How to Write a Loan Application Letter in Nigeria

Do you find it difficult to write a loan application letter or you are clueless about how to go about the process?

No need to fret, you have come to the right page for a solution.

It is not surprising that a lot of Nigerians apply for loans in various financial organisations ranging from commercial banks, and microfinance banks, and that online loan apps are on the increase in Nigeria.

Due to the current economic hardship coupled with debts incurred by some Nigerians, to settle their debts, they simply look forward to applying for a loan as a solution to their problems.

Nigerians apply for loans for different reasons and purposes. Some for their businesses, education, to pay off debt while some apply for loans to “japa”.

If you’re looking to apply for a loan here in Nigeria, in simple steps, I’ll guide and put you through how to write a loan application letter in Nigeria.

Table of Contents

Applying For a Loan in Nigeria

Firstly, you need to have a plan, ask yourself the question “what do I need this money for?”

Will the business you’re planning to venture into be productive enough to pay back the loan you’re applying for in the bank?

If you don’t have a plan, at the end of the day, when you write the application for a loan, you often find it difficult to pay back the loan.

This is why some of these loan sharks make public the loan defaulters personal details on social media platforms creating public embarrassment to the defaulters and the people close to them.

Steps in Applying for a Loan

The major thing you should look out for as you’re about to apply for a loan in Nigeria is the financial institution you want to go for.

Put in mind their interest rates, the loan duration (how long will it take for you to pay off?).

Read properly the T&Cs, and read it line by line before you append your signature.

Lots of Nigerians applying for loans make the mistake of not going through the terms and conditions thoroughly, you definitely don’t want to make this mistake to avoid “had I known?”

Don’t be too eager, I repeat, don’t be too eager.

Just recently someone told me something I want you to pick from, she said “one of the policies in giving loans is not to give a loan to a customer that is too eager, the one who never lets you rest”.

Read also: How to get loans without a salary account or collateral.

How to Write a Loan Application Letter

Writing a loan application letter in Nigeria is quite simple as you can refer to the letters you wrote while in school.

Your loan application letter should be well detailed and concise, not verbose.

There are two things to consider here, are you applying for personal use or for your company?

If it is a personal loan, it is simple, all you have to do is to walk into any bank of your choice to make some findings.

Make sure you get a clean sheet of paper (A4 Paper), your identity card (work id is included), a letter of introduction from your working place if you’re an employee of an organisation.

I’ll list out in bullet points what should be included in your loan application letter so you won’t make any mistakes or leave any information out of your loan application letter.

NOTE: You’re writing a formal letter, not an informal letter.

- The bank’s address (include the branch manager if you’re addressing the letter to him/her. This should be on the left side of your A4 paper.

- Your address should be on the right side of your letter.

- Under the address to the bank, “Dear Ma/Sir” should be written.

- Heading: You should provide heading to your loan application letter. See more details in the samples below.

- Body of your letter: You should explain in detail the reason and the duration.

Read also: Top banks in Nigeria for entrepreneurs.

Samples of a Loan Application Letter

Below are samples of loan application letters for an individual/personal use:

To the Branch Manager,

United Bank for Africa,

Lebanon Dugbe,

23rd April 2009.

40, Boladuro Street,

Challenge Ibadan,

Dear Ma/Sir,

LOAN REQUEST

I (your name), with the account number (×××××××××) wish to request for a loan in your business office.

I look forward to hearing from you soon.

Thanks in advance.

Yours faithfully,

(Signature)

(Phone number).

Applying for a loan in the name of your company? Ensure you have a great turnover with the bank to get a good loan.

The letter for loan application should be on your company’s letterhead. You can’t apply for a loan in Nigeria as a company on a plain sheet of paper.

XYZ CONSULTING FIRM LTD.

+234***********, 40 Boladuro Street Challenge Ibadan. Oyo State.

To the Branch Manager,

No 40 Boladuro Street,

Dear Sir/Ma,

Our company (name), with the account number (×××××××××) wishes to request for a loan in your business office to get some equipment for our business.

Sponsor your business on Insight.ng for a wider reach of your target audience.

Applying For a Loan on Your Mobile Phone

Do you know you can pick up your phone and apply for that loan you’ve been searching for?

Simply visit the Play Store/Apple store app, there are lots of applications offering loan services.

From Okash to New Credit, Fairmoney, 9ja Cash, Soko Loan and a host of others.

It is not surprising that some Nigerians prefer to apply for a loan using these mobile applications than walking into the bank.

Everyone wants comfort and a very easy experience.

Once you download the application of your choice, you click on the register button (all your information would be recorded together with your bank verification number).

While some Nigerians don’t like to apply for a loan from these Loan apps, due to the embarrassment/disgrace they put people through if they fail to make payment after the payback day, some apply for the loan and pay back in due time.

Read also: Top 10 best loan apps in Nigeria.

Conclusion

I hope you’ve learnt a thing or two from this article on how to write a loan application letter in Nigeria.

Whenever you’re in a fix or there’s something really urgent you need money to settle, you can simply visit any bank branch to make enquiries on the type of loan product they have to offer, or make use of online apps.

If you found this useful, subscribe to our newsletter for more insightful posts.

About Author

Latest entries

Angela Ajani

Give her books and you've made her day. Ajani Angela is a graduate of History and International Studies from Bowen University, currently pursuing her Masters Degree in Peace and Conflict Studies at the University of Ibadan. Angela loves to read and meet new people. Her interests are not limited to just education; she also loves to offer advice to people going through a lot. Angela loves to hear from readers. You can email her at [email protected] .

Expertnaire Tutorial: How to Start Making Millions in Expertnaire in Nigeria

How to write news stories: path to becoming a successful journalist in nigeria, you may also like, top 9 business books for aspiring business owners, how to start a modern hair salon business..., 7 best return on investment calculators for business..., a guide to youtube automation for your business, the potential of hospitality and tourism business in..., exploring career opportunities in agriculture and agribusiness in..., leave a comment.

Save my name, email, and website in this browser for the next time I comment.

- Write for Us

- Sponsored Post

- Privacy Policy

©2024 Insight.ng – All Right Reserved. Parent company for Business World Africa

- ELECTRICITY

- AIRTIME TO CASH

How to Write a Loan Application Letter: a Complete Guide

Have you been having challenges with how to write a loan application letter? If yes, then this article is for you. Nothing is as frustrating and depressing as finding a company or body ready to give you a loan but requires you to submit a loan application letter. Then you can’t write a convincing application letter.

Many people have had potential loans slip through their hands because they submitted an unconvincing letter. If you have had such a problem in the past, I’ve got good news for you. I have put up a guide on writing a detailed, convincing loan application letter that will help you get a loan to support your business or solve your problem. I have also written a sample that you can use as a guide. Without any further ado, let’s get started!

Table of Contents

When Should You Write A Loan Application Letter?

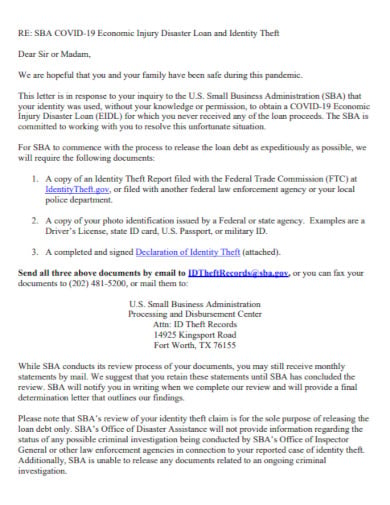

Two primary situations may necessitate the writing of a loan application letter. The first situation is needing a loan from a traditional bank lender. These financial institutions do not grant loans but make them available to the public. To prove their creditworthiness, applicants must typically submit a loan application to traditional banks.

The second situation that may require a loan application letter is when you are applying for an SBA-guaranteed loan. This type of loan involves the federal government, and applicants must undergo additional screening before being approved for funding. Submitting a formal loan application with supporting documentation can improve an applicant’s chances of receiving an SBA guarantee.

A well-written loan application letter can significantly affect the approval process in both situations. The letter should be personalized and provide all the details supporting your case for receiving a loan.

The letter must include your name, contact information, and an explanation of why you are seeking a loan. Additionally, you should provide details on how to use the loan funds and how to repay the loan.

Your loan application letter should be written formally and professionally, with proper grammar and formatting. It should also include supporting documentation, such as a business plan, financial statements, and tax returns. These documents will help substantiate your application and provide additional information lenders may require to make an informed decision.

It is essential to take the time to prepare a thorough and professional loan application letter that accurately reflects your financial situation and your ability to repay the loan.

What Your Loan Application Should Contain

Various elements must be found in your loan application letter; with these key elements, your loan application will be complete.

Personal Information: The first section of the loan application letter should contain personal information about the borrower. This information should include the borrower’s name, phone number, and email address. It is important to provide accurate information to ensure the lender can contact the borrower if necessary.

Loan Information: The next section of the loan application letter should provide details about the requested loan. This information should include the loan amount, the purpose of the loan, and the repayment terms. It is important to be specific about the loan amount and the repayment terms to ensure everything is clear.

Employment and Income Information: The lender will want to know about the borrower’s employment and income to determine if they can repay the loan. The borrower should provide information about their current employment status, including their job title, length of employment, and monthly income. If the borrower is self-employed, they should provide details about their business and income.

Credit History: The lender will also want to know about the borrower’s credit history. The borrower should provide information about past loans or credit accounts, including their current status and repayment history. They should also provide information about any bankruptcies or foreclosures.

Collateral: If the borrower is applying for a secured loan, they should provide information about the collateral they offer. This information should include a description of the collateral and its value.

Loan Purpose: The borrower should explain the purpose of the loan in detail. This could include paying off debt, making home improvements, or purchasing a vehicle. It is important to be specific about the loan’s purpose to help the lender understand how the loan will be used.

Repayment Plan: The borrower should provide a detailed repayment plan outlining how to repay the loan. This plan should include the repayment schedule, the amount of each payment, and the payment method. It is important to be realistic about the repayment plan to ensure the borrower can afford the payments.

Conclusion: The loan application letter should conclude with a summary of the borrower’s financial situation and why they are a good candidate for the loan. The borrower should thank the lender for considering their loan application and provide their contact information for follow-up.

Tips for Writing an Effective Loan Application Letter

- Be clear and concise in your writing.

- Provide accurate and detailed information.

- Use proper grammar and spelling.

- Be honest about your financial situation.

- Make sure your repayment plan is realistic.

- Include any relevant documents, such as pay stubs or tax returns.

Example of a Loan Application

[Your Name]

[Your Address]

[City, State ZIP Code]

[Your Phone Number]

[Your Email Address]

Dear [Lender’s Name],

I am writing to apply for a loan in the amount of [Loan Amount] to [Purpose of Loan]. I have researched various lenders and have determined that your lending institution offers the best terms for my needs.

I have been employed as an [Occupation] at [Company] for [Years of Employment] years and have a stable income of [Monthly Income]. My credit score is [Credit Score], and I have no outstanding debts or obligations. I am confident I can repay this loan in full and on time.

The funds from this loan will be used for [Purpose of Loan], which is important to me for [Reason for Purpose of Loan]. I have attached a detailed budget plan outlining how I intend to use the funds and how I plan to repay the loan.

I would appreciate your consideration of my loan application. Please let me know if you require additional information or documentation through this contact [phone number] or [email address]. I am available to discuss my application at your convenience.

As part of my loan application, I have included the following documents for your review:

- Business plan

- Financial statements for the past three years

- Articles of incorporation

- Personal financial statements for all owners

- Tax returns for the past three years

- Cash flow projections

- A list of collateral that will be used to secure the loan.

Thank you for your time and consideration.

Frequently Asked Questions

What is the most important factor in getting a loan.

The most important factor in getting a loan is your Debt-to-Income Ratio.

What is The Best Reason to Put When Asking for a Loan

You can use emergency expenses like medical emergencies, job loss, car repair, the death of a family member, etc., as reasons for requesting a loan.

Should I Attach Any Supporting Documents with My Loan Application Letter?

Yes. Attaching any supporting documents you have is very important, as they will help increase your chances of getting a loan.

Final Wrap Up

A loan application letter is an important part of the loan application process. Providing accurate and detailed information about your financial situation and the requested loan is essential. Following the tips outlined in this article, you can write an effective loan application letter that increases your chances of getting approved for a loan.

Related posts:

- How to Check Glo Data Balance 2024

👉 Relocate to Canada Today!

Live, study and work in canada. no payment is required hurry now click here to apply >> immigrate to canada.

5 Best Format Examples of Loan Application Letter in Nigeria 2023 Code

Loan Application Letter in Nigeria – Do you wish to apply for a Loan in Nigeria? Whether it’s a business Loan or a personal loan, knowing how to properly write loan application letter can help you obtain the loan you are currently looking for. Do you know the right format in writing a loan application in Nigeria? If no, then continue reading this post to see the best loan format for all types of loan in Nigeria. Information Guide Nigeria

A well written application letter can be just what you need to land that loan you’ve been waiting for. Most business owners often apply for a business loan to maybe expand their business enterpr i se, or to cover for a new business idea they wish to venture into. However, getting the loan isn’t as easy as it may seem sometimes. Although, there are several financial institutions that offers loans to business owners, but they usually require you to write an application letter before getting the loan. That’s why you need to learn the proper format in writing a loan application.

Read Also: How to Print NYSC Call Up Letter

What is a Loan Application Letter?

A loan application letter is formally written application letter to a your employer, financial institution, or company to express your intention of acquiring a business or personal loan from them.

The loan application letter highlights your personal achievements, skills, and life as an individual. It helps you to gain the attention of the employer or the financial institution responsible for reviewing the loan applications.

For your loan appl i cation to be approved, it must be interesting enough to the manager, and it must highlight your key qualifications that makes you fit for the type of loan you’re requesting for.

Read Also: How to Write NYSC Relocation Letter With Samples

How to Write a Loan Application Letter

To write a good loan application letter, follow the key points below:

1. Address the Letter to the Right Authority

One of the important key note of writing a loan application letter is addressing it to the authority. If your loan application letter is addressed to the wrong authority, then your loan application will not be processed. Always conf i rm the right authority to which you are expected to address the loan application before addressing your letter. For example: HR, Your Manager, or Loan Officer.

2. State Your Reasons For Requesting the Loan

When applying for a loan, whether for business use or personal use, it is important that you explain in details how the money will be spent. When you apply for a loan with vague explanation of how the money is to be spent, then your loan application may not be approved. The lender needs to know why you need the money in other to determine if it is reasonable or not.

Read Also: How to Write NYSC Acceptance Letter With Samples

3. Be Specific About the Amount you want

Always be specific about the amount you’re requesting for when applying for a loan. It is believed that if your reason for requesting a loan is legitimate, then you should know the exact amount of loan you need to solve your problem. Also, this will help the lender know if you have the borrowing capacity for the amount you’re requesting for.

4. Present Your Positive Attributes

When applying for a loan, make sure you describe all your good attributes in the application letter to show the lender that you are trustworthy. Describe your positive work history, and what you can offer to guarantee that the loan will be paid on time.

5. Describe How You Intend to Pay the Loan

This a an important part of the loan application letter. Make you depict your intention of repaying the loan if granted to you. This will let the lender know that you are indeed worthy of the loan you are requesting for.

6. Make Sure the Information You Provided are Correct and be Honest

Money lending is a sensitive issue, that’s why money lenders only loan money to people who are honest and factual about the situation. Also, it is important that you keep a good credit history, to enjoy smooth loan application.

Read Also: How to Get NYSC Rejection Letter

Loan Application Letter (5 Best Format)

The loan application letter is divided into six paragraphs, with each paragraph addressing a major topic like the loan amount, descr i ption of your business, purpose of loan, target market, repayment plan, etc. See the best loan application letter format below:

Business Loan Application Letter Format

Let’s take a look at how to write a business loan. Taking a case study of a businessman who owns a furniture business and is requesting for a loan amount of N30 million to expand his business.

Mr. Victor Nnaji

Chief Executive Officer

Nnaji’s Furniture Homes

Mr Johnson Michael JAMB Result

The manager

Administration Department

XYZ Co. Ltd.

Application for Loan to Expand My Business

Dear Mr Johnson,

I am requesting a business loan of N30 million to help me expand my furniture business most especially my warehouse facilities. In the last 2 years, my business have experienced a major boost in sales and income which has made me see reasons to opt for an expansion.

I have accumulated a huge experience in the furniture business industry and I could be considered an expert and also a top marketer in this industry. JAMB Form

I started the Nnaji’s Furniture Homes in 1992 and since then, the company has consistent profit till date. Although there have been some ups and downs in the business, which is normal with all businesses, but the company has thrived greatly under my leadership.

The market for Furniture business depends on the housing market of the economy and we have lots of clients who have been satisfied with our products and have given good reviews about our products.

In recent years, the housing market has improved greatly and the projected growth in the next 10 years exceeds the numbers prior to recession. So at Nnaji’s furniture, we are doing our very best to ensure we meet up with the growing demand for furniture as well as the keeping up to date with the latest designs coming up, so we can always be ahead in the market.

I utilized cost-effective marketing strategies that resulted in an average of 4000 new orders every month from numerous private homeowners across the nation.

So far, I have invested about N20 million into the business, and my collateral consist of business assets with a fair market value of N45 million, while my personal assets is valued at N25 million. Npower Recruitment

I am disclosing my business plan which shows in details the reasons for the loan request. You can contact me on +2341647745362 if there are any questions you wish to ask.

Kind Regards,

Chief Executive Officer 5 Best Format Examples of Loan Application Letter in Nigeria

Nnaji’s Furniture Homes.

Read Also: How to Get NYSC Call-Up Letter

Personal Loan Application Letter Format

If your loan application is for personal use, then use the format below. The case study here is customer service officer who is applying for loan to pay his children’s school fees.

Brian Dennis.

Customer Service Officer

Administration Team WAEC Result

Mr Bruce Banner

BCV Co. Ltd.

Application for Loan to Pay Up Children’s School Fees

Dear Mr Bruce, How to Check MTN Bonus Balance

I am humbly request for a personal loan of N200,000 to enable me pay my children’s school fees. I was supposed to have paid the fees before now but due to some unplanned events came up, and was quite urgent, I couldn’t pay the fees.

This unplanned event led to the reduction of the money set aside for my children’s school fees and I was hoping to get a loan from you to enable me paid up their fees.

It is no news that I have been with the company for over five years now and I throughout my time a the company, I have shown utmost loyal and dedicated to the organization and so I believe you could consider my request for the loan and deem me worthy of getting the loan.

You can use your discretion to determine or suggest a repayment plan for me as an employee of this organization.

Thanks in anticipation as I hope to hear from you soon.

Kind regards,

Brian Dennis. How to Connect NIN to Glo SIM

Administration Team

Check and Confirm: How much is Dollar to Naira Today Pounds to Naira Today

📢 We are hiring writers!

Copyright warning.

Victor Nnaji

Who is kylie prew all about jojo siwa’s current girlfriend, ari fletcher's biography: age, height, nationality, net worth, related articles.

Banks charge customers N715bn for electronic transactions, others

How to transfer money from gtbank without atm card

Ganduje calls new naira policy ‘COVID-23

Wema Bank Savings Account Interest Rate

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

It looks like you're using an ad blocker!

- Get Job Alert

Advertisements

Best 8 Format for Loan Application Letter in Nigeria

A loan application letter in Nigeria stands out when you attach an application letter outlining your interest in the organization as well as your qualifications, experience, and talents.

The letter also should demonstrates to the lender why you are the best candidate for the loan.

If you looking for the best format for your loan application letter as well as what to include, then you have found a perfect guide.

Let’s show you how to write the best loan application letter in Nigeria

What is a Loan Application Letter

This is a detailed letter explaining your aims and the reasons behind your loan request addressed to a possible employer or a company.

The loan application letter presents you as a unique personality, showcasing your accomplishments and abilities in an effort to catch the hiring manager’s or application reviewer’s eye.

This letter should grab the manager’s interest enough to prompt him to ask for an interview with you by highlighting your essential credentials for the loan.

The loan application letter, can make or break your chances of getting a loan. A compelling credit application letter ought to just be one page long and contain six or less passages.

What to Include in Your Loan Application Letter For Business

The letter should persuade the financial lender to approve your loan application by emphasizing critical details about your company’s financial history and current state.

You must be careful with how you structure your loan application letter, what you include in it, and the tone you use throughout because banks use the loan application letter to percieve borrowers and their creditworthiness.

Salutation and Heading

A header and greeting section are essential components of a strong loan application letter. The header of the letter will include the applicant’s name,

address, and phone number, the date, the recipient’s name, address, and phone number, as well as a formal salutation addressed to the recipient.

The information you should include in this section is your name, the name of your company, your business address, your business mobile phone number, the receiver’s name, title, and contact information,

including their physical addresses, as well as a clear subject line that states the purpose of the letter and the precise amount of money you are asking the potential lender for.

Acknowledge The Right Authority

Any correspondence must be addressed to the appropriate person. It is highly important since it marks the beginning of a formal engagement,

and you want this to get off on the proper approach. Always try to determine to whom the application must be filed and be sure to address it.

You can use a more general salutation, such as Dear Loan officer, Manager, etc. if you are unable to identify the loaning officer’s or agent’s name.

Give a Brief Summary

Briefly state the aim of the letter and the amount you are requesting from the potential lender at the start of the loan application letter.

Additionally, you should briefly describe your firm, how the money will be used, and your creditworthiness in this part.

When composing this part, think about excluding everything except the most important information to direct the reader to the letter’s body.

Include Your Business Details

Give the crucial information about your firm in the first body paragraph of your loan application letter. The specific business structure (such as a sole proprietorship, partnership, limited liability company, etc.)

of your company, its legal name, how long it has been in operation, the number of employees it has at present, if any, as well as its annual revenue and profit, are all things you should include in this section.

State The Purpose of The Loan

Describe the loan’s purpose and intended use in the second body paragraph of your letter of loan application.

You must be as explicit as you can in this section and use numbers to describe your objectives.

Avoid making any ambiguous comments, though, as this might give the lender cause for concern and cause them to reject your loan application.

State The Exact Amount

A particular sum must be stated when you have a valid justification for the loan request because this will help the lender determine whether you have the borrowing capacity.

If your earnings are high enough to cover the cost of returning the borrowed funds, that is. It also indicates whether the amount borrowed is appropriate for the purpose for which it was borrowed.

State the Means of Repayment

This expresses your desire to refund the money. Because it provides a complete picture of the loan cycle, this is important.

Be truthful and accurate when giving out information: Because lending money is risky in itself, maintaining a strong credit history depends heavily on you being truthful and accurate about the circumstance.

A strong loan application letter conclusion should include a paragraph referencing the financial statements of your company that are attached,

a few sentences encouraging the reader to review the loan application materials and expressing your eagerness to meet with them,

your signature and printed name, and a list of enclosures.

Sample Letter

[Applicant’s Name] [Applicant’s Title] [Business Name] [Physical Address] [City, State, Zip Code]

[Loan Officer/Agent/Lender’s Name] [Official Title] [Financial Institution’s Name] [Physical Address] [City, State, Zipcode]

REF: Small Business Loan Request for [Dollar Amount]

To Mr/Mrs [Receiver’s Surname],

I am writing this loan request letter to ask for a small business loan amounting to [specify the loan amount you wish to borrow] for the purpose (s) of [provide a practical purpose for the loan, e.g., expanding the business, marketing your business to a target audience, recruiting new staff, etc.]

My business, [mention the company name and specify the business structure], became operational in the year[write the year] with [Mention the number of employees at the time of inception] and one location. Over the last 12 years, we have consistently grown, and we now have [Total number of branches] located in [Mention the various branch locations], and we currently have [write your current number of employees].

My business solely specializes in the [Mention the industry type, e.g., food-service, motor vehicle spare parts, building, and renovation industry, etc.]. We advertise on our official website, [provide your business’s website link] and market our products/services on various social media channels such as [Mention the social media pages, e.g., Twitter, Instagram, Facebook, etc.]. So you can visit those sites to follow our business journey and success stories.

In the previous business financial year, our annual sales revenue amounted to [provide the factual figure in dollar amount], and the business generated a net profit of [write profit in dollar amount or percentages]. These figures prove that we have consistently maintained our cash flow for the past [write the number of years] and have managed to generate profits each year we have been operational.

To promote our continued growth, we have strategized a business expansion plan to reach our target market in remote areas. The loan we are requesting will help us meet our business expansion goals. In addition, we anticipate increasing our total revenue by [quantify in figures or percentages] within the first quarter of opening, which will contribute to our loan repayments.

We want to pursue this endeavor in (mention the anticipated project start dates], and we hope you consider financing our business expansion goals. I have also attached our business plan, the most recent financial statements, including our income statement, business balance sheet, and business credit reports, for your review.

I appreciate you for taking the time to review this loan application letter along with the enclosed financial documents. I look forward to hearing from you at your convenience.

Sincerely, [Loan applicant’s name]

[Loan applicant’s signature]

[Loan applicant’s business title]. [List the enclosures provided]

Format for Loan Request letter to Employer

- Address to the right authority

- State Your Reason for the loan

- State the specific amount

- Mention your positive Attributes in the company

- Mention how you intend to pay back

Peter Walters

The Manager

Administration Department

Sub: Application for Loan to purchase a New Bicycle.

Dear Mr. Walters ,

I would like to request you if you could please grant me a loan of $800 as a personal loan as I need to purchase a New Bicycle. Also, I am in need of a new Bicycle as my old one is broken beyond repair and this is the mode of transport to commute to work.

I do not have that amount of money in hand at the moment, hence, I was hoping if you could help me by lending me the money.

As you are aware that I have been with the company for the past 3 years and have proven me to be a loyal and dedicated employee under your kind leadership, hence I believe you would consider me worthy of the loan.

As per the company’s employee loan policy, you can suggest a repayment plan for me as per your discretion to be deducted from my salary.

Thanking you in advance and hoping to hear from you soon.

Kind regards,

Candy Silver

Customer Service Officer

Administration Team

- How to Respond to Interview Request: 5 Great Tips

- 10 Bright Questions to Ask a Recruiter

- Hot Schedule Login and Sign Up Portal

- How to List References on Resume

Now it’s Your Turn

You can use the above listed formats to write the best loan application letter in Nigeria

Drop a comment now if this was helpful

Comments are closed.

- Scholarships in USA for International Students

- Italian Government Scholarships for Foreign Students

- Denmark Government Scholarships for Non-EU Students

- Swedish Institute Scholarships for Global Professionals

- Swiss Government Excellence Scholarships for Foreign Students

- Privacy Policy

All Formats

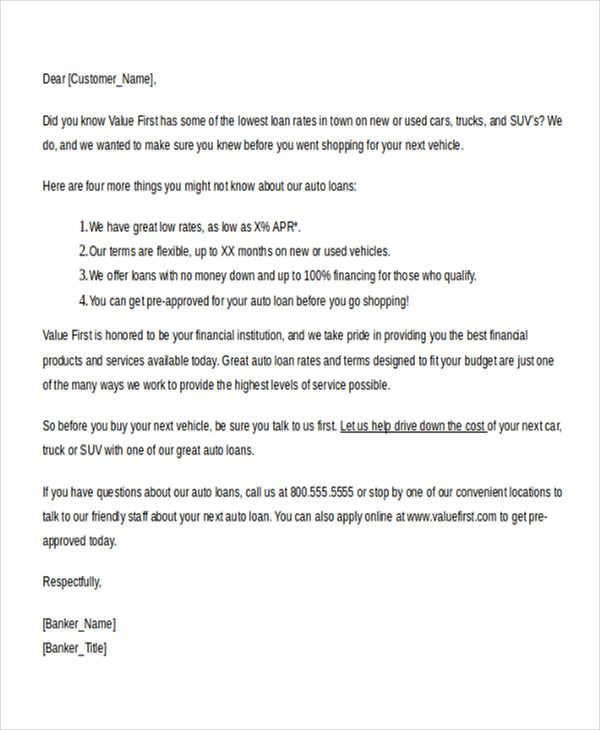

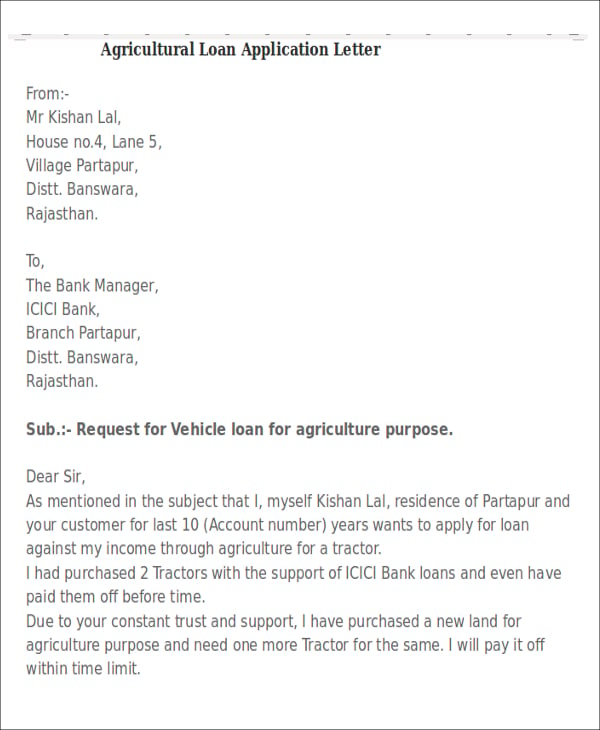

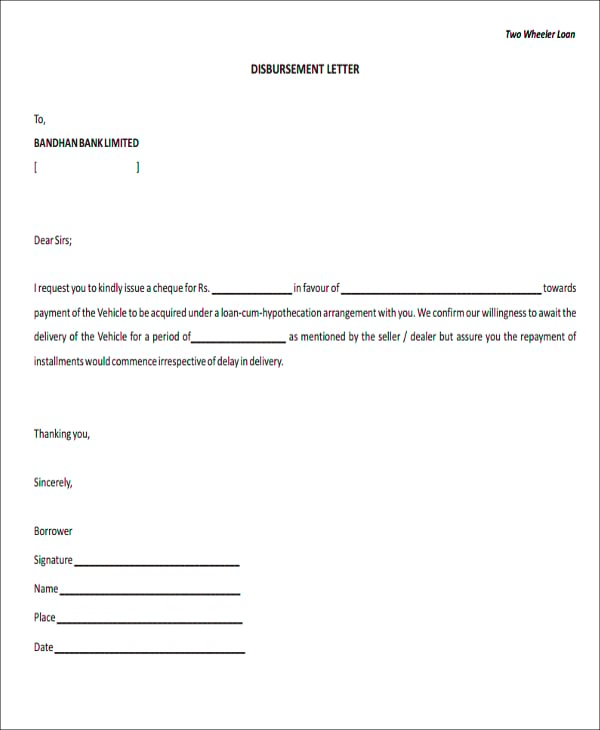

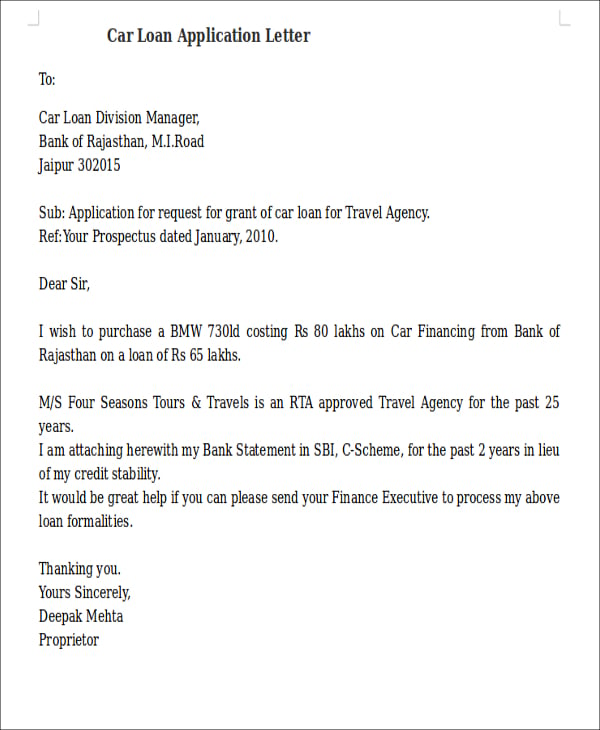

22+ Sample Loan Application Letters – PDF, DOC

There are times when we need financial aid to push through with our education, business ideas, or other personal projects or goals which require a huge amount of money for its realization. It is for this reason that lending companies have been existing ever since the days of old. Today, the primary step to being taken by someone who wants to borrow money from another individual or institution is to write a loan application letter .

Loan Application Letter

- Google Docs

- Apple Pages

Application for Loan Sample PDF

Simple Loan Application Letter

Application for Loan

Loan Letter Sample

Loan Request Letter

Letter for Loan Request

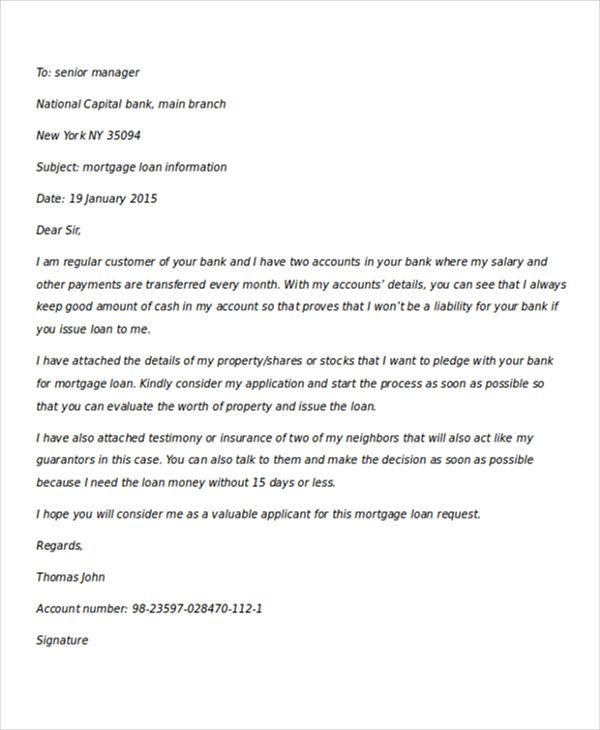

Formal Loan Purpose Application Letter to Senior Manager

Formal Event Management Small Business Letter

Sample Vehicle Application Letter Example

Agricultural Office Vehicle Application Letter Template

Sample Foreclosure Disbursement Application Form Letter

Example Work Travel Agency Letter

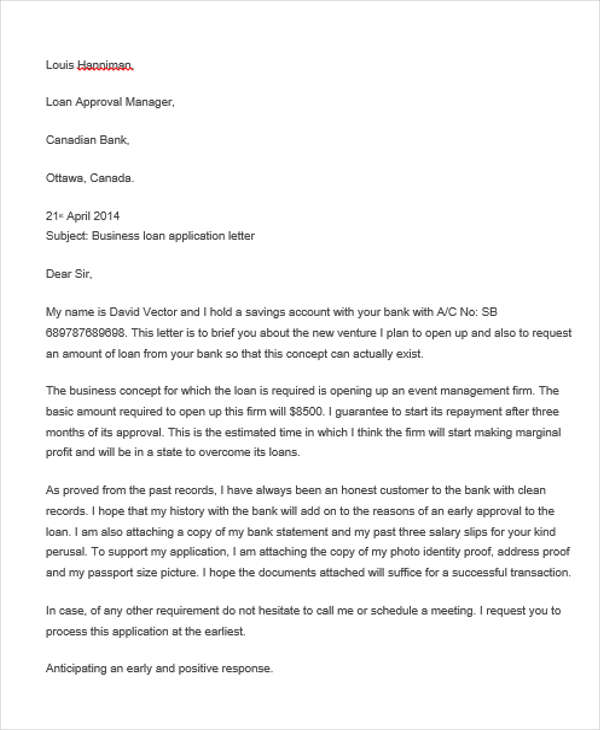

Application Letter to Canadian Bank for Loan

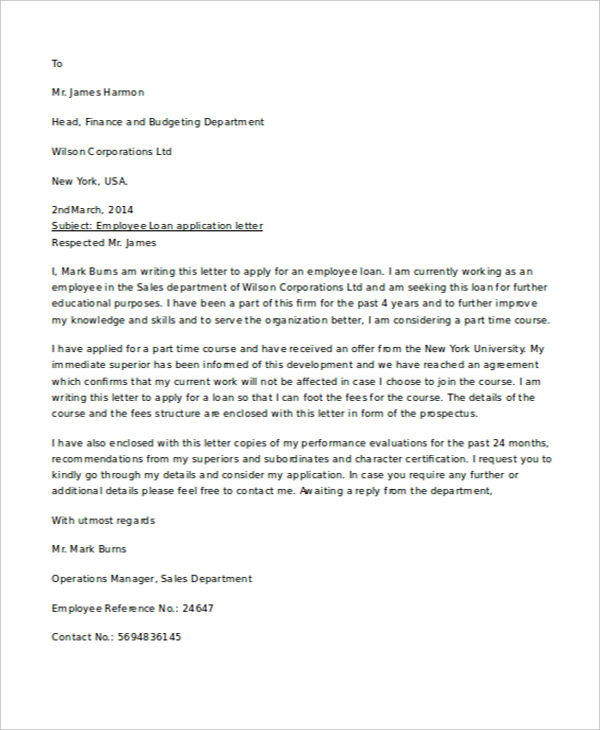

Sales Department Employee Application Letter Example

The Loan Application Process

- Before the loan contract , the borrower would send a loan application cover letter to the prospective lender to express his or her intent to ask for a loan.

- Afterward, when the lender has decided to consider the application for a loan made by the borrower, the borrower, and the lender would convene to negotiate the terms of the loan.

- The payment method, whether personal, through a check, online banking, etc.

- The number of times the payment is going to be made. There are various options. For example, the loan can be paid at one time, or it can be done in yearly or monthly installments.

- The amount of interest to be added on top of the loaned amount. The interest is the amount of money that is charged by the lender to the borrower on top of the amount which he/she has loaned. You may also see job reference letters .

- The assets (land, buildings, vehicles, or other properties) of the borrower would serve as collateral damage in case the borrower fails to make his/her payment on the time it is due.

Basic Senior Typist Home Loan Application Letter Template

Mortgage Loan Application Letter with Boss Recommendation

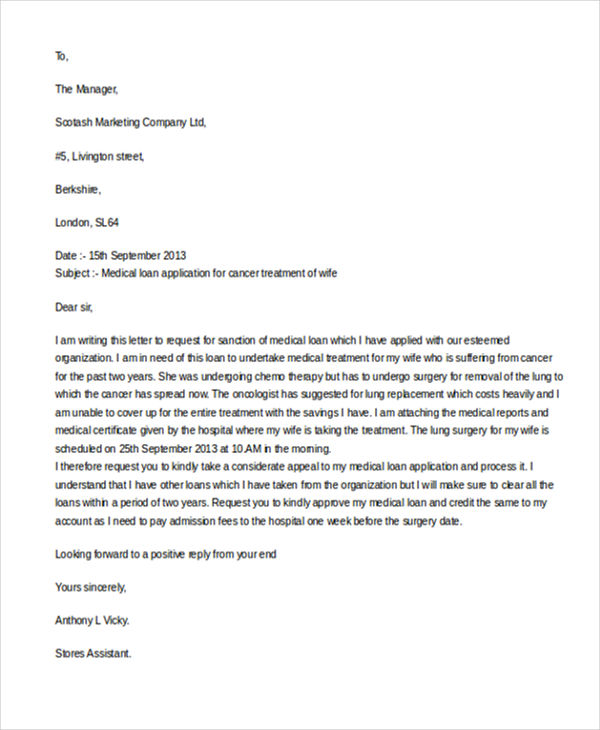

Professional Medical Loan Facility for Cancer Treatment

Professional Education Application Letter Template

Request Urgent / Emergency Loan Letter for Borrowing Money

Free Commercial Vehicle Application Letter Template

Loan Application Letter for Wedding/Marriage Template

Sample Staff Loan Request Application Letter for Covid-19

Things To Remember in Writing a Loan Application Letter

- Observe the proper rules for writing formal letters.

- State your intent to borrow a specific amount of money.

- Explain in detail the reason for borrowing money. You must be offering a clear, honest, and transparent explanation as to how you intend to utilize the money you intend to borrow. You may also see free application rejection letters .

- Enumerate your assets and liabilities.

- State the time, date, manner, and method which you prefer to make your payment.

More in Letters

Loan requisition letter, loan application letter template, sample loan application letter template, simple loan application letter template, loan application letter to employer template, personal loan application letter template, loan application letter for school fees template, loan application letter to bank manager template, loan application letter for house rent template, loan application letter from employee template.

- FREE 26+ Covid-19 Letter Templates in PDF | MS Word | Google Docs

- Thank You Letter for Appreciation – 19+ Free Word, Excel, PDF Format Download!

- 69+ Resignation Letter Templates – Word, PDF, IPages

- 12+ Letter of Introduction Templates – PDF, DOC

- 14+ Nurse Resignation Letter Templates – Word, PDF

- 16+ Sample Adoption Reference Letter Templates

- 10+ Sample Work Reference Letters

- 28+ Invitation Letter Templates

- 19+ Rental Termination Letter Templates – Free Sample, Example Format Download!

- 23+ Retirement Letter Templates – Word, PDF

- 12+ Thank You Letters for Your Service – PDF, DOC

- 12+ Job Appointment Letter Templates – Google DOC, PDF, Apple Pages

- 21+ Professional Resignation Letter Templates – PDF, DOC

- 14+ Training Acknowledgement Letter Templates

- 49+ Job Application Form Templates

File Formats

Word templates, google docs templates, excel templates, powerpoint templates, google sheets templates, google slides templates, pdf templates, publisher templates, psd templates, indesign templates, illustrator templates, pages templates, keynote templates, numbers templates, outlook templates.

5 Best Loan Application Letter Format In Nigeria

- by SAMUEL OKOSI

- May 27, 2022

5 Best Loan Application Letter Format In Nigeria-If you want to get a loan and you are looking for the format to use to write your loan application, then you have stopped at the right place as we are going to show you how to write a loan application letter so that your loan application will be accepted.

A loan application letter has a lot of important details about you that will show your creditworthiness which can either increase your chances of getting the loan or reduce it.

Your loan application letter can stand out if it is one that includes your interest in the company, stating your skills, experience and competencies and shows the lender why you are the ideal person to get the loan.

So without further delay, let’s show you how to write a good loan application letter.

What Is A Loan Application Letter?

This is a formal document that a borrower writes and submits to a prospective lender with the intent of getting a loan.

The letter explains the borrower’s request for loan, the amount of loan requested, the reason for the loan and also an explanation on why the lender should consider the applicant’s loan request. The letter also tells how the applicant intends to repay the loan.

Requesting for loan is not a bad thing especially when you are faced with some life challenges, personal and emergencies needs, expand your current business or take advantage of your current market opportunity.

Regardless of reason for wanting to get a loan, there are different lending options for you to choose from and you might spend more or less time and effort applying for a loan depending on which lending options you decide to pursue.

What You Should Know When Writing A Loan Application Letter

When writing a loan application letter, there are some points you should take note of and they are:

· Address of the right authority

Your application letter should be addressed to the right person or party as it is very important when starting a conversation especially in a formal way. Always try to find out who the application letter is to be submitted to and address the letter to them.

So it could be to the Human Resource Manager or the loan officer.

· Reason for the loan

Before you will be giving any loan or before your loan application will be approved, you must mention the reason you want to take the loan.

You should make sure your reason is to too vague and unnecessary as the lender wants to the see the urgency and great need for the loan as this plays a role in determining your creditworthiness.

The lender needs to know if the need is reasonable and if you are going to put the money to good use. ~Best Loan Application Letter Format In Nigeria~

Also, they would want to be sure that what you want to use the money for is legal as no lender would want to be associated with illegal activities.

· Be specific with the amount you want

When you have a pressing need and reasonable reason to request for a loan, you will need to be specific with the amount you want to collect as this will help the lender know if you have the borrowing capacity.

This will help the lender know if your earnings will be sufficient to recover the repayment of the money borrowed.

· Attributes about yourself that makes you trustworthy

Some lenders might require you to state your positive attributes as these play a role in determining your creditworthiness. You will need to talk about your positive work history and some good behaviour.

· Mention how you intend to repay the loan

Here, you will have to show how you intend repaying the loan. This is very important as a lot of lenders will use this to determine if you are creditworthy.

You will have to provide the information and also be honest: lending money is a risk in itself and the opportunity cost of lending that money to you is the other thing the lender was supposed to use the money to do.

Ensure that you have a good credit history.

Loan Application Letter Format And Content

Generally, a loan application letter is not supposed to be too long as it should have about five to six paragraphs with each major topic discussed in a separate paragraph.

The contents include a description of your business, the amount you have invested in your business, the purpose of the loan, the loan amount requested and the target market and competition.

Try to find out the name of the person that handles business loans and address the letter to that person.

Loan Application Letter Sample

If you want to collect a business loan, you will have to be very “straight to the point”.

· Business Loan Application Letter Sample

In this loan application letter sample we will be talking about here, the owner of a furniture business is requesting a loan in the amount of N20 million to expand his warehouse and some other parts of his business.

He includes information regarding the business success to help increase her chances of getting her loan application approved.

Dear Mr John,

I am requesting a business loan of about N20 million to help me expand my business most especially my warehouse facilities. In the last two years, my business has experienced a major boost which has made us see reasons for an expansion.

I have a huge experience in the furniture business and when it comes to the industry, I am considered an expert and also a top marketer.

I started the Charles Furniture Homes in 2000 and the company has earned profit consistently since its establishment till date although there have been some ups and downs which is normal with all businesses.

The market for this business depends on the housing market of the economy and we have has a lot of clients that give good reviews about our products.

In recent years, the housing market is improving greatly and the projected growth exceeds the numbers prior to recession. So we are doing our best to meet up with the growing demand for furniture as new design are coming up and we always want to be ahead in the market.

I utilized cost-effective marketing strategies that result in an average of 200 new orders every month from private homeowners.

So far, I have invested about N15 million of my own money and my collateral consist of business assets with a fair market value of N40 million and personal assets valued at N25 million.

I am disclosing my business plan which shows in details the reasons for the loan request. You can contact me on 01 647 7453 if there are any questions.

Mr. Charles Mark

Chief Executive Officer

Charles Furniture Homes

Enclosure: Business Plan ~Best Loan Application Letter Format In Nigeria~

· Personal Loan Application Letter Sample

Mr Emmanuel David

The manager

Administration Department

XYZ Co. Ltd.

Sub: Application for Loan to pay up children school fees.

Dear Mr David,

I am writing this to request if you could please grant me a personal loan of N100,000 to enable me pay up my children school fees. I was supposed to have paid up their fees before now but some other unplanned events came up and we had to meet them.

This led to the reduction of the money for the fees and I was hoping I could get a loan from your to enable me paid up their fees.

It is no news that I have been with the company for over three years now and I have shown to be a loyal and dedicated employee to the organization and so I believe you could consider my request for the loan and grant we worthy of getting the loan.

You can use your discretion to determine and suggest a repayment plan for me as an employee of this organization.

Thanks in anticipation as I hope to hear from you soon.

Kind regards,

Michael Smith.

Customer Service Officer

Administration Team

Sample Plot Loan From a Company

Request For Loan From Company Sample

Personal Loan Application Letter Sample

For whichever type of loan you want to take, we have given you a format that you can use to write yours. if you really want your loan application to be approved, you will have to take your time to write a loan application letter that will capture the attention of the lender and make them see reasons they should grant your loan request. ~Best Loan Application Letter Format In Nigeria~

The format and samples are just guides on how to write a loan application letter. Using the format or sample doesn’t guarantee that you would be granted your loan request as lenders look at some other factors in order to determine your creditworthiness.

- loan application letter format

SAMUEL OKOSI

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Top 20 Colleges in Canada Offering Scholarships to International Students

Top 5 best colleges for education majors, you may also like, how to link nin to airtel.

- by AWEB MEDIA GROUP

- May 1, 2022

Apply Now: BluEarth Renewables Scholarship

- July 11, 2022

Top 10 Best Deepfake Apps

- September 25, 2022

Young Lady Graduates With PhD From Towson University As One Of The Only Two Black Students In A Class Of 20

- October 14, 2022

Niagara College 2022 Programs Application – Toronto

- May 8, 2022

Top 10 Best High Schools In Brisbane

- June 20, 2022

Global site navigation

- Celebrity biographies

- Messages - Wishes - Quotes

- TV-shows and movies

- Fashion and style

- Capital Market

- Celebrities

- Family and Relationships

Local editions

- Legit Nigeria News

- Legit Hausa News

- Legit Spanish News

- Legit French News

Loan application letter to bank manager: how to write it?

There could be a situation in life when we need some financial help. Anyone can meet a reason to turn to the bank with loan application letter. In this post, we are going to tell you how to write it.

What is loan application letter to bank?

The list of possible reasons for requesting the loan is long, it can be a starting capital for your business, or a need in credit to buy a house, and so on. So, let’s try to figure out all the features of an application letter and how to write it.

Loan application letter helps the manager to make a decision about your request. Loan application letter could be written in the case when the applicant needs some monetary assistance that can be given in the form of a loan. One of the most popular reasons for asking for loan is the hypothec for property.

Interesting tips on how to end a cover letter

Such a letter is a request, that is why it should be written in right and polite tone. Here we have for you some tips and exemplars to write effective loan application letter to the bank.

READ ALSO: LAPO microfinance bank loan: how to get?

Let’s start with some tips:

- Such kind of letter is formal that is why one should choose phrases and words carefully

- All the words should be easy to understand

- The content should be straightforward and short

An important thing, before writing such a letter one should think about the amount to be, the term of repayment, and the rate of interests. There shouldn't be any doubts that you can repay the loan at proposed terms.

Loan application letter format

The letter is required to be short and to-the-point. Generally, such a letter has six paragraphs to discuss each major topic. The content always contains the requested amount, most likely a description of your business, and of course the purpose of the loan. You can call, or visit the official web page of the bank to know the name of the manager who handles loan questions. See also: SME loans in Nigeria.

Best advice and samples of how to write a resignation letter

Some letters can contain the date of complete repayment. It is also good to insert some positive information about you in the letter, to show that you are a trustworthy person. It can be for example past financial history of loans, information about employment, or business. You should be honest in providing all the information, because the bank manager may check it, any untruth would lead to rejection.

READ ALSO: How to Access Loan from the Bank of Industry in Nigeria?

If you are the owner of the business, there is a need to provide some documents to confirm that the loan would be used for legitimate purposes. One should explain how this loan can help his or her business.

Loan request letter to bank manager sample

Here we have the sample that will help you to write the loan application letter for bank:

- To (Branch Manager’s name, bank branch address)

- From (Your name and address)

- Dear Mr. /Ms (name of the manager or concerned person)

- There is my saving account in your bank (account number) for (quantity) years. I want to apply for (write the type of loan) for (write about your purpose).

How to write an informal letter like a pro (with samples)

- I want to know the details and required formalities to receive the loan from your bank. I'm ready to meet you at the earliest time. Thank you.

- Yours Sincerely (Your name)

- Date and signature

Remember that it is possible to send such a request in email format.

Business-purpose loans or personal loan requests letters have the same structure, business variation just requires to insert more information about you and your business. There is nothing difficult in writing such letters. The format is formal but it allows for some creative approach, the main rule is to be truthful. We wish you luck and beneficial loans to receive.

READ ALSO: How to get car loan in Nigeria.

DISCLAIMER : This article is intended for general informational purposes only and does not address individual circumstances. If a reader clicks on our advertising partner links within our platform, we may receive a referral fee. Our team will never mention an item as the best overall product unless they believe it is the best option. Compensation does not direct our research or editorial content and in most cases does not impact how our listing articles are written. It is not a substitute for professional advice or help and should not be relied on to make decisions of any kind.

How to write a letter of permission: step by step guide with tips

Source: Legit.ng

Adrianna Simwa (Lifestyle writer) Adrianna Simwa is a content writer at Legit.ng where she has worked since mid-2022. She has written for many periodicals on a variety of subjects, including news, celebrities, and lifestyle, for more than three years. She has worked for The Hoth, The Standard Group and Triple P Media. Adrianna graduated from Nairobi University with a Bachelor of Fine Arts (BFA) in 2020. In 2023, Simwa finished the AFP course on Digital Investigation Techniques. You can reach her through her email: [email protected]

My Japa Guide

Best Resource on How to Travel Abroad

How to write a Loan Application Letter in Nigeria

Share this:.

How to write a Loan Application Letter in Nigeria easy

Want to know How to write a Loan Application Letter in Nigeria this article would guide on it step by step.

- Ever dreamt of a new business venture but lacked the capital?

- Facing unexpected expenses and need a financial lifeline?

If you’re nodding your head, then a well-crafted loan application letter could be your key to unlocking the funds you need. But navigating the world of loan applications in Nigeria can feel like deciphering ancient hieroglyphics. Fear not, aspiring borrower! This comprehensive guide will equip you with the knowledge and tools to write a loan application letter that stands out from the crowd and increases your chances of securing approval.

Table of Contents

Crafting a Winning Application:

1. Understand Your Needs:

- Before diving in, take a step back and ask yourself: what type of loan do you need? Is it a personal loan, a business loan, or something else? Each type has its own specific requirements and considerations.

- Determine the loan amount : Research the average cost of achieving your goal and be realistic about what you can afford to repay.

2. Choose Your Lender Wisely:

- Research different banks, microfinance institutions, and other lending institutions in Nigeria. Compare interest rates, terms, and eligibility criteria to find the best fit for your needs and financial situation.

3. Structure Your Letter:

- Formal Format: Use a professional letter format with your contact information, date, and the lender’s address at the top.

- Clear and Concise: Write in simple, easy-to-understand language, avoiding jargon and technical terms.

- Proofread Meticulously: Ensure your letter is free of typos and grammatical errors. A polished presentation reflects well on your attention to detail and professionalism.

4. Key Elements of Your Letter:

- Introduction: Briefly introduce yourself and state your intention to apply for a loan.

- Purpose of Loan: Clearly explain why you need the loan and how you plan to use the funds. Be specific and avoid vague statements.

- Financial Situation: Highlight your income sources, employment status, and any assets you own. Be transparent about your financial health and ability to repay the loan.

- Repayment Plan: Outline your proposed repayment schedule, including monthly installments and duration. Show the lender you have a realistic and achievable plan to manage the debt.

- Collateral (if applicable): If the loan requires collateral, mention the type and value of the assets you can offer as security.

- Closing: Thank the lender for their time and consideration, and express your enthusiasm for a positive response.

5. Supporting Documents:

- Attach relevant documents like pay stubs, bank statements, tax returns, or business plans depending on the loan type.

- Ensure all documents are clear, authentic, and up-to-date.

Additional Tips: How to write a Loan Application Letter in Nigeria

- Be Honest and Transparent: Don’t try to embellish your financial situation or sugarcoat any potential risks. Honesty goes a long way in building trust with the lender.

- Highlight Your Strengths: Showcase your experience, skills, and track record of success (if applicable). This demonstrates your potential for responsible loan management.

- Tailor Your Letter: Don’t use a generic template. Adapt your letter to the specific lender and loan type you’re applying for.

- Follow Up: Don’t be afraid to follow up with the lender after submitting your application. Show your continued interest and address any questions they may have.

Frequently Asked Questions (FAQ):

1. What documents are typically required with a loan application letter?

This varies depending on the loan type and lender. However, common documents include pay stubs, bank statements, tax returns, and business plans (for business loans).

2. Can I apply for a loan if I have a bad credit history?

Some lenders may consider applicants with bad credit, but it may affect your interest rate and loan terms. Be upfront about your credit history and explain any mitigating factors.

3. How long does it take to process a loan application?

Processing times vary depending on the lender and the complexity of your application. Expect anywhere from a few days to several weeks.

4. What are some common reasons for loan application rejection?

Incomplete applications, insufficient income, poor credit history, and lack of collateral are common reasons for rejection.

5. What happens if my loan application is rejected?

Don’t get discouraged! Review the lender’s feedback and address any shortcomings in your application. You can also consider applying to other lenders with more favorable terms.

Conclusion: How to write a Loan Application Letter in Nigeria

Remember, a well-written loan application letter is your chance to make a strong first impression on potential lenders. By following these tips and tailoring your approach to each application, you can increase your chances of securing the funding you need to turn your dreams into reality.

- How to get Loan from Zenith Bank

Which loan App is the Best in Nigeria

- Best Loan App in Nigeria with Low Interest rate in 2024

How to Check Nirsal Loan Approval with Your BVN Number

Does Opay give loan: The Truth

How to Borrow a Loan from Opay: Instant Loan

- How to Qualify for GTBank Loan Full Guide

How to Check Your NIRSAL Loan Status Easy Step

Transfer Money From Cash App to Apple Pay Without a Card In Few Easy Steps

How to Transfer Money from My PayPal to my Bank Account

About The Author

See author's posts

Important Reading:

- How to check Loan balance on Access Bank

- How to Become a Travel Nurse and Explore the World Is It Easy?

- How to Get a Scholarship to Study Abroad After 12th in 2024

- How to Check Your NMFB Loan Status

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Related News

How to Get Loans In Nigeria Without A Salary Account in 2024

How To Get A Small Business Loan In Nigeria

You may have missed.

How Much is Student Loan in Nigeria: Unveiling the Costs

How Much Loan is Nigeria Owing China?: Unveiling the Debt Dynamics

Where to Get Long Term Loans in Nigeria: Top Trusted Sources

How to borrow loan online in nigeria: quick & easy guide.

What are the Requirements to Get Student Loan: A Complete Guide

How to get loan in nigeria with bvn: quick approval tips.

How to Apply for a Student Loan in Nigeria

Lydia Kibet

Lydia Kibet is a freelance writer with a knack for personal finance, investing, and all things money. She's passionate about explaining complex topics in easy-to-understand language. Her work has appeared on Business Insider, Investopedia, The Motley Fool, GOBankingRates, and Monito. She currently writes about personal finance, insurance, banking, real estate, mortgages, credit cards, loans, and more.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Nigeria has made significant strides towards making higher education more accessible to its citizens. The president, Bola Tinubu, recently signed the Students Loan Bill into law, giving Nigerian students access to interest-free loans.

If you’re wondering how to secure a student loan in Nigeria, this guide is for you. We’ll highlight the step-by-step process of applying for a student loan in Nigeria. We’ll also cover eligibility criteria, the application process, and important information you should have.

The loan, which covers tuition fees and living expenses, is available to all Nigerian students admitted to any public university, college of education, polytechnic, or TVET school.

Apply for a Student Loan in Nigeria

- 01. Requirements for a student loan in Nigeria scroll down

- 02. Eligibility criteria for a student loan in Nigeria scroll down

- 03. How to apply for a student loan in Nigeria scroll down

- 04. Student Loans for Foreigners to Study in Nigeria scroll down

- 05. Loan repayment scroll down

- 06. Legal implications scroll down

- 07. Tips for applying for a student loan in Nigeria scroll down

- 08. Final thoughts scroll down

Requirements for a Student Loan in Nigeria

For your application, you must provide the following documents:

- A duly filled application form

- A copy of your admission letter to a public university, TVET, college of education, or polytechnic

- A copy of your JAMB result slip

- A photocopy of your NECO/WAEC result certificate

- A copy of your birth certificate

- A passport photograph

- A letter from each of your guarantors addressed to the bank’s chairman or governing board, recommending you for the loan and accepting liability in the event of default.

- Two passport photographs from each of the guarantors

- Each of the guarantor’s employment letter

- If self-employed, provide particulars of your business as registered with the CAC or other relevant authorities.

Eligibility Criteria for a Student Loan in Nigeria

It’s vital to review the criteria for accessing student loans in Nigeria before beginning the application process to know whether you meet the qualifications is vital.

Section 17 of the Act outlines the following conditions for loan applicants:

- Admission into an accredited institution: You must have secured admission into a Nigerian university, college of education, polytechnic, or vocational school established by the government.

- Income limit: Your individual or family income must not be above N500,000 per annum.

- Guarantors: You must provide a minimum of two guarantors.

An applicant is considered ineligible for the loan if:

- The student is found to have defaulted on any previous loan granted by any organization

- The student is found guilty of examination irregularities by any school authority

- The student has been previously convicted of a felony or an offense involving fraud or dishonesty

- The student has been convicted of committing a drug offense

- The student’s parents have defaulted on their student loans or any other loans from any organization

If you’ve determined that you meet the eligibility criteria, you can move to the next step and apply for the student loan. The Student Loan Bill also outlined the application process for prospective students.

Here’s the step-by-step process of applying for a student loan in Nigeria:

Step 1: Prepare Your Documents

Before starting the application, ensure you have all the necessary documents. You’re required to provide documents like your personal certificate, admission letter, JAMB result slip, and others, as highlighted above.

Step 2: Submit the Application to the Student Affairs Office

The loan application must go through your institution, so once you’ve filled out the application form, attach all the required documents and submit them to your school’s Student Affairs office.

Ensure all the documents you provide are factual and accurate to smoothen the application process and avoid unnecessary delays.

Step 3: Application Review

Your institution’s Student Affairs Office carefully examines your application and gives a recommendation to the Central Bank of Nigeria (CBN).

Step 4: CBN’s Decision

Based on the information provided and the recommendation from your institution’s Student Affairs Office, the CBN makes the final decision on whether you get the loan.

Step 5: Loan Disbursement

If the CBN approves your loan application, the money is sent to your school. Your school then sends the funds to your account for your access.

The application and disbursement process must be completed within 30 days of the application reaching the Committee Chairman.

Student Loans for Foreigners to Study in Nigeria

Student loans are also available for foreigners who wish to study in Nigeria. The number one requirement is acceptance to a public institution in Nigeria. So if you have your eye on a particular renowned institution or vocational school, you can get financial aid for your studies.

Once you’re accepted into the school of your choice, you can fill out the loan application form and provide your details. Ideally, the loans are designed to cater for various education-related expenses including tuition fees, accommodation, textbooks, and more.

Loan Repayment

It’s crucial to familiarize yourself with the repayment terms of the loan before applying for it.

Beneficiaries of student loans must commence loan repayment two years after completing the National Youth Service Corps program. This repayment is facilitated by a 10% direct deduction of the beneficiary’s salary.

Self-employed beneficiaries are required to remit 10% of their total monthly profit as repayment. These individuals must also report their self-employment status by submitting relevant information such as the business name, registration documents, and location.

Legal Implications

It’s also vital to note that there are legal consequences if you default. According to the Act, if you fail to pay back the loan or help others avoid paying it, you stand to face up to 2 years in prison or pay a fine of N500,000.

As such, you must faithfully fulfill your loan repayment responsibilities when the time comes. Timely, responsible repayment of the loan helps to sustain the loan program for future students.

Tips for Applying for a Student Loan in Nigeria

Like most financial decisions, applying for a student loan is a crucial decision you should think about carefully, as it has lasting implications on your future. Here are a few tips to keep in mind as you apply for a student loan:

Apply for Grants and Scholarships

Before applying for a student loan, apply for as many grants and scholarships as possible. There are plenty of resources online you can use to access grants and scholarships for higher education.

Since scholarships are free money, it’s better to get a scholarship than to apply for a loan you’ll have to repay.

Read the Terms and Conditions Carefully

Take time to read and understand the terms, interest rates, and repayment conditions before applying for the loan. You must understand the repayment conditions so you don’t accidentally break the contract and risk paying a fine or, worse, going to prison.

Only Borrow What You Need

Calculate the exact amount you’ll need for tuition fees and other expenses. The more you borrow, the higher the amount you have to repay later, so ensure you don’t borrow more than you need.

Final Thoughts

Accessing student loans in Nigeria has been made easier than ever. You can complete your application and submit it to your institution’s Student Affairs Office, provided you meet the eligibility criteria.

It’s essential to understand the obligations and requirements of the loan during the application process to avoid breaching the legally binding contract.

FAQs About Applying for a Student Loan in Nigeria

Yes. Nearly all banks in Nigeria give different types of loans designed to cater to various customer needs. You can get a personal or business loan from any bank of your choice in Nigeria, provided you meet the conditions.

Several banks in Nigeria offer student loans. Some of these banks include:

- Access Bank

- Guarantee Trust Bank

- First City Monument Bank

- Fidelity Bank

- Stanbic IBTC Bank

- Zenith Bank

The CBN does not give funds to individuals, so you can only secure funding by applying through a registered business, company, or institution.

You May Also Like These Guides

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

How to get a loan from the First Bank of Nigeria

- Updated March 25, 2024

- Read Time 12 mins

First Bank of Nigeria Limited (“FirstBank”), established in 1894, in line with its name, is the premier Bank in West Africa. First Bank commenced business on a modest scale in Lagos, Nigeria under the name, Bank of British West Africa (BBWA). First Bank is a well-diversified financial services group and the largest private-sector financial services provider in sub-Saharan Africa (excluding South Africa).

First Bank offers a comprehensive range of retail and corporate financial services, amongst which are loans and mortgages. First Bank loans are tailored to provide capital for customers to start a new business venture, own a dream home, or upgrade a car. This article is cooked to help you discover the First Bank loan that suits your need and how to apply for the loan.

Table of Contents

How to apply for a personal home loan

Requirements for personal home loan, how to apply for auto loan, requirements for auto loan, how to apply for salary loan, requirements for salary loan, how to apply for firstadvance loan through firstmobile app, how to apply for firstadvance loan using ussd code, how to apply for firstmonie agent credit, how to apply for secured overdraft, requirements for secured overdraft, how to apply for first bank contract finance, requirements for first bank contract finance, how to apply for secured term loans, requirements for secured term loan, first bank sme products financing, how to apply for import finance, requirements for import finance, how to apply for oil and gas contract finance, requirements for oil and gas contract finance, how to apply cement distributorship finance, requirements for cement distributorship finance, how to apply for invoice discounting finance, how to apply for bonds and guarantee, requirements for bonds and guarantee, how to apply for telecommunications distributorship finance, how to apply for petroleum dealership finance, how to apply for fmcg key distribution finance, requirements for fmcg key distributorship finance, how to apply for local purchase orders finance, requirements for local purchase orders finance, how to apply for operational vehicle loan, requirements for operational vehicle loan, how to apply for firstedu loan, requirements for firstedu loan, revenue loans and overdraft, how to apply for commercial mortgage, requirements for commercial mortgage, how to apply for health finance loan, how to apply for firsttrader solutions (fts), first bank personal home loans.

This loan is suitable for you if you’re looking to buy your first home, construct or simply renovate an already built house.

To apply for the Personal Home Loan, download the Home Loan Application form on First Bank website . Complete the form and submit it at the nearest FirstBank branch.

- Application letter

- Last three months payslip

- Statement of accounts

- Applicant’s letter of total emolument

- Confirmation of applicant’s employer on FBN-approved list

- Valid title document

- Letter for irrevocable domiciliation of salary for the duration of the facility.

First bank auto loan

This loan is designed to help you own your dream car within a short time frame. This loan also extends to Businesses that want to acquire vehicles for the day-to-day running of their business or other purposes. Firstbank Auto loan is restricted to employees in paid employment.

To apply for the Auto loan, download the Auto Loan Application Form on the First Bank website. Complete the form and submit it at the nearest FirstBank branch.

- Proforma Invoice from FirstBank-approved vendors

- Payslip for the last three months

- Statement of account

- Letter of total emolument.

First bank Salary loans

This loan is designed for customers who have a salary account with First Bank, to help to cover pressing financial obligations before payday arrives. There are three categories of First Bank salary loans.

Complete the form and submit it at the nearest FirstBank branch.

To apply for the Personal Loan Against Salary, you will need the following documents:

- Personal Loan Application form

- Statement of accounts.

- Applicant’s letter of total emolument.

- Confirmation of applicant’s employer on FBN approved list.

- Letter of irrevocable domiciliation of salary for the duration of the facility.

FirstAdvance loan

- Download the recent FirstMobile App from Google Play Store or Apple Store on your smartphone

- Log on to the FirstMobile App

- Open menu options on the top left-hand side

- Select ‘loans’

- Next, select ‘FirstAdvance’

- The next Menu Option shows your eligible amount and the applicable pricing and fees.

- Next, accept the terms and conditions

- Next, input desired loan amount not more the eligible amount.

- Followed by your transaction pin.

- Successful, the loan is disbursed to your salary account within minutes.

- Your account is debited for management fee & VAT, interest rate, and insurance as upfront fees and charges.

- Upon receipt of salary or 30 days (whichever comes first), your account is debited for Principal repayment.

- Dial *894# to connect to FirstBank’s USSD Banking, select 3, [Get Loans], or *894*11#

- The next menu shows your eligible loan amount

- Input desired amount and send

- Interest rate, management fees, and Insurance are displayed

- Input five-digit transaction PIN to accept terms and conditions

- The loan is disbursed into your salary account within minutes.