SAP SD FI Integration and Account Determination

SAP Sales & Distribution deals with sales to customers. So it a process where sales is made to customer against sales order and revenue is realized. That,s why SD is also called O2C (Order to Cash).

Table of Contents

1. Preparation for SD-FI Integration

We will create the sales order first . Then on the basis of sales order, we will create outbound delivery. At the time of goods issue to outbound delivery, system posts the respective amount to the corresponding GL account. This is SD-FI integration area.

1.1 Creation of Sales Order & Outbound Delivery

In the below post the process of sales order creation, Outbound delivery creation & subsequently PGI (Post Goods Issue) has been explained step by step.

2. SD-FI Integration starts From PGI of OBD

In the above post we have explained that since SD-FI configuration is still not done, so as soon as we tried to post goods issue to outbound delivery, system throws the below error.

2.1 Accounting entries at PGI

At the time of goods issue , stock is lessened by the quantity & value equal to the quantity & value of goods issue.

The offsetting entry is done on COGS (Cost of Goods Sold) account

As soon as we tried to post goods issue system throws the error due to absence of SD-FI integration configuration

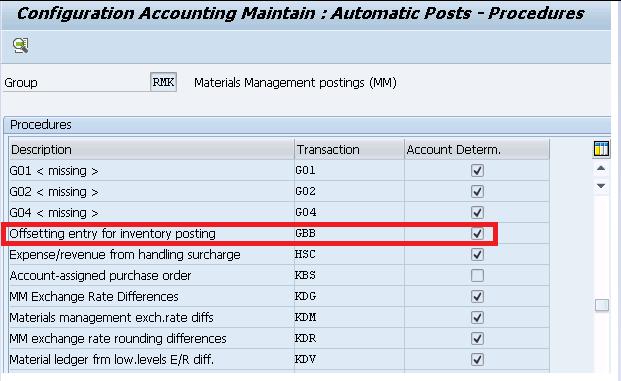

2.1.1 First Error M8147 -Account determination for entry PPIN GBB not possible

This error is coming because of absence of configuration of inventory offsetting. We need to configure account determination of VAX key

VAX: for goods issues for sales orders without account assignment object (the account is not a cost element)

COGS account at the time of goods issue is determined based on this key.

For our car business GBB-VAX posting is done on GL 550200000 (PPIN-Cost of Goods Sold (Trade w/o Cost Element).

Please click HERE to check the creation of GL 550200000 step by step

Start OBYC and double click on GBB

3. Now try to post Goods Issue again

After GBB VAX configuration now try to post PGI again

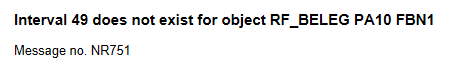

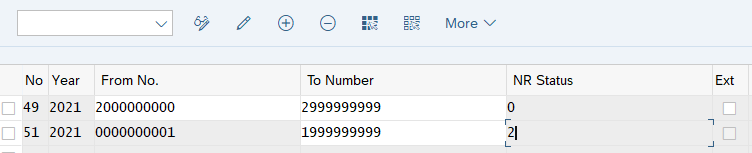

3.1 Error NR751

3.1.1 Number Range 49 Maintenance for object RF_BELEG

Try PGI now

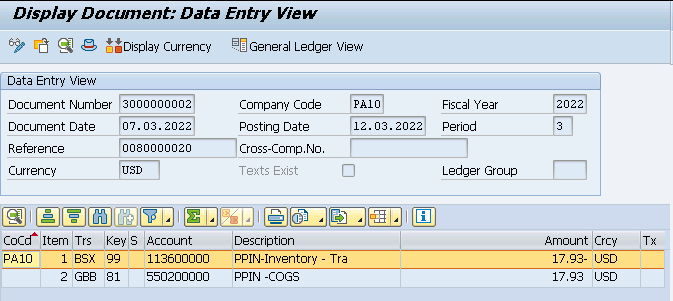

PGI is done successfully this time

Material document & accounting document is generated

3.2 FI Postings (SD-FI Integration OBD PGI Part)

System creates a material document to update the quantity in the Plant/SLOC. On the back of it, system generates an accounting document to post the values on the respective GL accounts.

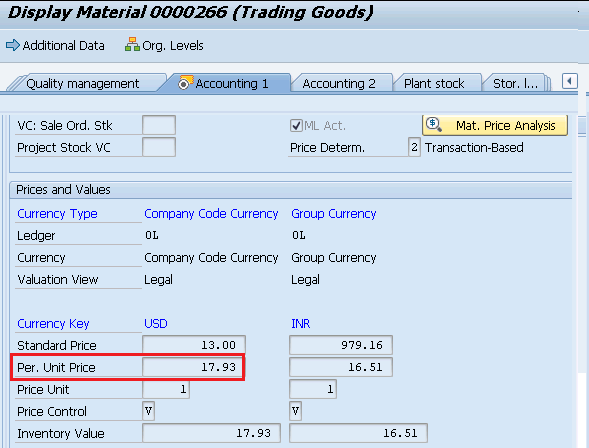

3.2.1 Reminder -Check the FI document above in light of the Material Pricing

Check the material price i the material master “Accounting 1” view.

4. Account Determination in SD

Account determination in SD is also called revenue account determination

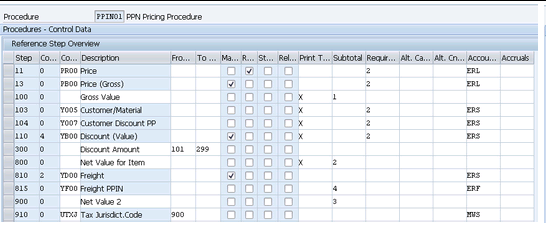

We have configured our own customized pricing procedure in the post below

The Ultimate SAP S4 HANA Sales Pricing Guide with FAQ

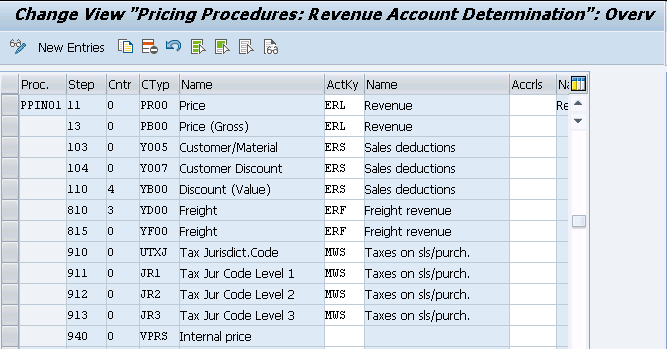

Account Keys (for example ERL, ERS, MWS etc. in the above screenshot) are assigned to the different conditions in the pricing procedures.

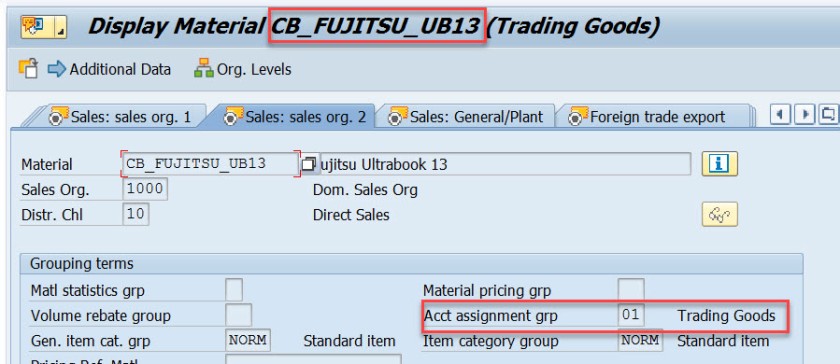

4.1 Account Assignment Groups for Materials

Account assignment groups are used to classify a material as a product, service, or equipment for the purpose of GL account differentiation.

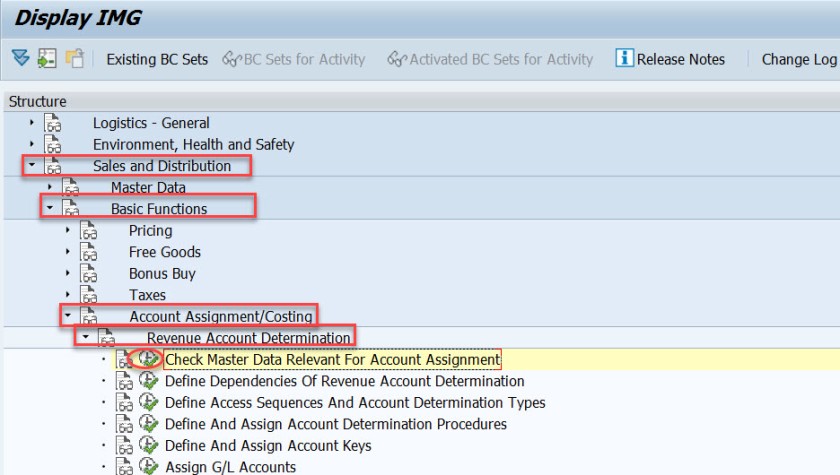

SPRO –> IMG –> Sales and Distribution –> Basic Functions –> Account Assignment/Costing –> Revenue Account Determination –> Check Master Data Relevant For Account Assignment –> Define Account Assignment Groups for Materials

We have defined below account assignment groups for materials.

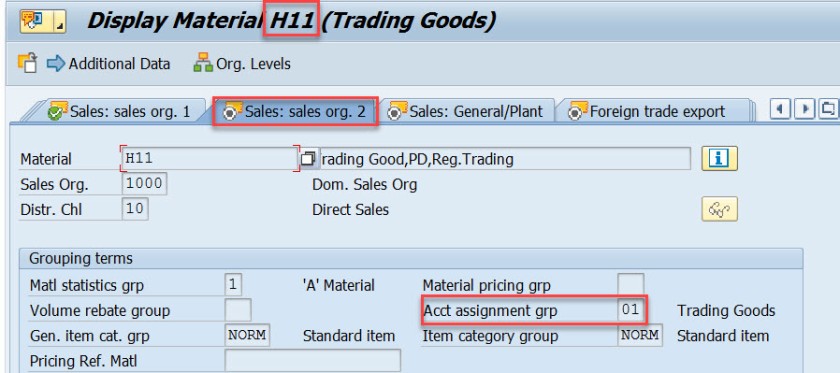

Account keys are assigned to the material master record on the material sales org 2 view.

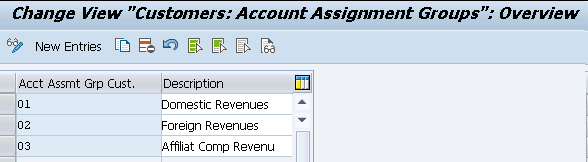

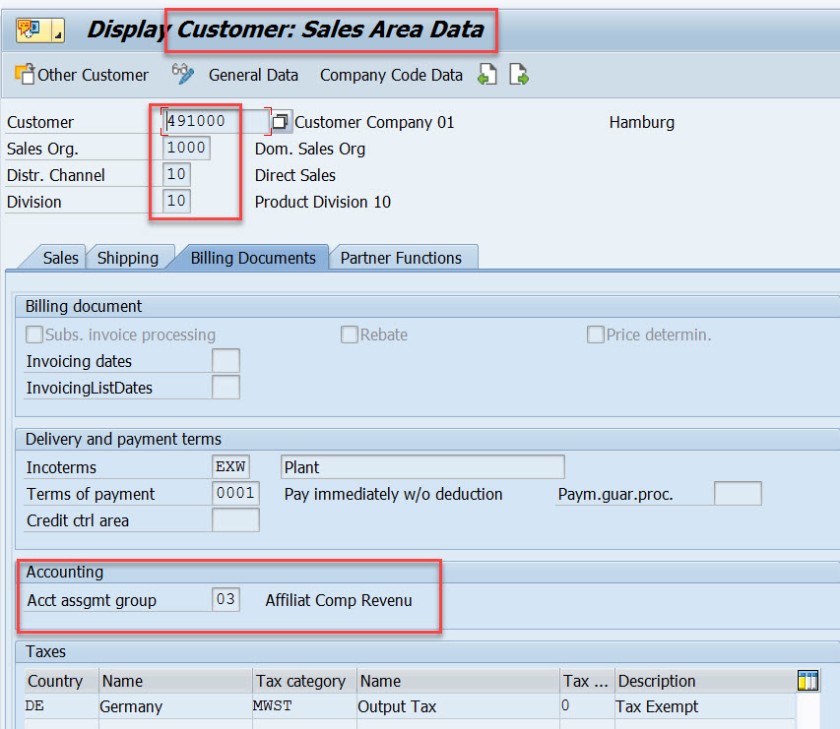

4.2 Account Assignment Groups for Customers

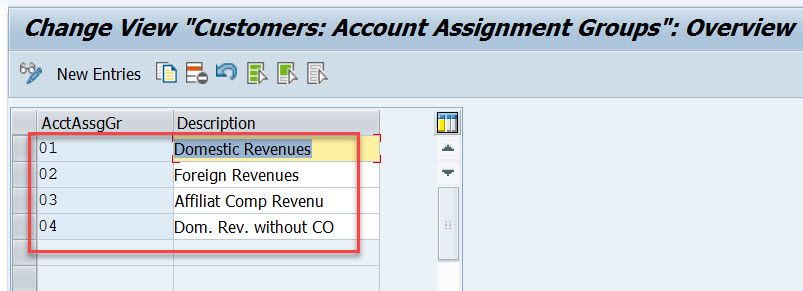

Account assignment groups for customers are useful if we want to post let,s say domestic sales revenue into different account while international sales revenue should be posted into different account.

SPRO –> IMG –> Sales and Distribution –> Basic Functions –> Account Assignment/Costing –> Revenue Account Determination –> Check Master Data Relevant For Account Assignment –> Define Account Assignment Groups for Customers

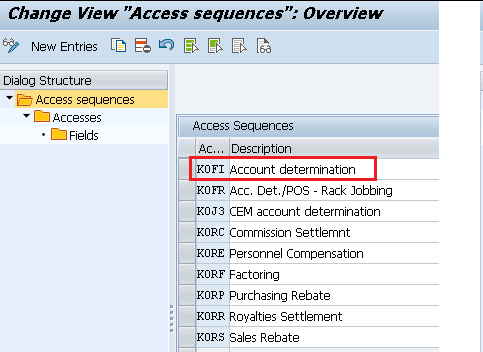

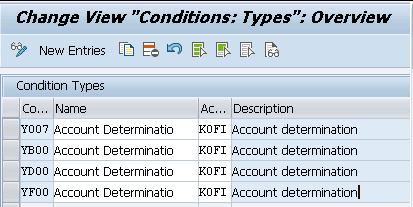

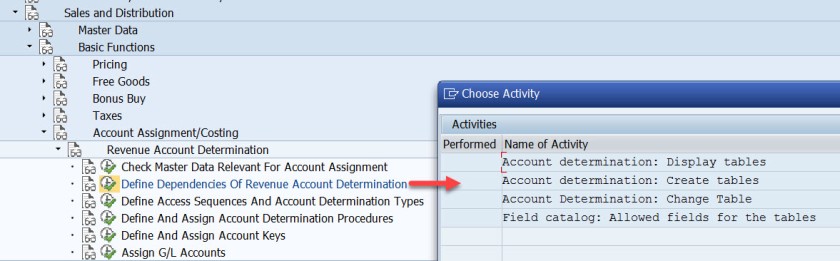

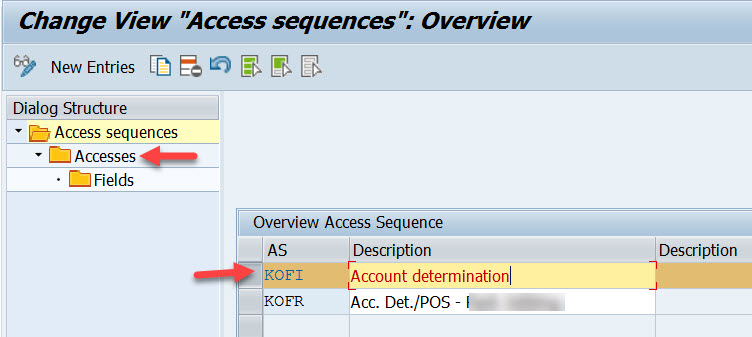

4.3 Define Access Sequences and Account Determination Types

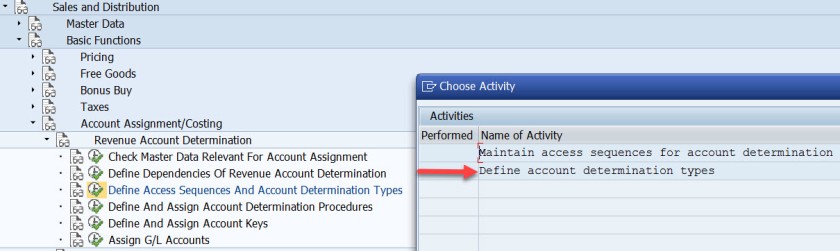

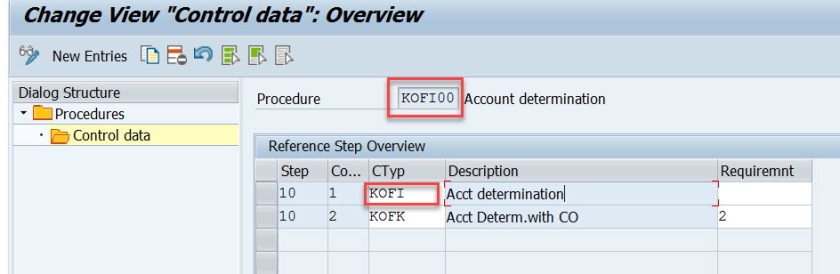

The Standard SAP has two condition types: KOFI (account determination) and KOFK (account determination with CO).

For our car business we will use the standard condition type KOFI, which uses the access sequence with the key KOFI.

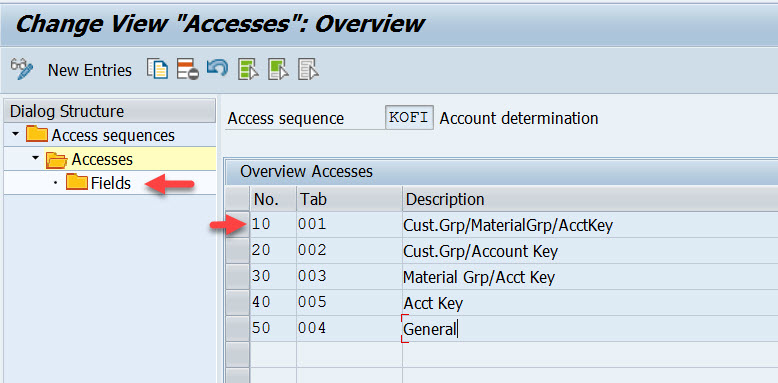

The KOFI access sequence has five condition tables assigned to it

S PRO –> IMG –> Sales and Distribution –> Basic Functions –> Account Assignment/Costing –> Revenue Account Determination –> Define Access Sequences and Account Determination Types –> Define Access Sequences for Revenue Account Determination

S PRO –> IMG –> Sales and Distribution –> Basic Functions –> Account Assignment/Costing –> Revenue Account Determination –> Define Access Sequences and Account Determination Types –> Define Account Determination Types

We can now allocate our chosen access sequence KOFI to the relevant account determination type (condition type) of our pricing procedure.

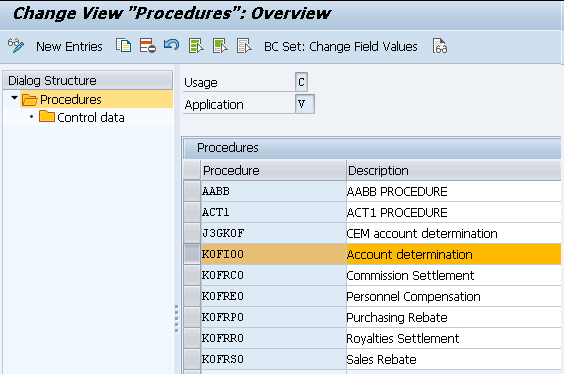

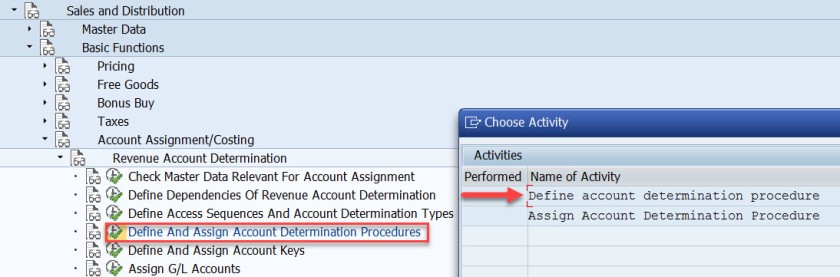

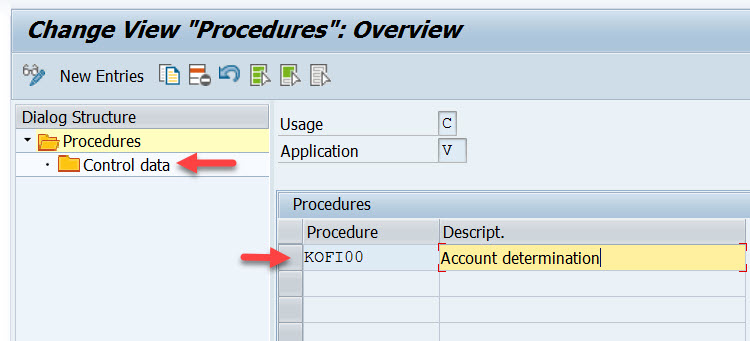

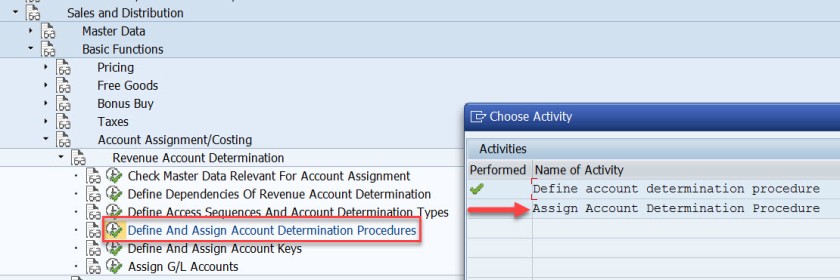

4.4 Define & Assign Account Determination Procedures

Here we define account determination procedures and allocate them to the billing types.

In an account determination procedure, we define the sequence in which the system should read the account determination types (condition types).

S PRO –> IMG –> Sales and Distribution –> Basic Functions –> Account Assignment/Costing –> Revenue Account Determination –> Define And Assign Account Determination Procedures –> Define account determination procedure

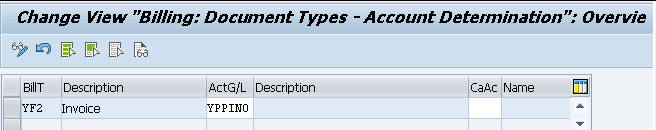

S PRO –> IMG –> Sales and Distribution –> Basic Functions –> Account Assignment/Costing –> Revenue Account Determination –> Define And Assign Account Determination Procedures –> Assign Account Determination Procedure

Here we will assign our account determination procedure YPPIN0 to our customized billing type YF2

Please click HERE to check the configuration of our billing type “YF2”

4.5 Define And Assign Account Keys

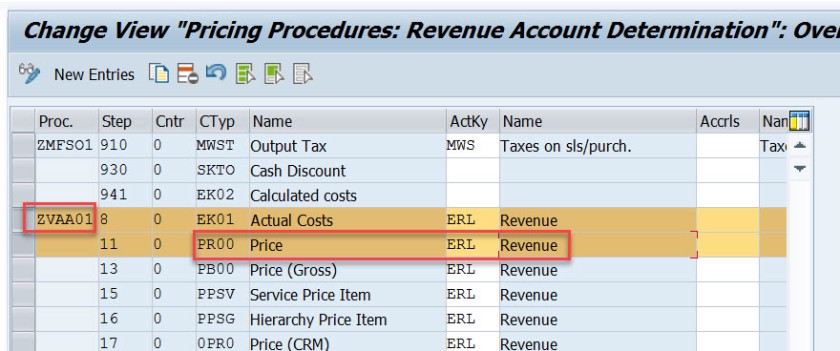

We define account keys here and allocate them to the condition types in the pricing procedures. We have already defined and assigned account keys to our pricing procedure PPIN01

S PRO –> IMG –> Sales and Distribution –> Basic Functions –> Account Assignment/Costing –> Revenue Account Determination –> Define And Assign Account Keys –> Assign Account Keys

With the account keys, we group together similar accounts in financial accounting.

Using the account key, system finds the relevant GL account.

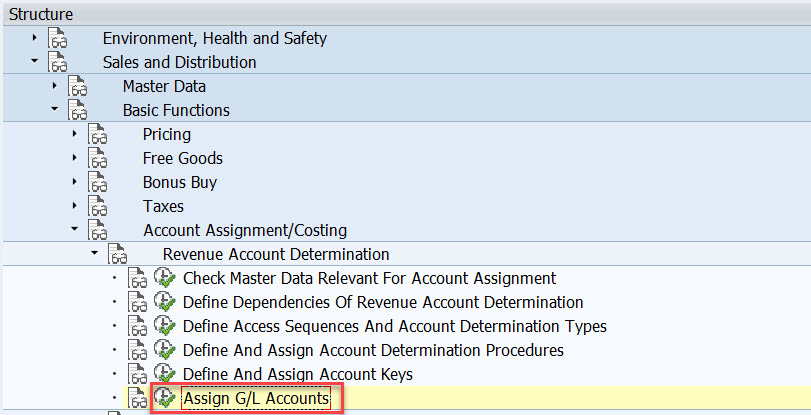

4.6 Assign G/L Accounts (VKOA)

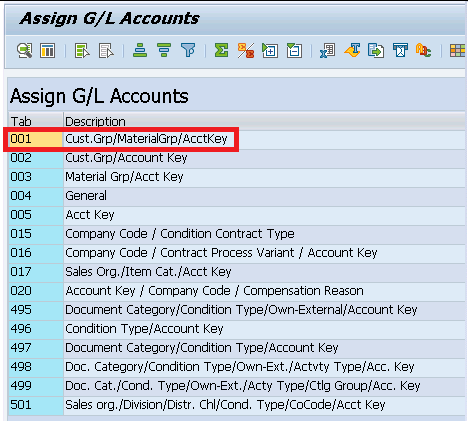

Here based on the access sequence of tables for KOFI, we will select the table “001” Cust.Grp/MaterialGrp/AcctKey. Here we will assign all the relevant GL accounts.

Below are the components for GL assignment

S PRO –> IMG –> Sales and Distribution –> Basic Functions –> Account Assignment/Costing –> Revenue Account Determination –> Assign G/L Accounts

We have created GL account corresponding to the every key of our pricing determination.

Now assign all the three GL accounts to the respective keys

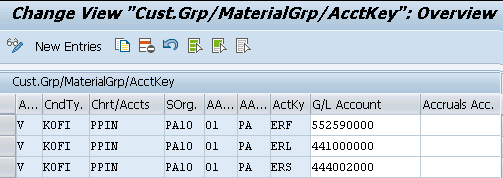

4.7 Assign G/L Accounts For Tax Posting

Here we first create the tax account for output tax and assign this to the respective key (MWS)

GL 222000000 – PPIN-Output Tax (MWS) will be used to post tax amount.

Please see HERE to see the step by step GL 222000000 account creation

Assign the GL for tax posting as per the below

SPRO –> IMG –> Financial Accounting Global Settings –> Tax on Sales/Purchases –> Posting –> Define Tax Accounts

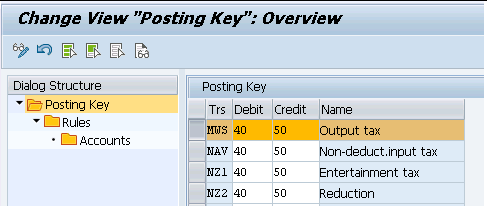

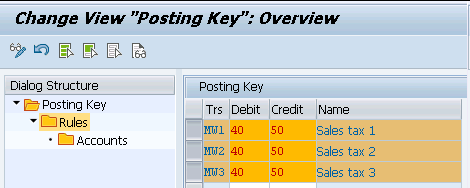

4.8 Tax Accounts Keys MW1, MW2 & MW3

Since tax keys MW1, MW2 & MW3 are given in our output tax determination schema so system will post the tax amounts on the GL accounts corresponding to these three keys

We have given GL 222000000 for all the three tax keys

5. Create Billing

now the next part of the O2C cycle is to post the billing. At the time of billing system will post the respective values onto the determined & assigned GL accounts as per the revenue account determination procedure.

start VF01 and input our Outbound delivery number

Create the billing and click on

Billing Documents –> Release to Accounting

system throws the below error

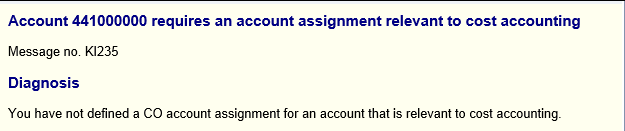

5.1 Error KI235 -GL requires an account assignment relevant to cost accounting

system throws the below error.

To resolve this error we need to activate profit center accounting as well as cost center accounting for our controlling area.

5.1.1 Profit Center Accounting

First we need to set our controlling area PPIN to set up Profit Center Accounting.

Then we need to maintain the global settings for Profit Center Accounting in our controlling area PPIN.

5.1.1.1 Controlling Area setting for Profit Center Accounting

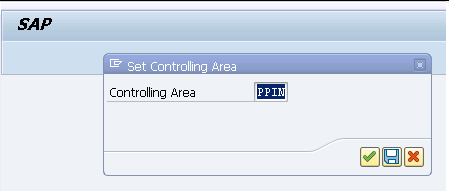

We will set our controlling area PPIN

SPRO –> IMG –> Controlling –> Profit Center Accounting –> Profit Center Accounting –> Set Controlling Area

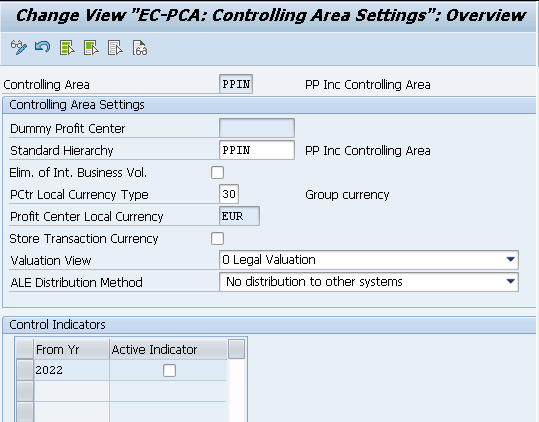

5.1.1.2 Maintain Controlling Area setting

Maintain the PPIN controlling area setting as below

SPRO –> IMG –> Controlling –> Profit Center Accounting –> Controlling Area Settings–> Maintain Controlling Area Settings

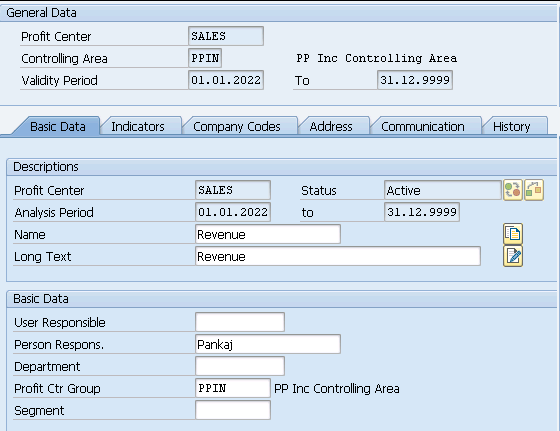

5.1.2 Create Profit Center

Run KE51 and created profit center “SALES”

5.1.3 Cost Center Accounting

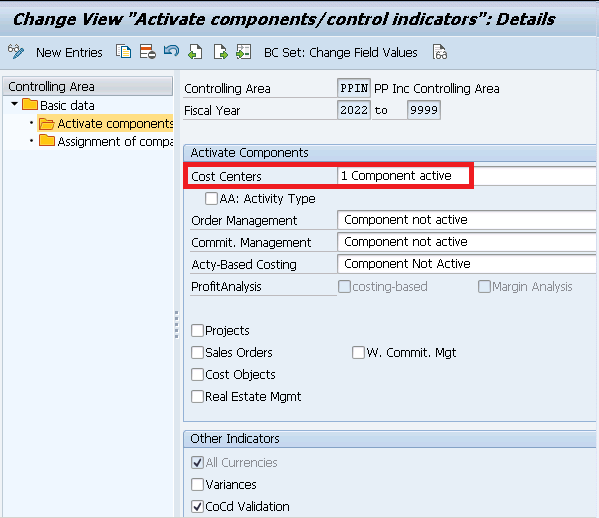

we need to first activate cost center accounting on our controlling area.

SPRO –> IMG –> Controlling –> Cost Center Accounting –> Activate Cost Center Accounting in Controlling Area

activate for our controlling area PPIN

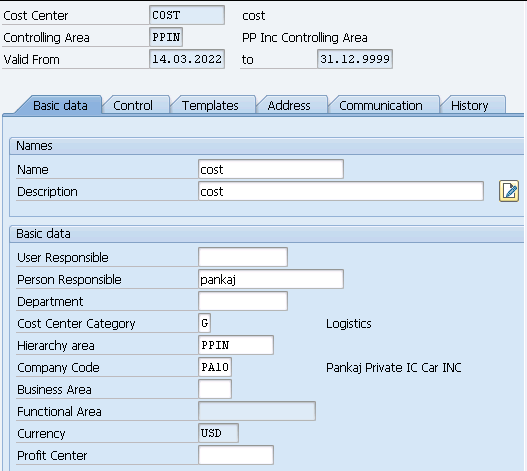

5.3.1.1 Create Cost Center

Start KS01 and create cost center “Cost”

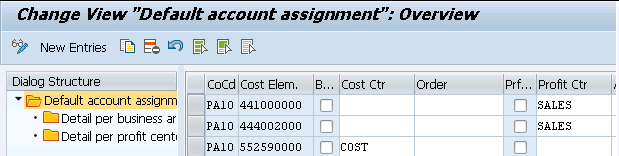

5.2 Error KI235 -Resolution (OKB9)

Since now we have created profit center & cost center so assign them to the respective cost element under OKB9 to resolve this error

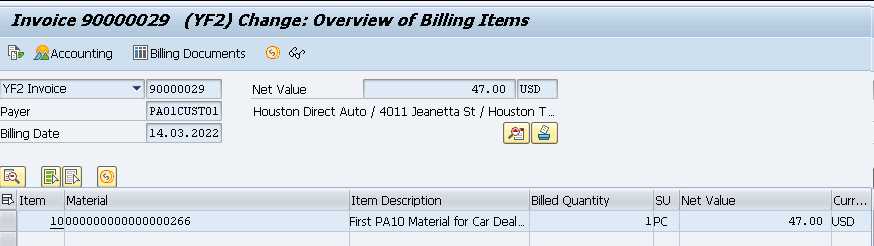

6. Create Billing – Retry after Error Resolution

Start VF01 and input outbound delivery number and press enter

Billing document is successfully posted to accounting

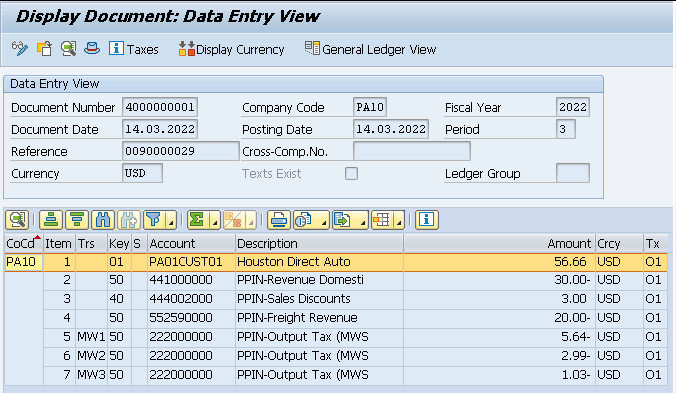

6.1 Accounting Entries at Billing

Billing is now created and released to accounting

Display accounting document

SD-FI integration completes here.

Picture Courtesy : Inter vector created by rawpixel.com – www.freepik.com

Join the discussion Cancel reply

Further reading.

Configure SAP S4 HANA SD Output Tax in 6 Quick Steps

An Ultimate guide to Sales Order in SAP S4 HANA SD

Configure SAP S4 HANA Sales Documents in 10 Minutes

G/L Account Determination in SAP SD

Most of the transactions in SAP are recorded against the GL account. During creation of billing document form a sales order , an accounting document is created where material value is posted against a G/L account. The post describes how the system determines the G/L account for a material sold to a particular customer by the GL account determination technique.

Lets try to create a sales order for a customer with some material and then creating a billing document from the sales order which also generated the accounting document.

To create sales order go to Tx- Va01

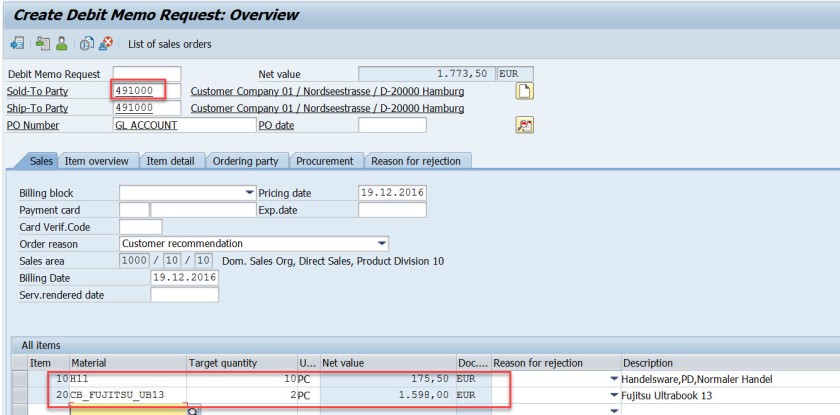

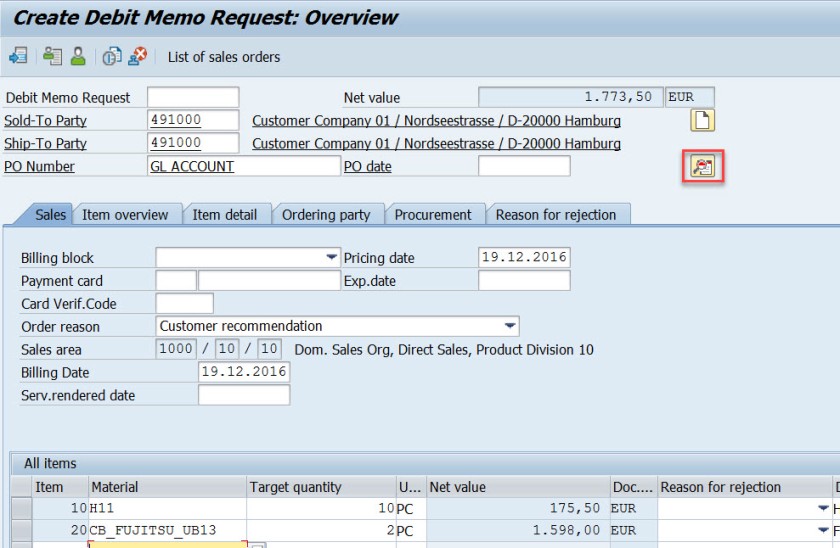

Lets create a debit memo request for the sales area 1000/10/10.

Provide the customer number and few materials and its quantity and double click on the first material to see the item details.

From the pricing procedure – for the pricing condition type- PR00 material value is calculated as 175.50 EUR.

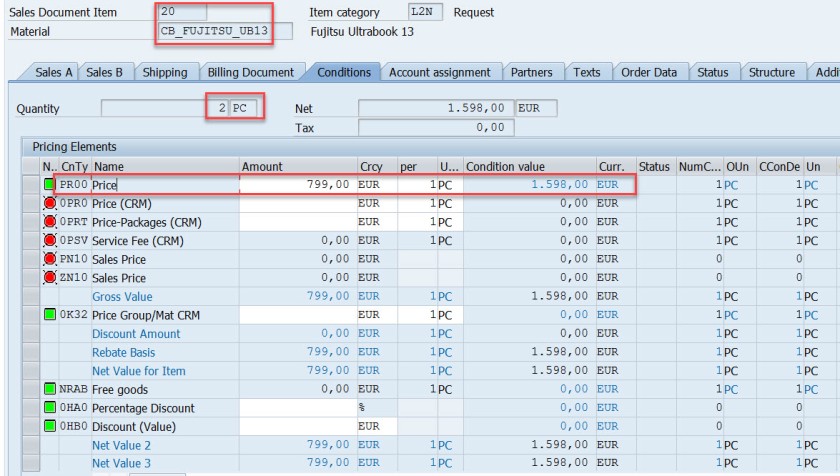

For the second material for the pricing condition type- PR00 material value is calculated as 1598.00 EUR. Go back.

Select the header button.

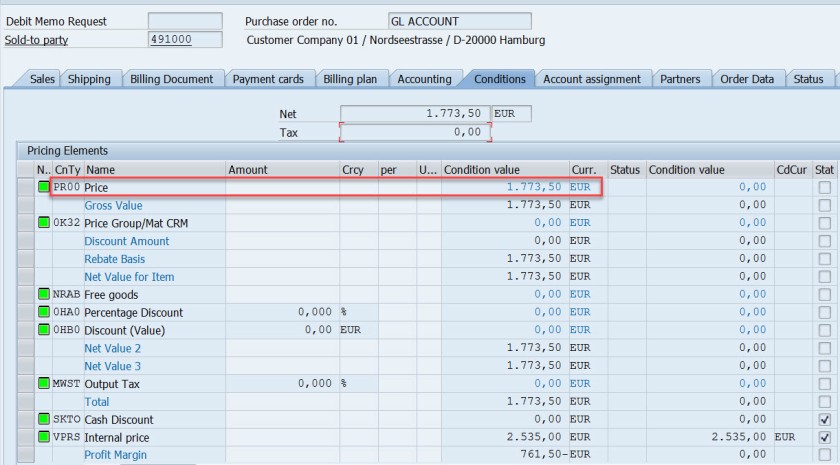

In the header section, in the Conditions tab, the total price is the sum of two materials.

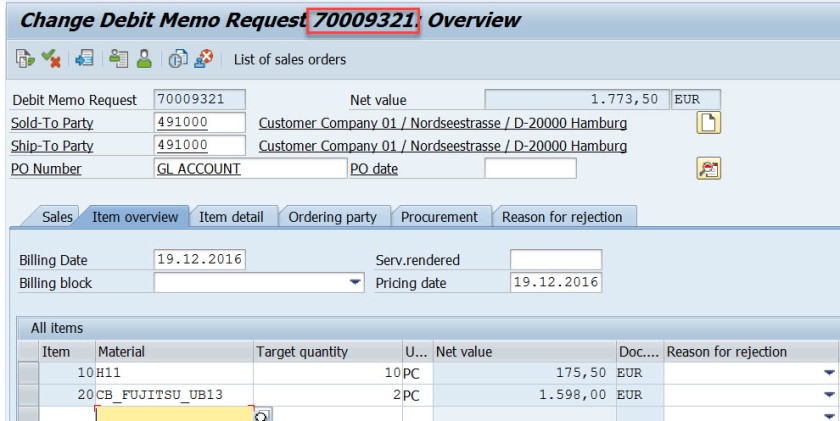

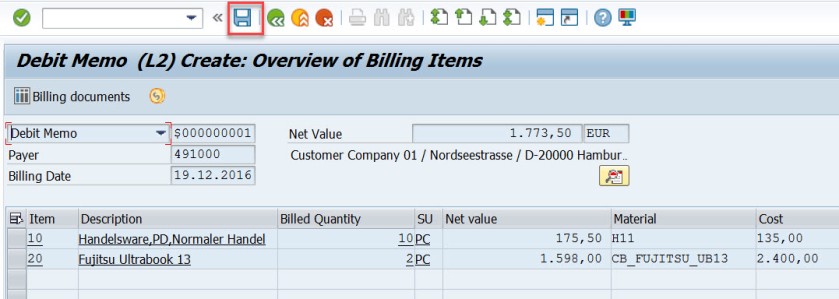

Save and DMR is created.

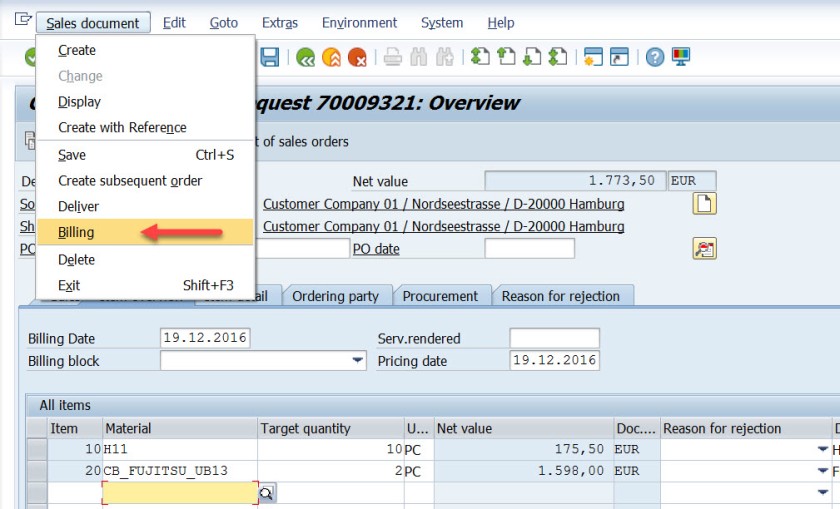

Go to Tx- VA02 and from the menu choose Billing.

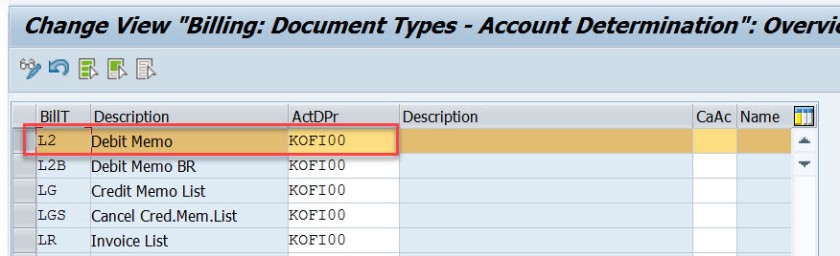

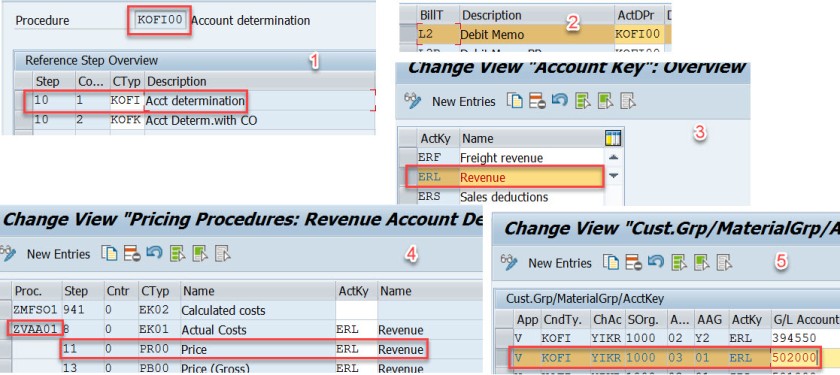

Select Save button to create a billing document. mark billing document type is determined as – L2.

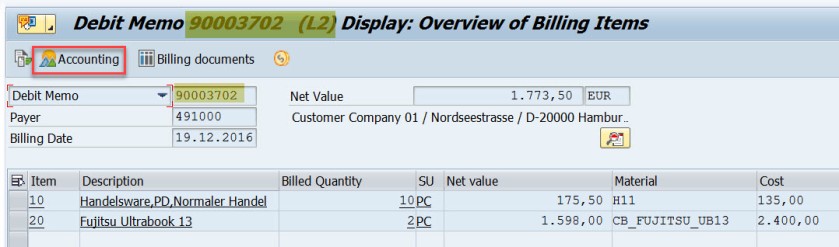

Go to Tx- VF03 and display the billing document. Choose Accounting button.

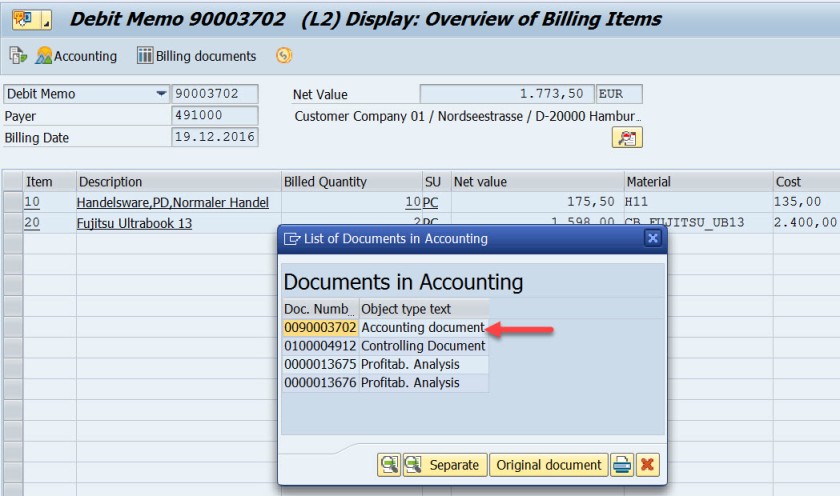

Choose Accounting document.

Here is the accounting doc with few lines.

First entry is for the customer as we used the customer – 491000, the account becomes 491000 for the customer.

For the second line, the GL account calculated as 502000. Let’s figure it out how this g/L account is determined.

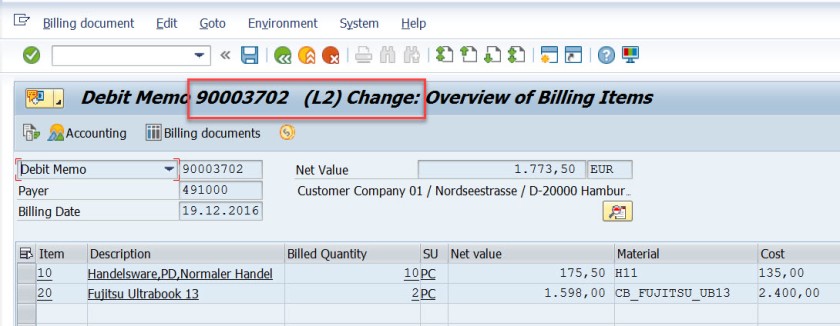

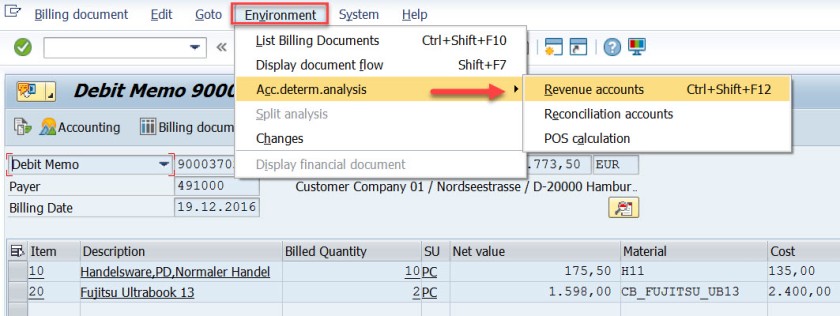

Go to Tx- VF02 and edit the billing document.

From menu, navigate along the highlighted path.

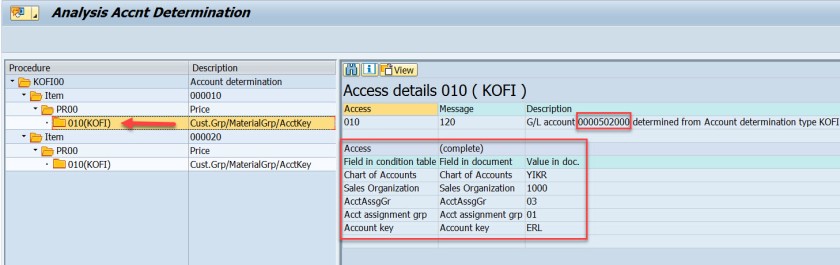

Well, it says the Account Determination procedure is KOFI00 and for the first item , for the pricing condition type PR00, the G/L account as 502000.

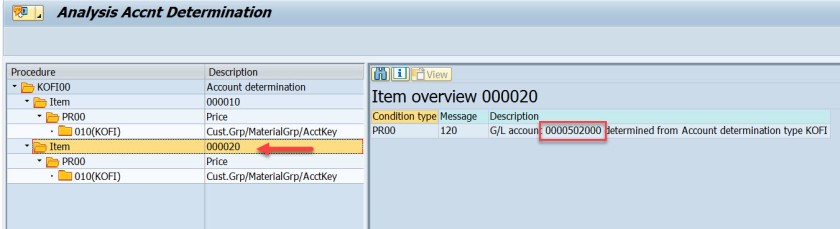

Same for the second item.

The G/L account determination requires few customizing steps.

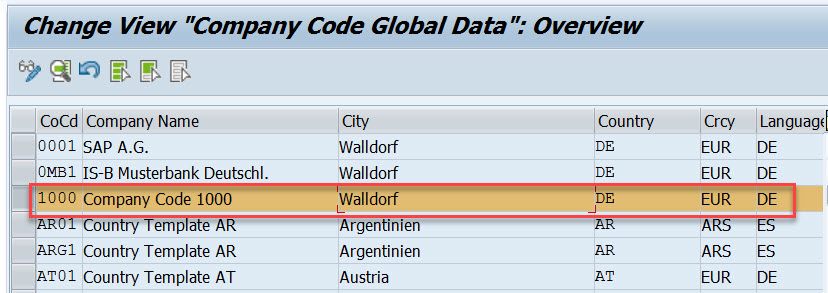

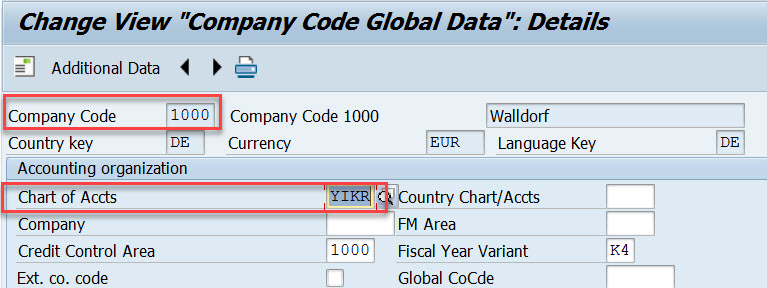

First check what is the chart of account assigned to the company code. In SPRO IMG structure navigate along the highlighted path to see the chart of account assigned to the company code.

For the demo we use company code- 1000

The chart of account is – YIKR

Next step , the customizing in the Sales&Distribution section for the Account Assignment/Costing.

First execute – Check master data relevant for account assignment.

Select first option- Materials : Account Assignment Groups.

Here Material account assignment group is created which is assigned to the material master when created in Tx- MM01

Select second option- Customer : Account Assignment Groups.

Here Cusomter account assignment group is created which is assigned to the customer master when created in Tx- XD01

For our used material in sales order- H11, open this material in Tx- MM03 and in the Sales: sales org.2 tab, the material account assignment group is assigned to the material.

Similarly for another material used in sales order, it is assigned to the material account assignment group.

For our customer – 491000, open this customer in Tx- XD03 and go to the sales area data & in the billing document tab, customer account assignment group is assigned to the customer.

This customer and material account assignment group will help to determine the GL account.

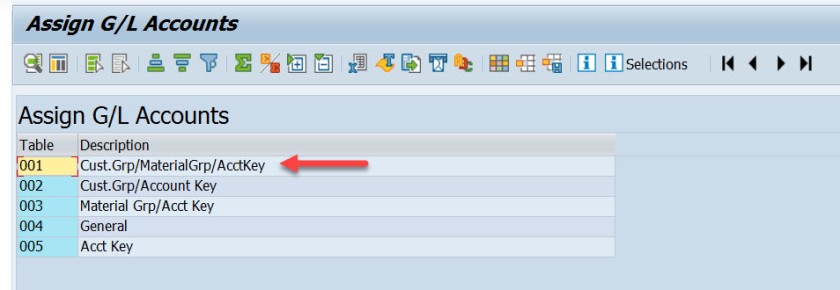

GL account determination uses the condition technique. Now the next step is to define the condition tables. So choose option- Define Dependencies of Revenue Account Determination. If you want to create new tables you can choose Create Table option. For this demo we are leaving this as already we have few condition tables.

Next is defining the access sequence and the condition type. So choose the highlighted opton.

Access Sequence is defined as – KOFI( a new access sequence can be created bu New Entries button ). Select the access sequence and choose Accesses from left hand section to see all the access lines with condition table.

Well this access sequence KOFI has five access line each refers to one condition table.

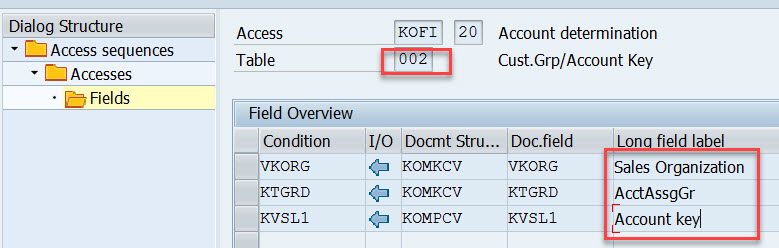

Select one access line and choose Fields button to see all the fields included in the condition table to form the access line 10.

Access line-10 with condition table 001 has 4 fields.

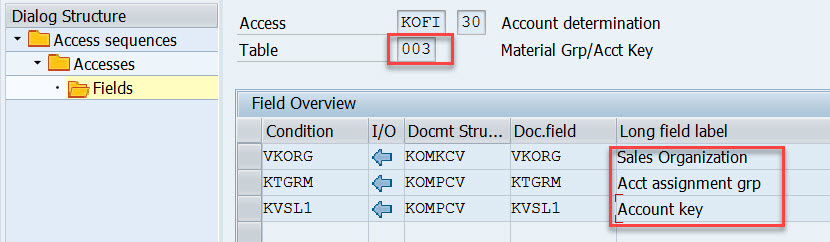

Similarly for other access lines with condition tables other fields are there.

For access line 30.

For access line 40.

Choose Define Account Determination type.

Here Condition type- KOFI is created which is assigned to the access sequence KOFI which has 5 access lines with different condition tables.

Choose the option as pointed to create account determination procedure.

Procedure KOFI00 is created and assigned to the account condition types. Choose the procedure and select Control data from left side.

Here the account determination procedure is assigned to the condition type.

Choose the option – Assign account determination procedure.

Here the account determination procedure is assigned to the billing type.

Next step is to define account key. Choose the marked option.

For different types like revenue, tax and other different account keys are defined. For revenue its ERL.

Next step is to assign the account key to the pricing procedure – condition type PR00.

Here for the pricing procedure ZVAA01 and condition type PR00, the account key is assigned as ERL.

In the above created sales order, item we can check the pricing procedure as below bu selecting the Analysis button in the conditions tab of the item detailed screen.

Next time is to assign the G/L account. Choose the marked option.

Here we have five options. as account condition type KOFI of the account determination procedure KOFI00 is assigned to the access sequence – KOFI with five access lines.

This is like maintaining the condition records. During the GL account determination process, it checks to find the GL account by taking all the values from the billing document and checking against the condition records for table 001. If found it calculated the G/L account and if not found then checks for the condition records for the second table and so on upto 005 until it finds a G/L account.

Choose/double click on the first line.

Here we have maintained for V-Sales, KOFI- account condition type, YIKR as the chart of account and other four fields like sales org, customer account group, material account group and account key comes from the condition table, for our demo purpose we have assigned the G/L account as- 502000.

( Before assigning to the G/L account here it should be created first).

For our demo

- From Billing Type L2 it derives the account determination procedure as- KOFI00

- From account determination procedure- KOFI00 it find the account condition type as – KOFI

- During creation of billing its finds for the item, pricing procedure and the condition type as PR00

- Then it finds the account key for the pricing procedure with condition type PR00 as ERL

- The customer account assignment group is – 03

- The material account assignment group is – 01

- The chart of account as- YIKR fot the company code- 1000

- By taking all these values, the G/l account number calculated as – 502000

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

12 comments

Very well explained

Can you please explain me how to assign different GL account while creating accounting document? What changes do I have to make?

is there any way to do a mass analysis on how account assignment has been done over a period of time? ie which tables were used with with criteria? We want tot clean up the SD account assigment tables which currently have over 100.000 entries and are not manageble anymore.

It’s truly a nice and useful piece of info. I’m happy that you shared this useful info with us. Please keep us up to date like this. Thank you for sharing.

Hi. I have an inquiry regarding the classification of ERL account group. In my current company, there are two GL accounts which are currently tagged to ERL (Revenue) – one is cash and another is VAT adjustment (based on their description). My question is, are those two accounts valid to be determined under ERL? If so, what is the impact if this matter is unresolved? Hope someone can take up and provide me a good input. Many thanks in advance.

this is how the fucking a document must be. excellent!

Thank you so much, detail explanation. Appreciate the hard work

Could you add little detail on ” how does the pricing procedure ZVAA01 and condition type PR00 linked/determined for an item”

Pricing procedure is not determined on the item level. Pricing Procedure is determined on the header level. In tx- OVKK , the determination of pricing procedure customizing are maintained. The sales area, document pricing procedure and the customer pricing procedure determines the pricing procedure. When an order is created we know the sales area(sales org, dist channel and division), the document pricing procedure derived from the document type and from the sold-to-party (customer) the customer pricing procedure is derived. With all these information, Pricing procedure is derived.

The pricing procedure contains condition types like PR00 and others. In Tx- VK11/VK12/Vk13 we can maintain pricing condition records against each condition types. When we enter a material in an item, from the already determined pricing procedure it gets the condition types and tries to find the pricing condition record for the material. This is how the price is found for that item condition type.

Hope this helps!

Like Liked by 1 person

Thanks to you Siva and Manish, I am not in to SD but was trying to have extended understanding between FI-SD integration and found your tutorial, its really help full. I was going through with the tutorial and played your videos as well in you tube. It helps me to understand the process and bridge the gaps from SD side. Really appreciate your effort on preparing and sharing the knowledge

Thanks for the details .suggest reading the note on account-determination helpful things are described there

execellent..well done..thank you

Leave a Reply Cancel reply

- Already have a WordPress.com account? Log in now.

- Subscribe Subscribed

- Copy shortlink

- Report this content

- View post in Reader

- Manage subscriptions

- Collapse this bar

Setting Up Account Determination

After completing this lesson, you will be able to:

- Use the control options for account determination

Account Determination Influencing Factors

The system automatically determines the financial accounts that are automatically posted with the goods movement.

When a goods movement is recorded, the system posts to the stock account of the material and to one or more offsetting accounts depending on the goods movement. This automatic account determination depends on various factors, such as the chart of accounts, the plant (or valuation area), but also on the material.

The following table roughly represents the account determination logic for goods movements with the determining factors.

It shows an example for a simple goods issue to a cost center.

Let's look at the influencing factors one by one.

The type of goods movement

Depending on whether you are posting a goods issue to a cost center or a goods receipt with reference to a purchase order, for example, different posting schemas result:

- A goods receipt with reference to a purchase order results in at least a debit posting to an inventory account, possibly another debit posting to a price difference account if the material is valuated at standard price, and a credit posting to a GR/IR clearing account that is cleared when the invoice is posted.

- A goods issue to a cost center results in at least one credit posting to an inventory account and one debit posting to a cost account.

The posting schema, that is the possible posting line types to be generated, is assigned to the movement type. You can view it in the movement type configuration.

Start the following interactive demo to learn more about the posting schema depending on the type of goods movement.

In the previous demo, we learned that when a goods issue is posted to a cost center, in addition to the stock account (transaction key BSX), an offsetting account is also updated, which is further specified by transaction key GBB plus account modification VBR. This explains columns 2 and 3 in the table above.

- The valuation area

The valuation area is a logical organizational unit that structures a company for the purpose of uniform and complete valuation of material stocks. In SAP S/4HANA Cloud Public Edition, each plant represents a valuation area.

This means that you can basically control automatic account determination per plant. You assign a valuation grouping code to each plant to group plants that should be treated the same for account determination. The valuation grouping code is an account determination key (see column 4 of the table above).

The following image shows the Group Together Valuation Areas configuration activity where you assign a valuation grouping code to plants. Here, you can see that valuation grouping code 0001 is assigned to all plants.

The product

The following video explains how account determination is affected by the valuation class in the material master record.

To learn how to create and assign valuation classes start the following interactive demo.

To learn how to create an account category reference and assign it to a material type, start the following interactive demo.

We have reviewed each of the following factors that influence account determination:

- The movement type

- The material

Account Determination Configuration

Automatic account determination configuration activity.

Now that we have examined the factors that influence account determination, start the following demo to learn how you can define accounts for certain combinations of factors that the system can automatically determine for goods movements.

In practice, account determination for goods movements is a joint task of the logistics/supply chain and finance teams. An important contribution of the supply chain consultants is to understand the interrelationships and influencing factors so that the finance people can assign the correct accounts.

Log in to track your progress & complete quizzes

SAP SD Transaction Codes – List of SAP SD TCodes

Sap sd transaction codes.

SAP SD Transaction Codes – Important List of SAP Sales and Distribution Transactions (T-Codes) that are used for configuration and implementation of SAP SD module, integration, and end-user level transaction codes.

Refer below for the complete SAP Transaction codes of the SAP Sales and Distribution module.

SAPHANATUTOR.COM

SAP ECC | SAP S/4 Hana Tutorials

How Customer Account Groups in SAP SD are created | Saphanatutor.com

Introduction to customer account groups in sap sd.

Customer Account groups in SAP SD are essential for effectively managing and organizing customer and vendor data. They play a key role in defining the structure and attributes of customer and vendor master records. Below are some of their critical functions:

Table of Contents

- Field Selection Control : Account groups determine which fields in the master record are mandatory, optional, or hidden. This standardization ensures consistency and completeness in data entry.

- Number Range Definition : Account groups assign specific number ranges to customer or vendor accounts. This assignment dictates whether account numbers are generated automatically by the system or entered manually.

- Master Data Management : These groups control the maintenance of master data for customers or vendors. This includes creating, modifying, and viewing master records.

- Customer/Vendor Classification : Account groups classify customers or vendors into distinct categories, simplifying management and analysis. For example, they can differentiate between domestic and international customers.

In SAP S/4HANA Sales, standard customer account groups are essential for managing customer master data, each serving specific roles in sales transactions. These include:

- Sold-To Party (SP) : Customers who receive goods or services.

- Ship-To Party (SH) : Customers to whom goods or services are delivered.

- Bill-To Party ( BP ) : Customers responsible for invoice payments.

- Payer (PY) : Customers who make the actual payments.

- Contact Person (CP) : Individuals serving as contact points at customer locations.

These account groups organize customer data efficiently, catering to different aspects of sales and distribution processes in SAP S/4HANA. These standard account groups are designed to address typical business scenarios in SAP systems. They can be adjusted or augmented with new groups to align better with specific business processes and needs.

Step by step process to create Customer Account Groups in SAP SD

In this SAP Sd tutorial , we are creating a new customer account group called “ SAHT ” with a number range “ ZS ” . In SAP SD creating Account groups are like setting up a new category in your customer database. You’ll give it a name, maybe a description that explains it’s for customers related to products, and then assign a unique code “ ZS ” to identify customers in this group.

- Create Number range intervals for customer Account groups.

- Create Customer Account Groups and assign the number ranges intervals.

Creating Customer Account Groups in SAP SD (OVT0)

First, log into the SAP system using your credentials. Then, go to the section where you manage customer account groups, using a specific code (like OVT0 ). Here, you’ll add a new entry for your “SAHT” group.

- Transaction code : OVT0

- Img path : SPRO => Logistics general => Business partner => Customer control => define a/c group and field selection for customer.

Select the Standard Account Group “0001” (Sold to party) and define your own Account Group (SHT) as shown below.

As shown below, enter your desired Account name and select the number ranges that created earlier.

Save the Settings.

Customer Account Group is SAP SD has been created Successfully.

To check open the transaction code XD01 to create Customer Account Groups in Sales and Distribution.

In this SAP SD tutorial, we successfully covered how to create an Account Group within the Customer Master, a key step for managing customer data effectively in SAP. Next up, we’re preparing an in-depth, step-by-step guide on the Partner Determination Procedure in SAP SD.

Related posts:

- Most used SAP SD Transaction codes in Realtime

- SAP SD TCodes List

- Revenue Account Determination in SAP SD: A Comprehensive Guide

- Defining Number Ranges for Customer Account Group | XDN1

- Comprehensive Guide to SAP Customer Master

In this topic, we described about the Accounting Key and Define Accounting Key process along with technical information.

Condition type needs a defined key to write its value. The key might have established outside the pricing procedure. The key is called as Account Key.

Account key is a table entry and describes the pricing procedure where to copy the calculated condition values. The account key enables the system to post amounts to certain types of revenue account.

Define Accounting Key: -

Step-1: Enter the transaction code OV34 in the SAP command field and click Enter to continue.

Enter the transaction code SPRO in the SAP command field and click Enter to continue.

Click on SAP Reference IMG .

Expand SAP Customizing implementation guide → Sales and Distribution → Basic Functions → Account Assignment/Costing → Revenue Account Determination → Define and Assign Account Keys . Click on Execute .

In the next screen, select Define Account Keys and click on Choose button.

Step-2: In the next screen, Click on New Entries button.

Step-3: Enter the below details and click on Enter .

- ActKy -- Enter 3-digit alphanumeric account key.

- Name -- Enter the account description.

Step-4: Once all the details entered, click on the Save button to save the changes.

Step-5: It prompt for the Change Request. Create/Select the change request and Click on right mark to proceed.

Step-6: Status bar displays the below message once the accounting key saved successfully.

Technical details: -

- Transaction: OV34

- Menu Path: SPRO → SAP Reference IMG → SAP Customizing implementation guide → Sales and Distribution → Basic Functions → Basic Functions → Account Assignment/Costing → Revenue Account Determination → Define and Assign Account Keys

- ABAP Snippets

- Top SAP Courses

- Top SAP Books

SAP and ABAP Free Tutorials

Account assignment in SAP Purchasing (MM) – FAQ

This note provides answers to frequently asked questions regarding account assignment in purchasing documents. This post is based on Snote 496082.

Table of Contents

FAQ: Account Assignement in SAP Purchasing

Account assignement : g/l account for a sales order.

Question: Why is the G/L account for a sales order with nonvaluated individual sales order stock different from the account with valuated indivi dual sales order stock?

Answer: See Note 458270.

Multiple Account Assignment in Purchasing

Question: Can you create several assets at the same time in the new purchasing transactions?

Answer: You can create several assets at the same time. However, you must first ensure that at least as many account assignment lines have bee n created as the number of assets that you want to create. You can do this very easily using the copy function.

G/L Account is not saved if switch to a material group

Question: You create a purchase order with account assignment using transaction ME22. You enter a material group, from which a G/L account is de termined using the valuation class. If you then switch to a material group that does not determine a G/L account via the valuation class, the system deletes the previous G/L account and prompts you to enter a G/L account. If you cancel the account assignment screen and change the material group back on the item detail screen, the previously determined G/L account is not determined again. Why is this ?

Answer: Unfortunately, this system behavior cannot be changed. First, enter any G/L account, so that the item is valid. If you then switch to the old material group again, the system also determines the correct G/L account again.

Entering the same account assignments for different items

Question: Is there an easy way of entering the same account assignments for different items in the new EnjoySAP transactions?

Answer: Ensure that Note 315676 has been implemented in your system and follow the procedure described there

Repeat account assignment function not work in the new EnjoySAP

Question: Why does the repeat acc. assignment function not work in the new EnjoySAP transactions when you create new account assignments in multiple acc. assign. ?

Solution: Use the copy function in multiple acc. assignment to create identical account assignment lines. You can use the repeat account assi gnment function to create similar account assignments for different items with the same account assignment category. To do this, proce ed as described in the answer to question 4.

Issue message KI 161 “Cost center &/& does n ot exist on &

Question: When you change the account assignment of an existing purchase order, why does the system issue message KI 161 “Cost center &/& does n ot exist on &” ? The same phenomenon occurs for other account assignment objects (for example, profit center).

Solution: Refer to Note 193371.

Can you create assets from the single account assignment screen?

Solution: Assets can only be created from the multiple account assignment screen (“Account assignment” tab). You can switch between single account assignment and multiple account assignment on the “Account assignment” tab page by clicking the icon above on the left.

Why does the system not display an account assignment tab page even though you have entered an account assignment category?

Solution: After you have implemented Note 520149, the account assignment tab is not displayed until all the required information is available, for example, the company code.

Why are account assignment objects derived in some situations, even though the relevant field on the account assignment tab page is hidden?

Solution: Refer to Note 619203.

ME 453 “Changing consump. or spec. stock indicator not allowed

You create a purchase order with reference to a subcontracting purchase requisition. This purchase requisition was created with an unknown account assignment, that is, account assignment category “U”. When you change the account assignment category in the purchase order, the system issues error message ME 453 “Changing consump. or spec. stock indicator not allowed (subcontracting)”.

Solution: See Note 205597

Select a valuated goods receipt together with multiple account assignment

Why can you not select a valuated goods receipt together with multiple account assignment in a purchase order or purchase requisition?

Solution: See Note 204252.

EBAN-FISTL, -GEBER, -KBLNR, -GRANT and -FKBER (as in table EKPO) empty

Funds Management is active. Why are the fields EBAN-FISTL, -GEBER, -KBLNR, -GRANT and -FKBER (as in table EKPO) empty? Solution: These fields are only filled if the account assignment category is set to “blank”. If you maintain an account assignment category in t he purchasing document, the system adds the information from these fields to the EBKN table (as in EKKN).

AA 334 “You cannot post to this asset (Asset & & blocked for acquisitions)

You try to change a purchase order item with acc. assignment category “A”, which contains a locked asset. The system issues error message AA 334 “You cannot post to this asset (Asset & & blocked for acquisitions)”. Solution: This is the standard system design. To make changes to this purchase order item, you have the following two options:

a) If you no longer require the purchase order item with the blocked asset, delete the purchase order item. b) Otherwise, you must activate the asset, make the required changes to the purchase order item, and then block the asset again.

The indicator for the account assignment screen

Question: What is the meaning of the indicator for the account assign. screen that you can set in Customizing for single account assignment/m ultiple account assignment? Solution: The indicator determines which account assignment screen is used by default for maintaining the account assign. for a purchase orde r item. For the EnjoySAP transactions, this value is simply a proposal that you can change in the purchasing document. For the old transactions, this value is the only one that you can use.

Question: Is there an unknown account assign. for standard purchase orders?

Solution: This is generally not allowed, and the system issues message ME 069 “Unknown account assignment not defined for use here”. There is an exception in the case of service items that are created with item category D (service) or B (limit).

Acc. Assignment check is not performed when Purchase Order is updated

Question: You change data in a purchase order item (for example, purchase order value, delivery date, and so on). Why does the system not perform another acc. assignment check?

Solution: This is the standard system design. When you created the purchase order item, if the system already checked the acc. assignment and there were no errors, another acc.?assignment check only takes place if you change a field that is relevant to account assign.?(for example, quantity, material number, and so on). If this system response does not meet your requirements, implement the account assignment check in the BAdI ME_PROCESS_PO_CUST. The BA dI is called each time the purchase order is changed.

“In case of account assignment, please enter acc. assignment data for item”

Question: If you delete all the account assign?lines that were entered in the account assignment screen, the system exits the account assign. tab page and goes to the material data. In addition, the system issues the error message “In case of account assignment, please enter acc. assignment data for item”.

Answer: In the current system design, if you delete all the account assignment lines, the system assumes that you do not want to maintain any account assignment data. This conflicts with the account assignment category and the system issues error message 06 436. You can then remove the account assignment indicator. Procedure: If you want to delete all the account assignment data that was entered, see the answer to question 24.

Third-party order processing (CS) and individual purchase order processing (CB)

Question: Which account assignment categories should you enter in schedule line categories for third-party order processing (CS) and individual purchase order processing (CB)? Solution: See Note 210997.

G/L Account is not transfered from Valuation class

Question: In a blanket purchase order or blanket purchase requisition with account assignment, you subsequently change the material group. Even though the new material group is assigned to another G/L account via the valuation class, the system does not redetermine the account assignment for the relevant item. The old G/L account remains.

Solution: See Note 449216.

Customizing Account assignment fields as required entry, optional entry, or display fields

Question: In Customizing, you can set the, or as completely hidden fields, depending on the account assignment category. These settings also determine whether the system deletes or retains the values for the account assignment fields when you change the account assignment category in a purchase order item.

Answer: In Customizing for materials management (MM), when you maintain account assignment categories (IMG: Materials Management-> Purchasing -> Account Assignment-> Maintain Account Assignment Categories), you can control the different account assignment fields as follows: Required entry: You must make an entry in the field, otherwise the system issues error message ME 083.

- Optional entry: Entry in this field is optional.

- Display: The field is displayed, but it is not ready for input.

- Hidden: The field is hidden. Example:

The acc. assignment category is K, the cost center is an optional entry field and it is filled with the value 1000. You change the acc. assignment category to P. Subject to the field settings for the cost center for the acc. assignment category P, the system response is as follows: The cost center is a required entry or an optional entry field: The system transfers the value 1000 for the cos t center.The cost center is a display field: First, the value 1000 for the cost center is deleted. If the system can determine a value again after you enter the changed acc. assignment category, this value is transferred. The cost center is a hidden field: The system deletes the value 1000 for the cost center.

System ignores the acc. assignment data of the purchase requisition for the second schedule line.

Question: You create a purchase order item assigned to an account with reference to a purchase requisition. For this purchase order item, you create a second schedule line with reference to another purchase requisition. The system ignores the acc. assignment data of the purchase requisition for the second schedule line. Solution: This is the standard system design. The system does not generate multiple acc. assignment in the purchase order item, even if the t wo referenced purchase requisitions are assigned to different CO objects. Refer to Note 47150 for the old transactions and to Notes 422609 and 771045 for the EnjoySAP transactions.

Undelete an item in a purchase requisition if assignment data is no longer valid

Question: Why can you undelete an item in a purchase requisition if the corresponding acc. assignment data is no longer valid? Solution: When you undelete an item in a purchase requisition, the system does not perform a new acc. assignment check. Therefore, the accoun t assignment data is not checked again. Nevertheless, errors occur if you try to create a purchase order with reference to this purchase requisition. When you undelete an item in a purchase order, however, the system does perform another acc. assignment check.

Transfer of Acc. Assign. with Reference Document

Question: You create a purchasing document with reference to a reference document. What account assig. data is transferred? Solution: The acc. assignment data is derived from the reference document. If you delete the acc.?assignment category and enter it again, a new automatic general ledger account determination takes place.

Question What is the correct procedure for changing acc. assignment data?

– If, for example, you want to change the acc. assignment category: Note that you MUST first delete all existing acc. assignment data for the relevant item. You can do this by initializing (deleting) the acc. assignment category and confirming by choosing ENTER. Following this, you can enter the new acc. assignment category and the relevant acc. assignment data.

– If you want to change acc. assignment data for the relevant item: For example, you want to change the main acc. assignment objects such as cost center, G/L account, sales order, network, or WBS ele ment, and so on. Here also, we recommend deleting all existing acc. assignment data by initializing (deleting) the account assignme nt category and confirming by choosing ENTER.If you are working with contracts, you must delete the acc. assignment line on the acc. assignment screen and enter a new line t o ensure that the data is derived correctly again. You MUST NOT change the current settings. For example, in some circumstances, the requirements type (OVZH) or the valuation of the requirements class (OVZG) is changed after th e purchasing document is created. This can cause errors in a valuation of goods movements (goods receipt, for example) and MUST BE AVOIDED.

Read more on? Account Assignment

Related Posts

The Most Important SAP Payment Terms Tables (ZTERM, Text…)

October 21, 2018 March 24, 2021

SAP Batch Management: User-exits and BAdIs

June 17, 2017 January 21, 2022

SAP Batch Management Tcodes, Tables and Customizing (SAP Batch Management)

June 16, 2017 January 21, 2022

IMAGES

VIDEO

COMMENTS

Now, create the account determination procedure. IMG -> SD -> Basic fncs -> Account Assignment >> Revenue account determination >> Define and assign account determination procedures [std = KOFI00 - KOFI, KOFK] The account determination procedure is then assigned to a billing type. The column described as "CaAc" represents the cash allocation ...

Table of Contents. Revenue Account Determination in SAP SD. Step 1: Master Data Relevance in Account Assignment. Step 2: Defining Dependencies. Step 3: Access Sequence and Account Determination Types. Detailed Configuration Steps. Step 4: Account Determination Procedure.

The Standard SAP has two condition types: KOFI (account determination) and KOFK (account determination with CO). For our car business we will use the standard condition type KOFI, which uses the access sequence with the key KOFI. The KOFI access sequence has five condition tables assigned to it. S PRO -> IMG -> Sales and Distribution ...

In SAP S4HANA We can assign different GL accounts to different Sales Conditions using the Account Keys, this video explains the configuration stepsSupport th...

The account assignment category determines: The nature of the account assignment (cost center, sales order, and so on) Which accounts are to be charged when the incoming invoice or goods receipt is posted. Which account assignment data you must provide. Account Assignment Categories. Description. Required account assignment data.

First entry is for the customer as we used the customer - 491000, the account becomes 491000 for the customer. For the second line, the GL account calculated as 502000. Let's figure it out how this g/L account is determined. Go to Tx- VF02 and edit the billing document. From menu, navigate along the highlighted path.

Conclusion. In practice, account determination for goods movements is a joint task of the logistics/supply chain and finance teams. An important contribution of the supply chain consultants is to understand the interrelationships and influencing factors so that the finance people can assign the correct accounts. Continue to quiz.

SAP SD Transaction Codes - Important list of SAP Sales and Distribution Modules transaction codes (Tcodes) that are used for configuration. ... Assignment Sales organization - distribution channel: OVXB: Define Divisions: ... Customer Account Analysis: FD32: Change Customer Credit Management: VD05: Block/Unblock Customer:

Performance Functions for Reporting. Position Flow List. Posting Journal. Reversal of Account Assignment Reference Transfer. General Selections. Example: Valuation and Transfer not Affecting Net Income. Example: Exercise of a Put Warrant with Delivery. Initialization of Parallel Position Management.

Account Assignment Transaction Codes in SAP (66 TCodes) Login; Become a Premium Member; TCodes; Tables; Table Fields; SAP Glossary; FMs; ABAP Reports; ... SD - Billing: 35 : ME22N: Change Purchase Order MM - Purchasing: 36 : FB01: Post Document FI - Financial Accounting: 37 : IAOMA: Log for account assignment Manager

Creating Customer Account Groups in SAP SD (OVT0) First, log into the SAP system using your credentials. Then, go to the section where you manage customer account groups, using a specific code (like OVT0 ). Here, you'll add a new entry for your "SAHT" group. Transaction code : OVT0.

Step-2: In the next screen, Click on New Entries button. Step-3: Enter the below details and click on Enter. ActKy -- Enter 3-digit alphanumeric account key. Name -- Enter the account description. Step-4: Once all the details entered, click on the Save button to save the changes. Step-5: It prompt for the Change Request.

Solution: The indicator determines which account assignment screen is used by default for maintaining the account assign. for a purchase orde r item. For the EnjoySAP transactions, this value is simply a proposal that you can change in the purchasing document. For the old transactions, this value is the only one that you can use.

Attribution of a prepaid or a postpaid account to an item of the provider contract. It is used by the charging function and the refilling function to determine the account (s) to be credited or debited. Account Assignment in SAP - Everything you need to know about Account Assignment; definition, explanation, tcodes, tables, wiki, relevant SAP ...

Standard account s Table. FI - Financial Accounting. Pooled Table. 24. EKKN. account assignment in Purchasing Document. MM - Purchasing. Transparent Table.