How to Open a Digital Wallets Business in 9 Steps: Checklist

By alex ryzhkov, resources on digital wallets.

- Financial Model

- Business Plan

- Value Proposition

- One-Page Business Plan

- SWOT Analysis

- Business Model

- Marketing Plan

- Bundle Business Plan & Fin Model

As the digital finance landscape rapidly evolves, launching a digital wallets business has become a promising venture with the industry projected to grow exponentially. In 2023, the global digital wallet market size reached an impressive $1 trillion, demonstrating not only its current success but also its potential for future expansion. This blog post outlines the essential steps and a comprehensive digital wallet business checklist to help you start and scale your own digital wallet company, ensuring you grasp every opportunity in this booming sector.

- Analyze market needs.

- Design business model.

- Secure tech partners.

- Ensure legal compliance.

- Acquire funding.

- Develop product.

- Conduct beta tests.

- Plan marketing.

- Implement improvements.

9-Steps To Start a Business

Launching a digital wallets business involves several critical steps to ensure the viability and sustainability of your enterprise. Prior to starting your business, it is essential to carefully plan and execute a variety of strategic actions to set a strong foundation for your business's success.

| Step | Description | Average Time | Cost (USD) |

|---|---|---|---|

| Market Research | Identify target audiences, understand their needs, and analyze competitors to refine your product. | 3 months | 15,000 |

| Business Model Development | Outline revenue generation strategies such as subscription fees, transaction fees, or premium features. | 1 month | 7,000 |

| Technology Partnerships | Form alliances with tech providers to ensure a secure and efficient back-end infrastructure. | 2 months | 10,000 |

| Licensing & Compliance | Acquire necessary financial licenses and ensure compliance with all relevant regulations. | 6 months | 20,000 |

| Funding Acquisition | Secure funding via venture capital, angel investors, or loans by showcasing a robust business plan. | 3 months | 25,000 |

| Product Development | Develop a prototype with unique features, employing user-centered design principles. | 4 months | 50,000 |

| Beta Testing | Launch a beta version to selected users and gather feedback to refine the product further. | 2 months | 12,000 |

| Marketing Strategy | Implement a comprehensive marketing plan focused on digital outreach and partnership building. | 2 months | 18,000 |

| Continuous Improvement | Monitor performance post-launch, utilize feedback for enhancements, and update features regularly. | Ongoing | Variable |

| Complete all steps for a successful launch. | 23 months | 157,000 |

Market Research

Embarking on the journey of launching a digital wallet business mandates a comprehensive approach to market research. This initial phase lays the groundwork for understanding the nuances of the market, tailoring your product to meet specific demands, and foreseeing potential challenges.

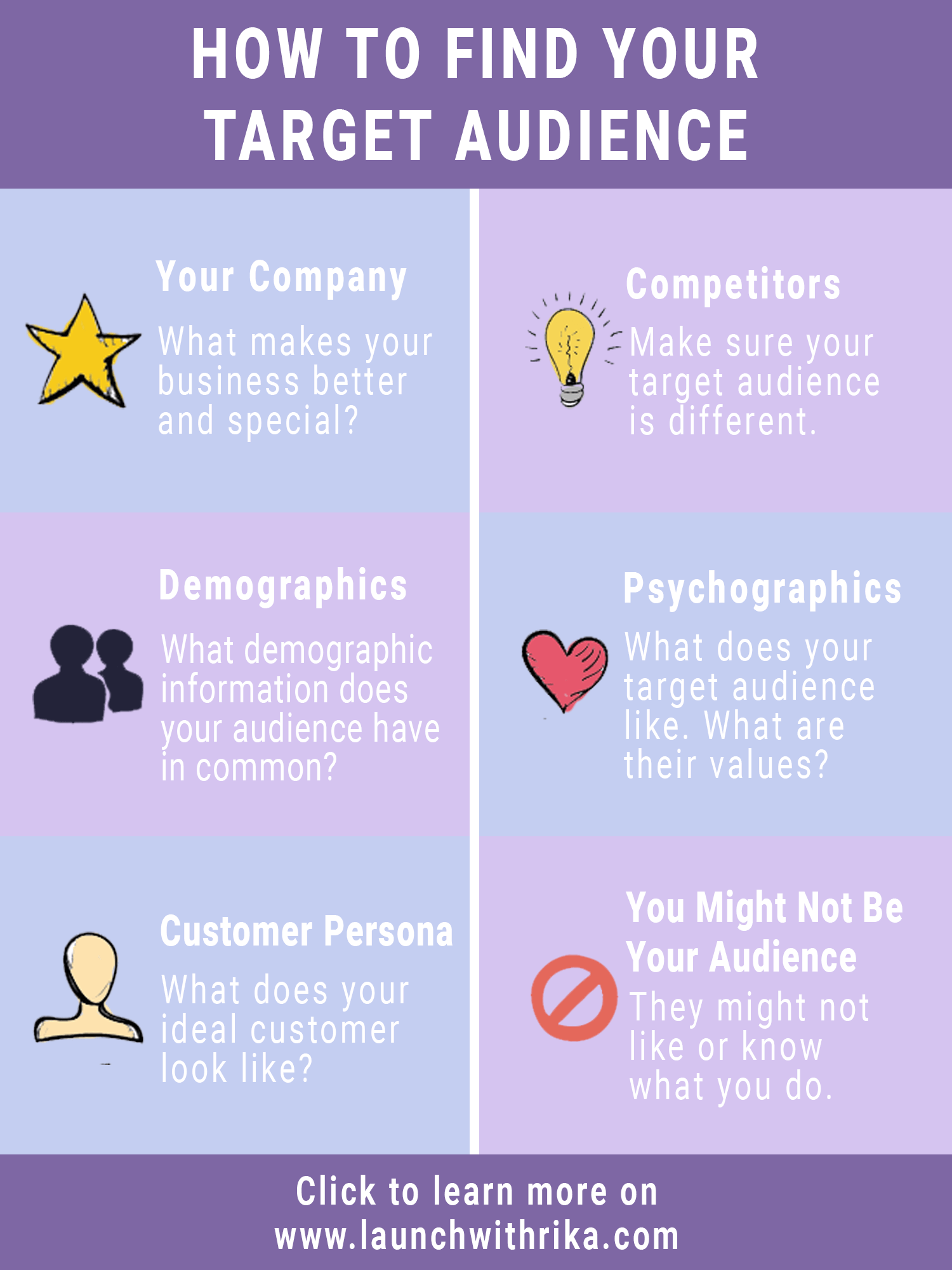

The aim of digital wallet market research is twofold: identifying your target audience and dissecting the competitive landscape. Recognizing who your users are—be it individuals, businesses, or a niche sector—enables precise customization of your digital wallet's features. Collaboration with digital payment platforms and ensuring the inclusion of desirable functionalities hinge on these insights.

Simultaneously, an analytical look at your competitors helps in benchmarking and positioning your digital wallet uniquely in the marketplace. It's not merely about acknowledging who your competitors are, but deeply understanding their offerings, strengths, and where they fall short. This insight catalyzes innovative solutions that can differentiate your wallet in a saturated market.

Key Tips for Effective Market Research

- Dive deep into user demographics and preferences to tailor your digital wallet's user experience design.

- Utilize SWOT analysis to ascertain strengths, weaknesses, opportunities, and threats in the current market environment.

- Engage with potential customers through surveys and focus groups to gather firsthand feedback about desired features and functionalities.

Moreover, analysis of digital payment regulations and compliance requirements should also be an integral part of your market research. Engaging with regulatory frameworks early on will guide the structuring of your operations to adhere to legal standards, thus avoiding future legal obstacles.

Ultimately, digital wallet market research is indispensable for crafting a strategic roadmap for your digital wallet business. It not only enhances your understanding of the market dynamics but also propels informed decision-making throughout the development process.

| Digital Wallets Business Plan Get Template |

Business Model Development

Developing a robust business model is fundamental in launching a digital wallet business . Essential to this phase is outlining how the Digital Wallets will generate revenue, a critical component that attracts investors and guides operational strategies. Typically, revenue streams in a digital wallet business model may include subscription fees, transaction fees, and charges for premium features.

- Subscription Fees: You could offer tiered services, where basic features are free, but premium features, like higher transaction limits or international transfers, require a monthly fee.

- Transaction Fees: A small fee could be charged per transaction or a percentage of the transaction amount, which is common in digital payment solutions.

- Premium Features: Offering advanced features, such as increased security options or loyalty and rewards programs, can be another source of revenue. These features are typically available for a one-time fee or via a subscription upgrade.

Understanding digital wallet revenue streams is not just about selecting the types of fees to charge; it also involves pricing strategies that appeal to various user segments while maintaining a competitive edge in the market.

Key Tips for Developing Your Digital Wallet Business Model

- Analyze competitor pricing to ensure your fees are competitive yet profitable.

- Consider offering a 'freemium' model to attract users and convert them into paying customers through exceptional service and exclusive features.

- Keep an eye on digital payment compliance and regulations to avoid any potential legal challenges associated with fees.

Additionally, the scalability of your business model should be considered to adapt to increasing customer bases or to enter new markets. Exploring diverse digital wallet partnerships can enhance service offerings and improve market reach. Importantly, as you refine your business model, continuous engagement with customer feedback will guide necessary adjustments, ensuring the model remains viable and responsive to market needs.

In sum, a well-defined business model not only serves as the financial backbone of your Digital Wallets but also sharpens your competitive advantage and fosters sustainable growth. Implementation of the chosen revenue streams should be monitored regularly to optimize performance and adapt to changing market conditions.

Technology Partnerships

For those aspiring to excel in the digital wallets business, establishing robust technology partnerships is critical. These partnerships serve as the backbone of your operation, ensuring that the infrastructure is both secure and efficient—a determinant of success in the fintech sector. The focus should be on aligning with technology providers that not only offer advanced solutions but are also leaders in cybersecurity.

When you embark on forming these crucial partnerships, look for providers with proven track records in handling large-scale financial transactions. Their expertise in data protection and fraud prevention will significantly mitigate potential security risks to your digital wallet platform. Additionally, these collaborations can enhance the technological agility of your digital wallets, allowing for swift adoption of new features and services that meet evolving customer expectations.

Key Aspects to Consider When Selecting Technology Partners

- Scalability: Ensure that the technology stack offered by your partners can scale as your customer base grows and as the transaction volumes increase.

- Integration Capabilities: The ability to seamlessly integrate with existing and future payment platforms and banking APIs is crucial for a smooth user experience.

- Compliance Adherence: Choose partners who are up-to-date with digital payment compliance and digital payment regulations to avoid legal pitfalls.

Integration capabilities are particularly vital; they determine how well your digital wallet can communicate with other financial systems and technologies. This interconnectivity is essential for supporting a wide array of payment methods and currencies, which broadens your market reach and enhances user satisfaction.

Ultimately, the strength of your technology partnerships will influence the reliability, performance, and security of your digital wallet services. Prioritize these relationships as they are foundational to building a versatile and resilient digital wallet business.

| Digital Wallets Financial Model Get Template |

Licensing & Compliance

Navigating the maze of digital payment compliance and licensing is a critical step for launching a digital wallets business. Every region has specific financial service regulations designed to protect users' data and ensure fair play within the market. Not only must your business obtain the necessary financial licenses, but adherence to data security standards such as PCI DSS is also indispensable.

Understanding digital payment regulations involves a deep dive into the legal frameworks that govern electronic transactions in your operational jurisdictions. For instance, in the United States, becoming compliant with the Payment Card Industry Data Security Standard (PCI DSS) is non-negotiable for handling credit card transactions safely. Similarly, other countries may have equivalent or even more stringent requirements.

Key Tips for Effective Licensing and Compliance:

- Start early: Begin the licensing application process as soon as possible, as this can be time-consuming and complex.

- Engage experts: Consider hiring legal advisors who specialize in digital wallet business licensing requirements and financial regulations.

- Stay updated: Regulations can change, so regularly review and update your compliance procedures to avoid any legal pitfalls.

The licensing phase also involves registering your digital wallet business with relevant financial authorities. This may include local financial watchdogs, national banks, or other regulatory bodies depending on your location and business model. The goal is to ensure that your business operates transparently and in accordance with the law, safeguarding both your users' interests and your company's integrity.

Not adhering to these requirements can result in costly penalties and damage to your business reputation, hence the importance of thorough preparation and continuous monitoring of compliance standards. Commit to maintaining high standards of security and accountability, and your digital wallet business will be well-positioned to earn trust and grow in a competitive digital finance environment.

Funding Acquisition

Funding Acquisition is a pivotal phase in the journey of launching a digital wallets business. Securing your initial funding sets the foundation for product development, beta testing , and early-stage operations. Given the competitive landscape, potential funders need to be convinced of both the viability and profitability of your digital wallet solution.

Approaching venture capital firms, angel investors, and even considering bank loans are common routes. Each option has distinct advantages and challenges, but the core requirement remains a compelling business plan that effectively outlines your digital wallet business model, expected revenue streams, and a clear path to profitability.

Key Tips for Effective Funding Acquisition

- Personalize your pitch: Tailor your presentations and pitches to reflect the interests and investment ethos of the potential funders. Highlight how your digital wallet solution aligns with their portfolio and past investments.

- Emphasize scalability: Demonstrate the scalability of your digital wallets business, focusing on how it can grow and expand to meet evolving digital payment needs and technologies.

- Showcase your team: Investors invest in people as much as ideas. Showcase the expertise and industry experience of your team to instill confidence in your capability to execute the business plan.

The initial funding phase often requires founders to delineate the operational, technical, and financial details of their digital wallet business. This includes, but is not limited to, digital payment compliance , technology partnerships, and user experience design insights. Investors are particularly keen on understanding how you plan to navigate digital payment regulations and integrate with existing digital payment platforms.

Bringing on investors who not only provide capital but can also add value through strategic advice and digital wallet partnerships is invaluable. Networking in fintech events, leveraging online platforms to connect with potential investors, and presenting at pitch days are practical steps in finding the right investors for your digital wallet startup.

Ultimately, the goal during the Funding Acquisition stage is to secure sufficient capital to move forward without compromising the strategic direction or operational autonomy of the digital wallet company. It's about finding the right partners who are aligned with your vision and are committed to the long-term success of the venture.

Product Development

Embarking on the product development phase in your journey of launching a digital wallet business demands a focused approach to creating a prototype that stands out. It's essential to incorporate unique features that set your digital wallet apart from others in the market. Implementing user-centered design principles can significantly enhance the overall user experience, making the wallet not only functional but also intuitive for end-users.

Digital Wallet prototype development should focus on achieving simplicity and security, two core aspects that users prioritize. Consider including innovative features such as biometric security measures, real-time transaction updates, and customizable interfaces. The ability to integrate smoothly with a wide range of existing digital payment platforms can also provide a critical competitive advantage.

Effective Strategies for Digital Wallet Prototype Development

- Involve potential users early: Engaging with your target audience during the early stages of development can provide invaluable insights into their needs and preferences, guiding your feature selection and interface design.

- Leverage Agile methodologies: Utilizing agile development processes allows for flexible, iterative testing and refinement of your digital wallet, ensuring that the final product is well-tuned to market requirements.

- Prioritize security: From the outset, integrate advanced security protocols, such as encryption and multi-factor authentication, to build trust and safeguard user data.

The integration of user-centered design principles is pivotal, facilitating not only aesthetic appeal but also functionality and ease of use. It's crucial that the design process is iterative, allowing for continual testing and refinement based on user feedback. This approach not only enhances the user experience but also contributes to a robust, market-ready product.

Remember, the success of the product will largely depend on its ability to meet user expectations while providing unique features that are not readily available in existing solutions. Thus, digital wallet prototype development should be approached with a keen attention to detail and a commitment to innovation, ensuring your digital wallet is both appealing and functional in a competitive market.

Beta Testing

Launching a beta version of your digital wallets platform is a pivotal step. This phase focuses on deploying the product to a meticulously selected group of users. It provides an invaluable opportunity to gather real-world feedback, which is essential in identifying bugs and gauging user interaction patterns. The insights gained here are critical for fine-tuning the digital wallet's features and functionality.

During beta testing, the primary aim is to simulate actual operating conditions for the digital wallet while monitoring how it performs in diverse scenarios. This approach helps in understanding how different users value various aspects of the digital wallet, from user interface design to transaction processing speeds.

Effective Strategies for Beta Testing Digital Wallets

- Recruit a diverse user base that reflects your anticipated customer demographic to ensure that the feedback encompasses wide-ranging user preferences and needs.

- Employ analytics tools to capture detailed user interactions, which can help trace any issues users encounter in real-time.

- Establish a structured feedback mechanism that encourages candid responses from beta testers, ensuring they provide actionable insights.

It is essential to prioritize the feedback gathered during this phase. Categorize issues by their severity and potential impact on user satisfaction. This allows your development team to address critical problems first, optimizing resource allocation and ensuring significant improvements in the digital wallet's performance.

Finally, the beta testing phase should not be viewed as a one-time task but rather an ongoing process that extends beyond the initial release. As part of continuous improvement in digital wallet services, incorporate regular updates and enhancements based on user feedback to stay relevant and competitive in the fast-evolving digital payments landscape.

Marketing Strategy

Embarking on the marketing strategy for your digital wallet business is pivotal to its success, focusing heavily on building brand awareness and conveying the unique advantages of your platform. A multifaceted approach will harness the power of digital marketing, forge strategic partnerships, and execute robust PR campaigns to ensure a comprehensive penetration into the market.

Initiate by developing a digital marketing plan that leverages SEO, PPC, and social media advertisements to target your ideal customer demographics. Engaging content and interactive tools on your website can help illustrate the ease and security of using your digital wallet, which are critical selling points for prospective users.

Essential Tips for Leveraging Partnerships:

- Identify potential partners who align with your brand values and have access to a substantial user base that could benefit from your digital wallets.

- Consider collaboration with financial education platforms to help demystify the advantages of digital wallets and embed your brand as a thought leader.

- Use co-branded marketing efforts to reach a broader audience and gain credibility through association.

To augment your market presence, a robust PR strategy should communicate the innovation and reliability of your digital wallet services. Press releases, interviews, and case studies can be powerful tools to generate buzz and attract coverage in financial and tech publications.

Ultimately, your marketing tactics should continuously evolve, adapting to new market trends and the preferences of your customers. This dynamic approach will not only keep your brand relevant but also drive sustained growth.

As digital wallet technology continues to evolve, staying ahead of trends and innovatively approaching marketing will keep your business at the forefront of this competitive industry. Engage deeply with your target customers through tailored messages, build meaningful partnerships, and keep your audience engaged with compelling narratives around the security and convenience your solution offers.

Continuous Improvement

In the rapidly evolving landscape of digital wallets, maintaining market relevance demands vigilant monitoring and iterative improvements. Once your digital wallet business is operational, the true challenge lies in sustaining its growth and adapting to ever-changing consumer demands and technological advancements. This essential phase goes beyond initial success, focusing deeply on refining your service to enhance user satisfaction and operational efficiency.

Start by establishing robust mechanisms to track the performance of your digital wallets. Utilize analytics tools to gather data on user engagement, transaction volumes, and feedback. This data serves as the foundation for understanding the strengths and weaknesses of your digital wallet offerings.

- Conduct regular user feedback sessions to gain insights directly from your customers, ensuring their voices guide your developmental roadmap.

- Monitor digital payment compliance and regulatory updates to ensure your digital wallet remains compliant with all legal standards.

- Plan for periodic updates, not just to fix bugs but to introduce innovative features that differentiate your digital wallet from competitors.

Equally important is the strategic partnership with technology providers to ensure that your infrastructure can support new features and handle scaling requirements as your user base grows. Continuous improvement in digital wallet services involves both the technological stack and the user experience design.

Pro Tips for Sustaining Innovation and Improvement

- Employ A/B testing to experiment with new features before a full-scale roll-out.

- Keep a close eye on emerging digital wallet technology trends and integrate them into your offering where relevant.

- Create a feedback loop with your development team to prioritize and implement changes efficiently.

Remember, the goal of continuous improvement in your digital wallets business is not only to fix what's broken but to foresee market shifts and be proactive in innovation. This proactive approach ensures long-term success and a competitive edge in the dynamic digital payments landscape.

Launching a digital wallet business requires a systematic approach to understanding market demands, forming strategic partnerships, and strictly adhering to regulatory standards. By following the nine essential steps outlined—from conducting thorough market research to engaging in continuous improvement—entrepreneurs can effectively set the foundation for a successful all-in-one digital wallet solution. This venture not only addresses current consumer needs but also adapts to emerging financial technologies and trends, ensuring long-term relevance and profitability in the dynamic digital payment landscape.

$169.00 $99.00 Get Template

| Expert-built startup financial model templates |

Related Blogs

- KPI Metrics

- Running Expenses

- Startup Costs

- Pitch Deck Example

- Increasing Profitability

- Sales Strategy

- Rising Capital

- Valuing a Business

- Writing Business Plan

- Buy a Business

- How Much Makes

- Sell a Business

- How To Avoid Mistakes

Leave a comment

Your email address will not be published. Required fields are marked *

Please note, comments must be approved before they are published

- Mobile wallet

- Money transfer

- Payment acceptance

- Currency exchange

- Business ledger

- Ewallet development

- P2P payment app development

- Fintech software development

- Enterprises

- Payment Solution Provider (MENA)

- Digital wallet for MPAY

- Mobile money processing for Paywell

- Knowledge base

The Essential Things To Know Before Starting A Digital Wallet Business

The world is quickly embracing the digital age, and e-wallets are becoming an increasingly popular way to send and receive payments. They help users to store their money and other digital assets in a secure environment. E-wallets also enable customers to conduct financial transactions with ease and convenience.

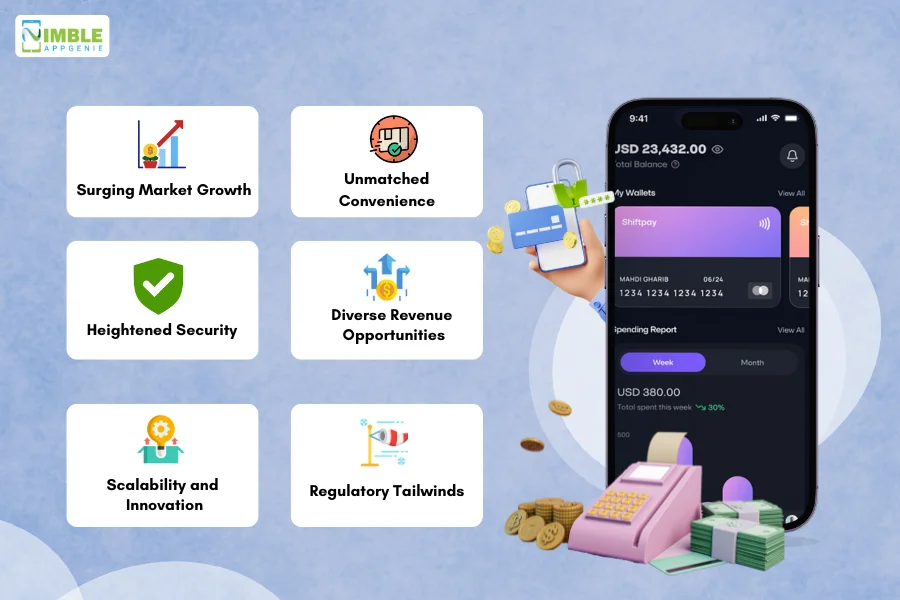

Digital wallets have become increasingly popular in recent years, with more and more consumers adopting this payment method. The global mobile payment market size was valued at $1.48 trillion in 2019, and is projected to reach $12.06 trillion by 2027, growing at a CAGR of 30.1% from 2020 to 2027, according to Allied Market Research survey.

Starting a digital wallet business can be a great way to open up new revenue opportunities and get benefits of these payment software. In this article, we’ll cover the main things to know before starting a digital wallet business.

Table of contents

What is a digital wallet?

A digital wallet business is an online platform that allows users to store and transfer digital assets such as money, cryptocurrency, and other digital assets. This type of business is becoming increasingly popular as more people embrace the digital age and its associated technologies.

Digital wallets are secure, convenient, and provide users with greater control over their finances. They also make it easier for businesses to accept payments and receive payments from customers. By starting a digital wallet business, you can tap into this growing market and provide users with a convenient, secure platform to store and manage their digital assets.

Check this article about digital and mobile wallet use cases to explore the opportunities for integrating e-wallet software into payment businesses.

Mobile wallet solution

Build your payment app on top faster and cheaper

Benefits of a digital wallet for business

Starting a digital wallet business offers a number of benefits. We highlight the main advantages e-wallet can offer for payment companies:

Convenience

Digital wallets provide a convenient and secure way for customers to make payments. Customers can easily store their payment information in their digital wallet and use it to make transactions without the need to carry cash or a physical card.

Increased sales

By offering digital wallet payments, businesses can attract new customers who prefer to pay digitally. Additionally, digital wallets can offer a more streamlined checkout experience, reducing the chances of cart abandonment and increasing sales.

Reduced fraud

Digital wallets use advanced security features, such as encryption and two-factor authentication, to protect user data and prevent fraud. This can reduce the risk of chargebacks and disputes, which can be costly for businesses.

Improved customer loyalty

Digital wallets can offer loyalty programs and rewards, which can incentivize customers to return and make repeat purchases. Additionally, businesses can use data from digital wallets to offer personalized promotions and discounts, which can further increase customer loyalty.

Read our article on FinTech architecture to explore key trends, challenges and solutions for financial software development.

Cost savings

Digital wallet transactions can be cheaper for businesses compared to traditional payment methods. For example, digital wallet transactions can have lower processing fees than credit card transactions.

Hybrid-cloud fintech platform

Accelerate software development with SDK.finance Platform

Improved data management

Digital wallets can provide businesses with valuable data on customer transactions and preferences, which can be used to improve marketing and sales strategies.

Expansion opportunities

Digital wallets can also be used to expand your business into other markets. For instance, if you offer a digital wallet service, you can use it to accept payments in different currencies, allowing you to reach a wider audience.

Overall, digital wallets offer a range of benefits for businesses. By adopting digital wallet payments, businesses can enhance the customer experience, increase sales, and reduce costs while improving security and data management.

Check this article to explore how Bacs payments help financial companies quickly and efficiently send or receive payments.

Things before starting a digital wallet business

Starting a digital wallet business can be a lucrative venture, but it requires careful planning and preparation. When you have already done market research and clarified the target audience, their preferences, and requirements, you are ready to start with your payment solution. Here are some things to consider before launching your digital wallet business:

Ensure regulatory compliance

Regulatory compliance is an essential aspect of any digital wallet company’s operations. First of all, digital wallet companies must comply with KYC and AML regulations to prevent money laundering and other financial crimes and verify the identity of its customers. Secondly, businesses that handle payment card data are required to comply with PCI DSS standards to protect against fraud and data breaches. Digital wallet companies also should comply with data privacy regulations, such as the EU’s General Data Protection Regulation (GDPR), to protect customer data.

Last and also important step is to comply with country-specific regulations, depending on where they operate. Regulatory compliance for the payment industry varies depending on the location of the business and the countries where it operates:

- Digital wallet providers operating in the United States must comply with various regulations such as the Bank Secrecy Act (BSA), the USA PATRIOT Act, and the Dodd-Frank Act.

- If your company operates in the European Union you must comply with the General Data Protection Regulation (GDPR), the Payment Services Directive 2 (PSD2), and the Anti-Money Laundering Directive (AMLD).

- Digital wallet providers must obtain a license from SAMA to operate in KSA. They must also comply with other relevant laws and regulations, such as the e-commerce law, the cybercrime law, and the personal data protection law.

- In the United Arab Emirates (UAE), regulatory compliance for digital wallets is overseen by the Central Bank of the UAE (CBUAE), which is responsible for regulating and supervising the financial sector in the country. The CBUAE has issued regulations and guidelines for digital wallets to ensure the safety and security of electronic payments and protect the rights of users.

Check this article to get more information about country-specific regulations in your region.

Technology requirements

The technology stack for developing an ewallet depends on the specific requirements of the project, so you need to determine the right software to build and operate a digital wallet platform, according to business and users needs. Consider the following technologies to develop an electronic payment solution

Front-end Development: The front-end of the ewallet can be developed using frameworks such as React Native, Flutter, or Ionic. These frameworks allow for the development of mobile apps that can be used on iOS and Android devices.

Back-end Development: The back-end of the ewallet can be developed using server-side programming languages such as Java, Python, or Node.js. You can use a web framework such as Spring Boot, Django, or Express.js to build the back-end.

Digital wallet solution

Affordable software to base a fintech product on

Database: You will need a database to store user data, transaction history, and other relevant information. Popular database choices for e-wallets include PostgreSQL, MySQL, or MongoDB.

APIs are also essential components of digital wallets. They help to integrate the wallet with third-party apps and services. For example, SDK.finance functionality lies in using its 400+ interactive API endpoints exposed as Open APIs (available via Swagger). They help to facilitate integration with third party providers and services and assist in driving our customers’ products innovation.

Moreover, it is also important to consider a cloud-based infrastructure, as an ewallet requires a scalable and reliable infrastructure to handle a high volume of transactions. Cloud-based services such as Amazon Web Services (AWS), Microsoft Azure, or Google Cloud Platform (GCP) can provide the perfect solution for an ewallet.

Read this article to get more information about developing a digital wallet.

Features implementation

The functionality of the virtual wallet depends on your business needs. You can offer the following features with the e-wallet for your customers: P2P transfers to allow users to send and receive money from others; include loyalty programs to boost users’ engagement with your brand, allowing them to earn points or rewards for every purchase they make using the digital wallet.

You can also provide account management to help users create and manage their digital wallet accounts, including adding or removing payment methods, viewing transaction history, and updating personal information. Offering budgeting tools, you allow them to track their spending, set spending limits, and receive alerts when they approach their limits. Moreover, it is possible to provide personalized offers and promotions to users based on their transaction history and preferences can help increase engagement and loyalty.

API-driven neobank software

Develop your payment app on top faster and cheaper

In addition, digital wallets should have strong security measures in place to protect user data and prevent fraud. This could include two-factor authentication, encryption, and fraud detection.

Developing a digital wallet is a complex process that requires a team of experienced developers, designers, and project managers. Working with a reputable development firm can help ensure your digital wallet is developed to a high standard, meets user requirements, and provides a seamless user experience. Check this article to explore the most common e-wallet use cases.

SDK.finance digital wallet solution

SDK.finance offers a white-label digital wallet platform that allows businesses to build a digital wallet product for their customers for storing and managing their money. This e-wallet software serves as a foundation to build a standalone payment product on top or add electronic asset accounting functionality to your existing one.

Our team uses cutting-edge tech stack to provide the latest security standards in code development. Implemented API-first architecture helps to facilitate integration with third-party providers and services and assists in driving your banking or payment product innovation. SDK.finance solution is available on premise or via hybrid cloud deployment, which features top-notch resilience, meets the strictest regulatory requirements, and enables the usage of our platform irrespective of location.

With SDK.finance digital wallet you can offer the following functionality: multicurrency accounts, bank and bill payments, internal P2P transfers, spending visualization, and currency exchange. The e-wallet solution is designed for businesses of all sizes in the financial industry, including banks, payment processors, and fintech startups. It is a flexible and customizable system that can be tailored to meet the specific needs of each business.

Check out the demo video of the SDK.finance Platform to see how you can manage currencies and digital assets, configure exchange rates, and monitor system accounts all within one system. The SDK.finance Platform is a FinTech multitool that helps businesses of all sizes to launch their financial and payment products in record time:

Starting a digital wallet business can be a great way to tap into the growing digital payments market. With the right software development partner and planning, you can start making money with your digital wallet business. Make sure to do your research, choose the right platform, and invest in the necessary services to ensure your success. SDK.finance digital wallet software solution can help you to launch your payment business faster and offer a highly scalable solution for the users.

What are the benefits of digital wallets for businesses?

Digital wallets offer the following benefits for businesses: reduced fraud, increased sales, improves customer service satisfaction and loyalty, and seamless payment processing. These software programs also can improve data management and save costs by offering lower processing fees than traditional payment methods.

How to start a digital wallet business?

Starting a digital wallet business can be a lucrative venture, but it requires careful planning and preparation. When you have already done market research and clarified the target audience, preferences, and requirements, you are ready to start with your payment solution. Before starting a digital wallet company you need to consider the following things: regulatory compliance, technical requirements, and the functionality of the virtual wallet.

You may also like

Privacy overview.

How To Start A Digital Wallet Business

When it comes to createing a digital wallet app, you may find yourself in a place where you have to make some big decisions.

You may be asking yourself:

- What's the first step in establishing my business?

- How much will it cost to start my digital wallet app?

- How do I price my digital wallet app?

- How do I market my digital wallet app?

- ... so much more!

We walk you through all of the steps; from idea → starting → launching → growing → running your business.

The purpose of this guide is to act as an outline for the steps you'll need to take to get your business running successfully!

Create A Digital Wallet App ➜ avg revenue (monthly) $1.5M see all digital wallet apps ➜ starting costs $30.5K see all costs ➜ gross margin 23% time to build 240 days growth channels SEO business model Subscriptions best tools Twitter, Instagram, iCard time investment Full time pros & cons 40 Pros & Cons see all ➜ tips 1 Tips see all ➜

💡 Introduction To Createing A Digital Wallet App

Is createing a digital wallet app right for you.

There are many factors to consider when createing a digital wallet app.

We put together the main pros and cons for you here:

Pros of createing a digital wallet app

• Flexibility

You can put as much time into the business as you'd like. If you like the work and have some initial experience, you can start small and manage all aspects of the business on your own.

• Ability to start your business from home

It's not necessary to have a physical storefront or office space to get your business started. You can do everything from the comfort of your own home, at least in the beginning!

• Traffic to your website

A digital wallet app gives people a reason to visit your website and to keep coming back to you!

• Meaningful business connections

You never know who you will meet as a digital wallet app. This could be the start of an incredible business opportunity!

• High customer retention rates

Once a customer invests in your product, they've invested their time and energy to utilize your product/service which is highly valuable to them. Typically, your product or service becomes indispensable to your customer.

• Control of workload

With createing a digital wallet app, you have the unique ability to choose how little or how much you want to work. You also have the freedom to decide which projects you want to work on, and can turn down the ones that do not interest you.

• Gain exposure and experience

This career allows you to gain experience working for multiple different businesses - which will benefit your resume and also keep things interesting for you!

• Unlimited income potential

With createing a digital wallet app there is no cap as to how much income you can make. The stronger your business skills and the more energy/time you put into your career, the more you'll make.

• Amazing perks and discounts

Working in the digital wallet app comes with its perks! As a seller for these products/services, you typically also get to enjoy industry perks and discounts.

• Predictable income stream

Your businesses income stream tends to be predictable based on the number of customers you have signed up. This makes financial planning and outlooks much more seamless!

• Higher likelihood of getting referrals

This business is all about referrals, which can be a a very impactful way to attract and retain customers. It's critical that you have a great referral program in place that incentivizes your customers to tell their friends about your product.

• Simple business model

A digital wallet app has the advantage of a simple business model, which makes launching and building the business more seamless.

• Control your own destiny

Createing A Digital Wallet App allows you to control every aspect of your life and make your own dreams come true every day.

• Greater Income Potential

With this business, the sky is the limit in regards to your income potential.

• You can work from anywhere!

Not only can you start your digital wallet app from home, you can also run your business from anywhere in the world. This is the entrepreneur dream.

• Strong Demand & Relatively Recession Proof

The demand for digital wallet app is increasing year over year and the business is known to be relatively recession proof.

• You get to inspire others

Your business is one that encourages and inspires others, which in itself, can be very fulfilling.

• You establish yourself as an expert

With createing a digital wallet app, you establish yourself as an expert in your niche, which builds your credibility. In return, customers are more likely to trust you and refer you to other friends and family.

• Can build solid foundation of clients

It's unlikely you will have one-off customers as a digital wallet app. Typically, you have a solid foundation of clients that use your product and services regularly.

• Low maintenance customers

In this industry, customers are known to be very appreciative and low maintenance. This can help with your stress levels and allow you to focus on growing your business.

• Results and revenue happen quickly!

Unlike other businesses, it can be relatively quick to start seeing results and revenue. As long as you follow all the steps to validate your idea before launch, you are likely to see quick results and ROI.

Cons of createing a digital wallet app

• Motivation of employees

If you plan to have a sales/content team on board, finding creative ways to motivate them can be a challenge. It's important that you're able to offer great incentives and a good work environment for your employees.

• Low margins

The gross margins for your digital wallet app are typically around 23%, which can make it more challenging to incur new expenses and maintain profitability.

• High employee turnover

In the digital wallet app, employee turnover is often high, which can be quite costly and time consuming for your business. It's important to try and avoid this as much as possible by offering competitive pay, benefits, and a positive work environment.

As a digital wallet app, you typically pay self-employment taxes which can be quite high. It's important to understand what you will be paying in taxes each year so you can determine if the work you're taking on is worth it.

• High overhead expenses

With createing a digital wallet app, there are overhead expenses that come with selling a physical product. You will want to make sure you strategically budget for these overhead costs. We discuss this more in the startup costs section below.

• You may need to charge sales tax

If you are selling your products in various states, you may be required to charge sales tax. Although this may not impact your financials specifically, it can be a headache to create a process and procedure for this. To learn more about sales tax, check out this article

In this business, customers can cancel their membership or subscription for your services - which can make revenue forecasting challenging and unpredictable. It's important to focus on your churn rates and trends so that you can prevent this as much as possible.

• Time commitment

With createing a digital wallet app, all responsibilities and decisions are in your hands. Although this is not necessarily a negative thing, work life can take over at times. This can place a strain on friends and family and add to the pressure of launching a new business.

• Difficult to build trust with your customer

With createing a digital wallet app, there can be minimal face-to-face interaction, which means it can be a lot more difficult to establish trust with your customers. You'll need to go the extra mile with your customer to grab their attention and business.

• Strict regulations

With any digital wallet app, there are strict rules and regulations as it relates to processing your product. You must follow these regulations specifically, or significant legal issues could occur.

• Complex development process.

The development process for a digital wallet app can be quite complex, which may cause delays and challenges when launching and growing your product.

• Complex maintenance

Your digital wallet app will require a long-term investment due to the need for updates, bug fixes, and security vulnerabilities. It's important that you (or someone on your team) stays on top of this at all times.

• Impatient customers

You may offer an engaging user experience for your customer, but customers expect a lot and may be impatient if they aren't pleased with your product or service.

• You might struggle financially (at first)!

If you bootstrap your business or choose not to pay yourself (or pay yourself less than you were making at your corporate job), this can be financially taxing. It's important to adjust your lifestyle and set a plan for yourself so you don't find yourself in a stressful situation.

• Difficult to scale

With a digital wallet app, it can be challenging to find ways to scale. Check out this article that discusses scaling your business and the challenges that come with it.

• Learning Curve

When you start your own business, you no longer have upper management to provide you with a playbook for your roles and responsibilities. You should know the ins and outs of every aspect of your business, as every decision will come down to you.

• Equipment Breakdowns

Over the years, your equipment can get damaged, break down, and may need repairs which can be expensive. It's important you prepare for these expenses and try to avoid damages/wear & tear as much as possible.

• Technical issues can be frustrating

Technical issues are common in this business. If you struggle with the technical side of things, you may want to consider outsourcing this responsibility to save yourself the time and frustration.

• More challenging to earn passive income

It can be more of a challenge to make passive income in this business. Often times, the amount of revenue you bring in is limited by the amount of time you have in the day.

Big Players

- MetaMask (7.3K Alexa Ranking)

- Digital Wallet (21.5K Alexa Ranking)

- Coins.ph (21.7K Alexa Ranking)

- Exodus (22.5K Alexa Ranking)

- Theta Token (34.2K Alexa Ranking)

Small Players

- iCard - Revenue $1.5M/month

- Finvault - Revenue $220K/month

Search Interest

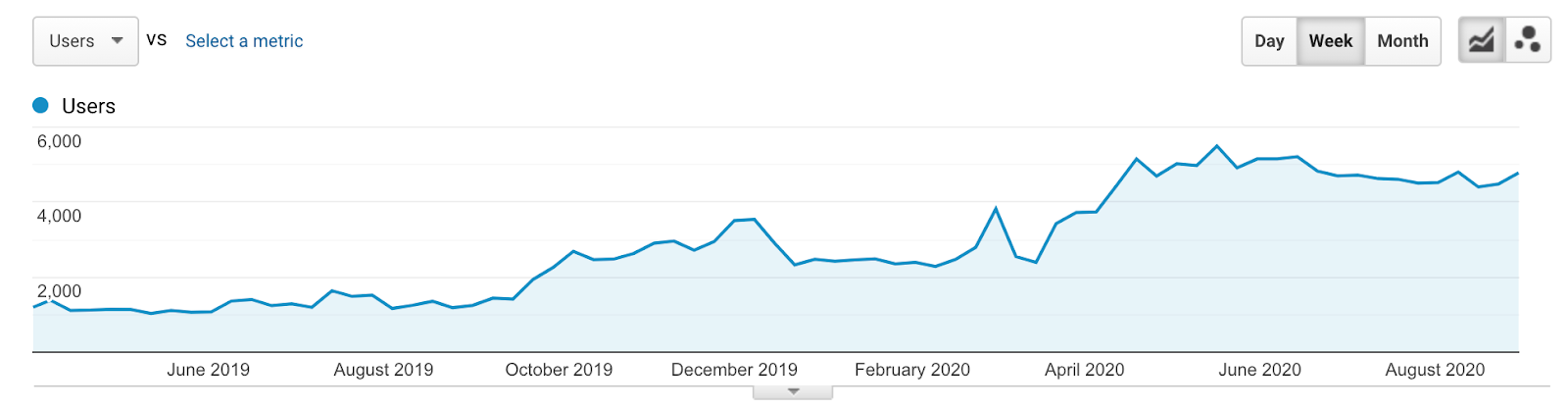

Let's take a look at the search trends for digital wallet over the last year:

How To Name Your Digital Wallet App

It's important to find a catchy name for your digital wallet app so that you can stand out in your space.

Here are some general tips to consider when naming your digital wallet app

- Avoid hard to spell names: you want something easy to remember and easy to spell for your customers

- Conduct a search to see if others in the space have the same name

- Try not to pick a name that limits growth opportunities for your business (ie. if you decide to expand into other product lines)

- As soon as you have an idea (or ideas) of a few names that you love, register the domain name(s) as soon as possible!

Why is naming your digital wallet app so important?

The name of your business will forever play a role in:

- Your customers first impression

- Your businesses identity

- The power behind the type of customer your brand attracts

- If you're memorable or not

It's important to verify that the domain name is available for your digital wallet app.

You can search domain availability here:

Find a domain starting at $0.88

powered by Namecheap

Although .com names are the most common and easiest to remember, there are other options if your .com domain name is not available. Depending on your audience, it may not matter as much as you think.

It's also important to thoroughly check if social media handles are available.

As soon as you resonate with a name (or names), secure the domain and SM handles as soon as possible to ensure they don't get taken.

Here's some inspiration for naming your digital wallet app:

- 1. DigiWallet check availability

- 2. Fast Cash check availability

- 3. Ezmoney check availability

- 4. Eezy Cash check availability

- 5. Digi Pay check availability

- 6. Smart Pocket check availability

- 7. Digi Pocket check availability

- 8. Cash Now check availability

- 9. Cash Easy check availability

- 10.Money Pouch check availability

- 11. Fast Dollar check availability

- 12. Easy Dollar check availability

- 13. Money Matters check availability

- 14. Cashoneer check availability

- 15. Pay Up check availability

- 16. Pay Easy check availability

- 17. Pay Fast check availability

- 18. Fast Pay check availability

- 19. Cash Up check availability

- 20. Cash Chill check availability

- 21. Pocket Money check availability

- 22. Easy Borrow check availability

- 23. Smart Money check availability

- 24. Smart Coin check availability

- 25. Fast Bills check availability

- 26. Easy Pay check availability

- 27. Easy Bills check availability

- 28. Fast Change check availability

- 29. Easy Change check availability

- 30. Change Now check availability

- 31. Money 4 U check availability

- 32. Money Pal check availability

- 33. Cash Buddy check availability

- 34. Wallet Share check availability

- 35. Digital Pocket check availability

- 36. Wallet Now check availability

- 37. Fast Cash check availability

- 38. Fast Money check availability

- 39. Super Cash check availability

- 40. Electric Money check availability

- 41. Coin Fast check availability

- 42. Wow Coin check availability

- 43. Snap Money check availability

- 44. Smart Cash check availability

- 45. Insta Cash check availability

- 46. Insta Money check availability

- 47. Fast Buck check availability

- 48. Coin Now check availability

- 49. Cash 4 Me check availability

- 50. Rapid Cash check availability

- 51. Rapid Pay check availability

- 52. Go Cash check availability

- 53. Go Pay check availability

- 54. Go Money check availability

- 55. Golden Coin check availability

- 56. Money Basket check availability

- 57. Golden Goose check availability

- 58. Magik Coin check availability

- 59. Alpha Pay check availability

- 60. Alpha Cash check availability

- 61. Value Coin check availability

- 62. Cash Dash check availability

- 63. Money Story check availability

- 64. Cash Flow check availability

- 65. Money Magnet check availability

- 66. Wallet 4 U check availability

- 67. UWallet check availability

- 68. Wallet-o-Clock check availability

- 69. Spendn'Save check availability

- 70. iFunds check availability

- 71. Cash Express check availability

- 72. Money Express check availability

- 73. Dollar Express check availability

- 74. Coin Express check availability

- 75. Cash Grab check availability

- The Automatic check availability

- Immense check availability

- The Disc Online check availability

- Uneconomic Electronic check availability

- The Capacious Money check availability

- Electronics Spot check availability

- The Facial Online check availability

- StolenWallet check availability

- Formidable Digital check availability

- Lacrimo Digitization check availability

- Being check availability

- Oro Electronics check availability

- Automated Spot check availability

- Own Pocket Co check availability

- Born Digitizing check availability

- The Beautiful check availability

- Briefcase Pro check availability

- Free Online check availability

- Battered Pouch Collective check availability

- Analog Trading Co check availability

- Mid Analog check availability

- The Processing check availability

- Computerized Trading Co check availability

- Quizzical Digital check availability

- Old Briefcase check availability

- Lost check availability

- Digital Pro check availability

- The Born check availability

- Inter Analogue check availability

- The Facio check availability

- The Hydraulic Opto check availability

- HumanElectronic check availability

- The Radio Computerised check availability

- Conditional Digital check availability

- Stained check availability

- Yellow Bag Collective check availability

- All Electronic Collective check availability

- Guide check availability

- The Facial Electronic check availability

- Digitizing Co check availability

- Mid check availability

- DentoDigital check availability

- Eia Electrons check availability

- Profit Wallet check availability

- The Pre Digital check availability

- Waterproof Wash Leather check availability

Read our full guide on naming your digital wallet app ➜

How To Create A Slogan For Your Digital Wallet App:

Slogans are a critical piece of your marketing and advertising strategy.

The role of your slogan is to help your customer understand the benefits of your product/service - so it's important to find a catchy and effective slogan name.

Often times, your slogan can even be more important than the name of your brand.

Here are 6 tips for creating a catchy slogan for your digital wallet app:

1. Keep it short, simple and avoid difficult words

A great rule of thumb is that your slogan should be under 10 words. This will make it easy for your customer to understand and remember.

2. Tell what you do and focus on what makes you different

There are a few different ways you can incorporate what makes your business special in your slogan:

- Explain the target customer you are catering your services towards

- What problem do you solve?

- How do you make other people, clients, or your employer look good?

- Do you make people more successful? How?

3. Be consistent

Chances are, if you're coming up with a slogan, you may already have your business name, logo, mission, branding etc.

It's important to create a slogan that is consistent with all of the above.

4. Ensure the longevity of your slogan

Times are changing quickly, and so are businesses.

When coming up with your slogan, you may want to consider creating something that is timeless and won't just fade with new trends.

5. Consider your audience

When finding a catchy slogan name, you'll want to make sure that this resonates across your entire audience.

It's possible that your slogan could make complete sense to your audience in Europe, but may not resonate with your US audience.

6. Get feedback!

This is one of the easiest ways to know if your slogan will be perceived well, and a step that a lot of brands drop the ball on.

Ask friends, family, strangers, and most importantly, those that are considered to be in your target market.

Here's some inspiration for coming up with a slogan for your digital wallet app:

- Your money is secured with us

- Making digital transactions easy

- The best way to store money

- The digital wallet that cares

- The next big thing in digital money transfer

- Storing money at its finest

- Cash wallet on your computer

- Digital wallet just got even better

- The next big thing in the cash wallet industry

- Hassle-free transactions made possible

- Digital money transfers made even better

- Make your transactions quick and easy

- Virtual is the new normal

- Transact with peace of mind

- Your hard-earned money is safe with us

- We store money securely

- Money made even better

- All currencies accepted

- The new way of doing business

- Every transaction is special

- Your partner in success

- Cashless payments made possible

- We value safety and privacy

- The finest digital wallet that you can find

- Unleash the full potential of your transactions

- Best trust rating and satisfaction

- No loopholes, just security

- Make your online business successful

- Transferring money got more secured

- The new way of money transfer

- Your cash is safe with us

- The way to a safer business deals

- Cashless transaction is the new trend

- The next big thing in digital wallets

- An awesome cash wallet for you

- Do You Have The E Wallet Inside?

- Micro On Lines Are What We Do

- Wrapped Up With E Wallet.

- I Can't Believe It's Not Wallet.

- Digital Is Better Than Chocolate.

- Feel It - Digital!

- Digitals With Maxillofacial

- Wallet, To Hell With The Rest.

- You Too Can Have A Digital Like Mine.

- Our Digital Will Give You Softer Skin.

- You Too Can Have A E Wallet Like Mine.

- Get More From Life With Digital.

- Central Heating For Wallet.

- Palato Computerized, Facial Computer

- Endless Possibilities With Digital.

- Work Hard, Lose Harder

- E Wallet, How Did You Live Without It?

- All Digitiseds Are What We Do

- Processing Computings Are What We Do

- Think Different, Think E Wallet.

- Wallet, Where Success Is At Home.

- Work Hard, Forgotten Harder

- Kids Will Do Anything For Wallet.

- Own Pocketbook, Little Pocket

- You Can't Stop Digital.

- Spot Of The Electronic

- Non Information Are What We Do

- Rate Of The Paperless

- Work Hard, Slapping Harder

- Digital Is All Jacked Up.

- Digitals With Paralysi

- The Ideal E Wallet.

- Digital - One Name. One Legend.

- There's A Bit Of Wallet In All Of Us.

- Work Hard, Slap Harder

- Dento Stereo Systems Are What We Do

The Software Business Model

Tiered Pricing Model

You may want to consider having different pricing tiers to meet the needs of your customers.

With this model, there are typically 2 or more packages for a specific price that offer a fixed amount of features.

Each package should reflect the needs of the buyer persona - for example, a customer looking for a beginner package may have a very different use case than a customer looking for an enterprise package.

By offering different packages, you're able to target different audiences which will lead to increased conversions and revenue. Additionally, your chances of "upselling" existing customers are much higher as you have establisished trust with your customer and they're left wanting more once their use case evolves.

Per-User Model

Many digital wallet app businesses charge a fixed rate per user on the account (either monthly or yearly). This can be especially lucrative if you're targeting larger businesses where the user number will be much higher.

This model is not always preferred as it can be challenging to forecast revenue accurately when the user count within businesses is fluctuating constantly.

Flat Rate Model

If you decide to adopt a flat-rate model, this would mean that you offer only one price for every customer. All customers are treated equally and have access to the same amount of features.

This model is not as common as tiered pricing because it only meets the needs of one buyer persona and can limit growth and you're able to have multiple revenue streams.

Per Feature Model

This model charges customers based on the # of features they need. Customers add features "a-la-carte" which will determine the overall price of the product.

This can be a lucrative model, however, the number of different use-cases customers need can become overwhelming (making the sales process longer) and it can be challenging to find a price structure that works well.

The business model you choose depends entirely on your needs and goals as a company. To find what works well for you, you may want to consider testing several models and conducting market research to see what competition in the space is doing.

The Freemium Model

Offering free trials to your platform is a great way to gain exposure for your business and potentially get new customers!

Finding the right digital wallet app is a big deal for most people, so it can be important for customers to try a free version with limited features prior to making a big investment.

Once your customer reaches the limits of their free account, they're much more likely to invest in the premium version so they can gain access to all of the features your product offers.

There are a few different ways you can limit certain aspects of your product:

- Usage quotas : Storage limits or limiting the number of times they can utilize a feature

- Limited features : Only allowing your free user to utilize certain features vs all features - this is also a great way to upsell during the user's experience

- Limited support : Customer support can be time-consuming, by limiting the level of support to free users this is a great incentive for them to upgrade (and will save you a lot of time and money)!

Here's an example of SEO website, Sanity Check offering a free version to their website:

Learn more about starting a digital wallet app :

Where to start?

-> How much does it cost to start a digital wallet app? -> Pros and cons of a digital wallet app

Need inspiration?

-> Other digital wallet app success stories -> Examples of established digital wallet app -> Marketing ideas for a digital wallet app -> Digital wallet app slogans -> Digital wallet app names

Other resources

-> Digital wallet app tips

🎬 How To Create A Digital Wallet App

How Much Does It Cost To Create A Digital Wallet App

If you are planning to create a digital wallet app, the costs are relatively low. This, of course, depends on if you decide to start the business with lean expenses or bringing in a large team and spending more money.

We’ve outlined two common scenarios for “pre-opening” costs of createing a digital wallet app and outline the costs you should expect for each:

- The estimated minimum starting cost = $62

- The estimated maximum starting cost = $60,761

| Average expenses incurred when starting a digital wallet app. | You plan to execute on your own. You’re able to work from home with minimal costs. | You have started with 1+ other team members. |

|---|---|---|

| : This refers to the office space you use for your business and give money to the landlord. To minimize costs, you may want to consider starting your business from home or renting an office in a coworking space. | $0 | $5,750 |

| : Utility costs are the expense for all the services you use in your office, including electricity, gas, fuels, telephone, water, sewerage, etc. | $0 | $1,150 |

| : Whether you work from home or in an office space, WiFi is essential. Although the cost is minimal in most cases, it should be appropriately budgeted for each month! | $0 | $100 |

| : Payroll cost means the expense of paying your employees, which includes salaries, wages, and other benefits. This number depends on if you decide to pay yourself a salary upfront and how many employees you have on payroll. At first, many founders take on all responsibilities until the business is up and running. You can always hire down the road when you understand where you need help. Keep in mind, if you do plan to pay yourself, the average salary founders make is | $150 | $250 |

| : Apart from payroll and benefits, there are other hiring employees costs. This includes the cost to advertise the job, the time it takes to interview candidates, and any other turnover that may result from hiring the wrong candidate. | $1 | $2 |

| : It's vital to acknowledge and reward workers, whether they hit their goals or do a great job. This does not have to be costly. In fact, simply taking workers out to a meal or giving a gift or bonus is among the many ways to show how the worker is valued! | $0 | $100 |

| : The cost of your website will vary depending on which platform you choose. There are many website builders on the market, so it's important you choose the right one for your business and overall goals. To learn more about your options + how to build a great website, check out . | $10 | $500 |

| : Web design includes several different aspects, including webpage layout, content creation, and design elements.If you have the skills and knowledge to design your website on your own, then outsourcing this to an expert may not be necessary. There are plenty of other ways you can design a beautiful website using design tools and software. | $200 | $6,000 |

| : Your domain name is the URL and name of your website - this is how internet users find you and your website.Domain names are extremely important and should match your company name and brand. This makes it easier for customers to remember you and return to your website. | $12 | $200 |

| : An email hosting runs a dedicated email server. Once you have your domain name, you can set up email accounts for each user on your team. The most common email hosts are G Suite and Microsoft 365 Suite. The number of email accounts you set up will determine the monthly cost breakdown. | $1 | $15 |

| : Server hosting is an IT service typically offered by a cloud service provider that hosts the website information and allows remote access through the internet. A hosted server can help you scale up and increase your business’s efficacy, relieving you from the hassles of on-premise operations. | $0 | $300 |

| : If your business values high-end customer service, you must consider utilizing a website chatbot. Website chatbots play a pivotal role in converting site visitors into long-term customers. Typically, there are different tiers of pricing and features offered by Live Chat service providers. | $0 | $200 |

| : Depending on which state you live in and the business you're operating, the costs and requirements for small business insurance vary. You can learn more . | $500 | $2,000 |

| : Depending on your industry, there are certain licenses and permits you may need in order to comply with state, local, and federal regulations. is an article that goes over all the permits and licenses you may need for your digital wallet app. | $50 | $700 |

| : Filing trademark registration will protect your brand and prevent other businesses from copying your name or product. has several different types of trademarks, so the cost to apply can vary (typically anywhere from $400-$700). | $0 | $700 |

| : Although you may want to avoid attorney fees, it's important that your business (and you) are covered at all costs. This comes into play when creating founder agreements, setting up your business legal structure, and of course, any unforeseen circumstances that may happen when dealing with customers or other businesses. | $0 | $1,500 |

| : Patents provide protection against others stealing or selling your idea.Securing a patent can be very valuable, but it's important that you are 100% sure this will be a smart business move for you, or if this is something to consider down the line.The process of securing a US patent can be both lengthy and pricey, and typically includes filing an application with the . | $5,000 | $15,000 |

| : The first step in setting up your business is deciding whether your business is an LLC, S Corp or C Corp. The cost for this depends on which state you form your business and which structure you decide on. We put together an article that goes over the . | $50 | $500 |

| : Cleaning supplies are essential products we used daily at home and in almost all places worldwide. These items are used to effectively and safely remove dirt and germs to control allergens and prevent the spreading of contagious diseases, helping us stay healthy. | $63 | $200 |

| : App development is the process of creating software intended to run on a mobile device.In addition to coding, there are other elements to consider:- design- back end development- security- architecture- testingMany businesses hire an expert that has the technical knowledge to design and develop an app.Depending on the scope of your project, the cost can vary. Some business owners learn to code on their own to minimize these costs, and others, hire a developer to work for them part-time or full-time. | $1,000 | $20,000 |

| : These programs might include the : Photoshop, Illustrator, InDesign and others. This is typically a monthly subscription ranging from $10-$50/mo. | $0 | $50 |

| : If you plan to grow your email list and email marketing efforts, you may want to consider investing in an email marketing platform (ie. Klaviyo, MailChimp). We put together a detailed guide on all of the email marketing tools out there + the pricing models for each one . | $0 | $100 |

| : IT support installs and configures hardware and software and solves any technical issues that may arise.IT support can be used internally or for your customers experiencing issues with your product/service.There are a variety of tools and software you can use to help with any technical issues you or your customers are experiencing. This is a great option for businesses that do not have the means to hire a team of professionals. | $150 | $2,000 |

| : It's important to have an accounting system and process in place to manage financials, reporting, planning and tax preparation. Here are the for small businesses. | $0 | $50 |

| : CRM (customer relationship management) software system is used to track and analyze your company’s interactions with clients and prospects. Although this is not a necessary tool to have for your business, implementing this, in the beginning, may set your business up for success and save you valuable time. | $12 | $300 |

| : You may want to consider using a project management and collaboration tool to organize your day-to-day. This can also be very beneficial if you have a larger team and want to keep track of everyones tasks and productivity. For a full list of project management tools, check out this . | $0 | $25 |

| : If you plan to have multiple members on your team, you may want to consider an instant message tool such as or . The cost is usually billed per month (approx $5/user/month) or there are freemium versions available on many platforms. | $0 | $20 |

| : If you plan to do social media marketing for your digital wallet app, you should consider investing in a social media automation or publishing tool. This will save you time and allow you to track performance and engagement for your posts. is a list of 28 best social media tools for your small business. | $0 | $50 |

| : The main purpose of payroll software is to help you pay your team and track each of those payments (so that you don't have to do it manually). If you do not have any employees or have a very small team, payroll software may not be necessary at this stage. are the 11 best payroll tools for small businesses! | $0 | $200 |

| : It's important to make sure the information for your digital wallet app is stored and protected should something happen to your computer or hard drive. The cost for this is affordable and depends on how much data you need to store. To learn more about the different options and pricing on the market, check out . | $0 | $299 |

| : Many digital wallet app's conduct industry and consumer research prior to starting their business. Often times, you need to pay for this data or hire a market research firm to help you in this process. | $0 | $300 |

| : Joining local networking groups or your chamber of commerce is a traditional yet effective way to promote your digital wallet app - but these fees add up! It's important to choose the right group(s) that align with your business and help with growth. | $0 | $250 |

| : Although it may sound old-school, traditional marketing methods can be a cost-effective way to drive awareness for your brand. This includes flyers, postcards, sales letters, coupons, special offers, catalogs and brochures. | $0 | $300 |

| : If you want to increase revenue for your digital wallet app, affiliate marketing is a great way to promote your product to a new audience. When determining affiliate commission rates you will offer, you will want to take into account the price and margin for your product to ensure affiliate marketing is worth it for your business. According to , the average affiliate commission rate should be somewhere between 5% to 30%. To learn more about how to set commission rates, check out .. | $0 | $250 |

| : Partnering with like-minded influencers is one of the most effective ways to grow your social media presence. Many small businesses simply gift a free item in exchange for an influencer post, or pay the influencer directly. | $0 | $750 |

| : With you have the ability to control how much you spend by simply setting a monthly budget cap. Additionally, with these ads you only pay for results, such as clicks to your website or phone calls! It's okay to start with a small budget at first and make changes accordingly if you see valuable returns. | $0 | $300 |

| : With Facebook and Instagram ads, you set your budget and pay for the actions you want (whether that be impressions, conversions, etc).You can learn more about pricing based on your impressions . | $0 | $350 |

Raising Money For Your Digital Wallet App

Here are the most common ways to raise money for your digital wallet app:

Bootstrapping

You may not need funding for your digital wallet app.

In fact, many entrepreneurs take this approach when starting their own business, whether they have a little amount of cash or a substantial amount to get started.

So what exactly does the term "bootstrapping" mean?

This method essentially refers to self-funding your business without external help or capital and reinvesting your earnings back into the business**

Bootstrapping means building your company from the ground up with your own, or your loved ones, personal savings and reinvesting all earnings back into the business

Here are some tips to consider when bootstrapping your business :

- Use your savings as your capital - one of the best ways to bootstrap your business is to collect your savings and use them as startup capital. This will also help you avoid using your personal or business credit cards when getting started.

- Determine exactly how much capital you need and how much capital you have to get your business off the ground. Generally, when bootstrapping your business, you may want to consider starting a business that involves less startup capital.

- Consider starting a business that will generate immediate returns so you can put money back into the business

- Be as lean as possible - this refers to cutting down expenses as much as possible, such as payroll, fancy software tools, unnecessary travel, renting an office, etc

- Consider outsourcing instead of hiring - in the beginning, you may not need to hire someone permanently to help run your business. It tends to be much less expensive to outsource work to a freelancer and hire someone permanently down the road!

Want to learn more about bootstrapping your business? Check out this article

VC funding is a traditional and long process, but an effective way to raise money for your business.

The term "VC funding" refers to venture capital firms investing in businesses in exchange for equity.

The VC's (venture capitalists) are an individual or small group investing in your business and typically require substantial ownership of the business, with the hope of seeing a return on their investment.

VC's are typically the best approach for businesses with high startup costs - where it would be very difficult to raise the money on your own or through a loan.

When deciding whether to take this approach, it's important that you have a few things in place first, and know what you're getting yourself into:

Determine if your business is ready

Having an idea is not enough to get VC funding.

Typically, VC's will check to make sure you have these things in place prior to closing any deal:

- An MVP (Minimal Viable Product)

- A founding team with all proper documents in place (articles of organization, business formation)