- GK for competitive exams

- General Awareness for Bank Exams

- Current Affairs

- Govt Schemes

- Financial Awareness

- Computer GK

- Social Issues

- General Knowledge for Kids

Application for ATM Card

- Unified Mobile Application

- Real Life Applications of Microcontroller

- Software Testing - Bank Domain Application Testing

- Important Computer Abbreviations for Bank Exams

- Blockchain - Electronic Cash

- Mini Banking Application in Java

- What is Application Service Provider (ASP) ?

- C++ Program to Implement Trading Application

- Java Application to Implement Bank Functionality

- Multifactor Authentication

- Online Chat Application Project in Software Development

- Applications of Augmented Reality in Retail Automation

- Works Applications Interview Experience | Set 3

- UPSC Admit Card

- How to Create a Credit Card Form in Android?

- How to Send Money by Cash App?

- Journal Entry for Capital

- Multi Factor authentication Card using Tailwind CSS

- How to Apply for IPO in Zerodha?

An ATM (Automated Teller Machine) card is an essential banking tool that provides convenient access to your financial accounts. It allows you to withdraw cash, check account balances, transfer funds, and perform other transactions without having to visit a bank branch during business hours. The application letter serves as the primary means of communicating your ATM card requirements to the bank.

In this article, we will look into the format of an ATM application letter. Let’s start.

Writing an Application for ATM Card – Things to Remember

When applying for an ATM (Automated Teller Machine) card, there are a few essential things to keep in mind. Firstly, you must have an active bank account with the financial institution you’re applying to. Secondly, gather all the required documents, such as a valid ID proof and address proof. Thirdly, ensure you understand the terms and conditions, fees, and charges associated with the ATM card.

Format of ATM Card Application Letter

Here is a format and explanation for writing an ATM card application letter:

Your Name Your Address City, State, Zip Date The Manager Name of Bank Bank Branch Address City, State, Zip Subject: Application for New ATM/Debit Card Dear Sir/Madam, I am writing this letter to request for issuance of a new ATM/Debit card for my following bank account(s): Account Number(s): [Mention your account number(s)] Account Type(s): [Savings/Current/etc.] I would like to apply for a new ATM card, as [mention reason – my previous card has expired/damaged/lost/stolen]. Please issue me a new ATM card and send it to my current mailing address mentioned above. I request you to link all my above-mentioned accounts with the new ATM card for easy access and operations. In case you need any other details or documents from me, please let me know. I will be glad to provide the same. Thank you for your assistance in this matter. Sincerely, [Your Name]

Important Things to Remember:

1) Start with your full name and current mailing address where you want the new ATM card delivered.

2) Address it properly to the bank manager with bank’s branch address.

3) Mention the subject line clearly as “Application for New ATM/Debit Card”.

4) In the first paragraph, state your request for issuance of a new ATM card.

5) Provide your bank account number(s) and account type(s) to be linked to the new card.

6) Give a brief reason for applying for a new card – previous expired, damaged, lost or stolen.

7) Confirm your current mailing address and request to link all mentioned accounts to the new card.

8 ) Optionally, you can add a line about providing any other required details/documents.

9) Thank the bank for their assistance and end with a polite closing salutation.

Sample Application for ATM Card in English

Date: June 1, 2023 To, The Branch Manager ABC Bank 123 Main Street Cityville, State 12345 Subject: Application for Issuance of a New ATM Card Dear Sir/Madam, I am writing to request the issuance of a new ATM card for my savings account number 987654321 with your bank. My account details are as follows: Account Number: 987654321 Account Holder’s Name: John Doe Contact Number: 555-0123 I have enclosed copies of my driver’s license and recent utility bill as proof of identity and address, respectively. Kindly process my request for a new ATM card at your earliest convenience. I will be happy to provide any additional information or documentation required. Thank you for your assistance. Sincerely, John Doe

Sample Letter for New ATM Card Issue Application

Date: [Current Date] To, The Branch Manager [Bank Name and Address] Subject: Application for Issuance of a New ATM Card Dear Sir/Madam, I am writing to request the issuance of a new ATM card for my savings account with your bank. My account details are as follows: Account Number: [Your Account Number] Account Holder’s Name: [Your Full Name] Contact Number: [Your Mobile Number] I have enclosed copies of my [ID Proof] and [Address Proof] for your reference. Kindly process my request for a new ATM card at your earliest convenience. I will be happy to provide any additional information or documentation required. Thank you for your assistance. Sincerely, [Your Name]

Sample Letter for ATM Card Renewal/Replacement

Date: [Current Date] To, The Branch Manager [Bank Name and Address] Subject: Request for ATM Card Renewal/Replacement Dear Sir/Madam, I am writing to request the renewal/replacement of my existing ATM card for my savings account with your bank. My account details are as follows: Account Number: [Your Account Number] Account Holder’s Name: [Your Full Name] Contact Number: [Your Mobile Number] Existing ATM Card Number: [Your Current ATM Card Number] The reason for this request is [state the reason, e.g., card expired, lost, damaged, etc.]. I have enclosed copies of my [ID Proof] and [Address Proof] for your reference. Kindly process my request for a new ATM card at your earliest convenience. I will be happy to provide any additional information or documentation required. Thank you for your assistance. Sincerely, [Your Name]

Sample ATM Card Application Letter

Date: [Today’s Date] To, The Bank Manager [Name of Bank and Address] Subject: Asking for a New ATM Card Dear Sir/Madam, I am writing to you to ask for a new ATM card for my bank account with your bank. My account details are: Account Number: [Your Account Number] Name: [Your Full Name] Phone Number: [Your Mobile Number] I am giving copies of my [ID Proof] and [Address Proof] with this letter. Please give me a new ATM card as soon as possible. I will give any other information or documents needed. Thank you for your help. Sincerely, [Your Name]

Remember, these are sample letters and may need to be modified based on your specific requirements and the bank’s guidelines.

Applying for an ATM card is a straightforward process that requires submitting a formal application letter along with the necessary documents to your bank. By following the proper format and providing the required information, you can ensure a smooth and efficient process for obtaining or renewing your ATM card. Maintaining a polite and professional tone in your application letter can also help facilitate a positive experience with your bank

People Also View:

- How to Write Job Application Letter? (with Samples)

- Casual Leave Application: Check Format & Samples

- Letter to Principal, Format And Samples

FAQs on Application for ATM Card

How can i write an application for an atm card.

To apply for a new ATM card, write a letter addressed to the bank manager or customer service department. Mention your full name, account number, and type of account. State that you want to apply for a new ATM/Debit card for your account. If it’s to replace an expired/damaged card, mention that. Provide your current mailing address to receive the new card. Request them to link your existing accounts to the new card. Thank them for their assistance.

How do I write an application letter for ATM card block and reissue?

Address the letter to the bank manager. Clearly state that you want to block your existing ATM card number and mention the card number. Explain the reason, such as the card being lost, stolen, or compromised. Request them to reissue a new ATM card linked to your accounts. Provide your updated mailing address to receive the new card. Thank them for their cooperation.

How do I write a request for an ATM card?

To request an ATM card, write a letter to the bank. Mention your full name, account number, and type of account. State that you want to apply for a new ATM/Debit card for your account. If it’s to replace an expired/damaged card, mention that. Provide your current mailing address to receive the new card. Request them to link your existing accounts to the new card. Thank them for their assistance.

How to apply for an ATM card?

To apply for an ATM card, write an application letter addressed to the bank manager or customer service department. Mention your full name, account number, and type of account. State that you want to apply for a new ATM/Debit card for your account. If it’s to replace an expired/damaged card, mention that. Provide your current mailing address to receive the new card. Request them to link your existing accounts to the new card.

How to write a letter for lost passbook and ATM card?

Address the letter to the bank manager. State that you have lost both your passbook and ATM card. Request them to block the lost ATM card number immediately. Apply for a replacement passbook and ATM card. Provide your account details like account number and type. Confirm your current mailing address. Thank them for their assistance.

Please Login to comment...

Similar reads.

- General Knowledge

- SSC/Banking

Improve your Coding Skills with Practice

What kind of Experience do you want to share?

- Application For ATM Card

To be honest, ATM cards have replaced the hard cash in our pockets. Technology has become so advanced that ATM cards have mitigated money thefts all over the world. Even if you lost your ATM card, you can immediately block it and apply for a new one. Moreover, you can make other payments and get amazing offers. Hence, today we will see how to write an application for ATM card. Moreover, this article will help you write the correct application for ATM card to your bank. We have also included a few samples for your reference.

Nowadays, you can easily get an ATM card. In fact, you directly get it when you open a new account in any bank. For instance, you get your ATM card with your passbook. Therefore, you do not need to submit an application for it. However, you must write an application for ATM card if you opened an account a few years back.

Therefore, you must submit a request letter to the bank manager if you hold an account but do not have an ATM card. In fact, you have to write an application in case your ATM is expiring. Here are a few guidelines to follow while submitting an application for ATM card.

Guidelines For Writing An Application For ATM Card

- Firstly, mention your bank account number. Furthermore, cross-check it for any mistakes.

- Attach necessary proofs like passbook, ID, Aadhar card, etc.

- Provide your contact details. For example, your phone number and email id.

- Write the application to the bank manager.

- Make sure to write it in a formal tone. However, do not forget to mention your account number.

- Make it short and precise.

- Finally, end with thanking the bank manager.

Format For Writing An Application For ATM Card

Your address

City – Pincode

Date: dd/mm/yy

The Bank Manager

Branch name

City- Pincode

Body of the letter

- Firstly, mention your name and account number

- Now, give the reason why you are writing.

- Finally, attach the necessary documents.

Closing with yours sincerely, yours faithfully, etc.

Contact number

Attached documents

Sample Letters On Writing An Application For ATM Card

56, Trimurtee apartment

Trimurtee Nagar

Nagpur – 440022

Shivaji Nagar Branch

Nagpur – 440011

Subject: Application for ATM card

Dear Sir/Ma’am,

I’m Kavita Iyer. I have a savings account in your bank since 2008. Moreover, my bank account number is 3458xxxxxxxx0991. As my account is very old, I didn’t get any ATM card back then. Moreover, I never applied for one.

Additionally, I used to do all the transactions via bank. However, it is now difficult for me. Therefore, I request you to please issue me an ATM card.

Also, I have attached a copy of my bank passbook and Aadhar card for your reference.

Hope to hear from you soon.

Yours sincerely,

Kavita Iyer

Contact number: 9188888888

Attached documents:

- Copy of bank passbook

- Aadhar card

Explore More Sample Letters

- Leave Letter

- Letter to Uncle Thanking him for Birthday Gift

- Joining Letter After Leave

- Invitation Letter for Chief Guest

- Letter to Editor Format

- Consent Letter

- Complaint Letter Format

- Authorization Letter

- Application for Bank Statement

- Apology Letter Format

- Paternity Leave Application

- Salary Increment Letter

- Permission Letter Format

- Enquiry Letter

- Cheque Book Request Letter

- Application For Character Certificate

- Name Change Request Letter Sample

- Internship Request Letter

- Application For Migration Certificate

- NOC Application Format

- DD Cancellation Letter

Sample 2 –

2nd floor, Shrey Siddhi Apartment

Bajaj Nagar

Nagpur – 440009

State Bank Of India

Sakkardhara Branch

Nagpur – 440045

Subject: Application for new ATM card

Dear Sir/ Ma’am,

I am Edward Mathew, a premium account holder in your bank. I request you to issue me a new ATM card as I misplaced the old one. Since I use my ATM card for almost every transaction, I need it very urgently. Moreover, it would be great if I get it within a week.

Also, I have attached a xerox of my bank passbook and ID proof for your reference.

I really appreciate any help you can provide.

Edward Mathew

Contact number: 9100000000

Amey House, 7th Main

Civil Lines

Nagpur – 440018

Bank Of Baroda

Shankar Nagar Branch

Nagpur – 440040

I am Neha Sharma. I am a savings account holder in your bank, and my account number is 3421xxxxxxx9011. To conclude, my current ATM card is expiring in October 2022. Therefore, I need a new ATM card before October. Hence, I request you to issue me a new ATM card before the given time.

Also, I have attached a copy of my Aadhar card and bank passbook.

I appreciate any help you can provide.

Neha Sharma

Contact number: 9999999999

- Copy of Aadhar card

Frequently Asked Questions

Q1. What are the documents required for ATM card?

Answer. To summarize, you only need your bank account number and identity proof for ATM card.

The following documents are considered valid for identity proof –

- Voter ID card

- Driving license

Q2. Can I apply for an ATM card from any branch?

Answer. Yes you can. In fact, you can visit the nearest branch of your bank. Afterwards, meet the relationship manager and write an application for ATM card. Moreover, you can also ask for an instant ATM card (Debit card).

Q3. Who is eligible for ATM card?

Answer. Accordingly, there are a couple of conditions for getting an ATM card

- Firstly, you must be a citizen of India.

- The second thing is that you must have a bank account.

- Finally, you should be 18+

However, if you are a minor, your parents can open a bank account on your behalf.

Q4. How much time will it take to get ATM card?

Answer. Once you apply for an ATM card, you will briefly get it in 7 working days. Moreover, you will get it via speed post to your registered address.

Q5. How can I get my lost ATM card number?

Answer. Firstly, you need to visit your bank branch. Then, provide your bank account to the bank official. Further, they will enquire in the system to get your ATM card number.

Customize your course in 30 seconds

Which class are you in.

Letter Writing

- Letter to School Principal from Parent

- ATM Card Missing Letter Format

- Application for Quarter Allotment

- Change of Address Letter to Bank

- Name Change Letter to Bank

- Application for School Teacher Job

- Parents Teacher Meeting Format

- Application to Branch Manager

- Request Letter for School Admission

- No Due Certificate From Bank

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Download the App

20+ New ATM Card Request Letter Format – Check Examples Here

- Letter Format

- March 20, 2024

- Request Letters , Bank Letters

New ATM Card Request Letter Format: An ATM card is an essential tool for modern banking, allowing you to withdraw cash, make purchases, and conduct various transactions . However, if your ATM card has been lost, stolen, or damaged, you will need to request a new one from your bank . Writing a new ATM card request letter format can seem daunting, but by following a few simple tips, you can create a New ATM Card Request Letter Format that is clear, concise, and effective .

Also Check:

- 15+ Balance Confirmation Letter Format In Word – Format, Examples

- 13+ Mobile Number Change In Bank Account Letter Format, Samples

New ATM Card Request Letter Format

Content in this article

- Begin with a professional greeting: Start your New ATM Card Request Letter Format with a professional greeting, such as “Dear Sir/Madam” or “To Whom It May Concern.” This sets the tone for a formal request and shows respect for the recipient of the letter.

- State the reason for the request: In the opening paragraph of New ATM Card Request Letter Format, clearly state the reason for your request. This New ATM Card Request Letter Format could be because your card has been lost, stolen, or damaged, or because you are a new customer and need a new card.

- Provide your account details: To help the bank locate your account and process your request, provide your account details, such as your account number and the name on the account. You may also want to include your contact information, such as your phone number or email address, so the bank can reach you if necessary.

- Request the new card: After providing your account details, make a clear request for the new card. Be specific about the type of card you need, such as a debit card or credit card, and any additional features or services you require.

- Close with a polite request: In the closing paragraph of New ATM Card Request Letter Format, thank the bank for their assistance and politely request a prompt response to your request. You may also want to offer any additional information that may help the bank process your request, such as a copy of your ID or a police report if your card was stolen.

- Proofread your letter: Before sending your New ATM Card Request Letter Format, make sure to proofread it carefully for any errors or typos. A well-written, error-free letter can make a strong impression and increase the likelihood of a positive response from the bank.

New ATM Card Request Letter Format – Sample format

Below is a sample format of New ATM Card Request Letter Format:

[Your Name] [Your Address] [City, State, Zip Code] [Your Email Address] [Your Phone Number] [Date]

[Bank Manager’s Name] [Bank Name] [Bank Address] [City, State, Zip Code]

Subject: Request for New ATM Card

Dear [Bank Manager’s Name],

I hope this letter finds you well. I am writing to request a new ATM card for my bank account [Account Number].

Unfortunately, my current ATM card has been misplaced/lost, and I am unable to locate it despite thorough searches. As a result, I kindly request your assistance in issuing a replacement ATM card to ensure uninterrupted access to my account.

I understand that there may be administrative procedures involved in processing this request. Please let me know if there are any forms I need to fill out or if any further documentation is required to facilitate the issuance of the new ATM card.

I apologize for any inconvenience this may cause, and I appreciate your prompt attention to this matter.

Thank you for your assistance and understanding. I look forward to receiving the new ATM card at your earliest convenience.

Yours sincerely,

[Your Name]

Feel free to customize this sample format of New ATM Card Request Letter Format with specific details about your bank account and the reason for requesting a new ATM card. Ensure to include any additional information or documentation requested by the bank.

New ATM Card Request Letter Format – Sample Format

Email Format about New ATM Card Request Letter format

Here’s an Email format of New ATM Card Request Letter Format:

Subject: New ATM Card Request

Dear [Bank Representative Name],

I am writing to request a new ATM card for my account [account number]. Unfortunately, my previous card was [lost/stolen/damaged], and I am unable to use it for transactions.

I would like to request a new [debit/credit] card with the same features and services as my previous card. Please let me know if any additional information or documents are required to process my request.

Additionally, I have attached a scanned copy of my ID and a police report regarding the loss of my previous card, which may be required for the issuance of the new card.

Thank you for your assistance in this matter. I kindly request a prompt response to my request.

[Your Contact Information]

Email Format about New ATM Card Request Letter Format

letter for ATM card replacement

Here is a letter for ATM card replacement:

Subject: Request for ATM Card Replacement

I hope this letter finds you well. I am writing to inform you that my ATM card associated with my bank account [Account Number] has been misplaced/lost.

I kindly request your assistance in issuing a replacement ATM card to ensure continued access to my account.

For security reasons, I have already blocked the lost ATM card by contacting your customer service helpline. Enclosed are the details of the lost card and any other information required for the replacement process.

I understand that there may be administrative procedures involved in processing this request. Please let me know if there are any forms I need to fill out or if any further documentation is required.

Thank you for your assistance and understanding. I look forward to receiving the replacement ATM card at your earliest convenience.

Feel free to customize this letter with specific details about your bank account and the reason for requesting an ATM card replacement. Ensure to include any additional information or documentation requested by the bank.

Letter for ATM Card Replacement

Request letter to bank for lost ATM card

This is a Request letter to bank for lost ATM card:

[Your Address]

[City, State, Zip Code]

[Your Email Address]

[Your Phone Number]

[Bank Manager’s Name]

[Bank Name]

[Bank Address]

Subject: Notification of Lost ATM Card and Request for Replacement

I am writing to inform you that I have unfortunately lost my ATM card associated with my bank account [Account Number]. I am concerned about the security of my account and would like to take immediate action to prevent any unauthorized transactions.

I kindly request your assistance in blocking the lost ATM card to prevent any unauthorized use. Additionally, I would like to request a replacement ATM card to ensure continued access to my account.

Below are the details of the lost ATM card:

- Cardholder Name: [Your Name]

- Account Number: [Account Number]

- Date of Loss: [Date of Loss]

- Last Known Transactions (if any): [List of Last Known Transactions]

Thank you for your assistance and understanding. I look forward to receiving confirmation of the lost card blockage and the issuance of a replacement ATM card at your earliest convenience.

Feel free to customize this letter with specific details about your lost ATM card and the reason for requesting a replacement. Ensure to include any additional information or documentation requested by the bank.

Request Letter to Bank for Lost ATM Card

New ATM Card Request Letter Format – Template

Here’s a Template of New ATM Card Request Letter Format:

[Your Name] [Your Address] [City, State ZIP Code] [Date]

[Bank Name] [Bank Address] [City, State ZIP Code]

Dear Sir/Madam,

I am writing to request a new ATM card for my account [account number]. My previous card was [lost/stolen/damaged], and I am unable to use it for transactions.

I kindly request a new [debit/credit] card with the same features and services as my previous card. Please let me know if any additional information or documents are required to process my request.

Thank you for your assistance in this matter. I look forward to receiving my new ATM card soon.

letter for requesting a replacement ATM card

Here’s a letter for requesting a replacement ATM card:

Subject: Request for Replacement ATM Card

I hope this letter finds you well. I am writing to request a replacement ATM card for my bank account [Account Number].

Unfortunately, my current ATM card has been damaged/lost, and I am unable to use it for transactions. To ensure uninterrupted access to my account, I kindly request your assistance in issuing a replacement ATM card as soon as possible.

I understand that there may be administrative procedures involved in processing this request. Please let me know if there are any forms I need to fill out or if any further documentation is required to facilitate the issuance of the replacement ATM card.

Feel free to customize this letter with specific details about your bank account and the reason for requesting a replacement ATM card. Ensure to include any additional information or documentation requested by the bank.

Letter for Requesting a Replacement ATM Card

Formal letter for new ATM card application

This is a Formal letter for new ATM card application:

Subject: Application for New ATM Card

I hope this letter finds you well. I am writing to formally request the issuance of a new ATM card for my bank account [Account Number].

As my current ATM card has expired/been lost/damaged, I am in need of a replacement to ensure continued access to my account and facilitate banking transactions. Therefore, I kindly request your assistance in processing the application for a new ATM card.

Enclosed with this letter are any required forms and documents, including identification proof and account details, as per the bank’s requirements for the issuance of a new ATM card. I am available for any further verification or documentation required to expedite the process.

I understand that there may be administrative procedures involved, and I assure you of my cooperation throughout the application process.

I apologize for any inconvenience this may cause and appreciate your prompt attention to this matter.

Feel free to customize this letter with specific details about your bank account and the reason for requesting a new ATM card. Ensure to include any additional information or documentation requested by the bank.

Formal Letter for New ATM Card Application

Letter format for requesting a duplicate ATM card

Here is a Letter format for requesting a duplicate ATM card:

Subject: Request for Duplicate ATM Card

I hope this letter finds you well. I am writing to formally request the issuance of a duplicate ATM card for my bank account [Account Number].

Unfortunately, my current ATM card has been lost/damaged, and I am unable to use it for transactions. To ensure uninterrupted access to my account, I kindly request your assistance in processing the application for a duplicate ATM card.

Enclosed with this letter are any required forms and documents, including identification proof and account details, as per the bank’s requirements for the issuance of a duplicate ATM card. I am available for any further verification or documentation required to expedite the process.

Thank you for your assistance and understanding. I look forward to receiving the duplicate ATM card at your earliest convenience.

Feel free to customize this letter with specific details about your bank account and the reason for requesting a duplicate ATM card. Ensure to include any additional information or documentation requested by the bank.

Letter Format for Requesting a Duplicate ATM Card

New ATM Card Request Letter Format – Example

Here’s an Example of New ATM Card Request Letter Format:

I am writing to request a new ATM card for my account [account number]. Unfortunately, my current card was [lost/stolen/damaged], and I am unable to use it for transactions.

I would like to request a new [debit/credit] card with [specific features or services]. Please let me know if any additional information or documents are required to process my request.

ATM card reissuance letter format

This is an ATM card reissuance letter format:

Subject: Request for Reissuance of ATM Card

I hope this letter finds you well. I am writing to formally request the reissuance of my ATM card for my bank account [Account Number].

Unfortunately, my current ATM card has been lost/damaged, and I am unable to use it for transactions. To ensure uninterrupted access to my account, I kindly request your assistance in processing the application for a new ATM card.

Enclosed with this letter are any required forms and documents, including identification proof and account details, as per the bank’s requirements for the reissuance of an ATM card. I am available for any further verification or documentation required to expedite the process.

I understand that there may be administrative procedures involved, and I assure you of my cooperation throughout the reissuance process.

Thank you for your assistance and understanding. I look forward to receiving the reissued ATM card at your earliest convenience.

Feel free to customize this letter with specific details about your bank account and the reason for requesting a reissuance of the ATM card. Ensure to include any additional information or documentation requested by the bank.

ATM Card Reissuance Letter Format

letter for requesting a new debit card

Here is a letter for requesting a new debit card:

Subject: Request for New Debit Card

I hope this letter finds you well. I am writing to request the issuance of a new debit card for my bank account [Account Number].

Unfortunately, my current debit card has expired/been lost/damaged, and I am unable to use it for transactions. To ensure uninterrupted access to my account and facilitate banking transactions, I kindly request your assistance in processing the application for a new debit card.

Enclosed with this letter are any required forms and documents, including identification proof and account details, as per the bank’s requirements for the issuance of a new debit card. I am available for any further verification or documentation required to expedite the process.

Thank you for your assistance and understanding. I look forward to receiving the new debit card at your earliest convenience.

Feel free to customize this letter with specific details about your bank account and the reason for requesting a new debit card. Ensure to include any additional information or documentation requested by the bank.

Letter for Requesting a New Debit Card

FAQS about New ATM Card Request Letter Format

What should be included in a new atm card request letter format.

The New ATM Card Request Letter Format should include your contact details, account number, reason for requesting a new card (e.g., lost, damaged, expired), and a polite request for assistance in issuing a new card.

Is it necessary to provide identification proof with the New ATM Card Request Letter Format?

Yes, it is usually necessary to provide identification proof to verify your identity and ensure the security of the account. This New ATM Card Request Letter Format may include a copy of your valid identification card (e.g., driver’s license, passport).

How should I address the New ATM Card Request Letter Format to the bank manager?

You can address the New ATM Card Request Letter Format to the bank manager by using “Dear [Bank Manager’s Name]” or “To the Bank Manager” as the salutation.

Should I mention the reason for requesting a New ATM Card Request Letter Format?

Yes, it’s important to mention the reason for requesting a new ATM card, whether it’s due to loss, damage, or expiration. This New ATM Card Request Letter Format helps the bank understand the urgency of your request.

How long does it typically take for the bank to process a new ATM card request?

Processing times vary depending on the bank’s procedures and workload. Generally, it can take a few business days to a couple of weeks for the new ATM card to be issued and delivered to you. You can follow up with the bank if you haven’t received it within a reasonable timeframe.

Requesting New ATM Card Request Letter Format can be a simple process if you follow a clear and concise letter format . Remember to provide your account details, state the reason for the request, make a clear request for the new card, and close with a polite request. By following New ATM Card Request Letter Format tips and proofreading your New ATM Card Request Letter Format, you can increase the chances of receiving a prompt response from the bank and getting your new ATM card quickly .

Related Posts

24+ Car Parking Letter Format – How to Write, Email Templates

11+ Authorized Signatory Letter Format – Templates, Writing Tips

Write 1 Hour Permission Letter Format for Office – 14+Templates

20+ Warranty Letter Format – How to Write, Examples, Email Ideas

15+ Vigilance Complaint Letter Format, Key Tips, Templates

25+ Undertaking Letter Format for Students – Tips, Examples

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Name *

Email *

Add Comment

Save my name, email, and website in this browser for the next time I comment.

Post Comment

Write an application for your bank request letter for issuing a new ATM card

Hello Everyone, How to Write an application for your bank request letter for issuing a new ATM card . This application is very useful to get your new ATM card for any bank.

Write an application to bank manager to close the bank locker facility

Write an application for bank manager to no objection for closing my savings account, write an e-mail through the hr manager for a software job., the bank manager,.

[ Bank Name ]

[ Branch Name ]

[Date: – DD-MM-YYYY ]

Sub: – Requesting for issuing new ATM card

Respected sir/madam,.

I am an account holder of this bank and my account number is [ Account number ]. I request you to issue a new ATM card for my account as soon as possible I hear with enclose all the necessary documents along with this letter. Please do the needful. Thanking you.

Yours faithfully

[ Signature ]

[ Your name ]

State Bank of India

Mumbai, maharashtra, i am an account holder of this bank and my account number is 625458xxxxx . i request you to issue a new atm card for my account as soon as possible i hear with enclose all the necessary documents along with this letter. please do the needful., thanking you, yours faithfully , rakesh jain, that’s all for now, soon you will meet with a new topic., this was all about write an application for your bank request letter for issuing a new atm card ., keep visiting:- infofriendly, 36 replies to “ write an application for your bank request letter for issuing a new atm card ”.

I ᴡant to thank you foг this fantastic read!!

Mera ATM nahi aaya hai

Hello Babulal,

Please visit your nearest Bank, or call your bank.

Nice Application

Very helpful application 👍

Mera ATM nahi aaya hai sir William is and my address Muvarijpur Rampur achnera aagra 203201 hai

Sir, Mera application kho gaya tha mujhe samajh me nahi aa raha tha kiya kaise start kare aap ka ye application dekh mujhe bahut help mela Thank you sir 🙂

It’s my pleasure Jitendra. Thanku!

Hey babulal! please visit your bank and tell your quarry, sometimes this problem comes under address or postmen side. So best think you go your bank tell them this think or is it possible you can change you ATM delivery address. Thanku!

Thanks for all your efforts that you have put into this.

Sir mera atm new nahi aaya hai to mai mobailse kaise apply karu

Hello Bhagwan Kandilwad If you tell us the name of your bank then we will be able to solve the problem. Thanks

Mera Atm card nhi aarha h 4 Baar apply kr chukka hu

Hello Vikash, Find out in your post office, if you would not have come, then consult your branch. Thanks

Thank you so much it helped me today to write letter to my mom as she needed new ATM & I was bit confused how to star wats the matter I should write though I’ve idea bit I was confused thanks for helping me

It’s our pleasure

Well right application

Thank You so much sir

My new atm mobile appali karna h mobile se kese karu

Hey Salam! Tell me your bank name, other-wise you can search in the search_box on the same top of the page. Thnaku!

Awesome…..Nice

Ho sir I need your help

Hello Rohit, Please let me know your question with the subject line. Thanks

Mujhe atm card apply karna hai

Hello Tajmeen, Please let me know your question with the subject line. Thanks

Send my new debit card pleas sir

Hello Arvind, Please contact your bank otherwise tell me your bank name, we will send your bank contact details Thanks

Sir Mera ATM card abhi tak nahi aaya

Hello Pooja, Please contact your bank otherwise tell me your bank name, we will send your bank contact details Thanks

Thank You Sir

Thank You Sir.

Thank you for your letter

I want to thank [email protected] for getting me blank atm card and get rich

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Application for New ATM Card – 7+ Samples, Formatting Tips, and FAQs

Are you tired of waiting in long queues for cash withdrawals? Do you want to have hassle-free access to your money 24/7?

An ATM card is the solution you’re looking for!

In today’s cashless society, an ATM card has become a necessity. It gives us access to our bank account anytime and anywhere. However, sometimes we may need to replace our existing ATM card due to various reasons like damage, loss, or expiry. In such situations, the first step is to apply for a new ATM card.

But how do you apply for a new ATM card? What are the necessary documents and formats required to do so? And how do you ensure that your application is successful? This article aims to answer all of these questions and guide you through the process of applying for a new ATM card in India.

Whether you’re living in a rural area or an urban city, our samples and formats will help you write a compelling application that increases your chances of success. Keep reading to learn more!

- 1 Sample Application for New ATM Card

- 2 ATM Card Apply Letter Format

- 3 New ATM Card Request Letter Format SBI Example

- 4 Sample Application to Bank Manager for ATM Card Format

- 5 Formal Request Letter for ATM Card Sample

- 6 New ATM Card Issue Application Format

- 7 Sample Application Letter to Bank Manager for New ATM Card

- 8 Sample Application for New ATM Card in Hindi

- 9.1 Components of a Proper Application

- 9.2 Structuring the Application

- 10 FAQs on Application for a New ATM Card

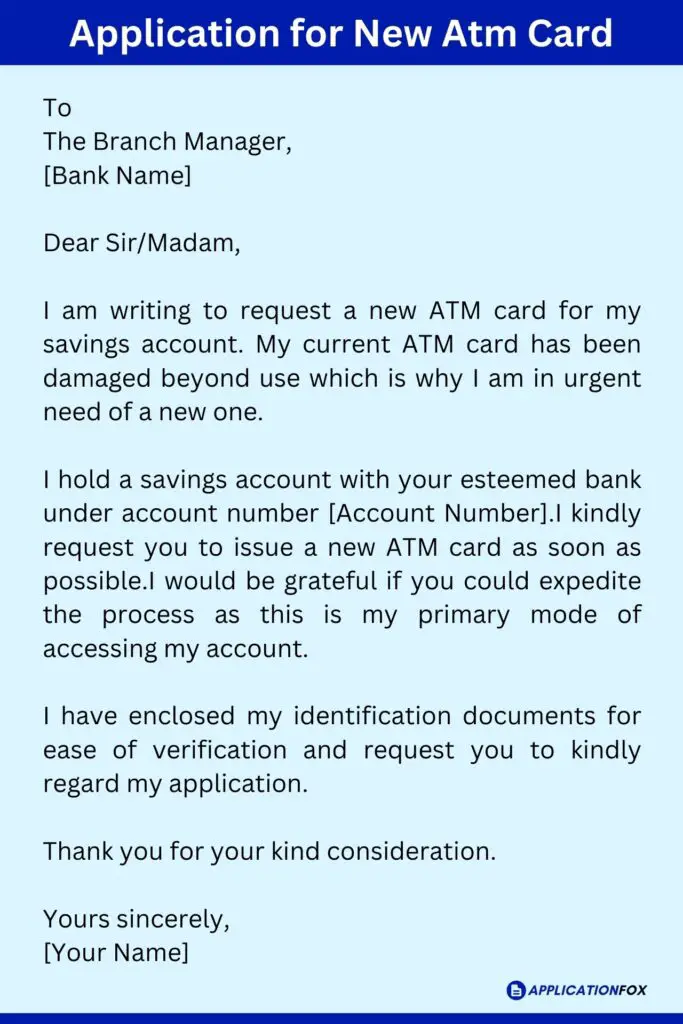

Sample Application for New ATM Card

To The Branch Manager, [Bank Name]

Dear Sir/Madam,

I am writing to request a new ATM card for my savings account. My current ATM card has been damaged beyond use which is why I am in urgent need of a new one.

I hold a savings account with your esteemed bank under account number [Account Number].I kindly request you to issue a new ATM card as soon as possible. I would be grateful if you could expedite the process as this is my primary mode of accessing my account.

I have enclosed my identification documents for ease of verification and request you to kindly regard my application.

Thank you for your kind consideration.

Yours sincerely, [Your Name]

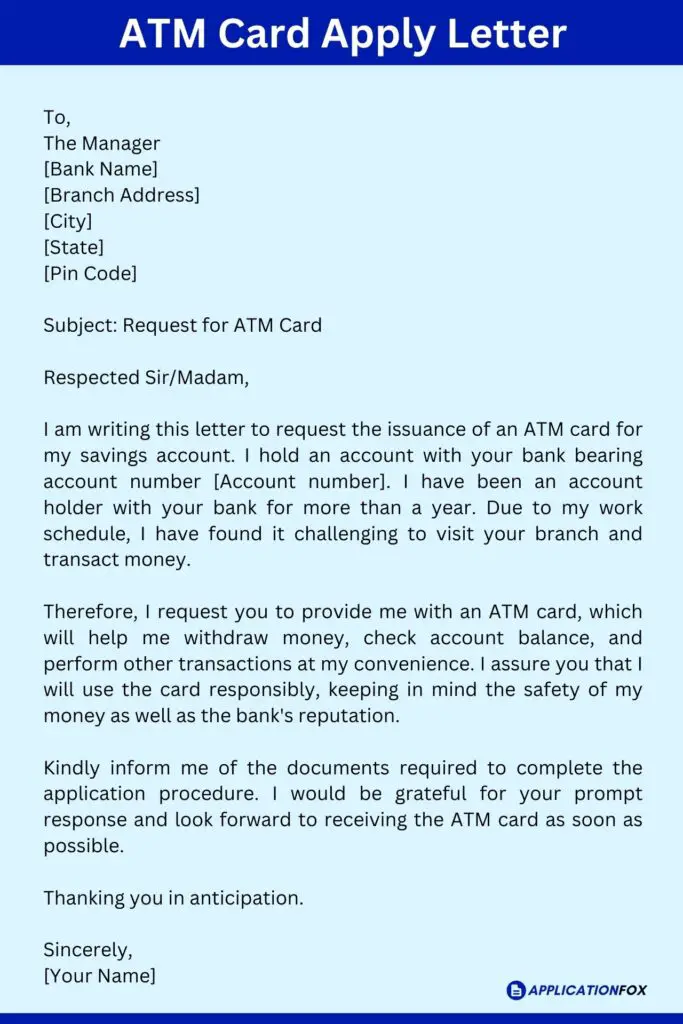

ATM Card Apply Letter Format

To, The Manager [Bank Name] [Branch Address] [City] [State] [Pin Code]

Subject: Request for ATM Card

Respected Sir/Madam,

I am writing this letter to request the issuance of an ATM card for my savings account. I hold an account with your bank bearing account number [Account number]. I have been an account holder with your bank for more than a year. Due to my work schedule, I have found it challenging to visit your branch and transact money.

Therefore, I request you to provide me with an ATM card, which will help me withdraw money, check account balance, and perform other transactions at my convenience. I assure you that I will use the card responsibly, keeping in mind the safety of my money as well as the bank’s reputation.

Kindly inform me of the documents required to complete the application procedure. I would be grateful for your prompt response and look forward to receiving the ATM card as soon as possible.

Thanking you in anticipation.

Sincerely, [Your Name]

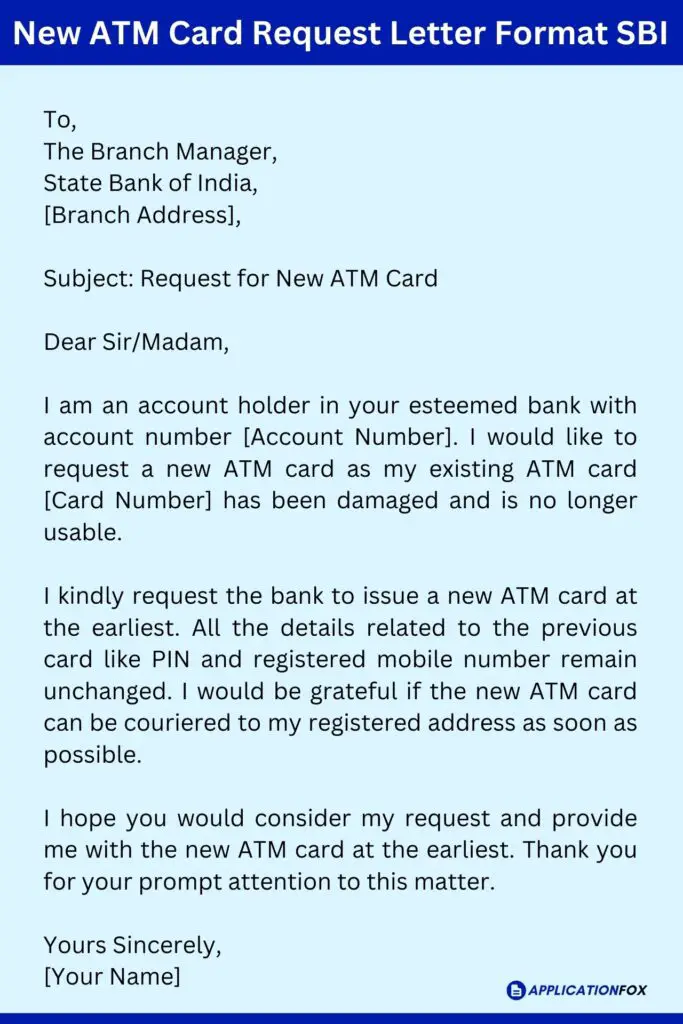

New ATM Card Request Letter Format SBI Example

To, The Branch Manager, State Bank of India, [Branch Address],

Subject: Request for New ATM Card

I am an account holder in your esteemed bank with account number [Account Number]. I would like to request a new ATM card as my existing ATM card [Card Number] has been damaged and is no longer usable.

I kindly request the bank to issue a new ATM card at the earliest. All the details related to the previous card like PIN and registered mobile number remain unchanged. I would be grateful if the new ATM card can be couriered to my registered address as soon as possible.

I hope you would consider my request and provide me with the new ATM card at the earliest. Thank you for your prompt attention to this matter.

Yours Sincerely, [Your Name]

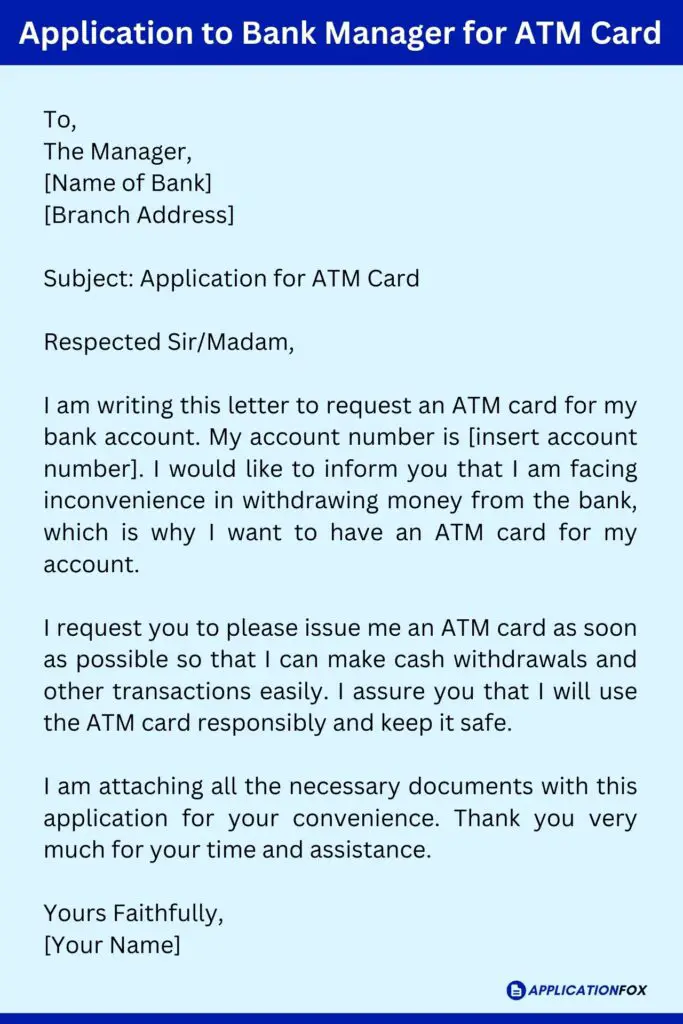

Sample Application to Bank Manager for ATM Card Format

To, The Manager, [Name of Bank] [Branch Address]

Subject: Application for ATM Card

I am writing this letter to request an ATM card for my bank account. My account number is [insert account number]. I would like to inform you that I am facing inconvenience in withdrawing money from the bank, which is why I want to have an ATM card for my account.

I request you to please issue me an ATM card as soon as possible so that I can make cash withdrawals and other transactions easily. I assure you that I will use the ATM card responsibly and keep it safe.

I am attaching all the necessary documents with this application for your convenience. Thank you very much for your time and assistance.

Yours Faithfully, [Your Name]

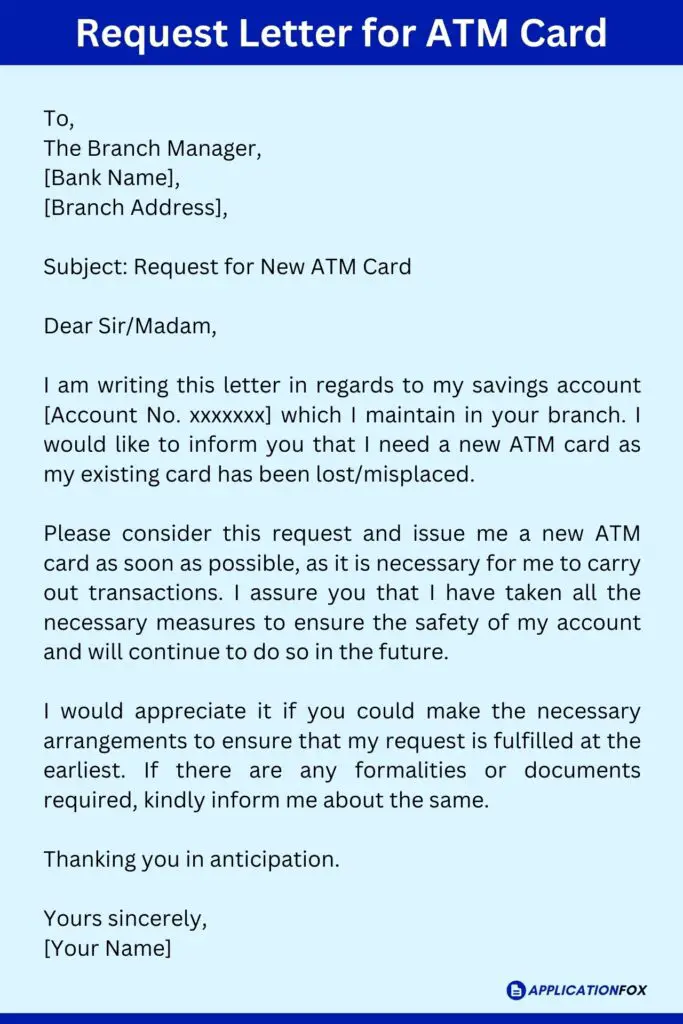

Formal Request Letter for ATM Card Sample

To, The Branch Manager, [Bank Name], [Branch Address],

I am writing this letter in regards to my savings account [Account No. xxxxxxx] which I maintain in your branch. I would like to inform you that I need a new ATM card as my existing card has been lost/misplaced.

Please consider this request and issue me a new ATM card as soon as possible, as it is necessary for me to carry out transactions. I assure you that I have taken all the necessary measures to ensure the safety of my account and will continue to do so in the future.

I would appreciate it if you could make the necessary arrangements to ensure that my request is fulfilled at the earliest. If there are any formalities or documents required, kindly inform me about the same.

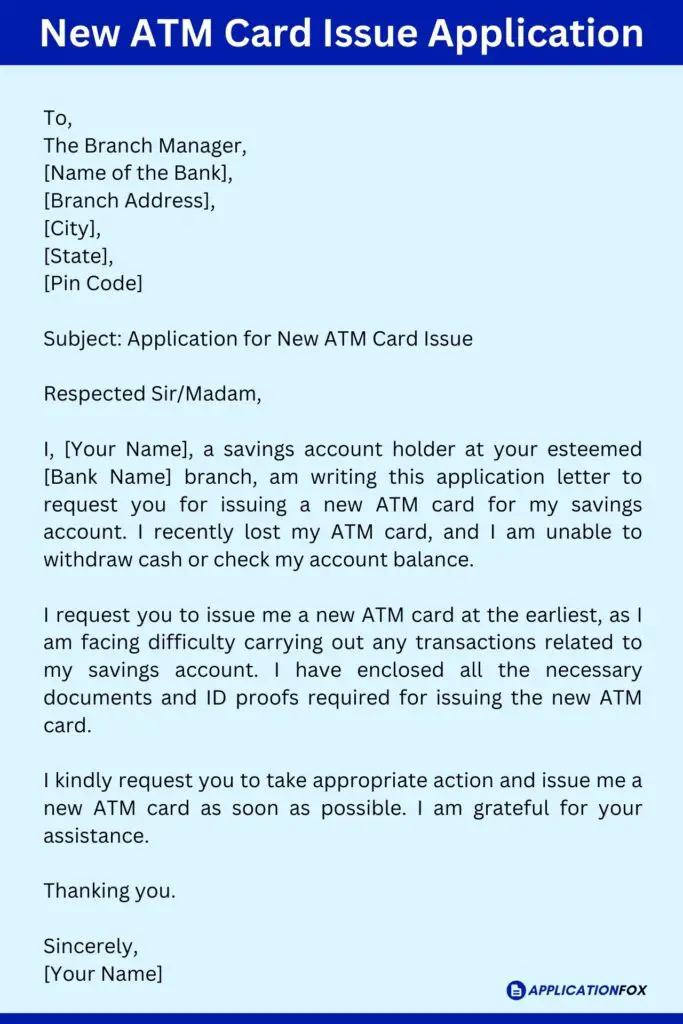

New ATM Card Issue Application Format

To, The Branch Manager, [Name of the Bank], [Branch Address], [City], [State], [Pin Code]

Subject: Application for New ATM Card Issue

I, [Your Name], a savings account holder at your esteemed [Bank Name] branch, am writing this application letter to request you for issuing a new ATM card for my savings account. I recently lost my ATM card, and I am unable to withdraw cash or check my account balance.

I request you to issue me a new ATM card at the earliest, as I am facing difficulty carrying out any transactions related to my savings account. I have enclosed all the necessary documents and ID proofs required for issuing the new ATM card.

I kindly request you to take appropriate action and issue me a new ATM card as soon as possible. I am grateful for your assistance.

Thanking you.

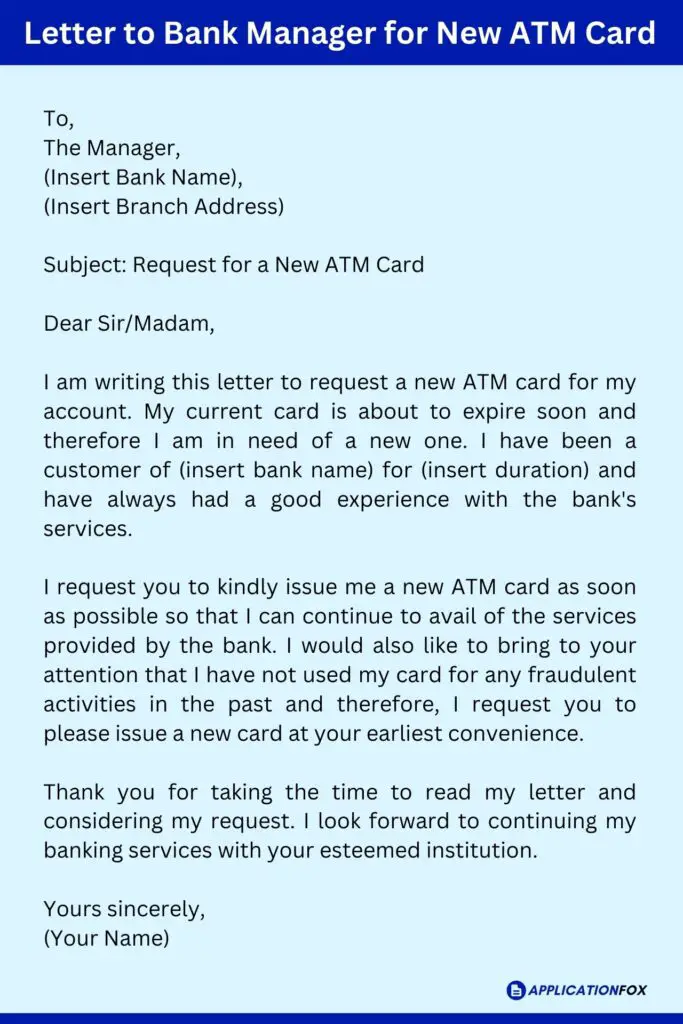

Sample Application Letter to Bank Manager for New ATM Card

To, The Manager, (Insert Bank Name), (Insert Branch Address)

Subject: Request for a New ATM Card

I am writing this letter to request a new ATM card for my account. My current card is about to expire soon and therefore I am in need of a new one. I have been a customer of (insert bank name) for (insert duration) and have always had a good experience with the bank’s services.

I request you to kindly issue me a new ATM card as soon as possible so that I can continue to avail of the services provided by the bank. I would also like to bring to your attention that I have not used my card for any fraudulent activities in the past and therefore, I request you to please issue a new card at your earliest convenience.

Thank you for taking the time to read my letter and considering my request. I look forward to continuing my banking services with your esteemed institution.

Yours sincerely, (Your Name)

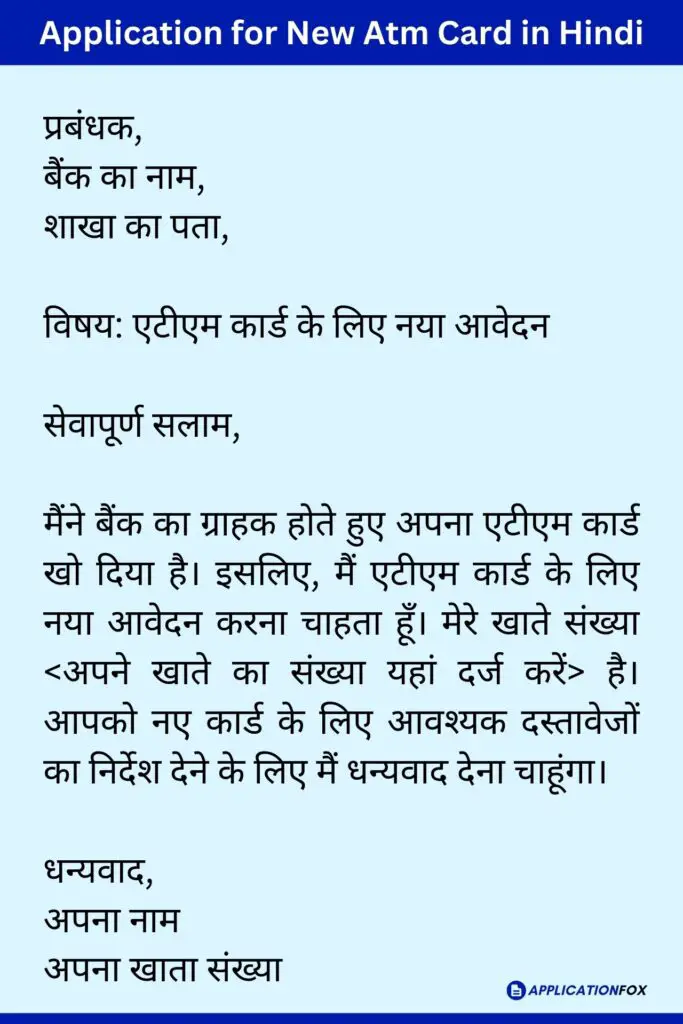

Sample Application for New ATM Card in Hindi

प्रबंधक, बैंक का नाम, शाखा का पता,

विषय: एटीएम कार्ड के लिए नया आवेदन

सेवापूर्ण सलाम,

मैंने बैंक का ग्राहक होते हुए अपना एटीएम कार्ड खो दिया है। इसलिए, मैं एटीएम कार्ड के लिए नया आवेदन करना चाहता हूँ। मेरे खाते संख्या <अपने खाते का संख्या यहां दर्ज करें> है। आपको नए कार्ड के लिए आवश्यक दस्तावेजों का निर्देश देने के लिए मैं धन्यवाद देना चाहूंगा।

धन्यवाद, अपना नाम अपना खाता संख्या

Application for New ATM Card: Things to Consider

When it comes to applying for a new ATM card, a proper application is necessary to ensure its approval. Your application should include all the necessary information and details that the bank requires. In this section, we’ll explore the essential components of a proper application, and how to structure it effectively.

Components of a Proper Application

- Purpose of Application: A brief introduction to your intent for applying for a new ATM card, such as a lost or stolen card, expiration, damage, or upgrading to a better card.

- Account Details: Important information about your account, such as account number, type of account, and branch name.

- Personal Information: Contact information like name, address, phone number, and email ID.

- Reason for Requesting a New ATM Card: A clear explanation for requesting a new ATM card and why replacing the existing card is necessary.

- Supporting Documents: Any necessary documents, such as photo identity proofs, address proofs, and other forms that the bank might require.

Structuring the Application

Writing a structured and well-formatted application is vital for getting a quick approval. Even minor discrepancies or lack of required information could lead to rejection or delays in processing. Therefore, you should follow the correct format while drafting your application letter. Here are some tips for structuring the application:

- Start with a proper heading containing the subject matter, reference number, and date.

- Address the letter formally to the bank manager or the concerned authority with proper salutations.

- Inform the bank about the reason for requesting a new ATM card and the account details.

- Elaborate the reason for requesting the new card and provide supporting documents if necessary.

- In conclusion, thank the bank manager or appropriate authority for considering the application and for their services.

By following the above tips, you can create a clear, concise, and well-structured application that increases your chances for the quicker process and faster approval of your new ATM card. Remember, preparing a structured and comprehensive application can pave the way to your cashless payment journey.

FAQs on Application for a New ATM Card

How can I apply for a new ATM card?

You can apply for a new ATM card by visiting your bank’s nearest branch or by applying through their online banking portal.

What documents are required to apply for a new ATM card?

You will need to submit a valid ID proof (such as Aadhaar card, driving license, passport), proof of address (such as utility bills), and your bank’s account details.

How long does it take to get a new ATM card?

The processing time may vary from bank to bank, but generally, it takes 7-10 working days to get a new ATM card.

Is there any fee for a new ATM card application?

Yes, most banks charge a nominal fee for a new ATM card . The fee may differ for different types of accounts.

Related posts:

- Application for Bank Statement – 11+ Samples, Formatting Tips, and FAQs

- Bank Passbook Missing Letter – 8+ Samples, Formatting Tips, and FAQs

- Application for Mobile Number Registration in Bank – 6+ Samples, Formatting Tips, and FAQs

- Application for Changing Signature in Bank – 5+ Samples, Formatting Tips, and FAQs

- Application for Name Change in Bank Account – 11+ Samples, Formatting Tips, and FAQs

- Application for Unblock Atm Card – 3+ Samples, Formatting Tips, and FAQs

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Application for New ATM Card (5+ Updated Samples)

If you have a bank account and have not received an ATM card while opening the account or you already have an ATM card that is lost or expired and now you need a new ATM card. So in order to issue a new ATM card, you have to write a request letter for an ATM card to the branch manager of your respective bank. In this post, I will share samples of applications requesting a new ATM card from the branch manager.

An ATM card is one of the easiest ways through which one can withdraw money from any ATM machine at any time. An ATM card is also known as a debit card and a debit card is used for many purposes.

Those of you who have used the facility of internet banking are eligible to apply for an ATM card through online mode, many banks provide online facilities for issuing new ATM cards. Otherwise, you can submit an application to the branch of the bank for a new ATM.

1. ATM Card Apply Letter

2. new atm card request letter sbi, 3. application to bank manager for atm card, 4. request letter for atm card, 5. application for atm card issue, 6. letter to bank manager for new atm card.

To, The Branch Manager, Canara Bank, A Block XYZ Road, Mumbai.

Date:- Date/Month/Year

Subject:- Request letter for new ATM card.

Requested Sir/Madam, I would like to inform you that I am “your name” an account holder in your branch. My account holder name is _________ and my account number is **********. I request you kindly issue me an ATM card as I do not have an ATM card. Also when I opened my bank account in your branch still I did not get the ATM card. Now, I need an ATM card for my work.

Therefore, kindly issue me an ATM card as soon as possible.

Thanking You, Yours Faithfully Signature

To, The Branch Manager, State Bank of India, B Block XYZ Road, Delhi.

Subject:- ATM card request letter.

Requested Sir/Madam, I am “your name” maintaining a savings bank account in your branch for the last 4 years. My account number is ********** and I live in _______. My ATM card having the number XXXXXXXXXXXX has been lost 3 days ago in “mention the area where your ATM is lost”. Now, I request you block my ATM card at the earliest and issue me a new ATM card. Documents required for the issue of a new ATM card to me are also attached to this letter.

Thank you in Advance, Yours Obediently Signature

To, The Branch Manager, Punjab National Bank, C Block XYZ Road, Bangalore.

Subject:- Application to issue new ATM card.

Requested Sir/Madam, I have lost my ATM card which was issued through your bank when I opened my bank account at your branch. My account holder name is ________ and my account number is **********. Now I request you cancel/block my ATM card and issue me a new ATM card.

I will be forever grateful to you if you do this in less time.

To, The Branch Manager, Union Bank, D Block XYZ Road, Hyderabad.

Subject:- Letter for ATM card issue.

Requested Sir/Madam, I am “mention your name” and I have a current account having account number **********. I request you please issue me a new ATM card because my current ATM card has been lost. Now I do not have an ATM card and due to this, I am not able to withdraw money.

Therefore, please accept my letter and do the needful.

Thanking You, Yours Truly Signature

To, The Branch Manager, Central Bank of India, E Block XYZ Road, Ahmadabad.

Subject:- New ATM card request application.

Requested Sir/Madam, With due respect, I request you to please issue me a new ATM card because my old ATM is broken into pieces and now it’s of no use. My account holder name is _____ and my account number is **********. I have attached the Xerox copy of my aadhaar card and PAN card in this application.

Therefore, please accept my application and start the process of issuing me a new ATM.

Thank you in Advance, Your Trusty Signature

To, The Branch Manager, Bank of India, F Block XYZ Road, Chennai.

Subject:- Issuing of ATM card for my account number **********.

Sir/Madam, With utmost respect, I would like to draw your attention that my ATM card which was issued at the time of opening a savings account with your branch is not working. Till now I have faced a lot of difficulties in withdrawing money from ATMs. My account details are as follows:

Account Holder Name:- _____________ Account Number:- _____________ Pan Number:- _____________ Aadhaar Number:- _____________ Mobile Number:- _____________

Hence, I request you please deactivate my current ATM card (mention the card number) and issue me a new ATM card as soon as possible.

Thanking You, Regards Signature

Related Read

- Cheque Book Request Letter

- Bank Account Address Change Letter for Bank

- Application for Change Mobile Number in Bank

- Bank Account Closing Letter

Frequently Asked Questions (FAQs)

What are the documents to apply for an atm card.

Documents required to apply ATM card are an Aadhar card, PAN card, Bank passbook, Voter ID card, and DOB proof.

How can I renew my ATM card?

You can renew your ATM card either through your respective bank ATM or by visiting your respective bank branch.

Can we apply for an ATM card from home?

Yes, some banks offer this facility through net banking. Whereas some banks only provide ATM card after visiting the respective bank.

Share this:

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to share on Telegram (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to print (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on Tumblr (Opens in new window)

- Click to share on Pocket (Opens in new window)

- Click to email a link to a friend (Opens in new window)

Related Post

1 thought on “application for new atm card (5+ updated samples)”.

New ATM card

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Smart Letters

Collection of Free Sample Letters

Application Letter for Credit Card

Brief Description of Application Letter for Credit Card:

The application letter for credit card is a formal and very common letter that is written by individuals to the banks and credit card companies in order to get a new credit card. The process of issuing a new credit card to a customer takes some time and it starts when the client makes a formal request to the bank or credit card Company asking for the card. This letter is formal but there is no need to hire professional drafter or lawyer to prepare this letter but it just needs a formal request to the bank manager or any other person who is in charge of credit cards in the bank by the client and it can written by individuals very easily.

Sample Application Letter for Credit Card To: senior manager Capital Citizen bank, main branch New York NY 35094 Subject: credit card issuance Date: 3 February 2015 Dear Sir, I am running a savings account in your bank with the number provided below for more than 5 years and up until now, I never felt the use of a credit card but as my business is expanding and I need to make additional expenses on daily basis, now it is very important for me to have a credit card. I am a regular customer of your bank for more than 4 years and that’s why I chose you to get the credit card. I talked to one of your employees in the credit card department last week and he asked me to write a formal request letter to the bank manager for a new credit card. So here I am sending you this formal letter and making a request to issue me a credit card with credit limit of $50,000 or more. I also have attached my account statement and you can see that I keep a good amount of cash in my account every time so I can assure you that I am not a liability for your bank. I have attached the testimony of one of your customers, Mr. Johnson and he has provided guaranty on behalf of me. So you can consider me request seriously. I hope you will start the process as soon as possible. I have attached the required documents with this application and if there is anything else needed, please let me know. Regards, Steven Britt Account number: 7467-0910940-01846-10-1934 Signature

More from my site

Related Post

Sample application letter, application letter for car lease, sample request letter to cancel a credit card, absence excuse letter for not attending school camp, excuse letters for being absent in school, excuse letters for missing work, sympathy and condolence letter.

Application To Bank Manager For Atm Card – New, Lost, Expired, Block

If you are looking for an application to bank manager for ATM card issues, we have covered you.

Wheater you want to issue a new atm card, or your atm expired or lost, and you want a new atm card, we have got all types of request letters for atm to the bank manager.

So let’s get started.

Table of Contents

1.Application for new ATM card

The Bank Manager

[Bank name]

[Branch name]

[Name of city/vill]

Date : day/month/year

Subject : Application requesting new ATM card

Respected sir/madam,

With the subject cited above I wish to draw your attention to the fact that I am an account holder in your esteemed bank, __ (branch name) branch. Earlier I used the bank itself to withdraw money. But now I need an ATM card due to lack of time and hence want to request you to issue me a new ATM card so that I can perform seamless transitions like before.

My account details are cited below:

[Account holder name :]

[Account number:]

[IFSC code]

[Old ATM card number ]

[Registered mobile number]

I therefore request you to grant my application and provide me with a new ATM card at the earliest possible time. I shall always be grateful to you for this kind act.

Thanking you

Yours sincerely

[Signature]

[Address with pin code]

2. Application for duplicate ATM card.

The Bank manager

Subject : Application requesting duplicate ATM card

With cordial regards I want to draw your attention to the fact that I have a savings account in your distinguished bank. A few days back a mishap occurred and I lost my ATM card. My account number is __ (your account number) . I urge you to kindly issue me a new ATM card and please block the previous ATM one.

I therefore request you to kindly consider this matter as of urgency and do the needful. This act of kindness will be highly applauded and appreciated.

Bank details:

[Account number]

Yours faithfully

3. Application for bank manager for ATM card first time

Branch name

Name of city/vill

Date: day/month/year

Subject : Application for the issue of ATM card

This is to bring to your kind attention that recently I have opened a savings account in your bank. I have been debiting money through the bank directly but now I have understood the drainage of time this process allows. I want you to kindly provide me with a ATM card which will save my precious time.

My bank account details

I am hopeful that you will do the needful at the earliest. If any money is required for the above mentioned process you are welcome to debit it from my account itself. You can also send the card to my below mentioned address. Your kind cooperation will really be high appreciated.

A lso Read:

- Application For Bank Account Transfer Letter To Manager

- Application For Closing Bank Account – Letter Format & 15+ Samples

- Application For Mobile Number Change In Bank Account Request Letter

- Bank Statement Application Letter To Manager – Format & Samples

4. Sample letter format to request new ATM card replacing expired ATM card

Subject : Letter requesting new ATM card.

I am Vickey Malhotra, a savings account holder in your bank. I want you to kindly issue a new ATM card as the old one has reached its expiry date and is not usable anymore.

Bank account details

It would be really appreciated if you treat this matter as of urgency and act accordingly.

[Signature ]

[Address with pin code]

5. Application to bank manager for ATM card not working

Subject: Application showcasing issues with ATM card.

The solemn intention of writing this letter is to gently notify you about the fact that I have been holding a savings account in your esteemed bank. My ATM card has stopped responding to the ATM machines. My ATM card number is __ (your ATM card number) .

I would like you to kindly provide me with a new ATM card as soon as possible.

All the necessary bank details and documents are attested with this application. I would feel highly served if you could look into this regard as soon as it is possible.

[Account holder name]

Yours sincerely

6. Application to bank manager for ATM card lost.

Date :day/month/year

Subject : Application to bank manager for lost ATM card.

I am writing this letter to inform you that my name is Ryan sharma, I am an account holder of your bank. I have recently lost my ATM card and am unable to debit money from the ATM machines. I want you to grant me a new ATM card.

My bank details

I therefore hope that you will act accordingly and help me out at the earliest possible.

Yours faithfully

7. Application to bank manager for ATM card block

Subject : Application requesting bank manager to ATM card block.

With due respect I want to state that I am Leela Jain, an account holder of your esteemed bank. I have recently lost my ATM card due to my own carelessness. I gravely regret this incident and will never repeat it. I request you to kindly block the card and issue me a new one.

My bank account details :

I hope that you will look into this matter at the earliest and help me out.

[Address with pin code]

8. Application to bank manager for ATM card unblock.

Subject : Application to bank manager for ATM card unblock.

This is to bring to your kind attention that I am a savings account holder in your esteemed bank. My account number is __ (your account number) . Recently it has come to my notice that my ATM card has been blocked due to unknown reasons. I wish to request you to kindly unblock it so that I can perform swift transactions.

My bank details are:

[ATM card number]

I urge you to kindly do the needful at the earliest possible. I shall be always grateful to you for this act of your kindness.

9. New ATM card request letter format canara bank

[Canara bank]

Subject : Application requesting new ATM card issue.

The intention behind this letter is that I am Nidhi Iyer, an account holder of your Canara bank branch.I have done my previous transactions through the bank itself and without an ATM card. I wish to request you to kindly issue me an ATM card which will save me time and will be of less hassle. My account number is __ (your account number) .

My bank account details:

[Registered mobile number]

I shall be obliged and grateful for your promptness towards my request.

10. India bank ATM card request letter

[India bank ]

[Branch name ]

Subject : Letter requesting issue of ATM card.

I wish to inform you that I have a savings account in your bank. I did not apply for an ATM card before as I did not require one. But now, I am in dire need of an ATM card. Through this letter I request you to kindly get me a new ATM card.

My bank details are as follows:

I therefore wish to request you to kindly help me out and issue me a new ATM card at the earliest possible.

More From Us: 10+ Application For Name Change & Correction In Bank Account

You may also like

10+ Application For Name Change & Correction In Bank Account

Application Letter For KYC Update In Bank Account – Samples

Application For Closing Bank Account – Letter Format & 15+ Samples

10+ Application for Update Email ID in Bank Account – Sample Letter

About the author.

Golam Md is the founder of Applicationloop.in, a blog that is exclusively dedicated to providing helpful tips, Samples and advice on writing effective application letters.

Leave a Comment X

Save my name, email, and website in this browser for the next time I comment.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit Cards

Credit card application rules by issuer

Lee Huffman

Ashley Barnett

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Grace Pilling

Published 5:53 a.m. UTC May 16, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

PaperFox, Getty Images

Many people get new credit cards to earn valuable bonuses, take advantage of special perks or get interest-free financing. These features can be expensive for card issuers, so they implement rules to limit how often you can get a new credit card. Some rules are explicitly written, while others are learned by trial and error.

Learn about the credit card application rules for the major card issuers, so you know when to take advantage of lucrative offers.

What are credit card application rules?

Credit card application rules dictate how often you can apply for a new credit card or receive a welcome bonus. These rules limit your ability to take advantage of welcome bonuses, intro APR offers and other benefits offered by the best credit cards . Some rules are time-based, while others kick in based on what credit cards you already have.

Each issuing bank has unique application rules for its credit cards, so it is important to understand how they affect you before applying.

Rules by issuer

By thoroughly reviewing issuer websites, getting feedback from readers and using our personal experiences, we’ve created this list of rules for the major credit card issuers . Following these rules will help you avoid unnecessary credit inquiries when you’re likely ineligible to receive a new credit card.

Here’s how to get a credit card from each of the major credit card companies in the U.S.

American Express application rules

American Express application rules state that customers can get approved for up to two credit cards every 90 days. However, if you apply for both cards on the same day, your applications may be put on hold while the bank reviews them manually.

Welcome offers and restrictions

American Express has a “once per lifetime” rule on welcome bonuses. This means that you can only receive a bonus once for each version of a credit card. However, anecdotal evidence suggests that you may become eligible again after seven years.

During the application process, Amex now has an online eligibility checker so you can avoid credit inquiries if you’re ineligible for a bonus. If you’re ineligible, you can close out your application before the bank checks your credit report.

Occasionally, American Express releases offers with no lifetime limit language. In this case, you may be eligible for a welcome bonus even if you’ve had the card previously.

Multiple credit card limits

American Express limits customers to five credit cards open at one time. However, charge cards are excluded from this limit.

Eligibility

American Express requires good to excellent credit for approval and does not offer subprime or secured credit cards. This typically means a FICO Score of 670 or higher.

Explore the top cards from this issuer: Best American Express credit cards of May 2024 .

our partner

Blueprint receives compensation from our partners for featured offers, which impacts how and where the placement is displayed.

American Express® Gold Card

Welcome bonus

- Earn 60,000 Membership Rewards® points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership.

Regular APR

Credit score.

Credit Score ranges are based on FICO® credit scoring. This is just one scoring method and a credit card issuer may use another method when considering your application. These are provided as guidelines only and approval is not guaranteed.