- Certifications

- Associate Business Strategy Professional

- Senior Business Strategy Professional

- Examination

- Partnership

- For Academic Affiliation

- For Training Companies

- For Corporates

- Help Center

- Associate Business Strategy Professional (ABSP™)

- Senior Business Strategy Professional (SBSP™)

- Certification Process

- TSI Certification Examination

- Get your Institution TSI Affiliated

- Become a Corporate Education Partner

- Become a Strategy Educator

- Frequently Asked Questions

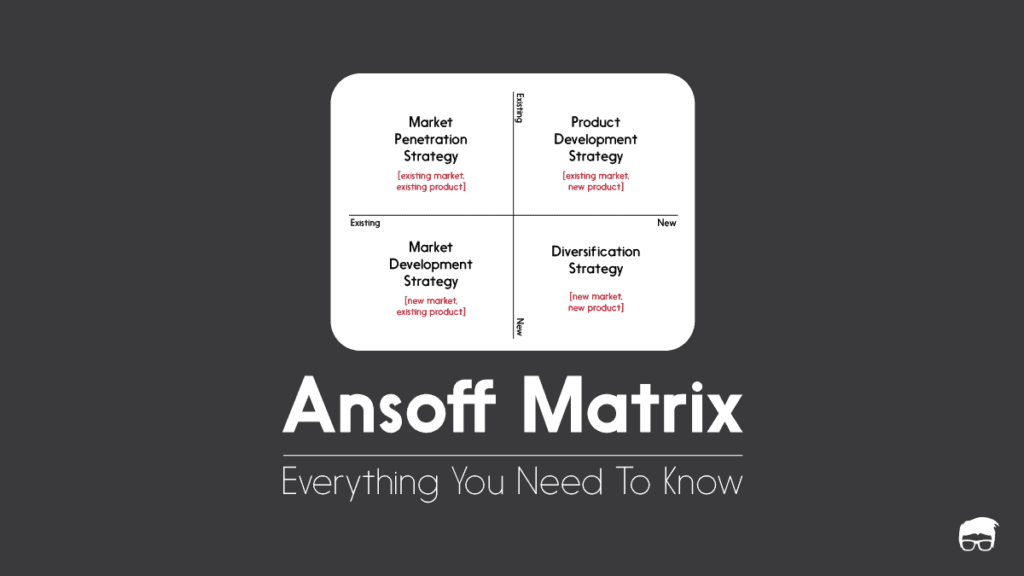

The Ansoff Matrix: A Powerful Tool for Business Strategy and Growth

In today's fast-paced and ever-changing business landscape, companies must continuously seek out new opportunities for growth in order to remain competitive and thrive. However, identifying the most promising avenues for expansion and weighing the associated risks can be a daunting challenge for any business leader. This is where the Ansoff Matrix comes in - a simple yet highly effective strategy framework that has helped countless organizations successfully navigate the complexities of business growth for over half a century.

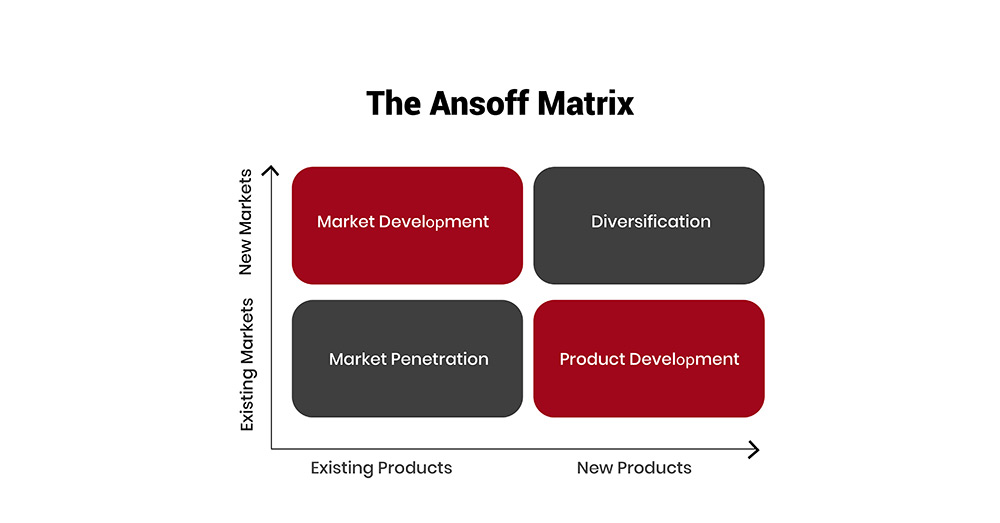

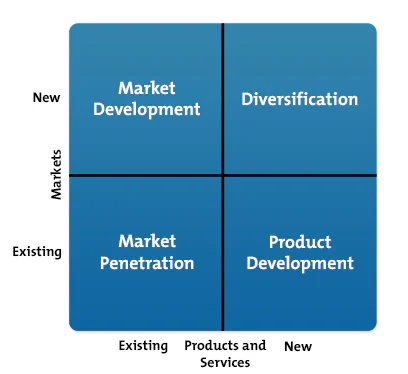

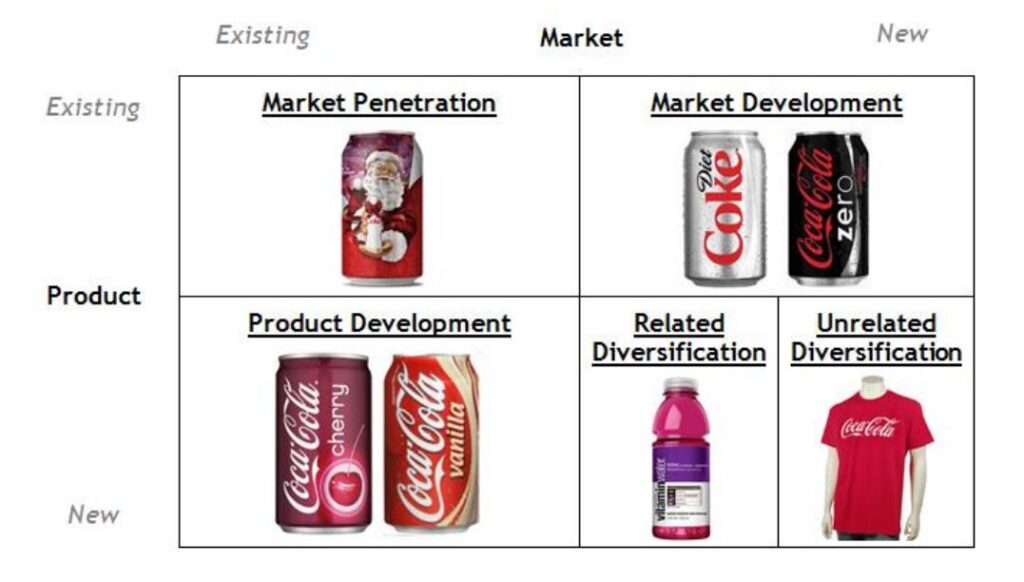

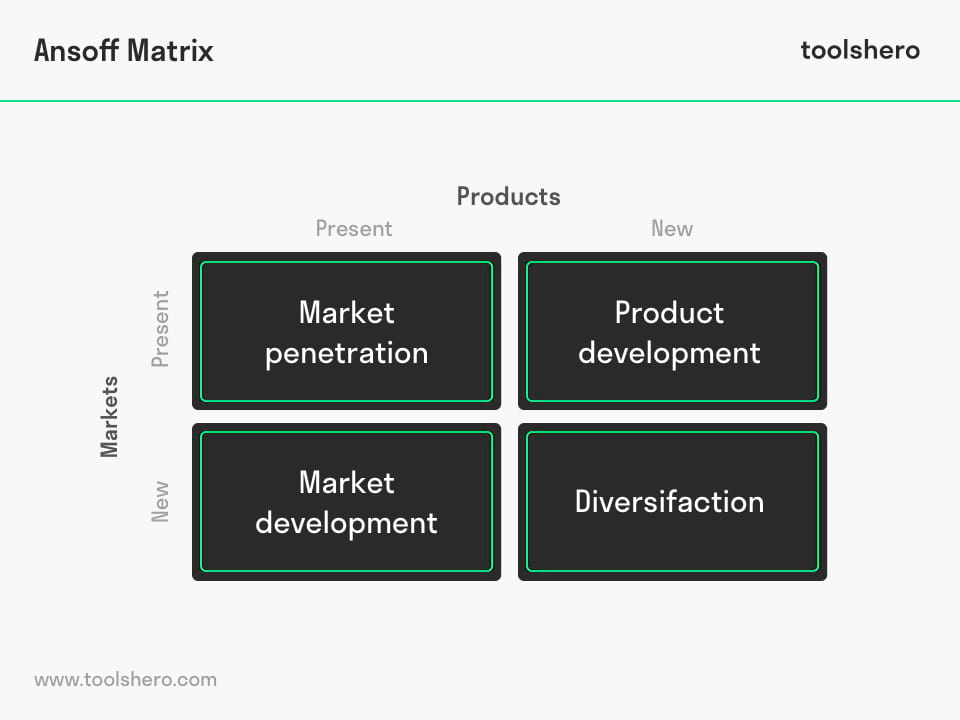

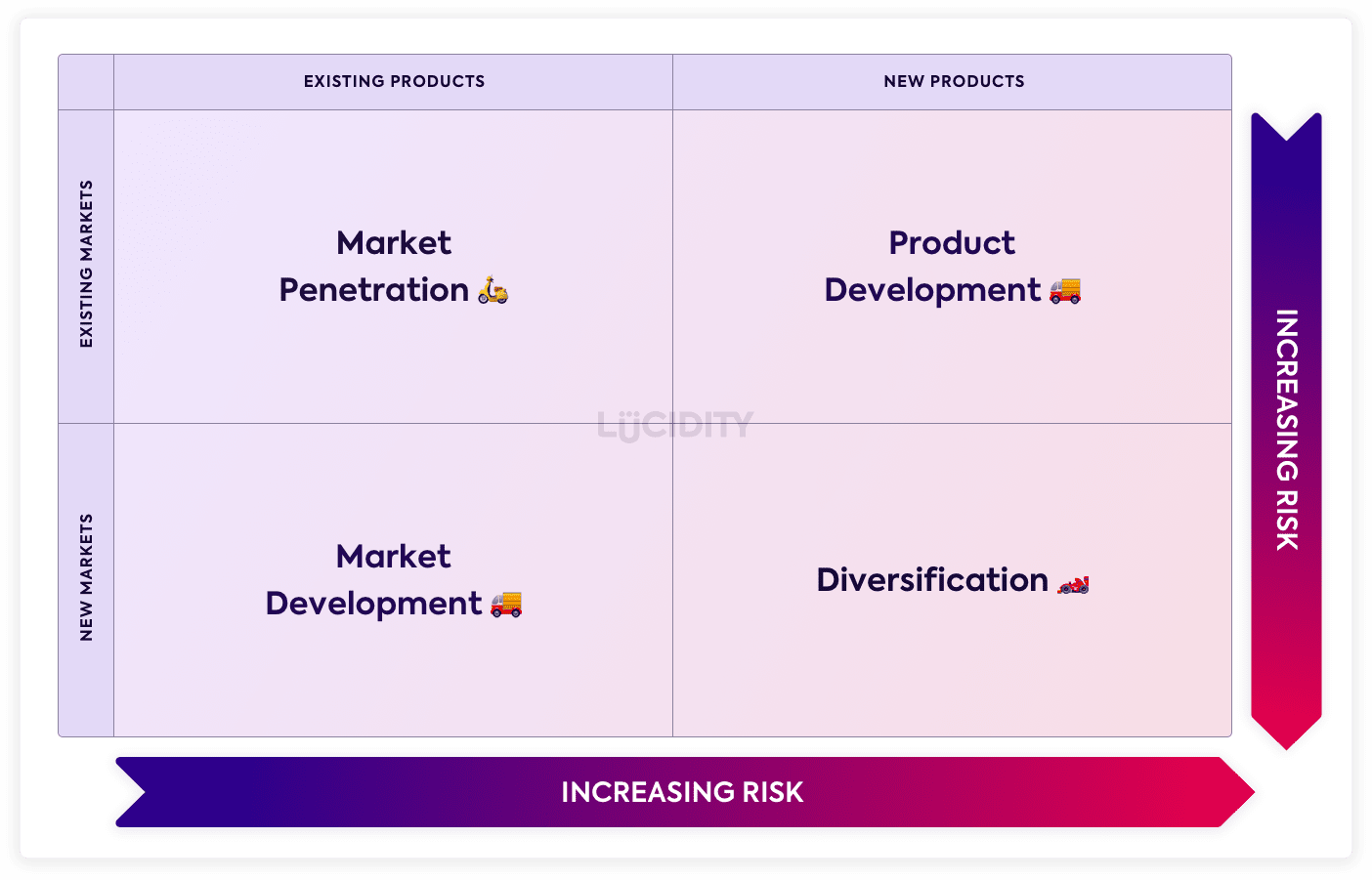

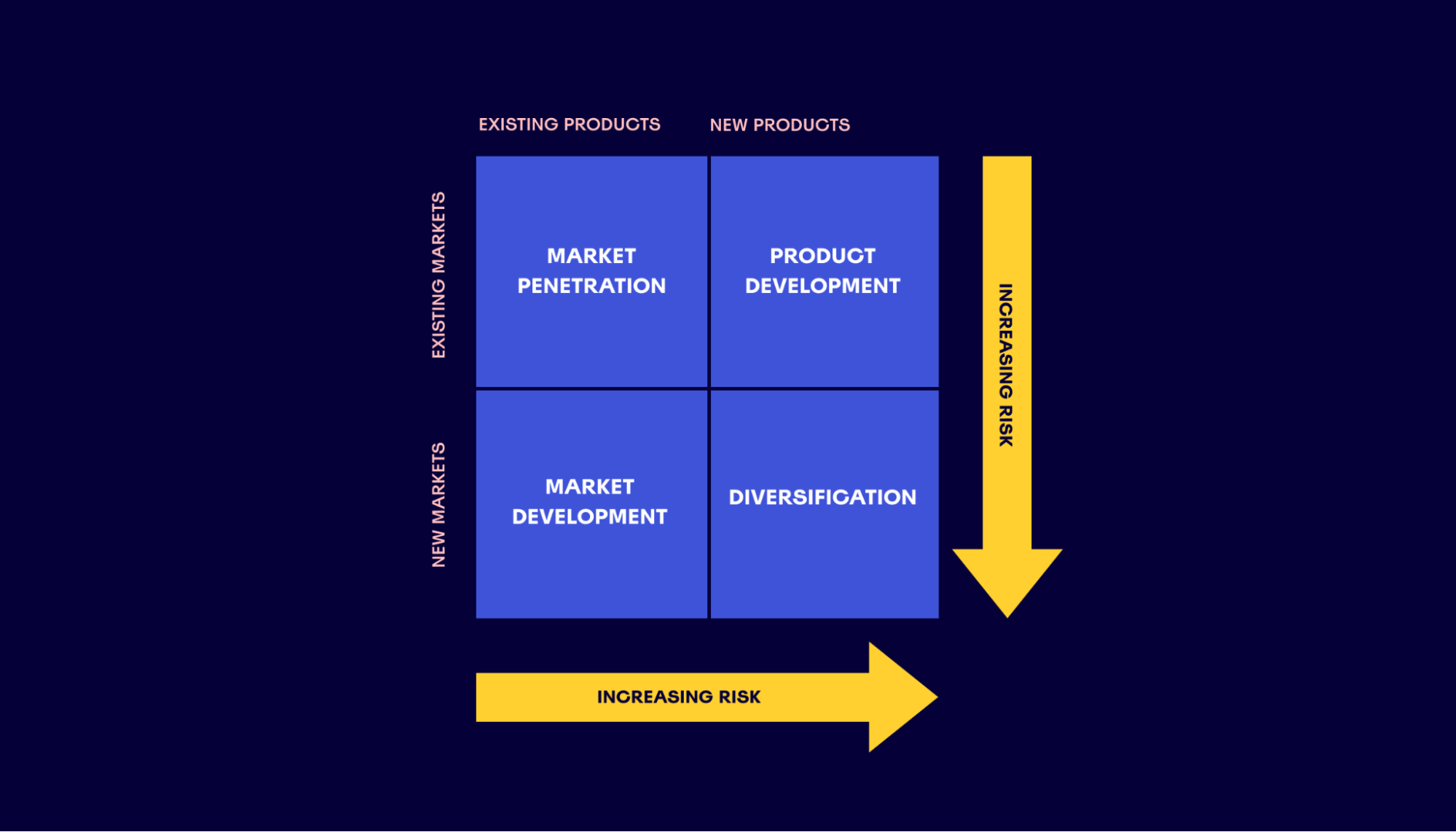

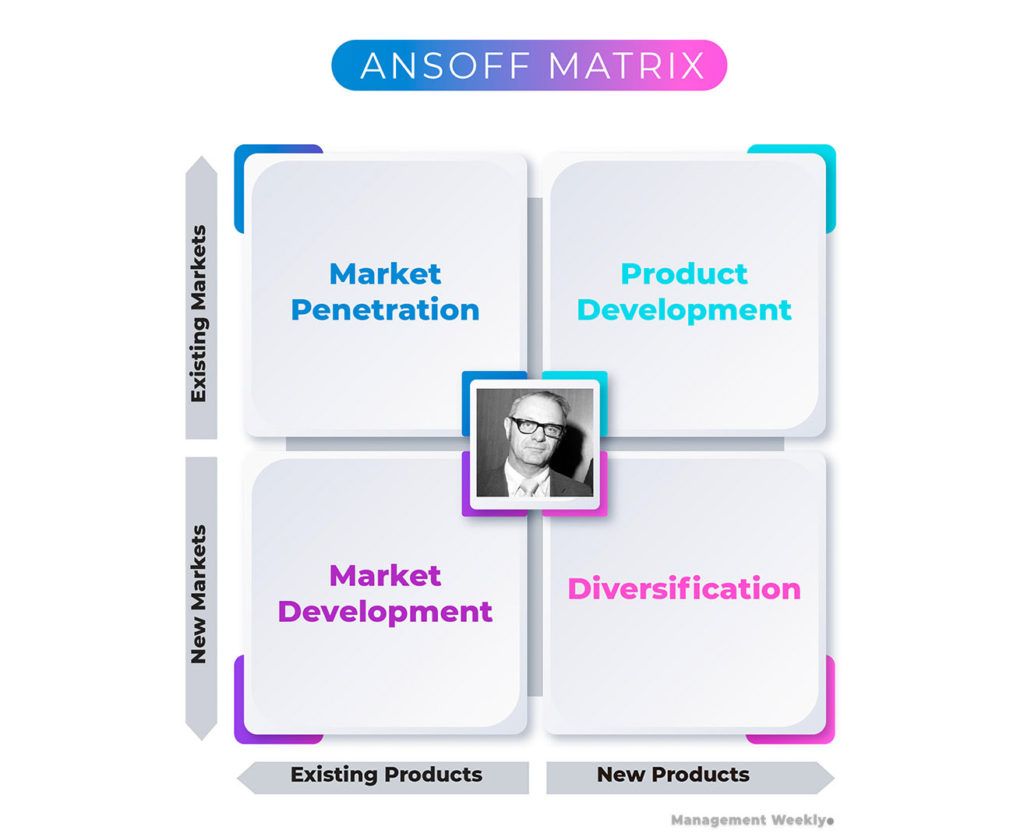

Developed by applied mathematician and business manager H. Igor Ansoff in 1957, the Ansoff Matrix (also known as the Product/Market Expansion Grid) provides a structured approach for evaluating different growth strategies based on whether they involve new or existing products and markets. By examining the four distinct quadrants of the matrix - Market Penetration, Market Development, Product Development, and Diversification - decision makers can gain valuable insights into the potential risks and rewards associated with each option, enabling them to make more informed choices and allocate resources effectively.

In this article, we will take an in-depth look at the Ansoff Matrix and its applications in business strategy . We'll explore the key characteristics and considerations for each of the four growth strategies, discuss the benefits and challenges of using the Ansoff Matrix, and provide practical tips and examples for putting this powerful tool into action. Let's dive in!

Understanding the Four Quadrants of the Ansoff Matrix

At the heart of the Ansoff Matrix lie four distinct growth strategies, each defined by a unique combination of products and markets (existing or new). These strategies are:

- Market Penetration: Focusing on increasing sales of existing products in existing markets.

- Market Development: Introducing existing products into new markets.

- Product Development: Developing new products for existing markets.

- Diversification: Creating new products for new markets.

The Four Growth Strategies of the Ansoff Matrix

Let's take a closer look at each quadrant and the key considerations for pursuing growth within these areas.

1. Market Penetration

The market penetration strategy focuses on increasing sales of existing products within existing markets. This approach is generally considered the least risky of the four options, as it leverages the company's established strengths and market knowledge. Typical tactics for achieving market penetration include:

- Increasing marketing and promotional efforts to attract new customers.

- Improving product quality or features to encourage repeat purchases.

- Adjusting pricing strategies to boost sales volume.

- Acquiring competitors to gain market share.

For example, a consumer packaged goods company seeking to increase its share of the snack food market might invest in targeted advertising campaigns, introduce new packaging designs, or offer promotional discounts to drive sales of its existing product lineup.

The primary advantage of the market penetration strategy is that it allows businesses to capitalize on their current assets and capabilities, minimizing the need for substantial investments in new product development or market exploration. However, the potential for growth may be limited, particularly in mature or saturated markets where competition is fierce and opportunities for differentiation are scarce.

2. Market Development

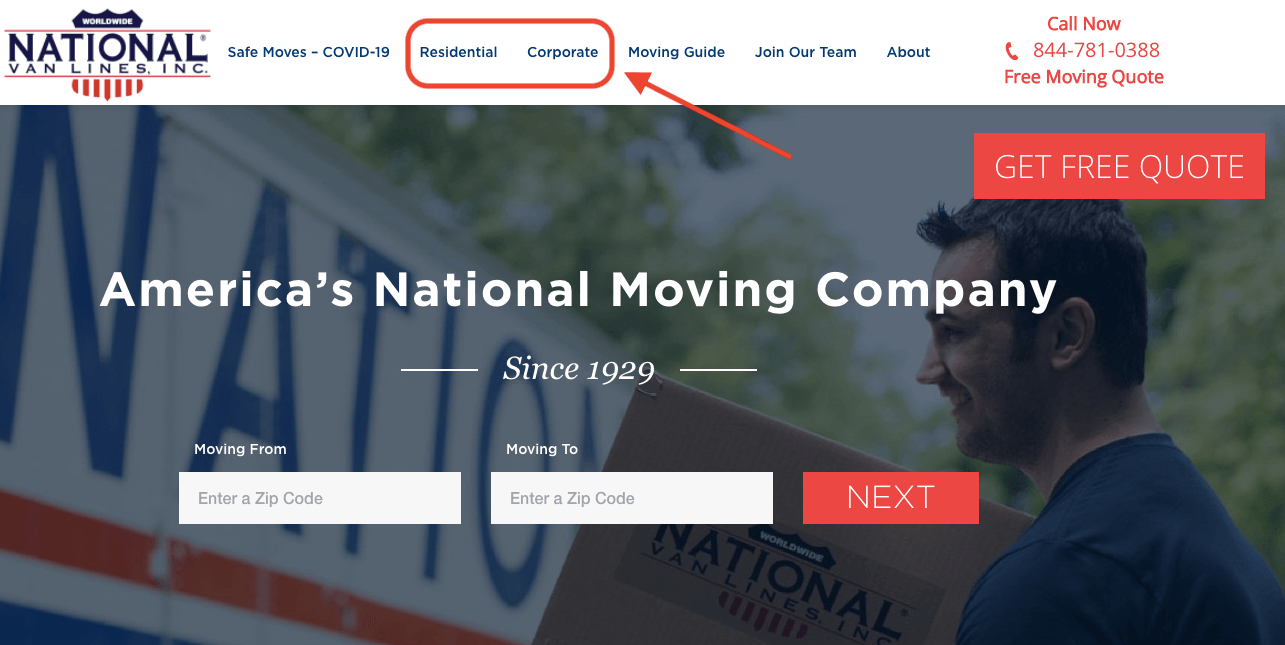

The market development strategy involves taking existing products into new markets, whether by targeting different customer segments, expanding into new geographic regions, or exploring alternative distribution channels. This approach enables companies to leverage their proven product offerings while tapping into fresh sources of demand. Common market development tactics include:

- Adapting products or marketing messages to appeal to new demographics.

- Establishing a presence in untapped geographic markets, either domestically or internationally.

- Partnering with new distributors or retailers to reach wider audiences.

- Developing online sales channels to complement brick-and-mortar operations.

A classic example of successful market development is Apple's expansion into the Chinese market, where the company's iconic iPhone and iPad products have found a massive new customer base.

While market development can open up significant growth opportunities, it also comes with its own set of risks and challenges. Entering new markets often requires substantial investments in market research, localization, and infrastructure development, and companies may face intense competition from established players or cultural barriers to adoption.

3. Product Development

Product development focuses on creating new products to serve your existing market. This strategy aims to leverage your brand's reputation and customer loyalty to introduce innovative offerings that address evolving customer needs or capitalize on emerging trends.

To implement a product development strategy , businesses should:

- Invest in research and development to identify opportunities for innovation and create products that align with customer needs.

- Gather customer feedback and insights to inform product design and features.

- Collaborate with key stakeholders, such as suppliers and distributors, to ensure successful product launches.

- Develop a strong value proposition and marketing strategy to generate interest and demand for the new product.

An example of product development is a smartphone manufacturer introducing a new model with advanced features to appeal to its loyal customer base.

4. Diversification

Diversification is the riskiest of the four growth strategies, as it involves entering entirely new markets with new products. This strategy can be further divided into two types:

a. Related Diversification: Expanding into new markets or products that are related to your existing business, allowing for potential synergies in terms of resources, capabilities, or customer base. An example of related diversification is a car manufacturer expanding into the electric bicycle market, leveraging its expertise in vehicle design and manufacturing.

b. Unrelated Diversification: Venturing into markets or products that are unrelated to your current business, which can help mitigate risks associated with relying on a single market or product line. An example of unrelated diversification is a software company acquiring a chain of fitness centers to diversify its portfolio.

To pursue a diversification strategy, businesses should:

- Thoroughly assess the risks and potential returns associated with entering new markets or developing new products.

- Conduct extensive market research to validate the demand for the new product or service in the target market.

- Develop a clear understanding of the resources and capabilities required to successfully execute the diversification strategy.

- Create a robust plan for integrating the new business into the organization's overall structure and operations.

By carefully considering diversification opportunities through the lens of the Ansoff matrix, business leaders can make strategic decisions that drive growth while managing risk. The key is to find the right balance between leveraging existing strengths and exploring new opportunities in a way that aligns with the company's overall vision and goals.

Benefits of Using the Ansoff Matrix

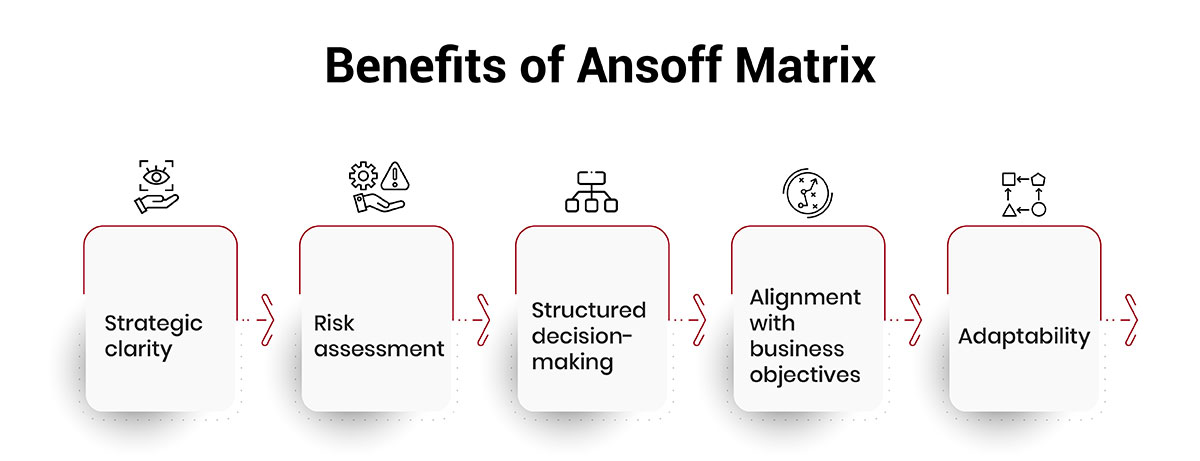

The Ansoff Matrix offers several key benefits for business leaders and organizations:

- Strategic clarity: By providing a clear framework for evaluating growth options, the Ansoff Matrix helps business leaders gain clarity on their strategic direction and prioritize initiatives based on their risk-return profile.

- Risk assessment: The matrix helps businesses understand the relative risks associated with each growth strategy, enabling them to make informed decisions and allocate resources appropriately.

- Structured decision-making: Using the Ansoff Matrix encourages a structured approach to decision-making, ensuring that all relevant factors are considered when evaluating growth opportunities.

- Alignment with business objectives: By aligning growth strategies with the overall business strategy and objectives, the Ansoff Matrix helps ensure that initiatives are focused and purposeful.

- Adaptability: The framework can be applied to various industries, business sizes, and market conditions, making it a versatile tool for any organization seeking growth.

How to Apply the Ansoff Matrix in Your Business

To effectively use the Ansoff Matrix in your business, follow these steps:

- 1. Assess your current situation: Evaluate your existing products, markets, and capabilities to establish a clear understanding of your starting point.

- 2. Identify potential growth opportunities: Brainstorm potential growth options within each of the four quadrants of the Ansoff Matrix, considering your business's strengths, weaknesses, and market trends.

- 3. Evaluate risks and potential returns: Assess the risks and potential returns associated with each growth option, taking into account factors such as market demand, competition, and required resources.

- 4. Prioritize growth strategies: Based on your risk assessment and alignment with business objectives, prioritize the growth strategies that offer the best balance of risk and return for your organization.

- 5. Develop an implementation plan: Create a detailed plan for executing your chosen growth strategy, including resource allocation, timelines, and key performance indicators (KPIs) to measure success.

- 6. Monitor and adapt: Continuously monitor the performance of your growth initiatives and be prepared to adapt your strategy as market conditions or business circumstances change.

Real-World Examples of Ansoff Matrix Application

Here are some real-world examples of Ansoff Matrix application:

- Market Penetration: Coca-Cola, the global beverage giant, has successfully employed market penetration strategies by increasing its advertising efforts, running promotional campaigns, and expanding its distribution network to reach more consumers within its existing markets.

- Market Development: Netflix, the streaming service provider, has pursued market development by expanding its services globally, entering new countries, and adapting its content offerings to suit local preferences.

- Product Development: Apple, the technology company, consistently engages in product development by introducing new products and services, such as the iPhone, iPad, and Apple Watch, to its existing customer base.

- Diversification: Amazon, the e-commerce and cloud computing company, has diversified its business by entering new markets and offering new products, such as Amazon Web Services (AWS) and Amazon Prime Video, which are distinct from its original online retail business.

The Ansoff Matrix is a powerful strategy framework that helps business leaders evaluate and plan for growth. By considering market penetration, market development, product development, and diversification strategies, companies can make informed decisions about how to expand their business while managing risk.

Each growth strategy within the Ansoff Matrix comes with its own set of opportunities and challenges. Market penetration, the least risky option, focuses on increasing sales of existing products within current markets. Market development involves selling existing products in new markets, while product development introduces new products to existing markets. Diversification, the riskiest strategy, entails entering new markets with new products and can be further divided into related and unrelated diversification.

To effectively apply the Ansoff Matrix, businesses should assess their current situation, identify potential growth opportunities, evaluate risks and returns, prioritize strategies, develop an implementation plan, and continuously monitor and adapt their approach as needed.

Whether pursuing market penetration, market development, product development, or diversification, the key is to find the right balance between leveraging existing strengths and exploring new opportunities in a way that aligns with the company's overall vision and goals.

Recent Posts

How Data Analytics Can Revolutionize Your Business - A Strategist's Guide

Download this Strategist's Guide to empower yourself with resourceful insights:

- Roadblocks to Data Usage

- Advantages that Data Analytics offer for businesses

- Elements of a Data Analytics Strategy

- Top reasons why businesses must adopt a Data Analytics Strategy

- Case studies, Scenarios, and more

CredBadge™ is a proprietary, secure, digital badging platform that provides for seamless authentication and verification of credentials across digital media worldwide.

CredBadge™ powered credentials ensure that professionals can showcase and verify their qualifications and credentials across all digital platforms, and at any time, across the planet.

Verify A Credential

Please enter the License Number/Unique Credential Code of the certificant. Results will be displayed if the person holds an active credential from TSI.

Stay Informed!

Keep yourself informed on the latest updates and information about business strategy by subscribing to our newsletter.

Start Your Journey with The Strategy Institute by Creating Your myTSI Account Today.

- Manage your professional profile conveniently.

- Manage your credentials anytime.

- Share your experiences and ideas with The Strategy Institute.

Account Login

- Remember Password

- Forgot Password?

Forgot Password

How it works

For Business

Join Mind Tools

Article • 8 min read

The Ansoff Matrix

Understanding the risks of different strategic options.

By the Mind Tools Content Team

(Also known as the Product/Market Expansion Grid)

Successful leaders understand that if their organization is to grow in the long term, they can't stick with a "business as usual" mindset, even when things are going well. They need to find new ways to increase profits and reach new customers.

There are numerous options available, such as developing new products or entering new or existing markets, but how do you know which one will work best for your organization?

In this article, we'll look at a model called the Ansoff Matrix which can help you to do just that by getting you to think about the potential risks of each option, and to devise the most suitable plan based on your situation.

What Is the Ansoff Matrix?

The Ansoff Matrix was developed by H. Igor Ansoff and first published in the Harvard Business Review in 1957, in an article titled "Strategies for Diversification." [1] It has given generations of marketers and business leaders a quick and simple way to think about the risks of growth.

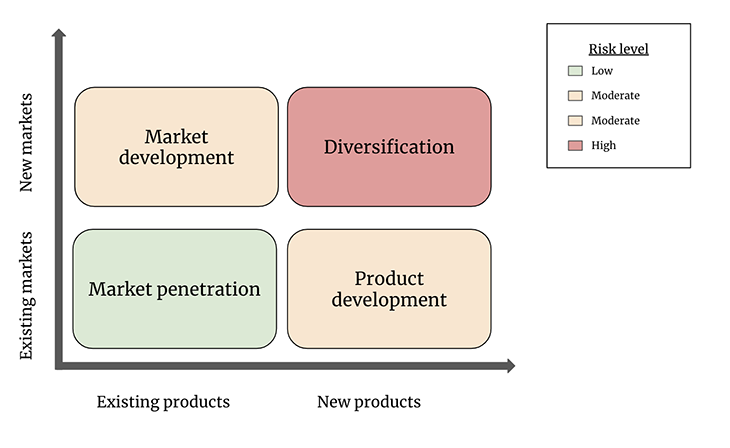

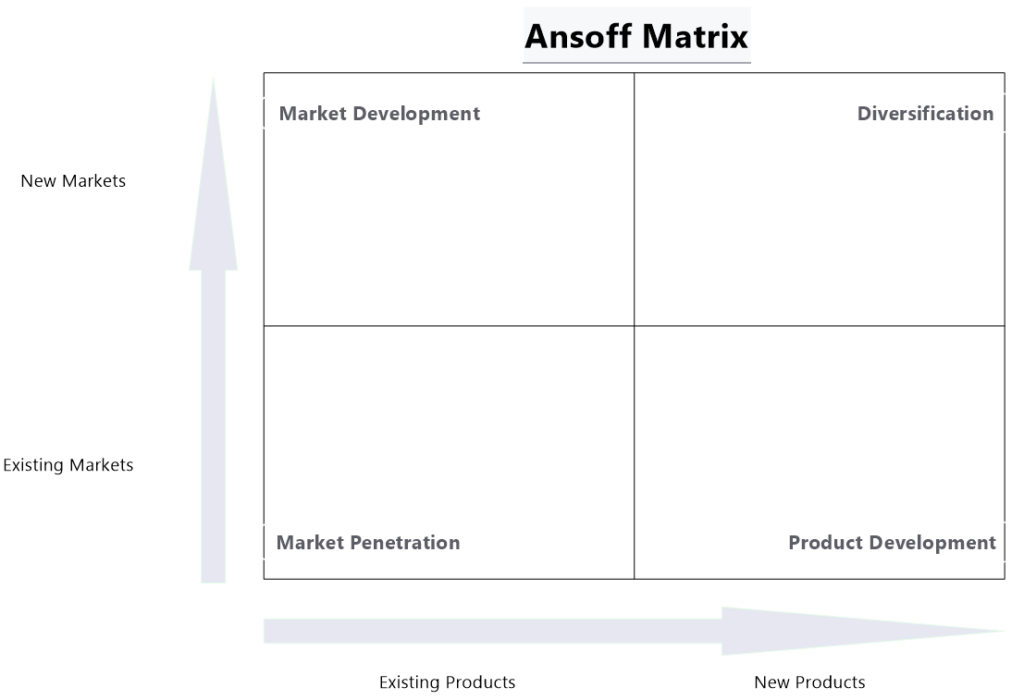

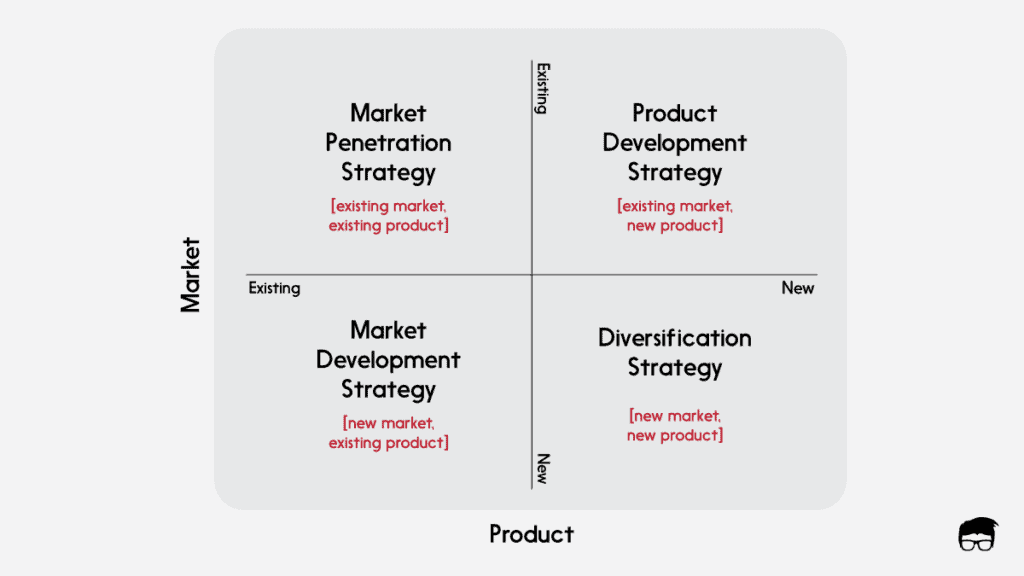

Also known as the Corporate Ansoff Matrix and the Product/Market Expansion Grid, the Matrix (see figure 1, below) shows four strategies you can use to grow your business. It also helps you analyze the risks associated with each one. The idea is that each time you move into a new quadrant (horizontally or vertically), risk increases.

Figure 1: The Ansoff Matrix

You can also use the Ansoff Matrix as a personal career planning tool. It can help you weigh up the risks of certain career decisions, and to choose the best option for you. Learn more about how to do this in our article, the Personal Ansoff Matrix .

The Four Quadrants of the Ansoff Matrix

Let's examine each quadrant of the Matrix in more detail.

- Market Penetration (lower left quadrant) . This is the safest of the four options. Here, you focus on expanding sales of your existing product in your existing market: you know the product works, and the market holds few surprises for you.

- Product Development (lower right quadrant) . This area is slightly more risky, because you're introducing a new product into your existing market.

- Market Development (upper left quadrant) . Here, you're putting an existing product into an entirely new market. You can do this by finding a new use for the product, or by adding new features or benefits to it.

- Diversification (upper right quadrant) . This is the riskiest of the four options, because you're introducing a new, unproven product into an entirely new market that you may not fully understand.

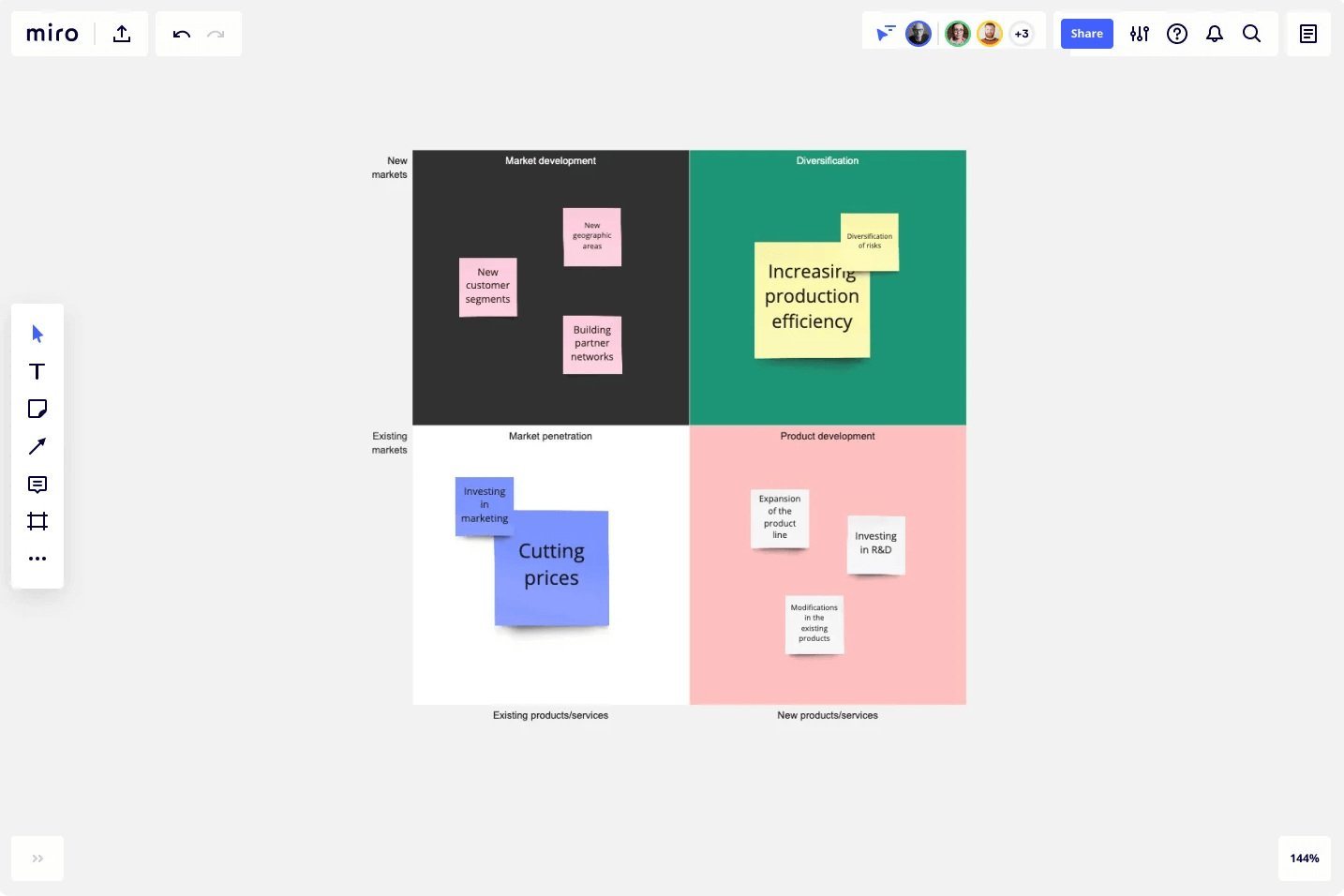

How to Use the Ansoff Matrix

Now, let's take a look at how you can use the Ansoff Matrix to weigh up the different risks involved when making strategic growth and marketing decisions:

Step 1: Analyze Your Options

Download our free Ansoff Matrix Worksheet . You can use this to plot the approaches you're considering on the Matrix. The table below helps you to think about how you might classify different approaches.

Reprinted by permission of Harvard Business Review . From "Strategies for Diversification" by H. Igor Ansoff, 1957. Copyright © 1957 by the Harvard Business School Publishing Corporation; all rights reserved. [1]

Step 2: Manage Risks

Conduct a Risk Analysis to gain a better understanding of the dangers associated with each option. (If there are a lot of these, prioritize them using a Risk Impact/Probability Chart .) Then, create a contingency plan that addresses the risks you'll most likely face.

Step 3: Choose the Best Option

By now, you might have a sense of which option is right for you and your organization. But to double-check your findings use the Decision Matrix Analysis to weigh up the different factors you've brainstormed for each quadrant.

Using a Nine-Box Ansoff Matrix

Some marketers use a nine-box grid for a more sophisticated analysis. This puts "modified" products between existing and new ones (for example, a different flavor of your existing pasta sauce rather than launching a soup), and "expanded" markets between existing and new ones (for example, opening another store in a nearby town, rather than expanding internationally).

This is useful as it shows the difference between product extension and true product development, and also between market expansion and venturing into genuinely new markets (see figure 2, below).

However, be careful of the three "options" in orange, as they involve trying to do two things at once without the one benefit of a true diversification strategy: completely escaping a downturn in a single-product market.

Figure 2: The Nine-Box Grid

The Ansoff Matrix was originally developed by H. Igor Ansoff in 1957. It offers marketers a simple and effective way of weighing up the options and risks involved when taking new strategic decisions.

The Matrix outlines four possible avenues for growth, which vary in risk:

- Market Penetration.

- Product Development.

- Market Development.

- Diversification.

To use the Matrix, plot your options into the appropriate quadrant. Next, look at the risks associated with each one, and develop a contingency plan to address the ones that will most likely affect you. This will help you make informed and effective strategic marketing decisions for your organization.

Download Worksheet

[1] Ansoff, H. (1957.) 'Strategies for Diversification,' Harvard Business Review , Volume 35, Issue 5, October 1957. (Available here .)

You've accessed 1 of your 2 free resources.

Get unlimited access

Discover more content

Different types of budget.

A Quick Summary of the Format and Purpose of the Different Types of Budgets

Book Insights

The Strategy Book

Max Mckeown

Add comment

Comments (1)

Annelies Tjebbes

Thanks for this valuable article. Just a heads up that the link to the Ansoff Matrix leads to a link for the Force Field Analysis worksheet by accident. Would love to have access to the Ansoff Matrix worksheet if possible. Thanks!

Sign-up to our newsletter

Subscribing to the Mind Tools newsletter will keep you up-to-date with our latest updates and newest resources.

Subscribe now

Business Skills

Personal Development

Leadership and Management

Member Extras

Most Popular

Latest Updates

Pain Points Podcast - Presentations Pt 2

NEW! Pain Points - How Do I Decide?

Mind Tools Store

About Mind Tools Content

Discover something new today

Finding the Best Mix in Training Methods

Using Mediation To Resolve Conflict

Resolving conflicts peacefully with mediation

How Emotionally Intelligent Are You?

Boosting Your People Skills

Self-Assessment

What's Your Leadership Style?

Learn About the Strengths and Weaknesses of the Way You Like to Lead

Recommended for you

Eisenhower's urgent/important principle.

Using Time Effectively, Not Just Efficiently

Business Operations and Process Management

Strategy Tools

Customer Service

Business Ethics and Values

Handling Information and Data

Project Management

Knowledge Management

Self-Development and Goal Setting

Time Management

Presentation Skills

Learning Skills

Career Skills

Communication Skills

Negotiation, Persuasion and Influence

Working With Others

Difficult Conversations

Creativity Tools

Self-Management

Work-Life Balance

Stress Management and Wellbeing

Coaching and Mentoring

Change Management

Team Management

Managing Conflict

Delegation and Empowerment

Performance Management

Leadership Skills

Developing Your Team

Talent Management

Problem Solving

Decision Making

Member Podcast

Ansoff Matrix: Use, Examples, Case Study, and Template – Comprehensive Overview

What is the ansoff matrix.

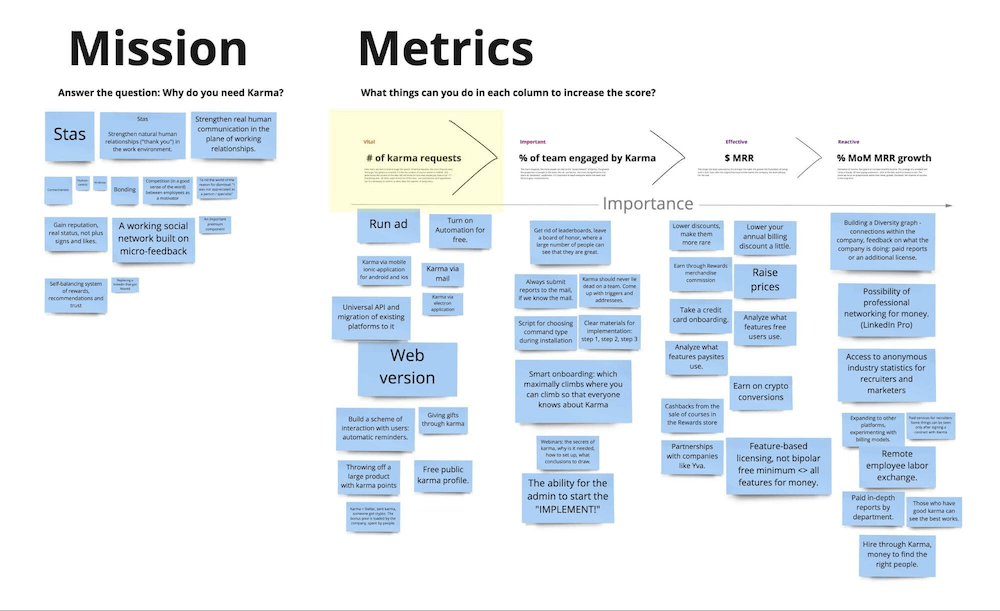

Ansoff matrix also known as corporate Ansoff matrix and product/market expansion grid is an essential business strategy tool used in business schools globally. The model focuses on providing a structure for business owners and marketers to strategize growth and risks of growth for their businesses. The Ansoff Matrix can be used during various stages of a product or a company life cycle making it one of the most versatile tools for managers. From Strategic Exercise to Market Planning,

Ansoff matrix helps marketers get opportunities to grow their sales and generate revenue by using different combinations of new markets and products and existing markets and products.

Ansoff Matrix finds wide usage in almost every field of management. Ansoff Matrix also helps in identifying potential growth areas and areas where management should retract, making it an important tool for business prioritization as well. The universality of the tool makes it a favorite of strategic consultants who carve out new and niche strategies for the organization. in this blog, we will discuss in detail the history, usage, and advantages of a case study.

Find other Tools for Management assessments here

History of Ansoff matrix

H. Igor Ansoff, an applied mathematician, and business manager developed the Ansoff model. The matrix was first published in Harvard Business Review in 1957 under an article called “strategies for diversification”. In his model, Ansoff has hinted at some of the strongest and weakest business strategies.

According to Ansoff, there are only two approaches to developing a growth strategy, diversifying Product Growth and Market Growth.

Uses of Ansoff matrix

Ansoff matrix can be used to assess the different strategies for business growth also known as the four quadrants of the Ansoff model. The four quadrants are:

Market penetration

Product development, market development.

- Diversification

In the first quadrant, market penetration is the safest with minimum risk. This strategy focuses on increasing sales of existing products or offerings in the markets you are already familiar with. This can be achieved by:

- Lowering your prices or giving discounts

- Promoting your business on a larger scale

- Buying or obtaining a rival’s company in the very market

- Changing opening hours for stores

- Focusing on product refinement

For a better understanding, let us take an example: Popular brands like coca cola are known to focus a lot on getting their brand distributed among the right target audience. They spend a lot of money on getting help from supermarkets, sports stadiums, diners, etc. to penetrate the market and get their brand sold on a higher scale.

In the second quadrant, product development is riskier than market penetration. This strategy focuses on selling new products in the existing markets. You can also modify the products or extend the range of existing products. The strategy also focuses on the needs and welfare of target customers and markets. This can be achieved by:

- Making investments in the research and development of new products.

- Buying someone else’s products and obtaining the rights to claim them as one’s own.

- Acquiring the rights to build someone else’s products

- Creating new packaging for the existing products

The strategy also focuses on the needs and welfare of target customers and markets. A good example of product development can be taken from the pharmaceutical companies that have been actively investing in the research and development of new drugs.

Market development or the third quadrant carries furthermore risks. The strategy focuses on sales of existing offerings in new markets and among different types of customers. This can be accomplished by:

- Promoting your offerings in different customer segments

- Targeting markets in new areas of the country

- Foreign marketing

- Taking the help of online sales

Market development strategy is not that risky if the new markets are similar to the previous ones that you are familiar with. This can be better understood with an example, such as: google started in California, United States but extended its business to Chinese markets.

Diversification

In the last quadrant, diversification is the riskiest of all. It focuses on taking new products into new markets . Even with high risks, diversification can sometimes procure greater rewards. This strategy can be of two types, related and unrelated.

- Related diversification : there remains a connection between the new offerings and the existing firms/businesses.

- Unrelated diversification : there are no connections between the businesses and the new offerings.

The strategy proves to give an edge in a way that, if one business fails to flourish, the others will remain unaffected. Let us take two examples to understand each of these diversifications better.

A shoemaker making shoe with leather decides to make belts and bags instead. This is a case of related diversification as the products are different but the raw material is common for both. Another example can be the company Samsung. Samsung offers a variety of products from mobile phones, laptops, and air conditioners to hotel chains, insurance, and chemicals. This example is of unrelated diversification. Even if the hotel chains don’t return promising results, mobile phone sales of Samsung won’t be affected.

Advantages/Benefits of using Ansoff Matrix

Simplicity : Ansoff Matrix is a very simple yet powerful tool for visualization for managers. Many managers depend on Ansoff Matrix to find the right strategy for the organization

Easier for brainstorming : Unlike other strategic tools, Ansoff Matrix is perfect for a brainstorming session.

Management Summary : The final outcome of a strategic exercise is often very complex. With Ansoff Matrix, it is relatively easier to find a management summary easily. It also becomes easier for an organization to communicate new or changed strategies down the line.

Universality : The Ansoff matrix is very universal. It can be used in a wide range of problems ranging from consulting to new business expansion to strategic marketing problems. It is widely used in assessing the current strategy and finding what’s needed to go to derived strategy

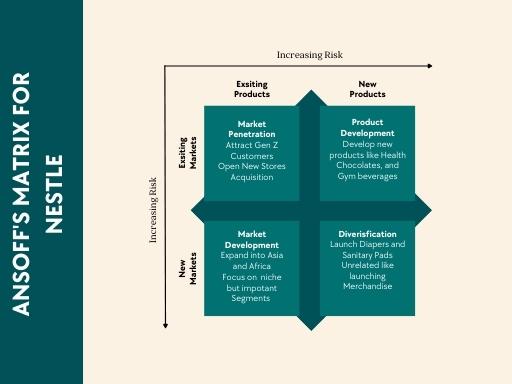

Ansoff Matrix: Case Studies

Founded by Henri Nestle, the famous multinational company, Nestle is one of the world’s largest food and drinks processing companies. Nestle was started in 1866 as a small firm known to produce infant milk and now it has earned the name of a business with the most winning marketing strategy. It is headquartered in Switzerland. The products the company offers are diverse, such as beverages, ice creams, baby food, pet food, bottled water, etc.

For over 150 years, their business has been flourishing. The company also possesses a special focus on sustainable development. They have the largest research and development network in the food and beverage industry which makes them stand out. With the tagline “Good Food, Good Life”, the brand has created a catalyst to promote its sales.

Nestle is a multibillion-dollar company with a market capitalization of more than 247 billion USD. As of 2021, the brand has generated a revenue of around CHF 87.10 billion. Nestle has made use of Ansoff Matrix successfully over the years to become the leading international food processing brand in the world. Let us have a look at the strategic analysis of the Ansoff Matrix of Nestle.

Market penetration by Nestle

For smooth market penetration, Nestle uses its existing products in the existing markets to grow their sales. They focus on aggressive marketing to increase purchases. Nestle uses various tactics to grow their sales such as manufacturing different packaging sizes to give customers a wider choice of selection, offering discounts on larger purchases, lowering prices on certain products, etc.

They are also known to acquire similar brands and companies to reduce competition. Nestle uses promotion strategies like encouraging people to purchase their products by including the customers’ pain points in their advertisements. The brand also keeps on introducing new flavors to keep their customers interested in their products.

Product development by Nestle

Nestle launches new products in the existing markets almost regularly. For instance, they first manufactured chocolates that many customers liked. They later went one step ahead and introduced ice creams using those chocolate flavors.

To promote these ice creams they kept the prices low, advertised more, and used different channels to increase the reach of their products. Once the ice creams were a hit, they adjusted the prices, improved the packaging, and also introduced more variants of the product. All this helped them generate revenue from the ice creams and grew their sales. This is how Nestle focuses on its product development

Market development by Nestle

Nestle uses exciting products in new markets for market development. They expand consistently to new geographical areas where they haven’t marketed yet. They make sure that the products are readily available with the help of different distribution channels to help them increase their reach to the local markets. For this very goal, they also advertise the products through the regional media. They also focus on making the products affordable, targeting the customers’ needs, and introducing variants according to the preference of customers from that particular region. For example, India has more variants of Maggi instant noodles that aren’t available elsewhere.

Diversification by nestle

Nestle regularly launches new products in new markets for diversification. The new products can be related to the existing range of products or can be a different range itself. For example, Nestle offers baby food but they can also launch diapers and other baby products in new markets to grow their sales. Of course, it takes a strategic plan to execute such a stunt with so much risk. But with such marketing understanding, Nestle rarely disappoints.

Coca-Cola is a giant in the beverage industry. It serves almost every continent in the world.

Samrat is a Delhi-based MBA from the Indian Institute of Management. He is a Strategy, AI, and Marketing Enthusiast and passionately writes about core and emerging topics in Management studies. Reach out to his LinkedIn for a discussion or follow his Quora Page

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Advisory boards aren’t only for executives. Join the LogRocket Content Advisory Board today →

- Product Management

- Solve User-Reported Issues

- Find Issues Faster

- Optimize Conversion and Adoption

The Ansoff matrix: Comprehensive overview with examples

Numerous considerations are important in a decision-making context. One of those considerations is making the decision-making process transparent and easy to grasp in a quick glance.

The good news is that there are numerous decision-making techniques available — many of which are easy to learn and can provide visibility into trade-off decisions in particular.

In this article, we’ll take a look at one such technique: the Ansoff matrix.

What is the Ansoff matrix?

The Ansoff matrix is one of many manifestations of a 2×2 matrix that helps with product decision making. Being visually-oriented, the Ansoff matrix is especially appealing for making rapid trade-off decisions.

The idea behind the Ansoff matrix originated in a paper from the 1950s by the mathematician Igor Ansoff. In the paper, Ansoff articulated considerations behind product-market fit. In particular, he focused on ways in which organizations could balance risk by assessing the potential for new or existing products in new or existing markets.

What are the four factors of the Ansoff matrix?

The four components (quadrants) of an Ansoff matrix serve to help with making trade-off decisions. They’re each based on what is known about products and the markets they potentially operate in.

The four components are market penetration, product development, market development, and product/market diversification:

The decision-making power behind the Ansoff matrix has a lot to do with its ability to make the level of relative risk immediately apparent. There is a big difference between making adjustments to an existing product, in a familiar market, as opposed to playing in a completely different product and/or market space.

The four areas that an Ansoff Matrix focuses on are:

- Market penetration (lower left quadrant) — Low risk because it focuses on existing products in existing markets. Any idea that lands in this quadrant means that the organization is sticking with familiar terrain, and seeking to leverage the familiar to find ways to extract greater value with minimal investment

- Product development (lower right quadrant) — Moderate risk because it focuses on new products in existing markets . Any idea that is part of this quadrant looks to augment product offerings within a reasonably familiar market context. Risk exposure is minimized by introducing the new product to a familiar market segment or demographic, as it tests the new product before sending it to a less-familiar market

- Market development (upper left quadrant) — Moderate risk because market development focuses on existing products in new markets. Any idea that is part of the market development quadrant flips the risk to be mostly in the product domain instead of being mostly in the market domain, while keeping the risk manageable

- Product/market diversification (upper right quadrant) — High risk because it focuses on new products in new markets. Ideas that startup companies pursue tend to be in the product/market diversification quadrant, as in such cases the hypothesis is that there is a significant market opportunity open to the company that launches a “good enough” product into that space. The risk of failure is considerable

Risk is not the only factor worthy of consideration when making decisions about product-market fit, however. The flip side to risk is reward. And often, the highest potential reward tends to land in the upper right quadrant. Let’s take a look at each of the four components in greater detail.

Market penetration

We’re certainly on familiar terrain when it comes to evaluation of market penetration. When we’re working in this quadrant, we’re looking at products that already exist, and where we’re selling those products into an existing market.

For this and subsequent examples, let’s say we work for a company that makes chewing gum, and let’s call this company Chewing Yum. Let’s further suppose that at Chewing Yum, our products focus primarily on health-conscious adults, and that our product distribution is limited to the United States.

At Chewing Yum, our market analysis tells us that we’re seeing consistent erosion in market share. Given that information, we might decide to embark on a number of relatively low-risk strategies to address this situation, by experimenting in areas such as:

- Distribution

- Minor product enhancements

For example, we might choose to experiment by dropping the price, for:

- One of our products, in a single existing market segment

- One of our products, in multiple existing market segments

- A family of related products, in a single existing market segment

- A family of related products, in multiple existing market segments

We might even find that by swapping one ingredient with another, we can get more flavor, we can get a lower cost, or we may find that our customers are more likely to buy our product if it’s located in the health section of the store.

Product development

As we move into the lower right quadrant of the Ansoff matrix, we’ve entered the domain of introducing new products into existing markets. In some cases, when we say “new product,” it could mean releasing an existing product with significant modifications, it could mean a brand new product that takes us in a significantly different direction as a company, or multiple other variations around the same theme.

On the less ambitious end of the spectrum, let’s suppose that our Chewing Yum market research tells us that our product packaging would be more likely to generate sales if we gave it a fresh look, and we’ve decided to do that in conjunction with changing the name of an existing product (where we’ll have a bold new marketing campaign associated with those changes). And that product re-launch in turn might lead to an idea for a brand new product.

Over 200k developers and product managers use LogRocket to create better digital experiences

On the more ambitious end of the spectrum, let’s say that we’re looking closely at our competitors, and that we’re seeing an opportunity to increase our market share via some form of acquisition. For example, we might decide to:

- Acquire a competitor and thereby increase our product portfolio

- Obtain the rights to make and distribute a different company’s product

- Jointly develop a new product with another company

Market development

Market development takes us into the upper left side of the Ansoff matrix, where we seek to find new settings in which we can sell our existing products. Also known as market extension, market development offers a number of approaches that we could potentially consider.

At Chewing Yum, we might very well have found via research that we have a significant growth opportunity if we explore selling our products outside of normal retail outlets, where we can reach more health-conscious people by partnering with health clubs or health spas to sell our products into several large, well-established partners in that space. We might also have found that we can significantly expand our market share by moving into online sales, to enhance our more traditional distribution channels.

And looking further afield, let’s suppose that we see a particularly promising opportunity in the English-speaking European market, where we can potentially dramatically increase our reach without making changes to product packaging or branding. We might even catch a break because a prominent health guru has mentioned our product on a television show or a podcast, which opens the door to one or more additional potential markets.

Product/market diversification

The fourth and final quadrant of the Ansoff matrix is the upper right quadrant. It is here where we can potentially explore opportunities that may come with the largest possible payoff, but these often are accompanied with the largest potential risk.

Given that the potential for surprises is the greatest when exploring diversification, it’s especially important for our market research to be particularly robust. Indeed, we might decide that we are not yet ready to explore diversification until we invest in further research and data collection.

The good news is that at Chewing Yum, we’ve done our homework. Thanks to our research, we envision a phased approach, where we envision introducing new products, and also entering new markets. It can be helpful when thinking about diversification to break it down into a couple of sub-categories. Let’s call these categories:

Parallel diversification

Orthogonal diversification.

In parallel diversification, the changes that we’re contemplating with respect to new products and new markets are largely in alignment with our existing branding and product offerings.

At Chewing Yum, we’ve decided the first part of our diversification strategy will be to augment our market share by introducing a new product line focusing on a younger audience. And as part of the launch of the new product line, we plan to expand into the English-speaking component of the Canadian market, because we see less competition in that space than we do in some other markets for our new product offering.

In orthogonal diversification, we’re going in a significantly new direction for our company. At Chewing Yum, we’ve discovered that there is a growing market for chewables for pets (dogs in particular). To expand into this market, we’re going to offer a new product line that acts as a dietary supplement and also cleans the dogs’ teeth and gums. As part of this product launch, we’re going to initially sell into existing markets, and also explore the possibility of exploring into new markets.

Note : There are additional ways to articulate forms of diversification, which we won’t delve into here. For instance, some practitioners distinguish between horizontal diversification (similar to what I’m calling parallel diversification) and vertical diversification. In vertical diversification, a company might choose to increase how much it is involved in different parts of the value chain. For instance, a company might choose to focus its diversification activities more on the top of the funnel, or it might choose to diversify in areas such as procurement and manufacturing.

Advantages and disadvantages of using the Ansoff matrix

Let’s now turn to advantages and drawbacks associated with the use of an Ansoff Matrix. Advantages include:

- Simplicity — It’s an easy technique to master, with little introduction required

- Portability — It’s straightforward to use in a variety of settings, whether virtual, in-person, or hybrid

- Transparency — It offers visibility into the decision-making process

As is the case with any decision-making tool, it’s important to recognize the strengths, and also the weaknesses, inherent in the approach. Examples of disadvantages associated with Ansoff matrix usage include:

- It’s not a stand-alone artifact . Depending on the level of rigor of the work that preceded usage of the Ansoff matrix, along with how well-understood the competitive landscape is, it’s important to see its usage as just one tool in the decision-making toolbox, and not rely on it alone for making key decisions

- It’s not a remedy for lack of alignment . If decision-makers do not have the same understanding of foundational terms and business dynamics, the Ansoff matrix alone cannot by itself address that gap

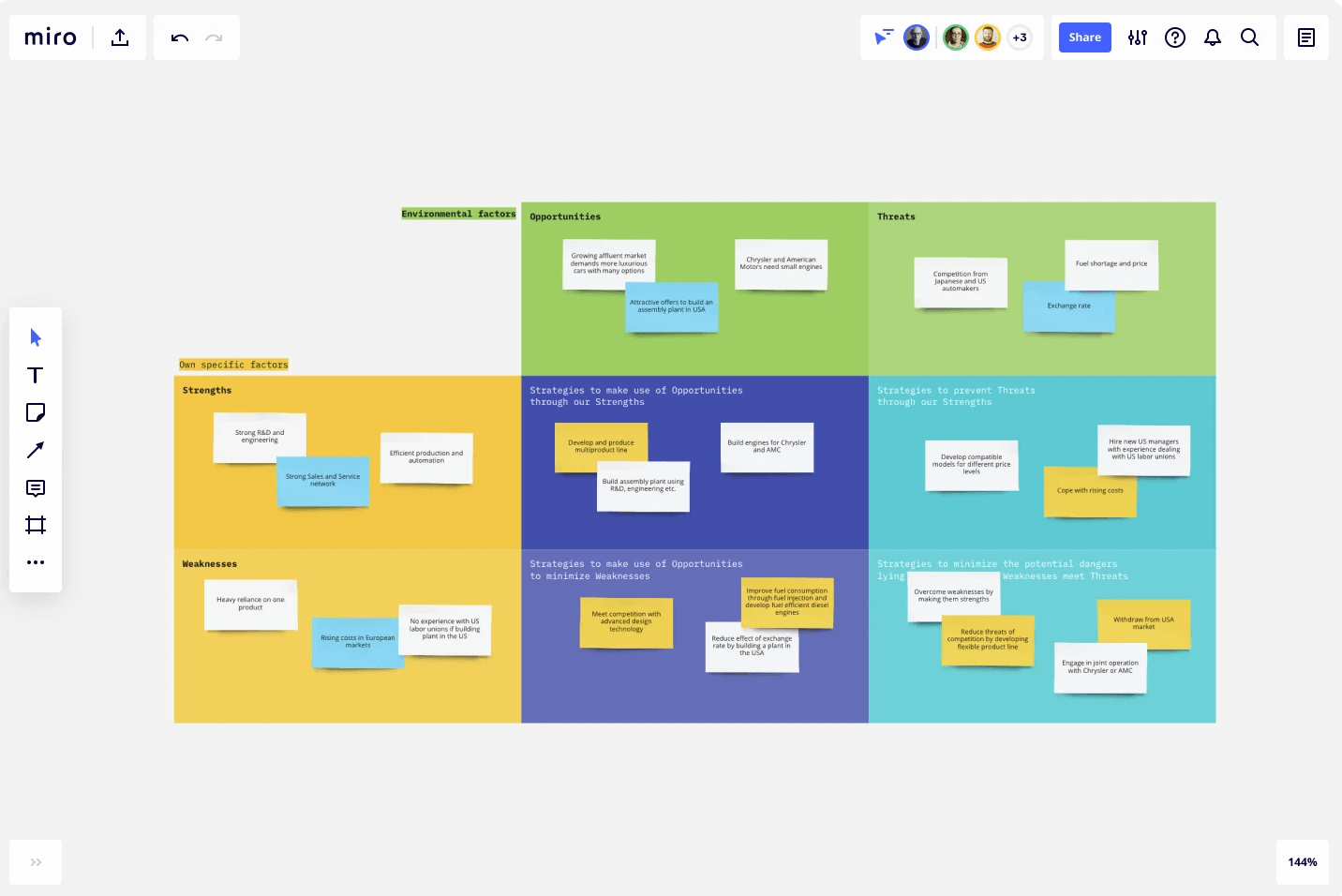

Complementary techniques to the Ansoff matrix

Given both the advantages and the disadvantages associated with usage of an Ansoff matrix, it is common to use it in conjunction with other techniques. To name a few examples:

- SWOT analysis — The thought process when considering strengths, weaknesses, opportunities, and threats works well in conjunction with an Ansoff matrix. For instance, by conducting a SWOT analysis before using an Ansoff matrix might best inform which quadrant of the Ansoff matrix to focus on

- PESTLE analysis — Because PESTLE (political, economic, sociocultural, technological, legal, and environmental) helps with taking a big-picture view, completing an Ansoff matrix might point to which aspect(s) of PESTLE is/are most important to focus on

- Porter’s Five Forces — This model can provide additional perspective, since it helps organizations better understand the risks in their business context, such as the bargaining power of buyers and suppliers, and the threat of potential competing goods and services or competing market players

Based on the preceding examples, using our fictitious Chewing Yum company, we have seen some of the most common ways in which organizations can use an Ansoff matrix. As such, it most often serves as a decision-making tool, enabling people in various parts of an organization to explore their growth options. Due in large part to its simplicity, and to its visual nature, it’s an excellent tool to include in any organization’s decision-making toolbox.

Because of its structure, an Ansoff matrix also serves as a reminder about certain realities in any organizational context. That is, it illustrates how business growth is possible without product or market development. And it also shows what options might exist in the middle ground, by expanding either products or markets, without relying on more risky diversification strategies.

Featured image source: IconScout

LogRocket generates product insights that lead to meaningful action

Get your teams on the same page — try LogRocket today.

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on Facebook (Opens in new window)

- #product strategy

Stop guessing about your digital experience with LogRocket

Recent posts:.

Understanding the problem space and its role in development

Failing to identify or understand a problem is, when it boils down to it, the main reason why most businesses fail.

Leader Spotlight: Setting processes to achieve organizational alignment, with Juan Gabarro

Juan Gabbaro discusses how product leadership should drive vertical alignment, but the product team should drive cross-functional alignment.

Practical ways to improve your customer experience

Improving your customer experience enhances customer satisfaction and boosts business growth and customer retention.

Leader Spotlight: Viewing loyalty as a commitment to the customer, with Josh Engleka

Josh Engleka talks about how his team at Lowe’s takes a unique perspective because they are all customers, as well as employees.

Leave a Reply Cancel reply

- Memberships

Ansoff Matrix explained plus example

Ansoff Matrix: this article explains the Ansoff Matrix by Igor Ansoff in a practical way. It covers an Ansoff Matrix example, what the Ansoff growth matrix is, along with an explanation of the four strategies, and what its limitation are. After reading you will understand the basics of this marketing strategy tool. Enjoy reading!

Introduction

“Stagnation means decline.” This is a significant starting principle for both profit and non-profit organizations.

When an organization wants to grow, it is important to take the right steps. Based on the factors product/ service and markets there are four different growth strategies that need to be developed and which have been set out in a matrix by Igor Ansoff , the Ansoff matrix.

What is the Ansoff Matrix?

This Matrix was developed by strategy professor Igor Ansoff in the 1960s.

The idea behind the Ansoff Matrix is simple; a company or organization gains a clear insight into the possible growth strategies based on the combination of existing and new products and existing and new markets. These could also be services instead of products.

The term market is aimed at concrete markets as well as various target groups. In addition, Ansoff’s Growth Matrix should always be considered from the perspective of the organization.

This strategic planning tool, Ansoff’s Growth matrix, is connected to the general strategic direction of an organisation. Additionally, four alternative growth strategies are presented in the table, being:

- Market growth : market penetration by pushing existing products in market segments

- Market development : development of new markets for existing products

- Product development : developing products for existing markets

- Diversification : developing new products for new markets

An Ansoff Matrix example

The Ansoff Matrix, also referred to as the product market matrix or growth matrix, can be divided into four strategies. Here, Igor Ansoff indicates that growth occurs in steps. For instance, he believes diversification can only be chosen after the stages of market penetration, product development and market development have been completed. Below is a brief and practical clarification.

Figure 1 – The Four Strategies of the Ansoff Matrix (Ansoff, 1965)

Market Penetration

This is a product/ market combination of a current product, offered in the current market; opening a new branch and/or focusing on competitors’ customers.

With this strategy, the organisation uses its own products in the existing market. In other words, a company aims to increase its market share with a penetrating market strategy. This market penetration can be conducted in several ways:

- Lower price to attract existing or new customers

- Greater efforts in the field of promotion and distribution

- Acquiring a competitor in the same market/ sector

An example of this are companies in telecommunication. These are all active within the same market and often use a penetration strategy by lowering their prices and increasing their distribution and promotion efforts.

Another example of a company that successfully deploys this strategy is Coca-Cola. This company, just like Heineken , is known for spending a lot of money on marketing to penetrate and conquer new markets.

Additionally, they try to maximise the use of distribution channels by closing attractive deals with large distributors such as supermarkets, restaurants and football stadiums.

Product Development

This is a product/ market combination of a new product, offered in a current market; renewing and improving the product range and attracting more customers this way.

In the product development strategy, a company develops a new product to meet the needs of consumers of an existing market. The shift typically includes extensive market research and development and expansion of the current product range. The product strategy is often used when companies are well informed of what is going on in the market, and are able to offer innovative solutions to meet the needs of the existing market. The product development strategy can be implemented in several ways:

- Investing in Research & Development to develop new products that respond to the existing market

- Acquiring a competitor’s product and joining forces to develop a new product that better meets consumers’ requirements

- Entering into strategic partnerships with other companies to gain access to the distribution channels and other resources of each partner

An example of product development strategy is a car company that manufactures electric cars to meet the consumers’ changing needs. The current consumers in the car market are typically becoming more eco-friendly.

Another example of a company that excels in applying product development is Apple . Every so often, Apple markets a brand-new smartphone, the iPhone, that is always an improvement of the last model. Other examples can be found in the pharmaceutical industry, where new and innovative medication is frequently developed.

Market development

The third quadrant of the Ansoff Matrix represents market development. This is a product/ market combination of a current product, offered in a new market; the own product range offered in a different way, such as online, abroad or through franchise at another company.

The market development strategy is applied when a company enters a new market with their existing product portfolio. Expansion to new markets means that companies expand to new regions, customer segments, etc. The market development strategy is most effective when:

- A company has its own technology and can utilise this in new markets

- Consumers in the new market are profitable

- Consumer behaviour doesn’t deviate much from existing markets

The market development strategy can be applied in several ways:

- Catering to a different customer segment

- Entering a new domestic market

- Entering a new foreign market

Examples of companies that have successfully managed to do this are Nike and Adidas. The two companies offer the same products to the market in China and Europe, for instance.

Diversification

This is a product/ market combination of a new product, offered in a new market; tapping into a new market with a new product range (parallelisation is an example of this).

The diversification strategy is applied when a company enters a new market with a new product. Such a strategy is by far the most risky of the four. This is due to the fact that this strategy demands both market and product development. On the other hand, diversification could also reduce future risk.

There are two types of diversification strategies a company may apply:

- Related diversification : when potential synergies can be realised between existing activities and the new product or the new market

- Unrelated diversification : there are no potential synergies to be realised between the existing activities and the new product or the new market

A manufacturer of handmade leather shoes that starts to produce phones is an example of an unrelated diversification strategy. When the same producer of leather shoes starts a line of leather wallets or other leather accessories, this is an example of related diversification.

As the growth strategy shifts from current products and markets to new products and markets, this increases the risk for the organisation. A new market must be explored and it takes time before new demographics are familiar with the products of a new provider.

Moreover, strategy guru Igor Ansoff emphasises that diversification is therefore actually separate from the other three strategies.

Ansoff Matrix limitations

The Ansoff matrix has several limitations that are important to consider before actually applying the tool in practice. Read the following points.

Isolation through the Ansoff Matrix

When the Ansoff matrix is used as an isolated tool, the results could be misleading. This is due to the fact that it doesn’t take competitors’ activities into account and the competitors’ ability to counter the shift to other industrial sectors.

Additionally, the model doesn’t take into account the risks and challenges involved in changes in an organisation’s daily activities.

A company that hopes to enter new markets or create new products, or both, must consider whether they possess the necessary skills, flexible structures and consenting stakeholders .

Consistency

Several critics indicate that the logic of the Ansoff matrix is dubious at best. These problems concern interpretations about novelty.

When one assumes that a product is truly new for a company, the product will often bring the company to a new, previously unknown market as well. In that case, one of the Ansoff quadrants, diversification, becomes redundant. On the other hand, when a new product doesn’t necessarily bring the company to a new market, the combination of new products in new markets doesn’t always equal diversification, as it concerns a completely unknown company.

Conclusion on the Ansoff Matrix

The Ansoff matrix is an effective framework for assessing a company’s options, with the goal to grow. The market penetration strategy is the least risky of the four and occurs most frequently in everyday situations.

Diversification is the most risky because a company introduces a completely unknown product to a completely new market. However, when a company is successful in entering unrelated markets, the advantage is that this creates a diverse portfolio, reducing the overall risk.

It’s Your Turn

What do you think? Is the Ansoff Matrix applicable in today’s modern economy and marketing? Do you recognize the practical explanation or do you have more suggestions? What are your success factors for the good matrix set up?

Share your experience and knowledge in the comments box below.

More information

- Ansoff, H. I. (1965). Corporate strategy: business policy for growth and expansion . McGraw-Hill .

- Ansoff, H. I. (1980). Strategic issue management . Strategic Management Journal, 1(2), 131-148.

- Green, P. E. (1977). A new approach to market segmentation . Business Horizons, 20(1), 61-73.

- Webster Jr, F. E. (1988). The rediscovery of the marketing concept . Business horizons, 31(3), 29-39.

How to cite this article: Mulder, P. (2013). Ansoff Matrix . Retrieved [insert date] from Toolshero: https://www.toolshero.com/strategy/ansoff-matrix/

Original publication date: 07/14/2013 | Last update: 11/08/2023

Add a link to this page on your website: <a href=”https://www.toolshero.com/strategy/ansoff-matrix/”>Toolshero: Ansoff Matrix</a>

Did you find this article interesting?

Your rating is more than welcome or share this article via Social media!

Average rating 4.3 / 5. Vote count: 12

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you!

Let us improve this post!

Tell us how we can improve this post?

Ben Janse is a young professional working at ToolsHero as Content Manager. He is also an International Business student at Rotterdam Business School where he focusses on analyzing and developing management models. Thanks to his theoretical and practical knowledge, he knows how to distinguish main- and side issues and to make the essence of each article clearly visible.

Related ARTICLES

Flywheel Concept by Jim Collins

Critical Success Factors: the Basics and Examples

North Star Metric: the Basics and Examples

SFA Matrix: Basics and Template (Johnson and Scholes)

Management By Objectives (MBO)

Carroll’s CSR Pyramid Model explained plus Example

Also interesting.

10 Rockefeller Habits by Verne Harnish

Organizational Network Analysis (ONA)

Abell model explained including an Example

Leave a reply cancel reply.

You must be logged in to post a comment.

BOOST YOUR SKILLS

Toolshero supports people worldwide ( 10+ million visitors from 100+ countries ) to empower themselves through an easily accessible and high-quality learning platform for personal and professional development.

By making access to scientific knowledge simple and affordable, self-development becomes attainable for everyone, including you! Join our learning platform and boost your skills with Toolshero.

POPULAR TOPICS

- Change Management

- Marketing Theories

- Problem Solving Theories

- Psychology Theories

ABOUT TOOLSHERO

- Free Toolshero e-book

- Memberships & Pricing

Ansoff Matrix Explained

Few businesses that have stuck to their traditional products and markets have managed to grow in the long term. Over the past century, America’s most valued companies that made it to Forbes’s top ten were very different when compared across the years 1917, 1967 and 2017:

Data suggests that merely to survive the race of innovation and competition, a company must go through continuous growth and change. To improve its position, it must do it twice as fast.

Evaluating growth strategies with Ansoff Matrix

The Ansoff Matrix , also known as the Product-Market Expansion Grid, is a tool used to evaluate growth strategies. It was developed by H. Igor Ansoff [2] , a Russian-American mathematician and business leader, dubbed the father of strategic management. His work was first published in Harvard Business Review in 1957 [3] .

Using a 2 x 2 grid, the Ansoff matrix lays out the four basic growth alternatives open to any business.

A business can pursue either any or all of these strategies which are: increase market penetration, market development, product development and diversification:

Market penetration strategy

This strategy involves increasing efforts to grow sales without departing from the original product-market strategy. Simply put, this is an approach where a company tries to sell more of the same things to the same people.

Out of the four options, this is the one with the lowest risk as there are no substantial changes involved and the company continues to do what it is already doing, only better.

Under this strategy, business performance can be improved in two ways: by increasing the volume of sales to present customers or by finding new customers within the same market for existing products.

Typical market penetration efforts include:

- New marketing and advertising efforts.

- Refined pricing.

- Offering incentives, discounts, or loyalty programs to encourage repeat purchases.

- Improved distribution (focus on improving/expanding channels).

- Productivity improvements.

An increased market penetration strategy is well-suited to organizations that find themselves operating in a large and growing market where their offerings have a competitive advantage over rivals. It is also relevant when the products are new and the benefits from factors such as economies of scale, learning effects, and network effects are yet to be fully realized.

Though the risks and investments are low, this strategy by itself is often insufficient to support ambitious growth plans. Beyond a point, a market cannot expand any further as there is a limit to what companies can sell to the same customers without changing products.

Product development strategy

In this strategy, a company remains in the same market but develops products that have new and different characteristics. In simple terms, it is about selling more things to the same people.

This is a medium-risk strategy requiring a company to develop additional skills and/or business processes to support the new offerings. Since the company (usually) has a sound understanding of the market, the risks are manageable.

There are two routes to pursue this strategy:

- Be the follower – Introduce products or services that are already known to the market but new to the business: For example, in 2015, Apple launched its smartwatch, which quickly became the top-selling wearable device, boasting over 4.2 million units sold in the second quarter of that fiscal year. Although the smartwatch was a fresh addition to Apple’s product line, it was a familiar offering in the market, already established by brands like Garmin and Fitbit.

- Pioneer ( Innovator ) – Introduce products that are new to the market. Apple’s iPhone launch in 2007 was a groundbreaking innovation that combined music, phone, and internet communication into a single device. At the time, there was no direct precedent for such a device in the market. Apple took the pioneering approach, capitalized on its strength in technology and revolutionized the smartphone industry.

A company can choose to develop its offerings in several ways such as own R&D efforts, by entering a joint venture, by purchasing other company’s products or through licensing.

Product development strategy is best suited to situations where a company can leverage its existing distribution channels, brand value, know-how, staff, and systems such that costs can be kept under control.

A drawback of this strategy is that unless a company can protect its offerings through patents and copyrights, the benefits are short-lived as competitors quickly catch up.

Market development strategy

Also referred to as the market extension strategy, this is about finding new markets for the same product or with minimal adaptation. It is basically selling more of the same things to different people.

This is also considered a medium-risk strategy, although the risks are slightly higher when compared to the product development strategy.

Efforts required to research and understand the needs of a new market, to become known, develop trust and therefore gain a meaningful market share is often greater than the effort of developing and launching a new product in a known market.

Typical risks include a failure to understand the characteristics of the new market, the competitive landscape, or the regulatory landscape. Many companies have tried and failed to implement this strategy.

Walmart’s entry into the German market in 1997 is a classic example. Known among the most successful retailers in the United States, Walmart opened its doors for business in Germany after acquiring the retail chain Wertkauf [7] .

However, it failed to understand the characteristics of the German supermarket industry. Unlike the US, German regulators favoured smaller shops vs hypermarkets and did not permit the predatory pricing that worked in Walmart’s favour. A mismatch in culture was another factor – for example, employees were trained to smile at customers when they shopped while the customers found the practice embarrassing.

By 2006, Walmart made a rare admission of failure to convert German shoppers and regulators to its low-price, American-style trading and announced its plan to exit after taking a loss of $1bn [8] .

Market development is the natural path for companies when they find that all opportunities in the existing markets have been exploited and there is no room to grow, even with the introduction of new products.

In the context of new market development, the word “new” can mean several things, such as:

- Geographical area (e.g.: domestic or international, a new country or a state).

- Customer segments.

- Sales outlets and distribution channels that expand reach (e.g.: going online from a store-only model).

- Rebranding/repackaging existing products with slight modifications (e.g.: Coca-Cola reached new markets by introducing low-sugar alternatives such as Coke Zero).

Nike’s transformation from a purely sportswear brand to a lifestyle brand that today includes athleisure – comfortable clothing suitable for both exercise and daily wear – is a classic example of an effective market development strategy.

According to Grand View Research, the worldwide athleisure market size is anticipated to reach USD 662.56 billion by 2030 [9] . Being a leader, Nike is well-positioned to exploit this growth.

Diversification strategy

Diversification is the final alternative which calls for a simultaneous departure from the present product line as well as the present market structure.

It is the riskiest of the four strategies as it involves two unknowns. On one hand, there is the challenge of creating a new product with all the potential problems that may occur during the process, while on the other, developing a new market where there is little experience and whose characteristics may differ significantly from the currently known market.

Despite the risks, diversification is attractive and adopted by many firms because the rewards of a successfully executed strategy far exceed the risks. When done right, firms can achieve significantly higher growth and greater returns when compared to the other three conservative options.

In the long term, firms that diversify build resilience. For example, a change in regulatory norms in a geographic location or a particular market or a shift in customer preference may impact one segment or a product line but will have a limited impact on the overall revenue of a well-diversified firm.

The test for diversification

Michael Porter proposed three questions that a firm must answer to determine if it must pursue a proposed diversification [10] :

- How attractive is the industry that a firm is considering entering? Unless the industry has strong profit potential, entering it may be very risky. Porter’s Five Forces Analysis [11] can help with this assessment.

- How much will it cost to enter the industry? Executives need to be sure that their firm can recoup the expenses that it absorbs in diversifying. For example, when Philip Morris, a tobacco giant bought 7Up with plans to diversify into the soft drinks business, it paid four times what 7Up was worth. Making up these costs proved to be impossible and 7Up was sold in less than 10 years [12] .

- Will the new unit and the firm be better off? Unless at least one side gains a competitive advantage, diversification should be avoided. In the case of Philip Morris and 7Up, for example, neither side benefited significantly from joining together.

Firms that choose to diversify can look at two types of diversification strategies: related and unrelated which are explained in more detail:

Related diversification

A firm pursuing this strategy diversifies into business lines within the same industry which has important similarities with the firm’s existing industry/industries.

Businesses are considered related if they [13] :

- Serve similar markets and use similar distribution systems.

- Employ similar production technologies.

- Exploit similar science-based research.

Volkswagen’s acquisition of Audi and Disney’s purchase of the American Broadcasting Company (ABC) are examples of related diversification.

Firms that engage in related diversification aim to develop and exploit a core competency to become more successful. A core competency is a skill set that is difficult for competitors to imitate, can be leveraged in different businesses, and contributes to the benefits enjoyed by customers within each business.

For example, Google’s core competency lies in search technology and monetizing online advertising. When it acquired YouTube in 2006, Google extended its core competency into video streaming, allowing it to capitalize video content market and grow revenue.

Honda Motor Company is another good example of a firm leveraging its core competency through related diversification. Honda started out in the motorcycle business and developed a unique ability to build small and reliable engines. It applied its engine-building skills to diversify into cars, all-terrain vehicles, lawnmowers, boats and even generators.

But sometimes the benefits of related diversification that executives hope to enjoy are never achieved. For example, soft drinks and cigarettes are products that companies must convince consumers to buy through marketing activities such as branding and advertising.

On the surface, the acquisition of 7Up by Philip Morris seemed to offer the potential for Philip Morris to leverage its marketing competency, but the benefits never materialized.

Unrelated diversification

An unrelated diversification occurs when a firm enters an industry that lacks any important similarities with the firm’s existing industry/industries.

Such a firm pursues growth in markets where the main success factors are unrelated to each other and expects little or no transfer of functional skills among its various businesses.

Unrelated diversifications are hard to pull through and success is rare. Only companies that possess the skills and resources to analyze and manage the strategies of widely different businesses can consider unrelated diversification to be the best strategic option.

Berkshire Hathaway is a case in point, it owns controlling stakes in businesses spread over 35 sectors!

The Virgin Group is another example of unrelated diversification. Virgin started business as a record shop, first by mail order and in 1971 with a physical store and today, 50 years later it has diversified into a multinational venture capital conglomerate.

In the 1980s, Virgin entered the airline industry and applied its internal competence of providing excellent customer experience throughout its existing family of companies. At the time, great customer service was a rare quality in the airline industry, which was instead plagued by canceled flights, delays, and lost baggage. Virgin offered an advantage that was hard for competitor airlines to replicate and, therefore, could charge a price premium [16] .

But unrelated diversification strategy is far from foolproof and there are examples of failure within the very same Virgin group.

The short rise and rapid fall of Virgin Cola in the 1990s after an ambitious, but unsuccessful plan to compete with Coca-Cola and Pepsi is a classic example of failure. Despite the growing fizzy drinks market, Virgin Cola managed a mere 3% market share on its home turf UK before exiting [17] .

As of 2023, the group has a presence in over 20 sectors ranging from banking to aviation to commercial spaceflight [18] .

Another risk that comes with the unrelated diversification strategy is the threat of losing brand strength by blurring the delivery of a single strong message.

When a firm diversifies into sub-brands that do not comfortably fit together, it must depart from the way it currently defines itself. This brings the risks of being perceived as a generic brand and not a leader.

Benefits and limitations of the Ansoff Matrix

Even though the Ansoff Matrix is over 60 years old, it remains an important tool in the strategic management toolkit. Even today, it is popular and widely used by organizations due to its simple, clear, and intuitively sensible design.

The matrix is particularly well suited for:

- Setting high-level corporate strategic direction-

- Helping management to consider all available growth options-

- Making apparent, the risks of pursuing different growth strategies – the greater the move from existing products or markets, the greater the risks-

However, the matrix is not suited for:

- Determine the detailed content and steps in any strategy.

- Considering the impact of the economic, technological, or social environment that a firm operates in.

- Matching strategy to the organization’s capabilities and resources.

Putting it together

It is important to remember that the four options in an Ansoff matrix are not mutually exclusive and an organization’s strategy can have elements of all four options.

The below figure summarizes the essence of the Ansoff Matrix:

- “A Century of America’s Top 10 Companies, in One Chart”. Howmuch.net, https://howmuch.net/articles/100-years-of-americas-top-10-companies . Accessed 27 Feb 2024

- “Igor Ansoff”. Wikipedia, https://en.wikipedia.org/wiki/Igor_Ansoff . Accessed 27 Feb 2024

- “Strategies For Diversification”. H Igor Ansoff, https://archive.org/details/strategiesfordiversificationansoff1957hbr . Accessed 27 Feb 2024

- “The Ansoff Matrix – GBRW Bank Strategy Guide Series”. GBRW, https://gbrw.com/the-ansoff-matrix-gbrw-bank-strategy-guide-series-1/ . Accessed 27 Feb 2024

- “Apple Watch 42mm (1st gen) pictures”. GSM Arena, https://www.gsmarena.com/apple_watch_42mm_(1st_gen)-pictures-7696.php . Accessed 26 Feb 2024

- “The evolution of Apple’s iPhone”. Computer World, https://www.computerworld.com/article/3692531/evolution-of-apple-iphone.html . Accessed 26 Feb 2024

- “Wertkauf”. Wikipedia, https://en.wikipedia.org/wiki/Wertkauf . Accessed 25 Feb 2024

- “Wal-Mart pulls out of Germany”. The Guardian, https://www.theguardian.com/business/2006/jul/28/retail.money . Accessed 25 Feb 2024

- “Athleisure Market Worth $662.56 Billion By 2030 | CAGR: 9.1%”. Grand View Research, https://www.grandviewresearch.com/press-release/global-athleisure-market . Accessed 01 Mar 2024

- “From Competitive Advantage to Corporate Strategy”. Michael E. Porter (Harvard Business Review), https://hbr.org/1987/05/from-competitive-advantage-to-corporate-strategy . Accessed 01 Mar 2024

- “Porter’s Five Forces”. Strategic Management Insight, https://strategicmanagementinsight.com/tools/porters-five-forces/ . Accessed 27 Feb 2024

- “Philip Morris to Sell Seven-Up’s U.S. Operations to Dallas Group”. LA Times, https://www.latimes.com/archives/la-xpm-1986-10-04-fi-4239-story.html . Accessed 27 Feb 2024

- “Diversification via Acquisition: Creating Value”. Malcolm S. Salter and Wolf A. Weinhold, https://hbr.org/1978/07/diversification-via-acquisition-creating-value . Accessed 27 Feb 2024