Great, you have saved this article to you My Learn Profile page.

Clicking a link will open a new window.

4 things you may not know about 529 plans

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some juristictions to falsely identify yourself in an email. All information you provide will be used solely for the purpose of sending the email on your behalf. The subject line of the email you send will be “Fidelity.com”.

Thanks for you sent email.

How dividends can increase options assignment risk

Most experienced investors are familiar with the adage that "if an investment opportunity sound too good to be true, it probably is." While this sentiment may often be associated with overly optimistic assumptions, it also applies to investors who sell options contracts without first considering the ex-dividend date for a stock or ETF.

How dividends work

A quick review of how dividends work: A dividend represents a payment of a company's revenues to shareholders, most often in the form of cash. Cash dividends are paid out on a per-share basis. For example, if you own 100 shares of a stock that pays a $0.50 quarterly dividend, you will receive $50.

Not all companies pay dividends, but if you're investing in options contracts for companies that do pay them, you need to keep several important dates in mind:

- Declaration date: Date on which a company announces the per-share amount of its next dividend.

- Record date: The cut-off date established by the company to determine which shareholders of its stock are eligible to receive a distribution. This is usually, but not always, 1 day after the ex-dividend date.

- Ex-Dividend date: Date on which a stock's price adjusts downward to reflect its next dividend payment. For example, if a stock pays a $0.50 dividend, the stock price will drop by a half point prior to trading on the ex-dividend date. If you buy a stock on or after the ex-dividend date, you are not entitled to the next dividend.

- Dividend (payment) date: Date shareholders receive cash in their account from a dividend.

See Locating dividend information for stocks for additional details.

Dividends offer an effective way to earn income from your equity investments. However, call option holders are not entitled to regular quarterly dividends, regardless of when they purchase their options. And, unlike stock or ETF prices, options contract prices are not adjusted downward on ex-dividend dates.

This can cause a problem for anyone who has sold an options contract without first considering the impact of dividends. Why? Because the risk of being assigned on an option contract is higher when the underlying security of an in-the-money option starts trading ex-dividend. To understand the risks and how dividends impact options contracts, let's explore some potential scenarios.

Avoiding or managing early assignment on covered calls

As noted above, the ex-dividend date is particularly important to anyone who writes a covered or uncovered call option. If a covered call option you have sold is in the money and the dividend exceeds the remaining time value of the option, there is a good chance an owner of those calls will exercise his options early.

If you are assigned, you must deliver your shares of the underlying security, as well as the dividend income, to the owner of the call. Let's examine a hypothetical example to illustrate how this works.

- Bob owns 500 shares of ABC stock, which pays a quarterly $0.50 dividend.

- The stock is trading around $25 a share on August 1 when Bob decides to sell 5 October 30 calls.

- By early October, ABC stock has risen to $31 and, as a result, Bob's covered calls are in the money by $1. The calls will expire in 10 days and tomorrow the stock will start trading ex-dividend.

- Because the remaining time value of the call option is less than the value of the dividends, the call owner will likely exercise his options on the day before the ex-dividend date.

See Locating option values in Active Trader Pro ® .

If Bob does not take any action to close his covered call position, there is a good chance he will be assigned on the ex-dividend date. This means he will no longer own 500 shares of the stock and he will not receive the dividend income.

To avoid this scenario, Bob has a couple of choices:

- He could buy back the calls he sold to retain the stock and the dividend. However, he would have to do this prior to the ex-dividend date. If he waits until the ex-dividend date or later, he will not be entitled to the dividend income. Keep in mind that it's possible to get assigned prior to the day before the ex-dividend date, so this strategy is not foolproof.

- The other option is to close out his short position and write a new covered call with a later expiration date or a higher strike price. This strategy is known as "rolling" your options contract forward.

Sign up for Fidelity Viewpoints weekly email for our latest insights.

Avoiding or managing early assignment on calls not covered by shares

Now let's consider what could happen if Bob had sold uncovered calls on ABC stock:

- As in the example above, ABC stock pays a quarterly $0.50 dividend and is trading around $25 a share

- Bob has a negative view on the stock and decides to sell 5 uncovered October 30 calls

- By early October, ABC stock has risen to $31 and, as a result, his uncovered calls are in the money by $1

To make matters worse, Bob learns that tomorrow the stock will start trading ex-dividend. Because the remaining time value of the options is less than the value of the dividends, owners of these calls will likely exercise their options 1 day prior to the ex-dividend date.

To limit his exposure, Bob has several choices. He can buy back his uncovered calls at a loss, buy the stock to capture the dividend, or sit tight and hope to not be assigned. If his calls are assigned, however, he will have to pay the $250 in dividend income, in addition to covering the cost of delivering 500 shares of ABC stock. If Bob had initiated an option spread (buying and selling an equal number of options of the same class on the same underlying security but with different strike prices or expiration dates), he could also consider exercising his long option position to capture the dividend.

Other considerations and risks

If you are implementing a spread strategy that includes long contracts and short contracts, you need to remain particularly vigilant in regard to assignment risk. If both contracts are in the money and you are assigned on the short contracts, you will not be notified until the following business day. While you can exercise your long position on the ex-dividend date to eliminate the short stock position that was created, you will still owe the dividend because you were short the stock prior to the ex-dividend date.

Ways to avoid the risk of early assignment

If you are selling options (covered or uncovered), there is always the risk of being assigned if your trade moves against you. This risk is higher if the underlying security involved pays a dividend. However, there are ways to reduce the likelihood of being assigned early. These include:

- Do your homework: Know if the stock or ETF pays a dividend and when it will start trading ex-dividend

- Avoid selling options on dividend-paying stocks or ETFs when your trade includes ex-dividend

- Invest in European-style options: American-style options can be assigned at any time before the option expires, European-style options can only be exercised at expiration

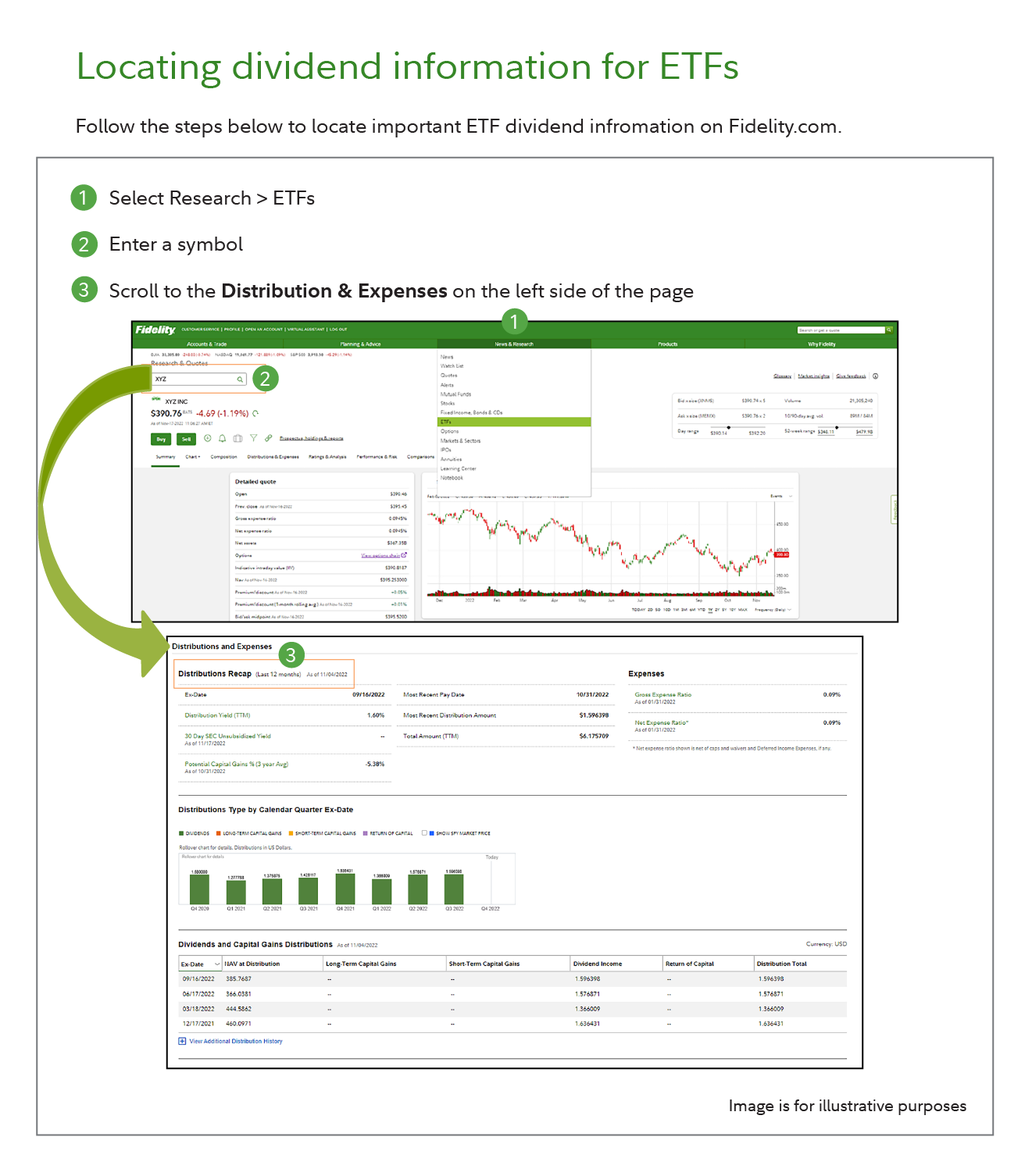

See Locating dividend information for ETFs for details.

If you are a Fidelity customer and you have questions about your exposure to assignment risk, you can always contact a Fidelity representative for help.

Research options

Get new options ideas and up-to-the-minute data on options.

More to explore

Options strategy guide, 5 steps to develop an options trading plan, subscribe to fidelity viewpoints ®, looking for more ideas and insights, thanks for subscribing.

- Tell us the topics you want to learn more about

- View content you've saved for later

- Subscribe to our newsletters

We're on our way, but not quite there yet

Oh, hello again, thanks for subscribing to looking for more ideas and insights you might like these too:, looking for more ideas and insights you might like these too:, fidelity viewpoints ® timely news and insights from our pros on markets, investing, and personal finance. (debug tcm:2 ... decode crypto clarity on crypto every month. build your knowledge with education for all levels. fidelity smart money ℠ what the news means for your money, plus tips to help you spend, save, and invest. active investor our most advanced investment insights, strategies, and tools. insights from fidelity wealth management ℠ timely news, events, and wealth strategies from top fidelity thought leaders. women talk money real talk and helpful tips about money, investing, and careers. educational webinars and events free financial education from fidelity and other leading industry professionals. fidelity viewpoints ® timely news and insights from our pros on markets, investing, and personal finance. (debug tcm:2 ... decode crypto clarity on crypto every month. build your knowledge with education for all levels. fidelity smart money ℠ what the news means for your money, plus tips to help you spend, save, and invest. active investor our most advanced investment insights, strategies, and tools. insights from fidelity wealth management ℠ timely news, events, and wealth strategies from top fidelity thought leaders. women talk money real talk and helpful tips about money, investing, and careers. educational webinars and events free financial education from fidelity and other leading industry professionals. done add subscriptions no, thanks. analyzing stock fundamentals investing for beginners finding stock and sector ideas advanced trading strategies trading options stocks using technical analysis a covered call writer forgoes participation in any increase in the stock price above the call exercise price, and continues to bear the downside risk of stock ownership if the stock price decreases more than the premium received. there are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, and collars, as compared with a single option trade. options trading entails significant risk and is not appropriate for all investors. certain complex options strategies carry additional risk. before trading options, please read characteristics and risks of standardized options . supporting documentation for any claims, if applicable, will be furnished upon request. 772967.5.0 mutual funds etfs fixed income bonds cds options active trader pro investor centers stocks online trading annuities life insurance & long term care small business retirement plans 529 plans iras retirement products retirement planning charitable giving fidsafe , (opens in a new window) finra's brokercheck , (opens in a new window) health savings account stay connected.

- News Releases

- About Fidelity

- International

- Terms of Use

- Accessibility

- Contact Us , (Opens in a new window)

- Disclosures , (Opens in a new window)

Any trader holding a short option position should understand the risks of early assignment. An early assignment occurs when a trader is forced to buy or sell stock when the short option is exercised by the long option holder. Understanding how assignment works can help a trader take steps to reduce their potential losses.

Understanding the basics of assignment

An option gives the owner the right but not the obligation to buy or sell stock at a set price. An assignment forces the short options seller to take action. Here are the main actions that can result from an assignment notice:

- Short call assignment: The option seller must sell shares of the underlying stock at the strike price.

- Short put assignment: The option seller must buy shares of the underlying stock at the strike price.

For traders with long options positions, it's possible to choose to exercise the option, buying or selling according to the contract before it expires. With a long call exercise, shares of the underlying stock are bought at the strike price while a long put exercise results in selling shares of the underlying stock at the strike price.

When a trader might get assigned

There are two components to the price of an option: intrinsic 1 and extrinsic 2 value. In the case of exercising an in-the-money 3 (ITM) long call, a trader would buy the stock at the strike price, which is lower than its prevailing price. In the case of a long put that isn't being used as a hedge for a long stock position, the trader shorts the stock for a price higher than its prevailing price. A trader only captures an ITM option's intrinsic value if they sell the stock (after exercising a long call) or buy the stock (after exercising a long put) immediately upon exercise.

Without taking these actions, a trader takes on the risks associated with holding a long or short stock position. The question of whether a short option might be assigned depends on if there's a perceived benefit to a trader exercising a long option that another trader has short. One way to attempt to gauge if an option could be potentially assigned is to consider the associated dividend. An options seller might be more likely to get assigned on a short call for an upcoming ex-dividend if its time value is less than the dividend. It's more likely to get assigned holding a short put if the time value has mostly decayed or if the put is deep ITM and close to expiration with a wide bid/ask spread on the stock.

It's possible to view this information on the Trade page of the thinkorswim ® trading platform. Review past dividends, the price of the short call, and the price of the put at the call's strike price. While past performance cannot be relied upon to continue, this information can help a trader determine whether assignment is more or less likely.

Reducing the risk associated with assignment

If a trader has a covered call that's ITM and it's assigned, the trader will deliver the long stock out of their account to cover the assignment.

A trader with a call vertical spread 4 where both options are ITM and the ex-dividend date is approaching may want to exercise the long option component before the ex-dividend date to have long stock to deliver against the potential assignment of the short call. The trader could also close the ITM call vertical spread before the ex-dividend date. It might be cheaper to pay the fees to close the trade.

Another scenario is a call vertical spread where the ITM option is short and the out-of-the-money (OTM) option is long. In this case, the trader may consider closing the position or rolling it to a further expiration before the ex-dividend date. This move can possibly help the trader avoid having short stock on the ex-dividend date and being liable for the dividend.

Depending on the situation, a trader long an ITM call might decide it's better to close the trade ahead of the ex-dividend date. On the ex-dividend date, the price of the stock drops by the amount of the dividend. The drop in the stock price offsets what a trader would've earned on the dividend and there would still be fees on top of the price of the put.

Assess the risk

When an option is converted to stock through exercise or assignment, the position's risk profile changes. This change could increase the margin requirements, or subject a trader to a margin call, 5 or both. This can happen at or before expiration during early assignment. The exercise of a long option position can be more likely to trigger a margin call since naked short option trades typically carry substantial margin requirements.

Even with early exercise, a trader can still be assigned on a short option any time prior to the option's expiration.

1 The intrinsic value of an options contract is determined based on whether it's in the money if it were to be exercised immediately. It is a measure of the strike price as compared to the underlying security's market price. For a call option, the strike price should be lower than the underlying's market price to have intrinsic value. For a put option the strike price should be higher than underlying's market price to have intrinsic value.

2 The extrinsic value of an options contract is determined by factors other than the price of the underlying security, such as the dividend rate of the underlying, time remaining on the contract, and the volatility of the underlying. Sometimes it's referred to as the time value or premium value.

3 Describes an option with intrinsic value (not just time value). A call option is in the money (ITM) if the underlying asset's price is above the strike price. A put option is ITM if the underlying asset's price is below the strike price. For calls, it's any strike lower than the price of the underlying asset. For puts, it's any strike that's higher.

4 The simultaneous purchase of one call option and sale of another call option at a different strike price, in the same underlying, in the same expiration month.

5 A margin call is issued when the account value drops below the maintenance requirements on a security or securities due to a drop in the market value of a security or when buying power is exceeded. Margin calls may be met by depositing funds, selling stock, or depositing securities. A broker may forcibly liquidate all or part of the account without prior notice, regardless of intent to satisfy a margin call, in the interests of both parties.

Just getting started with options?

More from charles schwab.

Weekly Trader's Outlook

Today's Options Market Update

Covered Calls: Beyond the Basics

Related topics.

Options carry a high level of risk and are not suitable for all investors. Certain requirements must be met to trade options through Schwab. Please read the options disclosure document titled Characteristics and Risks of Standardized Options before considering any options transaction. Supporting documentation for any claims or statistical information is available upon request.

With long options, investors may lose 100% of funds invested.

Spread trading must be done in a margin account.

Multiple leg options strategies will involve multiple commissions.

Commissions, taxes and transaction costs are not included in this discussion, but can affect final outcome and should be considered. Please contact a tax advisor for the tax implications involved in these strategies.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

Trading Education Guides Options Trading

Stock Assignment With Options

- By Lucien Bechard

- Updated May 12, 2023

SHARE THIS ARTICLE

Are you at risk for stock assignment with options? That’s a question new options traders focus on. The thought of being assigned sounds scary, but it’s not. While rare, it’s important to be aware of how the assignment process works. You have no control on when options assignment takes place. If you don’t have the funds then your broker will automatically close the trade for you. If you are assigned shares of the stock and you don’t want them, then you can just sell them. Nothing to worry about!

Table of Contents

When Will I Get Assigned

Selling options and your risk of stock assignment, are you at risk for stock assignment when selling a naked call, two key things to be aware of, call/put spread, what are the two ways to prevent assignment, key takeaways, how trade options smarter, what is stock assignment with options.

When I talk to traders, especially those interested in options trading , one of their biggest fears is getting assigned stock. To refresh your memory, when you buy/sell an option, you control 100 shares of that option’s stock. Even more unsettling is the options traders who never think about assignment as a possibility until it happens to them. So are you at risk for stock assignment? It’s like a pop quiz at school – generally unexpected and typically jarring if you haven’t factored in the assignment.

Even more so if you’re running a multi-leg strategy like long or short spreads, and usually it’s not a good feeling!

Well, I’m hoping to help you put some of that anxiety to rest with this post. Let’s start with the 3 most common questions we get asked here at the Bullish Bears stock trading service :

- In what situations would I get assigned stock?

- How do I prevent being assigned stock?

- If I am assigned, what do I need to do?

Are you at risk for stock assignment? As an options seller, you have no control over an assignment.

First things first, let’s tackle the most obvious question, “when will I get assigned share of stock?”. In our experience, the easiest way to be assigned stock is if you short (sell) an option that expires in the money.

On the flip side, when you buy an option -either a call or a put, you cannot be assigned stock unless you decide to exercise your option(s).

As the purchaser of an option contract, you are in control. And by control I mean you, and you alone will always have the choice to exercise the option .

Do you see how I wrote a choice? Yes, you have the choice but not the obligation to do so.

Let’s say you bought a Facebook (ticker symbol FB) option a few weeks ago and it is set to expire today. Right now, since the option is in the money – there is never a risk of assignment. Because of this, you have two choices, you can:

- Let the option expire in the money to collect the profit, or…

- Decide to exercise the option and collect the 100 shares of stock

That said, let’s circle back to the most common way to get assigned stock – selling options. Make sure to take our options strategies course to learn how to safely sell options.

Are you at risk for stock assignment? Put simply, you will be assigned stock if you sell an option that is in the money at expiration.

It boils down to this: as the options seller; you have no control over an assignment, or when it could happen. Typically the risk of assignment increases as the expiration date gets closer. With that said, an assignment can still occur at any time.

Let’s say you sold an AAPL ( ticker symbol for Apple) option a couple of weeks ago. Your option is set to expire today and its in the money.

If this happens, you are automatically assigned 100 shares of stock. So if you sold a call, you would be assigned, and if you sold a put, you would be assigned.

In both cases, it’s 100 shares of stock for each one contract. Check out our trade room where we talk options.

When you buy a naked call, you have control over what you do with the option. But, when you’re the seller of a naked call option, you have no control over assignment if your call expires in the money.

And, it only has to be $.01 in the money for the assignment to happen. If you find yourself in this situation, you automatically will be forced to sell 100 shares of stock to the person who bought your option.

Hypothetically, let’s say you sell a FB call option to your friend Amanda at a strike price of $525. Amanda then decides to exercise her option because it’s in the money.

You then have to turn around and sell her 100 FB shares for each option contract at $525/share. Even if you do not own FB stock, you will still have to sell Amanda the shares. Now you find a situation in which you are short 100 shares of FB stock.

- Assignment and commission fees. If you do not close the trade out or roll it before expiration and have to sell the shares, you’ll have fees to pay.

- Dividends. Be wary when a company has upcoming dividends because this will increase your assignment risk. You need to be on high alert if the extrinsic value on an ITM short call is LESS than the dividend amount. And why? Well, it would only make sense that the ITM call owner would want to exercise their option in order to benefit from the dividend associated with owning the stock

Once again, similar to selling a naked call, when you sell a naked put, if your option expires in the money at expiration, you do not have control over an assignment.

What does this mean for you? You will be assigned 100 shares of stock at the options strike price if your short put is in the money at expiration. And don’t forget the assignment fee and commissions.

Like the example above with your friend Amanda, if you sell her a naked put that is expiring in the money, she has options.

If Amanda chooses to exercise those options, you need to buy 100 shares of FB stock for each of her option contracts, at $525 a share – even if you don’t have the money in your account!

Our stock watch lists have options trades on there with alert setups.

Assignment risk happens when your short strike expires in the money.

If you sell a put or call spread , the assignment risk stems from your short strike expiring in the money at expiration. If this scenario happens, you will be forced to sell 100 shares to the buyer for each option contract they purchased.

Likewise, if you sell a put spread you will be assigned 100 shares of stock per contract if the short strike is in the money at expiration.

On the flip side, however, if both strikes expire in the money, they will cancel each other out. Even though the short strike is assigned, you can turn around and exercise the long strike.

Are you at risk for stock assignment? You don’t want to be hurt financially if the assignment happens. So it’s wise to avoid this situation to the best of your ability. In my opinion, you have two avenues to avoid assignment:

- You close the trade before it expires which means you take any profits or losses

- You can simply roll the trade to extend the days to expiration. What this does is give you more time for the trade to be profitable.

Despite your best efforts to avoid unwanted assignment, it can occasionally still happen. So if you find yourself in this situation, here’s what to do…

Don’t panic.

There are two things you can do if you sold an option that has expired in the money.

- You can hold the long or short stock or buy/sell the shares back for a profit or loss. In this scenario, you will need the money in your account to pay for the shares.

- If you were assigned shares and didn’t have the money to cover the shares you were assigned (a.k.a. a margin call), immediately buy/sell back the shares. Before the end of the trading day, your broker will do it for you if you don’t.

- As an options seller, you have no control over the assignment or its timing

- The options buyer controls when an assignment happens.

- If you do not have enough money in your account to cover either your long or short stock position, be wise and immediately close your position. Your broker will do it for you if you fail to.

- Spreads are one way to have protection against being assigned, but, BOTH legs need to be in the money if you are to be protected.

- Additional assignment risk happens if you have a short call position that is in the money at the time of the dividend.

The best defense against early assignment is a good offence; so be prepared and factor it into your thinking early.

Otherwise, it can cause you to make defensive, in-the-moment decisions that are less than logical. This is because the assignment can happen pretty easily if you are not monitoring your positions regularly. Sometimes it can even happen if you are.

If you’re anything like me, you get busy during the day and don’t get a chance to check your positions. Worse yet, you’re trading options on an illiquid underlying.

You might find yourself in a position without any buyers/sellers available so you cannot close your position. So my point is this; monitor your positions closely and watch liquidity closely.

If you need more help, take our options trading course .

Related Articles

Poor mans covered call.

What is a “poor mans covered call?” It is a long option covered with a shorter dated short call option. This article will discuss this

Cash Secured Put

What is a cash secured put trade, and how do we trade it? A cash secured put is a trade that sells a put to

Options Trading Levels

What are options trading levels? Brokers implement levels on new trading accounts to protect new traders. Options allow you to trade big-name stocks with less

Options Put Call Ratio Meaning

Options traders and those frequently observing the markets often speak about the Put-Call ratio. Although you might be able to determine what it means by

Option Flow Data Explained

Are you an options trader or looking to get into trading options? Options can be overwhelming and seem over-complicated to those just starting. One tool

Free Trading Courses

- We want to teach you

- Learn day trading, swing trading, options, futures, and price action

- Rated Best Value Courses by Investopedia

If you do not agree with any term of provision of our Terms and Conditions, you should not use our Site, Services, Content or Information. Please be advised that your continued use of the Site, Services, Content, or Information provided shall indicate your consent and agreement to our Terms and Conditions.

If you would like to contact the Bullish Bears team then please email us at bbteam[@]bullishbears.com and we will get back to you within 24 hours.

BullishBears.com, 60 Pinney St, Ellington, CT. 06029 United States

Disclaimer: We’re not licensed brokers or advisors. You’re 100% responsible for any trades that you make. Please read our full disclaimer.

Trading contains substantial risk and is not for every investor. An investor could potentially lose all or more of their initial investment. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not indicative of future results. Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

© 2023 by Bullish Bears LLC.

Stock trading service.

Our chat rooms will provide you with an opportunity to learn how to trade stocks, options, and futures. You’ll see how other members are doing it, share charts, share ideas and gain knowledge.

Our traders support each other with knowledge and feedback. People come here to learn, hang out, practice, trade stocks, and more. Our trade rooms are a great place to get live group mentoring and training.

TRADE ALERTS “SIGNALS”

The Bullish Bears trade alerts include both day trade and swing trade alert signals. These are stocks that we post daily in our Discord for our community members.

These alert signals go along with our stock watch lists. Our watch lists and alert signals are great for your trading education and learning experience.

We want you to see what we see and begin to spot trade setups yourself.

REAL-TIME STOCK ALERTS SERVICE

We also offer real-time stock alerts for those that want to follow our options trades. You have the option to trade stocks instead of going the options trading route if you wish.

Our stock alerts are simple to follow and easy to implement. We post entries and exits.

Also, we provide you with free options courses that teach you how to implement our trades as well.

STOCK TRAINING DOESN’T NEED TO BE HARD

Stock training doesn’t need to be hard. But it sure feels hard when you don’t know where to turn for legitimate knowledge. There are tons of places to learn, but what makes us different?

Well, for starters, we’re just real everyday people who like trade stocks. We’re not gurus portraying a fancy lifestyle of cars and jets and beaches. Can you obtain those things with what we teach you? Sure you can. Is that what motivates us when teaching you how to trade?

Nope. What we really care about is helping you, and seeing you succeed as a trader. We want the everyday person to get the kind of training in the stock market we would have wanted when we started out.

WHY WE’RE DIFFERENT

What else makes us different? When it comes to the stock market, we’ve won, we’ve lost, we’ve lived, and learned. We’ve been through the ups and downs in the market and figured out what really matters. The Charts…Candlesticks = PRICE ACTION! We’ve created a site that passes all this knowledge on to you.

We don’t charge you an arm and a leg for the stock training we give you. We charge a modest amount that goes towards running our day-to-day operations and paying for our invaluable team moderators that are passionate about teaching YOU!

That’s about it. We could charge more, but we have a pay it forward, give back mentality. It’s not about the money. The best and most important thing for us is YOU. We want to feel good about what we do, and the results and reviews speak for themselves.

Those emails we get, the feedback, the success we see. That is what our educational trading community is all about. We hold no secrets back. Our trading edge is your trading edge.

STOCK TRAINING DONE RIGHT

We don’t care what your motivation is to get training in the stock market. If it’s money and wealth for material things, money to travel and build memories, or paying for your child’s education, it’s all good. We know that you’ll walk away from a stronger, more confident, and street-wise trader.

In our stock trading community, you’re going to get it all. Futures, options trading, and stocks. Not just penny stocks either. Small, mid, and large caps. Each day we have several live streamers showing you the ropes, and talking the community though the action.

There’s no catch, no smoke or mirrors. What you see is what you get. If you’re looking to change your life, or someone else’s, we’re here to help you reach that goal. Get started learning day trading, swing trading, options, or futures trading today!

Click Here to start your 7-day free trial.

TRADING STOCKS IN THE BULLISH BEARS COMMUNITY

Yes, we work hard every day to teach day trading, swing trading, options futures, scalping, and all that fun trading stuff. But we also like to teach you what’s beneath the Foundation of the stock market.

Tell you the TRUTH about how the market works. The importance of controlling your emotions and having a proper mindset when trading. We’re really passionate about teaching you this stuff!

Money isn’t our #1 priority in life. YOU are. Our members come first. Making sure you get comfortable with trading is our priority.

We have members that come from all walks of life and from all over the world. We love the diversity of people, just like we like diversity in trading styles. It creates an environment much like a university or college.

TRADING ROOMS AND LIVE STOCK TRAINING

Each day our team does live streaming where we focus on real-time group mentoring, coaching, and stock training. We teach day trading stocks, options or futures, as well as swing trading. Our live streams are a great way to learn in a real-world environment, without the pressure and noise of trying to do it all yourself or listening to “Talking Heads” on social media or tv.

We will help to challenge your ideas, skills, and perceptions of the stock market. You will learn and grow as a trader. Every day people join our community and we welcome them with open arms. We are much more than just a place to learn how to trade stocks.

Feel free to ask questions of other members of our trading community. The Bullish Bears are a very helpful crew. We realize that everyone was once a new trader and needs help along the way on their trading journey and that’s what we’re here for. To give you a hand up along your trading journey.

Click Here to try our trading community free for 7 days.

FREE ONLINE TRADING COURSES

If you’ve looked for trading education elsewhere then you’ll notice that it can be very costly.

We are opposed to charging ridiculous amounts to access experience and quality information.

That being said, our website is a great resource for traders or investors of all levels to learn about day trading stocks, futures, and options. Swing trading too!

On our site, you will find thousands of dollars worth of free online trading courses, tutorials, and reviews.

We put all of the tools available to traders to the test and give you first-hand experience in stock trading you won’t find elsewhere.

Our content is packed with the essential knowledge that’s needed to help you to become a successful trader.

It’s important to treat day trading stocks, options, futures, and swing trading like you would with getting a professional degree, a new trade, or starting any new career.

Invest the proper time into your Trading Education and don’t try to run before you learn to crawl. Trading stocks is not a get-rich-quick scheme. It’s not gambling either, though there are people who treat it this way. Don’t be that person!

STOCK TRADING COURSES FOR BEGINNERS

The Bullish Bears team focuses on keeping things as simple as possible in our online trading courses and chat rooms. We provide our members with courses of all different trading levels and topics.

If you’re a beginner, intermediate level, or looking for expert trading knowledge…we’ve got you covered.

We have a basic stock trading course, swing trading course, 2 day trading courses, 2 options courses, 2 candlesticks courses, and broker courses to help you get started. Free.

Just choose the course level that you’re most interested in and get started on the right path now. Become a leader, not a follower. When you’re ready you can join our chat rooms and access our Next Level training library. No rush. We’re here to help.

Click Here to take our free courses.

- Privacy Overview

- Strictly Necessary Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

You have the right to refuse unsafe assignments

July 11, 2019.

Unsafe Assignments

According to the American Nurses Association , Nurses have the "professional right to accept, reject or object in writing to any patient assignment that puts patients or themselves at serious risk for harm. Registered Nurses have the professional obligation to raise concerns regarding any patient assignment that puts patients or themselves at risk for harm." In short, Nurses are empowered to say "no" when management puts our patients at risk by violating safe staffing laws. Here are some articles that explain this right—and how to claim it.

Think your assignment violates the law? Follow this flow chart!

"Unfortunately, many nurses – and many leaders — will answer the question with some form of “suck it up and do the best you can.” And while I know that questioning an assignment, let alone refusing it, is hard, this is exactly what you must consider doing." —Nurse Guidance

When an Assignment is Unsafe (via Nurse Guidance) The scenarios described in this quick read might sound too familiar to Nurses that work in chronically understaffed hospitals. But fear not Nurse Guidance has you covered with great tips on what to do when it's time to say "I refuse."

California Code Regs Disciplinary Action for Nurses There are laws that protect Nurses so we can practice our profession ethically. Know the Codes!

Moral Resilience: Managing and Preventing Moral Distress and Moral Residue Moral resilience is defined by the author of this paper as “the ability and willingness to speak and take right and good action in the face of an adversity that is moral/ethical in nature.” Nurses that say no to unsafe assignments need plenty of this.

Empowering You With Knowledge That Can Change Your Life

Learning Investment With Jason Cai

What Is Early Assignment Risk In Options Trading? Who Is Affected & How To Mitigate It?

In options trading (American style), the options contract owner (or buyer) has the right to exercise the options contract anytime between the start of the contract and the expiration date. An early assignment means the options contract buyer chooses to exercise the contract before the expiration date.

However, it is usually rare as there is a time value as part of the premium that he has paid for when the options contract was established. An early assignment would mean that he would forgo some of the premium he had paid when the contract was established.

Who Is At Risk Of Early Assignment?

However, there are a few scenarios where early assignment (exercise) of a contract may happen and it is important for the options seller to take note of them, especially if he has no intention to buy ( PUT contract) or sell ( CALL contract) his shares. The risk applies to the options contract sellers because only the options buyer has the right to exercise the contract anytime before the expiration date.

The PUT options seller may just want to collect a premium through selling a PUT options contract and has no intention of owning the shares. Thus, he would hope that the PUT options contract that he sold would expire worthless instead of expiring In-The-Money (ITM) .

I am in this group when I use the SOP strategy to collect monthly income through selling OTM PUT options contracts: My Options Trading Strategy For 2023 | Introducing SOP Options Trading Strategy

In another scenario, the PUT seller may not have enough capital to purchase the shares, which means it is not a cash-secured PUT , where the seller has set aside capital to purchase the shares if he gets assigned the contract.

This is possible with a margins account: How I Use My Margins Account To Earn Extra Income (Safely)? | How My Margins Account Help In My Selling PUT Strategy?

In another group of CALL options sellers who are at risk, the seller may not wish to sell away his shares at the strike price, which he could have set much lower than his breakeven pricing. It may also be a naked short CALL, whereby the seller may not have the shares to honor the contract if it gets assigned early.

What Are The Possible Scenarios Of Early Assignment?

The risk of assignment for the CALL options contract sellers increases when the underlying stock pays dividends and when it is nearing the ex-dividend date. The CALL options contract buyers are not entitled to dividend payments, so if they wish to receive the dividend, they will have to exercise the CALL options and become stock owners.

If the upcoming dividend amount is larger than the time value remaining in the call’s price, it makes sense to exercise the option contract. But the CALL buyers will have to exercise the options contract prior to the ex-dividend date.

So for CALL options sellers who do not wish to get assigned, always be mindful if you are selling a stock that is paying dividends, and do take note if the ex-dividend date is close to the expiration date, the call options contract is in-the-money, and the dividend is relatively large. All these scenarios will significantly increase the chance of early assignment.

For PUT options contract sellers , the risk will increase in the scenario whereby the buyer is in an advantageous position and wishes to sell away his shares to collect the cash. However, he must factor the time value into the equation, before deciding if it is indeed a wise decision to exercise the PUT options early.

For PUT options contract buyers, it is usually a good idea to sell the put first and then immediately sell the stock. That way, he can capture the time value for the put along with the value of the stock. However, as expiration approaches and time value becomes negligible, early exercise seems plausible. That’s because by exercising the PUT contract, the PUT buyer can accomplish his aim of selling the shares and collecting the capital, all in one simple transaction without any further hassles or extra commission charges.

Therefore, for PUT options contract sellers, remember that the less time value there is in the price of the option as the expiration date nears, the higher the risk of an early assignment. So keep a close eye on the time value left in your short puts and have a plan in place in case you’re assigned early.

For PUT options contract sellers, an approaching ex-dividend date can be a deterrent against early exercise for PUT. By an early assignment, the options contract buyer will receive the cash now. However, this will create a short sale of stock if the PUT owner wasn’t owning the stock in the first place. So exercising the PUT options the day before an ex-dividend date means the PUT buyer will have to pay the dividend. So, this means PUT sellers may have a lower chance of being assigned early, but only until the ex-dividend date has passed.

Concluding Thoughts

To summarise, an options contract buyer (owner) will exercise early if certain conditions are met to ensure that what he receives is more than enough to cover the remaining time value in the contract (which he has already paid upfront when the contract was established).

For CALL buyers, it would be the dividends paid out, that are greater than the remaining time value. For PUT buyers, it would be the increase in premium (due to the underlying share price moving in the intended direction, i.e. stock price collapsing) being greater than the remaining time value in the contract.

In a nutshell, as the difference between the intrinsic value (the difference between the current price of a stock and the strike price of the option) and the extrinsic value (the difference between the market price of an option and its intrinsic value) increases, the risk of early assignment also increases. So, to manage the risk of early assignment, the options seller must be mindful of the increasing intrinsic value and the decreasing extrinsic value.

To mitigate against early assignment, the options contract seller can prolong the contract duration by rolling it to a later date and collecting more upfront premiums in the process. This also increases the extrinsic value of the options contract. Alternatively, he can also avoid selling CALL options on stocks that pay dividends or with an expiration date close to the ex-dividend date.

*** SEE MY TRADES & PORTFOLIO ON PATREON ***

If you are interested to find out more about my options trades and investment portfolio, I will be updating them on Patreon (on the same day I made the trades), so do follow me there if you need some reference or inspiration.

*** EARN FREE MONEY ***

Sign up for WeBull Securities Brokerage and sure-win free shares: Receive Free Money When You Sign Up With WeBull Securities Platform

*** FREE BEGINNER GUIDE TO OPTIONS TRADING ***

Keen to learn about options trading but do not wish to pay for expensive courses, this newbie guide will help gain the knowledge and fundamentals to understand options better. And it’s totally free! The Newbie’s Guide To Options Trading

*** FREE MOTIVATIONAL BOOK ***

If earning more money from your investment does not excite you anymore, you may be seeking a purpose that brings fulfillment and meaning in life. I have written a motivational book that may be useful to you in some ways. You can also download a free copy here: https://learninginvestmentwithjasoncai.com/finding-the-magical-realm-of-happiness-motivational-book

*** FOLLOW US ON SOCIAL MEDIA ***

Follow me on Facebook , LinkedIn , to get notified of my latest posts on social media. Or subscribe to my blog (scroll to the bottom of the page) to have my new posts sent directly to your mailbox.

*** BUY ME A CUP OF COFFEE ***

If my blog has benefited you in some ways and you would like to offer a token of appreciation, you may do so via this page . Thank you very much for your support!

*** MUST-READ BLOG POSTS *** After accumulating more than 600k of unrealized losses on my portfolio, I wrote this article to encourage friends and investors who are also losing a lot of money to the market. If You Are Feeling Depressed From Losing Lots Of Money In The Stock Market, Here’s An Article For You

In the 10 years of my investing journey, I have made many mistakes but also learned many lessons from these mistakes. I compiled the 10 most valuable lessons that I have learned and may they help you succeed in your investing journey. Happy 10 Years Of Investing | 348k (Realised) Profit, 635k (Unrealized) Loss & 10 Lessons Learnt

The precious 6 lessons I learnt after cutting more than half a million of losses in the stock market through bad investments and risky trades. 6 Lessons Learnt After Losing 551k In 10 Years Of Investing & Options Trading | What Newbies Should Know They Start Investing/ Trading

How I managed to build a 1M investment/ trading portfolio despite coming from humble beginnings. How A Poor Kid Got To A 1M Investment Portfolio | Tips & Principles Of Building Wealth

I did these 10 side hustles while holding a full-time job, so I share them here so you can be inspired to grow your wealth through a side hustle that you enjoy. I Did These 10 Side Hustles While Working Full Time | 10 Side Hustle Ideas To Help You Earn An Extra Income

Struggling with inflation and high cost of living? Try these 10 methods to help you save money and accumulate more savings for investments or rainy days. 10 Ways To Save Money To Help You Fight Inflation & Rising Costs Of Living

Why I am building $120,000 of cash reserves in Singapore Savings Bonds (SSB) & 5 reasons why I think SSB is a worthy low or zero-risk investment that you can consider. Why I Am Building $120,000 Of Cash Reserves In Singapore Savings Bonds (SSB)? | 5 Reasons Why SSB Is A Worthy Low-Risk Investment

Sharing why I am doing Dollar Cost Average (DCA) into SPY and QQQ ETF for long-term investments and a step-by-step guide to doing it automatically with Interactive Brokers. Why I Am Doing DCA (Automatically) For SPY & QQQ For My Long Term Investment? (20% ~ 30% Upside Potential) | Step By Step Guide To Activating Automatic Recurring Investment On IBKR

Can options trading provide you with extra sideline income every month? In this post, I share my experience of generating income from options trading over the last 3 years. Options Trading For Passive Income: Truth Or Myth?

Share this:

Leave a comment cancel reply.

Legal Disclosure: I’m not a financial advisor. The information contained in this blog is for sharing purposes only. Before investing, please consult a licensed professional. Any stock purchases I show on my blog should not be considered “investment recommendations”. I shall not be held liable for any losses you may incur for investing and trading in the stock market in an attempt to mirror what I do. Unless investments are FDIC insured, they may decline in value and/or disappear entirely. Please be careful!

- Already have a WordPress.com account? Log in now.

- Subscribe Subscribed

- Copy shortlink

- Report this content

- View post in Reader

- Manage subscriptions

- Collapse this bar

Stack Exchange Network

Stack Exchange network consists of 183 Q&A communities including Stack Overflow , the largest, most trusted online community for developers to learn, share their knowledge, and build their careers.

Q&A for work

Connect and share knowledge within a single location that is structured and easy to search.

What are my risks of early assignment?

I have started writing covered puts and calls recently. Everything I read talks about the risk of early assignment of your position, but I don't really understand how often this happens. It seems that you should only exercise an option when the extrinsic value is lower than the brokerage fees for buying/selling the stock (say about $0.10). Otherwise you could always make more money by selling the option than exercising (assuming there are no dividend payouts on the underlying stock). It seems only an irrational investor would exercise an option with time value left on it, and I assume that is exceedingly rare.

I've read that early assignment of a put is more likely than a call as the money is flowing to the exerciser rather than from, which is more likely to happen early (money in as early as possible vs money out as late as possible). But it seems to me that the contract holder would still get more money if they just sold the contract (and their stock if they're holding it). Am I doing that math right?

I am trading ETFs and will start with ETNs soon. So the detailed questions are:

- At what level of extrinsic value does the possibility of assignment become likely?

- Is there really a risk of early assignment if there's time value left? Or is this just some CYA verbage that everyone includes because it is technically possible?

- Does that risk change when you are looking at ETN vs ETF vs Company Stock? How?

- Does the risk change between a put and a call?

- option-exercise

- covered-call

- options-assignment

- Uh...Possible duplicate? money.stackexchange.com/questions/5696/… . I promise I searched first, but I didn't find anything. SE didn't suggest anything useful when I wrote it, either. I just found the other answer through the [options-assignment] tag. Please close if I haven't asked anything new. – yossarian Jan 20, 2012 at 16:48

3 Answers 3

One reason this happens is due to dividends. If the dividend amount is greater than the time value left on a call, it can make sense to exercise early to collect the dividend.

Deep in the money puts also may get exercised early. There's usually little premium on a deep in the money put and the spread on the bid-ask might erase what little premium there is. If you have stock worth $5,000 but own puts on them that will give you $50,000 upon exercise (and no spread to worry about), the interest you can gain on the $50k might be more than the little to no time value left on the position... even at several weeks to expiration.

- There's no profitable arb in exercising a deep ITM call to capture the dividend (where the time premium is less than the dividend). That applies to the put, not the call. – Bob Baerker Oct 23, 2018 at 18:51

Per CBOE stats, only about 7% of options are exercised.

There are several reasons why an option might be exercised early:

The owner doesn't know any better and throws away remaining time premium, not realizing that he'd salvage that time premium by selling the option. This is rare.

The time premium is low and exit costs (commissions and B/A spread) are lower than selling the option. This is an infrequent occurrence because most firms charge for exercise, sometimes more than a simple sell commission.

An ITM option trades at a discount (the bid is less than the intrinsic value) and selling to close would be a haircut. Taking the opposing position in the underlying and exercising the option would avoid the haircut. This discount occurs regularly but even more often just before the ex-dividend date. For example:

XYZ is $40 Jan $35 call is $4.80

The intrinsic value of the call is 5 points. Buy the call for $4.80, shorts the stock at $40 and exercise the call to buy the stock at $35 (- 4.80 + 40.00 - 35.00 = + 20 cent profit)

Speaking of dividends, it's an incorrect statement that ITM calls are exercised early if the time premium remaining is less than the pending dividend. This was stated in another answer and is often found across the net. If you run the numbers, you'll see that you are just throwing away the time premium and that the arb loses money.

XYZ is $40 Jan $35 call is $5.30 Ex div is tomorrow for 50 cts

Buy call, exercise to buy stock, sell stock after ex-div

- $35.00 - $5.30 + $39.50 + $.50 = - 20 cts (loser)

This assumes that you can sell the stock on ex-div morning for the adjusted close.

It is true that a dividend arbitrage is available when the time premium of an ITM put is less than the amount of the dividend. For example:

XYZ is $40 Jan $45 put is $5.30 Ex div is tomorrow for 50 cts

Buy stock/buy put, exercise after ex-div

- $40.00 - $5.30 + $45.00 + $.50 = + 20 cents

The put vs call assignment risk, is actually the reverse: in-the-money calls are more likely to be exercised early than puts. Exercising a call locks in profit for the option holder because they can buy the shares at below market price, and immediately sell them at the higher market price. If there are dividends due, the risk is even higher. By contrast, exercising an in-the-money put locks in a loss for the holder, so it's less common.

- This answer that "exercising an in-the-money put locks in a loss for the holder" makes no sense. It could be a profitable put that went ITM. It could be an ITM option exercised to avoid the haircut of the bid trading below intrinsic value. it could be part of a Discount Arbitrage. It could be because the holder is unloading a position in the underlying. So many reasons, some profitable some not, depending on the P&L of the option and possibly a married position in the underlying. – Bob Baerker Oct 23, 2018 at 18:50

You must log in to answer this question.

Not the answer you're looking for browse other questions tagged options option-exercise covered-call options-assignment ., hot network questions.

- What should I get paid for if I can't work due to circumstances outside of my control?

- Calculation of centrifugal liquid propellant injectors

- In Catholicism, is it OK to join a church in a different neighborhood if I don't like the local one?

- Calculating Living Area on a Concentric Shellworld

- Is bike tyre pressure info deliberately hard to read?

- How is this function's assembly implementing the conditional?

- How can I obtain a record of my fathers' medals from WW2?

- Filter by partition number when the table is partitioned by computed column

- How does Death Ward interact with Band of Loyalty?

- What is the translation of a feeler in French?

- How might a physicist define 'mind' using concepts of physics?

- Effects if a human was shot by a femtosecond laser

- Do you have an expression saying "when you are very hungry, bread is also delicious for you" or similar one?

- How to justify formula for area of triangle (or parallelogram)

- Understanding the Amanda Knox, Guilty Verdict for Slander

- how do I constrain a shape key

- Why does the proposed Lunar Crater Radio Telescope suggest an optimal latitude of 20 degrees North?

- Why are spherical shapes so common in the universe?

- Verifying if "Hinge Vehicle Roof Holder 1 x 4 x 2 (4214)" in blue and white is LEGO

- Are there any jobs that are forbidden by law to convicted felons?

- Leaders and Rulers

- Who are the mathematicians interested in the history of mathematics?

- How did ALT + F4 become the shortcut for closing?

- What is every charm combo in Hollow Knight?

- Emergency preparedness

- Public health

- Regulation and liability

- Safe patient handling

- Safe staffing

- Volunteer opportunities

- Whistleblowing

- Workplace violence

- Resource library

- Professional Nursing and Health Care Council

- Staffing Complaint / ADO Form

- Understanding your representation rights

- Labor Executive Council

- WSNA in Olympia

- Legislative Session

- Advocacy toolkit

- Legislative and Health Policy Council

- 2024 election endorsements

- Membership application

- Benefits of membership

- Your regional nurses association

- Update your member record

- Our structure and our work

- Strategic priorities

- Leadership and governance

- Affiliations and partners

- Our history

- Hall of Fame

- Work at WSNA

- Employment opportunities

- Press releases and statements

- In the media

- The Washington Nurse magazine

- Staff directory

Nurses facing abnormally dangerous patient care assignments

March 18, 2020 • 2 minutes to read

You may have to make a decision about accepting an assignment involving abnormally dangerous conditions that pose an imminent risk to your safety and health, and could potentially cause serious injury or death. If you are a WSNA member and you accept an abnormally dangerous assignment, fill out an ADO to document that you are accepting an assignment despite objection.

If you have already accepted the assignment, your professional license may be at risk if you fail to continue that assignment, unless you have handed off the assignment and have been relieved of responsibility for the patient. If you decide to refuse the assignment, you should remain at the workplace and offer to perform other work that does not pose an imminent risk to your safety and health (e.g., an assignment for which you are provided proper safety equipment and training).

A decision to refuse an assignment could result in disciplinary action taken against you by the employer. Under collective bargaining agreements between employers and WSNA, there must be "just cause" for any discipline. If you are represented by WSNA for collective bargaining, we would defend you if you are subjected to unjust discipline, but resolution of any such discipline would likely be delayed and the outcome may be uncertain as a result of the current national and state emergency declarations.

Predicted Academic Performance: A new approach to identifying at-risk students in public schools

Subscribe to the brown center on education policy newsletter, ishtiaque fazlul , ishtiaque fazlul assistant professor, college of public health and school of public and international affairs - university of georgia @ishtiaquefazlul cory koedel , and cory koedel associate professor of economics and public policy - university of missouri eric parsons eric parsons professor - university of missouri, director of undergraduate studies, department of economics - university of missouri @esparsons.

January 17, 2024

- The availability of modern education data systems has not translated into meaningful improvements in how consequential state policies use data to identify students in need of additional resources and supports.

- Predicted Academic Performance (PAP) is more effective than common alternatives at identifying students who are at risk of poor academic performance and can be used to target resources toward these students more effectively than alternative risk indicators.

- The status quo approach to measuring student risk is limited in two ways: (1) The use of basic risk categories is a dated technology, and (2) common indicators used to identify at-risk students are both inaccurate and subject to change based on external policy decisions.

There have been substantial advances in the development of states’ education data systems over the past 20 years, supported by large investments from the federal government. However, the availability of modern data systems has not translated into meaningful improvements in how consequential state policies, such as funding and accountability policies, use data to identify students in need of additional resources and supports. Today, as has been the case for decades, states ubiquitously rely on blunt categorical indicators associated with disadvantage to identify these students, such as free and reduced-price lunch enrollment (among others). In other words, we are still using 20th-century technology to identify at-risk students in 21st-century schools.

In a recent article published in Educational Evaluation and Policy Analysis , we develop a new measure of student risk that can be used in consequential education policies. Our new measure leverages the rich information available in state data systems to better identify at-risk students, whom we define precisely as those at risk of poor academic performance . We refer to our new measure as “Predicted Academic Performance,” or PAP.

Academic performance can mean many things—achievement on standardized tests, on-time grade progression, school attendance, high-school graduation, college attendance, etc.—and in principle, PAP can be built around any of these outcomes. In our proof-of-concept application in Missouri, we measure student performance using state standardized tests. To construct PAP, we predict student performance using data from Missouri’s State Longitudinal Data System (SLDS). Specifically, we use information about student mobility across schools, family income, English language learner status, individualized education program (IEP) status, sex, and race/ethnicity. (The precise set of predictor variables is flexible, and in our academic article, we also consider versions of PAP that use subsets of this information.)

These and related variables are typically included in emerging early warning systems (EWSs) in some states and school districts. EWS indicators are diagnostic indicators that identify students at risk of poor academic performance, with the goal of helping schools target proactive support toward these students. In fact, PAP can be viewed as a special case of an EWS indicator, with the added constraint that PAP predictors are not manipulable (course grades are an example of a manipulable predictor used in some EWSs). This added constraint makes PAP well suited for use in consequential education policies, such as funding and accountability policies. In contrast, EWS indicators are not designed for policy use and would create perverse incentives for schools and districts if used in this way.

We show that PAP is more effective than common alternatives at identifying students who are at risk of poor academic performance, as intended. Using a funding policy simulation, we further show PAP can be used to target resources toward these students more effectively than alternative risk indicators. In addition, PAP also increases the effectiveness with which resources are targeted toward students who belong to many other associated risk categories.

Why we need to think differently about risk measurement

The status quo approach to measuring student risk is limited in two ways. First, the use of basic risk categories is a dated technology. It made sense when states’ data systems were underdeveloped and it was difficult to assemble detailed information about students. But today, we have a plethora of information, most of which is ignored. For instance, many states allocate funding to school districts based on the number of students from low-income families. However, we are not aware of any state policy that acknowledges the difference between students identified as low-income for one year versus those who are persistently identified as low-income. This is despite clear evidence that the persistence of student circumstances matters and readily available data that allow us to measure it.

The second limitation of the current approach is that common indicators used to identify at-risk students are both inaccurate and subject to change based on external policy decisions. The inaccuracy of common risk indicators has been shown most conclusively for free and reduced-price lunch (FRL) enrollment, which research shows is greatly oversubscribed (an outcome that is not surprising given program incentives for families and schools to increase enrollment but not to verify enrollment accuracy). For other risk indicators—e.g., indicators for English language learner status or special education status—much less is known about their accuracy, although there is cause for concern . Compounding this issue, policy changes outside the control of the education system can significantly alter the informational content of some risk indicators. This occurred, for example, for FRL enrollment with the implementation of the Community Eligibility Provision in the National School Lunch Program.

It is instructive to juxtapose the investments we make to measure student risk with the investments we make to measure student achievement. We view these two measures as the most important measures for informing education policies at all levels of government. States spend 1.7 billion dollars annually to administer standardized tests alone, and this does not count the many other tests administered locally by school districts. Furthermore, an entire subfield of education scholarship is devoted to understanding test-measurement issues. In contrast, it is hard to identify any meaningful investments in the development of risk measures that are suitable for use in consequential education policies. Rather, it seems we have done the bare minimum, using convenient and readily available indicators that often have a different purpose (e.g., to allocate free or subsidized school meals to students) with no substantive efforts to verify the accuracy of the data.

How PAP could improve identification

The limitations of existing measurement practices motivate our development of PAP. PAP is a singular indicator of student risk that draws on numerous data elements available in state systems. In essence, PAP is a weighted average of many student attributes, where the weights are higher for attributes that are more strongly associated with how students perform in school.

The PAP framework is flexible and can incorporate a variety of types of information into students’ total risk scores. It can also incorporate this information contemporarily (e.g., income and mobility status this year) and accounting for individual persistence (e.g., income and mobility status over the past three years) and schooling context (e.g., average income and mobility status at the student’s school). PAP is limited by the same fundamental challenges as current categorical systems in that some of the underlying data elements are inaccurate and may be subject to change. However, by using a large number of predictors of student risk—rather than just one or two variables as is the current policy norm—the influence of inaccuracies in the individual variables is reduced, as is the impact of policy-induced changes to the variables’ meanings.

In our proof-of-concept application of PAP using Missouri data—the details of which can be found in our academic article —we show that PAP is more effective than common alternatives at identifying students at risk of poor academic performance. This is not surprising because PAP is designed precisely to identify these students. Still, we believe this basic finding is important: It shows that states can do a better job of identifying these students—arguably those most in need of additional supports—than is currently the case. We further show that in the context of a school funding policy, PAP can be used to target resources toward these students more effectively.

In addition, we show that PAP is more effective than common alternatives at identifying—and targeting resources toward—other at-risk student groups. Examples include English language learners, special education students, and underrepresented minority students.

Moving forward

State longitudinal data systems contain rich information about students and permit the construction of risk indicators that are much more informative than in the past. However, earnest efforts to improve risk measurement in state education policies have largely failed to materialize. PAP is a step toward the development of more informative, modernized measures of student risk that put the information in states’ longitudinal data systems to work. PAP can be readily used for diagnostic purposes now—for instance, to help policymakers better understand the allocation of resources under current funding formulas and how effectively those resources reach students at risk of poor academic performance. In addition, with further testing and development, we are optimistic that PAP, or something like it, can be incorporated directly into consequential education policies.

PAP has limitations and is not a panacea. Given the inherent difficulty of measuring student risk, no measure will be. However, it is important to remember that while we wait for the perfect solution to arrive, we continue to use the same decades-old status quo approach to measuring student risk. And we can surely do better than that.

Related Content

Tom Swiderski, Sarah Crittenden Fuller

November 6, 2023

Wendy Castillo

August 28, 2023

Rachel M. Perera, Melissa Kay Diliberti

June 8, 2023

K-12 Education

Governance Studies

U.S. States and Territories

Brown Center on Education Policy

Douglas N. Harris

June 6, 2024

Phillip Levine, Luke Pardue

June 5, 2024

Carly D. Robinson, Katharine Meyer, Susanna Loeb

June 4, 2024

Assignment Risk: Finance Explained

Feb 6, 2024 — Sarah Saves

Understanding assignment risk is crucial for any investor in the financial markets. Assignment risk refers to the risk that the writer (seller) of an option contract will be required to fulfill their obligation to buy or sell the underlying asset (such as stocks) if the option is exercised by the buyer. This risk applies to both call options, where the writer may be forced to sell the asset, and put options, where the writer may be forced to buy the asset.

When selling options, especially naked options (options not hedged by an offsetting position), assignment risk becomes a significant consideration. If an option you wrote is assigned, you must either buy or sell the underlying asset at the contract's strike price, regardless of the current market price. This can lead to unexpected losses if the market moves against your position.

To manage assignment risk, option writers can take several precautions. One common strategy is to monitor options positions closely, especially as they near expiration. Rolling options, which involves closing out current positions and opening new ones with different expiration dates, can help delay or avoid assignment. Additionally, utilizing risk management techniques such as stop-loss orders can limit potential losses from assigned positions.

Investors should also be aware of ex-dividend dates when holding short option positions. If a short call option is in the money (the stock price is above the strike price) as it approaches the ex-dividend date, there is a higher likelihood of assignment as the option buyer may exercise the option to capture the dividend. Being mindful of corporate actions and market events can help investors navigate assignment risk more effectively.

Overall, understanding assignment risk is essential for option writers and investors using options strategies. By being aware of the potential outcomes and implementing risk management techniques, investors can mitigate the impact of assignment risk on their portfolios.

Looking to enhance your options trading skills? Join Tiblio today and explore our platform to elevate your trading experience. Join Tiblio

- Mobile Equity Services

- Mobile Workforce Management

- Mobility Tax Compliance and Consulting

- Private Client Services

- In the News

- Resource Center

- My GTN Portal

Managing Global Assignment Risk for Expatriates

EXPATRIATES | May 13, 2021

During the past year, the uncertainty that came with the COVID-19 pandemic combined with travel bans caused many companies to put a hold on new expatriate assignments. However, the increased rate of vaccination, especially within the US, is now creating opportunities for companies to consider re-starting international assignments. At the same time, the combination of increased spending by governments to fight the pandemic along with reduced tax revenue due to pandemic-induced economic slowdowns, are creating an environment ripe for tightening regulatory compliance for cross-border assignments and business travelers.

The coming increase in global relocation in the face of increased scrutiny will result in heightened risk for those managing mobility programs. Below, we look at some of the key risk areas related to your expatriate employees and four steps companies should consider implementing to help manage the global assignment risk for their expatriate employees.

Key global assignment risks for expatriates

Given the importance of mobility to many companies’ growth and talent management, it is critical that key risk areas for both the company and employee are understood and managed.

Regulatory and compliance risk

Compliance risk due to increased regulations is on the rise. As an example, Canadian tax authorities continue to audit companies for adherence to withholding tax requirements for business travelers who may otherwise be exempt from income tax under a treaty. The authorities typically look back five years to assess withholding tax, with those companies potentially incurring significant costs relating to compliance and difficulties in filing individual income tax returns to receive refunds.