Underwriting Manager resume examples for 2024

A successful underwriting manager resume highlights a combination of customer service, risk management, and performance management skills. They use underwriting guidelines to evaluate financial statements and make informed decisions. Expertise in credit policy and strong analytical skills are also important to ensure profitable growth and high-quality underwriting. Understanding commercial property and loss ratio is crucial, as well as the ability to manage direct reports and collaborate with other departments.

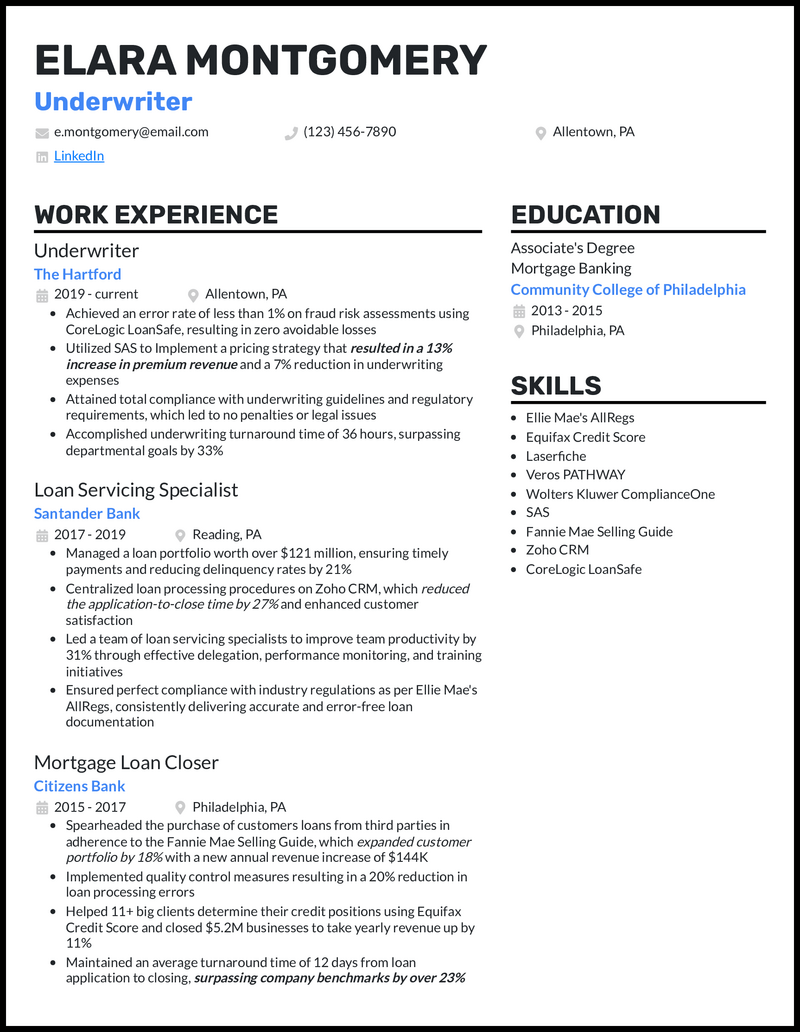

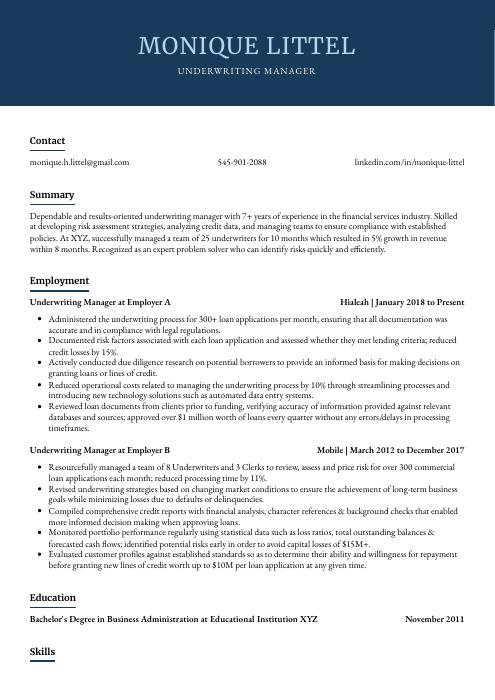

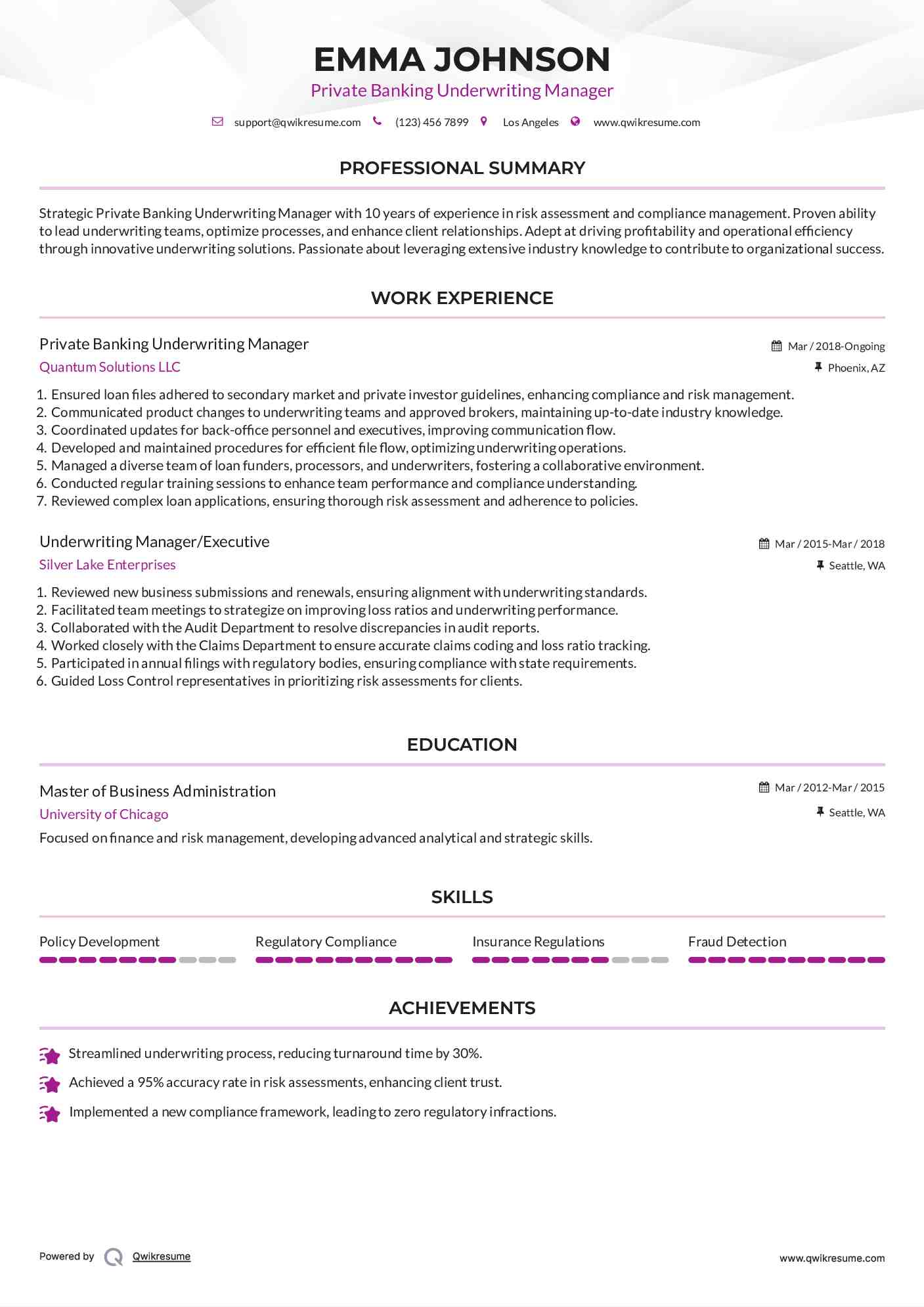

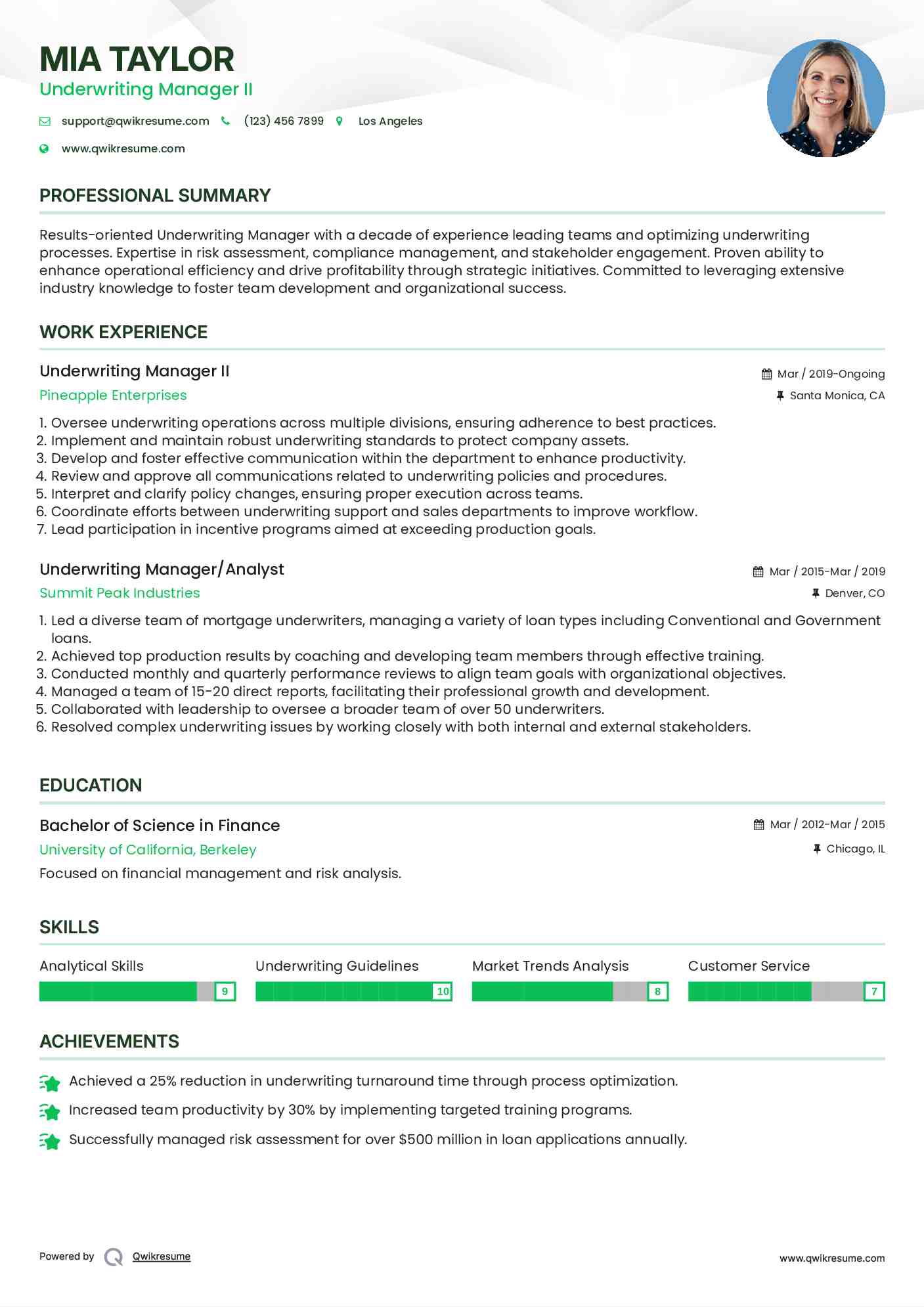

Underwriting Manager resume example

How to format your underwriting manager resume:.

- Use the same job title on your resume as the applied position of Underwriting Manager

- Highlight achievements in work experience section, emphasizing results from underwriting processes and policy changes

- Limit the resume to one page, prioritizing relevant experience and accomplishments for an Underwriting Manager role

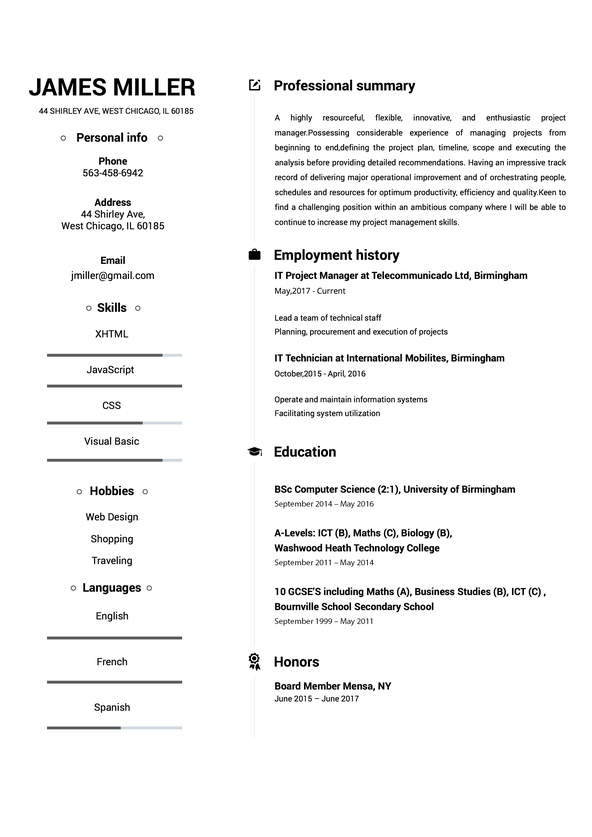

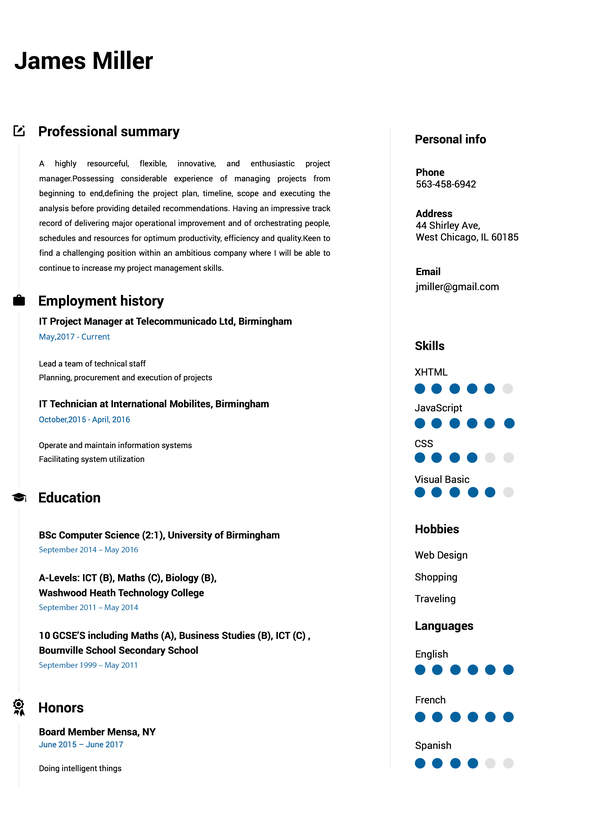

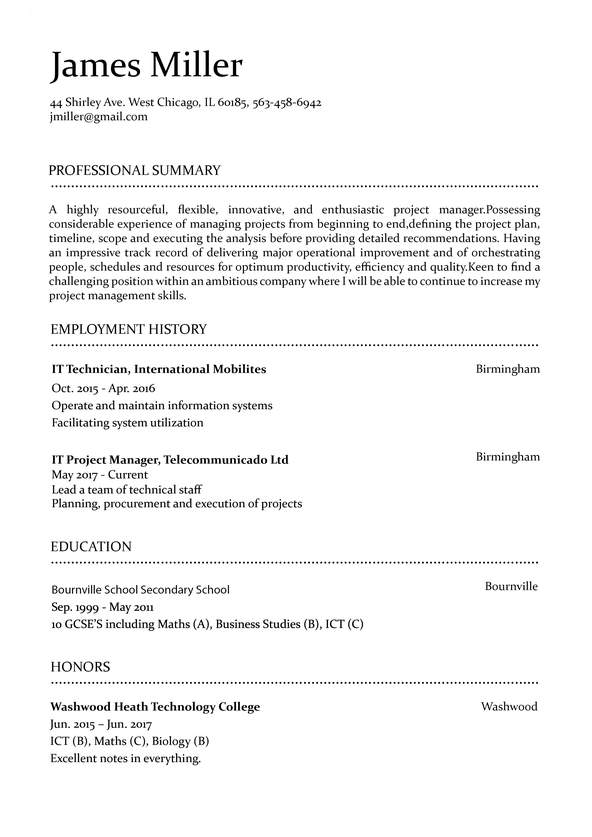

Choose from 10+ customizable underwriting manager resume templates

Choose from a variety of easy-to-use underwriting manager resume templates and get expert advice from Zippia’s AI resume writer along the way. Using pre-approved templates, you can rest assured that the structure and format of your underwriting manager resume is top notch. Choose a template with the colors, fonts & text sizes that are appropriate for your industry.

Underwriting Manager resume format and sections

1. add contact information to your underwriting manager resume.

Underwriting Manager Resume Contact Information Example # 1

Dhruv Johnson

[email protected] | 333-111-2222 | www.linkedin.com/in/dhruv-johnson

2. Add relevant education to your underwriting manager resume

Your resume's education section should include:

- The name of your school

- The date you graduated ( Month, Year or Year are both appropriate)

- The name of your degree

If you graduated more than 15 years ago, you should consider dropping your graduation date to avoid age discrimination.

Optional subsections for your education section include:

- Academic awards (Dean's List, Latin honors, etc. )

- GPA (if you're a recent graduate and your GPA was 3.5+)

- Extra certifications

- Academic projects (thesis, dissertation, etc. )

Other tips to consider when writing your education section include:

- If you're a recent graduate, you might opt to place your education section above your experience section

- The more work experience you get, the shorter your education section should be

- List your education in reverse chronological order, with your most recent and high-ranking degrees first

- If you haven't graduated yet, you can include "Expected graduation date" to the entry for that school

Check More About Underwriting Manager Education

Underwriting Manager Resume Relevant Education Example # 1

Bachelor's Degree In Finance 1999 - 2002

University of Iowa Iowa City, IA

Underwriting Manager Resume Relevant Education Example # 2

Bachelor's Degree In Business 1997 - 2000

Central State University Wilberforce, OH

3. Next, create an underwriting manager skills section on your resume

Your resume's skills section should include the most important keywords from the job description, as long as you actually have those skills. If you haven't started your job search yet, you can look over resumes to get an idea of what skills are the most important.

Here are some tips to keep in mind when writing your resume's skills section:

- Include 6-12 skills, in bullet point form

- List mostly hard skills ; soft skills are hard to test

- Emphasize the skills that are most important for the job

Hard skills are generally more important to hiring managers because they relate to on-the-job knowledge and specific experience with a certain technology or process.

Soft skills are also valuable, as they're highly transferable and make you a great person to work alongside, but they're impossible to prove on a resume.

Example of skills to include on an underwriting manager resume

Customer service is the process of offering assistance to all the current and potential customers -- answering questions, fixing problems, and providing excellent service. The main goal of customer service is to build a strong relationship with the customers so that they keep coming back for more business.

Risk management is the method of recognizing, evaluating, and managing risks to an organization's resources and profits. Financial insecurity, regulatory liability, strategic management mistakes, incidents, and natural hazards are just some of the challenges or dangers that could arise. For digitalized businesses, IT security vulnerabilities and data-related threats, as well as risk management techniques to mitigate them, have become top priorities.

Underwriting guidelines are a set of rules and requirements an insurer provides to its agents and underwriters. The underwriter then uses these instructions to judge the prospective insured, whether to accept, modify or reject it. These guidelines help the insurers set the criteria for the customer and let them know the amount of money that should be offered to the client, or whether not to offer an insurance policy in the first place.

A financial statement is a report of an individual or a company that includes all the information about the declared assets, the use of money, income, and also the contribution of shareholders over a certain period.

A credit policy encompasses guidelines that constitute the amount of credit granted, along with means and methods of collections for delinquent accounts. A credit policy typically addresses credit terms, credit limits, information requirements, and collection progression. The credit policy is tweaked to match business strategies and reflect any change in economic conditions.

Loss ratio is a term used in the insurance industry to represent the ratio of losses to earned premiums. The formula stands for adjustment expenses plus insurance claims divided by the total premiums.

Top Skills for an Underwriting Manager

- Customer Service , 13.3%

- Portfolio , 7.0%

- Risk Management , 6.5%

- Underwriting Guidelines , 6.3%

- Other Skills , 66.9%

4. List your underwriting manager experience

The most important part of any resume for an underwriting manager is the experience section. Recruiters and hiring managers expect to see your experience listed in reverse chronological order, meaning that you should begin with your most recent experience and then work backwards.

Don't just list your job duties below each job entry. Instead, make sure most of your bullet points discuss impressive achievements from your past positions. Whenever you can, use numbers to contextualize your accomplishments for the hiring manager reading your resume.

It's okay if you can't include exact percentages or dollar figures. There's a big difference even between saying "Managed a team of underwriting managers" and "Managed a team of 6 underwriting managers over a 9-month project. "

Most importantly, make sure that the experience you include is relevant to the job you're applying for. Use the job description to ensure that each bullet point on your resume is appropriate and helpful.

- Developed PowerPoint of ACT structure/philosophy and criteria for staff training.

- Administered corporate policies and procedures and ensures compliance with legal and regulatory requirements of Trust operations.

- Monitored communication between associates with foreclosure, litigation and mediation attorneys to oversee progress and minimize losses and legal risks.

- Improved support availability and reporting metrics globally.

- Mitigated operational risk through conception and execution of documented policies for emerging process.

- Used to determine DTI (Debt to Income) ratios to qualify clients for a specific repayment program.

- Performed in depth review of FHA and Conventional financing which includes experience working with DU and maneuvering through the system.

- Assisted other departments with questions on litigation for current accounts and Foreclosure Systems: Aspen, LPS/Fidelity, LIV, Aspen

- Evaluated home loans, revised necessary forms, organized into specific folders, located additional information, filed when complete.

- Managed all components of loan transaction process for approximately 6,000 conforming, non-conforming and jumbo residential mortgages and construction loans.

- Managed overall processing functions in accordance with KPI minimum productivity standard metrics.

- Mentored and developed lenders through weekly and monthly reviews and annual performance evaluations.

- Monitored case queue volume and assigned to staff throughout the day to ensure SLA was met.

- Negotiated directly with FNMA/FHLMC to resolve agency mortgage loan repurchase requests.

- Audited customer service calls for quality assurance and ensured associates performed proper procedures and compliance.

- Analyzed income documentation including personal, partnership and corporate tax returns including 4506T Audit results.

- Maintained a $750K signing authority for portfolio loan products.

- Created an innovative way to complete the underwriting process which maintained quality and increased productivity.

- Conducted time sensitive investigations specific to market value manipulation, flipping trends, misrepresentation of loan transactions.

- Improved audit turnaround time and productivity by restructuring existing procedures effectively utilizing target dates and tracking monthly goals.

5. Highlight underwriting manager certifications on your resume

Specific underwriting manager certifications can be a powerful tool to show employers you've developed the appropriate skills.

If you have any of these certifications, make sure to put them on your underwriting manager resume:

- Chartered Property Casualty Underwriter (CPCU)

- Associate in General Insurance (AINS)

- Certified Residential Underwriter (CRU)

6. Finally, add an underwriting manager resume summary or objective statement

A resume summary statement consists of 1-3 sentences at the top of your underwriting manager resume that quickly summarizes who you are and what you have to offer. The summary statement should include your job title, years of experience (if it's 3+), and an impressive accomplishment, if you have space for it.

Remember to emphasize skills and experiences that feature in the job description.

Common underwriting manager resume skills

- Customer Service

- Risk Management

- Underwriting Guidelines

- Financial Statements

- Underwriting Process

- Performance Management

- Credit Policy

- Profitable Growth

- Underwriting Decisions

- Commercial Property

- Direct Reports

- Strong Analytical

- Financial Analysis

- Product Development

- Underwriting Quality

- Underwriting Policies

- Performance Reviews

- Tax Returns

- Underwriting Functions

- Loan Products

- Renewal Business

- Credit Decisions

- Credit Risk

- Credit Reports

- Account Executives

- Quality Standards

- Risk Analysis

- Mortgage Loans

- Strong Negotiation

- Due Diligence

- Underwriting Authority

- Underwriting Issues

- Investor Guidelines

- Training Programs

- Credit Worthiness

- Loan Applications

Underwriting Manager Jobs

Links to help optimize your underwriting manager resume.

- How To Write A Resume

- List Of Skills For Your Resume

- How To Write A Resume Summary Statement

- Action Words For Your Resume

- How To List References On Your Resume

Updated April 25, 2024

Editorial Staff

The Zippia Research Team has spent countless hours reviewing resumes, job postings, and government data to determine what goes into getting a job in each phase of life. Professional writers and data scientists comprise the Zippia Research Team.

Underwriting Manager Related Resumes

- Accounting Manager Resume

- Asset Manager Resume

- Audit Manager Resume

- Bank Manager Resume

- Cash Manager Resume

- Cost Accounting Manager Resume

- Credit Manager Resume

- Finance Center Manager Resume

- Finance Manager Resume

- Manager Resume

- Mortgage Underwriter Resume

- Reporting Manager Resume

- Risk Manager Resume

- Senior Underwriter Resume

- Tax Manager Resume

Underwriting Manager Related Careers

- Accounting Manager

- Asset Manager

- Audit Manager

- Bank Manager

- Branch Manager

- Business Relationship Manager

- Cash Manager

- Collections Manager

- Cost Accounting Manager

- Credit Manager

- Finance Center Manager

- Finance Manager

- Investments Manager

- Mortgage Underwriter

Underwriting Manager Related Jobs

What similar roles do.

- What Does an Accounting Manager Do

- What Does an Asset Manager Do

- What Does an Audit Manager Do

- What Does a Bank Manager Do

- What Does a Branch Manager Do

- What Does a Business Relationship Manager Do

- What Does a Cash Manager Do

- What Does a Collections Manager Do

- What Does a Cost Accounting Manager Do

- What Does a Credit Manager Do

- What Does a Finance Manager Do

- What Does an Investments Manager Do

- What Does a Manager Do

- What Does a Mortgage Underwriter Do

- What Does a Reporting Manager Do

- Zippia Careers

- Executive Management Industry

- Underwriting Manager

- Underwriting Manager Resume

Browse executive management jobs

Build my resume

- Build a better resume in minutes

- Resume examples

- 2,000+ examples that work in 2024

- Resume templates

- Free templates for all levels

- Cover letters

- Cover letter generator

- It's like magic, we promise

- Cover letter examples

- Free downloads in Word & Docs

5 Underwriter Resume Examples Created for 2024

Underwriter Resume

- Underwriter Resumes by Experience

- Underwriter Resumes by Role

- Write Your Underwriter Resume

You effortlessly navigate the complex world of underwriting, ensuring your organization is compliant with the evolving regulatory landscape every step of the way.

Assessing client risk, negotiating contracts, and calculating premiums are things that are now second nature to you. However, you’ll need to tap into a different set of skills to create a resume that summarizes your strengths.

Good news—we’ve helped many underwriters like you score their dream jobs! Using our sample underwriter resume examples , resume tips , and free cover letter builder , you can land more interviews and, ultimately, the job you desire.

or download as PDF

Why this resume works

- Including your role in managing a $121M loan portfolio in your underwriter resume is adequate evidence to attest to your abilities to perform at the highest levels and deliver desirable results.

Entry Level Underwriter Resume

- Leverage your past work experiences and mention how you’ve used tools such as Pipedrive, eFileCabinet, and your negotiation skills to identify customer trends, analyze financial reports, and manage databases. Have any risk navigator projects up your sleeve? Add them too.

Commercial Underwriter Resume

- It’s also a great addition to having any majors or specialization in insurance and risk management. This will prove that you’re flexible and can help prevent and minimize risk as much as possible to ensure a company makes the best financial decisions at all times for its customers.

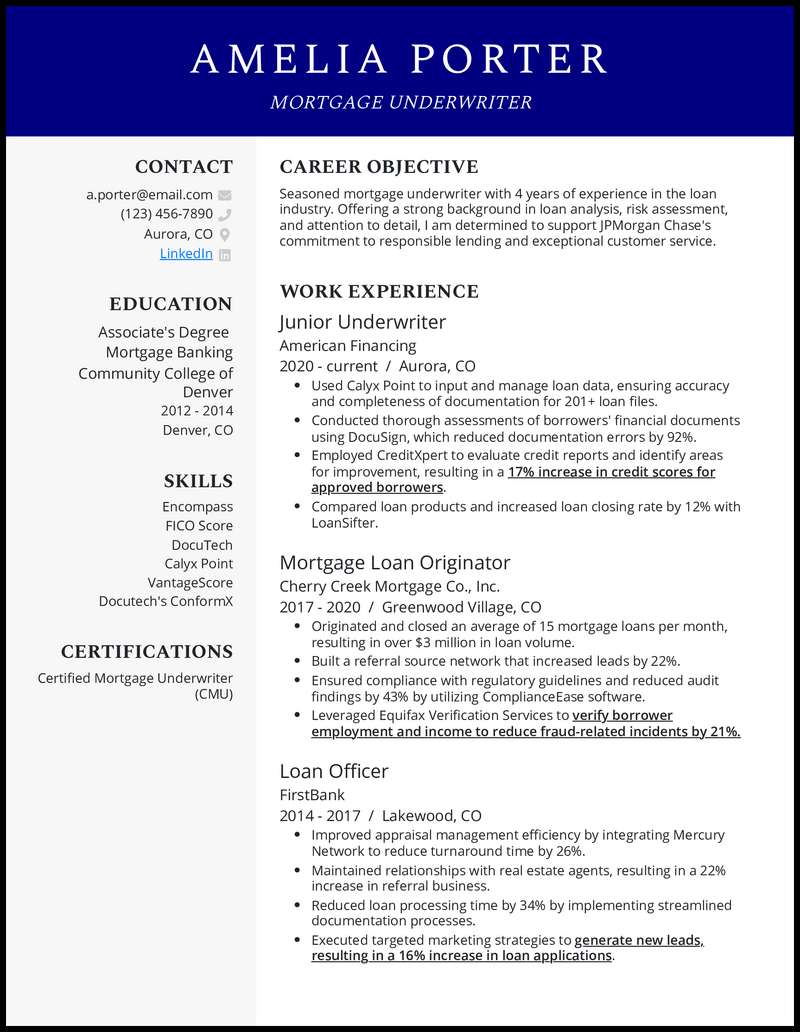

Mortgage Underwriter Resume

- Therefore, your mortgage underwriter resume should show a track record of closed deals through established and trusted networks built over the years if you’re to make a great impression on hiring managers.

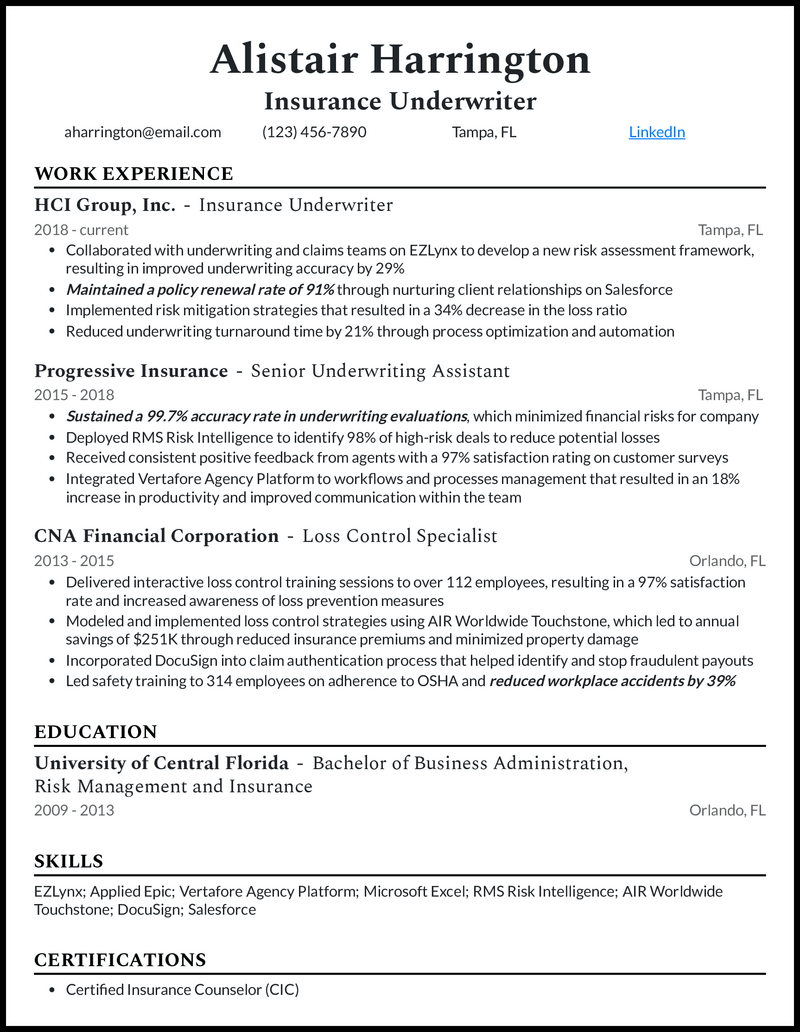

Insurance Underwriter Resume

- Therefore, achieving a 97% customer satisfaction score in your insurance underwriter resume, among other measurable achievements, gives you a niche-specific advantage.

Related resume examples

- Retail Manager

- Retail Sales Associate

- Office Manager

- Office Assistant

- Office Administrator

Fine-tune Your Underwriter Resume to Match the Job

Your work drives companies’ financial decisions when it comes to issuing loans, mortgages, or insurance policies. Lean into your skills and knowledge that guide your process and allow you to make these judgments, avoiding generic terms like “teamwork” or “meticulous.”

Given the analytical nature of underwriting, it’s best to focus primarily on your technical and job-specific skills . Talk about things like regulatory compliance and financial analysis, and don’t forget to mention your software proficiencies, such as underwriting tools, risk management software, or database management systems.

Need some ideas?

15 popular underwriter skills

- Risk Assessment

- Financial Analysis

- Regulatory Compliance

- Database Management

- Microsoft Excel

- RMS Risk Intelligence

- Oracle Database

- Calyx Point

Your underwriter work experience bullet points

No matter the type of underwriting you specialize in, you spend your days analyzing client data, conducting risk assessments, collaborating with brokers and agents, and making decisions on policy issuance. As these tasks are known to recruiters, you’ll make more of an impression if you focus on your achievements instead.

Your work impacts your organization’s bottom line; hence it can be neatly quantified. Use this to your advantage. Show off your effectiveness and the impact you could have on a potential employer by providing concrete metrics.

Whether your strongest achievements are bulletproofing a risk assessment framework, or managing record monthly volumes of loans, this section is where you talk about them, substantiating them with data to convey your unique professional value.

- Highlight instances where your work refining and automating workflows led to reducing underwriting turnaround times.

- Show off improvements to loss ratios that your risk assessment and mitigation strategies resulted in.

- Emphasize the specific software you leveraged to achieve your goals, such as the reduction in claim rates your analysis with Excel and Tableau brought on.

- List instances where your work directly bolstered company financials, such as spearheading an increase in insurance premiums or trimming expenses.

See what we mean?

- Implemented risk mitigation strategies that resulted in a 34% decrease in the loss ratio

- Employed CreditXpert to evaluate credit reports and identify areas for improvement, resulting in a 17% increase in credit scores for approved borrowers

- Achieved an error rate of less than 1% on fraud risk assessments using CoreLogic LoanSafe, resulting in zero avoidable losses

- Utilized SAS to implement a pricing strategy that resulted in a 13% increase in premium revenue and a 7% reduction in underwriting expenses

9 active verbs to start your underwriter work experience bullet points

- Implemented

3 Tips for Writing an Underwriter Resume if You’re Just Starting Out

- If you have certifications such as the Chartered Property Casualty Underwriter (CPCU), Associate in Commercial Underwriting (ACU), or specialized certifications such as Certified Mortgage Underwriter (NAMU-CMU), display them prominently in your resume. They may not always be required, but they do showcase your commitment to the role.

- Be selective with which skills you list in your resume , prioritizing those you feel confident in and that each job description emphasizes. For instance, if a role highlights the need for UnderRight proficiency, and it’s something you know you’re good at, then display it at the top of your skills list.

- If you’re applying for your first job as an underwriter, leverage your academic and extracurricular experiences to highlight your skills. For example, reaffirm your catastrophe modeling skills by talking about the college case study you undertook using Applied Epic to forecast potential losses.

3 Tips for Writing an Underwriter Resume if You’re Already Experienced

- With your experience, your work has positively impacted the financials of companies you’ve worked for. Get into the specifics of initiatives you led that affected revenues, such as the fraud detection overhaul you instituted, which led to reduced losses due to fraud.

- Instead of listing “collaboration” or “stakeholder management” in your resume skills , show recruiters that it’s in your repertoire. Talk about instances where you liaised with brokers, loan originators, or policyholders, and the impact your collaboration had.

- Go into detail about your specialty within underwriting. For instance, if you specialize in insurance or mortgage underwriting, talk about specific certifications, courses, or work experience you have that contribute to your expertise.

Pinpoint some of your transferable skills from your other financial roles, such as your ability to work with Microsoft Excel or database management systems—and more generally, your flair for interpreting vast sums of data.

If you do include one, be sure to tailor it to each job description , mentioning the company and role specifically. Include your career highlights and key strengths, such as risk assessment or financial analysis.

Lender policies and federal regulations are constantly evolving. If you’ve taken steps to stay abreast of industry developments, such as attending industry workshops or conferences, mention these to show recruiters your commitment to underwriting.

Underwriting Manager Resume Sample

The resume builder.

Create a Resume in Minutes with Professional Resume Templates

Work Experience

- Ensures timely renewal and/or review of BusinessLink portfolio

- Provides ongoing training for underwriting staff to ensure consistent credit decisions

- Ensures that customers (internal) receive prompt, courteous and accurate responses

- Knowledge of Bank’s operations, systems, and compliance and regulatory issues

- Review employees’ time and labor (including time cards and PTO requests) and monitor/manage overtime hours of underwriting staff

- Manages a team that functions as a National resource that provides timely assistance, primarily by phone, and support for inquiries pertaining to information within Fannie Mae's Selling Guide to both external and internal Fannie Mae customers

- Stay abreast of and well versed on all Guide/Product changes (e.g. Announcements, Lender Letters, Publications, etc.). Ensure that team is continually briefed on and understands changes

- Interprets internal and external customer service related surveys to monitor the level of quality, satisfaction and success of the services provided by the SGST as a means to identify any area(s) for process improvement, improved customer service, fewer missed opportunities and overall service excellence

- Coordinate and administer assignments, monitor team progress, and maintain schedules. Identify opportunities to streamline, improve efficiencies, and reduce costs

- Report to management on the unit's production, activities, and efforts

- Plan, document, and manage the performance of subordinate staff. Provide for professional or technical growth through assignment, mentoring, or training

- Supervise Underwriting Department personnel. This includes hiring, training, coaching and conducting performance appraisals

- Underwrite loan files. Complete a thorough analysis of entire loan packages to determine compliance with company, investor, and FHA/VA guidelines. File load to be determined by manager

- Underwrite complex tax returns and complicated loan and income scenarios for Portfolio and Construction-Perm loans

- Ensure the accurate and timely underwriting of all loan files within the department

- Provide daily review and support to underwriting staff on files requiring a second signature

- Complete a thorough analysis of entire loan packages to determine compliance with company, investor, and FHA/VA guidelines

- Experience underwriting loan files, understanding of complex tax returns, and complicated loan and income scenarios for Portfolio and Construction Perm loans

- Be responsible for evaluating, analyzing and forming opinions for the approving or denying of agricultural and/or commercial loan applications according to business unit standards

- Gathers information as necessary to make sound decisions

- Ensures credit requests are processed in accordance with bank policy

- Monitor overall pipeline and ensure workloads are adjusted

- Coach team to achieve/exceed optimal performance against metrics; take action to optimize productivity, quality, efficiency and service-levels

- Conduct monthly reviews of approved and declined loan applications to ensure compliance with underwriting standards and risk management factors, quality decision standards, and provide coaching and training to team to build capabilities

- Review and respond promptly to address/clear outstanding finding in audit reports received from Post Closing,Quality Assurance, Secondary Investors; assist Corporate in clearing Shipping and Suspense deficiencies

- Monitor various reports to identify possible training opportunities

Professional Skills

- Strong relationship management and operational abilities, analytical and problem solving skills, and project management skills

- Excellent communication skills both verbal and written including presentation skills

- Analytical skills: Demonstrated ability to analyze transaction/portfolio risks and effectively mitigate

- Outstanding leadership skills, with the ability to effectively manage, delegate, mentor and motivate teams

- Excellent underwriting skills – makes quality credit decisions, able to easily read &

- Excellent writing and communication skills; requires ability to articulate complex requirements to a wide range of audiences

- Strong management, influencing, negotiation, and communication skills

How to write Underwriting Manager Resume

Underwriting Manager role is responsible for underwriting, leadership, interpersonal, analytical, business, credit, customer, organizational, risk, lending. To write great resume for underwriting manager job, your resume must include:

- Your contact information

- Work experience

- Skill listing

Contact Information For Underwriting Manager Resume

The section contact information is important in your underwriting manager resume. The recruiter has to be able to contact you ASAP if they like to offer you the job. This is why you need to provide your:

- First and last name

- Telephone number

Work Experience in Your Underwriting Manager Resume

The section work experience is an essential part of your underwriting manager resume. It’s the one thing the recruiter really cares about and pays the most attention to. This section, however, is not just a list of your previous underwriting manager responsibilities. It's meant to present you as a wholesome candidate by showcasing your relevant accomplishments and should be tailored specifically to the particular underwriting manager position you're applying to. The work experience section should be the detailed summary of your latest 3 or 4 positions.

Representative Underwriting Manager resume experience can include:

- Assist Operations Managers with training branch/region employees regarding disclosures, use of company software systems, and branch-specific procedures related to underwriting

- Highly effective business written and oral communication skills, which includes strong presentation skills and influencing/persuasive skills

- Strong relationship, presentation skills, negotiation and leadership skills

- Superior communication and organizational skills, as well as strong interpersonal and analytical skills

- Experience, 2 years currently managing a diversified Mortgage Underwriting Operation with strong technical, business and managerial skills

- University graduate with strong analytical skills or lower academic qualification with more than 10 years of NB/ Underwriting system project experience

Education on an Underwriting Manager Resume

Make sure to make education a priority on your underwriting manager resume. If you’ve been working for a few years and have a few solid positions to show, put your education after your underwriting manager experience. For example, if you have a Ph.D in Neuroscience and a Master's in the same sphere, just list your Ph.D. Besides the doctorate, Master’s degrees go next, followed by Bachelor’s and finally, Associate’s degree.

Additional details to include:

- School you graduated from

- Major/ minor

- Year of graduation

- Location of school

These are the four additional pieces of information you should mention when listing your education on your resume.

Professional Skills in Underwriting Manager Resume

When listing skills on your underwriting manager resume, remember always to be honest about your level of ability. Include the Skills section after experience.

Present the most important skills in your resume, there's a list of typical underwriting manager skills:

- A good team player with excellent negotiation, influencing and selling skills

- Personal lines underwriting experience with at least 2 years of prior leadership/management experience

- Strong overall computer skills (i.e., MS Office, automated underwriting systems)

- Excellent organizational and team-building skills

- Good computer programming skills

- Good underwriting skills of Health Business

List of Typical Experience For an Underwriting Manager Resume

Experience for regional underwriting manager resume.

- Demonstrated leadership effectiveness with strong analytical skills

- Effective verbal and written communication skills- which include active listening, and presenting findings and recommendations

- Effective decision-making, customer service, sales, customer support and problem solving skills

- Demonstrated ability to interact effectively with branch, regional and corporate personnel as well as outside vendors

- Strong Excel and math skills

- University graduate with strong analytical skills

Experience For Assistant Underwriting Manager Resume

- Effective interpersonal skills needed to create and expand partnerships with internal and external customers as well as to influence and negotiate

- Customer focus, good interpersonal and communication skills

- Demonstrated experience in originating and/or underwriting, structuring and negotiating LIHTC investments for a syndicator or direct investor

- Good knowledge & experience in evaluating complex exposures as well as directing and assisting others in analysing unusual and complex risks

- Evaluate staff to identify skills and training needs; create opportunities to expand roles to match employee strengths or address weaknesses

- Risk Selection: Responsible for implementing a strategy to better evaluate risk quality and further UWs skillset in qualifying, selecting and assessing risk

Experience For Underwriting Manager, Select Express Resume

- Effectively manage all risks in underwriting to ensure portfolio is within risk appetite

- Work alongside business development colleagues to effectively maximize our distribution partner network

- Expert level underwriting skills as it relates to title, income, credit reports and collateral

- Effectively manage selected distribution channels

- Effectively adapt to cultural differences as well as to organisational demands

Experience For Mortgage Underwriting Manager Resume

- Experience influencing/managing teams, including matrix partners and 3rd party vendor resources

- Experience in a group employee benefits pricing underwriting, focusing on Group Life & Disability

- Knowledge of employee benefits financing mechanisms including insured, self-insured, experience rating and captives

- Provide technical training to underwriting staff to increase skill levels and authority

- Provide quality through appropriate mentoring, training and development of less experienced team members

- Strong Knowledge and understanding of Small Commercial and Branch distribution and business strategies

- UW experience

- Field underwriting experience

- Experience working in commercial insurance

Experience For Senior Underwriting Manager Resume

- Reviews, analyzes, and documents evidence for New Business to determine appropriate risk classifications. Signing authority up to $15 million

- Knowledge and experience with Medical Information Bureau (MIB) coding

- Experience writing documents such as emails, correspondence, adverse disclosure notices, etc

- Demonstrated strength in the preparation of projections, budgets and pro-forma statements, preferably in Multifamily

- Identify areas of opportunity to earn new business and improve the underwriting experience

- Strong understanding of the operational responsibilities involved in the purchase and transfer of whole loan assets as it pertains to credit quality

- Handles escalated issues for Underwriting Department, prior to upper managements’ involvement

Experience For Avp-regional Underwriting Manager Resume

- Handle renewals and presales; demonstrate sound judgment in knowing when to elevate case level issues to leadership

- Demonstrate understanding of analytics

- Excellent working rapport with wholesale brokerage community

- Manage and develop staff ensuring effective talent development, employee relations as well as performance management

- Underwriting experience in the Casualty field

- Experience/existing relationships with retail brokers in Southeast Region

- Supervises a team of Underwriters and promotes effective underwriting through standardization, simplification, and organization

- Experience with territory management and identifying Underwriting needs to maximize growth and profitability

- Manage priorities and be responsive to client needs and expectations

Experience For AVP Underwriting Manager Central Resume

- Establish and maintain relationships with Ops and Sales leadership to ensure timely and effective resolutions to customer service issues

- Previous experience Team Lead or Manager to Underwriters

- Good understanding of Commercial & Risk Underwriting and claims matters and Credit insurance contracts and procedures

- Five (5)+ years’ underwriting experience, preferably in manual/traditional processing

- Previous experience of EDI/Polaris systems working with or mapping to industrywide standards for both on and offline channels of business,

- Experience of liaising and reporting to senior management

Experience For Commercial MBS Senior Underwriting Manager Resume

- Experience leading workers compensation underwriting teams

- Develop strong relationships with key business partners whilst maximising Company’s profitable growth objective

- Good knowledge of general insurance and underlying legal principles and practices

- Experience underwriting loss-sensitive and large casualty accounts

- Experience managing a team of underwriters

- Experience of underwriting highly technical risks

Experience For Divisional Underwriting Manager Resume

- Build, maintain and demonstrate a comprehensive knowledge and understanding of Marsh

- Assist Underwriter in prioritizing RUSH’s, conditions and newly submitted loans to meet required turn-around time

- Develop and maintain good relationship with business partners

- Ensure reinsurance is obtained where needed and cost effective

- Strong relationships with Western US retail brokerage community

- Cooperate and coordinate with IT to ensure the user requirement deliverables are on a timely basis

- Good command of English and Chinese

- Strong relationships with wholesale brokerage community

- Personally establish and cultivate relationships with key producers to maintain a strong position in the marketplace

Experience For Multifamily Underwriting Manager Resume

- Evaluate operational performance, identify opportunities for improvement, prioritize initiatives, and allocate operational resources

- Determined and motivated, demonstrates initiative, is goal-orientated

- Establish and maintain excellent relations with internal and external entities

- Seven to eight years of experience in mortgage activities

- Proven ability to influence and negotiate across the organization

List of Typical Skills For an Underwriting Manager Resume

Skills for regional underwriting manager resume.

- Excellent organizational skills; ability to manage and prioritize multiple tasks. Strong analytical skills

- Skilled presenter with excellent written & oral communication skills

- Excellent math or statistic skills with good judgment and attention to detail

- Knowledge and skills: Clear and concise oral and written communication skills

- Excellent organizational skills and able to manage and prioritize multiple tasks

- Strong problem solving, analysis and communication skills, with the ability to influence stakeholders at all levels

- Good team player with excellent interpersonal skill

Skills For Assistant Underwriting Manager Resume

- Strong customer service and negotiations skills

- Strong time management skills; ability to multi-task

- Strong managerial and leadership skills to set direction and manage a complex underwriting, product, and data management organization

- Strong aptitude and demonstrated experience with Excel, Word, and PowerPoint

- Excellent analytical, written, and verbal communications skills

- Excellent time management skills to enable successful delivery to deadlines and to the required standard

Skills For Underwriting Manager, Select Express Resume

- Strong PC skills (eg Excel, PowerPoint)

- Strong PC skills (e.g. Excel, PowerPoint)

- Proven initiative and judgement to resolve routine problems independently or effectively utilize appropriate resources

- Excellent communication and collaboration skills with the ability to influence others

- Prior analytical coding experience using languages such as SQL, SAS, Emblem would be extremely beneficial

- Negotiation, influencing and selling skills

- Solid experience in handling Group Medical insurance underwriting and administration

Skills For Mortgage Underwriting Manager Resume

- Added preference for skills in structuring multinational insurance business in a compliant manner

- Demonstrates and fosters a sense of urgency, strong commitment and accountability for achieving results

- Demonstrable Powerpoint presentation and KSH management skills

- Highly developed leadership skills for coaching and feedback

- 2 + yrs of managerial, supervisory and/or demonstrated leadership experience

Skills For Senior Underwriting Manager Resume

- Prior experience in commercial loan valuation / underwriting

- Advanced critical evaluation and analytical skills

- Capacity to effectively translate complex issues into standard financial language that can be used to make decisions

- Good interpersonal skill and business networks of Health Industry

- Demonstrated experience at a senior credit authority level and ability to analyze risks and balance with opportunity

- Good underwriting experience in Property and Casualty Business

- Experience: At least 5 years total work experience with 3+ years in insurance or financial services

- Analytical and quantitative skills; familiarity with actuarial concepts

- Continue to develop skills and knowledge by seeking out opportunities for growth

Skills For Avp-regional Underwriting Manager Resume

- Able to effectively lead and direct staff

- Leading an underwriting team, to include: planning, monitoring, and skill development/performance management

- Developing and maintaining strong relationships with internal and external partners

- Strong knowledge of underwriting philosophy, techniques, national/local filing regulations and guideline

- Experience of subprime underwriting in a consumer lending business

- Experience concurring on others’ credit decisions and/or handling of escalated

- Previous experience of EDI/Polaris systems working with or mapping to industrywide standards for both on and offline channels of business

- Wholesale Underwriting or Wholesale Portfolio Management Experience

Skills For AVP Underwriting Manager Central Resume

- Previous experience underwriting Large Structured Transactions

- Previous supervisory experience of a mortgage loan processing team

- Manual underwriting experience

- Proven track record of driving client delight results

- Manage multiple tasks/projects/competing priorities

- Previous mortgage underwriting Leadership experience required

- Experience with leading a large scale organization

- Experience in executing large strategy change programmes

- Additional experience or knowledge of Group Medical or Dental underwriting and products

Skills For Commercial MBS Senior Underwriting Manager Resume

- Re-insurance experience and working knowledge

- Demonstrated leadership and decision-making ability

- Experience in commercial underwriting for both small and midsize companies

- Ten years Large Commercial Casualty Underwriting Experience

- Additional experience in sales, business development or marketing preferable

- Transportation, Construction and Industrial Equipment Finance Experience

- Strong partnership with sales colleagues

- Strong relationships with wholesale and retail brokerage community

Skills For Divisional Underwriting Manager Resume

- Analytical individual with strong business acumen

- A good understanding of Credit insurance, including legal aspects

- A passion for customer service and a good understanding of the advisor's role and challenges

- Experience in Underwriting Group Employee Benefits

- Demonstrated results in continuous improvement (speed, quality, cost and finesse )

- Ten years Casualty underwriting experience required; preferably in the Excess & Surplus Lines sector

- Experience in underwriting or actuarial

- Previous experience of qualitative assessment in a large-scale operation, ideally within a claims or underwriting environment

Skills For Multifamily Underwriting Manager Resume

- Preferable experience in a corporate environment

- Demonstrates Self-Awareness and Accountability

- Strives for strong employee engagement at all levels

- 5 + 7 yrs of risk management experience with substantial background in group ancillary benefits

- Excellent ability in both Word and Excel

- Insurance industry experience

List of Typical Responsibilities For an Underwriting Manager Resume

Responsibilities for regional underwriting manager resume.

- Demonstrated effective management, communication, and leadership skills

- Effectively leading a team of people and driving a high performance culture whilst being adaptable to change

- Working experience with substantial experience gained within the insurance industry

- Deep knowledge of underwriting practices, products, processes, and industry trends. Analytical and quantitative skills

- Communicate effectively across multi-vendor environment

Responsibilities For Assistant Underwriting Manager Resume

- Ensure effective utilization of detailed monitoring standards including quality reviews and peer reviews to assess underwriting results and compliance

- Strong knowledge of SBA underwriting, servicing and liquidation regulations

- Demonstrate understanding and awareness of market dynamics and market cycle to drive and enhance business performance

- Cooperate with co-workers to foster a teaming atmosphere. Establish and monitor workflows to meet goals

- Commercial Underwriting, Loan Portfolio Management or other related experience

- Advanced knowledge and experience managing a commercial loan portfolio

- Experience with SBA portfolio servicing and liquidations

- Or above experience in General Insurance, especially in Property and Casualty underwriting

- Solid understanding of business technologies and workflows

Responsibilities For Underwriting Manager, Select Express Resume

- Experience or equivalent

- Min of 3 years managerial experience, preferably in financial or banking organizations beneficial

- Communicate to advisers and other intermediaries in an effective and timely manner

- Understands team dynamics and how to facilitate good teamwork; fosters commitment and team spirit

- Related supervisory/management experience

Responsibilities For Mortgage Underwriting Manager Resume

- Progressive responsibility underwriting and book of business management experience

- Recent manual underwriting experience

- Proven ability to influence and negotiate across organization

- Direct underwriter’s activity-work schedules, daily priorities, project, assignments, and

- Excellent technical knowledge of relevant insurance classes and EBITAC principles

- Proven track record of robust financial management and wider management principles and techniques

- Experience with agribusiness insurance

- Experience in Healthcare Professional Liability line of business or segment

Responsibilities For Senior Underwriting Manager Resume

- Experience in Errors and Omissions, Cyber, Security & Privacy lines line of business or segment

- Demonstrated leadership ability to lead direct reports and/or major cross-functional sales or project teams

- Experience in EB field

- Good customer service mindset

- Good commend of both spoken and written English and Chinese

- Experience in Employee Benefits field

- Multi-line product experience, focused on operational excellence

- Experience in Management Liability Products

- Strong ability to read and analyze financial statements, negotiate Financial Lines coverage and make informed decisions on transactions

Responsibilities For Avp-regional Underwriting Manager Resume

- Leading, designing and implementing Underwriting rules and guidelines in support of our Underwriting strategy and philosophy

- Building and maintaining products in the Company’s Polaris and Internet environments

- Developing a team of Underwriting Managers and Underwriters

- Setting forth clear performance expectations and ensuring accountability for results and behaviors

- Underwriting of new business / renewals from Agents/ Brokers in accordance to underwriting authority

- Holding life insurance professional qualification. e.g. LOMA, ICA,…etc

Responsibilities For AVP Underwriting Manager Central Resume

- Working knowledge of change, project and process management methods and tools

- Working knowledge of First Mortgage Policies & Procedure and primary applications

- Underwriting small to large Workers’ Compensation accounts on a Guaranteed Cost basis as well as Loss Sensitive Plans

- Being instrumental in ensuring compliance to underwriting guidelines & procedures

- Working knowledge of mortgage-related systems and underwriting requirements

Responsibilities For Commercial MBS Senior Underwriting Manager Resume

- Mentoring and Coaching of Underwriters

- Being responsible for implementing the underwriting strategies across all the A&H business in China

- Overseeing the underwriting function for multiple production divisions

- Drafting the policies and procedures of the execution

- Determining which LIHTC investment meets the program requirements

Responsibilities For Divisional Underwriting Manager Resume

- Planning and delivery of key tools/systems used in underwriting and portfolio management

- Positioning of our product/program advantages in such a way that differentiate the program from existing competitors

- Acting as manager for the Brooklyn Property team

- Assisting underwriters to achieve business targets

- Holding life insurance professional qualification. e.g. LOMA and/ or well verse in LifeAsia system are preferable

- Working closely with Pricing, Product, Sales, New Business Operations & Data Analytics in order to achieve company goals of profit and growth

- Talent Management, including prospecting, interviewing, hiring and managing direct underwriting reports

- Assist in developing, promoting, and communicating Company goals and values to staff including key behaviors, profitability, production and service issues

- Continually develop expertise and technical knowledge through identifying and implementing appropriate learning and development activities

Responsibilities For Multifamily Underwriting Manager Resume

- Coordinate strategy and work collaboratively with other aligned business functions including claims, actuarial, engineering, analytics, legal and marketing

- Responsible for hiring and maintaining training schedules

- Assess training needs of Underwriting staff and assist in implementing staff Development Plans

- Comprehensive knowledge of medical underwriting rating principles, funding arrangements, BSC business drivers and broker/employer sales operations

- Be responsible for creating, maintaining and training on residential mortgage credit guidelines and policies

- Lead your region through creating and communicating a clear vision of your region’s plans and ambitions and by acting as a positive role model

- Be flexible between acting as team player and operating as an individual leader and knowing when to emphasize these roles

Related to Underwriting Manager Resume Samples

Editorial manager resume sample, underwriting consultant resume sample, underwriting officer resume sample, editor, associate, / editor, associate resume sample, editor, senior resume sample, manager & writer resume sample, resume builder.

Underwriting Manager Resume Guide

Underwriting Managers are responsible for analyzing and evaluating risk, making decisions about whether to accept or reject insurance applications. They review financial statements and other data to determine the amount of coverage needed, set appropriate premium rates, negotiate terms with clients, and ensure compliance with relevant regulations.

You have the experience and knowledge to become an outstanding underwriting manager, but potential employers won’t know who you are unless you create a resume that shows off your qualifications. Put together a document that demonstrates all of your abilities in order to get their attention.

This guide will walk you through the entire process of creating a top-notch resume. We first show you a complete example and then break down what each resume section should look like.

Table of Contents

The guide is divided into sections for your convenience. You can read it from beginning to end or use the table of contents below to jump to a specific part.

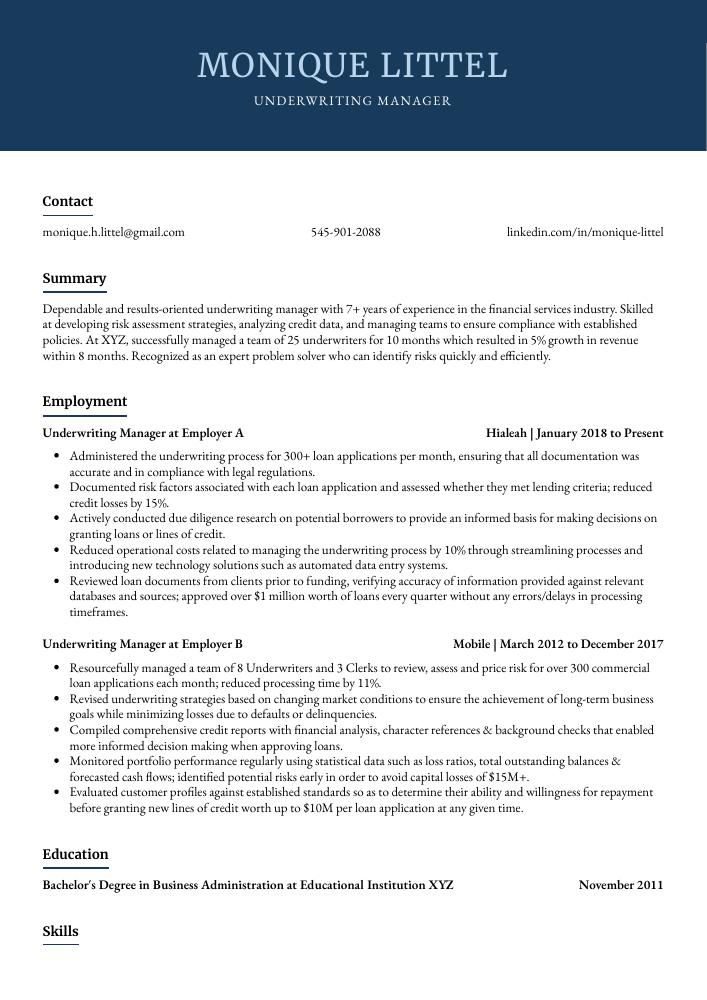

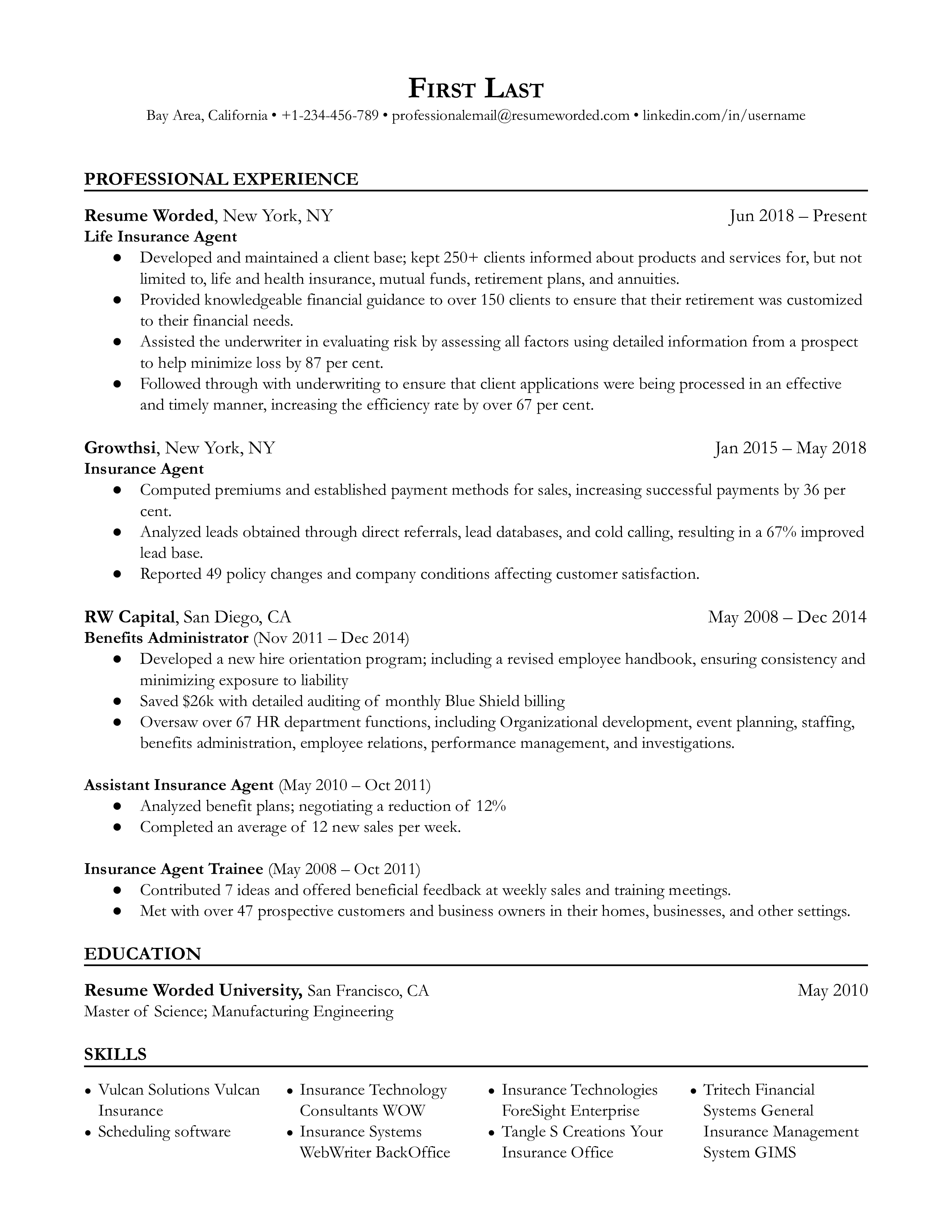

Underwriting Manager Resume Sample

Monique Littel Underwriting Manager

[email protected] 545-901-2088 linkedin.com/in/monique-littel

Dependable and results-oriented underwriting manager with 7+ years of experience in the financial services industry. Skilled at developing risk assessment strategies, analyzing credit data, and managing teams to ensure compliance with established policies. At XYZ, successfully managed a team of 25 underwriters for 10 months which resulted in 5% growth in revenue within 8 months. Recognized as an expert problem solver who can identify risks quickly and efficiently.

Underwriting Manager, Employer A Hialeah, Jan 2018 – Present

- Administered the underwriting process for 300+ loan applications per month, ensuring that all documentation was accurate and in compliance with legal regulations.

- Documented risk factors associated with each loan application and assessed whether they met lending criteria; reduced credit losses by 15%.

- Actively conducted due diligence research on potential borrowers to provide an informed basis for making decisions on granting loans or lines of credit.

- Reduced operational costs related to managing the underwriting process by 10% through streamlining processes and introducing new technology solutions such as automated data entry systems.

- Reviewed loan documents from clients prior to funding, verifying accuracy of information provided against relevant databases and sources; approved over $1 million worth of loans every quarter without any errors/delays in processing timeframes.

Underwriting Manager, Employer B Mobile, Mar 2012 – Dec 2017

- Resourcefully managed a team of 8 Underwriters and 3 Clerks to review, assess and price risk for over 300 commercial loan applications each month; reduced processing time by 11%.

- Revised underwriting strategies based on changing market conditions to ensure the achievement of long-term business goals while minimizing losses due to defaults or delinquencies.

- Compiled comprehensive credit reports with financial analysis, character references & background checks that enabled more informed decision making when approving loans.

- Monitored portfolio performance regularly using statistical data such as loss ratios, total outstanding balances & forecasted cash flows; identified potential risks early in order to avoid capital losses of $15M+.

- Evaluated customer profiles against established standards so as to determine their ability and willingness for repayment before granting new lines of credit worth up to $10M per loan application at any given time.

- Underwriting

- Risk Management

- Commercial Insurance

- Property and Casualty Insurance

- General Insurance

- Mortgage Lending

Bachelor’s Degree in Business Administration Educational Institution XYZ Nov 2011

Certifications

Chartered Property Casualty Underwriter (CPCU) The May 2017

1. Summary / Objective

Your resume summary should be the first thing a hiring manager reads, so make sure it’s compelling and succinct. In this section, you can highlight your experience in underwriting management by mentioning how many years of experience you have in the field, any relevant certifications or qualifications that demonstrate your expertise, and any successful projects or initiatives you’ve completed. Additionally, mention what sets you apart from other candidates – such as an innovative approach to risk assessment or superior customer service skills.

Below are some resume summary examples:

Professional underwriting manager with 8+ years of experience in risk analysis and financial management. Proven success in reducing losses by up to 15% across multiple industries. At XYZ, implemented a new process for evaluating loan applications that drastically improved the turnaround time from 5 days to 24 hours while maintaining accuracy standards. Skilled at developing efficient strategies aligning with organizational goals and objectives.

Reliable underwriting manager with 7+ years of experience in the insurance industry. Proven track record of increasing efficiency and accuracy throughout the underwriting process while maintaining compliance standards. At XYZ, improved turnaround time by 20%, allowing for faster quote generation, new business acquisition, and customer satisfaction. Skilled at developing strong relationships with clients to ensure their long-term loyalty.

Passionate and experienced underwriting manager with over 10 years of experience in the insurance industry. Specializing in risk assessment, financial analysis and policy review for commercial clients. Skilled at managing a team of 5-10 staff members while ensuring compliance to company policies and procedures. Successfully decreased average turnaround time by 20% during my tenure as Underwriting Manager at XYZ Insurance Company.

Amicable underwriting manager with 7+ years of experience in the financial services industry. Adept at managing a team, providing guidance on risk management strategies, and developing solutions to minimize loss ratios. At XYZ Inc., developed an innovative Underwriting Risk Program which reduced losses by 22%. Possess excellent communication skills and ability to build relationships with clients, vendors, and colleagues alike.

Seasoned Underwriting Manager with 10+ years of experience in the banking and finance industries. Proven ability to manage a team, assess risk, analyze data and develop business strategies for generating profitable loan portfolios. Seeking to leverage my knowledge and expertise at ABC Bank as an Underwriting Manager where I can help reduce losses while helping create opportunities for growth.

Well-rounded underwriting manager with 10+ years of experience in the insurance industry. Skilled at risk assessment, policy renewal management and customer relations. Proven track record of successfully managing a team to meet deadlines while ensuring quality standards are met. Seeking to leverage leadership skills and extensive knowledge for ABC Insurance’s Underwriting Manager position.

Hard-working underwriting manager with 8+ years of experience in the insurance industry. Proven track record for leveraging sound judgment to review and analyze complex risk profiles, leading to successful policy placements up to $2 million. At XYZ Insurance, managed a team of 20 Underwriters that achieved 95% customer satisfaction rate and improved overall performance by 20%.

Proficient underwriting manager with 10+ years of experience in the insurance industry. Proven ability to lead a team and manage risk effectively, increasing customer satisfaction by 19% at XYZ Insurance Company. Aiming to leverage extensive knowledge of policies and procedures to become ABC’s next Underwriting Manager and help build long-term relationships with clients.

2. Experience / Employment

The employment (or experience) section is where you provide details on your work history. It should be written in reverse chronological order, which means the most recent job comes first.

Stick to bullet points when writing this section; it helps make it easier for the reader to digest what you have said quickly and efficiently. When providing detail, explain what you did and any quantifiable results that were achieved as a result of your efforts.

For example, instead of saying “Reviewed loan applications,” say “Evaluated over 500 loan applications per month for creditworthiness using established underwriting criteria.”

To write effective bullet points, begin with a strong verb or adverb. Industry specific verbs to use are:

- Recommended

- Administered

- Coordinated

Other general verbs you can use are:

- Demonstrated

- Facilitated

- Participated

- Reorganized

- Represented

- Spearheaded

- Streamlined

Below are some example bullet points:

- Meticulously underwrote and evaluated over 200 loan applications every month; reduced exposure to risk by identifying any discrepancies within the documents, resulting in a 20% decrease in default rates.

- Structured customized underwriting processes for large-scale projects of up to $10 million; improved productivity by streamlining existing systems and eliminating manual labor efforts.

- Utilized advanced analytics models such as linear regression and logistic regressions to assess creditworthiness on potential investments; identified high-yield opportunities that generated an additional return of $1 million annually.

- Optimized workflow with data-driven decision making tools, leveraging automated workflows from application input through closing decisions while maintaining compliance standards at all times.

- Collaborated closely with cross functional teams including sales, operations & finance departments to ensure successful completion of transactions within allotted time frames set forth in company policies and procedures guidelines.

- Managed a team of 8 underwriters, delegating tasks and ensuring that quality standards were met; reduced turnaround time on claims processing by 30%.

- Effectively identified risks associated with new business opportunities and established appropriate policy terms in order to reduce losses by 20%.

- Negotiated complex insurance deals between clients and managed relationships proactively to ensure the best possible outcomes for both parties.

- Facilitated face-to-face meetings with existing & prospective customers in order to understand their needs better and develop customised products accordingly; increased customer satisfaction rating from 80% to 90%.

- Mentored junior staff members on various aspects of underwriting operations, providing guidance as needed while developing a high performing team culture within the organization.

- Represented the company at insurance industry conferences and meetings to discuss best practices, build professional relationships with underwriters, agents and brokers.

- Developed an efficient system for underwriting risk assessments that saved $10K in administrative costs annually while increasing accuracy by 30%.

- Achieved a 25% reduction in renewal rate errors through improved communication between departments & continuous training of staff members.

- Coordinated weekly team meetings to review new policies and identify areas for improvement; increased collaboration among underwriters by 45%.

- Diligently monitored regulatory changes within the industry to ensure compliance with all state/federal laws; trained over 100 employees on updated requirements within 2 months of implementation date.

- Participated in the underwriting of over 400 loans, policies and contracts per month with a 99.2% accuracy rate; successfully improved loan approval times by 49%.

- Recommended risk management strategies for companies to reduce their exposure to loss and fraud cases; implemented efficient processes that resulted in an 11% decrease in fraudulent activities.

- Expedited the application process of high-value clients by expediting documents & audits within 10 days on average, allowing them access to funds quickly while meeting all legal requirements as specified by bank regulations.

- Reliably managed a team of 8 underwriters who were responsible for conducting background checks, verifying financial information and processing customer data prior to approving or denying applications; led a reduction in errors from 4% down to 0%.

- Analyzed complex policy documentation thoroughly before deciding whether insurance coverage should be provided or not; maintained 95+ rating score throughout tenure as Underwriting Manager.

- Improved underwriting processes and procedures, resulting in a 50% reduction of application processing time.

- Processed over 300 loan applications per week from initial review to final approval/decline decisions; successfully decreased the rate of declined loans by 20%.

- Reorganized underwriters into product-specific teams for better efficiency and accuracy; achieved an 8% increase in total approvals within 6 months.

- Presented weekly progress reports to senior management outlining current trends, issues and opportunities across all products; identified $500K+ worth of potential revenue growth opportunities annually.

- Substantially increased customer satisfaction levels by 35%, due to improved turnaround times on average loan requests by 15 days or more depending on complexity.

- Researched and analyzed credit risk of potential borrowers and loan applicants, approving or denying applications within established underwriting guidelines; reduced default rate by 10%.

- Spearheaded the implementation of a new online underwriting system that streamlined processes and improved accuracy from 79% to 95%, resulting in cost savings of $25K per quarter.

- Demonstrated exemplary customer service skills when interacting with clients via telephone, email and face-to-face meetings, addressing all inquiries promptly and professionally.

- Advised senior management on best practices for business development strategies related to improving portfolio quality while increasing profitability; increased volume of approved loans by 15%.

- Competently trained junior staff members on proper evaluation techniques as well as review methods for submitted documentation prior to issuing loan decisions, ensuring compliance with industry regulations at all times.

- Formulated underwriting strategies and policies to assess risk factors, minimize losses, and maximize productivity; developed series of rules that resulted in a 20% decrease in operating costs.

- Prepared detailed reports on market conditions, customer trends and competitor activities to ensure compliance with the latest regulations; provided analysis for over 300 loan applications monthly.

- Consistently achieved high levels of accuracy when evaluating financial documents such as tax returns & credit scores for potential borrowers; reduced errors by 15%.

- Assessed outstanding debts from previous loans and payments made by clients on a regular basis to determine eligibility requirements for new applicants; identified $5K worth of fraudulent transactions annually.

- Streamlined internal processes related to loan origination, closing contracts & document management using automated software tools; increased operational efficiency by 35%.

Skill requirements will differ from employer to employer – this can easily be determined via the job advert. Organization ABC may be looking for someone with experience in underwriting commercial insurance, while Organization XYZ may require the candidate to have knowledge of both personal and commercial lines.

It is important to tailor your skills section accordingly as many employers use applicant tracking systems (ATS) which scan resumes for certain keywords before passing them on to a human.

You should not only list relevant skills here but also explain how you used those abilities in previous roles or projects; this will give potential employers an idea of what kind of value they can expect from you if hired.

Below is a list of common skills & terms:

- Account Management

- Casualty Insurance

- Claims Management

- Commercial Lines

- Consumer Lending

- Credit Analysis

- Credit Risk

- Employee Benefits

- Employment Practices Liability

- FHA Financing

- Financial Analysis

- Financial Risk

- Financial Services

- Health Insurance

- Inland Marine

- Investment Properties

- Legal Liability

- Life Insurance

- Loan Origination

- Mortgage Banking

- Mortgage Underwriting

- Portfolio Management

- Process Improvement

- Professional Liability

- Real Estate

- Reinsurance

- Residential Mortgages

- Team Leadership

- Umbrella Insurance

- Workers Compensation

4. Education

Mentioning an education section on your resume will depend on how far along you are in your career. If you recently graduated and don’t have much work experience, include it below your resume objective. However, if you have been working as an underwriting manager for years with plenty of responsibilities to showcase, omitting the education section is perfectly acceptable.

If including a separate education section, try to mention courses relevant to the role such as business management or finance that demonstrate your knowledge of the industry.

5. Certifications

Certifications demonstrate to potential employers that you have the necessary knowledge and skills for a particular job. Having certifications in your field of expertise can help set you apart from other applicants, as it shows that you are committed to staying up-to-date with industry standards.

Include any relevant certifications on your resume when applying for jobs so hiring managers know what qualifications and experience you possess. This will give them an idea of how well suited you are for the role they’re looking to fill.

6. Contact Info

Your name should be the first thing a reader sees when viewing your resume, so ensure its positioning is prominent. Your phone number should be written in the most commonly used format in your country/city/state, and your email address should be professional.

You can also choose to include a link to your LinkedIn profile, personal website, or other online platforms relevant to your industry.

Finally, name your resume file appropriately to help hiring managers; for Monique Littel, this would be Monique-Littel-resume.pdf or Monique-Littel-resume.docx.

7. Cover Letter

Providing a cover letter with your job application is a great way to make yourself stand out from the competition. These letters are usually made up of 2-4 paragraphs, and provide recruiters with more information about who you are and why you would be an excellent fit for the role.

Cover letters give you an opportunity to explain what makes you unique as a professional, highlight any relevant experience or skills that weren’t included in your resume and demonstrate how passionate you are about the position. Whilst they may not always be required by employers, submitting one can help increase your chances of being considered for the job!

Below is an example cover letter:

I am interested in applying for the Underwriting Manager position at Acme Insurance. As an underwriting professional with more than 10 years of experience leading teams and developing new business, I am confident I can make a significant contribution to your organization.

In my current role as Assistant Vice President of Underwriting at XYZ Insurance, I manage a team of 15 underwriters responsible for commercial lines business in six states. I have successfully developed and implemented strategies that have increased production by 20% while reducing costs by 10%. In addition, I have played a key role in expanding our operations into new markets through the successful launch of three greenfield offices.

I am a problem solver who is not afraid to take on challenging projects. For example, when our company was struggling to meet profit goals due to poor loss ratios, I led a comprehensive review of our underwriting guidelines and processes. As a result of this effort, we were able to identify and correct several issues that had been contributing to losses, resulting in an immediate improvement in profitability.

I possess excellent communication and interpersonal skills that enable me to build strong relationships with internal and external stakeholders alike. My ability to effectively collaborate with others has been critical to my success in achieving objectives and driving results.

I would welcome the opportunity discuss how my skills and experience could benefit Acme Insurance as your next Underwriting Manager. Thank you for your time and consideration; please do not hesitate to contact me if you have any questions or need additional information about my qualifications.

Underwriting Manager Resume Templates

- ResumeBuild

- Underwriting Manager

5 Amazing underwriting manager Resume Examples (Updated 2023) + Skills & Job Descriptions

Build your resume in 15 minutes, underwriting manager: resume samples & writing guide, harry campbell, employment history.

- Monitor and assess current underwriting processes and procedures to ensure compliance with regulatory requirements

- Create and maintain underwriting policies and procedures

- Ensure compliance with all applicable laws and regulations

- Review and approve new and renewal business

- Prepare and present reports to senior management on underwriting activities

- Develop and implement underwriting strategies to maximize profitability

- Identify and analyze potential new markets

Do you already have a resume? Use our PDF converter and edit your resume.

Larry Jackson

Professional summary.

- Work with other departments to ensure timely and accurate processing of underwriting transactions

- Develop and implement training programs for underwriters

- Manage a team of underwriters and provide guidance and direction

- Develop and implement quality control measures to ensure accuracy in underwriting decisions

Nate Patterson

- Negotiate terms and conditions with customers

- Develop and maintain relationships with internal and external stakeholders

- Monitor and analyze underwriting performance and adjust strategies accordingly

Karl Franklin

- Analyze financial data to assess risk and make underwriting decisions

Not in love with this template? Browse our full library of resume templates

Table of Content

- Introduction

- Resume Samples & Writing Guide

- Resume Example 1

- Resume Example 2

- Resume Example 3

- Resume Example 4

- Resume Example 5

- Jobs Description

- Jobs Skills

- Technical Skills

- Soft Skills

- How to Improve Your Resume

- How to Optimize Your Resume

- Cover Letter Example

underwriting manager Job Skills

For an underwriting manager position, your job skills are a key factor in demonstrating your value to the company and showing recruiters that you're the ight fit for the role. It's important to be specific when highlighting your skills and ensure that they are directly aligned with the job requirements, as this can greatly improve your chances of being hired. By showcasing your relevant skills and experience, you can make a compelling case for why you're the best candidate for the job.

How to include technical skills in your resume:

Technical skills are a set of specialized abilities and knowledge required to perform a particular job effectively. Some examples of technical skills are data analysis, project management, software proficiency, and programming languages, to name a few. Add the technical skills that will get hired in your career field with our simple-to-use resume builder. Select your desired resume template, once you reach the skills section of the builder, manually write in the skill or simply click on "Add more skills". This will automatically generate the best skills for your career field, choose your skill level, and hit "Save & Next."

- Data Analysis

- Computer Literacy

- Database Management

- Financial Management

- Risk Management

- Quality Assurance

- Troubleshooting

- Project Management

- Business Acumen

- Process Improvement

- Visualization

- Strategic Thinking

- Documentation

- Supervisory

- Relationship Management

- Programming.

How to include soft skills in your resume:

Soft skills are non-technical skills that relate to how you work and that can be used in any job. Including soft skills such as time management, creative thinking, teamwork, and conflict resolution demonstrate your problem-solving abilities and show that you navigate challenges and changes in the workplace efficiently. Add competitive soft skills to make your resume stand-out to recruiters! Simply select your preferred resume template in the skills section, enter the skills manually or use the "Add more skills" option. Our resume builder will generate the most relevant soft skills for your career path. Choose your proficiency level for each skill, and then click "Save & Next" to proceed to the next section.

- Communication

- Interpersonal

- Time Management

- Problem Solving

- Decision Making

- Critical Thinking

- Adaptability

- Organization

- Public Speaking

- Negotiation

- Conflict Resolution

- Attention to Detail

- Self-Motivation

- Stress Management

- Collaboration

- Emotional Intelligence

- Flexibility

- Reliability

- Professionalism

- Customer Service

- Presentation

- Written Communication

- Social Media

- Relationship Management.

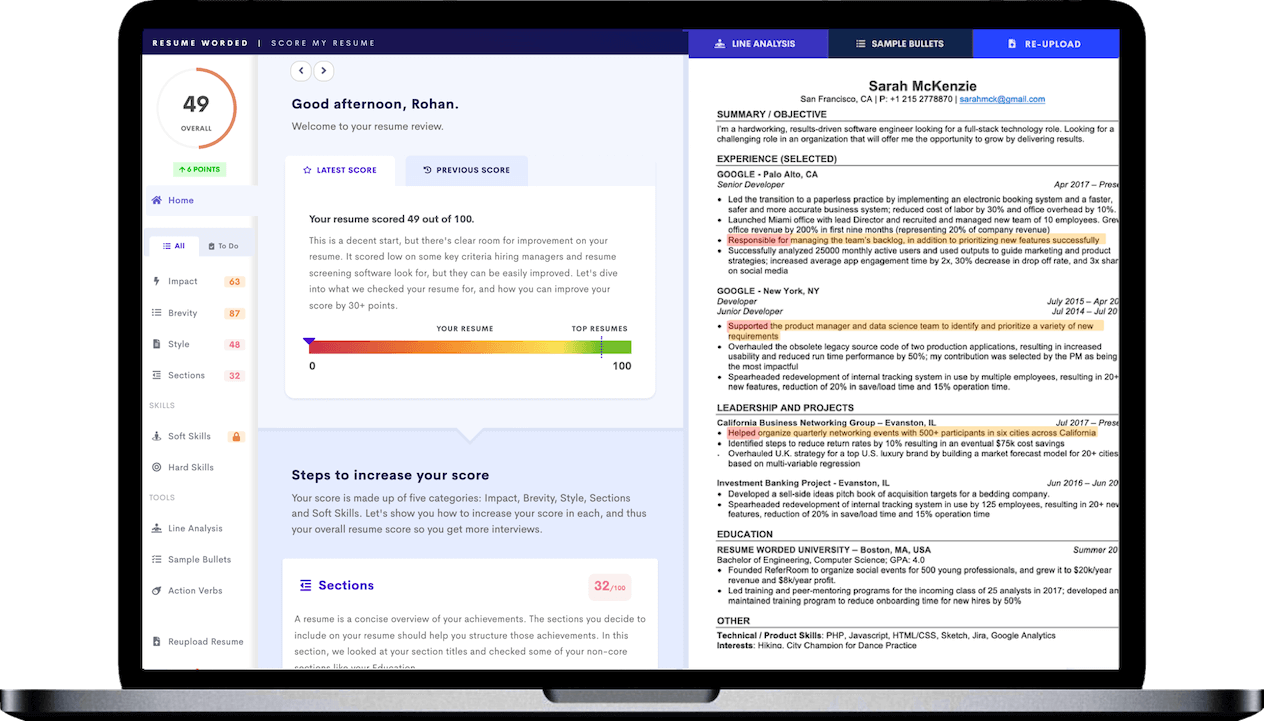

How to Improve Your underwriting manager Resume

Navigating resume pitfalls can mean the difference between landing an interview or not. Missing job descriptions or unexplained work history gaps can cause recruiters to hesitate. Let's not even talk about the impact of bad grammar, and forgetting your contact info could leave your potential employer hanging. Aim to be comprehensive, concise, and accurate.

Unexplained Year Gaps and Missing Job Experiences are a No-no

Gaps in your resume can prevent recruiters from hiring you if you don't explain them..

- It's okay to have gaps in your work experience but always offer a valid explanation instead of just hiding it.

- Use the gap to talk about positive attributes or additional skills you've learned.

- Be honest and straightforward about the gap and explain it using a professional summary.

How to Optimize Your underwriting manager Resume