Financial Tips, Guides & Know-Hows

Home > Finance > How To Start A Consumer Finance Business

How To Start A Consumer Finance Business

Modified: December 30, 2023

Learn how to start a consumer finance business and navigate the world of finance with our comprehensive guide. Empower your financial future today!

- Consumer Finance

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more )

Table of Contents

Introduction, understanding the consumer finance industry, market research and analysis, developing a business plan, setting up legal and regulatory requirements, obtaining financing, establishing operations and infrastructure, developing products and services, marketing and advertising strategies, hiring and training staff, risk management and compliance, building customer relationships, continuous improvement and growth strategies.

Welcome to the world of consumer finance! This dynamic industry serves as the backbone of our economy by providing individuals and households with the necessary funds to meet their financial needs. Consumer finance businesses play a vital role in facilitating personal loans, credit cards, auto financing, and other forms of credit to help people make major purchases, cover unexpected expenses, or simply manage their day-to-day expenses.

If you’re considering starting a consumer finance business, you’re stepping into a sector with immense potential for growth and profitability. However, it’s important to note that this industry is highly regulated and competitive. It requires a comprehensive understanding of financial services, compliance with legal and regulatory requirements, and strategic planning to succeed.

In this article, we will guide you through the essential steps to start a consumer finance business. From conducting market research to establishing operations, developing products and services, and implementing marketing strategies, we will cover all the key elements you need to consider.

It’s important to note that starting a consumer finance business requires a deep understanding of finance, lending practices, risk management, and compliance. It’s recommended to have a background or experience in finance or work closely with financial experts and legal advisors to ensure your business is set up for success.

So, if you’re ready to embark on this rewarding entrepreneurial journey, let’s dive into the world of consumer finance and explore how to establish and grow your own business in this exciting industry.

Before diving into the world of consumer finance, it’s crucial to gain a solid understanding of the industry and its key components. Consumer finance refers to the range of financial products and services that are designed to meet the borrowing and credit needs of individuals and households. This includes personal loans, credit cards, installment plans, and various other forms of credit.

The consumer finance industry plays a vital role in supporting economic growth by providing individuals with the means to make major purchases, cover unexpected expenses, and manage their finances. It helps bridge the gap between consumers’ financial needs and the available resources by offering convenient and accessible funding options.

Consumer finance companies typically operate by borrowing money from various sources such as banks, investors, or other financial institutions, and then lending it to consumers at a higher interest rate. They generate revenue through the interest charged on loans and fees associated with the financial services they provide.

One of the key aspects of the consumer finance industry is risk assessment and management. Lenders must carefully evaluate the creditworthiness of borrowers to mitigate the risk of default. This is done through assessing various factors including credit history, income stability, debt-to-income ratio, and other relevant financial indicators.

In recent years, technology has played a significant role in transforming the consumer finance landscape. Online lending platforms, mobile banking apps, and digital payment solutions have made financial services more accessible and efficient for consumers. As a result, consumer finance businesses face the challenge of staying up-to-date with technological advancements and adapting their operations to cater to the evolving needs of consumers.

Furthermore, consumer finance is a heavily regulated industry. Governments and regulatory bodies enforce strict rules and guidelines to ensure fair lending practices, protect consumers, and maintain the integrity of the financial system. To operate in this industry, businesses must comply with these regulations, which can vary by jurisdiction.

By understanding the consumer finance industry’s intricacies and keeping abreast of the latest trends and regulations, you can position yourself for success and develop strategies that meet the needs of both your target market and the regulatory environment.

Conducting thorough market research and analysis is a critical step in starting a consumer finance business. This process involves gathering data and insights about the target market, competitor landscape, and customer preferences to make informed decisions and develop effective strategies. Here are some key points to consider:

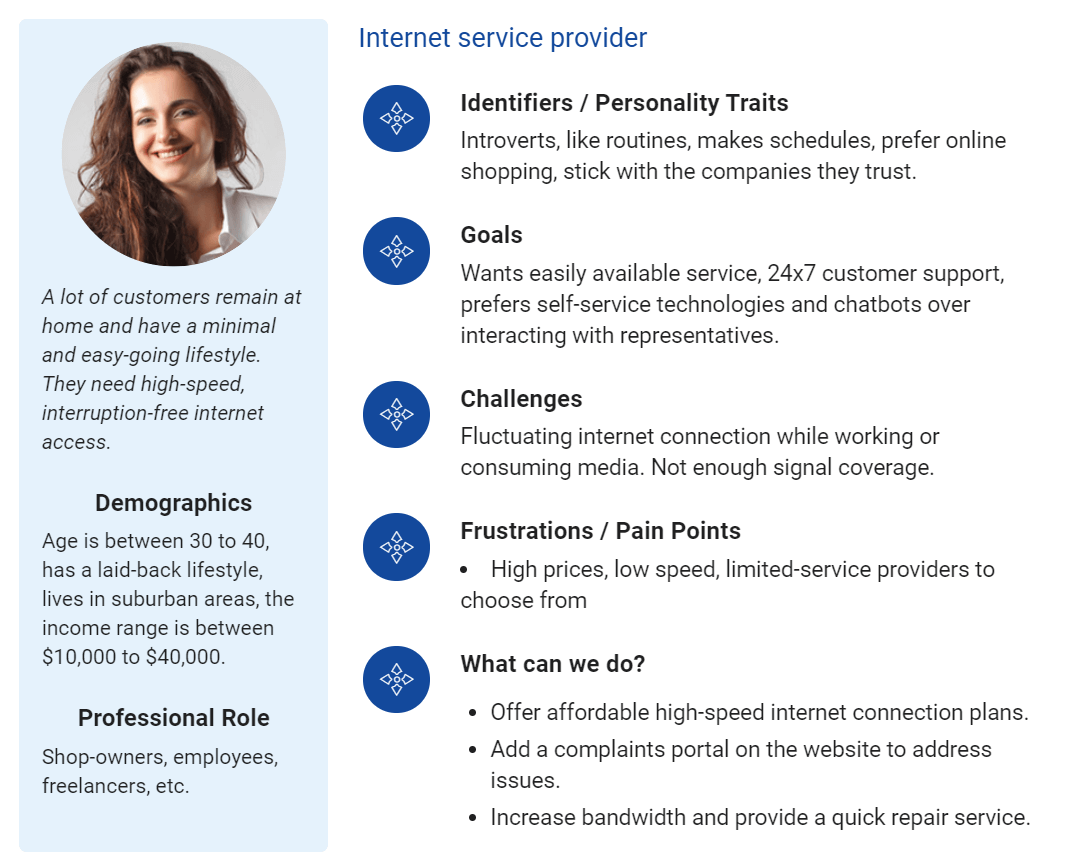

Identify your target market: Determine the specific demographic and psychographic characteristics of the customers you want to serve. Consider factors such as age, income level, creditworthiness, and financial goals. Understanding your target market will help tailor your products and services to meet their needs.

Assess market demand: Evaluate the demand for consumer finance in the market. Analyze market trends, economic indicators, and consumer behavior to identify the potential size of the market and growth opportunities. This information will help you determine the viability and profitability of your business.

Analyze the competition: Understand the competitive landscape by researching existing consumer finance companies in your area. Assess their offerings, pricing strategies, target markets, and customer satisfaction levels. This analysis will help you identify gaps in the market and develop a unique value proposition that sets your business apart.

Research regulatory requirements: Familiarize yourself with the legal and regulatory frameworks governing consumer finance businesses in your jurisdiction. Ensure compliance with licensing, reporting, and disclosure requirements to avoid legal issues and penalties.

Gather customer insights: Conduct surveys, interviews, or focus groups to understand customer preferences, pain points, and expectations in the consumer finance sector. This information will guide the development of products, services, and marketing strategies that resonate with your target audience.

Analyze risks and opportunities: Assess the potential risks associated with operating a consumer finance business, such as regulatory changes, economic downturns, and credit risk. Develop risk management strategies to mitigate these risks and capitalize on opportunities for growth.

Consider technology and innovation: Evaluate emerging technologies and innovations within the consumer finance industry, such as online lending platforms or digital payment solutions. Determine how these advancements can enhance your operations and customer experience.

By conducting comprehensive market research and analysis, you will gain valuable insights into your target market, competition, and regulatory environment. Armed with this knowledge, you can make informed decisions and develop a solid foundation for your consumer finance business.

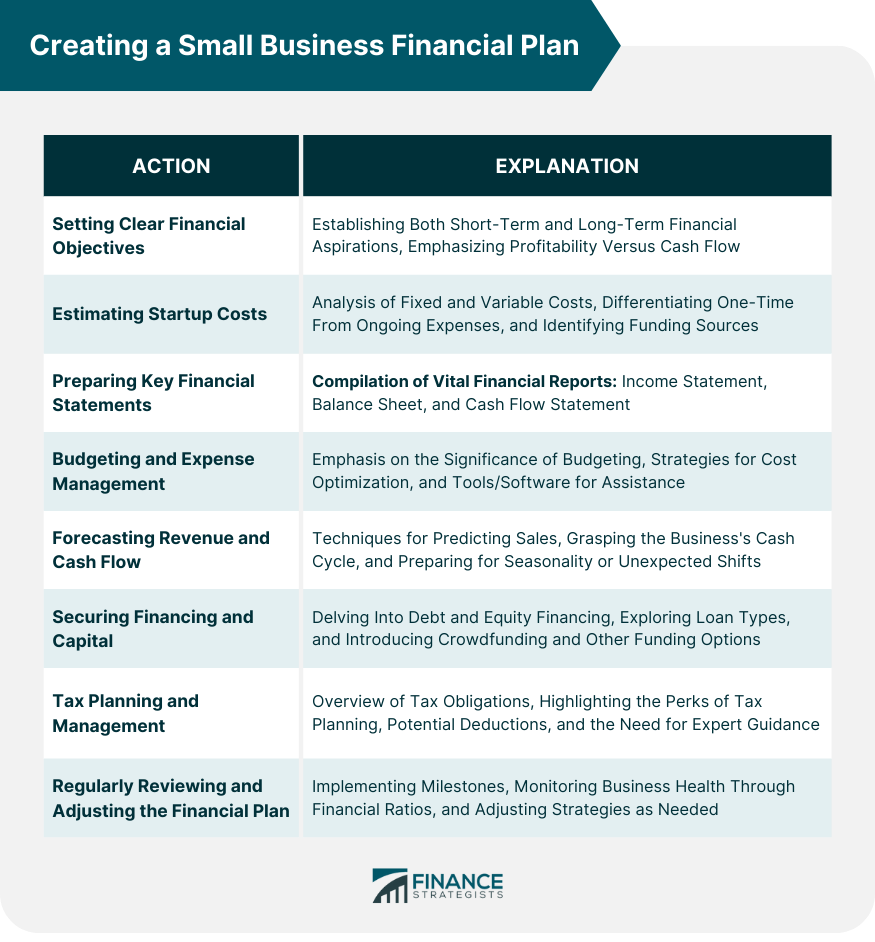

Creating a comprehensive business plan is essential for the success of your consumer finance business. A business plan serves as a roadmap that outlines your company’s goals, strategies, and financial projections. Here are the key elements to consider when developing your business plan:

Executive Summary: Provide an overview of your business, including its mission statement, target market, unique value proposition, and competitive advantage. This section should grab the reader’s attention and summarize the key highlights of your business plan.

Company Description: Describe your consumer finance business in more detail. Explain your business structure, ownership, and legal status. Highlight your experience and credentials in the industry and outline the key products or services you offer.

Market Analysis: Conduct a thorough analysis of the consumer finance industry, including market size, growth potential, and trends. Identify your target market and analyze the competitive landscape. Provide insights into consumer preferences, regulatory requirements, and risks and opportunities.

Products and Services: Outline the range of financial products and services you will offer to consumers. Detail their features, eligibility criteria, interest rates, and fees. Highlight how your offerings meet the unique needs of your target market and differentiate your business from competitors.

Marketing and Sales Strategies: Develop a marketing plan that outlines how you will attract and retain customers. Identify your target audience and outline your marketing channels, such as digital marketing, social media, and partnerships. Explain your sales strategy and how you will promote your products or services to potential clients.

Operational Plan: Describe the day-to-day operations of your consumer finance business. Explain how you will process loan applications, manage risk, and ensure compliance with regulations. Outline the technology and infrastructure you will need to operate efficiently.

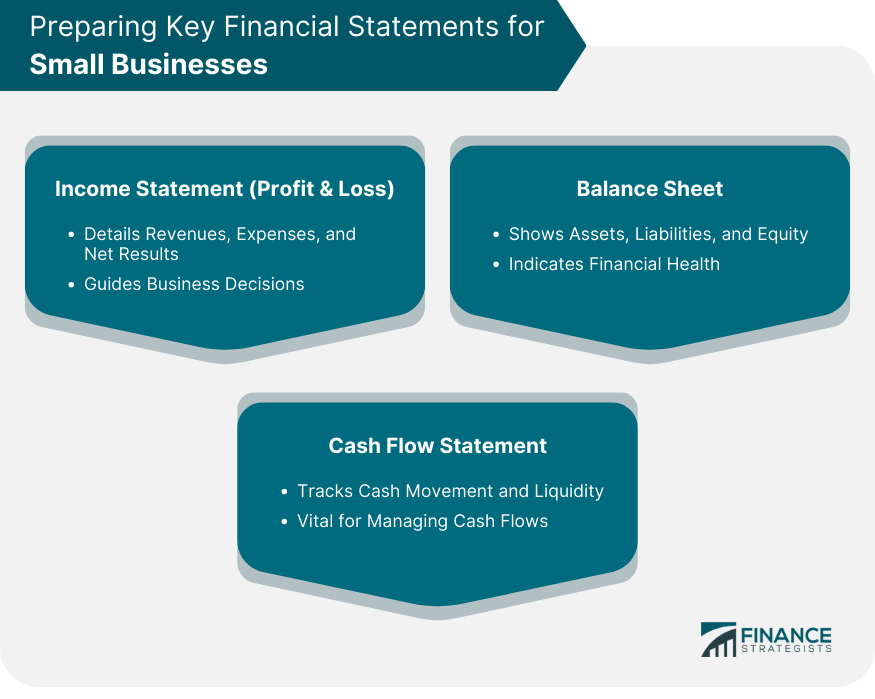

Financial Projections: Provide financial forecasts for your business, including revenue projections, cash flow statements, and profitability analysis. Consider factors such as loan volumes, interest rates, operating expenses, and loan default rates. Back up your projections with market research and industry benchmarks.

Management and Personnel: Outline the organizational structure of your business and introduce key members of your team. Highlight their experience, qualifications, and roles. Emphasize how your team’s expertise will contribute to the success of your consumer finance business.

Risk Management and Contingency Plans: Identify potential risks and challenges your business may face and develop strategies to mitigate them. Consider regulatory changes, economic downturns, and credit risk. Develop contingency plans to handle unexpected situations and maintain a resilient business.

Exit Strategy: Although it may seem premature, having an exit strategy is vital. Outline how you plan to exit the consumer finance business, whether through selling the company, merging with another organization, or passing it on to a successor.

Remember, a business plan is a living document that should be regularly reviewed and adapted as your consumer finance business evolves. It serves as a guiding tool and a reference point to ensure that you stay focused on your goals and stay on track for success.

When establishing a consumer finance business, it is crucial to understand and comply with the legal and regulatory requirements of the industry. Adhering to these requirements ensures that you operate within the law, protects the interests of consumers, and avoids costly penalties or legal issues. Here are the key steps to setting up the legal and regulatory aspects of your consumer finance business:

Research and understand the regulatory framework: Familiarize yourself with the laws and regulations governing consumer finance in your jurisdiction. Consult relevant government agencies, financial regulators, and legal experts to ensure you have a comprehensive understanding of the requirements.

Business registration and licensing: Register your consumer finance business as a legal entity. Choose a suitable business structure – such as a sole proprietorship, partnership, or corporation – and complete the necessary registration and licensing procedures with the appropriate authorities.

Compliance with lending regulations: Consumer finance businesses are subject to specific lending regulations that vary by jurisdiction. These regulations typically include interest rate limits, disclosure requirements, fair lending practices, and credit reporting obligations. Ensure that your lending practices and loan terms comply with these regulations to protect your business and provide transparent services to consumers.

Data protection and privacy: Consumer finance businesses handle sensitive customer information, such as personal and financial details. Ensure compliance with data protection and privacy laws, and implement strong security measures to safeguard customer data from unauthorized access or misuse.

Anti-money laundering (AML) and know-your-customer (KYC) requirements: Implement robust AML and KYC procedures to prevent your business from being used for money laundering or fraudulent activities. Understand the requirements for customer identification, due diligence, record-keeping, and suspicious transaction reporting.

Consumer protection and disclosure requirements: Consumer finance businesses are obligated to provide clear and transparent information to customers about loan terms, fees, interest rates, and repayment obligations. Incorporate appropriate disclosure practices and adopt customer-friendly policies to ensure consumer protection and fair treatment.

Risk management and compliance policies: Develop comprehensive risk management and compliance policies to monitor and mitigate risks associated with your consumer finance operations. These policies should address credit risk assessment, loan approval processes, collections practices, and adherence to relevant regulations.

Obtain professional advice: Engage with legal advisors, compliance professionals, and industry experts to ensure you are fully aware of the legal and regulatory requirements specific to the consumer finance industry. Seek their guidance throughout the setup process and for ongoing compliance and risk management strategies.

Setting up your consumer finance business in compliance with legal and regulatory requirements is essential for establishing a trustworthy reputation and building long-term success. By ensuring compliance from the outset, you demonstrate your commitment to operating ethically, protecting your customers, and maintaining the integrity of the financial system.

Obtaining financing is a crucial step in starting a consumer finance business. It involves securing the necessary funds to establish your operations, cover initial expenses, and have sufficient working capital. Here are some key considerations to help you navigate the financing process:

Evaluate your capital needs: Determine how much capital you will need to launch and sustain your consumer finance business. Consider factors such as office space, technology infrastructure, employee salaries, marketing expenses, and regulatory compliance costs. Develop a detailed budget to calculate your funding requirements.

Self-funding: Using your personal savings or resources to fund your business is a common option. Self-funding demonstrates your commitment and belief in your venture, but it may not be sufficient to cover all your financial needs. Evaluate how much personal capital you can contribute to the business.

Explore traditional lenders: Banks and financial institutions are potential sources of financing for your consumer finance business. Prepare a comprehensive business plan, financial projections, and collateral (if required) to present to potential lenders. Explore loan options such as small business loans, lines of credit, or equipment financing.

Consider alternative lenders: If traditional lenders are not an option or if you need additional funding, consider alternative financing sources. Peer-to-peer lending platforms, online lenders, or business credit cards can provide access to capital with less stringent requirements. However, carefully review the terms and interest rates associated with these alternatives.

Establish strategic partnerships: Seek partnerships with investors or financial institutions that can provide both financial support and industry expertise. Consider private equity firms, venture capital funds, or angel investors who may be interested in supporting consumer finance startups.

Pitch to potential investors: Prepare a compelling pitch deck and present your business to potential investors. Highlight your unique value proposition, market potential, competitive advantage, and financial projections. Be prepared to answer questions and negotiate terms if investors express interest.

Government programs and grants: Research government programs and grants available to support small businesses in the consumer finance sector. These programs may provide financial assistance, mentorship, or access to resources that can help you establish and grow your business.

Bootstrap and seek growth funding: In the early stages, focus on bootstrapping and managing your expenses wisely. As your consumer finance business grows and establishes a track record, you may become eligible for additional funding options such as business expansion loans or lines of credit to fuel your growth.

Financial projections and investor confidence: Presenting realistic and well-researched financial projections can instill confidence in potential lenders and investors. Demonstrate how your consumer finance business will generate revenue, manage expenses, and achieve profitability over time.

Remember, securing financing for your consumer finance business may require a combination of approaches. Be prepared to demonstrate your expertise, market potential, and risk mitigation strategies to increase your chances of obtaining the necessary funds. With the right financing in place, you can lay a strong foundation for success in the consumer finance industry.

Once you have secured financing, the next step in starting a consumer finance business is to establish your operations and infrastructure. Properly setting up your operations is crucial for smooth day-to-day functioning and delivering excellent services to your customers. Here are key points to consider when establishing your operations and infrastructure:

Physical Location: Determine the location of your consumer finance business. Consider factors such as accessibility, visibility, proximity to your target market, and cost. Choose a location that aligns with your business goals and regulatory requirements.

Office Setup: Set up a functional and professional office space that accommodates your staff and supports the operations of your consumer finance business. Furnish the office with the necessary equipment, such as computers, phones, printers, and other office supplies.

Technology Infrastructure: Invest in a robust technology infrastructure to support your operations. This includes a secure network, hardware, software applications, and data management systems. Implement encryption and other security measures to protect sensitive customer information.

Lending and Loan Management Systems: Implement a loan management system to effectively process loan applications, assess creditworthiness, calculate interest rates, and manage loan portfolios. Choose a system that is compliant with regulatory requirements and integrates with your other operational systems.

Accounting and Financial Systems: Set up accounting and financial systems to track and manage your finances accurately. This includes bookkeeping software, payroll management, and financial reporting tools. Maintain accurate records of income, expenses, loan repayments, and overall financial performance.

Compliance and Risk Management: Develop comprehensive policies and procedures to ensure compliance with legal and regulatory requirements. Implement robust risk management practices to mitigate the risk of fraud, default, and non-compliance. Regularly review and update your policies to reflect changes in regulations or industry best practices.

Staffing and HR: Hire and train a skilled and knowledgeable workforce to handle the day-to-day operations of your consumer finance business. Develop job descriptions, recruitment processes, and training programs. Implement HR policies and procedures, including employee contracts, benefits, and performance management.

Customer Relationship Management (CRM) System: Implement a CRM system to manage your customer relationships effectively. This includes capturing and organizing customer data, tracking interactions, and providing personalized services. Utilize the CRM system to nurture customer relationships and identify cross-selling or upselling opportunities.

Partnerships and Vendor Management: Identify strategic partnerships with third-party vendors, such as credit bureaus, payment processors, or collections agencies. Establish clear communication channels and service level agreements with these partners to ensure smooth operations and enhance the customer experience.

Comprehensive Training: Provide comprehensive training to your employees on your company’s policies, procedures, and compliance requirements. Ensure that they have a thorough understanding of lending practices, customer interactions, and the regulatory environment. Regularly provide refresher training to keep staff informed of industry updates and best practices.

Continuous Improvement: Establish a culture of continuous improvement within your consumer finance business. Encourage feedback from customers and staff, and regularly evaluate your operations to identify areas for improvement. Stay up-to-date with industry trends and technological advancements to ensure your operations remain efficient and competitive.

By carefully establishing your operations and infrastructure, you are setting a strong foundation for the success of your consumer finance business. Efficient processes, compliant systems, and a skilled workforce will enable you to deliver exceptional services to your customers and drive growth in the competitive consumer finance industry.

In the consumer finance industry, developing a comprehensive range of products and services is essential to meet the diverse financial needs of your target market. By offering tailored and innovative solutions, you can attract and retain customers, differentiate your business from competitors, and drive growth. Here are key points to consider when developing your products and services:

Market Research and Analysis: Conduct in-depth market research to understand the specific financial needs and preferences of your target market. Analyze market trends, customer feedback, and competitor offerings to identify gaps and opportunities for differentiation.

Product Portfolio: Create a portfolio of products and services that cater to different customer segments and financial requirements. This may include personal loans, credit cards, auto financing, debt consolidation, or installment plans. Tailor your offerings to meet customers’ needs for convenience, flexibility, and competitive interest rates.

Interest Rates and Terms: Determine interest rates, loan terms, and repayment options based on market conditions, risk assessment, and regulatory requirements. Strive for competitive rates that offer value to customers while maintaining profitability for your business.

Flexible Financing Options: Offer flexible financing options to accommodate various customer preferences and financial situations. This may include adjustable repayment terms, interest-only periods, or grace periods for late payments. Empower customers to choose options that align with their cash flow and financial goals.

Streamlined Application Process: Develop a user-friendly and efficient loan application process to streamline customer interactions. Utilize technology to automate data collection, credit checks, and document processing. Offer online applications for added convenience and faster approvals.

Credit Assessment and Financial Education: Develop robust credit assessment processes to evaluate the creditworthiness of applicants. Consider factors such as credit history, income stability, and debt-to-income ratio. Additionally, provide educational resources to help customers make informed financial decisions and improve their credit scores.

Value-Added Services: Enhance your product offering with value-added services that differentiate your business. This may include financial planning consultations, debt management programs, or credit monitoring services. These additional services can attract and retain customers by providing comprehensive financial support.

Digital Solutions: Embrace technology to provide digital solutions that enhance the customer experience. Offer online account management, mobile banking applications, and secure digital payment options. Implement e-signatures and e-documents to streamline processes and reduce paperwork.

Compliance and Transparency: Ensure that your products and services comply with all relevant legal and regulatory requirements. Clearly communicate terms, fees, and any potential risks to customers. Maintain transparency and provide customers with all the information they need to make informed decisions.

Continuous Improvement: Regularly assess the performance and feedback of your products and services. Monitor market trends, customer needs, and competitor offerings to identify areas for improvement or the development of new products. Stay agile and adaptable to meet evolving financial demands.

By developing a robust portfolio of products and services, you can position your consumer finance business as a trusted financial partner. Tailor your offerings to meet the unique needs of your target market, leverage technology for efficiency, and continuously improve to stay competitive in the ever-changing consumer finance industry.

In the highly competitive consumer finance industry, effective marketing and advertising strategies are essential to attract customers, build brand awareness, and differentiate your business from competitors. A well-executed marketing plan will help you reach your target audience and drive growth. Here are key points to consider when developing your marketing and advertising strategies:

Define Your Target Audience: Clearly identify the demographic and psychographic characteristics of your target market. Understand their financial needs, preferences, and pain points. This will help you tailor your marketing messages and channels to resonate with your ideal customers.

Brand Identity and Messaging: Develop a strong brand identity that communicates your unique value proposition, mission, and commitment to customer satisfaction. Craft clear and compelling messaging that highlights the benefits of your products and services. Consistently communicate your brand message across all marketing channels.

Multi-Channel Marketing: Utilize a mix of marketing channels to reach your target audience. This may include digital marketing (such as SEO, content marketing, social media, and online advertising), traditional advertising (such as print and broadcast media), direct mail, and event marketing. Experiment with different channels to determine the most effective ones for your business.

Content Marketing: Create valuable and informative content that educates customers about personal finance, credit management, and other relevant topics. Publish blog articles, videos, and downloadable resources on your website or through other platforms. Position your business as a trusted source of financial knowledge.

Referral Programs: Implement referral programs that incentivize your existing customers to refer friends, family, or colleagues to your consumer finance business. Offer rewards or discounts for successful referrals. Word-of-mouth referrals can be a powerful marketing tool in building trust and expanding your customer base.

Partnerships and Affiliations: Seek strategic partnerships with other businesses or organizations that align with your target market. This could include real estate agencies, car dealerships, or educational institutions. Collaborate on joint marketing initiatives or referral programs to reach a wider audience and increase brand visibility.

Online Presence and Website Optimization: Invest in a professional and user-friendly website for your consumer finance business. Optimize your website for search engines (SEO) to improve visibility in organic search results. Provide informative and engaging content, user-friendly navigation, and clear calls-to-action to drive website conversions.

Customer Testimonials and Reviews: Encourage satisfied customers to provide testimonials and reviews about their positive experiences with your consumer finance business. Display these testimonials on your website, social media, or other marketing materials to build trust and credibility with potential customers.

Data-driven Marketing: Utilize data analytics to track and measure the effectiveness of your marketing efforts. Monitor key performance indicators (KPIs) such as website traffic, conversion rates, and customer acquisition costs. Use these insights to optimize your marketing strategies and allocate resources effectively.

Compliance with Advertising Regulations: Ensure that your marketing and advertising materials comply with relevant laws and regulations specific to the consumer finance industry. Review guidelines on fair lending practices and truth-in-advertising requirements. Avoid misleading claims or deceptive practices that could harm your reputation and attract legal issues.

Continuous Brand Monitoring and Adaptation: Continuously monitor your brand reputation and customer feedback. Stay updated on industry trends, consumer preferences, and regulatory changes. Adapt your marketing strategies accordingly to capitalize on emerging opportunities and address any potential challenges.

By implementing effective marketing and advertising strategies, you can build brand awareness, establish credibility, and attract customers to your consumer finance business. Tailor your messaging to resonate with your target audience, leverage a diverse range of marketing channels, and measure the effectiveness of your efforts to optimize your campaigns over time.

Building a skilled and knowledgeable team is crucial for the success of your consumer finance business. The people you hire will be the face of your company and will play a significant role in delivering excellent customer service and driving growth. Here are key points to consider when hiring and training staff:

Define Roles and Responsibilities: Clearly define the roles and responsibilities you need to fill within your consumer finance business. Consider positions such as loan officers, customer service representatives, underwriters, collections agents, and compliance officers. Determine the qualifications, experience, and skills required for each role.

Recruitment Strategy: Develop a recruitment strategy to attract top talent. Advertise job openings on online job boards, your company website, and social media platforms. Leverage professional networks and consider working with recruitment agencies specialized in the finance industry. Screen applicants thoroughly to ensure they align with your business values and possess the necessary skills and qualifications.

Financial Industry Knowledge: Seek candidates with a solid understanding of the consumer finance industry. Look for individuals with experience in lending, credit analysis, risk management, compliance, or other relevant areas. Their familiarity with industry regulations and best practices will contribute to your business’s success and provide valuable insights to your customers.

Customer Service Skills: Customer service is a critical aspect of the consumer finance industry. Look for candidates who possess exceptional communication skills, empathy, and the ability to handle customer concerns and inquiries with professionalism and respect. Prioritize candidates who are attentive to detail and have the ability to explain complex financial concepts in a clear and understandable way.

Training and Development: Implement a comprehensive training program to equip your staff with the necessary skills and knowledge. Provide training on lending processes, compliance requirements, customer service protocols, and any specific systems or software you use. Offer ongoing professional development opportunities to keep your team updated on changes in the industry and enhance their skills.

Compliance and Ethics: Emphasize the importance of compliance and ethical practices within your consumer finance business. Train your staff on regulatory requirements, fair lending practices, and customer data confidentiality. Foster a culture of integrity and ensure that all employees adhere to established policies and guidelines.

Team Collaboration: Encourage a collaborative and supportive work environment. Foster teamwork, open communication, and knowledge sharing among your staff. Create opportunities for cross-training and skill development to increase versatility within your team.

Performance Management: Develop a performance management system to set clear expectations and goals for your staff. Conduct regular performance evaluations and provide constructive feedback to help them improve. Recognize and reward high-performing employees to foster motivation and job satisfaction.

Company Culture: Cultivate a positive company culture that promotes inclusivity, respect, and continuous growth. Clearly communicate your company values and ensure your staff understands and embraces them. This will help create a cohesive and productive work environment.

Employee Engagement: Foster employee engagement by offering competitive compensation and benefits packages, opportunities for career advancement, and a healthy work-life balance. Encourage open communication, provide regular feedback, and empower your staff to contribute ideas and suggestions for improving processes and customer service.

Compliance with Labor Laws: Ensure compliance with labor laws and regulations related to hiring, employment contracts, working hours, and compensation. Stay updated with legal requirements to avoid any legal issues or penalties.

Hiring and training staff who are knowledgeable, skilled, and aligned with your company’s values is essential for the success of your consumer finance business. Invest in their professional development, foster a positive work environment, and prioritize exceptional customer service to create a culture that drives growth and exceeds customer expectations.

In the consumer finance industry, effective risk management and compliance practices are critical to protect your business, maintain regulatory compliance, and safeguard the interests of your customers. By implementing robust risk management strategies and organizational compliance, you can minimize potential financial losses and maintain the integrity of your operations. Here are key points to consider when managing risks and ensuring compliance:

Identify and Assess Risks: Conduct a comprehensive risk assessment to identify potential risks and vulnerabilities within your consumer finance business. This includes assessing credit risk, interest rate risk, liquidity risk, operational risk, regulatory risk, and reputational risk. Evaluate the likelihood and potential impact of each risk to establish a risk profile for your business.

Develop Risk Management Strategies: Develop strategies to manage and mitigate identified risks. This may involve implementing risk control measures, such as underwriting guidelines, monitoring systems, internal controls, and audit procedures. Establish protocols for addressing risks and ensuring prompt action when risks are detected.

Compliance with Regulatory Requirements: Stay up-to-date with the regulatory landscape governing the consumer finance industry. Regularly review and assess any changes or updates to regulatory frameworks and ensure your business is compliant. Develop and maintain policies and procedures that align with regulatory requirements, including fair lending practices, data protection, and anti-money laundering measures.

Employee Training and Awareness: Provide comprehensive training to your staff on compliance requirements, risk management protocols, and regulatory obligations. Ensure that employees understand the importance of compliance, ethical behavior, and their individual responsibilities. Foster a culture of compliance and provide ongoing training to keep your staff updated on regulatory changes.

Data Security and Privacy: Implement robust security measures to protect sensitive customer data. Encrypt data, restrict access on a need-to-know basis, and regularly monitor systems for any suspicious activity. Comply with data protection and privacy regulations, and have protocols in place for data breaches or incidents.

Internal Controls and Audits: Establish internal controls and audit procedures to ensure compliance with regulations and identify any potential weaknesses in your processes. Regularly review and assess your policies, procedures, and control mechanisms. Conduct internal audits to identify areas for improvement and ensure ongoing compliance.

Compliance Monitoring and Reporting: Establish a compliance monitoring program to regularly assess your adherence to regulatory requirements. Designate individuals or teams responsible for monitoring compliance, conducting periodic reviews, and producing compliance reports. Report any non-compliance issues promptly and take appropriate corrective actions.

Vendor and Partner Due Diligence: Conduct due diligence on vendors and partners to ensure they comply with relevant regulations and adhere to industry best practices. Regularly assess their performance and take appropriate actions if any compliance issues arise. Maintain clear communication and documentation with vendors and partners to ensure all parties understand compliance expectations.

Regular Compliance Reviews: Conduct regular compliance reviews to evaluate the effectiveness of your risk management and compliance programs. Engage with external experts or auditors for independent assessments when necessary. Use findings from these reviews to make necessary improvements and adjustments to your risk and compliance strategies.

Continual Risk Assessment and Adaptation: Regularly reassess and adapt your risk management and compliance strategies to address emerging risks and regulatory changes. Stay informed about industry trends, market conditions, and evolving customer behaviors to proactively mitigate risks and adjust your compliance practices as needed.

By effectively managing risks and ensuring compliance within your consumer finance business, you can protect your assets, maintain the trust of your customers, and operate within the boundaries of the law. Establishing a strong risk management and compliance framework will contribute to the long-term success and sustainability of your business in the consumer finance industry.

In the consumer finance industry, building strong and lasting customer relationships is essential for the success of your business. By fostering trust, providing exceptional service, and offering personalized experiences, you can attract and retain loyal customers. Here are key points to consider when building customer relationships in the consumer finance industry:

Customer-Centric Approach: Place the customer at the center of your business strategy. Understand their needs, preferences, and pain points. Tailor your products, services, and customer interactions to meet their individual requirements. Demonstrate genuine care and empathy to build a strong foundation of trust.

Personalized Customer Experience: Provide a personalized experience for each customer. Use data analytics and customer relationship management (CRM) systems to track individual preferences, history, and interactions. Leverage this information to offer customized recommendations, targeted offers, and a seamless customer journey.

Excellent Customer Service: Strive for excellence in customer service at every touchpoint. Train your staff to provide personalized and efficient service. Respond promptly to customer inquiries, concerns, and complaints. Resolve issues promptly and make the customer feel valued and appreciated.

Proactive Communication: Engage with your customers regularly through various channels. Keep them informed about updates, new products or services, and any changes that may affect them. Be proactive in providing relevant information, such as payment reminders or educational resources, to help them make informed financial decisions.

Building Trust: Trust is crucial in the consumer finance industry. Act with integrity, transparency, and professionalism at all times. Honor your commitments, explain your products and services clearly, and ensure that customers understand the terms and conditions. Safeguard customer data and maintain strict confidentiality to instill confidence in your business.

Reward Loyalty: Implement a customer loyalty program to reward and incentivize repeat business. Offer exclusive discounts, rewards, or VIP benefits for loyal customers. Regularly communicate with your loyal customers to express gratitude and offer personalized promotions or upgrades.

Feedback and Improvement: Encourage customer feedback and actively seek input on their experience with your business. Conduct surveys, monitor online reviews, and engage with customers through social media platforms. Use this feedback to identify areas for improvement and make necessary adjustments to enhance the customer experience.

Community Engagement: Engage in community initiatives and sponsorships to build a positive presence and demonstrate your commitment to the communities you serve. Participate in local events, support charitable causes, and be a contributing member of the community. This can enhance your brand reputation and generate goodwill among your customers.

Continual Relationship-Building: Building customer relationships is an ongoing process. Maintain regular communication and engagement even after a transaction is complete. Follow up with personalized messages, birthday or anniversary greetings, or relevant financial tips. This keeps your business top of mind and fosters long-term loyalty.

Adapting to Customer Needs: Stay agile and adaptive to changing customer needs and preferences. Regularly assess market trends and emerging technologies to ensure your products and services align with evolving customer expectations. Continually innovate and introduce new features or enhancements based on customer feedback and market demands.

Handling Complaints Effectively: Address customer complaints promptly and effectively. Train your staff to handle complaints with empathy and professionalism. Resolve issues to the customer’s satisfaction and use complaints as an opportunity to improve your processes and prevent similar occurrences in the future.

By focusing on building strong customer relationships, you can differentiate your consumer finance business in a crowded market, enhance customer loyalty, and drive long-term growth. Prioritize excellent customer service, personalization, and trust to establish your business as a trusted financial partner and preferred choice for consumers.

In the consumer finance industry, continuous improvement and strategic growth are essential to stay competitive and meet the evolving needs of your customers. By embracing innovation, adopting new technologies, and implementing effective growth strategies, you can expand your customer base, increase revenue, and solidify your position in the market. Here are key points to consider for continuous improvement and growth in the consumer finance industry:

Market Research and Analysis: Continuously conduct market research to identify emerging trends, customer preferences, and market opportunities. Stay informed about changes in regulations, industry competition, and technological advancements. Use this information to optimize your offerings and develop targeted growth strategies.

Innovation and Technological Advancements: Embrace innovation and stay updated with the latest technologies that can enhance your operations and customer experience. Explore digital payment solutions, advanced data analytics, mobile banking apps, and automation tools. Leverage technology to streamline processes, improve efficiency, and deliver greater convenience to your customers.

Product Diversification: Expand your product portfolio to meet a broader range of customer needs. Identify additional services, such as insurance products, investment options, or financial planning services, that align with your business and customer base. Diversification can attract new customers, increase revenue streams, and enhance customer loyalty.

Targeted Marketing and Customer Acquisition: Develop targeted marketing strategies to reach new customer segments. Utilize data analytics and customer segmentation to tailor your marketing messages and channels to specific demographic or psychographic groups. Implement customer acquisition tactics such as referral programs, strategic partnerships, and digital marketing campaigns to attract new customers.

Customer Retention and Upselling: Focus on retaining and deepening relationships with existing customers. Implement strategies to foster loyalty, such as personalized communication, rewards programs, and proactive customer service. Continually analyze customer data and behavior to identify opportunities for upselling or cross-selling additional products or services.

Partnerships and Collaborations: Seek strategic partnerships or collaborations with complementary businesses or industries. This can expand your reach, provide access to new customer segments, and offer opportunities for joint marketing or product development. For example, partnering with a real estate agency can help you connect with potential homebuyers who may require financing.

Enhanced Customer Experience: Continuously seek ways to improve the customer experience at every touchpoint. Conduct customer satisfaction surveys, analyze feedback, and implement necessary improvements. Leverage technology to provide self-service options, streamline processes, and offer personalized financial guidance. Invest in employee training to ensure exceptional customer service across all interactions.

Continuous Education and Industry Involvement: Stay up-to-date with industry trends, regulatory changes, and best practices. Attend industry conferences, join professional associations, and pursue continuing education opportunities for you and your staff. Engage in thought leadership by sharing insights and expertise through articles, speaking engagements, or webinars.

Strategic Acquisitions or Expansion: Explore opportunities for strategic acquisitions or expanding into new markets. Assess the potential benefits, risks, and alignment with your long-term goals. Acquiring established businesses or expanding geographically can provide access to new customer bases, talent, and additional revenue streams.

Financial Analysis and Key Performance Indicators (KPIs): Continually monitor and analyze key financial indicators to assess your business’s performance. Regularly review metrics such as loan portfolio quality, profitability, customer acquisition costs, and customer lifetime value. Use these insights to inform decision-making, identify areas for improvement, and determine the effectiveness of your growth strategies.

Agility and Adaptability: Be agile and adaptable to changing market dynamics and consumer preferences. Continually assess and adjust your strategies as needed. Embrace a culture of continuous improvement, encourage innovation, and empower your employees to contribute ideas and suggestions for growth and optimization.

By embracing continuous improvement and implementing strategic growth strategies, you position your consumer finance business for long-term success and sustainability. Regularly evaluate market trends, innovate, and prioritize customer-centricity to differentiate your business and maximize growth opportunities in the dynamic consumer finance industry.

Starting a consumer finance business requires careful planning, extensive market research, and a focus on delivering excellent customer service. As you navigate through the complex landscape of the consumer finance industry, it is essential to understand the regulatory requirements, manage risks effectively, and continuously adapt to changing market trends.

By conducting thorough market research and analysis, you can identify opportunities, understand customer needs, and position your business for success. Develop a robust business plan that encompasses your market strategy, operational setup, and financial projections.

Obtaining the necessary financing and setting up the legal and regulatory requirements are vital steps in establishing your consumer finance business. Complying with relevant laws and regulations and implementing risk management strategies are essential for maintaining the trust of your customers and protecting your business.

Building strong customer relationships and providing exceptional service are key to winning the loyalty of your customers. Continuously improve your offerings, leverage technology, and tailor your marketing strategies to meet the unique needs and preferences of your target audience.

As you grow and expand your business, prioritize continuous improvement and strategic thinking. Stay informed about industry trends, engage in continuous education, and seek opportunities for collaboration and expansion.

Ultimately, succeeding in the consumer finance industry requires a combination of industry expertise, compliance with regulations, customer-centricity, and a proactive approach to risk management. By focusing on these core elements, you can navigate the competitive landscape, gain a competitive edge, and build a profitable and sustainable consumer finance business.

20 Quick Tips To Saving Your Way To A Million Dollars

Our Review on The Credit One Credit Card

What Is Installment Credit Good For

How To Get A Copy Of My State Tax Return

Latest articles.

Navigating Crypto Frontiers: Understanding Market Capitalization as the North Star

Written By:

Financial Literacy Matters: Here’s How to Boost Yours

Unlocking Potential: How In-Person Tutoring Can Help Your Child Thrive

Understanding XRP’s Role in the Future of Money Transfers

Navigating Post-Accident Challenges with Automobile Accident Lawyers

Related post.

By: • Finance

Please accept our Privacy Policy.

We uses cookies to improve your experience and to show you personalized ads. Please review our privacy policy by clicking here .

- https://livewell.com/finance/how-to-start-a-consumer-finance-business/

- ABLE Microfinance (MFI)

- ABLE Loan Origination

- ABLE Credit Scoring

- ABLE Loan Management

- ABLE Debt Collection

- ABLE Credit Risk Management

- Payday Loans

- Buy now pay later (BNPL)

- POS Lending

- Digital lending

- Personal Loans

- Consumer Lending

- Commercial Lending

- SME Lending

- Agriculture Lending

- Auto Financing

- Mortgage Loans

- Success stories

How To Start A Consumer Lending Business

Till recent years, the lending industry was strongly associated with banks, credit unions, and other financial organizations. The area was rather complicated and required a large staff to operate.

With the development of digital technologies and automated tools, starting a lender business has become much simpler and less time-consuming.

Let’s analyze the process of starting a lending business step by step.

Table of Contents

What is consumer financing?

The term consumer financing refers to the financial tool that enables customers to pay for services or goods in installments instead of repaying the whole sum at once.

In the case of consumer financing, the lenders either offer their own funds or get them from third-party lending companies, such as banks, credit unions, or other alternative funding institutions.

This enables customers to purchase high-ticket goods that they wouldn’t buy if they are sold without installments. The retailers can convert passive browsers into active buyers by offering them consumer finance programs.

The rise of digitization of consumer lending helps shorten the distance between buyers and sellers. Fast and convenient online customer financing allows retailers to easily turn potential clients into regular customers by offering them transparent lending programs on fair and understandable conditions.

The fairer and simpler the consumer financing program is, the better the conversion rate of potential clients into loyal repaying customers.

Consumer financing can be applied not only to luxury or high-ticket goods. It can be used to fund a wide range of services or goods.

Due to the development of digital technologies, online consumer lending made instantaneous purchasing very fast and convenient.

Figure 1 shows the areas of consumer lending with top KPIs: auto financing, vacation and recreation, credit card issuing, luxury and electronic equipment purchasing.

Figure 1. Spheres of consumer lending with the highest KPIs

Consumer financing. The way it works

Simply put, consumer financing is a form of crediting when a loan is repaid for a certain period of time in equal installments. A lender defines the amount of the down payment and collects monthly payments with interest rate until the loan is repaid.

The most crucial reason for outsourcing the service to banks or other alternative lenders is the complexity of accurate risk evaluation and borrower creditworthiness assessment.

Now, with a wide range of digital technologies for lenders, it’s easy to automate risk evaluation, loan origination, decisioning, servicing, collection, and reporting without hiring an underwriting department.

Now, it’s much easier for alternative lenders to get a competitive edge over traditional banks or credit unions. Due to intelligent automation of the lending process at all stages and bank-grade software solutions available for everyone, lending has become safer for lenders and more transparent for borrowers.

The opportunities to launch an online store, start POS financing or issue student loans have become easily accessible to anyone due to online lending automation solutions delivered by experienced software providers.

The spheres for online lending are versatile, from secured and unsecured personal lending to POS financing and real estate crowdfunding. Figure 2 shows the available touchpoints for online lending.

Figure 2. Online lending application touchpoints

Consumer lending company. Steps to start

To successfully launch a lending company, it’s necessary to have a clear picture of how to start a money lending business . Here is a small guide to follow for you.

Business model selection

The online lending industry usually embraces two major business models. The first is focused on consumer lending. The other one has its specialization in commercial lending. They often differ in amounts of funding, interest rates, and repayment periods.

Commercial lending programs are usually referred to short-term loans as a prominent type of loan to operate with. Their characteristics are:

- Loan amounts from $1,000

- The repayment period is 3-18 months

- 13-70% annual interest rates

Online consumer loans (also known as “payday loans”) usually have the following conditions:

- The funding amount is up to $500

- 2-4 weeks for repayment

- Interest rates may go up to 400%

Consumer loans are more appealing to lending companies due to the low-risk rate and smaller funding amounts. In addition, they are offered at significantly higher interest rates and their turnover is much faster than that of business loans.

Business or commercial loans are often less risky and have a comparatively low default probability. But they bring lower profit margins and are repaid in a longer period of time.

Compliance with state legislation and local regulations

Yet online lending is as simple as a few clicks of the mouse, this convenience is often accompanied by the complexity of government regulations and laws.

Without knowing the laws and complying with them, the lending business has a risk of being penalized or even closed. Consultations with experts in the sphere of legislation are vital to ensure full compliance of the lending business.

Business plan creation

After outlining the online lending model type and clearing out laws regulating the industry, the next challenge is writing a detailed business plan. It should be clear and comprehensive and contain the following parts:

- An executive summary should contain the description of what you plan to do, market challenges and opportunities, your leadership qualifications, and advantages in comparison with competitors.

- The detailed business description should comprise full information about strategies of lending and interest rates, describe online branding, operational points of interest, and marketing plans.

- Market research should demonstrate your expertise in the industry, online lending statistics, the potential for revenue, marketing of services, growth points, and expected challenges.

- Team description should include information about the founder and all key team members, and describe their experience and skills that add value to the business for the potential investors.

- Financial data should have detailed projections and reports on anticipated losses and profit, expected revenue, operational costs calculation, and cash flow statements for at least three next years.

Business planning

During the stage of planning, it’s necessary to choose a brand name and incorporation type, and figure out the way of lending company financing. It’s vital to have consultations with all necessary experts or attorneys at this stage to clear up all disputable questions.

Underwriting criteria are also defined at this stage for efficient and fast loan application assessment while staying compliant with different legal rules and regulations governing the market.

Search of funding sources

The funding of an online lending company can be realized either by the founder, investors, or have a mixed basis.

It’s possible to collect the necessary funds from family, friends, or through crowdfunding. The involvement of independent investors is often more complicated because they usually carefully study the perspectives of the future lending endeavor.

A mixed or hybrid approach is a usage of funding from private investors and commercial loans to get to a point of launching the business.

Obtaining merchant services

The availability of reliable and fair merchant services is the right start for an online lending business. Since all payments are collected electronically, the appropriate equipment for card processing is a must-have for accepting direct payments and credit cards.

But obtaining approval for payment processing can be rather complicated in the lending industry because alternative lenders are often ranked as “highly risky” by banks.

Site launching

As a qualified lender, you need to have an official website to maintain your brand. To launch a site, it’s necessary to find an experienced web developer.

The web developer should have a full understanding of the importance of designing a GDPR-compliant website for the company. To ensure website security, it’s necessary to implement effective security and encryption services for the protection of borrowers’ financial and personal information.

Building a contingency plan

A contingency plan is another must, since starting to extend loans to customers. It’s necessary for the continuous evolution of business strategy and for building further experience and knowledge.

Bearing in mind the changes in legislation and local rules, contingency plan development is a wise choice to always comply with them and stay as flexible and adaptable as possible.

Digital solutions for online lending

While launching an online money lending business, you may face lots of challenges on the way. At ABLE Platform, we hope our small guide will help you solve the majority of them. As well, software solutions designed by our team can lead your lending business to success.

Mikhail Chirkunov

Founder and CEO

Copyright © 2023 ABLE Platform Inc.

By submitting your request you agree with our Privacy and Cookies Policy.

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, how often should a business plan be updated, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

- How to Start a Business: A Comprehensive Guide and Essential Steps

- How to Do Market Research, Types, and Example

- Marketing Strategy: What It Is, How It Works, How To Create One

- Marketing in Business: Strategies and Types Explained

- What Is a Marketing Plan? Types and How to Write One

- Business Development: Definition, Strategies, Steps & Skills

- Business Plan: What It Is, What's Included, and How to Write One CURRENT ARTICLE

- Small Business Development Center (SBDC): Meaning, Types, Impact

- How to Write a Business Plan for a Loan

- Business Startup Costs: It’s in the Details

- Startup Capital Definition, Types, and Risks

- Bootstrapping Definition, Strategies, and Pros/Cons

- Crowdfunding: What It Is, How It Works, and Popular Websites

- Starting a Business with No Money: How to Begin

- A Comprehensive Guide to Establishing Business Credit

- Equity Financing: What It Is, How It Works, Pros and Cons

- Best Startup Business Loans

- Sole Proprietorship: What It Is, Pros & Cons, and Differences From an LLC

- Partnership: Definition, How It Works, Taxation, and Types

- What is an LLC? Limited Liability Company Structure and Benefits Defined

- Corporation: What It Is and How to Form One

- Starting a Small Business: Your Complete How-to Guide

- Starting an Online Business: A Step-by-Step Guide

- How to Start Your Own Bookkeeping Business: Essential Tips

- How to Start a Successful Dropshipping Business: A Comprehensive Guide

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.

- For established companies, a business plan can help keep the executive team focused on and working toward the company's short- and long-term objectives.

- There is no single format that a business plan must follow, but there are certain key elements that most companies will want to include.

Investopedia / Ryan Oakley

Any new business should have a business plan in place prior to beginning operations. In fact, banks and venture capital firms often want to see a business plan before they'll consider making a loan or providing capital to new businesses.

Even if a business isn't looking to raise additional money, a business plan can help it focus on its goals. A 2017 Harvard Business Review article reported that, "Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs."

Ideally, a business plan should be reviewed and updated periodically to reflect any goals that have been achieved or that may have changed. An established business that has decided to move in a new direction might create an entirely new business plan for itself.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. These include being able to think through ideas before investing too much money in them and highlighting any potential obstacles to success. A company might also share its business plan with trusted outsiders to get their objective feedback. In addition, a business plan can help keep a company's executive team on the same page about strategic action items and priorities.

Business plans, even among competitors in the same industry, are rarely identical. However, they often have some of the same basic elements, as we describe below.

While it's a good idea to provide as much detail as necessary, it's also important that a business plan be concise enough to hold a reader's attention to the end.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, it's best to fit the basic information into a 15- to 25-page document. Other crucial elements that take up a lot of space—such as applications for patents—can be referenced in the main document and attached as appendices.

These are some of the most common elements in many business plans:

- Executive summary: This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services: Here, the company should describe the products and services it offers or plans to introduce. That might include details on pricing, product lifespan, and unique benefits to the consumer. Other factors that could go into this section include production and manufacturing processes, any relevant patents the company may have, as well as proprietary technology . Information about research and development (R&D) can also be included here.

- Market analysis: A company needs to have a good handle on the current state of its industry and the existing competition. This section should explain where the company fits in, what types of customers it plans to target, and how easy or difficult it may be to take market share from incumbents.

- Marketing strategy: This section can describe how the company plans to attract and keep customers, including any anticipated advertising and marketing campaigns. It should also describe the distribution channel or channels it will use to get its products or services to consumers.

- Financial plans and projections: Established businesses can include financial statements, balance sheets, and other relevant financial information. New businesses can provide financial targets and estimates for the first few years. Your plan might also include any funding requests you're making.

The best business plans aren't generic ones created from easily accessed templates. A company should aim to entice readers with a plan that demonstrates its uniqueness and potential for success.

2 Types of Business Plans

Business plans can take many forms, but they are sometimes divided into two basic categories: traditional and lean startup. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These plans tend to be much longer than lean startup plans and contain considerably more detail. As a result they require more work on the part of the business, but they can also be more persuasive (and reassuring) to potential investors.

- Lean startup business plans : These use an abbreviated structure that highlights key elements. These business plans are short—as short as one page—and provide only the most basic detail. If a company wants to use this kind of plan, it should be prepared to provide more detail if an investor or a lender requests it.

Why Do Business Plans Fail?

A business plan is not a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections to begin with. Markets and the overall economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All of this calls for building some flexibility into your plan, so you can pivot to a new course if needed.

How frequently a business plan needs to be revised will depend on the nature of the business. A well-established business might want to review its plan once a year and make changes if necessary. A new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is an option when a company prefers to give a quick explanation of its business. For example, a brand-new company may feel that it doesn't have a lot of information to provide yet.

Sections can include: a value proposition ; the company's major activities and advantages; resources such as staff, intellectual property, and capital; a list of partnerships; customer segments; and revenue sources.

A business plan can be useful to companies of all kinds. But as a company grows and the world around it changes, so too should its business plan. So don't think of your business plan as carved in granite but as a living document designed to evolve with your business.

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

U.S. Small Business Administration. " Write Your Business Plan ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Reinventing the Direct-to-Consumer Business Model

- Leonard A. Schlesinger,

- Matt Higgins,

- Shaye Roseman

Instagram ads and influencer campaigns can only take you so far.

Over the past decade, a new breed of “direct-to-consumer” startups including Warby Parker and Casper helped forge a new business model. But lately that business model is faltering as the advantages that early entrants enjoyed have evaporated. To retool, DTC companies will need to embrace an omnichannel strategy, create tighter ties with their communities, and vertically integrate to increase margins.

For decades, a handful of brands dominated consumer retail in the United States. Whether Kodak in cameras or Gillette in razors, the top brands in more than 10 categories were unchanged from 1923 to 1983.

- Leonard A. Schlesinger is the Baker Foundation Professor at Harvard Business School, where he serves as chair of its practice-based faculty.

- Matt Higgins is an executive fellow at Harvard Business School and a cofounder of RSE Ventures, a private investment firm. He is the author of Burn The Boats: Toss Plan B Overboard and Unleash Your Full Potential .

- SR Shaye Roseman is a member of the 2021 MBA Class at Harvard Business School.

Partner Center

Language selection

- Français fr

Financial Consumer Agency of Canada Business Plan 2024–2025

From: Financial Consumer Agency of Canada

Business Plan 2024–2025 [ PDF - 309 KB ]

Information contained in this publication or product may be reproduced, in part or in whole, and by any means, for personal or public non-commercial purposes without charge or further permission, unless otherwise specified.

Commercial reproduction and distribution are prohibited except with written permission from the Financial Consumer Agency of Canada.

For more information, contact:

Financial Consumer Agency of Canada 427 Laurier Ave. West Ottawa, Ontario K1R 7Y2

ww.canada.ca/en/financial-consumer-agency

Cat. No. FC2-4E-PDF (PDF, English)

ISSN 2562-5896

©His Majesty the King in Right of Canada, as represented by the Minister of Finance Canada, May 2024.

Aussi disponible en français sous le titre : Plan d’activités 2024-2025

Message from the Interim Commissioner

I am pleased to present the 2024–2025 Business Plan for the Financial Consumer Agency of Canada (FCAC).

The transformation of the financial services industry and the escalating pace of change is continuing. This brings both risks and opportunities that require all members of the financial ecosystem to work together to protect financial consumers and support their diverse needs. The Agency’s activities for the coming fiscal year demonstrate an ongoing commitment to advance the rights and interests of consumers in this changing and challenging environment.

The Agency is currently in a transition phase as we await the appointment of a new Commissioner. During this time, we will continue the steady progress we’ve achieved over the past 4–5 years. This includes advancing the strategic goals identified in our five-year 2021–2026 Strategic Plan, which position us to be a leader and innovator in financial consumer protection.

The Agency can also look forward to taking on new responsibilities because of Budget 2024, which included announcements that demonstrate the importance of our consumer protection mandate. FCAC will be mandated to oversee, administer and enforce a Consumer–Driven Banking Framework (also known as open banking). We are excited about this opportunity which we are well-placed to take on. Our policy, research and education functions have already made important contributions to the development of a future framework that prioritizes innovation and ensures strong and consistent protection for financial consumers.

The Agency will remain focused on mobilizing efforts to advance financial consumer protections, guided by the milestone Financial Consumer Protection Framework and our ambitious National Financial Literacy Strategy. We will also continue to grow our capacity to leverage data and conduct cutting-edge research. Data-driven approaches, such as our analysis of regulatory data and the National Strategy’s Measurement Plan, are an essential component of designing effective interventions and informing policy responses to protect consumers and enable them to build financial resilience.

As always, at the core of everything we do is our people. We know that by investing in our team members and promoting initiatives that prioritize their well-being, we not only enhance individual growth but also propel the organization towards greater heights of achievement. This work is founded on a commitment of continuous improvement, and includes actions to modernize our internal processes, enhance our risk management practices, and administer our resources in an effective and disciplined manner.

It is an honour to lead FCAC during this exciting period. FCAC is adapting to changing dynamics in the financial sector, embracing emerging technologies, and responding to evolving regulatory frameworks. We are staying ahead of the curve and meeting the needs of Canadians in an ever-changing landscape.

Werner Liedtke Interim Commissioner

The Financial Consumer Agency of Canada (FCAC) is a federal government agency that was established in 2001 to protect the rights and interests of Canadian consumers of financial products and services. FCAC derives its mandate from the Financial Consumer Agency of Canada Act .

As a regulator, FCAC protects financial consumers by supervising the compliance of federally regulated entities with their market conduct obligations as established by legislation, codes of conduct and public commitments. The Supervision Framework describes the Agency’s approach and the variety of supervisory tools and activities that FCAC uses to promote, monitor and enforce the obligations that govern federally regulated entities in Canada’s financial ecosystem.

The Agency is also mandated to strengthen the financial literacy of Canadians and:

- promote awareness of the rights and responsibilities of Canadians in their dealings with financial institutions

- monitor, evaluate and promote awareness of trends and issues that may affect financial consumers

- develop and publish research, content, tools and programs to strengthen the financial literacy of Canadians

- foster an understanding of financial services and related issues in collaboration with stakeholders, including government, regulatory and community organizations

Our vision and mission

To be a leader and innovator in financial consumer protection

Our mission