Financial Plan Assumptions

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on July 11, 2023

Get Any Financial Question Answered

Table of contents, what are financial plan assumptions.

Financial plan assumptions are the key variables, estimates, and predictions used to develop a company's financial projections and strategy. They serve as the foundation for forecasting revenues , costs, investments, and taxes , among other elements.

Assumptions are critical in financial planning because they help businesses set realistic goals, allocate resources efficiently, and identify potential risks and opportunities. They also enable management to make informed decisions based on the best available data and industry insights.

Financial plan assumptions aim to create a comprehensive picture of a company's future financial performance by incorporating a range of factors.

These assumptions are designed to be flexible and adaptable, allowing for adjustments as new information becomes available or market conditions change.

Key Financial Plan Assumptions

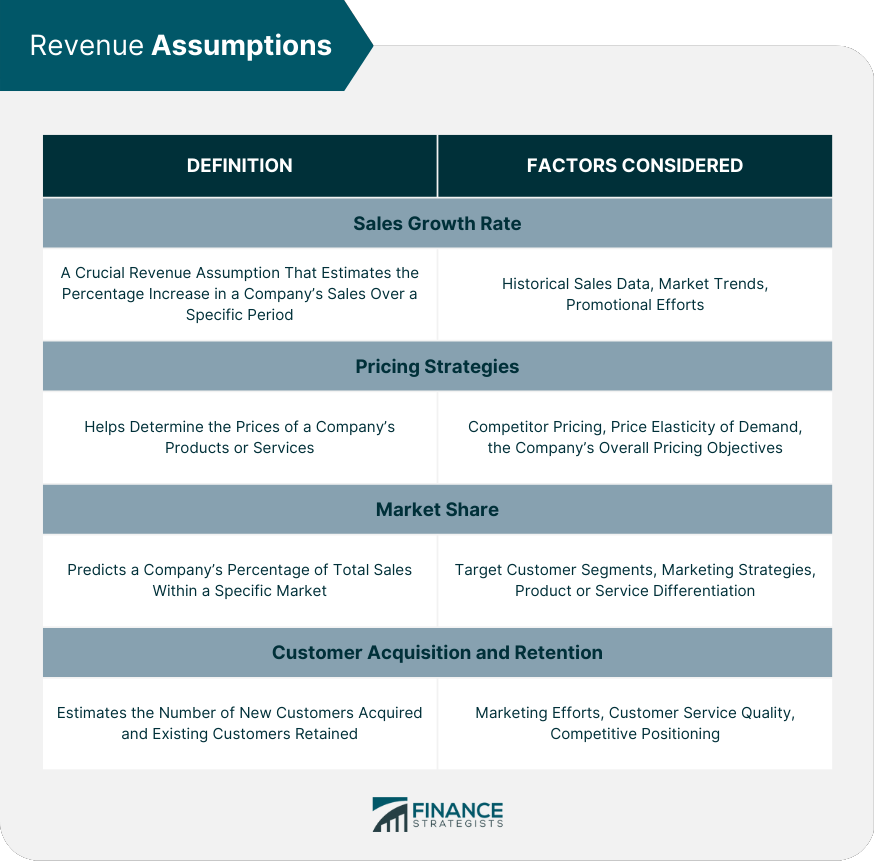

Revenue assumptions, sales growth rate.

The sales growth rate is a crucial revenue assumption that estimates the percentage increase in a company's sales over a specific period. This rate takes into account factors such as historical sales data, market trends, and promotional efforts.

Pricing Strategies

Pricing strategies help determine the prices of a company's products or services. Assumptions related to pricing may include competitor pricing, price elasticity of demand, and the company's overall pricing objectives.

Market Share

Market share assumptions predict a company's percentage of total sales within a specific market. Estimations consider factors such as target customer segments, marketing strategies, and product or service differentiation.

Customer Acquisition and Retention

Customer acquisition and retention assumptions estimate the number of new customers acquired and existing customers retained. These assumptions depend on factors such as marketing efforts, customer service quality, and competitive positioning.

Cost Assumptions

Fixed and variable costs.

Fixed and variable costs are essential components of a company's financial plan . Fixed costs include expenses that remain constant, regardless of production levels or sales, such as rent and salaries. Variable costs vary with production or sales, including raw materials and shipping costs.

Cost of Goods Sold (COGS)

COGS is the total cost of producing goods or services sold by a company. Key assumptions for COGS may include production costs , labor costs, and manufacturing overheads.

Operating Expenses

Operating expenses are the costs associated with running a business, excluding COGS. Assumptions for operating expenses may include marketing costs, administrative expenses, and research and development expenditures .

Inflation Rate

The inflation rate assumption estimates the increase in the general price level over time. This assumption affects various cost projections, such as wages, raw materials, and utilities.

Investment Assumptions

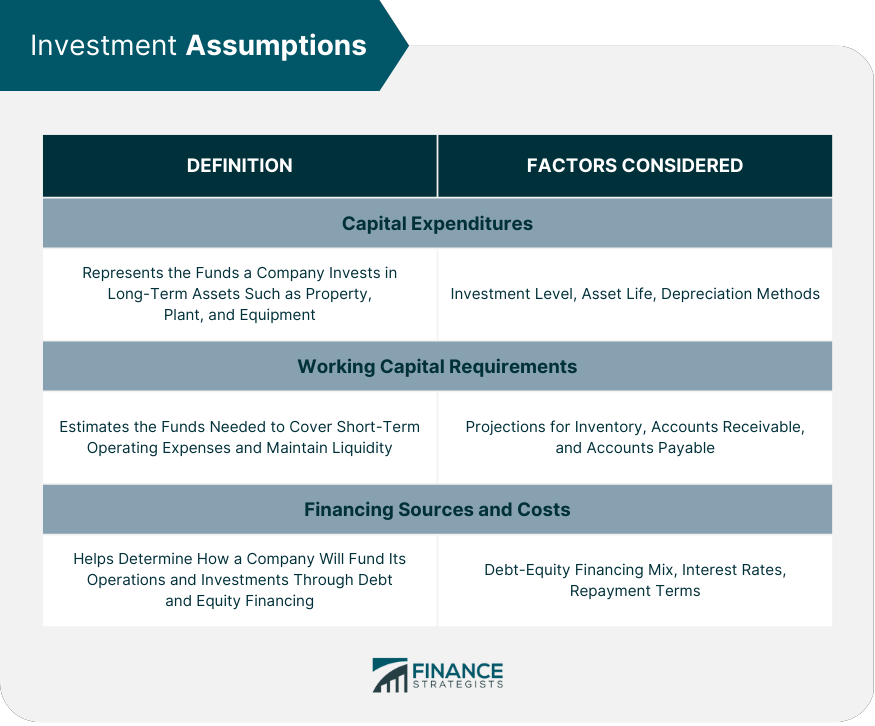

Capital expenditures.

Capital expenditures represent the funds a company invests in long-term assets, such as property, plant, and equipment. Assumptions for capital expenditures may include the anticipated level of investment , the useful life of assets , and depreciation methods.

Working Capital Requirements

Working capital assumptions estimate the funds needed to cover short-term operating expenses and maintain sufficient liquidity . These assumptions may include projections for inventory levels, accounts receivable , and accounts payable .

Financing Sources and Costs

Financing assumptions help determine how a company will fund its operations and investments. These assumptions include the mix of debt and equity financing, interest rates , and repayment terms.

Tax Assumptions

Corporate tax rates.

Corporate tax rate assumptions estimate the percentage of a company's profits subject to taxation. These assumptions take into account federal, state, and local tax rates, as well as any changes to tax laws.

Tax Credits and Incentives

Tax credits and incentives are reductions in tax liability offered by governments to encourage specific business activities. Assumptions related to tax credits may include eligibility criteria, application deadlines, and the expected amount of tax savings.

Tax Planning Strategies

Tax planning strategies are methods used by companies to minimize their tax liabilities. Assumptions related to tax planning may include the use of tax-efficient structures, deductions, and loss carryforwards.

Economic and Industry Assumptions

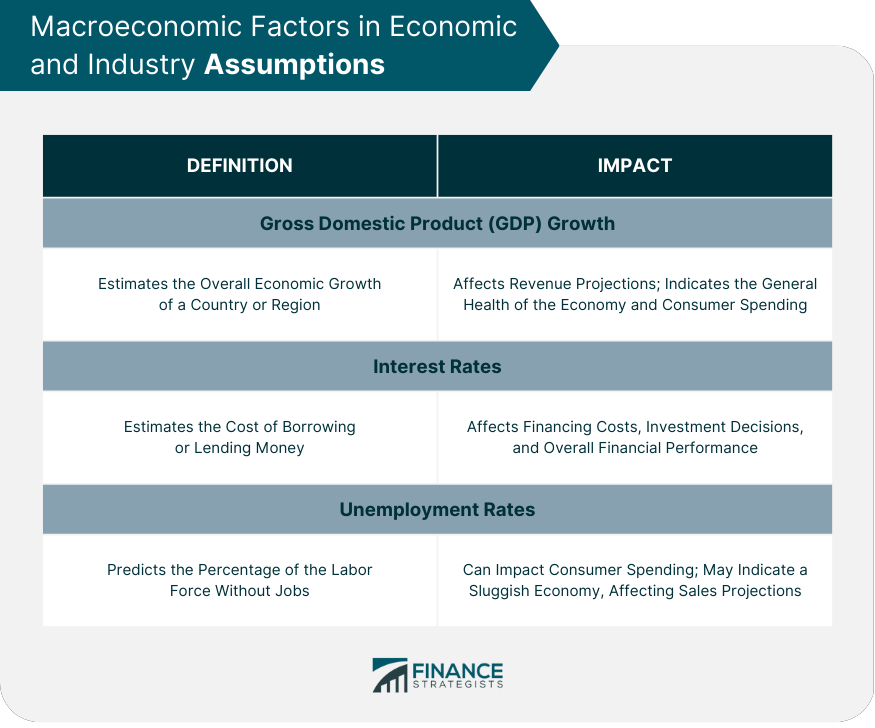

Macroeconomic factors.

Gross domestic product (GDP) growth rate assumptions estimate the overall economic growth of a country or region. These assumptions impact a company's revenue projections, as they help gauge the general health of the economy and consumer spending.

Interest Rates

Interest rate assumptions estimate the cost of borrowing or lending money. These rates affect a company's financing costs, investment decisions, and overall financial performance.

Unemployment Rates

Unemployment rate assumptions predict the percentage of the labor force without jobs. High unemployment rates can impact consumer spending and may indicate a sluggish economy, affecting a company's sales projections.

Industry Trends and Competition

Market size and growth.

Market size and growth assumptions help estimate the overall potential of an industry and the opportunities it presents for a company. Factors considered may include historical data, demographic trends, and technological advancements.

Technological Advancements

Technological advancements can disrupt industries and create new markets. Assumptions related to technology may include the adoption of new technologies, the impact of innovations on the market, and the potential for competitive advantage.

Regulatory Changes

Regulatory changes can significantly impact a company's operations and financial performance. Assumptions related to regulation may include potential changes in laws, compliance requirements, and the effects on the industry landscape.

Competitive Landscape

Competitive landscape assumptions evaluate a company's position within its industry and the level of competition it faces. These assumptions may consider factors such as market share, competitor strategies, and barriers to entry.

Sensitivity Analysis and Scenario Planning

Identifying key variables and uncertainties.

Sensitivity analysis and scenario planning involve identifying key variables and uncertainties in a company's financial plan. These variables may include economic factors, industry trends, or company-specific factors.

Developing Scenarios and Assumptions

Scenario planning involves creating alternative future scenarios based on varying assumptions. Companies develop multiple scenarios to explore the potential impact of different events, trends, and risks on their financial performance.

Analyzing the Impact on Financial Performance

Companies analyze the impact of different scenarios on their financial performance to identify potential risks and opportunities. This analysis helps management make informed decisions and adapt their strategies as needed.

Risk Mitigation and Contingency Planning

Based on the results of sensitivity analysis and scenario planning, companies develop risk mitigation and contingency plans. These plans help companies prepare for potential challenges and capitalize on emerging opportunities.

Regular Review and Update of Assumptions

Importance of ongoing monitoring.

Regularly reviewing and updating financial plan assumptions is essential to ensure their continued relevance and accuracy. Ongoing monitoring helps companies stay informed of market changes and adapt their strategies accordingly.

Frequency of Assumption Updates

The frequency of assumption updates depends on the nature of the company and its industry. Companies operating in rapidly changing environments may need to update their assumptions more frequently than those in more stable industries.

Incorporating New Information and Data

As new information and data become available, companies should incorporate them into their financial plan assumptions. This ensures that the assumptions remain relevant and provide an accurate basis for decision-making.

Adjusting Financial Plans as Needed

Based on updated assumptions, companies may need to adjust their financial plans to reflect changes in market conditions, industry trends, or company-specific factors. Regular adjustments help maintain the accuracy and relevance of financial projections.

Financial plan assumptions play a crucial role in the development of a company's financial strategy and projections. By incorporating a wide range of factors and estimates, assumptions help create a comprehensive picture of a company's future financial performance.

Regularly reviewing and updating financial plan assumptions is essential for ensuring their continued relevance and accuracy. As new information becomes available or market conditions change, companies must adapt their assumptions and adjust their financial plans accordingly.

Sensitivity analysis and scenario planning are valuable tools for managing risks and identifying potential opportunities.

By analyzing the impact of different scenarios on a company's financial performance, management can make informed decisions and develop risk mitigation and contingency plans.

In conclusion, financial plan assumptions are critical components of a company's financial planning process.

By incorporating a wide range of factors and regularly reviewing and updating these assumptions, companies can create accurate financial projections, identify potential risks and opportunities, and make informed decisions that drive their long-term success.

Financial Plan Assumptions FAQs

What are financial plan assumptions, and why are they important.

Financial plan assumptions are the underlying estimates and predictions that a financial plan is based upon. They are essential because they provide the framework for determining how much money you need to save, how much you can expect to earn on your investments, and how long your money will last in retirement.

How do I choose the right financial plan assumptions for my personal financial plan?

The right financial plan assumptions will depend on your personal circumstances, financial goals, and risk tolerance. You should consider your current income, expenses, debts, and assets when selecting your assumptions. Additionally, you should consider factors such as inflation, investment returns, and life expectancy.

What are some common financial plan assumptions used by financial planners?

Common financial plan assumptions used by financial planners include assumptions about inflation rates, investment returns, life expectancy, and tax rates. Other assumptions may include future expenses such as college tuition or medical costs, changes in income or employment, and changes in interest rates.

How often should I review and update my financial plan assumptions?

You should review and update your financial plan assumptions regularly, at least annually, and whenever there are significant changes in your life circumstances, such as a new job, a significant change in income or expenses, or a change in your investment portfolio.

What are the potential risks of relying on incorrect financial plan assumptions?

Relying on incorrect financial plan assumptions can lead to a variety of risks, including not saving enough for retirement, running out of money in retirement, or being unable to meet other financial goals. Additionally, incorrect assumptions can lead to poor investment decisions, resulting in lower investment returns and higher taxes. It is essential to ensure that your financial plan assumptions are as accurate as possible to help you achieve your financial goals.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- Affordable Care Act's (ACA) Medicaid

- Aggressive Investing

- Behavioral Finance

- Brick and Mortar

- Cash Flow From Operating Activities

- Cash Flow Management

- Debt Reduction Strategies

- Depreciation Recapture

- Divorce Financial Planning

- Education Planning

- Envelope Budgeting

- Farmland Investments

- Financial Planning for Allied Health Professionals

- Financial Planning for Military Families

- Global Macro Hedge Fund

- Inventory Turnover Rate (ITR)

- Lieutenant Colonel Pension Plans

- Medicaid Asset Protection Trust

- Medical Lines of Credit

- Military Spouse Financial Planning

- Multi-Family Line of Credit

- Pension Pillar

- Pension Scheme

- Post-Divorce Debt Management

- Succession Planning

- Trustee Succession

- Types of Fixed Income Investments

Ask a Financial Professional Any Question

Meet top certified financial advisors near you, find advisor near you, our recommended advisors.

Taylor Kovar, CFP®

WHY WE RECOMMEND:

Fee-Only Financial Advisor Show explanation

Certified financial planner™, 3x investopedia top 100 advisor, author of the 5 money personalities & keynote speaker.

IDEAL CLIENTS:

Business Owners, Executives & Medical Professionals

Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation

Claudia Valladares

Bilingual in english / spanish, founder of wisedollarmom.com, quoted in gobanking rates, yahoo finance & forbes.

Retirees, Immigrants & Sudden Wealth / Inheritance

Retirement Planning, Personal finance, Goals-based Planning & Community Impact

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

Hey, did we answer your financial question.

We want to make sure that all of our readers get their questions answered.

Great, Want to Test Your Knowledge of This Lesson?

Create an Account to Test Your Knowledge of This Topic and Thousands of Others.

Get Your Question Answered by a Financial Professional

Create a free account and submit your question. We'll make sure a financial professional gets back to you shortly.

To Ensure One Vote Per Person, Please Include the Following Info

Great thank you for voting..

- AI ASSISTANTS

Upmetrics AI Your go-to AI-powered business assistant

AI Writing Assist Write, translate, and refine your text with AI

AI Financial Assist Automated forecasts and AI recommendations

- TOP FEATURES

AI Business Plan Generator Create business plans faster with AI

Financial Forecasting Make accurate financial forecasts faster

Strategic Planning Develop actionable strategic plans on-the-go

AI Pitch Deck Generator Use AI to generate your investor deck

See how it works →

AI-powered business planning software

Very useful business plan software connected to AI. Saved a lot of time, money and energy. Their team is highly skilled and always here to help.

- Julien López

- BY USE CASE

Starting & Launching a Business Plan your business for launch and success

Validate Your Business Idea Discover the potential of your business idea

Secure Funding, Loans, Grants Create plans that get you funded

Business Consultant & Advisors Plan with your team members and clients

Business Schools & Educators Simplify business plan education for students

Students & Learners Your e-tutor for business planning

- Sample Plans

- WHY UPMETRICS?

Reviews See why customers love Upmetrics

Customer Success Stories Read our customer success stories

Blogs Latest business planning tips and strategies

Strategic Planning Templates Ready-to-use strategic plan templates

Business Plan Course A step-by-step business planning course

Ebooks & Guides A free resource hub on business planning

Business Tools Free business tools to help you grow

- 400+ Sample Business Plans

How to Prepare a Financial Plan for Startup Business (w/ example)

Free Financial Statements Template

Ajay Jagtap

- December 7, 2023

13 Min Read

If someone were to ask you about your business financials, could you give them a detailed answer?

Let’s say they ask—how do you allocate your operating expenses? What is your cash flow situation like? What is your exit strategy? And a series of similar other questions.

Instead of mumbling what to answer or shooting in the dark, as a founder, you must prepare yourself to answer this line of questioning—and creating a financial plan for your startup is the best way to do it.

A business plan’s financial plan section is no easy task—we get that.

But, you know what—this in-depth guide and financial plan example can make forecasting as simple as counting on your fingertips.

Ready to get started? Let’s begin by discussing startup financial planning.

What is Startup Financial Planning?

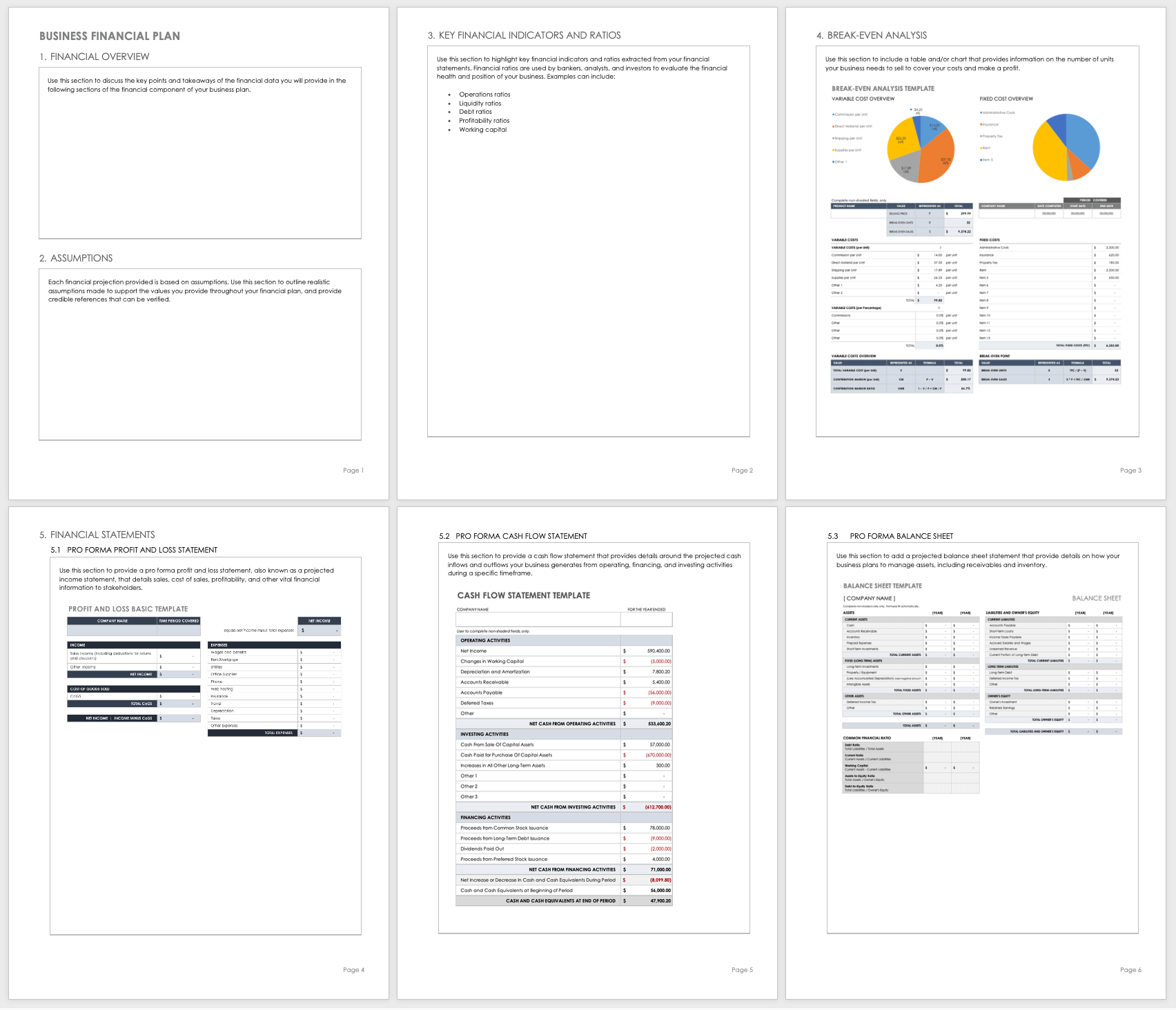

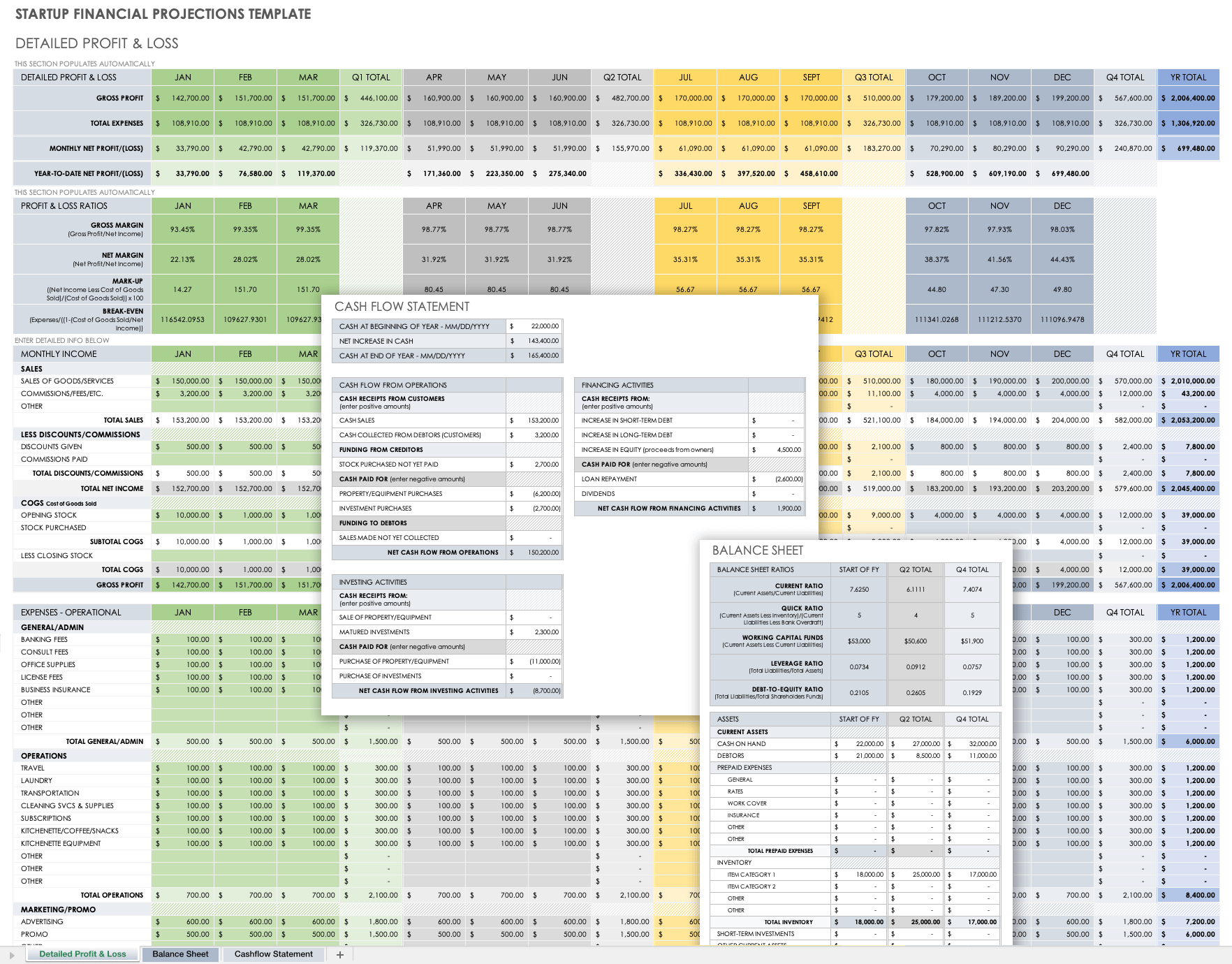

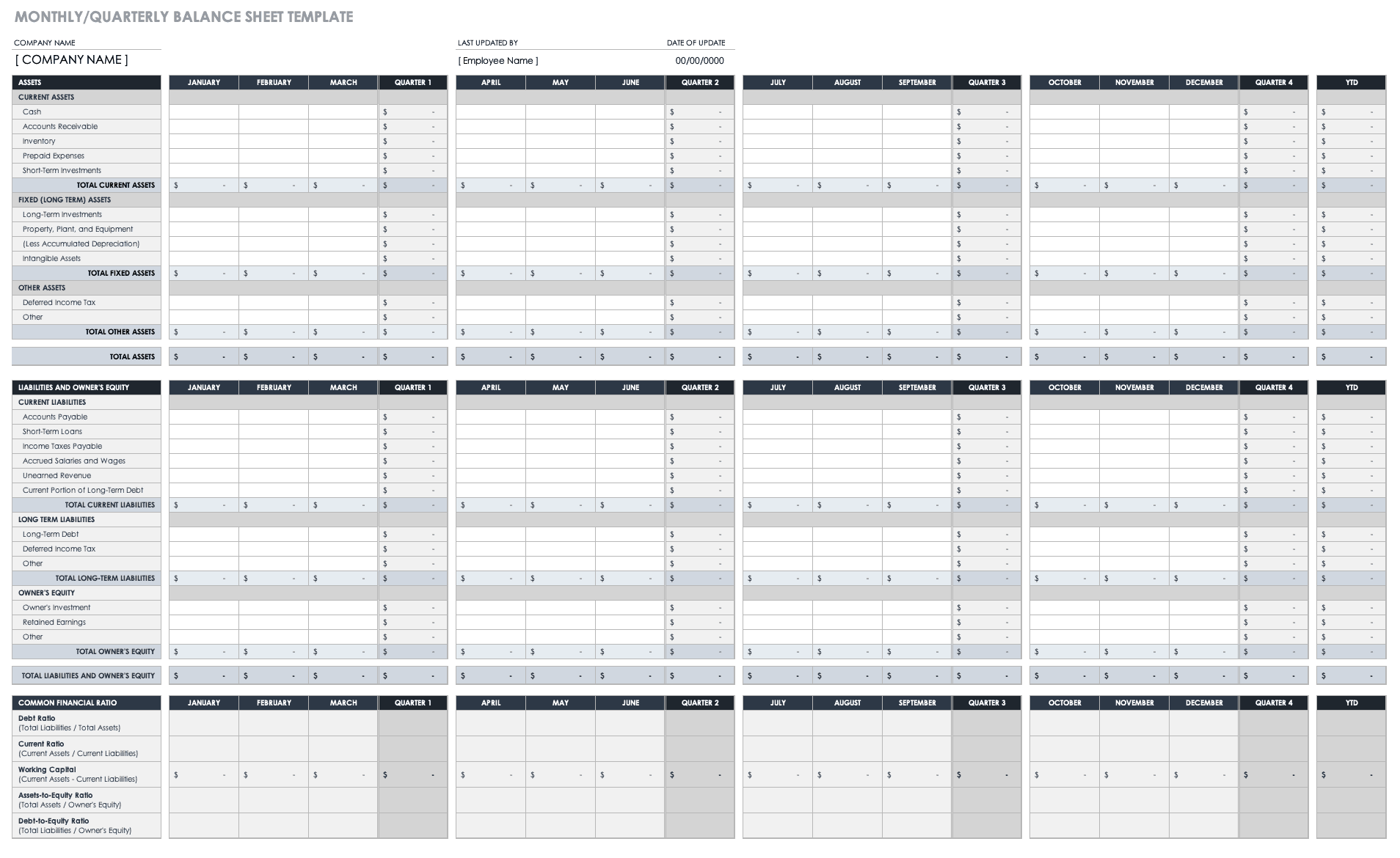

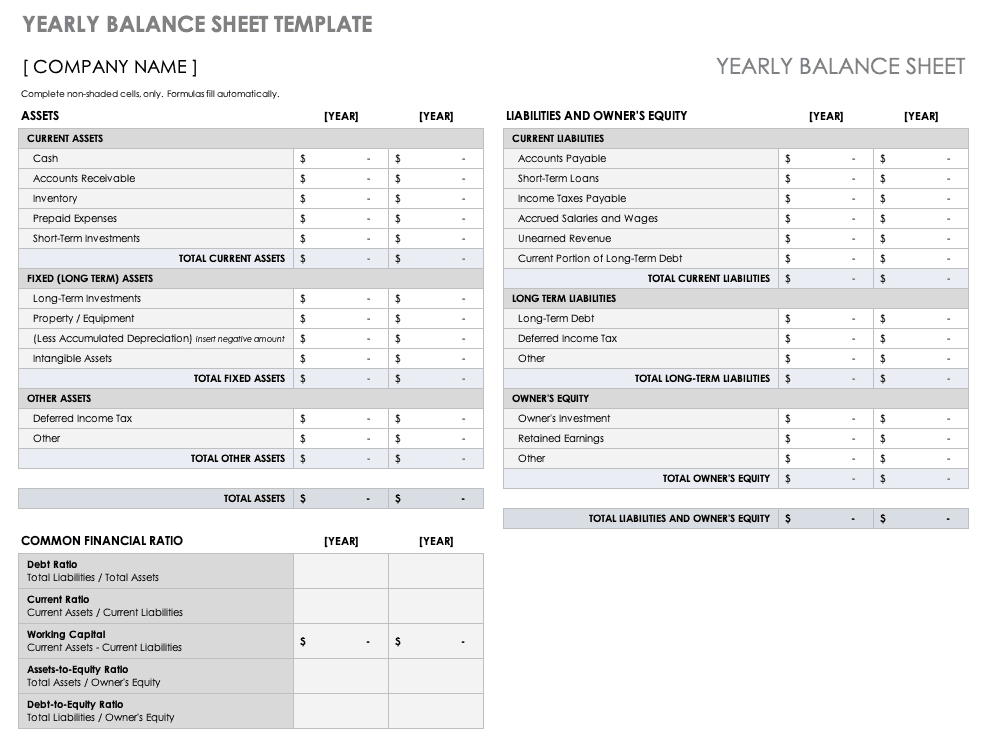

Startup financial planning, in simple terms, is a process of planning the financial aspects of a new business. It’s an integral part of a business plan and comprises its three major components: balance sheet, income statement, and cash-flow statement.

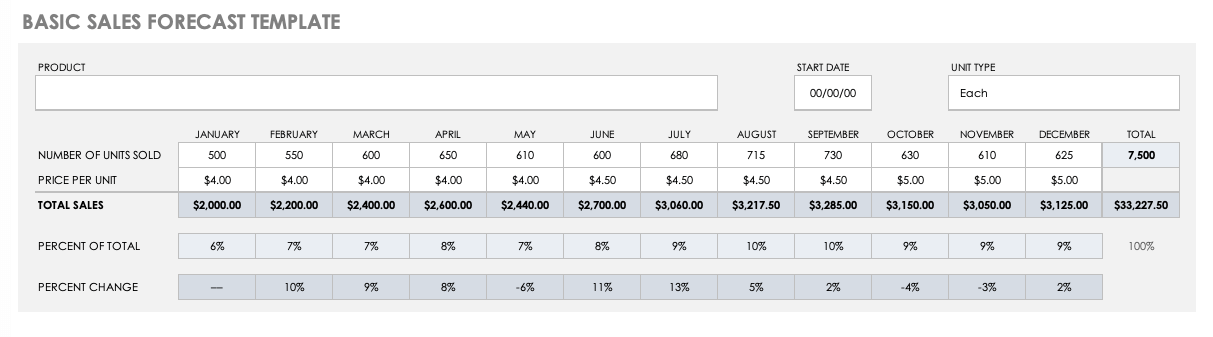

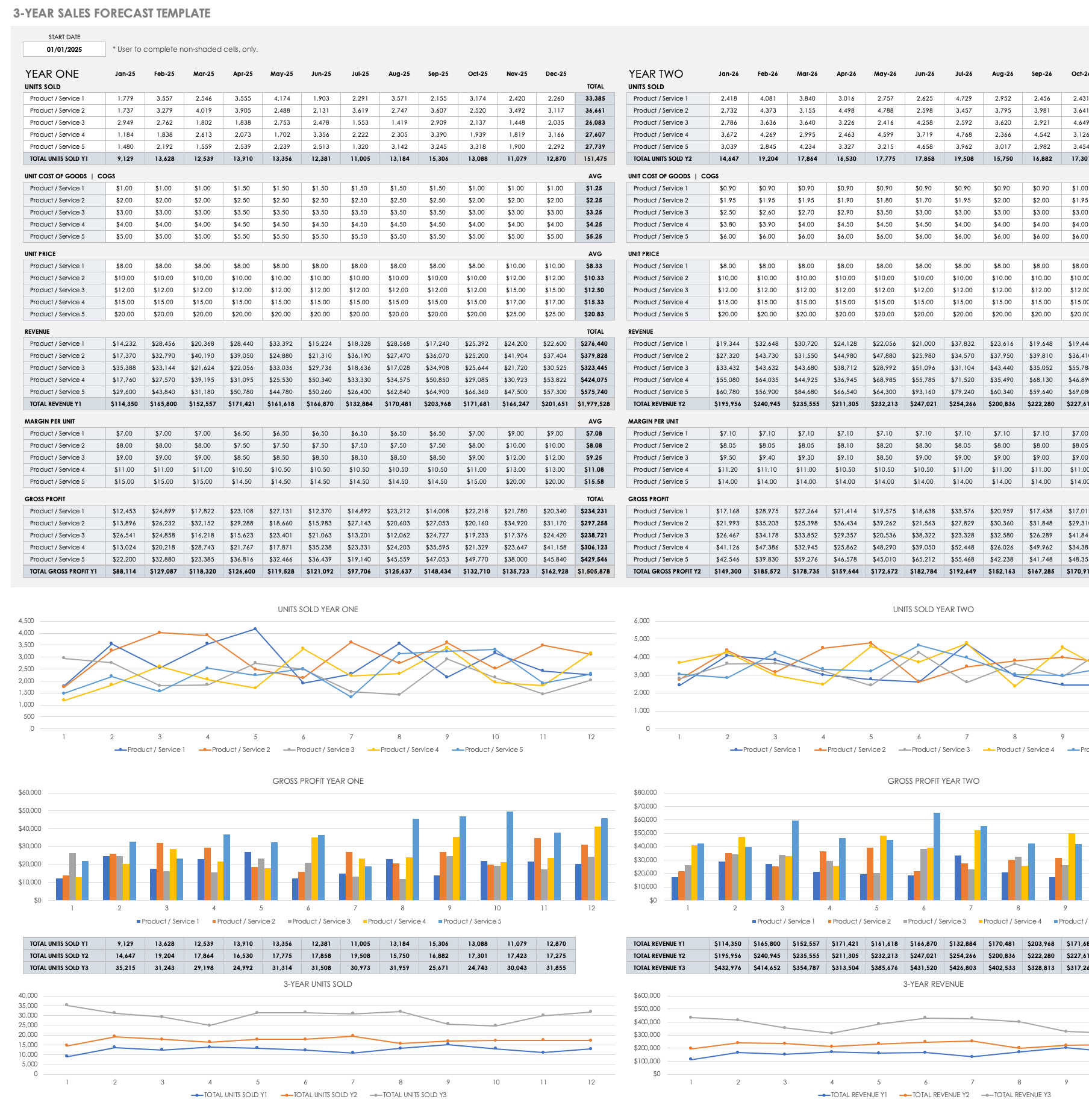

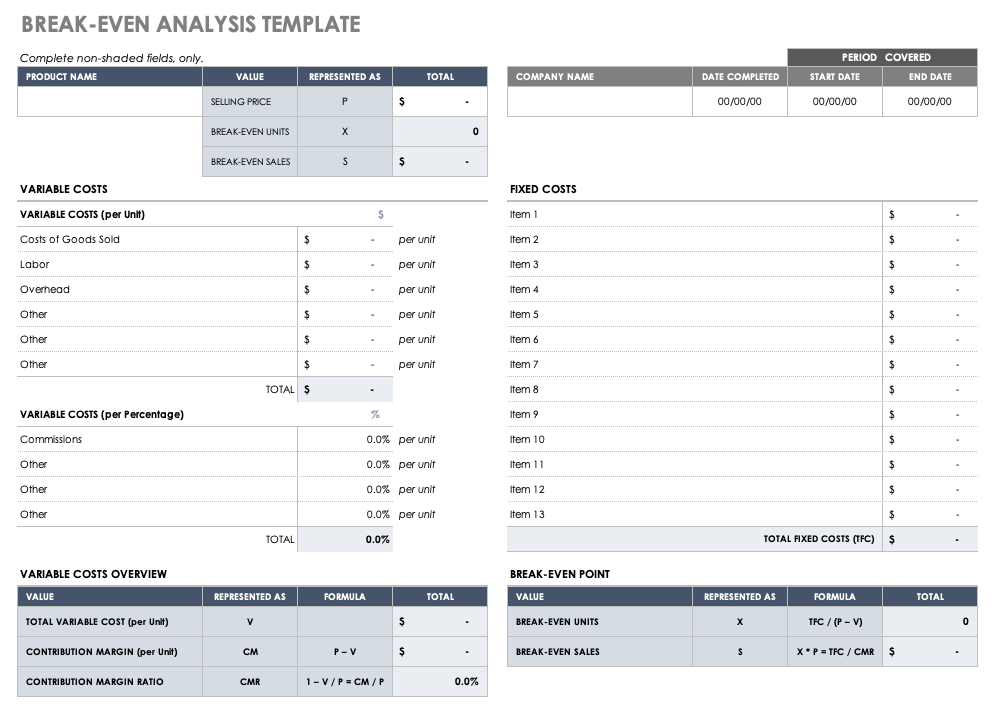

Apart from these statements, your financial section may also include revenue and sales forecasts, assets & liabilities, break-even analysis , and more. Your first financial plan may not be very detailed, but you can tweak and update it as your company grows.

Key Takeaways

- Realistic assumptions, thorough research, and a clear understanding of the market are the key to reliable financial projections.

- Cash flow projection, balance sheet, and income statement are three major components of a financial plan.

- Preparing a financial plan is easier and faster when you use a financial planning tool.

- Exploring “what-if” scenarios is an ideal method to understand the potential risks and opportunities involved in the business operations.

Why is Financial Planning Important to Your Startup?

Poor financial planning is one of the biggest reasons why most startups fail. In fact, a recent CNBC study reported that running out of cash was the reason behind 44% of startup failures in 2022.

A well-prepared financial plan provides a clear financial direction for your business, helps you set realistic financial objectives, create accurate forecasts, and shows your business is committed to its financial objectives.

It’s a key element of your business plan for winning potential investors. In fact, YC considered recent financial statements and projections to be critical elements of their Series A due diligence checklist .

Your financial plan demonstrates how your business manages expenses and generates revenue and helps them understand where your business stands today and in 5 years.

Makes sense why financial planning is important to your startup, doesn’t it? Let’s cut to the chase and discuss the key components of a startup’s financial plan.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $7/month

Key Components of a Startup Financial Plan

Whether creating a financial plan from scratch for a business venture or just modifying it for an existing one, here are the key components to consider including in your startup’s financial planning process.

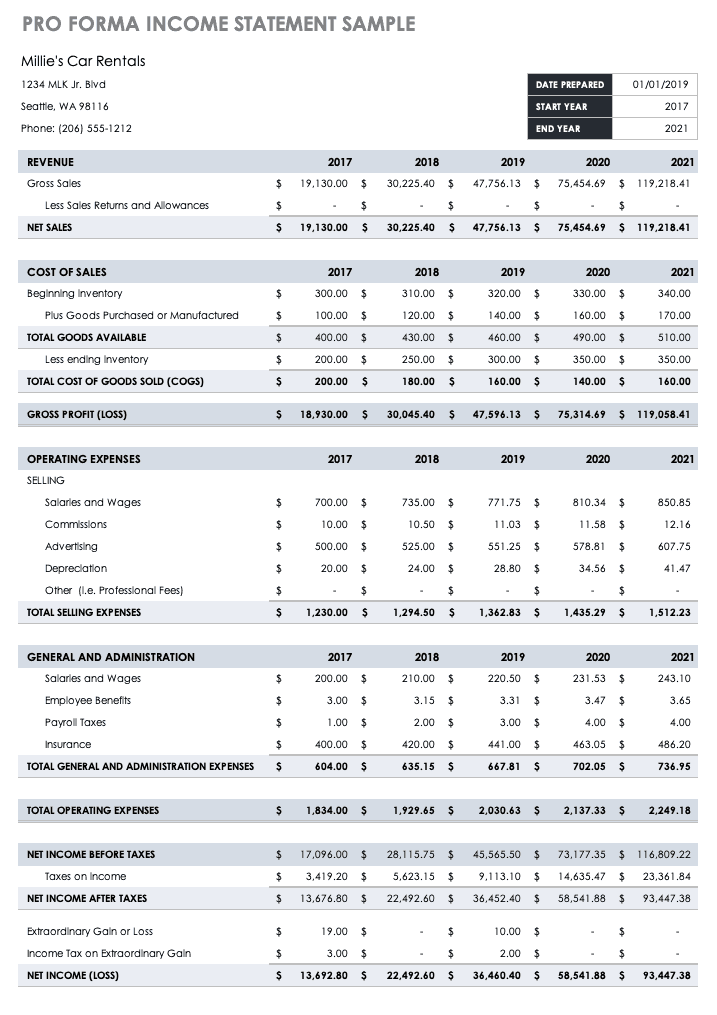

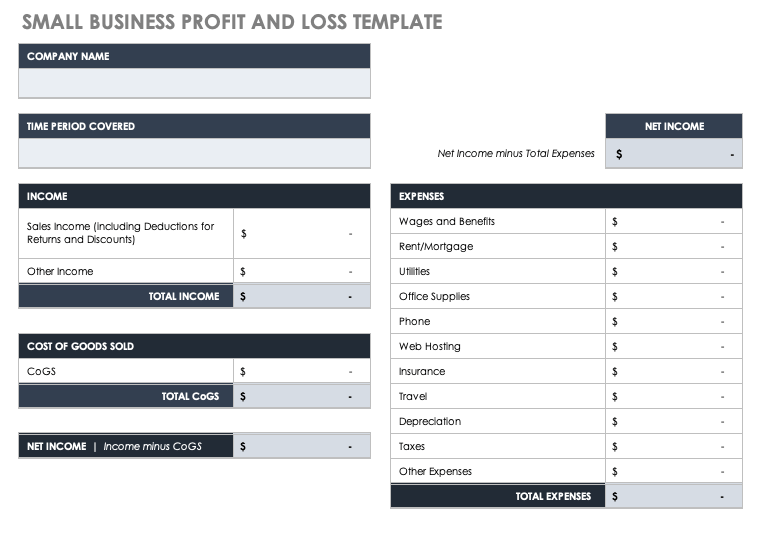

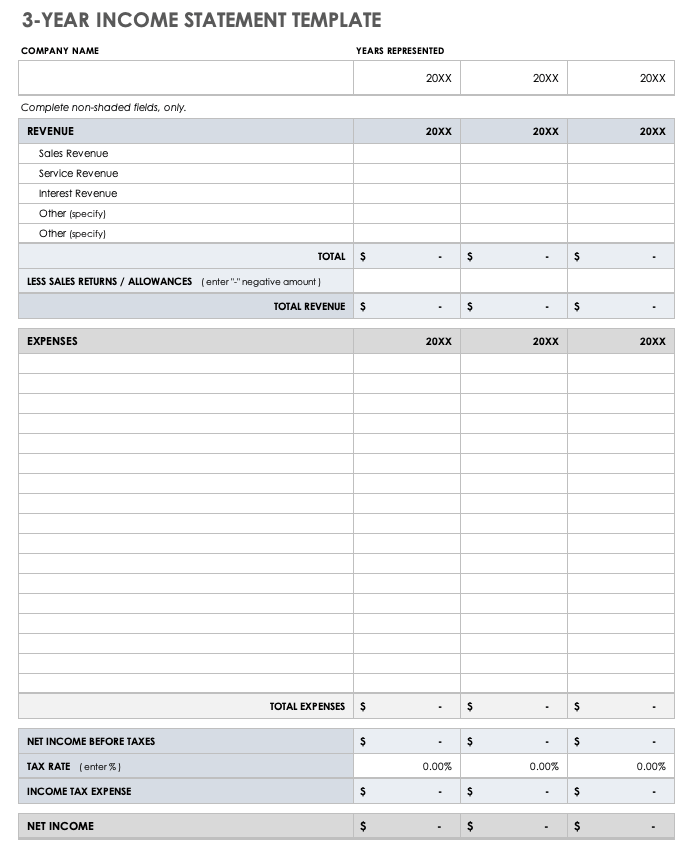

Income Statement

An Income statement , also known as a profit-and-loss statement(P&L), shows your company’s income and expenditures. It also demonstrates how your business experienced any profit or loss over a given time.

Consider it as a snapshot of your business that shows the feasibility of your business idea. An income statement can be generated considering three scenarios: worst, expected, and best.

Your income or P&L statement must list the following:

- Cost of goods or cost of sale

- Gross margin

- Operating expenses

- Revenue streams

- EBITDA (Earnings before interest, tax, depreciation , & amortization )

Established businesses can prepare annual income statements, whereas new businesses and startups should consider preparing monthly statements.

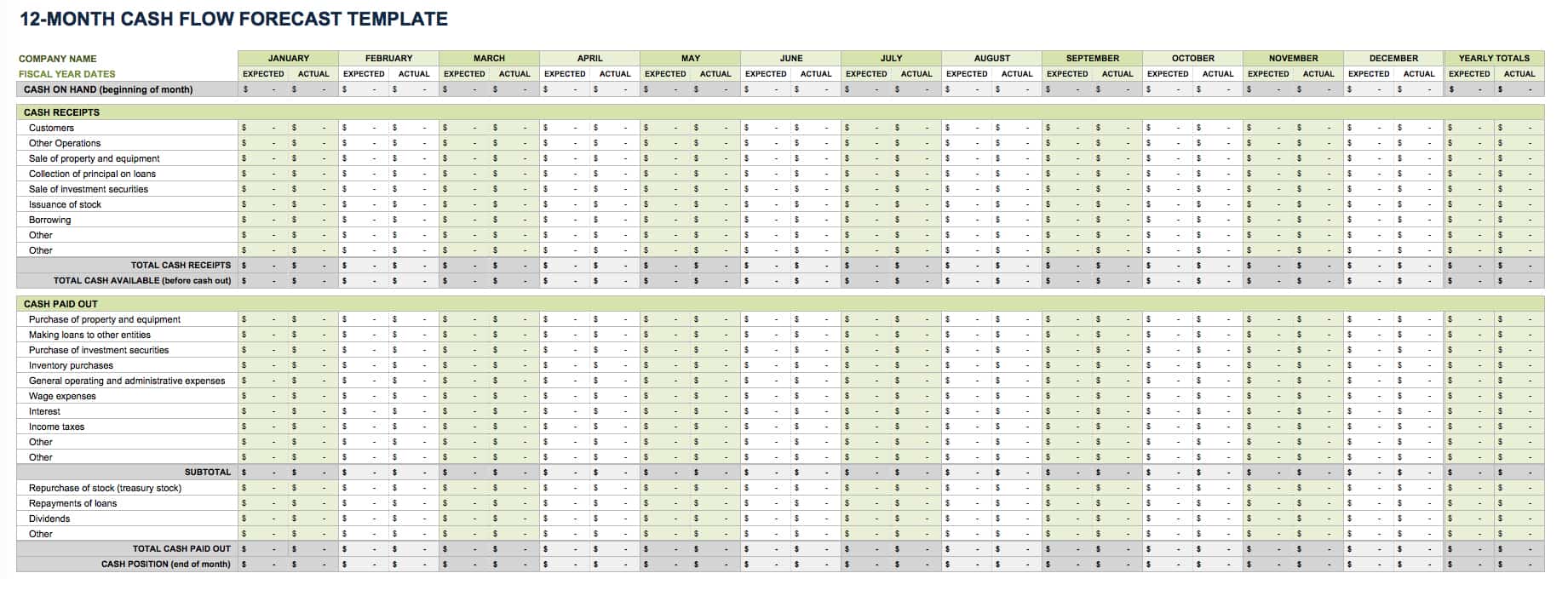

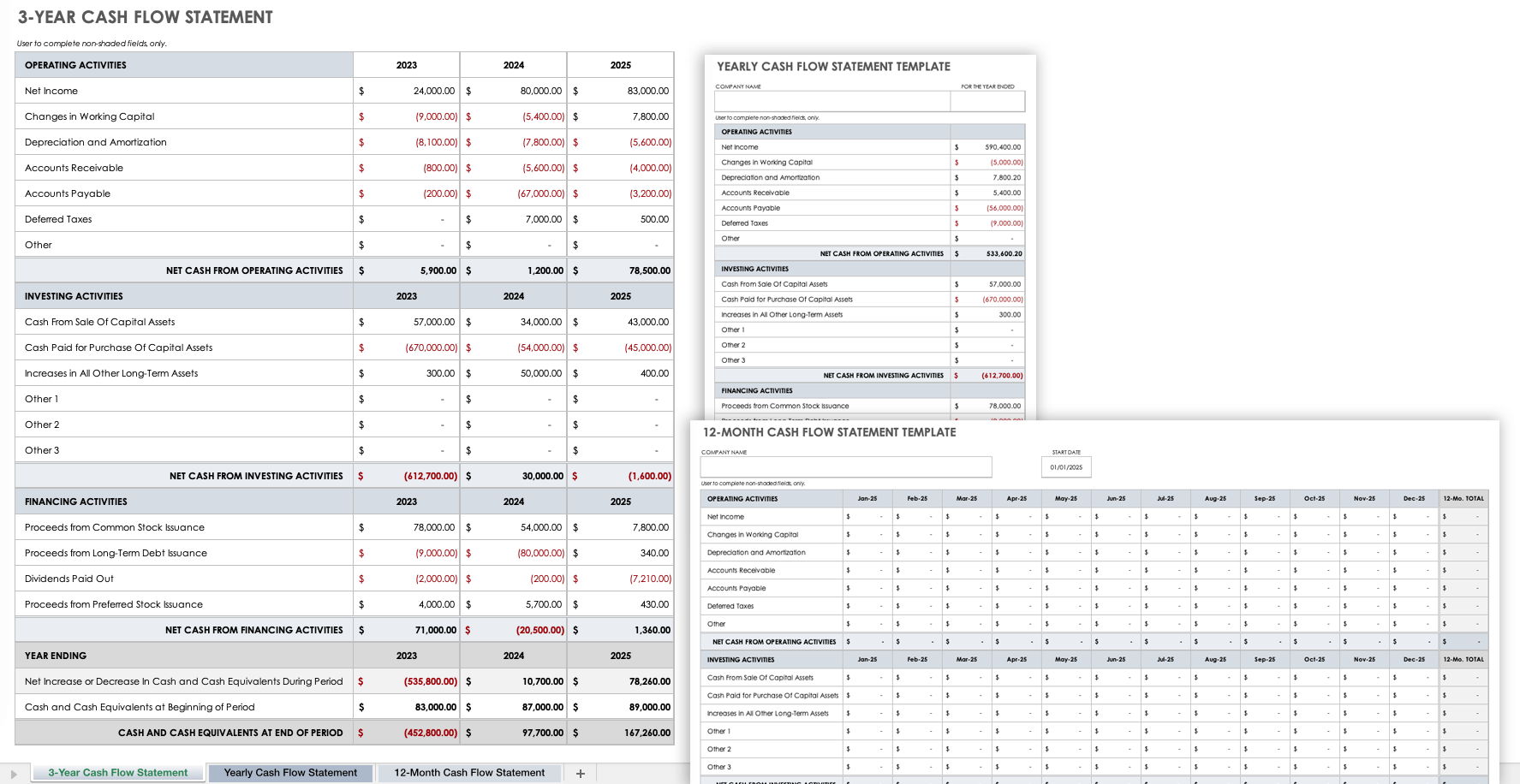

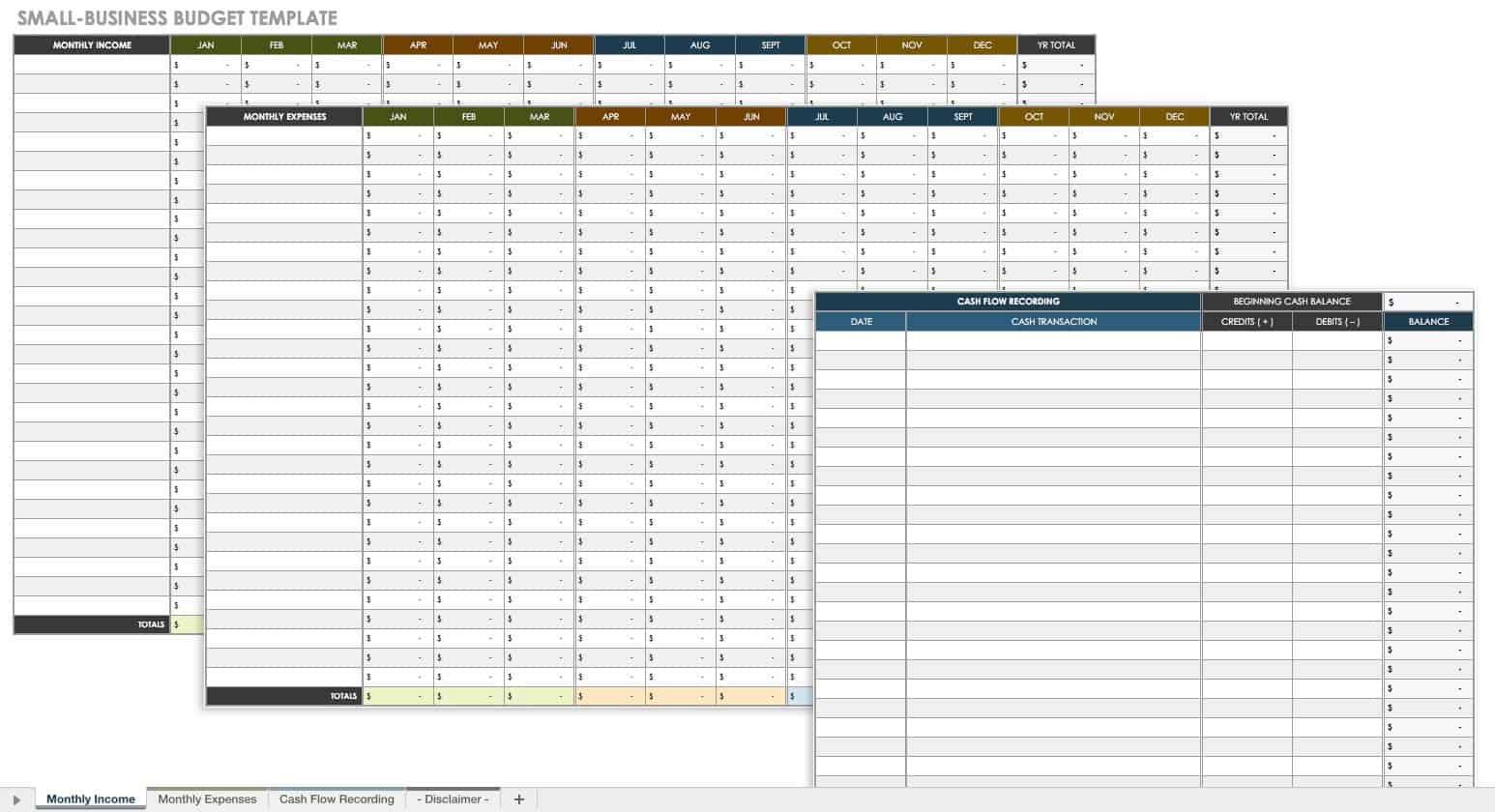

Cash flow Statement

A cash flow statement is one of the most critical financial statements for startups that summarize your business’s cash in-and-out flows over a given time.

This section provides details on the cash position of your business and its ability to meet monetary commitments on a timely basis.

Your cash flow projection consists of the following three components:

✅ Cash revenue projection: Here, you must enter each month’s estimated or expected sales figures.

✅ Cash disbursements: List expenditures that you expect to pay in cash for each month over one year.

✅ Cash flow reconciliation: Cash flow reconciliation is a process used to ensure the accuracy of cash flow projections. The adjusted amount is the cash flow balance carried over to the next month.

Furthermore, a company’s cash flow projections can be crucial while assessing liquidity, its ability to generate positive cash flows and pay off debts, and invest in growth initiatives.

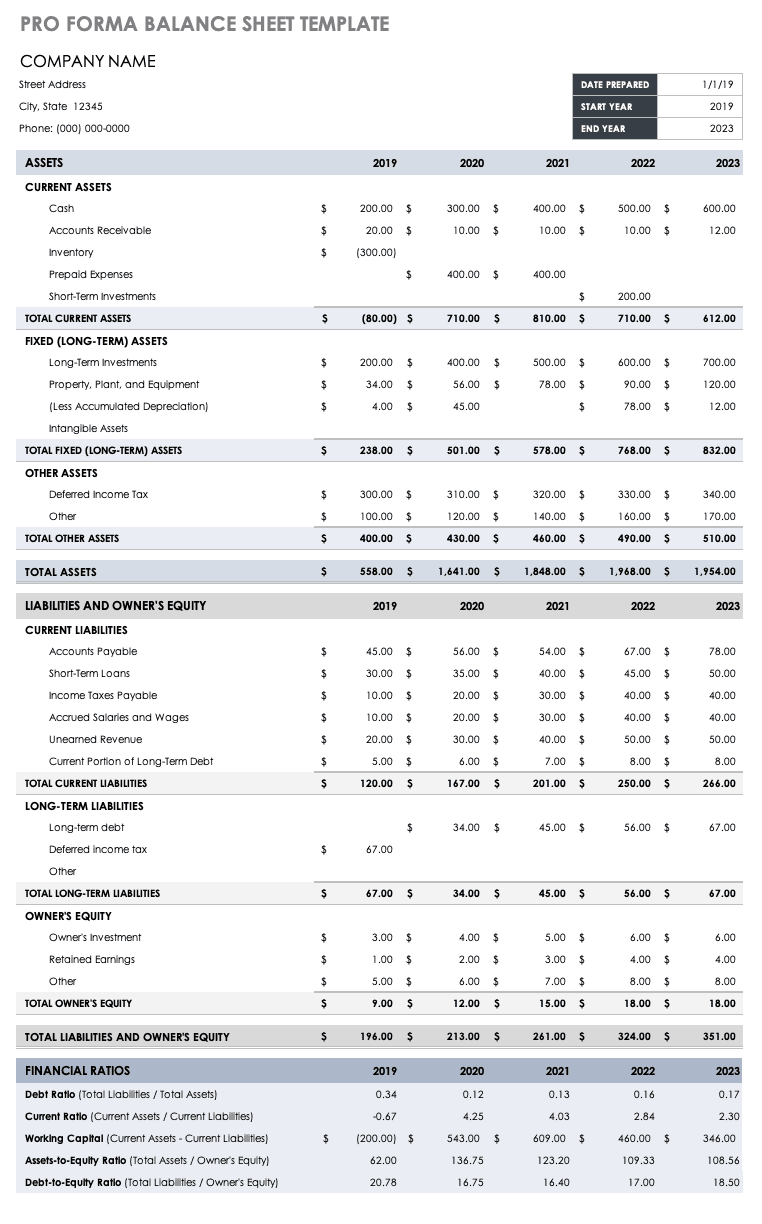

Balance Sheet

Your balance sheet is a financial statement that reports your company’s assets, liabilities, and shareholder equity at a given time.

Consider it as a snapshot of what your business owns and owes, as well as the amount invested by the shareholders.

This statement consists of three parts: assets , liabilities, and the balance calculated by the difference between the first two. The final numbers on this sheet reflect the business owner’s equity or value.

Balance sheets follow the following accounting equation with assets on one side and liabilities plus Owner’s equity on the other:

Here is what’s the core purpose of having a balance-sheet:

- Indicates the capital need of the business

- It helps to identify the allocation of resources

- It calculates the requirement of seed money you put up, and

- How much finance is required?

Since it helps investors understand the condition of your business on a given date, it’s a financial statement you can’t miss out on.

Break-even Analysis

Break-even analysis is a startup or small business accounting practice used to determine when a company, product, or service will become profitable.

For instance, a break-even analysis could help you understand how many candles you need to sell to cover your warehousing and manufacturing costs and start making profits.

Remember, anything you sell beyond the break-even point will result in profit.

You must be aware of your fixed and variable costs to accurately determine your startup’s break-even point.

- Fixed costs: fixed expenses that stay the same no matter what.

- Variable costs: expenses that fluctuate over time depending on production or sales.

A break-even point helps you smartly price your goods or services, cover fixed costs, catch missing expenses, and set sales targets while helping investors gain confidence in your business. No brainer—why it’s a key component of your startup’s financial plan.

Having covered all the key elements of a financial plan, let’s discuss how you can create a financial plan for your startup.

How to Create a Financial Section of a Startup Business Plan?

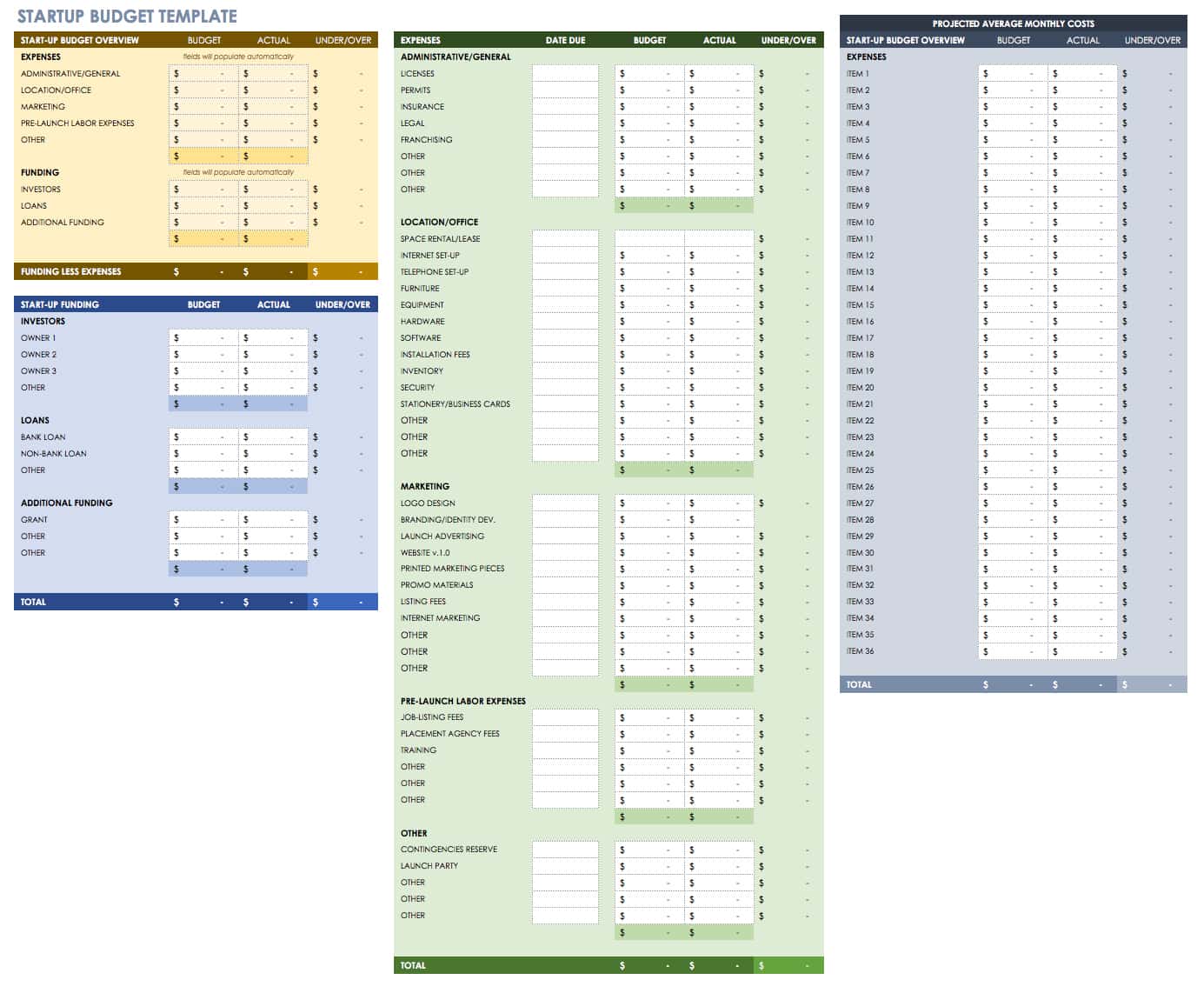

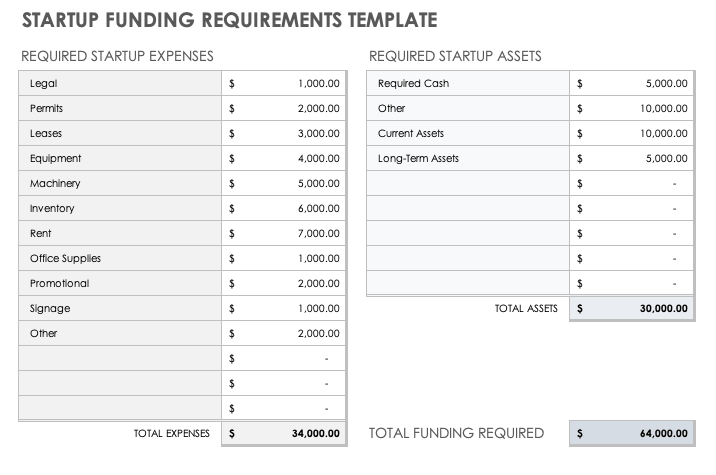

1. determine your financial needs.

You can’t start financial planning without understanding your financial requirements, can you? Get your notepad or simply open a notion doc; it’s time for some critical thinking.

Start by assessing your current situation by—calculating your income, expenses , assets, and liabilities, what the startup costs are, how much you have against them, and how much financing you need.

Assessing your current financial situation and health will help determine how much capital you need for your startup and help plan fundraising activities and outreach.

Furthermore, determining financial needs helps prioritize operational activities and expenses, effectively allocate resources, and increase the viability and sustainability of a business in the long run.

Having learned to determine financial needs, let’s head straight to setting financial goals.

2. Define Your Financial Goals

Setting realistic financial goals is fundamental in preparing an effective financial plan. So, it would help to outline your long-term strategies and goals at the beginning of your financial planning process.

Let’s understand it this way—if you are a SaaS startup pursuing VC financing rounds, you may ask investors about what matters to them the most and prepare your financial plan accordingly.

However, a coffee shop owner seeking a business loan may need to create a plan that appeals to banks, not investors. At the same time, an internal financial plan designed to offer financial direction and resource allocation may not be the same as previous examples, seeing its different use case.

Feeling overwhelmed? Just define your financial goals—you’ll be fine.

You can start by identifying your business KPIs (key performance indicators); it would be an ideal starting point.

3. Choose the Right Financial Planning Tool

Let’s face it—preparing a financial plan using Excel is no joke. One would only use this method if they had all the time in the world.

Having the right financial planning software will simplify and speed up the process and guide you through creating accurate financial forecasts.

Many financial planning software and tools claim to be the ideal solution, but it’s you who will identify and choose a tool that is best for your financial planning needs.

Create a Financial Plan with Upmetrics in no time

Enter your Financial Assumptions, and we’ll calculate your monthly/quarterly and yearly financial projections.

Start Forecasting

4. Make Assumptions Before Projecting Financials

Once you have a financial planning tool, you can move forward to the next step— making financial assumptions for your plan based on your company’s current performance and past financial records.

You’re just making predictions about your company’s financial future, so there’s no need to overthink or complicate the process.

You can gather your business’ historical financial data, market trends, and other relevant documents to help create a base for accurate financial projections.

After you have developed rough assumptions and a good understanding of your business finances, you can move forward to the next step—projecting financials.

5. Prepare Realistic Financial Projections

It’s a no-brainer—financial forecasting is the most critical yet challenging aspect of financial planning. However, it’s effortless if you’re using a financial planning software.

Upmetrics’ forecasting feature can help you project financials for up to 7 years. However, new startups usually consider planning for the next five years. Although it can be contradictory considering your financial goals and investor specifications.

Following are the two key aspects of your financial projections:

Revenue Projections

In simple terms, revenue projections help investors determine how much revenue your business plans to generate in years to come.

It generally involves conducting market research, determining pricing strategy , and cash flow analysis—which we’ve already discussed in the previous steps.

The following are the key components of an accurate revenue projection report:

- Market analysis

- Sales forecast

- Pricing strategy

- Growth assumptions

- Seasonal variations

This is a critical section for pre-revenue startups, so ensure your projections accurately align with your startup’s financial model and revenue goals.

Expense Projections

Both revenue and expense projections are correlated to each other. As revenue forecasts projected revenue assumptions, expense projections will estimate expenses associated with operating your business.

Accurately estimating your expenses will help in effective cash flow analysis and proper resource allocation.

These are the most common costs to consider while projecting expenses:

- Fixed costs

- Variable costs

- Employee costs or payroll expenses

- Operational expenses

- Marketing and advertising expenses

- Emergency fund

Remember, realistic assumptions, thorough research, and a clear understanding of your market are the key to reliable financial projections.

6. Consider “What if” Scenarios

After you project your financials, it’s time to test your assumptions with what-if analysis, also known as sensitivity analysis.

Using what-if analysis with different scenarios while projecting your financials will increase transparency and help investors better understand your startup’s future with its best, expected, and worst-case scenarios.

Exploring “what-if” scenarios is the best way to better understand the potential risks and opportunities involved in business operations. This proactive exercise will help you make strategic decisions and necessary adjustments to your financial plan.

7. Build a Visual Report

If you’ve closely followed the steps leading to this, you know how to research for financial projections, create a financial plan, and test assumptions using “what-if” scenarios.

Now, we’ll prepare visual reports to present your numbers in a visually appealing and easily digestible format.

Don’t worry—it’s no extra effort. You’ve already made a visual report while creating your financial plan and forecasting financials.

Check the dashboard to see the visual presentation of your projections and reports, and use the necessary financial data, diagrams, and graphs in the final draft of your financial plan.

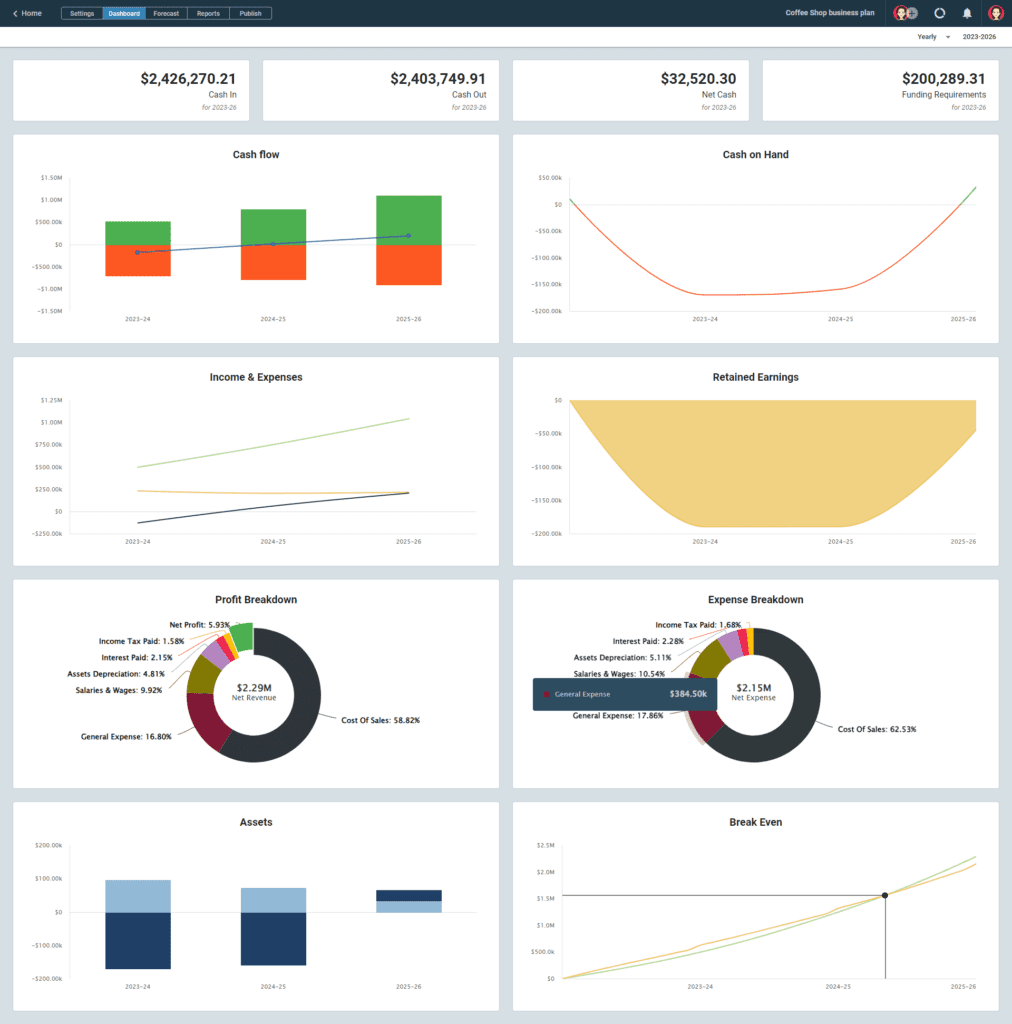

Here’s what Upmetrics’ dashboard looks like:

8. Monitor and Adjust Your Financial Plan

Even though it’s not a primary step in creating a good financial plan, it’s quite essential to regularly monitor and adjust your financial plan to ensure the assumptions you made are still relevant, and you are heading in the right direction.

There are multiple ways to monitor your financial plan.

For instance, you can compare your assumptions with actual results to ensure accurate projections based on metrics like new customers acquired and acquisition costs, net profit, and gross margin.

Consider making necessary adjustments if your assumptions are not resonating with actual numbers.

Also, keep an eye on whether the changes you’ve identified are having the desired effect by monitoring their implementation.

And that was the last step in our financial planning guide. However, it’s not the end. Have a look at this financial plan example.

Startup Financial Plan Example

Having learned about financial planning, let’s quickly discuss a coffee shop startup financial plan example prepared using Upmetrics.

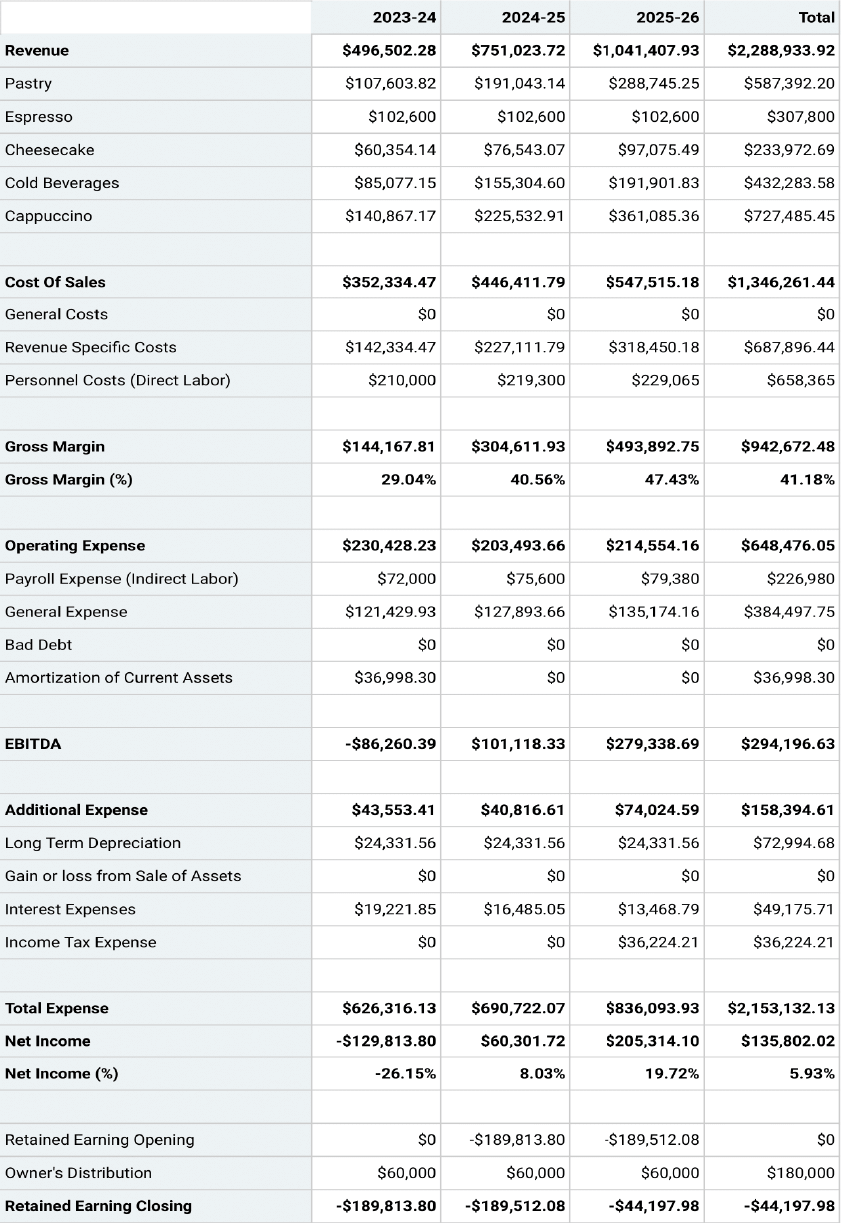

Important Assumptions

- The sales forecast is conservative and assumes a 5% increase in Year 2 and a 10% in Year 3.

- The analysis accounts for economic seasonality – wherein some months revenues peak (such as holidays ) and wanes in slower months.

- The analysis assumes the owner will not withdraw any salary till the 3rd year; at any time it is assumed that the owner’s withdrawal is available at his discretion.

- Sales are cash basis – nonaccrual accounting

- Moderate ramp- up in staff over the 5 years forecast

- Barista salary in the forecast is $36,000 in 2023.

- In general, most cafes have an 85% gross profit margin

- In general, most cafes have a 3% net profit margin

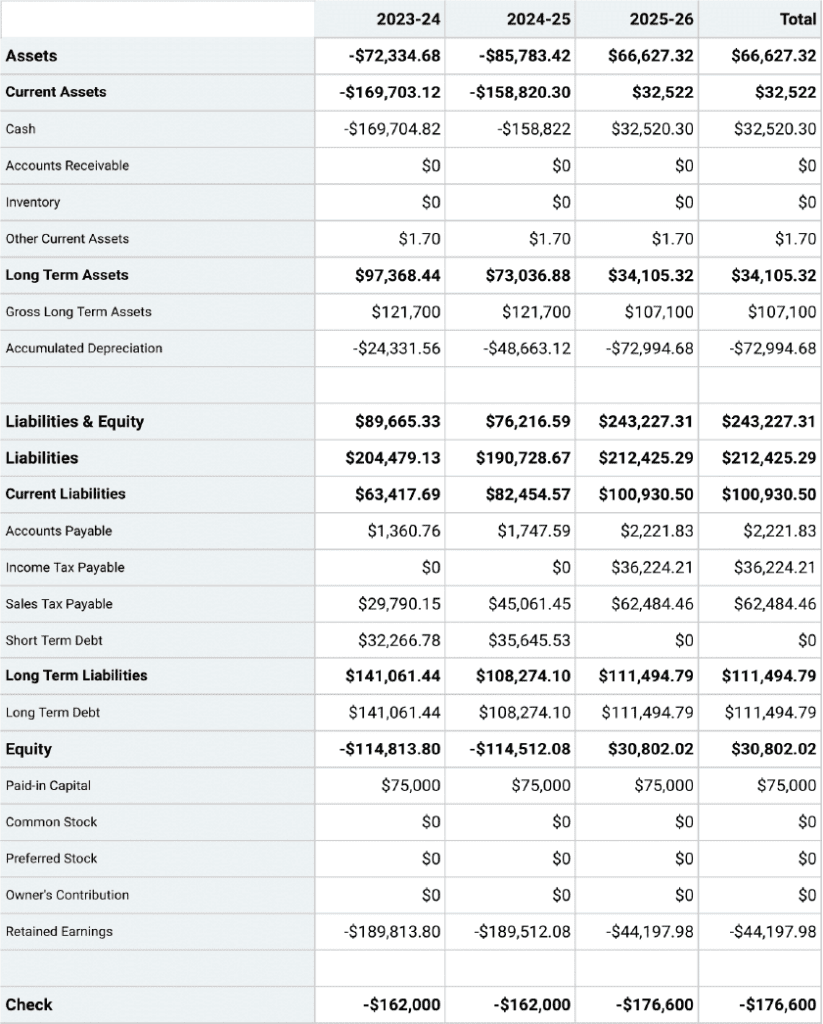

Projected Balance Sheet

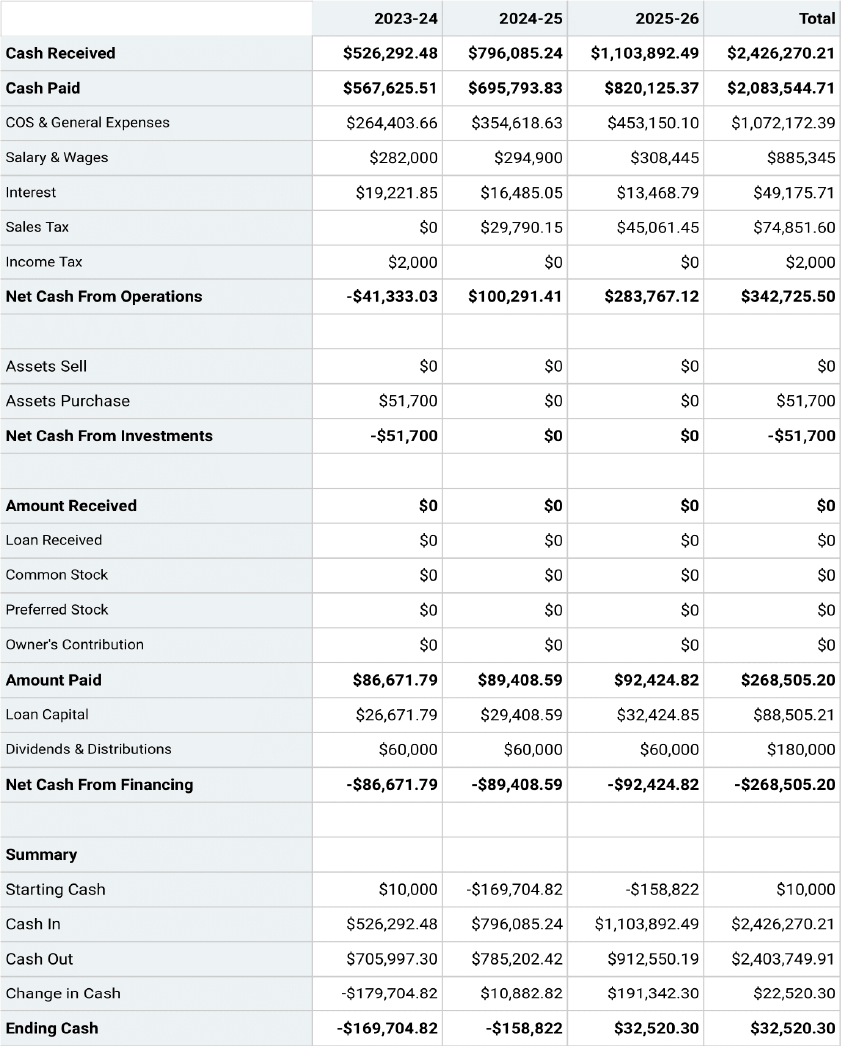

Projected Cash-Flow Statement

Projected Profit & Loss Statement

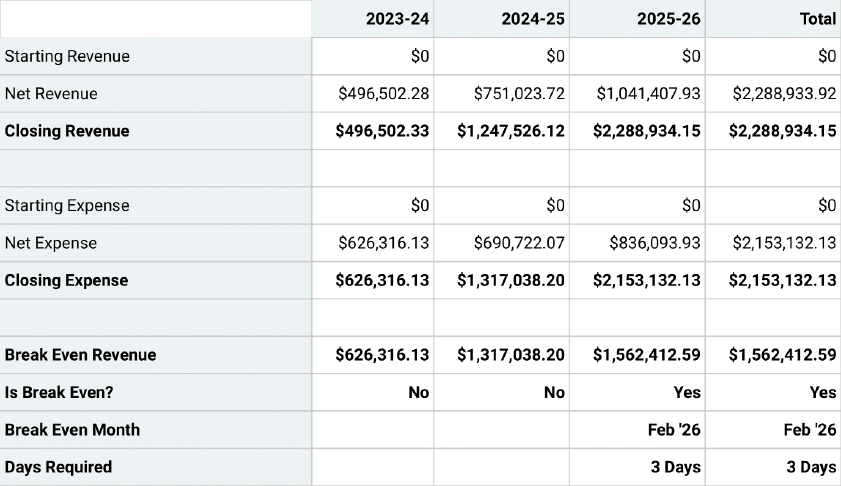

Break Even Analysis

Start Preparing Your Financial Plan

We covered everything about financial planning in this guide, didn’t we? Although it doesn’t fulfill our objective to the fullest—we want you to finish your financial plan.

Sounds like a tough job? We have an easy way out for you—Upmetrics’ financial forecasting feature. Simply enter your financial assumptions, and let it do the rest.

So what are you waiting for? Try Upmetrics and create your financial plan in a snap.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

How often should i update my financial projections.

Well, there is no particular rule about it. However, reviewing and updating your financial plan once a year is considered an ideal practice as it ensures that the financial aspirations you started and the projections you made are still relevant.

How do I estimate startup costs accurately?

You can estimate your startup costs by identifying and factoring various one-time, recurring, and hidden expenses. However, using a financial forecasting tool like Upmetrics will ensure accurate costs while speeding up the process.

What financial ratios should startups pay attention to?

Here’s a list of financial ratios every startup owner should keep an eye on:

- Net profit margin

- Current ratio

- Quick ratio

- Working capital

- Return on equity

- Debt-to-equity ratio

- Return on assets

- Debt-to-asset ratio

What are the 3 different scenarios in scenario analysis?

As discussed earlier, Scenario analysis is the process of ascertaining and analyzing possible events that can occur in the future. Startups or businesses often consider analyzing these three scenarios:

- base-case (expected) scenario

- Worst-case scenario

- best case scenario.

About the Author

Ajay is a SaaS writer and personal finance blogger who has been active in the space for over three years, writing about startups, business planning, budgeting, credit cards, and other topics related to personal finance. If not writing, he’s probably having a power nap. Read more

Reach Your Goals with Accurate Planning

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

How to Write a Small Business Financial Plan

Noah Parsons

4 min. read

Updated April 22, 2024

Creating a financial plan is often the most intimidating part of writing a business plan.

It’s also one of the most vital. Businesses with well-structured and accurate financial statements are more prepared to pitch to investors, receive funding, and achieve long-term success.

Thankfully, you don’t need an accounting degree to successfully create your budget and forecasts.

Here is everything you need to include in your financial plan, along with optional performance metrics, funding specifics, mistakes to avoid , and free templates.

- Key components of a financial plan

A sound financial plan is made up of six key components that help you easily track and forecast your business financials. They include your:

Sales forecast

What do you expect to sell in a given period? Segment and organize your sales projections with a personalized sales forecast based on your business type.

Subscription sales forecast

While not too different from traditional sales forecasts—there are a few specific terms and calculations you’ll need to know when forecasting sales for a subscription-based business.

Expense budget

Create, review, and revise your expense budget to keep your business on track and more easily predict future expenses.

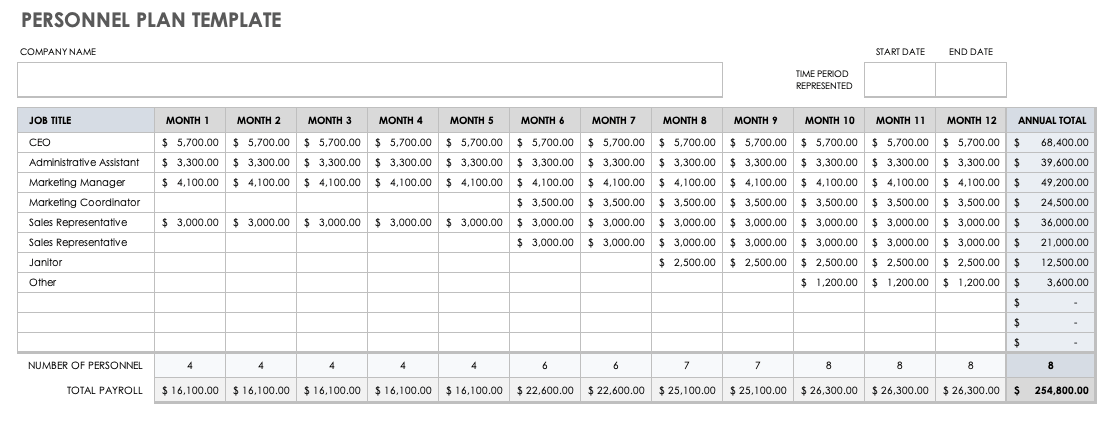

How to forecast personnel costs

How much do your current, and future, employees’ pay, taxes, and benefits cost your business? Find out by forecasting your personnel costs.

Profit and loss forecast

Track how you make money and how much you spend by listing all of your revenue streams and expenses in your profit and loss statement.

Cash flow forecast

Manage and create projections for the inflow and outflow of cash by building a cash flow statement and forecast.

Balance sheet

Need a snapshot of your business’s financial position? Keep an eye on your assets, liabilities, and equity within the balance sheet.

What to include if you plan to pursue funding

Do you plan to pursue any form of funding or financing? If the answer is yes, then there are a few additional pieces of information that you’ll need to include as part of your financial plan.

Highlight any risks and assumptions

Every entrepreneur takes risks with the biggest being assumptions and guesses about the future. Just be sure to track and address these unknowns in your plan early on.

Plan your exit strategy

Investors will want to know your long-term plans as a business owner. While you don’t need to have all the details, it’s worth taking the time to think through how you eventually plan to leave your business.

- Financial ratios and metrics

With your financial statements and forecasts in place, you have all the numbers needed to calculate insightful financial ratios.

While including these metrics in your plan is entirely optional, having them easily accessible can be valuable for tracking your performance and overall financial situation.

Key financial terms you should know

It’s not hard. Anybody who can run a business can understand these key financial terms. And every business owner and entrepreneur should know them.

Common business ratios

Unsure of which business ratios you should be using? Check out this list of key financial ratios that bankers, financial analysts, and investors will want to see.

Break-even analysis

Do you want to know when you’ll become profitable? Find out how much you need to sell to offset your production costs by conducting a break-even analysis.

How to calculate ROI

How much could a business decision be worth? Evaluate the efficiency or profitability by calculating the potential return on investment (ROI).

- How to improve your financial plan

Your financial statements are the core part of your business plan that you’ll revisit most often. Instead of worrying about getting it perfect the first time, check out the following resources to learn how to improve your projections over time.

Common mistakes with business forecasts

I was glad to be asked about common mistakes with startup financial projections. I read about 100 business plans per year, and I have this list of mistakes.

How to improve your financial projections

Learn how to improve your business financial projections by following these five basic guidelines.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- Financial plan templates and tools

Download and use these free financial templates and calculators to easily create your own financial plan.

Sales forecast template

Download a free detailed sales forecast spreadsheet, with built-in formulas, to easily estimate your first full year of monthly sales.

Download Template

Accurate and easy financial forecasting

Get a full financial picture of your business with LivePlan's simple financial management tools.

Get Started

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- What to include for funding

Related Articles

24 Min. Read

The 10 AI Prompts You Need to Write a Business Plan

6 Min. Read

How to Write Your Business Plan Cover Page + Template

10 Min. Read

How to Set and Use Milestones in Your Business Plan

How to Write a Competitive Analysis for Your Business Plan

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

What Are the Financial Assumptions on a Business Plan?

- Small Business

- Business Planning & Strategy

- Financial Business Plans

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

How to Obtain Short-Term Financing for a Business

Keys to a successful business pitch, how to write the perfect business plan.

- How to Start a Candy Store Business

- How to Write a One-Year Profit Projection Letter

Business plans are required for all small businesses seeking loans or investors. Financial assumptions and projections are critical components of all business plans. Three universal financial presentations are expected in all business plans.

You must include a projected income statement, balance sheet and cash flow statement for the coming three to five years. Along with the numbers, include a narrative that explains your assumptions and how the line items were computed.

Financial assumptions and projections are critical components of all business plans. They include income and expense assumptions, as well as the inventory and accounts receivable in the balance sheet. Assumptions for balance sheet presentations should be conservative and based on reasonable expectations of asset acquisitions in the coming five years. These will help to construct the assumptions in the cash flow statement.

Construct an Income Statement

Construct your income statement on a month-to-month basis for the first one to two years. You can then switch to quarterly projections for years three through five. One key item dominates this presentation. Base your income and expense assumptions on factual, verifiable information.

For example, if your product competitively sells for $25 to $40, refrain from using a $60 selling price to craft your sales projections. Also, base your sales volume assumptions on realistic statistics, easily verified by a quick market analysis.

Balance Sheet Presentations

Assumptions for balance sheet presentations should be conservative and based on reasonable expectations of asset acquisitions in the coming five years. Of particular concern to lenders and investors are inventory and accounts receivable. Both are functions of sales. Therefore, carefully match your inventory assumptions with your gross income projections.

Unless accounts receivable are typically large in your industry, do not project high balances. Because cash is usually in short supply for small businesses, tying up this precious resource in excessive inventory or accounts receivable can be damaging.

Cash Flow Statement

If you have a new small business or a modest company needing financing or investment, the projected cash flow Statement may be the most important financial assumption you make. While both lenders and investors want your small business to generate solid net income and have a strong balance sheet, cash flow is more important. It is from cash flow that you can repay loans or distribute cash to investors from profits.

Warning when Making Assumptions

Making financial projections based on solid assumptions is wonderful. But you must explain the derivation and calculations to give business plan readers confidence in your data. Don't commit newer entrepreneur mistakes. Many spend hours pouring over data and create reasonable financial projections.

However, newbies often forget or feel inadequate to explain their assumptions in text format. Assuming that loan officers are experts in reading business plans is smart. However, assuming they are experts in your industry is a mistake. Write as detailed a narrative as possible for your financial assumptions, with references that your loan officer can verify.

Diligent Research and Expert Insight

Making valid financial assumptions, and explaining them clearly, can make the difference in receiving the funds you need or suffering rejection by lenders or investors. Often, the primary reason for approval or rejection relates to your display of expertise in your industry. Perform your industry and competition research diligently and with a total focus on becoming an expert. You must then make financial assumptions based on this expertise – and communicate this clearly in your business plan. Your financial assumptions will be challenged. Have knowledgeable answers ready for these challenges.

- Growthink: How to Develop Reasonable Financial Assumptions

- Inc.: How to Write the Financial Section of a Business Plan

- Rodgers Associates: Three Key Assumptions To Make in Financial Planning

- PlanWare: Software to Make Good Financial Projections

Related Articles

How to present business plans to donors, differences between forecasting & budgeting, why is it important for entrepreneurs to develop financial plans for their companies, how to sell business ideas, how to write your business proposal, business objectives in designing reports, what factors make the difference between a good business plan & an excellent one, how to design a corporate financial plan, what are the key assumptions of a business plan, most popular.

- 1 How to Present Business Plans to Donors

- 2 Differences Between Forecasting & Budgeting

- 3 Why Is It Important for Entrepreneurs to Develop Financial Plans for Their Companies?

- 4 How to Sell Business Ideas

How Financial Assumptions Can Make Or Break Your Business Plan

May 9, 2022

Adam Hoeksema

A business plan is only as good as its financial assumptions. These are the key input data that your financial projections will extrapolate from and will form a picture of the future of your company. With a robust method of researching for these assumptions, and then the corresponding analysis of the available data, you’re left with more accurate assumptions, leading to a more realistic picture of your financial future.

Conversely, with weak assumptions from lack of sufficient research or bad analysis, you can get a dramatically different output that doesn’t remotely reflect reality. When looking for outside investment, these are the skills a savvy investor is going to value in an entrepreneur. So how best to improve your assumptions? Keep reading for the answer.

Financial Assumptions

Any entrepreneur, startup founder, or young company is going to need to form detailed financial reports, including forecasts and projections of the financial situation to come. These documents rely entirely on input data to extrapolate from, and these data are based on historical records and key assumptions .

The accuracy of these financial assumptions determines the accuracy of the output of these projections, and since the divergence from reality increases over time, it’s important for them to be as accurate as possible to precisely depict a realistic situation in the future.

The importance of these assumptions comes into play significantly when trying to attract capital from outside. These investors or lenders will be looking closely at your assumptions as a metric of your credibility; strong assumptions show you’ve done your due diligence and you know what you’re talking about. Weak ones will greatly harm your chances of success.

Here we’re going to go over the basics of financial assumptions, what they’re for, and common mistakes people make with them.

The Role of Financial Assumptions in Forecasting

In business planning, forecasting is a crucial step in visualizing how a company will perform in the future. Companies forecast future outcomes based on past and current data, using assumptions.

Forecasted elements of a financial plan include revenue, margin, and expenses, among others. When done accurately, these forecasts allow businesses to:

- Predict future expenses

- Make budgets

- Make informed decisions about the direction of the company

- Plan growth and financing options

However, accuracy requires more than just historical data; it’s important to input the rate of change over time correctly, and this is where assumptions come in.

Essentially, assumptions are educated guesses about the nature of your business and its market, and how these will affect future outcomes in your forecasts. As projections reach further into the future, the need for accuracy of the input assumptions increases. Small mistakes become significantly larger over time, and this skews projections to the point of making them worthless.

For investors to take notice, you’ll need accurate and well-thought-out assumptions that aren’t plucked from thin air. We’ll go into more detail about how to find these assumptions shortly, but first, let’s consider why accuracy is so important.

The Importance of Accuracy in Financial Assumptions

The financial statements of a business plan are an indication of the company’s profitability. They are the strongest display of the worthiness of investment that your company has, therefore, they’re going to need to be founded on accurate assumptions.

Even with relatively accurate initial figures, long-term projections can still be way off the mark. Essentially, any forecast is a calculation with decreasing accuracy over time, which is why they usually don’t project out past time frames of longer than around five years. Take the following example:

Let’s say you’ve done the research into the market, into the reducing costs of production over time, the rapid expected growth of your company, and the increase in value you’re going to make to your product or service over the next few years. What comes out is an assumed increase in revenue projected into the future.

If you assume your total revenue will increase by 20% over 5 years with a starting revenue of $20,000, the first-year outcome will be $24,000, an increase of four thousand dollars. The fifth-year outcome will be $49,767; an increase of almost thirty thousand dollars.

If your initial assumption is off by only 5% in either direction, the first year will show a difference from the above forecast of $1000 , either returning $23,000 or $25,000 at the low and high ends, respectively.

This isn’t a huge amount of money at this stage, so a misjudgment of 5% seems reasonable. However, if we extend this effect to the fifth year, an error of 5% brings a difference of either $9,500 or $11,268 to what you had projected, depending on whether your assumption was low or high.

If you’re smart or lucky enough to have made a conservative assumption, you’re now $11k better off. On the other hand, if you were too hasty and overestimated in your assumption, you may now owe somebody over $9k.

So, the effect of an assumption is greater with distance from the starting point. This means that when you’re designing a business plan to show to potential investors, they’re going to be very critical of your assumptions in order to assess the chances of their ROI in your company.

Regardless of whether you assumed low or high, if there’s a discrepancy that becomes obvious to investors, it will make them question the rest of your estimates and how accurate you will be in future calculations.

Therefore, accurate assumptions are critically Important to not only the precise understanding of the state of your company in the future but any chances of investors taking you seriously. Without good assumptions there is no forecast. Without a forecast, there’s not going to be any investment.

If your business is going to be relying on VC or other investors helping out, you’re going to find yourself out of luck. So, with that in mind, let’s take a look at some of the classic assumptions you’ll need to make when designing your forecasts and projections.

Key Financial Assumptions Examples

Building a business plan relies on numerous assumptions. These are the where, when, and how’s of your company, and will create projections in order for you to know where to direct your energy. The most important assumptions are called key assumptions, and without these, it’s going to be impossible to make informed decisions on the direction of your company.

Changes in assumptions can dramatically alter the outcomes of your forecasts. If you assume, for example, that your product or service is going to have a decreasing churn rate - or loss of customers - over the coming years of service improvement, you have to know what that rate is going to decrease by each year for your forecast to be of any use.

It’s worth thinking about these assumptions in terms of how you will persuade investors to commit. Here is a list of some of the areas in which key assumptions are needed for financial planning, for use as financial assumptions examples:

- Market – There’s no business without a market. This assumption isn’t so much a financial one as a general business one, but it has strong financial implications.

By the time you come to financial planning for your startup, you should know who your ideal customer is and how you’re addressing their pain points.

You should also know how much they’re willing to spend on your product or service, which will come in handy for your income statement and cash flow projections.

- Cost of production - Production cost changes over time. Even if it’s simply an increase in outgoings to match an increase in demand, this needs to be assumed. Usually, production costs can be reduced as economies of scale come into play, but regardless, it’s easy to overlook some data here.

Calculating production costs involves covering rent for manufacturing spaces, materials, utilities such as power and water, and essentially every little thing that goes into the manufacture of your product or provision of your service. Obviously, these will be more or less complicated depending on the type of business you’re running.

This step is crucial for the following revenue and costs to be accurate.

- Cost of Sales – This one is closely related to the cost of production and there may be some overlap in these costs such as labor, so separate them as you wish, however, make sure to calculate the cost of distribution; shipping, handling, marketing, etc. it’s possible to combine these assumptions under production and sales for convenience.

- Cost of Administration – This is a monthly expenditure covering all the outgoings related to your workforce and company maintenance. Payroll needs to be financially covered by any income or capital funding you’re expecting and this includes any bonuses you’re expecting to put out. One key assumption regarding bonuses will be in their timing, should you choose to pay them, and this needs to be factored into projections for costs.

- Pricing – This assumption should be made with detailed research backing it up. Since pricing alone can make or break your company, investors are going to want to see how you came up with your figures here. The costs of sales and production are going to determine your range of pricing options.

To accurately calculate prices, you’re going to need to understand how much value your product or service has to your customers, which is where the key assumptions from the Market section above come in. Pricing needs to match the value of what you’re offering, so this is the opposing force to the production and distribution costs, since it will always be pulling your price down towards its value, while costs of production and distribution will be pushing it up.

- Sales Forecast – For every different service or product that you’re offering, a sales forecast needs to be calculated. For an accurate sales forecast, you’re going to need to know the desired sales funnel in detail and how long the conversion process will take. These assumptions need to be backed up by your market research.

Further, you’re going to have to make assumptions on when your sales will complete; this means how long banking processes will take, etc. These assumptions will be critical to accurately forecast your profits in your financial plan.

- Cash Flow – This section will involve numerous key assumptions. Capital will hopefully be flowing into the company from numerous streams, and these need to be calculated well in order to project financial coverage of the aforementioned costs.

Timings of loan payments, loan repayments, cash equity, and others need to be reliably assumed to make sound predictions in these cases. Interest adjustments or early repayment fees are also things to take into consideration, and if you will be offering customer credit, this will create more complexities to look into in terms of when you’ll see that capital again.

These are some of the major areas in which financial assumptions are necessary, and their need for accuracy is obvious. An accurate assumption comes down to reliable and robust research and analysis practices, and for these, it’s important to follow the best practices of business planning, and consider expert help where needed.

Of course, the specifics of these areas and their significance to your company will depend entirely on the type of service, product, business, or market you’re involved with. As such, there’s no standard template, but there are some key practices worth following.

Find Your Industry Specific Projections Template to Help Create Assumptions:

Why There are no one-size-fits-all Financial Assumptions

Startup founders and entrepreneurs need to provide convincing projections of the financial state of the company over the following years to reassure investors that their capital will be returned. They do this by creating robust assessments of their current state and the state of company and market metrics as accurately as possible and factoring them into projection calculations as assumptions.

The best way to begin building your financial assumptions is to consider them from the perspective of an investor. If you’re looking to put down a significant investment in a project you’re going to want to guarantee your ROI, and to do that, you need to be persuaded of the project’s profitability.

Every company is different, and every market has its own needs and challenges. This is why there’s no strict financial assumptions template to follow, but by following these four basic principles, you’ll be closer to developing more accurate assumptions.

At the planning stage of a company, the historical financial data simply won’t exist. This reduces the power of the financial assumptions, and even further necessitates their precision. The trouble is, this is a lengthy process. AQPC showed that even financial analysts spend almost half their time collecting and validating data, and they’re experts at it.

This means you have to expect a grind. If you’re going it alone with this process, make sure to get a handle on your research methods, and which areas to focus on and in the right order. This is a topic for its very own article, but the point is, expect to dedicate and schedule a lot of time for this part of the process.

So we know the research is important, but how do you go about it? For costs of manufacturing, meeting with suppliers is essential to get written quotes for supplies covering any wholesale discounts that might be available. Then, for marketing and distribution, studying your market in depth is crucial to making accurate assumptions about the value of what you’re offering and how much it’ll cost to get it out there.

Find out exactly where and how to look, and gather the necessary data on all the elements your company needs to be able to predict. From this, you will work on the analysis.

Outsourcing

There are definitely ways to go this alone, especially if this relates to a field you’re familiar with, but the option to use outside help shouldn’t be overlooked. ProjectionHub offers a range of services that can help with the financial planning process. From basic projection templates to detailed, expert guidance and tailored forecasting spreadsheets specifically designed for your business, there are a lot of useful options that can help speed up the process and improve your accuracy.

Demonstration

Finally, show your workings! If you’ve spent the due time and energy collecting and analyzing the data, it’s not going to matter if you can’t demonstrate how you came to the conclusions you did. Putting in the work is how you get accurate assumptions, but describing your process is how you persuade others to trust them.

Financial forecasts are the backbone of a business plan for investors. They’re a demonstration that you’ve done your homework and you know what you’re doing, and with bold claims, there comes the need for strong evidence.

Making assumptions is the key to any projection. Assumptions about change over time, consistency over time, and any other incomings and outgoings that you anticipate as part of the process. The accuracy of these assumptions is what makes or breaks a business plan, as they hold the key to future, long-term investment as well as countless other business choices made by decision-makers.

If this seems like a daunting task, don’t’ worry. There are countless opportunities to take advantage of expert help with services like ours at ProjectionHub , which provides templates and expert advice to get you started.

Accurate assumptions should not be underestimated. Putting in the work at this stage of your financial projections will pay dividends and command great respect from investors.

About the Author

Adam is the Co-founder of ProjectionHub which helps entrepreneurs create financial projections for potential investors, lenders and internal business planning. Since 2012, over 40,000 entrepreneurs from around the world have used ProjectionHub to help create financial projections.

Other Stories to Check out

How to know if your financial projections are realistic.

It is important for financial projections for a small business or startup to be realistic or else an investor or lender may not take them seriously. More importantly, the founder may make a financial mistake without a reliable plan.

How to Finance a Small Business Acquisition

In this article we are going to walk through how to finance a small business acquisition and answer some key questions related to financing options.

How to Acquire a Business in 11 Steps

Many people don't realize that acquiring a business can be a great way to become a business owner if they prefer not to start one from scratch. But the acquisition process can be a little intimidating so here is a guide helping you through it!

Have some questions? Let us know and we'll be in touch.

- Business Planning

Business Plan Financial Projections

Written by Dave Lavinsky

Financial projections are forecasted analyses of your business’ future that include income statements, balance sheets and cash flow statements. We have found them to be an crucial part of your business plan for the following reasons:

- They can help prove or disprove the viability of your business idea. For example, if your initial projections show your company will never make a sizable profit, your venture might not be feasible. Or, in such a case, you might figure out ways to raise prices, enter new markets, or streamline operations to make it profitable.

- Financial projections give investors and lenders an idea of how well your business is likely to do in the future. They can give lenders the confidence that you’ll be able to comfortably repay their loan with interest. And for equity investors, your projections can give them faith that you’ll earn them a solid return on investment. In both cases, your projections can help you secure the funding you need to launch or grow your business.

- Financial projections help you track your progress over time and ensure your business is on track to meet its goals. For example, if your financial projections show you should generate $500,000 in sales during the year, but you are not on track to accomplish that, you’ll know you need to take corrective action to achieve your goal.

Below you’ll learn more about the key components of financial projections and how to complete and include them in your business plan.

What Are Business Plan Financial Projections?

Financial projections are an estimate of your company’s future financial performance through financial forecasting. They are typically used by businesses to secure funding, but can also be useful for internal decision-making and planning purposes. There are three main financial statements that you will need to include in your business plan financial projections:

1. Income Statement Projection

The income statement projection is a forecast of your company’s future revenues and expenses. It should include line items for each type of income and expense, as well as a total at the end.

There are a few key items you will need to include in your projection:

- Revenue: Your revenue projection should break down your expected sales by product or service, as well as by month. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

- Expenses: Your expense projection should include a breakdown of your expected costs by category, such as marketing, salaries, and rent. Again, it is important to be realistic in your estimates.

- Net Income: The net income projection is the difference between your revenue and expenses. This number tells you how much profit your company is expected to make.

Sample Income Statement

2. cash flow statement & projection.

The cash flow statement and projection are a forecast of your company’s future cash inflows and outflows. It is important to include a cash flow projection in your business plan, as it will give investors and lenders an idea of your company’s ability to generate cash.

There are a few key items you will need to include in your cash flow projection:

- The cash flow statement shows a breakdown of your expected cash inflows and outflows by month. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

- Cash inflows should include items such as sales revenue, interest income, and capital gains. Cash outflows should include items such as salaries, rent, and marketing expenses.

- It is important to track your company’s cash flow over time to ensure that it is healthy. A healthy cash flow is necessary for a successful business.

Sample Cash Flow Statements

3. balance sheet projection.

The balance sheet projection is a forecast of your company’s future financial position. It should include line items for each type of asset and liability, as well as a total at the end.

A projection should include a breakdown of your company’s assets and liabilities by category. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

It is important to track your company’s financial position over time to ensure that it is healthy. A healthy balance is necessary for a successful business.

Sample Balance Sheet

How to create financial projections.

Creating financial projections for your business plan can be a daunting task, but it’s important to put together accurate and realistic financial projections in order to give your business the best chance for success.

Cost Assumptions

When you create financial projections, it is important to be realistic about the costs your business will incur, using historical financial data can help with this. You will need to make assumptions about the cost of goods sold, operational costs, and capital expenditures.

It is important to track your company’s expenses over time to ensure that it is staying within its budget. A healthy bottom line is necessary for a successful business.

Capital Expenditures, Funding, Tax, and Balance Sheet Items

You will also need to make assumptions about capital expenditures, funding, tax, and balance sheet items. These assumptions will help you to create a realistic financial picture of your business.

Capital Expenditures

When projecting your company’s capital expenditures, you will need to make a number of assumptions about the type of equipment or property your business will purchase. You will also need to estimate the cost of the purchase.

When projecting your company’s funding needs, you will need to make a number of assumptions about where the money will come from. This might include assumptions about bank loans, venture capital, or angel investors.

When projecting your company’s tax liability, you will need to make a number of assumptions about the tax rates that will apply to your business. You will also need to estimate the amount of taxes your company will owe.

Balance Sheet Items

When projecting your company’s balance, you will need to make a number of assumptions about the type and amount of debt your business will have. You will also need to estimate the value of your company’s assets and liabilities.

Financial Projection Scenarios

Write two financial scenarios when creating your financial projections, a best-case scenario, and a worst-case scenario. Use your list of assumptions to come up with realistic numbers for each scenario.

Presuming that you have already generated a list of assumptions, the creation of best and worst-case scenarios should be relatively simple. For each assumption, generate a high and low estimate. For example, if you are assuming that your company will have $100,000 in revenue, your high estimate might be $120,000 and your low estimate might be $80,000.

Once you have generated high and low estimates for all of your assumptions, you can create two scenarios: a best case scenario and a worst-case scenario. Simply plug the high estimates into your financial projections for the best-case scenario and the low estimates into your financial projections for the worst-case scenario.

Conduct a Ratio Analysis

A ratio analysis is a useful tool that can be used to evaluate a company’s financial health. Ratios can be used to compare a company’s performance to its industry average or to its own historical performance.

There are a number of different ratios that can be used in ratio analysis. Some of the more popular ones include the following:

- Gross margin ratio

- Operating margin ratio

- Return on assets (ROA)

- Return on equity (ROE)

To conduct a ratio analysis, you will need financial statements for your company and for its competitors. You will also need industry average ratios. These can be found in industry reports or on financial websites.

Once you have the necessary information, you can calculate the ratios for your company and compare them to the industry averages or to your own historical performance. If your company’s ratios are significantly different from the industry averages, it might be indicative of a problem.

Be Realistic