Property Development Business Plan Template

Written by Dave Lavinsky

Property Development Business Plan

You’ve come to the right place to create your Property Development business plan.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their property development companies.

Below is a template to help you create each section of your Property Development business plan.

Executive Summary

Business overview.

Redstone Development is a new property development company located in Salt Lake City, Utah. We focus on residential property development for single-family and multi-family homes. We handle all steps of the process, from sourcing the land to selling the finished property. Redstone Development aims to be the most trusted source of affordable housing in the Salt Lake City metro area.

Redstone Development is owned and operated by Jack Grant, a real estate development industry veteran who is well-versed in the entire property development process. Jack has over 30 years of experience developing residential properties and holds a Master’s in Real Estate Development. His education, experience, and industry connections will ensure that Redstone Development becomes one of the area’s most successful property development businesses.

Product Offering

Redstone Development will handle the entire development process, including sourcing land, securing all necessary approvals and permits, construction, and sale of the finished property.

The company focuses on building single-family homes and multi-family apartment complexes in the heart of Salt Lake City. All projects are designed to make these homes aesthetically appealing and luxurious. However, they will also be affordable to ensure that anyone in the Salt Lake City area can afford to live in our properties.

Customer Focus

Redstone Development will serve home buyers and real estate investors who live and work in Salt Lake City, Utah, or the surrounding area. Salt Lake City is a growing city in need of additional housing. More people come to this beautiful city every year, which reduces the number of available homes and apartment units. Therefore, we will target buyers who are struggling to find affordable housing.

Furthermore, there are thousands of first-time home buyers in the area. These buyers are an ideal target market for the company.

Management Team

Redstone Development will be owned and operated by Jack Grant. He recruited his former administrative assistant, Sheila Johnson, to be his Office Manager and help manage the office and operations.

Jack has over 30 years of experience developing residential properties and worked for several of our competitors. He also holds a Master’s in Real Estate Development from the University of Utah. His education, experience, and industry connections will ensure that Redstone Development becomes one of the area’s most successful real estate development businesses.

Sheila Johnson has been Jack Grant’s loyal administrative assistant for over ten years at a former property development firm. Jack relies strongly on Sheila’s diligence, attention to detail, and focus when organizing his clients, schedule, and files. Sheila has worked in the property development industry for so long that she understands all aspects required to run a successful property development company.

Jack will also employ several other full-time and part-time staff to assist with all aspects of running a real estate development business.

Success Factors

Redstone Development will be able to achieve success by offering the following competitive advantages:

- Location: Redstone Development’s office is near the center of town, in the shopping district of the city. It is visible from the street, where many residents shop for both day-to-day and luxury items.

- Client-oriented service: Redstone Development will have a full-time assistant with property development experience to keep in contact with clients and answer their everyday questions. Jack realizes the importance of accessibility and will further keep in touch with his clients through monthly newsletters.

- Management: Jack has been highly successful working in the property development sector. His unique qualifications will serve customers in a much more sophisticated manner than many of Redstone Development’s competitors.

- Relationships: Having worked and lived in the community his whole life, Jack knows many local leaders, real estate agents, and other influencers in the local property development industry.

Financial Highlights

Redstone Development is seeking $1,000,000 in debt financing to launch its property development business. The funding will be dedicated to purchasing our first property, construction costs, securing the office space, and purchasing office equipment and supplies. Funding will also be dedicated toward six months of overhead costs, including payroll, rent, and marketing costs. The breakout of the funding is below:

- Office space build-out: $50,000

- Office equipment, supplies, and materials: $20,000

- Land purchase and construction expenses: $530,000

- Six months of overhead expenses (payroll, rent, utilities): $250,000

- Marketing costs: $50,000

- Working capital: $100,000

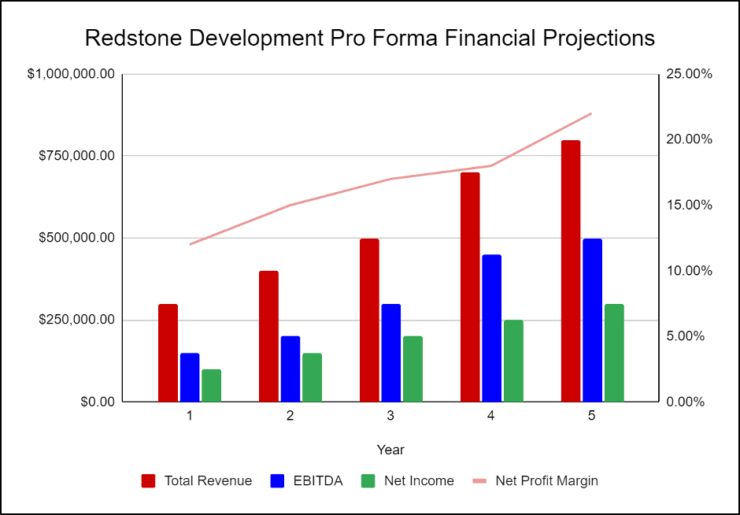

The following graph below outlines the pro forma financial projections for Redstone Development.

Company Overview

Who is redstone development.

Redstone Development is a new property development company located in Salt Lake City, Utah. We focus on residential property development for single-family and multi-family homes. We handle all steps of the property development process, from sourcing the land to selling the finished property. Redstone Development aims to be the most trusted source of affordable housing in the Salt Lake City metro area.

Redstone Development is owned and operated by Jack Grant, who is a real estate development industry veteran and well-versed in the entire property development process. Jack has over 30 years of experience developing residential properties and holds a Master’s in Real Estate Development. His education, experience, and industry connections will ensure that Redstone Development becomes one of the area’s most successful property development businesses.

Redstone Development’s History

After 30 years of working in the property development industry, Jack Grant began researching what it would take to create his own property development company. This included a thorough analysis of the costs, market, demographics, and competition. Jack has compiled enough information to develop his business plan and approach investors.

Once his market analysis was complete, Jack began surveying the local office spaces available and located an ideal location for the property development headquarters. Jack incorporated Redstone Development as a Limited Liability Corporation on October 1st, 2022.

Once the lease is finalized on the office space, renovations can be completed to make the office a welcoming environment to meet with clients.

Since incorporation, Redstone Development has achieved the following milestones:

- Located available office space for rent that is ideal for meeting with clients

- Identified the first property to develop

- Developed the company’s name, logo, and website

- Hired an interior designer for the decor and furniture layout

- Determined equipment and fixture requirements

- Began recruiting key employees

Redstone Development’s Services

Redstone Development will handle the entire property development process, including sourcing land, securing all necessary approvals and permits, construction, and sale of the finished property.

Industry Analysis

The real estate and property development industries have been strong over the past few years. As of 2021, the real estate industry was valued at $3.69 trillion and is expected to grow at a compound annual growth rate of 5.2% from now until 2030.

This growth will be driven by increasing demand for personal housing. Millennials and Gen-Z are beginning to rent their first apartments or buy their first homes. After years of living with family or roommates, they are ready to have a space to call their own. This trend is leading to a substantial demand for housing that many cities are struggling to supply.

The main challenge to the property development industry is the decrease in market size in the land development industry. Over the past five years, the industry saw an average annual decline of 0.7%. However, we believe that the pandemic was a considerable factor in this decline. Currently, the land development market is valued at $12 billion USD, and we expect it to grow substantially due to the growth of similar industries and the increasing demand for housing, as mentioned above.

Customer Analysis

Demographic profile of target market.

Redstone Development will serve home buyers and real estate investors in Salt Lake City, Utah, and its surrounding areas.

The community of Salt Lake City has thousands of first-time home buyers, residential real estate investment firms, and people looking for affordable housing options in the area. The company will also target millennials specifically since the majority of first-time home buyers are in this age group.

The precise demographics for Salt Lake City, Utah are:

Customer Segmentation

Redstone Development will primarily target the following customer profiles:

- Home buyers

- Real estate investors

- Millennials

- Apartment/Condominium management companies

Competitive Analysis

Direct and indirect competitors.

Redstone Development will face competition from other companies with similar business profiles. A description of each competitor company is below.

Upscale Property Developers, Inc.

Upscale Property Developers, Inc. is a property development company in Salt Lake City. In business for over 40 years, Upscale Property Developers, Inc. provides oversight for the entire property development process for new single-family and multi-family residences, commercial offices, and government buildings across the area. Upscale Property Developers, Inc also offers a variety of property renovation, demolition, and revitalization services for existing buildings.

Although Upscale Property Developers, Inc. provides homes with a luxury aesthetic, they are also the most expensive property developments on the market, thus resulting in many first-time home buyers being priced out of the market.

Premium Property Development Solutions

Established in 1990, Premium Property Development Solutions is a property developer of new commercial and residential properties in Salt Lake City. The company specializes in eco-friendly building materials and upscale design options for individual and corporate clients. Clients can customize their building design or choose from a variety of standard design options. The company employs experienced property developers and designers who are well-versed in green building design.

Premium Property Development Solutions is more affordable than Upscale Property Developers Inc. but is still out of most first-time home buyers’ price ranges.

Salt Lake Residential

Salt Lake Residential is also a local property development company that manages the complete property development process from sourcing and permitting to construction and sale. They are mostly known for their unique apartment complex designs but are equipped to take on a variety of different builds. The company has been in business for about ten years and has developed a reputation for building quality homes for affordable prices.

Although Salt Lake Residential has a similar value proposition of luxury homes at affordable prices, this company lacks the green building and eco-efficiency component to their business model, thus losing out on business from eco-conscious home buyers.

Competitive Advantage

Redstone Development enjoys several advantages over its competitors. Those advantages include:

- Location: Redstone Development’s office is near the center of town, in the city’s shopping district. It is visible from the street, where many residents shop for both day-to-day and luxury items.

Marketing Plan

Brand & value proposition.

Redstone Development will offer the following unique value proposition to its clientele:

- Service built on long-term relationships and personal attention

- Big-firm expertise in a small-firm environment

- Client-focused property development, where the company’s interests are aligned with the client

- Effective project management

- Affordable pricing

Promotions Strategy

The promotions strategy for Redstone Development is as follows:

Website/SEO

Redstone Development will invest heavily in developing a professional website that displays all of the features and benefits of the property development company. It will also invest heavily in SEO so the brand’s website will appear at the top of search engine results.

Social Media

Redstone Development will invest heavily in a social media advertising campaign. The marketing manager will create the company’s social media accounts and invest in ads on all social media platforms. It will use targeted marketing to appeal to the target demographics.

Print Advertising

The company will invest in professionally designed advertisements to be printed in real estate publications. Redstone Development will also list its properties for sale in key local publications, including newspapers, area magazines, and its own newsletter.

Community Events/Organizations

The company will promote itself by distributing marketing materials and participating in local community events, such as local festivals, business networking, or sporting events.

Redstone Development’s pricing will be moderate so consumers feel they receive great value when purchasing properties from the company.

Operations Plan

The following will be the operations plan for Redstone Development.

Operation Functions:

- Jack Grant will be the Owner and President of the company. He will oversee all staff and manage client relations. He will also oversee all major aspects of the development projects. Jack has spent the past year recruiting the following staff:

- Sheila Johnson – Office Manager who will manage the office administration, client files, and accounts payable.

- Kenneth Bohannon – Staff Accountant will provide all client accounting, tax payments, and monthly financial reporting.

- Beth Martinez – Marketing Manager who will provide all marketing for Redstone Development and each property it manages.

- Jack will also hire a team of architects, engineers, interior designers, and contractors to design and build the properties.

Milestones:

The following are a series of steps that lead to our vision of long-term success. Redstone Development expects to achieve the following milestones in the following six months:

1/1/202X Finalize lease agreement

2/1/202X Design and build out Redstone Development

3/1/202X Hire and train initial staff

4/1/202X Purchase first property for development

5/1/202X Kickoff of promotional campaign

6/1/202X Find second property for development

Jack has over 30 years of experience developing residential properties and worked for several of our competitors. He also holds a Master’s in Real Estate Development from the University of Utah. His education, experience, and industry connections will ensure that Redstone Development becomes one of the area’s most successful property development businesses.

Jack will also employ several other full-time and part-time staff to assist with all aspects of running a real estate development business as outlined in the Operations Plan.

Financial Plan

Key revenue & costs.

Redstone Development’s revenues will come primarily from the sale of completed properties. The company will sell new single-family homes, multi-family townhomes, and apartment complexes/condominium properties to individual buyers and investors.

The cost drivers will be the overhead costs required to staff a property development office. The expenses will be the payroll cost, rent, utilities, office supplies, and marketing materials.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required to achieve the revenue and cost numbers in the financials and to pay off the startup business loan.

- Average monthly payroll expenses: $50,000

- Office lease per year: $100,000

Financial Projections

Income statement, balance sheet, cash flow statement, property development business plan faqs, what is a property development business plan.

A property development business plan is a plan to start and/or grow your property development business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Property Development business plan using our Property Development Business Plan Template here .

What are the Main Types of Property Development Businesses?

There are a number of different kinds of property development businesses , some examples include: Single-family detached housing, Multifamily housing, Developing and Subdividing Lots, and Commercial buildings.

How Do You Get Funding for Your Real Estate Development Business Plan?

Property Development businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding. This is true for a real estate developer business plan and a real estate investment business plan template.

What are the Steps To Start a Property Development Business?

Starting a property development business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Write A Property Development Business Plan - The first step in starting a business is to create a detailed real estate development company business plan that outlines all aspects of the venture. This should include market research on the real estate market and potential target market size, information the services you will offer, marketing strategies, pricing details and a solid financial plan.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your property development business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your property development business is in compliance with local laws.

3. Register Your Property Development Business - Once you have chosen a legal structure, the next step is to register your property development business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your property development business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Property Development Equipment & Supplies - In order to start your property development business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your property development business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

- AI ASSISTANTS

Upmetrics AI Your go-to AI-powered business assistant

AI Writing Assist Write, translate, and refine your text with AI

AI Financial Assist Automated forecasts and AI recommendations

- TOP FEATURES

AI Business Plan Generator Create business plans faster with AI

Financial Forecasting Make accurate financial forecasts faster

Strategic Planning Develop actionable strategic plans on-the-go

AI Pitch Deck Generator Use AI to generate your investor deck

See how it works →

AI-powered business planning software

Very useful business plan software connected to AI. Saved a lot of time, money and energy. Their team is highly skilled and always here to help.

- Julien López

- BY USE CASE

Starting & Launching a Business Plan your business for launch and success

Validate Your Business Idea Discover the potential of your business idea

Secure Funding, Loans, Grants Create plans that get you funded

Business Consultant & Advisors Plan seamlessly with your team members and clients

Business Schools & Educators Simplify business plan education for students

Students & Learners Your e-tutor for business planning

- Sample Plans

- WHY UPMETRICS?

Reviews See why customers love Upmetrics

Customer Success Stories Read our customer success stories

Blogs Latest business planning tips and strategies

Strategic Planning Templates Ready-to-use strategic plan templates

Business Plan Course A step-by-step business planning course

Ebooks & Guides A free resource hub on business planning

Business Tools Free business tools to help you grow

- Sample Business Plans

- Construction, Architecture & Engineering

Real Estate Development Business Plan

Real estate industry has grown tremendously over the past few years, and we don’t anticipate any significant shifts any time soon. Incredible profit potential, income diversification, and various tax benefits make it an excellent consideration.

Are you looking to start writing a business plan for your real estate development business? Creating a business plan is essential to starting, growing, and securing funding for your business. So we have prepared a real estate development business plan template to help you start writing yours.

Free Business Plan Template

Download our free business plan template now and pave the way to success. Let’s turn your vision into an actionable strategy!

- Fill in the blanks – Outline

- Financial Tables

How to Write a Real Estate Development Business Plan?

Writing a real estate development business plan is a crucial step toward the success of your business. Here are the key steps to consider when writing a business plan:

1. Executive Summary

An executive summary is the first section of the business plan intended to provide an overview of the whole business plan. Generally, it is written after the entire business plan is ready. Here are some components to add to your summary:

Start with a brief introduction:

Market opportunity:, mention your services:, management team:, financial highlights:, call to action:.

Ensure you keep your executive summary concise and clear, use simple language, and avoid jargon.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

2. Business Overview

Depending on what details of your business are important, you’ll need different elements in your business overview. Still, there are some foundational elements like business name, legal structure, location, history, and mission statement that every business overview should include:

About the business:

- The name and type of your real estate development company: mention whether you are a development company focusing on residential, commercial, resort & hospitality development, or industrial development. Maybe, you offer a mix of some of these services—so mention it.

- Company structure of your real estate business, whether it is an LLC, partnership firm, or something else.

- Location of your property development company and why you selected that place.

Mission statement:

Business history:, future goals:.

This section should provide an in-depth understanding of your real estate development business. Also, the business overview section should be engaging and precise.

3. Market Analysis

Market analysis provides a clear understanding of the market in which your real estate development business will run along with the target market, competitors, and growth opportunities. Your market analysis should contain the following essential components:

Target market:

Market size and growth potential:, competitive analysis:, market trends:, regulatory environment:.

Some additional tips for writing the market analysis section of your business plan:

- Use a variety of sources to gather data, including industry reports, market research studies, and surveys.

- Be specific and provide detailed information wherever possible.

- Include charts and graphs to help illustrate your key points.

- Keep your target audience in mind while writing the business plan

4. Products And Services

The product and services section of a property development business plan should describe the specific services and products that will be offered to customers. To write this section should include the following:

List the services:

- Create a list of services your development business will offer, including construction and project management, architectural designing and planning, property acquisition, financing services, etc.

- Describe each service: Provide a detailed description of what it entails, the time required, and the qualifications of the professionals who will provide it. For example, a project manager is responsible for overseeing the day-to-day operations of a project.

Emphasize safety and quality:

Overall, a business plan’s product and services section should be detailed, informative, and customer-focused. By providing a clear and compelling description of your offerings, you can help potential investors and readers understand the value of your business.

5. Sales And Marketing Strategies

Writing the sales and marketing strategies section means a list of strategies you will use to attract and retain your clients. Here are some key elements to include in your sales & marketing plan:

Develop your unique selling proposition (USP):

Determine your pricing strategy:, marketing strategies:, sales strategies:, customer retention:.

Overall, the sales and marketing strategies section of your business plan should outline your plans to attract and retain customers and generate revenue. Be specific, realistic, and data-driven in your approach, and be prepared to adjust your strategies based on feedback and results.

6. Operations Plan

When writing the operations plan section, it’s important to consider the various aspects of your business processes and procedures involved in operating a business. Here are the components to include in an operations plan:

Hiring plan:

Operational process:, equipment and machinery:.

By including these key elements in your operations plan section, you can create a comprehensive plan that outlines how you will run your real estate development business.

7. Management Team

The management team section provides an overview of the individuals responsible for running the real estate development business. This section should provide a detailed description of the experience and qualifications of each manager, as well as their responsibilities and roles.

Key managers:

Organizational structure:, compensation plan:, board of advisors:.

Describe your company’s key personnel and highlight why your business has the fittest team.

8. Financial Plan

When writing the financial plan section of a business plan, it’s important to provide a comprehensive overview of your financial projections for the first few years of your business.

Profit & loss statement:

Cash flow statement:, balance sheet:, break-even point:, financing needs:.

Remember to be realistic with your financial projections and provide supporting evidence for your estimates.

9. Appendix

When writing the appendix section, you should include any additional information that supports the main content of your plan. This may include financial statements, market research data, legal documents, and other relevant information.

- Include a table of contents for the appendix section to make it easy for readers to find specific information.

- Include financial statements such as income statements, balance sheets, and cash flow statements. These should be up-to-date and show your financial projections for at least the first three years of your business.

- Provide market research data, such as statistics on the size of the real estate development industry, consumer demographics, and trends in the industry.

- Include any legal documents such as permits, licenses, and contracts.

- Provide any additional documentation related to your business plans, such as marketing materials, product brochures, and operational procedures.

- Use clear headings and labels for each section of the appendix so that readers can easily find the information they need.

Remember, the appendix section of your real estate development business should only include relevant and essential information supporting your plan’s main content.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

This real estate development business plan sample will provide an idea for writing a successful real estate development plan, including all the essential components of your business.

After this, if you still need clarification about writing an investment-ready real estate business plan to impress your audience, download our real estate development business plan pdf .

Related Posts

Architecture Business Plan

Construction Company Business Plan

How to Start a Construction Business

Interior Design Business Plan

Best AI Business Planning Softwares

Key Components of a Business Plan

Frequently asked questions, why do you need a real estate development business plan.

A business plan is an essential tool for anyone looking to start or run a successful real estate development company. It helps to get clarity in your business, secures funding, and identifies potential challenges while starting and growing your real estate business.

Overall, a well-written plan can help you make informed decisions, which can contribute to the long-term success of your real estate business.

How to get funding for your real estate development business?

There are several ways to get funding for your real estate business, but one of the most efficient and speedy funding options is self-funding. Other options for funding are:

- Bank loan – You may apply for a loan in government or private banks.

- Small Business Administration (SBA) loan – SBA loans and schemes are available at affordable interest rates, so check the eligibility criteria before applying for it.

- Crowdfunding – The process of supporting a project or business by getting a lot of people to invest in your development business, usually online.

- Angel investors – Getting funds from angel investors is one of the most sought options for startups.

- Venture capital – Venture capitalists will invest in your business in exchange for a percentage of shares, so this funding option is also viable.

Apart from all these options, there are small business grants available, check for the same in your location and you can apply for it.

Where to find business plan writers for your real estate development business?

There are many business plan writers available, but no one knows your business and idea better than you, so we recommend you write your real estate development business plan and outline your vision as you have in your mind.

What is the easiest way to write your real estate development business plan?

A lot of research is necessary for writing a business plan, but you can write your plan most efficiently with the help of any real estate development business plan example and edit it as per your need. You can also quickly finish your plan in just a few hours or less with the help of our business plan software.

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

ZenBusinessPlans

Home » Sample Business Plans » Real Estate

A Sample Property Development Business Plan Template

Are you about starting a real estate development company? If YES, here is a complete sample property development business plan template you can use for FREE. Okay, so we have considered all the requirements for starting a property development business.

We also took it further by analyzing and drafting a sample property marketing plan template backed up by actionable guerrilla marketing ideas for property development businesses. So let’s proceed to the business planning section.

Why Start a Property Development?

It is therefore no doubt that housing is one very essential ingredient to life. The moment one is able to find a place of abode, there comes a form of huge relief. It is for that reason that the need for the government of different parts of the world to provide basic shelter for its citizens cannot be over flogged.

Every day there are an avalanche of people who dive into the property development business because they know how lucrative this trade is and how money spinning it becomes when one is able to get a hang of it. This is why those who have scaled through the teething stage of the business know that adequate planning is one of the hurdles that just must be scaled so as to get things right.

1. Industry Overview

The property development industry falls into the real estate category and it is indeed a very large industry that has the potential to make entrepreneurs millionaire within a short period of time. Property development industry is a many-sided business that covers all aspect of activities, ranging from acquiring raw lands, to selling or renting or leasing of fully finished and furnished properties.

In essence, developers are responsible for turning ideas into real properties; i.e. they acquire lands, they finance real estate deals, they engage in building projects and they sell, rent, lease and even manage properties on behalf of their clients.

Beyond every reasonable doubt, one of the most profitable, creative and interesting aspect of the real estate industry is property development. As a matter of fact, developers are major players when it comes to determining the prices of properties. Although this type of business venture can be risky, but in order to make it big in the trade as a property developer, you have got to just take calculated risks.

Just like all other investment vehicles, there are potential down sides that you need to look out for as a property developer. One of the major risks in property development is a sudden down turn in the economy. Property development could take a period of two to three years from conception to completion, depending on the size of the project and the cash flow.

As a matter of fact, some projects could even take much longer than that. Because of the time frame involved in developing properties from start to finish, loads of unanticipated things could crop up and it falls in the thick of property cum economy downturn which is not good for the business considering the investment that has gone into the project.

Another factor that is of major concerns and a threat to property development business generally could be cost increase as a result of inflation, currency devaluation as well as economic challenges.

Unforeseen delays from the part of government agencies, litigation and also delays from contractors could lead to substantial cost increase especially if the project is heavily dependent on bank loans. If perhaps during this period there is a change in the supply and demand dynamics of the property sector, the project could as well be affected negatively.

As a property developer, it is very important to be creative, to be able to use your ideas to meet the rapidly changing needs of the society when it comes to properties; you should be able to convert a slum into a beautiful city, if indeed you want to become a major player in the real estate industry.

Over and above, the property development sector is known to be a major contributor in the economy of many nations of the world and the industry is notable for producing some of the richest men in the world.

2. Executive Summary

Solorio’s® Property Development Company is a property development company that will be based in 530 Madison Avenue New York, NY 10033, USA. Our aim of starting this business is to work in tandem with the government of the united states of America to deliver affordable homes and properties for all classes of people in the United States of America.

Our Head Office will be located in New York City, but we will have our branch offices in major cities in all regions of the United States of America. During the first two years of operation we would have set up our offices in the following locations; Las Vegas, Washington, DC, Dallas, Texas and Boston.

Solorio’s® Property Development Company is going to be a self-administered and a self-managed real estate investment trust (REIT). We will work towards becoming one of the largest owners, managers, and developers of first-class properties (accommodations, public buildings and office properties) in the United States of America.

We are quite aware that property development business requires a huge capital base, which is why we have perfect plans for steady flow of cash from private investors who are interested in working with us. We can confidently say that we have a robust financial standing and we are ready to take on any property development deal that comes our way.

As part of our plans to make our customers our number one priority and to become the leading property development company in New York City, we have perfected plans to work with our clients to deliver projects that can favorably compete with the best in the industry, at an affordable and reasonable price within the stipulated completion date barring any unforeseen circumstance and also to generate great value from any property that we manage (both for our clients and for the company).

Solorio’s® Property Development Company will become a specialist in turning slums into beautiful cities and turning a run –down and dilapidated building into a master piece. And that hopefully will be our brand and signature.

Solorio’s® Property Development Company will be owned majorly by Shannon McKenzie and family. Shannon McKenzie is a property guru that has worked with top Real Estate Companies in the United States of America for many years; prior to starting his own business. Other investors with same investment ideology whose name cannot be mentioned here for obvious reasons are also part owners of the business.

3. Our Products and Services

Solorio’s® Property Development Company will be involved in the core real estate business and because we aspire to become one of the leading property development company in New York City, we have decided to explore every available means of generating money from Property Development. Our business offering can are listed below;

- Developing Properties for our Clients

- Leasing of Properties

- Renting of Properties

- Selling of Fully Furnished Properties

- Selling of Landed Properties

- Leasing of Bare Land

- Manage Properties and Facility for Clients

- Property Makeover Services

- Real Estate Consultancy and Advisory Services

4. Our Mission and Vision Statement

- To deliver affordable and quality properties to all classes of people in the United States of America.

- At Solorio’s® Property Development Company, our mission and values is to help people and businesses in the United States of America and throughout the world realize their dreams of owning properties.

Our Business Structure

Solorio’s® Property Development Company is aiming to be amongst the leading property development companies in New York City, and the only way for us to attain this position is to structure the business for growth and to hire the best hands we can get in the industry.

We want to build a team that will work together towards achieving the company’s goal and also a business with standard structure and processes; a business that runs on auto pilot. In view of the above, we have made provisions for the following positions in our organization;

- Chief Executive Officer

Project Manager

Civil Engineer

- Structural Engineer

- Quantity Surveyor

Land Surveyor

Company’s Lawyer/Secretary

Admin and HR Manager

Business Developer

- Front Desk Officer

5. Job Roles and Responsibilities

Chief Executive Officer – CEO:

- Responsible for providing direction for the business

- Creating, communicating, and implementing the organization’s vision, mission, and overall direction – i.e. leading the development and implementation of the overall organization’s strategy.

- Responsible for the day to day running of the business

- Responsible for handling high profile clients and deals

- Responsible for fixing prices and signing business deals

- Responsible for signing checks and documents on behalf of the company

- Evaluates the success of the organization

- Reports to the board

- Responsible for the planning, management and coordinating all projects on behalf of the company

- Supervise projects

- Ensures compliance during project executions

- Provides advice on the management of projects

- Responsible for carrying out risk assessment

- Using IT systems and software to keep track of people and progress of ongoing projects

- Responsible for overseeing the accounting, costing and billing of every project

- Represents the organization’s interest at various stakeholders meetings

- Ensures that project desired result is achieved, the most efficient resources are utilized and different interests involved are satisfied.

- Responsible for preparing bids for tenders, and reporting to clients, public agencies and planning bodies

- Ensures that sites meet legal guidelines, and health and safety requirements

- Assesses the environment impact and risks connected to projects

- Responsible for judging whether projects are workable by assessing materials, costs and time requirements

- Draws up blueprints, using Computer Aided Design (CAD) packages

- Discusses requirements with the client and other professionals (e.g. architects and project managers et al)

- Responsible for managing, directing and monitoring progress during each phase of a project

- Responsible for creating building designs and highly detailed drawings both by using the hands and by using specialist computer – aided design (CAD) software

- Working around constraining factors such as town planning legislation, environmental impact and project budget

- Writes and presents reports, proposals, applications and contracts

- Adapts plans according to circumstances and resolving any problems that may arise during construction

- Works with project team and management to achieve a common goal

- Responsible for applying for planning permission and advice from governmental new building and legal department.

- Responsible for undertaking land surveys/measurements using a variety of specialist technical equipment such as theodolites, laser alignment devices and satellite positioning systems et al.

- Responsible for presenting data to clients

- Responsible for producing and advising about construction plans and drawings

- Responsible for advising about technical matters and whether the construction plans are viable

- Responsible for drawing up contracts and other legal documents for the company

- Consults and handles all corporate legal processes (e.g. intellectual property, mergers & acquisitions, financial/securities offerings, compliance issues, transactions, agreements, lawsuits and patents et al)

- Develops company policy and position on legal issues

- Researches, anticipates and guards company against legal risks

- Represents company in legal proceedings (administrative boards, court trials et al)

- Plays a part in business deals negotiation and take minutes of meetings

- Responsible for analyzing legal documents on behalf of the company

- Prepares annual reports for the company

- Responsible for overseeing the smooth running of HR and administrative tasks for the organization

- Defines job positions for recruitment and managing interviewing process

- Carries out staff induction for new team members

- Responsible for training, evaluation and assessment of employees

- Responsible for arranging travel, meetings and appointments

- Oversees the smooth running of the daily office activities.

- Identifies, prioritizes, and reaches out to new partners, and business opportunities et al

- Responsible for supervising implementation, advocate for the customer’s need s, and communicate with clients

- Develops, executes and evaluates new plans for expanding increase sales

- Documents all customer contact and information

- Represents the company in strategic meetings

- Helps increase sales and growth for the company

- Responsible for preparing financial reports, budgets, and financial statements for the organization

- Responsible for financial forecasting and risks analysis.

- Responsible for developing and managing financial systems and policies

- Responsible for administering payrolls

- Ensures compliance with taxation legislation

- Handles all financial transactions for the company

- Serves as internal auditor for the company

Front Desk/Customer’s Service Officer

- Receives Visitors/clients on behalf of the organization

- Receives parcels/documents for the company

- Handles enquiries via e-mail and phone calls for the organization

- Distributes mails in the organization

- Handles any other duties as assigned my the line manager

6. SWOT Analysis

In as much as property development business is a very lucrative business, there are loads of investors and entrepreneurs who are interested in owning a business portfolio in the industry, so as such the competition for available business deals will be much.

This is why we invested time and resources to prepare a killer property development marketing plan. Prior to setting up Solorio’s® Property Development Company we employed the services of tested and trusted business and HR consultants to help us conduct critical SWOT analysis for us.

We did this so as to know how to maximize our strength and opportunities and also to look for ways to properly manage our weakness and the threat that we may likely face in the property development industry as a newbie. Here is a summary from the result of the SWOT analysis that was conducted on behalf of Solorio’s® Property Development Company;

Solorio’s® Property Development Company prides itself in the fact that the management team are core professionals and experts in their own chosen fields and they are some of the best in New York City. Despite the fact that we a new property development company, we can confidently say that we have a strong financial strength to handle most of the deals that we will have to handle.

Our weakness could not be farfetched; we are a new property development company, and there is the possibility of clients to think twice before awarding us contracts. Most people would prefer to deal with companies that have been in existence for a long period of time , as against dealing with a new company that they are not sure will deliver as planned.

- Opportunities:

Our business concepts and our mission and vision put us at an advantage in the industry. We are set to not only work with big money bags but also to work with smaller clients whose wish is just to have a roof over their head. Furthermore, we are certain that the location of our business is going to bring multiple business opportunities to us.

Some of the threats that we are likely going to face as a property development company are unfavorable government policies, global economic downturn and other big money bags that are major players in the property development industry. There is hardly anything we could do as it concerns this threats, other than to be optimistic that things will continue to work for our good.

7. MARKET ANALYSIS

- Market Trends

It is no longer news that property development involves various stakeholders with various contributions and responsibilities. In property development you have a synergy involving the property owner, the financier, the property developer and a team of technical experts. The property owner may be an individual or a group and could also be a corporate body.

Before now, the interest of most owners is to sell the property to any willing buyer and move on with their life. However, because of the profitability of the business, there are land owners now who are willing to use their property as a leverage to have an equity stake in the project.

This is a win-win for all the parties since the developer too will use the extra cash savings to accelerate the completion of the project and also to handle other projects. It is obvious that loads of investors are now very much interested in property development business, because it is one of the quickest means of becoming a millionaire and as a matter of fact, it is rare to see a multi – millionaire who does not have a business portfolio in the real estate industry.

One good thing about the property development industry is that it has room wide enough to accommodate as many investors that wants to dive into the industry. We know that we can achieve our business goals and targets in the property development industry in New York City and the United States, which is why we have mapped out our own marketing and sales strategies.

8. Our Target Market

Our target market cuts across people of different classes and people from all walks of life. We are coming into the industry with a business concept that will enable us work with the highly placed people in the country and at the same with the lowly placed people who are only interested in putting a roof under their head.

We are in business to make profits at the same we in business to give our customers the opportunities to own their own properties at an affordable price.

Solorio’s® Property Development Company wants to be known as a company that has the interest of the rich, the middle class and the poor in the United States of America. Below is a list of the people and organizations that we have specifically design our products and services for;

- Families who are interested in renting/leasing or acquiring a property

- Corporate organizations who are interested in renting/leasing or acquiring their own property/properties

- Land Owners

- Properties Owners

- University Campuses (Private Hostels)

- Foreign investors who are interested in owning properties in the United States of America

- The government of the United States of America (Government contracts)

- Managers of public facilities

Our Competitive Advantage

There are major players who have gotten a grip of the property development business in New York, but that does not deter us from entering the trade to build our business to become one of the top property development businesses in New York City. Solorio’s® Property Development Company has a management team members that are considered experts in their own chosen area of specialization.

Our CEO has a robust experience in the real estate industry and he is bringing the experience to help build Solorio’s® Property Development Company to become a top brand as far as property development business is concern. Of course, we are a new company, but we have been able to build our capital base to be able to handle most of the projects that we will bid for and also to acquire properties for the organization.

9. SALES AND MARKETING STRATEGY

- Sources of Income

Solorio’s® Property Development Company is established with the aim of maximizing the profits in the real estate industry via delivering quality and affordable property to our highly esteemed clients. The property business is wide in scope and there are several means of generating income for the company. Below are the sources we intend exploring to generate income for Solorio’s® Property Development Company;

10. Sales Forecast

Prior to launching Solorio’s® Property Development Company we have serious interest in the industry and we have been able to secure some properties that is still under construction. We are optimistic that the projects / properties will be completed within the next two months and we have concluded plans to put the property for lease.

They are office complexes and it is interesting to know that people are already queuing up to rent / lease the available spaces. We are quite optimistic that we will meet out set target of generating enough income / profits from the first month or operations.

We have critically studied the property market and we have examined our chances in the industry and we have been able to come up with the following sales forecast. The sales projection is based on information gathered on the field and some assumptions;

- Build/develop at least 2 office complex (3 story building each) within the first 12 months of operation

- Manage a minimum of 5 properties for clients within the first 6 months of operations

- Sell a minimum of 20 hectares of land within the first 12 months of operation

- Develop at least one estate within the first 24 months of operations

- Provide advisory and consultancy services for a minimum of 1 client per month

- Handle a minimum of 12 building makeover projects within the first 12 months of operations

N.B: Please note that we could not put a specific amount to the projection because the prices may differ for different services and for different clients. Part of our business strategy is to work within the budget of our clients to deliver quality property / properties hence it will be difficult to project what we are likely going to make from such deals.

But the bottom line is that we are definitely going to make reasonable profits from any business deal that we execute. The property market is structured in such a way that property developers will always make profits from any deal they handle.

- Marketing Strategy and Sales Strategy

Solorio’s® Property Development Company is aware that there are stiffer competition in the property development market in the United States of America, hence we have been able to hire some of the best business developer to handle our sales and marketing.

Our sales and marketing team will be recruited based on their vast experience in the industry and they will be trained on a regular basis so as to be well equipped to meet their targets and the overall goal of the organization.

Our goal is to become one of the leading property development companies in New York City and in every other city where we operate, which is why we have mapped out strategies that will help us take advantage of the available market. Solorio’s® Property Development Company will adopt the following marketing and sales strategies;

- Introduce our business by sending introductory letters alongside our brochures to all the corporate organizations in New York and other States in the US.

- Promptness in bidding for contracts.

- Advertise our business in real estate / properties magazines and websites.

- List our business on yellow pages.

- Attend expos, seminars, and business fairs et al.

- Create different packages for different category of clients in order to work with their budgets and still deliver quality housing/ property to them.

- Leverage on the internet to promote our business.

11. Publicity and Advertising Strategy

We have been able to work with our consultants to help us map out publicity and advertising strategies that will help us walk our way into the hearts of our target market. First and foremost, we want our brand to be visible and well communicated, which is why we have decided to work with different classes of people in the society.

All our publicity materials and jingles are done by some of the best hands in the industry. Below are the platforms we intend to leverage on to promote and advertise our property development business;

- Place adverts on both print and electronic media platforms (real

- Sponsor relevant TV shows

- Maximize our company’s website to promote our business

- Leverage on the internet and social media platforms like; Instagram, Facebook ,Twitter, LinkedIn, Badoo, Google+ et al

- Install our Bill Boards on strategic locations

- Distribute our fliers and handbills in targeted areas from time to time

12. Our Pricing Strategy

Part of business strategy is to ensure that we work within the budget of our clients to deliver excellent properties to them. We are quite aware that there are major players in the property development industry in the United Stated of America who are not interested in small business deals.

Although our prices may not be outrageously lower than what is obtained in the industry, but we are hopeful that whatever price we bill our customer will be amongst the lowest they can get in the industry. The fact that we are going to be billing our clients lower than what is obtainable in the industry does not in any way affect the quality of our properties.

- Payment Options

Our payment policy is all inclusive because we are quite conscious that different people prefer different payment options as it suits them but at the same time, we will not accept payment by cash because of the volume of cash that will be involved in most of our transactions Here are the payment options that we will make available to our clients;

- Payment by via bank transfer

- Payment via online bank transfer

- Payment via check

- Payment via bank draft

In view of the above, we have chosen banking platforms that will help us achieve our plans without any itches.

13. Startup Expenditure (Budget)

- The Total Fee for incorporating the Business in New York: $750.

- The budget for Liability insurance, permits and license: $5,000

- The Amount needed to acquire a suitable Facility with enough space in New York City (Re – Construction of the facility inclusive): $80,000.

- The Cost for equipping the office (computers, printers, fax machines, furniture, telephones, filing cabins, safety gadgets and electronics et al): $15,000

- The Cost of Launching a Website: $600

- Additional Expenditure (Business cards, Signage, Adverts and Promotions et al): $5,000

- Working capital (investment fund): $3,000,000 (3 Million US Dollar)

Going by the report from our research and feasibility studies, we will need about $3,200,000 (3.2 US Million Dollars) to set up a property development company in New York City. In property development business, the larger your capital base, the greater the opportunities you can access and the more profits you will make.

Despite the fact that we have a working capital of 3 Million US Dollar, we have been able to create a business relationship with our banks so as to easily access loans when the need arises.

Generating Funding/Startup Capital for Property Development Company

- The CEO Dr. Shavonne McPherson will generate 20 percent of the start – up capital from her personal savings

- 30% of the capital will be generated from partners and investors

- 50% of the capital will be sourced from banks

14. Sustainability and Expansion Strategy

Solorio’s® Property Development Company was established with the aim of building a company that will outlive the founders and partners. Part of the vision of the company is to handover the baton of the company from one generation to another generation; hence we have perfected our plans to put the right structures in place that will aid our succession plan.

We are quite aware that the growth of any business depends solely to the business deals or sales they execute per financial year. We will continue to give our marketing team all the supports they would need to continue to deliver and meet all set targets and corporate goals.

Lastly, we will not relent in taking calculated business risks when it comes to investment and taking on new business challenges and new business frontiers.

Check List/Milestone

- Business Name Availability Check: Completed

- Business Incorporation: Completed

- Opening of Corporate Bank Accounts various banks in the United States: Completed

- Opening Online Payment Platforms: Completed

- Application and Obtaining Tax Payer’s ID: In Progress

- Application for business license and permit: Completed

- Purchase of All form of Insurance for the Business: Completed

- Renting of Office Facility in New York City: Completed

- Conducting Feasibility Studies: Completed

- Generating capital from the CEO and Business Partners: Completed

- Applications for Loan from our Bankers: In Progress

- Writing of business plan : Completed

- Drafting of Employee’s Handbook: Completed

- Drafting of Contract Documents (Tenancy Agreements et al), and other relevant Legal Documents: In Progress

- Design of The Company’s Logo: Completed

- Graphic Designs and Printing of Packaging Marketing / Promotional Materials: Completed

- Recruitment of employees: In Progress

- Purchase of the Needed furniture, office equipment, electronic appliances and facility face lift: In progress

- Creating Official Website for the Company: In Progress

- Creating Awareness for the business (Business PR): In Progress

- Health and Safety and Fire Safety Arrangement: In Progress

- Establishing business relationship with key players in the industry (networking and membership of relevant real estate bodies): Completed

More on Real Estate

How To Write a Business Plan for Property Development Company in 9 Steps: Checklist

By alex ryzhkov, resources on property development company.

- Financial Model

- Business Plan

- Value Proposition

- One-Page Business Plan

- SWOT Analysis

- Business Model

- Marketing Plan

Are you dreaming of starting your own property development company? With the real estate market booming in the US, now is the perfect time to turn that dream into a lucrative business venture. According to the latest statistics, the property development industry is experiencing steady growth, with an annual revenue of over $500 billion. This presents a massive opportunity for entrepreneurs like you to capitalize on the demand for new properties and generate substantial profits. But before you jump in, it's essential to have a solid business plan in place. In this blog post, we will guide you through nine crucial steps to help you write a comprehensive business plan for your property development company.

Identify Target Market and Location

In order to successfully start a property development company, it is crucial to identify your target market and location early on in the process. This step will lay the foundation for the entire business plan and help guide your decision-making throughout the development process.

First, identify your target market . Who are the potential buyers or renters of the properties you plan to develop? Are you targeting young professionals, families, retirees, or a specific demographic? Understanding your target market will enable you to tailor your properties and marketing efforts to meet their needs and preferences.

Next, identify the ideal location for your property development projects. Consider factors such as proximity to amenities, schools, transportation, and employment opportunities. Research the real estate market in your desired location to determine if there is demand for property development and if it aligns with your target market's preferences.

Tips for identifying your target market and location:

- Conduct market research to understand the demographics and preferences of your target market.

- Visit potential locations to assess the potential for growth and development.

- Consider working with a real estate agent or consultant familiar with the local market.

- Explore potential partnerships with local businesses or organizations to gain insights into the target market.

By carefully identifying your target market and location in the early stages of your business plan, you can ensure that your property development company is positioned for success. This knowledge will assist you in making informed decisions, developing properties that meet market demand, and ultimately generating profits from your real estate ventures.

Conduct Market Research

In order to successfully develop a property, it is crucial to conduct thorough market research. This step will provide you with valuable insights into the current real estate market trends, buyer preferences, and potential demand for your development project.

Here are some important factors to consider during your market research:

- Identify the target market and location: Determine the specific demographic and geographic characteristics of the market segment you intend to target. This will help you tailor your property development project to meet the needs and preferences of potential buyers or renters.

- Evaluate market demand: Analyze the current demand for properties in your target market. Consider factors such as population growth, employment opportunities, and overall economic conditions that may influence the demand for real estate in the area.

- Assess competition: Research and analyze your competitors in the local market. Identify their strengths, weaknesses, and market positioning. This will enable you to differentiate your property development company and identify unique selling points for your projects.

- Study market trends: Stay up-to-date with the latest market trends and developments in the real estate industry. Monitor changes in buyer preferences, design trends, and emerging technologies that may impact the success of your property development projects.

- Utilize online resources: Take advantage of online platforms, databases, and industry reports to gather information about the local real estate market.

- Engage with local professionals: Network with real estate agents, brokers, and industry experts to gain insights into the local market dynamics and gather valuable advice.

- Visit potential development sites: Conduct site visits to evaluate the suitability of potential properties for your development projects. Assess factors such as accessibility, infrastructure, and neighborhood amenities.

- Stay informed about zoning regulations: Familiarize yourself with the local zoning or planning regulations to ensure compliance and avoid potential obstacles during the development process.

By conducting thorough market research, you will have a solid understanding of the market dynamics and be able to make informed decisions throughout the property development process. This will increase the chances of success for your business and maximize the profitability of your projects.

Determine Project Scope And Objectives

Once you have identified your target market and location, the next crucial step in writing a business plan for your property development company is to determine the scope and objectives of your projects. This step is essential as it sets the foundation for the entire development process.

When determining project scope, consider the size, type, and complexity of the projects you plan to undertake. Are you aiming for residential, commercial, or mixed-use developments? Will you focus on new construction or renovation projects? Clearly defining the scope helps you understand the resources, expertise, and timeline required for each project.

Setting clear objectives is equally important. These objectives should align with your overall business goals and reflect the specific outcomes you aim to achieve for each project. Are you looking to maximize profits through quick property sales, or are you more focused on long-term rental income? Define your objectives to provide direction and guide decision-making throughout the development process.

Assess Competition And Market Demand

Assessing the competition and market demand is a crucial step in developing a business plan for a property development company. Understanding the landscape of competitors and the level of demand in the market will help you make informed decisions and develop strategies for success.

1. Research your competition: Conduct a thorough analysis of other property development companies operating in your target market. Identify their strengths, weaknesses, and unique selling points. This will help you identify gaps in the market and differentiate your company from the competition.

2. Understand market demand: Analyze the current demand for properties in your target market. Consider factors such as population growth, economic indicators, and trends in the real estate industry. Determine whether there is a demand for the type of properties you aim to develop.

3. Identify unique selling points: Differentiate your property development company by identifying unique selling points that cater to the needs and preferences of your target market. This could be offering eco-friendly features, luxury amenities, or innovative architectural designs.

By thoroughly assessing the competition and market demand, you will be equipped with the necessary information to make informed decisions and devise effective strategies for your property development company. This step sets the foundation for success in the highly competitive real estate industry.

Develop A Business Structure And Legal Framework

When starting a property development company, it is vital to establish a solid business structure and legal framework to ensure smooth operations and compliance with relevant laws and regulations.

The first step in developing a business structure is to determine the legal entity for your company. Common options include sole proprietorship, partnership, limited liability company (LLC), or corporation. Each option has its own advantages and disadvantages, so it's important to consult with a lawyer or accountant to determine the best fit for your specific circumstances.

Once you have chosen the legal entity, you will need to register your company with the appropriate government agencies. This typically involves obtaining a business license or permit, registering the company name, and obtaining any necessary certifications or permits required for property development activities.

In addition to the legal structure, you will also need to develop a comprehensive legal framework for your property development company. This includes drafting contracts for various aspects of your business, such as purchase agreements, lease agreements, contractor agreements, and partnership agreements. These contracts will serve as the backbone of your company's operations and help protect your interests.

It is crucial to consult with a qualified attorney experienced in real estate and property development to ensure that your legal framework covers all necessary aspects and protects your company from any potential liabilities or disputes.

- Consult with professionals: Seek advice from lawyers, accountants, and other professionals to ensure you choose the right legal entity and develop a robust legal framework.

- Compliance with regulations: Research and understand the local, state, and federal regulations that apply to property development companies to ensure full compliance.

- Protection of interests: Draft contracts and agreements that safeguard your company's interests, including provisions for dispute resolution and liability limitations.

- Insurance: Consider obtaining appropriate insurance coverage, such as general liability insurance, to protect your company from unforeseen risks and potential lawsuits.

- Building relationships with experienced real estate attorneys and legal advisors can provide ongoing support and guidance as your property development company grows.

- Keep up-to-date with changes in laws and regulations relevant to the real estate industry to ensure your legal framework remains current and compliant.

By developing a strong business structure and legal framework, you lay a solid foundation for your property development company, allowing you to operate efficiently, mitigate risks, and pursue growth opportunities with confidence.

Create A Financial Plan And Secure Funding

Developing a comprehensive financial plan is crucial for the success of your property development company. It allows you to effectively manage your financial resources and secure funding to support your projects. Here are some important steps to consider:

- Evaluate your financial needs: Analyze the costs associated with property acquisition, development, and ongoing expenses. Determine how much funding you will require to complete each project.

- Assess available funding options: Research various funding sources such as investors, banks, or private equity funds. Consider the pros and cons of each and identify the most suitable option for your company.

- Create a detailed financial plan: Develop a comprehensive plan that includes projected income and expenses, cash flow forecasts, and return on investment analysis. This plan will not only help you secure funding but also guide your financial decisions throughout the project.

- Present your financial plan to potential investors: Clearly communicate the potential risks and rewards associated with your projects. Show investors how their funding will be used, the expected returns, and how you plan to mitigate risks.

- Build relationships with financial institutions: Establish connections with banks and other financial institutions to explore loan options and secure favorable terms. Maintain good credit history and financial records, as these are often crucial in obtaining funding.

- Consider partnering with joint venture partners: Collaborating with experienced developers or investors who have access to capital can provide additional funding opportunities and enhance your company's credibility.

- Thoroughly research potential investors or financial institutions to ensure they align with your company's goals and values.

- Be prepared to negotiate terms and conditions to secure the best funding options for your projects.

- Regularly review and update your financial plan to reflect changes in the market or unexpected expenses.

Creating a solid financial plan and securing funding are essential steps to ensure the financial stability and growth of your property development company. By carefully considering your financial needs, exploring various funding options, and presenting a compelling financial plan, you will be well-positioned to successfully fund and execute your projects.

Identify Key Team Members and Partners

Building a successful property development company requires a strong team of individuals with diverse skills and expertise. Identifying key team members and partners is crucial for executing your business plan effectively. Here are some important factors to consider:

- Project Manager: A skilled project manager is essential to oversee the entire development process, ensuring timely completion and adherence to budgetary constraints.

- Architect: Collaborating with an experienced architect will help in designing functional and appealing properties that meet the needs of the target market.

- Contractor: Finding a reliable contractor who can execute construction projects efficiently and within budget is vital for the success of your property development ventures.