How to Write a Real Estate Investment Business Plan + Free Sample Plan PDF

Elon Glucklich

8 min. read

Updated February 19, 2024

Download a free one-page real estate investment sample business plan

With the worst of recent inflation in the rear-view mirror and interest rates projected to start falling in 2024, real estate investors see signs of optimism.

New apartment construction is rising sharply . These new properties coming onto the market and the prospect of lower borrowing costs point to plenty of long-term opportunities for investors.

However, investing in real estate requires a sharp eye for market trends, as well as significant upfront resources. Investors need to understand the different strategies for securing financing, and how to manage their properties to increase their value before reselling.

A business plan reduces your likelihood of making a bad investment, because it gets you in the habit of organizing your market research, and updating it as conditions evolve. The plan ultimately helps align your investment strategies with your opportunities.

| Looking for a fix and flip , home inspection , or other type of plan? Browse the Bplans library of sample real estate business plans |

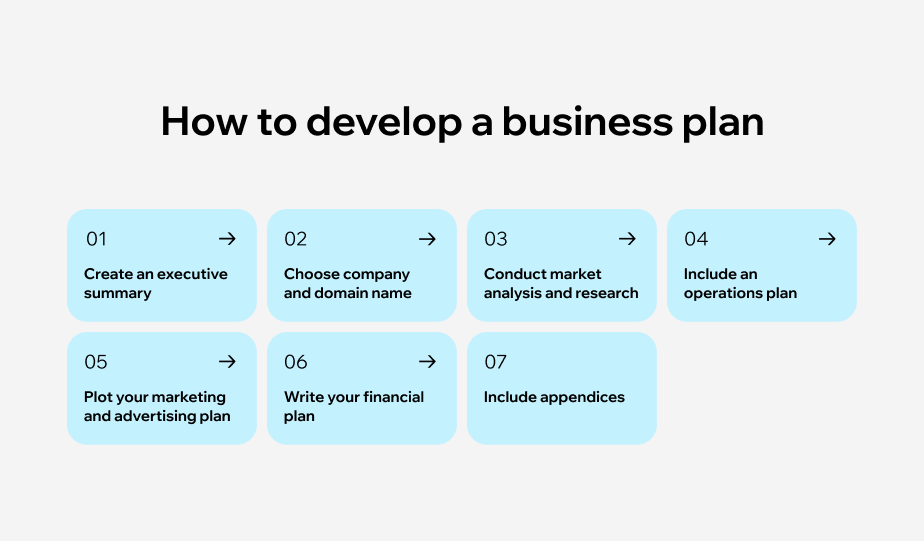

- What should you include in a real estate investment business plan?

Here are the most common sections any real estate investor should consider including in their plan:

- Executive summary

- Company overview

- Investment strategy

- Market analysis

- SWOT analysis

- Financial plan and forecasts

- Exit strategy

The length and depth of your business plan will vary depending on your business. For instance, a real estate investment firm with a national portfolio of office and apartment buildings is bound to have a more complex set of financial projections and supporting documents than an investor with single-family houses in a few markets.

Here’s an example of a real estate investment business plan outline.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- The 8 elements of an effective real estate investment business plan

1. Executive summary

Most business plans start with an executive summary outlining the business opportunity and the core strategies of your business.

It’s the first section that most readers (including loan officers) will read. You’ll want to highlight any unique value or competitive edge you have, such as a track record of generating positive returns, or knowledge of a specific market.

You should also give a high-level overview of your financial projections and anticipated returns, which you’ll go into greater detail on in the plan’s financial section. If you’re writing a business plan because you’re seeking bank financing or an investment, this is a good section to state your funding request and how you’ll use those funds.

2. Company overview

The company overview describes your company’s operational and legal structure .

List whether you have any partners, and detail your team’s experience, expertise, and roles within the company. Also, outline your portfolio, such as investing in residential properties, commercial buildings, or new development projects.

3. Investment strategy

There are many ways to invest in real estate — buying homes to rent out, fixing and flipping houses, pooling your resources with partners into a real estate investment group, investing in real estate investment trusts, and more. Describe your strategy and why it will generate the highest returns.You should also describe your criteria for choosing properties to invest in, and whether your primary focus is to invest in a certain geographic region or a type of property, such as apartments or fixer-upper homes.

4. Market analysis

If you have any experience in investment real estate, you know how important market research is. Imagine paying $1 million for an apartment building and adding $100,000 on renovations, only to realize you can’t find tenants to pay the higher rents you want to charge.

That’s where a thorough market analysis comes in. It helps you understand the landscape you’re operating in.

Use resources like the U.S. Census Bureau to research your target market’s age, income, and population trends. Look online for local data about real estate prices and how they’ve changed over time, or reach out to local realtors to get a feel for the market.

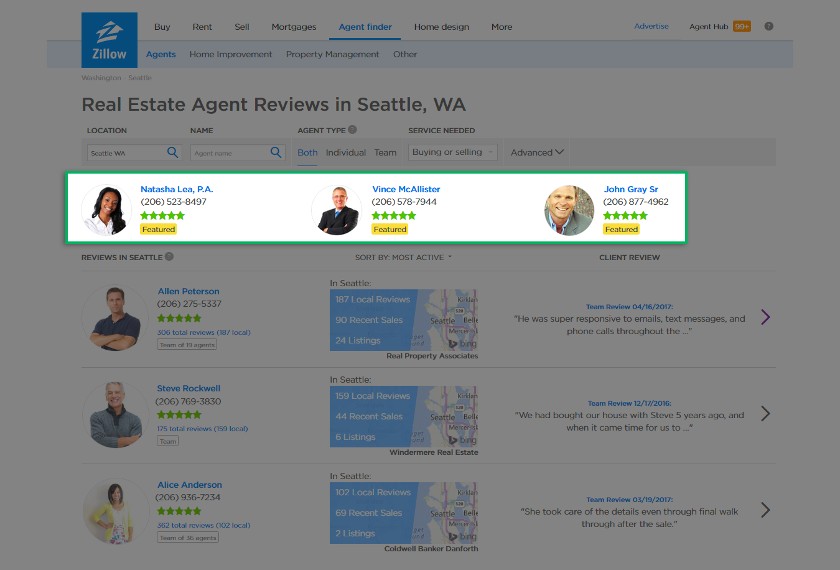

You should also try to determine how much investment activity is taking place in the market and who you’re competing with for opportunities.

Many cities and larger towns with development departments make their building permit databases available online, since permits are typically public records. Reviewing permit records can show you how much development activity is already occurring where you plan to invest.

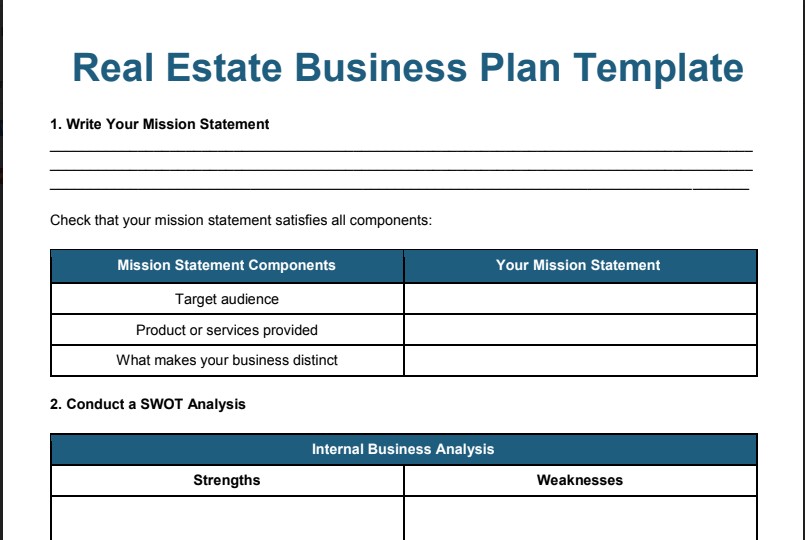

5. SWOT analysis

Because of the risks involved in real estate investment, a SWOT analysis can be a helpful exercise. It’s a strategic way of evaluating your company’s internal and external environment (think about your company’s financial health as an internal factor, and interest rates as an external factor).

The SWOT analysis gets you thinking about your company’s:

Strengths: What you do well , and what unique resources you have.

Weaknesses: What you need to improve on, what resources you lack, or what your competitors do better than you.

Opportunities: What are the current opportunities you want to take advantage of?

Threats: What factors could expose your company to risk, or what might competitors do to harm your position?

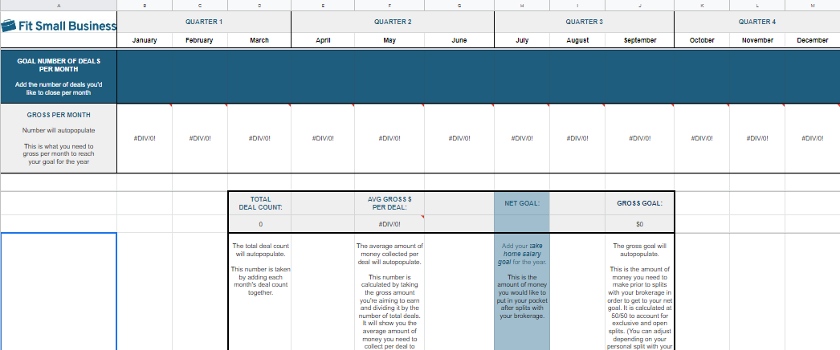

6. Financial plan and forecasts

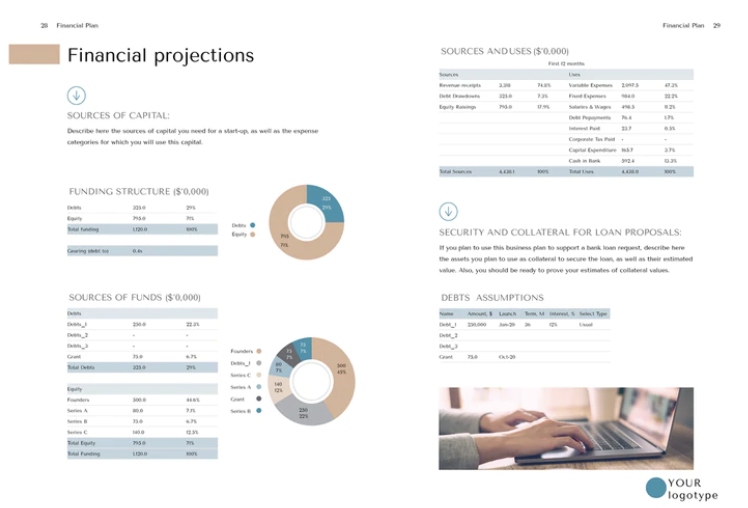

Your financial plan should provide a detailed view of the expected financial performance of your real estate investments. Include income statements , cash flow forecasts , and balance sheets projecting the next 3-5 years.

List the assumptions you used in your projections, such as rental income changes from rent increases or unrealized revenue due to certain amounts of vacant commercial space.

You should also include a break-even analysis. This calculates when you expect a property’s operating income to exceed the debt taken to buy and maintain it.

7. Exit strategy

If you’re writing your business plan for investors, detailing your exit strategy will clarify their pathways for realizing their returns. It also trains you to think about the long-term timeline for your investments and how to maximize their value.

Consider strategies that will help you maximize your profits, like refinancing your properties or looking into potential tax-deferral opportunities like a 1031 exchange.

8. Appendix

The appendix is an optional section at the end of your business plan. It’s where you include additional documents that support your business plan but don’t fit in the plan. This might include your detailed market research data, financial tables not covered in the main sections of the plan, legal documents, or permit records.

- Key considerations for writing a real estate investment business plan

To write a business plan that you can use as a guide for your decision making, consider places in the plan to emphasize these key points.

1. Develop a niche

If you’re a small investor or just starting, focus on carving out a specific niche for your investment strategy instead of trying to compete in multiple real estate segments. This could mean concentrating on a particular property type, such as multi-family homes, commercial real estate, or foreclosure properties, and diversifying your portfolio only after you’ve developed some traction. Or, you may decide to focus only on the segment you have the greatest advantage in.

2. Understand your risks

Real estate investment is inherently risky.

Market dynamics, regulatory changes, and economic fluctuations can all impact the performance of your investments.

As you compile research for your market analysis, dedicate time to conduct a detailed risk analysis to understand these factors and their potential impact on your investments. This includes assessing location-specific risks, economic cycles, and tenant or occupancy issues.

Writing these out before they happen will help you think of strategies to mitigate these risks if they actually occur.

3. Network and develop market knowledge

Building a strong network with other real estate professionals, such as brokers and contractors, can provide valuable insights into the markets you hope to operate in. Document in your business plan how you will cultivate these relationships — you can include timelines for developing contacts in the milestones section of your plan.

Also, try to keep up to date on current events in the area, especially news about the regional economy. Look into the tax climate in the area, as well. All of this helps you build a deeper understanding of your market dynamics, and helps validate your investment strategy — or gives you reasons to reconsider.

4. Consider help with your financials

Even if you have the financial background to write financial forecasts, you may want to leave room in your budget for accounting support.

If you’re starting or investing in an unfamiliar market, a CPA will help you navigate tricky tax issues that could throw off your projections.

Include the expense of hiring an accountant in your plan if you decide to bring one on, and describe their role, whether it’s helping with budgeting, tax planning, or financial analysis.

- Download your free real estate investment one page sample business plan

Download your free real estate investment sample business plan right now, or explore the Bplans gallery of over 550 sample business plans if you want to see plans for other industries.

You can also see how other real estate businesses have written their plans by checking out our free library of real estate business plans .

There are many reasons why real estate investors should write a business plan . Not only does it demonstrate credibility to the banks or investors you want to fund your acquisitions — it also increases your chances for growth , and gives you a strategy to manage your finances for the long term.

Elon is a marketing specialist at Palo Alto Software, working with consultants, accountants, business instructors and others who use LivePlan at scale. He has a bachelor's degree in journalism and an MBA from the University of Oregon.

Table of Contents

Related Articles

5 Min. Read

How to Write an Agritourism Business Plan + Example Templates

6 Min. Read

How to Write a Real Estate Business Plan + Example Templates

How to Write a Fast Food Restaurant Business Plan + Free Template

8 Min. Read

How to Write an Auto Repair Shop Business Plan + Free PDF

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Your 10 Step Guide to Building a Real Estate Investing Business Plan

Real estate empires grow from a blueprint, not last-minute hunches. This guide outlines how to create a real estate investing business plan to help you navigate market dynamics, seek funding, and add to your team so that you can successfully grow your business.

Let’s be honest, the idea of drafting a formal real estate investing business plan probably doesn’t excite you. After all, you got into real estate investing to scout deals and transform properties, not write novels full of financial projections.

But experienced investors know a solid plan spells the difference between profitability and major headaches. It forces clarity on direction and feasibility before you sink hundreds of thousands into property purchases and rehabs.

Think of your business plan as a blueprint for success tailored to your unique investment goals and market conditions. Whether you currently own a few rentals or are launching a full-fledged development firm, a plan guides decisions, aligns partners, and demonstrates viability to secure financing.

So how do you build one effectively without needless complexity? What key strategy areas require your focus? Let’s explore components that set you up for growth while avoiding common first-timer pitfalls. With realistic planning as your foundation, your investing journey can start smooth and stay the course.

What is a real estate investing business plan?

At its core, a real estate investment business plan is simply a strategic guide outlining your intended real estate approach. It defines target markets, preferred project types based on expertise, capital sources, growth strategy, key operational procedures, and other investment specifics tailored to your situation.

View your plan as an evolving document rather than a rigid static rulebook collecting dust. It should provide goalposts and guardrails as markets shift over time and new opportunities appear. You'll be able to refer back to the plan to confirm that these new opportunities align with proven tactics that yield predictable returns.

Detailed upfront planning provides a sound foundation for confident direction. It protects stakeholders by identifying potential pitfalls and mitigation strategies before costly surprises trip up the stability of your real estate business.

So, it's worth it to take the time and develop a customized plan aligned to your niche, resources, and risk tolerance. While initially tedious, the practice of putting together your strategic real estate business plan ultimately provides clarity and confidence moving forward.

Importance of having a business plan

Now that we’ve defined what a business plan is, let’s explore why having one matters — especially if you want to grow a successful real estate investment company.

Have you considered what originally attracted you to investing in properties? Whether it was rehabbing flips, acquiring rentals, or simply a lucrative hobby, your motivations and ideal path can get lost in the daily distractions of life. That’s where an intentional business plan provides clarity and conviction moving forward.

Reasons every real estate investor should prioritize planning are:

- Goals and vision : You might be wanting to quit your day job and focus on real estate full time, or you might simply want to generate some extra income on the side. Either way, a business plan forces you to define what success looks like for you.

- Due diligence : Creating a plan forces you to research the real estate markets you want to invest in — analyzing sales, rents, permits, zoning, demographics, and growth projections. This helps you objectively identify high-potential neighborhoods and properties rather than relying on hearsay or intuition.

- Funding and financing : Lenders and potential investors will want to review your business plan to evaluate the viability and profitability of your real estate investment business before offering any financing . A complete plan builds credibility and confidence with stakeholders.

- Guide decision-making : It's easy to get distracted by the latest real estate seminar or shiny new construction techniques. But sticking to the parameters and strategies laid out in your plan prevents you from making hasty changes or going down rabbit holes.

- Identify potential risks : There are always things that can unexpectedly go wrong: what if interest rates spike and make your loans unaffordable, or your best tenants move out and unreliable folks move in? Brainstorming these scenarios in advance allows you to minimize risks and have contingency plans.

- Systemize operations : As you grow, how will you scale operations? A business plan helps you identify areas that will require attention as your business evolves, like creating maintenance checklists for rentals, standardizing lease agreements , or automating accounting procedures.

- Build the right team : Your business plan provides guidance on the team you'll need for your business. Know if you require a real estate agent to help you find deals or a property manager to handle tenant complaints at 2 AM.

- Track progress : Your plan helps you compare things like actual rehab costs, rental occupancy rates, cash flow, etc. to your initial projections and determine whether you're on track. You can then make adjustments as needed.

- Maintain strategy : As you scale your operations with new hires or partnerships, you'll want to maintain direction in alignment with your original business plan. For example, if you are considering new verticals like commercial real estate, does evaluation criteria match your proven risk metrics and return hurdles? A real estate business plan keeps everyone focused on the same goals as your business grows.

What to include in a real estate investment business plan

A good real estate investing business plan covers everything from business goals to financing strategy. Here are the ten key elements you should include:

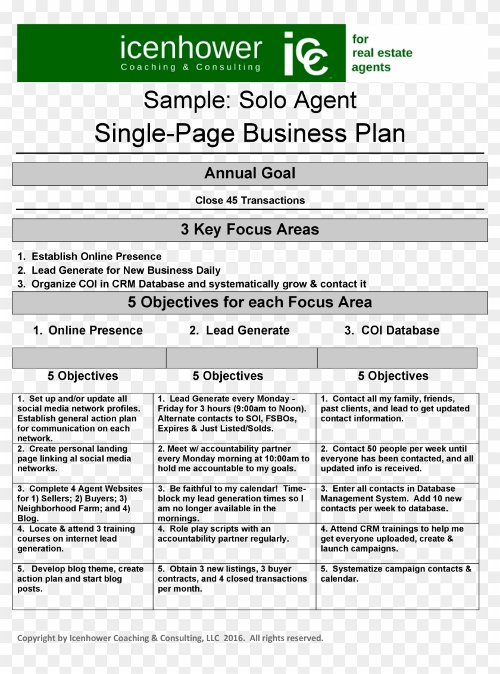

1. Executive summary

The executive summary provides a high-level overview of your real estate investment business plan. It briefly describes your company mission, objectives, competitive advantages, growth strategies, team strengths, and financial outlook.

Think of it as the elevator pitch for your business plan, and write it last after you have completed the full plan. Limit it to 1-2 pages at most.

Make your executive summary compelling and motivate investors or lenders to learn more. Be sure to also summarize your past successes and experiences to build credibility.

2. Company description

The company description section provides background details on your real estate investment company. Keep this section brief, but use it to legitimize your business and team.

- Business model : Explain your core business model and investment strategies. Will you primarily flip properties, buy and hold rentals, conduct wholesale deals, or use another approach?

- Company history and achievements : Provide a brief timeline of your company's history, including its formation, past projects, key milestones, and achievements.

- Legal business structure : Identify your corporate structure, such as LLC , S-Corp , C-Corp, or sole proprietorship.

- Office location : Provide your company's office address, which lends you credibility. If you are initially working from home, consider establishing a local PO Box or virtual address.

- Founders and key team members : Introduce your founders and key team members. Highlight relevant real estate, finance, management expertise, and credentials.

- Past projects : Provide an overview of any successful prior real estate projects your company or founders have executed.

- Competitive advantages : Explain unique resources, systems, or other strengths that give your company an edge over competitors. These could be proprietary analytic models, contractor relationships, deal access, or specialized expertise.

- Technologies and tools : Discuss technologies, software programs, or tools your company uses to streamline processes and optimize operations.

3. Market analysis

The market analysis section validates whether your real estate investment strategy makes sense in a given area.

Conduct detailed research from multiple sources to create realistic real estate investment market projections and identify potentially profitable opportunities.

Outline why certain neighborhoods, property types, or price points pique your interest more than others.

Your market analysis should dig deep into factors like:

- Local sales and rental price trends : Analyze pricing history and current trends for both sales and rents. Look at different property types, sizes, and neighborhoods.

- Housing inventory and demand analysis : Research the balance of supply and demand and how that impacts prices. Is the market undersupplied or oversupplied?

- Market growth projections : Review forecasts from real estate analysts on expected market growth or decline in coming years. Incorporate these projections into your analysis.

- Competitor analysis : Identify other real estate investors actively acquiring or managing properties in your target areas. Look at their business models and strategies.

- Target neighborhood and property analysis : Provide an in-depth analysis of your chosen neighborhoods and target property types. Outline positive attributes, risks, and opportunities.

- Demographic analysis : Analyze the demographics of potential tenants or homebuyers for your target properties. Factors like income, age, and family size impact demand.

- Local construction and renovation costs : Research materials and labor costs for accurate budgets and understand the permitting process and timelines.

- Regional economic outlook : Factor in projections for job growth, new employers, infrastructure projects, and how they may impact the real estate market.

4. SWOT analysis

SWOT stands for strengths, weaknesses, opportunities and threats. Conducting a SWOT analysis means stepping back from day-to-day business to assess your broader position and path from a strategic lens.

Internal strengths for your real estate investment business may include an experienced team skilled in major rehab projects, strong contractor relationships, or access to private lending capital. Weaknesses might be limited staff for handling tenant maintenance issues across a growing rental portfolio or only having a small number of referral partners for deal flow.

External opportunities can come from accelerating population growth and development in your target market, new zoning favorable to multifamily housing, or record-low mortgage interest rates. Threats could be rising material prices that hurt your flip margins, laws imposing restrictions on non-primary residence owners, or an oversupply of new luxury rentals, allowing tenants to be choosy.

The SWOT analysis highlights strengths to double down on and risks to mitigate in the real estate market.

5. Financial projections

The financial plan helps for both internal preparation and attracting investors. For real estate companies, the financial plan section should cover:

- Startup costs : Include the expected startup costs involved to start your investment project, such as getting licenses and permits or paying for legal fees.

- Profit and loss forecasts : Create projected profit and loss statements that outline what you think your revenues and expenses will be over the next 3-5 years.

- Cash flow projections : Put together projected cash flow statements that show expected cash flow for each month.

- Return on investment projections : Project your company's expected ROI over time under the different investment scenarios.

- Funding requirements : Based on your forecasts, detail exactly how much capital you will need to start and operate your business until it is profitable. Specify whether you plan to use debt or equity financing.

6. Investment strategy

The investment strategy outlines your niche — will you focus on flipping, buying rentals, commercial properties, or a blend? Define any geographic targets like certain cities or zip codes backed by your research on growth potential.

Specify your criteria for ideal investment properties based on your goals. Decide which factors — age, size, layout, condition, or price point — matter most to you.

You can also use this section to explain how you plan to find deals, whether that's by scouting listed properties, attending foreclosure auctions, or networking to create off-market opportunities.

Clearly conveying your approach allows lenders and potential private investors to grasp your niche, planned pursuits, and process for finding deals. Having a strong strategy that summarizes how you locate, evaluate and capture deals matching your investing thesis can increase lender and private investor confidence in your ability to execute.

7. Marketing plan

Real estate marketing can’t just be an afterthought; it helps attract profitable deals, financing, and tenants to your business, making it a necessary component of your business plan to prioritize.

Components of your marketing plan can include:

- Networking: Actively networking at local real estate meetups puts you directly in front of promising off-market opportunities and partnerships with motivated sellers, lenders and contractors in your community.

- Social media: Consistently nurturing your social media presence can also pay off to help you find opportunities or potential investors.

- Direct marketing: Never underestimate old school direct marketing — sending postcards to addresses with outdated “We Buy Houses” signs or calling the For Sale by Owners numbers from public listings can help you reach motivated sellers.

- Listings management: Note that marketing does not end once you own property. To keep rental vacancies filled, leverage listing sites that can publish your units to a wide audience of prospective tenants.

8. Operations plan

Without systems, real estate investors struggle through renovations plagued by cost overruns, shoddy contractors who never call back, and frustrating tenants who always pay late . The operations component of your plan should consider aspects like:

- Renovations: Ever lined up a contractor who juggles too many clients and leaves your projects languishing? Create standardized processes for accurate scoping, vetting subs, enforcing deadlines contractually, and maintaining contingency funds.

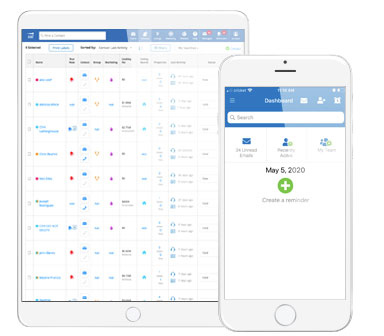

- Business technologies: As your portfolio grows, tasks like tracking income, expenses , assets, and communicating with tenants can quickly overwhelm. Identify technologies early on that help centralize details to avoid getting swamped. Look into property management platforms that automate listings, tenant screening , digitized lease agreements, maintenance work order flows, and communications.

- Insurance: Tenants or contractors can sometimes damage assets. Discuss landlord insurance policies to protect you against lawsuits, natural disasters, and major property repairs as you scale up.

9. Team structure

If you plan to grow your team beyond just yourself or a few partners, your business plan should outline your organization's key roles and responsibilities. This helps you consider what positions you may need to fill as your company scales.

- Partners or co-founders: These are the main decision-makers and equity holders. Outline their background, skills, and the value they bring.

- Property manager: This person handles day-to-day management of properties, tenants and maintenance issues.

- Bookkeeper: You may need daily help managing bank accounts, invoices, taxes, and financial reporting.

- Contractors and project managers : You'll need trusted renovations, repairs, and landscaping contractors. Dedicated project managers help oversee large jobs.

- Leasing agents : As you grow and add more properties, leasing agents handle showings, applications, and signing new tenants.

- Real estate attorneys : Real estate investing requires proper legal filings and compliance. Attorneys can help you manage this risk.

10. Exit strategies

Every wise investor plans their exit strategy upfront before acquiring a property. Will you aim to flip the asset quickly or retain it as a rental long-term? What factors determine ideal timing and the right profit margin for you to walk away?

Build flexibility into your strategy, as markets move in unpredictable ways. Especially with flips, have contingency plans if your listing gets lowballs or no offers. Be willing to rent short-term, refinance and hold if possible, convert to condos, or just patiently wait until the market changes. Having reserves and backup options allows you to avoid a distress sale.

Also include plans for strategies after a property sale, like a 1031 exchange to defer capital gains taxes and reinvest in another property. You may want to use sale proceeds to reduce or clear outstanding debts, enhancing cash flow and financial standing.

Tips for your real estate business plan

Now that you know what to include, consider the following four tips to help your real estate investment business plan stand out.

1. Be detailed and specific

Resist the urge to gloss over details as you put together your plan. Drill down on the specifics for parameters like:

- Target purchase and rehab costs.

- Timelines for completing projects.

- Minimum profit margins.

- Maximum allowable vacancy rates .

- Minimum cash reserves.

2. Refine and update regularly

Markets change, so don't create your business plan and file it away. Review your plan regularly to see how market conditions and your actual results compare to projections.

Make adjustments as needed. Tweak your approach if your rehabs are going over budget or your properties aren't selling as quickly as expected.

Aim to update your full plan annually at a minimum. Even if your overall strategy remains consistent, refresh the details around market factors, financials, tactics, risks, and projections.

3. Seek expert feedback

Before implementing your new real estate investment business plan, seek feedback from advisors who can identify potential issues or weaknesses.

Ask experienced real estate investors in your area to review your plan and provide constructive input. It's also a good idea to share your plan and numbers with your CPA and legal counsel as well.

4. Keep it simple

While specificity is good, don't over complicate your business plan to the point where it becomes difficult to follow. You want to inform readers without confusing them.

The goal is for stakeholders, such as co-investors, lenders, and partners, to easily digest your plan and understand it after a quick skim. Make it easy for readers to grasp your reasons behind focusing on a given area or project type based on market conditions and opportunity.

A property investment business plan fit to your goals

After finally finishing your business plan, you’re probably eager to dive into tangible investments rather than tweaking spreadsheets. But in the real estate industry, even experienced investors periodically step back and update strategies.

Approach your business plan as a living document that evolves as the market shifts, as you create new partnerships, or when you need to make changes in strategy. Set reminders to revisit quarterly and confirm your activities of today still align with the vision from day one.

Solid planning is proven to improve outcomes in dynamic industries like real estate investing. Though preparation isn’t glamorous, it pays dividends. Thoughtfully constructing your playbook puts the odds of executing successfully in your favor.

With a solid blueprint backed by your research, you’re now ready to capture the best real estate investment opportunities.

Business plan real estate investor FAQs

How do i stay flexible and adapt my business plan to changes in the market.

To stay flexible, review your real estate investing business plan regularly and update it based on changes in market conditions, trends, and opportunities. If things change in the market, find ways to adapt your strategy. This can include your goals, target market, financing, and even your exit plans.

How do I know if my real estate investing business plan is effective?

You'll know your business plan is effective if you're meeting the key objectives and metrics you outlined. Let's say your plan called for you to purchase a certain number of properties and achieve a specific cash flow or rate of return. If you're falling short, you can use the plan to course-correct.

Are there any specific software or tools for creating a real estate investing business plan?

Azibo is a helpful software tool for creating real estate investing business plans. This comprehensive platform has templates and tools to build out key sections of your plan. Its robust accounting and financial capabilities help construct accurate statements and projections.

Incorporating Azibo's online rent collection allows you to model cash flows. By centralizing lease documents , accounting, and portfolio management, Azibo streamlines the process of putting together a strategically sound real estate business plan.

Important Note: This post is for informational and educational purposes only. It should not be taken as legal, accounting, or tax advice, nor should it be used as a substitute for such services. Always consult your own legal, accounting, or tax counsel before taking any action based on this information.

Nichole co-founded Gateway Private Equity Group, with a history of investments in single-family and multi-family properties, and now a specialization in hotel real estate investments. She is also the creator of NicsGuide.com, a blog dedicated to real estate investing.

Other related articles

Whether you’re a property owner, renter, property manager, or real estate agent, gain valuable insights, advice, and updates by joining our newsletter.

Latest posts

The landlord lien: key insights for renters and owners.

Understanding landlord liens is important for property owners to secure unpaid rent through the tenant's personal property. This guide explores the legal framework, benefits, and best practices, ensuring landlords and tenants navigate liens effectively.

Fair Credit Reporting Act: Details for Landlords and Tenants

Running credit checks on prospective tenants? As a landlord or renter, you should understand the Fair Credit Reporting Act and how it impacts the rental process. This article covers the key elements of this law and how it governs the use of credit information during the rental process. Both property owners and prospective tenants will discover how this regulation supports a fair rental experience for all parties involved.

Implied Warranty of Habitability: The Landlord and Tenant Handbook

Rental properties are meant to provide safe, livable housing, and the implied warranty of habitability helps ensure that that's the case. However, not every repair issue falls under this rule. Discover the key areas landlords must address, what lies outside the warranty's scope, and steps tenants can take if landlords fail to make necessary repairs to maintain rental habitability.

How to Start a Real Estate Investment Company

Free Real Estate Investment Business Plan Template

11 Min Read

Are you thinking about growing your wealth? Consider the power of real estate! This industry has a strong track record, with an average annual growth of around 5.4% over the last six decades.

With a whopping $5.16 trillion market, the opportunities are huge. But it’s not just about owning buildings—it’s a chance to really make a difference in our communities and shape the way cities evolve.

If you’re ready to learn how to start a real estate investment company , let this guide be your roadmap to success. We’ll cover market trends, smart real estate investing strategies, and everything you need to build your own thriving investment business.

Benefits of Starting a Real Estate Investment Business

It’s not just about watching your property value climb – real estate investment is also about generating steady cash flow from rental income. This kind of reliable stream pays off big time, especially when the rest of the market experiences a downturn.

Another bonus? Real estate adds variety to your portfolio. It often moves independently of stocks and bonds, making it a great way to spread your risk and weather those market storms.

Plus, unlike some real estate investments, real estate has tangible assets. Even if the project doesn’t hit a home run, you still have the land and the building—there are ways to recover a good chunk of your investment.

And that’s just the start! A real estate business also offers a whole range of benefits like:

- Steady income streams

- Potential for properties to increase in value

- Tax benefits

- A way to protect your money against inflation

What You Need to Start a Real Estate Business?

Starting a real estate investment company isn’t about just finding properties! Think of it like building a house – you need a strong foundation first. Here’s what you’ll need:

- A Business Plan: Your business plan is your roadmap. What’s your mission? How much does it cost to launch? How will you track success?

- Investment Strategy & Capitalization: Before chasing deals, know your investment plan. What type of properties? How much cash do you have on hand?

- Operations plan: This is your business blueprint. Decide on a solo or team approach, define your daily tasks, and make sure everything supports your main goals.

- Networking: Build that network! Finding the gems and closing those deals often hinges on solid connections in the real estate market.

Now that you understand the benefits of starting a real estate investment company, let’s explore the steps involved.

- Select a suitable business type

- Write a comprehensive business plan

- Form a legal business entity

- Open business banking accounts

- Figure out business finances

- Obtain required licenses and permits

- Build a professional network

- Develop an investment strategy

1. Select a suitable business type

Choosing the right real estate path is critical to building your dream business. Let’s break down a few popular options:

Residential Rental Company

Become a landlord! This is about finding suitable properties, attracting reliable tenants, and generating steady rental income. If you hold on to the property, it might even gain value over time.

Commercial Real Estate Company

Think outside the (residential) box! Retail spaces, offices, warehouses – this diverse sector offers a unique way to expand your holdings and tap into different market trends.

Wholesaling

Do you have a nose for a good deal? Wholesalers track down discounted properties, secure the rights, and then connect with buyers looking for a bargain. It’s a fast-paced world of deal-making, not long-term ownership.

Real Estate Investment Group (REIGs)

REIGs let you team up with other investors. You can combine your money to take on bigger projects and share the rewards.

Real Estate Development Business

Got an eye for potential? Developers transform land or renovate existing buildings. This includes house flippers and those who build massive new projects – they see opportunity where others see problems.

2. Write a comprehensive business plan

Your real estate business plan is your blueprint for success. It’s where you strategize about your property focus, nail those operational details, and craft a marketing plan that attracts serious investors.

A solid real estate investment business plan should cover:

- Your Focus: What types of properties will you target? Residential, commercial, or a mix? Will you specialize in a niche, like fixer-uppers or luxury condos?

- Marketing that Matters: How will you reach potential investors and stand out in a crowded market? What channels will you use?

- Know Your Rivals: Who else is competing for those same deals? How will you differentiate yourself and secure the best properties?

- The Bottom Line: Project your finances realistically. This isn’t just about finding excellent properties; it’s about building a profitable business!

The best part? The planning process forces you to understand your ideal real estate investor. Are you targeting those seeking steady income or high-risk/high-reward players? Knowing your audience puts you in the driver’s seat.

Not very good at writing? Need help with your plan?

Write your business plan 10X faster with Upmetrics AI

Plans starting from $7/month

3. Form a legal business entity

Stepping into business registration is more than a formality; it’s your entry ticket into the business world. This crucial move sets the stage for paying taxes, securing funding, and everything in between.

Plus, the moment your business is registered, it transforms from an idea to reality — it’s official, and it’s yours.

Here’s what you will need to get started:

Location Matters

Your location choice impacts taxes, legal hoops, and potential earnings. While many stick to their home turf, eyeing other states could offer competitive advantages, especially for real estate ventures.

If you’re open to relocating, your business could benefit significantly. And remember, moving your business isn’t as difficult as it sounds.

Choose the right business structure

Choosing your business structure is akin to choosing its foundation. Each option — be it real estate LLC, sole proprietorship, or corporation — comes with its unique impact on taxes, liability, and paperwork.

Tip: For real estate investment, LLCs are often favored for their flexibility and lighter regulatory load.

Lastly, registering for taxes means obtaining an Employer Identification Number (EIN), a straightforward process via the IRS website.

Your EIN is essential for tax purposes, and if you’re a sole proprietor, your social security number can also serve this purpose. Selecting your tax year is crucial, too, as it defines your financial reporting period.

4. Open business banking accounts

Separating your personal and business finances is a smart safeguard, especially when dealing with a real estate holding company.

It helps protect your personal assets from any potential hiccups related to your properties and keeps your financial life organized, especially when tax season rolls around.

The best way to do this? Set up separate bank accounts specifically for your company.

Only use these accounts for your real estate business – rent, maintenance, taxes, the whole nine yards. This creates a clear divide and makes tracking your finances a whole lot easier.

5. Figure out business finances

Jumping into real estate investing means having a good amount of cash ready. Depending on your approach, the upfront investment can range significantly from around $120,300 to $1,090,000 .

To make smart financial moves, it’s essential to understand where that money is going. This includes down payments, closing fees, and maybe even some renovation costs.

A detailed budget plan is essential. It helps you make informed investment decisions and sets you up for a successful, long-term real estate business.

Now, how do you fund these costs? Well, you have a few options:

Your own savings

Using your cash reserves is tempting, but remember, real estate deals have their ups and downs. You don’t want to put all your funds in one property and risk getting stuck if the market shifts.

Borrow from friends or family

While loved ones might be supportive, blending money and relationships can get complex. What happens if a renovation takes longer than expected or your projected returns hit a snag?

Seek external funding

This is where your real estate investments strategy really takes shape! Consider:

6. Obtain required licenses and permits

Starting a real estate investment business means navigating a bit of a permit and license jungle. It depends on where you’re operating, but expect to deal with paperwork at the local, state, and sometimes even federal levels.

Now, the good news: you don’t necessarily need a real estate agent or broker license to be a real estate investor. But here’s the thing – getting that license could save you a serious chunk of change.

Why? Because you can cut out the realtor and their commission fees when buying or selling real estate properties. If you’re planning on doing a lot of transactions, the license might pay for itself.

Of course, each state has its own rules about getting licensed, and so does your research.

Beyond the real estate license, there’s the whole world of business permits. Think DBA (“Doing Business As”), maybe health and safety stuff from OSHA, and protecting trademarks for your excellent company name.

Depending on your specific investment niche, there might be industry-specific licenses to deal with.

Then comes the local stuff: state, county, and city permits can all be involved. The best way to figure this out is to visit the websites of your local governments or, better yet, actually call them.

7. Build a professional network

Building a robust network is the lifeblood of your real estate investing business. The right connections can open doors to incredible deals, fast funding, and serious profits.

It’s your secret weapon, especially when things get unpredictable.

So, let’s dive into the best ways to get out there and make those connections:

Expand Your Territory

Traveling isn’t just about vacation; it’s about expanding your turf. Look up local players in the areas you visit – investors, lenders, you name it. A few coffee meetings could land you a deal that funds your whole trip and maybe even gets you some tax breaks (talk to your accountant!).

Attend Strategic Events

Every town has networking events – happy hours, trade shows, the works. These folks are there to meet people like you! Don’t just show up, do your homework and target the attendees you want to connect with.

Leverage Social Media

Social media is powerful, but don’t just collect followers. Build genuine relationships with potential partners, clients, and those who share your interests. Find relevant groups, offer value, and be genuine.

Share Your Expertise

Once you’ve gained some experience, host your own classes or workshops. Share your expertise on buying, flipping, or whatever you’re good at. This will position you as the go-to expert and attract like-minded folks.

Foster Community Connections

Get involved in local events, charities, or community improvement projects. This builds strong relationships within your area and can organically generate leads, funding sources, and partnerships.

Utilize Your Network

Don’t underestimate the power of your existing contacts. Ask for referrals, introductions, and recommendations to expand your reach exponentially. Be sure to reciprocate by connecting with others within your network.

8. Develop an investment strategy

Building a successful portfolio takes more than just enthusiasm. A well-defined strategy aligned with the market is your roadmap to success. Let’s break down the essential steps:

Define Your Goals & Risk Profile

Before buying even a single brick, ask yourself: Are you in it for the long haul, aiming for slow and steady growth? Or is fast cash flow your top priority?

Understanding your goals shapes every decision that follows. Also, be honest about your risk tolerance. Some investors love a high-stakes gamble; others need the security of a slow-and-steady approach.

Conduct Thorough Market Research

Winning at real estate means knowing the playing field. Dig into market trends – not just your neighborhood, but the bigger economic picture.

Study rental demand, job growth, and all those factors that drive the value up (or down!). Informed investors spot opportunities others miss and dodge potential pitfalls.

Embrace Diversification

Diversification is your best friend. Sure, spread it across different locations, but think bigger—residential vs. commercial, traditional rentals vs. real estate investment trusts (REITs), or crowdfunding. An intelligent mix protects you if one market segment takes a temporary dip.

Prioritize Financial Planning & Risk Management

Real estate is a business, not just a romantic dream about fancy houses. Have a rock-solid budget, know your cash flow needs, and leave room for those “oops” moments – vacancies, repairs, etc.

Build in safety nets like insurance and get savvy about legal structures to protect your personal assets.

Real estate can build serious wealth, give you options with your money, and even offer some tax advantages. But it’s also a serious commitment – there’s money on the line, risks to manage, and you need a good dose of patience.

The key to making it work? A rock-solid business plan. Think of it as your roadmap – it gets your goals clear, helps you understand the market, and keeps you focused on building a sustainable real estate investment business.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks, AI-assistance, and automatic financials make it easy.

Frequently Asked Questions

Do i need a degree to start a real estate investing company.

Nope! While a business or finance degree can be useful, it’s not mandatory. Success depends more on real-world knowledge – understanding the market, smart financial strategies, and the legal side of things.

Is starting a real estate investment company profitable?

It absolutely can be! But think of it as a long game, not a get-rich-quick scheme. There are different ways to profit: steady rental income, riskier fix-and-flips, even large-scale development projects. The key is finding the strategy that fits.

Should I hire an investment property manager for my real estate investing business?

That depends! Do you have the time and energy to handle tenant issues, repairs, and the day-to-day grind? Investment Property managers take that burden off your plate, freeing you up to focus on growth, but it’s an added expense.

Is there a most profitable type of real estate investing?

No single magic bullet here. Different real estate investing strategies come with their own risk-reward balance. Want steady, predictable income? Think established rentals. Up for some risk in exchange for potentially huge profits? Flipping or development might be your thing.

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Reach Your Goals with Accurate Planning

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

How to Start a Real Estate Investment Company

Starting a real estate investment company can be very profitable. With proper planning, execution, and hard work, you can enjoy great success. Below you will learn the keys to launching a successful real estate investment company.

Importantly, a critical step in starting a real estate investment company is to complete your business plan. To help you out, you should download Growthink’s Ultimate Real Estate Investment Business Plan Template here .

Download our Ultimate Real Estate Investment Business Plan Template here

14 Steps to Start a Real Estate Investment Company:

- Choose the Name for Your Real Estate Investment Company

- Develop Your Real Estate Investment Business Plan

- Choose the Legal Structure for Your Real Estate Investment Company

- Secure Startup Funding for Your Real Estate Investment Company

- Find an Ideal Location for Your Real Estate Investment Company

- Register Your Real Estate Investment Company with the IRS

- Open a Business Bank Account

- Get a Business Credit Card

- Get the Required Business Licenses and Permits

- Get Business Insurance for Your Real Estate Investment Company

- Buy or Lease the Right Real Estate Investment Company Equipment

- Develop Your Real Estate Investment Company Marketing Materials

- Purchase and Setup the Software Needed to Run Your Real Estate Investment Company

- Open for Business

1. Choose the Name for Your Real Estate Investment Company

When choosing a name for your real estate investment company, it is important to find a name that reflects the type of business you are running. If your real estate investment company is focused on flipping houses, then a good name might be “House Flipping” or “House Hunting.” You will also want to make sure that the name you choose for your real estate investment company is unique.

This is a very important choice since your company name is your brand and will last for the lifetime of your business. Ideally, you choose a name that is meaningful and memorable. Here are some tips for choosing a name for your real estate investment company:

- Make sure the name is available. Check your desired name against trademark databases and your state’s list of registered business names to see if it’s available. Also, check to see if a suitable domain name is available.

- Keep it simple. The best names are usually ones that are easy to remember, pronounce and spell.

- Think about marketing. Come up with a name that reflects the desired brand and/or focus of your real estate investment company.

2. Develop Your Real Estate Investment Business Plan

One of the most important steps in starting a real estate investment company is to develop your business plan. The process of creating your plan ensures that you fully understand your market and your business strategy. The plan also provides you with a roadmap to follow and if needed, to present to funding sources to raise capital for your business.

To enhance your planning process, incorporating insights from a sample real estate investment company business plan can be beneficial. This can provide you with a clearer perspective on industry standards and effective strategies, helping to solidify your own business approach.

Your real estate investment business plan should include the following sections:

- Executive Summary – this section should summarize your entire business plan so readers can quickly understand the key details of your real estate investment company.

- Company Overview – this section tells the reader about the history of your real estate investment company and what type of real estate investment company you operate. For example, are you a real estate investment company that buys homes, flips them for quick profits, or leases them?

- Industry Analysis – here you will document key information about the real estate investment company industry. Conduct market research and document how big the industry is and what trends are affecting it.

- Customer Analysis – in this section, you will document who your ideal or target customers are and their demographics. For example, how old are they? Where do they live? What do they find important in services like the ones you will offer?

- Competitive Analysis – here you will document the key direct and indirect competitors you will face and how you will build a competitive advantage.

- Product: Determine and document what products/services you will offer

- Prices: Document the prices of your products/services

- Place: Where will your business be located and how will that location help you increase sales?

- Promotions: What promotional methods will you use to attract customers to your real estate investment company? For example, you might decide to use pay-per-click advertising, public relations, search engine optimization, and/or social media marketing.

- Operations Plan – here you will determine the key processes you will need to run your day-to-day operations. You will also determine your staffing needs. Finally, in this section of your plan, you will create a projected growth timeline showing the milestones you hope to achieve in the coming years.

- Management Team – this section details the background of your company’s management team.

- What startup costs will you incur?

- How will your real estate investment company make money?

- What are your projected sales and expenses for the next five years?

- Do you need to raise funding to launch your business?

Finish Your Business Plan Today!

3. choose the legal structure for your real estate investment company.

Next, you need to choose a legal business structure for your real estate investment company and register it and your business name with the Secretary of State in each state where you operate your business.

Below are the five most common legal structures:

1) Sole proprietorship

A sole proprietorship is a company entity in which the owner and the company are legally the same person. The owner of a sole proprietorship is responsible for all business debts and responsibilities. A sole proprietorship does not require any formalities to set up or run, and it is simple to do so. One of its major advantages is that it is the easiest company entity to create and maintain.

2) Partnerships

A business partnership is a legal entity utilized by small enterprises. It’s the agreement between two or more people who want to start a company. The business partners split any profits and losses from the company equally.

The advantages of forming a partnership are that it is simple to start and the business partners share in the profits and losses of the firm. The disadvantages of real estate investment partnerships are that the partners are jointly responsible for the company’s debts, and partner conflict resolution may be difficult.

3) Limited Liability Company (LLC)

An LLC, often known as a “limited liability company,” is a sort of business entity that protects its owners from responsibility. This implies that the proprietors of an LLC are not personally liable for the firm’s debts and liabilities. The flexibility of an LLC includes management freedom, pass-through taxation (which avoids double taxation), and limited personal liability.

4) C Corporation

A C Corporation is a business entity that is independent of its owners. It has its own tax identification number and can have shareholders. The major benefit of a C Corporation is that it provides limited responsibility to its shareholders. This implies that the company’s owners are not held accountable for the firm’s debts and liabilities. The disadvantage is that C Corporations are taxed separately from their owners, which means they also pay taxes at the corporate tax rate.

5) S Corporation

An S Corporation is a type of business organization that offers its owners limited liability protection and allows them to transfer earnings from their company to their personal tax returns, avoiding double taxation. There are several restrictions placed on S Corporations, including the number of shareholders they can have, among others.

Once you register your business, your state will send you your official “Articles of Incorporation.” You will need this among other documentation when establishing your banking account (see below). We recommend that you consult an attorney in determining which legal structure is best suited for your real estate investment firm.

4. Secure Startup Funding for Your Real Estate Investment Company

In developing your real estate investment business plan , you might have determined that you need to raise funding to launch your business.

Other common sources of funding for a real estate investment firm to consider are personal savings, family and friends, bank loans, crowdfunding, and angel investors. Angel investors are individuals who provide capital to early-stage businesses. Angel investors typically will invest in a real estate investment company that they believe has a high potential for growth.

Incorporate Your Business at the Guaranteed Lowest Price

We are proud to have partnered with Business Rocket to help you incorporate your business at the lowest price, guaranteed.

Not only does BusinessRocket have a 4.9 out of 5 rating on TrustPilot (with over 1,000 reviews) because of their amazing quality…but they also guarantee the most affordable incorporation packages and the fastest processing time in the industry.

5. Find an Ideal Location for Your Real Estate Investment Company

When choosing a location for your real estate investment firm, you should consider factors such as your budget, customer demographics, and the demographics of the real estate market.

If you have a limited budget, you might want to choose a location where rent is inexpensive. If you’re operating in more rural areas with low population densities, it will be easier for you to find discounted real estate investment properties. However, if your target market is composed of customers who are located in the surrounding area, you will need to offer them easy access to your business. When choosing a location, you should also consider factors that could affect foot traffic such as where do customers live, work and play.

The real estate market also plays a role in deciding on a location for your business. For instance, some markets will be better for multifamily real estate, while some markets might be more suitable for commercial real estate.

You should also consider the demographics and the income and employment levels of potential customers in your target market. This is key to helping you determine location and customer traffic.

Places with high concentrations of upscale homes or luxury retail stores are examples of good markets.

6. Register Your Real Estate Investment Company with the IRS

Next, you need to register your business with the Internal Revenue Service (IRS) which will result in the IRS issuing you an Employer Identification Number (EIN).

Most banks will require you to have an EIN in order to open up an account. In addition, in order to hire employees, you will need an EIN since that is how the IRS tracks your payroll tax payments.

Note that if you are a sole proprietor without employees, you generally do not need to get an EIN. Rather, you would use your social security number (instead of your EIN) as your taxpayer identification number.

7. Open a Business Bank Account

It is important to establish a bank account in your real estate investment company’s name. This process is fairly simple and involves the following steps:

- Identify and contact the bank you want to use

- Gather and present the required documents (generally include your company’s Articles of Incorporation, driver’s license or passport, and proof of address)

- Complete the bank’s application form and provide all relevant information

- Meet with a banker to discuss your business needs and establish a relationship with them

8. Get a Business Credit Card

You should get a business credit card for your real estate investment company to help you separate personal and business expenses.

You can either apply for a business credit card through your bank or apply for one through a credit card company.

When you’re applying for a business credit card, you’ll need to provide some information about your business. This includes the name of your business, the address of your business, and the type of business you’re running. You’ll also need to provide some information about yourself, including your name, Social Security number, and date of birth.

Once you’ve been approved for a business credit card, you’ll be able to use it to make purchases for your business. You can also use it to build your credit history which could be very important in securing loans and getting credit lines for your business in the future.

9. Get the Required Business Licenses and Permits

The licenses and permits required to start a real estate investment firm include the following:

- Sales Tax License (if required in your state)

- Business License (if required by the city, county, or state where you plan to operate)

- Occupational Permit (often required for your business category)

10. Get Business Insurance for Your Real Estate Investment Company

Below are the main types of insurance to consider for your business:

- General liability insurance : This covers accidents and injuries that occur on your property. It also covers damages caused by your employees or products.

- Auto insurance : This can cover a single vehicle or a fleet of vehicles. If you have employees, it’s especially important to get auto insurance because your employees drive business vehicles.

- Workers’ compensation insurance : If you have employees, it works with your general liability policy to protect against workplace injuries and accidents. It also covers medical expenses and lost wages.

- Professional liability insurance : This protects your business against claims of professional negligence.

- Commercial property insurance : This covers damage to your property caused by fire, theft, or vandalism.

- Business interruption insurance : This covers lost income and expenses if your business is forced to close due to a covered event.

Find an insurance agent, tell them about your business and its needs, and they will recommend policies that fit those needs.

11. Buy or Lease the Right Real Estate Investment Company Equipment

The equipment required to start a real estate investment firm include the following:

- Computer with Internet access for research

- Laptop or tablet with Internet access for on-the-go research

- Scanner Printer Fax machine

- Photocopier

- Legal and accounting books and software

Depending on the laws of your state, you may be required to have a physical office in order to run your business.

12. Develop Your Real Estate Investment Company Marketing Materials

Marketing materials will be required to attract and retain customers to your real estate investment company.

The key marketing materials you will need are as follows:

- Logo : Spend some time developing a good logo for your real estate investment firm. Your logo will be printed on company stationery, business cards, marketing materials, and so forth. The right logo can increase customer trust and awareness of your brand.

- Website : Likewise, a professional real estate investment company website provides potential customers with information about the services you offer, your company’s history, and contact information. Importantly, remember that the look and feel of your website will affect how customers perceive you.

- Social Media Accounts : establish social media accounts in your companies name. Accounts on Facebook, Twitter, LinkedIn, and/or other social media networks will help customers and others find and interact with your real estate investment business.

13. Purchase and Setup the Software Needed to Run Your Real Estate Investment Company

The software needed to start a real estate investment company may include the following:

- Accounting software

- Email marketing software

- Office suite (includes word processing, spreadsheet, and presentation tools)

Real estate investment business-specific software is also available to help you track sales leads, manage projects, etc.

14. Open for Business

You are now ready to open your real estate investment firm. If you followed the steps above, you should be in a great position to build a successful business. Below are answers to frequently asked questions that might further help you.

How to Finish Your Ultimate Real Estate Investment Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your real estate investment company business plan?

With Growthink’s Ultimate Real Estate Investment Business Plan Template you can finish your plan in just 8 hours or less!

How to Start a Real Estate Investment Company FAQs

Where can i download a real estate investment business plan pdf.

You can download our real estate investment business plan PDF template here. This is a business plan template you can use in PDF format.

Is it hard to start a real estate investment company?

No. If you have experience in real estate, the right knowledge and training, good support from mentors, and some seed money to get started, then starting a real estate investment business should be relatively easy.

How can I start a real estate investment company with no experience?

You can be successful without having prior knowledge or experience if you have good mentors to offer guidance. Additionally, consider taking real estate courses by attending seminars and finding mentors who are already successfully owned and managed real estate investment companies.

Is a real estate investment company a good idea and/or a good investment?

Yes. However, running a real estate investment business can also be risky and challenging. As with any business, you should research the pros and cons of starting your own before deciding to start one.

What type of real estate investment company is most profitable?

The most profitable real estate investment business is one that understands what type of real estate to specialize in and how to manage it. For example, a passive real estate business invests in high-profit real estate investments such as apartment complexes, shopping centers, and other well-established projects.

How much does it cost to start a real estate investment company?

The cost to start a real estate business varies depending on the nature of your business. For example, opening a real estate company that invests in foreclosed investment properties requires less seed money than opening one that invests in rental properties for profit.

What are the ongoing expenses for a real estate investment company?

Ongoing expenses for a real estate investment company include licensing, payroll (employees and/or contractors), and marketing. Additionally, you should also budget for startup costs like rental and/or investment property and equipment.

How does a real estate investment company make money?

A real estate investment business can make money in a number of ways such as through receiving rent from tenants, collecting loan interest and/or principal repayment, selling portions of the property or project, and consulting services.

How much can you make owning a real estate investment company?

You can make a good amount of money owning your own real estate investment company. However, the amount you will make depends on the type of business you run and how successful it is. For example, a passive real estate investor typically does not work directly on their projects and tend to make more than active real estate investors.

Is owning a real estate investment company profitable?

Yes, a real estate investment company can be profitable for those who understand the market and take the time to learn about all aspects involved in running a successful business.

Why do real estate investment companies fail?

Real estate investment businesses fail for many reasons. Some of the common causes are poor cash flow management, lack of experience/expertise, and an unprofitable business model.

Other Helpful Business Plan Articles & Templates

How to Write a Real Estate Investment Business Plan: Complete Guide

- Tweet Share Share

Last updated on December 19, 2023

Building an investing business without a real estate investment business plan is sort of like riding a bike without handlebars.

You might be able to do it… but why would you?

It’s far easier and more practical to set out on your venture with a business plan that outlines things like your lead-flow, where you’ll find funding, and which market(s) you’ll operate.

Plus, according to Entrepreneur, having a business plan increases your chances of growth by 30%.

Download Now: Free marketing plan video and a downloadable guide

So don’t skip this critical first step.

Here’s how to do it.

Real Estate Investment Business Plan Guide

In this article we’re going to discuss:

- What is a real estate investment business plan?

- Create your mission and vision

- Run market analysis

- Choose your business model(s)

- Determine your business goals

- Find funding / Cash buyers

- Identify lead-flow source

- Gather property analysis information

- Create your brand

- Set growth milestones

- Plan to Delegate

What is a Real Estate Investment Business Plan and Why Does it Matter?

A real estate investment business plan is a document that outlines your goals, your vision, and your plan for growing the business .

It should detail the real estate business model you’re going to pursue, your chosen method for lead-gen, how you’ll find funding, and how you plan to close deals.

The kit and caboodle.

It shouldn’t be overly complicated.

Whether this real estate investment business plan is only for your personal use or to present to someone else, simplicity is best. Be thorough, be clear, but don’t over-explain what you’re going to do.

As far as why you should have a business plan, consider that it gives you a 30% better chance of growing your business.

Also, consider that setting out without a plan would be like — full of unexpected twists and turns — is that something you want to do?

Probably not.

It’s worth taking a few days or weeks to put together a business plan, even if it’s just for your own sake. By the time you’re complete, you’ll have greater confidence in the business you’re setting out to build.

And an entrepreneur’s confidence is everything.

How to Create Your Real Estate Investment Business Plan

Now we get into the nitty-gritty.

How do you create your real estate investment business plan? Here are the 10 steps!

1. Create Your Mission & Vision

This can be considered your “summary” section. You might not think that you need a mission statement or vision for your real estate business.

And you don’t.

We know a lot of real estate investors (many of our members, in fact) don’t have a clear mission or vision that they’ve outlined — and they’re successful regardless.

But if you’re just getting started…

Then we think it’s a worthwhile use of your time.

Because if you don’t know why you’re going to build your real estate investing business, if you don’t see what purpose it serves on a personal and professional level, then it’s not going to be very exciting to you.

You can either use this time to create a mission for your business… or a mission statement for you as it relates to growing your business (depending on your goals).

For instance…

- Our mission is to create affordable house opportunities in the Roseburg, Oregon community.

- Our mission is to provide homeowners with an exceptional experience when selling their properties for cash.

Or you could go a more personal route…

- My mission is to create a business that supports my family.

- My mission is to build a company that gives me more time for what matters most to me.

Or you could do both…

- My mission is to create a business that supports my family, and my business’ mission is to provide homeowners with an exceptional experience when selling their properties for cash.

Either way, it’s good to think about this before getting started.

Because if you know why you’re going to build your business — and if, ideally, that reason resonates with you — then you’ll be more excited and determined to work hard toward your goals.

It is also an excellent opportunity to outline the core values you’ll adhere to within your business as Brian Rockwell does on his website …

With this information in hand, you’re ready to move on to the next step.

2. Run Competitive Market Analysis

Which market are you going to operate in?

That might be an easy question to answer — if you’re just going to operate in the town where you live, fair enough.

But it’s worth keeping in mind that today’s technology has made it possible to become a real estate investor in any market from pretty much any location (remotely).

So if the market you’re in is lacking in opportunity, then you might consider investing elsewhere.

How do you know which market to choose?

Here are the 10 top real estate markets for investors, according to our own Carrot member data of over 7000 accounts, based on lead volume…

- Atlanta, GA

- Houston, TX

- Chicago, IL

- Charlotte, NC

- New York, NY

- Los Angeles, CA

- Orlando, FL

- Philadelphia, PA

- Phoenix, AZ

And here are the top 20 states…

- North Carolina

- Pennsylvania

- Oregon

That’ll give you some ideas.

But what makes a market good or bad for real estate investors? Here are some metrics to pay attention to when you’re doing your research.

- Median Home Value — This will tell you how much the average home sells for in the market, which will impact whether you’ll be willing to operate there. Because obviously, you want to play with numbers that feel reasonable to you.

- Median Home Value Increase Year Over Year — Ideally, you want to invest in a market where homes are appreciating every year. And a positive increase in this metric is a good sign that the properties you invest in will continue to increase in value.

- Occupied Housing Rate — A high housing occupancy rate means it’s easy to find tenants, and there’s a healthy demand for housing. That’s a good sign.

- Median Rent — This is the average cost of rent in the market and will give you a good idea of how much you’ll be able to charge on any rentals you own.

- Median Rent Increase Year Over Year — If you’re going to buy rentals, it’s a good sign if rental costs increase every year.

- Population Growth — When the population grows, it creates demand for housing, both rentals and on the MLS. That’s a good sign for a real estate investor.

- Job Growth — Job growth is a sign of a healthy economy and indicates that you’ll have an easier time capitalizing on your real estate investments.