dVIDYA : e-learning | CA/CS/CMA Foundation | CBSE/ISCE/Boards- Class 11-12 | Competitive Exams

Practical Assignments : GST Accounts–Tally

The Practical Assignments-Tax Accounts- covers Basic tasks of Maintaining GST Accounts, from set up, Data Entry to GST Reports, in Tally Prime Rel 3.x.

This assignment is in continuation to Practical Assignments of Basic Financial Accounting & Basic Invoicing & Inventory Accounts. Maintain GST Accounts in the same Company in which Basic Financial Accounts and Basic Invoicing & Inventory Accounts Practical Assignments data were entered.

Perform the operations for each Assignment as explained. Capture the screenshots (Prtscr) and paste it in MS Word file in 1×1 cell. Write the number and Name of screen shot as indicated. Explain the options and operational step.

This way, capture the screenshots and place in MS Word file, in sequence. Don’t repeat same screenshot.

After completing all assignments, take Back up of the data files. Now email to [email protected], attaching the Data Back Up file and screenshot zip file.

GST Accounting – Practical Assignments

Continue in same Company after previous assignments

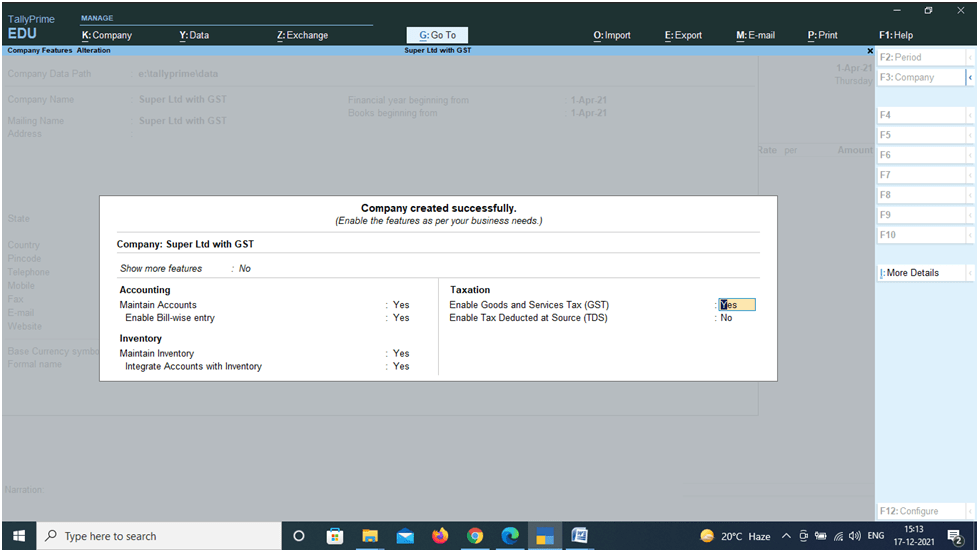

01-1 Company GST Features

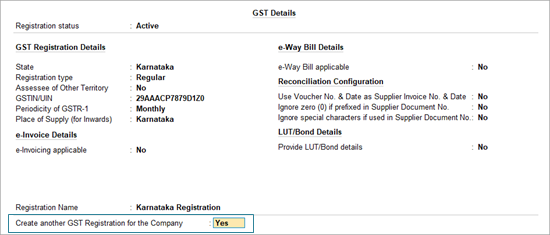

[At Company >Click F11. At Company Features , under section Taxation , set Yes at Enable Goods & Services Tax (GST) . Next, At GST Details screen , under GST Registration Details section, enter the relevant details.]

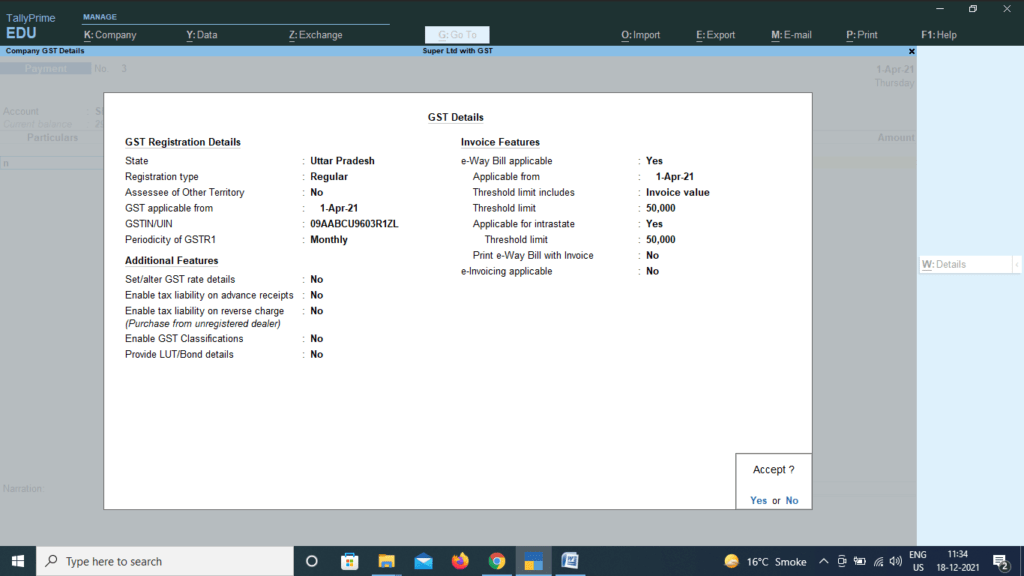

Capture Screenshot 1-1A : Company Features . 1-1B : Company GST Details set up

For more details, visit

https://dvidya.com/goods-service-tax-gst/ https://dvidya.com/goods-services-tax-gst-set-up-composition-dealers-tally/ https://dvidya.com/goods-services-tax-gst-set-up-regular-dealers-tally/ https://youtu.be/STv3wbduT8A https://youtu.be/RwJJIYC6msE https://youtu.be/VSS48c_LZXY https://youtu.be/OjSvFYUJ_bI https://youtu.be/mLrLyOeDX78 https://youtu.be/7wlTsturfks

02 GST Masters

02-1 Create SGST Ledger Account Master

[Select GoT>Create> Ledger. At Ledger Account creation , at Name , enter SGST; at Under , select Duties & Taxes ; at Tax Type , select SGST/UTGST ; At Inventory Values are affected , set No .

Capture Screenshot 1-2 : SGST Ledger Account Creation.

https://dvidya.com/gst-set-up-accounts-inventory-masters-tally/ https://youtu.be/x8VZLjVEeug https://youtu.be/XVZbi0-ufDY https://youtu.be/Uzsise4yZXg

02-2 Create CGST Ledger Account Master

[Select GoT>Create> Ledger. At Ledger Account creation , at Name , enter CGST; at Under , select Duties & Taxes ; at Tax Type. At Inventory Values are affected , set No . Capture Screenshot 2-2 : CGST Ledger Account Creation.

02-3 Create IGST Ledger Account Master

[Select GoT>Create> Ledger. At Ledger Account creation , at Name , enter IGST; at Under , select Duties & Taxes ; at Tax Type select I GST ; At Inventory Values are affected , set No .

Capture Screenshot 2-3 : CGST Ledger Account Creation.

https://youtu.be/XVZbi0-ufDY

02-4 UQC set up in UoM Master

Set UQC in UoM – Kilograms [Select GoT>Alter> Unit. Select Kilogram. At Unit Alteration , at Unit Quantity Code (UQC) , select KGS-Kilograms from the UQC list. Press Ctrl+A to save].

Capture Screenshot 2-4 : UoM-UQC set up.

https://youtu.be/KAKto78n9fQ

02-5 GST details set up in Stock Item Master

Set GST details in Stock Item Wheat, Select GoT>Alter> Item. Select Wheat, At Stock Item Alteration, Under HSN/SAC & Related Details, at HSN/SAC Details , select Specify Details Here. At HSN Description – Food grains, HSN Code- 1234, At Description of Goods, select Specify Details Here , Under GST Rate and related Details, At GST Rate details, select Specify Details Here . At Taxability Type, select Taxable . At GST Rate, enter the GST Rate applicable for the Item. At Type of Supply, select Goods .

2-5 : Capture Screenshot UoM-UQC set up.

https://youtu.be/U7fuonC9dkI https://youtu.be/LK-df_Oh6Vk

02-6 Set GST details in Supplier Master

At Supplier Ledger Account, enter Tax related details [Select GoT>Alter>Ledger, select ABC & Co. At Ledger Alteration, click F12:Configure. At Ledger Master Configuration screen, under Party Tax Registration details , set Yes at Provide GST Registration details . At Tax Registration details of Ledger Account Master, Enter Registration Type- Regular, GSTIN 19AAAC1234K1ZV. At Set Alter Additional Details, set Yes and then Place of Supply, select the State of the Party.

Capture Screenshot : 2-6A: Ledger Account Master, 2-6B: Ledger Master Configuration screen,

https://youtu.be/1_jlZD8mXkI https://youtu.be/B6jEPMw26Tg

03 GST Invoicing

3-1 Create GST Sales Invoice .

Create Sales Invoice for 10 kg of Wheat @25 per kg sold to ABC & Co on 1-5-21. [Select GoT>Vouchers. Click F8:Sales (or press F8). Select Sales Voucher type from List. Click Ctrl+H and select Item Invoice . Enter Voucher Date 1-5-21 . At Party A/c Name , select ABC & Co . At Sales Ledger, select Sales . At Name of Item , select Wheat , At Quantity , enter 10 kg. at Rate , enter 25/kg. The amount 250 would be shown. In next line, select End of List . Next select SGST, the SGST amount (15.00) would be auto calculated. Next select CGST. the CGST amount (15.00) would be auto calculated. The total Invoice amount (250.00+15.00+15.00 = 280.00) is displayed. Press Ctrl+A to save the Voucher].

Capture Screenshot : 3-1 GST Sales Invoice Entry ,

https://youtu.be/L57aR4Zb7GM https://youtu.be/S0y56oS7r1U

3-2 Print the Sales Voucher

Voucher dated 1-5-23 on ABC Co [Select GoT>Day Book . At Day Book display, press F2 and Date 1-5-23. Select the Sales Voucher from the list to get the Voucher Alteration. Press Ctrl+P to get the Print screen. Click I:Preview to View the Print form of the Invoice on screen]

Capture Screenshot : 3-2 GST Sales Invoice in Print ,

https://youtu.be/L57aR4Zb7GM https://youtu.be/S0y56oS7r1U

03-03 GST Reports

- Display GSTR-1 for 1-4-23 to 31-7-23

[Select GoT>Display more reports>GST Reports>GSTR-1. Click F2:Period (or press F2) and enter Period from 1-4-23 to 31-7-23 to display GSTR-1 Report

Capture Screenshot : 3-3 GSTR-1 Display, https://dvidya.com/gsrt-1-return-filing-tally/

Dvidya: Hello Student, How can I help you!

Ask Question, Get Answer

This will close in 0 seconds

- Class 6 Maths

- Class 6 Science

- Class 6 Social Science

- Class 6 English

- Class 7 Maths

- Class 7 Science

- Class 7 Social Science

- Class 7 English

- Class 8 Maths

- Class 8 Science

- Class 8 Social Science

- Class 8 English

- Class 9 Maths

- Class 9 Science

- Class 9 Social Science

- Class 9 English

- Class 10 Maths

- Class 10 Science

- Class 10 Social Science

- Class 10 English

- Class 11 Maths

- Class 11 Computer Science (Python)

- Class 11 English

- Class 12 Maths

- Class 12 English

- Class 12 Economics

- Class 12 Accountancy

- Class 12 Physics

- Class 12 Chemistry

- Class 12 Biology

- Class 12 Computer Science (Python)

- Class 12 Physical Education

- GST and Accounting Course

- Excel Course

- Tally Course

- Finance and CMA Data Course

- Payroll Course

Interesting

- Learn English

- Learn Excel

- Learn Tally

- Learn GST (Goods and Services Tax)

- Learn Accounting and Finance

- GST Tax Invoice Format

- Accounts Tax Practical

- Tally Ledger List

- GSTR 2A - JSON to Excel

Are you in school ? Do you love Teachoo?

We would love to talk to you! Please fill this form so that we can contact you

You are learning...

Click on any of the links below to start learning from Teachoo ...

Learn Latest Tally ERP9 with GST free at Teachoo. Notes and videos provided on how to put ledgers, learn in which head the ledger will come, important tally features, reports and errors in Tally, how to prepare files for return filing

To practice GST Return Filing with Tally, take our Tally course .

In this Tally Tutorial, we cover

- Basics - What is Tally, How to install Tally for GST, Creating Company in Tally ERP9

- Ledgers - Creating Ledgers, Heads in which Ledger comes, Seeing Ledgers created, Alter or Changing Ledgers, Putting Opening Balances in Tally

- Passing Entries in Tally - Type of Accounting Vouchers in Tally ERP9, Seeing Entries Passed, Passing Duplicate Entries, Deleting Entries, Passing Receipt, Payment, Contra Entries, Passing Purchase Entries, Sales Entries, Mixed Entries

- Important Tally Features - Tally Shortcuts, Copying Narration in Tally, Copying Tally GST Data in Pendrive, How to Paste or load Tally Data, Mailing Tally Data, Exporting Tally Data in Excel or PDF, Seeing Party or Ledger Balance, Printing Voucher in Tally, Checking Daily Breakup of Transactions in Tally, Deleting Company from Tally

- Important Tally Reports - Debtor Aging Report, Cost Center Reporting/Segment Reporting, BRS (Bank Reconciliation in Tally)

- Common Errors in Tally - Duplicate Ledger, Period not accepting while passing entries in Tally, Difference in opening balances

Get the notes now... Click a topic to start!

You can now watch free videos for these Topics....Click a topic to watch!

You can also download various topics as assignments

Basics of Tally

Ledger creation and alteration, passing entry in tally, important tally features, important tally reports, common errors in tally.

What's in it?

Hi, it looks like you're using AdBlock :(

Please login to view more pages. it's free :), solve all your doubts with teachoo black.

Tally Prime Course Notes : GST Ledger and Voucher Entry

Tally Prime with GST Course Notes with Example. Step by Step Guide for GST implementation, create CGST, SGST, IGST ledgers, Sample Purchase and Sales entry with GST. Computer Training Institute Notes with practice assignment PDF is very useful for learners.

GST (Goods and Service Tax)

CGST – Centre Goods and Service Tax SGST – State Goods and Service Tax IGST – Integrated Goods and Service Tax

GST Rates slab in India

Tally prime course notes with gst : step by step guide.

Open New Company : F3 Company >Create Company

Activate GST in Tally Prime

Taxation Enable Goods and Service Tax (GST): Yes

GST Details State : Uttar Pradesh Reg Type : Regular GSTIN : 09AABCU9603R1ZL Periodicity : Monthly

Accept GST details and Accept Statutory and Taxation

Create GST Ledgers in Tally Prime

Gateway of Tally > Create > Ledgers

CGST Name : CGST Under : Duties and Taxes Type of Tax : GST Tax Type : Central Tax

SGST Name :SGST Under : Duties and Taxes Type of Tax : GST Tax Type : State Tax

IGST Name :IGST Under : Duties and Taxes Type of Tax : GST Tax Type : Integrated Tax

Purchase Under : Purchase Account GST Details : Applicable Type of Supply : Goods

Sales Under :Sales Account GST Details : Applicable Type of Supply : Goods

SBI Bank Under : Bank Account

Ledger for Purchase Party

Super Computer Store

Under : Sundry Creditors State : Uttar Pradesh Reg Type : Regular GSTIN : 09AABCD1203R1ZL Set Alt GST details : No

Delhi Computer Traders

Under : Sundry Creditors State : Delhi Reg Type : Regular GSTIN : 09AABCD1203R1ZL Set Alt GST details : No

Ledger for Sales Party

Sudhir Saini Under : Sundry Debtors Set Alt GST details : No State : Uttar Pradesh

Sanju Rawat Under : Sundry Debtors Set Alt GST details : No State : Uttarakhand

Stock Group Creation : Gateway of Tally> Create > Stock Group

Computer Parts Under : Primary Set / Alt GST : No

Note: If all the items of a group have same GST rate, than GST rates can be set for groups. But for training purpose, we will set GST rate for each individual items.

Create Unit : Gateway of Tally> Create > Stock Units

Symbol : Pcs Name : Pieces

Create Stock Items with GST Rates in Tally Prime

Gateway of Tally> Create > Items

Keyboard –Dell Under : Computer Parts Unit : Pcs GST : Applicable Set/Alter GST : Yes Calculation Type : On Value Taxability : Taxable Tax Type : Integrated : 18% Type of Supply : Goods

Keyboard – HP Under : Computer Parts Unit : Pcs GST : Applicable Set/Alter GST : Yes Calculation Type : On Value Taxability : Taxable Tax Type : Integrated : 18% Type of Supply : Goods

Mouse (Normal) Under : Computer Parts Unit : Pcs GST : Applicable Set/Alter GST : Yes Calculation Type : On Value Taxability : Taxable Tax Type : Integrated : 18% Type of Supply : Goods

Mouse (Cordless) Under : Computer Parts Unit : Pcs GST : Applicable Set/Alter GST : Yes Calculation Type : On Value Taxability : Taxable Tax Type : Integrated : 18% Type of Supply : Goods

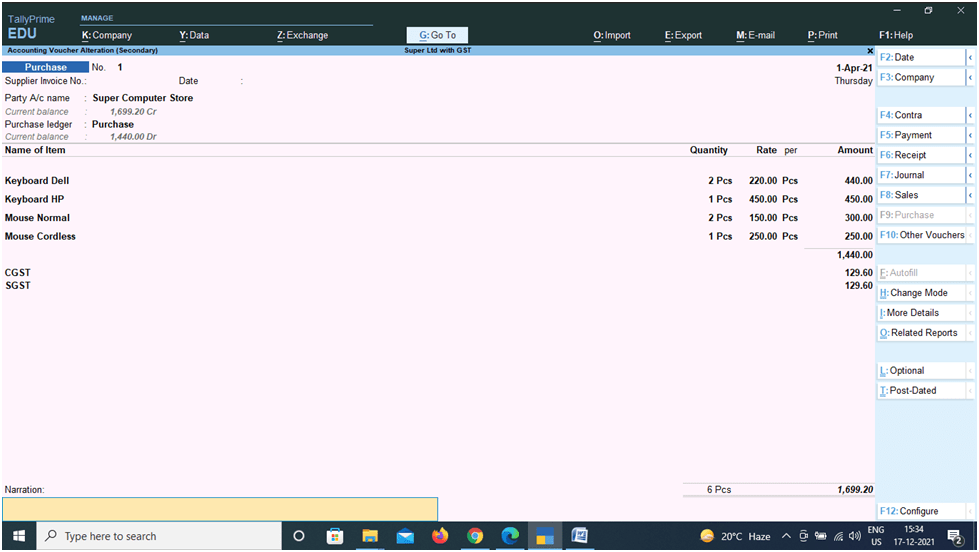

Purchase the Items with GST in Tally Prime

Purchase with in state: cgst and sgst applicable.

Gateway of Tally > Voucher > F9 (Purchase) Party Account : Super Computer Store

Enter and Accept : Our company is Registered in Uttar Pradesh and supplier Super Computer Store is also from Uttar Pradesh (Same State). Therefore, CGST and SGST are applicable. Screen Shot is shown below:

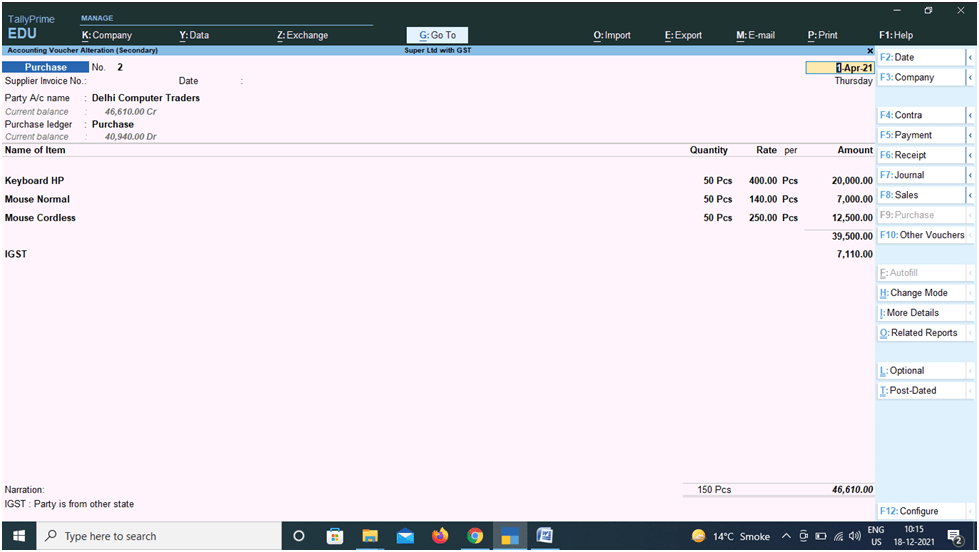

Purchase from Other State : IGST Applicable

Gateway of Tally > Voucher > F9 (Purchase) Party Account : Delhi Computer Traders

Our company is Registered in Uttar Pradesh and supplier Delhi Computer Trader is from Delhi (Other State). Therefore, IGST are applicable, in place of SGST and CGST. Screen Shot is given below:

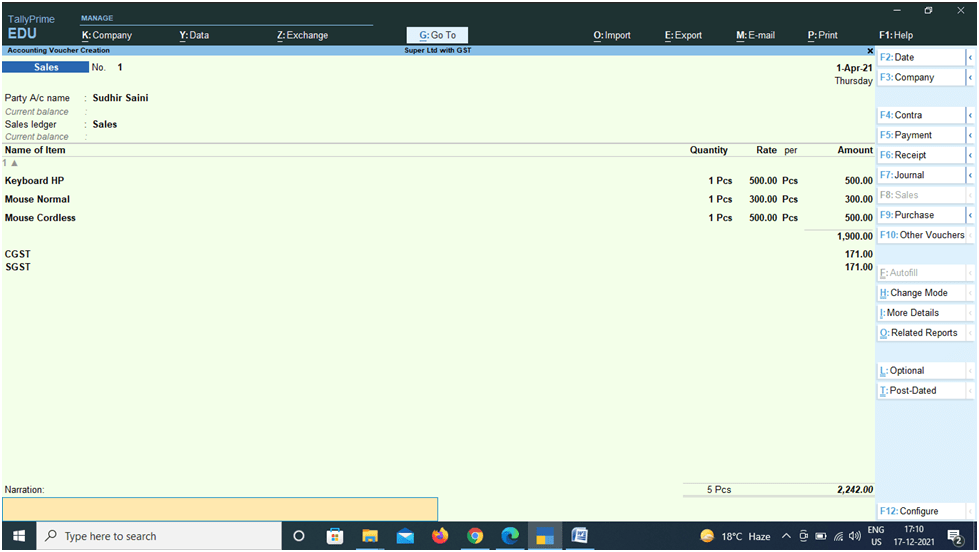

Sales the Items: with in State : CGST and SGST Applicable

GOT > Account Voucher > F8 (Sales) Party Account : Sudhir Saini

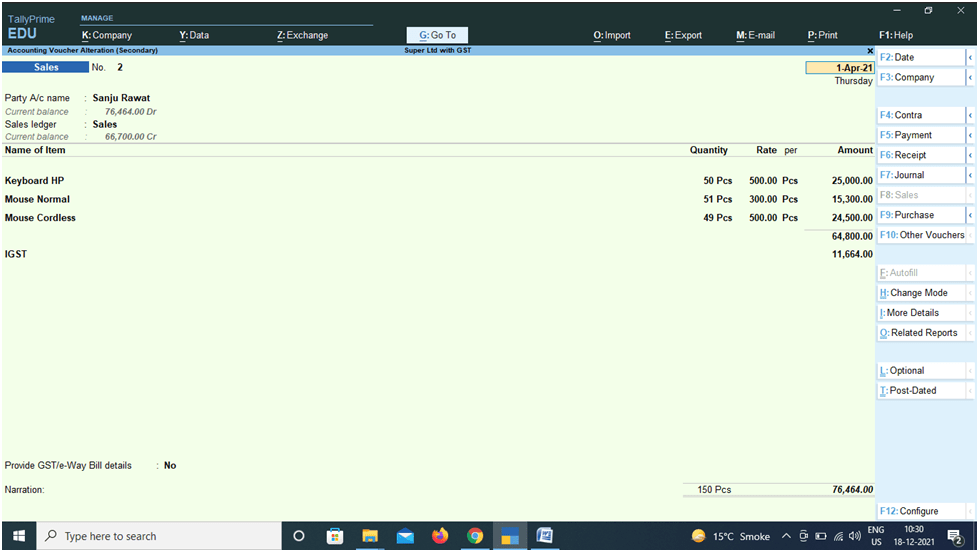

Sales the Items: Other State : CGST and SGST Applicable

GOT > Account Voucher > F8 (Sales) Party Account : Sanju Rawat ( Uttarakhand) Sales Ledger : Sales

Check Reports

Display More Report > Statement of Accounts > Outstanding > Receivable/ Payables Balance Sheet

Receive Amount against Sale

Gateway of Tally > Voucher > F6 (Receipt) Account : Cash Cr Sudhir Saini : 2242 Accept

Account : SBI Bank Cr Sanju Rawat : 76464 Accept

Make Payment to Supplier

Gateway of Tally > Voucher > F5 (Payment) Account : Cash Super Computer Store (Dr): 1699.20 Accept

Account : SBI Bank Dr Delhi Computer Traders : 76464 Accept

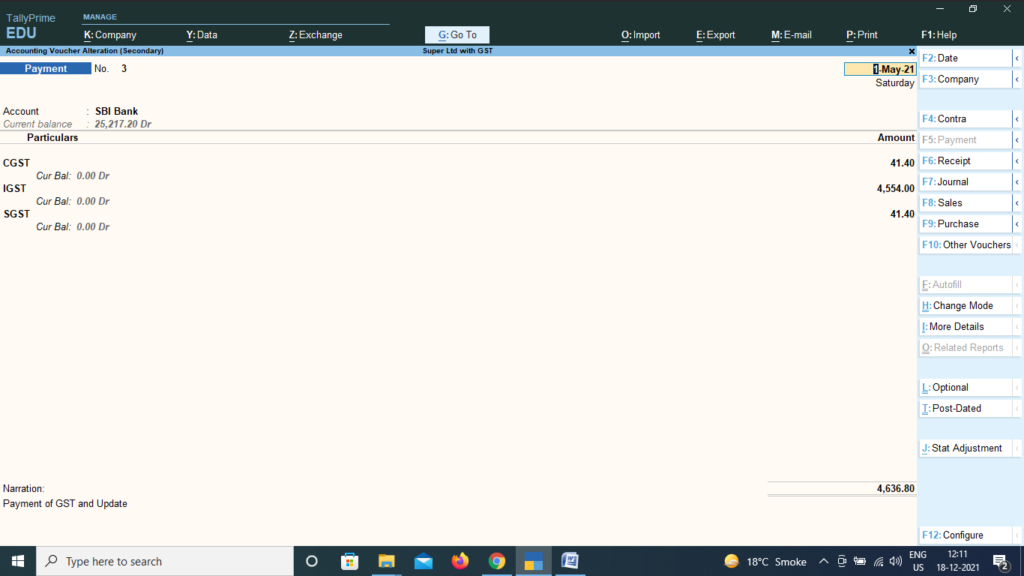

Report Balance Sheet > Current Liabilities

Duties and Taxes : 4636.80 CGST : 41.40 IGST : 4554.00 SGST : 41.40

Pay GST and Update in Tally Prime

Gateway of Tally > Vouchers >Payment (F5) Change Date F2 – 1.5.2021 ( For Tally training version)

Account -SBI Bank CGST : 41.40 SGST : 41.40 IGST : 4554.00 Total : 4636.80 Mode of Payment : Net banking / Name of Bank : SBI

Check Balance Sheet > Current Liabilities > Duties and Taxes – NIL

Tally Prime Course Notes PDF Download

Download Tally Computer Course Notes and Practice Assignment Bill Book PDF :

Tally Prime Notes : All Topic

Getting Started with GST in TallyPrime

Once you have packed the essentials for your GST journey, TallyPrime is here to ensure that your journey goes as smoothly as possible. This article will show you how you can easily get started with GST in TallyPrime.

Let us begin with a few baby steps. First and foremost, you will have to enable GST in TallyPrime and save the details of your GST registration in the Company. These details, such as State, GSTIN/UIN, and so on , will be reflected in your transactions, and you can easily print them in your invoices.

Moreover, your business might have multiple GST registrations (GSTINs) to cater to multiple branches or units, which are an integral part of your own company. TallyPrime understands your special needs, and accordingly it allows you to conveniently save the details of all your registrations in the same company. After saving the details, you can select the relevant registration while recording transactions, and also view the combined financial reports for all your GST registrations. What’s more, you can also file your GST returns based on the required registrations.

Set Up GST Rates and HSN/SAC Details

The next order of business is setting up GST rates. You can easily save these details in TallyPrime, according to the nature of goods or services that your business deals with. TallyPrime offers you the flexibility to apply these rates at various levels, depending on your comfort and business requirements. For example, you can configure the GST rates up front for your company, or you can apply the rates directly in the transaction.

What’s more, TallyPrime will also help you select the source or order in which you want to apply the tax rates. For example, if some of your stock items belong to a single stock group and fall under a common tax rate, then you can directly set the tax rate in the stock group. This rate will be subsequently applied to all the corresponding stock items. Moreover, you will always have a clear idea of where the rates are being applied from, by opening GST – Tax Analysis from the transactions.

Similarly, you can set up HSN/SAC details at different levels, and also override these details in transactions, if needed

Set Up GST Details for Parties

Once you have set up the GST details for your company, it is time to save the GST details for your parties as well. TallyPrime will help you create ledgers for all your customers or suppliers, and store the required details, such as GSTIN/UIN, Registration Type, Place of Supply, Assessee of Other Territory information, and so on.

Moreover, TallyPrime also provides you with the option to maintain a common party ledger across transactions. If you do not want to maintain GST details (such as GSTIN) for all your parties separately, then you can create a common party ledger and enter the GST details directly in the transaction. Even if you have saved certain details in the common party ledger, you will have the option to override them in the transaction.

What’s more, with TallyPrime you can specify the Effective Date for any change in the party details, and also view the history of the registration details at any point in time.

Set Voucher Numbering

TallyPrime will also help you comply with department guidelines for maintaining GST transactions. For example, the department requires sequential voucher num bering for your GST invoices, and accordingly TallyPrime will help you in easily creating and maintaining multiple series of voucher numbers.

Create or Update Masters for GST

TallyPrime also provides you with a host of other masters and ledgers that will help you record your GST transactions in peace. For example, you have sales and purchase ledgers for GST, GST duty ledgers, service ledgers, expense/income/round-off ledgers, discount ledger s, and so on.

Moreover, TallyPrime also provides you with the option to use your ledgers in a flexible manner, depending on your needs. For example, you can use a non-tax ledger (such as Direct Expenses) as a Duties and Taxes ledger. I f you are a composition dealer, then you can use a Direct Expenses ledger to record tax details, such as the type and percentage of tax. This will help you calculate and apply taxes easily in your transactions, while also recording the tax as a cost or Direct Expense in your financial records. Similarly, you have the flexibility to use Current Assets and Current Liabilities for either sales or purchases, depending on your business requirements. TallyPrime provides you with the freedom to use your masters and ledgers based on the way your business operates.

Enable GST for Your Company – Single and Multi-Registration

To use GST in TallyPrime, you have to first enable GST for your company. After that, you can easily save the GST details such as State, GSTIN/UIN, Registration Type, and so on. Once these details are saved in the company GST Details, they will be reflected in your GST transactions. Once GST is activated in the Company, GST-related features will be available in ledgers, stock items, and transactions, and you can conveniently generate GST returns for your business.

Furthermore, if your company has multiple GST registrations (GSTINs), then you can conveniently save the details of all your registrations within the same company, and select the relevant registration while recording transactions. All the transactions for your GST registrations will be saved in the same company, and accordingly you can easily view the combined financial reports for all your registrations.

- Open the company and press F11 > Enable Goods and Services Tax (GST) > Yes .

- State : The State selected during Company Creation will be reflected here. If you update the State here, it will also be updated in the Company and existing transactions.

- Registration type : You can select the Registration type as Regular, Composition, or Regular – SEZ, as per your original GST registration with the department.

- Assessee of Other Territory : If your business is located in an Exclusive Economic Zone (Other Territory). then you can enable this option. GST details will be applied accordingly in your masters and transactions.

- Periodicity of GSTR-1 : Select the Periodicity of GSTR1 as Monthly or Quarterly, based on the annual turnover of your business. To know more about periodicity and other filing details, refer to our blog .

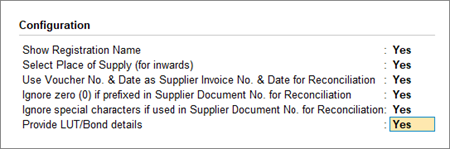

- Use Voucher No. & Date as Supplier Invoice No. & Date : Once you enable this option, the Voucher No. and Date will be considered as the Supplier Invoice No. and Date during reconciliation. In other words, even if you have not provided the Supplier Invoice No. and Date, then you don’t have to worry, as the Voucher No. and Date will be considered.

- Ignore zero (0) if prefixed in Supplier Document No. : If your business does not prefix zeroes in the Document No., but your supplier follows this practice, then this might lead to a mismatch during reconciliation. However, once you enable this option, then the prefixed zeroes will be ignored, and you won’t have to worry about a mismatch.

- Ignore special characters if used in Supplier Document No. : If your supplier prefers to use special characters, such as hyphen and slash, in the document number, then it might cause issues during reconciliation. However, once you enable this option, such special characters will be ignored and you will have a smooth reconciliation.

- Registration Name : This will be derived from the State selected earlier. For example, if you have selected Karnataka, then the Registration Name will appear as Karnataka Registration for easy identification. However, you will have the option to rename the registration, as needed. For example, if you have many branches or GST registrations in Karnataka, you can name the branches as Bengaluru Branch, Mangalore Branch, and so on.

- Press Ctrl+A to save the details.

If you are on a previous release of TallyPrime, then click here to know more about GST activation.

- Open the company for which you need to activate GST.

- Press F11 (Features) > set Enable Goods and Services Tax (GST) to Yes .

- Set Show more features to Yes .

- Set the Registration type as Regular .

- Set the option Assessee of Other Territory to Yes , if your business unit in located in the Exclusive Economic Zone (other territory).

- Specify GST applicable from date. GST will be applicable for your transactions from this date onwards.

- Specify the GSTIN/UIN for the business. This can be printed in the invoices as required. You can specify this later.

- Select the Periodicity of GSTR1 > as Monthly or Quarterly , based on your business turnover. The option e-Way Bill applicable is set to Yes, with the Applicable from date and Threshold limit.

- Select the value to be considered for e-Way Bill for the option Threshold limit includes .

Additional fields may appear for few states depending on the statutory needs of that state.

- Set the option Enable tax liability on advance receipts to Yes to activate calculation of tax liability on advance receipts. This options is disabled by default.

- Set the option Enable tax liability on reverse charge (Purchase from unregistered dealer) to Yes to activate calculation of tax liability for reverse charge on URD purchases. This option is disabled by default.

- Enable the option Set/alter GST rate details? to enter the GST details at the company level.

- Set the option Enable GST Classification? to Yes , to create and use the classifications in the GST Details screen of masters.

- Accept the screen. As always, you can press Ctrl+A to save.

Set Up GST Rates and HSN/SAC Details

After enabling GST, you can proceed to set up the GST rates for your goods and services. TallyPrime offers you the flexibility to apply GST rates at one or more levels. Depending on your business need, you can set the tax rates up front at the company level, if your goods or services fall under a common tax rate. Alternatively, you can choose a different level such as ledger, accounting group, stock item, stock group, or even apply the rates directly in the transaction.

Apart from setting up GST rates at multiple levels, you have the additional benefit of deciding the order in which you want to apply the rates. You can select either the ledger or the stock item as the primary source for applying GST rates, and choose one of the following two orders:

- Ledger (Default) : Ledger > Accounting Group > Stock Item > Stock Group > Company

- Stock Item : Stock Item > Stock Group > Ledger > Accounting Group > Company

In both of the above orders, Ledger refers to Sales or Purchase ledgers.

Apply GST Rate and HSN/SAC Details in the Company

- Specify Details Here : Once you select this option, you will be able to enter the details right here in Company GST Details.

- Use GST Classification : This option allows you to select a previously created GST Classification, or create one on the spot. The details will be applied accordingly.

- Specify in Voucher : If you are not aware of the details at the moment, and if you want to add the details directly in the transaction, then you can select this option.

- GST Rate Details : Like in the previous field ( HSN/SAC Details ), you have the same three options to choose from.

- Ledger : Ledger > Accounting Group > Stock Item > Stock Group > Company

- Source of HSN/SAC details in transactions : Like in the previous field ( Source of GST rate details in transactions ), you can apply the HSN/SAC details either from Ledger or Stock Item.

- Reset status of manually reconciled transactions for downloaded data : Even if you have manually marked the status of any transactions as Reconciled in your books, this option will help you restore the original status of the transactions as per the downloaded or imported data.

Similarly, you can easily apply or update GST Rate and HSN/SAC Details in other areas such as stock items, party masters, and so on. Refer to the Create/Update Masters for GST section to know more.

Further reading

- While creating a GST registration, you have the option to create a special voucher numbering series for this particular registration. Refer to the Create Voucher Numbering Series section to know more.

- You can also apply GST Rate and HSN/SAC Details directly in the transaction. Refer to our Sales Under GST article to know more.

Set up Voucher Numbering from a GST Perspective

TallyPrime provides you with the best options to configure your voucher numbering as per GST requirements. When you are uploading invoices to the GSTN portal, the department expects the voucher numbers to be unique and to follow a proper sequence. For example, if you had recorded a sales transaction with the voucher number as 11, and a sales return takes place, then voucher number 12 should be assigned to the sales return or debit note. This will ensure that the overall voucher numbers follow the proper flow of the sales cycle.

Based on your business requirement, you can select your preferred method of voucher numbering, such as Automatic, Manual, Automatic (Manual Override), or Multi-user Auto. If you select the Automatic method of voucher numbering, then you also have the benefit of either retaining the original voucher numbers or renumbering the vouchers. Subsequently, while recording transactions, you can select the relevant voucher type, and then the voucher number series will be automatically selected.

Moreover, if your business consists of multiple GST registrations, then you can create and maintain unique voucher numbering series for all your GST registrations. For example, using a single series for sales, you can maintain and track both sales transactions and sales returns. While creating or altering a numbering series, you can set the Series Name and Method of Voucher Numbering.

What’s more, you can also choose to use a common series for all your registrations. You can set this option from the Company Features (S et/Alter Company GST Rate and Other Details > Use common voucher numbering series for all GST Registratio ns).

Configure Voucher Numbering for GST

- Gateway of Tally > Create/Alter > Voucher Type . Alternatively, press Alt+G (Go To) > Create/Alter Master > Voucher Type .

- Select the voucher type from the List of Voucher Types, or create a new one, as needed. To learn more about voucher types, refer to the Voucher Types in TallyPrime article.

- Method of Voucher Numbering : Select the required method as per your business and GST requir ements.

- Numbering behaviour on insertion/deletion : You will see this option if you have selected Automatic or Multi-user Auto as the Method of Voucher Numbering. Generally, when you insert or delete a transaction, your existing voucher numbers might get affected. However, you now have the option to either retain the original voucher numbers or renumber the vouchers, as per your requirement.

Create Voucher Numbering Series

TallyPrime provides you with the flexibility to create multiple voucher numbering series either from the voucher type or from the Chart of Accounts. Irrespective of whether your business has single or multiple GST registrations, you can create multiple voucher numbering series based on your business needs.

If your business consists of multiple GST registrations, then you can use this feature to create and maintain special voucher numbering series for all your GST registrations. Once you have created the required voucher numbering series, you can select it while recording transaction s.

From Voucher Type

- Press Alt+G (Go To) > Create/Alter Master > Voucher Type . Alternatively, go to Gateway of Tally > Create/Alter > Voucher Type .

- Select the required Voucher Type from the List of Voucher Types.

- Press F12 (Configure) > Set Method of Voucher Numbering > Yes , and then enable Define multiple numbering series for vouchers .

- Provide a relevant Series Name. For example, if your business has a branch office (say, in Bangalore), then you can name the series after the branch and save the details accordingly.

- Method of Voucher Numbering : Select the required method as per your business and GST requirements.

From Chart of Accounts

- Press Alt+G (Go To) > Create / Alter Master > Voucher Type . Alternatively, go to Gateway of Tally > Chart of Accounts .

- Select Voucher Types from the List of Masters.

- Select the required voucher types and press Alt+S (Create Vch No. Series). A common numbering series will be created for the voucher types that you select.

Create/Update Masters for GST

TallyPrime also provides you with a host of other masters and ledgers that will help you record your GST transactions in peace. For example, you have sales and purchase ledgers for GST, GST duty ledgers, service ledgers, expense/income/round-off ledgers, discount ledgers, and so on. You can also update your stock items and stock groups for GST, and easily manage HSN/SAC and the corresponding tax rates. What’s more, TallyPrime provides you with a consistently easy experience in updating the GST details across masters.

In this section

- Apply GST Rate and HSN/SAC Details in the Accounting Group

- Apply GST Rate and HSN/SAC Details in the Stock Group

- Apply GST Rate and HSN/SAC Details in the Stock Item

- Apply GST Rate and HSN/SAC Details in Sales/Purchase Ledgers

- Update GST Rate in GST Duty Ledgers

Update GST Details in Party Ledgers

Apply gst details in service ledger, apply gst rate and hsn/sac details in accounting group.

Once you update the GST details for an accounting group, it will be carried forward to all the masters, sub-groups, or ledgers under this group.

- Press Alt+G (Go To) > Create/Alter Master > Group (under Accounting Master ). Alternatively, go to Gateway of Tally > Create/Alter > Group .

- Select the required group from the List of Groups, or create a new one, as needed.

- As per Company/Group : This option will help you re-use the HSN/SAC details if you had already updated them in the company or parent accounting group.

- Specify Details Here : Once you select this option, you will be able to enter the relevant details right here in Group Creation/Alteration.

- Specify in Voucher : This option allows you to skip the details at the moment, and add them directly in the transaction.

Apply GST Rate and HSN/SAC Details in Stock Group

A stock group provides you with the capability to apply the same tax rates and HSN/SAC details to all the stock items that fall under it. For example, if you have a stock group called Iron Ore Products, then you can group related stock items like iron rods, iron sheets, and so on, under the same group, and apply the same GST rate and HSN/SAC details.

- Gateway of Tally > Create/Alter > Stock Group (under Inventory Master ). Alternatively, press Alt+G (Go To) > Create/Alter Master > Stock Group .

- Select the stock group from the List of Stock Groups, or create a new one, as needed.

- Specify Details Here : Once you select this option, you will be able to enter the relevant details right here in Stock Group Creation/Alteration.

In case you need the same tax rates for the items in a stock group, modify the group to include tax applicability and rates.

- Gateway of Tally > Alter > type or select Stock Group > and press Enter . Alternatively, press Alt + G (Go To) > Alter Master > Stock Group > and press Enter .

- Select Stock Group from List of Stock Groups .

- Set the Taxability to Taxable for goods and services that are classified as taxable type of supply under GST. Select Exempt , if the type of supply is exempted from tax under GST, or select Nil Rated , if the tax rate applicable to the type of supply is 0% under GST.

- Accept the screen. As always, you can press Ctrl + A to save.

Apply GST Rate and HSN/SAC Details in Stock Item

If your business deals with many unique stock items that have their own tax rates and HSN/SAC details, then you can directly update the details in the stock item master. After that, you only have to select the required stock items while recording transactions. The corresponding tax rates and HSN/SAC details will be picked up easily.

- Gateway of Tally > Create/Alter > Stock Item (under Inventory Master ). Alternatively, press Alt+G (Go To) > Create/Alter Master > Stock Item .

- Select the stock item from the List of Stock Items, or create a new one, as needed.

- Specify Details Here : Once you select this option, you will be able to enter the relevant details right here in Stock Item Creation/Alteration.

If you are on a previous release of TallyPrime, then click here to know more about updating stock items for GST.

In case you need different tax rates for different items, modify the stock items to include the applicable tax rates.

- Gateway of Tally > Alter > type or select Stock Item > and press Enter . Alternatively, press Alt + G (Go To) > Alter Master > Stock Item > and press Enter .

- Select Stock Item from List of Stock Items .

- Set the Taxability to Taxable , for goods and services that are classified as taxable type of supply under GST. Select Exempt , if the type of supply is exempted from tax under GST, or select Nil Rated , if the tax rate applicable to the type of supply is 0% under GST.

If you have modified the tax rates before, press Alt+W (Details) to view the history of tax rate changes.

The type of supply selected for a stock item is applicable only for that item. If multiple items with varying type of supply configuration are selected in an invoice, the type of supply configured for one item is not inferred for another.

Non-GST Goods

Some goods such as petroleum crude, high-speed diesel, motor spirit (petrol), natural gas, aviation turbine fuel, and liquor fit for human consumption, are not covered under GST and hence are classified as non-GST goods.

- In the GST Details screen of the stock item or stock group, press F12 (Configure).

- Enable the option Set type of goods .

- Press Ctrl + A to accept.

- In the GST Details screen, set the option Is non-GST goods to Yes to configure the item/group as non-gst.

Set MRP Details

To capture the MRP of stock items in the invoice, you have to enter the MRP details in the stock item master.

- Set Show more configurations to Yes .

- Set Show all configurations to Yes .

To enter the MRP for the stock item

- Allow MRP modification in voucher – Yes , if you want to modify the MRP during the transaction.

- Consider MRP for calculation of GST rate in Slab rate – Set this to Yes if you want the MRP of a stock item to be considered for GST rate calculation when slab rates are applicable. In this case, the tax amount still gets calculated on the selling price of the item.

To enter state-wise MRP for the stock item

- In the MRP Details screen , press F12 (Configure) > set Allow state-wise MRP to Yes .

- Enter the Applicable From date.

- Select the State Name from the List of States .

If the invoice is configured to Provide Rate Inclusive of Tax for Stock Items :

- The MRP defined in the stock item appears as Rate (Incl. of Tax) . The MRP appears even when, Standard Selling Price is defined in the stock item master, or Rate per unit is defined in the Price List .

- You can enter the MRP (if not defined in the stock item) in the column Rate (Incl. of Tax) .

When the option Provide Rate Inclusive of Tax for Stock Items is disabled in the invoice, the Rate appears:

- As defined in the Price List .

- As per the Standard Selling Price , if price list is not selected.

- As entered in the last voucher recorded on the same or previous date, in the absence of Standard Selling Price or Price List . If you have selected the stock item for the first time, you have to enter the Rate per unit.

Set slab-wise GST details (tax on item rate)

- Gateway of Tally > Alter > type or select Stock Item > and press Enter . Alternatively, press Alt+G (Go To) > Alter Master > Stock Item > and press Enter .

- Set/Alter GST Details – Yes .

- Consider additional expense/income ledger for slab rate calculation – Set this option to Yes when you want to apportion additional expenses in slab rate calculation for a stock item.

- Under Rate , set the slab rates in Greater than and Up to .

Map UoM to UQC

- In the Stock Item Alteration screen, press F12 (Configure) > set Provide Units of Measurement (UoM) for Stock Items to Yes and Use Alternative Units to Yes , so that you can map alternate units to the reporting UQC.

- Select the Units .

- In Alternate units , select the Units . As always, press Alt + C , to create a master on the fly. Alternatively, press Alt + G (Go To) > Create Master > type or select Units > press Enter .

Apply GST Rate and HSN/SAC Details in Sales/Purchase Ledgers

If your business sells many items with the same tax rate, then you can conveniently apply the tax rate and other GST details directly in a common sales ledger. This way, you only have to select the relevant sales ledger while recording the transaction, and the GST details will be applied seamlessly.

Similarly, if your business purchases many items with the same tax rate, then you can apply the GST details directly in a common purchase ledger and select it while recording a purchase.

- Gateway of Tally > Create/Alter > Ledger . Alternatively, press Alt+G (Go To) > Create/Alter Master > Ledger .

- Select the required sales/purchase ledger from the List of Ledgers, or create a new one, as needed.

- As per Company/Group : This option will help you re-use the HSN/SAC details if you had already updated them in the company or accounting group.

- Specify Details Here : Once you select this option, you will be able to enter the relevant details right here in Ledger Creation/Alteration.

Update Sales Ledger

- Gateway of Tally > Alter > type or select Ledger > Sales . Alternatively, press Alt + G (Go To) > Alter Master > type or select Ledger > Sales .

- Is GST Applicable – Applicable .

- Taxability : Select Taxable , if sales ledger is used for supply of goods and services that are classified as taxable under GST. Select Exempt , if it is used for sale of type of supply that is exempted from tax under GST, or select Nil Rated , if it is used for sale of goods or services that attract 0% tax rate under GST.

- To view the history of tax rate changes, press Alt+W (Details).

Update Purchase Ledger

- Gateway of Tally > Alter > type or select Ledger > Purchase . Alternatively, press Alt + G (Go To) > Alter Master > type or select Ledger > Purchase .

While recording a sale or purchase transaction, you can select the respective ledger.

Update GST Rate Details in GST Duty Ledgers

TallyPrime provides you with the flexibility to use either a common duty ledger (without adding any tax rates) or separate duty ledgers (with specific tax rates), based on your business requirement.

If you use a common duty ledger, then you have the flexibility to apply GST rates at many levels, such as company, stock items, stock groups, or even apply the rates directly in the transaction. On the other hand, if you create separate duty ledgers and add the corresponding tax rates, then these details will be applied seamlessly in the transaction.

Create/Alter Common Duty Ledger

If your business deals with many items with unique tax rates, then you can conveniently apply the tax rate at many levels, based on your business needs, and skip the rate in the duty ledger. Depending on the nature of your transactions (interstate or intra-state), you can update your duty ledgers as IGST or SGST/UTGST and CGST ledgers. This way, you only have to select the relevant duty ledger while recording the transaction, and the GST details will be applied seamlessly.

- Press Alt+G (Go To) > Create/Alter Master > Ledger (under Accounting Master ). Alternatively, go to Gateway of Tally > Create/Alter > Ledger .

Create/Alter Rate-wise Duty Ledger

If your business deals with many items with the same tax rate, then you can conveniently apply the tax rate directly in the duty ledger. Depending on the nature of your transaction (interstate or intra-state), you can update your duty ledgers as IGST or SGST/UTGST and CGST ledgers. This way, you only have to select the relevant duty ledger while recording the transaction, and the GST details will be applied seamlessly.

- Select the required duty ledger from the List of Ledgers, or create a new one, as needed.

Central Tax Ledger

- Gateway of Tally > Create > type or select Ledger . Alternatively, press Alt + G (Go To) > Create Master > type or select Ledger .

- Group it under Duties & Taxes .

- Select GST as the Type of duty/tax .

- Press Enter to save.

Similarly, you can create ledgers for state tax, integrated tax, and cess by selecting the relevant Tax type under GST.

Cess Ledger

You can create separate cess ledgers for quantity and value, to print the breakup of these values in the invoice. Do not alter the existing cess ledgers as it will impact the transactions recorded earlier.

- Select Cess as the Tax type .

- Based on Quantity to calculate cess on quantity.

- Press Ctrl+A to save.

Set the Valuation Type to Any to use it as a common ledger.

UT Tax Ledger

If your business is located in a union territory, or you are an Assessee of Other Territory and have enabled this option in the Company GST Details screen, you can create the UT tax ledger.

With TallyPrime, you can easily set up the ledgers of your suppliers and customers from a GST perspec tive, by adding important details such as GSTIN/UIN and Registration Type. These details will be applied seamlessly in the transaction.

- Select the required party ledger from the List of Ledgers, or create a new one, as needed.

- Select the party Registration type and enter the GSTIN/UIN .

- Assessee of Other Territory : Set this option to Yes if the party is belongs to Exclusive Economic Zone (Other Territory).

- Ignore prefixes and suffixes in Doc No. for reconciliation : If your party uses prefixes or suffixes in the Doc No. but your business does not use them, then it might cause mismatch during reconciliation. This option will help you ignore such prefixes or suffixes, and lead to a smooth reconciliation.

- Press Ctrl + A to save the details.

Supplier Ledger

- Gateway of Tally > Create > type or select Ledger > and press Enter . Alternatively, press Alt + G (Go To) > Create Master > Ledger > and press Enter .

- Enter the Name of the supplier’s ledger.

- Select Sundry Creditors in the Under field.

- Set the option Maintain balances bill-by-bill to Yes . If you do not see this option, press F12 (Configure) > set Maintain balances Bill-by-Bill to Yes .

- Enter the Default credit period , if any.

- Select the party Registration type, and enter the GSTIN/UIN .

- Set the option Assessee of Other Territory to Yes if the party is belongs to Exclusive Economic Zone (other territory) .

Customer Ledger

- Enter the Name of the customer’s ledger.

- Select Sundry Debtors from the List of Groups in the Under field.

- Set the option Maintain balances bill-by-bill to Yes .

- Select the party Registration type , and enter the GSTIN/UIN .

GSTIN/UIN Format

The GSTIN/UIN entered in party ledger gets validated by considering the formats prescribed for all the party types. If a GSTIN/UIN does not fall in the supported formats, a warning message appears as shown below:

If you have provided a valid GSTIN/UIN (the format that is newly introduced by the department), you can ignore this message and save the ledger. The transactions recorded using this ledger will appear as exceptions in the Information required for generating table-wise details not provided section of GSTR-1 , GSTR-2 , GST CMP-08 .

You can do the following to include such transactions in the returns.

- Press Alt+V (Accept GSTIN/UIN)

- Press Enter to skip the GSTIN/UIN validation and accept the voucher.

To move the voucher back to exceptions, press Alt+V (Accept GSTIN/UIN) in the Vouchers Accepted without Party GSTIN/UIN Validation screen.

If your business deals in services instead of goods, then TallyPrime has got you covered. You can easily create a service ledger and update the relevant GST details. While recording the transaction, you only have to select the Accounting Invoice mode and select the relevant service ledger and duty ledgers. The GST details will be applied seamlessly.

- Select the required service ledger from the List of Ledgers, or create a new one, as needed.

- Specify Details Here : Once you select this option, you will be able to enter the details right here in the service ledger.

To update taxes and other GST details for your service items, you need to modify your service ledgers.

- To specify further GST-related details, press F12 (Configure).

- Select Type of supply as Services .

You can use this ledger to bill the services rendered by your business, in Accounting Invoice mode.

Post a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Please wait while you are redirected to the right page...

Forgot ID/Password?

Reset password.

How To Easily Learn Tally Online With Practical Assignments

Every business needs accounting since it’s essential for everything from tracking expenses to choosing investments to calculating profits. we can say that learning tally is a terrific skill to have in the job market. even there’s no need to be physically present in the class to learn tally. nowadays, thanks to the internet you can learn tally online. this article has included how to learn tally online and everything you need to know about tally. there are so many institutes that provide tally courses online. so, let’s get started..

What is Tally?

- Tally stands for Transaction Allowed in Linear Line Yards.

- It is an accounting and inventory management application software.

- It which can record daily business transactions or accounting works like sales, purchases, payments received, banking or taxation, etc.

- The most popular way we can say that Tally is an Accounting Software.

- It is designed and developed by Tally Solutions which is a Bangalore-based IT Solution Company.

- In 1986, S.S Goenka was the founding chairperson of Tally Solutions Private Limited.

- Developed based on Accounting principles and Mercantile Law.

- It is simple yet powerful software.

- It is a window-based software.

- It is a stand-alone application.

- It is developed using the Tally Definition Language (TDL).

- It supports,

-Bookkeeping

-MIS report

Versions of Tally Software

Other features of tally software.

- User-friendly accounting software

- Multi-lingual

- Excellent backup provisions

- Easy exit to an operating system

- Tally can maintain books of account either with inventory or without inventory.

- It can work with multiple company accounts simultaneously.

- Tally can get offline and online support.

- It can be installed on any version of Windows OS like NT, 2000, ME, 95, 98, XP, 7 Ultimate, Vista, and Windows 8. Etc.

- Many computerized accounting software requires numeric codes to maintain the account. But Tally pioneered that no accounting codes were needed.

Skills required in Tally

Career and scope in tally.

Having the skill set of Tally software may help you land your chosen job path quickly if you are someone wishing to start a futuristic career in the accounting field. It is because Tally is extensively used across all business sizes, from small to large across all sectors.

90% of companies and businesses are said to use Tally software for their daily accounting tasks.

Additionally, the top MNCs and Retail businesses of all kinds, financial institutions, financial organizations (NGOs), hospitals, BPO and KPO sectors, and chartered accountant companies are among the many different industries that use Tally software.

You can have so many career choices in Tally. Such as-

- Inventory Manager

- Data Entry Operator

- Billing Executive

- Tally freelancers

- Tally Course Benefits

- Scope of Tally Courses in India

Job Profiles and Salary in Tally

The common job profiles offered in the organizations for accountants with Tally skill sets are-

Many students who are looking for Diploma Courses after 10th/12th or after graduation and planning to look for career opportunities in computer accounting can learn tally.

The purpose of the tally training course is to teach students the fundamentals of accounting and how to integrate such concepts with the tally platform. Although it’s easy to learn, for ways of operation one must grasp how the software works as well as be familiar with its applications.

Tally Jobs in India

Requirements for Learning Tally Online.

- Any student who wants to learn tally software online should have a computer or laptop with an internet connection.

- Nowadays it has become very easy to learn any software or anything from home.

- There are so many courses with certification and placement assistance in Tally you can opt for.

- Here we have listed some of the best Tally courses you can learn online.

- All of these courses are completely online, so there’s no need to show up to a classroom in person.

- You can access your lectures, readings, and assignments from reputable institutes anytime and anywhere via the web or your mobile device.

More Professional Courses from IIM SKILLS

- Digital Marketing Course

- Technical Writing Course

- Content Writing Course

- Investment Banking Course

- Business Accounting And Taxation Course

- CAT Coaching

Learn Tally Online: IIM SKILLS

IIM SKILLS is one of the global leading institutes that provides professional courses in various subjects including writing, marketing, accounting, etc.

The tally master course by IIM SKILLS is one of the best for getting hands-on experience. It is a comprehensive training program that covers all of Tally’s topics and features. Students learn precisely how to manage and maintain accounts, inventory, GST, and payroll at Tally in the course modules. The training module is particularly informative because it starts from the basics, providing a foundation for your understanding of Tally. Also, a variety of practical assignments and tasks are included to ensure that students grasp the subject well. IIM SKILL’s professional guidance allows one to interact, clear doubts and learn more effectively.

Course Name: Tally Course

Duration of the Course: 18 Hours of Self Learning, 20 Hours of Lecture

Mode of the Course: Online

Fees: Rs.2, 900 + 18% GST

Course Syllabus:

Course offerings:.

- Access to Learning Management System (LMS)

- Self-Paced Learning

- Software Tools

- 60+ Hours Practical Assignment

- Internship Opportunities

- Dedicated Placement Cell

- Govt. of India Recognized Certification

Certificate Availability: Yes

Contact Information:

Email ID: [email protected]

Phone Number: +91 9580 740 740

Learn Tally Online: Tally Training

In-depth information is covered in the Tally ERP9 online course with GST to match the industry’s accounting standards. With the use of real-world examples and tally entries, Tally Training not only explain the principles but also show you how to practically apply them in your day-to-day accounting process.

Course Name: Tally ERP9 Expert Course

Duration of the Course: 1 or 2 Months

Fees: Rs.1800

Couse Syllabus:

- Learning in Hing-lish language

- DVD(Videos + eBook PDF)

Contact Information

Phone Number: +91 9081211174

Learn Tally Online: Vskills

Intelligent Communication Systems India Limited (ICSIL), a department of the Indian government, manages the skills certification programs.

Their certification programs help students measure and exhibit the skills that have high demand and business value. Vskills Tally ERP9 course provides students with a clear understanding of accounting as well as the necessary practical aspects. Thanks to their self-paced training, even newbies can gain from the course’s worthwhile teaching.

Course Name: Certificate in Tally ERP9

Duration of the Course: 19 Hours

Fees: Rs.3, 499

Couse Syllabus:

- Introduction to Tally ERP9

- Stock and Godwon in Tally

- Groups, Ledgers, Vouchers and, others

- Reports in Tally ERP9

- Back and Restore in Tally ERP9

- Tally.NET in Tally ERP9

- Government Certification

- Lifelong e-learning access

Phone Number: +011 4734 4723

Recommend Read,

- Advanced Tally Courses

- Tally ERP 9 Certificate

- Learn Online Tally

- Tally Training Benefit

- Tally Courses Uses

- Tally Course Eligibility

Learn Tally Online: LearnVern

LearnVern teaches students in the user’s native language. You can learn their Tally courses in Hindi.

Their method of instruction encourages critical thinking, learning by doing, and teaching by example. To help students in remembering the subject better, their Tally course material is enhanced with graphics, animations and, photos. LearnVern also gives practical training through assignments and tests.

Phone Number: +91 88490 04643

Learn Tally Online: UDEMY

Udemy is one of the best online platforms that provide various Tally certification courses. All of these courses are accessible from anywhere at affordable prices. Here we’ve listed three courses among others with the highest rating. You will learn how to use the tally program for payroll, audit, TDS, and GST accounting of any organization. Their tally course provides students the chance to work on real-time projects in addition to assignments.

- Assignments

- Access on Mobile and TV

- Full Lifetime Access

Please, go to their official website for further details.

Learn Tally Online: Coursera

Students who want to build a career in bookkeeping or want to learn how to manage their account books, Coursera offers the best Tally Bookkeeper professional certificate course.

In their unique 4-month Tally Book Keeper Professional Certificate program, three separate Tally software-related courses are offered. It comprises most of the theoretical and instructional modules. You have to take the course in the specific order listed because the content builds on the previous session.

Program Name: Tally Bookkeeper Professional Certificate

Fees: You can enroll for free.

- Interview Prep

Learn Tally Online: InternShala Trainings

InternShala is an Ed-tech company that provides live, interactive learning in digital format.

Their Online Tally course has covered all the accounting-related concepts. They also provide quizzes and assignments after completing every module to revise your knowledge.

Duration of the Course: 6 Weeks, 1hr/day (Flexible Schedule)

Fees: Rs.4499

- Basic Concepts of Accounting

- The world of Tally

- Accounting process in Tally

- Bank reconciliation statement

- Tax Deducted at source (TDS) & Collected at Source (TCS) accounting in Tally

- Payroll in Tally

- Goods and Service Tax (GST) accounting in Tally

- Data extraction from Tally

- Some extra topics

- Final training project

- Placement Assistance

- Learn in Hindi

- 1:1 Doubt Solving

- Hands-On-Practice

Learn Tally Online: FITA Academy

Tally Online courses at FITA Academy offer comprehensive instruction in the tally ERP9 software from Journal Entries to finalizing accounts, including managing GST and other taxation.

You will learn the ins and outs of accounting and finance-related Tally. The modules are covered from both basic and advanced standpoints to help student comprehension of the subject better. Their online Tally course also includes real-world assignments to meet industry standards.

Course Name: Online Tally Course

Duration of the Course:

- Tally-Advanced accounting professional-basics in financial accounting

- Introduction to Tally

- Configuring Tally ERP9

- Company Management

- Master- Ledgers and Groups

- Understanding Vouchers in Tally

- Tally ERP9 reports

- Inventory configuration in Tally ERP9

- Managing inventory using Tally ERP9

- Goods and Service Tax (GST)

- Purchase and Sales reports

- GST reports and returns

- Using tally to manage point of sales (POS)

- Bank reconciliation

- Tally-expert accounting professional

- Payroll accounting

- More advanced topic

- Live Projects

- Instructor-led Live Class

- Flexibility

- Placement Support

Phone Number: 93450 45466

Learn Tally Online: Frequently Asked Questions

Q. can i learn to tally online through a laptop.

Answer: Yes, Students who wish to study tally software online should have access to a computer or laptop with an internet connection.

Q. Which Tally is best for beginners?

Answer: The latest version of Tally Prime is easy to learn. There is no longer a need for prior expertise or specialized training in Tally. You can easily use Tally Prime for your regular accounting tasks with only a simple installation and setup.

Q. Can learning Tally online is difficult?

Answer: Beginners have the choice of enrolling in expert courses provided by reputable institutions or learning the program on their own with the help of blogs and videos that are easily available online.

Q. Where can I practice Tally?

Answer: The Tally Software Education version is available on www.tallysolution.com website. You may practice it by downloading it for free.

Q. Which industries can one enter after completing the Tally course?

Answer: The private and public sectors provide a ton of options. Banking, finance, business manufacturing, IT industries, and so on. You can also work in sales, marketing, insurance, and HR.

Learn Tally Online: Conclusion

That’s all about how to learn tally online. In this article, we have focused on tally software, its feature, also the scope and career opportunities in tally. And institutions that provide tally training online. We hope this might have helped to get some insights about tally. If you plan to learn tally online, you can get in touch with the experts of this institute that will provide you with the information and exposure you need in this area.

Author: Swati Varli

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Request For A Call Back

- Email This field is for validation purposes and should be left unchanged.

You May Also Like To Read

Article writing format: steps, objectives, and types, zoom vs google meet: which one is best for you, when gst is applicable for the top 3 sectors, a guide to fundamentals of technical communication skills, investment banking meaning – a complete guide, a complete guide to the project finance modeling, 7 highest paying jobs in india in 2024 (updated), top 5 investment banking courses in germany with placements, top 10 writing tip that motivates you to write everyday like a pro.

- 100% assured internships

- Placement Assured Program

- 500+ Hiring Partners

- 100% Money Return Policy

Sunday Batch - 26th May 2024

Sunday 10:00 AM - 2:00 PM (IST)

Share Your Contact Details

- Name This field is for validation purposes and should be left unchanged.

Weekdays Batch - 14th May 2024

Tues & Thur - 8:00 PM - 9:30 PM (IST)

Saturday Batch - 18th May 2024

Saturday 10:00 AM - 1:00 PM (IST)

- Phone This field is for validation purposes and should be left unchanged.

Download Course Brochure

- Comments This field is for validation purposes and should be left unchanged.

- Hidden Unique ID

Weekdays Batch - 28th May 2024

Every Tue, Wed & Thur - 8:00 PM - 10:00 PM (IST)

Weekend Batch - 19th May 2024

Every Sat & Sun - 10:00 AM - 1:00 PM (IST)

Download Hiring Partners List

Download tools list, weekend batch - 25th may 2024.

Every Sat & Sun - 10:00 AM - 12:00 PM

Request for Online DEMO

Weekend batch - 18th may 2024.

Every Sat & Sun - 10:00 AM - 12:00 PM (IST)

- Learn From An Expert

- Steroids To Crack CAT Exam

- Flip The Classroom Concept

- Technology Driven

Request to Speak with MBA ADVISOR

- Select Course * * Select Course Advanced Search Engine Optimization Business Accounting & Taxation Course Business Analytics Master Course Content Writing Master Course Digital Marketing Master Course Data Analytics Master Course Data Science Master Course Financial Modeling Course Investment Banking Course GST Practitioner Certification Course Technical Writing Master Course Tally Advanced Course Other Course

- ADDITIONAL COMMENT

Download Our Student's Success Report

Watch our module 1 recording live for free, get realtime experience of training quality & process we follow during the course delivery.

Talk To An Agent

Talk to our agent, download student's success report, weekday batch - 28th may 2024, request for a callback, weekend batch - 30th may 2024, start hiring.

- Company Name *

- Hiring for * Select Program Content Writer Digital Marketer Data Analyst Financial Modellers Technical Writer Business Accounting & Taxation Search Engine Optimization Investment Banking

- Attach Document * Max. file size: 256 MB.

- Company Name * First

- Select Program Select Program Business Accounting & Taxation Course Content Writing Master Course Digital Marketing Master Course Data Analytics Master Course Financial Modeling Course Search Engine Optimization Technical Writing Master Course

- Select Members Select Mumbers 1-5 6-20 21-50 51-100 100+

- Additional Comments

Tallyeducation

- International Courses

Specialization

- TallyEssential

- TallyProfessional

- Online course

- TallyCalculus

- Government Skilling Programme

Brings an array of industry preferred specialized courses!

TallyPrime with GST

- 5 hours 30 minutes course

- Self- learning videos

Accessibility from multiple devices

- Accessibility to content for 1 year

- Lifelong access to Tally Job Portal

- Industry- recognized Tally Certificate after completion

About the Course

TallyPrime with GST is an essential course for learners belonging to Accounting, Finance, MIS, Data Analysis, Tax and Business Management Sectors . With TallyPrime, managing GST compliance has become simpler and the same has been explained in the course as well. It includes four modules namely TallyPrime Start-up, TallyPrime with GST, TallyPrime Printing Configurations and GST Filing Concepts.

The course is enriched with real-life business scenarios, charts, screenshots, observations and solved illustrations on TallyPrime . The professional course is structured in a blended format which gives you flexibility to learn at your own pace while getting help from experts. As a certified learner you get an edge among your fellow competitors in the job market.

Course Created by: Vedanta Soft Solutions Medium: English

Course preview:

COURSE DURATION

5 hrs 30 Mins

Course Completion Certificate

Course content, module 1: tallyprime start-up.

- Downloading and Installation of TallyPrime

- Launching TallyPrime – Education Mode and Activating License

- Creating New Company, Alteration, Deletion

- Introduction – TallyPrime Pre-defined Vouchers

- Recording Purchases and sales

- Recording Contra, Receipt and Payment Vouchers

- Recording Journals in TallyPrime

Module 2: TallyPrime with GST

- Introduction to GST

- GST Classifications and Place of Supply

- Creating New Company and Enabling GST

- Recording GST Transactions – Single Slab

- Recording GST Transactions – Multiple Tax Slabs

- GST Configuration in Group Level

- Enabling Auto-Billing in TallyPrime

- Recording GST Services

- Recording GST Expenses

- Recording Assets

- Recording RCM Transactions in TallyPrime

Module 3: TallyPrime Printing Configurations

- Update Invoice or Voucher Numbering in TallyPrime

- Setup Logo Printing in TallyPrime

- How to Print Additional Description of Stock Items

- Printing Preferences – Cust Seal and Signature, Jurisdiction, Bank Details, Invoice Status

- Optimize Printing Paper Size

- How to Enable Rate Inclusive of GST Column

Module 4: GST Filing Concepts

- What are GST Returns, Types of GST Returns

- GST Tax Computation and Adjustments

- Learn GSTR-1 Tables

- File GSTR-1 using TallyPrime

- GSTR-1 Filing Nil

- GSTR-2 & 2A Reconciliation

- GSTR-3B Filing, Online and Offline methods – GST Payments

- E-way Bill Registration

- E-way Bill Generation, Update Vehicle Number and Cancellation

Module 5: E- Invoicing

- E-Invoice introduction

- E-Invoice Registration, Enablement

- API Users Creation

- Generate E-Invoice using Tally API logins

- Generate E-Way bill cum E-Invoice

- Generate E-Invoice using Excel- Utility

- Cancel E-Invoice

Cost Centre Management

This specialization course covers various concepts and its application related to Cost Centre and Strategy.

TallyPrime Basics

This specialization course help learners understand the various concepts related to TallyPrime and its application at length.

We want to connect you to a world of opportunities and new avenues.

Drop Your Query!

frequently asked question

Drop your queries.

If you have any further queries, please write to us!

Thanks for reaching out to us. We are looking into it and will get back to you in sometime.

Tally Realistic Assignment with Determinations PDF

Tally Practical Assignment including GST with Solutions PDF for free upload. Cool Success Institute Tally computer training coaching class per by day task. Notes is very useful with learn and practice the tally ERP 9 with GST. We finding the student face problem on find the practice assignment of Tally. The Training Capacity of Superb Success Institute compiled who procedure task in this PDF for personality study are learners. Opinion 150360812-Tally-assignment-Book.pdf for ACG 2021 at Eastern Florida State Institute. PRACTICAL QUESTIONS Tally 9 Counter 9 is most useable software to any business Organizations .Therefor use of Tally

Our Tally Coaching Class Assignment / task includes following:-

Purchase Invoice Bills Sundry Creditors Sales Invoice Bills Sundry Debtors Purchase Invoice Bills Type Wise Details

Brief of GST Business For Purchase & Sales Of Goods Business for Service providing Who are Obligatory For GST Registration Document Imperative For GST Registration GST What is GSTIN Batch Types of GST Rates GST Rates How GST Apply in Tally How GST Apply in Bills SGST (State Tax) & CGST (Central Tax) IGST (Interstate Tax) – Purchase GST Invoice Sundry Creditors Sale GST Checkout Sundry Debtors

Purchase Eintritt

Purchase Invoice with GST (Sundry Creditors)

Sales Invoice with GST Sundry Debtors

Entry of 25 Variety Debater bills are given in to PDF

Download Tally Procedure Assignment PDF

Document Name : Tally Practice Assignment with resolution

Publisher : S uper Success Research Muzaffarnagar and https://onlinestudytest.com Author : Super Calculator Muzaffarnagar Number of Pdf Pages : 28 Good Very good

Hint : The Tally Practical Assignment with Solutions notes PDF were eigentumsrecht of Super Past Institute Muzaffarnagar. We are sharing the google drive download link including due consent of Compute Coaching Institute.

Match Prime Notes

- Fundamental of Accounting and Tally Prime Records

- Introduction of Tally Prime Notes

- Groups plus Ledgers in Tally Priming Notes

- Voucher Entry in Tally Prime Notes

- Create Stock Single in Count Prime Notes for Practice

- Bill wise entry in Tally Prime

- Mixed wise Details by Tabulation Prime Cash

- Cost Center in Allow Prim Notes

- Export Import Ledger in Tally Prime

More Tally PDF may be found – Tally Notes PDF Archives – SSC STUDY

Tally Prime Register PDF Free Download – SSC STUDY

Tally ERP9 Question Paper in Hindi – Online Study Test

Share these:

Related posts, coreldraw notices pdf free download.

Photoshop Records PDF

Computer full form list pdf load, cc register pdf 2023 cost-free download, computer question answer pdf download, digital working questions for bench exams pdf, compute notes pdf in english.

Computer Book PDF for Bank Exam

IMAGES

VIDEO

COMMENTS

Practical Assignments and work review is essential and integral part of dVidya Training. This post describes practical assignments for students covering GST Accounts in Tally Prime. Guidance for performing the tasks included for convenience. The students do the work and submit the report and data files for review.

Tally Practical Assignment including GST with Solutions PDF for free download. Super Success Institute Tally computer training coaching classes day by day task. Notes is very useful for learn and practice the tally ERP 9 with GST. We found that student face problem to find the practice assignment of Tally. The Training Faculty of Super Success ...

Company Creation: You can create a Company profile by using the following procedure : 1. Press Alt+K > Create. Alternatively, at the Gateway of Tally, press F3 > Company > Create Company. A Self-Study Practical Assignment on TallyPrime-Rel.4. TallyPrime-4 [Practical Assignment]Page: 7Visit us:www.tallyprimebook.com.

Learn Latest Tally ERP9 with GST free at Teachoo. Notes and videos provided on how to put ledgers, learn in which head the ledger will come, important tally features, reports and errors in Tally, how to prepare files for return filing. To practice GST Return Filing with Tally, take our Tally course. In this Tally Tutorial, we cover.

II. Creating a Purchase Ledger: Purchase-GST/IGST (both for Local & Outside State) To Create a Purchase Ledger i.e. GST - Purchase (Local) Follow the steps used for Creating the Sales Ledger i.e. GST-Sales as above. [32-Practical Assignment-TallyPrime] Gateway of Tally > Create > type or select Ledger and press Enter.

Tally Prime with GST Course Notes with Example. Step by Step Guide for GST implementation, create CGST, SGST, IGST ledgers, Sample Purchase and Sales entry with GST. Computer Training Institute Notes with practice assignment PDF is very useful for learners. GST (Goods and Service Tax) CGST - Centre Goods and Service Tax

GST using TallyPrime course covers topics from basic to advanced GST concepts, e-Way Bill, e-Invoice, and accounting of GST-compliant transactions. ... If you are a student or a working professional and an expert in the Accounting and Finance domain, then GST using TallyPrime is the course designed for your career growth. ... Tally Education ...

Swayam Education - GST Practical Assignment-TallyERP9Book - Page 1 - Created with Publitas.com. Powered by. Learn GST Practical Assignment using Tally.ERP9 Accounting Software. Suitable for Businessman, Executives and Students. More...log on : www.tallyerp9book.com.

This practical work book Including: Financial Accounting, Inventory Management, and Sales/Purchase Order Processing in Tally.ERP 9 with GST.Each and every step is described with help of screenshots.Have a bright future by learning computerized financial accounting with Tally.All books in this series are available in printed format here - https ...

We found that student faces problem in finding practice assignments for Tally. The training faculty of Super Success Institute has compiled practice tasks in this PDF for self-study of students. Brief of GST. Purchase Entry. Tally Prime Practical Assignment With Solutions PDF Free Download. Computer Networking PDF. Class 8 Computer Book PDF.

17 Chapters in TallyPrime Book + 45 Practical Assignment with GST in TallyPrime & All features are described with Practical Problems with Solutions. Buy Now. Disclaimer : ... Tally,TallyPrime,Tally GST,TallyERP9 GST, Tally9, Tally.ERP, Tally.ERP -9, Tally.Server 9, Tally.NET & Power of Simplicity are either registered trademarks or trademarks ...

Gateway of Tally > Create > type or select Ledger and press Enter. Alternatively, press Alt+G (Go To) > Create Master > type or select Ledger and press Enter. [25-Practical Assignment-TallyPrime] In Under, select Duties & Taxes. Select GST as the Type of duty/tax. [26-Practical Assignment-TallyPrime] Select State Tax as the Tax type.

TallyPrime Basic with GST Essentials (Tally Certification) PW Skills is the go-to destination for mastering Tally Prime. Our comprehensive courses, including Tally Prime with GST, equip you with essential accounting skills. Prepare for career opportunities in finance with potential earnings from ₹5-25 LPA. $.

Tally Assignment With GST (Sscstudy.com) - Free download as PDF File (.pdf), Text File (.txt) or read online for free. Scribd is the world's largest social reading and publishing site.

Learn to maintain books under GST Composition, activate GST for composition dealers, set GST rates for stock items, and other related activities. Download TallyPrime. Search History My Favourites Logout. Login Home; ... Tally.ERP 9; Home TallyPrime Taxation Compliance India GST ...

Tally Course Syllabus. Tally Course is a highly regarded course that teaches students GST, TDS, inventory management, and accounting. There are no undergraduate or postgraduate tally courses; however, students in the BBA, BCom, MCom, and MBA Finance or Banking programs receive a brief introduction to tally as part of their curriculum.

In case you need the same tax rates for the items in a stock group, modify the group to include tax applicability and rates. Gateway of Tally > Alter > type or select Stock Group > and press Enter. Alternatively, press Alt+G (Go To) > Alter Master > Stock Group > and press Enter.; Select Stock Group from List of Stock Groups.; Set the option Set/Alter GST Details to Yes, to specify the details ...

The training module is particularly informative because it starts from the basics, providing a foundation for your understanding of Tally. Also, a variety of practical assignments and tasks are included to ensure that students grasp the subject well. IIM SKILL's professional guidance allows one to interact, clear doubts and learn more ...