You are using an outdated browser. Upgrade your browser today or install Google Chrome Frame to better experience this site.

- IMF at a Glance

- Surveillance

- Capacity Development

- IMF Factsheets List

- IMF Members

- IMF Financial Statements

- IMF Senior Officials

- IMF in History

- Archives of the IMF

- Job Opportunities

- Climate Change

- Fiscal Policies

- Income Inequality

Flagship Publications

Other publications.

- World Economic Outlook

- Global Financial Stability Report

- Fiscal Monitor

- External Sector Report

- Staff Discussion Notes

- Working Papers

- IMF Research Perspectives

- Economic Review

- Global Housing Watch

- Commodity Prices

- Commodities Data Portal

- IMF Researchers

- Annual Research Conference

- Other IMF Events

IMF reports and publications by country

Regional offices.

- IMF Resident Representative Offices

- IMF Regional Reports

- IMF and Europe

- IMF Members' Quotas and Voting Power, and Board of Governors

- IMF Regional Office for Asia and the Pacific

- IMF Capacity Development Office in Thailand (CDOT)

- IMF Regional Office in Central America, Panama, and the Dominican Republic

- Eastern Caribbean Currency Union (ECCU)

- IMF Europe Office in Paris and Brussels

- IMF Office in the Pacific Islands

- How We Work

- IMF Training

- Digital Training Catalog

- Online Learning

- Our Partners

- Country Stories

- Technical Assistance Reports

- High-Level Summary Technical Assistance Reports

- Strategy and Policies

For Journalists

- Country Focus

- Chart of the Week

- Communiqués

- Mission Concluding Statements

- Press Releases

- Statements at Donor Meetings

- Transcripts

- Views & Commentaries

- Article IV Consultations

- Financial Sector Assessment Program (FSAP)

- Seminars, Conferences, & Other Events

- E-mail Notification

Press Center

The IMF Press Center is a password-protected site for working journalists.

- Login or Register

- Information of interest

- About the IMF

- Conferences

- Press briefings

- Special Features

- Middle East and Central Asia

- Economic Outlook

- Annual and spring meetings

- Most Recent

- Most Popular

- IMF Finances

- Additional Data Sources

- World Economic Outlook Databases

- Climate Change Indicators Dashboard

- IMF eLibrary-Data

- International Financial Statistics

- G20 Data Gaps Initiative

- Public Sector Debt Statistics Online Centralized Database

- Currency Composition of Official Foreign Exchange Reserves

- Financial Access Survey

- Government Finance Statistics

- Publications Advanced Search

- IMF eLibrary

- IMF Bookstore

- Publications Newsletter

- Essential Reading Guides

- Regional Economic Reports

- Country Reports

- Departmental Papers

- Policy Papers

- Selected Issues Papers

- All Staff Notes Series

- Analytical Notes

- Fintech Notes

- How-To Notes

- Staff Climate Notes

Press Release No. 21/315

Imf releases the 2021 financial access survey results.

November 1, 2021

Washington, DC: On November 1 st , 2021, the International Monetary Fund released the results of the twelfth annual Financial Access Survey (FAS) . [1] The survey results reveal considerable expansion in the usage of digital financial services during the pandemic, while the usage of traditional financial services remained stable.

The use of digital financial services expanded considerably during the pandemic

Social distancing and lockdowns have reinforced the use of digital financial services, and the latest FAS data confirm this development. Mobile money usage increased significantly in low- and middle-income economies, with the value of mobile money transactions as a share of GDP increasing by 2 percentage points on average for low- and lower middle-income economies in 2020. The number and the value of mobile and internet banking transactions also grew for all country income groups, most notably among upper middle- and high-income economies.

Mobile money and mobile and internet banking transactions

Source: IMF Financial Access Survey and staff calculations.

Note: These charts show the weighted average of the indicators for respective groups.

Traditional financial services usage remained broadly stable

Aggregated data show that both access to and use of financial services at commercial banks remained broadly stable for countries in all income groups in 2020. This could be a result of the policy measures implemented to support individuals and enterprises during the pandemic. However, in some countries, including a few fragile and conflict-affected states, indicators of financial service usage (particularly those related to lending) fell in 2020. The data on microfinance institutions—which are key financial service providers to more vulnerable groups including women—also point to a few reversals.

Outstanding SME loans remained mostly stable for many low- and lower middle-income economies

SMEs are central to many countries’ economic activity and several governments have taken policy measures to support them. The IMF’s Financial Access COVID-19 Policy Tracker shows that financial assistance in the form of grants has been the most used SME policy measure during the pandemic, followed by public guarantees on loans, loan moratoriums, tax relief, and low interest rates. Many jurisdictions recorded little change or an increase in outstanding loans to SMEs by commercial banks in 2020, potentially because of the effectiveness of these policy measures, despite a few cases where outstanding SME loans declined.

Outcomes were mixed for women’s access to and use of financial services

The latest FAS gender-disaggregated data show mixed results in terms of women’s financial inclusion. Female-owned deposits and loans at commercial banks remained stable or even increased in some countries. These results may be partly attributed to gender-sensitive measures taken to support women’s financial access during the pandemic. However, the number of female borrowers per 1,000 female adults fell in several economies and, in some cases, gains from previous years were reversed in 2020. On average, most indicators point to unchanged gender gaps in financial access during the pandemic, but given the pre-existing gender gaps, advancing women’s financial access in low- and middle-income economies remains challenging.

FAS reporting remained strong despite the challenges posed by the COVID-19 pandemic

As of October 2021, 165 jurisdictions have submitted data to the FAS. The number of jurisdictions reporting gender-disaggregated data increased to 71—a ten percent increase from the previous round. The number of mobile money reporters also grew to 83—roughly 90 percent of countries with live mobile money services.

[1] The FAS is a unique supply-side database on access to and use of financial services, including digital financial services and gender-disaggregated data. It covers 189 jurisdictions, with more than 100 data series and historical data from 2004. The latest FAS data with country-specific metadata are available at http://data.imf.org/FAS , and the 2021 FAS Trends and Development can be downloaded here . The 2021 FAS was made possible with the generous support of the Data for Decisions (D4D) Fund.

IMF Communications Department

Media relations.

PRESS OFFICER: David Sharrock

Phone: +1 202 623-7100 Email: [email protected]

@IMFSpokesperson

Reaching Financial Inclusion: Necessary and Sufficient Conditions

- Original Research

- Published: 06 January 2022

- Volume 162 , pages 599–617, ( 2022 )

Cite this article

- Helena Susana Amaral Geraldes ORCID: orcid.org/0000-0002-6581-3454 1 ,

- Ana Paula Matias Gama ORCID: orcid.org/0000-0002-8064-6244 1 &

- Mário Augusto ORCID: orcid.org/0000-0001-7345-1679 2

1092 Accesses

9 Citations

Explore all metrics

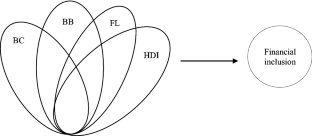

Financial inclusion is a vital development policy concern; different combinations and conditions of access to (supply) and use of (demand) financial services may predict levels of financial inclusion. With a fuzzy set qualitative comparative analysis, conducted across 61 countries worldwide, the current research establishes that financial literacy and human development are conditions of high financial inclusion; supply-side drivers, such as bank concentration and bank branches, represent substitutive conditions for attaining high levels of financial inclusion. With separate analyses of a split sample, designating developed and developing countries, the authors also determine that the absence of financial literacy and human development, as demand-side drivers, leads to diminished financial inclusion for both sets of countries. In turn, this research offers novel ideas for achieving more efficient policies to prompt financial inclusion.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Financial Inclusion: An Overview of Its Various Dimensions and Its Assistance in Reducing Private Sector Insolvency

Expanding the Financial Inclusion Frontiers: An Assessment of the Roles of Developing Eight (D-8) Countries Financial Regulators

Introduction

Availability of data and material.

Public data.

Code Availability

Public web sites.

Even in developed countries, Klapper et al. ( 2013 ) highlight that the lack of FL leaves people more vulnerable to macroeconomics shocks (e.g., international financial crisis of 2008).

Worldwide, 56% of adults do not use formal financial services, but this number diverges across high and low income countries. High income countries include 17% unbanked adults, but this number rises to 64% in low income countries (Ardic et al., 2011 ).

World Bank Data Catalog, Databank, available at https://databank.worldbank.org/source/world-development-indicators (accessed April 2021).

Financial Access Survey (2014), International Monetary Fund, available at https://data.imf.org/?sk=388dfa60-1d26-4ade-b505-a05a558d9a42 (accessed April 2021).

S&P Global FinLit Survey (2014), available at https://gflec.org/initiatives/sp-global-finlit-survey/ (accessed April 2021).

Human Development Data Center, UNDP, available at http://hdr.undp.org/en/data (accessed April 2021).

More traditional correlation-based analytical procedures (e.g., multiple regressions or structural equation modelling) assume causal relationships between the explanatory variables and the outcome. However, when the effects of the variables are asymmetrical, and the form of interactions among them is unknown, regression analysis may be inappropriate. Under these circumstances, fsQCA may return useful information by identifying the combinations of conditions that lead to a given outcome (Vis, 2012 ), and furthermore distinguishing between the necessary and the sufficient conditions (Schneider & Eggert, 2014 ).

Ababio, J. O. M., Attah-Botchwey, E., Osei-Assibey, E., & Barnor, C. (2020). Financial inclusion and human development in frontier countries. International Journal of Finance & Economics, 26 (1), 42–59. https://doi.org/10.1002/ijfe.1775

Article Google Scholar

Adetunji, O. M., & David-West, O. (2019). The relative impact of income and financial literacy on financial inclusion in Nigeria. Journal of International Development, 31 (4), 312–335. https://doi.org/10.1002/jid.3407

Allen, F., Demirgüç-Kunt, A., Klapper, L., & Peria, M. S. M. (2016). The foundations of financial inclusion: Understanding ownership and use of formal accounts. Journal of Financial Intermediation, 27 , 1–30. https://doi.org/10.1016/j.jfi.2015.12.003

Ardic, O. P., Heimann, M., & Mylenko, N. (2011). Access to financial services and the financial inclusion agenda around the world: A cross-country analysis with a new data set. Policy Research Working Paper Series 5537, The World Bank. Available at http://documents.worldbank.org/curated/en/519351468137108112/Access-to-financial-services-and-the-financial-inclusion-agenda-around-the-world-a-cross-country-analysis-with-a-new-data-set . Retrieved April 2021

Beck, T., Demirgüç-Kunt, A., & Honohan, P. (2009). Access to financial services: Measurement, impact, and policies. The World Bank Research Observer, 24 (1), 119–145.

Beck, T., Demirgüç-Kunt, A., & Martinez Peria, M. S. M. (2008). Banking services for everyone? Barriers to bank access and use around the world. The World Bank Economic Review, 22 (3), 397–430. https://doi.org/10.1093/wber/lhn020

Beck, T., Demirgüç-Kunt, A., & Peria, M. S. M. (2007). Reaching out: Access to and use of banking services across countries. Journal of Financial Economics, 85 (1), 234–266. https://doi.org/10.1016/j.jfineco.2006.07.002

Bongomin, G. O. C., Munene, J. C., Ntayi, J. M., & Malinga, C. A. (2017). Financial literacy in emerging economies: Do all components matter for financial inclusion of poor households in rural Uganda? Managerial Finance, 43 (12), 1310–1331. https://doi.org/10.1108/MF-04-2017-0117

Bongomin, G. O. C., Munene, J. C., Ntayi, J. M., & Malinga, C. A. (2018). Nexus between financial literacy and financial inclusion: Examining the moderating role of cognition from a developing country perspective. International Journal of Bank Marketing, 36 (7), 1190–1212. https://doi.org/10.1108/IJBM-08-2017-0175

Bongomin, G. O. C., Ntayi, J. M., Munene, J. C., & Nabeta, I. N. (2016). Social capital: Mediator of financial literacy and financial inclusion in rural Uganda. Review of International Business and Strategy, 26 (2), 291–312. https://doi.org/10.1108/RIBS-06-2014-0072

Boyd, J. H., & Prescott, E. C. (1986). Financial intermediary-coalitions. Journal of Economic Theory, 38 , 211–232. https://doi.org/10.1016/0022-0531(86)90115-8

Burgess, R., & Pande, R. (2005). Do rural banks matter? Evidence from the Indian social banking experiment. American Economic Review, 95 (3), 780–795. https://doi.org/10.1257/0002828054201242

Chakravarty, S. R., & Pal, R. (2013). Financial inclusion in India: An axiomatic approach. Journal of Policy Modelling, 35 (5), 813–837. https://doi.org/10.1016/j.jpolmod.2012.12.007

Chliova, M., Brinckmann, J., & Rosenbusch, N. (2015). Is microcredit a blessing for the poor? A meta-analysis examining development outcomes and contextual considerations. Journal of Business Venturing, 30 (3), 467–487. https://doi.org/10.1016/j.jbusvent.2014.10.003

Cucinelli, D., Trivellato, P., & Zenga, M. (2019). Financial literacy: The role of the local context. Journal of Consumer Affairs . https://doi.org/10.1111/joca.12270

Datta, S. K., & Singh, K. (2019). Variation and determinants of financial inclusion and their association with human development: A cross-country analysis. IIMB Management Review, 31 , 336–349. https://doi.org/10.1016/j.iimb.2019.07.013

Demir, A., Pesqué-Cela, V., Altunbas, Y., & Murinde, V. (2020). Fintech, financial inclusion and income inequality: A quantile regression approach. European Journal of Finance . https://doi.org/10.1080/1351847X.2020.1772335

Demirgüç-Kunt, A., Klapper, L. F., Singer, D., & Van Oudheusden, P. (2015). The global Findex database 2014: Measuring financial inclusion around the world. 7255. Policy Research Working Paper.

Demirgüç-Kunt, A., Klapper, A., Singer, D., Ansar, S., & Hess, J. (2017). The Global Findex Database 2017. Measuring financial inclusion and the fintech revolution . World Bank.

Google Scholar

Demirgüç-Kunt, A., & Klapper, L. (2013). Measuring financial inclusion: Explaining variation in use of financial services across and within countries. Brookings Papers on Economic Activity, 44 (1), 279–340. https://doi.org/10.1353/eca.2013.0002

Dev, S. M. (2006). Financial inclusion: Issues and challenges. Economic and Political Weekly . https://doi.org/10.2307/4418799

Di Giannatale, S., & Roa, M. J. (2019). Barriers to formal saving: Micro- and macroeconomic effects. Journal of Economic Surveys, 33 (2), 541–566. https://doi.org/10.1111/joes.12275

Emara, N., & Kasa, H. (2020). The non-linear relationship between financial access and domestic savings: The case of emerging markets. Applied Economics, 53 (3), 345–363. https://doi.org/10.1080/00036846.2020.1808174

Esquivias, M. A., Sethi, N., Ramandha, M. D., & Jayanti, A. D. (2020). Financial inclusion dynamics in Southeast Asia: An empirical investigation on three countries. Business Strategy and Development . https://doi.org/10.1002/bsd2.139

Fiss, P. C. (2011). Building better causal theories: A fuzzy set approach to typologies in organization research. Academy of Management Journal, 54 (2), 393–420. https://doi.org/10.5465/amj.2011.60263120

Fouejieu, A., Sahay, R., Cihak, M., & Chen, S. (2020). Financial inclusion and inequality: A cross-country analysis. Journal of International Trade & Economic Development, 29 (8), 1018–1048. https://doi.org/10.1080/09638199.2020.1785532

Fu, J. (2020). Ability or opportunity to act: What shapes financial well-being? World Development, 128 , 1–20. https://doi.org/10.1016/j.worlddev.2019.104843

Goyal, K., & Kumar, S. (2020). Financial literacy: A systematic review and bibliometric analysis. International Journal of Consumer Studies, 45 , 80–105. https://doi.org/10.1111/ijcs.12605

Grohmann, A., Klühs, T., & Menkhoff, L. (2018). Does financial literacy improve financial inclusion? Cross-country evidence. World Development, 111 , 84–96. https://doi.org/10.1016/j.worlddev.2018.06.020

Hauswald, R., & Marquez, R. (2006). Competition and strategic information acquisition in credit markets. Review of Financial Studies, 19 (3), 967–1000. https://doi.org/10.1093/rfs/hhj021

Kabakova, O., & Plaksenkov, E. (2018). Analysis of factors affecting financial inclusion: Ecosystem view. Journal of Business Research, 89 , 198–205. https://doi.org/10.1016/j.jbusres.2018.01.066

Kaiser, T., & Menkhoff, L. (2017). Does financial education impact financial literacy and financial behavior, and if so, when? World Bank Economic Review, 31 , 611–630. https://doi.org/10.1093/wber/lhx018

Karakurum-Ozdemir, K., Kokkizil, M., & Uysal, G. (2019). Financial literacy in developing countries. Social Indicators Research, 143 , 325–353. https://doi.org/10.1007/s11205-018-1952-x

Kim, J. H. (2016). Study on the effect of financial inclusion on the relationship between income inequality and economic growth. Emerging Markets Finance and Trade, 52 (2), 498–512. https://doi.org/10.1080/1540496X.2016.1110467

Kimmitt, J., & Muñoz, P. (2017). Entrepreneurship and financial inclusion through the lens of instrumental freedoms. International Small Business Journal: Researching Entrepreneurship, 35 (7), 803–828. https://doi.org/10.1177/0266242617700699

Klapper, L., El-Zoghbi, M., & J. Hess. (2016). Achieving the Sustainable Development Goals: The role of financial inclusion. CGAP. Retrieved April 2021, from https://www.cgap.org/sites/default/files/Working-Paper-Achieving-Sustainable-Development-Goals-Apr-2016_0.pdf

Klapper, L., Lusardi, A., & Oudheusden, P. (2014). Financial literacy around the world: Insights from the Standard & Poor’s ratings services global financial literacy survey. Retrieved April 2021, from https://responsiblefinanceforum.org/wp-content/uploads/2015/12/2015-Finlit_paper_17_F3_SINGLES.pdf

Klapper, L., Lusardi, A., & Panos, G. A. (2013). Financial literacy and its consequences: Evidence from Russia during the financial crisis. Journal of Banking & Finance, 37 , 3904–3923. https://doi.org/10.1016/j.jbankfin.2013.07.014

Le, Q. H., Ho, H. L., & Mai, N. C. (2019). The impact of financial inclusion on income inequality in transition economies. Management Science Letters, 9 , 661–672. https://doi.org/10.5267/j.msl.2019.2.005

Levine, R. (1997). Financial development and economic growth: Views and agenda. Journal of Economic Literature, 35 (2), 688–726.

Lusardi, A., & Mitchell, O. S. (2014). The economic importance of financial literacy: Theory and evidence. Journal of Economic Literature, 52 (1), 5–44. https://doi.org/10.1257/jel.52.1.5

Mengistu, A., & Perez-Saiz, H. (2018). Financial inclusion and bank competition in sub-Saharan Africa. IMF Working Papers 18/256. Retrieved April, 2021, from https://www.imf.org/en/Publications/WP/Issues/2018/12/07/Financial-Inclusion-and-Bank-Competition-in-Sub-Saharan-Africa-46388

Nizam, R., Karim, Z. A., Rahman, A. A., & Sarmidi, T. (2020). Financial inclusiveness and economic growth: New evidence using a threshold regression analysis. Economic Research-Ekonomska Istraživanja, 33 (1), 1465–1484. https://doi.org/10.1080/1331677X.2020.1748508

Nuzzo, G., & Piermattei, S. (2020). Discussing Measures of financial inclusion for the main Euro area countries. Social Indicators Research, 148 , 765–786. https://doi.org/10.1007/s11205-019-02223-8

OECD. (2014). PISA 2012 technical background. In OECD (Ed.), PISA 2012 Results: Students and money—Financial literacy skills for the 21st century (Vol. VI, pp. 123–145). OECD Publishing.

Chapter Google Scholar

OECD. (2020a). OECD/INFE 2020 International Survey of Adult Financial Literacy. Retrieved April, 2021, from www.oecd.org/financial/education/launchoftheoecdinfeglobalfinancialliteracysurveyreport.htm

OECD. (2020b). PISA 2018 results (volume IV): Are students smart about money? PISA, OECD Publishing. https://doi.org/10.1787/48ebd1ba-en

Book Google Scholar

Omar, M. A., & Inaba, K. (2020). Does financial inclusion reduce poverty and income inequality in developing countries? A panel data analysis. Journal of Economic Structures, 9 (37), 1–25. https://doi.org/10.1186/s40008-020-00214-4

Owen, A. L., & Pereira, J. M. (2018). Bank concentration, competition, and financial inclusion. Review of Development Finance, 8 , 1–17. https://doi.org/10.1016/j.rdf.2018.05.001

Ozili, P. K. (2020). Financial inclusion research around the world: A review. Forum for Social Economics . https://doi.org/10.2139/ssrn.3515515

Peet, R., & Hartwick, E. (2009). Theories of development, contentions, arguments, alternative . Guilford Press.

Philippas, N. D., & Avdoulas, C. (2019). Financial literacy and financial well-being among generation-Z university students: Evidence from Greece. European Journal of Finance, 26 (4–5), 360–381. https://doi.org/10.1080/1351847X.2019.1701512

Ragin, C. (2000). Fuzzy set social science . University of Chicago Press.

Ragin, C. (2006). Set relations in social research: Evaluating their consistency and coverage. Political Analysis, 14 (3), 291–310. https://doi.org/10.1093/pan/mpj019

Ragin, C. (2008). Qualitative comparative analysis using fuzzy sets (fsQCA). In C. C. Ragin & B. Rihoux (Eds.), Configurational comparative methods: Qualitative comparative analysis (QCA) and related techniques (pp. 87–122). Sage.

Rihoux, B., & Ragin, C. (2008). Configurational comparative analysis . Sage.

Sarma, M. (2008). Index of financial inclusion. ICRIER working paper 215.

Schneider, C. Q., & Wageman, C. (2010). Standards of good practice in qualitative comparative analysis (QCA) and fuzzy-sets. Comparative Sociology, 9 (3), 397–418. https://doi.org/10.1163/156913210X12493538729793

Schneider, M. R., & Eggert, A. (2014). Embracing complex causality with the QCA method: An invitation. Journal of Business Marketing Management, 7 (1), 312–328.

Schneider, M. R., Schulze-Bentrop, C., & Paunescu, M. (2010). Mapping the institutional capital of high-tech firms: A fuzzy-set analysis of capitalist variety and export performance. Journal of International Business Studies, 41 (2), 246–266. https://doi.org/10.1057/jibs.2009.36

Sethi, D., & Acharya, D. (2018). Financial inclusion and economic growth linkage: Some cross-country evidence. Journal of Financial Economic Policy, 10 (3), 369–385. https://doi.org/10.1108/JFEP-11-2016-0073

United Nations. (2019). Human development report 2019. Beyond income, beyond averages, beyond today: Inequalities in human development in the 21st century. New York. Retrieved April, 2021, from http://hdr.undp.org/en/content/human-development-report-2019

Vis, B. (2012). The comparative advantages of fsQCA and regression analysis for moderately large-N analyses. Sociological Methods & Research, 41 , 168–198.

Zins, A., & Weill, L. (2016). The determinants of financial inclusion in Africa. Review of Development Finance, 6 , 46–57. https://doi.org/10.1016/j.rdf.2016.05.001

Download references

Acknowledgements

This work was funded by FCT, Fundação para a Ciência e a Tecnologia, I.P., Projects: PTDC/EGE-OGE/31246/2017, UIDB/04630/2020; UIDB/05037/2020.

The authors acknowledge financial, research and administrative support from the FCT (UBI&NECE: UIDB/04630/2020; PTDC/EGE-OGE/31246/2017).

Author information

Authors and affiliations.

University of Beira Interior, Research Center in Business Science (NECE), Covilhã, Portugal

Helena Susana Amaral Geraldes & Ana Paula Matias Gama

University of Coimbra, CeBER, Faculty of Economics, Coimbra, Portugal

Mário Augusto

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Helena Susana Amaral Geraldes .

Ethics declarations

Conflict of interest.

Not applicable.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Reprints and permissions

About this article

Geraldes, H.S.A., Gama, A.P.M. & Augusto, M. Reaching Financial Inclusion: Necessary and Sufficient Conditions. Soc Indic Res 162 , 599–617 (2022). https://doi.org/10.1007/s11205-021-02850-0

Download citation

Accepted : 16 November 2021

Published : 06 January 2022

Issue Date : July 2022

DOI : https://doi.org/10.1007/s11205-021-02850-0

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Financial inclusion

- Financial literacy

- Human development

- Financial infrastructure

- Find a journal

- Publish with us

- Track your research

Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

- My Account Login

- Explore content

- About the journal

- Publish with us

- Sign up for alerts

- Open access

- Published: 05 October 2023

Bridging the financial divide: a bibliometric analysis on the role of digital financial services within FinTech in enhancing financial inclusion and economic development

- Mohd Afjal ORCID: orcid.org/0000-0002-1234-6055 1

Humanities and Social Sciences Communications volume 10 , Article number: 645 ( 2023 ) Cite this article

4018 Accesses

5 Citations

2 Altmetric

Metrics details

- Information systems and information technology

Financial technology (FinTech) and financial inclusion have become increasingly significant as means to alleviate poverty, reduce income inequality, and promote economic growth. This study presents a bibliometric analysis of research on the role of digital financial services in promoting financial access and economic development between 2010 and 2023. Using Scopus database, 695 documents were selected, and Biblioshiny and VOSviewer software were employed for analysis. The study aims to identify research themes, analyze publication trends, assess geographical distribution, recognize influential authors, institutions, and journals, uncover highly cited articles, and determine research gaps. The results reveal a growing interdisciplinary interest in FinTech and financial inclusion, with a surge in research production since 2016, emphasizing the significance of digital financial services in addressing the limitations of traditional financial institutions. The findings also highlight influential authors, institutions, and publications that have shaped the discourse, global collaboration patterns, and emerging research themes and trends. Policymakers are encouraged to foster an environment conducive to the growth and integration of FinTech, while future research directions should focus on the impact of digital financial services on vulnerable populations, alternative financing solutions, and the potential of emerging technologies in advancing financial inclusion and economic development. This analysis underscores the importance of interdisciplinary collaboration, global cooperation, and vigilance in addressing the challenges and opportunities presented by the rapid adoption of digital financial services in promoting inclusive and sustainable economic development.

Similar content being viewed by others

Systematic review and meta-analysis of ex-post evaluations on the effectiveness of carbon pricing

The role of artificial intelligence in achieving the Sustainable Development Goals

Participatory action research

Introduction.

The rapid evolution of financial technology (FinTech) has transformed the financial services industry, creating new opportunities for financial inclusion and economic development. FinTech refers to the innovative use of technology in the design and delivery of financial products and services (Morse, 2015 ). The emergence of FinTech has accelerated financial innovation, enhanced the efficiency of financial services, and expanded the reach of financial institutions, particularly in underserved markets (Chen et al., 2020 ). As a result, the potential role of FinTech in promoting financial access and economic development has attracted considerable attention from researchers, policymakers, and practitioners. Financial inclusion, defined as the availability and accessibility of financial services to all segments of society, is a key enabler of sustainable economic growth and poverty reduction (Demirgüç-Kunt et al., 2018 ). Despite significant progress in recent years, an estimated 1.7 billion adults still lack access to formal financial services, with the majority residing in low- and middle-income countries (World Bank, 2014 ). Financial exclusion exacerbates income inequality, limits economic opportunities, and perpetuates the cycle of poverty (Banerjee and Duflo, 2011 ). FinTech emerged as a result of the convergence of financial services and digital technology, encompassing a wide range of applications, such as mobile banking, peer-to-peer lending, digital payments, and blockchain-based solutions (Zavolokina et al., 2016 ). Over the past decade, FinTech has grown rapidly, disrupting traditional financial institutions and reshaping the way individuals and businesses access and use financial services (Arner et al., 2017a ).

FinTech innovations have significant potential to address the barriers to financial inclusion, such as lack of physical access to financial institutions, high costs, and complex requirements associated with traditional financial services (Bhattacharya et al., 2020 ). By leveraging digital technologies, FinTech firms can offer more affordable, accessible, and tailored financial products and services to underserved populations, including low-income individuals, women, and rural residents (Kim et al., 2020 ). For instance, mobile money services have enabled millions of unbanked individuals in developing countries to access basic financial services, such as savings, remittances, and credit, through their mobile phones (Suri, 2017 ). Similarly, peer-to-peer lending platforms have democratized access to credit by connecting borrowers directly with investors, bypassing traditional intermediaries and reducing borrowing costs (Zhang et al., 2015 ). Blockchain technology, on the other hand, has the potential to enhance financial inclusion by facilitating secure, transparent, and cost-effective transactions and record-keeping (Tapscott and Tapscott, 2016 ).

This study presents a nuanced focus on FinTech’s role in advancing financial inclusion and promoting economic development, an aspect not deeply explored in the comprehensive analysis of Li and Xu ( 2021 ). Whereas Li and Xu conducted a broad bibliometric analysis on FinTech as a whole, our research narrows down to understand better how digital financial services contribute to economic development and financial accessibility. This granular focus offers unique insights not captured in their broad approach. Furthermore, our research extends to 2023, thereby encompassing more recent developments in the FinTech space that were outside the scope of Li and Xu’s study, which ended in 2021. In addition, the Scopus database, as utilized in our research, diverges from the Web of Science database that Li and Xu employed. Different databases often yield different document sets and thus can provide distinctive insights into the field of study. This study also advances one step further by identifying research gaps and suggesting potential directions for future investigation, a valuable addition to the academic community that seeks unexplored avenues. Moreover, this study provides policy recommendations designed to foster an environment conducive to FinTech’s growth, a policy-oriented approach that adds practical relevance to the study, making it not only academically interesting but also beneficial for policymakers and practitioners. This study emphasis on the importance of interdisciplinary collaboration and global cooperation in addressing the challenges and opportunities presented by the rapid adoption of digital financial services adds a unique perspective not evident in the study by Li and Xu ( 2021 ). Thus, while both studies contribute to the rapidly evolving field of FinTech, this research offers a specific focus, employs a different database, covers a more recent time span, provides policy recommendations, and underscores the importance of interdisciplinary and global approaches.

Objectives of the study

Given the growing interest in FinTech and financial inclusion, a large and diverse body of research has emerged on the topic. However, understanding the scope, trends, and key findings of this research remains a challenge due to the interdisciplinary nature of the field and the rapid pace of technological advancements. A bibliometric analysis can help address this challenge by systematically mapping the research landscape, revealing patterns in the publication output, citation activity, authorship, and research themes.

The objective of this bibliometric analysis is to provide a comprehensive overview of the research on the role of digital financial services in promoting financial access and economic development. Specifically, the study aims to:

Identify the main research themes and emerging topics in the field.

Analyze the trends in publication output and citation activity over time.

Assess the geographical distribution of publications and research collaboration.

Recognize the most influential authors, institutions, and journals in the field.

Uncover the highly cited articles and their main findings.

Determine research gaps and potential avenues for future investigation.

Scope of the study

Although FinTech encompasses a wide range of technological innovations in the financial sector, this study focuses on the role of digital financial services in promoting financial access and economic development. Digital financial services refer to a subset of FinTech that includes mobile money, digital payments, peer-to-peer lending, crowdfunding, and other technology-driven financial services that are accessible through digital platforms, such as mobile phones, computers, and other internet-enabled devices.

The bibliometric analysis covers research articles published in academic journals, conference proceedings, and other scholarly outlets indexed in major databases, such as Web of Science, Scopus, and Google Scholar. The study period is determined by the availability of data and the most recent developments in the field, with a focus on the research published from the early 2000s to the present. The analysis excludes books, book chapters, and other non-peer-reviewed publications, as well as research that does not directly address the role of digital financial services in promoting financial access and economic development.

The bibliometric analysis also takes into account the interdisciplinary nature of the research on FinTech and financial inclusion, encompassing fields such as economics, finance, information systems, business, and development studies. By focusing on the intersection of these disciplines, the study aims to provide a comprehensive and nuanced understanding of the research landscape on the role of digital financial services in promoting financial access and economic development.

Review of literature

Financial technology (FinTech) has emerged as a significant force in shaping the financial landscape, particularly in promoting financial inclusion. The rapid advancements in digital technology have enabled a proliferation of innovative solutions to address financial access barriers and foster economic development. This literature review aims to provide a comprehensive understanding of the existing research on FinTech and financial inclusion, exploring key findings, trends, and gaps in the research. By analyzing the current research landscape, this review sets the context for a bibliometric analysis and highlights the importance of understanding the impact of digital financial services on financial access and economic development. The term “FinTech” was first coined in the late 20th century, with technological innovations such as electronic trading platforms and automated teller machines (ATMs) revolutionizing traditional banking and financial services (Gomber et al., 2017 ). The early stages of FinTech were characterized by the automation of financial processes, and the term became synonymous with the digitalization of the financial industry (Zavolokina et al., 2016 ). In the early 21st century, the rise of the internet and mobile technology fueled the growth of digital financial services, which enabled the delivery of financial services to previously underserved populations (GSMA, 2017 ). Mobile money, for instance, revolutionized the way people in developing countries accessed and managed their finances, providing an affordable and accessible alternative to traditional banking (Jack and Suri, 2014 ). As FinTech innovations continued to expand, the potential for leveraging digital technology to promote financial inclusion became increasingly evident. The World Bank ( 2014 ) highlighted the role of FinTech in accelerating financial access, emphasizing the importance of digital financial services in empowering underserved populations and fostering economic growth. This marked the beginning of a new era in which FinTech and financial inclusion became inextricably linked.

The diffusion of digital financial services has been studied extensively in the context of technology adoption models. The Technology Acceptance Model (TAM) (Davis, 1989 ) and the Unified Theory of Acceptance and Use of Technology (UTAUT) (Venkatesh et al., 2003 ) are two prominent frameworks that have been employed to analyze the factors influencing the adoption of FinTech services. These models emphasize the role of perceived usefulness, perceived ease of use, and social influence in shaping users’ attitudes and intentions towards digital financial services (Shaikh and Karjaluoto, 2015 ). Financial inclusion research has focused on understanding the barriers and drivers of access to financial services. The Access, Usage, and Quality (AUQ) framework (Cull et al., 2009 ) and the Financial Inclusion Index (Global Findex) (Demirgüç-Kunt et al., 2018 ) are two widely used frameworks for assessing financial inclusion levels. These frameworks emphasize the need for accessible, affordable, and high-quality financial services to promote financial access and economic development.

There is a growing body of literature that highlights the positive impact of digital financial services on financial access. For example, Suri and Jack ( 2016 ) found that the adoption of mobile money in Kenya significantly increased financial access, particularly for women and rural populations. Similarly, Batista and Vicente ( 2018 ) demonstrated that the introduction of mobile banking in Mozambique improved financial access for low-income individuals, while Mbiti and Weil ( 2016 ) reported that mobile money services in Tanzania led to increased access to savings and credit facilities. FinTech innovations have also been shown to contribute to improved financial literacy, which is a key determinant of financial inclusion. For example, Carpena et al. ( 2011 ) found that digital financial education programs in India and the Philippines led to increased financial knowledge and better financial decision-making among participants. Similarly, Xu and Zia ( 2012 ) demonstrated that mobile-based financial education programs in South Africa significantly improved participants’ financial literacy levels.

The impact of FinTech on economic development has also been a subject of extensive research. Studies such as Aker et al. ( 2016 ) have demonstrated that mobile money services can lead to increased agricultural productivity and income growth in rural areas. Other research, such as Gutiérrez and Singh ( 2013 ), has shown that digital financial services can contribute to economic growth by facilitating the flow of remittances, reducing transaction costs, and fostering entrepreneurship. The regulatory environment plays a crucial role in the adoption and success of FinTech innovations in promoting financial inclusion. Research by Arner et al. ( 2015 ) and Zetzsche et al. ( 2017a ) highlights the importance of developing a supportive and flexible regulatory framework that can adapt to the rapid evolution of digital financial services. Moreover, studies such as Chen et al. ( 2019 ) emphasize the need for regulatory authorities to balance innovation with the protection of consumers and the stability of the financial system. The bibliometric analysis on FinTech and financial inclusion finds resonance with several other works in the field. Rakshit et al. ( 2021 ) underscore the role of sentiment analytics in digital finance. The behavioral finance research by Sajeev et al. ( 2021 ) reiterates the impact of FinTech on investor behavior. Afjal’s ( 2022 ) study on Bitcoin’s volatility elucidates the complexities of the financial ecosystem within the FinTech landscape. Moreover, Afjal et al. ( 2023 ) probe into the interplay between FinTech, energy consumption, and environmental sustainability, hinting at wider implications of FinTech. Nagarajan and Afjal ( 2023 ) provide insights into the potential of blockchain technology in financial services. Lastly, Trivedi et al. ( 2022 ) underline the effect of external shocks, like the COVID-19 pandemic, on financial markets, accentuating the need for adaptability.

Another area of interest within the literature is the role of FinTech in promoting financial resilience and crisis management. As financial systems have become increasingly interconnected and complex, understanding how digital financial services can help individuals and institutions manage and recover from economic shocks is crucial. FinTech innovations, particularly digital payment systems, have been used to facilitate rapid and targeted responses to economic crises, natural disasters, and pandemics. For instance, during the COVID-19 pandemic, governments worldwide leveraged digital financial services to deliver emergency cash transfers and social safety net payments to vulnerable populations (Gentilini et al., 2020 ). The ability of FinTech solutions to promote financial resilience by enabling individuals and businesses to better manage financial risks is another important area of research. Studies have shown that digital financial services, such as mobile money and peer-to-peer lending platforms, can help individuals and SMEs diversify income sources, manage cash flows, and access emergency funds, thus increasing their ability to cope with economic shocks. The impact of FinTech on the stability of the financial system as a whole is also an important topic of investigation. While some research suggests that FinTech innovations can enhance financial stability by reducing reliance on traditional intermediaries and increasing competition (Liang et al., 2017 ), other studies highlight the potential risks and challenges associated with the rapid growth of digital financial services, such as cybersecurity threats, fraud, and systemic risks (Brière et al., 2020 ).

Materials and methods

The investigation was executed utilizing a pre-established search query within the Scopus database, with the retrieved results being imported into reference management software. In formulating the search string for this study, a combination of keywords and terms employed that are commonly used in research focusing on the interplay between financial technology and financial inclusion. These keywords are designed to cover the broad spectrum of concepts in the realm of FinTech and its role in economic development and poverty reduction. This approach to query formation is consistent with best practices in bibliometric analysis as it provides a comprehensive and inclusive search (Aria and Cuccurullo, 2017 ). A variety of filters were employed to refine these findings. The primary filter constituted a temporal range constraint, encompassing documents published from 2010 to 2023. The secondary filter pertained to subject domains, encompassing Economics, Econometrics, and Finance; Social Sciences; Business, Management, and Accounting; Computer Science; and Environmental Science. The tertiary filter involved document classification, specifically incorporating articles and conference papers. The ultimate filter addressed language, including solely English-language documents.

Search string

TITLE-ABS-KEY ((“financial technology” OR “FinTech” OR “digital financial services” OR “mobile banking” OR “mobile money” OR “digital finance” OR “digital payments” OR “peer-to-peer lending”) AND (“financial inclusion” OR “financial access” OR “unbanked” OR “underbanked” OR “banking the unbanked” OR “economic development” OR “poverty reduction” OR “financial empowerment” OR “financial literacy”)) AND PUBYEAR > 2009 AND PUBYEAR < 2024 AND (LIMIT-TO, (“ECON”) OR LIMIT-TO (SUBJAREA, “SOCI”) OR LIMIT-TO (SUBJAREA, “BUSI”)) AND (LIMIT-TO (DOCTYPE, “ar”) OR LIMIT-TO (DOCTYPE, “cp”)) AND (LIMIT-TO (LANGUAGE, “English”)).

The given search string is designed to perform a bibliometric analysis on the research topic “Bridging the Financial Divide: A Bibliometric Analysis on the Role of Digital Financial Services within FinTech in Enhancing Financial Inclusion and Economic Development.” The search string is constructed using a combination of keywords, filters, and Boolean operators to ensure the retrieval of relevant literature for the analysis.

PRISMA statement

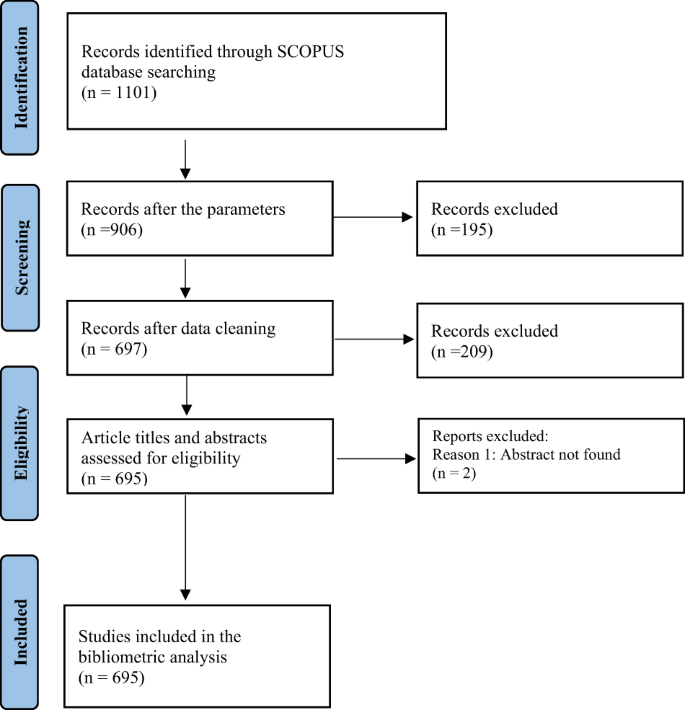

Following the application of the search string, the “Preferred Reporting Items for Systematic Reviews and Meta-Analysis” (PRISMA statement) was employed to meticulously refine the search outcomes (Page et al., 2020 ; Haddaway et al., 2022 ). This entire procedure is depicted in Fig. 1 . The rationale for adopting the PRISMA statement stemmed from its capacity to enhance dependability across diverse reviews, its commendation founded upon its exhaustiveness, and the recent surge in its utilization within numerous bibliometric investigations.

PRISMA flow diagram showing the flow of the search in the identification and screening of sources for the bibliometric analysis. PRISMA Preferred Reporting Items for Systematic Reviews and Meta-Analyses.

The study’s objective was to pinpoint pertinent documents within the Scopus database, adhering to predefined parameters. The search was conducted systematically, with the results undergoing refinement through the application of diverse filters. The initial search yielded 1174 documents from the Scopus database. A subset of these documents, numbering 906, comprised English-language articles and conference papers published between 2010 and 2023, spanning the subject areas of Economics, Econometrics, and Finance; Social Sciences; Business, Management, and Accounting; Computer Science; and Environmental Science. The established criteria and filters were employed to condense the search results to a more manageable collection of germane documents, suitable for subsequent analysis or review.

Additional filters were applied, resulting in 697 records post-data cleansing, with the exclusion of 209 documents. A total of 695 articles and abstracts were deemed eligible, while two reports were omitted due to the unavailability of their abstracts. Ultimately, 695 studies met the inclusion requirements and were incorporated into the bibliometric analysis.

In the present study, the robust bibliometric analysis tool, Bibliometrix®, was employed for comprehensive examination. Bibliometric analyses should encompass various aspects, including descriptive and collaborative network analyses such as co-citation, bibliographic coupling, and co-occurrence testing (Aria and Cuccurullo, 2017 ). Bibliometrix® delivers an extensive assessment of scientific mapping, utilizing the biblioshiny interface (Aria and Cuccurullo, 2017 ). Moreover, VOSviewer is adept at managing substantial datasets, offers superior mapping features, and presents enhanced display options (Martínez-López et al., 2018 ; Donthu et al., 2020 ). Both tools cater to the full spectrum of functions investigated within this research.

Analysis using Biblioshiny

Firstly, the analyses commenced with the innovative utilization of Biblioshiny, a powerful and user-friendly web application designed to simplify the bibliometric process. This state-of-the-art tool streamlines the extraction, organization, and visualization of complex research data, enabling researchers to effectively examine intricate patterns and trends in the vast realm of academic literature. By leveraging Biblioshiny’s capabilities, our study delves into the FinTech and financial inclusion landscape, unearthing valuable insights and fostering a deeper understanding of how digital financial services are reshaping access to financial resources and driving economic development.

After extraction from the Scopus database, the dataset comprising articles on FinTech and Financial Inclusion is presented in Table 1 . This compilation exported from Biblioshiny and offers valuable insights pertaining to the research analysis in this domain.

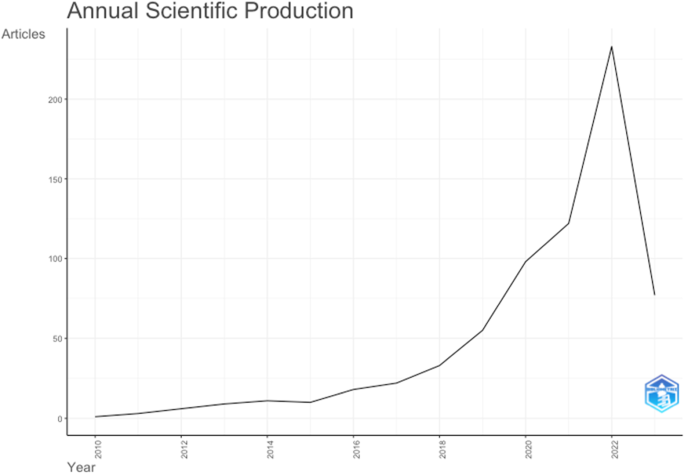

Production and most important journals in FinTech and financial inclusion

The provided Fig. 2 represents a research production on the role of digital financial services in promoting financial access and economic development. It highlights the number of articles published per year on financial technology (FinTech) and financial inclusion in the most important journals in the field, spanning from 2010 to 2023. The data reveals an increasing trend in the number of published articles, which indicates a growing interest in the subject matter. This can be attributed to rapid advancements in financial technology and the increasing recognition of the importance of financial inclusion in achieving economic growth and poverty reduction.

Research production on the role of digital financial services in promoting financial access and economic development.

Between 2010 and 2014, the research field experienced a slow but steady increase in the number of published articles, reflecting the early stages of exploration in the field. In 2015, there was a slight decrease in the number of articles, potentially due to fluctuations in research interest or funding. However, from 2016 to 2021, a significant surge in the number of publications occurred, reflecting the rapid development of FinTech solutions and the growing awareness of their potential in promoting financial inclusion. This trend continued in 2022, with a dramatic increase in the number of articles, which might be attributed to the expansion of FinTech applications and research on their impact on financial inclusion, as well as the growing importance of this subject in the context of economic development and sustainability.

It’s important to note that the data for 2023 only includes 77 articles. As the year is not yet complete, the number of publications is expected to increase by the end of the year. In conclusion, the table showcases the growing interest and research production in the field of FinTech and financial inclusion. This trend highlights the significance of digital financial services in promoting financial access and economic development, which serves as the focus of your research paper.

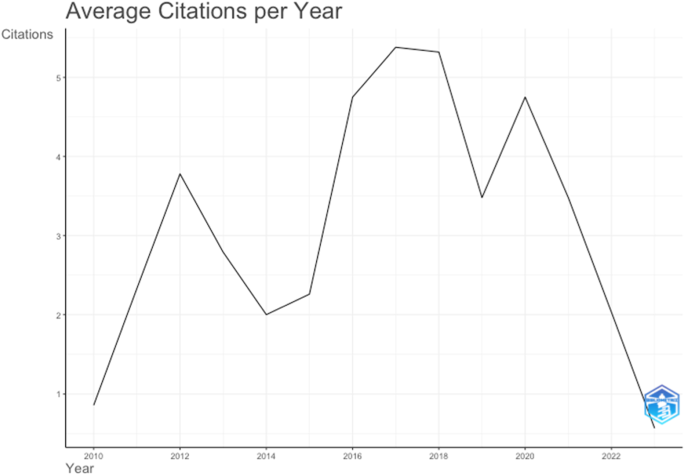

Average citation per year

The provided Fig. 3 offers a bibliometrics analysis of research production on digital financial services in promoting financial access and economic development, focusing specifically on the average citations per year for each year between 2010 and 2023. The table highlights the mean total citations per article and per year, providing insights into the reception and influence of research on FinTech and financial inclusion within the academic community.

Research production on digital financial services in promoting financial access and economic development, focusing specifically on the average citations per year.

From Fig. 3 , it can be observed that the citation impact of articles published in earlier years (2010–2012) is generally higher than those published in later years. This is an expected outcome, as older articles have had more time to accumulate citations. The citation impact of articles published between 2013 and 2018 remains relatively stable, with a slight peak in 2016 and 2017. This could be attributed to the growing interest in FinTech and financial inclusion during these years, resulting in more citable research.

However, there is a noticeable decrease in citation impact for articles published in more recent years (2019–2023). This can be attributed to the fact that newer articles have had less time to accrue citations. It is important to consider that the citation impact of these articles may increase in the coming years as they receive more attention from the academic community. It is essential to note that the citation impact of more recent articles is likely to evolve over time.

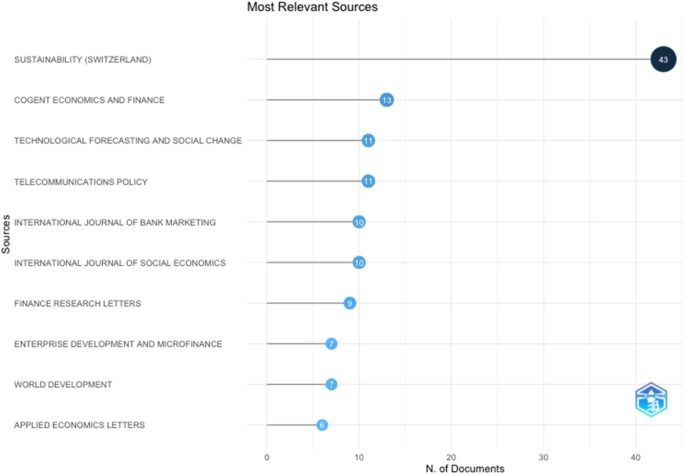

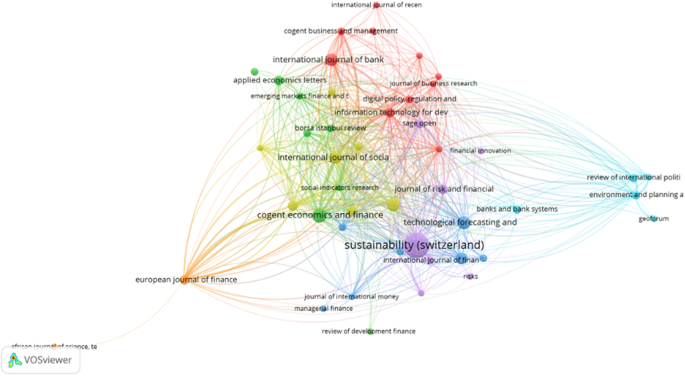

Most relevant sources

The provided Fig. 4 presents a bibliometrics analysis of the most relevant sources for research on the role of digital financial services in promoting financial access and economic development. It showcases the top 10 sources, ranked by the number of articles published on the topic of FinTech and financial inclusion, highlighting the key publications in the field. The most relevant source for research in this area is “Sustainability (Switzerland),” with 43 articles published on the topic. This suggests that the journal has a strong focus on FinTech and financial inclusion, likely due to the interdisciplinary nature of sustainability research and the increasing importance of financial inclusion in the context of sustainable development.

Most relevant sources for research on the role of digital financial services in promoting financial access and economic development.

Other sources contribute significantly to the research field, encompassing a diverse range of disciplines. These include economics and finance journals such as “Cogent Economics and Finance,” “International Journal of Bank Marketing,” “International Journal of Social Economics,” “Finance Research Letters,” and “Applied Economics Letters.” The list also features publications related to technology forecasting and social change (“Technological Forecasting and Social Change”), telecommunications policy (“Telecommunications Policy”), enterprise development and microfinance (“Enterprise Development and Microfinance”), and development studies (“World Development”).

The analysis of the most relevant sources for research on the role of digital financial services in promoting financial access and economic development serves as a valuable reference for researchers seeking to publish their work in reputable and influential outlets. These sources demonstrate the interdisciplinary nature of the research field and highlight the growing importance of FinTech and financial inclusion in a variety of academic disciplines.

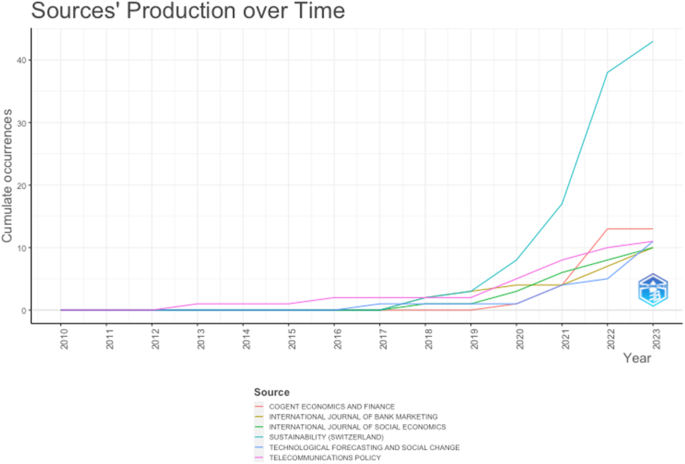

Sources’ production over time

The analysis of Table 2 highlights a discernable trend of increasing scholarly interest and output in the field of FinTech and financial inclusion. The rapid proliferation of research in recent years underscores the growing recognition of the crucial role that digital financial services play in fostering financial access and bolstering economic development. Furthermore, this table substantiates the importance of the top six journals in shaping and advancing the discourse in this emergent and increasingly consequential domain of study.

The table under examination, Table 2 , elucidates the evolution of research production in the domain of Financial technology (FinTech) and financial inclusion, specifically focusing on the output of the top six academic journals in this field. The table spans from 2010 to 2023 and delineates the publication count for each journal as well as the cumulative total and respective percentage share of the publications. The six preeminent journals that constitute the crux of this analysis are Sustainability, Cogent Economics and Finance (CEF), Technological Forecasting and Social Change (TFSC), Telecommunications Policy (TP), International Journal of Bank Marketing (IJBM), and International Journal of Social Economics (IJSE).

A gradual upsurge in research production can be observed from 2016 onward, with the number of published articles displaying a consistent annual increase. The most significant growth transpired between 2017 and 2023, with the total number of published articles amplifying from a meagre three in 2017 to an impressive 98 in 2023. The year 2023 stands out as a zenith in research output, with all six journals experiencing a heightened level of scholarly contributions.

Among the six journals, Sustainability emerges as the most prolific contributor to the field, accounting for 41.11% of the total publications. In contrast, the International Journal of Social Economics occupies the lowest rung, with a 10.74% share of the published articles. The remaining four journals—Cogent Economics and Finance, Technological Forecasting and Social Change, Telecommunications Policy, and International Journal of Bank Marketing—exhibit varying degrees of contribution, with their respective percentages ranging between 8.89 and 16.67%.

Figure 5 also illustrates the sources’ production over time for research on the role of digital financial services in promoting financial access and economic development, focusing on the top six most relevant sources from 2010 to 2023. It is evident from Fig. 5 that the initial years, ranging from 2010 to 2012, witnessed a dearth of scholarly contributions in the field, with no articles published. However, a nascent emergence of research interest becomes apparent in 2013, with the publication of a solitary article in Telecommunications Policy. The following years, 2014 and 2015, also saw a modest increment, with one article published each year in the same journal.

Evolution in the number of articles published by the top 6 journals in FinTech and Financial Inclusion.

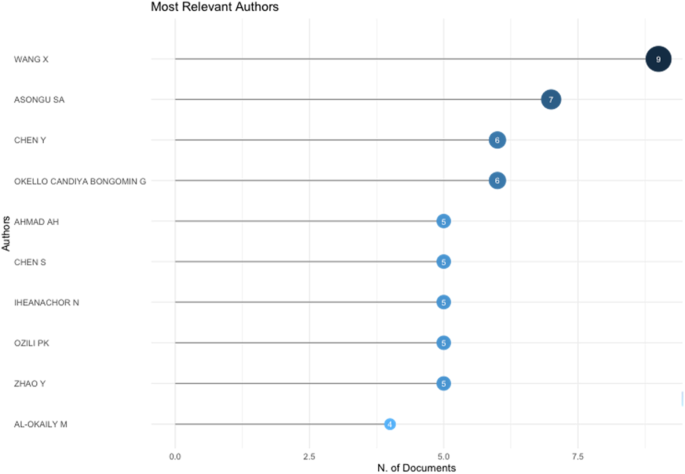

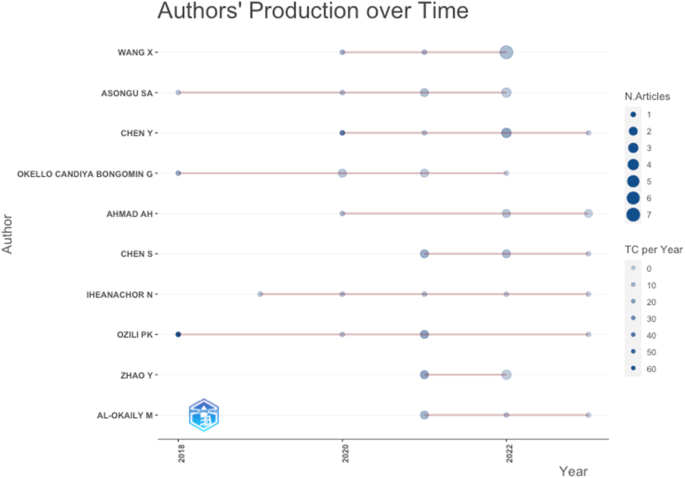

Most relevant author’s production over time

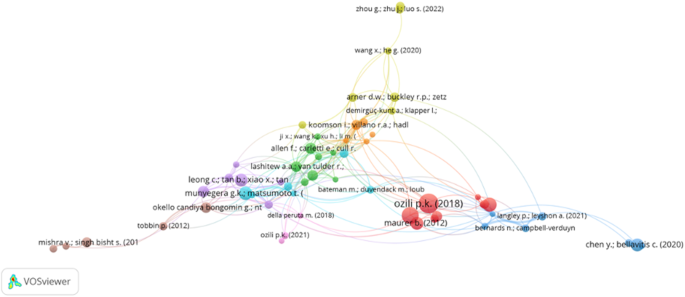

The provided, Fig. 6 , showcases the top 10 authors’ production over time in the research field of Financial technology (FinTech) and financial inclusion, specifically on the role of digital financial services in promoting financial access and economic development. The analysis of the top authors’ production over time is crucial for understanding the key researchers driving this field and identifying potential collaborators.

Top 10 authors’ production over time in the research field of Financial Technology (FinTech) and Financial Inclusion, specifically on the role of digital financial services in promoting financial access and economic development.

Wang X is the most productive author, with a total of 9 articles and a fractionalized count of 3.75. Asongu SA follows closely with 7 articles and a fractionalized count of 3. Other authors, such as Chen Y, Okello Candiya Bongomin G, Ahmad AH, Chen S, Iheanachor N, Ozili PK, Zhao Y, and Al-Okaily M, also contribute significantly to the research field.

The fractionalized count of articles takes into account shared authorship, giving partial credit to each author depending on their contribution to the publication. This metric provides a more accurate representation of the authors’ research output and their impact on the field.

By analyzing the production of the top 10 authors in the field of FinTech and financial inclusion, we can gain insights into the research trends and topics they are focused on. This information is beneficial for researchers who aim to engage with the leading experts in the field and build upon their work to contribute to the existing body of knowledge on the role of digital financial services in promoting financial access and economic development.

Authors’ production over time

Figure 7 illustrates the top 10 authors’ scholarly output over time in the domain of Financial Technology (FinTech) and financial inclusion, with an emphasis on digital financial services’ role in fostering financial accessibility and economic growth. The figure provides data on the authors, publication years, total citations (TC), and annual citation rates (TCpY).

Top 10 authors’ production over time on FinTech and Financial Inclusion.

Wang X stands out as the most prolific author, with publications from 2020 to 2022 exhibiting diverse citation counts and yearly citation rates. Wang X’s peak TC occurred in 2020 with 45 citations and a corresponding TCpY of 11.25. Asongu SA, another noteworthy contributor, has a publication history spanning from 2018 to 2022. Their highest TC was 23 in 2020, accompanied by a TCpY of 5.75. Chen Y’s work ranges from 2020 to 2023, with their most notable TC of 160 in 2020 and a TCpY of 40. Okello Candiya Bongomin G’s publications, dating from 2018 to 2022, achieved their highest TC of 101 in 2018 and a TCpY of 16.83. Other authors, including Chen S, Ahmad AH, Ozili PK, Iheanachor N, and Zhao Y, also display diverse citation counts and annual citation rates.

Examining the top 10 authors’ total citations and yearly citation rates offers valuable insights into the significance and impact of their research within the FinTech and financial inclusion field. By exploring their scholarly production over time, researchers can pinpoint pivotal contributions and gain a deeper understanding of the research landscape’s evolution, focusing on key themes and influential publications.

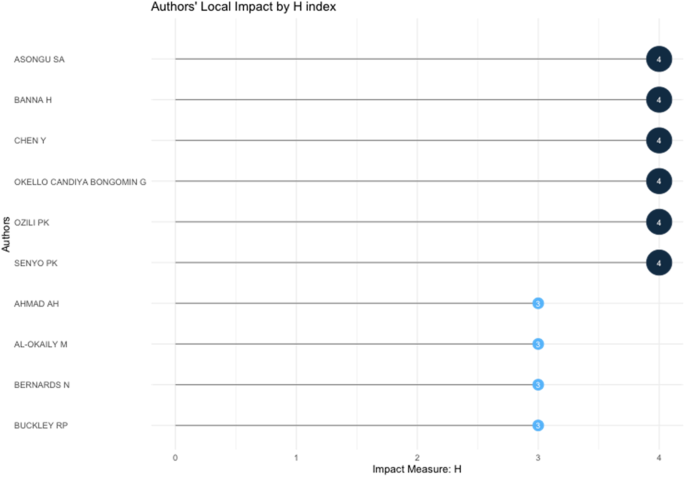

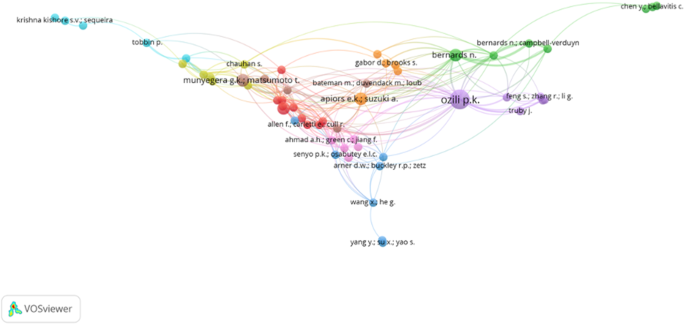

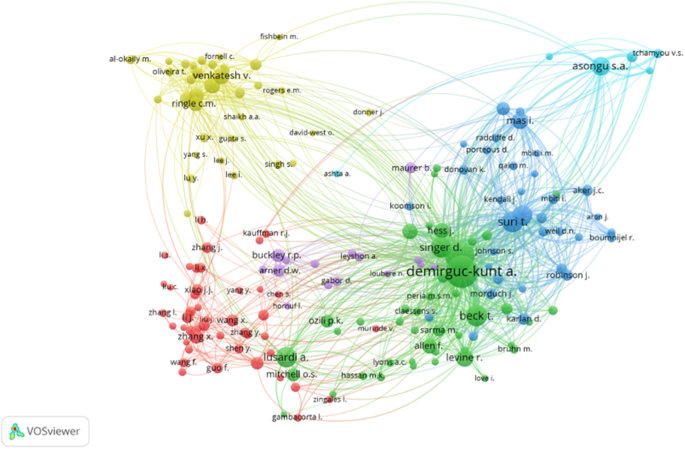

Author’s local impact by H Index

Figure 8 presents the local impact of authors in the research domain of Financial Technology (FinTech) and financial inclusion, with a focus on the role of digital financial services in promoting financial access and economic development, as measured by the H-Index. The H-Index is a valuable metric that captures both productivity and the impact of a researcher’s work by considering the number of publications and citations.

H-Index of each author is displayed, along with their G-Index, M-Index, total citations (TC), number of publications (NP), and the year of their first publication.

In Fig. 8 , the H-Index of each author is displayed, along with their G-Index, M-Index, total citations (TC), number of publications (NP), and the year of their first publication (PY_start). Asongu SA, for example, has an H-Index of 4, a G-Index of 7, an M-Index of 0.67, 66 total citations, 7 publications, and began publishing in this area in 2018. Chen Y has a similar H-Index of 4, but with a G-Index of 6, an M-Index of 1, 217 total citations, and 6 publications since 2020.

The H-Index provides insights into the influence and relevance of each author’s research in the field of FinTech and financial inclusion. Higher H-Index values indicate that an author has a greater number of highly cited publications, signaling a more significant impact on the research community. The G-Index, M-Index, total citations, and the number of publications further illustrate each author’s scholarly contributions, allowing for a comprehensive understanding of their local impact within the research landscape. By examining these metrics, researchers can identify key contributors and their influence within the field, helping to recognize essential research topics and publications that have shaped the discourse on FinTech and financial inclusion.

Table 3 presents a comprehensive analysis of the top 10 authors within the realm of Financial technology (FinTech) and financial inclusion research. The table is divided into three distinct categories: Most Relevant Authors, Author Local Impact, and Most Local Cited Authors. Each category evaluates the authors based on distinct metrics, thereby offering a holistic view of their prominence and influence in the field. The first category, Most Relevant Authors, ranks authors by the total number of articles published (AP). Wang X emerges as the most prolific author, with nine articles to his credit, followed by Asongu SA with seven articles. Chen Y and Okello C.B.G are tied with six articles each, while the remaining authors in this category have published between four and five articles. This category highlights the authors who have significantly contributed to the body of knowledge in the field of FinTech and financial inclusion.

The second category, Author Local Impact, gauges the influence of authors on the basis of their H-index (h_index) and their regional affiliation (Element). The H-index is a widely recognized metric that quantifies both the productivity and impact of a researcher’s publications by considering the number of citations they receive. The table showcases six authors with an H-index of 4 and four authors with an H-index of 3. Asongu SA, Banna H, Chen Y, and Okello C.B.G boast the highest H-index values, signifying that their work has had a substantial impact within the academic community.

The third and final category, Most Local Cited Authors, assesses the authors’ influence by examining the total number of citations (TC) their work has garnered and their most locally cited (MLC) status. Ozili PK leads this category with a remarkable 439 citations, followed by Brooks S and Gabor D, each with 261 citations. The MLC column enumerates the number of times an author’s work has been cited by other researchers within their local research community, with the highest MLC value being 3.

Table 3 provides valuable insights into the leading authors in the field of FinTech and financial inclusion, emphasizing their scholarly contributions, local impact, and citation influence. By examining these three distinct categories, the table accentuates the importance of these authors in shaping the discourse and advancing knowledge within the realm of digital financial services and their role in promoting financial access and economic development.

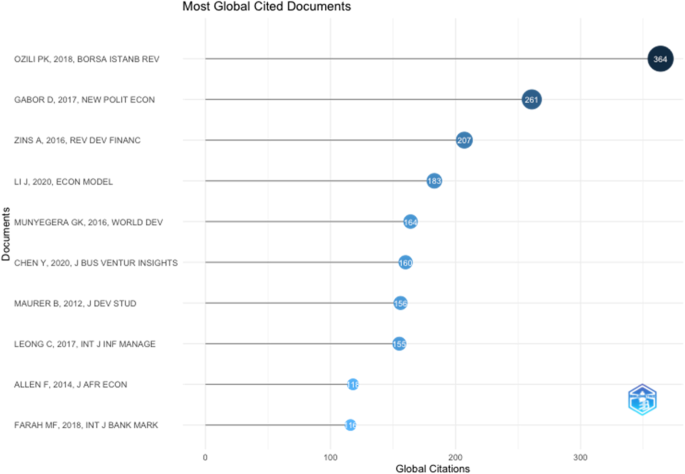

Most global cited documents

Figure 9 presents the most globally cited documents in the research domain of Financial Technology (FinTech) and financial inclusion, emphasizing the role of digital financial services in promoting financial access and economic development. The table highlights the papers, total citations, total citations per year (TC per Year), and normalized total citations (Normalized TC) for each document.

Most globally cited documents in the research domain of Financial Technology (FinTech) and Financial Inclusion, emphasizing the role of digital financial services in promoting financial access and economic development.

The paper by Ozili ( 2018 ) published in 2018 in the Borsa Istanbul Review, has the highest total citations (364) and citations per year (60.67), indicating its significant impact on the research community. The paper also has a high normalized total citation value of 11.40, further emphasizing its relevance within the field.

Another noteworthy paper is by Gabor ( 2017 ), published in 2017 in the New Political Economy, with 261 total citations and 37.29 citations per year. Its normalized total citation value is 6.93, which also underscores its importance in the domain.

Other highly cited papers include Chen Y’s 2020 paper in the Journal of Business Venturing Insights, and Munyegera GK’s 2016 paper in World Development. These papers have relatively high total citations, citations per year, and normalized total citations, reflecting their influence and recognition within the research community.

By examining the most globally cited documents, researchers can identify the pivotal publications that have significantly contributed to shaping the discourse on FinTech and financial inclusion. These highly cited papers indicate the key topics, theories, and findings that have resonated with the research community and have the potential to guide future investigations in this area.

Table 4 delineates the most globally cited documents within the field of Financial technology (FinTech) and financial inclusion. This table offers a nuanced perspective on the most influential scholarly contributions, highlighting their impact and relevance within the research community. The table presents a list of ten research papers, outlining the publication year, total citations (TC), citations per year (TC per Year), and normalized total citations (Normalized TC).

The paper with the highest total citation count, as well as the highest normalized citation value, is “Ozili PK, 2018 , Borsa Istanbul Review,” amassing a remarkable 364 citations and a normalized citation score of 11.40. The high normalized citation value signifies that this paper has garnered considerable attention and recognition within the academic community. Furthermore, the paper has a striking citation rate of 60.67 citations per year, reflecting its strong impact and relevance in the field of FinTech and financial inclusion. The second most globally cited paper is “Gabor D, 2017 , New Political Economy,” with 261 total citations, a citation rate of 37.29 per year, and a normalized citation score of 6.93. This paper, like the aforementioned work by Ozili, has exerted a significant influence on the research community and has contributed profoundly to the body of knowledge in the domain. Other noteworthy papers featured in Table 4 include “Zins A, 2016 , Review of Development Finance,” with 207 total citations, and “Li J, 2020, Economic Modelling,” with 183 total citations. These publications exhibit high citation rates of 25.88 and 45.75 per year, respectively, as well as normalized citation scores of 5.45 and 9.64. The remaining papers in the table also display commendable citation counts and normalized citation values, highlighting their contributions to the scholarly discourse on FinTech and financial inclusion. The list features works published between 2012 and 2020, indicating the ongoing interest in and evolution of this research area.

Table 5 delves into the most locally cited documents within the realm of Financial technology (FinTech) and financial inclusion. This table emphasizes the significance of these publications within their local research communities, providing a more nuanced understanding of their impact and relevance. The table lists ten documents, detailing the year of publication, local citations, global citations, the ratio between local and global citations, normalized local citations, and normalized global citations.

The first document, “Allen F, 2014, Journal of African Economics,” has garnered three local citations and 118 global citations. With a local-to-global citation ratio of 2.5, this paper exhibits a substantial impact both locally and globally. The normalized local and global citation values of 11 and 5.90, respectively, further underscore its importance within the academic community. “Asongu S, 2022, Quality & Quantity” is notable for its remarkable local-to-global citation ratio of 100.0, signifying that this paper has had an exceptional impact within its local research community. The normalized local citation value of 233 demonstrates its substantial local influence, while the normalized global citation value of 0.246 indicates a relatively modest global impact. The documents “Mehrotra A, 2019, International Conference on Automation, Computing, Technology and Management (ICACTM)” and “Senyo PK, 2020, International Conference on Information Systems (ICIS)” both have local-to-global citation ratios of 16.7, indicating their significance within the local research communities. The normalized local and global citation values for these papers further emphasize their relevance in the respective local and global contexts.

The remaining documents in Table 5 exhibit various local-to-global citation ratios, reflecting their diverse levels of local and global impact. For instance, “Ozili PK, 2018 , Borsa Istanbul Review” has a local-to-global citation ratio of 0.3, while “Saraswati BD, 2020, Business Theory & Practice” has a ratio of 12.5. The normalized local and global citation values for these documents illustrate their relative importance within the local and global research communities.

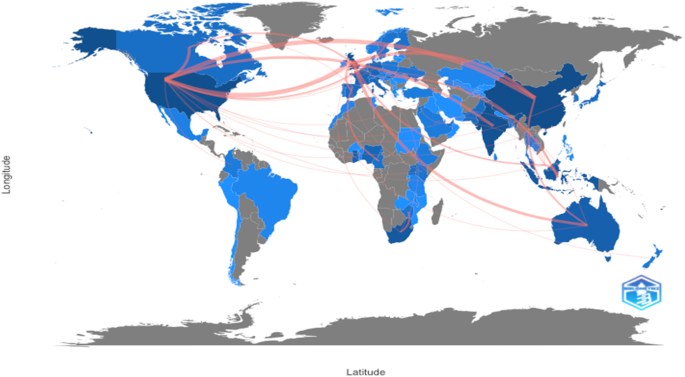

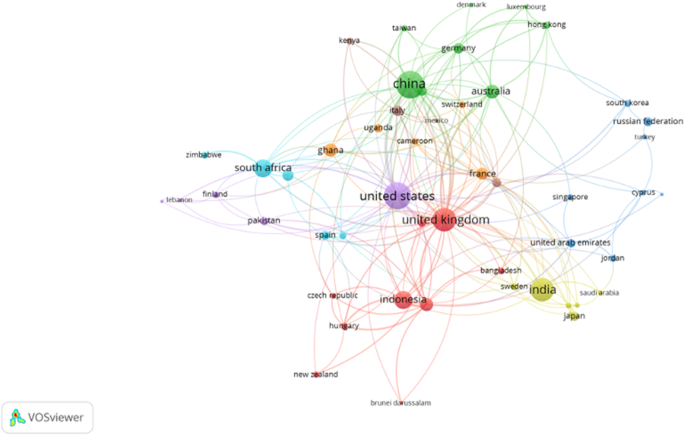

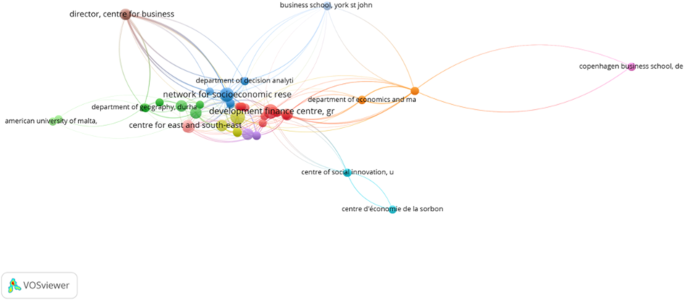

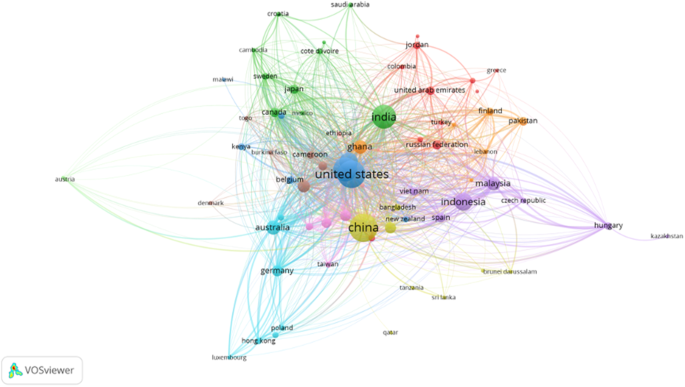

Collaboration world map

By examining the collaboration world map, researchers can identify the key countries and partnerships that contribute significantly to the development of the research field. This understanding can help scholars recognize the existing collaborative networks, identify potential research partners, and foster future collaboration to address pressing challenges in FinTech and financial inclusion.

Figure 10 showcases the collaboration world map in the research field of Financial Technology (FinTech) and financial inclusion, emphasizing the role of digital financial services in promoting financial access and economic development. The table lists the countries involved in collaborative research efforts and the frequency of these collaborations.

Examining the collaboration map helps researchers pinpoint key countries and partnerships crucial to the research field’s growth.

Notably, China and the United States exhibit the highest frequency of collaborations, with 13 instances of joint research efforts. This finding highlights the strong research ties between these two influential countries in the FinTech and financial inclusion domain. Similarly, the United States and the United Kingdom also share a high frequency of collaborations, with 13 instances as well, indicating a robust research relationship between these two countries.

Furthermore, China and the United Kingdom have collaborated on seven research projects, while India and the United States have worked together on six projects. The United Kingdom and Australia have jointly conducted six research projects, demonstrating the strong collaborative ties between these two countries in this field.

Other noteworthy collaborations include those between Indonesia and Malaysia, the United States and Canada, and the United Kingdom and the Netherlands. These collaborations highlight the importance of international research cooperation in advancing the understanding of FinTech and financial inclusion globally.

Thematic map

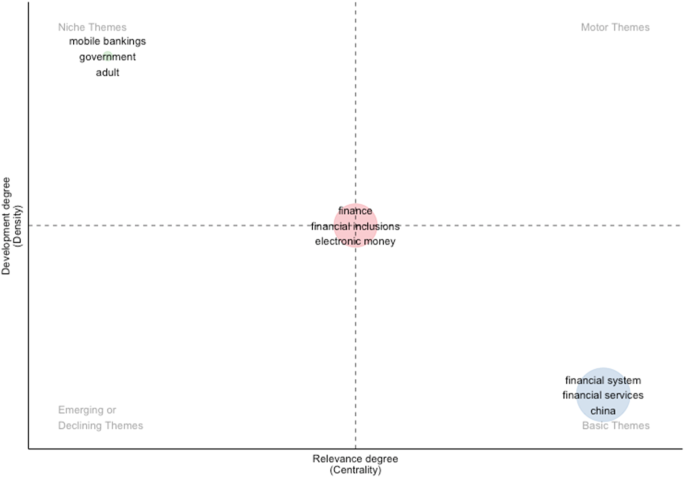

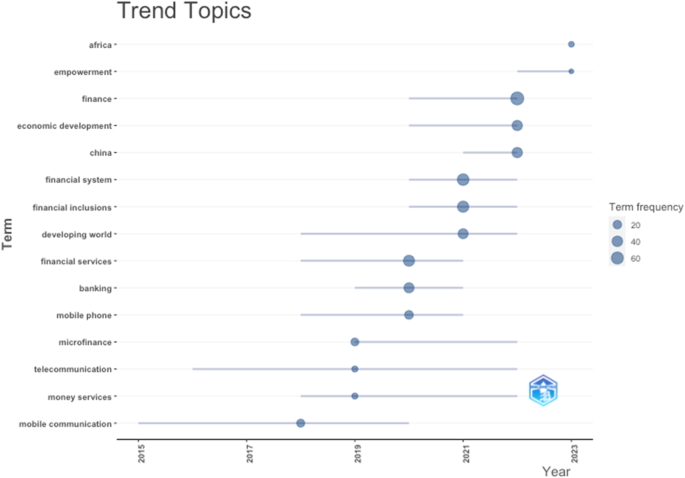

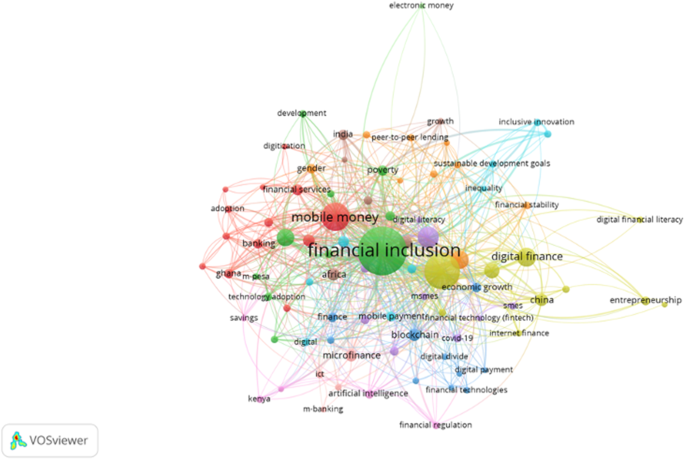

Figure 11 represents thematic map analysis of the research conducted on the role of digital financial services in promoting financial access and economic development. The table lists the most frequently occurring words, their respective clusters, cluster labels, betweenness centrality, closeness centrality, and PageRank centrality.

Thematic map analysis of the research conducted on the role of digital financial services in promoting financial access and economic development.

The table is organized into two major clusters, as represented by the Cluster_Label column. Cluster 1, labeled “finance,” contains words primarily related to the financial aspects of FinTech and financial inclusion. Cluster 2, labeled “financial system,” focuses on the broader financial systems, services, and the impact of FinTech on economic development.

Betweenness centrality, closeness centrality, and PageRank centrality are network analysis metrics that help identify the most relevant and influential words within the clusters. A higher value for these centrality measures indicates a more influential and connected word in the network.

In Cluster 1, the most frequently occurring words include ‘finance’, ‘financial inclusions’, ‘electronic money’, and ‘financial service’, which have relatively high betweenness centrality, closeness centrality, and PageRank centrality values. These words signify the importance of finance and financial services in driving the FinTech and financial inclusion research. The cluster also encompasses specific concepts such as ‘mobile money’, ‘digital finance’, and ‘technology diffusion’, highlighting the critical role of technology in expanding financial access.