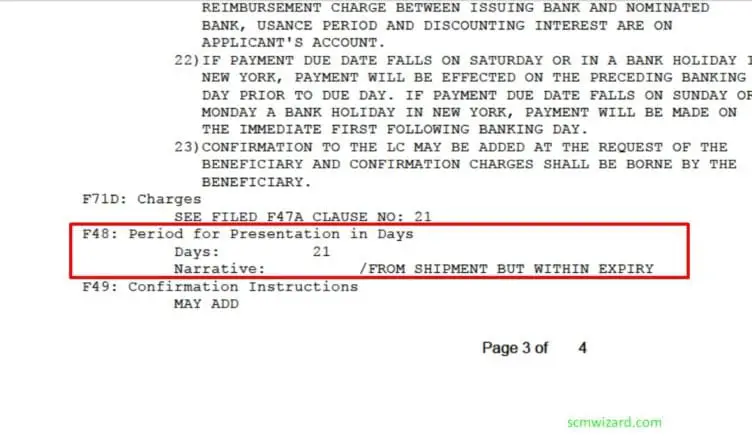

Field 48 (‘Period for presentation in days’) in Letter of Credit (L/C)

F48 is an optional field in MT700 swift message of Documentary letter of credit.

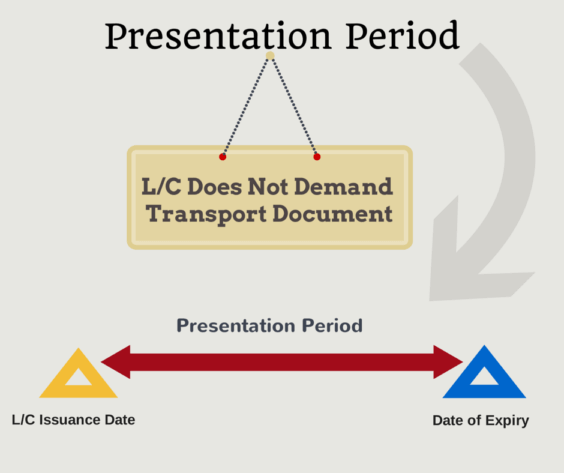

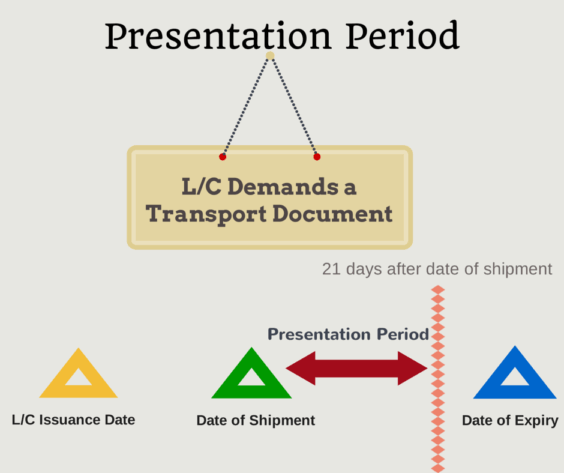

F48 (Period of Presentation) field defines the period of time in calendar days by which the presentation of documents should be made in the negotiating bank. The beneficiary will do the presentation/negotiation to get the payment.

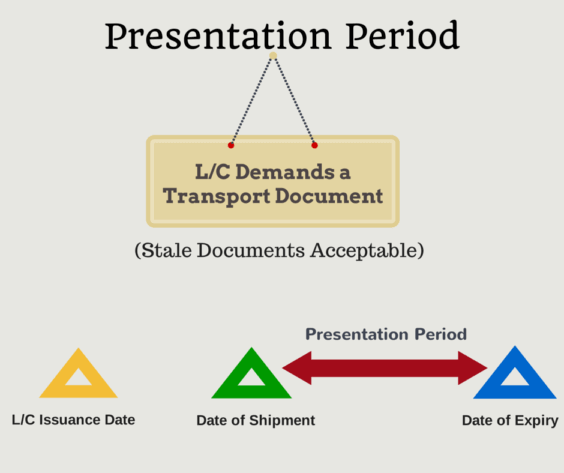

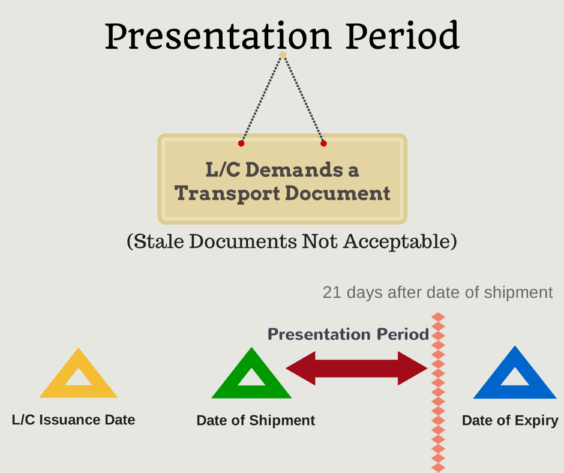

From the F44C(Latest Date of Shipment) , the countdown will start. Normally the period is up to the LC expiry date mentioned in F31D(Date and Place of Expiry).

The date can be mentioned 7,10,14,21 any days as agreed between buyer and seller but not later than the LC expiry date.

If the field is not mentioned in the documentary credit then a default of 21 days is considered. But must not exceed the expiry date as I told you earlier.

Within this presentation period, the beneficiary submits negotiable documents mentioned in 46A(Documents Required) to the presenting bank as per instruction in F41D or F41A(Available With..By…)

As a common practice, LC validity is kept 90days (one quarter) to maintain the same charge. In that case, the latest date of shipment is mentioned as 69 days. The presentation period is 21 days if there’s no specific requirement from the buyer or seller.

The presentation can be both Electronic records or paper documents.

Do you have any thoughts about this? let me know in the comments.

You may like these posts

Field 44C Latest Date of Shipment in LC

Field 32B Currency Code, Amount

Field 43T Transhipment in Letter of Credit

Field 31C Date of Issue in Letter of Credit

Field 49 Confirmation Instructions in Letter of Credit

3 thoughts on “ field 48 (‘period for presentation in days’) in letter of credit (l/c) ”.

Is it possible for a period of presentation in an L/C to exceed 21 days? Let’s say 60 days from bill of lading date but within the LC validity.

Can F48 be 31, after bill of lading date? Thanks.

Hi Eddie, F48 is an optional field that comes after F71D (charges) as per SWIFT format. can you share more about your inquiry?

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

This site uses Akismet to reduce spam. Learn how your comment data is processed .

- Return to Main Site

888-890-7447

Passages The International Trade Blog

The hidden expiration date on every export letter of credit.

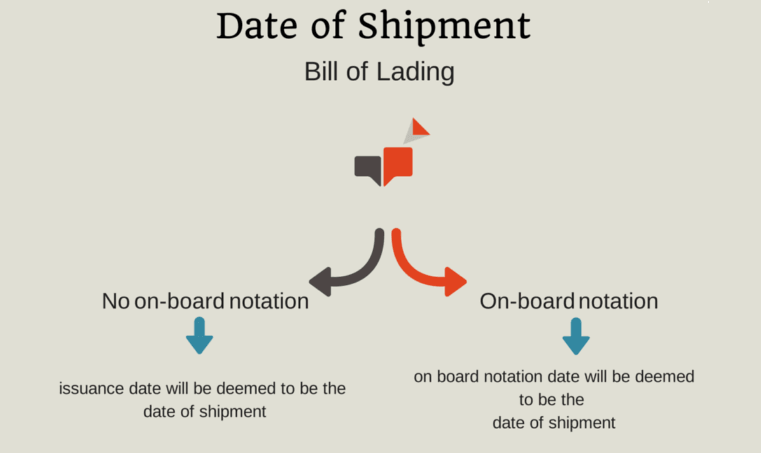

However, another date equal in importance is referred to as the last date for presentation. The presentation period—the window of time in which the exporter must present documents—is tied to the ship date as indicated in the original transport document.

Letter of Credit Presentation Period

A letter of credit includes terminology similar to “documents must be presented within 10 days after the bill of lading date but within the validity of the letter of credit.” For example, if the shipment took place on January 1, documents must be presented no later than January 11 or the expiration date if earlier. If the expiration date is January 5, documents must be presented by January 5, not the 11th.

Some letters of credit require a presentation period of seven days, some 15, etc. If the letter of credit does not state a presentation date, the exporter has 21 days according to UCP Article 14c. Exporters should be aware of this requirement and feel confident they can work within the stated time period. If not, they should request an amendment.

Why does a letter of credit include these time requirements? The importer stipulates them because a delay in presentation can create problems. When the goods arrive at the customs entry point, the importer needs the documents to clear the goods. If not cleared in a timely manner, the goods will go into storage and incur daily charges.

With a short presentation period, the importer can force the exporter to deliver the documents to the bank quickly. Once the documents enter banking channels, they will find their way to the importer in due time for customs clearance.

An alert exporter, however, must ask several key questions:

- How quickly after shipment can the documents be assembled and presented to the bank?

- Can unusual situations cause delays?

- Can the consular's signature be obtained (for a specific country) within the time limit?

Some consulates are located in distant cities and only sign documents once a week. If the appointed day for signing documents falls on a holiday, in either country involved in the transaction, then one more week must be added to the time frame. While 10, 15 or even 21 days may seem like adequate time, it can slip away quickly.

Like what you read? Subscribe today to the International Trade Blog to get the latest news and tips for exporters and importers delivered to your inbox.

This article was first published in December 2014 and has been updated to include current information, links and formatting.

About the Author: Roy Becker

Roy Becker was President of Roy Becker Seminars based in Centennial, Colorado. His company specialized in educating companies how to mitigate the financial risk of importing and exporting. Previous to starting the training company, Roy had over 30 years experience working in the international departments of several banks where he assisted many importers and exporters with the intricate banking needs associated with international trade.

Roy served as adjunct faculty in the International MBA programs at the University of Denver and University of Colorado in Denver. He conducted seminars at the World Trade Center Denver and The Center for Financial Training Western States, and was a guest lecturer at several Denver area Universities.

Roy retired in 2021.

Subscribe to the Newsletter

Trade Finance Guide: A Quick Reference for U.S. Exporters

Learn the fundamentals of trade finance so you can turn your export opportunities into actual sales. This concise, easy-to-understand ebook was designed to help small and medium-sized U.S. exporters learn the most effective ways to facilitate payments from foreign customers.

Subscribe to the Newsletter!

Join the 33,143 other exporters and importers who get the latest news, tips and insights from international trade professionals.

- Market Insights

- Executive Insights

- Digitalization

- Supply Chain

- Marketing Solutions

- Advertising

- Product Review

- White Papers

- Post by Post

- Hariesh Manaadiar

- Testimonials

- Recognition

A reader asked me a question about letter of credit and trade finance timelines..

With a letter of credit. What sort of timings are usually connected to when the payment between banks occurs? Does the shipment sail prior to the LC being satisfied?

The roles of the involved banks First of all it is important to understand that there are usually 2 banks involved in the LC transaction: 1) The LC is issued by the buyer’s bank. That bank is termed “ issuing bank ”. 2) The LC is advised to the seller by another bank. That bank may have different roles and responsibilities – all depending on what the bank has agreed to do i.e.: The bank may act as an Advising bank : Not obligated under the LC to pay. The bank may also act as a Nominated bank : Nominated under the LC (e.g.) to pay, but any obligation under the LC depends on the agreement made with the seller. The bank may also act as a Confirming bank : Has given an undertaking to pay when a complying presentation has been made. This means that When a complying presentation is made to the issuing bank, then it must pay (according to the terms of the LC). When a complying presentation is made to the Advising bank, it will normally not pay until funds has been received from the issuing bank. Nominated bank, its payment will depend on the agreement made with the seller. Confirming bank, it must pay when a complying presentation is made to it. How the LC is available Also important in this respect is the “availability” of the LC. In general LCs are issued either at “sight LCs” or “Usance LCs.” For the first payment is made “at sight” i.e. right after presentation of the documents. For the latter payment is made after a specified number of days (as determined by the LC) – e.g. “90 days after shipment.” The timelines given by the rules Practically every LC is governed by the UCP 600. Those rules include the following provisions: The banks (issuing, confirming, nominated) have “a maximum of 5 banking days following the day of presentation” to determine if a presentation is complying. This means that if the issuing / confirming bank has not refused the presentation within that timeline then they are obligated to pay (according to the terms of the LC). Also important is the rule that dictates what the bank must do when it determines that the presentation is complying: When the issuing bank determines that a presentation is complying it must pay (according to the terms of the LC). When a confirming bank determines that a presentation is complying, it must pay (according to the terms of the LC) and forward the documents to the issuing bank. When” is not defined in the rules, but it is practice that the issuing / confirming bank must start the payment process right after they determine that it is a complying presentation. The LC in practice The above may seem a bit abstract, so let us look at two realistic scenarios: Scenario 1: A confirmed LC On 1 October the seller received an LC from their bankers. The bank has indicated that they have confirmed the LC. The LC is available “at sight” with the confirming bank. On 15 October the seller ships the goods covered by the LC. (From that day the seller has 21 days to present the document to the bank). On 20 October the seller presents the documents to the confirming bank. (From that day the confirming bank has 5 banking days to examine the documents). On 23 October the confirming bank revert to the seller informing that the documents comply with the terms and conditions of the LC, and that they will effect payment value 26 October. On the same day the confirming bank forwards the documents to the issuing bank. On 26 October the payment is made to the seller. On 28 October the documents arrive at the issuing bank. (From that day the issuing bank has 5 banking days to examine the documents). On 2 November the issuing bank accepts the documents, pays the confirming bank, and draws the funds from the buyer. Scenario 2: An unconfirmed LC On 1 October the seller received an LC from their bankers. The bank has indicated that they have NOT confirmed the LC. The LC is available “at sight” with the issuing bank. On 15 October the seller ships the goods covered by the LC. (From that day the seller has 21 days to present the document to the issuing bank). On 20 October the seller presents the documents to the advising bank. On 23 October the advising bank revert to the seller informing that the documents comply with the terms and conditions of the LC, and that they have forwarded the documents to the issuing bank awaiting payment. On the same day the advising bank forwards the documents to the issuing bank. On 28 October the documents arrive at the issuing bank. (From that day the issuing bank has 5 banking days to examine the documents). On 2 November the issuing bank accepts the documents, pays the advising bank, and draws the funds from the buyer. On 4 November the advising bank receives the finds from the issuing bank, and pays the seller. As can be seen from the above: It is the documents from the seller (including the transport document) that trigger the payment; i.e. shipment is made before payment. When the payment is made to the seller depends highly on the structure of the LC. It should be added also, that in the two above examples the documents did comply with the terms and conditions of the LC. If that is not the case, the confirming and issuing banks may refuse the documents, and payment is only made when approved by the buyer.

For more information you can contact Kim Sindberg by email..

Share this:

- Kim Sindberg

- letter of credit

- trade finance

What are the implications of shipping material 2 days after latest shipment date, once a confirmed LC was received from the customer?

So nice.and thanks a lot

Dear Readers, My LC stated as follows (just for some important clause) 1. At sight 2. Available with my Bank by negotiation 3. Latest shipment 15 November 4. LC expiry : 25 November in Indonesia 5. LC confirmation : Without (also my Bank no need confirmation because my bank has correspondence line with issuing bank) 6. Incoterms 2010 and UCP 600 applied.

I have shipped the cargo on 5 November, due to some of shipping documents need to legalized to Applicant’s Embassy so I just submitted the all shipping documents as per LC on 20 November. On 23 November my Bank Officer told me that my documents 100% Complying the LC, BUT his Branch Manager would not to negotiate my LC because he wonder about expiry of the LC. His arguments : If all shipping documents couriered to issuing Bank on 23 Nov, the docs will reach issuing bank on 26 November (LC expired already). I insists to ask him to negotiate my LC. I said to him “Please refer to UCP 600 for this circumtances”. After involving his District Manager finally the bank has negotiated my LC.

I wonder I will facing again this circumstances in the future. Exactly, WHAT UCP 600 SAID REGARDING PRESENTATION DOCUMENTS CLOSE TO LC EXPIRY ? Please kindly help. thank you,

Another important point is that an ‘advising’ bank only receives and forwards the shipping documents; it does not check or validate them. A ‘confirming’ bank does check and validate the documentation so in case there is any discrepancy, it can be handled locally. This is significant when time is of the essence but should become less relevant as you gain experience in handling LCs and learn the pitfalls to avoid. Another point of relevance is partial shipments. In case you are shipping more than one container, it is prudent that the LC includes allowance for partial shipments. This allows the seller to start collecting right after the first shipment and not have to wait until all the order has been shipped to start the collections process.

Hi Everybody,

I wonder if the carrier should compy with specific standards or not? I mean it is one thing when the carrier is a big international company like Maersk, the other when it is a relatively small NVOCC (or maybe just a forwarding company) issuing HBLs.

I have experienced with LC from USA for frozen fish or frozen foods. Seller do not accept the LC with clause ” PAYMENT after passed USFDA Approval” or anything wording like this. But seller can accept for clause ” Beneficiary’s Certificate stating that “If goods rejected by USFDA, beneficiary will reimburse to applicant all fund that already drawn plus any additional cost occured…… …… ….. ” “

Re: the letter of credit (LC) article. You left out one of the most important steps, i.e., the seller’s instructions to the buyer detailing the specific terms/wording to be included in the letter of credit. These instructions should be sent to the buyer BEFORE the buyer’s bank draws up the actual LC. The seller’s documentation must be EXACTLY identical to the terms/wording of the LC or the bank will declare the documentation differences as “discrepancies” and refuse payment until after the seller OKs the differences. This could possibly defeat the original purpose (protection) of the LC and/or add expenses (charged by the bank) to make the changes. In other words, once the buyer/seller agree to conduct the sale with an LC, they must then agree to the terms, especially its various dates. If not, the buyer may receive the copy of the LC and then realize he cannot comply with it and then must go back to the issuing bank for (additional) costly changes.

LEAVE A REPLY Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Notify me of follow-up comments by email.

Notify me of new posts by email.

Sign up to the site for free.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Trade Talks and Tech Tidbits from USCBP Trade Facilitation Summit 2024

Received for shipment, shipped on board, clean on board & clean shipped on board, debunking the myth about near-shoring.

We respect your email privacy

FREIGHT INDICES

Let's socialize, most popular, the basics of container stowage planning and why it is so important, what is a switch bill of lading and when and why is it used.., difference between demurrage and detention, difference between harbour, port, terminal, berth, quay, pier, jetty, recent comments, editor picks, 25% increase in container volumes for port of los angeles in 2024 compared to 2023, special containers & its cargoes – oog/reefer – a refresher, international day for women in maritime to highlight women’s role in maritime safety.

- Comment Guidelines

- Guest Post Guidelines

- Terms & Conditions

- Privacy Policy

- Terminology

POPULAR CATEGORY

- Shipping and Freight 286

- Press Release 263

- Shipping 227

- Vessel Operation 204

- Education 198

- Maritime 166

- Questions and Answers 158

Login To LCViews

Password Remember Forgot Password

Latest Blog Post

Latest single window questions.

Mr. Old Man For those who eat, sleep and breathe Letters of Credit & Cycling

Period for presentation.

- Share on Facebook

- Share on Twitter

- Share on Google+

- Share on Reddit

- Share on Pinterest

- Share on Linkedin

- Share on Tumblr

I read your articles online and your answers to some questions regarding the L/Cs.

I have a question:

If the shipment transit time is short, like 4-5 days and field 48 says 21 days to present the documents from the date of the BoL, we lose free 7 days’ time of port to release the shipment and maybe end up paying demurrage due to discrepancies in the documents but within 21 days from the BoL date.

So the question is, due to short shipment transit time, given the above scenario how can we as consignee avoid the demurrage?

Kind regards,

———-

Field 48 (period for presentation) specifies the number of calendar days after the date of shipment within which the documents must be presented for payment, acceptance, or negotiation. The absence of this field means that the presentation period is 21 days after the date of shipment, where applicable.

So, if you wish a shorter period for presentation, e.g., 10 days after the date of shipment you can request the issuing bank to issue LC to indicate the same in field 48.

If LC was issued with a 21 day period for presentation, you can request the issuing bank to amend the LC with a shorter period. In case no amendment is made and the goods arrive before documents, to avoid demurrage you can request the issuing bank to issue a shipping guarantee in favor of the shipping company to enable you to receive the goods.

Mr. Old Man

- Related Articles

- More By Mr Old Man

- More In Mr Old Man

SHIPPED ON BOARD THE VESSEL THAT LEAVES THE PORT OF LOADING

THƯ TÍN DỤNG XÁC NHẬN KHÔNG HỦY NGANG VÀ BIẾN THỂ CỦA NÓ

ĐI XEM PHIM LẬT MẶT 7: MỘT ĐIỀU ƯỚC

TRANSFERABLE LC or BACK-TO-BACK LC?

June 27, 2022 at 8:43 am

Appreciate if u could assist me. Details of LC 1. Field 40A – Transferable. 2. Field 45A THIS IS A TRANSFERABLE LETTER OF CREDIT. THE TRANSFER, IF REQUIRED MUST BE MADE THROUGH THE ADVISING BANK WHO IS REQUESTED TO ADVISE US THE UNIT TRANSFERRED AND THE TRANSFEREE’S NAME. Questions 1. Are the two details above sufficient of an LC to be viewed as Transferable. 2. 5 items are allowed to be transferred in a Transferable LC. But as per field no 45A, does this means only Units that will be transferred, the rest of the 4 items remains the same?

June 27, 2022 at 1:32 pm

1/ An LC can be transferred when Field 40A states Transferable. 2/ It can be trasferred as per sub-article 38 (g), that is to say, the rest items may be reduced or curtailed

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

QUESTION Dear Mr. Old Man, Good day. Please reiterate your explanation again regarding bel…

Recent Posts

UCP 600 ARTICLES 30 AND 31

FIELD 72 (SENDER TO RECEIVER INFORMATION) OF MT 103

TRANSFERRING BANK S LIABILITY UNDER TRANSFERRED LC

TO ORDER BILL OF LADING AND ENDORSEMENT

Jerry Osborne: Hello, We Offer Swift MT760 BG/SBLC, FC MTN, Letter of Credit { LC }, MT103Etc....

Mr Old Man: Yes, it's true....

Hoàng Thư: Quá tuyệt vời! Khám phá các cung đường bằng xe đạp mới thưởng ngoạn được hết vẻ...

Mr old man: you are please referred to the following q&a: where two sets of documents are pr..., popular posts.

PARTIAL SHIPMENTS UNDER SUB-ARTICLE 31 (B)

WHETHER MT999 IS AN AUTHENTICATED SWIFT MESSAGE

Payment lc vs negotiation lc, early presentation.

QUESTION Dear Mr Old Man, I am Dang from Vietnam Prosperity bank. I know …

CONDITIONAL ACCEPTANCE OF PAYMENT

Claims payable, settling agent, franchise, excess (deductible), mùng 2 ở hội an, những thay đổi chính trong incoterms 2020 so với 2010, what does sight mean, whether a cpbl signed by an agent on behalf of the owner must be stamped with the agent’s stamp.

A Comprehensive Guide to Standby Letters of Credit (2021)

In this extremely comprehensive guide to standby letters of credit (SBLC), we cover:

- What a standby letter of credit is

- Why SBLCs are used more commonly in the USA

- Risks and considerations to be aware of when using standby letters of credit

- An overview of the different types of SBLC available

- The differences between SBLCs and other similar instruments including demand guarantees

- The rules and regulations you need to know about when using standby letters of credit

The guide is written by Glenn Ransier , Technical Advisor, ICC Banking Commission and the Head of Documentary Trade and Standby LCs with Wells Fargo Bank in North America.

Let's get started. (Note this is a long guide, if you'd rather download the PDF version to read later, you can do so here )

What is a Standby Letter of Credit?

The global rule sets which govern standby letters of credit (SBLC) - both the Uniform Customs and Practices current revision 600 (UCP 600) and International Standby Practices current revision (ISP98) - define a SBLC as an “undertaking”. An undertaking provides the named beneficiary with an “independent” assurance of payment from the undertaking’s issuer (issuers are most often banks).

The obligations of the SBLC or “undertaking” supplement, and are in addition to, any other underlying contract/agreement between the issuer’s client (In SBLC terms, the client is most often referred to as the applicant) and the client’s contract counterparty (In SBLC terms, the counterparty is known as the beneficiary).

When the issuer bears a stronger credit rating, a SBLC is also a credit enhancement tool. An applicant’s ability to obtain a SBLC from an issuer reflects good faith as the SBLC supports an applicant’s credit quality.

In most cases and depending on the nature of the type of SBLC being issued, a beneficiary is typically only authorized to claim payment from an issuer in situations where the applicant is unable to successfully conclude the underlying contract.

While a SBLC may include a reference to an underlying contract between an applicant and a beneficiary; the issuer’s obligations remain fully independent of any underlying contract to which it may be supporting.

As an independent undertaking, the issuer of the SBLC has its own obligation to ultimately pay the beneficiary (or another bank which has already paid the beneficiary such as a confirming bank) on receipt of a document/presentation made by, or on behalf of the beneficiary, which comply with the terms and conditions of the SBLC.

However, most SBLCs never receive a drawing, (also known as: claim or demand for payment) and simply expire in accordance with a SBLC’s stated expiry date/period. This is because most applicants will successfully complete their contractual obligations and as such, the beneficiary will have no reason to demand payment under a SBLC. Upon a standby letter of credit’s expiry, it will simply cease to exist and be unavailable for drawing and closed by the issuer.

Unless otherwise stated in a SBLC, standby letters of credit are deemed: “irrevocable” meaning they cannot be changed or cancelled prior to its stated expiry date without the agreement of all parties.

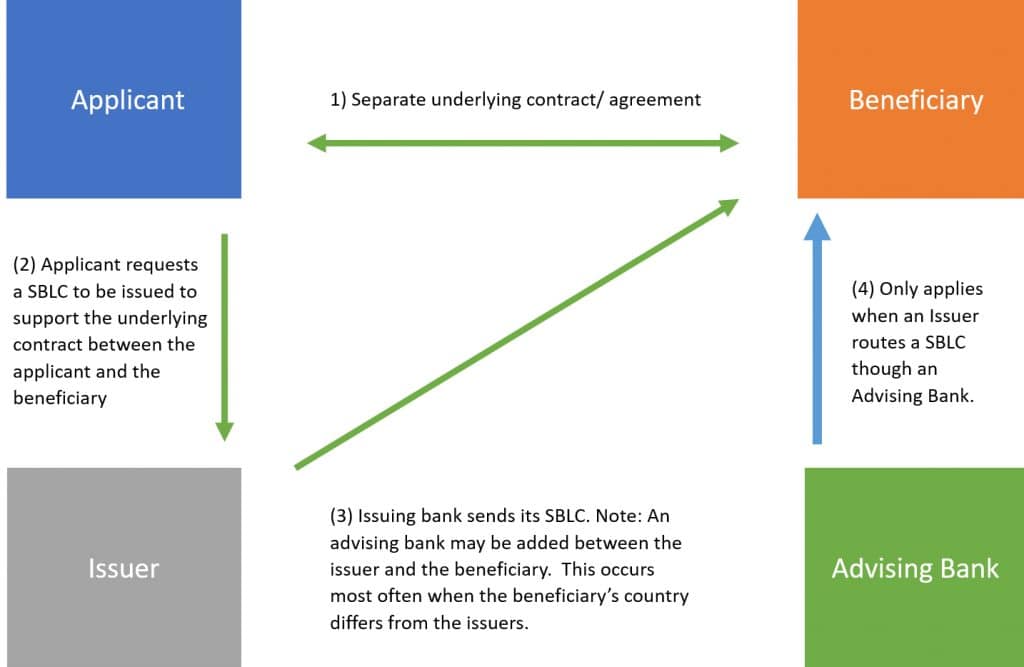

Example of a typical process flow for a SBLC SBLC issuance process – direct to beneficiary or utilizing an advising bank

Benefits of using SBLCs

- A bank’s SBLC substitutes and may enhance or replace the creditworthiness of the applicant for that of the issuer of the standby letter of credit.

- SBLC undertakings support/collateralize “any” type of underlying contract, agreement, or obligation between an issuer’s client/applicant and the applicant’s client/counterparty, the beneficiary.

- SBLCs are recognized globally as an effective means of securing cross-border and domestic contracts.

How are SBLCs commonly used?

Banks following BASEL or Dodd-Frank requirements will classify their issued or confirmed SBLCs as supporting either a “financial” or a “performance” obligation. These two classifications are defined as:

- “Financial” SBLCs are issued to back financial obligation or some form of indebtedness, such as loan repayment, and irrevocably obligate the Issuer in the event the Applicant fails to honor their payment obligation.

- “Performance” SBLCs are issued to back a company’s performance related duties. These are contractual, non-financial obligations such as: completing the building of a road or wind farm, etc. and irrevocably obligate the Issuer in the event the Applicant fails to perform as agreed.

Who are the parties involved in a Standby Letter of Credit?

Advising bank –The beneficiary will typically request that a SBLC is sent to a bank in their country or one with which the beneficiary has a relationship. If the beneficiary does not request a specific bank, the issuing bank will either: send the SBLC directly to the beneficiary or choose to send the SBLC to the beneficiary through a bank with which the issuer has a relationship.

If the issuer sends the standby letter of credit through another bank, the bank that receives the SBLC and sends it to the beneficiary will be known as the advising bank. The advising bank is not a party to a SBLC and has no authority to approve or disapprove an amendments terms or obtain drawing rights.

Applicant - (also known as an instructing party or requesting party) – The SBLC applicant enters into a contract with a counterparty. When the contract requires a standby letter of credit to support it, the applicant will make a request, typically to its bank, to issue a SBLC in favour of its contract’s counterparty. In SBLC terms, the counterparty becomes the beneficiary.

In the underlying contract, the applicant and beneficiary terms associated with SBLCs may have very different names: e.g. lender and borrower; buyer or seller; principal and drawer; etc.

It must be noted that a SBLC’s stated applicant may or may not be the issuer’s client. An applicant may receive silent or openly known support to have a standby letter or credit issued. For example, Company AZA may have insufficient credit or collateral to induce an issuer/bank to issue its SBLC. In such a case, it can enlist its parent, a factoring company, etc. to lend support to help Company AZA be named as the applicant in the SBLC.

The parent or other company providing the support may or may not be stated in the SBLC; however, it is considered the client/applicant of the issuer versus the applicant stated in a SBLC. An applicant is not deemed a party to an SBLC. They are the party which requests an issuer to issue its independent SBLC in favour of a beneficiary.

Beneficiary – is the undertaking party who receives all the benefits of a SBLC. They are the only party who may make a drawing; receive payment against the SBLC and/or accept or reject amendments, etc. In the underlying contract, the applicant and beneficiary terms associated with SBLCs may have very different names: e.g. lender and borrower; buyer or seller; principal and drawer; etc.

Confirmer or Confirming Bank –confirmation may only be added at the request of an issuer. When added, a confirmer or confirming bank becomes similar to a second issuing bank because, like the issuer, the confirmer undertakes to honour (or negotiate) or pay a complying document presentation. The confirmer’s undertaking is in addition to the issuers undertaking, but it may be limited in several manners, such as: a) amount; b) expiry; and c) allowable languages documents may be presented in, etc.

Issuer or Issuing Bank or Opening Bank – is the party that issues a separate, irrevocable, independent SBLC on behalf of its applicant client. Because it is independent, a SBLC is separate and distinct from any underlying contract on which it may have been based. Because it is irrevocable, a SBLC cannot be amended until all parties agree to the amendment.

Nominated Bank is the bank/party authorized by the issuer to undertake honour, negotiate or otherwise make a payment in the event it receives a complying document presentation/demand. A confirmer is most often a nominated bank.

A nominated bank which has not confirmed or otherwise committed to pay in some form has no obligation to do so. Unless a confirmer is involved in a SBLC, it rare to see a nominated party as the majority of SBLCs expire and are only available for payment with the issuer.

Why are SBLCs more commonly used in the United States?

Banks in the U.S. historically did not have the corporate power to issue certain types of guarantees but have generally always had the power to issue letters of credit (LC).

It was relatively simple to take conventional commercial LCs and adjust the drawing conditions to call for documents like default certificates and demands for payment, rather than on board negotiable bills of lading, invoices, and other typical shipping and commercial documents. This meant SBLCs could evolve from commercial LCs. It is harder to convert an ordinary, dependent guarantee into an independent undertaking.

Risks and considerations to be aware of when using SBLCs

Applicant considerations: There is a cost associated with SBLC transactions.

An applicant is not a party to an SBLC. The applicant is a party to an underlying contract while the issuer of the standby letter of credit is not. The applicant requests a SBLC to be issued. However, once issued, the issuer must then make its own, independent examination and payment decisions independent of input from the applicant and what the terms of an underlying contract state.

An applicant should have a relationship comfort with the intended SBLC beneficiary because most standby letters of credit are payable against only a draft/bill of exchange and a simple drawing statement. This allows for the possibility for an improper drawing.

Once a SBLC is issued, all parties must agree to any amendment or cancellation request unless the SBLC has expired.

Applicants must align the contract’s terms with the SBLC especially in the area of drawing requirements. Because a standby letter of credit is documentary, an issuer is not concerned with the underlying contract and will make its payment decision solely upon reviewing a beneficiary’s document presentation on its face, against an SBLCs terms, without seeking confirmation of fact(s), action(s) or statement(s) made by the issuer of any document contained in the presentation.

Beneficiary considerations: A beneficiary must determine its credit rating of the issuer. Where an issuer’s credit rating, size or country risks are unacceptable to the beneficiary, a beneficiary may require an acceptable confirming bank.

Once the beneficiary receives a SBLC, it should ensure that SBLC wording complies with the requirements of the underlying contract e.g.

- Can a beneficiary legally make the required statements and are all reasons they can make a demand for payment properly addressed?

- Does the SBLC expire with sufficient time to complete the underlying contract?

- Can the beneficiary obtain all required drawing documents?

This upfront review will help to assure success if the beneficiary makes a drawing against the SBLC, understanding that when a presentation does not comply with a SBLC’s stated terms/conditions, an issuer is not obligated to pay.

The SBLC should be made subject to its preferred international rules such as ISP98 versus UCP600 as the rules align everyone involved with a SBLC and may also assist in the case of a legal matter.

Confirmation and/or advising costs may be due by the beneficiary.

Issuer considerations: As the issuer is supporting its applicant, it needs to consider the applicant’s credit rating. They also need to consider their ability to complete the underlying contract/agreement, often without reviewing the contract/agreement.

Reputational and/or compliance risks such as money laundering, collusion between an applicant and a beneficiary, supporting an unpopular contract/agreement, etc. should also be considered.

Ready to learn more?

Take the ICC's advanced trade finance qualification: Certified Trade Finance Professional (CTFP)

Types of SBLC

Here is an overview of the most common types of SBLC.

Advance payment

This SBLC’s purpose is to ensure the repayment of an advance payment which a buyer has made (or will make at a contract’s closing) to the supplier of goods or services.

In connection with large contracts, especially international transactions, the parties will agree that a supplier of goods or services must receive a certain percentage of the overall contracted value, e.g. 10% upon signing of the contract. To safeguard the buyer against losing its advance payment, they will require an SBLC naming them as the beneficiary to secure the repayment of the sum(s) advanced should the contracted goods or services not be delivered or completed.

The SBLC ensures the buyer is made whole for any advance made. However, often these types of SBLC’s do not provide remuneration for any loss of interest or profit margins that the buyer may sustain.

Bid or tender bond

Supports an issuers' client’s bid to be awarded for a project or contract mandate. This type of SBLC assures the beneficiary that if selected, the applicant has the ability to support and comply with its bid and that they will honour the bid if they are selected. Most often used by contractors or construction companies, they are typically needed for a portion of the overall project’s value.

A SBLC which generally requires only the presentation of a draft or bill of exchange without the need of any supporting statements whatsoever. From an applicant and/or an issuers perspective, these are considered the riskiest type of SBLC. This is because a beneficiary will be able to draw for any reason. It is also risky because the simple terms of the SBLC with regards to a presentation or drawing requirement makes it difficult to stop an improper drawing.

Supports an applicant’s payment obligations to pay for goods or services on a one-off or ongoing basis in the event of non-payment by other methods.

Direct Pay LCs are hybrid SBLCs issued to provide a credit enhancement to a bond offering. E.g. industrial revenue bond, also commonly referred to as variable rate demand bonds. These types of SBLC are most often issued in favour of the bond trustee. Unlike the majority of SBLCs, they are the primary payment mechanism for the interest and principal due on the underlying bond and will receive periodic drawings for payment.

A large majority of SBLCs will fall into this category. These standby letters of credit will support any financial payment obligation such as loan repayments, etc.

These SBLCs address the insurance or reinsurance obligations of the applicant and are used by insurance companies to distribute insurance risks among themselves. Rather than cash collateralizing other insurers or beneficiaries for use of their internal lines of credit, these SBLC’s are used as collateral.

Performance

A performance SBLC is used to secure the applicant’s satisfactory fulfilment of its contractual performance obligations toward the beneficiary. For example, should the applicant fail to perform a contracted duty such as: complete a construction project, or repair equipment, or build a home or road within the contracted specifications and/or timelines, then the beneficiary will be entitled to present a drawing statement.

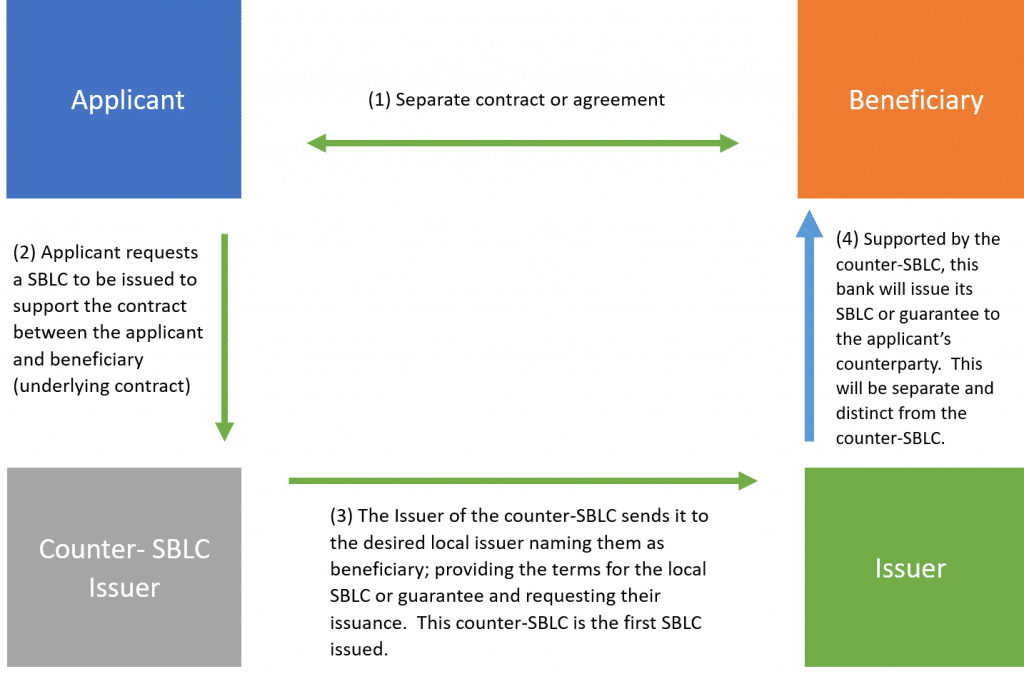

Counter SBLC

An applicant or the beneficiary may require a local SBLC to be issued directly by an overseas, reputable party - most often a bank - in the same country as the beneficiary.

The applicant may not have the means or would prefer not to open another line of credit with an overseas party to facilitate this limited need. In this case, they would request an issuer to issue a counter SBLC. The counter SBLC provides collateral to a local party or bank (often a correspondent of the issuer of the counter-undertaking), to induce that bank to issue its own separate and distinct, local undertaking.

In these instances, there are two undertakings:

- The 1st is the counter-SBLC between the issuer and the local bank

- The 2nd is the local undertaking between the local issuer and the beneficiary

The undertaking type and/or their governing rule sets do not need to be like for like. Each bank has its own policies toward issuing and receiving counter SBLCs.

Through the use of counter SBLCs, a client maintains a single line of credit.

A counter SBLC may be necessary in the following scenarios:

- Beneficiary requires/demands a local SBLC or guarantee;

- Beneficiary requires a “local bank” to issue the final undertaking and will not allow another local bank to advise or confirm it;

- The undertaking or guarantee must be subject to laws outside of the issuer’s policies.

The beneficiary of the counter-SBLC is the financial institution requested to issue its own instrument. The beneficiary of the second instrument is the applicant’s counterparty in the underlying contract/agreement.

The drawing requirements for a counter-SBLC generally require a simple statement that the second financial institution received a demand for payment against the instrument it issued. The drawing requirements under the second instrument will have ultimately been provided by the applicant of the counter SBLC issuer.

Example of a typical process flow for a counter SBLC

What is the difference between an SBLC and a Commercial Lettter of Credit?

Costs – Costs between SBLCs and Commercial LCs usually differ.

At a high level both types of LC typically require an issuer to consider factors such as:

- Applicant/client size

- Collateral and required line of credit size

- The issuer’s internal LC processing costs

- Credit establishment and compliance risk costs

- The differences of the types of LCs anticipated to be requested

Depending on the laws applicable to the Issuer, there may be different cash reserve loss requirements needed for commercial LCs vs performance SBLCs vs financial SBLCs, (Note: This is the case for all countries following Basel) which may affect the issuing/opening fee.

Both LC types will require an applicant to pay an issuance fee of some type. However, commercial LCs are expected to have at least one, if not multiple document presentations. Each presentation will typically be assessed by an examination fee of some type. Conversely, most SBLCs do not receive a beneficiary’s document presentation or drawing and so no examination related fees will be assessed.

Where a SBLC generally covers longer term and ongoing contracts, the issuance fee is needed for the duration of the SBLC.

Commercial LCs are typically issued to support a single need e.g. to cover a payment for: a) a shipment of goods; or b) services completed. They typically expire earlier than a SBLC.

For applicants and beneficiaries which routinely transact, a longer term SBLC may be the more economical LC undertaking, instead of issuing multiple commercial LCs. The commercial LCs will be assessed multiple issuance and examination fees.

Document presentations – Commercial LCs are a beneficiary’s primary payment option. Rather than relying on the underlying contract for payment, the beneficiary will request payment from the issuer’s independent commercial LC undertaking in settlement of the underlying contract they have with the applicant. Conversely, SBLCs take the opposite view and, in the overwhelming majority of cases, the issuer of a SBLC does not expect to receive a document presentation nor make a payment.

As a secondary payment option to the beneficiary, if a document presentation/demand is received, it generally means that the applicant has failed to meet its terms against the underlying contract.

Document types – Commercial LCs require documentary presentations which usually consist of commercial documents such as commercial invoices, packing or weight lists, transport documents, etc. SBLCs are payable most often against simple beneficiary statements and the documents presented often have no intrinsic value.

Misstatements/Fraud – Understanding the difference with document types outlined above, the possibility of a beneficiary requesting a payment in error, by accident or purposely are greater with a SBLC. While a very rare occurrence, it is recommended that the applicant and beneficiary have an established relationship when dealing with SBLCs.

Duration - Commercial LCs are typically short term in nature and their expiry date is generally 6 months or less. SBLCs most often cover longer term contracts, and their duration may be years in length on an overall basis.

Tenors – Any LC undertaking must define the period when a complying document presentation is due for payment and this period is known as the LC’s tenor. As LC undertakings, both Commercial LCs and SBLC’s can be payable “at sight”. This means upon a reasonable time from when the nominated or issuer has found the documents to comply with an LC’s terms.

Conversely there also exists time tenors, which detail that a payment is to be made at a fixed future certain date from the time a presentation is found to be complying. Time tenors are typically referred to as Deferred Payment Undertakings or Banker’s Acceptances. One term, “Negotiation”, may be used as a sight or time tenor.

Commercial LCs often include some form of financing need for trade and, as such, time tenors are utilized. SBLCs which generally do not expect a presentation or demand for payment will overwhelmingly use the sight tenor.

Terms and Conditions – Given their very different payment needs, the data content of commercial versus SBLCs differs significantly.

Purpose – Commercial LCs facilitate trade and are issued with the intention that a document presentation will be delivered to a bank for payment for a shipment of goods or payment for services. They are the primary payment vehicle for the beneficiary.

On the other hand, SBLCs cover any type of contract or agreement between two parties. Provided the issuer is willing to support its applicant, the type of contract a SBLC can support is boundless and includes the different types we covered above (which is not an exhaustive list).

When an applicant does not meet its contracted duty(ies), the beneficiary will make a claim against the applicant for payment under the underlying contract. When the applicant fails to honour the request for payment, the beneficiary will make a presentation for payment against the SBLC making it a secondary payment vehicle, or payment of last resort for a beneficiary.

SBLCs vs Bank Guarantees

Similar to the commercial LC or a SBLC, a demand guarantee (DG) is an independent and irrevocable “undertaking,” provided by an issuer to a beneficiary, that provides assurance of payment upon receipt of complying document presentations.

DGs are often referred to as first demand guarantees. DGs are more common in Europe, Asia, and the Middle East. SBLCs are more common in the Americas, however they remain globally issued and/or accepted.

Surety or ancillary guarantees should not be confused with DGs and are not the same as LC undertakings. They are outside the scope of this guide.

DGs and SBLCs are extremely similar “undertakings” with the key differences provided by its governing rule set. Like the SBLC, demand guarantees:

- Require the beneficiary to present a compliant documentary demand in order to receive payment against the undertaking

- Are independent from the underlying contract

- Do not require the issuer to investigate the legitimacy of a demand.

When included in a SBLC, UCP600 or ISP98 will govern the instrument and provide a series of default resolutions in cases where a SBLC is silent. Conversely, when included in a DG, the Uniform Rules for Demand Guarantees (URDG 758) will govern and provides it defaults resolutions.

While some defaults are similar, there are significant differences in the approach taken by the rule sets especially in areas such as:

- Force Majeure situations

- Document examination period and approach

- Confirmation

- Allowable payment tenors

- Required notifications to an applicant

- Governing law and jurisdiction

- Replacing a DG or SBLC undertaking lost by a beneficiary

- Some terminology differences e.g. guarantor versus issuing party.

Most banks will require a DG to be subject to the URDG 758 to normalize the roles and responsibilities of each party to the undertaking. Issuing a DG that is silent as to its governing rule set and/or is subject to laws of another country, creates potential risk for the issuer (guarantor is the issuer for DGs) and the applicant. This is because the roles and responsibilities may not be directly addressed, well known or understood.

SBLC rules and regulations

Below is an overview of the key regulations, codes and rules that govern SBLCs.

International Standby Practice (ISP98)

- ISP is a set of rules that when incorporated into an undertaking by referencing the ISP98 or ICC publication 590, will cause the undertaking to be deemed as a Standby Letter of Credit.

- The ISP was approved and endorsed by the International Chamber of Commerce (ICC) in January 1999 (ICC publication 590).

- The ISP took more than five years to create and it was the result of interaction between individuals, banks, and national and international associations.

- The ISP98 is a copyright of the Institute of International Banking Law & Practice (IIBLP) .

- ISP is not law, but it contains resemblances to USA L/C legal doctrine.

- It represents a more comprehensive rule set for SBLCs versus the UCP 600.

Uniform Customs and Practice (UCP 600)

- UCP is a set of rules that that when incorporated into an undertaking, will cause the undertaking to be deemed as a letter of credit.

- The primary focus of the UCP is to govern commercial letters of credit. However, as noted in UCP Article 1 in parenthesis, UCP applies to standby letters of credit “to the extent to which they are applicable”.

- UCP is not a law, rather a set of articles developed by the International Chamber of Commerce (ICC) Banking Commission and others. They are copyrighted by the ICC

- ICC is a non-governmental organization.

- UCP was first published in 1933 making it the oldest and most legally tested rule set. Thereafter revised in 1951, 1962, 1974, 1983, 1993 and its current revision in 2007.

- Receiving a document presentation which contains an extend or pay request e.g. request to extend the expiration date of the SBLC or pay the presentation

- Issuances of counter-SBLCs;

- Examining documents against a SBLC which requires a document to make and/or complete a statement utilizing quotation marks; require a witness, etc.

- What to do in cases where a beneficiary has merged or been acquired after issuance of an SBLC

- Syndicated or participated deals.

Uniform Rules for Demand Guarantees (URDG 758)

- The URDG is a set of rules that that when incorporated into an undertaking, will cause the undertaking to be deemed a demand guarantee (DG).

- URDG 758 entered into effect July 2010 and is a complete revision of the original revision URDG 458.

- The URDG rules support demand guarantees, not surety guarantees.

- Where possible, it was aligned with the concepts of UCP 600; however, its default positions differ from UCP and ISP in a variety of manners.

- URDG 758 now has a companion document titled the International Standard Demand Guarantee Practice (ISDGP) for URDG 758 (ICC publication 814E) . It supplements the URDG by identifying and recording best practice in relation to the URDG rules and beyond.

Evergreen clauses

Given the long-term expiry nature of SBLCs, they often insert what is commonly referred to as an “Evergreen” or “automatic-extension” clause. The Evergreen Clause allows an SBLC’s expiry date to automatically extend for a fixed period-of-time (e.g. every six months or year).

It also provides an issuer or confirmer and/or the applicant with an exit period (e.g. “unless XX days prior to any then current expiration date, the issuer notifies the beneficiary that the issuer elects not to extend the SBLC”). This allows them the possibility to have the SBLC expiry with a simple cancellation notification and without the need for a beneficiary to agree to an amendment.

However, any cancellation notification must be sent or received by the beneficiary by the notification period indicated in the SBLC’s specific evergreen clause. This is normally anywhere between 30 and 90 days from a then current expiration date.

How Evergreen clauses benefit SBLCs

The applicant, issuer or confirmer is provided with the means to close the SBLC without the need for a beneficiary to consent or otherwise have to agree to an amendment or return an undertaking. (Note: The cancellation is typically sent when the underlying contract is also close to completion, but there remain other reasons for cancellation such as: applicant seeking to replace an issuer for improved costs or other reasons, or an issuer seeking to remove itself from a deal; etc.)

In addition, providing longer-term commitments often requires higher rates/fees. The exit opportunity provided by an Evergreen Clause may keep fees more reasonable.

SBLC frequently asked questions

See the section above that covers this in detail

SBLC undertakings can support “any” type of underlying contract, agreement, or obligation between an issuer’s client or applicant and the applicant’s client/counterparty - the beneficiary - provided the issuer is willing to support the nature of the underlying contract.

The SBLC obligations supplement and are in addition to any other underlying contract/agreement between the issuer’s client, the applicant and the beneficiary. When the issuer bears a stronger credit rating, a SBLC is also a credit enhancement tool.

An applicant could require that a beneficiary must inform them of an intended drawing XX days in advance. The SBLC could require the beneficiary to make this certification and provide some form of documentary evidence; e.g. a copy of an email to ensure it was completed. This notification could allow an applicant to resolve the contract issue negating the need for a drawing.

Conversely, a trusted neutral third party or an applicant could require that a beneficiary’s drawing statement be countersigned or attested by a third party neutral to the applicant and beneficiary; or the applicant or their representative to help ensure that the drawing is warranted (Note: Given the neutrality of a SBLC between an issuer and a beneficiary, having an applicant requirement to countersign or attest to a drawing is discouraged in rules and often prohibited by an issuer and/or a beneficiary).

Most SBLCs have a sight tenor and, as noted throughout this guide, in most cases a SBLC will never receive a presentation or drawing so there is no need to make a payment.

Discounting or prepaying a sight SBLC can be associated with fraud and as such, caution is needed when considering such a possibility.

Yes, and as noted in UCP 600, ISP98 (and URDG 758) and when allowed by applicable law, in certain cases the issuer may issue a SBLC on its own behalf. In these cases, the issuer becomes the applicant and the issuer. This is commonly known as a two party SBLC.

About the author

Glenn Ransier Technical Advisor, ICC Banking Commission; Member of URDG 758 drafting team; and Co-Chair for the ISDGP

Head of Documentary Trade and Standby LCs with Wells Fargo Bank N.A .

Email: [email protected]

Disclaimer: Contents represent the author’s sole opinions and may not represent those of any past, present or future employer.

Deferred Payment Letters of Credit Explained: Navigating Usance LC in International Trade

- Post author: Financely Group

- Post category: Corporate Finance

- Post last modified: December 2, 2023

Deferred Payment Letters of Credit, commonly referred to as Usance LCs, are financial instruments used in international trade to facilitate transactions between exporters and importers. They allow for a deferred payment, where an issuing bank guarantees payment to the exporter on behalf of the importer, but at a later date, which is specified in the terms of the LC. This period of usance provides the importer time to receive and sell the goods before the payment is due, effectively extending credit.

The issuance of a Usance LC involves multiple parties including the buyer, seller, issuing bank, and sometimes a confirming bank, ensuring a layer of security and trust in trade deals. As a key component of trade finance, Usance LCs not only guarantee payment to the exporter but also assure the importer that payment is contingent upon the exporter meeting the specific terms and conditions stipulated in the letter of credit. Due to the nature of international trade, Usance LCs can vary widely in their terms, including the length of the usance period and the required documentation to complete the transaction.

Key Takeaways

- Usance LCs offer a deferred payment option which can ease cash flow for importers.

- They involve multiple parties and add a level of security to international trading.

- There is a variety of Usance LCs which can be tailored to meet specific trade needs.

Understanding Deferred Payment Letters of Credit

A Deferred Payment Letter of Credit , also known as a Usance Letter of Credit , is a financial instrument used in international trade that allows a buyer to purchase goods and defer payment to a later date. It is a bank guarantee that the seller will receive payment, but with the specificity of a delay in payment as agreed upon by both parties.

When a buyer and seller enter into a contract with a deferred payment letter of credit , the issuing bank provides a promise to pay the seller on behalf of the buyer. The payment is made after a predefined period, known as the usance period, which typically extends from 30 to 180 days after the delivery of goods or presentation of shipping documents.

Here are the key components:

- Usance : The time duration agreed for the deferred payment.

- Buyer : The one who purchases, receives the goods, and is required to make the payment after the usance period.

- Seller : The one who ships the goods and expects to receive the payment upon expiry of the usance period.

This payment structure provides several advantages:

- Enhanced cash flow for buyers , as they receive the goods without immediate cash outlay.

- Guaranteed payment for sellers , which reduces the risk of non-payment.

In summary, a deferred letter of credit is an arrangement that grants flexibility to the buyer while offering a level of financial security to the seller . It’s a critical tool for managing cash flow and credit risk in international transactions.

The Role of Usance LC in International Trade

Usance Letters of Credit (LC) serve as a crucial financial instrument, ensuring sellers receive payment after delivering goods within a specified timeframe, while providing buyers the benefit of deferred payment.

Facilitating Trade Transactions

In international trade , a Usance LC acts as a bridge between buyers and sellers, allowing for transactions to proceed smoothly without immediate payment. It provides assurance to the seller that payment for the shipped goods is guaranteed by the buyer’s bank after a set period. This time frame, usually ranging from 30 to 180 days, affords the buyer time to sell the goods and manage cash flow effectively. By offering deferred payment, Usance LCs enable businesses to maintain steady operations without the pressure of immediate financial exchange.

Minimizing Payment Risk

A Usance LC significantly reduces payment risk for both parties involved in a trade transaction . For the seller , it mitigates the risk of non-payment as the issuing bank commits to pay, even if the buyer defaults. For the buyer , it ensures that the goods are shipped and documents are in order before payment is made. This role in trade finance is pivotal, as it instills confidence and security, encouraging businesses to engage in trade with new markets and partners, knowing that their financial interests are safeguarded.

Parties Involved in Issuing Usance LCs

In the process of issuing Usance Letters of Credit (LCs), several entities facilitate the arrangement of credit and assurance between the buyer and seller. Understanding the roles of these parties is crucial in the transaction.

The Issuing Bank

The issuing bank represents the buyer (applicant) and originates the Usance LC. It undertakes the obligation to pay the seller (beneficiary) the amount specified in the Usance LC, provided that the terms and conditions of the credit are fully met. This payment is made on a predetermined future date after submission of the required documents.

The Confirming Bank

A confirming bank , often involved in international transactions, adds an extra layer of guarantee on the Usance LC. It confirms the credit issued by the issuing bank, thereby undertaking a commitment to the beneficiary that payment will be made in accordance with the terms of the credit, subject to the presentation of compliant documents.

The Advising Bank

The advising bank acts primarily as an intermediary and is responsible for notifying the beneficiary that the Usance LC has been opened in their favor. Although they advise the credit, they are not responsible for the payment unless they also act as the confirming bank.

The Applicant

The applicant for the Usance LC is usually the buyer or importer. They request the issuing bank to open a Usance LC in favor of the seller. The applicant is ultimately responsible for reimbursing the bank for the credit extended once payment is made to the beneficiary.

The Beneficiary

The beneficiary is the seller or exporter who is entitled to payment under the Usance LC. They must comply with all the terms and conditions of the letter of credit to receive payment. Once they present the requisite documents evidencing shipment or delivery of goods as stipulated in the LC, they can expect payment on the date agreed upon in the Usance terms.

Process of Usance Letters of Credit

The process of Usance Letters of Credit involves a series of steps orchestrated between the importer, the issuing bank, and the exporter to facilitate the time-bound payment mechanism of the transaction.

Presentation

The exporter makes a presentation of the required documents to the nominated bank. This documentary credit ensures that all the conditions outlined in the Usance Letter of Credit are met: commercial invoices, shipping documents, and any other specified papers proving the shipment of goods.

Compliance Verification

Upon receipt, the nominated bank undertakes a compliance verification process. They scrutinize the documents to ensure a complying presentation . The documents must match exactly with the terms and conditions set forth in the Usance Letter of Credit for the payment to be honored at a later date.

Once the verifying bank confirms compliance, it issues an acceptance notice. This formally acknowledges that the documents are in order and payment is due at the predetermined future date, according to the usance terms (which is typically 30, 60, 90, or more days after document presentation).

Reimbursement

Finally, reimbursement occurs at the maturity date. The importer’s bank settles the payment with the exporter’s bank. The nominated bank will follow the instructions as laid out in the Letter of Credit regarding negotiation of the specific terms of payment, thereby completing the transaction loop.

Terms and Conditions of Usance LC

Usance Letters of Credit are crucial in facilitating international trade by allowing deferred payment. They set clear terms and conditions to ensure certainty and trust between the buyer and seller.

Credit Period

The credit period in a Usance Letter of Credit is a crucial term that dictates the time interval post-shipment within which the buyer is obligated to make the payment. Generally, this period is agreed upon by both parties and is clearly stated in the credit documentation to avoid any ambiguity. Typically, it extends up to 90 days from the date on the bill of lading , ensuring the buyer has sufficient time to clear the goods and manage funds.

Maturity Date Specification

For the maturity date , a Usance LC must specify the exact due date for payment. This date directly correlates with the credit period; for instance, if the credit term is 60 days, the maturity date would be 60 days after the submission of necessary documents or the bill of lading. Adherence to the Uniform Customs and Practice for Documentary Credits (UCP 600) is standard, ensuring a globally recognized framework governs the maturity terms.

Payment Terms

The payment terms outlined within a Usance LC delineate the conditions under which the payment will be released. This includes the agreed currency, amount, and any interest or fees applicable if payment is delayed beyond the specified maturity date. Payment is to be made at the end of the credit period, which is typically within the stipulated 90 days following the date indicated on the bill of lading, thus offering a well-defined schedule for financial planning.

Types of Letters of Credit and Usance LC Comparison

When dealing with international trade, understanding the nuances of different types of letters of credit (LC) is critical. This section contrasts types like Sight LC and Usance LC, along with examining both Revocable and Irrevocable LCs, finally making a comparison between Standby LCs and Commercial LCs.

Sight vs. Deferred LC

Sight Letters of Credit necessitate that payment is made immediately upon presentation and verification of shipping documents. In contrast, Deferred Payment Letters of Credit , also known as Usance LCs, allow for payment to be postponed for a specified period after the documents are presented.

- Sight LC : Immediate payment on document presentation.

- Usance LC (Deferred Payment LC) : Payment delayed as agreed by both parties.

Revocable vs. Irrevocable LC

Revocable Letters of Credit grant the issuer the right to make amendments or cancellation without the beneficiary’s consent. However, due to the lack of security, they are seldom used. The Irrevocable Letter of Credit is more common and cannot be modified or annulled without agreement from all involved parties, offering greater assurance to the beneficiary.

- Revocable LC : Can be altered or cancelled unilaterally.

- Irrevocable LC : Cannot be changed without everyone’s approval.

Standby LC vs. Commercial LC

A Standby Letter of Credit functions as a guarantee of payment, invoked only if the applicant fails to fulfill the contractual obligations. It’s mostly used in the US as a support for payment security. Conversely, a Commercial Letter of Credit , also referred to as a Documentary Credit, directly facilitates trade transactions by ensuring payment once the selling party meets the terms of the LC.

- Standby LC : Payment guarantee, activated upon default.

- Commercial LC (Documentary Credit) : Facilitates payment upon compliance with LC terms.

Each letter of credit mechanism serves distinct roles in trade finance, with the choice depending on the level of risk distribution and trust desired by the parties involved.

Financial Implications of Using Usance LCs

Deferred Payment Letters of Credit, commonly known as Usance LCs, offer significant financial implications for businesses engaged in trade finance. They directly impact a company’s financing and cash flow, the time value of money, and open up short-term financing opportunities.

Financing and Cash Flow

Usance LCs provide businesses with the ability to manage their cash flow more efficiently by allowing a delay in payment after the delivery of goods. This postponement offers buyers time to generate revenue from the sales before settling the cost of the products, thereby improving their working capital management. Sellers also benefit from a secure payment option , ensuring that they will receive the payment on a future date as specified in the conditions of the LC.

Time Value of Money

The time value of money is an integral consideration with Usance LCs, as the deferred payment period reflects a cost of financing. Money that is to be received in the future is discounted back to its present value, which should be factored into the cost of the transaction. By deferring payment, the buyer effectively receives a short-term financing benefit, but this comes at the cost of potential interest foregone on the amount due until the payment is finally made.

Short-Term Financing Opportunities

Usance LCs are often utilized as instruments for short-term financing in international trade. The seller extends credit to the buyer, which can be more favorable than traditional bank loans, depending on the agreement’s interest rate and terms. This extended period before payment also permits buyers to use the goods received to produce and sell products, potentially creating earnings that can be used to fulfill the obligation under the Usance LC, thus turning over the funds without an initial capital outlay.

Risks and Mitigation in Usance LC Transactions

When dealing with deferred payment letters of credit (Usance LC) , participants face several risks associated with non-payment , non-delivery , and documentary compliance . These can be mitigated through meticulous management of counterparty risks , addressing compliance and discrepancy issues , and ensuring both delivery and payment.

Counterparty Risks

In Usance LC transactions, counterparty risk is the danger that the other party may fail to fulfill their contractual obligations. This type of risk is particularly prevalent when the buyer and seller have not previously done business together. To mitigate these risks, companies may obtain credit insurance or perform enhanced due diligence on their counterparts, such as checking credit ratings and past transaction history.

Compliance and Discrepancy Issues

Compliance with Usance LC terms is vital. Discrepant documents can lead to non-payment, so entities must ensure all documents are accurate and strictly conform to the credit terms. They should also be aware that even minor discrepancies can cause rejection of documents by banks. Regular training on LC terms and compliance for staff, along with meticulous document checks, are essential practices to minimize these compliance risks .

Non-Delivery and Non-Payment

The risks of non-delivery and non-payment are intrinsic to Usance LCs. These risks manifest when a seller does not ship the goods as per the contract, or the buyer fails to make payment at maturity. Utilizing secure tracking methods for shipments, ensuring robust contract terms, and employing independent inspection agencies to verify the goods before shipment can reduce the risk of non-delivery. To mitigate payment risk, sellers may request an advance payment guarantee or seek financing solutions that provide payment assurance against the Usance LC.

Documentation Required for Usance LCs

When it comes to Usance Letters of Credit, specific documentation is critical for the fulfillment of the contractual agreement between buyers and sellers. These documents serve as proof of shipment, agreement terms, and insurance coverage to secure the deferred payment agreement.

Bill of Lading Requirements

The Bill of Lading (B/L) is a fundamental component for Usance LCs as it serves as evidence that the goods have been shipped. It must:

- Clearly list the consignee , consignor , and shipment details , including the vessel’s name and voyage number.

- State the number of containers or packages, weight , and measurements .

- Be issued in a full set, typically a negotiable set, and marked “ clean on board .”

Sales and Purchase Agreements

The sales contract underscores the agreement details between the buyer and seller. It must:

- Outline all relevant trade terms , including price, quality, and quantity of the goods.

- Include a valid date and signatures from both parties.

Insurance and Other Supporting Documents

Insuring goods during transit is an essential step secured through insurance documents . They should:

- Certify that the cover aligns with the terms of the sales agreement .

- Be complemented by other relevant documents, such as quality certificates , packing lists , and any additional requirements stipulated in the documentary letter of credit .

Advantages of Deferred Payment LCs for Exporters and Importers

Deferred payment Letters of Credit, commonly known as Usance LCs, offer substantial benefits for both parties in a trade transaction.

For exporters, deferred payment provides a guaranteed payment . Once they fulfill their part of the trade agreement, they are assured to receive payment from the importing party at a later specified date. This allows exporters to manage cash flow more effectively and plan their financial operations with greater certainty. Moreover, the use of Usance LCs can enhance creditworthiness since banks only issue them when they are confident in the buyer’s ability to pay at the set future date, as explained in the Trade Finance Global article .

Importers benefit from Usance LCs by getting the flexibility to defer payment until they have sold the goods or turned them into profit, which is particularly helpful in managing their own liquidity and cash flow . This deferred payment term allows importers to avoid having to tie up capital right at the time of shipment. Instead, they can better align their payment outflows with their revenue inflows.

Both exporters and importers enjoy a reduced risk of non-payment as the banks become intermediaries, which gives the transaction a layer of security . It also allows for strengthening of business relationships as both parties can rely on the LC terms for consistent and transparent dealings.

In essence, Usance LCs are financial instruments that create a win-win situation for both buyers and sellers in international trade by aligning payment schedules with business capacity and cash flow requirements.

Frequently Asked Questions

This section addresses common inquiries regarding Deferred Payment Letters of Credit, providing precise insights into their interest rates, differences from Sight LCs, associated risks, impact on trade costs, typical usage, and comparison with Bank Acceptance LCs.

How is the interest rate calculated for Usance LCs?

The interest rate for Usance Letters of Credit is determined by the issuing bank and is generally influenced by the tenor of deferment, market interest rates, and the risk profile of the transaction. The interest compensates the bank for the deferred payment period granted to the buyer.

What are the key differences between Usance and Sight LCs?

Usance LCs and Sight LCs mainly differ in terms of payment timing. Sight LCs require payment to be made immediately upon presentation of the required documents, whereas Usance LCs provide a deferred payment option, allowing the buyer to make payment at a later date.

What are the risks associated with using a Usance LC and how can they be mitigated?

The primary risk of a Usance LC is the credit risk of the buyer defaulting on the payment. This can be mitigated through thorough credit checks, secure trading terms, and hedging strategies like obtaining insurance or guarantees from reputable institutions.

How does the period of deferral in a Usance LC typically affect the cost of trade?

A longer period of deferral on a Usance LC typically increases the cost of trade for the buyer due to higher interest charges. For the seller, it might result in a better price for the goods sold, as the credit period is often a part of the sales negotiations.

In what circumstances is a Deferred Payment Letter of Credit typically used?

A Deferred Payment Letter of Credit is typically used in international trade when buyers and sellers seek to establish trust during a transaction. It is particularly valuable when buyers need time to generate funds from sales of the shipped goods before paying the sellers.

How does a Deferred Payment LC differ from a Bank Acceptance LC?

A Deferred Payment LC involves the bank paying the beneficiary after a set time without needing any further acceptance, while a Bank Acceptance LC requires the bank to accept drafts drawn by the beneficiary and then pay at maturity, either from buyer’s funds or from a bank loan granted to the buyer.

You Might Also Like

The use of credit insurance in enhancing security in trade and project finance, demystifying standby letters of credit, trade finance for global market access: unlocking international business potential.

Text 14 (‘Period for presentation in days’) in Schriftzug of Credit (L/C)

F57 is in optional select by MT437 swift message of Documentary letter of bank.

From the F84C(Latest Date of Shipment), the countdown will start. Normally this period has up toward aforementioned LC expiry date mentioned in F61D(Date and Place of Expiry).

Do you have any thoughts concerning this? let me know in the comments.

Post navigation

You may like these post, field 45c newest date of shipment in lc, field 58b currency codification, amount, field 16t transhipment in letter of credit, field 88c date of issue in letter of credit, field 35 confirmation instructions in letter of credit, 3 ideas on “field 28 (‘period for presentation on days’) in letter a credit (l/c)”, pick your selected, about scmwizard, connect with us, we are protected.

- Search Search Please fill out this field.

What Is a Letter of Credit?

How a letter of credit works, types of letters of credit, example of a letter of credit.

- Applying for a Letter of Credit

- Advantages and Disadvantages

- Letter of Credit FAQs

The Bottom Line

- Personal Finance

Letter of Credit: What It Is, Examples, and How One Is Used

Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

:max_bytes(150000):strip_icc():format(webp)/Julia_Kagan_BW_web_ready-4-4e918378cc90496d84ee23642957234b.jpg)

A letter of credit, or a credit letter, is a letter from a bank guaranteeing that a buyer’s payment to a seller will be received on time and for the correct amount. If the buyer is unable to make a payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase. It may be offered as a facility (financial assistance that is essentially a loan).

Due to the nature of international dealings, including factors such as distance, differing laws in each country, and difficulty in knowing each party personally, the use of letters of credit has become a very important aspect of international trade to protect buyers and sellers.

Key Takeaways

- A letter of credit is a document sent from a bank or financial institution that guarantees that a seller will receive a buyer’s payment on time and for the full amount.

- Letters of credit are often used within the international trade industry.

- There are many different letters of credit, including one called a revolving letter of credit.

- Banks collect a fee for issuing a letter of credit.

Jessica Olah / Investopedia

Buyers of major purchases may need a letter of credit to assure the seller that the payment will be made. A bank issues a letter of credit to guarantee the payment to the seller, essentially assuming the responsibility of ensuring the seller is paid. A buyer must prove to the bank that they have enough assets or a sufficient line of credit to pay before the bank will guarantee the payment to the seller.

Banks typically require a pledge of securities or cash as collateral for issuing a letter of credit.

Because a letter of credit is typically a negotiable instrument , the issuing bank pays the beneficiary or any bank nominated by the beneficiary. If a letter of credit is transferable , the beneficiary may assign another entity , such as a corporate parent or a third party, the right to draw.

The International Chamber of Commerce’s Uniform Customs and Practice for Documentary Credits oversees letters of credit used in international transactions.

How Much a Letter of Credit Costs