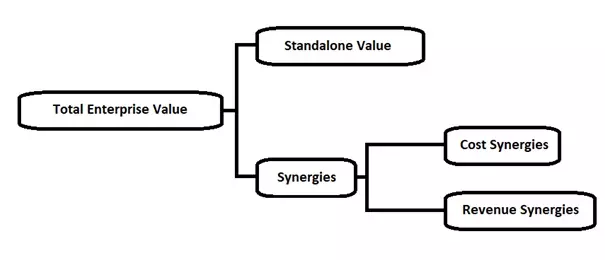

The TEV of the second steel producer can be calculated as the sum of the "standalone" or "market" value of that company plus any "synergies" which emerge when it is combined with our client's operation. Those synergies can be further divided into revenue synergies and cost synergies . Segmenting the problem in this manner yields the following structure:

That was quick enough, but now we need to turn our attention to what the contents of those boxes actually mean...

Standalone Value

We'll deal with synergies shortly, for now, let's focus on how we might calculate the standalone value of an asset - the second steel producer in our example. As per our remarks on the variety of valuations above, there are several ways in which we might go about estimating the standalone value of a company . Three of the most common are:

- Net Present Value This is generally the most robust method of company valuation and is the most commonly used in consulting interviews . This is the method we will use here and we will return to NPV below.

- Multiples This is a method of valuing a company based on the ratio between the company's value and some financial metric such as EBITDA - which stands for "Earnings Before Interest, Taxes, Depreciation and Amortisation", but which we can approximate as cash flow for the purpose of case interviews.

- Asset Based Valuation In some cases, the cash flow or similar of a company might misrepresent its value . This might be especially useful in cases concerning businesses like shipping or real estate companies, and especially any companies which might be loss-making, but hold a large volume of valuable assets . In such situations, an asset based valuation calculates the net present value associated with owning individual assets rather than for the company as a whole.

Net Present Value

Let's focus on the Net Present Value, which is more relevant to our example. The NPV represents the value today of the expected future cash flows of the company . This is often referred to as the value of cash flows in "perpetuity".

Join thousands of other candidates cracking cases like pros

Imagine you have the option to buy some bond which yields you a payment of $20 per year every year. The NPV of this bond is the amount which it would be sensible for you to pay today to receive this guarantee of $20 per year in perpetuity.

In our video lesson on valuation in the MCC Academy , we give a full explanation as to the rationale and mathematics underpinning NPV - which can be very important in tacking more complex case studies involving valuation . However, with limited space here, we'll skip straight to the payoff, and note that the NPV can be calculated via the following equation:

Discount rate

A crucial element of the Net Present Value equation is the discount rate (r). The discount rate effectively accounts for the intuitive fact that a dollar today is not worth the same as the guarantee of a dollar one year from now . In normal circumstances, having the same amount of money immediately will be more valuable than having the same amount at some later point in time. For instance, if you are given your dollar right away, you might deposit it in a savings account and earn interest , so you will have a dollar and a few cents more a year from now.

The discount rate will vary for different scenarios and you might be expected to make a reasonable estimation of its expected level for a case. Generally, the discount rate will be higher where a business venture is more risky . This reflects the higher interest rates which will be required by lenders or investors to entrust their money with a business has a higher risk of never managing to pay them back.

As a rule of thumb, you can think about a spectrum of discount rates ranging from 3% for a very safe business to 20% for a very risky venture .

Now, let's turn our gaze to synergies. The possibility of synergies is what will ultimately make our steel producer worth more or less to different buyers , as the new company may interact more or less beneficially with the companies or other assets they already own.

The idea that what one owns already determines how much one is willing to pay for new items if pretty intuitive. Imagine you are selling a collectable item - say a novelty teapot, baseball card or the like. You will obviously get a lot more for it if you find a buyer who needs that item to complete their collection! Higher up the value scale, effects like this are known to cause interesting phenomena in the art market . In particular, there are cases where it makes sense for buyers to pay as much as possible for a painting at auction, as the new market value will increase the prices of the other works in their collection by the same artist by an amount that more than compensates their extra expenditure.

Looking for an all-inclusive, peace of mind program?

Returning to our example, we can divide the possible synergies for our client in acquiring the steel producer into two sides - cost synergies and revenue synergies. Let's look at each in turn.

Cost synergies

Cost synergies are realised when the merging of two companies allows for the reduction of costs . Such synergies might be achieved in a few different ways. For instance:

- Merging cost centres Combining two companies can allow for the removal of duplicated structures or staff . In our example, the newly merged company might make cuts to staff in supporting roles such as HR, management or R&D.

- Economies of scale Increasing the size of a business often allows for savings to be made by procuring goods or services in larger volumes - and thus for lower prices . For example, steel manufacture will require both raw materials and fuel/energy and a larger operation buying larger volumes of these might be able to negotiate lower prices. Similarly, the larger company might be able to negotiate lower shipping costs on their outgoing products.

Revenue Synergies

Revenue synergies are realised when combining two companies allows them to increase the revenue they generate . A typical way of deriving revenue synergies is via cross-selling , where two merged companies can sell their products to each other's customers.

In our example, cross-selling would be a strong possibility where our client and the acquired producer have previously specialised in different parts of a full spectrum of steel products which the same customers might be interested in buying. For instance, say our client's company has previously only offered large, unshaped ingots of raw steel and the new producer has specialised in smaller slabs or pre-formed items. The newly merged entity could cross-sell to existing customers who need both kinds of product.

Otherwise, revenue synergy could be obtained even if the two had already been selling the same products to the same customers as the newly combined operation might allow the merged company to fulfil larger orders and so access new customers dealing in larger volumes.

Not always a good thing...

Note that synergies will not always be positive . It might be that merging two companies would actually cause problems. For example, it would be highly damaging from a brand perspective for a health food company to acquire a processed food producer, and could cost them a lot in sales. Brand will likely not be a major concern in the steel industry, but will often be crucial in other case.

With our structure complete, we can proceed to lead the analysis as usual. This will mean asking the interviewer a few considered questions in order to estimate values for the various elements of the structure . Once you have these values, calculating the value of the company is straightforward.

Let's say that, in our example, we valued the steel producer as being worth $1.5m. If there are no other opportunities available with higher values, then we should recommend that our client goes ahead with the acquisition. However, if our client could invest the same $1m in another company or set of assets valued at over $1.5m, then we should advise that they do this instead. Valuation has given us a means to objectively choose between opportunities.

Impress your interviewer

This article is a good primer on valuation, helping you get to grips with the main concepts and walking you through a relatively simple example of a valuation-based case study. However, the problems in your case interview are likely to be somewhat more involved. To get across all aspects of valuation in the detail you will need to land an MBB consulting job, the best resource is the "building blocks" section of the MCC Academy . There, our full length video lesson explores more complex aspects of valuation - including things like a full discussion of risk as it pertains to case studies and of the mathematics around net present value. We do our best, but it simply isn't possible to cram all this material into an article of this size!

For now, though, you should certainly start applying what you have learnt here to practice case studies . Remember to also check out our other building block articles on estimates , profitability , pricing and competitive interaction to learn about more themes that come up again and again in consulting interviews!

Find out more in our case interview course

Ditch outdated guides and misleading frameworks and join the MCC Academy, the first comprehensive case interview course that teaches you how consultants approach case studies.

Discover our case interview coaching programmes

Discover our career advancement programme

Account not confirmed

- Mastering Inventory Valuation Methods: Real-World Insights and Case Studies

Understanding Inventory Valuation Methods: Real-World Applications Explored

Embarking on your journey to master inventory valuation methods is akin to equipping yourself with a powerful arsenal for navigating the complex terrain of business operations. Whether you're a student delving into this subject or a professional seeking to refine your understanding, the significance of comprehending various inventory valuation methods cannot be overstated. In this comprehensive guide, we'll delve into the intricacies of inventory valuation methods, explore their real-world applications, and present compelling case studies that illuminate their relevance and efficacy in diverse business settings. If you need assistance with your inventory valuation assignment , this guide will provide the insights and knowledge necessary to excel.

Inventory valuation methods serve as the cornerstone of financial management for businesses across industries, providing insights into the value of goods held for sale. As you navigate through this terrain, understanding the nuances of these methods will not only enhance your academic prowess but also equip you with practical insights essential for making informed business decisions.

Exploring Inventory Valuation Methods:

In this section, we delve deeper into the complexities of inventory valuation methods. Understanding FIFO, LIFO, and the weighted average cost is pivotal for students. FIFO ensures accurate revenue matching, LIFO addresses rising costs strategically, and the weighted average cost method provides balance in diverse product scenarios. Real-world applications through case studies will illuminate the practical implications, enriching your comprehension and preparation for your inventory valuation assignment.

1. FIFO (First-In, First-Out):

The FIFO method, a cornerstone of inventory valuation, operates on the principle that the first items added to inventory are the first to be sold. This ensures a chronological depletion of inventory, mirroring the natural flow of goods. In real-world applications, FIFO is often employed in industries where product shelf life is a crucial factor, such as the food and pharmaceutical sectors.

Understanding the mechanics of FIFO is essential for students, as it aligns with the logical sequence of inventory turnover. Consider a case where a retail business adopts the FIFO method: the oldest goods are sold first, minimizing the risk of obsolete inventory and optimizing the matching of costs with revenue.

In this method, the cost of goods sold (COGS) reflects the costs associated with the earliest inventory purchases. This has profound implications for financial statements, providing a transparent representation of profitability. FIFO can be particularly beneficial during periods of inflation when costs are rising. By matching revenue with lower-cost inventory, businesses employing FIFO can present a more favorable financial picture.

Moreover, FIFO plays a pivotal role in inventory turnover ratios. Businesses can gauge how efficiently they are selling their products by examining the rate at which older inventory is depleted. This metric is invaluable for refining stocking strategies and managing cash flow effectively.

As you delve into your inventory valuation assignment, grasp the significance of FIFO not just as a theoretical concept but as a strategic tool with tangible impacts on financial outcomes. The case studies in subsequent sections will further elucidate how businesses leverage the FIFO method for enhanced financial management and operational efficiency.

2. LIFO (Last-In, First-Out):

LIFO, or Last-In, First-Out, presents a contrasting approach to inventory valuation compared to FIFO. This method assumes that the last items added to inventory are the first to be sold. While FIFO mirrors a natural chronological flow, LIFO takes a more recent-centric perspective.

In real-world applications, LIFO is often adopted by businesses facing rising costs, particularly during inflationary periods. This method allows companies to match the most recent, and often higher, costs with revenue, resulting in a higher cost of goods sold (COGS). This higher COGS, in turn, lowers taxable income, offering potential tax advantages.

Consider a manufacturing industry scenario where raw material costs are on the upswing. By implementing LIFO, the company strategically showcases a higher cost of goods sold, reducing its taxable income. This not only optimizes tax liabilities but also provides a conservative financial outlook during periods of inflation, aligning with the prudent principle of matching current costs with revenue.

However, it's important for students to recognize the limitations of LIFO. In times of rising costs, LIFO can lead to understated profits, potentially affecting financial ratios and investor perceptions. Additionally, LIFO may not be in compliance with international financial reporting standards (IFRS), which prefer FIFO.

As you navigate your inventory valuation assignment, understanding LIFO's nuances is crucial. Real-world case studies will shed light on how businesses strategically leverage LIFO, demonstrating its practical application in dynamic economic environments. This insight will equip you with a holistic understanding of inventory valuation, preparing you for the complexities of financial management in diverse industries.

3. Weighted Average Cost:

The Weighted Average Cost method provides a balanced approach to inventory valuation by calculating the average cost of all items in inventory. Unlike FIFO and LIFO, which focus on the chronological order of purchases, weighted average cost considers the total cost pool and assigns an average cost per unit.

In practical terms, this method is particularly valuable when a business deals with a diverse product portfolio, each with varying costs. The weighted average cost is calculated by dividing the total cost of goods available for sale by the total number of units available.

Imagine a scenario where a company manufactures a range of products, each with different production costs. The weighted average cost method allows the business to arrive at a unit cost that reflects the overall cost structure, offering a fair representation of expenses related to inventory.

The significance of the weighted average cost method becomes apparent in industries where products have distinct cost profiles. By using an average cost, businesses can streamline accounting processes and financial reporting, providing a more accurate representation of costs associated with inventory.

As a student engaged in your inventory valuation assignment, mastering the weighted average cost method is crucial for comprehending its application in diverse business environments. This method empowers businesses to avoid the extreme outcomes associated with FIFO and LIFO and provides a more stable representation of costs over time.

In subsequent case studies, we will explore real-world applications where the weighted average cost method proves instrumental in navigating the complexities of inventory valuation, offering you practical insights that extend beyond the theoretical realm of academic study.

Real-World Applications:

Discover the tangible impact of inventory valuation methods in diverse business scenarios. Real-world applications illuminate the strategic implementation of FIFO, LIFO, and the weighted average cost method. From retail giants optimizing revenue matching with FIFO to manufacturing industries strategically managing rising costs with LIFO, these case studies provide invaluable insights. As you explore these practical applications, deepen your understanding of inventory valuation's dynamic role in shaping financial outcomes. Now, let's delve into how these inventory valuation methods manifest in real-world business scenarios:

1. Retail Industry:

In the dynamic realm of retail, inventory valuation methods play a pivotal role in shaping financial strategies. Consider a scenario where a retail giant adopts the FIFO method. By depleting the oldest inventory first, this approach ensures a precise reflection of profitability and aids in strategic pricing decisions. The seamless integration of FIFO in retail enables businesses to optimize inventory turnover, minimize obsolescence risks, and enhance overall operational efficiency. This real-world application showcases how mastering inventory valuation methods is not just an academic exercise but a strategic imperative for retail enterprises, influencing their bottom line and competitive standing in a rapidly evolving market landscape.

2. Manufacturing Sector:

In the manufacturing sector, inventory valuation methods are critical tools for financial management, particularly during periods of fluctuating raw material costs. Imagine a manufacturing company grappling with rising costs; adopting the LIFO method strategically matches the most recent, higher costs with revenue. This results in a higher cost of goods sold (COGS), providing tax advantages and presenting a conservative financial outlook during inflation. The practical application of LIFO in the manufacturing sector showcases its significance in optimizing tax liabilities and maintaining financial prudence. This case study illustrates how businesses navigate economic challenges by leveraging inventory valuation methods, emphasizing the direct impact these strategies have on financial statements and tax planning in the intricate landscape of manufacturing operations. As a student, understanding these real-world applications enriches your comprehension, equipping you for informed decision-making in a dynamic business environment.

3. Food Industry:

In the dynamic and perishable world of the food industry, inventory valuation methods are indispensable for financial precision and operational agility. Consider the application of the weighted average cost method in a food business with a diverse product range. With varying costs associated with different ingredients, the weighted average cost allows for a balanced representation of expenses, aiding in accurate pricing and financial reporting. This approach ensures that the overall cost structure is reflected in the unit cost, enhancing the business's ability to make informed decisions. The weighted average cost method becomes a strategic tool, especially when dealing with fluctuating commodity prices and evolving consumer preferences. As students explore inventory valuation, understanding its application in the food industry not only sharpens academic acumen but also unveils the pragmatic significance of these methods in sustaining profitability and competitiveness in a sector where precision is paramount.

Navigating Challenges and Maximizing Opportunities in Inventory Valuation:

Inventory valuation methods serve as both a shield against challenges and a catalyst for seizing opportunities in the business landscape. As we delve into case studies spanning diverse industries, you'll witness how companies strategically deploy FIFO, LIFO, and the weighted average cost method to overcome hurdles and optimize their operations.

1. Retail Giant: Mastering Profitability

In the retail sector, a leading player demonstrates the effective use of FIFO. By ensuring the first-in inventory is the first-out, the company aligns costs with revenue, optimizing profitability. This approach not only provides a clear financial picture but also aids in setting competitive prices and managing inventory turnover efficiently. Challenges such as minimizing obsolescence risks are deftly addressed through this method, showcasing how businesses can turn inventory management into a competitive advantage.

2. Manufacturing Marvel: Adapting to Cost Fluctuations

In the manufacturing industry, a prominent player adeptly navigates rising raw material costs using the LIFO method. By assuming that the last items added are the first sold, the company can present a higher COGS, reducing taxable income during periods of inflation. This case study illustrates how LIFO helps companies navigate economic challenges, showcasing its adaptive power in a fluctuating cost environment.

3. Culinary Enterprise: Balancing Costs in Food Production

Transitioning to the food industry, a culinary enterprise exemplifies the significance of the weighted average cost method. With a diverse product range, each with distinct costs, the weighted average cost offers a balanced representation of expenses. This method proves invaluable when dealing with fluctuating ingredient prices and evolving consumer preferences, enabling the company to maintain profitability while offering quality products.

4. Tech Innovator: Strategic Use of FIFO in Electronics

In the rapidly evolving tech industry, a forward-thinking electronics manufacturer showcases the strategic implementation of FIFO. By prioritizing the sale of earlier acquired components, this company not only maintains accurate cost reflections but also ensures that the latest technologies are integrated into its products. This approach allows for dynamic adaptation to market trends and enhances the company's competitive edge in an industry driven by innovation.

5. Pharmaceutical Powerhouse: LIFO for Cost Management

Within the pharmaceutical sector, a major player adeptly employs LIFO to address the challenges posed by fluctuating drug manufacturing costs. By considering the most recent additions as the first sold, this company strategically manages its cost of goods sold. This not only aids in optimizing tax liabilities but also provides a conservative financial stance, essential for a sector where research and development costs can significantly impact the bottom line.

6. Automotive Manufacturer: Weighted Average Cost Precision

In the realm of automotive manufacturing, a leading company relies on the weighted average cost method to streamline its cost accounting processes. With a diverse range of vehicle models, each with distinct production costs, this method allows the company to arrive at a unit cost that accurately reflects its overall cost structure. By utilizing this precision, the automotive manufacturer enhances decision-making related to pricing strategies and product portfolio management in an industry driven by efficiency and consumer demands.

Conclusion:

In conclusion, mastering inventory valuation methods is essential for students and professionals alike, providing a robust framework for financial analysis and decision-making. As you delve deeper into the intricacies of FIFO, LIFO, and weighted average cost, remember their real-world applications and the transformative impact they can have on businesses across industries. Whether you're analyzing case studies or tackling inventory valuation assignments, the insights gained from this guide will serve as invaluable tools in your academic and professional journey. So, equip yourself with the knowledge and expertise to excel in inventory valuation and unlock new horizons in the realm of business management.

Post a comment...

Mastering inventory valuation methods: real-world insights and case studies submit your assignment, attached files.

The marketplace for case solutions.

Jaguar Land Rover plc: Bond Valuation – Case Solution

Jaguar Land Rover Automotive plc is a subsidiary of Tata Motors Limited, an Indian company. It declared a bond issue of US$500 million, the proceeds of which would be used for more expensive outstanding bonds. This case study analyzes how the company can save on costs through financing strategies.

S. Veena Iyer Harvard Business Review ( W15332-PDF-ENG ) July 31, 2015

Case questions answered:

- What factors might have enabled Jaguar Land Rover plc to raise new debt at less than half the coupon rate of interest in 2015, compared with the debt raised in 2011?

- Compute the amount at which existing bondholders might be willing to surrender their holdings.

- Assuming JLR purchases all existing outstanding bonds at a price determined in Question 2, determine the incremental cash flows of this bond issue vis-a-vis the original issue. Does the financing strategy result in cost savings for JLR?

- What other benefits, if any, might accrue to JLR as a result of this financing strategy? Does this strategy add value to the firm? To the existing bondholders? To JLR’s equity-holders?

Not the questions you were looking for? Submit your own questions & get answers .

Jaguar Land Rover plc: Bond Valuation Case Answers

This case solution includes an Excel file with calculations.

1. What factors might have enabled Jaguar Land Rover plc to raise new debt at less than half the coupon rate of interest in 2015, compared with the debt raised in 2011?

The factors that enabled Jaguar Land Rover plc to raise new debt at less than half the coupon rate of interest in 2015 include an upgrade of their bond rating from Ba3 to Ba2, a natural hedge for decreasing currency risk with both their dollar and pound-denominated debt, and the face value of JLR’s new issuance as well.

The issuers with higher creditworthiness can borrow at a lower rate. However, less creditworthy companies may have to pay a higher interest.

Consequently, bonds with higher credit ratings would always carry lower coupon rates. Bonds with lower ratings usually have higher rates to compensate for the risk associated with the bonds.

Since Moody’s Investors Services had upgraded Jaguar Land Rover plc’s bond rating from Ba3 to Ba2, this higher credit rating would cause its coupon rate to decrease.

In this case, we can look at the coupon rate as a scale of creditworthiness. The higher the coupon rate, the higher the risk. On the other hand, the lower the coupon rate is, the higher the creditworthiness.

Currency fluctuations may impact bonds significantly. Because the currency risk may lead to the possibility of losing money due to currency volatility, JLR’s strategy of issuing both the US dollar and the European pound will reduce currency risk.

By doing this, JLR’s issuance of senior notes in two different currencies would create a natural hedge for the company by diminishing the risk. Accordingly, the coupon rate will then decrease by mitigating currency risk.

Lastly, the face value of Jaguar Land Rover plc’s new bond issuance would also be another factor that enabled the company to raise new debt at less than half the coupon rate of interest in 2015. Compared to the previous issuance in 2011, the new senior notes issuance has a face value of $500 million when it matures.

As mentioned in the case material, the previous notes signaled an 11% premium over its face value. This indicates that the bond value has…

Unlock Case Solution Now!

Get instant access to this case solution with a simple, one-time payment ($24.90).

After purchase:

- You'll be redirected to the full case solution.

- You will receive an access link to the solution via email.

Best decision to get my homework done faster! Michael MBA student, Boston

How do I get access?

Upon purchase, you are forwarded to the full solution and also receive access via email.

Is it safe to pay?

Yes! We use Paypal and Stripe as our secure payment providers of choice.

What is Casehero?

We are the marketplace for case solutions - created by students, for students.

Business Valuation Case Study: Cash Flow is King

Case Background

The business in question was a sole proprietorship that provided “sales, repair, and installation” services to homes and businesses. The business operated out of a 2,500 square foot shop located at the owner’s residence. The business did not pay rent for use of the facilities, did not pay a salary to the owner for his services, but did pay a small wage to the spouse. The business had a consistent revenue stream, but profitability varied year to year.

Approaches Used

The opposing valuation expert (Expert A) relied solely on the Privately Traded Guideline Company Method to determine the value of the business . Expert A used the Pratt’s Stat’s – Private Company Merger and Acquisition database to search for transactions involving companies deemed similar to the subject business. Using search criteria of similar NAICS codes, a comparable range of revenue, and a timeframe of the previous 10 years to the effective date of the valuation, Expert A found 38 transactions involving companies deemed comparable to the subject business. Using these 38 transactions, Expert A determined that the mean (average) sales multiple was 0.73. Expert A then multiplied this sales multiple by an average of the previous 3 years sales to arrive at the estimated enterprise value of the business of approximately $432,000.

I also used the Privately Traded Guideline Company Method in my valuation, and the same historical data as Expert A, but made normalization adjustments to the income statements to account for the market rate rent expense for the shop, estimated market level compensation of the owner based upon services performed, and removed compensation paid to the spouse which would not be required for operation of the business. I also used the Pratt’s Stat’s database and similar search criteria. My search resulted in 40 transactions which included all 38 transactions that Expert A used. In addition, I chose the Seller’s Discretionary Earnings (SDE) multiple and the sales multiple as the two multiples to use in my valuation. According to Pratt’s Stats FAQ, it defines SDE as Operating Profit (Earnings Before Interest and Taxes) + Owners Compensation + Depreciation/Amortization. I believe that SDE closely resembles the earnings stream available to a purchaser of the business and thus is the more relevant multiple.

By way of example, my report stated,

“If you have two similar companies that both generate $500,000 in net sales annually, but Company A produces cash flow available for distribution to an owner of $150,000 while Company B produces $25,000, Company A will be more valuable than Company B regardless of the top line revenue. Using a net sales multiple alone does not account for the differences in profitability of the companies in the sample, unless the revenue multiple selected represents comparable profitability to the subject company.”

I calculated the normalized SDE for the subject company (considering the normalization adjustments discussed previously) and then calculated the SDE as a % of sales for the subject company. This percentage was then compared to the SDE as a % of sales for the transactions in my search. The results were the subject company’s normalized SDE as a percentage of sales approximated the SDE as a % of sales in the 21st percentile of the transactions in my search. The SDE multiple for the 21 st percentile associated with the transactions was 1.93 times SDE. I also calculated the sales multiple for the 21 st percentile which was 0.41 times revenue. By using these two multiples to calculate the estimated enterprise value of the business, the end result was approximately $145,000.

My approach considered the bottom line cash flow available to a potential purchaser of the business and used multiples corresponding to transactions with similar levels of cash flow. My report highlighted that top line measures of profitability, such as revenue, should be supported with an analysis to show its relationship with bottom line cash flow measures. Simply put, if the “mean” multiple for revenue should be used, then the bottom line cash flow available to a purchaser of the business should approximate the “mean” cash flow of the data set. Within these transactions it did not, and I believed a different multiple should be used.

The judge on the case heard arguments from both sides and due to the disparity in results called for a 3 rd independent valuation expert to review both reports and state to the court which approach they believed was more credible. The 3 rd expert testified that they would have valued the company using a bottom line cash flow approach that considered normalization adjustments similar to ones used in my report. When asked if they would have used the “mean” revenue multiple, they stated that they would only have used it if the bottom line cash flow approximated the “mean” of the data set for the transactions considered. The judge ruled in favor of my valuation report.

Visit our webpage for more information on McKonly & Asbury’s Business Valuation Services . Should you have questions about the importance of the cash flow available to a purchaser of a business, or business valuation in general, don’t hesitate to contact me, T. Eric Blocher CPA, ASA, CVA at [email protected] .

About the Author

McKonly & Asbury is a Certified Public Accounting Firm serving companies across Pennsylvania including Camp Hill, Lancaster, Bloomsburg, and Philadelphia. We serve the needs of affordable housing, construction, family-owned businesses, healthcare, manufacturing and distribution, and nonprofit industries. We also assist service organizations with the full suite of SOC services (including SOC 2 reports), ERTC claims, internal audits, SOX compliance, and employee benefit plan audits.

Related Services

Subscribe to our newsletter.

Related Insights

The Rising Cost of SOX Compliance and What Organizations Can Do About It

Preparing for an Audit: 2024 Edition

Mastering the Meet: A Student’s Guide to Navigating College Recruiting Events

The Final DOL Fiduciary Rule is Here!

Don't have an account? Sign up now

Already have an account login, get 10% off on your next order.

Subscribe now to get your discount coupon *Only correct email will be accepted

(Approximately ~ 0.0 Page)

Total Price

Thank you for your email subscription. Check your email to get Coupon Code.

Teuer Furniture A Discounted Cash Flow Valuation Case Study Solution

Posted by John Berg on Feb-16-2018

Introduction

Teuer Furniture A Discounted Cash Flow Valuation Case Study is included in the Harvard Business Review Case Study. Therefore, it is necessary to touch HBR fundamentals before starting the Teuer Furniture A Discounted Cash Flow Valuation case analysis. HBR will help you assess which piece of information is relevant. Harvard Business review will also help you solve your case. Thus, HBR fundamentals assist in easily comprehending the case study description and brainstorming the Teuer Furniture A Discounted Cash Flow Valuation case analysis. Also, a major benefit of HBR is that it widens your approach. HBR also brings new ideas into the picture which would help you in your Teuer Furniture A Discounted Cash Flow Valuation case analysis.

To write an effective Harvard Business Case Solution, a deep Teuer Furniture A Discounted Cash Flow Valuation case analysis is essential. A proper analysis requires deep investigative reading. You should have a strong grasp of the concepts discussed and be able to identify the central problem in the given HBR case study. It is very important to read the HBR case study thoroughly as at times identifying the key problem becomes challenging. Thus by underlining every single detail which you think relevant, you will be quickly able to solve the HBR case study as is addressed in Harvard Business Case Solution.

Problem Identification

The first step in solving the HBR Case Study is to identify the problem. A problem can be regarded as a difference between the actual situation and the desired situation. This means that to identify a problem, you must know where it is intended to be. To do a Teuer Furniture A Discounted Cash Flow Valuation case study analysis and a financial analysis, you need to have a clear understanding of where the problem currently is about the perceived problem.

For effective and efficient problem identification,

- A multi-source and multi-method approach should be adopted.

- The problem identified should be thoroughly reviewed and evaluated before continuing with the case study solution.

- The problem should be backed by sufficient evidence to make sure a wrong problem isn't being worked upon.

Problem identification, if done well, will form a strong foundation for your Teuer Furniture A Discounted Cash Flow Valuation Case Study. Effective problem identification is clear, objective, and specific. An ambiguous problem will result in vague solutions being discovered. It is also well-informed and timely. It should be noted that the right amount of time should be spent on this part. Spending too much time will leave lesser time for the rest of the process.

Teuer Furniture A Discounted Cash Flow Valuation Case Analysis

Once you have completed the first step which was problem identification, you move on to developing a case study answers. This is the second step which will include evaluation and analysis of the given company. For this step, tools like SWOT analysis, Porter's five forces analysis for Teuer Furniture A Discounted Cash Flow Valuation, etc. can be used. Porter’s five forces analysis for Teuer Furniture A Discounted Cash Flow Valuation analyses a company’s substitutes, buyer and supplier power, rivalry, etc.

To do an effective HBR case study analysis, you need to explore the following areas:

1. Company history:

The Teuer Furniture A Discounted Cash Flow Valuation case study consists of the history of the company given at the start. Reading it thoroughly will provide you with an understanding of the company's aims and objectives. You will keep these in mind as any Harvard Business Case Solutions you provide will need to be aligned with these.

2. Company growth trends:

This will help you obtain an understanding of the company's current stage in the business cycle and will give you an idea of what the scope of the solution should be.

3. Company culture:

Work culture in a company tells a lot about the workforce itself. You can understand this by going through the instances involving employees that the HBR case study provides. This will be helpful in understanding if the proposed case study solution will be accepted by the workforce and whether it will consist of the prevailing culture in the company.

Teuer Furniture A Discounted Cash Flow Valuation Financial Analysis