myCBSEguide

- Class 12 Economics Case...

Class 12 Economics Case Study Questions

Table of Contents

myCBSEguide App

Download the app to get CBSE Sample Papers 2023-24, NCERT Solutions (Revised), Most Important Questions, Previous Year Question Bank, Mock Tests, and Detailed Notes.

In this article, we will discuss how to download CBSE class 12 Economics Case Study Questions from the myCBSEguide App and our Student Dashboard for free. For the students appearing for class 12 board exams from the commerce/ humanities stream, Economics is a very lucrative and important subject. It is a very high-scoring subject that aids the students to increase their percentile and excel in academics.

The exam is divided into 2 parts:

- Macro Economics

- Indian Economics Development

12 Economics Case Study Questions

CBSE introduced case-based questions for class 12 in the year 2021-22 to enhance critical thinking in students. CBSE introduced a few changes in the question paper pattern to enhance and develop analytical and reasoning skills among students. Sanyam Bharadwaj, controller of examinations, CBSE quoted that the case-based questions would be based on real-life situations encountered by students.

The purpose was to drift from rote learning to competency and situation-based learning. He emphasized the fact that it was the need of the hour to move away from the old system and formulate new policies to enhance the critical reasoning skills of students. Introducing case study questions was a step toward achieving the goals of the National Education Policy (NEP) 2020.

What is a Case Study Question?

As part of these questions, the students would be provided with a comprehensive passage, based on which analytical questions will have to be solved by them. The students will have to read the given passage thoroughly before attempting the questions. In The current examination cycle (2021-22), case-based questions have a weightage of around 20%.

Types of Case Study Questions in Economics

CBSE plans to increase the weightage of such questions in the following years, so as to enhance the intellectual and analytical abilities of the students. Case-based questions are predominantly of 3 types namely:

- Inferential

Local questions

Local questions can be easily solved as the answers are there in the given passage itself.

Global Questions

For Global questions, the students will have to read the passage in depth, analyze it and then solve it.

Inferential questions

Inferential questions are the ones that would require the student to have complete knowledge of the topic and could be answered by application of the concepts. The answers to such questions are tricky and not visible in the given passage, though the passage would highlight the concept on which the questions would be asked by CBSE.

HOTS Questions in Class 12 Economics

Personally, the concept of case-based questions is not new since CBSE has always included questions based on Higher Order Thinking Skills (HOTs). Though now we will have an increased percentage of such questions in the question paper.

Advantages of Case-based Questions

Class 12 Economics has two books and CBSE can ask Case study questions from any of them. Students must prepare themselves for both the books. They must practice class 12 Economics case-based questions as much as possible.

Case study questions:

- Enhance the intellectual and analytical abilities of the students.

- Provide a complete and deeper understanding of the subject.

- Inculcate intellectual reasoning and scientific temperamental in students.

- Help students retain knowledge for a longer time.

- Would definitely help to discard the concept of memorizing insanely and cramming without a factual understanding of the content.

- The questions would help to terminate the existing system of education in India that promotes rote learning.

Sample case study questions (Economics) class 12

Here are some case study questions for CBSE class 12 Economics. If you wish to get more case study questions and other related study material, download the myCBSEguide App now. You can also access it through our Student Dashboard.

Case Study 1

Keeping in view the continuing hardships faced by banks in terms of social distancing of staff and consequent strains on reporting requirements, the Reserve Bank of India has extended the relaxation of the minimum daily maintenance of the CRR of 80% for up to September 25, 2020. Currently, CRR is 3% and SLR is 18.50%.

“As announced in the Statement of Development and Regulatory Policies of March 27, 2020, the minimum daily maintenance of CRR was reduced from 90% of the prescribed CRR to 80% effective the fortnight beginning March 28, 2020 till June 26, 2020, that has now been extended up to September 25, 2020,” said the RBI.

Q.1 The full forms of CRR and SLR are:

- Current Reserve Ratio and Statutory Legal Reserves

- Cash Reserve Ratio and Statutory Legal Reserves

- Current Required Ratio and Statutory Legal Reserves

- Cash Reserve Ratio and Statutory Liquidity Ratio (ans)

Q.2 What will be the value of the money multiplier?

- None of these

Q.3 SLR implies:

- a) Certain percentage of the total banks’ deposits has to be kept in the current account with RBI

- b) Certain percentage of net total demand and time deposits have to be kept by the bank themselves (ans)

- c) Certain percentage of net demand deposits has to be kept by the banks with RBI

- d) None of the above

Q.4 Decrease in CRR will lead to __.

- a) fall in aggregate demand in the economy

- b) rise in aggregate demand in the economy (ans)

- c) no change in aggregate demand in the economy

- d) fall in the general price level in the economy

Case Study 2

An important lesson that the COVID-19 pandemic has taught the policymakers in India is to provide greater impetus to sectors that make better allocation of resources and reduce income inequalities. COVID-19 has also taught a lesson that in crisis the population returns to rely on the farm sector. India has a large arable land, but the farm sector has its own structural problems. However, directly or indirectly, 50 percent of the households still depend on the farm sector. Greater support to MSMEs, higher public expenditure on health and education and making the labour force a formal employee in the economy are some of the milestones that the nation has to achieve.

One of the imminent reforms to be done in the country is labour reforms. Labour laws are outmoded in India, and some of these date back to the last century.

India’s complex labour laws have been blamed for keeping manufacturing businesses small and hindering job creation. Industry hires labour informally because of complex laws and that is responsible for low wages.

- Which types of structural problems are faced by the agricultural sector?

- “It is necessary to create employment in the formal sector rather than in the informal sector.’’ Defend or refute the given statement with valid argument.

- Hired labour comes in …………………. (Informal organisation / formal organisation)

- What do you mean by MSMEs?

Case Study 3

People spend to acquire information relating to the labour market and other markets like education and health. This information is necessary to make decisions w.r.t investment in human capital and its efficient utilization. Thus, expenditure incurred for acquiring information relating to the labour market and other markets is also a source of human capital formation.

Q1. Which of the following is the source of human capital formation in India?

- Acquiring information

- All of these (ans)

Q2. Education provides

- Private benefit

- Social benefit

- Both 1) and 2) (ans)

Q3. __ persons contribute more to the growth of an economy.

Q4. Training given by a company to its employees is generally__________

- Investment (ans)

- Social wastage

- Both 1) and 2)

Tips to Solve Case Study Questions in Economics

Let’s understand how you can solve case study questions in class 12 Economics. The two books are Macroeconomics and Indian Economic Development.

- Read the passage thoroughly

- Can follow a reversal pattern, especially macroeconomics questions, i.e. read questions first and then look for the answers in the passage.

- In case the question asked is about Indian Economic Development, read the passage very carefully as most of the answers would be hidden in the passage itself.

- Macro Economics questions will be more application-based and would test your conceptual clarity.

- Answer briefly and precisely.

Important Chapters – Economics Case Study Questions

Following are some of the very important topics that need to be prepared very thoroughly under CBSE class 12 Economics. We expect that CBSE will certainly ask case-based questions from these chapters.

- National income and its aggregates

- Government budget

- Current challenges faced by the Indian economy

“Stop waiting for tomorrow, Start now”

Test Generator

Create question paper PDF and online tests with your own name & logo in minutes.

Question Bank, Mock Tests, Exam Papers, NCERT Solutions, Sample Papers, Notes

Related Posts

- Competency Based Learning in CBSE Schools

- Class 11 Physical Education Case Study Questions

- Class 11 Sociology Case Study Questions

- Class 12 Applied Mathematics Case Study Questions

- Class 11 Applied Mathematics Case Study Questions

- Class 11 Mathematics Case Study Questions

- Class 11 Biology Case Study Questions

- Class 12 Physical Education Case Study Questions

3 thoughts on “Class 12 Economics Case Study Questions”

thanks for your information, dont forget to visit airlangga university website https://www.unair.ac.id/mahasiswa-unair-dan-y20-indonesia-diskusikan-isu-resesi-ekonomi/

thank you for Economics MCQs

https://mcqquestions.net/economics

Leave a Comment

Save my name, email, and website in this browser for the next time I comment.

AssignmentsBag.com

Case Study Chapter 5 Government Budget and Economy

Please refer to Case Study Chapter 5 Government Budget and Economy with answers provided below. These case study based questions are expected to come in the upcoming Class 12 Economics examinations. We have provided economics case studies with answers class 12 for all chapters on our website as per the latest examination pattern issued by CBSE, NCERT, and KVS.

Chapter 5 Government Budget and Economy Economics Case study with Answers Class 12

Case Based Questions :

Finance Minister Nirmala Sitharaman has pegged fiscal deficit for the coming year 2021-22 at 6.8% of GDP and aims to bring it back below the 4.5% mark by 2025-26. The original fiscal deficit target for 2020-21 was 3.5%. However, in reality, the deficit shot up to a high of 9.5% of GDP due to the double impact of the COVID-19 pandemic- low revenue flows due to the lockdown and negative economic growth clubbed with the high government spending to provide essential relief to the vulnerable sections of the society, as well as a stimulus package aimed at reviving domestic demand.

Question. Fiscal deficit is financed through: (a) Borrowings (b) Tax revenue receipts (c) Disinvestment (d) All of the above

Question. If fiscal deficit is ₹4000 crore and interest payments is ₹500 crore, then primary deficit is: (a) ₹4,500 crore (b) ₹ 3,500 crore (c) ₹ 5,000 crore (d) ₹ 4,200 crore

Question. Deficit budget refers to a situation when: (a) government’s budget expenditure is less than its budget receipts (b) government’s budget expenditure is more than its budget receipts (c) government’s budget expenditure is equal to its budget receipts (d) government’s budget receipts are more than its budget expenditure

Question. Fiscal deficit is equal to: (a) Total expenditure -Total receipts other than borrowings (b) Capital expenditure – Capital receipts (c) Revenue expenditure – Revenue receipts (d) Revenue expenditure + Capital expenditure – Revenue receipts

Presenting the Union Budget for 2021-22, Finance Minister Nirmala Sitharaman said that the budget proposals for this financial year rest on six pillars – health and well-being, physical and financial capital and infrastructure, inclusive development for aspirational India, reinvigorating human capital, innovation and R &D, and ‘Minimum Government, Maximum Governance’. Significant announcements included a slew of hikes in customs duty to benefit Make in India, proposal to disinvest two more public sector banks (PSBs) and a general insurance company, and numerous infrastructure pledges to poll- bound states.

Question. Which of the following is not an objective of government budget? (a) Reallocation of resources (b) Increasing regional disparities (c) Economic Stability (d) Economic Growth

Question. In which of the following taxes, the impact and incidence of the tax lies on different person? (a) Goods and service tax (b) Custom duty (c) Income tax (d) both (a) and (b)

Question. Disinvestment of a general insurance company is an example of: (a) revenue receipt (b) revenue expenditure (c) capital receipt (d) capital expenditure

Question. Expenditure on infrastructure is a capital expenditure because: (a) It creates liability of the government (b) It reduces assets of the government (c) It increases assets of the government (d) It neither creates any liability nor reduces any asset of the government

Related Posts

Functions Class 12 Computer Science Important Questions

Class 12 chemistry important questions.

Class 12 Political Science Important Questions

NCERT Solutions for Class 12 Macro Economics Chapter 5 Government Budget and the Economy

NCERT Solutions for Class 12 Economics Chapter 5 Government Budget and the Economy – Macroeconomics designed and developed for session 2024-25023. Along with the solutions, student can get here class 12 Macroeconomics chapter 5 MCQ, Case Studies and extra question answers.

Class 12 Macroeconomics Chapter 5 Macroeconomics Government Budget and the Economy Question answers

- Class 12 Macroeconomics Chapter 5 Solutions

- Class 12 Macroeconomics Chapter 5 MCQ

- Class 12 Macroeconomics Chapter 5 Case Studies

- Class 12 Macroeconomics NCERT Books PDF

- Class 12 Economics all Chapters Solutions

- Class 12 all Subjects NCERT Solutions

There is a constitutional demand in Republic of India to present before the Parliament, an announcement of calculable receipts and expenditure of the govt in respect of each financial year which runs from 1st April to 31st March. This ‘Annual Financial Statement’ represent the primary budget document of the govt. The govt plays an awfully vital role in increasing the welfare of the people. Government provides certain goods and services that can’t be provided by the market mechanism, i.e.; by exchange between individual shoppers and producers.

Example of such merchandise are national defence, roads, government administration, etc., that are noted as public goods. To grasp why public merchandise, got to be provided by the govt, we must understand the difference between non-public merchandises such as garments, cars, food items, etc. and public merchandise. The benefit of public goods is available to all and not restricted to one particular user. Think about a public park or measures to scale back pollution, the advantages are obtainable to all or any. Just in case of personal merchandise, anyone who does not pay to obtain the product, can be excluded from enjoying its advantages. Like, if you don’t buy a ticket of the movie, you may not be allowed to enter the cinema hall.

However, in case of public merchandise, there is no possible approach of excluding anyone from enjoying the advantages of the product. That is why public merchandise is known as non-excludable. Even if some users do not pay, it’s tough and typically not possible to gather fees for the general public merchandise. These non-paying users are known as ‘free-riders’. There is, however, a distinction between public provision and public production. Public provision implies that they’re finances through the budget and may be used with none direct payment. Public merchandise could also be created by the govt or the non-public sector. When goods are created directly by the govt, it is known as public production.

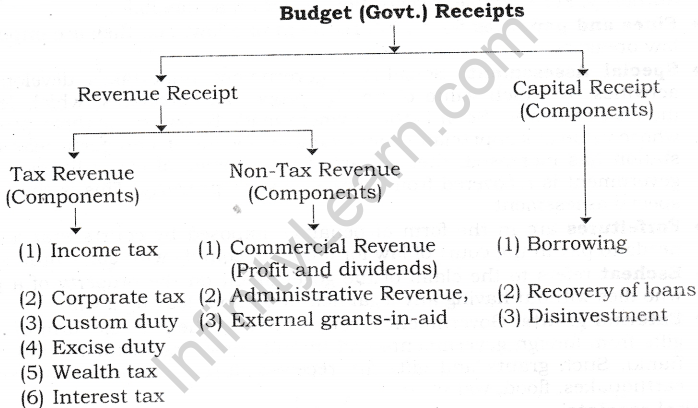

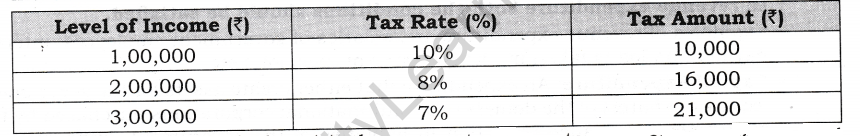

Revenue receipts : These receipts are those receipts that don’t lead result in a claim on the govt. They’re thus termed non-redeemable. They’re divided into tax and non-tax revenues. Taxation, a vital element of revenue receipts, have for long been divided into direct taxes and companies, and indirect taxes like excise taxes, custom duties and service taxes. Alternative direct taxes like wealth tax, gift tax and state duty haven’t brought in a great deal of revenue and therefore are remarked as paper taxes. The distribution objective is wanted to be achieved through progressive financial gain taxation, within which higher the financial gain, higher is that the rate. Companies are taxed on a proportional basis, wherever the rate could be an explicit proportion of the profits.

With respect to excise taxes, requirements of life are exempted or taxed at low rates, comforts and semi-luxuries are moderately taxed and luxuries, tobacco and fossil fuel merchandise are taxed heavily. Non-tax revenue of the central government primarily consists of interest receipts on account of loans by the central government, dividends and profits on investments created by the govt, fees and alternative receipts for services rendered by the govt. Money grant-in-aid from foreign countries and international organisations are enclosed. The estimate of revenue receipts takes into accounts the consequences of tax proposal created within the finance bill.

Capital receipts The govt additionally receives cash by means of loans or from the sale of its assets. Loans can need to be returned to the agencies from that they have been borrowed. Thus, they produce liability. Sale of presidency assets, like sale of shares in Public Sector Undertakings, that is remarked as PSU withdrawal, cut back the whole quantity of monetary assets of the govt. All those receipts of the govt that produce liability or cut back monetary assets are termed as capital receipts.

Revenue expenditure : It is an expenditure incurred for purposes other than the creation of physical or financial assets of the central govt. It relates to those expenses incurred for the normal functioning of the govt departments and various services, interest payment on debt incurred by the govt, and grants given to state govt and other parties. Budget documents classify total expenditure into planned and non-planned expenditure. By this classification, planned revenue expenditure relates to the central plans and central assistance for state and union territory plans.

Non-plan expenditure, covers a vast range of general, economic and social services of the govt. The main items of non-plan expenditure are interest payments, defence services, subsidies, salaries and pensions. Interest payments on market loan, external loans and from various reserve funds constitute the single largest component of non-plan revenue expenditure. Defence expenditure, is committed expenditure in the sense that given the national security concerns, there exists little scope for drastic reduction. Subsidies are an important policy instrument which aims at increasing welfare. Apart from providing implicit subsidies through under-pricing of public goods and services like education and health, the government also extends subsidy explicitly on items such as exports, interest on loans, food and fertilisers.

Capital expenditure There are expenditure of the govt which result in creation of physical or financial assets or reduction in financial liabilities. This includes expenditure on the acquisition of land, building, machinery, equipment, investment in shares, and loan and advances by the central govt to state and union territory govts, PSUs and other parties. Capital expenditures are also categorised as plan and non-plan in the budget documents. Plan capital expenditure, like its revenue counterpart, relates to central plan and central assistance for states and union territory plans. Non-plan capital expenditure covers various general, social and economic services provided by the govt.

What are the important topics of class 12 Macroeconomics chapter 5?

Class 12 Macroeconomics chapter 5 carries 6 marks according to CBSE board- split into two sub topics namely Foreign exchange and balance of payment. There are three systems of Foreign exchange determination. India follows the managed floating system. We study the merits and demerits of the fixed exchange system and the flexible exchange system. We try to understand what determines the demand and supply of foreign exchange in a flexible exchange rate system, We can also understand and appreciate the benefits/consequences of devaluation/ depreciation of currency. In the topic Balance of Payment (which is the concluding chapter of macroeconomics), we study the components of BOP namely the current account and the capital account. The current account deficit (CAD) can and does have adverse consequences on the overall BOP possession and foreign exchange rate (particularly the US Dollar). Numerical on calculation on BOT, current account deficit, devaluation of currency can also be asked in the Board examination- though the marks allotted would be 1 or 2. Students should note that these two sub-topics namely Balance of Payment and Foreign exchange are interrelated. Any deficit in BOP affects the foreign exchange rate adversely. Hence, these two have been combined into one unit.

What are the main concepts to prepare 12th Macroeconomics chapter 5?

The important concepts in the topic determination of foreign exchange are- Foreign exchange rate, Foreign exchange market, Devaluation, Depreciation, Revaluation and Appreciation of currency, Speculation, demand for foreign currency and supply of foreign currency. The important concepts in BOP are current account, Capital account, BOT, Autonomous items, accommodating items, disequilibrium in BOP, surplus or deficiting BOP, visible and invisible items in current account, Unilateral transfers.

Which questions, in chapter 5 of 12th Economics, are considered as most important for examination perspective?

- Discuss the concepts of: (2 marks each) (a) Fixed exchange rate system (b) Flexible exchange rate system (c) Managed floating rate system.

- Discuss the major reasons for demand (outflow) and supply (inflow) of foreign exchange. (4 marks)

- Distinguish between: (2- 3 marks each) (a) Devaluation and depreciation of domestic currency (b) Revaluation and Appreciation of Domestic Currency.

- What is the meaning of balance of payments? State its main components (3 marks)

- Distinguish between Autonomous items and Accommodating items. (3 marks)

- What is meant by deficit in balance of payments? How is it corrected? (3 marks)

What are the main Abbreviations in class 12 Macroeconomics chapter 5 to learn?

- BOP = Balance of payment

- BOT = Balance of trade

- CAD = Current account deficit

- NRI = Non – resident Indian

- CAS = Current account Surplus

- TCS = Tata consultancy services

- MNC = Multi-national corporations

Copyright 2024 by Tiwari Academy | A step towards Free Education

25,000+ students realised their study abroad dream with us. Take the first step today

Here’s your new year gift, one app for all your, study abroad needs, start your journey, track your progress, grow with the community and so much more.

Verification Code

An OTP has been sent to your registered mobile no. Please verify

Thanks for your comment !

Our team will review it before it's shown to our readers.

- Economics /

Government Budget And The Economy Class 12

- Updated on

- Mar 19, 2021

Every new year, the whole country eagerly waits for the new fiscal or the nation’s budget that the government presents in the parliament. Almost every news channel covers and telecasts this important day before the country. Class 12 Macroeconomics covers many such new topics that we have never discussed before in earlier classes. The chapter of Government Budget and the Economic is one such chapter that will make you understand the importance and need of government budget. It is an important part of class 12 economics . This blog will cover the study notes on the chapter Government Budget and the economy class 12.

This Blog Includes:

What is the government budget , objectives of the government budget, components of government budget , budget receipts , revenue receipts vs capital receipts , tax revenues vs non-tax revenues , budget expenditure , plan expenditure vs non-plan expenditure, types of budget, implications of revenue deficits and fiscal deficits, measures to reduce or correct different deficits.

According to the chapter government budget and the economy class 12, the government budget is basically an annual final statement which shows item wise expenditures of the government or a ruling entity during a fiscal year. It also presents the anticipated tax revenues and proposed spending or expenditures in areas like Healthcare, Defence, Education, Infrastructure, Banks, State Benefits, etc. The fiscal year is taken into account from 1st April to 31st March.

As per the chapter on Government Budget and the Economy class 12, the main purpose or the main objectives of the government budget is as follows:

- Reallocation of resources

- Redistribution of activities

- Stabilizing economic activities

- Management of public enterprises

- Economic growth

- Generation of employment

According to Government Budget and the Economy class 12, there are 2 components of the budget. These are:

- Revenue Receipts

- Revenue Expenditure

- Capital Receipts

- Capital Expenditure

According to the chapter government budget and the economy class 12, the budget receipts refer to the estimated receipts/revenue or money receipts that the government may earn from all the sources during a fiscal year. Receipts can be of 2 types, i.e. revenue receipts and capital receipts.

Government budget and the economy class 12 chapter gives the various differences between revenue receipts and capital receipts. They are tabulated below:

As we have discussed above in this blog of Government Budget and the Economy class 12 study notes, the revenue receipts are divided into 2 categories which are tax revenue receipts and non-tax revenue receipts. The tax revenue receipts can further be divided into 2 categories:

- Direct taxes

- Indirect taxes

On the other hand, the non-tax revenues, which is the second type of revenue receipts which government may receive from all other sources other than taxes are:

- Commercial Revenue

- Dividends and Profits

- External Grants

- Administrative Revenues

- License Fee

- Fines and/or Penalties

- Cash grants-in-aid from foreign countries and international organisations or the World Bank

The second component of the government budget is, of course, the government budget expenditure. As we have discussed above, these are of two types, the revenue expenditure and the capital expenditure. Let us understand the difference between these two according to Government Budget and the Economy class 12.

According to the chapter on Government Budget and the Economy class 12, expenditures can be of 2 types:

- Plan expenditures : all those expenditures of the government that are to be incurred during the fiscal or the financial year on things like development and investment programs are termed as plan expenditures.

- Non-plan expenditures : all those expenditures of the government that are not included in the current five year plan are termed as non-plan expenditures.

According to the chapter on Government Budget and the Economy class 12, we can bifurcate the government budget into 3 major types:

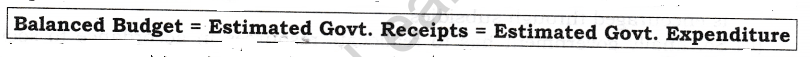

- Balanced Budget: when estimated receipts are equal to the government estimated expenditures.

- Surplus Budget: when government estimated receipts are shown more than the government estimated expenditures.

- Deficit Budget: when government estimated receipts are shown less than the government estimated expenditures. This implies an increase in the government liabilities and fall in the reserves.

Deficit can be of 3 types:

- Revenue Deficit: Total Revenue Expenditure – Total Revenue Receipts

- Fiscal Deficit: Total Budget Expenditure – Total Budget Receipts excluding borrowings

Fiscal Deficit = Borrowings

- Primary Deficit: Fiscal Deficit Interest Payment

Moving further in the government budget and the economy class 12, it mentions the implications of revenue deficits and fiscal deficit. They are tabulated below.

As per the chapter on Government Budget and the Economy class 12, the measures that can be adopted to reduce or correct different deficits in the economy are:

- Borrowing from international monetary institution and other countries

- Lowering government expenditure

- Increasing government revenue

- Monetary expansion

- deficit financing

- Borrowing from public

- Disinvestment

So we end this blog on Government Budget and the Economy class 12 chapter of macroeconomics hoping that this may prove to be helpful for that last moment revision for your exams. If you want to study abroad after 12th commerce or want to know more about the courses after 12th commerce , reach out to our experts at Leverage Edu . Sign up for a free session today!

Team Leverage Edu

Leaving already?

8 Universities with higher ROI than IITs and IIMs

Grab this one-time opportunity to download this ebook

Connect With Us

25,000+ students realised their study abroad dream with us. take the first step today..

Resend OTP in

Need help with?

Study abroad.

UK, Canada, US & More

IELTS, GRE, GMAT & More

Scholarship, Loans & Forex

Country Preference

New Zealand

Which English test are you planning to take?

Which academic test are you planning to take.

Not Sure yet

When are you planning to take the exam?

Already booked my exam slot

Within 2 Months

Want to learn about the test

Which Degree do you wish to pursue?

When do you want to start studying abroad.

September 2024

January 2025

What is your budget to study abroad?

How would you describe this article ?

Please rate this article

We would like to hear more.

- NCERT Solutions

- NCERT Class 12

- NCERT Class 12 Economics

- NCERT Class 12 Macro Economics

- Chapter 5: Government Budget And Economy

NCERT Solution for Class 12 Macroeconomics Chapter 5 - Government Budget and Economy

NCERT Solutions are considered one of the best study materials while preparing for the CBSE Class 12 Economics Board examinations. These Solutions of NCERT are collated by the subject matter experts to help students improve their understanding of economic concepts.

Download the PDF of NCERT Solutions for Class 12 Economics Chapter 5 – Government Budget and Economy

carouselExampleControls111

Previous Next

Access NCERT Solutions for Class 12 Economics Chapter 5

NCERT Macroeconomics Solutions Class 12 Chapter 5

1. Explain why public goods must be provided by the government.

Public goods are those goods where there is no competition, and the use of goods is not restricted to only one individual. These goods are for use by all individuals in society. Such goods are used for the welfare of society.

Therefore, the government should provide public goods for the following reasons:

1. So that benefits of the public goods can be enjoyed by all members of the society.

2. So that the consumption of these goods will not impact the consumption of any other individual.

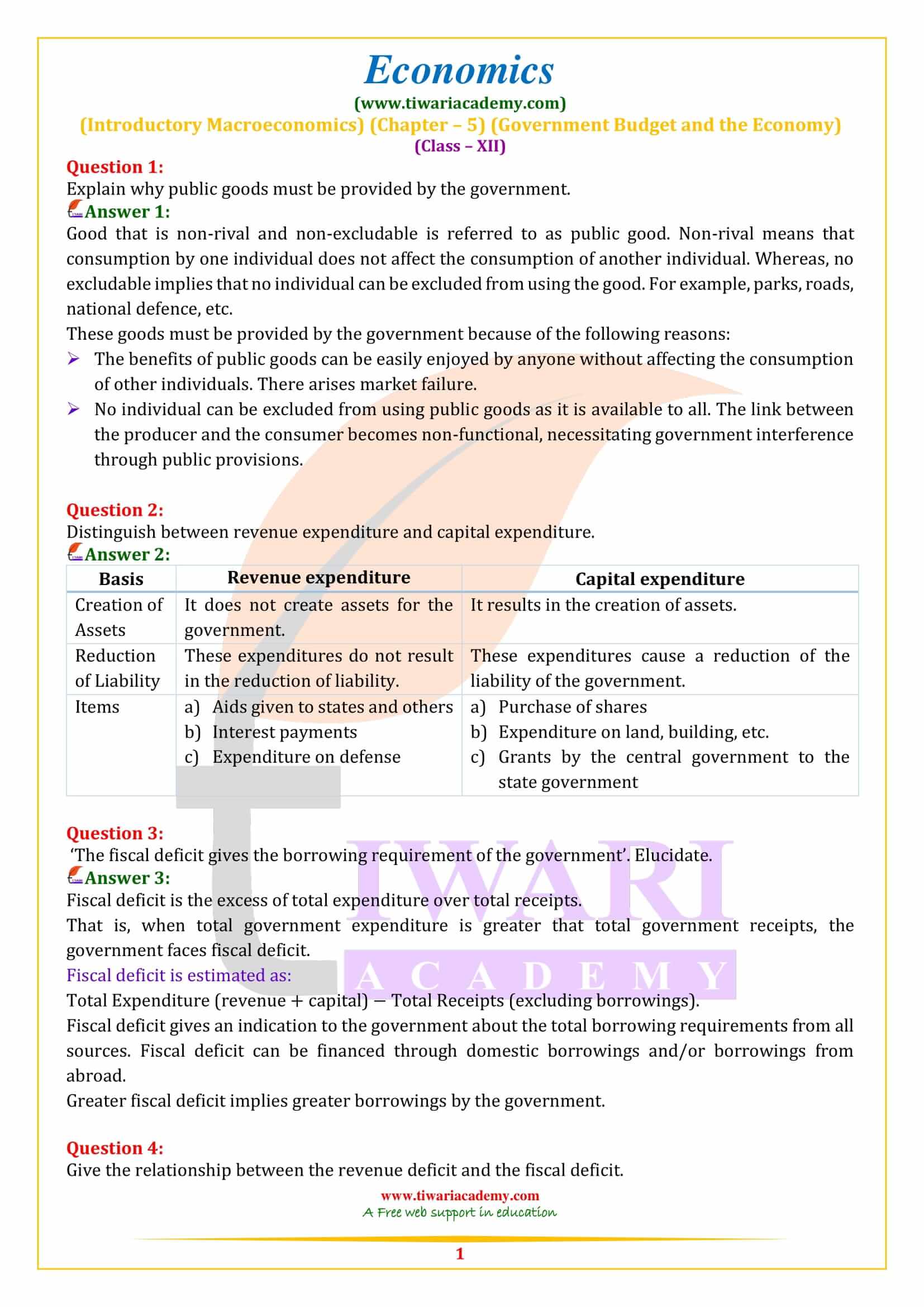

2. Distinguish between revenue expenditure and capital expenditure.

3. ‘The fiscal deficit gives the borrowing requirement of the government.’ Elucidate.

A fiscal deficit is referred to as a shortfall in the government’s income as compared to its spending. A high fiscal deficit means that the government is borrowing more money than it is earning. A higher fiscal deficit creates a burden of loan and interest payments for the future generation.

Fiscal deficit is determined by

Total Expenditure – Total Receipts excluding borrowings

4. Give the relationship between the revenue deficit and the fiscal deficit.

A revenue deficit is referred to as an excess of revenue expenditure as compared to earnings by revenue receipts of the government. A fiscal deficit is a bigger phenomenon where the difference is between the total expenditure and total receipts obtained by the government. When the revenue deficit increases correspondingly, the fiscal deficit also increases.

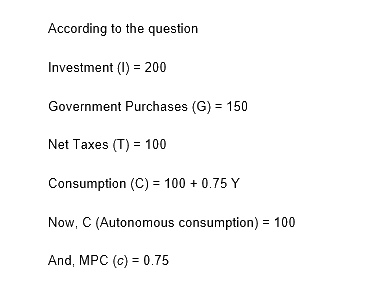

5. Suppose that for a particular economy, investment is equal to 200, government purchases are 150, net taxes (that is, lump-sum taxes minus transfers) is 100 and consumption is given by C = 100 + 0.75 Y (a) What is the level of equilibrium income? (b) Calculate the value of the government expenditure multiplier and the tax multiplier. (c) If government expenditure increases by 200, find the change in equilibrium income.

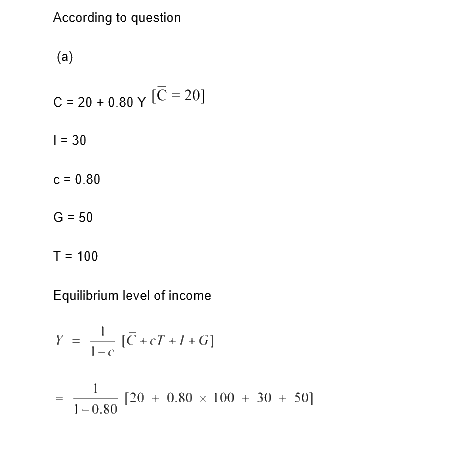

6. Consider an economy described by the following functions: C = 20 + 0.80Y, I = 30, G = 50, TR = 100 (a) Find the equilibrium level of income and the autonomous expenditure multiplier in the model. (b) If government expenditure increases by 30, what is the impact on equilibrium income? (c) If a lump-sum tax of 30 is added to pay for the increase in government purchases, how will equilibrium income change?

7. In the above question, calculate the effect on the output of a 10 per cent increase in transfers and a 10 per cent increase in lump-sum taxes. Compare the effects of the two.

8. We suppose that C = 70 + 0.70 Y D, I = 90, G = 100, T = 0.10 Y (a) Find the equilibrium income. (b) What are tax revenues at equilibrium Income? Does the government have a balanced budget?

9. Suppose the marginal propensity to consume is 0.75, and there is a 20 per cent proportional income tax. Find the change in equilibrium income for the following (a) Government purchases increase by 20 (b) Transfers decrease by 20.

Therefore, the change in equilibrium income is 20.

10. Explain why the tax multiplier is smaller in absolute value than the government expenditure multiplier.

The tax multiplier always has a negative value and therefore is smaller in absolute value than the government expenditure multiplier. Government expenditure creates an impact on the total expenditure and the taxes through the multiplier. It also influences disposable income, which impacts the overall consumption level.

The following example will help in understanding the tax multiplier better.

Assume MPC be to 0.50.

Now, the government expenditure multiplier = 1 / 1 – c

= 1 / 1 – 0.50

Tax multiplier = – c / 1- c

= -0.50 / 1 – 0.50

This shows that the government expenditure multiplier is always more than the tax multiplier.

11. Explain the relation between government deficit and government debt.

A government, in order to adjust the government deficit, which is created due to borrowings by the government, seeks more borrowings; these borrowings create further debt for the government in the form of interest payments. Therefore, an increase in the deficit will lead to an increase in debt.

12. Does public debt impose a burden? Explain.

Public debt is referred to the amount of money that a government owes to banks, financial institutions and other sources of finance. It is known to impose a burden on the economy in the following ways:

1. Government may impose taxes or print new money to repay the existing debts. Such a situation will hamper the productivity of the nation.

2. A high level of debt creates a burden on future generations in the form of interest and taxes being levied on the younger generation, which will result in lower consumption and savings.

3. More investments are attracted by the government by raising the interest rates on bonds and securities. Therefore, citizens’ money is utilised by the government and hence less private investment.

4. Wealth of the nation is depleted when loans are repaid to foreign institutions and countries.

13. Are fiscal deficits inflationary?

A fiscal deficit will not always result in inflation. If a situation arises when government expenditure increases and tax reduction is seen, it will cause a deficit in the government, which leads to an increase in aggregate demand. Firms will not be able to meet the demand thus generated, which will result in a price increase. Therefore, fiscal deficits can become inflationary, but they will not be inflationary in the case when resources are less utilised due to insufficient demand and less output. Then, if the government is spending more also, more resources will be employed in order to meet the growing demand, and there will be no pressure on price rise. In such a situation, a high fiscal deficit, along with high demand and greater output, will not create an inflationary situation.

14. Discuss the issue of deficit reduction.

Government can reduce the budget deficit by the following methods:

1. Decreasing expenditure

2. Increasing Revenue

Decreasing Expenditure can be achieved by

a. More planned activities should be undertaken by the government to reduce expenditure.

b. Encouraging the private sector to contribute to some major capital projects will help reduce expenditure.

An increase in revenue can be obtained by

a. Raising taxes or introducing new taxes can contribute to an increase in revenue.

b. By selling stakes in PSU, the process called divestment can bring in more revenue.

NCERT Solution for Class 12 Economics Chapter 5 – Government Budget and Economy. This chapter explains, in brief, a manner about how the budget and employment are determined.

Chief concepts of this chapter –

- Government Budget

- Objectives of Government Budget

- Public goods

- Revenue receipts

- Capital receipts

NCERT Solutions for Class 12 Economics Chapter 5 provide many illustrative examples, which help the students to comprehend and learn quickly. The above-mentioned are the illustrations for the Class 12 CBSE syllabus. For more solutions and study materials of NCERT Solutions for Class 12 Economics, visit BYJU’S website or download the app.

Also, explore –

NCERT Solutions for Class 12 Macroeconomics

Leave a Comment Cancel reply

Your Mobile number and Email id will not be published. Required fields are marked *

Request OTP on Voice Call

Post My Comment

- Share Share

Register with BYJU'S & Download Free PDFs

Register with byju's & watch live videos.

Counselling

- Bihar Board

SRM University

Tn 12th hse result 2024.

- CBSE 10th Result 2024

- CBSE 12th Result 2024

- TN Board Result 2024

- CG Board Result 2024

- CISCE Board Result 2024

- Karnataka Board Result 2024

- Shiv Khera Special

- Education News

- Web Stories

- Current Affairs

- नए भारत का नया उत्तर प्रदेश

- School & Boards

- College Admission

- Govt Jobs Alert & Prep

- GK & Aptitude

- CBSE Class 12

CBSE Class 12 Economics Important Case Study Based Questions for 2023 Board Exams

Cbse class 12 economics important case study based questions: class 12th economics exam is just a few hours away. get important case study questions to practice before cbse class 12 economics board examinations scheduled to be conducted on march 17, 2023. .

Important Case Study Based Questions for CBSE Class 12 Economics Board Exam 2023

Read the following case study paragraph carefully and answer the questions on the basis of the same..

Q1 The central bank of India i.e. Reserve Bank of India, is the apex institution that control the entire financial market. It's one of the major functions is to maintain the reserve of foreign

exchange. Also, it intervenes in the foreign exchange market to stabilise the excessive fluctuations in the foreign exchange rate.

In other words, it is the central bank's job to control a country's economy through monetary policy; if the economy is moving slowly or going backward, there are steps that central bank can take to boost the economy. These steps, whether they are asset purchases or printing more money, all Involve injecting more cash into the economy. The simple supply and demand economic projection occur and currency will devalue.

When the opposite occurs, and the economy is growing, the central bank will use various methods to keep that growth steady and in-line with other economic factors such as wages and prices.

Whatever the central bank does or in fact don't do, will affect the currency of that country.

Sometimes, it is within the central bank's interest to purposefully effect the value of a currency.

For example, if the economy is heavily reliant on exports and their currency value becomes too high, importers of that country's commodities will seek cheaper supply; hence directly effecting the economy.

1 Which of the following tools are used by the central bank to control the flow of money in domestic economy?

(a) Fiscal tools (b) Quantitative monetary tools

(c) Qualitative monetary tools (d) Both (b) and (c)

- a) Tighten the money supply in the economy

- b) Ease the money supply in the economy

- c) Allow commercial banks to work under less strict environment

- d) Both (b) and (c)

3 Which of the following steps should be taken by the central bank if there is an excessive rise in the foreign exchange rate?

(a) Supply foreign exchange from its stock

(b) Demand more of other foreign exchange

(c) Not intervene in the market as the exchange rate is determined by the market forces

(d) Help central government to stabilize the foreign exchange rate.

Answer:

1(d) Both (b) and (c)

2(a) Tighten the money supply in the economy

3(a) Supply foreign exchange from its stock

Q2 Changes in aggregate demand bring about changes in the level of output, employment, income, and price. These changes are generally cyclical in nature. These changes, more generally, follow a cycle of four different stages namely boom, recession, depression and recovery. The cyclical nature of economic activity is known as trade cycle or business cycle. Boom is a stage of economic activity characterized by rising prices, rising employment, rising purchasing power.

- During the time of ‘excess demand’, Govt. should .................. the public expenditure.

- a) Reduce b) increase c) unchanged d) none of these.

- Investment depends on: a) Supply b) income c) saving d) Both (a) and (c)

Answer: Income.

Q3 In the modern world, govt. aims at maximizing the welfare of the people and the country. It

requires various infrastructure and economic welfare activities. These activities require huge govt. spending through appropriate planning and policy. Budget provides a solution to all these concerns. Budget is prepared by the government at all levels.

Estimated expenditure and receipts are planned as per the objectives of the government. In India, budget is prepared by the parliament on such a day as the president may direct. The parliament approves the budget before it can be implemented. The receipts and expenditures as shown in the budget are only the estimated values for the upcoming fiscal year, and not the actual figure.

- a) Reallocation of resources.

- b) Re distribution of income

- c) Reducing expenditure

- d) Economic stability.

Answer: c) Reducing expenditure

Answer: False

Q4 India’s balance of payments position improved dramatically in 2013-14 particularly in the last three quarters. this moved in large part to measure taken by the government and the Reserve Bank of India (RBI) and eat some part to the overall macro-economic slowdown that fed into the external sector. current account deficit (CAD) declined sharply from a record high of U.S. dollar 88.2 billion (4.7% of GDP) in 2012 -1/3 to U.S. dollars 32.4 billion (1.7% of GDP) in 2013 -14. After staying at perilously unsustainable levels off well over 4.0 percentage of GDP in 2011 -12 and 2012 -13, the improvement in BOP position is a welcome relief, and there is need to sustain the position going forward. This is because even as CAD came down, net capital flows moderated sharply from U.S. dollars 92.0 billion in 2012 -13 do U.S. dollar 47.9 billion in 2013-14, that two after a special swap window of

The RBI under the nonresident Indian (NRI) scheme / overseas borrowings of banks alone yielded U.S. dollar 3 4.0 billion. This led to some increase in the level of external debt, but it has remained at the manageable levels. the large depreciation of the rupee during the course of the year, note with standing sizable accretion to reserve in 2013 – 14, could partly be attributed to frictional forces and partly to the role of expectations in the forex market. the rupiah has stabilized the recently, reflecting an overall sense of confidence in the forex market as in the other financial markets of a change for better economic

prospects there is a need to nurture and build upon this optimism through creation of an enabling environment for investment inflows so as to sustain the external position in an as yet uncertain global milieu. --------- The Hindu, archives

- a) credit, capital account

- b) debit, capital account

- c) credit, current account

- d) debit, current account

- a) current account

- b) revenue account

- c) capital account

- d) official reserves

- a) outward flow of foreign exchange

- b) inward flow of foreign exchange

- c) decrease in the level of external debt

- d) decrease in future claims

Answers: 1.b 2. c 3. b 4. d

Q5 The green revolution for the third agricultural revolution is the set of research technology

e-transfer initiatives earring between GNE E and the late 1960 that increased agricultural

production worldwide beginning most markedly in the late 1960 the initiative resulted in

the adoption of new technologies including high yield varieties of CSR rules of cells

especially does wheat and rice it was associated with chemical fertilizers agrochemicals

and controlled water supply and newer methods of cultivation including machine isolation

National bank for agriculture and rural development is and apex development finance

institution fully owned by government of India the bank has been entrusted with Martyrs

concerning policy planning and operations in the field of credit for agriculture and other

economic activities in rural areas in India.

1 Who among the following is known as the father of green revolution

(a) Dr. M S Swaminathan

(b) Dadabhai Naoroji

(c) Vikram Sarabhai

(d) all of these

2 Green revolution is also known as ..................

(a) Golden revolution

(b) milk revolution

(c) Wheat revolution

(d) None of this

3 Which of the following institutions were setup as the apex body in rural areas to support the small farmers in the adoption of modern farming methods?

4 Green revolution was the ............... set of agricultural reforms brought in India

Answer: 1 (a) 2 (c) 3 (d) 4(c)

- Narasimha Rao. This policy opened the door of the India Economy for the global exposure for the first time. In this New Economic Policy P. V. Narasimha Rao governmentreduced the import duties, opened reserved sector for the private players, devalued the Indian currency to increase the export. This is also known as the LPG Model of growth. New Economic Policy refers to economic liberalization or relaxation in the import tariffs, deregulation of markets or opening the markets for private and foreign players, and reduction of taxes to expand the economic wings of the country. Former Prime Minister Manmohan Singh is considered to be the father of New Economic Policy (NEP) of India. Manmohan Singh introduced the NEP on July 24,1991. Main Objectives of New Economic Policy – 1991, July 24 The main objectives behind the launching of the New Economic policy (NEP) in 1991 by the union Finance Minister Dr. Manmohan Singh are stated as follows:

The main objective was to plunge Indian Economy in to the arena of ‘Globalization and to give it a new thrust on market orientation. The NEP intended to bring down the rate of inflation.

1 New Economic Policy of India was launched in the year 1991 under the

- P. V. Narasimha Rao

- Atal Bihari Bajpayi

- Sharad Pawar

- None of these

2 .................................. is also known as the LPG Model of growth. ((choose

the correct alternative)) (New Economic Policy / New Education Policy)

Answer: New Economic Policy

3 State whether the given statement is true or false:

Former Prime Minister Manmohan Singh is considered to be the father of New Economic Policy (NEP) of India. ((choose the correct alternative))

True / False

Answer: True

Q7 Both forms of capital formation are the outcomes of conscious investment decisions. The decision regarding investment in physical capital is taken on the basis of one’s knowledge in this regard. The ownership of physical capital is the outcome of the conscious decision of the owner the physical capital formation is mainly an economic and technical process.

Human capital formation takes place in one’s life when she/he is unable to decide whether it would maximize her/his earnings. Children are given different types of school education and health care facilities by their parents and society. Moreover, the human capital formation at this stage is dependent upon the already formed human capital at the school level. Human capital formation is partly a social process and partly a conscious decision of the possessor of the human capital.

- a) Human capital is intangible whereas physical capital is tangible.

- b) Human capital can cope up with the changing technology whereas physical cannot.

- c) Human capital generates both personal and societal benefits whereas physical capital generates only personal benefit.

- d) Human capital gets obsolete with time whereas physical capital does not.

- In the context of the paragraph, it can be argued that human capital depreciates faster than the physical capital. The given statement is:

- c) Partially true

- d) can’t comment due to lack of proper estimation mechanism

- Machines and industrial tools are examples of _

- a) Physical capital

- b) Human capital

- c) Both physical and human capital

- d) Natural capital

- Investment in education by parents is the same as_______

- a) Investment in intermediate goods by companies

- b) Investment in CSR activity by companies

- c) Investment in capital goods by companies

- d) None of the above

Answer: – c) Investment in capital goods by companies

Q8 The central government will spend Rs. 9800 crores on livestock development over the next five years in a bid to leverage almost Rs. 55000 crore of outside investment into the Animal Husbandry Sector. It would do this by merging a slew of schemes of the Department of Animal Husbandry and Dairying into three main programmes, focused on indigenous cows and dairy development, livestock health and infrastructure development, an official statement said. The Cabinet Committee on Economic Affairs approved the implementation of the special livestock sector package by revising and realigning the various components of the existing schemes in order to boost growth and make animal husbandry more remunerative for the 10 crore farmers engaged in it.

1) Livestock production provides ------------- for the family without disrupting other food producing activities

(a)Increased stability in income

(b) food security

(c)transport and fuel

Answer: (d) all of these

2) The central bank undertakes to invest on livestock development in ----------- (horticulture/ animal husbandry) sector

Answer: animal husbandry

3) State one limitation of livestock sector in India

Answer: The livestock productivity is quite low as compared to other countries

Important resources for Class 12 Economics Board Exam 2023

Get here latest School , CBSE and Govt Jobs notification in English and Hindi for Sarkari Naukari and Sarkari Result . Download the Jagran Josh Sarkari Naukri App . Check Board Result 2024 for Class 10 and Class 12 like CBSE Board Result , UP Board Result , Bihar Board Result , MP Board Result , Rajasthan Board Result and Other States Boards.

- SSC GD Result 2024

- TNDGE HSE +2 Result 2024

- dge.tn.gov.in Result 2024

- tnresults-nic-in 12th Result 2024

- 12th Result 2024 Tamil Nadu

- ICSE 10th, ISC 12th Result 2024

- CISCE Result 2024

- cisce.org Result 2024

- ICSE, ISC Results Rechecking 2024

- DigiLocker ICSE 10th, ISC 12th Result 2024

Latest Education News

Current Affairs Hindi One Liners: 06 मई 2024- आईसीसी महिला टी20 विश्व कप 2024

RIMC Exam 2024 Postponed Due To Lok Sabha Election: Check Revised Schedule

SSC GD Result 2024 Live: Constable Results on ssc.gov.in; Check Expected Cut Off, Merit List Date, Marking Scheme

NIOS 12th Economics Syllabus 2023-2024: Download Class 12 Economics Syllabus PDF

SSC MTS Recruitment 2024 Live: Notification on 7th May, Check Exam Date, Age Limit and Other Details

MJPRU Result 2024 OUT at mjpruiums.in; Download UG and PG ODD Semester Marksheet

Current Affairs Quiz In Hindi: 06 मई 2024- यूनिसेफ इंडिया की नेशनल ब्रांड एंबेसडर

CUET UG History Syllabus 2024; PDF Download Link

Today’s School Assembly Headlines (7 May): Lok Sabha Election 2024, Delhi School Bomb Treats, Poonch Attack, IPL 2024, World Cup, Israel Vs Palestine, and Other News in English

CSIR NET Eligibility 2024: Check Age Limit, Qualification for Junior Research Fellowship (JRF), Lectureship

AU Result 2024 OUT at andhrauniversity.edu.in; Direct Link to Download UG and PG Marksheet

CUET UG 2024 Exam City Out Today: आज जारी होगी सीयूईटी की सिटी इंटीमेशन स्लिप, exams.nta.ac.in/CUET-UG से करें डाउनलोड

COMEDK UGET Admit Card 2024 Releasing Tomorrow, Steps to Download Hall Ticket Here

IPPB Recruitment 2024: Apply Online for 54 Information Technology Executive Vacancies

CGBSE Result 2024: 9 मई तक आ सकते हैं छत्तीसगढ़ बोर्ड 10वीं और 12वीं के नतीजे, यहाँ चेक करें लेटेस्ट अपडेट

CUET UG City Intimation Slip 2024 Live Updates: NTA to Release Exam City Slip Today at exams.nta.ac.in, Confirms UGC Chairman, Get Direct Link to Download Here

AP EAMCET 2024 Application Correction Window Closes Today, Check Steps To Make Changes, Exam Dates

Haryana Board Class 12 Philosophy Syllabus 2024-25: Download Free PDF

NEET 2024: What is Good Score in NEET for Government Colleges?

ICSE ISC Topper List 2024: Check CISCE Class 10th, 12th Toppers Name, Pass Percentage, Marks, Previous Year's Data

Government Budget And The Economy Chapter 4 Notes, QnA 2023

Government budget and the economy, government budget – meaning, objectives and components..

A government budget is an annual financial statement showing item wise estimates of expected revenue and anticipated expenditure during a fiscal year.

Just like your household budget, the government also has a budget of its income and expenditure. In the beginning of every year, the government presents before the Lok Sabha an estimate of its receipts and expenditure for the coming financial year.

The government plans a budget according to its expenditure and then tries to raise funds to meet the proposed expenditure.

Government earns money broadly from taxes, fees and fines, interest on loans given to states and dividends by public sector enterprises.

Government spends mainly on: Securing and providing goods and services to citizens, On law and order and Internal security, defence, staff salaries, etc.

In India there is a constitutional requirement to present a budget before Parliament for the ensuing financial year. The financial (fiscal) year starts on April 1 and ends on March 31 of next year.

General objectives of a government budget are as under:

- To promote rapid and balanced economic growth to improve the living standard of the people.

- To eradicate poverty and unemployment by creating employment opportunities and providing maximum social benefits to the poor

- To reduce inequalities of income and wealth, the government can influence distribution of income through levying taxes and granting subsidies.

- To reallocate resources so as to achieve social and economic objectives. e.g., public sanitation, rural electrification, education, health, etc.

- To bring economic and price stability, by controlling fluctuations in general price level through taxes, subsidies and expenditure.

- To finance and manage public enterprises like railways, power generation and water lines etc.

Components And Classification

There are two main components of the Government Budget.

Revenue Receipts

Incomes which are received by the government from all sources in its ordinary course of governance are revenue receipts.

Revenue receipts are further classified as tax revenue and non-tax revenue.

- Tax Revenue

Tax revenue is the income received from different taxes and other duties levied by the government. It is a major source of public revenue.

Taxes are of two types of tax], viz., Direct Taxes and indirect taxes

Direct taxes are taxes that an individual pays directly to the government, such as income tax, land tax, and personal property tax. Such direct taxes are based on the ability of the taxpayer to pay, higher their capability of paying is, the higher their taxes are.

Indirect taxes are those taxes which are levied on goods and services and affect the income of a person through their consumption expenditure. E.g. Custom duties, sales tax, services tax, excise duties, etc.

- Non-Tax Revenue

Apart from taxes, governments also receive revenue from other non-tax sources.

Fees : Fees paid for registration of property, births, deaths, etc.

Fines and penalties : Fines and penalties for not following (violating) the rules and regulations.

Profits from public sector enterprises : Many enterprises are owned and managed by the government. It is an important source of non-tax revenue. For example in India, the Indian Railways, Oil and Natural Gas Commission, Air India, etc.

Gifts and grants : Gifts and grants are received by the government. Citizens of the country, foreign governments and international organisations like the UNICEF, UNESCO, etc. donate during times of natural calamities.

Special assessment duty : It is a type of levy imposed on the people for getting some special benefit. For example, in a particular locality, if roads are improved, property prices will rise.

Capital Receipts

Receipts which create a liability or result in a reduction in assets are called capital receipts. They are obtained by the government by raising funds through borrowings, recovery of loans and disposing of assets.

Some more examples:

- Loans raised by the government from the public through the sale of bonds and securities. They are called market loans.

- Borrowings by government from RBI and other financial institutions through the sale of Treasury bills.

- Loans and aids received from foreign countries and other international Organisations like International Monetary Fund (IMF), World Bank, etc.

- Receipts from small saving schemes like the National saving scheme, Provident fund, etc.

- Recoveries of loans granted to state and union territory governments and other parties.

Click Below To Learn Other Chapter Notes

- Unit 1: National Income and Related Aggregates

- Unit 2: Money and Banking

- Unit 3: Determination of Income and Employment

- Unit 5: Balance of Payments

- Unit 6: Development Experience (1947-90) and Economic Reforms since 1991

- Unit 7: Current challenges facing Indian Economy

- Unit 8: Development Experience of India

Click Below For Class 12 All Subject Sample Papers 2024

1. 15+ Political Science Sample Paper 2024 2. 15+ Economics Sample Paper 2024 3. 15+ Business Studies Sample Paper 2024 4. 12+ Physical Education Sample Paper 2024 With Solution 5. 15+ Physics Sample Paper 2024 With Solution 6. 15+ Chemistry Sample Paper 2024 With Solution 7. 15+ Biology Sample Paper 2024 With Solution 8. 15+ English Sample Paper 2024 9. 15+ History Sample Paper 2024 10. 15+ Geography Sample Paper 2024 11. 15+ Maths Sample Paper 2024

Classification Of Capital Expenditure And Revenue Expenditure

Capital Expenditure

Any projected expenditure which is incurred for creating asset for a long life is capital expenditure.

Therefore, expenditure on land, machines, equipment, irrigation projects, oil exploration and expenditure by way of investment in long term physical or financial assets are capital expenditure.

The following are the examples of capital expenditure :

Expenditure incurred for :

- Acquisition of fixed tangible assets such as land, building, machinery, furniture, motor vehicle etc. Improvement or extension of fixed assets such as increasing the seating capacity of a theatre.

- Bring the fixed assets to the place of their use and expenditure incurred on their installation or erection such as freight on fixed assets, wages paid for purchase of intangible assets such as goodwill, patent rights, and trademarks, copyright, etc.

- Reconditioning of old fixed assets such as expenditure incurred on repairing or overhealing of secondhand machinery.

- Major repairs and replacement of plants which increase the efficiency of the plant.

Rules for Determining Capital Expenditure.

An expenditure is capital expenditure:

- When it is incurred for acquiring a long term asset (having a useful life of more than one year) for use in the business to earn revenue and not meant for sale.

- When it is incurred to put an asset into working condition. For example, the transportation and installation charges are added to the cost of machine, the legal charges like registration and stamp duty is added to the cost of land and building, etc.

- When it incurred for putting an old asset into working condition is treated as capital expenditure and added to the cost of the asset.

- When it is incurred to increase the earning capacity of a business is treated as capital expenditure. For example, expenditure incurred for shifting the factory to convenient site is a capital expenditure.

Revenue Expenditure

When an expenditure is made for running the business with a view to produce the profits is revenue expenditure. Such expenditure benefits the current period only.

It is incurred to maintain the existing earning capacity of the business. Administrative expenses and selling and distribution expenses are examples of revenue expenditure.

Rules for Determining Revenue Expenditure.

An expenditure incurred:

- For the purpose of acquiring goods purchased for resale, consumable items, etc. Other direct expenses like production and purchase of goods such as wages, power, freight etc. are revenue expenditure.

- For maintaining fixed assets in working order e.g. amount spent on repairs and renewals

- Depreciation on fixed assets

- On office and administrative and selling and distribution departments in the normal course of business. These include salaries, rent, telephone expenses, electricity, postage, advertisement, travelling expenses, commission to salesmen.

- On non-operating expenses and losses are revenue expenditures. For example, interest on loan taken after commencement of commercial production, loss on sale of a long term asset, loss by theft, loss by fire are revenue expenditures.

- By an enterprise to discharge itself from recurring liability is of revenue nature. For example, a lump sum amount paid to a pensioner by the employer is revenue expenditure.

- For protecting the business is a revenue expenditure. For example, the amount spent on propaganda campaign to oppose the threatened nationalisation of industry is of revenue nature.

- To maintain the existing efficiency or the earning capacity is of revenue type.

Distinction Between Capital Expenditure and Revenue Expenditure:

Measures Of Government Deficit

A Deficit is the budgetary situation where expenditure is higher than the revenue. When in a set budget government expenditure exceeds the income amount it is government deficit.

This deficit indicates the financial health of the economy. To reduce this deficit between expenditures and income, the government cut back certain expenditures and also increased revenue-generating activities.

This expenditure revenue gap may be financed by either printing of currency or through borrowing.

Nowadays most governments in the world are having deficit budgets and these deficits are often financed through borrowing.

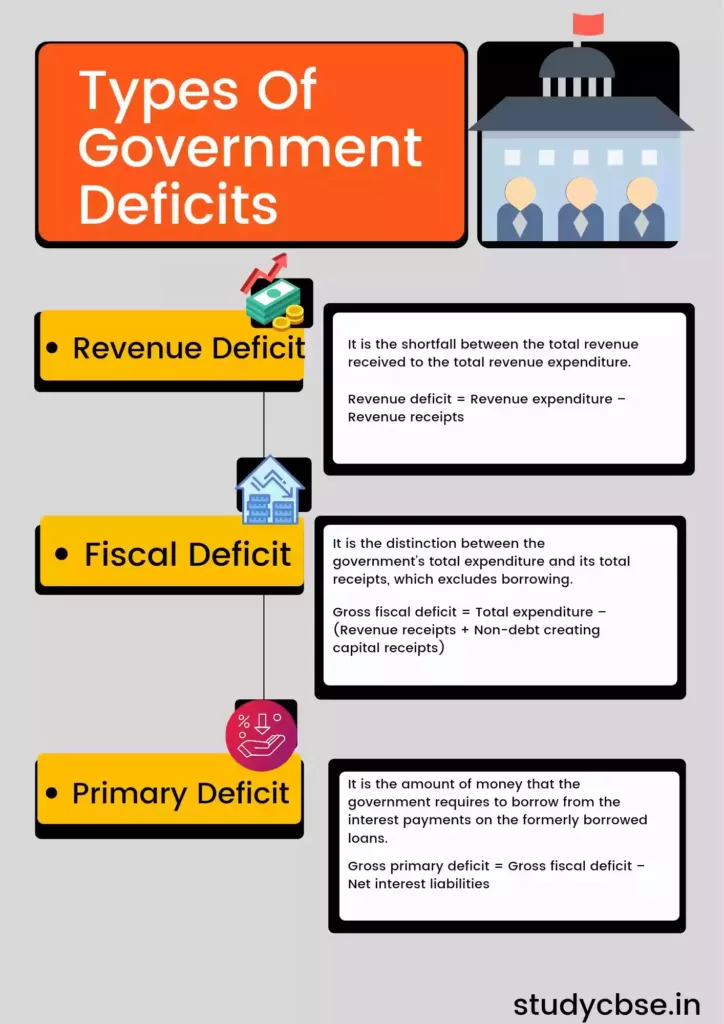

Types Of Government Deficits

- Revenue Deficit

- Fiscal Deficit

- Primary Deficit

Revenue Deficit

It is the surplus of the government’s revenue expenditure over the revenue receipts.

It is the shortfall between the total revenue received to the total revenue expenditure.

Revenue deficit = Revenue expenditure – Revenue receipts

Revenue deficit only incorporates current income and current expenses. A high degree of deficit symbolises that the government should reduce its expenses.

The government may raise its revenue receipts by raising income tax. Disinvestment and selling off assets is another corrective measure to minimise a revenue deficit.

Fiscal deficit

It is the distinction between the government’s total expenditure and its total receipts, which excludes borrowing.

Gross fiscal deficit = Total expenditure – (Revenue receipts + Non-debt creating capital receipts)

A fiscal deficit has to be financed by borrowing. Thus, it includes the total borrowing necessities of the government from all the possible sources. From the financing part.

A greater deficit implies more borrowing by the government and the extent of the deficit indicates the amount of expense for which the money is borrowed.

Gross fiscal deficit = Net borrowing at home + Borrowing from RBI + Borrowing from abroad

Fiscal deficit indicates the amount of money that the government will need to borrow during the financial year.

A disadvantage or implication of fiscal deficit is it may lead to a debt trap or it may lead to unnecessary and wasteful expenditure by the government which may lead to uncontrolled inflation.

Primary deficit

It is the amount of money that the government requires to borrow from the interest payments on the formerly borrowed loans.

The aim of quantifying the primary deficit is to concentrate on current fiscal imbalances.

Gross primary deficit = Gross fiscal deficit – Net interest liabilities

Net interest liabilities comprise interest payments – interest receipts by the government on the net domestic lending.

Difference between Fiscal Deficit and Revenue Deficit

Measures to Reduce Government Deficit

- Increased emphasis on tax-based revenues and appropriate measures to reduce tax evasion.

- Disinvestment should be done where assets are not being used effectively

- Reduction in subsidies by the government will also help reduce the deficit.

- Try to avoid unplanned expenditures.

- Borrowing from domestic sources.

- Borrowing from external sources.

- A broadened tax base

An uncontrolled government deficit may lead to decline in the financial health of the economy. The agenda of the government should be to plan the revenues and expenditures in such a way that the economy moves towards a balanced budget situation.

Frequently Asked Questions

Q1. What is Government Budget?

Answer : A government budget is an annual financial statement showing item wise estimates of expected revenue and anticipated expenditure during a fiscal year.

Q2. What is revenue receipts?

Answer : Incomes which are received by the government from all sources in its ordinary course of governance are revenue receipts.

Q3. What is Capital receipts?

Answer : Receipts which create a liability or result in a reduction in assets are called capital receipts. They are obtained by the government by raising funds through borrowings, recovery of loans and disposing of assets.

Q4. What is revenue deficit?

Answer : It is the surplus of the government’s revenue expenditure over the revenue receipts. It is the shortfall between the total revenue received to the total revenue expenditure.

Q5. What is Fiscal deficit?

Answer : It is the distinction between the government’s total expenditure and its total receipts, which excludes borrowing.

Q6. What is primary deficit?

Answer : It is the amount of money that the government requires to borrow from the interest payments on the formerly borrowed loans.

Government Budget and the Economy Unit 4 CBSE, class 12 Economics notes. This cbse Economics class 12 notes has a brief explanation of every topic that NCERT syllabus has.

You will also get ncert solutions, cbse class 12 Economics sample paper, cbse Economics class 12 previous year paper.

Final Words

From the above article you must have learnt about ncert cbse class 12 Economics notes of unit 4 Government Budget and the Economy. We hope that this crisp and latest Economics class 12 notes will definitely help you in your exam.

Project on Government Budget and its Components – CBSE class 12

Table of Contents

INTRODUCTION

A government budget is an annual statement presenting the government’s proposed revenues and spending for a financial year that is often passed by the legislature, approved by the chief executive or president, and presented by the finance minister to the Nation. The budget is also known as the Annual financial statement of the country. This document estimates the anticipated government expenditures for the ensuing financial year. A project on government budget and its components can help children understand how their country works. For EXAMPLE – Property tax

The budget is the financial plan of the government for a definite period. A budget is a document containing a preliminary approved plan of public resources and expenditure. The government budget is an annual statement showing item-wise estimates of receipts and expenditures during a fiscal year.

IMPACT OF COVID-19 ON GOVERNMENT BUDGET

The government is likely to meet the budget targets for 2020-21 due to the covid-19 crisis but contraction in economic growth may not be as severe as being pointed out by the outside world, economic affairs secretary Tarun Bajaj said. He said the government regularly is monitoring 14-15 parameters which can give early signs of where the economy is heading. This includes E-way bills, power consumption, GST collection, etc. and every parameter is showing promising results, he said.

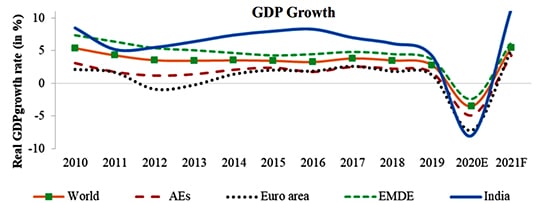

GRAPHICAL REPRESENTATION OF GDP

BUDGET AT A GLANCE

- The budget is prepared by the government at all levels, i.e., the central government prepares its respective annual budget.

- Estimates expenditures and receipts are planned as per the objectives of the government.

- The budget is presented in the parliament on such a day as the President may direct. By continuous it is presented before it can be implemented.

- It is required to be approved by the parliament.

- Reallocation of resources

- Economic stability

- Reducing inequalities in income and wealth

- Economic growth

- Management of public enterprises

OBJECTIVES OF GOVERNMENT BUDGET

- RELOCATION OF RESOURCES Through the budgetary policy, the government aims to reallocate resources to the economic and social priorities of the country. Tax concessions or subsidies. Directly producing goods and services.

- REDUCING INEQUALITIES IN INCOME AND WEALTH Economic inequality is an internet part of every economic system. The government aims to reduce such inequalities of income and wealth, through its budgetary policy. The government aims to influence the distribution of income by imposing taxes on the rich and spending more on the welfare of the poor.

- ECONOMIC STABILITY The government budget is used to prevent business fluctuation of inflation and deflation to achieve the objective of economic stability. Policies of the surplus budget during inflation and deficit budget during deflation help to maintain the stability of prices in the economy. There is a large number of public sector industries that are established and managed for the social welfare of the public. The budget is prepared with the objective of making various provisions for managing such enterprises.

- ECONOMIC GROWTH The growth rate of a country depends on the rate of savings and investments. For this purpose, the budgetary policy aims to mobilize sufficient resources for investment in the public sector. Therefore the government makes various provisions in the budget.

COMPONENTS OF BUDGET

Revenue budget.

- Revenue receipts

- Revenue expenditure

CAPITAL BUDGET

- Capital receipts

- Capital expenditure

Components of budget refer to the structure of the budget. Two main components of the budget are

REVENUE RECEIPTS It refers to those receipts that neither create any liability nor cause any reduction in the assets by the government. They are regular and recurring and the government receives them in its normal course of activities Revenue receipts satisfy these conditions

- The receipts must not create a liability for the government.

- The receipt must not cause a decrease in the assets of the government.

SOURCE OF REVENUE There are two types of revenue receipts of the government.

- Tax Revenue- refers to total receipts from taxes and duties imposed by the government. For example, Direct tax & Indirect tax is a compulsory payment, no one can refuse to pay them. Tax receipts are spent by the government for the common benefit of people in the country.

- Direct taxes are those which are imposed on property and the income of individuals and companies is paid directly by them to the government. They are imposed on individuals and companies.

- Indirect taxes refer to those taxes which affect the income and property of individuals and companies through their consumption expenditure.

HOW TO CLASSIFY A TAX AS DIRECT OR INDIRECT?

- A tax is a direct tax if its burden cannot be shifted. For example- income tax is a direct tax as its impact and incidence are on the same person.

- A tax is an indirect tax, if the actual burden of the tax lies on different persons, i.e. its burden can be shifted to the other.

ITEMS CATEGORISED( Gifts and Grants ) AS DIRECT OR INDIRECT TAX ?

- It is a direct tax as its impact and incidence lie on the same person. It is a direct line on the same person.

- Value-added tax is an indirect tax as it is imposed on the seller but beard by the customer.

- Services tax is an indirect tax as its impact and incidence lie on different people.

NON-TAX REVENUE It refers to receipts of the government from all sources there than those of tax receipts.

INTERNET Government receives interest on loans given by it to state government union territories FEES Fees refer to charges imposed by the government to cover the cost of recurring services provided by its conduct fees registration fees impact fees etc LICENSES FEES It is a payment charged by the government to grant permission of keeping a gun or commercial vehicle. FINES AND PENALTIES They refer to those payments that are imposed on lawbreakers, fines for jumping lights, etc. ESCHEATS It refers to claims of government on the property of a person who dies without leaving a will GIFTS AND GRANTS Government receives gifts and grants from the foreign government. FORFEITURES These are in the form of penalties that are imposed by the court for non-compliance with other contracts, etc

REVENUE EXPENDITURE

Revenue expenditure refers to the expenditure that neither creates any liability nor causes a reduction, in any liability of the government. It is recurring in nature. It is incurred on the normal functioning of the government. The expenditure must not create an asset of the government payment of salaries or pension is revenue expenditure as it does not create any asset. Metro is not a revenue expenditure as it leads to the creation of an asset for the government.

The main two components of the capital budget are

CAPITAL RECEIPTS

Those receipts which are either create liability or cause a reduction in the assets of the government. They are non-recurring and non-routine. The receipts must create a liability for the government. Borrowings are capital receipts as they lead to an increase in the liability of the govt.

However, the tax received is not a capital receipt as it does not result in the creation of any liability. The receipts must cause a decrease in the assets, receipts from the scale of share of public enterprises is a capital receipt as it leads to a reduction in assets of the government.