- PRO Courses Guides New Tech Help Pro Expert Videos About wikiHow Pro Upgrade Sign In

- EDIT Edit this Article

- EXPLORE Tech Help Pro About Us Random Article Quizzes Request a New Article Community Dashboard This Or That Game Popular Categories Arts and Entertainment Artwork Books Movies Computers and Electronics Computers Phone Skills Technology Hacks Health Men's Health Mental Health Women's Health Relationships Dating Love Relationship Issues Hobbies and Crafts Crafts Drawing Games Education & Communication Communication Skills Personal Development Studying Personal Care and Style Fashion Hair Care Personal Hygiene Youth Personal Care School Stuff Dating All Categories Arts and Entertainment Finance and Business Home and Garden Relationship Quizzes Cars & Other Vehicles Food and Entertaining Personal Care and Style Sports and Fitness Computers and Electronics Health Pets and Animals Travel Education & Communication Hobbies and Crafts Philosophy and Religion Work World Family Life Holidays and Traditions Relationships Youth

- Browse Articles

- Learn Something New

- Quizzes Hot

- This Or That Game

- Train Your Brain

- Explore More

- Support wikiHow

- About wikiHow

- Log in / Sign up

- Finance and Business

- Business by Industry

How to Start a Money Lending Business

Last Updated: April 15, 2024 Fact Checked

This article was co-authored by Clinton M. Sandvick, JD, PhD . Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013. There are 11 references cited in this article, which can be found at the bottom of the page. This article has been fact-checked, ensuring the accuracy of any cited facts and confirming the authority of its sources. This article has been viewed 330,041 times.

If you want to start a money lending business, you will need to decide what kinds of loans you want to make—payday, mortgage, or installment loans. You may choose to start a lending business using only your own money or money from a group of investors. Starting a money lending business will require that you develop a business plan and gain the necessary government licenses.

Preparing to Start the Business

- You should search your state’s business filing office to find out if a name has already been taken.

- Executive summary. You will need to briefly describe the nature of your business and why you think it will be successful. The executive summary should contain your mission statement as well as company information. As a startup, you should focus on explaining how your experience and background will contribute to the business’s success.

- Company description. Explain the nature of the business, your intended market, and the market needs your lending business will satisfy. For example, you might want to meet the small loan needs of your community, which are underserved.

- Also identify your competitors and describe their strength or weakness in the market.

- Product line. Describe the loans you want to make. You should explain the advantages of your loans over those of competitor’s.

- Marketing and sales. Discuss your overall sales strategy, including your plans for growth. For example, you may hope to grow geographically, offering your loans to a larger community. Or you might hope to grow by offering additional types of loans to your current market.

- Financial projections. Based on your market analysis, you should forecast your projected finances for five-years out.

- Some money lenders have dipped into their retirement accounts, such as their IRAs and 401(k) accounts, to fund their loans. Experts encourage money lenders who do this to understand the risks that they are taking. For example, loans might not be repaid, in which case you could lose a large percentage of the loan amount. [3] X Research source

- If you seek funding from investors, then you will need to work closely with a lawyer to draft a prospectus to share with investors. State and federal laws tightly regulate how you advertise securities to potential investors. Your lawyer will need to be experienced in securities regulation.

- Generally, you will assess risk by gathering information about the loan applicant’s financial history. For example, you would want to look at their income, FICO score, and other debt load. [4] X Research source

- To find an experienced business lawyer, you can visit your state’s bar association website, which should run a referral program.

- You can research any attorney by visiting his or her website. Look for experience with business formation, as well as banking or lending experience. If you are starting a lending business for real estate, then look for an attorney who has real estate experience as well.

- You can purchase your domain name from various registrars. Search the internet for “where to purchase domain name” and look at the different companies that provide this service.

Registering Your Business

- To incorporate, you will have to file articles of incorporation with your state. Your attorney should be able to get them, or you can get them yourself from your Secretary of State.

- In addition to state licenses, you may need municipal or local licenses. You must contact your state business licenses office and search for applicable licenses or permits. The Small Business Administration has links to each state’s office at https://www.sba.gov/content/what-state-licenses-and-permits-does-your-business-need .

- Not every state requires that you register a “doing business as” name. You can check registration requirements with your Secretary of State office as well as with your county clerk’s office.

- You should check with your attorney whether or not you need to register the securities and which agency you need to register with.

- You can apply for an EIN online. This is the preferred method. [6] X Trustworthy Source Internal Revenue Service U.S. government agency in charge of managing the Federal Tax Code Go to source To start the application, visit the EIN Assistant at https://sa.www4.irs.gov/modiein/individual/index.jsp .

- You can also apply by mail or fax by printing off Form SS-4 available at http://www.irs.gov/pub/irs-pdf/fss4.pdf . To find out where to mail or fax your form, you should visit the IRS website at https://www.irs.gov/filing/where-to-file-your-taxes-for-form-ss-4 .

- Under federal law, specifically the Fair Debt Collection Practices Act, you are prohibited from harassing or abusing the customer that owes you money. [7] X Trustworthy Source Federal Trade Commission Independent U.S. government agency focused on consumer protection Go to source Also, you cannot use false, deceptive, or misleading means to collect any debt. [8] X Trustworthy Source Federal Trade Commission Independent U.S. government agency focused on consumer protection Go to source If you fail to obey federal law, you and your business could face stiff civil penalties. [9] X Trustworthy Source Federal Trade Commission Independent U.S. government agency focused on consumer protection Go to source

- Each state will also have laws prohibiting certain debt collection activities. For example, in Iowa, you are prohibited from making illegal threats or from coercing or attempting to coerce a customer into paying a debt. [10] X Research source

- To find a compliance professional, you can ask your lawyer for recommendations. Alternately, if you met anyone at a national conference or panel, you could contact them for a recommendation.

Launching Your Business

- Rent is often one of the largest expenses for a new business. Accordingly, you should budget and not spend more than you can afford.

- Try to negotiate a one- to two-year lease with an option to renew. Because you don’t know if your business will be successful or not, you shouldn’t sign an initial lease for longer than that.

- Find out what other expenses you might incur in addition to the rent. For example, you could have to pay for maintenance and repair, upkeep, and utilities.

- Negotiate some add-on clauses, such as a right to sublease or an exclusivity clause (which prevents a landlord from leasing to a direct competitor at the same location).

- Business tax identification number (or Social Security Number if sole proprietor)

- Business license

- Business name filing document

- Articles of incorporation with corporate officers listed (for a corporation)

- If you are lending money for real estate, you will need not only the promissory note but also the mortgage note. Lenders working in the real estate field also typically use other documents, such as Letters of Intent (LOI) and preliminary title reports. [13] X Research source You should ask your attorney or compliance professional about what other contracts are necessary.

- For more information on loan agreements, see Write a Loan Agreement.

- If you want to make a few loans to acquaintances or people in your neighborhood, you could rely on word of mouth. However, if you want to reach a larger market or grow more quickly, then you should consider advertising in newspapers or online.

- You should also consider advertising in the form of imprinting your company name on pens, paper, calendars, and other giveaway items.

Expert Q&A

- Some experts recommend that you lend locally, preferably within 100 miles of your physical location. [14] X Research source Thanks Helpful 0 Not Helpful 0

- Running a collateral-free loan is an added advantage to run a successful lending business. Thanks Helpful 25 Not Helpful 6

- You should not underestimate the amount of work it will take to start a money lending business. If you find it difficult to write a business plan, you might want to rethink your objectives. Thanks Helpful 14 Not Helpful 5

You Might Also Like

- ↑ https://www.profitableventure.com/starting-a-micro-money-lending-business/

- ↑ https://www.sba.gov/writing-business-plan

- ↑ https://www.investopedia.com/terms/l/loan.asp

- ↑ http://www.creditinfocenter.com/mortgage/guidelines.shtml

- ↑ https://www.sba.gov/business-guide/launch-your-business/register-your-business

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online

- ↑ https://www.ftc.gov/enforcement/rules/rulemaking-regulatory-reform-proceedings/fair-debt-collection-practices-act-text

- ↑ http://www.nolo.com/legal-encyclopedia/iowa-fair-debt-collection-laws.html

- ↑ https://www.pacificprivatemoney.com/6-tips-for-a-successful-private-lending-practice/

- ↑ https://www.sba.gov/business-guide/manage-your-business/buy-assets-equipment

- ↑ http://www.fortunebuilders.com/becoming-private-money-lender-part-2-breaking-private-money-loan/

About This Article

To start a money lending business, you’ll need to draft a business plan and obtain the necessary licenses by completing the paperwork required by your state. Your business plan will need to include the types of loans you want to make, such as payday or mortgage, and strategies for how to grow your business. That way, you can attract potential investors, which is typically less risky than using your own savings. You should, however, work with an attorney experienced in securities to ensure you acquire your investments legally. Your lawyer can also help you apply for the needed licenses and register your business as a corporation, sole proprietorship, or whichever type of company you choose to be. For more advice from our Legal co-author, like how to advertise your new business, keep reading! Did this summary help you? Yes No

- Send fan mail to authors

Reader Success Stories

Pabalelo M.

Did this article help you?

Elsa Ngwele Toa

May 13, 2019

Tebogo Lepota

Nov 14, 2021

David Pittman

Jan 19, 2019

Jamar Jackson

Apr 29, 2018

Featured Articles

Trending Articles

Watch Articles

- Terms of Use

- Privacy Policy

- Do Not Sell or Share My Info

- Not Selling Info

wikiHow Tech Help Pro:

Level up your tech skills and stay ahead of the curve

How to Start a Microlending Company

Microlending is the practice of lending smaller sums of money, typically to those who are unable to obtain funding through an established federal institution. Microlenders typically don’t request any type of collateral before loaning out the money. For-profit institutions may charge a high rate of interest to mitigate financial risks should the borrower default on their loans.

Microlending has had a lot of traction overseas in developing nations, and most are non-profit ventures. Money is lent to people who need it to start a small business in their area. Would-be entrepreneurs can get the cash they need to fill a vital need in the community, and lenders can contribute in their own way to helping individuals find their niche and lead more productive lives.

Learn how to start your own Microlending Company and whether it is the right fit for you.

Ready to form your LLC? Check out the Top LLC Formation Services .

Start a microlending company by following these 10 steps:

- Plan your Microlending Company

- Form your Microlending Company into a Legal Entity

- Register your Microlending Company for Taxes

- Open a Business Bank Account & Credit Card

- Set up Accounting for your Microlending Company

- Get the Necessary Permits & Licenses for your Microlending Company

- Get Microlending Company Insurance

- Define your Microlending Company Brand

- Create your Microlending Company Website

- Set up your Business Phone System

We have put together this simple guide to starting your microlending company. These steps will ensure that your new business is well planned out, registered properly and legally compliant.

Exploring your options? Check out other small business ideas .

STEP 1: Plan your business

A clear plan is essential for success as an entrepreneur. It will help you map out the specifics of your business and discover some unknowns. A few important topics to consider are:

What will you name your business?

- What are the startup and ongoing costs?

- Who is your target market?

How much can you charge customers?

Luckily we have done a lot of this research for you.

Choosing the right name is important and challenging. If you don’t already have a name in mind, visit our How to Name a Business guide or get help brainstorming a name with our Microlending Company Name Generator

If you operate a sole proprietorship , you might want to operate under a business name other than your own name. Visit our DBA guide to learn more.

When registering a business name , we recommend researching your business name by checking:

- Your state's business records

- Federal and state trademark records

- Social media platforms

- Web domain availability .

It's very important to secure your domain name before someone else does.

Want some help naming your microlending company?

Business name generator, what are the costs involved in opening a microlending company.

Microlenders typically don’t have a lot of overhead, though you’ll likely need to hire a loan processor, a collector, and a bookkeeper. If you plan to take on all of these roles on your own at the beginning, you'll need to be extra careful. Even one mistake on your part can land you in legal hot water.

What are the ongoing expenses for a microlending company?

Overhead for a microlender is low, as you generally don’t need an office to conduct business:

- Employee salaries

- Advertising costs

- General office supplies

- Website costs

Who is the target market?

If you're hoping to make a social contribution as much as an economic one, an ideal person to lend a small sum of money to may be a woman in a third-world country, for example. She may be smart and capable of running a small family farm, but she lacks the resources to get started. A small sum of money may buy her enough for a few animals, which she can then raise to provide for her family. She may use the milk from goats or eggs from chickens to both nourish her family and sell to others in her community.

If you're hoping to make money on your loan, you may want to consider lending to young go-getters who lack the credit history they need to get a conventional loan. There are a number of reasons why people may need a small amount of money, so do your research first before you decide which areas need your assistance the most.

How does a microlending company make money?

Microlenders make money by charging people interest on their loans. You may lend out $500 at a 20% interest rate, meaning the debtor will owe $600 by the time all is said and done.

Interest rates vary widely from place to place. Some may charge 10% while others charge up to 80%. The average is about 35%, but you’ll want to do research on the interest rates in any given area. Some well-known non-profit microlending websites don't even offer the option of interest, while others may go as low as 3%. In these cases, it's more like charity than a business venture though. Those who charge extremely high interest rates are usually for-profit businesses.

How much profit can a microlending company make?

With persistence and patience, a microlender can make a considerable amount of money when in the right area. Some studies state that up to 97% of low-income borrowers pay back their loan under the agreed-upon terms. If you make $100 on average on each loan, you’ll need to make 600 loans in a year to make $60,000.

How can you make your business more profitable?

You may wish to expand to other parts of the world to make your business more profitable. Or you could consider opening up a payday loan store in your neighborhood if you feel you have a good handle on microlending and want to serve others who may need financial assistance.

Want a more guided approach? Access TRUiC's free Small Business Startup Guide - a step-by-step course for turning your business idea into reality. Get started today!

STEP 2: Form a legal entity

The most common business structure types are the sole proprietorship , partnership , limited liability company (LLC) , and corporation .

Establishing a legal business entity such as an LLC or corporation protects you from being held personally liable if your microlending company is sued.

Form Your LLC

Read our Guide to Form Your Own LLC

Have a Professional Service Form your LLC for You

Two such reliable services:

You can form an LLC yourself and pay only the minimal state LLC costs or hire one of the Best LLC Services for a small, additional fee.

Recommended: You will need to elect a registered agent for your LLC. LLC formation packages usually include a free year of registered agent services . You can choose to hire a registered agent or act as your own.

STEP 3: Register for taxes

You will need to register for a variety of state and federal taxes before you can open for business.

In order to register for taxes you will need to apply for an EIN. It's really easy and free!

You can acquire your EIN through the IRS website . If you would like to learn more about EINs, read our article, What is an EIN?

There are specific state taxes that might apply to your business. Learn more about state sales tax and franchise taxes in our state sales tax guides.

STEP 4: Open a business bank account & credit card

Using dedicated business banking and credit accounts is essential for personal asset protection.

When your personal and business accounts are mixed, your personal assets (your home, car, and other valuables) are at risk in the event your business is sued. In business law, this is referred to as piercing your corporate veil .

Open a business bank account

Besides being a requirement when applying for business loans, opening a business bank account:

- Separates your personal assets from your company's assets, which is necessary for personal asset protection.

- Makes accounting and tax filing easier.

Recommended: Read our Best Banks for Small Business review to find the best national bank or credit union.

Get a business credit card

Getting a business credit card helps you:

- Separate personal and business expenses by putting your business' expenses all in one place.

- Build your company's credit history , which can be useful to raise money later on.

Recommended: Apply for an easy approval business credit card from BILL and build your business credit quickly.

STEP 5: Set up business accounting

Recording your various expenses and sources of income is critical to understanding the financial performance of your business. Keeping accurate and detailed accounts also greatly simplifies your annual tax filing.

Make LLC accounting easy with our LLC Expenses Cheat Sheet.

STEP 6: Obtain necessary permits and licenses

Failure to acquire necessary permits and licenses can result in hefty fines, or even cause your business to be shut down.

State & Local Business Licensing Requirements

Certain state permits and licenses may be needed to operate a microlending business. Learn more about licensing requirements in your state by visiting SBA’s reference to state licenses and permits .

Most businesses are required to collect sales tax on the goods or services they provide. To learn more about how sales tax will affect your business, read our article, Sales Tax for Small Businesses .

Certificate of Occupancy

Businesses operating out of a physical location typically require a Certificate of Occupancy (CO). A CO confirms that all building codes, zoning laws, and government regulations have been met.

- If you plan to lease a microlending office location :

- It is generally the landlord’s responsibility to obtain a CO.

- Before leasing, confirm that your landlord has or can obtain a valid CO that is applicable to a microlending business.

- After a major renovation, a new CO often needs to be issued. If your place of business will be renovated before opening, it is recommended to include language in your lease agreement stating that lease payments will not commence until a valid CO is issued.

- If you plan to purchase or build a microlending office location :

- You will be responsible for obtaining a valid CO from a local government authority.

- Review all building codes and zoning requirements for your business’ location to ensure your microlending business will be in compliance and able to obtain a CO.

STEP 7: Get business insurance

Just as with licenses and permits, your business needs insurance in order to operate safely and lawfully. Business Insurance protects your company’s financial wellbeing in the event of a covered loss.

There are several types of insurance policies created for different types of businesses with different risks. If you’re unsure of the types of risks that your business may face, begin with General Liability Insurance . This is the most common coverage that small businesses need, so it’s a great place to start for your business.

Another notable insurance policy that many businesses need is Workers’ Compensation Insurance . If your business will have employees, it’s a good chance that your state will require you to carry Workers' Compensation Coverage.

FInd out what types of insurance your Microlending Company needs and how much it will cost you by reading our guide Business Insurance for Microlending Company.

STEP 8: Define your brand

Your brand is what your company stands for, as well as how your business is perceived by the public. A strong brand will help your business stand out from competitors.

If you aren't feeling confident about designing your small business logo, then check out our Design Guides for Beginners , we'll give you helpful tips and advice for creating the best unique logo for your business.

Recommended : Get a logo using Truic's free logo Generator no email or sign up required, or use a Premium Logo Maker .

If you already have a logo, you can also add it to a QR code with our Free QR Code Generator . Choose from 13 QR code types to create a code for your business cards and publications, or to help spread awareness for your new website.

How to promote & market a microlending company

The best way to promote and market your business is to understand the need you’re filling in any given area. For example, if you’re only targeting small family farmers, then you need to determine how they learn about financial opportunities in their area. This may include physical advertising, such as flyers, or online advertising on specific websites. Depending on your goals, it may even include going door to door.

You should also have your own website that describes what you do, and how you do it. Consider having your information in several languages for the best results, and hiring an interpreter for better communication.

How to keep customers coming back

The best way to generate customers is to be as fair a lender as possible. This doesn’t mean letting people get away with constantly missing payments, but it does mean trying to work with your clients whenever possible. Always do what you say you're going to do, and ensure excellent customer service and professional behavior at all times.

STEP 9: Create your business website

After defining your brand and creating your logo the next step is to create a website for your business .

While creating a website is an essential step, some may fear that it’s out of their reach because they don’t have any website-building experience. While this may have been a reasonable fear back in 2015, web technology has seen huge advancements in the past few years that makes the lives of small business owners much simpler.

Here are the main reasons why you shouldn’t delay building your website:

- All legitimate businesses have websites - full stop. The size or industry of your business does not matter when it comes to getting your business online.

- Social media accounts like Facebook pages or LinkedIn business profiles are not a replacement for a business website that you own.

- Website builder tools like the GoDaddy Website Builder have made creating a basic website extremely simple. You don’t need to hire a web developer or designer to create a website that you can be proud of.

Recommended : Get started today using our recommended website builder or check out our review of the Best Website Builders .

Other popular website builders are: WordPress , WIX , Weebly , Squarespace , and Shopify .

STEP 10: Set up your business phone system

Getting a phone set up for your business is one of the best ways to help keep your personal life and business life separate and private. That’s not the only benefit; it also helps you make your business more automated, gives your business legitimacy, and makes it easier for potential customers to find and contact you.

There are many services available to entrepreneurs who want to set up a business phone system. We’ve reviewed the top companies and rated them based on price, features, and ease of use. Check out our review of the Best Business Phone Systems 2023 to find the best phone service for your small business.

Recommended Business Phone Service: Phone.com

Phone.com is our top choice for small business phone numbers because of all the features it offers for small businesses and it's fair pricing.

Is this Business Right For You?

This business is excellent for those who understand the power of responsible lending. This isn't charity, but it is giving someone else a helping hand when they need it the most. The successful microlender will need an excellent balance between helping others and remaining financially solvent.

Want to know if you are cut out to be an entrepreneur?

Take our Entrepreneurship Quiz to find out!

Entrepreneurship Quiz

What happens during a typical day at a microlending company?

Microlenders must do a number of things to prepare to lend money:

- Research target client/demographic

- Screen clients

- Create reasonable billing plans for pay back

- Comply with all state/federal laws for financial lending

- Study lending practices in different areas.

What are some skills and experiences that will help you build a successful microlending company?

Having some type of formal education in how finances work around the world will help, as will an in-depth knowledge of current law for both the country you operate out of and the country of those you’ll be lending to.

What is the growth potential for a microlending company?

Microlending has done well in Latin American countries and third-world nations because there are a limited amount of ways to obtain conventional funding. If you wish to open a for-profit business, you may want to concentrate on these areas as opposed to lending within the US.

TRUiC's YouTube Channel

For fun informative videos about starting a business visit the TRUiC YouTube Channel or subscribe to view later.

Take the Next Step

Find a business mentor.

One of the greatest resources an entrepreneur can have is quality mentorship. As you start planning your business, connect with a free business resource near you to get the help you need.

Having a support network in place to turn to during tough times is a major factor of success for new business owners.

Learn from other business owners

Want to learn more about starting a business from entrepreneurs themselves? Visit Startup Savant’s startup founder series to gain entrepreneurial insights, lessons, and advice from founders themselves.

Resources to Help Women in Business

There are many resources out there specifically for women entrepreneurs. We’ve gathered necessary and useful information to help you succeed both professionally and personally:

If you’re a woman looking for some guidance in entrepreneurship, check out this great new series Women in Business created by the women of our partner Startup Savant.

What are some insider tips for jump starting a microlending company?

The best thing you can do is learn how to screen your clients, and to create detailed contracts about each loan. You will get a lot of applications from hard-working, responsible people who will do everything possible to use the funds wisely and pay you back. However, you will get a certain amount of people who are out to take your money, or who are asking for the money to achieve an unattainable goal. Consider video chat or in-person meetings as a way of getting to know your clients. Ask them about their business plan, and look to see how much effort went into their model.

You also need to keep meticulous records to ensure you’re never in danger of violating the laws. Start with sketching out a business plan that details how each transaction will work, and how everything will be recorded. Owners also need to have enough capital to start the business. Even with a limited amount of clients at the beginning, all of your loans will add up quickly.

How and when to build a team

Those familiar with the microlending business say to hire people right away because the risks of making a mistake can be high. However, if you’re starting small with just a few clients or you don’t have very much capital, you may be able to get everything started without external help.

Useful Links

Industry opportunities.

- A Brief History of Microlending

Real World Examples

- American Microloan

- Microfinance

Have a Question? Leave a Comment!

How To Start A Loan Shark Business

- The Dizaldo Blog!

Disclaimer: Starting a loan shark business is illegal and unethical. The following article is for informational purposes only and does not condone or encourage illegal activities.

Introduction

Step 1: research the local laws, step 2: define the target market, step 3: create a business plan, step 4: secure funding, step 6: determine the interest rate, step 7: set up a debt collection system.

A loan shark business involves lending money at a very high-interest rate and often using coercive methods to collect payments from borrowers. While it may seem like a lucrative business, it is illegal in most countries and can result in severe consequences. It is important to note that running such a business is not the right way to earn money.

Before starting any business, it is essential to understand the legal requirements related to it. In the case of loan shark business, it is important to determine the interest rate limits, registration or licensing requirements, and rules for debt collection. Consult with a lawyer to understand the local laws and regulations related to lending money.

Identify the target market to determine the potential demand for the loan shark business. The target market for this type of business usually includes people who have bad credit or are unable to secure loans from banks or other legitimate sources. Define the age, income level, and location of the target market to plan the marketing strategy accordingly.

Create a solid business plan that outlines the goals, objectives, and strategies for the loan shark business. Include details about the target market, available funding, operating costs, and projected revenue. Consult with a financial analyst to create a realistic and feasible business plan.

It is necessary to secure funding to start a loan shark business. This type of business requires a significant amount of capital to lend money to borrowers. Consider obtaining a business loan or partnering with an investor to secure funding.

Step 5: Develop a Marketing Strategy

Create a marketing strategy that focuses on reaching out to potential borrowers. Consider using online and offline platforms such as social media, flyers, and ads in local newspapers. Use attention-grabbing headlines and promotions to attract potential borrowers.

- Get Instant Cash! No Credit Check Required!

- Borrow now and pay later - with a low-interest rate!

Determine the interest rate to charge borrowers. Remember that the interest rate charged should be within the legal limit. Research the average interest rates offered by other lenders in the area and adjust accordingly. Be sure to inform the borrower of the interest rate and other fees associated with borrowing money.

Loan shark business involves loaning money to high-risk borrowers who are unlikely to repay the loan on time. Therefore it is crucial to have an efficient debt collection system in place. Establish a clear policy and procedure for collecting late payments and consider hiring an experienced debt collector.

Starting a loan shark business is not only illegal but also unethical. It can cause harm to individuals and communities. Instead of exploiting people in need, consider offering lending services at a fair and reasonable interest rate. Remember, there are legitimate ways to earn money that do not involve dishonest or illegal practices.

- How To Start A Logistics Company In South Africa Pdf

- How To Start A Funeral Parlour In South Africa

How To Hack My Boyfriend Phone

How To Hack Someones Instgram

How To Hack Someone's Instagram

How To Hack Bank Account

How To Make Cat Drug

This website uses cookies to offer you a better browsing experience, if you continue browsing we consider that you accept their use. Read more

To continue you must:

FTC official: Legal 'loan sharks' may be exploiting coronavirus to squeeze small businesses

Jason Indelicato, who owns a three-store clothing chain in Massachusetts called North River Outfitter, is under siege. As with many small business owners, he has closed his stores because of the coronavirus pandemic, and his revenues have disappeared.

Still, the virus isn't the worst of Indelicato's woes, he told NBC News. A lender is.

On March 19, as COVID-19 spread across the U.S., triggering a national emergency, a merchant cash advance company sued Indelicato and his wife, Alice. The company, PowerUp Lending Group of Great Neck, New York, had given North River money to be repaid from the stores' future sales. Now those sales are nonexistent — but PowerUp's suit demanded immediate payment of almost $91,000, plus legal fees. (The suit is now on hold.)

"I don't see how companies that are collecting future receipts can be litigating against companies that don't have any receipts," Indelicato said.

Merchants like Indelicato have been hammered by the coronavirus outbreak. But aggressive lenders are still trying to extract money from their empty coffers. Court documents show that amid the pandemic, so-called merchant cash advance companies are pursuing legal claims against owners that freeze their bank accounts and are pressing their family members, neighbors, insurers, distributors — even their customers — for money the lenders say they're owed.

Small businesses are the backbone of the U.S. economy, employing millions of people and paying taxes. But since the 2008 recession, they have struggled to get loans from commercial banks, which prefer to deal with bigger borrowers. Small businesses that need cash must increasingly rely on merchant cash advance lenders — members of a little-known industry with almost no government oversight; effective interest rates that can hit 400 percent, according to congressional testimony; and direct access to their customers' bank accounts. Some companies' aggressive, even menacing, collection techniques are documented in video, recordings and emails provided to NBC News.

"The coronavirus crisis is putting millions of small businesses in a precarious situation, and I'm really worried that loan sharks are exploiting the situation," said Rohit Chopra, one of the five commissioners who run the Federal Trade Commission. "We're already seeing a decadelong decline in small businesses. This type of predatory, extortionate approach is going to wipe out so many businesses, and they're not going to come back."

Full coverage of the coronavirus outbreak

Five years ago, the merchant cash advance industry financed around $8 billion for small businesses. But the industry's reach has exploded as money from traditional banks has become less available to these borrowers. In 2019, it provided an estimated $19 billion in funding.

"I will put you in the hospital ... Call the police I don't care."

If the merchants fall behind on their payments, some lenders send threatening emails and texts and even pay visits to borrowers' homes to try to collect, lawyers and small business owners say.

NBC News reviewed some of the communications, including videos of a visit by a collection agent to a borrower's home and another to a borrower's office by an expletive-spewing man trying to collect on a loan. "You will end up hurt. Hurt bad," one text said.

The most common arrangements between these companies and small business borrowers aren't technically loans, and therefore their terms and the companies offering them aren't regulated.

That must change, Chopra said. "The FTC has to seriously look at rules that ban some of the most extortionate clauses in these loan contracts," he said, adding that the FTC is prepared to "go after some of the loan sharks and their lawyers who run lawsuit mills that are filing some of these sham collection actions."

How it works

Merchant cash advance companies like PowerUp aggressively cold-call, email and text small business owners offering quick and easy funding, merchants told NBC News. The offers are alluring to owners who often operate on the edge and are strapped for cash.

The companies generally provide a predetermined amount of money to a business in exchange for future receipts. As in any industry, some of the companies' practices are more problematic than others.

The agreements are enforceable contracts the borrowers have agreed to, lawyers say, but some of the aggressive collection practices, such as visiting borrowers' homes, aren't legal, they contend.

Under a typical deal, a business might receive $40,000 in exchange for agreeing to hand over $50,000 in future revenue over a few months. Merchants are typically required to repay the advances via automatic withdrawals from their bank accounts every day or week.

To secure the financing, business owners must provide documents detailing their recent sales and identifying their business partners, including their customers, and the amounts they owe, known as accounts receivable.

Owners must also give the lenders unfettered access to their bank accounts for the automatic withdrawals. If revenue dries up and the money stops flowing, merchant cash advance companies can freeze business owners' accounts by filing so-called confessions of judgment.

Companies often choose to make the filings in New York state, because its statute is powerful and easy to use. For instance, the filings can be entered without a hearing or review by a judge.

The filings are often in amounts that are twice the money owed, say lawyers who work in the arena. They are filed without a business' knowledge; merchants often learn about them when they try to pay their employees and find their accounts blocked, the lawyers say.

The merchant cash advance companies often demand that borrowers also pay attorneys' fees, which can be 25 percent to 33 percent of the balance due under a borrower's agreement, documents show.

Legal filings by cash advance companies, including confessions of judgment filed against small businesses, have been ballooning amid the coronavirus crisis. Court filings in New York state show at least 313 legal actions brought by 98 companies from March 9 to March 20.

The flood receded when New York courts stopped accepting electronic filings in nonessential matters on March 23.

Download the NBC News app for full coverage and alerts about the coronavirus outbreak

Itria Ventures of New York City, an affiliate of Biz2Credit, is among the merchant cash advance companies that filed numerous lawsuits in March. During the three-week period, Itria filed suit against 20 small businesses for nonpayment, court records show, most of them outside the state. In all cases, the businesses had stopped paying in March, although Itria Ventures said some of the defaults dated back months before the coronavirus clobbered operations and governments required that many nonessential companies close.

Small businesses sued by Itria included a builder's company in Minnesota, a grocery in South Carolina, a Holiday Inn Express in Wyoming and a barbecue joint in Alabama, court filings show.

Lone Spur Café, a six-restaurant chain in Arizona and Colorado, was also sued by Itria on March 19, with a demand for $282,000.

On March 23, Kayla Kight, a server at a Lone Spur in Prescott, Arizona, told NBC News that hers was the only restaurant in the group open for business and that it was just providing takeout.

Business is hurting, Kight said by phone. "It's down a lot, more than 50 percent," she said. "Normally we're usually really busy. But there's nobody outside."

NBC News asked Itria and Biz2Credit why they were taking such an aggressive tack against small businesses during a national disaster.

Rohit Arora, Biz2Credit's co-founder and chief executive, said in a telephone interview: "In some cases, we have to file these cases, but we also try to work with our customers. A lot of these companies had problems prior to coronavirus; they were on a payment plan and they defaulted."

Shortly after NBC News spoke with Arora, Itria withdrew its court actions against Lone Spur and other small businesses, court records show. He said the actions were dropped because they worked out payment plans.

'A cycle of death'

"Now, more than ever, alternative lending is going to be needed by small businesses," said Shane Heskin, a lawyer at White and Williams, who represents Indelicato of North River Outfitter and other merchants against direct lenders. "You can't have people freezing assets and demanding payments at a time like this."

When merchants fall behind on their payments, some direct lenders send threatening emails and texts, owners and their lawyers say. (NBC News received no evidence that PowerUp, Itria or Biz2Credit had sent menacing messages to borrowers or had sent debt collectors to their homes, or had engaged in any other improper collection practice.)

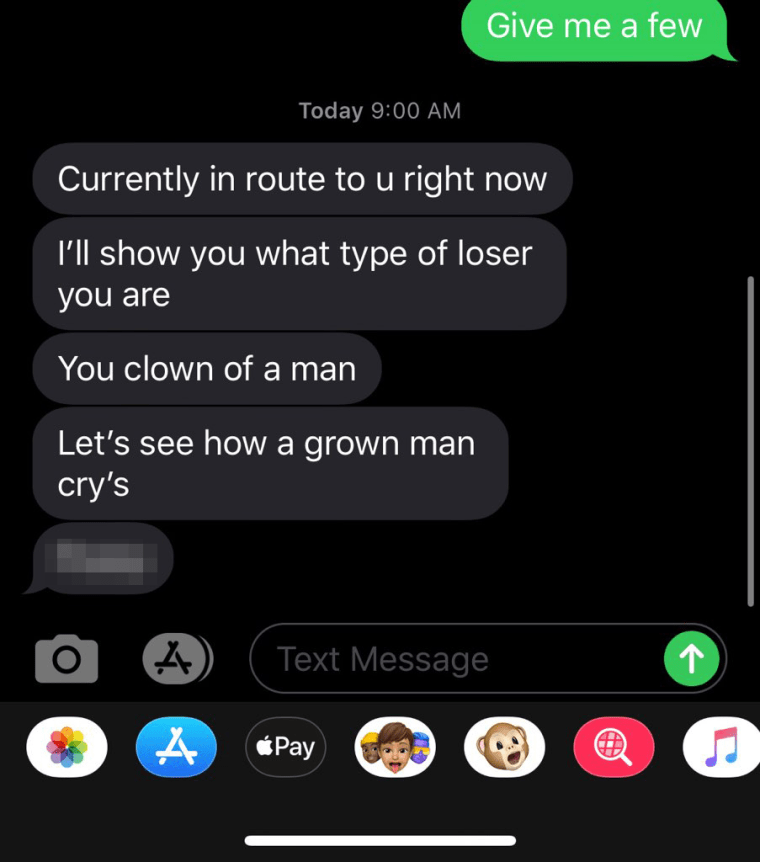

"If you don't send money to me today you're done," said a recent text shared by a business owner. "I will put you in the hospital and your family, call the police I don't care, you and your family will pay." Another text to the owner included a Google map showing a driving route the debt collector was taking to the borrower's home. "Currently in route to u right now," the text said. "I'll show you what type of loser you are you clown of a man."

Heskin, who testified last year before Congress about the lenders' tactics, said one of his law partners found a disemboweled rat splayed atop his mailbox in front of his home. He provided a photo to NBC News.

Indelicato said he began dealing with merchant cash advance companies around 2016, when he wanted to expand his business and needed more money than his conventional bank loan could provide. He said the companies have almost killed his business.

"We went from having good credit and eight or nine stores to having bad credit and three stores," Indelicato said in an interview. "On some of our loans, we were paying over 200 percent. It became a cycle of death. They have access to your bank accounts — they can wipe out an account overnight."

On March 27, NBC News contacted Bernard Feldman, a lawyer for PowerUp Lending, about the Indelicato case. In a return email, he said the firm had decided to stand down for the moment. "We have no intention of pursuing this matter at the present time," Feldman wrote.

An email to PowerUp requesting comment received no response.

Another small business borrower who's been through the wringer with merchant cash advance companies is Jon Runion of Runion Dental Group in Columbus, Ohio.

In mid-2018, Runion, an oral surgeon, wanted to add a second location to his practice and had initial approval from a bank for financing. But the bank backed out after he had signed a new lease and begun construction on the second office, and by spring of last year, Runion said, he desperately needed funding. The only source of capital he could find was from merchant cash advance companies.

"Working with a broker, I thought he was going to get me a traditional loan — that was how the conversation started," Runion said. "He more or less presented me the net cash I would receive and the payments. He didn't talk too much about how it was secured or the workings of it."

Soon after he received the money, the amount of the repayments began rocketing, Runion said. When they reached $70,000 a month, he had trouble paying his vendors.

Runion said he told the cash advance companies that he didn't have the money to pay them. "Their strategy was always to get more," he said.

He stopped paying around Thanksgiving and hired a restructuring firm, Second Wind Consultants, to help him work out the loans.

On March 15, the governor of Ohio ordered an end to all oral surgery procedures; Runion's practice is now open six to eight hours a week.

Runion said the companies that advanced him cash have persuaded an insurer holding $40,000 in reimbursements for procedures he had already completed to send the money to the advance company, not to Runion. Other insurers have stopped reimbursing Runion after the advance company notified them that it had sued him. The merchant cash advance agreements typically allow for these remedies.

Runion concedes that he signed the documents that have created the problems. "I tried to make it work," he said, "but I really was unable to."

Meanwhile, as the crisis spreads, cash advance companies are on the hunt for new customers. Some business owners said they are being swamped with new texts and emails offering funds.

"They're all capitalizing right now on the virus," a beleaguered borrower said, "and saying they are there to help you."

Gretchen Morgenson is the senior financial reporter for the NBC News Investigative Unit. A former stockbroker, she won the Pulitzer Prize in 2002 for her "trenchant and incisive" reporting on Wall Street.

Everything you need to know about loan sharks

A report published by the Centre for Social Justice estimated 1.08 million people could be borrowing from an illegal money lender – more commonly known as a loan shark. This figure has more than trebled since 2010.

With price increases on everything from fuel to food making it increasingly tough for households to make ends meet, unlicensed lenders are stepping in, offering loans to the desperate at astronomical interest rates.

Loan sharks prey on the most vulnerable people in our society. They make false promises of a quick and easy loan, then demand extortionate levels of repayment once their victims are trapped in a cycle of debt.

But what is a loan shark? A loan shark is someone who lends money illegally without the correct permissions from the Financial Conduct Authority (FCA). Lending money without a licence is illegal. However, it’s important to know that if you borrow from an illegal money lender, you have not broken the law, they have. Illegal money lending is a hidden and under-reported crime and causes a great degree of terror and fear in those who suffer from it. Borrowers become trapped in a spiral of extortion, facing intimidation, violence and financial ruin. Loan sharks are often seen as a last resort for people who have no other option for obtaining credit, including those with poor credit histories who are rejected by mainstream lenders. With just one unexpected bill, people can quickly find themselves in the grip of an illegal lender. The real danger of loan sharks is not just the large sums of money they lend out and extortionate rates of interest they charge. It’s the psychological toll it takes on victims and their families, leaving them feeling trapped and helpless. How can you spot a loan shark and what are the warning signs? The loan shark might be a friend or acquaintance, or they might simply be someone known in the area for lending money. They may deal in cash, rarely provide any paperwork, and will charge exorbitant amounts in repayment or they may not even be clear about what the borrower has to pay back. Loan sharks can be very dangerous and sometimes they use threats and violence against those who fall behind with their payments. Cyber loan sharks are also becoming more prevalent luring their prey in through social media and other online platforms. These online loan sharks use misleading ads, false promises of easy money, and harassment to trap unsuspecting victims in debt, using fear to suck them in and exploit their vulnerabilities. If you can answer yes to one or more of these questions, you may be borrowing from an illegal money lender: Did they offer you a cash loan or bank transfer? Did they not give you paperwork? Did they add huge amounts of interest or APR to your loan? Have they threatened you? Are you scared of people finding out? Have they taken your bank card, benefit card, passport, watch or other valuables from you? If you’re considering using a loan shark, think again. They often make it look like they’re helping you out but in reality, it’s a trap. Is your lender legal? If someone is lending you money, they must be registered with the Financial Conduct Authority (FCA). The Financial Services Register lists firms and individuals that have authorisation to offer loans and credit. Make sure you do your research before borrowing money. How to get help Are you struggling with debt? If so, it’s important to remember that you are not alone and it’s never too late to seek debt advice. A reputable and professional organisation like PayPlan can help get your finances back on track. If you have borrowed money from a loan shark or you’re worried about a loved one, you can access specialist advice and support from the England Illegal Money Lending Team . The team exists to help victims of illegal lending and their friends and family. The Stop Loan Sharks Helpline is available 24 hours a day, 7 days a week on 0300 555 2222 . You can also use the confidential live chat service on their website to speak to a support worker ( available 9am to 5pm, Monday to Friday). This article was checked and deemed to be correct as at the above publication date, but please be aware that some things may have changed between then and now. So please don't rely on any of this information as a statement of fact, especially if the article was published some time ago. Recent articles

- My PayPlan Story: How I kept my freelance business going whilst struggling with my debts

- Mental Health Awareness Week 2024 – Moving more for your mental health

- My PayPlan Story: Coming back from rock bottom with support from PayPlan

- Mum of three, 48, shares Debt Management Plan (DMP) story

- Am I responsible for my partner’s debts?

- Stress Awareness Month: Tips to help you manage your money

- What happens to my debt if I lose my job?

- World Bipolar Day: The link between debt and bipolar disorder

What's your approximate level of debt?

Great it looks like we can help you..

Simply complete your details below and connect to one of our friendly advisers.

How would you like to connect?

Best time for us to call

What is an IVA?

An Individual Voluntary Arrangement (IVA) is an agreement with the people you owe money to. You make affordable payments over a period of time (usually 5-6 years) and at the end, your remaining debts are written off.

What is a Debt Management Plan?

A debt management plan (DMP) allows you to pay back your creditors each month at an amount you can afford. The DMP lasts until you have repaid your debts in full or your circumstances improve.

What is a Self-employed IVA?

A self-employed Individual Voluntary Arrangement (IVA) is an agreement to pay back what you owe whilst still running your business. You make affordable payments over a period of time (usually 5-6 years) and at the end, your remaining debts are written off.

What is a Debt Relief Order?

A debt relief order is a solution available if you are not able to afford any payments to people you owe to. It freezes debts for a year at which time they are written off if your circumstances have not improved.

What is Bankruptcy?

Bankruptcy is a type of insolvency that involves applying to the court in order to clear your debts. There is an upfront fee and you may be required to make payments from your earnings into the bankruptcy for up to 3 years.

Share this article

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Successful Business Plan for a Loan

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does a loan business plan include?

What lenders look for in a business plan, business plan for loan examples, resources for writing a business plan.

A comprehensive and well-written business plan can be used to persuade lenders that your business is worth investing in and hopefully, improve your chances of getting approved for a small-business loan . Many lenders will ask that you include a business plan along with other documents as part of your loan application.

When writing a business plan for a loan, you’ll want to highlight your abilities, justify your need for capital and prove your ability to repay the debt.

Here’s everything you need to know to get started.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

A successful business plan for a loan describes your financial goals and how you’ll achieve them. Although business plan components can vary from company to company, there are a few sections that are typically included in most plans.

These sections will help provide lenders with an overview of your business and explain why they should approve you for a loan.

Executive summary

The executive summary is used to spark interest in your business. It may include high-level information about you, your products and services, your management team, employees, business location and financial details. Your mission statement can be added here as well.

To help build a lender’s confidence in your business, you can also include a concise overview of your growth plans in this section.

Company overview

The company overview is an area to describe the strengths of your business. If you didn’t explain what problems your business will solve in the executive summary, do it here.

Highlight any experts on your team and what gives you a competitive advantage. You can also include specific details about your business such as when it was founded, your business entity type and history.

Products and services

Use this section to demonstrate the need for what you’re offering. Describe your products and services and explain how customers will benefit from having them.

Detail any equipment or materials that you need to provide your goods and services — this may be particularly helpful if you’re looking for equipment or inventory financing . You’ll also want to disclose any patents or copyrights in this section.

Market analysis

Here you can demonstrate that you’ve done your homework and showcase your understanding of your industry, current outlook, trends, target market and competitors.

You can add details about your target market that include where you’ll find customers, ways you plan to market to them and how your products and services will be delivered to them.

» MORE: How to write a market analysis for a business plan

Marketing and sales plan

Your marketing and sales plan provides details on how you intend to attract your customers and build a client base. You can also explain the steps involved in the sale and delivery of your product or service.

At a high level, this section should identify your sales goals and how you plan to achieve them — showing a lender how you’re going to make money to repay potential debt.

Operational plan

The operational plan section covers the physical requirements of operating your business on a day-to-day basis. Depending on your type of business, this may include location, facility requirements, equipment, vehicles, inventory needs and supplies. Production goals, timelines, quality control and customer service details may also be included.

Management team

This section illustrates how your business will be organized. You can list the management team, owners, board of directors and consultants with details about their experience and the role they will play at your company. This is also a good place to include an organizational chart .

From this section, a lender should understand why you and your team are qualified to run a business and why they should feel confident lending you money — even if you’re a startup.

Funding request

In this section, you’ll explain the amount of money you’re requesting from the lender and why you need it. You’ll describe how the funds will be used and how you intend to repay the loan.

You may also discuss any funding requirements you anticipate over the next five years and your strategic financial plans for the future.

» Need help writing? Learn about the best business plan software .

Financial statements

When you’re writing a business plan for a loan, this is one of the most important sections. The goal is to use your financial statements to prove to a lender that your business is stable and will be able to repay any potential debt.

In this section, you’ll want to include three to five years of income statements, cash flow statements and balance sheets. It can also be helpful to include an expense analysis, break-even analysis, capital expenditure budgets, projected income statements and projected cash flow statements. If you have collateral that you could put up to secure a loan, you should list it in this section as well.

If you’re a startup that doesn’t have much historical data to provide, you’ll want to include estimated costs, revenue and any other future projections you may have. Graphs and charts can be useful visual aids here.

In general, the more data you can use to show a lender your financial security, the better.

Finally, if necessary, supporting information and documents can be added in an appendix section. This may include credit histories, resumes, letters of reference, product pictures, licenses, permits, contracts and other legal documents.

Lenders will typically evaluate your loan application based on the five C’s — or characteristics — of credit : character, capacity, capital, conditions and collateral. Although your business plan won't contain everything a lender needs to complete its assessment, the document can highlight your strengths in each of these areas.

A lender will assess your character by reviewing your education, business experience and credit history. This assessment may also be extended to board members and your management team. Highlights of your strengths can be worked into the following sections of your business plan:

Executive summary.

Company overview.

Management team.

Capacity centers on your ability to repay the loan. Lenders will be looking at the revenue you plan to generate, your expenses, cash flow and your loan payment plan. This information can be included in the following sections:

Funding request.

Financial statements.

Capital is the amount of money you have invested in your business. Lenders can use it to judge your financial commitment to the business. You can use any of the following sections to highlight your financial commitment:

Operational plan.

Conditions refers to the purpose and market for your products and services. Lenders will be looking for information such as product demand, competition and industry trends. Information for this can be included in the following sections:

Market analysis.

Products and services.

Marketing and sales plan.

Collateral is an asset pledged to a lender to guarantee the repayment of a loan. This can be equipment, inventory, vehicles or something else of value. Use the following sections to include information on assets:

» MORE: How to get a business loan

Writing a business plan for a loan application can be intimidating, especially when you’re just getting started. It may be helpful to use a business plan template or refer to an existing sample as you’re going through the draft process.

Here are a few examples that you may find useful:

Business Plan Outline — Colorado Small Business Development Center

Business Plan Template — Iowa Small Business Development Center

Writing a Business Plan — Maine Small Business Development Center

Business Plan Workbook — Capital One

Looking for a business loan?

See our overall favorites, or narrow it down by category to find the best options for you.

on NerdWallet's secure site

U.S. Small Business Administration. The SBA offers a free self-paced course on writing a business plan. The course includes several videos, objectives for you to accomplish, as well as worksheets you can complete.

SCORE. SCORE, a nonprofit organization and resource partner of the SBA, offers free assistance that includes a step-by-step downloadable template to help startups create a business plan, and mentors who can review and refine your plan virtually or in person.

Small Business Development Centers. Similarly, your local SBDC can provide assistance with business planning and finding access to capital. These organizations also have virtual and in-person training courses, as well as opportunities to consult with business experts.

Business plan software. Although many business plan software platforms require a subscription, these tools can be useful if you want a templated approach that can break the process down for you step-by-step. Many of these services include a range of examples and templates, instruction videos and guides, and financial dashboards, among other features. You may also be able to use a free trial before committing to one of these software options.

A loan business plan outlines your business’s objectives, products or services, funding needs and finances. The goal of this document is to convince lenders that they should approve you for a business loan.

Not all lenders will require a business plan, but you’ll likely need one for bank and SBA loans. Even if it isn’t required, however, a lean business plan can be used to bolster your loan application.

Lenders ask for a business plan because they want to know that your business is and will continue to be financially stable. They want to know how you make money, spend money and plan to achieve your financial goals. All of this information allows them to assess whether you’ll be able to repay a loan and decide if they should approve your application.

On a similar note...

- Search Search Please fill out this field.

- Is a Loan Business Right for You?

Develop a Business Plan

Form a legal entity, register your business with the irs, figure out financing.

- Get the Required Licenses & Permits

Set Up Business Accounting

Get business insurance.

- What to Expect

The Bottom Line

- Personal Loans

How to Start a Personal Loan Business

Before you start a moneylender business, learn more about what’s involved

:max_bytes(150000):strip_icc():format(webp)/picture-53878-1440082644-5bfc2a8ac9e77c00517fa300.jpg)

If you’re hoping to start a business , one of the most profitable is offering personal loans to others. However, getting the startup cash and investors required can be challenging.

Before you decide to start a personal loan business, it’s important to understand the ins and outs and be prepared for potential setbacks.

Key Takeaways

- A personal loan business can be flexible and profitable.

- You need investors to back a personal loan business, and it can be challenging to find them.

- It’s important to prepare ahead of time with paperwork, including loan documents.

- Federal, state, and local laws can make starting a personal loan business challenging, and you should review necessary information before moving forward.

Decide Whether a Personal Loan Business Is Right for You

Before you move forward with a personal loan business, you need to decide if it’s the right path for you. There are different potential ways to move forward with a personal loan business. Some potential options include:

- Your own money : You lend your own money to others. You can choose to provide secured loans or unsecured loans . However, you need to have a large amount of capital to get started, since you’re using your own money to move forward. In this case, though, you keep all the interest paid on the loan and can charge what fees you wish.

- Investor money : With this type of business, investors provide you with the funds to make loans. The investors receive the interest from the payments, and you receive compensation in the form of a loan fee charge at origination.

- Peer-to-peer (P2P) lending : Rather than directly lending money, you provide the means to connect borrowers and lenders . You might do it through an app or website. You take a cut of the deal but aren’t putting up your own money to get started.

A personal loan business can be profitable since you have the chance to earn money upfront from origination and administration fees. Plus, depending on how you set up your business, you might be able to benefit from the interest earned on repayments .

On the other hand, though, you have to be prepared to shoulder some of the risks. If a borrower misses payments or defaults , you could lose money—especially if you’re lending out your own money.

Don’t forget to consider the market potential as well. Loans are popular, and it’s possible to find customers all over the world. Even so, the industry has slowed in recent years, and there are concerns that increased scrutiny for moneylenders could lead to more challenges for those who want to start a personal loan business.

Pros and Cons of a Personal Loan Business

Potential for good profits, including upfront cash flow from charging fees

Flexible business model that can be managed from home if you choose

Customers available from a variety of markets, since many people need loans

Regulations can differ at the federal, state, and local levels, and it’s hard to predict how you need to comply.

It can be difficult to get enough capital to start, whether you use your own money or look for investors.

Growth in the installment loan industry has been slowing in the last few years.

Make sure to carefully consider the pros and cons of a personal loan business before you get started. Realize that regulations and the need for capital can make this a challenging business, even if you have the potential to make a good profit.

Don’t forget that heavy regulation at various levels of government can regulate how you collect interest, who you can lend to, and other aspects of personal loans. Working through the different regulations can be challenging, and it’s important to remember that financial services come with a lot of red tape. In fact, it’s important to note that there’s no one-size-fits-all approach to a moneylender business. You probably won’t be able to take one business template from one place and apply it to the same loan business in another location.

Next, you need to create a business plan . Unless you’re using your own money to fund the loans you make, you’ll need investors and other backers. Most of them aren’t likely to provide you with the money you need to get started unless you have a good business plan.

Some of the main elements of a business plan include the following:

- Executive summary : This is the overview of your business plan. It provides a way for investors and others to quickly understand the basics of your idea and how you expect to make money. It should be the last thing you write, even though it will be at the beginning of your overall plan.

- Business summary : Describe your business in this section. It should be an overview of what you hope to accomplish with your business and your goals. Key people in your company should be recognized here, along with their skills and what they contribute to the success of your business.

- Products : Be clear about what you’re providing and how you plan to deliver. Make sure you’re clear about the types of loans you’ll provide. This can include whether you plan to focus on microlending , traditional personal installment loans , cash advances , or some other type of loan . You can also share whether you plan to provide options such as allowing co-signers or accepting collateral .

- Market analysis : Next, you need to provide an analysis of your target market and potential demand. You’ll need to back this up with research and have an analysis of what type of growth you can reasonably expect, in addition to potential challenges.

- Competitive analysis : Take a look at your likely competitors in the space. You should be able to compare their strengths and weaknesses to your own and provide an overview of how your product and business will be advantageous compared to your competitors.

- Marketing plan : Provide a marketing plan . How will you reach your target market? What channels will you use, and do you have any promotional strategies? Flesh out a plan to show how you will reach customers and convert them.

- Operations plan : This section is all about logistics . Where will you be located? Will you have offices or operate online? Do you have special equipment or people who can be used to make this business a success?

- Financial plan : Don’t forget to lay out the numbers. In general, you should plan to have projects for startup costs and the type of investment you’ll need. Provide profit and loss estimates, and detail your expected cash flow . You should be able to estimate three to five years.

- Appendix : If you have any supplementary materials and documentation, it should go in this section of your business plan.

Once you have your business plan and a roadmap for the future, you need to form your legal entity. Decide whether you should be a sole proprietor or if it makes sense for you to form a limited liability company (LLC) or some other partnership . You can also form a corporation . An accountant or a business attorney can help you figure out what type of structure makes sense for you.

If you think you’ll hire others to work in the business, or if you have investors who might want to be partners, you’ll need to keep that in mind as you form a legal business entity. Depending on your state, you might need to file articles of organization and register your business with a city or state office.

You’ll need an Employer Identification Number (EIN) from the Internal Revenue Service (IRS) as you move forward. This will be used when you file your business or partnership tax returns . You can go to the IRS website and get an EIN and register your business within a matter of minutes. It’s also possible to complete this step by mail or fax.

One of the most challenging parts of starting a personal loan business is making sure you have the financing you need. If you’re going to loan money, you need a significant amount of capital.

If you’re using investors’ funds, you’ll need to build relationships and convince others to provide you with capital to lend to others. You’ll need to have agreements in place with your backers so that they know how much they can expect, including what types of returns they’re likely to receive.

All of this can require a lot of expense as you consult with lawyers and make sure you’re in compliance with federal, state, and local regulations.

Get the Required Licenses and Permits

Next, you need to figure out what licenses you need to operate a lending business. You might need permits as well, especially if you’re occupying a building. States, counties, and cities might have their own rules. These rules will be based on whether you operate out of your home or another location. Make sure you understand the requirements before you move forward and get the appropriate paperwork filed to operate legally.

Remember, too, that you might have to get certain licenses for financial services, depending on where you operate. Taking the appropriate tests and paying for the licenses can be costly, so evaluate whether this is something you want to pursue.

Don’t forget to set up business accounting. You should have a separate system from your personal finances. You’ll need bookkeeping and payroll for employees. You also need a way to keep track of when borrowers make payments and how much of each payment should go toward the principal and how much should go toward interest. And, if you have investors, your accounting should also take into account what’s going to them.

As a moneylender, you need business insurance to protect you if too many borrowers default or something else happens. Often, you might need business insurance to protect you in the case of lawsuits as well. If you have a building, you’ll need insurance to protect your premises. Don’t forget about workers’ compensation as well. There are many different types of business insurance, and you need to make sure you’re paying for policies that fit your needs and can help protect your assets.

What to Expect When Opening a Personal Loan Business

When you open a personal loan business, you should be prepared to work long hours and be ready to market yourself and your business. It’s also important to make sure you have enough capital available to fulfill the loans you plan to make to others, as well as meet all federal, state, and local regulatory requirements.