Business Analytics for Business and Economic Sectors: A Review and Bibliometrics Analysis from 2012 to 2022

- First Online: 12 July 2023

Cite this chapter

- Fatihah Mohd ORCID: orcid.org/0000-0002-4420-4908 3 ,

- Nurul Izyan Mat Daud ORCID: orcid.org/0000-0001-9649-5156 3 ,

- Noor Raihani Zainol ORCID: orcid.org/0000-0002-6091-2509 5 ,

- Nur Ain Ayunni Sabri ORCID: orcid.org/0000-0002-2154-0423 3 ,

- Nik Madeeha Binti Nik Mohd Munir ORCID: orcid.org/0000-0002-8114-2435 3 &

- Azila Jaini ORCID: orcid.org/0000-0001-5689-1621 4

Part of the book series: Contributions to Management Science ((MANAGEMENT SC.))

465 Accesses

Business Analytics (BA) generally refers to the application of models to analyze the data that is implemented by an organization in supporting decision-making. Currently, the use of business analytics has become a necessity to improve organizational performance and increase added business value. This situation has also attracted researchers to contribute studies in business analytics, mainly looking at current trends. This paper describes business analytics based on a study of the relevant literature, followed by a discussion of the current state of business analytics research and potential future paths. Based on the 1541 reviews and articles gathered from the Web of Science (WoS) between 2012 and 2022, we specifically carried out a bibliometric analysis of the influential studies of BA in terms of various aspects, such as research areas, journals, countries or regions, authors, most cited publications, and author keywords. The findings of the study report that the major research areas related to business analytics were “Management” (926, 60.09%), “Business” (759, 49.25%), and “Information Science and Library Science” (159, 10.32%) with TP and TPR%. The most productive journal was the Journal of Business Research, with a TP of 63. The USA, UK, and China were the top three contributing countries. Furthermore, “big data,” “big data analytics,” “business analytics,” “business intelligence,” and “analytics” were the most popular author keywords in the current ten years since 2012, apart from the author keywords of BA. When combined with the most cited articles in recent years, the topics on business intelligence by Chen in 2012 maintain in ten years as the hottest articles with the highest value of total citations, 2395.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Durable hardcover edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

De Bakker FG, Groenewegen P, Den Hond F (2005) A bibliometric analysis of 30 years of research and theory on corporate social responsibility and corporate social performance. Bus Soc 44(3):283–317

Article Google Scholar

Donthu N, Kumar S, Mukherjee D, Pandey N, Lim WM (2021) How to conduct a bibliometric analysis: an overview and guidelines. J Bus Res 133:285–296

Martínez-López FJ, Merigó JM, Valenzuela-Fernández L, Nicolás C (2018) Fifty years of the European Journal of Marketing: a bibliometric analysis. Eur J Mark

Google Scholar

Hashim KF, Rashid A, Atalla S (2018) Social media for teaching and learning within higher education institution: a bibliometric analysis of the literature (2008–2018). Int J Interac Mobile Technol 12(7)

Danvila-del-Valle I, Estévez-Mendoza C, Lara FJ (2019) Human resources training: a bibliometric analysis. J Bus Res 101:627–636

Wang X, Xu Z, Škare M (2020) A bibliometric analysis of economic research-Ekonomska Istra zivanja (2007–2019). Econ Res-Ekonomska istraživanja 33(1):865–886

Mat Daud NI, Mohd F, Che Nawi N, Ibrahim MAH, Tan WH, Zainuddin ZF, Mohd Yussoff NH (2023) Bibliometric analysis of optimization in sports from 2011 to 2020 using Scopus database. In: International conference on business and technology. Springer, pp 689–701

Chopra M, Saini N, Kumar S, Varma A, Mangla SK, Lim WM (2021) Past, present, and future of knowledge management for business sustainability. J Clean Prod 328:129592

Rita P, Ramos RF (2022) Global research trends in consumer behavior and sustainability in e-commerce: a bibliometric analysis of the knowledge structure. Sustainability 14(15):9455

Yin J, Fernandez V (2020) A systematic review on business analytics. J Indus Eng Manag 13(2):283–295

Hajiheydari N, Talafidaryani M, Khabiri S, Salehi M (2019) Business model analytics: technically review business model research domain. Foresight 21(6):654–679

Galetsi P, Katsaliaki K (2020) Big Data Analytics in Health: an overview and bibliometric study of research activity. Health Inf Libr J 37(1):5–25

Wang J, Hsu CC (2021) A topic-based patent analytics approach for exploring technological trends in smart manufacturing. J Manuf Technol Manag 32(1):110–135

Power D, Heavin C, McDermott J, Daly M (2018) Defining business analytics: an empirical approach. J Bus Anal 1(1):40–53

Chatterjee S, Rana NP, Dwivedi YK (2021) How does business analytics contribute to organisational performance and business value? A resource-based view. Inf Technol People

Chen H, Chiang RH, Storey VC (2012) Business intelligence and analytics: from big data to big impact. MIS Q:1165–1188

McAfee A, Brynjolfsson E, Davenport TH, Patil D, Barton D (2012) Big data: the management revolution. Harv Bus Rev 90(10):60–68

Sivarajah U, Kamal MM, Irani Z, Weerakkody V (2017) Critical analysis of big data challenges and analytical methods. J Bus Res 70:263–286

Wamba SF, Gunasekaran A, Akter S, Ren SJ-F, Dubey R, Childe SJ (2017) Big data analytics and firm performance: effects of dynamic capabilities. J Bus Res 70:356–365

Download references

Author information

Authors and affiliations.

Faculty of Entrepreneurship and Business, Universiti Malaysia Kelantan, Kota Bharu, Kelantan, Malaysia

Fatihah Mohd, Nurul Izyan Mat Daud, Nur Ain Ayunni Sabri & Nik Madeeha Binti Nik Mohd Munir

Faculty of Business and Management, Universiti Teknologi MARA, Cawangan Johor, Kampus Segamat, Segamat, Malaysia

Azila Jaini

Faculty of Entrepreneurship and Business, Universiti Malaysia Kelantan (UMK), Kelantan, Malaysia

Noor Raihani Zainol

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Fatihah Mohd .

Editor information

Editors and affiliations.

Department of Finance, University of Sousse-Tunisia and University of Salamanca-Spain, Monastir, Tunisia

Nadia Mansour

Faculty of Law, University of Salamanca, Salamanca, Salamanca, Spain

Lorenzo Mateo Bujosa Vadell

Rights and permissions

Reprints and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Mohd, F., Daud, N.I.M., Zainol, N.R., Sabri, N.A.A., Munir, N.M.B.N.M., Jaini, A. (2023). Business Analytics for Business and Economic Sectors: A Review and Bibliometrics Analysis from 2012 to 2022. In: Mansour, N., Bujosa Vadell, L.M. (eds) Finance, Accounting and Law in the Digital Age. Contributions to Management Science. Springer, Cham. https://doi.org/10.1007/978-3-031-27296-7_30

Download citation

DOI : https://doi.org/10.1007/978-3-031-27296-7_30

Published : 12 July 2023

Publisher Name : Springer, Cham

Print ISBN : 978-3-031-27295-0

Online ISBN : 978-3-031-27296-7

eBook Packages : Business and Management Business and Management (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

business analyst Recently Published Documents

Total documents.

- Latest Documents

- Most Cited Documents

- Contributed Authors

- Related Sources

- Related Keywords

ANEC: Artificial Named Entity Classifier based on BI-LSTM for an AI-based Business Analyst

Business users across enterprises today rely on reports and dashboards created by IT organizations to understand the dynamics of their business better and get insights into the data. In many cases, these users are underserved and do not possess the technical skillset to query the data source to get the information they need. There is a need for users to access information in the most natural way possible. AI-based Business Analysts are going to change the future of business analytics and business intelligence by providing a natural language interface between the user and data. This natural language interface can understand ambiguous questions from users, the intent and convert the same into a database query. One of the important elements of an AI-based business analyst is to interpret a natural language question. It also requires identification of key business entities within the question and relationship between them to generate insights. The Artificial Named Entity Classifier (ANEC) helps us take a huge step forward in that direction by not only identifying but also classifying entities with the help of the sequence recognising prowess of BiLSTMs.

Customer Segmentation using RFM Model and K-Means Clustering

Today as the competition among marketing companies, retail stores, banks to attract newer customers and maintain the old ones is in its peak, every company is trying to have the customer segmentation approach in order to have upper hand in competition. So Our project is based on such customer clustering method where we have collected, analyzed, processed and visualized the customer’s data and build a data science model which will help in forming clusters or segments of customers using the k-means clustering algorithm and RFM model (Recency Frequency Monetary) for already existing customers. The input dataset we used is UK’s E-commerce dataset from UCI repository for Machine Learning which is based on customer’s purchasing behavioral. At the very simple the customer clusters would be like super customer, intermediate customers, customers on the verge of churning out based on RFM score .Along with this we also have created a web model where an e-commerce startup or e-commerce business analyst can analyze their own customers based on model we created .So using this it will be easy to target customers accordingly and achieve business strength by maintaining good relationship with the customers .

A mathematical model to evaluate return on investment in higher education

Subject. The article assesses the effectiveness of investments in higher education. Objectives. The aim is to assess the performance of investments in higher education for a Master’s student at the Peter the Great St. Petersburg Polytechnic University, in the field of Economics, Business Analyst Specialty. Methods. The methodology, presented in the study, includes three stages. The first assesses the demand for skills, the second assesses how the supply of skills match the demand, and the third – the effectiveness of investments in higher education, based on the developed mathematical model, scenario analysis, and decision tree. Results. We revealed that for a business analyst, the most important categories of skills are project management, decision-making, organizational competencies, communication, and knowledge of corporate software. The most required skills in these categories are the knowledge of business processes, project documentation, systems thinking, teamwork, communication, and well-bred speech. The analysis of correspondence between the competencies required by employers and those acquired in the training process showed that Master’s graduates meet the demand for the position of a business analyst in the labor market by 69%. Conclusions. The evaluation of the effectiveness of investment in higher education for a Master’s student of the Peter the Great St. Petersburg Polytechnic University, in the field of Economics, Business Analyst Specialty, shows that it is more profitable for a Bachelor graduate to continue studying for a Master's degree, rather than go straight to work.

Business intelligence as a decision support system tool

The relevance of the topic considered in the article is to solve the problems of designing management decision support systems for enterprises based on business analytics technology. The research purpose is to analyze the applied methodologies during the design stage of the enterprise information system, to develop principles for using management decision support systems based on business intelligence. The problem statement is to analyze the technologies available on the market, which deal with business analyst systems, their potential use for decision support systems, and to identify the main stages of business analyst for enterprises. Business intelligence (BI) is information that can be obtained from data contained in the operational systems of a firm, enterprise, corporation, or from external sources. The BI can help the management of a company make the best decision in the chosen sphere of human activity faster, and, consequently, win the competition in the market for goods and services. A decision support system (DSS) which uses business intelligence, is an automated structure designed to assist professionals in making decisions in a complex environment and to objectively analyze a subject area. The decision support system is the result of the integration of management information systems and database management systems (DBMS). The internal development of BI is more cost-effective. The methods used are Structured Analysis and Design Technique and Object-oriented methods. The results of the research: the analysis of the possibilities was conducted and recommendations relating to the use of BI within DSS were given. Competition between BI software in business analysts reduces the cost of products created making them accessible to end-users – producers, traders and corporations.

A Literature Review and Overview of Performance Management: A Guide to the Field

The underlining presupposition and the supposition of performance management as a study field have been controversial or have a non-defined concept ever since the field was introduced to the mainstream economy. The paper covers the concept of performance management as a business analyst, scrum master, archeologist, and leader. The research delves into the founding history of performance management and analyzes critical performance management tools. Our findings show that performance management should be seen, managed, and played as an infinite game while creating incentives for the players who will, in turn, drive productivity in any industry.

PECULIARITIES OF USING BUSINESS ANALYSIS TECHNIQUES IN ADMINISTRATIVE MANAGEMENT DURING THE COVID PANDEMIC-19

The current state of motor transport enterprises, which is characterized by negative dynamics of development in all sectors of the transport sector, is studied. The research of scientific works determined the direction of the article and the object of research was business processes in administrative management. That is, it is impossible not to agree with the authors to solve the crisis of modern enterprises. It should be noted that all of them are solved through the mechanisms of the administrative management system. Therefore, it became necessary to form conceptual features of the use of business analyst in administrative management during the Covid pandemic 19. Modern approaches to administrative management are considered, providing reliable administrative management of the motor transport enterprise. Management of business processes in motor transport enterprises of business provides their constant improvement and optimization therefore the most important tools of process management are approaches and methods of improvement of business processes managed by administrative management systems. The researched approaches are aimed at identifying duplication of functions, bottlenecks, cost centers, quality of individual operations, missing information, the possibility of automation and quality management. The main directions and software products for automation of business processes in the system of administrative management are established. It is proved that the holistic application of approaches and elements of business analyst in the administrative management of the enterprise will lead to great chances of maintaining the competitiveness of motor transport enterprises and ways out of the post-crisis crisis. The measures of administrative management concerning improvement of activity of the motor transport enterprises are offered. Therefore, in order for trucking companies to develop and differ from their competitors in the level of services provided and the level of comfort, in the critical conditions of the COVID-19 pandemic it is necessary to radically change the methods of administrative management, ie reengineer business processes.

Business Analyst Tasks for Requirement Elicitation

Dealing with the challenge of business analyst skills mismatch in the fourth industrial revolution, features of the application of game theory in the economic activity of economic entities.

Today, there are a huge number of different tools that help reduce risks, but the problem is that they rely on classical probability theory, statistics, etc. These methods can be effective, but they do not take into account the interaction of market participants, psychological characteristics. These problems entail an increase in risks and, as a result, a drop in income and other difficulties. Often, to solve such problems, a business analyst turns to such a branch of mathematics as game theory. Game theory refers to a mathematical method that looks for optimal strategies in the course of a game, and a game refers to a situation in which there are two or more participants who are fighting to defend their interests. A special advantage of game theory is to take into account the struggle of interests of each party, this helps to better understand the current situation and find the optimal solution plan for the real processes taking place in the economy of an economic entity.

Development of a BI application. Moving from a business idea to formulation of the problem

Development of BI applications and, in general, Business Intelligence are no longer new concepts for the market. Nevertheless, there is practically no literature of practical significance. This article is aimed at analyzing the author’s practical experience with the generation of conclusions and specific advice for a novice business analyst to use in his work. Inexperienced professionals just starting their careers in BI can face a variety of challenges, especially when dealing with business customers and developers. Therefore, the article pays special attention to the description of research objects and their correct interaction with each other. It also provides a detailed analysis of the initial stages: from the customer’s need to develop an application to setting clear detailed requirements for the contractor. The result of this work was the proposed methodology for step-by-step work and analysis of the difficulties that may be encountered on the way of the “newly minted” business analyst.

Export Citation Format

Share document.

Business analytics: Research and teaching perspectives

Ieee account.

- Change Username/Password

- Update Address

Purchase Details

- Payment Options

- Order History

- View Purchased Documents

Profile Information

- Communications Preferences

- Profession and Education

- Technical Interests

- US & Canada: +1 800 678 4333

- Worldwide: +1 732 981 0060

- Contact & Support

- About IEEE Xplore

- Accessibility

- Terms of Use

- Nondiscrimination Policy

- Privacy & Opting Out of Cookies

A not-for-profit organization, IEEE is the world's largest technical professional organization dedicated to advancing technology for the benefit of humanity. © Copyright 2024 IEEE - All rights reserved. Use of this web site signifies your agreement to the terms and conditions.

How to Write a Business Analysis Report [Examples and Templates]

Table of contents

Enjoy reading this blog post written by our experts or partners.

If you want to see what Databox can do for you, click here .

Business analysis reports are a lot like preparing a delicious meal.

Sometimes, the recipe is simple enough that you only need to use the basic ingredients. Other times, you will have to follow specific instructions to ensure those tasty delicacies turn out just right.

Want to make sure your business report never turns out like a chewy piece of meat? You’ve come to the right place.

Stay tuned until the end of this blog post, and we promise you won’t be hungry… for business knowledge!

What Is a Business Analysis Report?

Why is analytical reporting important, what should be included in a business analysis report, how do you write a business analysis report, business data analysis report examples and templates.

- Improve Business Reporting with Databox

A business analysis report provides information about the current situation of your company. This report is usually created by the management to help in the decision-making process and is usually used by other departments within a company.

Business analysis reports can either focus your research on the effectiveness of an existing business process or a proposed new process. Besides, an effective business analysis report should also assess the results to determine if the process changes had a positive or negative effect on the company’s goals. In fact, according to Databox’s State of business reporting , an overwhelming majority of companies said that reporting improved their performance.

Analytical reports are the bridge that connects your company to an effective, data-driven business intelligence strategy . By leveraging analytical reports , you can make informed decisions about your organization’s most critical issues. You will no longer need to rely on gut instinct or anecdotal evidence when assessing risks, threats, and opportunities. Instead, you will have access to a wealth of reliable data to inform your decisions.

Here are some essential benefits of analytical reporting:

- Improve communication and foster collaboration – The most obvious benefit of business analysis report writing is an improvement in communication between all stakeholders involved in the project. Also, analytical business reports can help you to generate more trust and foster better collaboration among your employees and colleagues. By using data analytics reporting tools , you will be able to monitor your employees’ performance on a day-to-day basis. This will allow you to hold them accountable for their actions and give them greater freedom within the business as they know that their superiors have faith in their decision-making capabilities.

- Increase productivity – Without this level of shared insight, businesses struggle to stay on top of their most important tasks and can become less efficient. An effective analytical business report provides the information needed for more efficient internal processes and helps you find more time for strategic activities such as improving your business strategy or working on long-term goals .

- Innovation – In today’s digital age, the pressure to innovate was never greater. When consumers basically have everything they want at their fingertips, stepping up to the plate with a new and improved product or service has never been more important. With an accessible dashboard in place, you will be able to create data-driven narratives for each of your business’ critical functions. For example, if you are a software company, you can use the insights gained from report analysis done with your dashboard software to tailor your product development efforts to the actual needs of your customers. By doing so, you will be able to develop products that are better tailored to specific customer groups. You can also use the same information for developing new marketing strategies and campaigns.

- Continuous business evolution – When it comes to digital businesses, data is everything. No model lasts forever, so having access to a business dashboard software that allows you to constantly keep tabs on your business’ performance will help you refine it as time goes on. If there are any glitches in your business model, or if something isn’t panning out as expected, the insight offered by a business analysis report can help you improve upon what works while scrapping what doesn’t.

A business analysis report has several components that need to be included to give a thorough description of the topic at hand. The structure and length of business analysis reports can vary depending on the needs of the project or task.

They can be broken down into different sections that include an:

- Executive summary

- Study introduction

- Methodology

- Review of statistics

Reports of this nature may also include case studies or examples in their discussion section.

A report can be written in a formal or informal tone, depending on the audience and purpose of the document. While a formal tone is best for executives , an informal tone is more appropriate for technical audiences . It is also a good idea to use something like an executive summary template to report on the results repeatedly with ease.

A good business analysis report is detailed and provides recommendations in the form of actionable steps. Here we have listed some simple steps that you need to follow to write a good business analysis report. Report writing is a major part of the business analysis process. In this section, you will learn how to write a report for your company:

Preparation

Presentation.

Obtain an overview of what you want to analyze in the business report . For example, if you are writing a business analysis report on how to improve customer service at an insurance company, you will want to look through all the customer service processes to determine where the problems lie. The more prepared you are when starting a project, the easier it will be to get results. Here is what your preparation should look like:

Set your goals

The first step in writing this document is to set your goals . What do you hope to accomplish with this paper? Do you need to assess the company’s finances? Are you looking for ways to make improvements? Or do you have outside investors who want to know if they should buy into the company? Once you know what your goal is, then you can begin setting up your project.

PRO TIP: How Well Are Your Marketing KPIs Performing?

Like most marketers and marketing managers, you want to know how well your efforts are translating into results each month. How much traffic and new contact conversions do you get? How many new contacts do you get from organic sessions? How are your email campaigns performing? How well are your landing pages converting? You might have to scramble to put all of this together in a single report, but now you can have it all at your fingertips in a single Databox dashboard.

Our Marketing Overview Dashboard includes data from Google Analytics 4 and HubSpot Marketing with key performance metrics like:

- Sessions . The number of sessions can tell you how many times people are returning to your website. Obviously, the higher the better.

- New Contacts from Sessions . How well is your campaign driving new contacts and customers?

- Marketing Performance KPIs . Tracking the number of MQLs, SQLs, New Contacts and similar will help you identify how your marketing efforts contribute to sales.

- Email Performance . Measure the success of your email campaigns from HubSpot. Keep an eye on your most important email marketing metrics such as number of sent emails, number of opened emails, open rate, email click-through rate, and more.

- Blog Posts and Landing Pages . How many people have viewed your blog recently? How well are your landing pages performing?

Now you can benefit from the experience of our Google Analytics and HubSpot Marketing experts, who have put together a plug-and-play Databox template that contains all the essential metrics for monitoring your leads. It’s simple to implement and start using as a standalone dashboard or in marketing reports, and best of all, it’s free!

You can easily set it up in just a few clicks – no coding required.

To set up the dashboard, follow these 3 simple steps:

Step 1: Get the template

Step 2: Connect your HubSpot and Google Analytics 4 accounts with Databox.

Step 3: Watch your dashboard populate in seconds.

Assess the Company’s Mission

It’s almost impossible to write a business analysis report without access to the company’s mission statement. Even if you don’t plan on using the mission statement as part of your business analysis summary, it can help you understand the company’s culture and goals. Mission statements are typically short and easy to read, but they may not include every area of focus that you want to include in your report.

Thus, it is important to use other sources when possible. For example, if you are writing a business analysis report for a small start-up company that is just beginning to market its product or service, review the company website or talk directly with management to learn what they believe will be most crucial in growing the company from the ground up.

Stakeholder Analysis

Who is your audience? Create the reader’s persona and tailor all information to their perspective. Create a stakeholder map that identifies all the groups, departments, functions, and individuals involved in this project (and any other projects related to this one). Your stakeholder map should include a description of each group’s role.

Review Financial Performance

Review the financing of the business and determine whether there are any potential threats to the company’s ability to meet its future financial obligations. This includes reviewing debt payments and ownership equity compared with other types of financing such as accounts receivable, cash reserves, and working capital. Determine whether there have been any changes in the funding over time, such as an increase in long-term debt or a decrease in owners’ equity.

Apart from reviewing your debt payments and ownership equity with other types of financing, wouldn’t it be great if you could compare your financial performance to companies that are exactly like yours? With Databox, this can be done in less than 3 minutes.

For example, by joining this benchmark group , you can better understand your gross profit margin performance and see how metrics like income, gross profit, net income, net operating increase, etc compare against businesses like yours.

One piece of data that you would be able to discover is the average gross profit a month for B2B, B2C, SaaS and eCommerce. Knowing that you perform better than the median may help you evaluate your current business strategy and identify the neccessary steps towards improving it.

Instantly and Anonymously Benchmark Your Company’s Performance Against Others Just Like You

If you ever asked yourself:

- How does our marketing stack up against our competitors?

- Are our salespeople as productive as reps from similar companies?

- Are our profit margins as high as our peers?

Databox Benchmark Groups can finally help you answer these questions and discover how your company measures up against similar companies based on your KPIs.

When you join Benchmark Groups, you will:

- Get instant, up-to-date data on how your company stacks up against similar companies based on the metrics most important to you. Explore benchmarks for dozens of metrics, built on anonymized data from thousands of companies and get a full 360° view of your company’s KPIs across sales, marketing, finance, and more.

- Understand where your business excels and where you may be falling behind so you can shift to what will make the biggest impact. Leverage industry insights to set more effective, competitive business strategies. Explore where exactly you have room for growth within your business based on objective market data.

- Keep your clients happy by using data to back up your expertise. Show your clients where you’re helping them overperform against similar companies. Use the data to show prospects where they really are… and the potential of where they could be.

- Get a valuable asset for improving yearly and quarterly planning . Get valuable insights into areas that need more work. Gain more context for strategic planning.

The best part?

- Benchmark Groups are free to access.

- The data is 100% anonymized. No other company will be able to see your performance, and you won’t be able to see the performance of individual companies either.

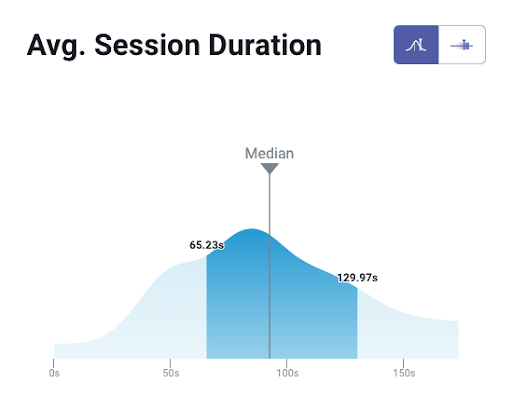

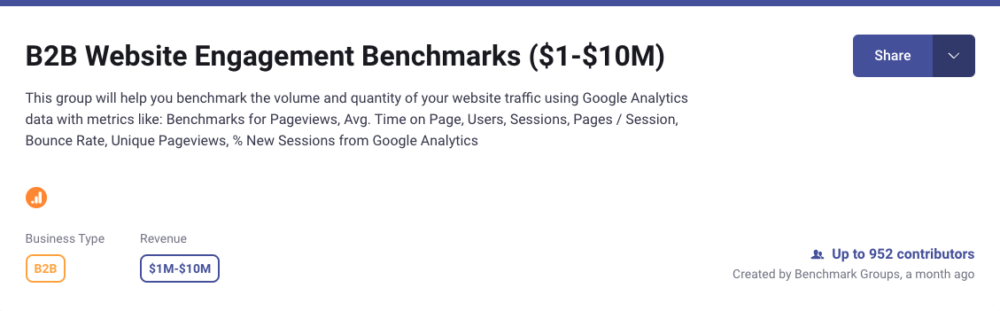

When it comes to showing you how your performance compares to others, here is what it might look like for the metric Average Session Duration:

And here is an example of an open group you could join:

And this is just a fraction of what you’ll get. With Databox Benchmarks, you will need only one spot to see how all of your teams stack up — marketing, sales, customer service, product development, finance, and more.

- Choose criteria so that the Benchmark is calculated using only companies like yours

- Narrow the benchmark sample using criteria that describe your company

- Display benchmarks right on your Databox dashboards

Sounds like something you want to try out? Join a Databox Benchmark Group today!

Examine the “Four P’s”

“Four P’s” — product , price , place, and promotion . Here’s how they work:

- Product — What is the product? How does it compare with those of competitors? Is it in a position to gain market share?

- Price — What is the price of the product? Is it what customers perceive as a good value?

- Place — Where will the product be sold? Will existing distribution channels suffice or should new channels be considered?

- Promotion — Are there marketing communications efforts already in place or needed to support the product launch or existing products?

Evaluate the Company Structure

A business analysis report examines the structure of a company, including its management, staff, departments, divisions, and supply chain. It also evaluates how well-managed the company is and how efficient its supply chain is. In order to develop a strong strategy, you need to be able to analyze your business structure.

When writing a business analysis report, it’s important to make sure you structure your work properly. You want to impress your readers with a clear and logical layout, so they will be able to see the strengths of your recommendations for improving certain areas of the business. A badly written report can completely ruin an impression, so follow these steps to ensure you get it right the first time.

A typical business analysis report is formatted as a cover page , an executive summary , information sections, and a summary .

- A cover page contains the title and author of the report, the date, a contact person, and reference numbers.

- The information section is backed up by data from the work you’ve done to support your findings, including charts and tables. Also, includes all the information that will help you make decisions about your project. Experience has shown that the use of reputable study materials, such as StuDocu and others, might serve you as a great assistant in your findings and project tasks.

- A summary is a short overview of the main points that you’ve made in the report. It should be written so someone who hasn’t read your entire document can understand exactly what you’re saying. Use it to highlight your main recommendations for how to change your project or organization in order to achieve its goals.

- The last section of a business analysis report is a short list of references that include any websites or documents that you used in your research. Be sure to note if you created or modified any of these documents — it’s important to give credit where credit is due.

The Process of Investigation

Explain the problem – Clearly identify the issue and determine who is affected by it. You should include a detailed description of the problem you are analyzing, as well as an in-depth analysis of its components and effects. If you’re analyzing a small issue on a local scale, make sure that your report reflects this scale. That way, if someone else reads your work who had no idea about its context or scope, they would still be able to understand it.

Explain research methods – There are two ways to do this. Firstly, you can list the methods you’ve used in the report to determine your actions’ success and failure. Secondly, you should add one or two new methods to try instead. Always tell readers how you came up with your answer or what data you used for your report. If you simply tell them that the company needs to improve customer service training then they won’t know what kind of data led you to that conclusion. Also, if there were several ways of addressing a problem, discuss each one and why it might not work or why it may not be appropriate for the company at this time.

Analyze data – Analyzing data is an integral part of any business decision, whether it’s related to the costs of manufacturing a product or predicting consumer behavior. Business analysis reports typically focus on one aspect of an organization and break down that aspect into several parts — all of which must be analyzed in order to come to a conclusion about the original topic.

The Outcome of Each Investigation Stage

The recommendations and actions will usually follow from the business objectives not being met. For example, if one of your goals was to decrease costs then your recommendations would include optimization strategies for cost reduction . If you have more than one suggestion you should make a list of the pros and cons of each one. You can make several recommendations in one report if they are related. In addition, make sure that every recommendation has supporting arguments to back them up.

Report Summary

Every business analysis report should start with a summary. It’s the first thing people see and it needs to capture their attention and interest. The report summary can be created in two ways, depending on the nature of the report:

- If the report is a brief one, that simply gives a summary of the findings, then it can be created as part of the executive summary.

- But if it’s a long report, it could be too wordy to summarise. In this case, you can create a more detailed overview that covers all the main aspects of the project from both an internal and external point of view.

Everything comes down to this section. A presentation is designed to inform, persuade and influence decision-makers to take the next action steps.

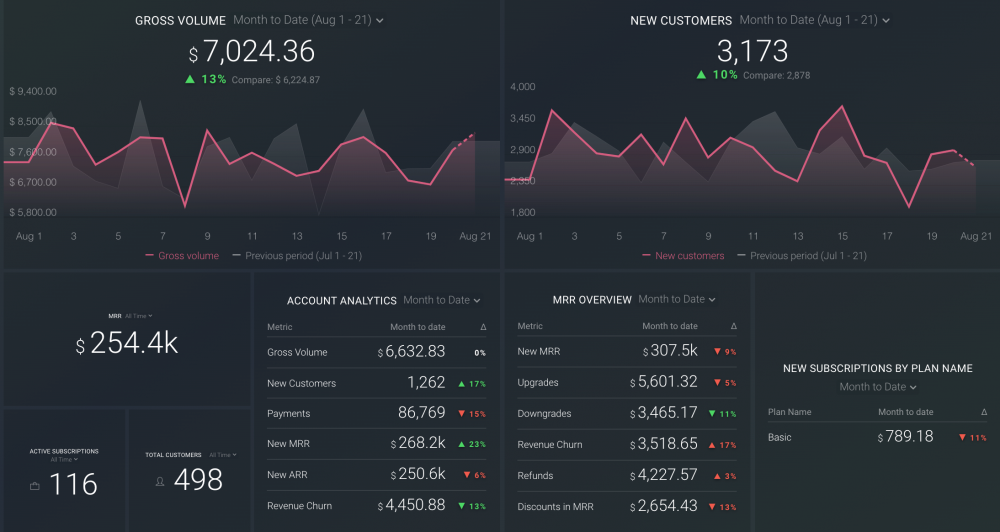

Sometimes a slide or two can make them change their mind or open new horizons. These days, digital dashboards are becoming increasingly popular when it comes to presenting data in business reports. Dashboards combine different visualizations into one place, allowing users to get an overview of the information they need at a glance rather than searching through a bunch of documents or spreadsheets trying.

Databox offers dynamic and accessible digital dashboards that will help you to convert raw data into a meaningful story. And the best part is that you can do it with a ‘blink of an eye’ even if you don’t have any coding or designs skills. There is also an option of individual report customization so that you can tailor any dashboard to your own needs.

Pre-made dashboard templates can be extremely useful when creating your own business analysis report. While examples serve as inspiration, templates allow you to create reports quickly and easily without having to spend time (and money) developing the underlying data models.

Databox dashboard templates come with some of the most common pre-built metrics and KPIs different types of businesses track across different departments. In order to create powerful business insights within minutes, all you need to do is download any of our free templates and connect your data source — the metrics will populate automatically.

Business Report Examples and Templates

Databox business dashboard examples are simple and powerful tools for tracking your business KPIs and performance. These dashboards can be used by executive teams and managers as well as by senior management, marketing, sales, customer support, IT, accounting, and other departments. If you are new to this kind of reporting, you may not know how to set up a dashboard or what metrics should be displayed on it. This is where a premade template for business dashboards comes in handy.

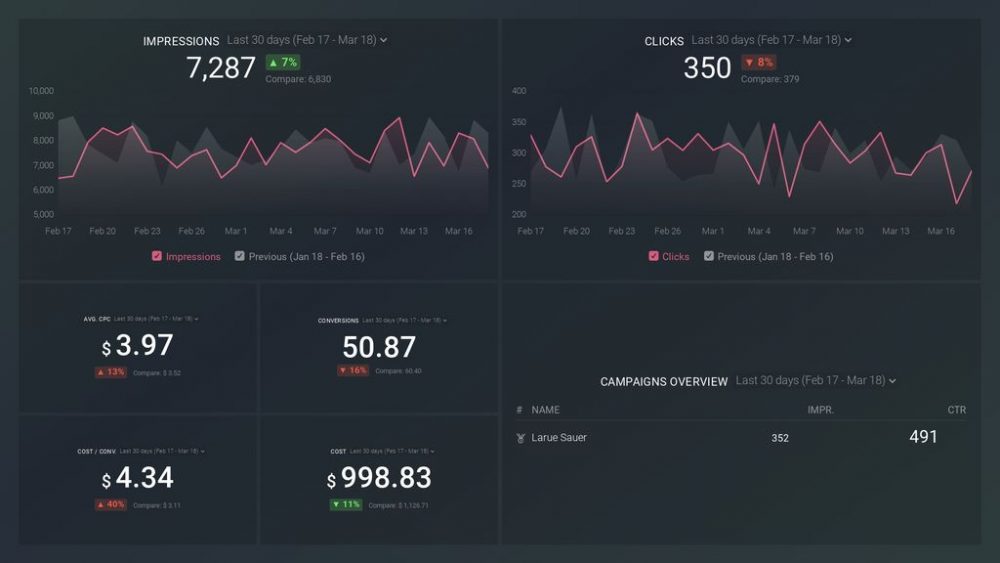

For example, this Google Ads Report Template is designed to give you a simple way to keep track of your campaigns’ performance over time, and it’s a great resource for anyone who uses Google’s advertising platform, regardless of whether they’re an SMB, an SME or an enterprise.

KPI Report Examples and Templates

KPIs are the foundation of any business analysis, and they can come in a multitude of forms. While we’ve defined KPIs as metrics or measurements that allow you to assess the effectiveness of a given process, department, or team, there are a number of ways to evaluate your KPIs. Through the use of color-coding, user-friendly graphs and charts, and an intuitive layout, your KPIs should be easy for anyone to understand. A good way to do this is by having a dedicated business analyst on your team who can take on the task of gathering data, analyzing it, and presenting it in a way that will drive actionable insights. However, if you don’t have a dedicated analyst or don’t want to spend money on one, you can still create KPI reporting dashboards using free KPI Databox templates and examples .

For example, this Sales Overview template is a great resource for managers who want to get an overview of their sales team’s performance and KPIs. It’s perfect for getting started with business analysis, as it is relatively easy to understand and put together.

Performance Report Examples and Templates

All businesses, regardless of size or industry, need to know how well they are performing in order to make the best decisions for their company and improve overall ROI. A performance dashboard is a strategic tool used to track key metrics across different departments and provide insight into the health of a business. Databox has a collection of 50+ Performance Dashboard Examples and Templates which are available for free download.

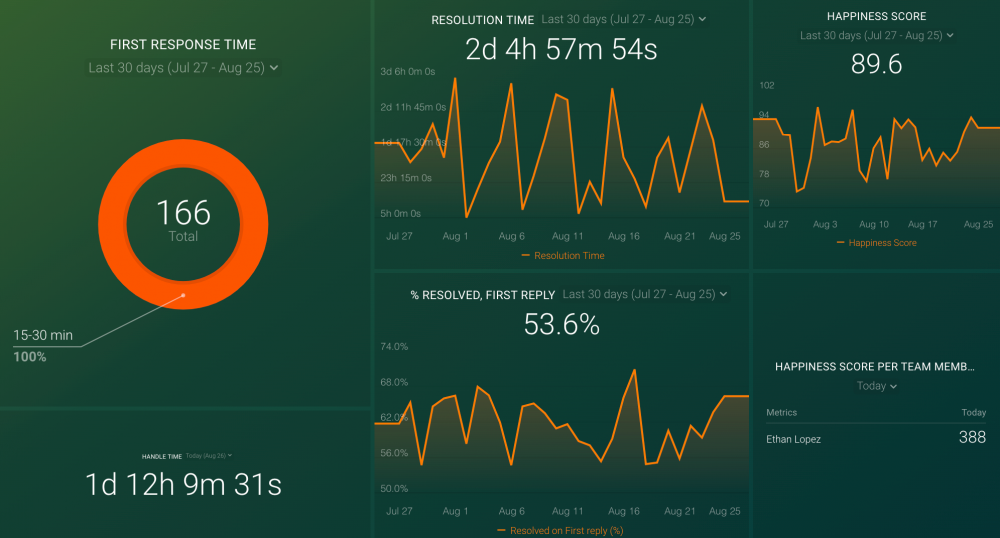

For example, if your business is investing a lot into customer support, we recommend tracking your customer service performance with this Helpscout Mailbox Dashboard which will give you insights into conversations, your team’s productivity, customer happiness score, and more.

Executive Report Examples and Templates

An executive dashboard is a visual representation of the current state of a business. The main purpose of an executive dashboard is to enable business leaders to quickly identify opportunities, identify areas for improvement, pinpoint issues, and make data-informed decisions for driving sales growth, new product launches, and overall business growth. When an executive dashboard is fully developed, as one of these 50+ Databox Free Executive Examples and Templates , it offers a single view of the most important metrics for a business at a glance.

For example, you probably have more than one set of financial data tracked using an executive dashboard software : invoices, revenue reports (for accounting), income statements, to mention a few. If you want to view all this data in one convenient place, or even create a custom report that gives you a better picture of your business’s financial health, this Stripe Dashboard Template is a perfect solution for you.

Metrics Report Examples and Templates

Choosing the right metrics for your business dashboard can be crucial to helping you meet your business objectives, evaluate your performance, and get insights into how your business is operating. Metrics dashboards are used by senior management to measure the performance of their company on a day-to-day basis. They are also used by mid-level managers to determine how their teams are performing against individual goals and objectives. Databox provides 50+ Free Metrics Dashboard Examples and Templates that you can use to create your company’s own dashboards. Each is unique and will depend on your business needs.

For example, if you are looking for ways to track the performance of your DevOps team, and get the latest updates on projects quickly – from commits, and repository status, to top contributors to your software development projects, this GitHub Overview Dashboard is for you.

Small Business Report Examples and Templates

A lot of small business owners don’t realize how important it is to have a proper dashboard in place until they actually use one. A dashboard can help you track and compare different metrics, benchmark your performance against industry averages, evaluate the effectiveness of your marketing and sales strategies, track financials, and much more. So if you’re looking for a tool to help you measure and manage your small business’ performance, try some of these 50+ Free Small Business Dashboard Examples and Templates .

For example, this Quickbooks Dashboard template can help you get a clear understanding of your business’s financial performance, ultimately allowing you to make better-informed decisions that will drive growth and profitability.

Agency Report Examples and Templates

Agency dashboards are not a new concept. They have been around for years and are used by companies all over the world. Agency dashboards can be powerful tools for improving your marketing performance, increasing client loyalty, and landing new clients. There is no single correct way to create an agency dashboard. Everyone has their own goals and objectives, which will ultimately determine which data points you choose to include or track using a client dashboard software , but with these Databox 100+ Free Agency Dashboard Examples and Templates you have plenty of options to start with.

For example, you can use this Harvest Clients Time Report to easily see how much time your employees spend working on projects for a particular client, including billable hours and billable amount split by projects.

Better Business Reporting with Databox

Business analysis is all about finding smart ways to evaluate your organization’s performance and future potential. And that’s where Databox comes in.

Databox can be a helpful tool for business leaders who are required to analyze data, hold frequent meetings, and generate change in their organizations. From improving the quality and accessibility of your reporting to tracking critical performance metrics in one place, and sharing performance metrics with your peers and team members in a cohesive, presentable way, allow Databox to be your personal assistant in these processes, minimize the burdens of reporting and ensure you always stay on top of your metrics game.

Sign up today for free to start streamlining your business reporting process.

Do you want an All-in-One Analytics Platform?

Hey, we’re Databox. Our mission is to help businesses save time and grow faster. Click here to see our platform in action.

- Databox Benchmarks

- Future Value Calculator

- ROI Calculator

- Return On Ads Calculator

- Percentage Growth Rate Calculator

- Report Automation

- Client Reporting

- What is a KPI?

- Google Sheets KPIs

- Sales Analysis Report

- Shopify Reports

- Data Analysis Report

- Google Sheets Dashboard

- Best Dashboard Examples

- Analysing Data

- Marketing Agency KPIs

- Automate Agency Google Ads Report

- Marketing Research Report

- Social Media Dashboard Examples

- Ecom Dashboard Examples

Does Your Performance Stack Up?

Are you maximizing your business potential? Stop guessing and start comparing with companies like yours.

A Message From Our CEO

At Databox, we’re obsessed with helping companies more easily monitor, analyze, and report their results. Whether it’s the resources we put into building and maintaining integrations with 100+ popular marketing tools, enabling customizability of charts, dashboards, and reports, or building functionality to make analysis, benchmarking, and forecasting easier, we’re constantly trying to find ways to help our customers save time and deliver better results.

Grew up as a Copywriter. Evolved into the Content creator. Somewhere in between, I fell in love with numbers that can portray the world as well as words or pictures. A naive thinker who believes that the creative economy is the most powerful force in the world!

Get practical strategies that drive consistent growth

12 Tips for Developing a Successful Data Analytics Strategy

What Is Data Reporting and How to Create Data Reports for Your Business

What Is KPI Reporting? KPI Report Examples, Tips, and Best Practices

Build your first dashboard in 5 minutes or less

Latest from our blog

- BTB: Mastering Data-Driven Legal Marketing Success (w/ Guy Alvarez, Good2BSocial) May 15, 2024

- The State of B2B Content Creation: Navigating the Future of In-House Marketing Innovation May 9, 2024

- Metrics & KPIs

- vs. Tableau

- vs. Looker Studio

- vs. Klipfolio

- vs. Power BI

- vs. Whatagraph

- vs. AgencyAnalytics

- Product & Engineering

- Inside Databox

- Terms of Service

- Privacy Policy

- Talent Resources

- We're Hiring!

- Help Center

- API Documentation

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

- We're Hiring!

- Help Center

Business Analysis

- Most Cited Papers

- Most Downloaded Papers

- Newest Papers

- Save to Library

- Last »

- 360 Feedback assessment Follow Following

- Accounting & Finance Follow Following

- HRM & Organisational Behaviour Follow Following

- Armenian Culture Follow Following

- Business Analytics Follow Following

- Competitive Intelligence Follow Following

- Competitive strategy Follow Following

- Business Strategy Follow Following

- Earnings Management Follow Following

- Sustainability Reporting Follow Following

Enter the email address you signed up with and we'll email you a reset link.

- Academia.edu Publishing

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

Innovative Statistics Project Ideas for Insightful Analysis

Table of contents

- 1.1 AP Statistics Topics for Project

- 1.2 Statistics Project Topics for High School Students

- 1.3 Statistical Survey Topics

- 1.4 Statistical Experiment Ideas

- 1.5 Easy Stats Project Ideas

- 1.6 Business Ideas for Statistics Project

- 1.7 Socio-Economic Easy Statistics Project Ideas

- 1.8 Experiment Ideas for Statistics and Analysis

- 2 Conclusion: Navigating the World of Data Through Statistics

Diving into the world of data, statistics presents a unique blend of challenges and opportunities to uncover patterns, test hypotheses, and make informed decisions. It is a fascinating field that offers many opportunities for exploration and discovery. This article is designed to inspire students, educators, and statistics enthusiasts with various project ideas. We will cover:

- Challenging concepts suitable for advanced placement courses.

- Accessible ideas that are engaging and educational for younger students.

- Ideas for conducting surveys and analyzing the results.

- Topics that explore the application of statistics in business and socio-economic areas.

Each category of topics for the statistics project provides unique insights into the world of statistics, offering opportunities for learning and application. Let’s dive into these ideas and explore the exciting world of statistical analysis.

Top Statistics Project Ideas for High School

Statistics is not only about numbers and data; it’s a unique lens for interpreting the world. Ideal for students, educators, or anyone with a curiosity about statistical analysis, these project ideas offer an interactive, hands-on approach to learning. These projects range from fundamental concepts suitable for beginners to more intricate studies for advanced learners. They are designed to ignite interest in statistics by demonstrating its real-world applications, making it accessible and enjoyable for people of all skill levels.

Need help with statistics project? Get your paper written by a professional writer Get Help Reviews.io 4.9/5

AP Statistics Topics for Project

- Analyzing Variance in Climate Data Over Decades.

- The Correlation Between Economic Indicators and Standard of Living.

- Statistical Analysis of Voter Behavior Patterns.

- Probability Models in Sports: Predicting Outcomes.

- The Effectiveness of Different Teaching Methods: A Statistical Study.

- Analysis of Demographic Data in Public Health.

- Time Series Analysis of Stock Market Trends.

- Investigating the Impact of Social Media on Academic Performance.

- Survival Analysis in Clinical Trial Data.

- Regression Analysis on Housing Prices and Market Factors.

Statistics Project Topics for High School Students

- The Mathematics of Personal Finance: Budgeting and Spending Habits.

- Analysis of Class Performance: Test Scores and Study Habits.

- A Statistical Comparison of Local Public Transportation Options.

- Survey on Dietary Habits and Physical Health Among Teenagers.

- Analyzing the Popularity of Various Music Genres in School.

- The Impact of Sleep on Academic Performance: A Statistical Approach.

- Statistical Study on the Use of Technology in Education.

- Comparing Athletic Performance Across Different Sports.

- Trends in Social Media Usage Among High School Students.

- The Effect of Part-Time Jobs on Student Academic Achievement.

Statistical Survey Topics

- Public Opinion on Environmental Conservation Efforts.

- Consumer Preferences in the Fast Food Industry.

- Attitudes Towards Online Learning vs. Traditional Classroom Learning.

- Survey on Workplace Satisfaction and Productivity.

- Public Health: Attitudes Towards Vaccination.

- Trends in Mobile Phone Usage and Preferences.

- Community Response to Local Government Policies.

- Consumer Behavior in Online vs. Offline Shopping.

- Perceptions of Public Safety and Law Enforcement.

- Social Media Influence on Political Opinions.

Statistical Experiment Ideas

- The Effect of Light on Plant Growth.

- Memory Retention: Visual vs. Auditory Information.

- Caffeine Consumption and Cognitive Performance.

- The Impact of Exercise on Stress Levels.

- Testing the Efficacy of Natural vs. Chemical Fertilizers.

- The Influence of Color on Mood and Perception.

- Sleep Patterns: Analyzing Factors Affecting Sleep Quality.

- The Effectiveness of Different Types of Water Filters.

- Analyzing the Impact of Room Temperature on Concentration.

- Testing the Strength of Different Brands of Batteries.

Easy Stats Project Ideas

- Average Daily Screen Time Among Students.

- Analyzing the Most Common Birth Months.

- Favorite School Subjects Among Peers.

- Average Time Spent on Homework Weekly.

- Frequency of Public Transport Usage.

- Comparison of Pet Ownership in the Community.

- Favorite Types of Movies or TV Shows.

- Daily Water Consumption Habits.

- Common Breakfast Choices and Their Nutritional Value.

- Steps Count: A Week-Long Study.

Business Ideas for Statistics Project

- Analyzing Customer Satisfaction in Retail Stores.

- Market Analysis of a New Product Launch.

- Employee Performance Metrics and Organizational Success.

- Sales Data Analysis for E-commerce Websites.

- Impact of Advertising on Consumer Buying Behavior.

- Analysis of Supply Chain Efficiency.

- Customer Loyalty and Retention Strategies.

- Trend Analysis in Social Media Marketing.

- Financial Risk Assessment in Investment Decisions.

- Market Segmentation and Targeting Strategies.

Socio-Economic Easy Statistics Project Ideas

- Income Inequality and Its Impact on Education.

- The Correlation Between Unemployment Rates and Crime Levels.

- Analyzing the Effects of Minimum Wage Changes.

- The Relationship Between Public Health Expenditure and Population Health.

- Demographic Analysis of Housing Affordability.

- The Impact of Immigration on Local Economies.

- Analysis of Gender Pay Gap in Different Industries.

- Statistical Study of Homelessness Causes and Solutions.

- Education Levels and Their Impact on Job Opportunities.

- Analyzing Trends in Government Social Spending.

Experiment Ideas for Statistics and Analysis

- Multivariate Analysis of Global Climate Change Data.

- Time-Series Analysis in Predicting Economic Recessions.

- Logistic Regression in Medical Outcome Prediction.

- Machine Learning Applications in Statistical Modeling.

- Network Analysis in Social Media Data.

- Bayesian Analysis of Scientific Research Data.

- The Use of Factor Analysis in Psychology Studies.

- Spatial Data Analysis in Geographic Information Systems (GIS).

- Predictive Analysis in Customer Relationship Management (CRM).

- Cluster Analysis in Market Research.

Conclusion: Navigating the World of Data Through Statistics

In this exploration of good statistics project ideas, we’ve ventured through various topics, from the straightforward to the complex, from personal finance to global climate change. These ideas are gateways to understanding the world of data and statistics, and platforms for cultivating critical thinking and analytical skills. Whether you’re a high school student, a college student, or a professional, engaging in these projects can deepen your appreciation of how statistics shapes our understanding of the world around us. These projects encourage exploration, inquiry, and a deeper engagement with the world of numbers, trends, and patterns – the essence of statistics.

Readers also enjoyed

WHY WAIT? PLACE AN ORDER RIGHT NOW!

Just fill out the form, press the button, and have no worries!

We use cookies to give you the best experience possible. By continuing we’ll assume you board with our cookie policy.

McKinsey Global Private Markets Review 2024: Private markets in a slower era

At a glance, macroeconomic challenges continued.

McKinsey Global Private Markets Review 2024: Private markets: A slower era

If 2022 was a tale of two halves, with robust fundraising and deal activity in the first six months followed by a slowdown in the second half, then 2023 might be considered a tale of one whole. Macroeconomic headwinds persisted throughout the year, with rising financing costs, and an uncertain growth outlook taking a toll on private markets. Full-year fundraising continued to decline from 2021’s lofty peak, weighed down by the “denominator effect” that persisted in part due to a less active deal market. Managers largely held onto assets to avoid selling in a lower-multiple environment, fueling an activity-dampening cycle in which distribution-starved limited partners (LPs) reined in new commitments.

About the authors

This article is a summary of a larger report, available as a PDF, that is a collaborative effort by Fredrik Dahlqvist , Alastair Green , Paul Maia, Alexandra Nee , David Quigley , Aditya Sanghvi , Connor Mangan, John Spivey, Rahel Schneider, and Brian Vickery , representing views from McKinsey’s Private Equity & Principal Investors Practice.

Performance in most private asset classes remained below historical averages for a second consecutive year. Decade-long tailwinds from low and falling interest rates and consistently expanding multiples seem to be things of the past. As private market managers look to boost performance in this new era of investing, a deeper focus on revenue growth and margin expansion will be needed now more than ever.

Perspectives on a slower era in private markets

Global fundraising contracted.

Fundraising fell 22 percent across private market asset classes globally to just over $1 trillion, as of year-end reported data—the lowest total since 2017. Fundraising in North America, a rare bright spot in 2022, declined in line with global totals, while in Europe, fundraising proved most resilient, falling just 3 percent. In Asia, fundraising fell precipitously and now sits 72 percent below the region’s 2018 peak.

Despite difficult fundraising conditions, headwinds did not affect all strategies or managers equally. Private equity (PE) buyout strategies posted their best fundraising year ever, and larger managers and vehicles also fared well, continuing the prior year’s trend toward greater fundraising concentration.

The numerator effect persisted

Despite a marked recovery in the denominator—the 1,000 largest US retirement funds grew 7 percent in the year ending September 2023, after falling 14 percent the prior year, for example 1 “U.S. retirement plans recover half of 2022 losses amid no-show recession,” Pensions and Investments , February 12, 2024. —many LPs remain overexposed to private markets relative to their target allocations. LPs started 2023 overweight: according to analysis from CEM Benchmarking, average allocations across PE, infrastructure, and real estate were at or above target allocations as of the beginning of the year. And the numerator grew throughout the year, as a lack of exits and rebounding valuations drove net asset values (NAVs) higher. While not all LPs strictly follow asset allocation targets, our analysis in partnership with global private markets firm StepStone Group suggests that an overallocation of just one percentage point can reduce planned commitments by as much as 10 to 12 percent per year for five years or more.

Despite these headwinds, recent surveys indicate that LPs remain broadly committed to private markets. In fact, the majority plan to maintain or increase allocations over the medium to long term.

Investors fled to known names and larger funds

Fundraising concentration reached its highest level in over a decade, as investors continued to shift new commitments in favor of the largest fund managers. The 25 most successful fundraisers collected 41 percent of aggregate commitments to closed-end funds (with the top five managers accounting for nearly half that total). Closed-end fundraising totals may understate the extent of concentration in the industry overall, as the largest managers also tend to be more successful in raising non-institutional capital.

While the largest funds grew even larger—the largest vehicles on record were raised in buyout, real estate, infrastructure, and private debt in 2023—smaller and newer funds struggled. Fewer than 1,700 funds of less than $1 billion were closed during the year, half as many as closed in 2022 and the fewest of any year since 2012. New manager formation also fell to the lowest level since 2012, with just 651 new firms launched in 2023.

Whether recent fundraising concentration and a spate of M&A activity signals the beginning of oft-rumored consolidation in the private markets remains uncertain, as a similar pattern developed in each of the last two fundraising downturns before giving way to renewed entrepreneurialism among general partners (GPs) and commitment diversification among LPs. Compared with how things played out in the last two downturns, perhaps this movie really is different, or perhaps we’re watching a trilogy reusing a familiar plotline.

Dry powder inventory spiked (again)

Private markets assets under management totaled $13.1 trillion as of June 30, 2023, and have grown nearly 20 percent per annum since 2018. Dry powder reserves—the amount of capital committed but not yet deployed—increased to $3.7 trillion, marking the ninth consecutive year of growth. Dry powder inventory—the amount of capital available to GPs expressed as a multiple of annual deployment—increased for the second consecutive year in PE, as new commitments continued to outpace deal activity. Inventory sat at 1.6 years in 2023, up markedly from the 0.9 years recorded at the end of 2021 but still within the historical range. NAV grew as well, largely driven by the reluctance of managers to exit positions and crystallize returns in a depressed multiple environment.

Private equity strategies diverged

Buyout and venture capital, the two largest PE sub-asset classes, charted wildly different courses over the past 18 months. Buyout notched its highest fundraising year ever in 2023, and its performance improved, with funds posting a (still paltry) 5 percent net internal rate of return through September 30. And although buyout deal volumes declined by 19 percent, 2023 was still the third-most-active year on record. In contrast, venture capital (VC) fundraising declined by nearly 60 percent, equaling its lowest total since 2015, and deal volume fell by 36 percent to the lowest level since 2019. VC funds returned –3 percent through September, posting negative returns for seven consecutive quarters. VC was the fastest-growing—as well as the highest-performing—PE strategy by a significant margin from 2010 to 2022, but investors appear to be reevaluating their approach in the current environment.

Private equity entry multiples contracted

PE buyout entry multiples declined by roughly one turn from 11.9 to 11.0 times EBITDA, slightly outpacing the decline in public market multiples (down from 12.1 to 11.3 times EBITDA), through the first nine months of 2023. For nearly a decade leading up to 2022, managers consistently sold assets into a higher-multiple environment than that in which they had bought those assets, providing a substantial performance tailwind for the industry. Nowhere has this been truer than in technology. After experiencing more than eight turns of multiple expansion from 2009 to 2021 (the most of any sector), technology multiples have declined by nearly three turns in the past two years, 50 percent more than in any other sector. Overall, roughly two-thirds of the total return for buyout deals that were entered in 2010 or later and exited in 2021 or before can be attributed to market multiple expansion and leverage. Now, with falling multiples and higher financing costs, revenue growth and margin expansion are taking center stage for GPs.

Real estate receded

Demand uncertainty, slowing rent growth, and elevated financing costs drove cap rates higher and made price discovery challenging, all of which weighed on deal volume, fundraising, and investment performance. Global closed-end fundraising declined 34 percent year over year, and funds returned −4 percent in the first nine months of the year, losing money for the first time since the 2007–08 global financial crisis. Capital shifted away from core and core-plus strategies as investors sought liquidity via redemptions in open-end vehicles, from which net outflows reached their highest level in at least two decades. Opportunistic strategies benefited from this shift, with investors focusing on capital appreciation over income generation in a market where alternative sources of yield have grown more attractive. Rising interest rates widened bid–ask spreads and impaired deal volume across food groups, including in what were formerly hot sectors: multifamily and industrial.

Private debt pays dividends

Debt again proved to be the most resilient private asset class against a turbulent market backdrop. Fundraising declined just 13 percent, largely driven by lower commitments to direct lending strategies, for which a slower PE deal environment has made capital deployment challenging. The asset class also posted the highest returns among all private asset classes through September 30. Many private debt securities are tied to floating rates, which enhance returns in a rising-rate environment. Thus far, managers appear to have successfully navigated the rising incidence of default and distress exhibited across the broader leveraged-lending market. Although direct lending deal volume declined from 2022, private lenders financed an all-time high 59 percent of leveraged buyout transactions last year and are now expanding into additional strategies to drive the next era of growth.

Infrastructure took a detour

After several years of robust growth and strong performance, infrastructure and natural resources fundraising declined by 53 percent to the lowest total since 2013. Supply-side timing is partially to blame: five of the seven largest infrastructure managers closed a flagship vehicle in 2021 or 2022, and none of those five held a final close last year. As in real estate, investors shied away from core and core-plus investments in a higher-yield environment. Yet there are reasons to believe infrastructure’s growth will bounce back. Limited partners (LPs) surveyed by McKinsey remain bullish on their deployment to the asset class, and at least a dozen vehicles targeting more than $10 billion were actively fundraising as of the end of 2023. Multiple recent acquisitions of large infrastructure GPs by global multi-asset-class managers also indicate marketwide conviction in the asset class’s potential.

Private markets still have work to do on diversity

Private markets firms are slowly improving their representation of females (up two percentage points over the prior year) and ethnic and racial minorities (up one percentage point). On some diversity metrics, including entry-level representation of women, private markets now compare favorably with corporate America. Yet broad-based parity remains elusive and too slow in the making. Ethnic, racial, and gender imbalances are particularly stark across more influential investing roles and senior positions. In fact, McKinsey’s research reveals that at the current pace, it would take several decades for private markets firms to reach gender parity at senior levels. Increasing representation across all levels will require managers to take fresh approaches to hiring, retention, and promotion.

Artificial intelligence generating excitement

The transformative potential of generative AI was perhaps 2023’s hottest topic (beyond Taylor Swift). Private markets players are excited about the potential for the technology to optimize their approach to thesis generation, deal sourcing, investment due diligence, and portfolio performance, among other areas. While the technology is still nascent and few GPs can boast scaled implementations, pilot programs are already in flight across the industry, particularly within portfolio companies. Adoption seems nearly certain to accelerate throughout 2024.

Private markets in a slower era

If private markets investors entered 2023 hoping for a return to the heady days of 2021, they likely left the year disappointed. Many of the headwinds that emerged in the latter half of 2022 persisted throughout the year, pressuring fundraising, dealmaking, and performance. Inflation moderated somewhat over the course of the year but remained stubbornly elevated by recent historical standards. Interest rates started high and rose higher, increasing the cost of financing. A reinvigorated public equity market recovered most of 2022’s losses but did little to resolve the valuation uncertainty private market investors have faced for the past 18 months.

Within private markets, the denominator effect remained in play, despite the public market recovery, as the numerator continued to expand. An activity-dampening cycle emerged: higher cost of capital and lower multiples limited the ability or willingness of general partners (GPs) to exit positions; fewer exits, coupled with continuing capital calls, pushed LP allocations higher, thereby limiting their ability or willingness to make new commitments. These conditions weighed on managers’ ability to fundraise. Based on data reported as of year-end 2023, private markets fundraising fell 22 percent from the prior year to just over $1 trillion, the largest such drop since 2009 (Exhibit 1).

The impact of the fundraising environment was not felt equally among GPs. Continuing a trend that emerged in 2022, and consistent with prior downturns in fundraising, LPs favored larger vehicles and the scaled GPs that typically manage them. Smaller and newer managers struggled, and the number of sub–$1 billion vehicles and new firm launches each declined to its lowest level in more than a decade.

Despite the decline in fundraising, private markets assets under management (AUM) continued to grow, increasing 12 percent to $13.1 trillion as of June 30, 2023. 2023 fundraising was still the sixth-highest annual haul on record, pushing dry powder higher, while the slowdown in deal making limited distributions.

Investment performance across private market asset classes fell short of historical averages. Private equity (PE) got back in the black but generated the lowest annual performance in the past 15 years, excluding 2022. Closed-end real estate produced negative returns for the first time since 2009, as capitalization (cap) rates expanded across sectors and rent growth dissipated in formerly hot sectors, including multifamily and industrial. The performance of infrastructure funds was less than half of its long-term average and even further below the double-digit returns generated in 2021 and 2022. Private debt was the standout performer (if there was one), outperforming all other private asset classes and illustrating the asset class’s countercyclical appeal.

Private equity down but not out

Higher financing costs, lower multiples, and an uncertain macroeconomic environment created a challenging backdrop for private equity managers in 2023. Fundraising declined for the second year in a row, falling 15 percent to $649 billion, as LPs grappled with the denominator effect and a slowdown in distributions. Managers were on the fundraising trail longer to raise this capital: funds that closed in 2023 were open for a record-high average of 20.1 months, notably longer than 18.7 months in 2022 and 14.1 months in 2018. VC and growth equity strategies led the decline, dropping to their lowest level of cumulative capital raised since 2015. Fundraising in Asia fell for the fourth year of the last five, with the greatest decline in China.

Despite the difficult fundraising context, a subset of strategies and managers prevailed. Buyout managers collectively had their best fundraising year on record, raising more than $400 billion. Fundraising in Europe surged by more than 50 percent, resulting in the region’s biggest haul ever. The largest managers raised an outsized share of the total for a second consecutive year, making 2023 the most concentrated fundraising year of the last decade (Exhibit 2).

Despite the drop in aggregate fundraising, PE assets under management increased 8 percent to $8.2 trillion. Only a small part of this growth was performance driven: PE funds produced a net IRR of just 2.5 percent through September 30, 2023. Buyouts and growth equity generated positive returns, while VC lost money. PE performance, dating back to the beginning of 2022, remains negative, highlighting the difficulty of generating attractive investment returns in a higher interest rate and lower multiple environment. As PE managers devise value creation strategies to improve performance, their focus includes ensuring operating efficiency and profitability of their portfolio companies.

Deal activity volume and count fell sharply, by 21 percent and 24 percent, respectively, which continued the slower pace set in the second half of 2022. Sponsors largely opted to hold assets longer rather than lock in underwhelming returns. While higher financing costs and valuation mismatches weighed on overall deal activity, certain types of M&A gained share. Add-on deals, for example, accounted for a record 46 percent of total buyout deal volume last year.

Real estate recedes

For real estate, 2023 was a year of transition, characterized by a litany of new and familiar challenges. Pandemic-driven demand issues continued, while elevated financing costs, expanding cap rates, and valuation uncertainty weighed on commercial real estate deal volumes, fundraising, and investment performance.

Managers faced one of the toughest fundraising environments in many years. Global closed-end fundraising declined 34 percent to $125 billion. While fundraising challenges were widespread, they were not ubiquitous across strategies. Dollars continued to shift to large, multi-asset class platforms, with the top five managers accounting for 37 percent of aggregate closed-end real estate fundraising. In April, the largest real estate fund ever raised closed on a record $30 billion.