This free Notion document contains the best 100+ resources you need for building a successful startup, divided in 4 categories: Fundraising, People, Product, and Growth.

This free eBook goes over the 10 slides every startup pitch deck has to include, based on what we learned from analyzing 500+ pitch decks, including those from Airbnb, Uber and Spotify.

This free sheet contains 100 accelerators and incubators you can apply to today, along with information about the industries they generally invest in.

This free sheet contains 100 VC firms, with information about the countries, cities, stages, and industries they invest in, as well as their contact details.

This free sheet contains all the information about the top 100 unicorns, including their valuation, HQ's location, founded year, name of founders, funding amount and number of employees.

12 Types of Business Risks and How to Manage Them

Description

Everything you need to raise funding for your startup, including 3,500+ investors, 7 tools, 18 templates and 3 learning resources.

Information about the countries, cities, stages, and industries they invest in, as well as their contact details.

List of 250 startup investors in the AI and Machine Learning industries, along with their Twitter, LinkedIn, and email addresses.

List of startup investors in the BioTech, Health, and Medicine industries, along with their Twitter, LinkedIn, and email addresses.

List of startup investors in the FinTech industry, along with their Twitter, LinkedIn, and email addresses.

90% of startups fail .

Thanks to the explosion of the digital economy, business founders have plenty of opportunities that they can tap into to build a winning business.

Unfortunately, there is a myriad of challenges your new business has to navigate through. These risks are inevitable, and they are a part of life in the business world.

However, without the right plan, strategy, and instruments, your business might be drowned by these challenges.

Therefore, we have created this guide to show you how can your business utilize risk management to succeed in 2022.

There are many types of startup and business risks that entrepreneurs can expect to encounter in 2022. Most of these threats are prevalent in the infancy stages of a business.

To know what you’ll be up against, here is a breakdown of the 12 most common threats.

12 Business Risks to Plan For

1) economic risks.

Failure to acquire adequate funding for your business can damage the chances of your business succeeding.

Before a new business starts making profits, it needs to be kept afloat with money. Bills will pile up, suppliers will need payments, and your employees will be expecting their salaries.

To avoid running into financial problems sooner or later, you need to acquire enough funds to shore up your business until it can support itself.

On the side, world and business country's economic situation can change either positively or negatively, leading to a boom in purchases and opportunities or to a reduction in sales and growth.

If your business is up and running, a great way to limit the effect of negative economic changes is to maintain steady cash flow and operate under the lean business method.

Here's an article from a founder explaining how he set up a lean budget on his $400k/year online business.

2) Market Risks

Misjudging market demand is one of the primary reasons businesses fail .

To avoid falling into this trap, conduct detailed research to understand whether you will find a ready market for what you want to sell at the price you have set.

Ensure your business has a unique selling point, and make sure what you offer brings value to the buyers.

To know whether your product will suit the market, do a survey, or get opinions from friends and potential customers.

Building a Minimum Viable Product of that business idea you've had is the recommendations made by most entrepreneurs.

This site, for example, was built in just 3 weeks and launched into the market to see if there was any interest in the type of content we offered.

The site was ugly, had little content and lacked many features. Yet, +7,700 users visited it within the first week, which made us realize we should keep working on this.

90% of startups fail. Learn how to not to with our weekly guides and stories. Join 40,000+ founders.

3) Competitive Risks

Competition is a major business killer that you should be wary of.

Before you even start planning, ask yourself whether you are venturing into an oversaturated market.

Are there gaps in the market that you can exploit and make good money?

If you have an idea that can give you an edge, register it. This will prevent others from copying your product, re-innovating it, and locking you out of what you started.

Competitive risks are also those actions made by competitors that prevent a business from earning more revenue or having higher margins.

4) Execution Risks

Having an idea, a business plan, and an eager market isn’t enough to make your startup successful.

Most new companies put a lot of effort into the initial preparation and forget that the execution phase is equally important.

First, test whether you can develop your products within budget and on time. Also, check whether your product will function as intended and whether it’s possible to distribute it without taking losses.

5) Strategic Risks

Business strategies can lead to the growth or decline of a company.

Every strategy involves some risk, as time & resources are generally involved to put them into practice.

Strategic risk in the chance that an implemented strategy, therefore, results in losses.

If, for example, the Marketing Department of a company implements a content marketing strategy and a lot of months, time & money later the business doesn't see any ROI, this becomes a strategic risk.

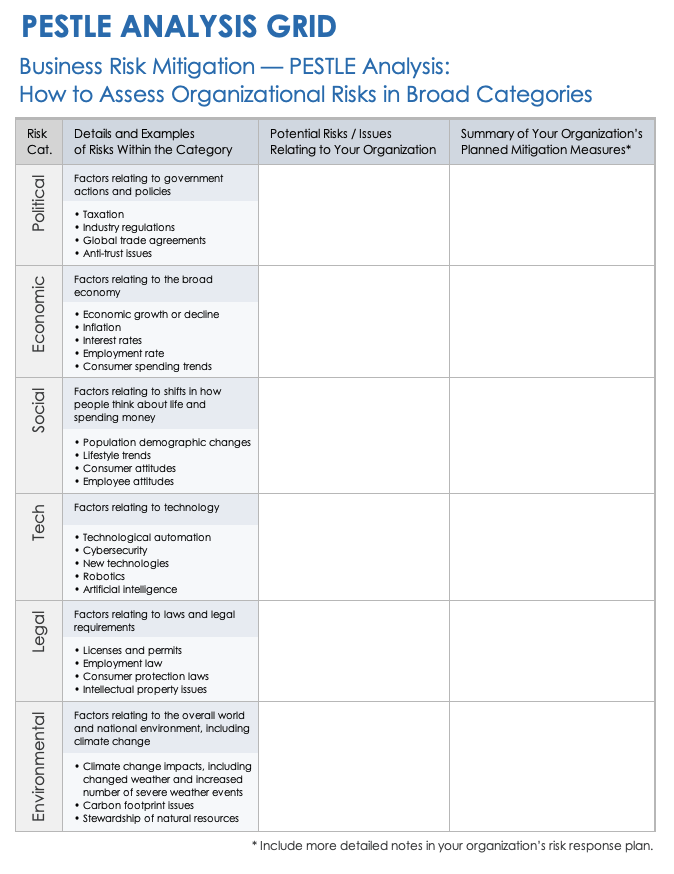

6) Compliance Risks

Compliance risks are those losses and penalties that a business suffers for not complying with countries' and states' regulations & laws.

There are some industries that are highly-regulated so the compliance risks of businesses within them are super high.

For example, in May 2018, the EU Commission implemented the General Data Protection Regulation (GDPR), a law in privacy and data protection in the EU, which affected millions of websites.

Those websites that weren't adapted to comply with this new rule, were fined.

7) Operational Risks

Operational risks arise when the day-to-day running of a company fail to perform.

When processes fail or are insufficient, businesses lose customers and revenue and their reputation gets ruined.

One example can be customer service processes. Customers are becoming every day less willing to wait for support (not to mention, receive bad quality one).

If a business customer service team fails or delays to solve customer's issues, these might find their solution in the business competitors.

8) Reputational Risks

Reputational risks arise when a business acts in an immoral and discourteous way.

This led to customer complaints and distrust towards the business, which means for the company a big loss of sales and revenue.

With the rise of social networks, reputational risks have become one of the main concerns for businesses.

Virality is super easy among Twitter so a simple unhappy customer can lead to a huge bad press movement for the company.

A recent example is the Away issue with their toxic work environment, as a former employee reported in The Verge .

The issue brought lots of critics within social networks which eventually led the CEO, Steph Korey, to step aside from the startup ( she seems to be back, anyway 🤷♂️! ).

9) Country Risks

When a business invests in a new country, there is a high probability it won't work.

A product that is successful in one market won't necessarily be in another one, especially when people within them are so different in cultures, climates, tastes backgrounds, etc.

Country risk is the existing failure probability businesses investing in new countries have to deal with.

Changes in exchange rates, unstable economic situations and moving politics are three factors that make these country risks be even more delicate.

10) Quality Risks

When a business develops a product or service that fails to meet customers' needs and quality expectations, the chance these customers will ever buy again is low.

In this way, the business loses future sales and revenue. Not to mention that some customers will ask for refunds, increasing business costs, as well as publicly criticize the company's products, leading to bad reputation (and a viral cycle that means even less $$ for the business).

11) Human Risk

Hiring has its benefits but also its risks.

Employees themselves involve a huge risk for a business, as they become to represent the company through how they work, mistakes committed, the public says and interactions with customers & suppliers,

A way to deal with human risk is to train employees and keep a motivated workforce. Yet, the risk will continue to exist.

12) Technology Risk

Security attacks, power outrage, discontinued hardware, and software, among other technology issues, are the events that form part of the technology risk.

These issues can lead to a loss of money, time and data, which has many connections with the previously mentioned risks.

Back-ups, antivirus, control processes, and data breach plans are some of the ways to deal with this risk.

How Businesses Can Use Risk Management To Grow Business

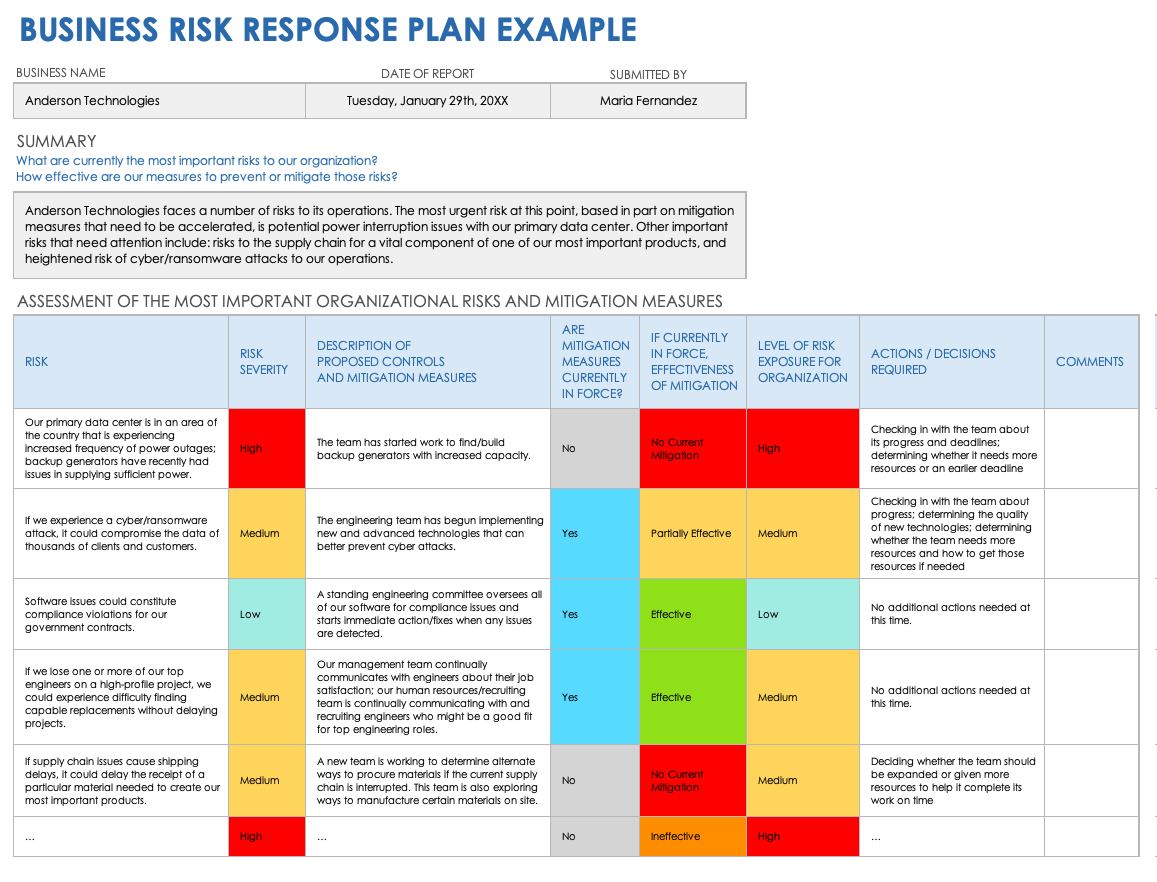

To mitigate any future threats, you need to prepare a comprehensive risk management plan.

This plan should detail the strategy you will use to deal with the specific challenges your business will encounter. Here’s what to do.

1) Identify Risks

Every business encounters a different set of challenges.

Before mapping the risks, analyze your business and note down its key components such as critical resources, important services or products, and top talent.

2) Record Risks

Once risks have been identified, you need to assess and document the threats that can affect each component.

Identify any warning signs or triggers of that recorded risk, also.

3) Anticipate

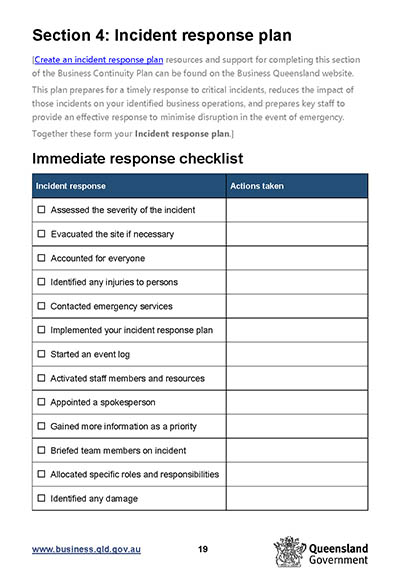

The best way to beat a threat is to detect and prepare for it in advance.

Once you know your business can be affected by a certain scenario, develop steps that you will take to stop the risk or to blunt its effects.

4) Prioritize Risks

Not all types of business risk have the same effect. Some can bring your startup to its knees, while others will only cause minimal effects.

To keep your business alive, start by putting in place measures that protect the vital functions from the most severe and most probable risks.

5) Have a Backup Plan

For every risk scenario, have at least two plans for countering the threat before it arrives.

The strategy you put in place should be in line with the current technology and trends.

Ensure your communicate these measures with all your team members.

6) Assign Responsibilities

When communicating measures with the team, assign responsibilities for each member in case any of the recorded risks affect the business.

These members should also be responsible for controlling the risks every certain time and maintaining records about them.

What is a Business Risk?

The term "business risk" refers to the exposure businesses have to factors that can prevent them from achieving their set financial goals.

This exposure can come from a variety of situations, but they can be classified into two:

- Internal factors: The risk comes from sources within the company, and they tend to be related to human, technological, physical or operational factors, among others.

- External factors: The risk comes from regulations/changes affecting the whole country/economy.

Any of these factors led to the business being unable to return investors and stakeholders the adequate amounts.

What Is Risk Management?

Risk management is a practice where an entrepreneur looks for potential risks that their business may face, analyzes them, and takes action to counter them.

The steps you take can eliminate the threat, control it, or limit the effects.

A risk is any scenario that harms your business. Risks can emanate from a wide variety of sources such as financial problems, management errors, lawsuits, data loss, cyber-attacks, natural calamities, and theft.

The risk landscape changes constantly, therefore you need to know the latest threats.

By setting up a risk management plan, your business can save money and time, which in some cases can be the determinant to keep your startup in business.

Not to mention, on the side, that risk management plans tend to make managers feel more confident to carry out business decisions, especially the risky ones, which can put their startups in a huge competitive advantage.

Wrapping Up

Becoming your own boss is one of the most rewarding things you can do.

However, launching a business is not a walk in the park; risks and challenges lurk around every corner.

If you are planning to establish a new business come 2022, make sure you secure its future by creating a broad risk management plan.

90% of startups fail. Learn how not to with our weekly guides and stories. Join +40,000 other startup founders!

An all-in-one newsletter for startup founders, ruled by one philosophy: there's more to learn from failures than from successes.

100+ resources you need for building a successful startup, divided into 4 categories: Fundraising, People, Product, and Growth.

What is business risk?

You know about death and taxes. What about risk? Yes, risk is just as much a part of life as the other two inevitabilities. This became all the more apparent during COVID-19, as each of us had to assess and reassess our personal risk calculations as each new wave of the pandemic— and pandemic-related disruptions —washed over us. It’s the same in business: executives and organizations have different comfort levels with risk and ways to prepare against it.

Where does business risk come from? To start with, external factors can wreak havoc on an organization’s best-laid plans. These can include things like inflation , supply chain disruptions, geopolitical upheavals , unpredictable force majeure events like a global pandemic or climate disaster, competitors, reputational issues, or even cyberattacks .

But sometimes, the call is coming from inside the house. Companies can be imperiled by their own executives’ decisions or by leaks of privileged information, but most damaging of all, perhaps, is the risk of missed opportunities. We’ve seen it often: when companies choose not to adopt disruptive innovation, they risk losing out to more nimble competitors.

The modern era is rife with increasingly frequent sociopolitical, economic, and climate-related shocks. In 2019 alone, for example, 40 weather disasters caused damages exceeding $1 billion each . To stay competitive, organizations should develop dynamic approaches to risk and resilience. That means predicting new threats, perceiving changes in existing threats, and developing comprehensive response plans. There’s no magic formula that can guarantee safe passage through a crisis. But in situations of threat, sometimes only a robust risk-management plan can protect an organization from interruptions to critical business processes. For more on how to assess and prepare for the inevitability of risk, read on.

Learn more about McKinsey’s Risk and Resilience Practice.

What is risk control?

Risk controls are measures taken to identify, manage, and eliminate threats. Companies can create these controls through a range of risk management strategies and exercises. Once a risk is identified and analyzed, risk controls can be designed to reduce the potential consequences. Eliminating a risk—always the preferable solution—is one method of risk control. Loss prevention and reduction are other risk controls that accept the risk but seek to minimize the potential loss (insurance is one method of loss prevention). A final method of risk control is duplication (also called redundancy). Backup servers or generators are a common example of duplication, ensuring that if a power outage occurs no data or productivity is lost.

But in order to develop appropriate risk controls, an organization should first understand the potential threats.

What are the three components to a robust risk management strategy?

A dynamic risk management plan can be broken down into three components : detecting potential new risks and weaknesses in existing risk controls, determining the organization’s appetite for risk taking, and deciding on the appropriate risk management approach. Here’s more information about each step and how to undertake them.

1. Detecting risks and controlling weaknesses

A static approach to risk is not an option, since an organization can be caught unprepared when an unlikely event, like a pandemic, strikes. So it pays to always be proactive. To keep pace with changing environments, companies should answer the following three questions for each of the risks that are relevant to their business.

- How will a risk play out over time? Risks can be slow moving or fast moving. They can be cyclical or permanent. Companies should analyze how known risks are likely to play out and reevaluate them on a regular basis.

- Are we prepared to respond to systemic risks? Increasingly, risks have longer-term reputational or regulatory consequences, with broad implications for an industry, the economy, or society at large. A risk management strategy should incorporate all risks, including systemic ones.

- What new risks lurk in the future? Organizations should develop new methods of identifying future risks. Traditional approaches that rely on reviews and assessments of historical realities are no longer sufficient.

2. Assessing risk appetite

How can companies develop a systematic way of deciding which risks to accept and which to avoid? Companies should set appetites for risk that align with their own values, strategies, capabilities, and competitive environments—as well as those of society as a whole. To that end, here are three questions companies should consider.

- How much risk should we take on? Companies should reevaluate their risk profiles frequently according to shifting customer behaviors, digital capabilities, competitive landscapes, and global trends.

- Are there any risks we should avoid entirely? Some risks are clear: companies should not tolerate criminal activity or sexual harassment. Others are murkier. How companies respond to risks like economic turmoil and climate change depend on their particular business, industry, and levels of risk tolerance.

- Does our risk appetite adequately reflect the effectiveness of our controls? Companies are typically more comfortable taking risks for which they have strong controls in place. But the increased threat of severe risks challenges traditional assumptions about risk control effectiveness. For instance, many businesses have relied on automation to increase speed and reduce manual error. But increased data breaches and privacy concerns can increase the risk of large-scale failures. Organizations, therefore, should evolve their risk profiles accordingly.

3. Deciding on a risk management approach

Finally, organizations should decide how they will respond when a new risk is identified. This decision-making process should be flexible and fast, actively engaging leaders from across the organization and honestly assessing what has and hasn’t worked in past scenarios. Here are three questions organizations should be able to answer.

- How should we mitigate the risks we are taking? Ultimately, people need to make these decisions and assess how their controls are working. But automated control systems should buttress human efforts. Controls guided, for example, by advanced analytics can help guard against quantifiable risks and minimize false positives.

- How would we respond if a risk event or control breakdown happens? If (or more likely, when) a threat occurs, companies should be able to switch to crisis management mode quickly, guided by an established playbook. Companies with well-rehearsed crisis management capabilities weather shocks better, as we saw with the COVID-19 pandemic.

- How can we build true resilience? Resilient companies not only better withstand threats—they emerge stronger. The most resilient firms can turn fallout from crises into a competitive advantage. True resilience stems from a diversity of skills and experience, innovation, creative problem solving, and the basic psychological safety that enables peak performance.

Change is constant. Just because a risk control plan made sense last year doesn’t mean it will next year. In addition to the above points, a good risk management strategy involves not only developing plans based on potential risk scenarios but also evaluating those plans on a regular basis.

Learn more about McKinsey’s Risk and Resilience Practice.

What are five actions organizations can take to build dynamic risk management?

In the past, some organizations have viewed risk management as a dull, dreary topic, uninteresting for the executive looking to create competitive advantage. But when the risk is particularly severe or sudden, a good risk strategy is about more than competitiveness—it can mean survival. Here are five actions leaders can take to establish risk management capabilities .

- Reset the aspiration for risk management. This requires clear objectives and clarity on risk levels and appetite. Risk managers should establish dialogues with business leaders to understand how people across the business think about risk, and share possible strategies to nurture informed risk-versus-return decision making—as well as the capabilities available for implementation.

- Establish agile risk management practices. As the risk environment becomes more unpredictable, the need for agile risk management grows. In practice, that means putting in place cross-functional teams empowered to make quick decisions about innovating and managing risk.

- Harness the power of data and analytics. The tools of the digital revolution can help companies improve risk management. Data streams from traditional and nontraditional sources can broaden and deepen companies’ understandings of risk, and algorithms can boost error detection and drive more accurate predictions.

- Develop risk talent for the future. Risk managers who are equipped to meet the challenges of the future will need new capabilities and expanded domain knowledge in model risk management , data, analytics, and technology. This will help support a true understanding of the changing risk landscape , which risk leaders can use to effectively counsel their organizations.

- Fortify risk culture. Risk culture includes the mindsets and behavioral norms that determine an organization’s relationship with risk. A good risk culture allows an organization to respond quickly when threats emerge.

How do scenarios help business leaders understand uncertainty?

Done properly, scenario planning prompts business leaders to convert abstract hypotheses about uncertainties into narratives about realistic visions of the future. Good scenario planning can help decision makers experience new realities in ways that are intellectual and sensory, as well as rational and emotional. Scenarios have four main features that can help organizations navigate uncertain times.

- Scenarios expand your thinking. By developing a range of possible outcomes, each backed with a sequence of events that could lead to them, it’s possible to broaden our thinking. This helps us become ready for the range of possibilities the future might hold—and accept the possibility that change might come more quickly than we expect.

- Scenarios uncover inevitable or likely futures. A broad scenario-building effort can also point to powerful drivers of change, which can help to predict potential outcomes. In other words, by illuminating critical events from the past, scenario building can point to outcomes that are very likely to happen in the future.

- Scenarios protect against groupthink. In some large corporations, employees can feel unsafe offering contrarian points of view for fear that they’ll be penalized by management. Scenarios can help companies break out of this trap by providing a “safe haven” for opinions that differ from those of senior leadership and that may run counter to established strategy.

- Scenarios allow people to challenge conventional wisdom. In large corporations in particular, there’s frequently a strong bias toward the status quo. Scenarios are a nonthreatening way to lay out alternative futures in which assumptions underpinning today’s strategy can be challenged.

Learn more about McKinsey’s Strategy & Corporate Finance Practice.

What’s the latest thinking on risk for financial institutions?

In late 2021, McKinsey conducted survey-based research with more than 30 chief risk officers (CROs), asking about the current banking environment, risk management practices, and priorities for the future.

According to CROs, banks in the current environment are especially exposed to accelerating market dynamics, climate change, and cybercrime . Sixty-seven percent of CROs surveyed cited the pandemic as having significant impact on employees and in the area of nonfinancial risk. Most believed that these effects would diminish in three years’ time.

Introducing McKinsey Explainers : Direct answers to complex questions

Climate change, on the other hand, is expected to become a larger issue over time. Nearly all respondents cited climate regulation as one of the five most important forces in the financial industry in the coming three years. And 75 percent were concerned about climate-related transition risk: financial and other risks arising from the transformation away from carbon-based energy systems.

And finally, cybercrime was assessed as one of the top risks by most executives, both now and in the future.

Learn more about the risk priorities of banking CROs here .

What is cyber risk?

Cyber risk is a form of business risk. More specifically, it’s the potential for business losses of all kinds in the digital domain—financial, reputational, operational, productivity related, and regulatory related. While cyber risk originates from threats in the digital realm, it can also cause losses in the physical world, such as damage to operational equipment.

Cyber risk is not the same as a cyberthreat. Cyberthreats are the particular dangers that create the potential for cyber risk. These include privilege escalation (the exploitation of a flaw in a system for the purpose of gaining unauthorized access to resources), vulnerability exploitation (an attack that uses detected vulnerabilities to exploit the host system), or phishing. The risk impact of cyberthreats includes loss of confidentiality, integrity, and availability of digital assets, as well as fraud, financial crime, data loss, or loss of system availability.

In the past, organizations have relied on maturity-based cybersecurity approaches to manage cyber risk. These approaches focus on achieving a particular level of cybersecurity maturity by building capabilities, like establishing a security operations center or implementing multifactor authentication across the organization. A maturity-based approach can still be helpful in some situations, such as for brand-new organizations. But for most institutions, a maturity-based approach can turn into an unmanageably large project, demanding that all aspects of an organization be monitored and analyzed. The reality is that, since some applications are more vulnerable than others, organizations would do better to measure and manage only their most critical vulnerabilities.

What is a risk-based cybersecurity approach?

A risk-based approach is a distinct evolution from a maturity-based approach. For one thing, a risk-based approach identifies risk reduction as the primary goal. This means an organization prioritizes investment based on a cybersecurity program’s effectiveness in reducing risk. Also, a risk-based approach breaks down risk-reduction targets into precise implementation programs with clear alignment all the way up and down an organization. Rather than building controls everywhere, a company can focus on building controls for the worst vulnerabilities.

Here are eight actions that comprise a best practice for developing a risk-based cybersecurity approach:

- fully embed cybersecurity in the enterprise-risk-management framework

- define the sources of enterprise value across teams, processes, and technologies

- understand the organization’s enterprise-wide vulnerabilities—among people, processes, and technology—internally and for third parties

- understand the relevant “threat actors,” their capabilities, and their intent

- link the controls in “run” activities and “change” programs to the vulnerabilities that they address and determine what new efforts are needed

- map the enterprise risks from the enterprise-risk-management framework, accounting for the threat actors and their capabilities, the enterprise vulnerabilities they seek to exploit, and the security controls of the organization’s cybersecurity run activities and change program

- plot risks against the enterprise-risk appetite; report on how cyber efforts have reduced enterprise risk

- monitor risks and cyber efforts against risk appetite, key cyber risk indicators, and key performance indicators

How can leaders make the right investments in risk management?

Ignoring high-consequence, low-likelihood risks can be catastrophic to an organization—but preparing for everything is too costly. In the case of the COVID-19 crisis, the danger of a global pandemic on this scale was foreseeable, if unexpected. Nevertheless, the vast majority of companies were unprepared: among billion-dollar companies in the United States, more than 50 filed for bankruptcy in 2020.

McKinsey has described the decisions to act on these high-consequence, low-likelihood risks as “ big bets .” The number of these risks is far too large for decision makers to make big bets on all of them. To narrow the list down, the first thing a company can do is to determine which risks could hurt the business versus the risks that could destroy the company. Decision makers should prioritize the potential threats that would cause an existential crisis for their organization.

To identify these risks, McKinsey recommends using a two-by-two risk grid, situating the potential impact of an event on the whole company against the level of certainty about the impact. This way, risks can be measured against each other, rather than on an absolute scale.

Organizations sometimes survive existential crises. But it can’t be ignored that crises—and missed opportunities—can cause organizations to fail. By measuring the impact of high-impact, low-likelihood risks on core business, leaders can identify and mitigate risks that could imperil the company. What’s more, investing in protecting their value propositions can improve an organization’s overall resilience.

Articles referenced:

- “ Seizing the momentum to build resilience for a future of sustainable inclusive growth ,” February 23, 2023, Børge Brende and Bob Sternfels

- “ Data and analytics innovations to address emerging challenges in credit portfolio management ,” December 23, 2022, Abhishek Anand , Arvind Govindarajan , Luis Nario and Kirtiman Pathak

- “ Risk and resilience priorities, as told by chief risk officers ,” December 8, 2022, Marc Chiapolino , Filippo Mazzetto, Thomas Poppensieker , Cécile Prinsen, and Dan Williams

- “ What matters most? Six priorities for CEOs in turbulent times ,” November 17, 2022, Homayoun Hatami and Liz Hilton Segel

- “ Model risk management 2.0 evolves to address continued uncertainty of risk-related events ,” March 9, 2022, Pankaj Kumar, Marie-Paule Laurent, Christophe Rougeaux, and Maribel Tejada

- “ The disaster you could have stopped: Preparing for extraordinary risks ,” December 15, 2020, Fritz Nauck , Ophelia Usher, and Leigh Weiss

- “ Meeting the future: Dynamic risk management for uncertain times ,” November 17, 2020, Ritesh Jain, Fritz Nauck , Thomas Poppensieker , and Olivia White

- “ Risk, resilience, and rebalancing in global value chains ,” August 6, 2020, Susan Lund, James Manyika , Jonathan Woetzel , Edward Barriball , Mekala Krishnan , Knut Alicke , Michael Birshan , Katy George , Sven Smit , Daniel Swan , and Kyle Hutzler

- “ The risk-based approach to cybersecurity ,” October 8, 2019, Jim Boehm , Nick Curcio, Peter Merrath, Lucy Shenton, and Tobias Stähle

- “ Value and resilience through better risk management ,” October 1, 2018, Daniela Gius, Jean-Christophe Mieszala , Ernestos Panayiotou, and Thomas Poppensieker

Want to know more about business risk?

Related articles.

What matters most? Six priorities for CEOs in turbulent times

Creating a technology risk and cyber risk appetite framework

Risk and resilience priorities, as told by chief risk officers

- My Account My Account

- Cards Cards

- Banking Banking

- Travel Travel

- Rewards & Benefits Rewards & Benefits

- Business Business

Curated For You

Related content, types of business risks and ideas for managing them.

Published: July 06, 2023

There are several types of business risks that can threaten a company’s ability to achieve its goals. Learn some of the most common risks for businesses and ideas for how to manage them.

Business risks can include financial, cybersecurity, operational, and reputational risks, all of which can seriously impact a company’s strategic plans if business leaders don’t take action to mitigate them.

What’s most important is that business owners are aware of the risks that could shake up their operations. That way, they can take steps to prevent them or minimize their impact if they occur. Here’s a look at some common business risks.

Financial Risks

Companies must generate sufficient cash flow to make interest payments on loans and to meet other debt-related obligations on time. Financial risk refers to the flow of money in the business and the possibility of a sudden financial loss. A company may be at financial risk if it doesn’t have enough cash to properly manage its debt payments and becomes delinquent on its loans.

Businesses with relatively higher levels of debt financing are considered at higher financial risk, since lenders often see them as having a greater chance of not meeting payment obligations and becoming insolvent. Types of financial risk include:

- Credit risk: When a company extends credit to customers, there is the possibility that those customers may stop making payments, which reduces revenue and earnings. A company also faces credit risk when a lender extends business credit to make purchases. If the company doesn’t have enough money to pay back those loans, it will default.

- Currency risk: Currency risk, also known as exchange-rate risk, can arise from the change in price of one currency in relation to another. For example, if a U.S. company agrees to sell its products to a European company for a certain amount of euros, but the value of the euro rises suddenly at the time of delivery and payment, the U.S. business loses money because it takes more dollars to buy euros.

- Liquidity risk: A company faces liquidity risk when it cannot convert its assets into cash. This type of business risk often occurs when a company suddenly needs a substantial amount of cash to meet its short-term debt obligations. For example, a manufacturing company may not be able to sell outdated machines to generate cash if no buyers come forward.

Cybersecurity Risks

As more businesses use online channels for sales and e-commerce payments, as well as for collecting and storing customer data, they are exposed to greater opportunities for hacking, creating security risks for companies and their stakeholders. Both employees and customers expect companies to protect their personal and financial information, but despite ongoing efforts to keep this information safe, companies have experienced data breaches, identity theft, and payment fraud incidents.

When these incidents happen, consumer confidence and trust in companies can take a dive.

Not only do security breaches threaten a company’s reputation, but the company is sometimes financially liable for damages.

Ideas for managing security risks:

- Investing in fraud detection tools and software security solutions .

- Educating employees about how they can do their part to keep the company’s data safe. Basic guidance includes not clicking suspicious links in emails or sharing sensitive data without encrypting it first.

Operational Risks

A business is considered to have operational risk when its day-to-day activities threaten to decrease profits. Operational risks can result from employee errors, such as undercharging customers. Additionally, a natural disaster like a tornado, hurricane, or flood might damage a company’s buildings or other physical assets, disrupting its daily operations.

Of course, one of the starkest examples of negative impacts to companies' production and supply chain operations is the Coronavirus pandemic. In an April 2022 Small Business Pulse Survey conducted by the U.S. Census Bureau, roughly 65 percent of respondents reported that the pandemic had either a moderate negative effect or a large negative effect on their business.

- Making time for necessary employee training to minimize internal mistakes.

- Developing contingency plans to shield against external events that may impact operations. For example, a restaurant impacted by a natural disaster might be able to partner with another local restaurant, bar, or coffee shop to use their kitchen and sell to-go items.

Reputational Risks

Reputational risk can include a product safety recall, negative publicity, and negative reviews online from customers. Companies that suffer reputational damage can even see an immediate loss of revenue, as customers take their business elsewhere. Companies may experience additional impacts, including losing employees, suppliers, and other partners.

Ideas for managing reputational risks:

- Pay attention to what customers and employees say about the company both online and offline.

- Commit not only to providing a quality product or service, but also to ensuring that workers are trained to deliver excellent customer service and to resolve customer complaints, offer refunds, and issue apologies when necessary.

The Takeaway

Business owners face a variety of business risks, including financial, cybersecurity, operational, and reputational. However, they can take proactive measures to prevent or mitigate risk while continuing to seize opportunities for growth . To learn more about the benefits of risk management planning read, "5 Hidden Benefits of Risk Management."

Frequently Asked Questions

1. what are the main types of business risks.

There are several types of business risks: • Financial Risks • Cybersecurity Risks • Operational Risks • Reputational Risks

2. What are common examples of business risks?

• Financial risks can include cash flow problems, inability to meet financial obligations, or taking on too much debt. • Cybersecurity risks are risks associated with data breaches, hacks, or cyber-attacks. • Operational risks include supply chain disruptions, natural disasters, or IT failures. • Reputational risks can occur when a company's reputation is damaged by negative publicity, scandal, or other events.

3. How can you identify a business risk?

There are a few key ways to identify business risks:

• Reviewing financial statements and performance indicators: This can help you identify risks related to cash flow, profitability, or solvency. • Conducting a SWOT analysis: A SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) can also be a helpful tool for identifying risks and brainstorming ways to mitigate them. • Identifying key dependencies: Key dependencies are things that your business relies on to function, and if they were to fail or be disrupted, it could have a serious impact on your business. • Carrying out root cause analysis: Conducting root cause analysis can help you to identify what underlying factors could lead to a problem or issue.

A version of this article was originally published September 01, 2022.

Photo: Getty Images

Trending Content

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading Change and Organizational Renewal

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

What Is Risk Management & Why Is It Important?

- 24 Oct 2023

Businesses can’t operate without risk. Economic, technological, environmental, and competitive factors introduce obstacles that companies must not only manage but overcome.

According to PwC’s Global Risk Survey , organizations that embrace strategic risk management are five times more likely to deliver stakeholder confidence and better business outcomes and two times more likely to expect faster revenue growth.

If you want to enhance your job performance and identify and mitigate risk more effectively, here’s a breakdown of what risk management is and why it’s important.

Access your free e-book today.

What Is Risk Management?

Risk management is the systematic process of identifying, assessing, and mitigating threats or uncertainties that can affect your organization. It involves analyzing risks’ likelihood and impact, developing strategies to minimize harm, and monitoring measures’ effectiveness.

“Competing successfully in any industry involves some level of risk,” says Harvard Business School Professor Robert Simons, who teaches the online course Strategy Execution . “But high-performing businesses with high-pressure cultures are especially vulnerable. As a manager, you need to know how and why these risks arise and how to avoid them.”

According to Strategy Execution , strategic risk has three main causes:

- Pressures due to growth: This is often caused by an accelerated rate of expansion that makes staffing or industry knowledge gaps more harmful to your business.

- Pressures due to culture: While entrepreneurial risk-taking can come with rewards, executive resistance and internal competition can cause problems.

- Pressures due to information management: Since information is key to effective leadership , gaps in performance measures can result in decentralized decision-making.

These pressures can lead to several types of risk that you must manage or mitigate to avoid reputational, financial, or strategic failures. However, risks aren’t always obvious.

“I think one of the challenges firms face is the ability to properly identify their risks,” says HBS Professor Eugene Soltes in Strategy Execution .

Therefore, it’s crucial to pinpoint unexpected events or conditions that could significantly impede your organization’s business strategy .

Related: Business Strategy vs. Strategy Execution: Which Course Is Right for Me?

According to Strategy Execution , strategic risk comprises:

- Operations risk: This occurs when internal operational errors interrupt your products or services’ flow. For example, shipping tainted products can negatively affect food distribution companies.

- Asset impairment risk: When your company’s assets lose a significant portion of their current value because of a decreased likelihood of receiving future cash flows . For instance, losing property assets, like a manufacturing plant, due to a natural disaster.

- Competitive risk: Changes in the competitive environment can interrupt your organization’s ability to create value and differentiate its offerings—eventually leading to a significant loss in revenue.

- Franchise risk: When your organization’s value erodes because stakeholders lose confidence in its objectives. This primarily results from failing to control any of the strategic risk sources listed above.

Understanding these risks is essential to ensuring your organization’s long-term success. Here’s a deeper dive into why risk management is important.

4 Reasons Why Risk Management Is Important

1. protects organization’s reputation.

In many cases, effective risk management proactively protects your organization from incidents that can affect its reputation.

“Franchise risk is a concern for all businesses,“ Simons says in Strategy Execution . “However, it's especially pressing for businesses whose reputations depend on the trust of key constituents.”

For example, airlines are particularly susceptible to franchise risk because of unforeseen events, such as flight delays and cancellations caused by weather or mechanical failure. While such incidents are considered operational risks, they can be incredibly damaging.

In 2016, Delta Airlines experienced a national computer outage, resulting in over 2,000 flight cancellations. Delta not only lost an estimated $150 million but took a hit to its reputation as a reliable airline that prided itself on “canceling cancellations.”

While Delta bounced back, the incident illustrates how mitigating operational errors can make or break your organization.

2. Minimizes Losses

Most businesses create risk management teams to avoid major financial losses. Yet, various risks can still impact their bottom lines.

A Vault Platform study found that dealing with workplace misconduct cost U.S. businesses over $20 billion in 2021. In addition, Soltes says in Strategy Execution that corporate fines for misconduct have risen 40-fold in the U.S. over the last 20 years.

One way to mitigate financial losses related to employee misconduct is by implementing internal controls. According to Strategy Execution , internal controls are the policies and procedures designed to ensure reliable accounting information and safeguard company assets.

“Managers use internal controls to limit the opportunities employees have to expose the business to risk,” Simons says in the course.

One company that could have benefited from implementing internal controls is Volkswagen (VW). In 2015, VW whistle-blowers revealed that the company’s engineers deliberately manipulated diesel vehicles’ emissions data to make them appear more environmentally friendly.

This led to severe consequences, including regulatory penalties, expensive vehicle recalls, and legal settlements—all of which resulted in significant financial losses. By 2018, U.S. authorities had extracted $25 billion in fines, penalties, civil damages, and restitution from the company.

Had VW maintained more rigorous internal controls to ensure transparency, compliance, and proper oversight of its engineering practices, perhaps it could have detected—or even averted—the situation.

Related: What Are Business Ethics & Why Are They Important?

3. Encourages Innovation and Growth

Risk management isn’t just about avoiding negative outcomes. It can also be the catalyst that drives your organization’s innovation and growth.

“Risks may not be pleasant to think about, but they’re inevitable if you want to push your business to innovate and remain competitive,” Simons says in Strategy Execution .

According to PwC , 83 percent of companies’ business strategies focus on growth, despite risks and mixed economic signals. In Strategy Execution , Simons notes that competitive risk is a challenge you must constantly monitor and address.

“Any firm operating in a competitive market must focus its attention on changes in the external environment that could impair its ability to create value for its customers,” Simons says.

This requires incorporating boundary systems —explicit statements that define and communicate risks to avoid—to ensure internal controls don’t extinguish innovation.

“Boundary systems are essential levers in businesses to give people freedom,” Simons says. “In such circumstances, you don’t want to stifle innovation or entrepreneurial behavior by telling people how to do their jobs. And if you want to remain competitive, you’ll need to innovate and adapt.”

Netflix is an example of how risk management can inspire innovation. In the early 2000s, the company was primarily known for its DVD-by-mail rental service. With growing competition from video rental stores, Netflix went against the grain and introduced its streaming service. This changed the market, resulting in a booming industry nearly a decade later.

Netflix’s innovation didn’t stop there. Once the steaming services market became highly competitive, the company shifted once again to gain a competitive edge. It ventured into producing original content, which ultimately helped differentiate its platform and attract additional subscribers.

By offering more freedom within internal controls, you can encourage innovation and constant growth.

4. Enhances Decision-Making

Risk management also provides a structured framework for decision-making. This can be beneficial if your business is inclined toward risks that are difficult to manage.

By pulling data from existing control systems to develop hypothetical scenarios, you can discuss and debate strategies’ efficacy before executing them.

“Interactive control systems are the formal information systems managers use to personally involve themselves in the decision activities of subordinates,” Simons says in Strategy Execution . “Decision activities that relate to and impact strategic uncertainties.”

JPMorgan Chase, one of the most prominent financial institutions in the world, is particularly susceptible to cyber risks because it compiles vast amounts of sensitive customer data . According to PwC , cybersecurity is the number one business risk on managers’ minds, with 78 percent worried about more frequent or broader cyber attacks.

Using data science techniques like machine learning algorithms enables JPMorgan Chase’s leadership not only to detect and prevent cyber attacks but address and mitigate risk.

Start Managing Your Organization's Risk

Risk management is essential to business. While some risk is inevitable, your ability to identify and mitigate it can benefit your organization.

But you can’t plan for everything. According to the Harvard Business Review , some risks are so remote that no one could have imagined them. Some result from a perfect storm of incidents, while others materialize rapidly and on enormous scales.

By taking an online strategy course , you can build the knowledge and skills to identify strategic risks and ensure they don’t undermine your business. For example, through an interactive learning experience, Strategy Execution enables you to draw insights from real-world business examples and better understand how to approach risk management.

Do you want to mitigate your organization’s risks? Explore Strategy Execution —one of our online strategy courses —and download our free strategy e-book to gain the insights to build a successful strategy.

About the Author

More From Forbes

14 smart ways to manage business risk.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

It’s impossible to truly eliminate risk when it comes to economic decisions that are best for your business. Decisions have to be made even when we don’t know all the facts and are unsure of the future. For instance, market regulations are an uncertain environment where the stakes are higher and risk-taking isn’t optional if you want to move forward.

So how do you account for those uncertainties when trying to make informed, smart decisions for your business? Below, 14 Forbes Business Development Council members explain how to manage risk in uncertain economic situations.

Forbes Business Development Council members share tips on managing risk in business.

1. Look To Past Situations

In every business decision, you have risks and uncertainties. First, you should try to define all risks. If you have had similar situations and experiences, have a look at the past to look for solutions. Create backup plans for different scenarios and be flexible enough to adjust your decision. - Hendrik Bender , Sovereign Speed GmbH

2. Think Through Multiple Scenarios

You’ll never have 100% of the information you need to make a decision. The goal is to manage the risk and make calculated decisions. I’ve found thinking through at least three different scenarios helps me understand potential risks. Best-case, likely-case and worst-case scenario planning is a good way to flush out possible outcomes. I also try to consider unplanned consequences that could arise. - Julie Thomas , ValueSelling Associates

Best Travel Insurance Companies

Best covid-19 travel insurance plans.

Forbes Business Development Council is an invitation-only community for sales and biz dev executives. Do I qualify?

3. Eliminate Business System Silos

Siloed business systems are too rigid to handle uncertain risk. Signals often exist but in disparate places and forms—such as from regulators or affected customers talking with your sales, support or finance teams. Businesses should feed signals from across functions into a unified view for visibility into cash position, future cash inflow and actions that can influence deals or renewals. - Dan Brown , FinancialForce

4. Control Whatever Variables You Can

Stay informed and analyze past data sets that are similar. Most importantly, control the variables that you can while being sure that you fail fast. Each failure brings you one step closer to success! Just don't make a habit of accepting failure. - Donald O'Sullivan , Pegasystems

5. Trust Your Intuition

This is the exact capability of visionary leaders, who search not only data but facts as well, learn from historical businesses or projects, apply SWOT, calculate risk and determination of mitigations and make a Plan B for consequences. These leaders not only trust their intuition but also never stop learning, taking risks and setting the future. - Majeed Hosseiney , Elements Global Services

6. Be Prepared For A Pivot

I recommend a combination of approaches when managing risk. A SWOT analysis can help steer a company or team in a promising direction. I also recommend a pivot strategy if market regulations drastically change. Start with Plan A, but quickly pivot to Plan B if necessary. Do quarterly or even monthly evaluations to determine if you are staying on track. - Matthew Rolnick , Yaymaker

7. Research And Assess Market Trends

The future is always uncertain. Leaders must research the market and trends and then assess the information at hand today and make a decision. Sometimes, the best decision is to wait until the future is a bit more certain. - Jan Dubauskas , Healthinsurance.com

8. Engage Regularly

Managing uncertainty requires being engaged and remaining informed so decisions can possess the flexibility needed to accommodate change. Being engaged with customers, regulators and suppliers enables you to help shape their direction in a manner positive to your business. Remaining informed of their leanings enables you to build in the flexibility needed to accommodate their changing positions. - Nathan Ives , DataGlance, Inc.

9. Embrace And Accept Change

Leaders should embrace change as the market will change, in good times or tough times. Accept this change and be able to pivot when needed to adapt to new normals, new regulations and other conditions. No one will ever have 100% of the information needed to make decisions, so thinking through different scenarios that could present themselves is always beneficial. - Michael Hines , Demand Management, Inc (DMI)

10. Make A Risk Management Plan

Apply standard project management and institute best practices for risk management. Make a risk management plan for your business by identifying potential risks and quantifying them the best you can. Plan how to best mitigate those risks based on their likelihood. Create a risk register to track it all and revisit the plan on a regular basis to keep it current as conditions change. - Michael Fritsch , Confoe

11. Break Potential Risks Into Smaller Risks

One strong point in favor of managing risk is to go by experience. Experience does help, but the same experiences will not work for Covid. Depending on the situation, I strongly suggest breaking risks into smaller risks. For smaller risks, identify what impact will be caused. Go back and check if any of the experiences of an individual or an organization will help. If it will, apply it. If not, address the risk. - Ashok Bhat , Acronotics

12. Prioritize Contingency Planning

Contingency planning has to be part of a firm’s armor when it comes to managing uncertainty. Starting early to plan through what-if scenarios and having pseudo-teams focused on contingency and implementation will be essential. Firms can also work with industry peers and industry bodies to ascertain industry assumptions; these will be critical for benchmarking through contingency planning. - Oluchi Ikechi , Accenture

13. Determine If You Can Manage The Risk

Weigh the risk and determine if you can manage it. Start by identifying and evaluating risk, which includes assessing its probability and impact. What do you then do with it? Based on your cost-benefit analysis, you may choose to accept it, take steps to reduce it or transfer it to someone else. A practical analysis will lead to more informed strategic decisions in the face of uncertainty. - Chor Meng Tan , Wiley

14. Think Through The Worst-Case Scenario

Paralysis by analysis can cause unnecessary indecision. Asking yourself, “What is the worst that could happen,” can put circumstances into perspective and help you be more decisive during times of uncertainty. Oftentimes, the worst-case scenario is manageable. - Brandon Rigoni , Lincoln Industries

- Editorial Standards

- Reprints & Permissions

How to Perform Business Risk Mitigation: Strategies, Types, and Best Practices

By Kate Eby | March 23, 2023

- Share on Facebook

- Share on LinkedIn

Link copied

Successful companies are always identifying, lessening, and eliminating business risks. We’ve gathered tips from industry experts on how they do this. We also provide risk assessment templates and step-by-step guidance on business risk mitigation.

Included on this page, you’ll find the main ways companies should respond to risks , best practices for business risk mitigation , a step-by-step process for performing good risk mitigation, and templates that can help guide you in assessing and dealing with business risks.

What Is Risk Mitigation?

Risks can pose a threat to a project or a business. Risk mitigation is the process of eliminating or lessening the impact of those risks. Teams can use risk mitigation in several ways to help protect a business.

Project leaders might use project risk management and mitigation to ensure the success of a specific project. Business leaders might use business risk mitigation — sometimes as part of overall enterprise risk management or enterprise risk assessment — to protect the long-term health of a company.

Why Is Risk Mitigation Important?

Risk mitigation is important because risks sometimes turn into realities. If your project team or business leaders haven’t figured out ways to deal with and lessen those risks, they can have a hugely negative impact on a project or business.

“Business risk mitigation is important because it helps organizations to identify and address potential risks that could impact their operations, reputation, or bottom line,” says Andrew Lokenauth, a former finance executive with Goldman Sachs and JP Morgan, an adjunct professor at the University of San Francisco School of Management, and the founder of Fluent in Finance . “By proactively managing risks, organizations can minimize disruptions and protect their assets, stakeholders, and long-term viability.”

Here are some of the top reasons that business risk mitigation is important:

- Maintain the Existence and Profitability of a Business: Some risks can torpedo the very existence of a business — especially if they happen when the business hasn’t prepared for them. Business leaders must identify and assess risks and figure out ways to lessen or eliminate high-priority risks.

- Maintain a Business Reputation for Stability: Some risks, when they happen, can damage a company’s customer relationships. Business leaders want customers to be able to trust the stability of a business. Preparing for risks helps ensure that stability.

- Keep Internal and External Stakeholders Happy: Both employees and external stakeholders want a business to succeed and be prepared for negative risks. Making sure your team performs good risk management — including risk mitigation — will give internal and external stakeholders confidence that the business is ready for any negative events.

- Keep Your Staff and Others Safe: The mitigation measures you need for weather events will also protect the safety of your staff and others. Mitigation measures against problems such as fire damage can also protect staff and customers.

- Avoid Negative Societal and Economic Impacts: In some cases, risks to your organization can have large societal and economic impacts. Examples include risks to the operations of utilities, government agencies, or internet companies. Perform solid risk mitigation to prevent these negative risks or lessen their impact.

- Know That No One Else Will Do It for You: Many people believe that certain risks just won’t happen or that some government agency or other group is monitoring the situation and will assist if there is a problem. That is often not true. “This is typical of most Americans — not even just business heads or business leaders — that you don’t think it’s gonna happen to you,” says Andresen. “You think if it does happen, it's not going to be that bad, and that you're going to get help from somewhere else. And all of those things are patently false.”

What Are the Types of Risk Mitigation?

When people talk about the types of risk mitigation, what they’re often referring to are types of risk responses or risk response strategies. Risk mitigation is one possible risk response, but it is not the only one.

Another important thing to remember is that not all risks are negative. There are positive risks — or opportunities — that can happen for your business as well. Experts have outlined five primary ways to respond to negative risks and five primary ways to respond to positive risks, both of which are important to the long-term health of a company.

These are the five primary risk response strategies for dealing with negative risks:

- Mitigate: Risk mitigation involves taking steps to reduce the likelihood or impact of a risk.

- Transfer: Leaders can choose to transfer a risk to another entity. Buying insurance is a good example of transferring risk. You still take steps to prevent fires at your property, but when you buy fire insurance, the insurance company assumes much of the financial risk if a fire happens.

- Accept: In some cases, it is simply not possible or economically feasible to avoid or mitigate risk. Leaders might choose to accept certain risks that are too costly to try to affect or that are unlikely to happen.“It may not be possible or practical to avoid or reduce a risk,” Lokenauth says. “In these cases, organizations may choose to accept the risk and manage it as it arises.”

- Escalate: In project risk management — though not often in business risk mitigation — leaders choose to escalate certain risks. This response involves providing information on the risk to top organizational leadership, so they can make a decision. This is usually the response to a significant risk that would require significant costs to mitigate.

These are the five primary risk response strategies for positive risks:

- Share: If your company chooses to share a positive risk, that means it will work with another company or entity to take advantage of an opportunity. Sharing positive risk can increase the likelihood and impact of opportunities. However, they also require that the company split the resulting benefits.

- Exploit: When a company chooses to exploit a positive risk, it devotes special attention and resources to making sure an event happens.

- Enhance: Companies can enhance positive risks by improving the likelihood that it will happen. This is different from exploiting a risk, because the possibility still exists that the opportunity will never arise.

- Accept: If your company understands that a positive risk might happen, it might prepare to act on it without investing resources to try to increase the chances that it will happen.

- Escalate: As with escalating negative risks, your team can escalate positive risks to company leadership to make decisions about which strategy to implement. This is common when teams identify opportunities that could have enormous benefit to the company but might take a large investment to enhance or exploit.

You can learn much more about risk assessments, and the primary ways that project managers and organizations can respond to both negative and positive risks, in this essential guide to project risk assessments .

Risk Mitigation Strategies

Businesses use a number of strategies to help them respond to business risks. These can include overall risk and contingency planning, as well as tactical moves, such as hiring a risk manager or outside risk management consultant.

Here are some overall risk response strategies teams can use:

- Risk Management Planning: Teams will very often produce a risk management plan for individual projects, but they can also create a risk management plan for an entire enterprise. This plan should describe how your team plans to identify, assess, respond to, and mitigate risks to the organization. You can learn much more about risk management plans and planning and can download risk management plan templates .

- Contingency Planning: Contingency planning is usually a part of project risk management, but teams can create contingency plans for their entire organization. Contingency plans include specific actions your team will take if a risk actually happens. The contingency plan might include extra funds or extra staff to respond to a risk.

- Business Continuity Planning: Business continuity planning is the most common risk response strategy that organizations use to deal with risks to the entire enterprise. For specific projects, organizations will more often use strategies such as contingency planning and project risk management planning. The goals of business continuity planning are to identify important risks to the organization and make plans for what the organization will do to lessen or eliminate those risks.

You can learn much more about business continuity plans . You can also download business continuity plan templates .

- Setting Aside Contingency Reserves: These are funds an organization sets aside to help it deal with and mitigate important risks if they happen.

- Employing a Risk Manager: Many organizations choose to employ a full-time risk manager to oversee the organization’s entire risk management program. This role may involve helping with project risk management, or overseeing the more general management of risk and compliance across an organization.

- Contracting with Outside Consultancies: Many organizations contract with outside risk experts to help with risk assessments and business continuity planning.

- Employee Training: Forward-thinking organizations also conduct employee training and drills to bolster their contingency and risk mitigation plans. The training helps employees understand what they should be doing if a risk happens. You can learn more about such training and drills as part of contingency plans.

- Product Testing: For software and technology companies especially, it’s important to do product testing throughout the development of a product. That testing will lower the risk that your organization will have to spend extra money to fix problems or to repeat development work.

- Following Information Security Best Practices: Information security issues are a huge risk for many organizations. Most organizations understand the importance of good information security practices, such as implementing strict password policies and two-factor authentication requirements.

Risk Mitigation Best Practices

Experts recommend following certain best practices for business risk mitigation. Some best practices include being proactive in identifying and assessing risks and making management policies clear to all stakeholders.

Here are some important best practices for business risk mitigation:

- Create a Strong Culture of Risk Management: It’s important that your organization and its leaders understand the importance of investing in solid risk management. Avoid the temptation to believe that risk management is not important or necessary. “Humans want to avoid risks, so we want to even avoid the discussion of risks,” Contreras says. “Good risk management forces you to have those discussions. You have to face them and look them in the eye, then make some decisions on how you're going to handle them. Don't let it fall by the wayside.”

- Involve Stakeholders: Make sure you communicate with and involve stakeholders in your risk management work. That means asking for their input as you identify and assess risks.

- Create a Clear and Transparent Risk Management Framework and Policy: Your organization should outline the basics of its risk management program in a risk management policy. Everyone in your organization should have access to and understand that policy. “A risk management policy should outline the organization's approach to risk management, including the roles and responsibilities of different stakeholders; the processes for identifying, analyzing, and responding to risks; and the methods for monitoring and reviewing the effectiveness of risk management efforts,” Lokenauth says.

- Be Proactive: It is vital for any organization to be proactive and aggressive in identifying and planning for risks. Lokenauth recalls a time when he worked for a large company in New York that wasn’t prepared for all risks. When Hurricane Sandy hit in October 2012, the firm had no place for its employees to work. “We were home for a week or two getting paid, and we weren't doing any work,” he says. “Things weren't getting done. It took them about a week or two to send us laptops. And then it took another week to try to figure out where to put us, to rent some space in Jersey City. If they had a plan in place for a thing like that, it would have been better. “It's important to be proactive about identifying and addressing potential risks rather than waiting for them to occur,” he says. Contreras adds that a business leader’s perspectives on risks can affect how an entire company approaches risk — either to the company’s benefit or to their detriment. “Small and medium-sized businesses are usually led by one big leader,” he says. “That leader’s perspective can really sway the business — and maybe not in a good way. The leader might be super optimistic, always thinking, ‘Yeah, we can do this.’ But the leadership team really needs to look at things and ask, ‘What if it doesn’t go?’ What would be the downside here? What are the things that can go wrong?’ So you want to get people in a room and start thinking negatively. ‘What are the things that can go wrong? And what can we do about them? What can we do to mitigate them?’”

- Be Comprehensive: It’s important that your organization thinks about risks in all areas. Avoid focusing only on what leaders think might be the most obvious areas for risk. “It's important to develop a comprehensive risk management plan rather than focusing on individual risks in isolation,” Lokenauth says.

- Conduct Employee Training or Drills: Risk mitigation isn’t finished once a company writes a contingency plan. Leaders must also train employees to perform the actions outlined in the plan. They must also determine whether that contingency plan is going to be effective by performing drills. You can learn more about training and drills in contingency planning.

- Continuously Monitor Possible Risks: Too many organizations perform one risk assessment, then believe they are finished — sometimes for a year or two or more, experts say. However, risks are constantly changing, and organizations need to continually identify and assess new risks to avoid costly oversights. That means requiring routine risk assessments and creating a culture that is always monitoring and addressing new risks. “You want to establish policies on how you identify and monitor risks, and you want to monitor them every month,” Lokenauth says. That can be as simple as making sure your risk department works through a monthly checklist of risks that you are tracking and what’s happening with them. It also means watching for new risks or for changing circumstances around current risks, experts say.

- Make Changes Where Needed: When your organization’s continual assessment shows that a new risk has arisen, or that an older risk is changing, it must make changes in its risk response plan. “If you grow as a company, you now have a different footprint in which you need to assess your risk,” Andresen says. “If you shrink — again, you have a different footprint. You might not need the same control measures or countermeasures, and you can put that money somewhere else.”

- Communicate Your Risk Management Plans: It’s vital that your organization communicates often and effectively with organization leaders, employees, and other stakeholders about the organization’s risk management work.

What Is the Risk Mitigation Process?

Experts sometimes use the term risk mitigation process to describe how organizations identify, assess, and prepare to lessen or mitigate risks. More often, experts use the term risk management to describe that work.

Here are the seven basic steps of the risk management process:

- Identify All Possible Risks: Gather a team or multiple teams to offer input on all possible risks to your organization. You might do this through formal meetings or gather input in other ways. “The first thing you would do is have every department do their risk analysis — but not in a silo,” Andresen says. “You do want them talking to each other. Because you’ll get some people being inspired by the others. You’ll get others validating the risk of others. And you get a whole operating picture of the entire company: ‘Where are we weak? Where are we strong?’” Lokenauth suggests using such options as “brainstorming sessions, risk assessments, or reviewing industry data” to identify risks. Ask everyone involved — internally and externally — to think broadly about all possible risks. Your team can use a questionnaire to assess potential risks to your organization and analyze its risk culture.

- Analyze Risk Probability and Impact: After your team identifies all risks, it will need to assess each risk’s probability and the potential impact on your business. “You have to figure out what exactly is the most vital piece of your ability to conduct your business, then figure out the risks to that,” Andresen says. “Then you have to look at internal and external risks. What are the internal risks that you can encounter? And what are your external risks that you could potentially encounter? How do you want to solve for them? ”Contreras notes that your team can also assess the top risks for various departments within your organization, along with various kinds of risks. “If, say, it's a supplier risk, what are the top three suppliers that we should be concerned about?” he says. “And what are the top three infrastructure risks? What are the top three HR staffing risks that we have?”