- USF Research

- USF Libraries

Digital Commons @ USF > Muma College of Business > Management > Theses and Dissertations

Management and Organization Theses and Dissertations

Theses/dissertations from 2023 2023.

For Love or Money: Investor Motivations in Equity-Based Crowdfunding , Jason C. Cherubini

The Great Resignation: An Exploration of Strategies to Combat School Bus Driver Shortages in the Post-COVID-19 Era , James E. Cole Jr.

An Empirical Analysis of Sentiment and Confidence Regarding Interest Rates in Disclosures of Public Firms in the U.S. Fintech Sector , James J. Farley

Motivations for Planning: Uncovering the Inhibitors to the Adoption of Comprehensive Financial Planning for Business Owners , Daniel R. Gilham

An Examination of Reward-Based Crowdfunding Performance and Success , Matthew Alan Grace

All Quiet on The Digital Front: The Unseen Psychological Impacts on Cybersecurity First Responders , Tammie R. Hollis

Commitment to Change Dimensions: The Influence of Innovative Work Behavior and Organizational Environments , Michael Holmes

Turmoil in the Workforce: Introduction of the Nomadic Employee , Catrina Hopkins

Attention-Grabbing Tactics on Social Media , Arjun Kadian

Theses/Dissertations from 2022 2022

Building a Mentor-Mentee Maturity Model , Leroy A. Alexander

Do Auditors Respond to Changes in Clients’ Analyst Coverage? Evidence from a Natural Experiment , Mohammad Alkhamees

Designing a Messaging Strategy to Improve Information Security Policy Compliance , Federico Giovannetti

Are all pictures worth 1,000 words? An Investigation of Fit Between Graph Type and Performance on Accounting Data Analytics Tasks , Shawn Paul Granitto

An Enterprise Risk Management Framework to Design Pro-Ethical AI Solutions , Quintin P. McGrath

Deceptive Appeals and Cognitive Influences Used in Fraudulent Scheme Sales Pitches , Rafael J. Toledo

Using Online Reviews to Identify How Hotels Can Satisfy Travelers With Pets While Making Money , Sonia Weinhaus

Theses/Dissertations from 2021 2021

The IS Social Continuance Model: Using Conversational Agents to Support Co-creation , Naif Alawi

The Use of Data Analytic Visualizations to Inform the Audit Risk Assessment: The Impact of Initial Visualization Form and Documentation Focus , Rebecca N. Baaske (Becca)

Identification of Entrepreneurial Competencies in I-Corps Site Teams at the University of South Florida , Mark A. Giddarie

Understanding Nonprofit Boards: An Exploratory Study of the Governance Practices of Regional Nonprofits , Susan Ryan Goodman

Strengthening the Entrepreneurial Support Community , Andrew J. Hafer

Who to Choose? Rating Broker Best Practices in the Medicare Advantage Industry , Darwin R. Hale

Bridging the Innovatino Gap at SOCOM , Gregory J. Ingram

Improving Environmental Protection: One Imagined Touch at a Time , Luke Ingalls Liska

Residential Curbside Recycle Context Analysis , Ntchanang Mpafe

Fighting Mass Diffusion of Fake News on Social Media , Abdallah Musmar

Managing Incomplete Data in the Patient Discharge Summary to Support Correct Hospital Reimbursements , Fadi Naser Eddin

GAO Bid Protests by Small Business: Analysis of Perceived and Reported Outcomes in Federal Contracting , David M. Snyder

Engagement and Meaningfulness as Determinants of Employee Retention: A Longitudinal Case Study , Calvin Williams

Public Budgeting as Moral Dilemma , Ben Wroblewski

Theses/Dissertations from 2020 2020

Improving Engagement: The Moderating Effect of Leadership Style on the Relationship Between Psychological Capital and Employee Engagement , Scott Beatrice

Physician Self-Efficacy and Risk-Taking Attitudes as Determinants of Upcoding and Downcoding Errors: An Empirical Investigation , Samantha J. Champagnie

Digital Identity: A Human-Centered Risk Awareness Study , Toufic N. Chebib

Clarifying the Relationship of Design Thinking to the Military Decision-Making Process , Thomas S. Fisher

Essays on the Disposition Effect , Matthew Henriksson

Analysis of Malicious Behavior on Social Media Platforms Using Agent-Based Modeling , Agnieszka Anna Onuchowska

Who Rises to the Top: An Investigation of the Essential Skills Necessary for Partners of Non-Big 4 Public Accounting Firms , Amanda K. Thompson-Abbott

Theses/Dissertations from 2019 2019

The Financial and Nonfinancial Performance Measures That Drive Utility Abandonments and Transfers in the State of Florida , Daniel Acheampong

Locating a New Collegiate Entrepreneurship Program, a Framework for a University Campus , Douglas H. Carter

Understanding Employee Engagement: An Examination of Millennial Employees and Perceived Human Resource Management Practices , Danielle J. Clark

The Potential Impact Radius of a Natural Gas Transmission Line and Real Estate Valuations: A Behavioral Analysis , Charles M. Hilterbrand Jr.

Introducing a Mobile Health Care Platform in an Underserved Rural Population: Reducing Assimilations Gaps on Adoption and Use via Nudges , Joseph Hodges

Controlling Turnover in an Inside Sales Organization: What are the Contributing Factors , Dennis H. Kimerer

An Emergent Theory of Executive Leadership Selection: Leveraging Grounded Theory to Study the U.S. Military's Special Forces Assessment and Selection Process , Darryl J. Lavender

Essays on Migration Flows and Finance , Suin Lee

The Underutilized Tool of Project Management - Emotional Intelligence , Gerald C. Lowe

Increasing the Supply of the Missing Middle Housing Types in Walkable Urban Core Neighborhoods: Risk, Risk Reduction and Capital , Shrimatee Ojah Maharaj

Playing Darts in the Dark: How are Chamber of Commerce Leaders Aligned for Greater Effectiveness? , Robert J. Rohrlack Jr.

Are Transfer Pricing Disclosures Related to Tax Reporting Transparency? The Impact of Auditor-Provided Transfer Pricing Services , Stephanie Y. Walton

Theses/Dissertations from 2018 2018

Price Transparency in the United States Healthcare System , Gurlivleen (Minnie) Ahuja

How to Build a Climate of Quality in a Small to Medium Enterprise: An Action Research Project , Desmond M. Bishop III

Banking on Blockchain: A Grounded Theory Study of the Innovation Evaluation Process , Priya D. Dozier

Enhancing the Design of a Cybersecurity Risk Management Solution for Communities of Trust , James E. Fulford Jr.

An Examination of the Progressive and Regressive Factors that Business Owners Consider When Choosing Whether or Not to Implement an Exit Strategy , David C. Pickard

The Relationship between Ambient Lighting Color and Hotel Bar Customer Purchase Behavior and Satisfaction , Kunal Shah

The Unmanned Aerial Systems (UASs) Industry and the Business Impacts of the Evolution of the Federal Regulatory Environment , Darren W. Spencer

Intercultural Communication Between International Military Organizations; How Do You Turn a ‘No’ Into a ‘Yes’? , Douglas A. Straka

Essential Leadership Skills for Frontline Managers in a Multicultural Organization , Janelle Ward

Moffitt Cancer Center: Leadership, Culture and Transformation , W. James Wilson

Two Essays on String of Earnings Benchmarks , Yiyang Zhang

Theses/Dissertations from 2017 2017

Multi-Step Tokenization of Automated Clearing House Payment Transactions , Privin Alexander

The Effect of Corporate Social Responsibility Investment and Disclosure on Cooperation in Business Collaborations , Sukari Farrington

What Factors during the Genesis of a Startup are Causal to Survival? , Gilbert T. Gonzalez

The Great Recession of 2007 and the Housing Market Crash: Why Did So Many Builders Fail? , Mohamad Ali Hasbini

The Effect of Expanded Audit Report Disclosures on Users’ Confidence in the Audit and the Financial Statements , Peter Kipp

An Examination of Innovation Idea Selection Factors in Large Organizations , Troy A. Montgomery

Essays on Sales Coaching , Carlin A. Nguyen

Vital Signs of U.S. Osteopathic Medical Residency Programs Pivoting to Single Accreditation Standards , Timothy S. Novak

Leaders Who Learn: The Intersection of Behavioral Science, Adult Learning and Leadership , Natalya I. Sabga

Toward a Systemic Model for Governance and Strategic Management: Evaluating Stakeholder Theory Versus Shareholder Theory Approaches , James A. Stikeleather

A Longitudinal Study of the Effects of Cognitive Awareness Training on Transaction Processing Accuracy: An Introduction to the ACE Theoretical Construct , John Townsend

Theses/Dissertations from 2016 2016

The Effect of Presentation Format on Investor Judgments and Decisions: Does the Effect Differ for Varying Task Demands? , Kevin Agnew

Theses/Dissertations from 2014 2014

Multi-Task Setting Involving Simple and Complex Tasks: An Exploratory Study of Employee Motivation , Maia Jivkova Farkas

Essays on Mergers and Acquisitions , Marcin Krolikowski

Do Social Biases Impede Auditor Reliance on Specialists? Toward a Theory of Social Similarity , Rina Maxine Limor

Theses/Dissertations from 2013 2013

Psychological Distance: The Relation Between Construals, Mindsets, and Professional Skepticism , Jason Rasso

Theses/Dissertations from 2011 2011

Combining Natural Language Processing and Statistical Text Mining: A Study of Specialized Versus Common Languages , Jay Jarman

An Empirical Investigation of Decision Aids to Improve Auditor Effectiveness in Analytical Review , Robert N. Marley

The Effects of Item Complexity and the Method Used to Present a Complex Item on the Face of a Financial Statement on Nonprofessional Investors` Judgments , Linda Gale Ragland

Theses/Dissertations from 2010 2010

Two Essays on Information Ambiguity and Informed Traders’ Trade-Size Choice , Ziwei Xu

Theses/Dissertations from 2008 2008

Two Essays on the Conflict of Interests within the Financial Services Industry-- Financial Industry Consolidation: The Motivations and Consequences of the Financial Services Modernization Act (FSMA) and “Down but Not Out” Mutual Fund Manager Turnover within Fund Families , Lonnie Lashawn Bryant

Two Essays on Multiple Directorships , Chia-wei Chen

Two Essays on Financial Condition of Firms , Sanjay Kudrimoti

A Study of Cross-Border Takeovers: Examining the Impact of National Culture on Internalization Benefits, and the Implications of Early Versus Late-Mover Status for Bidders and Their Rivals , Tanja Steigner

Two Essays on Corporate Governance⎯Are Local Directors Better Monitors, and Directors Incentives and Earnings Management , Hong Wan

Theses/Dissertations from 2007 2007

The Role of Ethnic Compatibility in Attitude Formation: Marketing to America’s Diverse Consumers , Cynthia Rodriguez Cano

Two Essays on Venture Capital: What Drives the Underpricing of Venture CapitalBacked IPOs and Do Venture Capitalists Provide Anything More than Money? , Donald Flagg

Two essays on market efficiency: Tests of idiosyncratic risk: informed trading versus noise and arbitrage risk, and agency costs and the underlying causes of mispricing: information asymmetry versus conflict of interests , Jung Chul Park

The impact of management's tone on the perception of management's credibility in forecasting , Robert D. Slater

Uncertainty in the information supply chain: Integrating multiple health care data sources , Monica Chiarini Tremblay

Theses/Dissertations from 2006 2006

Adolescent alcohol use and educational outcomes , Wesley A. Austin

Certificate of need regulation in the nursing home industry: Has it outlived its usefulness? , Barbara J. Caldwell

The impacts of the handoffs on software development: A cost estimation model , Michael Jay Douglas

Using emergent outcome controls to manage dynamic software development , Michael Loyd Harris

The information technology professional's psychological contract viewed through their employment arrangement and the relationship to organizational behaviors , Sandra Kay Newton

Advanced Search

- Email Notifications and RSS

- All Collections

- USF Faculty Publications

- Open Access Journals

- Conferences and Events

- Theses and Dissertations

- Textbooks Collection

Useful Links

- Rights Information

- SelectedWorks

- Submit Research

Home | About | Help | My Account | Accessibility Statement | Language and Diversity Statements

Privacy Copyright

- Browse All Articles

- Newsletter Sign-Up

Management →

- 07 May 2024

- Cold Call Podcast

Lessons in Business Innovation from Legendary Restaurant elBulli

Ferran Adrià, chef at legendary Barcelona-based restaurant elBulli, was facing two related decisions. First, he and his team must continue to develop new and different dishes for elBulli to guarantee a continuous stream of innovation, the cornerstone of the restaurant's success. But they also need to focus on growing the restaurant’s business. Can the team balance both objectives? Professor Michael I. Norton discusses the connections between creativity, emotions, rituals, and innovation – and how they can be applied to other domains – in the case, “elBulli: The Taste of Innovation,” and his new book, The Ritual Effect.

- 26 Apr 2024

Deion Sanders' Prime Lessons for Leading a Team to Victory

The former star athlete known for flash uses unglamorous command-and-control methods to get results as a college football coach. Business leaders can learn 10 key lessons from the way 'Coach Prime' builds a culture of respect and discipline without micromanaging, says Hise Gibson.

- 02 Apr 2024

- What Do You Think?

What's Enough to Make Us Happy?

Experts say happiness is often derived by a combination of good health, financial wellbeing, and solid relationships with family and friends. But are we forgetting to take stock of whether we have enough of these things? asks James Heskett. Open for comment; 0 Comments.

- Research & Ideas

Employees Out Sick? Inside One Company's Creative Approach to Staying Productive

Regular absenteeism can hobble output and even bring down a business. But fostering a collaborative culture that brings managers together can help companies weather surges of sick days and no-shows. Research by Jorge Tamayo shows how.

- 12 Mar 2024

Publish or Perish: What the Research Says About Productivity in Academia

Universities tend to evaluate professors based on their research output, but does that measure reflect the realities of higher ed? A study of 4,300 professors by Kyle Myers, Karim Lakhani, and colleagues probes the time demands, risk appetite, and compensation of faculty.

- 29 Feb 2024

Beyond Goals: David Beckham's Playbook for Mobilizing Star Talent

Reach soccer's pinnacle. Become a global brand. Buy a team. Sign Lionel Messi. David Beckham makes success look as easy as his epic free kicks. But leveraging world-class talent takes discipline and deft decision-making, as case studies by Anita Elberse reveal. What could other businesses learn from his ascent?

- 16 Feb 2024

Is Your Workplace Biased Against Introverts?

Extroverts are more likely to express their passion outwardly, giving them a leg up when it comes to raises and promotions, according to research by Jon Jachimowicz. Introverts are just as motivated and excited about their work, but show it differently. How can managers challenge their assumptions?

- 05 Feb 2024

The Middle Manager of the Future: More Coaching, Less Commanding

Skilled middle managers foster collaboration, inspire employees, and link important functions at companies. An analysis of more than 35 million job postings by Letian Zhang paints a counterintuitive picture of today's midlevel manager. Could these roles provide an innovation edge?

- 24 Jan 2024

Why Boeing’s Problems with the 737 MAX Began More Than 25 Years Ago

Aggressive cost cutting and rocky leadership changes have eroded the culture at Boeing, a company once admired for its engineering rigor, says Bill George. What will it take to repair the reputational damage wrought by years of crises involving its 737 MAX?

- 16 Jan 2024

How SolarWinds Responded to the 2020 SUNBURST Cyberattack

In December of 2020, SolarWinds learned that they had fallen victim to hackers. Unknown actors had inserted malware called SUNBURST into a software update, potentially granting hackers access to thousands of its customers’ data, including government agencies across the globe and the US military. General Counsel Jason Bliss needed to orchestrate the company’s response without knowing how many of its 300,000 customers had been affected, or how severely. What’s more, the existing CEO was scheduled to step down and incoming CEO Sudhakar Ramakrishna had yet to come on board. Bliss needed to immediately communicate the company’s action plan with customers and the media. In this episode of Cold Call, Professor Frank Nagle discusses SolarWinds’ response to this supply chain attack in the case, “SolarWinds Confronts SUNBURST.”

- 02 Jan 2024

Do Boomerang CEOs Get a Bad Rap?

Several companies have brought back formerly successful CEOs in hopes of breathing new life into their organizations—with mixed results. But are we even measuring the boomerang CEOs' performance properly? asks James Heskett. Open for comment; 0 Comments.

- 12 Dec 2023

COVID Tested Global Supply Chains. Here’s How They’ve Adapted

A global supply chain reshuffling is underway as companies seek to diversify their distribution networks in response to pandemic-related shocks, says research by Laura Alfaro. What do these shifts mean for American businesses and buyers?

- 05 Dec 2023

What Founders Get Wrong about Sales and Marketing

Which sales candidate is a startup’s ideal first hire? What marketing channels are best to invest in? How aggressively should an executive team align sales with customer success? Senior Lecturer Mark Roberge discusses how early-stage founders, sales leaders, and marketing executives can address these challenges as they grow their ventures in the case, “Entrepreneurial Sales and Marketing Vignettes.”

.jpg)

- 31 Oct 2023

Checking Your Ethics: Would You Speak Up in These 3 Sticky Situations?

Would you complain about a client who verbally abuses their staff? Would you admit to cutting corners on your work? The answers aren't always clear, says David Fubini, who tackles tricky scenarios in a series of case studies and offers his advice from the field.

- 12 Sep 2023

Can Remote Surgeries Digitally Transform Operating Rooms?

Launched in 2016, Proximie was a platform that enabled clinicians, proctors, and medical device company personnel to be virtually present in operating rooms, where they would use mixed reality and digital audio and visual tools to communicate with, mentor, assist, and observe those performing medical procedures. The goal was to improve patient outcomes. The company had grown quickly, and its technology had been used in tens of thousands of procedures in more than 50 countries and 500 hospitals. It had raised close to $50 million in equity financing and was now entering strategic partnerships to broaden its reach. Nadine Hachach-Haram, founder and CEO of Proximie, aspired for Proximie to become a platform that powered every operating room in the world, but she had to carefully consider the company’s partnership and data strategies in order to scale. What approach would position the company best for the next stage of growth? Harvard Business School associate professor Ariel Stern discusses creating value in health care through a digital transformation of operating rooms in her case, “Proximie: Using XR Technology to Create Borderless Operating Rooms.”

- 28 Aug 2023

The Clock Is Ticking: 3 Ways to Manage Your Time Better

Life is short. Are you using your time wisely? Leslie Perlow, Arthur Brooks, and DJ DiDonna offer time management advice to help you work smarter and live happier.

- 15 Aug 2023

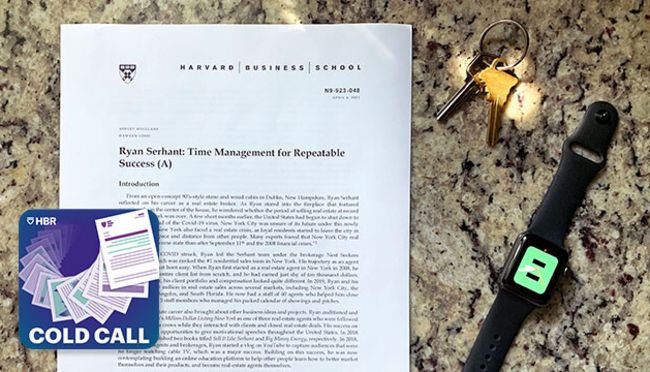

Ryan Serhant: How to Manage Your Time for Happiness

Real estate entrepreneur, television star, husband, and father Ryan Serhant is incredibly busy and successful. He starts his days at 4:00 am and often doesn’t end them until 11:00 pm. But, it wasn’t always like that. In 2020, just a few months after the US began to shut down in order to prevent the spread of the Covid-19 virus, Serhant had time to reflect on his career as a real estate broker in New York City, wondering if the period of selling real estate at record highs was over. He considered whether he should stay at his current real estate brokerage or launch his own brokerage during a pandemic? Each option had very different implications for his time and flexibility. Professor Ashley Whillans and her co-author Hawken Lord (MBA 2023) discuss Serhant’s time management techniques and consider the lessons we can all learn about making time our most valuable commodity in the case, “Ryan Serhant: Time Management for Repeatable Success.”

- 08 Aug 2023

The Rise of Employee Analytics: Productivity Dream or Micromanagement Nightmare?

"People analytics"—using employee data to make management decisions—could soon transform the workplace and hiring, but implementation will be critical, says Jeffrey Polzer. After all, do managers really need to know about employees' every keystroke?

- 01 Aug 2023

Can Business Transform Primary Health Care Across Africa?

mPharma, headquartered in Ghana, is trying to create the largest pan-African health care company. Their mission is to provide primary care and a reliable and fairly priced supply of drugs in the nine African countries where they operate. Co-founder and CEO Gregory Rockson needs to decide which component of strategy to prioritize in the next three years. His options include launching a telemedicine program, expanding his pharmacies across the continent, and creating a new payment program to cover the cost of common medications. Rockson cares deeply about health equity, but his venture capital-financed company also must be profitable. Which option should he focus on expanding? Harvard Business School Professor Regina Herzlinger and case protagonist Gregory Rockson discuss the important role business plays in improving health care in the case, “mPharma: Scaling Access to Affordable Primary Care in Africa.”

- 05 Jul 2023

How Unilever Is Preparing for the Future of Work

Launched in 2016, Unilever’s Future of Work initiative aimed to accelerate the speed of change throughout the organization and prepare its workforce for a digitalized and highly automated era. But despite its success over the last three years, the program still faces significant challenges in its implementation. How should Unilever, one of the world's largest consumer goods companies, best prepare and upscale its workforce for the future? How should Unilever adapt and accelerate the speed of change throughout the organization? Is it even possible to lead a systematic, agile workforce transformation across several geographies while accounting for local context? Harvard Business School professor and faculty co-chair of the Managing the Future of Work Project William Kerr and Patrick Hull, Unilever’s vice president of global learning and future of work, discuss how rapid advances in artificial intelligence, machine learning, and automation are changing the nature of work in the case, “Unilever's Response to the Future of Work.”

A review of strategic management research on India

- Published: 28 April 2022

- Volume 40 , pages 1341–1392, ( 2023 )

Cite this article

- Anil Nair ORCID: orcid.org/0000-0001-6033-8095 1 ,

- Mehdi Sharifi Khobdeh 2 ,

- Aydin Oksoy 3 ,

- Orhun Guldiken 4 &

- Chris H. Willis 1

1145 Accesses

3 Citations

Explore all metrics

In 1991 India embarked on far-reaching economic, financial and regulatory reforms, which led to not only a surge in economic growth, but also spurred scholarly interest in Indian firms, their strategies, and their business environment. As it has been almost three decades since the reforms were initiated, we believe that it is an appropriate time to take stock of the research on strategic management in the Indian setting. Our scoping review finds three dominant themes in extant research: impact of environment (specifically liberalization) on firms, strategies of firms, and the different ownership structures of firms. We discuss the key findings within these domains and identify the theories and methods that scholars have used to address their research questions. We assert that the unique Indian context — a mix of public and private economy operating within a democratic system — provides a rich environment for not only testing existing theories in strategic management but also generating new theories. We conclude by identifying several important areas of research and urging strategy scholars to engage with the opportunities offered by the evolving Indian business environment.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Institutional Approach to Strategic Management

Navigating cross-border institutional complexity: A review and assessment of multinational nonmarket strategy research

How Has Japan Accepted, Developed, and Transformed Strategic Management Theory?

Scoping reviews summarize the extant literature on a particular topic in order to investigate the extent and nature of research activities or to identify research gaps in the literature (Paré et al., 2015 ). These types of review studies focus more on the breadth of coverage of the literature than the depth of coverage.

Appendix 1 offers a brief narrative of India’s economic history and business environment to provide the context in which Indian firms and their strategies have evolved.

Use of the * character in ABI search produces all variants of relevant words such as strategy, strategies, strategic. We also searched the Web of Science and EBSCO databases to ensure that we did not miss any relevant peer-reviewed papers on Indian strategic management.

Our final search was performed on 10/31/2021.

The selection process for the table is based on citation rates (Podsakoff et al., 2008 ). We avoid the citation bias identified by Steel et al. ( 2021 ) by following Aguinis et al. ( 2011 ) coding citations per year. This allowed us to identify the impactful strategic management articles conducted in the context of India. We calculated the average cites per year per article following Judge et al. ( 2022 ) and included the articles that have above average cites per year from the total identified sample. Because of the time delay between release for new articles and resulting citations, we also include several of the more recent publications.

This was the latest edition of the yearbook that reported the total number of cooperatives.

Carr, Tagore & Company, the first managing agency company, was set-up in 1834 by Dwarkanath Tagore in Calcutta (Goswami, 2016 ).

One of the oldest surviving company in India was founded by one such immigrant, Thomas Parry, in 1839 (Menon, 2016 ).

Meyer, K. E. (2006). Asian management research needs more self-confidence. Asia Pacific Journal of Management, 23 (2), 119–137.

Article Google Scholar

Adbi, A., Chatterjee, C., Drev, M., & Mishra, A. (2019). When the big one came: A natural experiment on demand shock and market structure in India’s influenza vaccine markets. Production and Operations Management, 28 (4), 810–832.

Adbi, A., Bhaskarabhatla, A., & Chatterjee, C. (2020). Stakeholder orientation and market impact: Evidence from India. Journal of Business Ethics, 161 (2), 479–496.

Agarwal, N., & Brem, A. (2012). Frugal and reverse innovation-literature overview and case study insights from a German MNC in India and China. In Engineering, Technology and Innovation (ICE), 2012 18th International ICE Conference on (pp. 1–11).

Aguinis, H., Dalton, D., Bosco, F., Pierce, C., & Dalton, C. (2011). Meta-analytic choices and judgment calls: Implications for theory building and testing, obtained effect sizes, and scholarly impact. Journal of Management, 37 (1), 5–38.

Ahlstrom, D. (2010). Innovation and growth: How business contributes to society. Academy of Management Perspectives, 24 (3), 11–24.

Google Scholar

Ahlstrom, D., Young, M. N., Chan, E. S., & Bruton, G. D. (2004). Facing constraints to growth? Overseas Chinese entrepreneurs and traditional business practices in East Asia. Asia Pacific Journal of Management, 21 (3), 263–285.

Ahluwalia, M. S. (2002). Economic reforms in India since 1991: Has gradualism worked? Journal of Economic Perspectives, 16 (3), 67–88.

Amighini, A. A., Rabellotti, R., & Sanfilippo, M. (2013). Do Chinese state-owned and private enterprises differ in their internationalization strategies? China Economic Review, 27 , 312–325.

Ayyagari, M., Dau, L. A., & Spencer, J. (2015). Strategic responses to FDI in emerging markets: Are core members more responsive than peripheral members of business groups? Academy of Management Journal, 58 (6), 1869–1894.

Bajpai, N. (2002). A decade of economic reforms in India: the unfinished agenda. Metamorphosis, 1 (2), 125–154.

Bajwa, N. U. H., & König, C. J. (2017). On the lacking visibility of management research from non-Western countries: The influence of Indian researchers’ social identity on their publication strategy. Management Research Review, 40 (5), 538–555.

Banga, R. (2006). The export-diversifying impact of Japanese and US foreign direct investments in the Indian manufacturing sector. Journal of International Business Studies, 37 (4), 558–568.

Bapat, D., & Mazumdar, D. (2015). Assessment of business strategy: Implication for Indian banks. Journal of Strategy and Management, 8 (4), 306–325.

Bardhan, P. (2006). Resistance to economic reforms in India . Yale Global Online. Yale University.

Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17 (1), 99–120.

Basu, P. (2009). Villages, women, and the success of dairy cooperatives in India: Making place for rural development . Cambria Press.

Behera, S. (2002). India’s encounter with the Silk Road. Economic and Political Weekly, 37 (51), 5077–5080.

Benischke, M. H., Guldiken, O., Doh, J. P., Martin, G., & Zhang, Y. (2022). Towards a behavioral theory of MNC response to political risk and uncertainty: The role of CEO wealth at risk. Journal of World Business, 57 (1), 101265. https://doi.org/10.1016/j.jwb.2021.101265

Benmamoun, M., Singh, N., Lehnert, K., & Lee, S. B. (2019). Internationalization of e-commerce corporations (ECCs): Advanced vs emerging markets ECCs. Multinational Business Review .

Bertoldi, B., Giachino, C., & Marenco, S. (2012). Bringing gourmet coffee to India: Lessons of an Italian firm in an emerging market. The Journal of Business Strategy, 33 (5), 32–43.

Bharti, N. (2018). Evolution of agriculture finance in India: A historical perspective. Agricultural Finance Review, 78 (3), 376–392.

Bhatia, A., & Thakur, A. (2018). Corporate diversification and firm performance: An empirical investigation of causality. International Journal of Organizational Analysis, 26 (2), 202–225.

Aundhe, M. D., & Mathew, S. K. (2009). Risks in offshore IT outsourcing: A service provider perspective. European Management Journal, 27 (6), 418–428.

Bhaumik, S. K., & Driffield, N. (2011). Direction of outward FDI of EMNEs: Evidence from the Indian pharmaceutical sector. Thunderbird International Business Review, 53 (5), 615–628.

Bhaumik, S. K., Driffield, N., & Pal, S. (2010). Does ownership structure of emerging-market firms affect their outward FDI? The case of the Indian automotive and pharmaceutical sectors. Journal of International Business Studies, 41 (3), 437–450.

Boddewyn, J. J. (1988). Political aspects of MNE theory. Journal of International Business Studies, 19 (3), 341–363.

Bruton, G. D., & Lau, C. M. (2008). Asian management research: Status today and future outlook. Journal of Management Studies, 45 (3), 636–659.

Bruton, G. D., Peng, M. W., Ahlstrom, D., Stan, C., & Xu, K. (2015). State-owned enterprises around the world as hybrid organizations. Academy of Management Perspectives, 29 (1), 92–114.

Bruton, G. D., Ahlstrom, D., & Chen, J. (2021). China has emerged as an aspirant economy. Asia Pacific Journal of Management, 38 (1), 1–15.

Buckley, P. J., & Casson, M. (2016). The Future of the Multinational Enterprise . Springer.

Buckley, P. J., & Munjal, S. (2017). The role of local context in the cross-border acquisitions by emerging economy multinational enterprises. British Journal of Management, 28 (3), 372–389.

Buckley, P. J., Munjal, S., Enderwick, P., & Forsans, N. (2016). Do foreign resources assist or impede internationalisation? Evidence from internationalisation of Indian multinational enterprises. International Business Review, 25 (1), 130–140.

Buckley, P. J., Forsans, N. & Munjal, S. (2009). Foreign acquisitions by Indian multinational enterprises: A test of the eclectic paradigm. 35 th European International Business Academy Annual Conference (EIBA) , Valencia, Spain.

Chacar, A., & Vissa, B. (2005). Are emerging economies less efficient? Performance persistence and the impact of business group affiliation. Strategic Management Journal, 26 (10), 933–946.

Chari, M. D. (2013). Business groups and foreign direct investments by developing country firms: An empirical test in India. Journal of World Business, 48 (3), 349–359.

Chari, M. D., & Banalieva, E. R. (2015). How do pro-market reforms impact firm profitability? The case of India under reform. Journal of World Business, 50 (2), 357–367.

Chari, M. D., & David, P. (2012). Sustaining superior performance in an emerging economy: An empirical test in the Indian context. Strategic Management Journal, 33 (2), 217–229.

Chen, G., Chittoor, R., & Vissa, B. (2015). Modernizing without Westernizing: Social structure and economic action in the Indian financial sector. Academy of Management Journal, 58 (2), 511–537.

Chhibber, A., & Gupta, S. (2018). Public sector undertakings: Bharat’s other ratnas. The International Journal of Public Sector Management, 31 (2), 113–127.

Chittoor, R., Sarkar, M. B., Ray, S., & Aulakh, P. S. (2009). Third-world copycats to emerging multinationals: Institutional changes and organizational transformation in the Indian pharmaceutical industry. Organization Science, 20 (1), 187–205.

Chittoor, R., Aulakh, P. S., & Ray, S. (2015a). What drives overseas acquisitions by Indian firms? A behavioral risk-taking perspective. Management International Review, 55 (2), 255–275.

Chittoor, R., Kale, P., & Puranam, P. (2015b). Business groups in developing capital markets: Towards a complementarity perspective. Strategic Management Journal, 36 (9), 1277–1296.

Choudhury, P., & Khanna, T. (2014). Toward resource independence - why state-owned entities become multinationals: An empirical study of India’s public R&D laboratories. Journal of International Business Studies, 45 (8), 943–960.

Civera, C., de Colle, S., & Casalegno, C. (2019). Stakeholder engagement through empowerment: The case of coffee farmers. Business Ethics, 28 (2), 156–174.

Contractor, F. J. (2013). “Punching above their weight”: The sources of competitive advantage for emerging market multinationals. International Journal of Emerging Markets., 8 (4), 304–328.

Contractor, F. J., Hsu, C. C., & Kundu, S. K. (2005). Explaining export performance: A comparative study of international new ventures in Indian and Taiwanese software industry. Management International Review, 45 (3), 83–110.

Damaraju, N. L., & Makhija, A. K. (2018). The role of social proximity in professional CEO appointments: Evidence from caste/religion-based hiring of CEOs in India. Strategic Management Journal, 39 (7), 2051–2074.

Dandekar, V. M. (1988). Indian economy since independence. Economic and Political Weekly, 41–50.

Das, G. (2002). India unbound: From independence to the global information age . Penguin Books.

Das, M. (2016). Globalization and its positive impact on Indian economy. Available at SSRN 2738054.

Dau, L. A., Morck, R., & Yeung, B. Y. (2021). Business groups and the study of international business: A Coasean synthesis and extension. Journal of International Business Studies, 52 (2), 161–211.

De Beule, F., & Sels, A. (2016). Do innovative emerging market cross-border acquirers create more shareholder value? Evidence from India. International Business Review, 25 (2), 604–617.

Delios, A., Gaur, A. S., & Kamal, S. (2009). International acquisitions and the globalization of firms from India. In Expansion of Trade and FDI in Asia (pp. 72–89). Routledge.

DeLong, J. B. (2003). India since independence: An analytic growth narrative. In D. Rodrik (Ed.), In search of prosperity: Analytic Narratives on Economic Growth (pp. 184–204). Princeton University Press.

Denrell, J., Fang, C., & Winter, S. G. (2003). The economics of strategic opportunity. Strategic Management Journal, 24 (10), 977–990.

Deshpandé, R., Khanna, T. A. R. U. N., & Bijlani, T. (2013). India’s Amul: Keeping up with the times. Harvard Business Review . (October).

Dewan, S. M. (Ed.). (2006). Corporate governance in public sector enterprises . Pearson Education India.

Dewenter, K. L., & Malatesta, P. H. (2001). State-owned and privately owned firms: An empirical analysis of profitability, leverage, and labor intensity. American Economic Review, 91 (1), 320–334.

Dunning, J. H. (2001). The eclectic (OLI) paradigm of international production: Past, present and future. International Journal of the Economics of Business, 8 (2), 173–190.

Elango, B., & Pattnaik, C. (2007). Building capabilities for international operations through networks: A study of Indian firms. Journal of International Business Studies, 38 (4), 541–555.

Elg, U., Ghauri, P. N., Child, J., & Collinson, S. (2017). MNE microfoundations and routines for building a legitimate and sustainable position in emerging markets. Journal of Organizational Behavior, 38 (9), 1320–1337.

Feinberg, S. E., & Majumdar, S. K. (2001). Technology spillovers from foreign direct investment in the Indian pharmaceutical industry. Journal of International Business Studies, 32 (3), 421–437.

Gaur, A. S., & Kumar, V. (2009). International diversification, business group affiliation and firm performance: Empirical evidence from India. British Journal of Management, 20 (2), 172–186.

Gaur, A., & Kumar, M. (2018). A systematic approach to conducting review studies: An assessment of content analysis in 25 years of IB research. Journal of World Business, 53 (2), 280–289.

Gaur, A. S., Kumar, V., & Singh, D. (2014). Institutions, resources, and internationalization of emerging economy firms. Journal of World Business, 49 (1), 12–20.

Gaur, A. S., Chinmay, P., Singh, D., & Lee, J. Y. (2019). Internalization advantage and subsidiary performance: The role of business group affiliation and host country characteristics. Journal of International Business Studies, 50 (8), 1253–1282.

Gautam, R., & Singh, A. (2010). Corporate social responsibility practices in India: A study of top 500 companies. Global Business and Management Research: An International Journal, 2 (1), 41–56.

Ghemawat, P., & Khanna, T. (1998). The nature of diversified business groups: A research design and two case studies. The Journal of Industrial Economics, 46 (1), 35–61.

Ghorpade, J. (1973). Organizational ownership patterns and efficiency: A case study of private and cooperative sugar factories in South India. Academy of Management Journal, 16 (1), 138–148.

Goswami, H. (2016). Opportunities and challenges of digital India programme. International Education and Research Journal, 2 (11), 78–79.

Govindarajan, V., & Ramamurti, R. (2011). Reverse innovation, emerging markets, and global strategy. Global Strategy Journal, 1 (3–4), 191–205.

Goyal, S., Sergi, B. S., & Kapoor, A. (2017). Emerging role of for-profit social enterprises at the base of the pyramid: The case of Selco. Journal of Management Development, 36 (1), 97–108.

Grant, R. M. (2013). Contemporary Strategy Analysis . John Wiley & Sons.

Griffith, D. A., Cavusgil, S. T., & Xu, S. (2008). Emerging themes in international business research. Journal of International Business Studies, 39 (7), 1220–1235.

Gubbi, S. R., Aulakh, P. S., Ray, S., Sarkar, M. B., & Chittoor, R. (2010). Do international acquisitions by emerging-economy firms create shareholder value? The case of Indian firms. Journal of International Business Studies, 41 (3), 397–418.

Gubbi, S. R., Aulakh, P. S., & Ray, S. (2015). International search behavior of business group affiliated firms: Scope of institutional changes and intragroup heterogeneity. Organization Science, 26 (5), 1485–1501.

Gunasekar, S., & Sarkar, J. (2019). Does autonomy matter in state owned enterprises? Evidence from performance contracts in India. Economics of Transition and Institutional Change, 27 (3), 763–800.

Gupta, B., & Khanna, T. (2019). A recombination-based internationalization model: Evidence from Narayana Health’s journey from India to the Cayman Islands. Organization Science, 30 (2), 405–425.

Gupta, A. K., & Wang, H. (2009). Getting China and India right: Strategies for leveraging the world’s fastest growing economies for global advantage . John Wiley & Sons.

Hambrick, D. C. (2007). The field of management’s devotion to theory: Too much of a good thing? Academy of Management Journal, 50 (6), 1346–1352.

Hatten, K. J., & Hatten, M. L. (1987). Strategic groups, asymmetrical mobility barriers and contestability. Strategic Management Journal, 8 (4), 328–342.

Hawk, B. (2015). Law and Commerce in Pre-Industrial Societies . Brill.

Book Google Scholar

Heredia, R. R. (1997). Bilingual memory and hierarchical models: A case for language dominance. Current Directions in Psychological Science, 6 (2), 34–39.

Holmes, R. M., Jr., Hoskisson, R. E., Kim, H., Wan, W. P., & Holcomb, T. R. (2018). International strategy and business groups: A review and future research agenda. Journal of World Business, 53 (2), 134–150.

Hu, W. H., Cui, L., & Aulakh, P. S. (2019). State capitalism and performance persistence of business group-affiliated firms: A comparative study of China and India. Journal of International Business Studies, 50 (2), 193–222.

Iriyama, A., Kishore, R., & Talukdar, D. (2016). Playing dirty or building capability? Corruption and HR training as competitive actions to threats from informal and foreign firm rivals. Strategic Management Journal, 37 (10), 2152–2173.

Jaggi, B. (1979). An analysis of perceived need importance of Indian managers. Management International Review, 19 (1), 107–112.

Jain, H., Budhwar, P., Varma, A., & Ratnam, C. V. (2012). Human resource management in the new economy in India. International Journal of Human Resource Management, 23 (5), 887–891.

Jain, P. K., Gupta, S., & Yadav, S. (2014). Public Sector Enterprises in India: The Impact of Disinvestment and Self Obligation on Financial Performance . Springer India.

Jain, S., Nair, A., & Ahlstrom, D. (2015). Introduction to the Special Issue: Towards a theoretical understanding of innovation and entrepreneurship in India. Asia Pacific Journal of Management, 32 (4), 835–841.

Jalan, B. (1996). India’s Economic Policy: Preparing For The Twenty-First Century . Penguin Books.

Johanson, J., & Vahlne, J. E. (1977). The internationalization process of the firm: A model of knowledge development and increasing foreign market commitments. Journal of International Business Studies, 8 (1), 23–32.

Jormanainen, I., & Koveshnikov, A. (2012). International activities of emerging market firms. Management International Review, 52 (5), 691–725.

Judge, W.Q., Norouzi, A., & Farrell, M. (2022). National culture and strategic management. Chapter 21 In Gelfand, M. & Erez, M. (eds.), Oxford Handbook of Culture and Organizations . Oxford University Press.

Kaushik, S. K. (1997). India’s evolving economic model: A perspective on economic and financial reforms. American Journal of Economics and Sociology, 56 (1), 69–84.

Kedia, B. L., Mukherjee, D., & Lahiri, S. (2006). Indian business groups: Evolution and transformation. Asia Pacific Journal of Management, 23 (4), 559–577.

Khanna, T., & Palepu, K. (1997). Why focused strategies may be wrong for emerging markets. Harvard Business Review, 75 , 41–54.

Khosravi, M., Yahyazadefar, M., Ahlstrom, D., & Alizadeh Sanni, M. (2021a). Enhancement of intangible (immaterial) assets in formal and informal institutions by virtue enrichment of human capital. Philosophical Meditations, 11 (27), 19–48.

Khosravi, M., Yahyazadehfar, M., & Sani, M. A. (2021b). Economic growth and human capital in Iran: A phenomenological study in a major Central Asian economy. Asia Pacific Journal of Management , forthcoming.

Kohli, A. (1989). Politics of economic liberalization in India. World Development, 17 (3), 305–328.

Kohli, R. (2015). Financing strategies and shareholders’ risk in cross border acquisitions in India. International Journal of Commerce and Management, 25 (3), 294–308.

Kohli, R., & Mann, B. J. S. (2012). Analyzing determinants of value creation in domestic and cross border acquisitions in India. International Business Review, 21 (6), 998–1016.

Komera, S., Lukose, P. J., & Sasidharan, S. (2018). Does business group affiliation encourage R&D activities? Evidence from India. Asia Pacific Journal of Management, 35 (4), 887–917.

Kothari, T., Kotabe, M., & Murphy, P. (2013). Rules of the game for emerging market multinational companies from China and India. Journal of International Management, 19 (3), 276–299.

Kozhikode, R. K. (2016). Dormancy as a strategic response to detrimental public policy. Organization Science, 27 (1), 189–206.

Kozhikode, R. K., & Li, J. (2012). Political pluralism, public policies, and organizational choices: Banking branch expansion in India, 1948–2003. Academy of Management Journal, 55 (2), 339–359.

Kudaisya, M. (2014). " The Promise of Partnership": Indian Business, the State, and the Bombay Plan of 1944. Business History Review, 97–131.

Kumar, S., & Gulati, R. (2008). An examination of technical, pure technical, and scale efficiencies in Indian public sector banks using data envelopment analysis. Eurasian Journal of Business and Economics, 1 (2), 33–69.

Kumar, V., Gaur, A. S., & Pattnaik, C. (2012). Product diversification and international expansion of business groups. Management International Review, 52 (2), 175–192.

Kumar, V., Singh, D., Purkayastha, A., Popli, M., & Gaur, A. (2020). Springboard internationalization by emerging market firms: Speed of first cross-border acquisition. Journal of International Business Studies, 51 (2), 172–193.

Kumaraswamy, A., Mudambi, R., Saranga, H., & Tripathy, A. (2012). Catch-up strategies in the Indian auto components industry: Domestic firms’ responses to market liberalization. Journal of International Business Studies, 43 (4), 368–395.

Lamin, A. (2013). Business groups as information resource: An investigation of business group affiliation in the Indian software services industry. Academy of Management Journal, 56 (5), 1487–1509.

Lamin, A., & Ramos, M. A. (2016). R&D investment dynamics in agglomerations under weak appropriability regimes: Evidence from Indian R&D labs. Strategic Management Journal, 37 (3), 604–621.

Lampel, J., Bhalla, A., & Ramachandran, K. (2017). Family values and inter-institutional governance of strategic decision making in Indian family firms. Asia Pacific Journal of Management, 34 (4), 901–930.

Lasserre, P. (2017). Global strategic management . Macmillan International Higher Education.

Li, S., & Nair, A. (2007). A comparative study of the economic reforms in China and India: What can we learn? Global Economic Review, 36 (2), 147–166.

Li, S., & Nair, A. (2009). Asian corporate governance or corporate governance in Asia? Corporate Governance: An International Review, 17 (4), 407–410.

Li, Y., & Peng, M. W. (2008). Developing theory from strategic management research in China. Asia Pacific Journal of Management, 25 , 563–572.

Li, J. T., & Tsui, A. S. (2002). A citation analysis of management and organization research in the Chinese context: 1984 to 1999. Asia Pacific Journal of Management, 19 (1), 87–107.

Luo, Y., & Zhang, H. (2016). Emerging market MNEs: Qualitative review and theoretical directions. Journal of International Management, 22 (4), 333–350.

Madan, G. R. (2007). Co-operative movement in India . Mittal Publications.

Mahapatra, S., William, W. S., & Padhy, R. (2019). Alignment in the base of the pyramid producer supply chains: The case of the handloom sector in Odisha, India. Journal of Business Logistics, 40 (2), 126–144.

Maheshwari, S. K., & Ahlstrom, D. (2004). Turning around a state owned enterprise: The case of scooters India limited. Asia Pacific Journal of Management, 21 (1–2), 75–101.

Majumdar, S. K. (1998). Assessing comparative efficiency of the state-owned mixed and private sectors in Indian industry. Public Choice, 96 (1–2), 1–24.

Majumdar, S. (2013). Growth strategy in entrepreneur managed small organizations: A study in auto component manufacturing organizations in central India. South Asian Journal of Management, 20 (4), 31–55.

Majumdar, S. K., & Bhattacharjee, A. (2014). Firms, markets, and the state: Institutional change and manufacturing sector profitability variances in India. Organization Science, 25 (2), 509–528.

Majumdar, S. K., Vora, D., & Nag, A. K. (2010). Industry structure characteristics and international entrepreneurship in India’s software industry. Journal of Entrepreneurship, 19 (2), 109–136.

Makadok, R., Burton, R., & Barney, J. (2018). A practical guide for making theory contributions in strategic management. Strategic Management Journal, 39 (6), 1530–1545.

Malik, V. (2003). Disinvestments in India: Needed change in mindset. Vikalpa, 28 (3), 57–64.

Malik, O. R., & Kotabe, M. (2009). Dynamic capabilities, government policies, and performance in firms from emerging economies: Evidence from India and Pakistan. Journal of Management Studies, 46 (3), 421–450.

Mallon, M. R., Guldiken, O., Benischke, M. H., Dong, F., & Nguyen, T. (2022). Is there an advantage of emergingness? A Politico-Regulatory Perspective. International Business Review, 31 (2), 101940. https://doi.org/10.1016/j.ibusrev.2021.101940

Manikandan, K. S., & Ramachandran, J. (2015). Beyond institutional voids: Business groups, incomplete markets, and organizational form. Strategic Management Journal, 36 (4), 598–617.

Manikutty, S. (2000). Family business groups in India: A resource-based view of the emerging trends. Family Business Review, 13 (4), 279–292.

McCloskey, D. N. (2010). Bourgeois dignity: Why economics can’t explain the modern world . University of Chicago Press.

Menon, S, (2016). ‘Here are the 10 oldest companies in India that are still going strong’. https://economictimes.indiatimes.com/articleshow/53953790.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst Accessed: 11/05/2018.

Meyer, K. E., Estrin, S., Bhaumik, S. K., & Peng, M. W. (2009). Institutions, resources, and entry strategies in emerging economies. Strategic Management Journal, 30 (1), 61–80.

Mishra, S., & Suar, D. (2010). Does corporate social responsibility influence firm performance of Indian companies? Journal of Business Ethics, 95 (4), 571–601.

Mishra, D., Kumar, S., Sharma, R. R. K., & Dubey, R. (2018). Outsourcing decision: Do strategy and structure really matter? Journal of Organizational Change Management, 31 (1), 26–46.

Mohanty, R. P., & Augustin, P. (2014). Business strategy of automotive and farm equipment sector of the Mahindra & Mahindra Group of India. Journal of Strategy and Management, 7 (1), 64–86.

Mohindru, A., & Chander, S. (2007). Nature and extent of diversification: A comparative study of MNCs and domestic companies in India. South Asian Journal of Management, 14 (2), 60.

Mukherjee, V. (2002). Democratic Decentralization and Associative Patterns , Unpublished manuscript, Trivandrum.

Nadkarni, S., & Herrmann, P. O. L. (2010). CEO personality, strategic flexibility, and firm performance: The case of the Indian business process outsourcing industry. Academy of Management Journal, 53 (5), 1050–1073.

Nair, A., & Ahlstrom, D. (2008). Balancing Hamiltonian and Jeffersonian contradictions within organizations. Journal of Management Inquiry, 17 (4), 306–317.

Nair, A., Guldiken, O., Fainshmidt, S., & Pezeshkan, A. (2015a). Innovation in India: A review of past research and future directions. Asia Pacific Journal of Management, 32 (4), 925–958.

Nair, S. R., Demirbag, M., & Mellahi, K. (2015b). Reverse knowledge transfer from overseas acquisitions: A survey of Indian MNEs. Management International Review, 55 (2), 277–301.

Nair, S. R., Demirbag, M., & Mellahi, K. (2016). Reverse knowledge transfer in emerging market multinationals: The Indian context. International Business Review, 25 (1), 152–164.

Narula, R., & Kodiyat, T. P. (2016). How weaknesses in home country location advantages can constrain EMNE growth: the example of India. Multinational Business Review .

Nicholson, R. R., & Salaber, J. (2013). The motives and performance of cross-border acquirers from emerging economies: Comparison between Chinese and Indian firms. International Business Review, 22 (6), 963–980.

Ohmae, K. (1985). Triad Power . McGraw-Hill Book Company.

Oliver, C. (1991). Strategic responses to institutional processes. Academy of Management Review, 16 (1), 145–179.

Paré, G., Trudel, M. C., Jaana, M., & Kitsiou, S. (2015). Synthesizing information systems knowledge: A typology of literature reviews. Information & Management, 52 (2), 183–199.

Pattnaik, C., Lu, Q., & Gaur, A. S. (2018). Group affiliation and entry barriers: The dark side of business groups in emerging markets. Journal of Business Ethics, 153 (4), 1051–1066.

Peng, M. W., & Luo, Y. (2000). Managerial ties and firm performance in a transition economy: The nature of a micro-macro link. Academy of Management Journal, 43 (3), 486–501.

Peng, M. W., & Pleggenkuhle-Miles, E. G. (2009). Current debates in global strategy. International Journal of Management Reviews, 11 (1), 51–68.

Peng, M. W., Lu, Y., Shenkar, O., & Wang, D. Y. L. (2001). Treasures in the China house: A review of management and organizational research on Greater China. Journal of Business Research, 52 , 95–110.

Peng, M. W., Wang, D., & Jiang, Y. (2008). An institution-based view of international business strategy: A focus on emerging economies. Journal of International Business Studies, 39 (5), 920–936.

Penrose, E. (1959). The theory of the growth of the firm . Blackwell.

Phatak, A. (1968). Some causative factors of poor performance of government-owned firms in India. Management International Review, 8 (6), 99–107.

Podsakoff, P., MacKenzie, S., Podsakoff, N., & Bachrach, D. (2008). Scholarly influence in the field of management: A bibliometric analysis of the determinants of university and author impact in the management literature in the past quarter century. Journal of Management, 34 (4), 641–720.

Popli, M., & Sinha, A. K. (2014). Determinants of early movers in cross-border merger and acquisition wave in an emerging market: A study of Indian firms. Asia Pacific Journal of Management, 31 (4), 1075–1099.

Porter, M. E. (1985). The Competitive Advantage: Creating and Sustaining Superior Performance . Free Press.

Porter, M. E. (1996). What is strategy? Harvard Business Review, 74 (6), 61–78.

Prahalad, C. K., & Hart, S. L. (2002). The Fortune at the bottom of the pyramid. Strategy+ Business, 26 , 2–14.

Prashantham, S., & Yip, G. S. (2017). Engaging with startups in emerging markets. MIT Sloan Management Review, 58 (2), 51–65.

Pratap, S., & Saha, B. (2018). Evolving efficacy of managerial capital, contesting managerial practices, and the process of strategic renewal. Strategic Management Journal, 39 (3), 759–793.

Ramaswamy, K. (2001). Organizational ownership, competitive intensity, and firm performance: An empirical study of the Indian manufacturing sector. Strategic Management Journal, 22 (10), 989–998.

Ramaswamy, K., & Li, M. (2001). Foreign investors, foreign directors and corporate diversification: An empirical examination of large manufacturing companies in India. Asia Pacific Journal of Management, 18 (2), 207.

Ramaswamy, K., & Renforth, W. (1996). Competitive intensity and technical efficiency in public sector firms: Evidence from India. The International Journal of Public Sector Management, 9 (3), 4–17.

Ramaswamy, K., Gomes, L., & Veliyath, R. (1998). The performance correlates of ownership control: A study of US and European MNE joint ventures in India. International Business Review, 7 (4), 423–441.

Ramaswamy, K., Veliyath, R., & Gomes, L. (2000). A study of the determinants of CEO compensation in India. Management International Review, 40 (20), 167–191.

Ramaswamy, K., Li, M., & Veliyath, R. (2002). Variations in ownership behavior and propensity to diversify: A study of the Indian corporate context. Strategic Management Journal, 23 (4), 345–358.

Ramaswamy, K., Li, M., & Petitt, B. S. P. (2004). Who drives unrelated diversification? A study of Indian manufacturing firms. Asia Pacific Journal of Management, 21 (4), 403–423.

Ramesh, J. (1991). Commanding heights. Interview with PBS. At http://www.pbs.org/wgbh/commandingheights . Accessed 20 Jul 2020.

Ray, S., & Chaudhuri, B. R. (2018). Business group affiliation and corporate sustainability strategies of firms: An investigation of firms in India. Journal of Business Ethics, 153 (4), 955–976.

Rivett, K. (1959). The economic thought of Mahatma Gandhi. The British Journal of Sociology, 10 (1), 1–15.

Rosen, G. (1992). Contrasting styles of industrial reform: China and India in the 1980s . University of Chicago Press.

Sahasranamam, S., Rentala, S., & Rose, E. L. (2019). Knowledge sources and international business activity in a changing innovation ecosystem: A study of the Indian pharmaceutical industry. Management and Organization Review, 15 (3), 595–614.

Samuel, M. V., & Shah, M. (2009). Comparative study of organized agri-food businesses in India. Paradigm, 13 (2), 69–79.

Saranga, H., Schotter, A. P., & Mudambi, R. (2019). The double helix effect: Catch-up and local-foreign co-evolution in the Indian and Chinese automotive industries. International Business Review , 28 (5).

Sarkar, J. (2010). Business groups in India. In The Oxford Handbook of Business Groups .

Sathye, M. (2005). Privatization, performance, and efficiency: A study of Indian banks. Vikalpa, 30 (1), 7–16.

Scalera, V. G., Mukherjee, D., & Piscitello, L. (2020). Ownership strategies in knowledge-intensive cross-border acquisitions: Comparing Chinese and Indian MNEs. Asia Pacific Journal of Management, 37 (1), 155–185.

Sen, S. (2013). Philips Electronics: Light and shadow. Retrieved from https://www.businesstoday.in/magazine/special/oldest-mnc-in-india-philips/story/194628.html . Accessed 20 Jul 2020.

Shinkle, G. A., Kriauciunas, A. P., & Hundley, G. (2013). Why pure strategies may be wrong for transition economy firms. Strategic Management Journal, 34 (10), 1244–1254.

Shirodkar, V., & Mohr, A. T. (2015). Resource tangibility and foreign firms’ corporate political strategies in emerging economies: Evidence from India. Management International Review, 55 (6), 801–825.

Siddharthan, N. S., & Pandit, B. L. (1998). Liberalization and Investment: Behavior of MNEs and Large Corporate Firms in India. International Business Review, 7 (5), 535–548.

Singal, A., & Jain, A. K. (2012). Outward FDI trends from India: Emerging MNCs and strategic issues. International Journal of Emerging Markets, 7 (4), 443–456.

Singh, D. A., & Gaur, A. S. (2013). Governance structure, innovation and internationalization: Evidence from India. Journal of International Management, 19 (3), 300–309.

Singh, B., & Rao, M. K. (2016). Effect of intellectual capital on dynamic capabilities. Journal of Organizational Change Management, 29 (2), 129–149.

Singh, S., & Srivastava, R. K. (2018). Predicting the intention to use mobile banking in India. The International Journal of Bank Marketing, 36 (2), 357–378.

Singh, D. R. (1977). Capital budgeting and Indian investment in foreign countries. Management International Review , 101–110.

Singla, C., Veliyath, R., & George, R. (2014). Family firms and internationalization-governance relationships: Evidence of secondary agency issues. Strategic Management Journal, 35 (4), 606–616.

Smith, A., Judge, W., Pezeshkan, A., & Nair, A. (2016). Institutionalizing entrepreneurial expertise in subsistence economies. Journal of World Business, 51 (6), 910–922.

Srinivas, U., & Raviteja, J. (2017). Promotion and distribution strategies of NARMAC and Mulkanoor Women Cooperative Qairies: A quarterly peer reviewed multi-disciplinary international journal A quarterly peer reviewed multi-disciplinary international journal. Splint International Journal of Professionals, 4 (7), 61–68.

Srinivasan, T. N. (2003). Indian economic reforms: A stocktaking. S tanford Center for International Development, Working Paper, 190 , 1–35.

Srivastava, R. (2016). How Indian pharmaceutical companies are building global brands: The case of the Himalaya herbal brand. Thunderbird International Business Review, 58 (5), 399–410.

Steel, P., Beugelsdijk, S., & Aguinis, H. (2021). The anatomy of an award-winning meta-analysis: Recommendations for authors, reviewers, and readers of meta-analytic reviews. Journal of International Business Studies, 52 (1), 23–44.

Subramanian, S. (2015). Corporate governance, institutional ownership and firm performance in Indian state-owned enterprises. Asia-Pacific Journal of Management Research and Innovation, 11 (2), 117–127.

Tayeb, M. (1996). India: A non-tiger of Asia. International Business Review, 5 (5), 425–445.

Thite, M., Wilkinson, A., Budhwar, P., & Mathews, J. A. (2016). Internationalization of emerging Indian multinationals: Linkage, leverage and learning (LLL) perspective. International Business Review, 25 (1), 435–443.

Tiwana, A. (2008). Does interfirm modularity complement ignorance? A field study of software outsourcing alliances. Strategic Management Journal, 29 (11), 1241–1252.

Tolentino, P. E. (2010). Home country macroeconomic factors and outward FDI of China and India. Journal of International Management, 16 (2), 102–120.

Tomizawa, A., Zhao, L., Bassellier, G., & Ahlstrom, D. (2020). Economic growth, innovation, institutions, and the Great Enrichment. Asia Pacific Journal of Management, 37 (1), 7–31.

Triandis, H. C. (1989). The self and social behavior in differing cultural contexts. Psychological Review, 96 (3), 506–520.

Tsui, A. S. (2004). Contributing to global management knowledge: A case for high quality indigenous research. Asia Pacific Journal of Management, 21 (4), 491–513.

Tuschke, A., Sanders, W. G., & Hernandez, E. (2014). Whose experience matters in the boardroom? The effects of experiential and vicarious learning on emerging market entry. Strategic Management Journal, 35 (3), 398–418.

Vachani, S. (1997). Economic liberalization’s effect on sources of competitive adv8antage of different groups of companies: The case of India. International Business Review, 6 (2), 165–184.

Vaidyanathan, A. (2013). Future of cooperatives in India. Economic and Political Weekly, 48 (18), 30–34. Retrieved July 23, 2020, from www.jstor.org/stable/23527305

Vissa, B., Greve, H. R., & Chen, W. R. (2010). Business group affiliation and firm search behavior in India: Responsiveness and focus of attention. Organization Science, 21 (3), 696–712.

Wang, L. C., Ahlstrom, D., Nair, A., & Hang, R. Z. (2008). Creating globally competitive and innovative products: China’s next Olympic challenge. SAM Advanced Management Journal, 73 (3), 4–16.

Webster, A. (1990). The political economy of trade liberalization: The East India Company Charter Act of 1813. Economic History Review, 43 (3), 404–419.

White, S. (2000). Competition, capabilities, and the make, buy, or ally decisions of Chinese state-owned firms. Academy of Management Journal, 43 (3), 324–341.

White, S. (2002). Rigor and relevance in Asian management research: Where are we and where can we go? Asia Pacific Journal of Management, 19 , 287–352.

Young, M. N., Peng, M. W., Ahlstrom, D., Bruton, G. D., & Jiang, Y. (2008). Corporate governance in emerging economies: A review of the principal–principal perspective. Journal of Management Studies, 45 (1), 196–220.

Zaheer, S., Lamin, A., & Subramani, M. (2009). Cluster capabilities or ethnic ties? Location choice by foreign and domestic entrants in the services offshoring industry in India. Journal of International Business Studies, 40 (6), 944–968.

Zheng, P. (2013). The variation in Indian inward FDI patterns. Management International Review, 53 (6), 819–839.

Download references

Author information

Authors and affiliations.

Old Dominion University, Norfolk, VA, USA

Anil Nair & Chris H. Willis

Fayetteville State University, Fayetteville, NC, USA

Mehdi Sharifi Khobdeh

University of Hartford, West Hartford, CT, USA

Aydin Oksoy

Florida International University, Miami, FL, USA

Orhun Guldiken

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Anil Nair .

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We thank Professor Ajai Gaur of Rutgers for comments on an earlier version of the paper.

Appendix 1: Brief background: Economy, government and business

The evolution of India’s industry structure and firm strategies can be better understood by reviewing its history in terms of pre- and post-British colonization, which we briefly summarize below.

Early history

Prior to the arrival of British East India Company in 1608, India had its own organic system of trade and commerce. Merchants from the subcontinent were actively involved in trading silk, jewelry and spices across the world along the silk route for millennia (Behera, 2002 ). The Indian Ocean contained the most extensive trade routes of the day (McCloskey, 2010 ). An extensive review of early Indian business history is beyond the scope of this paper; we thus refer the reader to Hawk’s ( 2015 ) extensive analysis of law and commerce in pre-industrial societies, in which the author describes the various sophisticated markets (such as “haats” and “mandis”), trading structures, and trade routes that emerged in medieval India under various kingdoms.

Arrival of the British

With the arrival of the British East India company, some of these traditional practices changed. The British East India Company was initially established to trade with India, but gradually expanded its scope of operations to eventually control and govern a substantive part of the country. After a series of laws passed by Parliament to reform the East India Company, its monopoly rights were eliminated in 1813, which allowed for the entry of private merchants, traders and agencies into the economy (Goswami, 2016; Webster, 1990 ). Footnote 8 In 1858, the governance of the Indian subcontinent was fully taken over by the British Crown. The operations of the British East India Company and later the direct rule by the Crown led to the introduction of Western technology, education, legal system, institutions, business practices, and the founding of several industries. The development of ports and railroads and the establishment of the Bombay Stock exchange in 1875 further led to the growth of Indian enterprises (DeLong, 2003 ; Tomizawa et al., 2020 ).

India after independence

After independence, Indian leaders Gandhi, Nehru, and Patel had distinct visions for the economic development of the new country. Gandhi preferred an economic development model that was village-based, supported by small-scale enterprises relying on the widely available pool of labor (Rivett, 1959 ). In contrast, Nehru emphasized the need to embrace advanced technology and establish large-scale factories, with the public sector and central planning playing a dominant role in the economy. Patel, on the other hand, preferred the private sector to play a leading role in the economy (Kudaisya, 2014 ). Nehru’s vision prevailed (Ramesh, 1991 ), and in 1950 India adopted a path of centrally planned economic development (Das, 2016 ), along the lines of the former Soviet Union, through a series of five-year plans (Jalan, 1996 ). Due to the competing visions offered by cooperatives, small scale and private sectors had an important role in the Indian economy, resulting in a hybrid system where state-owned entities co-existed with a regulated private sector (Kaushik, 1997 ; Li & Nair, 2007 ). Even after his death in 1964, Nehru’s policies and the five-year plans were supported by several successive administrations (Dandekar, 1988 ). Yet by the early 1980s, as the success of the East Asian economies such as South Korea, Malaysia and Singapore became undeniable, some scholars and policy makers started acknowledging that India’s planned model of growth had failed (Tayeb, 1996 ). Between 1950 and 1980, India realized an average real economic growth rate of 3.5 percent – well under that of the rapidly growing East Asian economies such as Taiwan, Hong Kong, and Singapore. The government-dominated and over-regulated system had led to inefficiencies, shortages, and corruption (Ahlstrom, 2010 ; Ahlstrom et al., 2004 ; DeLong, 2003 ).

1980s reforms

India made some attempts at economic reform starting in the mid-1980s (Rosen, 1992 ). Although the Indian middle-class welcomed the reforms as it led to increased choices in consumer markets such as autos, consumer electronics and packaged goods, the same reforms received stiff resistance from the leaders steeped in socialist, nationalist, or communist ideologies as well as from business leaders who had profited from the Nehruvian protectionist regime. These interest groups stalled the reforms (Kohli, 1989 ).

1991: The second attempt at reforms

In 1991, Narasimha Rao was elected to serve as prime minister. Rao nominated the Cambridge- and Oxford-trained economist Manmohan Singh as finance minister in his new administration.

The Gulf War of 1991 led to declining remittances from Indian expatriates in the Middle East, and rising cost of importing oil. As a result, the Rao government faced a severe foreign exchange reserve crisis. The crisis led to an assistance from the IMF, which imposed several terms and conditions for structural reforms. Rao and Singh used the crisis to justify the introduction of far-reaching multi-faceted economic reforms that continued through the 1990s despite changes in administration (Bajpai, 2002 ). These reforms included initiatives in the following area (Srinivasan, 2003 ): lowered tax rates, subsidies (especially for fuel, fertilizer, electricity), reformed banking system and capital markets, opening of reserved sectors to private business, reduced controls on capacity creation, production and prices, market-determined exchange rate, diluted import controls by reducing tariffs, eased restrictions on portfolio and direct investment, and privatization and sale of state-owned firms.

The collapse of the Soviet Union and China’s accelerating economic development provided further legitimacy to a more market-based economy; yet legacies from the past continued to hinder the reforms (Bardhan, 2006 ).

Appendix 2: Brief summary of articles on strategy in Indian context

Rights and permissions.

Reprints and permissions

About this article

Nair, A., Khobdeh, M.S., Oksoy, A. et al. A review of strategic management research on India. Asia Pac J Manag 40 , 1341–1392 (2023). https://doi.org/10.1007/s10490-022-09820-1

Download citation

Accepted : 06 April 2022

Published : 28 April 2022

Issue Date : December 2023

DOI : https://doi.org/10.1007/s10490-022-09820-1

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Find a journal

- Publish with us

- Track your research

McKinsey Global Private Markets Review 2024: Private markets in a slower era

At a glance, macroeconomic challenges continued.

McKinsey Global Private Markets Review 2024: Private markets: A slower era

If 2022 was a tale of two halves, with robust fundraising and deal activity in the first six months followed by a slowdown in the second half, then 2023 might be considered a tale of one whole. Macroeconomic headwinds persisted throughout the year, with rising financing costs, and an uncertain growth outlook taking a toll on private markets. Full-year fundraising continued to decline from 2021’s lofty peak, weighed down by the “denominator effect” that persisted in part due to a less active deal market. Managers largely held onto assets to avoid selling in a lower-multiple environment, fueling an activity-dampening cycle in which distribution-starved limited partners (LPs) reined in new commitments.

About the authors

This article is a summary of a larger report, available as a PDF, that is a collaborative effort by Fredrik Dahlqvist , Alastair Green , Paul Maia, Alexandra Nee , David Quigley , Aditya Sanghvi , Connor Mangan, John Spivey, Rahel Schneider, and Brian Vickery , representing views from McKinsey’s Private Equity & Principal Investors Practice.

Performance in most private asset classes remained below historical averages for a second consecutive year. Decade-long tailwinds from low and falling interest rates and consistently expanding multiples seem to be things of the past. As private market managers look to boost performance in this new era of investing, a deeper focus on revenue growth and margin expansion will be needed now more than ever.

Perspectives on a slower era in private markets

Global fundraising contracted.

Fundraising fell 22 percent across private market asset classes globally to just over $1 trillion, as of year-end reported data—the lowest total since 2017. Fundraising in North America, a rare bright spot in 2022, declined in line with global totals, while in Europe, fundraising proved most resilient, falling just 3 percent. In Asia, fundraising fell precipitously and now sits 72 percent below the region’s 2018 peak.

Despite difficult fundraising conditions, headwinds did not affect all strategies or managers equally. Private equity (PE) buyout strategies posted their best fundraising year ever, and larger managers and vehicles also fared well, continuing the prior year’s trend toward greater fundraising concentration.

The numerator effect persisted

Despite a marked recovery in the denominator—the 1,000 largest US retirement funds grew 7 percent in the year ending September 2023, after falling 14 percent the prior year, for example 1 “U.S. retirement plans recover half of 2022 losses amid no-show recession,” Pensions and Investments , February 12, 2024. —many LPs remain overexposed to private markets relative to their target allocations. LPs started 2023 overweight: according to analysis from CEM Benchmarking, average allocations across PE, infrastructure, and real estate were at or above target allocations as of the beginning of the year. And the numerator grew throughout the year, as a lack of exits and rebounding valuations drove net asset values (NAVs) higher. While not all LPs strictly follow asset allocation targets, our analysis in partnership with global private markets firm StepStone Group suggests that an overallocation of just one percentage point can reduce planned commitments by as much as 10 to 12 percent per year for five years or more.

Despite these headwinds, recent surveys indicate that LPs remain broadly committed to private markets. In fact, the majority plan to maintain or increase allocations over the medium to long term.

Investors fled to known names and larger funds

Fundraising concentration reached its highest level in over a decade, as investors continued to shift new commitments in favor of the largest fund managers. The 25 most successful fundraisers collected 41 percent of aggregate commitments to closed-end funds (with the top five managers accounting for nearly half that total). Closed-end fundraising totals may understate the extent of concentration in the industry overall, as the largest managers also tend to be more successful in raising non-institutional capital.

While the largest funds grew even larger—the largest vehicles on record were raised in buyout, real estate, infrastructure, and private debt in 2023—smaller and newer funds struggled. Fewer than 1,700 funds of less than $1 billion were closed during the year, half as many as closed in 2022 and the fewest of any year since 2012. New manager formation also fell to the lowest level since 2012, with just 651 new firms launched in 2023.