Request Letter to Bank for Activate SMS Alert Service

Having SMS alert service activated on phone is a must because any transactions that take place in your account, you are updated about it via SMS. In case, you don’t have it activated on your bank account them you must write application for SMS alert in bank . By submitting this request letter for activation of mobile number , you can stay at ease because any amount debited or credited in your bank account will be informed via SMS.

We bring a sample request letter to bank manager for SMS alert service in mobile phone. Use these template to create a customized application to bank.

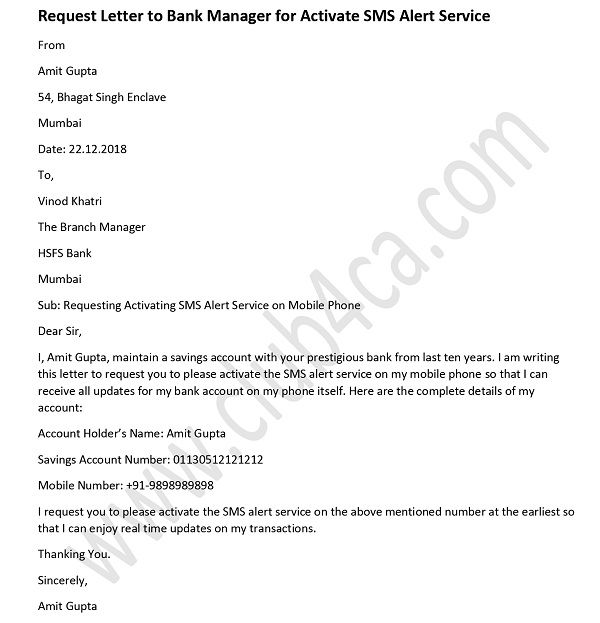

Request Letter for Activating SMS Alert Service

Amit Gupta 54, Bhagat Singh Enclave Mumbai

Date: 22.12.2018

Vinod Khatri The Branch Manager HSFS Bank Mumbai

Sub: Requesting Activating SMS Alert Service on Mobile Phone

I, Amit Gupta, maintain a savings account with your prestigious bank from last ten years. I am writing this letter to request you to please activate the SMS alert service on my mobile phone so that I can receive all updates for my bank account on my phone itself. Here are the complete details of my account:

Account Holder’s Name: Amit Gupta Savings Account Number: 01130512121212 Mobile Number: +91-9898989898

I request you to please activate the SMS alert service on the above mentioned number at the earliest so that I can enjoy real time updates on my transactions.

Thanking You.

Sincerely, Amit Gupta

Other Related Letter Formats

Letter to Bank for Refund of Excess Interest Charges Close Current Bank Account Letter Format Change of Invoice and Bank Account Details Letter to Client Request Letter to Bank Manager for Attestation Bank Account Opening Request Letter for Company Employees Letter Format to Bank to Rent Safe Deposit Locker Formal Letter to Bank Manager for Repayment of Loan Sample Letter of Reminder for Late Payment of Loan Loan Approval Letter Sample Letter Accompanying Loan Documents Sent to the Bank Bank Loan Request Letter for New Pvt. Limited Company Signature Verification Letter to Submit to Bank Letter To The Bank To Make Nomination In FDR Account Format for Authority Letter for Cash Deposit to Bank Application Letter for Business Loan to Bank Manager Authorization Letter To Bank to Collect ATM PIN Number Formal Authorization Letter for Signing Authority to Bank Letter Format for Change of Nominee in Bank Account

Top File Download:

- sbi otp sms request letter

- https://www club4ca com/formats/accounts/request-letter-to-bank-for-activate-sms-alert-service/

- sms alert application

- request letter to bank manager

- application for sms alert in bank in english

- a request letter for bank alert on transactions

- how to write a letter to bank manager

- bank letter for transaction alert

- application format for bank

- bank application format

Related Files:

- Letter to Supplier for Invoice or Billing Errors

- Letter Format to Bank to Rent Safe Deposit Locker

- Request Letter To Bank To Remove Name From Joint Account

- GST Receipt Voucher for Advance Payments under GST Format in Excel

Leave a comment Cancel reply

Your email address will not be published. Required fields are marked *

Search This Blog

Search letters formats here, letter to bank requesting activation of sms alert service.

submit your comments here

Gic housing finance Roi Increase without customer information sms and email

Post a Comment

Leave your comments and queries here. We will try to get back to you.

Application to Bank Manager for Updating Mobile Number in Account Records (with Samples & PDFs)

I have listed sample templates to help you craft an effective and professional application to bank manager for updating mobile number in account records.

Also, I would like to point out that you can also download a PDF containing all the samples at the end of this post.

Requesting Mobile Number Update in Records via Application to Bank Manager

First, find the sample template for application to bank manager for updating mobile number in account records below.

To, The Branch Manager, [Bank Name], [Bank Branch Address],

Subject: Request for Updating Mobile Number in Account Records

Dear Sir/Madam,

I, [Your Name], am a regular customer of your bank, holding a savings account with account number [Your Account Number]. I am writing this letter to inform you that I have recently changed my mobile number and would like to update the same in the bank’s records associated with my account.

My previous registered number was [Your Old Mobile Number]. Due to personal reasons, I am not using this number anymore. I kindly request you to update my new mobile number, which is [Your New Mobile Number], in the bank’s records associated with my account.

Updating my mobile number is crucial to me as it is required for various banking activities like OTP generation, transaction alerts, and mobile banking services.

I am attaching a self-attested photocopy of my Aadhaar card for your perusal and verification purposes.

Kindly process my request at the earliest to avoid any inconveniences related to my banking services.

Thank you for your prompt attention to this matter.

Yours faithfully,

[Your Name] [Your Full Address] [Your Email Address] [Your New Mobile Number] [Today’s Date]

Below I have listed 5 different sample applications for “application to bank manager for updating mobile number in account records” that you will certainly find useful for specific scenarios:

Application to Bank Manager for Replacing Lost SIM and Updating Mobile Number in Account Records

To, The Bank Manager, [Bank Name], [Bank Branch], [City],

Subject: Application for Replacing Lost SIM and Updating Mobile Number in Account Records

Respected Sir/Madam,

I, [Your Name], am an account holder in your esteemed bank, holding a savings account with account number [Account Number]. I would like to bring to your notice that I have recently lost my mobile phone and, as a result, the registered SIM card associated with my account. I have acquired a new SIM card in replacement, and I kindly request you to update my account records with the new mobile number.

My previous mobile number was [Old Mobile Number], and my new mobile number is [New Mobile Number]. I request you to please update my new mobile number in the bank records at the earliest to ensure seamless banking services, including transaction alerts and OTPs.

Kindly acknowledge this request and take necessary action to update my mobile number in the bank records. I shall be highly grateful for your prompt assistance.

Thanking you in anticipation.

Yours sincerely,

[Your Name] [Your Address] [City] [Date]

Application for Integration of Business and Personal Mobile Numbers in Account Profile

To, The Branch Manager, [Bank Name], [Branch Address],

Subject: Application for Integration of Business and Personal Mobile Numbers in Account Profile

I, [Your Name], have been a customer of your esteemed bank for the past [number of years] years. I hold a Savings Account (A/c No: [Account Number]) and a Current Account (A/c No: [Account Number]) in your branch.

In order to manage my accounts efficiently and receive timely updates on transactions, I request you to kindly integrate my business and personal mobile numbers in my account profile. My business mobile number is +91-[Business Mobile Number] and my personal mobile number is +91-[Personal Mobile Number]. I would like to receive SMS alerts and notifications on both numbers as it will help me keep track of all the transactions on both the accounts seamlessly.

Kindly process my request at the earliest and update my account profile accordingly. My Customer ID is [Customer ID]. I have attached a photocopy of my Aadhaar Card and PAN Card as proof of identity.

I appreciate your assistance in this matter, and I would like to thank you in advance for your prompt attention to my request.

[Your Name] [Address] [City, Pin Code] [Email Address] [Phone Number] [Date]

Requesting Bank Manager’s Assistance in Updating Mobile Number after International Move

To, The Bank Manager, [Bank Name], [Branch Address], [City, Pin Code]

Subject: Request for Updating Mobile Number after International Move

I, [Your Name], have been a loyal customer of [Bank Name] since [Year], and my account number is [Account Number]. I am writing this letter to request your assistance in updating my mobile number in the bank records due to my recent international relocation.

I have recently moved to [New Country] for [mention the purpose, e.g., work, study, etc.] and as a result, I had to change my mobile number. My previous mobile number registered with the bank was +91 [Old Indian Mobile Number]. However, as I am now residing in [New Country], I have procured a new mobile number: [New Mobile Number with Country Code]. I kindly request you to update my new mobile number in the bank records to ensure that I continue to receive important updates, alerts, and OTPs related to my account and transactions.

I understand that updating my mobile number might require additional verification procedures. I am willing to comply with any necessary steps to confirm my identity and validate the change. Kindly guide me through the process and let me know if any further information or documents are required to complete the update.

I would appreciate your prompt attention to this matter as it is crucial for me to have my updated mobile number linked to my bank account for a seamless banking experience.

Thanking you in advance for your assistance and cooperation.

[Your Name] [Your Full Address] [New Country] Email: [Your Email Address] Date: [DD/MM/YYYY]

Application to Change Mobile Number in Account Records due to Privacy and Security Concerns

Subject: Application to Change Mobile Number in Account Records due to Privacy and Security Concerns

I am writing to request a change of my registered mobile number in my account records with your esteemed bank. I hold a savings account in your branch with the account number: [Your Account Number]. Recently, I have been facing privacy and security concerns with my current mobile number, and I have decided to change it to ensure the safety of my personal and financial information.

In light of these concerns, I kindly request you to update my account records with my new mobile number: [Your New Mobile Number]. I understand that this process may require verification and completion of certain formalities, and I am willing to cooperate with the bank to ensure a smooth transition.

I would also like to take this opportunity to express my gratitude for the excellent banking services provided by your branch. I am confident that my request will be processed promptly and efficiently.

Thank you for your attention to this matter, and I look forward to a positive response from your end.

[Your Name] [Your Account Number] [Your Old Mobile Number] [Your New Mobile Number] [Your Address] [Date]

Application to Inform Bank Manager of Mobile Number Transfer to New Service Provider

To, The Bank Manager, [Bank Name], [Branch Name], [Branch Address],

Subject: Application to Inform Bank Manager of Mobile Number Transfer to New Service Provider

I, [Your Name], holding the account number [Account Number] in your esteemed bank, would like to bring to your kind attention that I have recently transferred my mobile number [Mobile Number] to a new service provider. The change in the service provider has been done without changing my existing mobile number, which is registered with my bank account.

I request you to kindly update the bank’s records to reflect this change in the service provider for my mobile number. I assure you that there will be no hindrance in receiving OTPs, bank alerts, and other communication from the bank on this number. I am enclosing a copy of my new service provider’s confirmation for your reference.

I hope you will consider my request and update the bank’s records accordingly. Kindly acknowledge the receipt of this application and confirm the necessary changes at the earliest.

Thanking you,

[Your Name] [Account Number] [Current Address] [Mobile Number] [Date]

How to Write Application to Bank Manager for Updating Mobile Number in Account Records

Some writing tips to help you craft a better application:

- Start with the date, bank manager’s name, bank name, and branch address at the top left corner.

- Write a clear and concise subject line, such as “Request for Updating Mobile Number in Account Records.”

- Begin the application with a formal salutation, addressing the bank manager with “Respected Sir/Madam” or “Dear Sir/Madam.”

- Introduce yourself by mentioning your name, account number, and account type in the first paragraph.

- Clearly state the purpose of your application, highlighting the need to update your mobile number in the bank’s records.

- Provide your old and new mobile numbers, specifying which number should be updated.

- Offer a reason for updating your mobile number, such as a change in contact information, loss of phone, or for security purposes.

- Request the bank manager to update your mobile number in the account records and to confirm the update via email or SMS.

- Thank the bank manager for their time and assistance in handling your request.

- End the application with a closing salutation, such as “Yours faithfully” or “Yours sincerely,” followed by your name, signature, and contact details.

Related Topics:

- Application to Bank Manager for Refunding Money

- Application to Bank Manager for Closing Account

- Application to Bank Manager

View all topics →

I am sure you will get some insights from here on how to write “application to bank manager for updating mobile number in account records”. And to help further, you can also download all the above application samples as PDFs by clicking here .

And if you have any related queries, kindly feel free to let me know in the comments below.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Application For SMS Alert In Bank

The application for SMS alert in a bank is a convenient solution that enables customers to receive real-time updates, notifications, and alerts on their mobile phones, providing enhanced convenience and transparency in managing their bank accounts. Stay informed about transactions, account balances, payment reminders, and security alerts, empowering you to stay in control of your finances with ease. Activate SMS alerts today and experience a seamless and secure banking experience.

Application for SMS Alert in Bank: A Convenient Solution for Modern Banking

Banks constantly strive to provide enhanced convenience and seamless customer experiences in today’s fast-paced digital world. One such innovation that has revolutionized the banking sector is the application of SMS alerts in banks. This cutting-edge technology enables customers to receive real-time updates, notifications, and attention on their mobile phones, ensuring they always stay informed about their financial transactions and account activities.

The Power of SMS Alerts

SMS alerts have become integral to modern banking services, allowing customers to stay connected with their financial institutions effortlessly. By opting for SMS alerts, bank customers can receive notifications about various aspects of their accounts, such as:

- Transaction Alerts: Stay informed about each transaction that takes place in your bank account. Whether it’s a deposit, withdrawal, or a purchase made using your debit or credit card, SMS alerts will instantly notify you about the transaction details, including the amount, date, and location.

- Account Balance Updates: Keep track of your account balance without the need to visit a physical branch or access online banking. SMS alerts can provide real-time updates regarding your available credit, ensuring you have complete visibility of your finances.

- Payment Reminders: Pay attention to every bill payment deadline. SMS alerts can serve as helpful reminders, notifying you about upcoming payment due dates and ensuring you stay on top of your financial obligations.

- Security Alerts: Banks prioritize the security of their customers’ accounts, and SMS alerts play a vital role. By enabling security alerts, you can receive instant notifications about suspicious activities or unauthorized access attempts, allowing you to act and protect your funds immediately.

How to Activate SMS Alerts in Your Bank

Activating SMS alerts in your bank is a simple process. Most banks offer multiple channels through which customers can set up and manage their SMS alert preferences. Here’s a step-by-step guide on how to activate SMS alerts in your bank:

- Log in to Your Online Banking Account: Visit your bank’s website and log in to your online banking account using your credentials.

- Navigate to the SMS Alerts Section: Find the SMS alerts section in your account settings or preferences once logged in. This section may be labeled differently depending on your bank’s interface.

- Select Alert Types: Choose the specific SMS alerts you wish to receive. These could include transaction alerts, balance updates, payment reminders, and security alerts.

- Provide Contact Details: Enter your mobile phone number and ensure it is accurate and current. This is where you will receive the SMS alerts.

- Customize Preferences: Some banks allow customers to further customize their SMS alert preferences. You may have the option to set specific thresholds for balance updates or choose particular transaction types that trigger alerts.

- Save Changes: Once you have reviewed and customized your preferences, save the changes to activate SMS alerts for your bank account.

Benefits of SMS Alerts in Banking

Implementing SMS alerts in the banking sector benefits banks and customers. Let’s explore some of the advantages:

- Instant Notifications: SMS alerts provide real-time updates, allowing customers to promptly stay informed about their accounts. This ensures transparency and reduces the need for customers to continuously check their account status manually.

- Enhanced Security: By receiving security alerts through SMS, customers can quickly identify and respond to any potential fraudulent activities. This helps in mitigating risks and safeguarding customers’ financial information.

- Convenient Account Management: SMS alerts offer a convenient way to manage and monitor your bank account without needing internet connectivity or computer access. You can receive vital account information anytime, anywhere, as long as you have your mobile phone. This flexibility empowers customers to control their finances and make informed decisions.

- Timely Financial Planning: Customers can effectively plan their finances with SMS alerts. By receiving real-time transaction alerts and balance updates, they can track their expenses, identify any unauthorized transactions, and ensure that they have sufficient funds for their financial commitments. This proactive approach to financial planning leads to better money management and peace of mind.

- Personalized Notifications: Many banks provide options for customers to personalize their SMS alerts. For example, customers can choose the specific times they want to receive alerts, ensuring they don’t get disturbed during certain hours. Additionally, customers can customize the format and content of the signs to suit their preferences, making the banking experience more tailored and user-friendly.

- Cost-Effective Solution: SMS alerts are cost-effective for both banks and customers. Banks can save on printing and sending physical statements or letters, while customers can avoid fees for paper statements or notifications sent through traditional mail. Furthermore, SMS alerts eliminate the need for customers to make phone calls or visit branches for routine account inquiries, saving time and resources for both parties.

Here’s a sample format for an application requesting SMS alerts in a bank:

[Your Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date ]

[Bank Name] [Bank Address] [City, State, ZIP Code]

Subject: Request for Activation of SMS Alerts

Dear [Bank Name],

I request the activation of SMS alerts for my bank account with [Bank Name]. As a valued customer, I believe that SMS alerts will significantly enhance my banking experience by providing real-time updates and notifications regarding my account activities.

Please find below the necessary information to activate SMS alerts for my account:

Account Holder Name: [Your Full Name] Account Number: [Your Account Number] Mobile Phone Number: [Your Mobile Phone Number]

I kindly request the activation of the following SMS alert services:

- Transaction Alerts: I would like to receive SMS notifications for all transactions made on my account, including deposits, withdrawals, and card transactions. This will help me stay informed about the financial activities related to my account.

- Balance Updates: Please provide SMS alerts regarding any changes to my account balance, including deposits, withdrawals, and any fees or charges applied to my account. This will allow me to keep track of my available funds and manage my finances effectively.

- Payment Reminders: I would appreciate receiving SMS reminders for upcoming payment due dates, including loan repayments, credit card bills, and any other outstanding obligations. This will help me ensure timely payments and avoid any late payment penalties.

- Security Alerts: Please enable SMS alerts for any security-related activities on my account, such as password changes, suspicious login attempts, or unauthorized access. This will help me identify and address any potential security breaches promptly.

I understand that standard messaging rates may apply, and I take full responsibility for any charges incurred by receiving SMS alerts on my mobile phone.

I appreciate your attention to this matter and request that you activate SMS alerts for my account at your earliest convenience. Please do not hesitate to contact me if you require any additional information or documentation.

Thank you for your prompt assistance. I look forward to enjoying the benefits of SMS alerts and a more secure and convenient banking experience.

Yours sincerely,

[Your Name]

In conclusion, the application for SMS alerts in a bank is a valuable tool that enhances the banking experience for customers. By requesting the activation of SMS alerts, customers can stay informed about their account activities, receive real-time transaction updates, monitor their account balances, and receive timely payment reminders. Furthermore, SMS alerts increase security by notifying customers of suspicious activities or unauthorized access attempts. The provided sample format for an application requesting SMS alerts demonstrates the necessary information to include when submitting the request to the bank. Following the design and providing accurate details, customers can ensure a smooth activation process for SMS alerts on their bank accounts. Implementing SMS alerts in banking provides convenience and peace of mind and promotes efficient financial management. With instant notifications and timely updates, customers can make informed decisions, track their transactions, and stay on top of their financial commitments. We encourage bank customers to explore the benefits of SMS alerts and take advantage of this convenient feature their financial institutions offer. By leveraging SMS technology, customers can enjoy a seamless banking experience, enhanced security measures, and better control over their finances. Remember, activating SMS alerts may be subject to standard messaging rates, and reviewing any associated charges or fees with your mobile service provider is essential. Stay connected, stay informed, and embrace the power of SMS alerts to optimize your banking experience.

Similar Posts

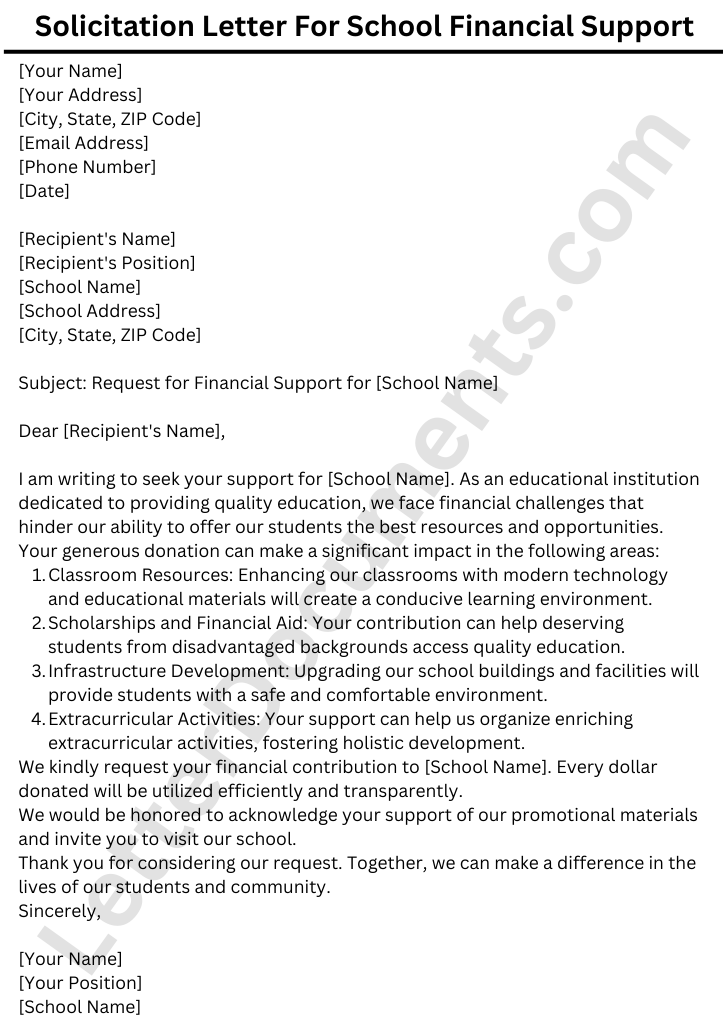

Solicitation Letter For School Financial Support

As educational institutions strive to provide quality education and enriching experiences for their students, securing financial support becomes critical to their operations. A well-crafted solicitation letter can be a powerful tool in garnering the necessary…

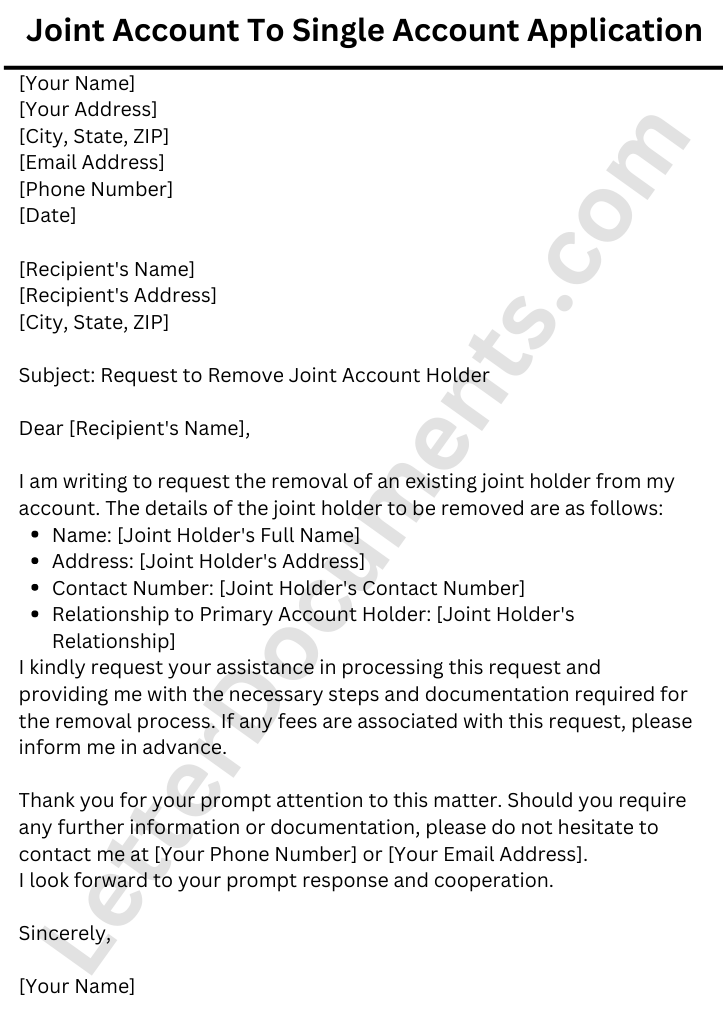

Joint Account To Single Account Application Sample

Managing money can sometimes be tricky, especially regarding joint bank accounts. If you’re considering turning a joint account into your personal one, we’ve got you covered! This sample application provides a template to help you…

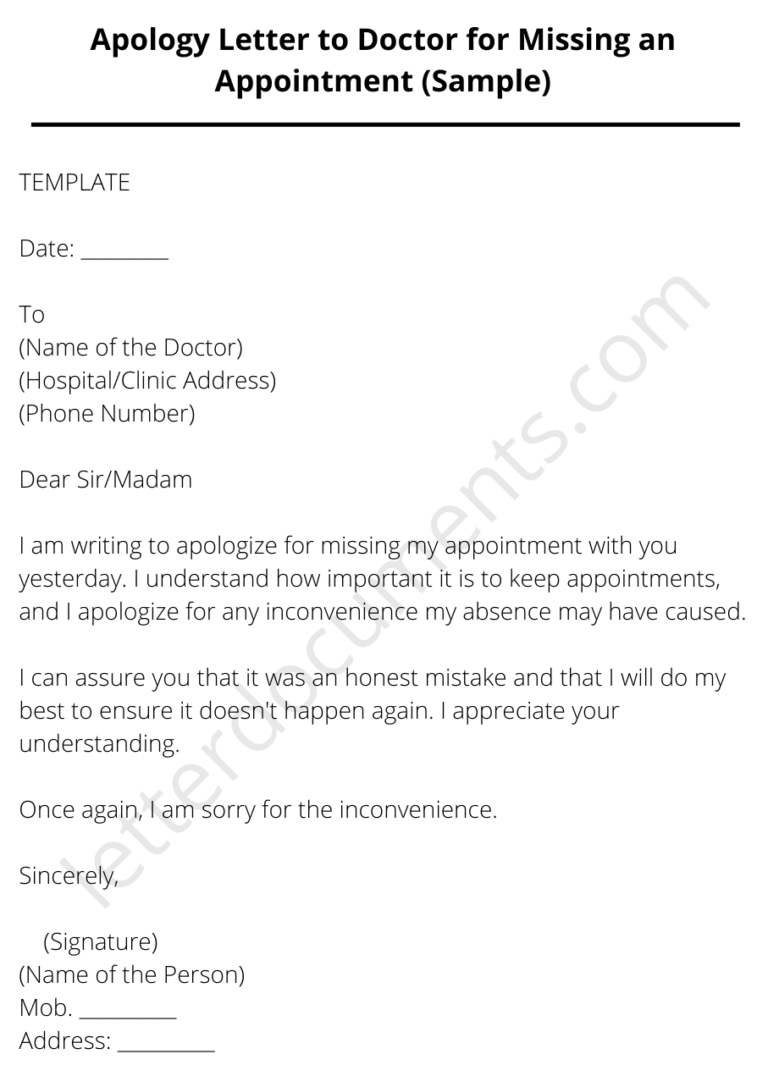

Apology Letter to Doctor for Missing an Appointment (Sample)

If you have missed an appointment with your doctor, there are a few things that you will need to do to reschedule. First, you will need to call the office and explain the situation. They…

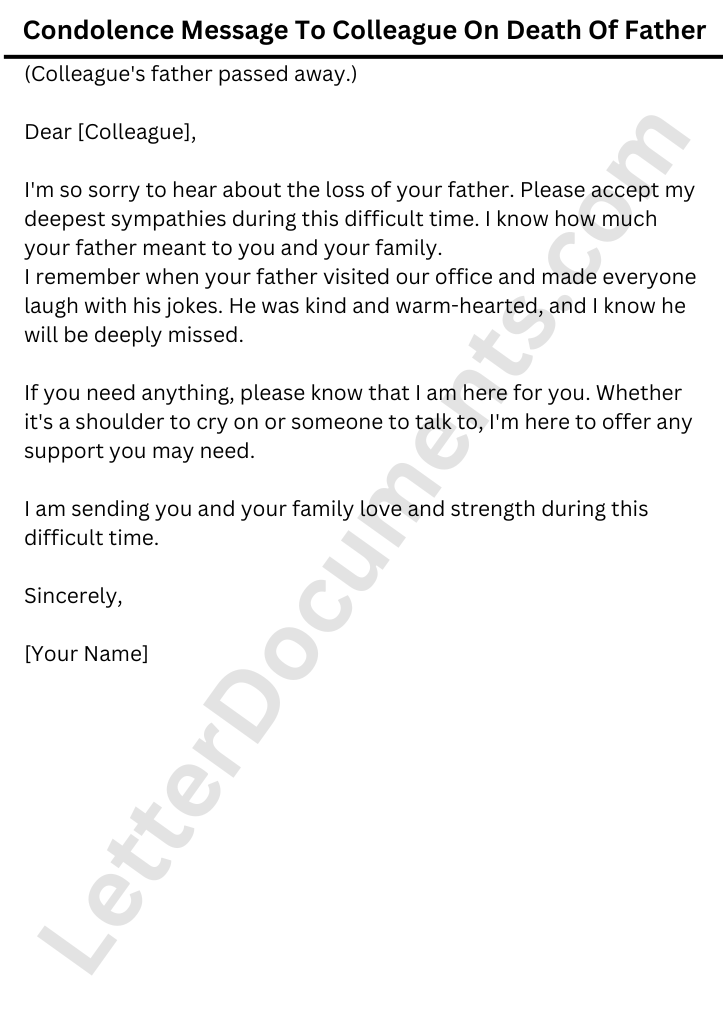

Condolence Message To Colleague On Death Of Father

Writing a condolence message to a colleague on the death of their father can be difficult. Still, expressing your sympathies and offering support during this difficult time is essential. Here are some steps to follow…

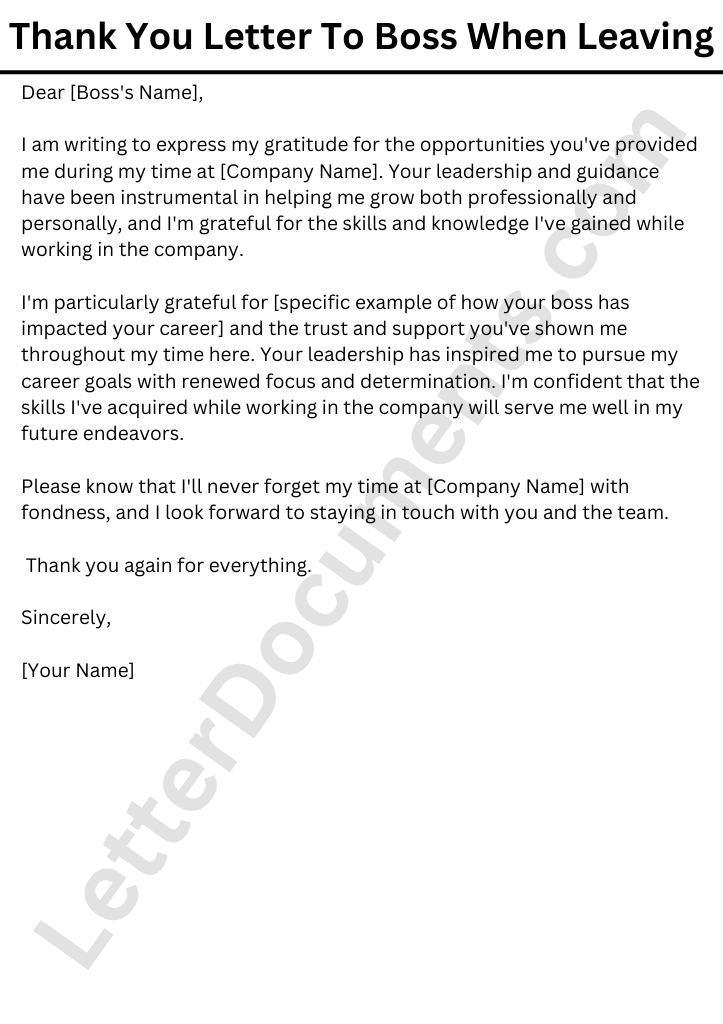

Thank You Letter To Boss When Leaving

Thank You Letter to Boss When Leaving: Tips and Samples When leaving a job, it’s always important to express gratitude towards your boss for the opportunities they provided and the support they offered throughout your…

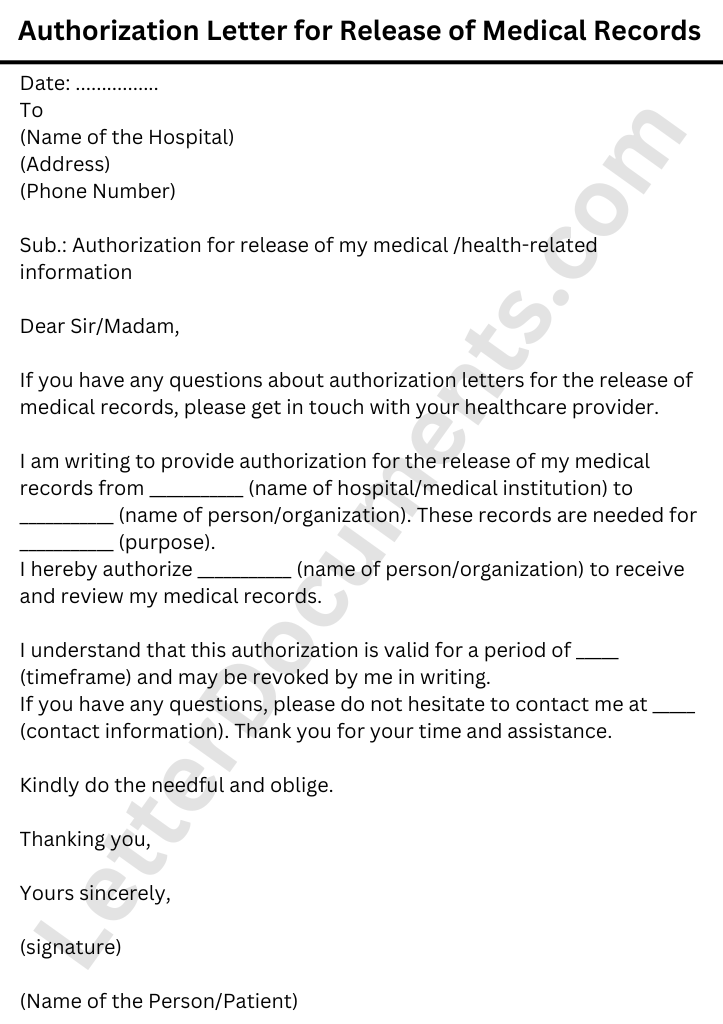

Authorization Letter for Release of Medical Records (Sample)

An authorization letter for the release of medical records is written consent from a patient that allows their healthcare provider to release their protected health information (PHI) to another individual or entity. The authorization letter…

- Learn English

- Universities

- Practice Tests

- Study Abroad

- Knowledge Centre

- Ask Experts

- Study Abroad Consultants

- Post Content

- General Topics

- Articles/Knowledge Sharing

- Sample Letters and Letter Formats

Sample format letter to bank requesting SMS alert service

Want to request SMS alert service for your bank account? If you want SMS alert service for your bank account to get intimated about transaction happening in your account number then use this sample letter format to request SMS alert for bank account.

Why do you need to request SMS alert service

Sample format letter to your bank to provide sms alert service, requesting sms service format letter to bank sample 2, conclusion:.

Please send different types of official letters i.e. note sheet format (specimen), how to write stationery items in office, and other official letters i.e. placed order, purchase letter etc.

- Do not include your name, "with regards" etc in the comment. Write detailed comment, relevant to the topic.

- No HTML formatting and links to other web sites are allowed.

- This is a strictly moderated site. Absolutely no spam allowed.

Top Contributors

- ABSivakumar (18)

- Neeru Bhatt (13)

- Vandana (303)

- DR.N.V. Sriniva... (206)

- Umesh (190)

About IndiaStudyChannel.com

Being the most popular educational website in India, we believe in providing quality content to our readers. If you have any questions or concerns regarding any content published here, feel free to contact us using the Contact link below.

- Admissions Consulting

- Adsense Revenue

- Become an Editor

- Membership Levels

- Winners & Awards

- Guest Posting

- Help Topics

STUDY ABROAD

- Study in Foreign Universities

- Study in Germany

- Study in Italy

- Study in Ireland

- Study in France

- Study in Australia

- Study in New Zealand

- Indian Universities

- Nursing in Mangalapuram

- BDS in Mangalore

- MBA in Bangalore

- Nursing admissions in Mangalore

- Distance MBA

- B Pharm in Mangalore

- MBBS in Mangalore

- BBA in Mangalore

- MBA Digital Marketing

- Privacy Policy

- Terms of Use

Promoted by: SpiderWorks Technologies, Kochi - India. ©

Write Letters online

Monday, october 22, 2018, letter to bank requesting for activation of sms alert service.

No comments:

Post a comment.

Home » Letters » Bank Letters » Request Letter to Bank Manager for Stop SMS Alert Service – Sample Letter Requesting SMS Alert Service Deactivation

Request Letter to Bank Manager for Stop SMS Alert Service – Sample Letter Requesting SMS Alert Service Deactivation

Table of Contents:

- Sample Letter

Live Editing Assistance

How to use live assistant, additional template options, download options, share via email, share via whatsapp, copy to clipboard, print letter, sample letter for sms alert service deactivation.

To, The Branch Manager, ____________ (Name of the Bank), ____________ (Branch Address)

Date: __/__/____ (Date)

Subject: Request for deactivation of SMS alert service for account no. __________ (account number)

Respected Sir/Madam,

With due respect, my name is ____________(Name) and I hold a __________ (type of account) account in your branch having account number ____________ (Account Number).

Through this letter, I would like to request you to kindly deactivate the SMS alert facility of account no. __________ (account number) due to _______ (mention reason for deactivation).

As per the requirements, I am also enclosing ___________ (customer request form/KYC/ any other applicable documents) along with this application.

Kind Regards, ______________ (Signature) ______________ (Name), ______________ (Account Number), ______________ (Registered Mobile Number)

Live Preview

The Live Assistant feature is represented by a real-time preview functionality. Here’s how to use it:

- Start Typing: Enter your letter content in the "Letter Input" textarea.

- Live Preview: As you type, the content of your letter will be displayed in the "Live Preview" section below the textarea. This feature converts newline characters in the textarea into <br> tags in HTML for better readability.

The letter writing editor allows you to start with predefined templates for drafting your letters:

- Choose a Template: Click one of the template buttons ("Start with Sample Template 1", "Start with Sample Template 2", or "Start with Sample Template 3").

- Auto-Fill Textarea: The chosen template's content will automatically fill the textarea, which you can then modify or use as is.

Click the "Download Letter" button after composing your letter. This triggers a download of a file containing the content of your letter.

Click the "Share via Email" button after composing your letter. Your default email client will open a new message window with the subject "Sharing My Draft Letter" and the content of your letter in the body.

Click the "Share via WhatsApp" button after you've composed your letter. Your default browser will open a new tab prompting you to send the letter as a message to a contact on WhatsApp.

If you want to copy the text of your letter to the clipboard:

- Copy to Clipboard: Click the "Copy to Clipboard" button after composing your letter.

- Paste Anywhere: You can then paste the copied text anywhere you need, such as into another application or document.

For printing the letter directly from the browser:

- Print Letter: Click the "Print Letter" button after composing your letter.

- Print Preview: A new browser window will open showing your letter formatted for printing.

- Print: Use the print dialog in the browser to complete printing.

- Begin with a respectful salutation and clearly state your request in the subject line. Provide essential details such as your name, account type, and account number. Clearly state the reason for requesting the deactivation of the SMS alert service. Enclose any necessary documents, such as a customer request form or KYC, if required.

- You may need to enclose documents such as a customer request form, KYC documents, or any other forms specified by the bank for processing your request.

- Address the branch manager or appropriate authority respectfully with a salutation such as "Respected Sir/Madam."

- Yes, ensure to include a clear subject line, essential details such as your name, account number, and reason for the request, and enclose any necessary documents as per the bank's requirements.

- If you don't receive confirmation within a reasonable timeframe, consider following up with the bank either through email, phone call, or visiting the branch to ensure your request is processed promptly.

Incoming Search Terms:

- sample letter to bank manager to stop SMS alert service

- how to write letter to deactivate SMS alert service

- letter format to stop SMS alert facility

By lettersdadmin

Related post, loan application letter | sample application letter to bank manager for loan, complaint letter to bank for amount deduction as processing charge – sample complaint letter regarding unexplained deduction from bank account, letter to bank for non-payment of loan – sample explanation letter for delay in loan payment, leave a reply cancel reply.

You must be logged in to post a comment.

Sample Job Joining Application for House Job – House Job Joining Application Sample

Complaint letter to employer about discrimination – complaint letter about discrimination at work, letter to editor complaining about loudspeaker nuisance – write a letter to the editor complaining about loudspeaker nuisance, write a letter to the editor about the noise pollution during the festival, privacy overview.

Write An Letter To The Bank Manager For Not Receiving Sms Alert In English

Bank Manager, SBI Bank, Magadi Road Branch Near Magadi Road metro station, Bengaluru- 454332

Subject : Letter to bank manager for not receiving sms alert

Respected sir, I would like to politely and respectfully inform you that I have a savings account in your account. XXXXX is my account number.

With due respect, I would like to bring up a problem that I have been having for a while. I selected the SMS alert option and paid the necessary fees for the service. Unfortunately, I am not getting any SMS updates for any transactions made from my account on the mobile number registered with the bank. I humbly ask that you check into the situation and assist me by guiding me through the process of having it fixed so that I won’t have to deal with this problem any longer. I will do my best to earn your favor. Please kindly consider.

Yours sincerely, Rajesh Shah

Related Posts:

- Random Job Generator [List]

- Write An Application To The Bank Manager To Add Mobile Number In English

- Why is it so hard to write an essay?

- Random Address Generator [United States]

- Random Phrase Generator [English]

- Common Conversational Phrases in English [List of 939]

Letter Formats and Sample Letters

Searching for letter formats? We howtoletter realized your need and thus come up with several types of sample letters and format of letters. Dig into the website and grab what you want.

Friday, April 21, 2017

Sample application for sms banking in andhra bank.

Related Articles

Emoticon Emoticon

Letter to Bank for Not Receiving SMS Alert – Sample Letter Regarding SMS Alert Not Receiving

Leave a reply cancel reply.

You must be logged in to post a comment.

COMMENTS

When writing a letter to the bank to activate SMS alert services for your account, it's crucial to maintain clarity and politeness. Start by addressing the bank manager and clearly state your request to activate SMS alerts for your account. Provide necessary details such as your account type, account number, and registered mobile number.

I am writing this letter to request you to please activate the SMS alert service on my mobile phone so that I can receive all updates for my bank account on my phone itself. Here are the complete details of my account: Account Holder's Name: Amit Gupta. Savings Account Number: 01130512121212.

Method of requesting the bank for activation of SMS alert service: (1) Go to the bank's branch office - collect the application form for this - fill up details, sign and submit it there. (2) Carry a written signed request letter, which has all the necessary details about your bank account for identification and submit to the bank.

Most of us don't care about the filling SMS alert details in the application form while account opening or you bank hadn't this SMS service when you opening the account. Whatever may the reason, the SMS alert service is very important in the present scenario. ... How to write letter to bank for SMS alert service? From. J. Alagar, 34, Urani ...

When composing a letter to the bank regarding not receiving SMS alerts, it's crucial to maintain a respectful and polite tone. Clearly state your name, account details, and the issue you're experiencing with the SMS alert service. Request the bank's assistance in resolving the issue promptly. Table of Contents: Sample Letter; Live Editing ...

Learn how to write a letter to the bank manager for activation of SMS alert service in mobile.Check out other templates at: https://www.lettersformats.com/20...

Bank SMS Alert Application - Bank SMS Alert Request Letter In this video, you will find sample request letter to bank manager for sms alert in mobile.To read...

Start with the date, bank manager's name, bank name, and branch address at the top left corner. Write a clear and concise subject line, such as "Request for Updating Mobile Number in Account Records.". Begin the application with a formal salutation, addressing the bank manager with "Respected Sir/Madam" or "Dear Sir/Madam.".

Bank may send SMS alerts to the Customer on the mobile phone number of the Customer duly registered with the Bank. Change of mobile phone number can only be done by the Bank on receipt of authenticated request from the Customer. In the case of accounts with joint holders; the change of mobile phone number request should be signed by all the ...

SMS Alert Service. I/We as account holder/s agree to receive SMS relating to all future transactions/renewals of my/our Savings Accounts and Fixed deposits and banks promotional messages from the above-mentioned SMS Service Provided to me as a value-added service and accept that the National savings bank is not liable for any delay or/failure ...

The application for SMS alert in a bank is a convenient solution that enables customers to receive real-time updates, notifications, and alerts on their mobile phones, providing enhanced convenience and transparency in managing their bank accounts. ... Before leaving, the student should submit a written leave application letter to the principal ...

This is to request your bank to provide me SMS alert service against my bank account number SB A/c*** (write a/c number). My account was opened in your bank in 1st March 2002 and SMS alert service was provided at that time. Now I want SMS alert service in by bank account against this mobile number [write mobile number]. Thank you. Your sincerely.

The Bank Manager, Indian Overseas Bank, Pudukkottai, TN, India. Respected Sir, Sub: Deactivating SMS alert service. I am your customer since last 7 years. I have SB account____________ [Write account number here] and SMS alert service is already active with this account. I feel the service charge for SMS alert is high and so want no more SMS ...

Method of requesting the bank for activation of SMS alert service: (1) Go to bank's branch office - collect the application form for this - fill up details, sign and submit it there; (2) Carry a written request letter (with your signature on it) which has all the necessary basic details about your bank account for identification and submit to ...

How to Use Live Assistant. The Live Assistant feature is represented by a real-time preview functionality. Here's how to use it: Start Typing: Enter your letter content in the "Letter Input" textarea. Live Preview: As you type, the content of your letter will be displayed in the "Live Preview" section below the textarea. This feature converts newline characters in the textarea into <br> tags ...

Welcome to the channelHello friendsIn this video I am sharing how to write application letter requesting to deactivate SMS alert service in bank account.I ha...

Subject: Letter to bank manager for not receiving sms alert. I would like to politely and respectfully inform you that I have a savings account in your account. XXXXX is my account number. With due respect, I would like to bring up a problem that I have been having for a while. I selected the SMS alert option and paid the necessary fees for the ...

The Accountholder acknowledges and places on record that there are inherent problems in verifying the authenticity of SMS transactions, and the Bank shall provide the SMS in an un-encrypted form for the convenience of the accountholder. Where the application for SMS Alert service is jointly signed by persons maintaining joint account on either ...

To register your new phone for the {*Company*} banking app, use the code {*CODE*}. Send Text Template. Copy SMS Template. Example. Card alert text message. There was a new transaction made on your card ending in {*Card no.*}. Please login securely online to view your account activity. Send Text Template.

Request Letter to Bank Manager for Stop SMS Alert Service - Samp - Free download as PDF File (.pdf), Text File (.txt) or read online for free. Bank Management

So those looking for other bank application for SMS banking are requested to search and find their related format. Read on! APPLICATION FOR SMS BANKING(PULL) To The Branch Manager _____ I/We wish to avail Andhra Bank mobile banking services (Both Pull and alerts facility) extended by the bank pertaining to my Account. 1. Name of the customer: 2 ...

Skip to content. Contact Us; Home; Article; Essay; India; Knowledge; Letter; News. Entertainment; Trending; Speech; Story; Menu. Contact Us; Home; Article; Essay ...

Letter to Bank for Not Receiving SMS Alert - Sample Letter Regarding SMS Alert Not Receiving. See also Letter to Bank Manager for Wrong Money Transfer to Another Account - Application For Money Got Transfer In Wrong Account. Leave a Reply Cancel reply. You must be logged in to post a comment.