Root out friction in every digital experience, super-charge conversion rates, and optimise digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered straight to teams on the ground

Know exactly how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re are saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Meet the operating system for experience management

- Free Account

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Employee Exit Interviews

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

- Artificial Intelligence

- Market Research

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

- Experience Management

- Sampling Methods

- How To determine Sample Size

Try Qualtrics for free

Determining sample size: how to make sure you get the correct sample size.

16 min read Sample size can make or break your research project. Here’s how to master the delicate art of choosing the right sample size.

What is sample size?

Sample size is the beating heart of any research project. It’s the invisible force that gives life to your data, making your findings robust, reliable and believable.

Sample size is what determines if you see a broad view or a focus on minute details; the art and science of correctly determining it involves a careful balancing act. Finding an appropriate sample size demands a clear understanding of the level of detail you wish to see in your data and the constraints you might encounter along the way.

Remember, whether you’re studying a small group or an entire population, your findings are only ever as good as the sample you choose.

Free eBook: Empower your market research efforts today

Let’s delve into the world of sampling and uncover the best practices for determining sample size for your research.

How to determine sample size

“How much sample do we need?” is one of the most commonly-asked questions and stumbling points in the early stages of research design . Finding the right answer to it requires first understanding and answering two other questions:

How important is statistical significance to you and your stakeholders?

What are your real-world constraints.

At the heart of this question is the goal to confidently differentiate between groups, by describing meaningful differences as statistically significant. Statistical significance isn’t a difficult concept, but it needs to be considered within the unique context of your research and your measures.

First, you should consider when you deem a difference to be meaningful in your area of research. While the standards for statistical significance are universal, the standards for “meaningful difference” are highly contextual.

For example, a 10% difference between groups might not be enough to merit a change in a marketing campaign for a breakfast cereal, but a 10% difference in efficacy of breast cancer treatments might quite literally be the difference between life and death for hundreds of patients. The exact same magnitude of difference has very little meaning in one context, but has extraordinary meaning in another. You ultimately need to determine the level of precision that will help you make your decision.

Within sampling, the lowest amount of magnification – or smallest sample size – could make the most sense, given the level of precision needed, as well as timeline and budgetary constraints.

If you’re able to detect statistical significance at a difference of 10%, and 10% is a meaningful difference, there is no need for a larger sample size, or higher magnification. However, if the study will only be useful if a significant difference is detected for smaller differences – say, a difference of 5% — the sample size must be larger to accommodate this needed precision. Similarly, if 5% is enough, and 3% is unnecessary, there is no need for a larger statistically significant sample size.

You should also consider how much you expect your responses to vary. When there isn’t a lot of variability in response, it takes a lot more sample to be confident that there are statistically significant differences between groups.

For instance, it will take a lot more sample to find statistically significant differences between groups if you are asking, “What month do you think Christmas is in?” than if you are asking, “How many miles are there between the Earth and the moon?”. In the former, nearly everybody is going to give the exact same answer, while the latter will give a lot of variation in responses. Simply put, when your variables do not have a lot of variance, larger sample sizes make sense.

Statistical significance

The likelihood that the results of a study or experiment did not occur randomly or by chance, but are meaningful and indicate a genuine effect or relationship between variables.

Magnitude of difference

The size or extent of the difference between two or more groups or variables, providing a measure of the effect size or practical significance of the results.

Actionable insights

Valuable findings or conclusions drawn from data analysis that can be directly applied or implemented in decision-making processes or strategies to achieve a particular goal or outcome.

It’s crucial to understand the differences between the concepts of “statistical significance”, “magnitude of difference” and “actionable insights” – and how they can influence each other:

- Even if there is a statistically significant difference, it doesn’t mean the magnitude of the difference is large: with a large enough sample, a 3% difference could be statistically significant

- Even if the magnitude of the difference is large, it doesn’t guarantee that this difference is statistically significant: with a small enough sample, an 18% difference might not be statistically significant

- Even if there is a large, statistically significant difference, it doesn’t mean there is a story, or that there are actionable insights

There is no way to guarantee statistically significant differences at the outset of a study – and that is a good thing.

Even with a sample size of a million, there simply may not be any differences – at least, any that could be described as statistically significant. And there are times when a lack of significance is positive.

Imagine if your main competitor ran a multi-million dollar ad campaign in a major city and a huge pre-post study to detect campaign effects, only to discover that there were no statistically significant differences in brand awareness . This may be terrible news for your competitor, but it would be great news for you.

With Stats iQ™ you can analyze your research results and conduct significance testing

As you determine your sample size, you should consider the real-world constraints to your research.

Factors revolving around timings, budget and target population are among the most common constraints, impacting virtually every study. But by understanding and acknowledging them, you can definitely navigate the practical constraints of your research when pulling together your sample.

Timeline constraints

Gathering a larger sample size naturally requires more time. This is particularly true for elusive audiences, those hard-to-reach groups that require special effort to engage. Your timeline could become an obstacle if it is particularly tight, causing you to rethink your sample size to meet your deadline.

Budgetary constraints

Every sample, whether large or small, inexpensive or costly, signifies a portion of your budget. Samples could be like an open market; some are inexpensive, others are pricey, but all have a price tag attached to them.

Population constraints

Sometimes the individuals or groups you’re interested in are difficult to reach; other times, they’re a part of an extremely small population. These factors can limit your sample size even further.

What’s a good sample size?

A good sample size really depends on the context and goals of the research. In general, a good sample size is one that accurately represents the population and allows for reliable statistical analysis.

Larger sample sizes are typically better because they reduce the likelihood of sampling errors and provide a more accurate representation of the population. However, larger sample sizes often increase the impact of practical considerations, like time, budget and the availability of your audience. Ultimately, you should be aiming for a sample size that provides a balance between statistical validity and practical feasibility.

4 tips for choosing the right sample size

Choosing the right sample size is an intricate balancing act, but following these four tips can take away a lot of the complexity.

1) Start with your goal

The foundation of your research is a clearly defined goal. You need to determine what you’re trying to understand or discover, and use your goal to guide your research methods – including your sample size.

If your aim is to get a broad overview of a topic, a larger, more diverse sample may be appropriate. However, if your goal is to explore a niche aspect of your subject, a smaller, more targeted sample might serve you better. You should always align your sample size with the objectives of your research.

2) Know that you can’t predict everything

Research is a journey into the unknown. While you may have hypotheses and predictions, it’s important to remember that you can’t foresee every outcome – and this uncertainty should be considered when choosing your sample size.

A larger sample size can help to mitigate some of the risks of unpredictability, providing a more diverse range of data and potentially more accurate results. However, you shouldn’t let the fear of the unknown push you into choosing an impractically large sample size.

3) Plan for a sample that meets your needs and considers your real-life constraints

Every research project operates within certain boundaries – commonly budget, timeline and the nature of the sample itself. When deciding on your sample size, these factors need to be taken into consideration.

Be realistic about what you can achieve with your available resources and time, and always tailor your sample size to fit your constraints – not the other way around.

4) Use best practice guidelines to calculate sample size

There are many established guidelines and formulas that can help you in determining the right sample size.

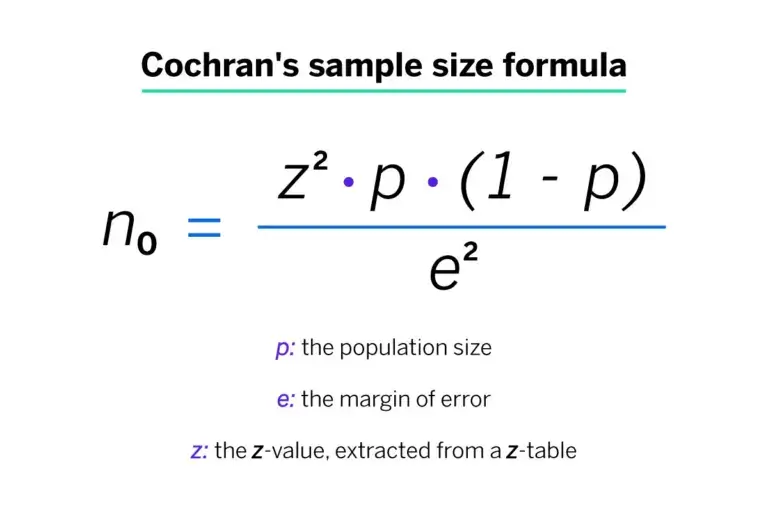

The easiest way to define your sample size is using a sample size calculator , or you can use a manual sample size calculation if you want to test your math skills. Cochran’s formula is perhaps the most well known equation for calculating sample size, and widely used when the population is large or unknown.

Beyond the formula, it’s vital to consider the confidence interval, which plays a significant role in determining the appropriate sample size – especially when working with a random sample – and the sample proportion. This represents the expected ratio of the target population that has the characteristic or response you’re interested in, and therefore has a big impact on your correct sample size.

If your population is small, or its variance is unknown, there are steps you can still take to determine the right sample size. Common approaches here include conducting a small pilot study to gain initial estimates of the population variance, and taking a conservative approach by assuming a larger variance to ensure a more representative sample size.

Empower your market research

Conducting meaningful research and extracting actionable intelligence are priceless skills in today’s ultra competitive business landscape. It’s never been more crucial to stay ahead of the curve by leveraging the power of market research to identify opportunities, mitigate risks and make informed decisions.

Equip yourself with the tools for success with our essential eBook, “The ultimate guide to conducting market research” .

With this front-to-back guide, you’ll discover the latest strategies and best practices that are defining effective market research. Learn about practical insights and real-world applications that are demonstrating the value of research in driving business growth and innovation.

Learn how to determine sample size

To choose the correct sample size, you need to consider a few different factors that affect your research, and gain a basic understanding of the statistics involved. You’ll then be able to use a sample size formula to bring everything together and sample confidently, knowing that there is a high probability that your survey is statistically accurate.

The steps that follow are suitable for finding a sample size for continuous data – i.e. data that is counted numerically. It doesn’t apply to categorical data – i.e. put into categories like green, blue, male, female etc.

Stage 1: Consider your sample size variables

Before you can calculate a sample size, you need to determine a few things about the target population and the level of accuracy you need:

1. Population size

How many people are you talking about in total? To find this out, you need to be clear about who does and doesn’t fit into your group. For example, if you want to know about dog owners, you’ll include everyone who has at some point owned at least one dog. (You may include or exclude those who owned a dog in the past, depending on your research goals.) Don’t worry if you’re unable to calculate the exact number. It’s common to have an unknown number or an estimated range.

2. Margin of error (confidence interval)

Errors are inevitable – the question is how much error you’ll allow. The margin of error , AKA confidence interval, is expressed in terms of mean numbers. You can set how much difference you’ll allow between the mean number of your sample and the mean number of your population. If you’ve ever seen a political poll on the news, you’ve seen a confidence interval and how it’s expressed. It will look something like this: “68% of voters said yes to Proposition Z, with a margin of error of +/- 5%.”

3. Confidence level

This is a separate step to the similarly-named confidence interval in step 2. It deals with how confident you want to be that the actual mean falls within your margin of error. The most common confidence intervals are 90% confident, 95% confident, and 99% confident.

4. Standard deviation

This step asks you to estimate how much the responses you receive will vary from each other and from the mean number. A low standard deviation means that all the values will be clustered around the mean number, whereas a high standard deviation means they are spread out across a much wider range with very small and very large outlying figures. Since you haven’t yet run your survey, a safe choice is a standard deviation of .5 which will help make sure your sample size is large enough.

Stage 2: Calculate sample size

Now that you’ve got answers for steps 1 – 4, you’re ready to calculate the sample size you need. This can be done using an online sample size calculator or with paper and pencil.

1. Find your Z-score

Next, you need to turn your confidence level into a Z-score. Here are the Z-scores for the most common confidence levels:

- 90% – Z Score = 1.645

- 95% – Z Score = 1.96

- 99% – Z Score = 2.576

If you chose a different confidence level, use this Z-score table (a resource owned and hosted by SJSU.edu) to find your score.

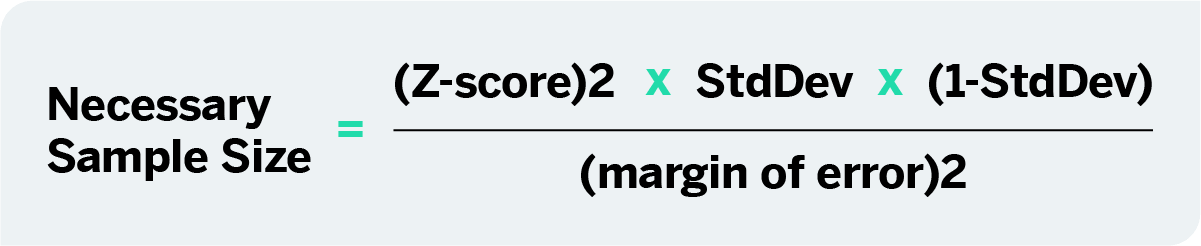

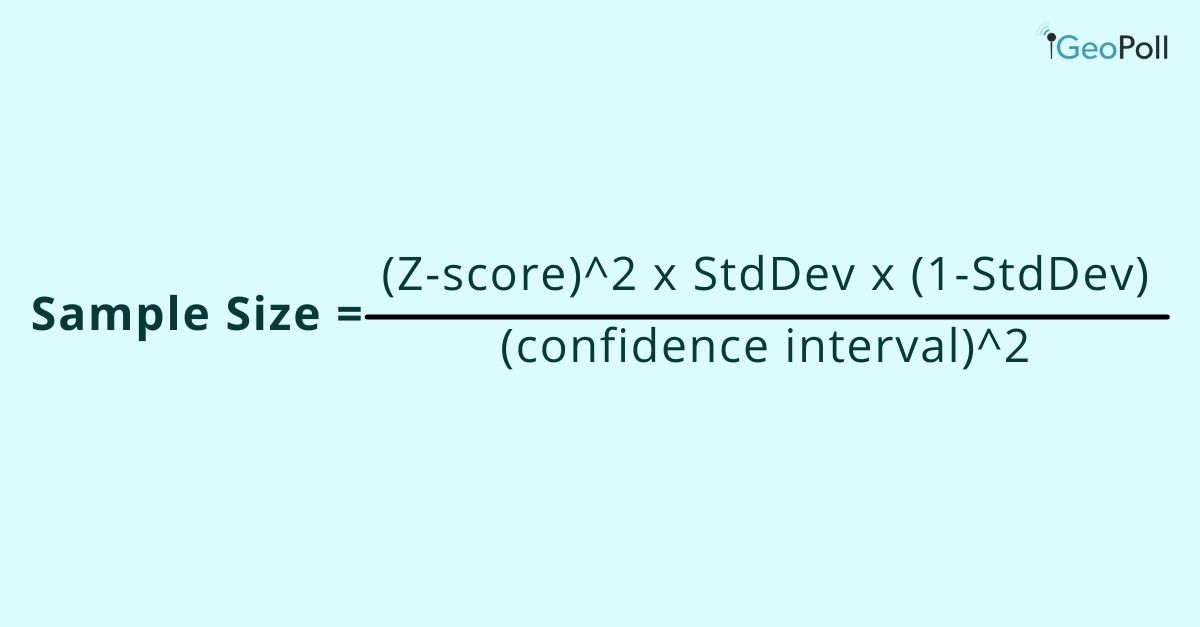

2. Use the sample size formula

Plug in your Z-score, standard of deviation, and confidence interval into the sample size calculator or use this sample size formula to work it out yourself:

This equation is for an unknown population size or a very large population size. If your population is smaller and known, just use the sample size calculator.

What does that look like in practice?

Here’s a worked example, assuming you chose a 95% confidence level, .5 standard deviation, and a margin of error (confidence interval) of +/- 5%.

((1.96)2 x .5(.5)) / (.05)2

(3.8416 x .25) / .0025

.9604 / .0025

385 respondents are needed

Voila! You’ve just determined your sample size.

eBook: 2022 Market Research Global Trends Report

Related resources

Convenience sampling 15 min read, non-probability sampling 17 min read, probability sampling 8 min read, stratified random sampling 13 min read, simple random sampling 10 min read, sampling methods 15 min read, sampling and non-sampling errors 10 min read, request demo.

Ready to learn more about Qualtrics?

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case NPS+ Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home Audience

Sample Size Determination: Definition, Formula, and Example

Are you ready to survey your research target? Research surveys help you gain insights from your target audience. The data you collect gives you insights to meet customer needs, leading to increased sales and customer loyalty. Sample size calculation and determination are imperative to the researcher to determine the right number of respondents, keeping in mind the research study’s quality.

So, how should you do the sample size determination? How do you know who should get your survey? How do you decide on the number of the target audience?

Sending out too many surveys can be expensive without giving you a definitive advantage over a smaller sample. But if you send out too few, you won’t have enough data to draw accurate conclusions.

Knowing how to calculate and determine the appropriate sample size accurately can give you an edge over your competitors. Let’s take a look at what a good sample includes. Also, let’s look at the sample size calculation formula so you can determine the perfect sample size for your next survey.

What is Sample Size?

‘Sample size’ is a market research term used for defining the number of individuals included in conducting research. Researchers choose their sample based on demographics, such as age, gender questions , or physical location. It can be vague or specific.

For example, you may want to know what people within the 18-25 age range think of your product. Or, you may only require your sample to live in the United States, giving you a wide population range. The total number of individuals in a particular sample is the sample size.

What is sample size determination?

Sample size determination is the process of choosing the right number of observations or people from a larger group to use in a sample. The goal of figuring out the sample size is to ensure that the sample is big enough to give statistically valid results and accurate estimates of population parameters but small enough to be manageable and cost-effective.

In many research studies, getting information from every member of the population of interest is not possible or useful. Instead, researchers choose a sample of people or events that is representative of the whole to study. How accurate and precise the results are can depend a lot on the size of the sample.

Choosing the statistically significant sample size depends on a number of things, such as the size of the population, how precise you want your estimates to be, how confident you want to be in the results, how different the population is likely to be, and how much money and time you have for the study. Statistics are often used to figure out how big a sample should be for a certain type of study and research question.

Figuring out the sample size is important in ensuring that research findings and conclusions are valid and reliable.

Why do you need to determine the sample size?

Let’s say you are a market researcher in the US and want to send out a survey or questionnaire . The survey aims to understand your audience’s feelings toward a new cell phone you are about to launch. You want to know what people in the US think about the new product to predict the phone’s success or failure before launch.

Hypothetically, you choose the population of New York, which is 8.49 million. You use a sample size determination formula to select a sample of 500 individuals that fit into the consumer panel requirement. You can use the responses to help you determine how your audience will react to the new product.

However, determining a sample size requires more than just throwing your survey at as many people as possible. If your estimated sample sizes are too big, it could waste resources, time, and money. A sample size that’s too small doesn’t allow you to gain maximum insights, leading to inconclusive results.

LEARN ABOUT: Survey Sample Sizes

What are the terms used around the sample size?

Before we jump into sample size determination, let’s take a look at the terms you should know:

1. Population size:

Population size is how many people fit your demographic. For example, you want to get information on doctors residing in North America. Your population size is the total number of doctors in North America.

Don’t worry! Your population size doesn’t always have to be that big. Smaller population sizes can still give you accurate results as long as you know who you’re trying to represent.

2. Confidence level:

The confidence level tells you how sure you can be that your data is accurate. It is expressed as a percentage and aligned to the confidence interval. For example, if your confidence level is 90%, your results will most likely be 90% accurate.

3. The margin of error (confidence interval):

There’s no way to be 100% accurate when it comes to surveys. Confidence intervals tell you how far off from the population means you’re willing to allow your data to fall.

A margin of error describes how close you can reasonably expect a survey result to fall relative to the real population value. Remember, if you need help with this information, use our margin of error calculator .

4. Standard deviation:

Standard deviation is the measure of the dispersion of a data set from its mean. It measures the absolute variability of a distribution. The higher the dispersion or variability, the greater the standard deviation and the greater the magnitude of the deviation.

For example, you have already sent out your survey. How much variance do you expect in your responses? That variation in response is the standard deviation.

Sample size calculation formula – sample size determination

With all the necessary terms defined, it’s time to learn how to determine sample size using a sample calculation formula.

Your confidence level corresponds to a Z-score. This is a constant value needed for this equation. Here are the z-scores for the most common confidence levels:

90% – Z Score = 1.645

95% – Z Score = 1.96

99% – Z Score = 2.576

If you choose a different confidence level, various online tools can help you find your score.

Necessary Sample Size = (Z-score)2 * StdDev*(1-StdDev) / (margin of error)2

Here is an example of how the math works, assuming you chose a 90% confidence level, .6 standard deviation, and a margin of error (confidence interval) of +/- 4%.

((1.64)2 x .6(.6)) / (.04)2

( 2.68x .0.36) / .0016

.9648 / .0016

603 respondents are needed, and that becomes your sample size.

Free Sample Size Calculator

How is a sample size determined?

Determining the right sample size for your survey is one of the most common questions researchers ask when they begin a market research study. Luckily, sample size determination isn’t as hard to calculate as you might remember from an old high school statistics class.

Before calculating your sample size, ensure you have these things in place:

Goals and objectives:

What do you hope to do with the survey? Are you planning on projecting the results onto a whole demographic or population? Do you want to see what a specific group thinks? Are you trying to make a big decision or just setting a direction?

Calculating sample size is critical if you’re projecting your survey results on a larger population. You’ll want to make sure that it’s balanced and reflects the community as a whole. The sample size isn’t as critical if you’re trying to get a feel for preferences.

For example, you’re surveying homeowners across the US on the cost of cooling their homes in the summer. A homeowner in the South probably spends much more money cooling their home in the humid heat than someone in Denver, where the climate is dry and cool.

For the most accurate results, you’ll need to get responses from people in all US areas and environments. If you only collect responses from one extreme, such as the warm South, your results will be skewed.

Precision level:

How close do you want the survey results to mimic the true value if everyone responded? Again, if this survey determines how you’re going to spend millions of dollars, then your sample size determination should be exact.

The more accurate you need to be, the larger the sample you want to have, and the more your sample will have to represent the overall population. If your population is small, say, 200 people, you may want to survey the entire population rather than cut it down with a sample.

Confidence level:

Think of confidence from the perspective of risk. How much risk are you willing to take on? This is where your Confidence Interval numbers become important. How confident do you want to be — 98% confident, 95% confident?

Understand that the confidence percentage you choose greatly impacts the number of completions you’ll need for accuracy. This can increase the survey’s length and how many responses you need, which means increased costs for your survey.

Knowing the actual numbers and amounts behind percentages can help make more sense of your correct sample size needs vs. survey costs.

For example, you want to be 99% confident. After using the sample size determination formula, you find you need to collect an additional 1000 respondents.

This, in turn, means you’ll be paying for samples or keeping your survey running for an extra week or two. You have to determine if the increased accuracy is more important than the cost.

Population variability:

What variability exists in your population? In other words, how similar or different is the population?

If you are surveying consumers on a broad topic, you may have lots of variations. You’ll need a larger sample size to get the most accurate picture of the population.

However, if you’re surveying a population with similar characteristics, your variability will be less, and you can sample fewer people. More variability equals more samples, and less variability equals fewer samples. If you’re not sure, you can start with 50% variability.

Response rate:

You want everyone to respond to your survey. Unfortunately, every survey comes with targeted respondents who either never open the study or drop out halfway. Your response rate will depend on your population’s engagement with your product, service organization, or brand.

The higher the response rate, the higher your population’s engagement level. Your base sample size is the number of responses you must get for a successful survey.

Consider your audience:

Besides the variability within your population, you need to ensure your sample doesn’t include people who won’t benefit from the results. One of the biggest mistakes you can make in sample size determination is forgetting to consider your actual audience.

For example, you don’t want to send a survey asking about the quality of local apartment amenities to a group of homeowners.

Select your respondents

Focus on your survey’s objectives:

You may start with general demographics and characteristics, but can you narrow those characteristics down even more? Narrowing down your audience makes getting a more accurate result from a small sample size easier.

For example, you want to know how people will react to new automobile technology. Your current population includes anyone who owns a car in a particular market.

However, you know your target audience is people who drive cars that are less than five years old. You can remove anyone with an older vehicle from your sample because they’re unlikely to purchase your product.

Once you know what you hope to gain from your survey and what variables exist within your population, you can decide how to calculate sample size. Using the formula for determining sample size is a great starting point to get accurate results.

After calculating the sample size, you’ll want to find reliable customer survey software to help you accurately collect survey responses and turn them into analyzed reports.

LEARN MORE: Population vs Sample

In sample size determination, statistical analysis plan needs careful consideration of the level of significance, effect size, and sample size.

Researchers must reconcile statistical significance with practical and ethical factors like practicality and cost. A well-designed study with a sufficient sample size can improve the odds of obtaining statistically significant results.

To meet the goal of your survey, you may have to try a few methods to increase the response rate, such as:

- Increase the list of people who receive the survey.

- To reach a wider audience, use multiple distribution channels, such as SMS, website, and email surveys.

- Send reminders to survey participants to complete the survey.

- Offer incentives for completing the survey, such as an entry into a prize drawing or a discount on the respondent’s next order.

- Consider your survey structure and find ways to simplify your questions. The less work someone has to do to complete the survey, the more likely they will finish it.

- Longer surveys tend to have lower response rates due to the length of time it takes to complete the survey. In this case, you can reduce the number of questions in your survey to increase responses.

QuestionPro’s sample size calculator makes it easy to find the right sample size for your research based on your desired level of confidence, your margin of error, and the size of the population.

FREE TRIAL LEARN MORE

Frequently Asked Questions (FAQ)

The four ways to determine sample size are: 1. Power analysis 2. Convenience sampling, 3. Random sampling , 4. Stratified sampling

The three factors that determine sample size are: 1. Effect size, 2. Level of significance 3. Power

Using statistical techniques like power analysis, the minimal detectable effect size, or the sample size formula while taking into account the study’s goals and practical limitations is the best way to calculate the sample size.

The sample size is important because it affects how precise and accurate the results of a study are and how well researchers can spot real effects or relationships between variables.

The sample size is the number of observations or study participants chosen to be representative of a larger group

MORE LIKE THIS

Life@QuestionPro: The Journey of Kristie Lawrence

Jun 7, 2024

How Can I Help You? — Tuesday CX Thoughts

Jun 5, 2024

Why Multilingual 360 Feedback Surveys Provide Better Insights

Jun 3, 2024

Raked Weighting: A Key Tool for Accurate Survey Results

May 31, 2024

Other categories

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Uncategorized

- Video Learning Series

- What’s Coming Up

- Workforce Intelligence

How to Determine Sample Size for a Research Study

Frankline kibuacha | apr. 06, 2021 | 3 min. read.

This article will discuss considerations to put in place when determining your sample size and how to calculate the sample size.

Confidence Interval and Confidence Level

As we have noted before, when selecting a sample there are multiple factors that can impact the reliability and validity of results, including sampling and non-sampling errors . When thinking about sample size, the two measures of error that are almost always synonymous with sample sizes are the confidence interval and the confidence level.

Confidence Interval (Margin of Error)

Confidence intervals measure the degree of uncertainty or certainty in a sampling method and how much uncertainty there is with any particular statistic. In simple terms, the confidence interval tells you how confident you can be that the results from a study reflect what you would expect to find if it were possible to survey the entire population being studied. The confidence interval is usually a plus or minus (±) figure. For example, if your confidence interval is 6 and 60% percent of your sample picks an answer, you can be confident that if you had asked the entire population, between 54% (60-6) and 66% (60+6) would have picked that answer.

Confidence Level

The confidence level refers to the percentage of probability, or certainty that the confidence interval would contain the true population parameter when you draw a random sample many times. It is expressed as a percentage and represents how often the percentage of the population who would pick an answer lies within the confidence interval. For example, a 99% confidence level means that should you repeat an experiment or survey over and over again, 99 percent of the time, your results will match the results you get from a population.

The larger your sample size, the more confident you can be that their answers truly reflect the population. In other words, the larger your sample for a given confidence level, the smaller your confidence interval.

Standard Deviation

Another critical measure when determining the sample size is the standard deviation, which measures a data set’s distribution from its mean. In calculating the sample size, the standard deviation is useful in estimating how much the responses you receive will vary from each other and from the mean number, and the standard deviation of a sample can be used to approximate the standard deviation of a population.

The higher the distribution or variability, the greater the standard deviation and the greater the magnitude of the deviation. For example, once you have already sent out your survey, how much variance do you expect in your responses? That variation in responses is the standard deviation.

Population Size

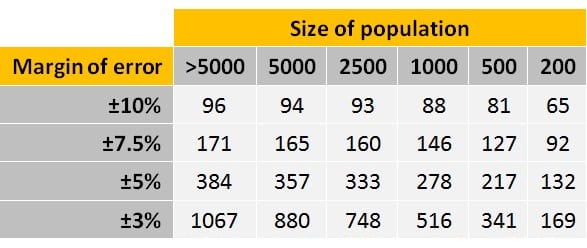

As demonstrated through the calculation below, a sample size of about 385 will give you a sufficient sample size to draw assumptions of nearly any population size at the 95% confidence level with a 5% margin of error, which is why samples of 400 and 500 are often used in research. However, if you are looking to draw comparisons between different sub-groups, for example, provinces within a country, a larger sample size is required. GeoPoll typically recommends a sample size of 400 per country as the minimum viable sample for a research project, 800 per country for conducting a study with analysis by a second-level breakdown such as females versus males, and 1200+ per country for doing third-level breakdowns such as males aged 18-24 in Nairobi.

How to Calculate Sample Size

As we have defined all the necessary terms, let us briefly learn how to determine the sample size using a sample calculation formula known as Andrew Fisher’s Formula.

- Determine the population size (if known).

- Determine the confidence interval.

- Determine the confidence level.

- Determine the standard deviation ( a standard deviation of 0.5 is a safe choice where the figure is unknown )

- Convert the confidence level into a Z-Score. This table shows the z-scores for the most common confidence levels:

| 80% | 1.28 | |

| 85% | 1.44 | |

| 90% | 1.65 | |

| 95% | 1.96 | |

| 99% | 2.58 | |

- Put these figures into the sample size formula to get your sample size.

Here is an example calculation:

Say you choose to work with a 95% confidence level, a standard deviation of 0.5, and a confidence interval (margin of error) of ± 5%, you just need to substitute the values in the formula:

((1.96)2 x .5(.5)) / (.05)2

(3.8416 x .25) / .0025

.9604 / .0025

Your sample size should be 385.

Fortunately, there are several available online tools to help you with this calculation. Here’s an online sample calculator from Easy Calculation. Just put in the confidence level, population size, the confidence interval, and the perfect sample size is calculated for you.

GeoPoll’s Sampling Techniques

With the largest mobile panel in Africa, Asia, and Latin America, and reliable mobile technologies, GeoPoll develops unique samples that accurately represent any population. See our country coverage here , or contact our team to discuss your upcoming project.

Related Posts

Sample Frame and Sample Error

Probability and Non-Probability Samples

How GeoPoll Conducts Nationally Representative Surveys

- Tags market research , Market Research Methods , sample size , survey methodology

- A/B Monadic Test

- A/B Pre-Roll Test

- Key Driver Analysis

- Multiple Implicit

- Penalty Reward

- Price Sensitivity

- Segmentation

- Single Implicit

- Category Exploration

- Competitive Landscape

- Consumer Segmentation

- Innovation & Renovation

- Product Portfolio

- Marketing Creatives

- Advertising

- Shelf Optimization

- Performance Monitoring

- Better Brand Health Tracking

- Ad Tracking

- Trend Tracking

- Satisfaction Tracking

- AI Insights

- Case Studies

quantilope is the Consumer Intelligence Platform for all end-to-end research needs

How To Determine Sample Size for Quantitative Research

This blog post looks at how large a sample size should be for reliable, usable market research findings.

Table of Contents:

What is sample size , why do you need to determine sample size , variables that impact sample size.

- Determining sample size

The sample size of a quantitative study is the number of people who complete questionnaires in a research project. It is a representative sample of the target audience in which you are interested.

Back to Table of Contents

You need to determine how big of a sample size you need so that you can be sure the quantitative data you get from a survey is reflective of your target population as a whole - and so that the decisions you make based on the research have a firm foundation. Too big a sample and a project can be needlessly expensive and time-consuming. Too small a sample size, and you risk interviewing the wrong respondents - meaning ultimately you miss out on valuable insights.

There are a few variables to be aware of before working out the right sample size for your project.

Population size

The subject matter of your research will determine who your respondents are - chocolate eaters, dentists, homeowners, drivers, people who work in IT, etc. For your respective group of interest, the total of this target group (i.e. the number of chocolate eaters/homeowners/drivers that exist in the general population) will guide how many respondents you need to interview for reliable results in that field.

Ideally, you would use a random sample of people who fit within the group of people you’re interested in. Some of these people are easy to get hold of, while others aren‘t as easy. Some represent smaller groups of people in the population, so a small sample is inevitable. For example, if you’re interviewing chocolate eaters aged 5-99 you’ll have a larger sample size - and a much easier time sampling the population - than if you’re interviewing healthcare professionals who specialize in a niche branch of medicine.

Confidence interval (margin of error)

Confidence intervals, otherwise known as the margin of error, indicate the reliability of statistics that have been calculated by research; in other words, how certain you can be that the statistics are close to what they would be if it were possible to interview the entire population of the people you’re researching.

Confidence intervals are helpful since it would be impossible to interview all chocolate eaters in the US. However, statistics and research enable you to take a sample of that group and achieve results that reflect their opinions as a total population. Before starting a research project, you can decide how large a margin of error you will allow between the mean number of your sample and the mean number of its total population. The confidence interval is expressed as +/- a number, indicating the margin of error on either side of your statistic. For example, if 35% of chocolate eaters say that they eat chocolate for breakfast and your margin of error is 5, you’ll know that if you had asked the entire population, 30-40% of people would admit to eating chocolate at that time of day.

Confidence level

The confidence level indicates how probable it is that if you were to repeat your study multiple times with a random sample, you would get the same statistics and they would fall within the confidence interval every time.

In the example above, if you were to repeat the chocolate study over and over, you would have a certain level of confidence that those eating chocolate for breakfast would always fall within the 30-40% parameters. Most research studies have confidence intervals of 90% confident, 95% confident, or 99% confident. The number you choose will depend on whether you are happy to accept a broadly accurate set of data or whether the nature of your study demands one that is almost completely reliable.

Standard deviation

Standard deviation represents how much the results will vary from the mean number and from each other. A high standard deviation means that there is a wide range of responses to your research questions, while a low standard deviation indicates that responses are more similar to each other, clustered around the mean number. A standard deviation of 0.5 is a safe level to pick to ensure that the sample size is large enough.

Population variability

If you already know anything about your target audience, you should have a feel for the degree to which their opinions vary. If you’re interviewing the entire population of a city, without any other criteria, their views are going to be wildly diverse so you’ll want to sample a high number of residents. If you’re honing in on a sample of chocolate breakfast eaters - there’s probably a limited number of reasons why that’s their meal of choice, so you can feel confident with a much smaller sample.

Project scope

The scope and objectives of the research will have an influence on how big the sample is. If the project aims to evaluate four different pieces of stimulus (an advert, a concept, a website, etc.) and each respondent is giving feedback on a single piece, then a higher number of respondents will need to be interviewed than if each respondent were evaluating all four; the same would be true when looking for reads on four different sub-audiences vs. not needing any sub-group data cuts.

Determining a good sample size for quantitative research

Sample size, as we’ve seen, is an important factor to consider in market research projects. Getting the sample size right will result in research findings you can use confidently when translating them into action. So now that you’ve thought about the subject of your research, the population that you’d like to interview, and how confident you want to be with the findings, how do you calculate the appropriate sample size?

There are many factors that can go into determining the sample size for a study, including z-scores, standard deviations, confidence levels, and margins of error. The great thing about quantilope is that your research consultants and data scientists are the experts in helping you land on the right target so you can focus on the actual study and the findings.

To learn more about determining sample size for quantitative research, get in touch below:

Get in touch to learn more about quantitative sample sizes!

Related posts, quantilope academy is now open to the broader insights community, quantilope & greenbook webinar: tapping into consumers' subconscious through implicit research, master the art of tracking with quantilope's certification course, van westendorp price sensitivity meter questions.

Popular searches

- How to Get Participants For Your Study

- How to Do Segmentation?

- Conjoint Preference Share Simulator

- MaxDiff Analysis

- Likert Scales

- Reliability & Validity

Request consultation

Do you need support in running a pricing or product study? We can help you with agile consumer research and conjoint analysis.

Looking for an online survey platform?

Conjointly offers a great survey tool with multiple question types, randomisation blocks, and multilingual support. The Basic tier is always free.

Catherine Chipeta

Source real human respondents swiftly and at scale through Conjointly.

Monthly newsletter

Get the latest updates about market research, automated tools, product testing and pricing techniques.

How many respondents do you need? Use our sample size calculator to get the right sample size for your next survey. We also answer frequently asked questions on sample size and provide suggestions to improve your surveys in this handy guide.

Conjointly's Respondent Recruitment Solutions

What is a sample and why sample size matters.

Researching the entire population is often not feasible due to many constraints. Instead, sampling is used, which is more practical for analysis and generates results more promptly.

A sample is a subset of individuals selected from the target population to estimate the characteristics of the population. Sample size is important because it determines the accuracy and quality of your survey results. It is especially important in market research as robust data is the key to unlocking meaningful and actionable insights about your target audience .

Want to identify the number of responses required for your survey quickly? Just use our sample size calculator.

If you want to learn more about the theories behind the calculator and sample size, we also compiled everything you need to know in this guide.

Sample Size Calculator

Four important components of sample size calculation.

Here are four key components you’ll need to understand in calculating your minimum sample size:

1. Population size

The population size is the total number of people in the population (target audience) you are looking to survey. For example, if you were surveying the general population of a city with 30,000 residents, the population size for your study is 30,000.

When surveying small populations, a finite population correction is used. You can use 100,000 with caution if you do not know the exact size of a large population; the sample size remains quite static over 100,000.

Get quality-assured responses directly from Conjointly

Reliable market research starts with quality sample. With access to millions of consumers from broad communities to deep-profiled niche markets, Conjointly provides numerous options to delivers quality respondents straight into your survey, starting at only $0.90 per response.

2. Confidence level

The confidence level indicates the probability that your confidence interval contains the true population value, if you were to repeat your study with a random sample selection .

For example, with a confidence level of 95%, your study could be repeated several times and your population would fall within the confidence interval on 95% of these occurrences.

The accuracy of your results is determined by how high your confidence interval is. You should also note that as your confidence level increases, so does your required sample size.

Conjointly’s default confidence level is 90% as it is most useful in business settings. However, you can easily adjust the confidence levels in your Conjointly reports.

3. Confidence interval (Margin of error)

The confidence interval is a range of values that are likely to contain your population value and is expressed in percentage points. For example, a confidence interval of ±2% means that your true population will lie either 2 percentage points above or below where it is shown in your results.

Your confidence interval will be higher or lower than your specified value as it is based on your actual sample proportion, rather than your estimated proportion. It also depends on how accurate the results you are seeking are (determined by your confidence level). A higher confidence level results in a wider confidence interval.

Check out the margin of error for different survey sample sizes under the standard 90% level of confidence.

4. Sample proportion

Your sample proportion (expressed as a percentage) indicates your estimated results and is calculated using a Quick Feedback study or previous survey results. Otherwise, 50% is a safe sample proportion to use without hindering the accuracy of your calculated sample size.

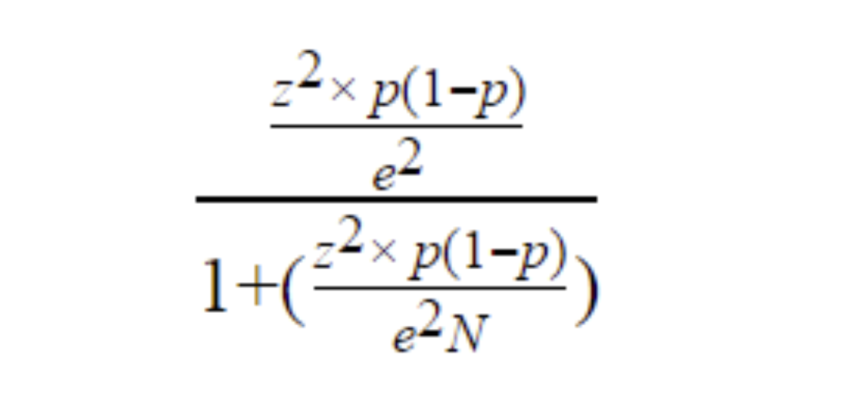

What is the formula for determining sample size?

The formula for calculating sample size is:

- n is the sample size,

- N is the population size,

- z is the confidence level (in percent, such as 90% = 0.9 ),

- p is the sample proportion (in percent, such as 50% = 0.5 ),

- e is the margin of error (in percent, such as 5% = 0.05 ).

What is a good sample size for a market research survey?

The ideal sample size for your study will depend on your population size, confidence level, and confidence interval. The survey design and methodology you use may also require you to adjust your sample size.

A good sample size will satisfy your criteria for accuracy in quantitative research results. It is usually determined by a combination of expected confidence, budget and resource availability for analysis.

Generally, the bigger the sample size, the more accurate your results will be. However, you should consider that large sample sizes are costlier and can complicate your study. You can use our sample size calculator to determine the minimum sample size for your project to ensure your survey is accurate and cost-effective.

What sample size do I need for 95 confidence?

Once you have selected your confidence level as 95%, you will need to determine your confidence interval and population size to calculate the sample size required for your study.

The sample size will be larger for 95% confidence than 90%, if all other factors remain the same.

Even though we recommend using 90% confidence level to achieve the right balance between cost and precision, you can increase it up to 99 percent. However, 99% confidence more than doubles the size of the required sample, compared to 90% confidence. This might produce unnecessary bloat of data for most quantitative research projects .

How do you find the sample size when given the margin of error?

To calculate sample size using your margin of error (confidence interval), you must also know your confidence level and population size.

The margin of error is usually expressed as ± value. This means your survey results can represent a range of values plus or minus the value of the margin of error.

Consider a survey that indicates that 40% of car owners in the USA would not consider the colour red for their next car. With a 5% margin of error, you should express your findings as 35-45% of car owners in the USA would not consider a red car. To gain more accurate insights , you could lower your margin of error to 2%, for example, and expect your findings to lie within a smaller confidence interval of 38-42%.

Why does the margin of error decrease as the sample size increases?

You will see in our sample size calculator, reducing your margin of error results in a large increase in recommended sample size.

It should be noted that this is not a linear relationship, increasing sample size will result in diminishing returns in the margin of error reduction. For example, the following chart illustrates the relationship between the margin of error and sample size, for a population of 1 million, seeking a 90% confidence interval, with a 0.5 sample proportion.

As shown above, moving from a 5% margin of error to a 1% margin of error would require a sample size over 20 times as large.

Why is a small sample size bad? Why is a larger sample size better? Why must sample size be greater than 30?

How do you justify a small sample size in quantitative research.

A small sample size can be justified when:

- The whole population is small. For example, in B2B research, when there are only 100 customers, then it is OK to sample ~30 to get a view of the opinions of the whole customer base.

- The cost of sampling is prohibitive.

Please note, it is not justifiable for most consumer surveys as they require a sample of hundreds of consumers from your product category, including current users and potential buyers. Conjointly provides numerous options and delivers quality respondents straight into your survey, starting at only $0.90 per response.

How does sample size affect validity of a study?

If sample size is not large enough for your study, the internal and external validity will be compromised and it can also result in cases of bias. A higher sample size results in more accurate results. Sample size is only one of many factors that affect the validity of your study.

You should also consider that data can still be useful in some instances even if you do not meet the required sample size for your study. For example, a customer satisfaction survey with open-ended questions can still provide meaningful insights as detailed consumer feedback is indispensable to market research.

Read these articles next:

Van westendorp psm excel template.

The Van Westendorp Price Sensitivity Meter is used to determine the psychologically acceptable range of prices for a single product or service. Learn more about the method and its output with our free Excel template.

Leading an Innovative Survey Panel Platform Provider

Conjointly sources quality respondents for your survey platforms such as Cint. Learn more from Jessica Murdoch VP of Sales and Customer Success ANZ at Cint.

How to Develop Effective Likert Scale Questions?

Learn to write and develop effective Likert scale questions for your market research using tips from this best practice guide, especially useful for concept validation.

Which one are you?

I am new to conjointly, i am already using conjointly, cookie consent.

Conjointly uses essential cookies to make our site work. We also use additional cookies in order to understand the usage of the site, gather audience analytics, and for remarketing purposes.

For more information on Conjointly's use of cookies, please read our Cookie Policy .

Do you want to be updated on new features from Conjointly?

We send occasional emails to keep our users informed about new developments on Conjointly , such as new types of analysis and features.

Subscribe to updates from Conjointly

You can always unsubscribe later. Your email will not be shared with other companies.

- Mathematical Sciences

- Sampling Design

- Sample Size

Research Sampling and Sample Size Determination: A practical Application

- October 2019

- University of Africa, Toru-Orua, Bayelsa State, Nigeria

- This person is not on ResearchGate, or hasn't claimed this research yet.

Discover the world's research

- 25+ million members

- 160+ million publication pages

- 2.3+ billion citations

- Osman Mahad Bagaja

- Isabella King’ori

- Anthony Ireri

- Ibrahim Abdelrasheed

- N.F. Shaafi

- M.M.M. Yusof

- E. Ellianawati

- S.N.A. Aziz

- Elias Rashidi

- Kevin Mokaya Isaboke

- Maina J. Mwangi

- Lungisani Nkomo

- Musawenkosi Donia Saurombe

- Recruit researchers

- Join for free

- Login Email Tip: Most researchers use their institutional email address as their ResearchGate login Password Forgot password? Keep me logged in Log in or Continue with Google Welcome back! Please log in. Email · Hint Tip: Most researchers use their institutional email address as their ResearchGate login Password Forgot password? Keep me logged in Log in or Continue with Google No account? Sign up

- Sign Up Now

- -- Navigate To -- CR Dashboard Connect for Researchers Connect for Participants

- Log In Log Out Log In

- Recent Press

- Papers Citing Connect

- Connect for Participants

- Connect for Researchers

- Connect AI Training

- Managed Research

- Prime Panels

- MTurk Toolkit

- Health & Medicine

- Conferences

- Knowledge Base

- A Researcher’s Guide To Statistical Significance And Sample Size Calculations

Determining Sample Size: How Many Survey Participants Do You Need?

Quick Navigation:

How to calculate a statistically significant sample size in research, determining sample size for probability-based surveys and polling studies, determining sample size for controlled surveys, determining sample size for experiments, how to calculate sample size for simple experiments, an example sample size calculation for an a/b test, what if i don’t know what size difference to expect, part iii: sample size: how many participants do i need for a survey to be valid.

In the U.S., there is a Presidential election every four years. In election years, there is a steady stream of polls in the months leading up to the election announcing which candidates are up and which are down in the horse race of popular opinion.

If you have ever wondered what makes these polls accurate and how each poll decides how many voters to talk to, then you have thought like a researcher who seeks to know how many participants they need in order to obtain statistically significant survey results.

Statistically significant results are those in which the researchers have confidence their findings are not due to chance . Obtaining statistically significant results depends on the researchers’ sample size (how many people they gather data from) and the overall size of the population they wish to understand (voters in the U.S., for example).

Calculating sample sizes can be difficult even for expert researchers. Here, we show you how to calculate sample size for a variety of different research designs.

Before jumping into the details, it is worth noting that formal sample size calculations are often based on the premise that researchers are conducting a representative survey with probability-based sampling techniques. Probability-based sampling ensures that every member of the population being studied has an equal chance of participating in the study and respondents are selected at random.

For a variety of reasons, probability sampling is not feasible for most behavioral studies conducted in industry and academia . As a result, we outline the steps required to calculate sample sizes for probability-based surveys and then extend our discussion to calculating sample sizes for non-probability surveys (i.e., controlled samples) and experiments.

Determining how many people you need to sample in a survey study can be difficult. How difficult? Look at this formula for sample size.

No one wants to work through something like that just to know how many people they should sample. Fortunately, there are several sample size calculators online that simplify knowing how many people to collect data from.

Even if you use a sample size calculator, however, you still need to know some important details about your study. Specifically, you need to know:

- What is the population size in my research?

Population size is the total number of people in the group you are trying to study. If, for example, you were conducting a poll asking U.S. voters about Presidential candidates, then your population of interest would be everyone living in the U.S.—about 330 million people.

Determining the size of the population you’re interested in will often require some background research. For instance, if your company sells digital marketing services and you’re interested in surveying potential customers, it isn’t easy to determine the size of your population. Everyone who is currently engaged in digital marketing may be a potential customer. In situations like these, you can often use industry data or other information to arrive at a reasonable estimate for your population size.

- What margin of error should you use?

Margin of error is a percentage that tells you how much the results from your sample may deviate from the views of the overall population. The smaller your margin of error, the closer your data reflect the opinion of the population at a given confidence level.

Generally speaking, the more people you gather data from the smaller your margin of error. However, because it is almost never feasible to collect data from everyone in the population, some margin of error is necessary in most studies.

- What is your survey’s significance level?

The significance level is a percentage that tells you how confident you can be that the true population value lies within your margin of error. So, for example, if you are asking people whether they support a candidate for President, the significance level tells you how likely it is that the level of support for the candidate in the population (i.e., people not in your sample) falls within the margin of error found in your sample.

Common significance levels in survey research are 90%, 95%, and 99%.

Once you know the values above, you can plug them into a sample size formula or more conveniently an online calculator to determine your sample size.

The table below displays the necessary sample size for different sized populations and margin of errors. As you can see, even when a population is large, researchers can often understand the entire group with about 1,000 respondents.

| Population Size | Sample Size Based on ±3% Margin of Error | Sample Size Based on ±5% Margin of Error | Sample Size Based on ±10% Margin of Error | |||||

|---|---|---|---|---|---|---|---|---|

| 500 | 345 | 220 | 80 | |||||

| 1,000 | 525 | 285 | 90 | |||||

| 3,000 | 810 | 350 | 100 | |||||

| 5,000 | 910 | 370 | 100 | |||||

| 10,000 | 1,000 | 385 | 100 | |||||

| 100,00+ | 1,100 | 400 | 100 |

| FAC Number | Effective Date | HTML | DITA | Word | EPub | Apple Books | Kindle | |

|---|---|---|---|---|---|---|---|---|

| 2024-05 | 05/22/2024 |

Browse FAR Part/Subpart and Download in Various Formats

| Parts/Subparts | HTML | DITA | |

|---|---|---|---|

- Data Initiatives

- Regulations

- Smart Matrix

- Regulations Search

- Acquisition Regulation Comparator (ARC)

- Large Agencies

- Small Agencies

- CAOC History

- CAOC Charter

- Civilian Agency Acquisition Council (CAAC)

- Federal Acquisition Regulatory Council

- Interagency Suspension and Debarment Committee (ISDC)

ACQUISITION.GOV

An official website of the General Services Administration

TechRepublic

TIOBE Index for May 2024: Top 10 Most Popular Programming Languages

Fortran is in the spotlight again in part due to the increased interest in artificial intelligence.

Adobe Adds Firefly and Content Credentials to Bug Bounty Program

Security researchers can earn up to $10,000 for critical vulnerabilities in the generative AI products.

NVIDIA GTC 2024: CEO Jensen Huang’s Predictions About Prompt Engineering

"The job of the computer is to not require C++ to be useful," said Huang at NVIDIA GTC 2024.

White House Recommends Memory-Safe Programming Languages and Security-by-Design

A new report promotes preventing cyberattacks by using memory-safe languages and the development of software safety standards.

How to Hire a Python Developer

Spend less time researching and more time recruiting the ideal Python developer. Find out how in this article.

Latest Articles

OpenAI, Anthropic Research Reveals More About How LLMs Affect Security and Bias

Anthropic opened a window into the ‘black box’ where ‘features’ steer a large language model’s output. OpenAI dug into the same concept two weeks later with a deep dive into sparse autoencoders.

Raspberry Pi Embraces AI With Hailo Collaboration

Plus, Raspberry Pi will list as an IPO on the London Stock Exchange, a boon for the market.

Master Python, Java, SQL, and C++ With This Coding Course Bundle, Now Under $70

Whether you’re chasing a technical job or hoping to build the next big tech startup, this bundle provides the ideal start to your coding career.

The 5 Best Udemy Courses That Are Worth Taking in 2024

Udemy is an online platform for learning at your own pace. Boost your career with our picks for the best Udemy courses for learning tech skills online in 2024.

TechRepublic Premium Editorial Calendar: Policies, Checklists, Hiring Kits and Glossaries for Download

TechRepublic Premium content helps you solve your toughest IT issues and jump-start your career or next project.

Google, Microsoft, Meta and More to Develop Open Standard for AI Chip Components in UALink Promoter Group

Notably absent from the group is NVIDIA, which has its own equivalent technology that it may not wish to share with its closest rivals.

Gartner’s 7 Predictions for the Future of Australian & Global Cloud Computing

An explosion in AI computing, a big shift in workloads to the cloud, and difficulties in gaining value from hybrid cloud strategies are among the trends Australian cloud professionals will see to 2028.

Price Drop: Learn Python Skills From Novice to Professional for Just $20

These self-paced courses are designed specifically to help complete novices develop the skills required for a real-world Python position. Now at $19.97 through 6/9.

Price Drop: Code Faster and More Accurately, Even in Collaboration, for Just $40

Microsoft Visual Studio Professional 2022 for Windows allows you to code with teams across platforms and languages, and offers advanced tools to ensure accuracy. Now at $39.97 through May 31st.

Snowflake Arctic, a New AI LLM for Enterprise Tasks, is Coming to APAC

Data cloud company Snowflake’s Arctic is promising to provide APAC businesses with a true open source large language model they can use to train their own custom enterprise LLMs and inference more economically.

Anthropic’s Generative AI Research Reveals More About How LLMs Affect Security and Bias

Anthropic opened a window into the ‘black box’ where ‘features’ steer a large language model’s output.

Learn How to Code From Novice-Friendly Courses for Just $40 Through 5/31

Learning to code can be so easy with the classes in this bundle; most were designed for novices, and others will take you further when you’re ready.

Microsoft Build 2024: Copilot AI Will Gain ‘Personal Assistant’ and Custom Agent Capabilities

Other announcements included a Snapdragon Dev Kit for Windows, GitHub Copilot Extensions and the general availability of Azure AI Studio.

Learn the Python Programming Language Online for Just $24

Get certified for the most popular language used by software development companies with these ten online training courses. Use code TRA20 at checkout to unlock an extra 20% off its already discounted price.

The Apple Developer Program: What Professionals Need to Know

If you want to develop software for macOS, iOS, tvOS, watchOS or visionOS, read this overview of Apple's Developer Program.

Create a TechRepublic Account

Get the web's best business technology news, tutorials, reviews, trends, and analysis—in your inbox. Let's start with the basics.

* - indicates required fields

Sign in to TechRepublic

Lost your password? Request a new password

Reset Password

Please enter your email adress. You will receive an email message with instructions on how to reset your password.

Check your email for a password reset link. If you didn't receive an email don't forgot to check your spam folder, otherwise contact support .

Welcome. Tell us a little bit about you.

This will help us provide you with customized content.

Want to receive more TechRepublic news?

You're all set.

Thanks for signing up! Keep an eye out for a confirmation email from our team. To ensure any newsletters you subscribed to hit your inbox, make sure to add [email protected] to your contacts list.

IMAGES

VIDEO

COMMENTS

3) Plan for a sample that meets your needs and considers your real-life constraints. Every research project operates within certain boundaries - commonly budget, timeline and the nature of the sample itself. When deciding on your sample size, these factors need to be taken into consideration.

The sample size for a study needs to be estimated at the time the study is proposed; too large a sample is unnecessary and unethical, and too small a sample is unscientific and also unethical. The necessary sample size can be calculated, using statistical software, based on certain assumptions. If no assumptions can be made, then an arbitrary ...

Stage 2: Calculate sample size. Now that you've got answers for steps 1 - 4, you're ready to calculate the sample size you need. This can be done using an online sample size calculator or with paper and pencil. 1. Find your Z-score. Next, you need to turn your confidence level into a Z-score.

Therefore, when estimating the sample size, population size is rarely important in medical research. 37 However, if the population is limited (e.g., in a study that evaluates an academic program, where the population is all students enrolled in the program), then the sample size equations can be adjusted for the population size. 37 , 38 , 39 ...

In order to make up for a rough estimate of 20.0% of non-response rate, the minimum sample size requirement is calculated to be 254 patients (i.e. 203/0.8) by estimating the sample size based on the EPV 50, and is calculated to be 375 patients (i.e. 300/0.8) by estimating the sample size based on the formula n = 100 + 50i.

Sample size is the number of observations or individuals included in a study or experiment. It is the number of individuals, items, or data points selected from a larger population to represent it statistically. The sample size is a crucial consideration in research because it directly impacts the reliability and extent to which you can ...

Determining the right sample size for your survey is one of the most common questions researchers ask when they begin a market research study. Luckily, sample size determination isn't as hard to calculate as you might remember from an old high school statistics class. Before calculating your sample size, ensure you have these things in place:

2.58. Put these figures into the sample size formula to get your sample size. Here is an example calculation: Say you choose to work with a 95% confidence level, a standard deviation of 0.5, and a confidence interval (margin of error) of ± 5%, you just need to substitute the values in the formula: ( (1.96)2 x .5 (.5)) / (.05)2.

You need to determine how big of a sample size you need so that you can be sure the quantitative data you get from a survey is reflective of your target population as a whole - and so that the decisions you make based on the research have a firm foundation. Too big a sample and a project can be needlessly expensive and time-consuming.

Alternatively, you can use a formula that corresponds to your research design and method, such as the one for simple random sampling: n = (Z^2 * p * (1-p)) / (e^2) where n is the sample size, Z is ...

The ideal sample size for your study will depend on your population size, confidence level, and confidence interval. The survey design and methodology you use may also require you to adjust your sample size.. A good sample size will satisfy your criteria for accuracy in quantitative research results.

Research Sampling and Sample Size Determination: A practical Application. Chinelo Blessing ORIBHABOR (Ph.D) Department of Guidance and Counseling, Faculty of Arts and Education, University of ...

All you have to do is take the number of respondents you need, divide by your expected response rate, and multiple by 100. For example, if you need 500 customers to respond to your survey and you know the response rate is 30%, you should invite about 1,666 people to your study (500/30*100 = 1,666).

It is the ability of the test to detect a difference in the sample, when it exists in the target population. Calculated as 1-Beta. The greater the power, the larger the required sample size will be. A value between 80%-90% is usually used. Relationship between non-exposed/exposed groups in the sample.

A formula for determining qualitative sample size. In 2013, Research by Design published a whitepaper by Donna Bonde which included research-backed guidelines for qualitative sampling in a market research context. Victor Yocco, writing in 2017, drew on these guidelines to create a formula determining qualitative sample sizes.

A good maximum sample size is usually around 10% of the population, as long as this does not exceed 1000. For example, in a population of 5000, 10% would be 500. In a population of 200,000, 10% would be 20,000. This exceeds 1000, so in this case the maximum would be 1000. Even in a population of 200,000, sampling 1000 people will normally give ...

For sample size estima-tion, researchers need to (1) provide information regarding the statistical analysis to be applied, (2) determine acceptable precision levels, (3) decide on study power, (4) specify the confidence level, and (5) determine the magnitude of practical significance differences (effect size).

(For more advanced students with an interest in statistics, the Creative Research Systems website (Creative Research Systems, 2003) has a more exact formula, along with a sample size calculator that you can use.

What is a good sample size for a qualitative research study? Our sample size calculator will work out the answer based on your project's scope, participant characteristics, researcher expertise, and methodology. Just answer 4 quick questions to get a super actionable, data-backed recommendation for your next study.

Request a consultation from sample-size.net developer Michael Kohn about sample size calculation, study design, data management, or statistical analysis. ... Our approach is based on Chapters 5 and 6 in the 4th edition of Designing Clinical Research ... Need help finding the right calculator? See all calculators. This project was supported by ...

Therefore, when estimating the sample size, population size is rarely important in medical research. 37 However, if the population is limited (e.g., in a study that evaluates an academic program, where the population is all students enrolled in the program), then the sample size equations can be adjusted for the population size. 37-39 The size ...

Media Files: APA Sample Student Paper , APA Sample Professional Paper This resource is enhanced by Acrobat PDF files. Download the free Acrobat Reader. Note: The APA Publication Manual, 7 th Edition specifies different formatting conventions for student and professional papers (i.e., papers written for credit in a course and papers intended for scholarly publication).