Home » Blog » Working Capital Management – Procedure | Estimation | Calculation

Working Capital Management – Procedure | Estimation | Calculation

- Blog | Account & Audit |

- 13 Min Read

- Last Updated on 30 April, 2024

Recent Posts

Blog, News, Company Law

Companies Can Retain DVR Shares With Differential Voting & Dividend Rights if Issued Before SEBI’s Restrictive Circular

[opinion] advocates, doctors, consultants, and other professionals no longer covered under the consumer protection act, latest from taxmann.

Table of Contents

- Estimation Procedure

- Working Capital as a Percentage of Net Sales

- Working Capital as a Percentage of Total Assets

- Working Capital Based on Operating Cycle

- Estimation of Working Capital Requirement

- Double Shifting Work

“The fact that cash inflows are not matched in both timing and amount by cash outflows, provides us with an operating cycle and rationale for investing in working capital. In any analysis of working capital, a distinction is made between temporary and permanent working capital requirements. The latter are a function of secular and cyclical trends in sales and operating expenses. The former depend on seasonal factors. In a proforma projection of working capital requirements, management must forecast the maximum level of current assets required to support an expected volume of sales and maximum level of short term credit it can anticipate to finance these assets.” 1

The efficiency of the planning and management is subject to the correct estimate of the working capital requirement. Irrespective of the planning exercise made and control mechanism adopted, the correct estimation of working capital requirement is the fundamental necessity of a good and efficient working capital management. The present article looks into the steps and calculations required to estimate the working capital requirement for a firm.

1. Estimation Process

A firm must estimate in advance as to how much net working capital will be required for the smooth operations of the business. Only then, it can bifurcate this requirement into permanent working capital and temporary working capital. This bifurcation will help in deciding the financing pattern i.e. , how much working capital should be financed from long term sources and how much be financed from short term sources. There are different approaches available to estimate the working capital requirements of a firm.

2. Working Capital as a Percentage of Net Sales

This approach to estimate the working capital requirement is based on the fact that the working capital for any firm is directly related to the sales volume of that firm. So, the working capital requirement is expressed as a percentage of expected sales for a particular period. The working capital estimation is thus, solely dependent on the sales forecast. This approach is Based on the assumption that higher the sales level, the greater would be the need for working capital. There are three steps involved in the estimation of working capital.

- To estimate total current assets as a % of estimated net sales.

- To estimate current liabilities as a % of estimated net sales, and

- The difference between the two above, is the net working capital as a % of net sales.

So, the firm has to find out on the basis of past experience, or on the basis of other firm’s experience in the same competitive environment, as to how much total current assets and total current liabilities should be maintained for a given level of expected sales. The step ( a ) above i.e. , total current assets as a % of net sales will give the gross working capital requirement and step ( b ) above i.e. , current liabilities as a % of net sales will give the funds provided by current liabilities. The difference between the two is the net working capital which the firm has to arrange for. For example, the following information is available for ABC Ltd. for past three years, on the basis of which the working capital requirement for the next year is to be estimated, given that the sales are expected to increase by 10% over sales level of current year.

In this case, the average of current assets as a % of sales is 21% i.e. , (20%+21%+22%)/3; and the average of current liabilities as a % of sales is 5%. So, the net working capital as a % of sales is 16% i.e. , 21%-5%. Now, if the firm expects an increase of 10% in sales next year, then its working capital requirement can be estimated as follows:

Expected Sales = Rs. 14,00,000 + 10% thereof = Rs. 15,40,000.

Net working capital as a % of sales = 16%. = Rs. 15,40,000 × 16% = Rs. 2,46,400.

The firm is expected to have gross working capital of Rs. 3,23,400 ( i.e. , 21% of Rs. 15,40,000) out of which financing by current liabilities is expected to be Rs. 77,000 ( i.e. , 5% of Rs. 15,40,000). It may be noted that in the above situation the simple arithmetic average of current assets and current liabilities as a % of sales have been taken. If there is a consistent trend (increase or decrease) in current assets or current liabilities or both, then the weighted average may be preferred.

3. Working Capital as a Percentage of Total Assets or Fixed Assets

This approach of estimation of working capital requirement is based on the fact that the total assets of the firm are consisting of fixed assets and current assets. On the basis of past experience, a relationship between

- total current assets i.e. , gross working capital; or net working capital i.e. , Current assets – Current liabilities, and

- total fixed assets or total assets of the firm is established. For example, a firm is maintaining 20% of its total assets in the form of current assets and expects to have total assets of Rs. 50,00,000 next year. Thus, the current assets of the firm would be Rs. 10,00,000 ( i.e. , 20% of Rs. 50,00,000).

In this approach, the working capital may also be estimated as a % of fixed assets. The firm basically plans the future level of fixed assets in terms of capital budgeting decisions. In order to use these fixed assets in an efficient and optimal way, the firm must have sufficient working capital. So, the working capital requirement depend upon the planned level of fixed assets. The estimation of working capital therefore, depends upon the estimation of fixed capital which depends upon the capital budgeting decisions. It has already been noted in Chapter 8 that the investment decisions of a firm are consisting of capital budgeting decisions (relating to fixed assets) and working capital management (relating to current assets and current liabilities). So, the working capital estimation, being a part of the investment decisions, should be made together with the capital budgeting decisions.

Both the above approaches to the estimation of working capital requirement are relatively simple in approach but difficult in calculation. The main shortcoming of these approaches is that these require to establish the relationship of current assets with the net sales or fixed assets, which is quite difficult. The past experience either may not be available, or even if available, may not help much in correct estimation. There is yet another approach to estimate the working capital requirement based on the concept of operating cycle.

4. Working Capital based on Operating Cycle

The concept of operating cycle, as discussed in the preceding chapter, helps determining the time scale over which the current assets are maintained. The operating cycle for different components of working capital gives the time for which an assets is maintained, once it is acquired. However, the concept of operating cycle does not talk of the funds invested in maintaining these current assets. The concept of operating cycle can definitely be used to estimate the working capital requirements for any firm.

In this approach, the working capital estimate depends upon the operating cycle of the firm. A detailed analysis is made for each component of working capital and estimation is made for each of these components. The different components of working capital may be enumerated as follows:

Different components of current assets require funds depending upon the respective operating cycle and the cost involved. The current liabilities, on the other hand, provide financing depending upon the respective operating cycle or the lag period in payment. The estimation of working capital requirement can now be made as follows:

(a) Need for Cash and Bank Balance: Every firm must maintain some minimum cash and bank balance ( i.e. , immediate liquidity) to meet day to day requirement for petty expenses, general expenses and even for cash purchases. The minimum cash requirement for these transactions can be estimated on the basis of past experience. The need or motives for holding cash and bank balance have been discussed in detail in the next chapter. However, it must be noted, at this stage that the cash and bank balance must be estimated correctly for two reasons:

(i) That the cash and bank balance is the least productive of all the current assets, hence a minimum balance be maintained, and

(ii) The cash and bank balance provide liquidity to the firm, which is of utmost importance to any firm.

The minimum cash and bank balance is also considered while preparing the cash budget for the firm.

(b) Need for Raw Materials: Every manufacturing firm has to maintain some stock of raw material in stores in order to meet the requirements of the production process. The number of units to be kept in stores for different types of raw materials depend upon various factors such as raw material consumption rate, time lag in procuring fresh stock, contingencies and other factors. For example, if it takes 5 days to procure fresh stock of raw materials, and 50 units are used daily, then there should be a minimum of 250 units in stock. The firm may also like to have a safety stock of 20 units. Thus, the total units to be maintained in stores would be 270 units. If the cost per unit of this item of raw material is Rs. 10 per unit, then the working capital requirement is Rs. 2,700 ( i.e. , 270 × Rs. 10).

(c) Need for Work-in-progress : In any manufacturing firm, the production process is continuous and is generally consisting of several stages. At any particular point of time, there will be different number of units in different stages of production. Some of these units may be 10% complete, some may be 60% complete and some may be even 99% complete. These units, which can neither be defined as raw material nor as finished goods, are known as work-in-progress or semi-finished goods. The value of raw material, wages and other expenses locked up in these semi-finished units is the working capital requirement for work-in-progress.

It may be noted that all the units are not equally completed and hence valuation of all these units is a difficult job. For this purpose, certain assumptions may be made as follows:

(i) The production process starts with the intake of full raw material. So, the value of raw material locked up in work-in-progress will be equal to full cost of number of units of raw material being represented in work-in-progress.

(ii) The units in work-in-progress may be unfinished with respect to labour expenses and overhead expenses only. Some of these units may be 10% complete, some may be 75% complete and some may be even 80% complete and so on. It is assumed for simplification, that all work-in-progress units are on an average 50% complete with respect to labour and overhead expenses. However, if some other information is given, then the valuation of work-in-progress may be made accordingly.

(d) Need for Finished Goods: In most of the cases, be it a trading concern or a manufacturing concern, the goods are not immediately sold after purchase/procurement/completion of production process. The goods in fact, remain in stores for some times before they are sold. The cost which is already incurred in purchasing, procuring or production of these units is locked up and hence working capital is required for them. It may be noted that these finished goods are valued on the basis of cost of these units. The carriage inward ofcourse, is included.

(e) Need for Receivables: The term receivables include the debtors and the bills. When the goods are sold by a firm on cash basis, the sales revenue is realized immediately and no working capital is required for after sale period. However, in case of credit sales, there is a time lag between sales and collection of sales revenue. For example, a firm makes a credit sale of Rs. 1,50,000 per month and a credit of 15 days given to customers. The working capital locked up in receivables is Rs. 75,000 (Rs. 1,50,000 × 1/2 month).

However, an important point is worth noting here. The calculation of Rs. 75,000 is based upon the selling price, whereas the actual funds locked up in receivables are restricted to the cost of goods sold only. There is no investment in profit element as such. Therefore, it is better to calculate the working capital locked up in receivables on the cost basis. Thus, if the firm is selling goods at a gross profit of 20% then the working capital requirement in the above case, for receivables would be Rs. 60,000 only ( i.e. , Rs. 75,000 × 80%).

The total of working capital requirement for all the above elements is also known as the gross working capital of the firm. At any particular point of time every firm requires this gross working capital as there will be some units of raw materials in stores, some units in work-in-progress, some units as finished goods and there will be some debtors yet to be collected.

(f) Creditors for the Purchases: Likewise a firm sells goods and services on credit it may procure/purchases raw materials and finished goods on credit basis. The payment for these purchases may be postponed for the period of credit allowed by suppliers. So, the suppliers of the firm in fact provide working capital to the firm for the credit period. For example, a firm makes credit purchases of Rs. 60,000 per month and the credit allowed by the suppliers is two month, then the working capital supplied by the creditors is Rs. 1,20,000 ( i.e. , Rs. 60,000×2 months). It means that the firm would be getting the supplies without however, making the payment for two months. The postponement of the payment to the creditors makes the firm to utilize this money elsewhere or help the firm to sell on credit without blocking its own funds.

(g) Creditors for Expenses and Wages: Usually, the expenses and wages are paid at the end of a month. However, these wages and expenses accumulate in the work-in-progress and finished goods on a regular basis. The time lag in payment of wages and other expenses also provide some working capital to the firm. It may be noted that these wages and expenses are considered for the valuation of work-in-progress and finished goods, but are paid usually at the end of the month, providing a working capital to the firm for that period.

The working capital estimation as per the method of operating cycle, is the most systematic and logical approach. In this case, the working capital estimation is made on the basis of analysis of each and every component of the working capital individually. As already discussed, the working capital, required to sustain the level of planned operations, is determined by calculating all the individual components of current assets and current liabilities. There are different steps required for estimation of working capital based on operating cycle. These steps are:

- Identify the current assets and current liabilities to be maintained. Estimation of each element of current assets and current liability is required.

- Determine the average operating cycle (or holding period) for each of these elements. Calculation of different holding periods has been explained in the previous chapter.

- Find out the rate per unit for each of these elements. For example, the rates of raw materials, work in progress, finished goods are to be ascertained.

- Find out the amount (funds) expected to be blocked in each of these elements. For example, in raw materials, the funds blocked are: Av. holding period × No. of units required Per Period × Rate per unit.

- Prepare the working capital estimation sheet and find out the working capital requirement.

The calculation of net working capital may also be shown as follows:

5. Estimation of Working Capital Requirements

The following points are also worth noting while estimating the working capital requirement:

- Depreciation: An important point worth noting while estimating the working capital requirement is the depreciation on fixed assets. The depreciation on the fixed assets, which are used in the production process or other activities, is not considered in working capital estimation. The depreciation is a non-cash expense and there is no funds locked up in depreciation as such and therefore, it is ignored. Depreciation is neither included in valuation of work-in-progress nor in finished goods. The working capital calculated by ignoring depreciation is known as cash basis working capital. In case, depreciation is included in working capital calculations, such estimate is known as total basis working capital.

- Safety Margin: Sometimes, a firm may also like to have a safety margin of working capital in order to meet any contingency. The safety margin may be expressed as a % of total current assets or total current liabilities or net working capital. The safety margin, if required, is incorporated in the working capital estimates to find out the net working capital required for the firm. There is no hard and fast rule about the quantum of safety margin and depends upon the nature and characteristics of the firm as well as of its current assets and current liabilities.

6. Double Shifting Work

In case, the firm is operating in double shift then a few adjustments are required in the working capital estimation. The double shift working has an effect on the working capital requirement. The reason being that extra working (production) would require additional raw materials and would result in higher stock of finished goods. Sometimes, the firm may be required to pay a higher wage rate to the labour. Fixed costs of production may remain same or may increase. The calculation of working capital requirement for double shift should be made depending on the information. If sufficient information is not available, then some assumptions may be made as follows:

- That the requirement of raw material will increase proportionately. The storage period of raw material may remain same. Similarly, stock of finished goods will also increase.

- The work on work-in-progress of the first shift will continue in the second shift and no extra funds would be blocked in the work in progress.

- Fixed costs may remain same, and consequently, the fixed cost per unit will decrease as the total production increases.

- The cost of raw materials and the selling price per unit of finished goods may decrease because of larger volumes. This change should be incorporated in the working capital estimation.

The effects of different CA and CL on working capital requirement due to Double Shift Operations are given below:

- Curran, W.S., Principles of Financial Management. McGraw-Hill Book Company, New York, First Edition, p. 161.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

One thought on “Working Capital Management – Procedure | Estimation | Calculation”

Before it components a selected invoice, the company reveals you the exact charge you pays for that invoice, so you won’t be caught off guard whenever you repay the advance.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

PREVIOUS POST

To subscribe to our weekly newsletter please log in/register on Taxmann.com

Latest books.

R.K. Jain's Customs Tariff of India | Set of 2 Volumes

R.K. Jain's Customs Law Manual | 2023-24 | Set of 2 Volumes

R.K. Jain's GST Law Manual | 2023-24

R.K. Jain's GST Tariff of India | 2023-24

Everything on Tax and Corporate Laws of India

Author: Taxmann

- Font and size that's easy to read and remain consistent across all imprint and digital publications are applied

Everything you need on Tax & Corporate Laws. Authentic Databases, Books, Journals, Practice Modules, Exam Platforms, and More.

- Express Delivery | Secured Payment

- Free Shipping in India on order(s) above ₹500

- Missed call number +91 8688939939

- Virtual Books & Journals

- About Company

- Media Coverage

- Budget 2022-23

- Business & Support

- Sell with Taxmann

- Locate Dealers

- Locate Representatives

- CD Key Activation

- Privacy Policy

- Return Policy

- Payment Terms

Estimating Working Capital Requirements

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on April 04, 2023

Fact Checked

Why Trust Finance Strategists?

Table of Contents

1. estimating working capital requirement using operating cycle method.

X Ltd Co. wants to estimate its working capital using the operating cycle method when:

- Estimated sales 20,000 units @ $5 P.U.

- Production and sales will remain similar throughout the year

- Production costs : Materials - 2.5 P.U., Labor 1.00 P.U., Overheads $17,500

Customers are given 60 days of credit and 50 of days credit from suppliers. The 40-day supply of raw materials and a 15-day supply of finished goods are kept in store.

The production cycle lasts 20 days. All materials are issued at the start of each production cycle. One-third of the average working capital is kept as a cash balance for contingencies.

(c) No. of operating cycles in the year = 365 / 85 = 4.3

(d) Working capital = 87,500 / 4.3 = $20,349

Add: Reserve for contingencies 1 / 3 = 6,789 / $27,132

2. Using Working Capital Method

Contingencies allowances = 15%

Required: Calculate the amount of working capital.

Current Assets

Account Receivables (Drs)

Local sales = (1,56,000 x 2) / 52 = $6,000

Outside sales = (6 x 6,24,000) / 52 = $72,000

Less: Current Liabilities

Accounts Payables (Crs.) = (1,92,000 x 4) / 52 = $14,770

O/S Wages = (5,20,000 x 2) / 52 = $20,000

Add: 15% for contingencies = 10,385

Total working capital required = $79,615

3. Using Cash Forecasting Method

John Trading Co. has asked you to prepare a working capital forecast using the following information:

- Issued share capital: $400,000

- 8% deb.: $1,50,000

- Fixed assets are valued at $300,000

- Production: 100,000 units.

- Expected ratios of cost to selling price are: R.M. 50%, Wages: 10%, Overheads: 25% = 85%

Raw materials remain in stores for 2 months, finished goods remain in stores for 4 months, the credit allowed by crs. is 3 months from the date of delivery of goods (Rm), and the credit given to Drs. is 3 months from the date of dispatch.

The production cycle is 2 months. Additionally, the sale price per unit is $6, and production and sales are uniform throughout the year.

4. Using Projected Balance Sheet Method

Libro Ltd. has $350,000 share capital, $70,000 G.R., $300,000 fixed assets, $30,000 stock, $97,500 Drs., and $15,000 Crs.

The company proposes increasing the business stock level by 50% at the end of the year. Credits are doubled and it is proposed that machinery worth $15,000 should be purchased.

Estimated profit during the year is $52,500 after changing $30,000 depreciation and 50% of profit for taxation.

Advance income tax is estimated at $45,000. Credits are likely to be doubled, 5% dividends will be paid, and 10% dividends are to be proposed for the next year.

Drs. are estimated to be outstanding for 3 months. The sales budget shows $750,000 as sales for the year to make a working capital forecast by the projected balance sheet method.

Estimating Working Capital Requirements FAQs

What is working capital.

Working Capital is the difference between current assets and current liabilities. It represents the amount of money which a company has in hand to run day to day business.

What is a solution to working capital requirement problems?

To solve Working Capital requirement problems, you must first understand what they are asking for. Then determine how much of each current asset and current liability the company needs to have on hand so it can meet its short term obligations. Once you have determined these amounts add them all up to get the total Working Capital.

What is the formula for working capital?

Working Capital = current assets – current liabilities. The number will always be a positive amount because it represents how much money the company has in hand to meet its short term financial obligations. If current assets are greater than current liabilities, you have a positive Working Capital position or what is called a funding surplus. If current liabilities are greater than current assets you have a negative Working Capital position or what is called a shortfall.

Is working capital the same thing as net worth?

No, it is not. Working Capital represents the difference between current assets and current liabilities at a given point in time whereas net worth represents all of the assets and liabilities of a company at a given point in time. Net worth is equal to total assets less total liabilities and shareholders' equity which includes the capital stock, Retained Earnings and other forms of equity.

What is the formula for net worth?

Net worth = total assets – total liabilities. The number will always be a positive or negative amount. If total assets are greater than total liabilities, you have a positive net worth position and if liabilities are greater than assets you have a negative net worth position.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Our Services

- Financial Advisor

- Estate Planning Lawyer

- Insurance Broker

- Mortgage Broker

- Retirement Planning

- Tax Services

- Wealth Management

Ask a Financial Professional Any Question

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

Hey, did we answer your financial question.

We want to make sure that all of our readers get their questions answered.

Great, Want to Test Your Knowledge of This Lesson?

Create an Account to Test Your Knowledge of This Topic and Thousands of Others.

Get Your Question Answered by a Financial Professional

Create a free account and submit your question. We'll make sure a financial professional gets back to you shortly.

To Ensure One Vote Per Person, Please Include the Following Info

Great thank you for voting..

- Cashflow management

Working capital: Everything you need to know !

Working capital and cash flow are closely connected. To operate properly, a business must have sufficient available funds to finance its operations: raw materials purchases, trade receivables, etc. This is where working capital comes in, as it is basically your company's “nest egg”!

If you would like to know what working capital is, how to have a healthy working capital, and how to calculate it, read on to learn the basic principles of WC.

Working Capital Defined

Working capital (WC) is an accounting metric that shows, in figures, how a business uses its money. This is a very important concept in terms of cashflow management . In practical terms, this metric represents the funds available to a business to pay its running expenses (suppliers, staff, operating expenses) until it obtains payment from its customers .

Overall Net Working Capital (ONWC)

Also known as overall net working capital (ONWC) , working capital is the capital you use to meet your financial obligations on a daily basis.

Having visibility of your working capital allows you to run your business more efficiently because you know in advance what expenses you can cover without resorting to a loan.

In practical terms, keeping an eye on this metric allows you to sustainably finance the investments that your business cannot do without.

Origins of Working Capital

Originally, working capital was used to assess a business's solvency by working out the difference between its most liquid assets (inventories, receivables and cash in hand) and its short-term liabilities or the difference between its long-term funds ( equity and borrowings ) and its fixed assets. If the difference was positive, the company's financial balance was considered satisfactory.

In the 1970s, theanalysis of financial balance was fine-tuned and to assess it, the amount of working capital calculated was compared with the company's recurring financial requirements generated by its operations. This became known as the working capital requirement (WCR ) .

What is working capital used for?

Today, this accounting instrument measures the funds a business has in the medium and long term to finance routine operations , outside its turnover. It gives a precise view of the financial health of your business in order to manage it confidently and build your development strategy. To optimise cash flow, this “reserve” must be adapted to the operating cycle of your business at all times. Key takeaway : the working capital must be sufficient to partly cover the working capital requirement (WCR) in order to support and maintain the operating cycle.

Working Capital VS Working Capital Requirement

Although these are two key concepts for a business, they are both interlinked and distinct.

👉 What is Working Capital Requirement (WCR) ?

- Working capital requirement is the money a company needs at a given point in time,

- whereas working capital is used to determine whether the long-term funds are sufficient to finance the fixed assets (durable assets).

Working capital is linked to the balance sheet whereas working capital requirement relates to the short-term financing of a business.

To fully understand :

- Working Capital Requirement : amount the business needs to cover its operating expenses;

- Working Capital : amount the business possesses to pay its operating expenses.

When to Calculate your Working Capital

A working capital calculation is needed in three precise situations:

- When starting up a business : to define the necessary share capital and the amount of bank loans needed.

- At specific times during the existence of a business : before launching new products, to anticipate the opening of a sales outlet, before a recruitment phase, etc.

- When selling a business : in this context, the working capital not only provides proof of financial strength but also helps to estimate the most coherent sale price.

Working Capital Formulas

Working capital is calculated based on the information found in the balance sheet. The balance sheet lists the assets and liabilities of your business.

In the example above, it is split into two parts: top and bottom. The top of the balance sheet is the part containing all of a company's long-term items (available for more than one year), whether assets or liabilities. It precisely sets out the investment capital and long-term uses.

Calculating working capital using long-term balance sheet items

The two calculation methods below are based on what is referred to in France as the top of the balance sheet.

Calculation method 1 : Overall net working capital (ONWC) = equity - fixed assets

However, on a day-to-day basis, a different formula is more often applied:

Calculation method 2 : Overall net working capital (ONWC) = investment capital - long-term uses

In this formula, the investment capital includes :

- financial debts,

- depreciation,

- provisions for contingencies and charges.

And long-term uses correspond to gross fixed assets. Calculating working capital using current assets and liabilities This formula is based on the current assets and liabilities in the balance sheet. Unlike the equation above, it measures it in the short term (less than a year).

Overall net working capital (ONWC) = short-term assets - short-term liabilities

Short-term assets include :

- current assets

- cash in hand

Short-term liabilities include :

- current liabilities

- short-term debts

Why a company director should focus on the long term

Even though it might seem less urgent to monitor these long-term items, as a company director or CFO , you should not overlook them. Because having a regular analysis allows you to optimise your cash flow, develop or diversify your business and even reduce your debt.

Composition of working capital

Overall net working capital (ONWC) breaks down into three main categories.

1/ Equity or capital funds

Capital funds represent the business's own resources . They come from the profits made by the business itself or inputs from investors. These available financial resources help support the investments and operating cycle of a business. The more capital funds a business has, the more its value is boosted.

- If capital funds are positive : the business has financial reserves to make long-term investments such as: machinery, but also to finance the business activity: expenditure on goods, book credit, etc.

- If equity is negative : this means that its value is zero or even negative and implies that the business has made a loss in previous years. In this context, the business must build its equity back up. Juridiquement ( article L. 223-42 du Code de Commerce ), vous disposez de 2 ans pour reconstituer votre capital en cas de pertes.

2/ Medium and long-term loan capital

Loan capital represents the amounts granted by a financial institution in the form of instalment loans. In fact, it often corresponds to borrowings and toshareholders' loans that are blocked over the medium or long term.

3/ Fixed Assets

Fixed assets , which can also be called long-term assets, mean those of the company's assets that are intended to be retained over the long term .

Fixed assets break down into three categories: intangible, tangible (property, plant and equipment) and financial (permanent investments.

Property, Plant and Equipment Once they are completed, they are entered in the balance sheet under the following line items:

- land, including fixtures and improvements;

- buildings: general facilities, structures and infrastructure;

- technical facilities, equipment and machinery.

Until they are completed, property, plant and equipment are entered in a work-in-progress item.

Intangible fixed assets include:

- preliminary expenses;

- research and development costs;

- concessions, patents, licences, trademarks and software; they represent the investments in intangibles made by the business;

- The goodwill consists of intangible items, including lease rights.

Permanent Investments

- Equity interests such as shares for example;

- Loans granted to staff or shareholders;

- Debt securities;

- Deposits and guarantees.

Example of working capital calculation

The company Smith & Jones has the following accounting data for 2020: 150,000 Euros equity 300,000 Euros of fixed assets

Here is the formula for calculating the working capital:

150,000 - 300,000 = - €150,000 ONWC

Financial Analysis : Here, we therefore have a negative ONWC. The funds available to Smith & Jones will not be sufficient to cover the operating expenses.

There are two possible solutions: find new financing or review the company's strategy.

Working Capital Analysis

There are three possibilities with working capital: depending on the result, it may be above zero, below zero or equal to zero.

Positive Working Capital

When the net working capital is positive , this means that the business generates a cash surplus , which allows it to finance all or part of the structural portion of its working capital requirement (WCR) . When it is calculated over the long term, a positive WC proves that the business has stable resources.

Conversely, when a positive working capital is calculated over the short term, it means that debts can be paid by realising short-term assets.

Negative Working Capital

When a business has a negative working capital , it is described as undercapitalised. This is a risky situation, as the business is unable to bear all of its investments. If the working capital is negative over the long term , this implies that the resources will not be sufficient for the business to operate correctly. If the working capital is negative in the short term, then the business is unable to pay its debts, even if it realises its assets.

Zero Working Capital

Zero ONWC means that the business has no long-term cash advance and this undermines its financial balance by making it insecure.

Working Capital and Net Cash

Net cash encompasses all liquid assets that are available in the short term; in accounting jargon, this is known as the “sight balance”. Link between net cash and working capital Net cash corresponds to the cash assets of a business less the financing of working capital (ONWC) and working capital requirement (WCR) .

Calculating Net Cash

Net cash is calculated using the following subtraction:

Net cash = working capital - working capital requirement or ONWC - WCR

This formula is the most frequently used; it corresponds to the approach by long-term assets and liabilities.

Net cash is calculated either : Before taking over or founding a business By calculating net cash when developing a business plan, the viability of a project can be checked for example.

Or during the life cycle of a business As CFO or Company Director, you may wish to track this management metric on a daily, weekly or monthly basis.

By carefully monitoring your net cash :

- you measure your short-term financial balance ;

- you guarantee efficient and sustainable management;

- you have visibility over your future investments;

- you have a reference to develop your budget forecast.

Drop in Working Capital: the most frequent causes

There are several reasons why a business may experience areduction in working capital. The most common are:

Loss of turnover

When a business loses a significant part of its turnover, this directly impacts its equity, in other words its cash flow and, therefore, its liquid assets.

This mechanism inevitably entails a reduction in working capital, with a decline in cash flow.

This loss of turnover may be temporary and due to a one-off event. If this is the case, the situation can be turned around by adopting a different strategy, revising the pricing policy, diversifying the products or services or targeting new customers for example. In general, to turn a business's financial situation around , a loan needs to be taken out over three to five years to reinforce the capital funds.

Self-Financing

Two means of financing are available to a business :

- either by using external funds: borrowing, raising capital, etc.

- or by using its capital funds, which is known as self-financing.

Businesses sometimes self-finance their investments to avoid resorting to a loan. This is a tricky choice as it can weaken a healthy cash position and reduce the working capital .

By opting for this solution, you increase your long-term needs without offsetting your investment capital. Generally, it is therefore wiser to finance an investment by means of a capital increase or a bank loan.

Dividend Distribution

By definition, dividends correspond to the profits generated by a business . These earnings are levied directly from the company's profits to be paid to shareholders: this is known as dividend distribution.

This distribution impacts the cash position , as it entails a disbursement and reduces the company's equity. The cash actually available should therefore be taken into account to optimise the dividend distribution.

In other words , if you pay less than the profit you increase the working capital; otherwise, you delve into your reserve funds.

In order to anticipate these variations, it is highly recommended to make a cash flow forecast .

Do you know all about cash management ? Need a refresher on cash management? Discover Cash Academy, a course totally free of charge!

Subscribe to our newsletter

You may also like.

201 Borough High Street London SE1 1JA

- Manage your cash flow

- Cash flow monitoring

- Cash flow forecast

- Consolidation

- Custom dashboards

- Debt management

- Late payment reminders

- Supplier Invoice Management

- £1M - £10M revenue

- Restaurants

- Terms of Use

- General Terms of Service

- Privacy Policy

- Legal Notice

- We're hiring

- Starting a Business

- Growing a Business

- Small Business Guide

- Business News

- Science & Technology

- Money & Finance

- For Subscribers

- Write for Entrepreneur

- Entrepreneur Store

- United States

- Asia Pacific

- Middle East

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

How to Determine Your Working Capital Needs Working capital has a direct impact on cash flow in a business. Consider these five common sources of short-term working capital financing.

By Entrepreneur Staff Feb 14, 2013

Working capital is one of the most difficult financial concepts for the small-business owner to understand. In fact, the term means a lot of different things to a lot of different people. By definition, working capital is the amount by which current assets exceed current liabilities. However, if you simply run this calculation each period to try to analyze working capital, you won't accomplish much in figuring out what your working capital needs are and how to meet them.

A more useful tool for determining your working capital needs is the operating cycle. The operating cycle analyzes the accounts receivable, inventory and accounts payable cycles in terms of days. In other words, accounts receivable are analyzed by the average number of days it takes to collect an account. Inventory is analyzed by the average number of days it takes to turn over the sale of a product (from the point it comes in your door to the point it is converted to cash or an account receivable). Accounts payable are analyzed by the average number of days it takes to pay a supplier invoice.

Most businesses cannot finance the operating cycle (accounts receivable days + inventory days) with accounts payable financing alone. Consequently, working capital financing is needed. This shortfall is typically covered by the net profits generated internally or by externally borrowed funds or by a combination of the two.

Most businesses need short-term working capital at some point in their operations. For instance, retailers must find working capital to fund seasonal inventory buildup between September and November for Christmas sales. But even a business that is not seasonal occasionally experiences peak months when orders are unusually high. This creates a need for working capital to fund the resulting inventory and accounts receivable buildup.

Some small businesses have enough cash reserves to fund seasonal working capital needs. However, this is very rare for a new business. If your new venture experiences a need for short-term working capital during its first few years of operation, you will have several potential sources of funding. The important thing is to plan ahead. If you get caught off guard, you might miss out on the one big order that could put your business over the hump.

Here are the five most common sources of short-term working capital financing:

- Equity . If your business is in its first year of operation and has not yet become profitable, then you might have to rely on equity funds for short-term working capital needs. These funds might be injected from your own personal resources or from a family member, a friend or a third-party investor.

- Trade creditors . If you have a particularly good relationship established with your trade creditors, you might be able to solicit their help in providing short-term working capital. If you have paid on time in the past, a trade creditor may be willing to extend terms to enable you to meet a big order. For instance, if you receive a big order that you can fulfill, ship out and collect in 60 days, you could obtain 60-day terms from your supplier if 30-day terms are normally given. The trade creditor will want proof of the order and may want to file a lien on it as security, but if it enables you to proceed, that should not be a problem.

- Factoring . Factoring is another resource for short-term working capital financing. Once you have filled an order, a factoring company buys your account receivable and then handles the collection. This type of financing is more expensive than conventional bank financing but is often used by new businesses.

- Line of credit . Lines of credit are not often given by banks to new businesses. However, if your new business is well-capitalized by equity and you have good collateral, your business might qualify for one. A line of credit allows you to borrow funds for short-term needs when they arise. The funds are repaid once you collect the accounts receivable that resulted from the short-term sales peak. Lines of credit typically are made for one year at a time and are expected to be paid off for 30 to 60 consecutive days sometime during the year to ensure that the funds are used for short-term needs only.

- Short-term loan . While your new business may not qualify for a line of credit from a bank, you might have success in obtaining a one-time short-term loan (less than a year) to finance your temporary working capital needs. If you have established a good banking relationship with a banker, he or she might be willing to provide a short-term note for one order or for a seasonal inventory and/or accounts receivable buildup.

In addition to analyzing the average number of days it takes to make a product (inventory days) and collect on an account (accounts receivable days) vs. the number of days financed by accounts payable, the operating cycle analysis provides one other important analysis.

You can see that working capital has a direct impact on cash flow in a business. Since cash flow is the name of the game for all business owners, a good understanding of working capital is imperative to making any venture successful.

Entrepreneur Staff

Want to be an Entrepreneur Leadership Network contributor? Apply now to join.

Editor's Pick Red Arrow

- Lock 3 Things Your Business Idea Must Have to Succeed — as Proven By Famous Harvard Business School Startups

- This Couple Cashed in Their 401ks to Launch a Virtual Business — Here's How It Led to a 9-Figure Exit and Co-Owning 2 Professional Soccer Teams

- Lock The No. 1 State to Retire in Might Not Even Be on Your Radar, According to a New Report

- Lock 12 Books That Self-Made Millionaires Swear By

- Lock These Are the Highest-Paying Side Hustles for a Single Day of Work

- Use These 3 Steps to Find the Perfect Franchise Opportunity for You

Most Popular Red Arrow

Red lobster breaks silence on 'misunderstood' bankruptcy filing: 'does not mean we are going out of business'.

The seafood chain filed for Chapter 11 bankruptcy protection on Monday.

Kickstarter Is Opening Up Its Platform to Creators and Making Big Changes to Its Model — Here's What's New

The company noted it is moving beyond traditional crowdfunding and making it easier for businesses to raise more money.

The Psychological Impact of Recognition on Employee Motivation and Engagement — 3 Key Insights for Leaders

By embedding strategic recognition into their core practices, companies can significantly elevate employee motivation, enhance productivity and cultivate a workplace culture that champions engagement and loyalty.

Know The Franchise Ownership Costs Before You Leap

From initial investments to royalty fees to legal costs, take stock of these numbers before it's too late.

Beyond the Great Resignation — How to Attract Freelancers and Independent Talent Back to Traditional Work

Discussing the recent workplace exit of employees in search of more meaningful work and ways companies can attract that talent back.

What the Mentality of the Dotcom Era Can Teach the AI Generations

The internet boom showed that you still need tenacity and resilience to succeed at a time of great opportunity.

Successfully copied link

Peter McKendry

Chief executive officer, the co-group limited.

After giving opportunities to numerous accounting services providers, we found Whiz consulting. The experience of working with Whiz was overwhelming. The timely and accurate deliverable of the team is commendable. Highly recommended.

Trusted by thousands of leading brands

Get 30 Mins Free Personalized Consultancy Just drop in your details here and we'll get back to you!

By using our offerings and services, you are agreeing to the Terms of Services and understand that your use and access will be subject to the terms and conditions and Privacy Notice .

Estimating Working Capital Requirements: What Every Business Needs To Know?

In any business, cash is king. Having a positive working capital ensures that a company has the resources it needs to meet its short-term obligations and take advantage of opportunities that may arise. Contrary to this, a company with a negative working capital may face difficulty meeting obligations like outstanding accounts payable and the risk of defaulting on loans or missing out on opportunities. Therefore, it is important to understand and accurately forecast the working capital required to keep operations running smoothly. However, this can be difficult if you do not know all the basics. In this blog, you will learn how to estimate your working capital requirements using different methods and ensure that you have the funds available for business operations. But first, let us learn the importance of working capital and why is working capital estimation necessary.

What is Working Capital?

Working capital is the amount of money a company needs for day-to-day operating expenses, such as raw materials, employee salaries, and rent. It tells you how well a company can pay its short-term obligations. It is the difference between a company’s current assets and current liabilities. If a company does not have enough working capital, it will be unable to pay financial obligations like accounts payable and may have to declare bankruptcy. Thus, ensuring positive working capital in your business is important. However, you can only ensure a positive working capital if you are aware of its elements or components. Here, we have highlighted certain important components of working capital to ensure a positive working capital and improve your financial literacy as a business owner .

Components of Working Capital

As mentioned above, every business must clearly understand its working capital requirements. This can be a complex task, as there are many factors to consider. However, you can better understand what is required by breaking it down into parts.

The first component of working capital is current assets. These are the assets that will be used to pay for the day-to-day operations of the business. They include cash, inventory, accounts receivable, and other short-term assets. Then the second component is the current liabilities. These are the debts and obligations that need to be paid in the short-term. They include things like accounts payable, taxes payable, and wages payable. The third and final component is called the cash conversion cycle. It refers to the time it takes for a business to convert its raw materials into finished products and then sell those products to customers.

By understanding these 3 components of working capital, you can get a better handle on how much cash balance your business needs to maintain smooth operations. So, now that you have gained a decent understanding of working capital and its components, let us delve deeper to explore its importance and why working capital estimation is needed.

Importance of Working Capital

- To ensure timely payment of bills and salaries: One of the most important uses of working capital is to ensure that all bills and salaries are paid on time. This is particularly important in businesses with tight cash flow or irregular income streams. If you are unaware of your working capital requirement, you will probably not have sufficient funds to pay off your short-term obligation. As a business owner, you can ensure timely payment of bills and salaries by investing in outsourced services as well.

- To maintain inventory levels: Another key use of working capital is to finance inventory levels. This is especially important for businesses that operate on just-in-time delivery models where any interruption in supply can lead to significant losses. Hiring outsourced accounting services from experienced service providers can help manage inventory levels more accurately.

- To take advantage of early payment discounts: Many suppliers offer early payment discounts, which can lead to significant savings for businesses. However, these discounts can only be taken advantage of if enough funds are available to make the payments on time. Positive working capital will enable you to take advantage of such discounts.

- To support expansion plans: If a business wants to expand, it will need access to additional funds to finance the growth. Working capital can provide this funding through internal accruals or external financing sources such as loans or equity injections. However, business expansion becomes possible only when you give complete attention to the core activities.

Purposes of Estimation

So far, we learnt that as a business owner, it is crucial to clearly understand your working capital needs to make well-informed financial decisions. Estimating your working capital requirements is a vital step in this process. There are several different purposes for which you may need to estimate your working capital requirements. You may need to estimate your working capital in order to:

- Develop a business plan: A key component of any business plan is a detailed financial analysis. This analysis will include an estimation of your working capital needs.

- Secure financing: If you are seeking financing from investors or lenders, they will likely require an estimation of your working capital needs as part of their due diligence process.

- Monitor cash flow: It is important to monitor your business’s cash flow closely. A part of this process includes estimating your future working capital needs so that you can make adjustments to your operations accordingly.

- Make strategic decisions: Whether you are starting your business from scratch or running an established one, you will need to make several strategic business decisions. Estimating your future working capital needs help in making different strategic decisions.

Not just the points mentioned above, you might encounter a lot of other reasons to estimate working capital. So, let us learn some methods for ensuring an effective working capital estimation.

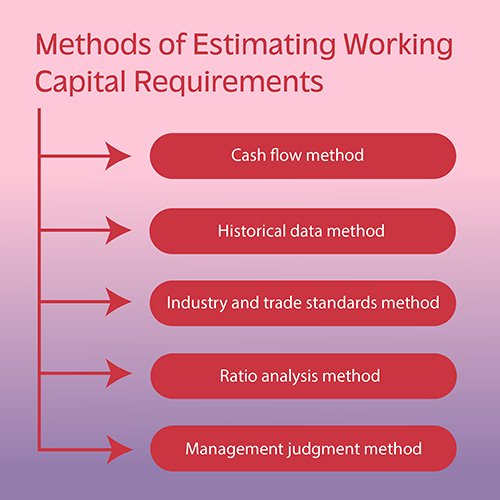

Different Methods of Estimating Working Capital Requirements

There are a number of different methods that can be used to estimate working capital requirements. Let us highlight some of the important ones.

- Cash flow method- The cash flow method is a popular option for estimating working capital requirements. With this method, you forecast your company’s future cash flow and use that information to estimate the amount of working capital you will need. The cash flow method simply projects future cash inflows and outflows to determine how much working capital will be required. This can be done using financial statements, such as income statements and balance sheets. This will give you a good idea of how much working capital you will need in the future.

- Historical data method- As the name suggests, the historical data method uses information from the company’s past to estimate future working capital requirements. This approach is based on the premise that a company’s future working capital needs will be similar to its past needs. To calculate working capital using this method, you first need to determine your company’s average cash conversion cycle (CCC) over time. The CCC is the number of days it takes for a company to convert raw materials into cash. Once you have determined the CCC, you can estimate your company’s future working capital needs by multiplying the CCC by your projected sales.

- Industry and trade standards method- This approach can be used to get a general idea of the minimum amount of working capital required for a specific industry or trade. To use this method, you will need to find industry-specific data on the average level of inventory, accounts receivable, and accounts payable. This information can be found in surveys or reports from trade associations or other similar organisations. Once you have gathered this data, you can estimate your company’s working capital requirements by applying these averages to sales volume. While this approach does not provide a precise estimate, it can help get a general idea of the minimum amount of working capital that may be required for your business.

- Ratio analysis method- With the ratio analysis method, businesses look at their financial statements and calculate some key financial ratios. The ratios used in the ratio analysis method are the current ratio, quick ratio, and inventory turnover. Even if you own a small business, such financial ratios help to give a snapshot of how well the business is doing and how much working capital is needed.

- Management judgment method- This method relies on the knowledge and experience of management to come up with an estimate. To use this method, management first needs to consider the company’s past working capital needs. They will then look at any changes that have happened within the company or industry which could impact future working capital requirements. After considering all this, management will come up with an estimate for the company’s future working capital needs. This method is often used because it is quick and easy and does not require sophisticated financial analysis. However, this method can be less accurate than other methods because it is based on subjective judgement rather than hard data.

Bottom line

So far, we have learnt that working capital describes the funds available to a business to grow, expand, and meet short-term obligations. It is important to maintain a healthy working capital balance to avoid defaulting on accounts payable and other debts. Thus, estimating working capital requirements is an important part of managing a business effectively and profitably. By understanding the various methods available to estimate the necessary funds, you can ensure access to the right amount of funds at all times and make sure your business finances remain healthy. Moreover, keeping on top of estimated costs can help you avoid overpaying for services or materials when too much cash has been set aside. Thus, be sure to use the best method when estimating how much working capital you need to ensure the successful operation of your company.

All Categories

- Accounts Reconciliation

- E-commerce Accounting

- Accounting & Bookkeeping

- Outsourcing

- Accounts Payable

- Accounts Receivable

- Reconciliation

- Financial Reporting & Analysis

- Payroll Management

- Inventory Management

- Business Structure

- Shopify Accounting and Bookkeeping

Recent Post

A comprehensive guide to amazon accounting and bookkeeping, a guide to accounting for care homes in uk, mastering e-commerce accounting: a comprehensive guide, get a free quote, would you like to comment, leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Post Comment

Check out our most Popular Searches

- Instant Personal Loan

- Collateral Free Business Loan

- Professional Loan for Doctors

- Check CIBIL Score for Free

- Loan for Medical Emergency

- Travel Loan

Choose The Product You Are Applying For

- Business Loan

- Professional Loan

- Personal Loan

- Pre-Owned Car Loan

- Medical Equipment Loan

- Loan Against Property

- Machinery Loan

Overview on Personal Loan

Personal Loan EMI Calculator

Personal Loan for CA

Personal Loan for CS

What is Working Capital? Its Meaning, Example and Importance

Loan up to 30 Lakhs | Attractive Interest Rate | Zero Foreclosure Charges

- What is Working Capital? Its Meaning, Formula, Example & Importance in Business

Table of Content

- What is Working Capital?

- How to Calculate Working Capital Requirement?

- What is working capital management?

Importance of Working Capital

Different types of working capital in business.

- Need for Additional Working Capital

What Happens If the Company Has Low Working Capital?

Frequently asked questions about working capital.

For a business to operate, it needs money. This money is often called the lifeblood of the business because it's essential to keep the business running. It's like the cash or deposits a business keeps on hand to pay for day-to-day operations. Working capital is a vital measure of a business's ability to pay its short-term debts. It's an important metric that shows how financially healthy a business is.

What is Working Capital - Meaning & Definition

Working capital is the difference between the current assets of the business and its short-term debts & current liabilities. You must have a positive working capital as it demonstrates that the business’s financial goals are achieved, and your business is financially stable to invest in other business operations. The importance of working capital is high especially for small businesses as they rely heavily on short-term financing. This also increases the significance of working capital for such businesses.

What is the Working Capital Formula and How to Calculate It?

The working capital formula is: Working capital = Current Assets – Current Liabilities

This formula tells us about the short-term liquid assets available after short-term liabilities have been paid off. The Working Capital formula is a measure of a company’s short-term liquidity and is an important factor for performing financial analysis, and managing cash flow.

For example, a company has current assets worth Rs.5,00,000 and current liabilities worth Rs.2,00,000. So, the working capital of the company will be Rs.3,00,000. Using the above-mentioned working capital formula:

Rs.5,00,000 – Rs.2,00,000 = Rs.3,00,000

The working capital calculation is used for understanding the liquidity of the business. Similarly, you can find out the working capital ratio using the working capital ratio formula:

Working capital ratio = Current Asset/ Current Liabilities

Using the above given example, where the current asset is Rs.5,00,000 and current liabilities are Rs.2,00,000. Your working capital ratio is 2.5

Rs.5,00,000/Rs.2,00,000 = 2.5

What is Working Capital Management?

Working capital management is a business tool that ensures the best usage of a business’s current liabilities and assets for its effective operation. The sole aim of working capital management is to examine a business’s current assets and liabilities to maintain cash flow and meet the business’s financial obligations. It assists in addressing planned as well as unplanned expenditures and determining the business’s efficiency by maintaining liquidity.

Working capital management is a business tool that helps businesses to make use of their current assets & liabilities and maintain an adequate cash flow to meet various business’s financial obligations. By managing working capital effectively, businesses can free up cash that would otherwise be lost on the balance sheet. To put it into simple words what is working capital management all about? Working capital management helps to improve the business’s profitability and earnings.

Also Read: Why Managing Working Capital is Important for Future Funding?

Now that you know what is working capital all about and which capital is known as working capital, let’s understand the importance of working capital finance management. No one can deny the importance of working capital in a business. Therefore, we must do the working capital finance management to understand and manage the working capital in a business. So that the business can flourish without any problem. Its importance is not restricted to just one aspect. Doing so helps you to:

- Plan for Funds

The very first importance of working capital finance is planning for funds. With a holistic view of your working capital, you can plan for funds accordingly. When you know the likely expenses to be incurred at present or in the future, you can chalk out the need for funds accordingly. If you are likely to incur a shortfall, then you can apply for an unsecured business working capital loan to overcome a cash crunch.

- Aids in Decision Making

The second importance of working capital finance is that it aids in decision-making. An accurate estimate of your working capital and its management helps you and your finance team to appropriately manage the available funds and decide how much to spend in the near term. The right estimate allows you to save and pay off your obligations with the utmost ease.

- Improves Creditworthiness

Another importance of working capital finance is that it improves creditworthiness. When you have adequately planned for your working capital, the same aids in timely payment to your vendor and lenders if any. This does not only strengthen relationships but also enhance your creditworthiness in the market. It helps you obtain a customizable business working capital loan to meet your fund requirements in the future.

- Builds Credibility

Building credibility is another importance of working capital finance management. It’s through working capital that you pay your employees and vendors. Effective management of working capital helps you make timely payments to them, thus building your credibility. It also motivates your employees to go the extra mile for the organization and go beyond their call of duty.

Also Read :- How Working Capital Loan Can Help Grow Your Small Business

The importance of working capital finance in business planning is known to everyone and how working capital finance plays a crucial role in the business plan. While formulating a business plan, you must make adequate provisions to lay your working capital needs and identify its sources. While the sources could be cash credit, bill discounting, trade deposits, and notes payable, among others, the plan must also include the different types of working capital that are as follows:

Permanent Working Capital

Also known as fixed working capital, it includes the minimum current assets that are required to keep operations running.

Variable Working Capital

This refers to the extra working capital that’s used for various operational expenses.

Reserve Margin Working Capital

As the name suggests, this capital is kept as a reserve for unforeseen expenses coming your way. This working capital helps you to meet liquidity needs in an emergency.

Special Variable Working Capital

It refers to the extra working capital that your business needs for fulfilling objectives such as launching new products, effectively managing risk, and undertaking marketing campaigns, among others.

Availing Unsecured Business Loans for Working Capital: A Guide for Entrepreneurs

Sometimes, your business may require additional working capital. For example, you may need additional working capital to pay vendors and suppliers during peak business season. In such a scenario, you can avail a Business Loan for working capital.

Such loans are also known as unsecured business Capital Working Loans as you don’t need to pledge any security to your lender. All you need to do is to fill up an application form and upload the relevant documents. Upon successful validation, the loan amount is disbursed and credited directly into your account.

The loan also comes in handy when you are undergoing a cash crunch due to non-payment from customers or experiencing a dip in business due to black swan events like the Covid-19 pandemic. The funds received help you to sail through tough times and meet your obligations. Poonawalla Fincorp offers a Working Capital Loan for business growth in a jiffy at a competitive rate of interest. Call us on our toll-free number 1800 266 3201 or write to us at [email protected] to know more.