How Costco's Unique Business Model Resulted In Global Success

Table of contents, here’s what you’ll learn from costco’s strategy study:.

- How developing a radically different business model can lead to an industry breakthrough.

- How global expansion can be safely explored when you’re at your very best.

- How to accompany a business model innovation with policies that create a cohesive strategy.

- How managing your competitive advantage requires the evolution of your strategic approach.

- How to respond to market trends without killing your strategic advantage.

Costco is the third biggest retail player in the world - behind only Walmart and Amazon. Yet there is something very unusual about the retail giant. Costco makes way less money per a sold product compared to other retail stores.

The company’s average gross profit margin was only around 12% in 2022 . That’s way lower than your average retailer gross margin which ranges from 20% all the way to 50% for department stores. E.g. Walmart’s average margin in 2022 was 24.4% . In fact, Costco even loses about $40 million a year on their $5 roasted chickens alone.

It also doesn’t have nearly as many stores as other big retailers, yet it outperforms everyone but Walmart. Costco has “only” 838 stores around the world, while Walmart has 10,593 retail stores in 2022 , Schwarz Group, the group that owns Lidl and Kaufland, has 13,500 stores , Kroger owns nearly 2,800 stores , and Target owns 1,948 stores .

After all, the company boasts:

- $222.7 billion net sales in 2022

- 314,000+ employees 273,000 employees

- Stores in 13 countries

- 120.9 million worldwide members

- A 93% membership renewal rate in the U.S. and Canada and an 90% renewal rate worldwide

Members - that’s Costco’s secret. Their warehouse retail stores are membership-only and that’s the foundation of their extremely successful business model.

Costco’s story is a masterclass of thinking outside the box and creating win-win scenarios which satisfy customers and employees while achieving the company’s business goals.

{{cta('fd46c809-bb8d-49c6-828e-a5f17d1471b4')}}

A warehouse club: the birth of a disruptive business model

Costco’s story begins with Price Club which was founded in 1976 by Sol Price and his son Robert Price. The store introduced a brand new concept - a retail warehouse club . In order to shop there, you had to be a member.

At first, Price Club was limited exclusively to business members, who could purchase a wide range of supplies and wholesale items. But after a while, it opened up its membership to employees of local businesses, non-profit organizations, and government.

One of the people who were instrumental in fine-tuning the new warehouse club concept was Jim Sinegal , the executive vice-president of merchandising, distribution, and marketing. He was previously employed by Sol Price and was familiar with the Price Club business model.

Seven years after the first Price Club store, Sinegal used his expertise to co-found Costco Wholesale with Jeff Brotman, and together they opened the first warehouse in Seattle, Washington in 1983.

In 1993, Costco and Price Club agreed to merge operations since Costco's business model and size were similar to those of Price Club, which made the merger more natural for both companies.

Costco has transformed the retail world as the world's first membership warehouse club for the wider public which accepted non-business members. While the idea of charging people to shop in your store seemed very bold and was not followed by any of the retail giants, it proved to be the right move. It allowed Costco more efficient buying and operating practices while giving the members access to unmatched savings.

Costco’s operating philosophy has always been simple:

Keep costs down and pass the savings on to our members.

People loved the concept, which resulted in Costco’s stunning rise. By the end of 1984, 200,000 people held Costco memberships and Costco soon became the first company ever to grow from zero to $3 billion in sales in less than six years since its inception.

The annual membership of Costco’s first Seattle store back in 1983 was $25. The cost of a membership nowadays starts from $60, which is around the same as it was back in 1983 once adjusted to inflation.

The merger between Price Club and Costco created the world's most successful warehouse club . In 1999 the name of the company was changed to Costco Wholesale Corporation and remained as such until this day.

Key takeaway #1: A radically different business model is a preposterously effective business strategy

Costco’s radically different business model was a disruptive innovation in the retail industry.

It created a constant flow of revenue that offered unmatched flexibility that was returned back to its customers. It’s important to note, though, that:

- Costco tested the model with a small circle before it proved successful. It didn’t go into full launch mode without validation .

- The model is not different for the sake of being different. It included an advantage (e.g. the fixed revenue stream) and a way to turn that advantage into increased customer value (e.g. unbeatable low prices). It was meaningfully different .

The different business model created a second, unique to Costco, profit model. The company faces the same challenges as any other retail, but its second profit model gives it the flexibility to challenge the conventional way of the industry (like having much lower profit margins). In other words, it offers an unfair advantage like every great strategy.

How Costco safely started its global strategy

Before Costco's international expansion, there was quite some doubt whether the innovative Costco retailing strategies would result in success outside the United States.

There are plenty of failure stories indicating that advantages aren’t easily transferred geographically:

- Target's exit from Canada in 2015

- Tesco's shutdown of its U.S. Fresh and Easy chain

- Walmart's store closings in Brazil in 2016

Being successful in the global market is not a given even for the biggest retail players.

However, Costco's expansion, which began in 2013, succeeded in ways that Target, Walmart, and Tesco failed to do. By January 2023 , Costco was present in 14 countries outside the US and Puerto Rico.

Costco membership sign ups in the first 8 to 12 weeks of a new store opening overseas are generally 10 times greater than at Costco store openings in the United States. Additionally, the company’s international membership renewal rate was 90% at the end of its 2022 fiscal year.

While many other retail chains open international locations as a defensive strategy in order to shore up declining sales, Costco isn't compensating for domestic weakness. Costco's international expansion came in the middle of high profits in the U.S. market, allowing the company to focus on a long-term international strategy and to test if its business model would be well-received in other markets.

And talk about great reception! In 2017, before Costco opened its doors in Iceland, one out of eight Icelanders had already signed up for membership. On the opening day, search-and-rescue teams were deployed to manage the crowds.

Perhaps even more impressive is Costco’s opening of its first store in mainland China in Shanghai in 2019. On an opening day, 139,000 people got their Costco membership. The store even had to close early on the first day due to traffic jams caused by crowds of shoppers and three-hour wait times just to park .

Key takeaway #2: A global expansion attempt as a growth experiment

Costco’s strategic plan was carefully formed before it was executed.

And the approach had a few critical traits that helped it to succeed where other retail giants failed:

- Costco tested the waters beforehand . Again, validation, then action. Before opening its first store, the company enabled its potential customers to subscribe ahead of time, giving a feel of the potential demand.

- Costco expanded when its US profits were still rising. That enabled it to take a long-term stance, in case the attempt wasn’t fruitful initially.

Costco’s business model innovation was market agnostic. The retail giant could transfer the advantages of its innovative approach to any market whose fundamental working principles were the same as the US market.

Now let’s see what exactly makes Costco’s business model so successful.

Understanding Costco’s business model

Costco’s strategy remains at its core a cost leadership approach.

Costco’s mission is “to continually provide members with quality goods and services at the lowest possible prices.”

This mission statement is directly linked to its business model and strategy. It emphasizes quality and cost leadership , which are two factors that top consumer’s priority charts. While they might seem mutually exclusive, Costco is known for both.

Costco is primarily a big-box store. Such stores achieve economies of scale by focusing on large sales volumes and are meant to be a one-stop shop for customers. Establishments like Costco took “the one-stop shop” a bit further and don’t offer just groceries and store products, but also a food court, optical services, gas stations, tire garages, or photo processing services.

Big-box stores typically carry items in extra-large sizes and lure customers with the promise of saving by buying in bulk . Costco is no exception - real bargains can be had by purchasing bulk non-perishable items or items with long shelf life.

As a result, Costco’s generic strategy is cost leadership.

This strategy entails maintaining the lowest prices possible and is used by many retail giants. However, Costco’s strategy incorporates the warehouse club membership business model, which differentiates it from other retailers and enables Costco to offer lower prices than its competitors.

Costco is so effective because its revenue is broadly divided into two streams:

- Product sales , which is revenue from all the sales of goods and services through all Costco’s channels.

- Membership fees , which is revenue from Gold Star, Business and Executive memberships to customers worldwide.

This is a very basic overview of Costco’s general business model. Now let’s go into more details and look at some specific elements - starting with the core of the business model, Costco’s membership.

Costco’s membership: the competitive advantage of Costco’s business model

As said, Costco uses a membership-only warehouse club business model , which means consumers pay a membership fee to access the low-cost products available at Costco stores.

Each member is entitled to issue a free supplementary card to someone living in the same household or to a fellow staff member working in the same company. Non-members may accompany members, but only members are allowed to purchase products in stores. In 2020, Costco had a total of 58.1 million paid members and 105.5 million cardholders .

Costco has two tiers of membership – basic and executive plans for consumers and businesses. Basic plans cost $60 per year, while Executive plans cost $120 per year.

Executive members get an annual 2% cashback on their purchases (up to $1,000 per year). This makes executive membership an enticing offer for people who often shop at Costco and there’s plenty of them. In fact, 45% of members pay $120 for the Gold Star Executive membership.

These membership fees actually represent the majority of Costco's operating profit. Yes, Costco makes most of its money by selling access to affordable products and not by selling those products.

In 2019, Costco made $4.2 billion from membership fees , an increase of 9% from the previous year. Its entire net income for the year was $5.8 billion.

Costco’s membership is also a powerful play on the human psyche. Once a customer pays the membership fee, it treats it like a sunk cost. The investment has been made and now it is time to get value from it. Because of that, customers will make additional trips to Costco to make sure they get value from their investment.

While other retailers need to worry that a decline in same-store sales will lead to collapsing profits, Costco doesn’t really face this problem. Its profits are mostly dependent on its memberships, which are getting renewed on an extremely high basis (93% in the US and 90% internationally).

Obviously, such high renewal rates aren’t a coincidence. Costco does reinvest the membership fees into low prices for customers and by doing so ensures that everyone wins. We’ll talk more about product prices later on, but now let’s see what kind of people Costco wants for its members.

Target market: suburban homeowners

From the very beginning, Costco targeted relatively affluent and college-educated customers who would understand the value of membership.

A typical Costco shopper is an upper-middle or upper socioeconomic class and has an income of about $93,000 a year.

But if Costco employs a cost leadership strategy, why does it target relatively wealthy people? Well, while all shoppers like a bargain, Costco’s customers also have the means to buy in bulk, which is the only way one can buy most products Costco stocks.

While the price of an individual product generally is the lowest around, shoppers usually have to buy at least a three-pack, which means that the average transaction total is quite high.

That also explains why the vast majority of Costco stores are located in affluent suburban areas both in the U.S. and around the world. It’s hard to make the most of a Costco membership if you’re renting a small flat as it takes a lot of space to store bulk purchases. That’s why a typical shopper is a suburban homeowner.

Speaking of buying and selling in bulk - that is also an important part of Costco’s business model.

Bulk purchasing

Product quality is a crucial aspect that Costco focuses on for driving growth and maintaining customer loyalty.

Instead of selling a hundred thousand different products as most other retailers, Costco’s merchandise is limited to under 4,000 items (for comparison, Walmart sells over 142,000 SKUs in each of its supercenters). This allows Costco’s procurement team to rigorously screen each product in order to provide the best quality and the best price to members. Each item Costco sells is meticulously selected . As a result, consumers don’t suffer from choice paralysis and can always rely on Costco for selling quality products.

Because of the lower number of options, each option has a higher perceived quality and is more likely to sell, which allows Costco to order more stock and thus lower the product’s price. Remember that Costco is selling most products in bulk packaging, so shoppers can’t buy just one cereal box but have to get 5 or them - which complements Costco’s ordering model.

By selling products in bulk Costco entices customers to buy large quantities of items. The perception of getting a deal often negates the fact that one may not even need all the products. Customers believe they're saving more money by spending more money , which leads them to spend more in the long run.

According to Perfect Price’s research from 2015 , customers spend by far the most money per shopping trip when visiting Costco compared to other retailers.

Here are the top 10 stores where customers spend the most per shopping trip:

- Costco, $136

- Sam’s Club, $81 (similar membership model)

- Target, $62

- Stop & Shop, $56

- Wal-Mart, $55

- Meijer, $54

- Whole Foods, $54

- Trader Joe’s, $50

- Kroger, $50

There’s another part of Costco’s business model we haven’t mentioned yet that makes big purchases less risky.

Costco’s refund policy is essentially a promise for a risk-free investment

Costco has a very liberal return policy where customers can return almost anything they have purchased at any time. Even their membership.

On Costco’s website it says:

“We are committed to providing quality and value on the products we sell with a risk-free 100% satisfaction guarantee on both your membership and merchandise. ”

Having such a liberal return policy is almost necessary if you want to entice shoppers to try new products which they can only buy in bulk. If you know you can return anything if you don’t like the first product in the box of ten, you’ll be much more inclined to buy something new.

And yes, members can also claim a refund on their memberships at any time if they are not satisfied with the service, which means anyone can try shopping at Costco risk-free.

There was even a case of a woman who successfully returned a Christmas tree 10 days after Christmas because the tree was dead.

Efficient inventory management and warehouse design

From a logistics standpoint, Costco is one of the most efficient retailers in the world. This is because of two factors: inventory management and warehouse design.

Costco uses its warehouse-style stores as retail and storage spaces in one . It utilizes cross-docking, which means that products from a supplier or a manufacturing plant are distributed directly to the retail chain with marginal to no handling or storage time, which reduces inventory management costs and storage space costs.

Costco also displays goods in their shipping pallets, instead of arranging individual items on shelves, which further reduces inventory costs.

Costco’s warehouses are strategically designed to make restocking as easy as possible . Warehouse design allows forklifts to restock the store, which also makes it easier to rotate seasonal products and enables the treasure-hunt experience. This purposeful design saves both time and costs.

The combination of impeccable inventory management and warehouse design also allows Costco to utilize the just-in-time stocking principle , which is a management strategy that has a company receive goods as close as possible to when they are actually needed.

Once you combine everything mentioned thus far in this chapter, you can see why Costco can cut prices even lower and pass on the savings to their members, thus attracting more membership sign-ups and directly increasing their bottom line.

However, their store design serves yet another purpose.

“Costco doesn’t use any fancy decor or lighting, instead, they make sure that their store resembles a warehouse with exposed beams, pallets, and simple metal shelving,” says Mark Ortiz, a marketing expert and founder of Reviewing This. “This is smart because it tricks the consumer into believing that they are purchasing goods at low prices . Logically, you would think, less money spent on decor equals less overhead cost equals the opportunity to lower your prices.”

The warehouse design is a part of “the Costco Experience”, which Costco is famous for, which shouldn’t be neglected when talking about their business model. Let’s see what the famed experience is all about.

The Costco experience and Costco culture

Shopping at Costco is often called “The Costco experience”.

As offering superior customer experience is the key to customer loyalty, Costco does its best to be an experience in itself. By putting customers first in every choice and innovation, Costco continues to build its loyal customer base

Consumers go crazy for a deal, and Costco has designed its entire strategy around this core tenet. A good deal “feels like winning,” says Bob Nelson, the senior vice president of financial planning and investor relations at Costco. And Costco would like their members to feel like they’re always winning, even if this means resisting the urge to raise prices and increase profits.

James Sinegal, Costco’s co-founder and former CEO, once talked about how once Costco was selling Calvin Klein men’s jeans for $29.99 a pair. The pants were selling faster than Costco could stock them, and when he bought another shipment for $22.99 per pair, it was ultra-tempting to charge more. However, Costco stayed true to their philosophy of passing the savings to their members and sold the jeans for $22.99 per pair.

Making sure that the customers get the best deal at Costco is an integral part of Costco’s culture.

Besides providing an exceptional shopping experience, Costco is also famous for an employee-focused organizational culture, which we’ll explore later.

The combination of cost, generous return policy, and satisfied employees resulted in a shopping experience that many customers get addicted to.

It was believed at the company that culture is not the most important thing, but the only way forward . Costco saw promoting its core values as the only recipe for success. Maintaining integrity, passion, motivation, and customer trust is what enables Costco to outdo its competitors.

Shopping features aside, there is something more to Costco that cultivates such a loyal customer base.

"Costco relaxes my soul," says John, the founder of the I love Costco blog.

"I do love that everyone at Costco appears to be relaxed humans," says Ellinger. "I love overhearing a weird personal conversation between two employees unloading a box and knowing that Costco is a safe space for people to just be people."

Costco also has great food courts which drive visits on their own. And they offer amazing deals, which are even losing them money in some cases.

We already mentioned the $5 roasted chicken, but there’s also the famous hot dog and soda combo for $1.50. It still costs the same as in 1985 when it was introduced and that is a big part of its almost mythical status among Costco’s members. Yes, Costco could make a lot of money by raising the price, but it’s much more valuable if they let it serve as a reminder of Costco culture every time a customer decides to grab a hot dog after a shopping trip.

All this helped the company build an outstanding image among its customers and it’s apparent that it leads to more sales year after year.

Key takeaway #3: Reap the benefits of a business model innovation with a cohesive strategy

Costco’s business model isn’t an isolated difference from its competitors, but one of many distinctly different policies, approaches, and benefits that create a cohesive corporate strategy.

Otherwise, any one of its competitors could duplicate the business model and reap the benefits for itself, rendering Costco competitively exposed. Here some policies that tie well with Costco’s innovative business model:

- Customer filtering. Costco’s subscription model discourages low-income customer groups from becoming members, like students and small household tenants. That ensures a larger average spend per shopping trip.

- Supplier independence. Since Costco makes most of its profits from its membership fees and has a more exclusive customer base, it doesn’t need a big variety of products. As a result, it can be more picky with its product and supplier selection, increasing its negotiating leverage.

- A loyal culture. Costco has one of the most supportive cultures in the business world. It pays its employees above average, provides rare benefits and powerful leadership initiatives. That’s why it enjoys a triple retention rate than the industry average (90%) and increased productivity. Also, customers feel employee loyalty by having a pleasurable experience while buying.

- A cheap design. Maintaining an industrial decoration keeps operating costs at lower levels and the “I’m getting a bargain” feeling at higher levels.

But does Costco’s strategy produce results? How successful has its business model been during the last few years? We’ll let the numbers do the talking.

Recommended reading: What is Strategic Analysis? 8 Best Strategic Analysis Tools + Examples

How Costco’s corporate strategy evolves leading to constant expansion

Costco pricing strategy - lower margins, lower prices, high value.

Offering quality products at the lowest prices is as much a part of Costco’s business model as the result of it.

According to Craig Jelinek, Costco's CEO and Director:

"Costco is able to offer lower prices and better values by eliminating virtually all the frills and costs historically associated with conventional wholesalers and retailers, including salespeople, fancy buildings, delivery, billing and accounts receivable. We run a tight operation with extremely low overhead which enables us to pass on dramatic savings to our members."

Unlike most other retailers, Costco’s membership model allows them to focus on strategies for making products cheaper for customers , rather than trying to increase revenue by finding ways to make customers pay more.

Because of its limited range of products, Costco can stay committed to delivering high-quality items at the lowest prices. Because of its efficient inventory management system and constant revenue from membership fees, Costco can keep its gross profit margins lower than most other retailers. Low margins result in cheaper products as Costco passes the savings to their members.

Kirkland Signature: one of the most trusted private-label brands

When it comes to affordable yet quality products, Costco’s own private-label brand, Kirkland Signature, deserves its own chapter.

In 1995 Costco began the Kirkland Signature. Its mission was to create an item of the same or better quality than the leading brand at a lower price and do so by controlling every element of the item’s creation , including packaging and transportation.

Costco claims that Kirkland Signature products are high-quality goods at simply excellent prices and openly invites customers to compare any Kirkland Signature product with its brand-name counterpart. The store’s return policy basically guarantees Kirkland’s quality.

Costco prices Kirkland Signature items according to its philosophy and that’s why they are always cheaper than their brand-name equivalents, often by more than 20%.

It’s no surprise that nowadays Kirkland products account for roughly 25% of Costco’s sales and shoppers can find them in virtually any category, from groceries to household products and clothing.

"I am not sure there is another [private-label] brand that has established this level of trust," says Timothy Campbell, a senior analyst at Kantar Consulting.

The success of Kirkland Signature is possible because of Costco’s business model as they have direct contact with lots of manufacturers and their members trust them that they will only choose and offer quality products.

In return, Kirkland Signature has become one of the top reasons that customers are so loyal to Costco. Creating such a strong store brand shows that Costco cares about its customers and wants them to have great products at a great price.

A lot of Kirkland products are actually manufactured under a private label by name-brands just for Costco.

Select varieties of Kirkland Signature Coffee are actually roasted by Starbucks Coffee Company, Kirkland Signature dry dog and cat foods are made by Diamond Pet Food and Craig Jelinek, Costco’s CEO, said in an interview that Kirkland Signature Batteries are made by Duracell.

There are many other examples and in each case, Kirkland products are cheaper than their brand-name counterparts.

The treasure hunt experience

If you’ve ever spoken with a Costco member, you’ve probably heard them brag about their latest find at our warehouse. Costco calls those products treasure hunt items , and they’re offered in various departments throughout the year.

They’re there to make the customers feel the thrill of discovery . The aisles at Costco aren’t labeled, which tempts shoppers to walk down each one. That makes them more likely to encounter what Costco calls its “treasures.”

“Treasures” make up 25% of Costco’s inventory and they are items that make shopping an adventure. When customers turn the corner they might suddenly find the luxury “surprise” of the week. It’s often something one would expect in upscale department stores, but certainly not in Costco. Surprises like Waterford Crystal, Coach handbags, Omega watches, Andrew Marc, Calvin Klein, Adidas, Chanel, Prada handbags and many more are offered at incredibly low prices. Other treasures include electronics, appliances and other less frequently purchased finds at extremely good prices. These products appear on Costco’s shelves one day, but are gone the next.

That uncertainty creates a sense of urgency , and means that Costco shoppers don't just buy a pack of gum on impulse - they buy an 80" 3D television or a whole box of fine wine.

The company refers to this strategy as “treasure hunting,” in which Costco shoppers must navigate through the entire warehouse in search of exciting deals and unbelievable bargains. And they know some of the things they can find as they receive a pamphlet filled with coupons and irresistible deals as soon as they walk into the warehouse.

Every Costco warehouse is purposely designed with the necessities at the back of the store, meaning customers have to walk through the rotating items and sales to get their most-needed products and groceries.

The treasure hunt atmosphere is also a safeguard against online competitors as customers have to go into a Costco store to see what is new and exciting.

One would think that unlabeled isles, rotating inventory and purposely longer shopping trips would bother customers, but in the case of Costco, it’s quite the opposite. It’s all a part of the famed Costco experience and members enjoy it as they feel that’s how they get the most value for their membership. Instead of a run-of-the-mill grocery trip, Costco becomes an adventure that loyal customers are obsessed with.

Setting up the adventure is made possible by Costco’s inventory management and warehouse design which enables the store to quickly and efficiently rotate merchandise and allows them to grab the best deals their procurement team can find.

The treasure hunt experience is once again something that is enabled by Costco’s business model and at the same time a part of it. It’s also another factor that contributes to Costco’s extremely high customer retention rate.

Customer loyalty

Most consumers take pride in being a Costco member and the company’s high level of customer loyalty is no secret.

The emphasis Costco places on excellent customer experience and the value to their members results in an extremely high membership renewal rate - 93% in the US and Canada and 90% on the global market .

Costco’s number of cardholders has also been steadily growing - there were 76.4 million cardholders in 2014 and the number rose to 120.9 million cardholders in 2022. Around 66.9 million of them are paying members as each member gets an additional card for their household. These numbers are what makes Costco’s customer retention rate even more impressive.

But Costco’s members aren’t just loyal, some of them are obsessed with the Costco experience. There are websites and blogs solely devoted to people talking about the warehouse. Some of them, like Costco Insider , have huge followings as they review recent deals at the store.

A blog dedicated to the Costco experience

This stable base of members who are making repeat purchases throughout the year is the result of Costco’s business model. There’s another very interesting thing Costco does or rather doesn’t do, in order to keep their profits higher and prices lower.

No advertising

Costco spends next to nothing on advertising and has no official advertising budget. It does send targeted emails to prospective members, email coupons and offers to existing members, but that’s negligible. Considering the huge sums of money most retailers spent to bring customers into their stores, that’s a really unorthodox approach.

How can Costco completely shun traditional advertising and still be successful? There are two reasons.

First, Costco has a product that sells itself . The membership offers great value to those who shop regularly at Costco, and because they’re excited about the deals they get, they spread the word.

Costco’s focus on customer satisfaction helped them create a strong brand and nowadays it’s safe to say that their reputation precedes them and that most of their target market has at least heard of Costco.

Second, spending on marketing to get existing members to shop more wouldn't really help Costco’s bottom line as membership fees are the real driver of profits. You might think that spending heavily to gain more members would make sense, but when you look at the numbers it actually doesn’t.

Spending just 0.5% of its revenue on marketing would wipe out 17% of the company's operating profit. If Costco was to spend 2% of revenue on advertising, as Target does, it would erase nearly 70% of their operating profit. The number of new members they’d get couldn’t possibly cover that loss, so it’s just not worth it.

Costco’s membership model allows them to focus on improving every aspect of the experience that leads to customer loyalty and inevitable word-of-mouth recommendations instead of spending on traditional marketing campaigns. This is one of the company’s core strengths as almost no other retailer can afford to pretty much ignore advertising.

Instead of investing in ads, Costco invests in something that much more directly impacts their members’ experience - their employees.

Higher wages and great employee benefits

Costco is often recognized as being much more employee-focused than other Fortune 500 companies. By offering higher wages and top-notch health benefits, the company has created a workplace culture that attracts positive, high-energy, talented employees.

Costco’s objective is to have motivated employees and reduce the employee turnover rate. And it succeeded as Costco's annual employee turnover is 13% while the industry turnover is believed to be well above 20% annually. The company also cultivates most of its leaders through internal leadership development, which presents an opportunity for professional growth and development.

Costco fosters a culture that is built on employee empowerment. It invests in its employees in order to improve operations and drive profits. Employees are recognized as an asset for the company as they are the ones driving the competitive advantage in the physical retail landscape. Costco doesn’t only provide them with good wages and health benefits but also promotes cultural diversity and inclusion.

This inclusive organizational culture and HRM practices have resulted in extreme popularity along with a strong social image - driving more and more loyal customers into the stores.

Apart from that, the focus of Costco has been on a company culture that promotes constructive criticism, and the philosophy has been ‘leading from the floor’, which means there’s much less micromanagement than in many other similar jobs.

Of course one of the biggest draws is a higher wage, so let’s take a closer look at it.

In early 2019, Costco raised its minimum hourly pay to $15. Its average hourly pay in 2019 was about $17.60 an hour, compared to about $10.88 on average for retailers, according to Payscale. When you add healthcare benefits, you get arguably the best job package in the retail sector.

According to Forbes surveys, Costco is consistently among the 5 top employees on America’s Best Large Employers chart. In 2017, it was even ranked as #1, and in 2021, it is ranked as #4.

How can Costco afford these higher wages and great benefits? Once again, it’s all thanks to its business model. In fact, Costco always had a much higher revenue per employee than other big retailers.

The average Costco employee generates nearly triple the revenue produced by the average Wal-Mart and Target employee and the latest results show, Costco is ranked #1 for revenue per employer in the retail sector, the wholesale industry as well as the general market!

Highly paid, motivated and happy employees help customers enjoy a consistently good shopping experience . That plays a large part when it comes to membership renewal and ensures that Costco’s customers keep coming back. In the end, that’s what matters the most.

Key takeaway #4: Expand your competitive advantages to evolve your strategy

Complacency is a giant killer in the business world.

Large enterprises that rest on their laurels, don’t evolve their strategies, and manage their competitive advantage die.

Costco’s strategy is constantly adapting to market changes. The company keeps finding new ways to take advantage of its unique business model and the policies surrounding it. Here is the list of the policies that no Costco competitor could benefit from implementing isolated:

- Offering premium product options with the lowest market prices.

- Spend zero on advertising and promoting its sales and special offers.

- Offer a treasure-hunt-like experience.

Other policies like its employee extensive support are repeatable but work exceptionally well for Costco.

Recommended reading: The 7 Best Business Strategy Examples I've Ever Seen

Why Costco’s growth strategy doesn’t follow the norm

Costco is a shining example of how very successful an innovative business model can be and how it can create an environment where everybody wins.

Almost everything we discussed in this study is thought-thru and purposeful innovation - from Costco’s membership model to its warehouse store design.

Despite its success (or because of it?) Costco never stopped evolving. It expanded its offering to services such as gas stations, pharmacies, beauty salons and travel agencies which generated about 16% of the company’s $166 billion in revenue in 2020.

It added a food court and if it weren't considered a retailer, Costco would be #14 on the list of the largest pizza chains in the U.S in 2018. They cannot be easily implemented by e-commerce giants like Amazon and as such make Costco more “future-proof” than many other retailers.

Let’s take a look at two interesting examples of how Costco evolved some aspects of its business and how it implemented its growth strategy.

The art of free samples

Free samples in stores are anything new or groundbreaking, but there’s no brand that’s as strongly associated with them as Costco.

The company took the promotional activity to the next level and people have been known to tour the sample tables at Costco stores for a free lunch, acquired piecemeal. There are even personal finance and food bloggers who’ve encouraged the practice .

There are shopper blogs about favorite sample options, and some say the samples are their main reason for coming into the store.

Of course, free samples boost sales of certain products (in some cases even up to 2,000% ), but Costco knows that they also can make the store a fun place to be .

Consider this - Penn Jillette, from the famous magic act Penn & Teller, has even taken his dates to Costco to enjoy free samples on more than one occasion. And he’s surely not the only one.

However, samples don’t just make Costco’s store more appealing, they operate on a more subconscious level as well. As author Robert Cialdini writes in his best-selling book Influence, the Psychology of Persuasion : “One of the most potent of the weapons of influence around us is the rule for reciprocation. The rule says that we should try to repay, in kind, what another person has provided us.”

This means that customers feel a stronger urge to buy something after they sample it and that creates a potent combination for Costco. Even if people come to their stores because trying samples is fun, a variety of psychological mechanisms kick in, compelling them to buy more products over a longer period of time.

The curious case of Costco and e-commerce

Costco actually entered the e-commerce world in 1998 , which shows that they were again quick to evolve and try something new. However, online shopping never became a substantial part of its business model.

As for most other companies, the COVID-19 pandemic changed that to a certain extent. Costco’s e-commerce sales grew by 10% in 2022 .

Costco definitely upped their e-commerce game and also started selling their products via Instacart, which had to hire 300,000 new staff to accommodate the surge in shopping delivery.

Costco now also offers same-day delivery service to its customers located within a 20 minute vicinity.

While Costco evolved its e-commerce activities, it hadn’t quite recreated the unique in-store experience online. And the interesting thing is, perhaps it doesn’t need to.

Costco’s online margins aren’t as good as their in-store sales and even as foot traffic slowed at some of its competitors, Costco saw their members spending more in stores during the pandemic. That’s why the company opened 16 new warehouses even in 2020.

“Ultimately, we still want our members to come into the warehouse,” CFO Richard Galanti said during a December 2020 earnings call . “When they come in, they see the items and they are more likely to buy some of those items.”

When you think about it, it’s apparent why Costco is more resistant to the rising e-commerce threat. Their members give them a stable income and treat their fees as a cost that makes them come to the store. Costco entices them with the services they offer and the treasure hunting experience which can’t really be replicated. Customers genuinely enjoy being there and they buy in bulk, which means they don’t have to visit the store that often if they don’t want to.

So in the case of e-commerce, it’s not that Costco wouldn’t be willing to further evolve, it just doesn’t make a lot of business sense for them at that very moment.

This already shows that there are some unusual strengths when it comes to Costco’s business model, which means it’s high time to look at Costco’s SWOT analysis.

Key takeaway #5: Study a market trend meticulously to understand how you fit in it

Costco is unlike any other retail player.

Naturally, its business is affected by market trends, but not in the same way as its competitors. Costco’s business model compels its members to go to the store to make their purchases. If Costco tried to make its online experience something like offline, it would kill its advantage.

The company would end up slowly transitioning to a more conventional retail player, lose its competitive advantage, and eventually die.

Instead, it uses its online presence in a complementary way that supports its offline experience and invites members back to the store.

Where initiatives like free samples have a big impact on buying behavior.

Recommended reading: Internal Analysis: What is it & How to conduct one

Costco’s SWOT analysis

While there’s certainly a lot to love when it comes to Costco and its business model, there are always things that could be improved. As the SWOT analysis is going to recap a lot of what you already read in this study.

Membership business model

Costco’s membership fees enable Costco to better predict their income, cut prices and ensure customers have an incentive to shop at the store.

Loyal customer base

Membership card renewal rates of 91% in the US and 88% worldwide show that Costco has an extremely loyal customer base in an industry where it’s very easy to switch brands and retailers.

Low prices, high quality

Costco’s strategy of stocking high-quality items, which are sold in bulk-size at low-profit margins entices their target customers to become Costco members and to buy more products during their shopping trip. Their own Kirkland Signature brand is also a result of Costco’s philosophy to offer the highest quality products at the lowest price.

Selling in bulk

Costco can keep their margins low because they sell more of the same product compared to other retailers. It significantly increases how much money customers spend during one trip to Costco.

Low operation costs

Costco’s inventory management, warehouse store design and selling in bulk directly from transport pallets keep overhead costs low.

Passing savings to customers

Costco is not reliant on making huge profit margins in sales and can therefore pass the savings to customers, which encourages loyalty and entices new members.

Costco doesn’t rely on ads to sell their products and doesn’t need to spend huge amounts of money on ad campaigns, which allows them to keep their prices lower than their competitors. Their strong brand name and word of mouth are enough to bring in new members.

High paying retail jobs with generous benefits

Costco takes care of their employees which translates into a better customer experience for their members. Satisfied and motivated employees do a better job and are less likely to leave which results in a low turnover rate.

Flexible inventory

Costco rotates their inventory faster than other retailers which enables them to make the most out of the best deals on the market (e.g. by buying the surplus stock at the lowest prices) and create a treasure hunting experience.

Eco-friendly

Costco’s eco-friendly approach focuses on four main objectives:

- Creating proper waste management systems

- Significantly reducing their carbon footprint

- Changing how they package designs

- Improving energy management systems in warehouses

This is important for eco-conscious shoppers, which a lot of their target customers are.

Limited product selection

While this is a plus for some, it’s indisputable that Costco offers much fewer choices than other retailers and that customers often can’t find more “exotic” products. Therefore, Costco is unable to attract a wider customer base, who want a bigger selection of products in smaller quantities.

Cumbersome transportation and storage

Buying in bulk can be very difficult for people living in cities and storing these products can be tough if a customer doesn’t own a house.

Aging customer base

Costco has an aging problem . It is mostly attributed to its lack of digital advertising and limited e-commerce. A lot of younger people prefer a quick shopping experience or an online shopping spree, which is not something Costco is known for.

Long lines at the checkout

That’s the biggest complaint of Costco members, which Costco is trying to address with self-service lanes at selected locations.

Wasted food

As consumers are becoming more eco-conscious, it’s starting to bother them that a lot of food from Costco goes uneaten as there’s just too much of it in the one big package the store offers.

Opportunities

Online presence and e-commerce

Although we said Costco might not need e-commerce as much as other retailers, it’s still an opportunity they can explore to attract new members and increase their revenue.

Social media

Costco could tap into new markets by using social media and social advertising for a fraction of the cost of traditional advertising. Currently, they have 0 tweets on their Twitter accounts and are lacking behind the competition on Facebook.

Global expansion

Costco has shown it can successfully enter new markets, which is an opportunity to expand further. China especially represents a huge opportunity after the success of Costco’s first Shanghai store.

Reputational damage

Costco relies on its strong brand name more than other retailers and therefore has to retain a strong reputation. Product recalls can seriously damage Costco’s image of a store that provides quality items. Instances such as a rotisserie chicken salad recall in November 2015 due to the outbreak of E. Coli toxin where 19 people were infected make Costco less attractive to potential members.

Data security

Costco gathers and hands over its customers’ and employees’ information to a third-party cloud service for safekeeping. In an era where people are more and more conscious of cybersecurity, any incident can create a major problem for the company.

Competition and digitalization

A lot of Costco’s competitors are ahead of them when it comes to e-commerce and digital services. While this might not be a problem yet it does represent a threat in the long run if Costco doesn’t evolve and starts losing younger potential members to their competitors.

Why is Costco so successful?

Costco has been so successful because it introduced a new business model, accompanied it with a cohesive strategy, and managed its competitive advantage cautiously.

It’s a company with strong leadership and a powerful culture.

Costco’s unwavering commitment to doing what they feel is the right thing for their members, their employees, their suppliers, and their communities have created a Costco culture and a strong brand with an impressive social image. That’s quite an achievement for a retail company that primarily employs a cost leadership strategy.

Growth by the numbers

|

| 2015 | |

|

| 848 | 698 |

|

|

| |

|

| 304,000 | 205,000 |

|

| $222.7 billion | $113.66 billion |

As a result, a lot of customers are crazy about Costco. They love the company and have fun going to their stores. It’s not just a shopping trip, it’s a Costco experience - an adventure where members look forward to what treasures they might find.

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Lessons from Costco on Sustainable Growth

Growing sustainably means doing the right thing for all your stakeholders.

Few companies succeed in growing at a sustainable rate over time. The reason is that leaders give in to the temptation to grow in ways that overlook the customer or they grow more quickly than their organizational capabilities allow. But the leaders of a handful of companies, including Costco and Four Seasons Hotels and Resorts, never forget that businesses are complex systems whose elements are interconnected. That gives them the discipline to reject temptations to grow faster than their organizations can sustain.

Under pressure to grow, leaders often give in to two temptations that can hurt their business in the long term:

- Zeynep Ton is a professor of the practice at MIT’s Sloan School of Management and a cofounder and the president of the nonprofit Good Jobs Institute. She is the author of The Good Jobs Strategy and The Case for Good Jobs: How Great Companies Bring Dignity, Pay and Meaning to Everyone’s Work (Harvard Business Review Press, 2023). zeynepton

Partner Center

Costco Case Study: Costco Wholesale Corporation Case Study

- To find inspiration for your paper and overcome writer’s block

- As a source of information (ensure proper referencing)

- As a template for you assignment

Introduction

Current situation, internal environment, recommendations.

Costco Wholesale Corporation is a membership club founded in 1983 and headquartered in Issaquah, US. The company deals in a variety of merchandise including televisions, computers, camcorders and phones.

In addition, the firm provides services such as website and online solutions, mortgage purchase and financing, business prescription insurance as well as payroll services. The corporation was formed with a mission of offering quality products as well as services to its members at achievable economical prices.

The company’s competitive advantages are the business strategies, customer approach and the diversified trade model.

Strategy elements

Low pricing as well as limited selection of products are the foundation of the corporation’s strategy. Further, Costco’s treasure-hunt merchandising is also an invaluable tactic applied by the firm in operations. Through treasure-hunt merchandising, the company is capable of purchasing high-end products and services on the gray economy from the vendors with the motive of eliminating surplus stocks.

Competitive approach

The company’s price leadership tactic attained through reduced handling and warehouse expenses, the utilization of just-in-time stocking principle and maintenance of in stock has proven invaluable in the reduction of prices and increased purchases.

The corporation also maintains preeminent value packs that contribute hugely in attracting large numbers of customers. The company undertakes minimal promotional activities resulting in minimal number of expenses incurred.

The business model

The firm currently utilizes business model that focuses on the provision of restricted categories of trademarked national stock while anticipating high proceeds from vending as well as prompt stock returns.

In fact, the company’s just-in-time stock, minimal handling of stock, volume purchases as well as efficient delivery channels has enabled the firm to generate higher revenues from its operations. Further, the corporation’s treasure-hunt merchandise has created a process that attracts large number of clients.

The macro-environment

Costco Corporation uses PEST analysis in the examination of the macro-environment in which it operates.

Political aspects

The corporation recognizes the significant roles played by both the political and the legal sectors in ensuring excellent status, success and trust in its operations. As such, the firm adheres to business morals as well as the legal provisions provided by the international business organizations. The company offers goods and services that meet the standards as well as gratifies the customers’ needs across the globe.

Economic aspects

The company’s repute appeals to large number of clients leading to increased sales. Additionally, the firm continues to offer superior goods and services to its clients. Further, the firm has spread remarkably across different states in the globe by opening various businesses causing an increase in its economic power and competitive position over similar firms in the industry.

Socio-cultural aspects

Culture influences the performance and productivity of Costco Corporation in a number of ways. First, the corporation recognizes the worth of its personnel’s ideas and beliefs without prejudice. The company also satisfies its client social assurance by the provision of high quality goods and services.

Technological aspects

The utilization of contemporary technology in businesses ensures efficiency and competitiveness. Costco is at the forefront of utilizing the current progression in expertise to come up with innovative products that suit the needs of the customers. Further, the company’s website enables the clients to familiarize with the firm’s products and services.

Key success factors

The company’s business model is instrumental in defining its achievements. The firm recognizes cultural perspective by seizing opportunities in different locations. In addition, the firm’s circular vision is instrumental in the reinvention of innovations leading to efficient delivery of products.

The corporation’s passion has been imperative in the designing of a collaboration-propelled paradigm enabling innovations of current value models. Moreover, entrepreneurial spirit and working for a purpose is invaluable in sharing ideas that deliver greater achievements.

Costco Strategic Group Map

| | | ||||

| Costco | Low costs and high volumes | $70 | 6% | 513 | International economy |

| Sam’s Club | Low cost and high volume | $45 | 4.5% | 490 | 20 club locations nationwide |

| BJ Club | Low cost and high volume | $10 | 3.5% | 170 | Retail shoppers and provision of more grocery |

The company relates with other two competitors including the Sam’s Club and BJ’s wholesale club. The map exhibits the stiff competition that Costco faces in the market from rivals. Based on the business model, all the firms apply low cost and high volumes model. In terms of revenue, Costco leads with $70 billion followed by Sam’s Club $45 billion and BJ”s Club at $10 billion.

Costco’s sales have declined by 6%, Sam’s by 4.5% and BJ by 3.5%. The firms have diversified their stores all over the globe with the Sam’s Club leading with the number of stores at 590 followed by Costco’s 513. BJ Club has 170 stores.

The firms are employing a number of current strategies to gain competitive advantage. For instance, Costco has diversified operations in the global economy while the Sam’s has opened up 20 new locations nationwide. The BJ’s Club focuses on retail shoppers as well as presenting volume groceries.

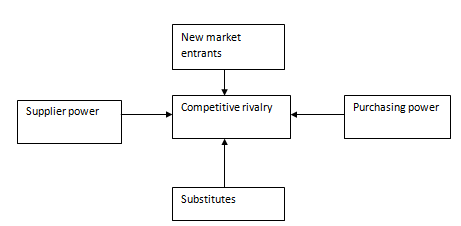

Porter’s five forces

New market entrants

The corporation has a competitive advantage over rivals due to high barriers of entry into the market, low threats from new firms and diversified products at low-costs.

Competitive rivalry

The company faces stiff competition from other firms such as the Sam’s Club. The firm’s delivery series is effortlessly duplicated leading to enjoyment of economies of scale. Low-cost strategies by many firms have resulted into meager proceeds to the firm.

Supplier power

The firm enjoys good working relations with its vendors who supply large quantities of products at low prices

Purchasing power

The firm enjoys high purchase bargaining power, high concentration and mobility of buyers

Substitutes

There is insignificant pressure of substitute and the customers get towering worth from the economical purchases as well as elevated membership maintenance.

SWOT analysis

| Strengths | Weaknesses |

| Opportunities | Threats |

The firm maintains devoted and rich clients, towering stock proceeds and consistent return on sales as well as resources together with incredible remunerations policy. All the aspects have enabled increased revenues.

The company diminishing profit levels, weak promotion activities, lack of self-checkouts and the primary focus on the club’s members opposed to the general customers make Costco less attractive to many potential customers.

Opportunities

Higher growth prospects are presented to the firm due to operations in high GDP states, expansion in membership, good repute regarding employee remuneration and societal responsibility as well as the augmenting trademark among the masses.

The firm faces stiff competition from competitors such as the Sam’s Club and BJ Club. Additionally, the firm’s geographical diversification is insignificant compared to the Sam’s Club.

Financial ratios

Liquidity ratios.

The current ratio showed a decreasing trend from 116% in 2010 to 110% in 2012. The quick ratio and cash ratio were 60% and 47% respectively in 2010 and declined to 52% and 40% respectively in 2012.

Profitability ratios

Costco’s profitability ratios have remained constant over the years. For example, gross margin has been at 13%, operating margin at 3% and profit margin at 2%. Return on investments after tax has been increasing from 12% in 2010 to 14% in 2012.

Value chain

The Costco’s CRX program enables clients to obtain inventory requests in time. In addition, the program enables the firm to measure performance and productivity against competitors thereby increases priceless insights in the viable economy.

The system has also provided efficient delivery series solution to the clients through updating stock information, forecasting and demand planning leading to enhanced business operations and reduction in costs.

Key strategic issues

The critical tactical aspects of Costco encompass low prices, limited product lines and selection as well as treasure-hunt shopping experience. In fact, the firm strives to offer quality goods and services to its members at economical costs achievable. The company operates a limited number of products approximated to be 4,000 through volume buying, effective delivery procedures and abridged inventory managing.

The firm should modify its strategies to address the shortcomings in its operations. For instance, the corporation should diversify selections of merchandise instead of limiting choices to only 4000 to expand the customer base.

Secondly, the firm should build many warehouses across the globe to counter the rising number of competitors like the Sam’s Club that may attract a large share of the market. Thirdly, the company should also diversify applied cost and pricing strategies since competitors are utilizing the low-cost tactics.

- Costco Wholesale Promotional Tools

- Costco Wholesale Corporation SWOT Analysis

- Costco Wholesale Company Analysis

- Strategic Analysis of Toronto’s Financial Sector

- Vodafone: Introducing Changes to the UK's Communication Industry

- Nicos Canine Hotel – Financial Plan

- Internal and External Consumer Strategies Analysis. British Airways, Hilton Hotel, and the Wembley Stadium

- Strategic Business Plan: Small Size Dog Boarding Business

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2019, July 5). Costco Case Study: Costco Wholesale Corporation Case Study. https://ivypanda.com/essays/case-analysis-costco-wholesale/

"Costco Case Study: Costco Wholesale Corporation Case Study." IvyPanda , 5 July 2019, ivypanda.com/essays/case-analysis-costco-wholesale/.

IvyPanda . (2019) 'Costco Case Study: Costco Wholesale Corporation Case Study'. 5 July.

IvyPanda . 2019. "Costco Case Study: Costco Wholesale Corporation Case Study." July 5, 2019. https://ivypanda.com/essays/case-analysis-costco-wholesale/.

1. IvyPanda . "Costco Case Study: Costco Wholesale Corporation Case Study." July 5, 2019. https://ivypanda.com/essays/case-analysis-costco-wholesale/.

Bibliography

IvyPanda . "Costco Case Study: Costco Wholesale Corporation Case Study." July 5, 2019. https://ivypanda.com/essays/case-analysis-costco-wholesale/.

- About / Contact

- Privacy Policy

- Alphabetical List of Companies

- Business Analysis Topics

Costco’s Mission, Business Model, Strategy & SWOT

Costco Wholesale Corporation’s case shows that the business continues to grow and expand. The company now has operations in overseas locations, such as Taiwan. The firm is among the biggest retail organizations in the world today. As a retail firm, Costco depends on consumer purchasing capacities. Consumer perceptions also have a significant impact because competition is high in the retail market. Competition involving other retailers, like Walmart , is especially notable. Costco must maintain competitive advantage to ensure long-term viability. At present, the ability of this company to continue growing and expanding is based on its affordable quality goods and services.

Costco Wholesale uses its business model to follow its mission statement. However, the internal analysis elements (strengths and weaknesses) and external analysis elements (opportunities and threats) show that Costco’s managers must formulate new strategies for sustained growth and development of the firm.

Costco’s Mission, Business Model & Strategy

Mission . Costco’s mission is “ to continually provide members with quality goods and services at the lowest possible prices. ” This mission statement is directly linked to its business model and strategy. The firm’s mission emphasizes quality and cost leadership, which are factors consumers usually look for in the retail market. Thus, the mission statement guides actions that contribute to Costco’s competitive advantage. A more detailed analysis of Costco’s mission statement shows strategic focus on customers and their needs as determinants of business development.

Business model . Costco uses a membership-only warehouse club business model. In this model, consumers pay a membership fee to access the low-cost products available at Costco stores. Non-members may accompany members, but only members are allowed to purchase in these stores. However, non-members can use Costco Cash Cards to shop at the company’s stores. Competitors, like Sam’s Club and BJ’s Wholesale Club, also use the same business model.

Strategy . Costco’s generic strategy is cost leadership. This strategy entails maintaining the lowest prices possible. Retail giants like Walmart also use the cost leadership strategy. Costco’s strategy also combines the membership warehouse club business model to differentiate it from other retail firms.

The company’s business model is a core factor that enables Costco to follow its mission. In fact, this business model aligns with the company’s mission. The generic strategy of cost leadership also agrees with and is needed to sustain Costco’s business model.

SWOT Analysis

Main article: Costco Wholesale SWOT Analysis

Costco’s Strengths (Internal Forces)

The company’s success capitalizes on the main strengths of the business, as follows:

- The company has very attractive low prices on practically every good or service offered in its stores and on its website.

- Costco has rapid inventory turnover combined with high sales volume, contributing to higher revenues. The high sales volume ensures high revenues in spite of low selling prices.

- The high sales volume contributes to high operating efficiency. Higher operating efficiency is achieved through minimization of variable costs. Variable costs are lower when volumes are higher.

Costco’s Weaknesses (Internal Forces)

Even though Costco is profitable and one of the largest retailers, the business suffers from the following weaknesses:

- Costco’s main weakness is the membership-only warehouse club retail business model. This model encourages customers to buy at Costco stores, but also limits the total number of customers. Non-member consumers might feel unwelcome at Costco stores.

- The company has the weakness of the limited array of goods and services. Customers might go to other retailers like Walmart, which has a wider array of goods and services.

Opportunities for Costco (External Forces)

To ensure long-term viability, Costco must consider and exploit these opportunities in the industry:

- The company has the opportunity to enter new markets, such as markets in developing Asian countries.

- Costco has the opportunity to expand the coverage of its e-commerce websites. The company currently offers online services to a limited group of markets, like the United States, Canada, United Kingdom, Australia, Mexico, Taiwan, South Korea, Japan, and Spain.

- The company also has the opportunity to increase the variety of its goods and services to improve the attractiveness of Costco stores to a more diverse population of consumers.

Threats to Costco’s Business (External Forces)

Threats in the retail market impose limits and barriers to Costco’s growth and expansion. These threats are as follows:

- The entry of new membership warehouse club retail companies threatens Costco’s potential to succeed in overseas markets. In overseas markets, new membership warehouse clubs are opening.

- The aggressive marketing of other retail firms also threatens Costco.

Costco Wholesale Corporation is a highly viable business. The business has the essential strengths to take advantage of opportunities in the retail industry. The firm’s low prices make it attractive even during times of economic difficulties. The company has opportunities to address threats to its long-term viability. The firm could use its website and its network of suppliers to compete with new warehouse club companies. Costco is expected to continue to grow in the years to come. Expansion in overseas markets could also further boost the company’s success.

- Costco Wholesale Corporation – Company Profile .

- Costco Wholesale Corporation – Form 10-K .

- Lim, S. F. W., Rabinovich, E., Park, S., & Hwang, M. (2021). Shopping activity at warehouse club stores and its competitive and network density implications. Production and Operations Management, 30 (1), 28-46.

- Park, J., Hong, E., & Park, Y. N. (2023). Toward a new business model of retail industry: The role of brand experience and brand authenticity. Journal of Retailing and Consumer Services, 74 , 103426.

- U.S. Department of Commerce – International Trade Administration – Retail Trade Industry .

- Copyright by Panmore Institute - All rights reserved.

- This article may not be reproduced, distributed, or mirrored without written permission from Panmore Institute and its author/s.

- Educators, Researchers, and Students: You are permitted to quote or paraphrase parts of this article (not the entire article) for educational or research purposes, as long as the article is properly cited and referenced together with its URL/link.

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Biden Economy

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Student Loans

- Personal Loans

- Car Insurance

- Mortgage Calculator

- Morning Brief

- Market Domination

- Market Domination Overtime

- Asking for a Trend

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Decoding costco wholesale corp (cost): a strategic swot insight.

Costco's net sales increased 9% to $57,392 million in Q3 2024, demonstrating robust growth.

Membership fee revenue rose by 8%, indicating strong customer loyalty and value perception.

Operating income surged to $2,197 million, reflecting efficient cost management and operational excellence.

Net income per common share increased to $3.78, showcasing solid profitability and shareholder value.

Warning! GuruFocus has detected 7 Warning Sign with COST.

Costco Wholesale Corp ( NASDAQ:COST ), a leading membership-based warehouse retailer, released its 10-Q filing on June 6, 2024, revealing a strong financial performance. With a 9% increase in net sales to $57,392 million for the 12 weeks ended May 12, 2024, and a significant rise in membership fees, Costco continues to demonstrate its ability to attract and retain a loyal customer base. The company's operating income has also seen a notable increase to $2,197 million, underscoring its operational efficiency. Furthermore, net income has grown to $1,681 million, translating to an earnings per share of $3.78, which is indicative of Costco's sustained profitability and its commitment to delivering shareholder value.

Robust Membership Model and Brand Loyalty : Costco's membership-based model is a cornerstone of its success, fostering a loyal customer base that contributes to recurring revenue streams. The 8% increase in membership fees to $1,123 million in the latest quarter is a testament to the brand's strong value proposition. Additionally, the high renewal rates, particularly in the U.S. and Canada at 93.0%, reflect the trust and satisfaction members have in Costco's offerings.

Operational Efficiency and High Sales Volume : Costco's no-frills retail model and efficient distribution system allow for high sales volume per warehouse, which is evident from the 9% increase in net sales. The company's ability to sell inventory before payment is due, even while taking early payment discounts, showcases its exceptional inventory turnover and cash flow management.

International Expansion and E-commerce Growth : With 876 warehouses worldwide and a growing e-commerce presence, Costco is effectively leveraging international markets and digital platforms to diversify its revenue streams. The expansion into new markets and the enhancement of online offerings are strategic moves that position Costco well for future growth.

Dependence on North American Markets : Despite international growth, Costco remains heavily reliant on its North American operations, which could expose the company to regional economic fluctuations. Diversification of revenue sources across more geographic regions could mitigate this risk.

Low Margin Vulnerability : Operating on thin margins, Costco's profitability is sensitive to cost fluctuations, particularly in merchandise costs and SG&A expenses. While the company has managed to increase its operating income, it must continuously monitor and manage costs to maintain its low-price strategy without compromising margins.

Limited Product Selection : Costco's limited product assortment strategy, while contributing to operational efficiency, may limit customer choice compared to competitors with broader ranges. This could potentially impact customer acquisition and retention in certain market segments.

Opportunities

Private Label Expansion : Costco's private-label brand, Kirkland Signature, has been a significant driver of customer loyalty and profitability. Expanding this product line could further enhance margins and differentiate Costco from competitors.

Technological Innovation : Investing in technology to improve the shopping experience, such as mobile apps and checkout optimization, could attract tech-savvy consumers and streamline operations. Additionally, leveraging data analytics for inventory management and personalized marketing could drive sales growth.

Sustainability Initiatives : As consumers become increasingly environmentally conscious, Costco has the opportunity to lead the retail sector in sustainability. Implementing green practices and offering eco-friendly products can strengthen the brand image and appeal to a broader customer base.

Intense Competition : The retail industry is highly competitive, with players like Walmart and Amazon offering similar bulk-sale models and e-commerce platforms. Costco must continue to innovate and provide exceptional value to maintain its market position.

Economic Sensitivity : Economic downturns can impact consumer spending, particularly on discretionary items. Costco's reliance on membership fees and bulk purchases makes it susceptible to changes in consumer behavior during economic slumps.

Regulatory Changes : Changes in trade policies, tariffs, and regulations can affect Costco's cost structure and international operations. The company must remain agile and adapt to these changes to avoid adverse impacts on its profitability.

In conclusion, Costco Wholesale Corp ( NASDAQ:COST ) exhibits a robust business model characterized by a strong brand, loyal customer base, and operational efficiency. However, it must navigate weaknesses such as its dependence on North American markets and low-margin vulnerability. Opportunities for growth lie in private label expansion, technological innovation, and sustainability initiatives. Meanwhile, threats from intense competition, economic sensitivity, and regulatory changes require strategic vigilance. Overall, Costco's strategic positioning and forward-looking strategies suggest a resilient outlook, with plans to leverage strengths and opportunities while addressing weaknesses and threats to sustain its competitive advantage.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus .

The cult of Costco: How one of America’s biggest retailers methodically turns casual shoppers into fanatics

On your first visit to a Costco Wholesale warehouse, it’s easy to feel as if the whole experience is designed to haze the newbie.

Sensory overload starts the second you enter the airplane-hangar-size store. The place is packed with people. And do I smell … hot-dog water? (Yes, you do.) The shopping floor is a bewildering jumble of merchandise, much of it stacked high above your head, still in its cardboard boxes. There are virtually no signs to tell you what’s where; you eventually realize that the stuff you came to buy is, of course, all the way in the back.