- INFOSYS LTD.

- SECTOR : SOFTWARE & SERVICES

- INDUSTRY : IT CONSULTING & SOFTWARE

Infosys Ltd.

NSE: INFY | BSE: 500209

Mid-range Performer

1444.30 -9.05 ( -0.62 %)

52W Low on May 19, 2023

7.8M NSE+BSE Volume

NSE 17 May, 2024 3:31 PM (IST)

- Share on Facebook

- Share on LinkedIn

- Share via Whatsapp

Broker average target upside potential%

Broker 1Year buys

5 active buys

Broker 1Year sells

1 active sells

Broker 1Year neutral

6 active holds

Broker 1M Reco upgrade

0 Broker 1M Reco upgrade

Infosys Ltd. share price target

Infosys ltd. has an average target of 1550.83. the consensus estimate represents an upside of 7.38% from the last price of 1444.30. view 34 reports from 13 analysts offering long-term price targets for infosys ltd...

- Recent Upgrades

- Recent Downgrades

- Sector Updates

- Most Recent

Stock Research Report for Infosys Ltd

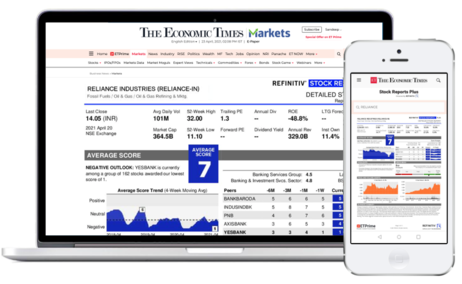

Stock score of Infosys Ltd moved down by 1 in a week on a 10 point scale (Source: Refinitiv). Get detailed report on Infosys Ltd by subscribing to ETPrime .

Get 4000+ Stock Reports worth ₹ 1,499* with ETPrime at no extra cost for you

*As per competitive benchmarking of annual price. T&C apply

Make Investment decisions

with proprietary stock scores on earnings, fundamentals, relative valuation, risk and price momentum

Find new Trading ideas

with weekly updated scores and analysts forecasts on key data points

In-Depth analysis

of company and its peers through independent research, ratings, and market data

Infosys Limited is an India-based company, which provides consulting, technology, outsourcing and digital services. Its segments include Financial Services; Retail; Communication; Energy, Utilities, Resources and Services; Manufacturing; Hi-Tech; Life Sciences and All other segments. All other segments represent the operating segments of businesses in India, Japan, China, Infosys Public Services and other enterprises in public services. Its core services primarily include application management services, proprietary application development services, independent validation solutions, product engineering and management, infrastructure management services, traditional enterprise application implementation, support and integration services. Its products and platforms include Finacle, Edge Suite of products, Panaya platform, Infosys Equinox, Infosys Helix, Infosys Applied AI, Infosys Cortex, Stater digital platform, Infosys McCamish and others. It also owns Danske Bank's IT center in India.

- Super Investors

- Account

- Consolidated Standalone

- Share Holding

- Balance Sheet

- Corp. Action

Infosys share price

NSE: INFY BSE: 500209 SECTOR: IT - Software 996k 11k 3k

Price Summary

₹ 1455.45

₹ 1439.5

₹ 1731

₹ 1252.2

Ownership Stable

Valuation fair, efficiency excellent, financials very stable, company essentials.

₹ 599500.94 Cr.

₹ 591309.94 Cr.

₹ 193.34

₹ 8191 Cr.

₹ 0 Cr.

₹ 65.6

Add Your Ratio

Your Added Ratios

Index presence.

The company is present in 39 Indices.

NIFTY100WEIGHT

NIFTYSERVICE

NIFTY200QLTY30

NIFTYLGEMID250

NY500MUL50:25:25

NIFTYTOTALMCAP

NIFTYDIGITAL

NIFTYDIVOPPT

NIFTY100ESG

NIFTYLOWVOL

BSE100LARGECAPTMC

S&PDIVSTABLE

S&P LARGEMIDCAP

- Price Chart

- Volume Chart

Price Chart 1d 1w 1m 3m 6m 1Yr 3Yr 5Yr

Volume chart 1d 1w 1m 3m 6m 1yr 3yr 5yr, pe chart 1w 1m 3m 6m 1yr 3yr 5yr, pb chart 1w 1m 3m 6m 1yr 3yr 5yr, peer comparison, group companies.

Track the companies of Group.

Sales Growth

Profit growth, debt/equity, price to cash flow, interest cover ratio, cfo/pat (5 yr. avg.).

Share Holding Pattern

Promoter pledging %, strengths.

- The Company is Virtually Debt Free.

- The Company has a good ROE track record of 33.9045192070091 %.

- PEG ratio is 1.29575879634938 %.

Limitations

Quarterly result (all figures in cr.), profit & loss (all figures in cr. adjusted eps in rs.), balance sheet (all figures are in crores.), cash flows (all figures are in crores.), corporate actions dividend bonus rights split, investors details promoter investors, annual reports.

- Annual Report 2023 26 Jan 2024

- Annual Report 2022 7 Jun 2022

- Annual Report 2021 27 May 2021

- Annual Report 2020 3 Jul 2020

- Annual Report 2019 9 Jan 2020

- Annual Report 2018 9 Jan 2020

- Annual Report 2017 2 Apr 2021

Ratings & Research Reports

- Credit Report By: CRISIL 9 Jan 2020

- Credit Report by:CRISIL 15 Jun 2020

- Research Nirmal Bang Institutional 9 Jan 2020

- Research IDBI Capital 6 Sep 2022

- Research IDBI Capital 30 Apr 2022

- Research IDBI Capital 25 May 2023

- Research IDBI Capital 25 Jan 2022

- Research IDBI Capital 24 Jul 2023

- Research IDBI Capital 22 Mar 2023

- Research IDBI Capital 17 Oct 2023

- Research IDBI Capital 17 Oct 2021

- Research IDBI Capital 16 Apr 2021

- Research IDBI Capital 15 Jan 2024

- Research IDBI Capital 1 May 2023

- Research HDFC Securities 9 Jan 2020

- Research HDFC Securities 28 Jul 2021

- Research HDFC Securities 22 Mar 2023

- Research Edelweiss 30 Mar 2022

- Research Edelweiss 3 May 2022

- Research Edelweiss 28 Jun 2022

- Research Edelweiss 25 Mar 2022

- Research BOB Capital Market 24 Jul 2023

- Research BOB Capital Market 23 Jun 2023

- Research BOB Capital Market 17 Oct 2021

- Research BOB Capital Market 16 Apr 2021

- Research BOB Capital Market 15 Jul 2021

- Research BOB Capital Market 1 Apr 2021

Company Presentations

- Concall Q4FY23 14 Jul 2023

- Concall Q4FY22 1 Jul 2022

- Concall Q4FY20 18 May 2020

- Concall Q3FY24 20 Jan 2024

- Concall Q3FY22 3 Feb 2023

- Concall Q3FY22 27 Jan 2022

- Concall Q2FY24 20 Oct 2023

- Concall Q2FY20 9 Jan 2020

- Concall Q1FY22 20 Jul 2021

- Presentation Q2FY20 9 Jan 2020

- Presentation Q4FY20 31 Mar 2020

Company News

Infosys stock price analysis and quick research report. is infosys an attractive stock to invest in.

Stock investing requires careful analysis of financial data to determine a company's true net worth. This is generally done by examining the company's profit and loss account, balance sheet and cash flow statement, which can be time-consuming and cumbersome.

An easier way to determine a company's performance is to examine its financial ratios, which can help to make sense of the overwhelming amount of information in its financial statements.

Here are a few indispensable ratios that should be a part of every investor’s research process, or, in simpler words, how to analyse Infosys .

PE ratio : Price to Earnings ratio, which indicates how much an investor is willing to pay for a share for every rupee of earnings. A general rule of thumb is that shares trading at a low P/E are undervalued (it depends on other factors too). Infosys has a PE ratio of 22.0167682926829 which is high and comparatively overvalued .

Share Price : - The current share price of Infosys is Rs 1444.3 . One can use valuation calculators of ticker to know if Infosys share price is undervalued or overvalued.

Return on Assets (ROA) : - Return on Assets measures how effectively a company can earn a return on its investment in assets. In other words, ROA shows how efficiently a company can convert the money used to purchase assets into net income or profits. Infosys has ROA of 25.2742357592294 % which is a good sign for future performance. (higher values are always desirable)

Current ratio : - The current ratio measures a company's ability to pay its short-term liabilities with its short-term assets. A higher current ratio is desirable so that the company could be stable to unexpected bumps in business and economy. Infosys has a Current ratio of 2.61950823303552 .

Return on equity : - ROE measures the ability of a firm to generate profits from its shareholders' investments in the company. In other words, the return on equity ratio shows how much profit each rupee of common stockholders’ equity generates. Infosys has a ROE of 37.0203221640726 % .(higher is better)

Debt to equity ratio : - It is a good metric to check out the capital structure along with its performance. Infosys has a Debt to Equity ratio of 0 which means that the company has low proportion of debt in its capital.

Sales growth : - Infosys has reported revenue growth of 3.96648765461964 % which is poor in relation to its growth and performance.

Operating Margin : - This will tell you about the operational efficiency of the company. The operating margin of Infosys for the current financial year is 24.6306221060551 % .

Dividend Yield : - It tells us how much dividend we will receive in relation to the price of the stock. The current year dividend for Infosys is Rs 46 and the yield is 3.1855 % .

Earnings Per Share : - It tells us how much profit is allocated to to each outstanding share of a common stock. The latest EPS of Infosys is Rs 65.6 . The higher the EPS, the better it is for investors.

One can find all the Financial Ratios of Infosys in Ticker for free. Also, one can get the Intrinsic Value of Infosys by using Valuation Calculators available with Finology ONE subscription.

Brief about Infosys

Infosys ltd. financials: check share price, balance sheet, annual report and quarterly results for company analysis.

Infosys Ltd. is a global leader in providing business consulting, information technology, and outsourcing services. In this article, we will analyze Infosys Ltd. from a stock market perspective. Our pre-built screening tools can help investors track the stock price of Infosys Ltd. and identify potential buying opportunities.

Infosys Ltd. Share Price:

Infosys Ltd.'s share price is a key indicator of investor sentiment towards the company. The share price is influenced by various factors such as the company's financial performance, global economic conditions, and market sentiment. Investors can use our pre-built screening tools to analyze Infosys Ltd.'s share price and identify any trends or patterns. The share price of Infosys Ltd. has been relatively stable over the past few years, with occasional fluctuations due to global economic conditions and market sentiment.

Infosys Ltd. Balance Sheet:

Infosys Ltd.'s balance sheet provides crucial information about its financial health. The company's assets include cash and cash equivalents, investments, and property and equipment. Liabilities include accounts payable, accrued expenses, and long-term debt. Equity includes retained earnings and common stock. Investors can use our pre-built screening tools to analyze Infosys Ltd.'s balance sheet and identify any red flags. The company's balance sheet has remained strong over the years, with a healthy mix of assets and liabilities.

Infosys Ltd. Annual Report:

Infosys Ltd. releases an annual report every year, which provides detailed information about the company's financial performance, strategic initiatives, and future plans. The annual report includes a letter from the CEO, financial statements, and management discussion and analysis. Investors can download Infosys Ltd.'s annual report from our website and use it to make informed investment decisions. The annual report provides valuable insights into the company's operations and financial performance.

Infosys Ltd. Dividend:

Infosys Ltd. pays dividends to its shareholders on a regular basis. Dividends are a portion of the company's profits that are distributed to shareholders. Investors can use our pre-built screening tools to track Infosys Ltd.'s dividend history and dividend yield. The company has a consistent track record of paying dividends to its shareholders, which is a positive sign for long-term investors.

Infosys Ltd. Quarterly Results:

Infosys Ltd. releases its quarterly results every three months. The quarterly results provide information about the company's revenue, earnings, and expenses. Investors can use our pre-built screening tools to analyze Infosys Ltd.'s quarterly results and identify any trends or patterns. The quarterly results are an important indicator of the company's financial health and performance.

Infosys Ltd. Stock Price:

Infosys Ltd.'s stock price is affected by various factors such as the company's financial performance, global economic conditions, and market sentiment . Investors can use our pre-built screening tools to track Infosys Ltd.'s stock price and identify potential buying opportunities. The stock price of Infosys Ltd. has been relatively stable over the years, with occasional fluctuations due to global economic conditions and market sentiment.

Infosys Ltd. Price Chart:

A price chart provides a visual representation of a company's stock price over a period of time. Investors can use our pre-built screening tools to analyze Infosys Ltd.'s price chart and identify any trends or patterns. The price chart shows that the stock price of Infosys Ltd. has remained relatively stable over the years, with occasional fluctuations due to global economic conditions and market sentiment.

Infosys Ltd. News:

Keeping up to date with the latest news about Infosys Ltd. is important for investors. Our website provides the latest news about Infosys Ltd. from various sources such as financial news websites and social media. Investors can use this information to make informed investment decisions.

Infosys Ltd. Concall:

Infosys Ltd. holds conference calls with analysts and investors to discuss its financial performance and future plans. Investors can listen to Infosys Ltd.'s concall and use the information provided to make informed investment decisions. Our website provides information about upcoming concalls and links to listen to past concalls.

Infosys Ltd. Transcripts:

Transcripts of Infosys Ltd.'s concalls are available on our website. Investors can download the transcripts and use them to analyze the company's financial performance and future plans. The transcripts provide valuable insights into the company's operations and financial performance.

Infosys Ltd. Investor Presentations:

Infosys Ltd. provides investor presentations on its website. These presentations provide information about the company's financial performance, strategic initiatives, and future plans. Investors can download Infosys Ltd.'s investor presentations from our website and use them to make informed investment decisions. The investor presentations provide valuable insights into the company's operations and financial performance.

Infosys Ltd. Promoters:

Promoters are individuals or entities that have a significant stake in a company. Infosys Ltd.'s promoters include its co-founders and their family members. Investors can use our pre-built screening tools to analyze Infosys Ltd.'s promoter holdings and identify any potential conflicts of interest. The promoter holdings of Infosys Ltd. are relatively stable, which is a positive sign for long-term investors.

Infosys Ltd. Shareholders:

Infosys Ltd. has a large number of shareholders, including institutional investors and individual investors. Investors can use our pre-built screening tools to analyze Infosys Ltd.'s shareholder base and identify any potential risks or opportunities. The shareholder base of Infosys Ltd. is diverse, which is a positive sign for long-term investors.

Infosys Ltd. Premium Features:

Our website provides premium features tools such as DCF Analysis, BVPS Analysis, Earnings multiple approach, and DuPont analysis. These tools can help investors make better investment decisions by providing more detailed insights into the company's financial performance and valuation.

Infosys Limited ROCE

Infosys Limited ROCE stands for Return on Capital Employed, which is a crucial financial ratio used to measure a company's efficiency in generating profits from the capital employed. This ratio is widely used by investors to determine the profitability of an investment in Infosys Limited. By analyzing the ratio's data, investors can determine if the company is utilizing its capital efficiently or not. You can get the ROCE data of Infosys Limited in the financials table or ratio section present on this stock analysis page.

Infosys Limited EBITDA

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. Infosys Limited EBITDA helps investors evaluate the company's operational efficiency by ignoring the non-operating expenses such as taxes and interest. This ratio helps investors to see how much cash flow Infosys Limited has generated from its operations. You can find the EBITDA data of Infosys Limited in the financials table or ratio section present on this stock analysis page.

Infosys Limited DPS

DPS stands for Dividend Per Share, which measures the amount of dividend paid per share. Infosys Limited DPS helps investors evaluate the company's dividend policy, how much dividend per share is paid, and the company's overall performance. By analyzing the DPS data, investors can determine how much income they expect to receive through holding Infosys Limited stocks. You can get the DPS data of Infosys Limited in the financials table or ratio section present on this stock analysis page.

Infosys Limited EPS

Infosys Limited EPS stands for Earnings Per Share, which is a crucial financial ratio used to evaluate a company's profitability. This ratio represents the amount of net income earned per share. It helps investors to determine the company's earnings power and future growth prospects. By analyzing EPS data of Infosys Limited, investors can determine the worthiness of investing in the company's shares. You can find the EPS data of Infosys Limited in the financials table or ratio section present on this stock analysis page.

Ratio Delete Confirmation

- Notifications

Equity Research Reports

Use this screener tool to find stocks that meet your search criteria

MUTUAL FUNDS

Insurance funds.

- Licensing Opportunities

- Our Signature Methodologies

- CSR Project Plan

Connect With Us

Here’s How to Write an Equity Research Report: The Best Guide

October 17, 2016

Equity Research is a rewarding career.

To keep up, you need a strong foundation with the judgment to think critically, act independently, and be relentlessly analytical.

That’s why I wrote this guide — to empower you with the equity research(ER) report writing skills to stay ahead in the equity research career.

There is almost NO guide available that teaches you how to write an equity research report.

From textbooks to online video tutorials, you can check and let me know if you find one.

And, I felt that I should write a detailed and step-by-step guide— a guide that really starts at the beginning to equip already-intelligent analysts with a healthy balance of conceptual and practical advice.

The Advanced Guide to Equity Research Report Writing takes your writing to the next level.

Who Is This Guide for?

I wrote this guide for an audience of equity research analysts , investment banking professionals, industry analysts, market research professionals, business management students, and freelance writers.

Most of all, I want you to walk away from this guide feeling confident about your equity report writing skill.

What Is an Equity Research Report

This chapter explains what exactly an ER report is.

The questions like—Who makes it? Who reads and uses it? What are the different types of equity research reports?—are answered clearly and elaborately.

It briefly talks about the various key contents of an ER report.

And lastly, it explains the need to provide a disclaimer at the end of an ER report.

So before understanding how to write an ER report, let’s try to understand what exactly an equity ER is.

FINRA , the Financial Industry Regulatory Authority, defines an equity research report, in Rule 2711 (a)(8) as,

“A written or electronic communication that includes an analysis of equity securities of individual companies or industries , and that provides information reasonably sufficient upon which to base an investment decision.

Readers of Equity Research, more so than anything else, identify trends that make investment decisions easier to justify.

In simpler words, equity research is a document written and published by a brokerage house or securities firm for its clients to help them to make better decisions regarding which stocks to choose for profitable investment.

The report should be such that it should convince the client to make a decision.

The report should be crisp; the point of view should be clearly structured and articulated concisely.

In the investment industry, equity reports usually refer to ‘sell-side’ research, or investment research created by brokerage houses.

Such research is circulated to the corporate and retail clients of the brokerage house that publishes it.

Research produced by the ‘buy-side’, which includes mutual funds, pension funds, and portfolio managers, is usually for internal use and is not distributed to outside parties.

a. Different types of equity reports

In the above paragraph, we saw terms such as ‘sell-side’ and ‘buy-side’.

Let’s quickly understand what these terms mean:

There are two main types of equity research reports:

i. Sell-Side reports

Sell-side reports are the most common type of equity research reports in circulation.

They are normally produced by investment banks , typically for their clients to guide their investment decisions.

A sell-side analyst works for a brokerage firm or bank which manages individual clients and makes investment recommendations to them.

Sell-side analysts issue the often-heard recommendations of “buy”, “hold”, “neutral”, or “sell”.

These recommendations help clients make decisions to buy or sell stocks.

This is favourable for the brokerage firm as each time a client takes a decision to trade; the brokerage firm gets a commission on the transactions.

Click here to see some examples of sell-side reports

ii. Buy-Side reports

The ‘buy-side’ reports are internal reports, produced for the bank itself, and are guided by differing perspectives and motivations.

A buy-side analyst generally works for a mutual fund or a pension fund company.

They perform research and make recommendations to the money managers of the fund that hires them.

Buy-side analysts will verify how promising an investment seems and how well it fits with the fund’s investment strategy.

These recommendations are made exclusively for the benefit of the fund that employs them and is not available to anyone outside the fund.

Within the buy/sell group, there are other types of reports like initiating coverage reports, standard reports, Issue reports, Investor notes, and sector reports.

iii. Initiating coverage reports

The initiating coverage reports are conducted on firms that the bank has begun following and are typically more comprehensive in nature.

Initiating coverage reports analyze a company’s historical financial information, order books, efficiency, SWOT, cash-flows, and future earning potential, basis which it estimates the future earnings of the company and its P/E multiples.

Click here to see some examples of initiating coverage reports

iv. Standard reports

After an initiating report is produced standard reports will follow for as long as the brokerage house continues to track the stock.

Stocks that are tracked are typically part of an index like the SENSEX or are amongst the top stocks in an industry as these are the stocks that investors care about and are traded in larger volumes.

v. Issue reports

These reports are issued when generally companies announce earnings each quarter (Quarterly earnings reports).

vi. Investor notes

These reports are published a few times in between for incremental information and news.

For example – investor conference companies hold a big M&A deal or a major new product announcement from a competitor.

These are usually short-run updates and are typically just quantitative in nature.

vii. Sector reports

A sector report is a document that evaluates a given industry and the companies involved in it.

It is often included as part of a business plan and typically seeks to establish how one company can gain an advantage in industry through detailed research on competition, products, and customers.

Click here to download the sector report

b. Contents of an equity research report

Now that we have understood the different types of equity research reports, let’s try to see the contents of an ER report.

An ER report should not be more than 10 to 15 pages long and should be very crisp and concise.

It should give the reader a clear understanding of the opinion of the analyst writing the report.

An ER report typically has the following contents:

1. Analyst opinion and summary

2. Key highlights of the company

3. A snapshot of the industry

4. Financial ratio analysis

5. Financial Modeling and Valuation analysis

6. Risk factors

7. Disclosure and rationale of rating

Usually, most of the equity research reports have this information; however, there is no hard and fast rule in which an ER report should be written.

We will study in detail (with examples) how to write each of these segments of an ER report in the forthcoming chapters.

c. Importance of Disclaimers in Analyst Reports

As every ER report is an investment document, and investors use it to make decisions for buying or selling securities based on it, it is important for the report to have certain disclaimers to show un-biases of the analyst writing the report.

Some typical disclaimers are as follows:

- Every ER report entirely reflects views and personal opinions of the analyst as on the date of publication

- The equity research analyst does not have an interest in the shares of the company

- Compensation of the analyst is not linked directly to any specific research recommendations contained in the report

Financial Analysts or equity research analysts working in brokerage firms or sell-side analysts write equity research reports.

Equity research report writing process

Equity Research Report writing

After completing the fundamental analysis, financial statement analysis, ratio analysis, and valuation, the last part of the equity research process is writing equity research reports.

As an equity research analyst, you need to analyze the industry and the company first and then write the stock research report.

This step is paramount in your equity research analysis career .

This is important to write the equity research reports in such a way that your clients understand every word of it.

It’s also important to include relevant analysis that you’ve done in the report.

How to write a report

Let’s see each step of writing an equity research report in detail.

1. Company fundamental analysis

a) Macroeconomic Analysis

b) Checking public information of the company

c) Discussion/ interviews with company management

d) Prepare a 5-year cash flow model and earnings forecast model

e) Review your operational and financial assumptions

f) Assess management and competitive environment, buyers, suppliers, substitutes, porter 5-forces model that tells you the competitive advantage of the company.

2. Company valuation analysis

1. Use intrinsic valuation—Discounted Cash Flow(DCF) method

2. Relative valuation

3. sum-of-the-parts valuation method, wherever required.

Pointers for writing equity research reports

I’ve created a list of pointers purely based on my experience and observations and a bit of research about dos and don’ts while writing an equity research report.

1. A clear view of the company

Before writing the report, have a clear view of the company in terms of—Investment rationale, risk assessment, key growth drivers, cost drivers, and revenue drivers.

2. Recommendation/Rating

Clearly write the company’s name at the top of the report and mention your recommendation—buy, sell, hold.

You can also use the words—outperform, underperform, neutral or accumulate based on your valuation.

Have an image of an equity research report in your mind, and so you won’t miss these details.

Usually, there are templates available in your company and you need to write the report using these templates.

3. Target price

You need to mention the target price based on your valuation along with the recommendation.

4. Investment rationale

Write clearly your investment rationale. Why do you think the share price will go up/down?

5. Share price chart

Include a price chart of the stock that will show the last 52-weeks’ share price movement.

6.Business model

Mention the analysis of the company’s business model and how will it perform in the next 2-3 years.

7. Key ratio analysis

Include important ratio analysis of the company and 52-week high-low share price on a stock exchange.

Include market capitalization, Enterprise Value(EV), Earnings Before Interest Tax and Depreciation (EBITDA), EV/EBITDA, and dividend yield (%)

8. Product profile and segments

Analyze the company’s product profile, its various segments, and brands. Include current sales and forecasted revenue figures, cost, market size, company’s market share, competition, the company’s performance in domestic and other markets.

9. Economy-Industry-Company (E-I-C) Analysis

Cover the company’s fundamental analysis with supportive data.

10. Intrinsic and relative valuation

Perform DCF analysis and relative valuation. Relative valuation should be done with the company’s peers on the basis of Price-Earnings ratio (P/E), Price to Book ratio (P/B), Price to Sales (P/S), Return on Equity (ROE) and Return on Capital Employed (ROCE).

11. Reasoning for recommendation

Write proper reasoning for your recommendation. For example—Why buy the stock or why not to buy the stock. So, your reasoning has to be strong.

12. Unlock the value

Write what can unlock/increase/reduce the value of the company .

13. Legal matters

If the company is battling any case, write what could be its effects on the stock price.

14. Common industry points

While writing industry reports, write the points which are common for all players in the industry, for example, regulatory limitation, excise duty, oil prices, etc.

15. Covering all the areas in an equity research report

While writing the equity research report, assume that the reader is new to the company and he doesn’t have any idea about its business.

So, your report should include precise information about—product, financials, management, market, future plans of the company, growth estimates, and the risk factors of the company.

In short, as an equity research analyst, your equity analysis report writing process should be structured and you should follow the dos and don’ts mentioned in this post.

Sample equity research reports (PDFs):

The Walt Disney Company

If you have any queries, Speak Your Mind.

Key Takeaways

- Equity research report writing is a skill . You need to build this skill to go to the next level in your career . Top-notch careers in finance–equity research, investment banking , asset management, financial research, Knowledge Process Outsourcing (KPO) units value this skill in high regard.

- There are different types of research reports–sell-side, buy-side, initiating coverage, standard, issue, investor notes, and sector reports. As an analyst, you should know all these reports.

- Contents of an equity research report include Analyst opinion and summary, Key highlights of the company, A snapshot of the industry, Financial and ratio analysis, Valuation analysis, Risk factors, and Disclosure and rationale of rating. I’m going to cover all these sections in detail with examples in the coming chapters.

Now You Try It

I hope you can see the potential of equity research report writing skills for your career.

Yes, it takes hard work to create something great.

But with this skill, you already know ahead of time that your hard work is going to pay off.

I want you to give the skill a try and let me know how it works for you.

If you have a question or thought, leave a comment below and I’ll get right to it.

- Download BIWS Course sample videos here .

- Read Students’ Testimonials here .

Avadhut is the Founder of FinanceWalk. He enjoys writing on Finance Careers topics. Check our Financial Modeling Courses . Contact us for Career Coaching based on Your Inner GPS.

View all posts

All FinanceWalk readers will get FREE $397 Bonus - FinanceWalk's Prime Membership.

If you want to build a long-term career in Financial Modeling, Investment Banking, Equity Research, and Private Equity, I’m confident these are the only courses you’ll need. Because Brian (BIWS) has created world-class online financial modeling training programs that will be with you FOREVER.

If you purchase BIWS courses through FinanceWalk links, I’ll give you a FREE Bonus of FinanceWalk's Prime Membership ($397 Value).

I see FinanceWalk's Prime Membership as a pretty perfect compliment to BIWS courses – BIWS helps you build financial modeling and investment banking skills and then I will help you build equity research and report writing skills.

To get the FREE $397 Bonus, please purchase ANY BIWS Course from the following link.

Breaking Into Wall Street Courses - Boost Your Financial Modeling and Investment Banking Career

To get your FREE Bonus, you must:

- Purchase the course through FinanceWalk links.

- Send me an email along with your full name and best email address to [email protected] so I can give you the Prime Bonus access.

Click Here to Check All BIWS Programs – Free $397 Bonus

Get new posts by email

Related post.

How To Do Equity Research: An Actionable Guide

ContentsWho Is This Guide for?What Is an Equity Research Reporta. Different types of equity reportsi. Sell-Side reportsii. Buy-Side reportsiii. Initiating coverage reportsiv. Standard reportsv. Issue reportsvi. Investor notesvii. Sector reportsb. Contents of an equity research reportc. Importance of Disclaimers in Analyst ReportsEquity research report writing processHow to write a report1. Company fundamental analysis2. Company valuation analysisPointers for writing equity research reports1. A clear view of the company2. Recommendation/Rating3. Target price4. Investment rationale5. Share price chart6.Business model7. Key ratio analysis8. Product profile ...

October 8, 2023

Equity Research Course: 10+ Lessons | Download XLS Free

September 22, 2023

Equity Research Interview Questions (Top 50 With Answers)

April 14, 2019

Equity Research Careers Guide – The Best Career Guide

January 24, 2019

How to Do Industry Analysis: Follow this 6-Step Process Model

Popular Post

$347 Free Bonus + Money-Back Guarantee

FinanceWalk

Reach out to us for a consultation. career coaching based on your inner gps., blog categories, navigations.

© 2007-2024 FinanceWalk - All rights reserved.

The state of diversity in global private markets: 2023

Over the course of 2022, the global private markets industry experienced a slowdown in fundraising and deal making because of rising interest rates and other factors. Despite the rocky year, private equity and alternative investments (hereafter PE) and alternative investments remain significant in the global economy. The industry now manages $11.7 trillion in assets, up from $8.0 trillion the previous year. 1 “ McKinsey Global Private Markets Review: Private markets turn down the volume ,” McKinsey, March 21, 2023. The financial power of PE reinforces the importance of understanding the composition of its talent, particularly the professionals who decide how this capital is deployed.

About the authors

This report is a collaborative effort by Pontus Averstad , Fredrik Dahlqvist , Eitan Lefkowitz, Alexandra Nee , Gary Pinshaw , David Quigley, and Mohammed Shafi, representing views from McKinsey’s Private Equity & Principal Investors Practice.

Building on McKinsey’s 2022 report , this year’s report examines the diversity of talent in PE firms, which we will refer to simply as PE firms. Specifically, we examine the gender breakdown in every region in our study and look at ethnicity and race in the United States and Canada (for more on the research and analysis, see sidebar “About the study”).

We are excited to invite Private Equity/Alternative Investing firms and Institutional Investors to participate in McKinsey & Company’s State of Diversity in Global Private Markets 2024 study! This annual study is the largest and most comprehensive study of diversity in private market firms globally.

This year’s report centers on the following core research objectives:

- understand the current state of gender diversity globally, and ethnic and racial diversity in the US and Canada, for the PE industry—specifically, which types of firms are leading and lagging on diverse talent

- how institutional investors influence the representation of diverse talent at PE firms, and the extent to which diversity matters to them

- highlighting the specific challenges facing different minority groups and identifying actions that can increase the diversity of talent in PE firms

About the study

In our second annual report, we build on the insights and findings from our inaugural report in 2022, as well as on prior McKinsey research on diversity in the workplace. This research explores diversity, equity, and inclusion (DEI) in the global private-markets industry, with a focus on private equity and alternative investment firms (PE) and institutional investors. We aim to make this the largest study of gender diversity and ethnic and racial diversity in the global private markets industry.

This year’s survey covers 66 discrete PE firms and institutional investors around the world. We also conducted interviews with several industry leaders to supplement the survey data we received from their firms. Participating firms directly employ more than 60,000 people globally and range from megafirms with more than $100 billion in assets under management (AUM) to smaller funds with less than $5 billion in AUM. Collectively, participating PE firms manage more than $6 trillion, and participating institutional investors manage more than $5 trillion in AUM.

Given the limitations of data collection, this report largely focuses on gender diversity globally and ethnic and racial diversity in private market firms with offices in the United States and Canada. We recognize there are several other categories that contribute to employee diversity and hope to broaden the categories we examine in future research as private market firms collect more diversity data on their employee base.

This report finds encouraging signs of progress in recent years. Diversity on investment committees (ICs) has ticked up, and the reporting of diversity metrics to institutional investors continues to grow.

Still, gaps remain, particularly regarding gender diversity in senior investing roles and uneven rates of progress for different ethnic and racial groups across roles and regions, and types of firms. Given the current pace of progress, it will be several decades before the PE industry achieves gender parity at the principal and managing-director levels.

Given the current pace of progress, it will be several decades before the PE industry achieves gender parity at the principal and managing-director levels.

A global view on gender diversity in private equity and alternative investing

There is a popular assumption that PE is dominated by men, but the evidence reveals a more nuanced reality. As we noted last year, PE firms have almost achieved gender parity globally at the entry level. At the end of 2022, 48 percent of all entry-level roles in PE were held by women.

Job levels in private equity

The language we use to classify jobs in private equity (PE) has not changed from last year's. The six levels we identify apply to PE jobs in investing, operational, and other noninvesting functions. For most of these levels, we include multiple possible job titles. In descending order of seniority, the roles are as follows:

L1. C-level executives or fund heads. We refer to this level as the C-level or C-suite.

L2. Managing directors or partners. We refer to jobs at this level as managing directors.

L3. Principals, directors, or senior vice presidents. We refer to jobs at this level as principals.

L4. Vice presidents or senior managers. We refer to jobs at this level as VPs.

L5. Associates or managers. We refer to jobs at this level as associates.

L6. Entry level roles.

For the sake of simplicity, we will refer to each level with only one title.

However, women in PE are still underrepresented in leadership positions, with only 20 percent representation in managing-director roles (for more on job levels, see sidebar “Job levels in private equity”). As Kelley King, senior vice president and chief DEI officer at HarbourVest, explained, “Identifying and attracting early-career diverse talent is not as challenging as finding later-career talent. As you ascend higher in the organization, the more patient and intentional firms need to be to reap the benefits of their DEI efforts.”

Women are well represented in most noninvesting roles, but gender parity remains distant in investing and operating roles

Disaggregating the data into investing, operating, and other noninvesting roles (the latter of which we will refer to as noninvesting roles) reveals that women hold only 33 percent of entry-level investing roles, compared with 44 percent of operating roles and 59 percent of noninvesting roles at that level. Women are also underrepresented at the managing-director level (L2), with only 15 percent of managing-director-level investing roles (Exhibit 1).

Women in PE have made modest gains in investing roles over the course of 2022. The share of C-suite roles held by women globally increased by 3.5 percentage points over the past year to 17 percent at the end of 2022. Similarly, women’s representation in post-MBA investing associate (L5) roles improved by three percentage points. However, gender diversity at the managing-director level remained constant.

Women in PE are slightly less represented in operating roles than in investing roles, with women holding only 25 percent of all operating roles. Notably, women in operations have achieved gender parity at the associate level (L5), with 52 percent of roles. However, gender diversity undergoes a steep decline at higher levels, with women holding just 21 percent of managing-director-level (L2) operating jobs.

Progress is generally cause for optimism, but if the pace of progress doesn’t accelerate, the path to gender parity in the industry will be long. At the current rate of progress, reaching gender parity in investing roles at the managing-director level (L2) would take more than six decades. Achieving gender parity at the principal level (L3) would take more than three decades (Exhibit 2).

While these numbers are sobering, the outlook is significantly brighter at the entry level. Based on current figures, the industry could reach gender parity at the analyst level (L6) and associate level (L5) within the next decade.

At the current rate of progress, reaching gender parity in investing roles at the managing-director level (L2) would take more than six decades.

Promotion rates: Women in investing face a longer road

In demanding PE careers, women find themselves navigating a longer route to reach the same milestones as their male colleagues. At almost every level, women in investing roles are promoted at significantly lower rates than men. Globally, men in investing roles are about 50 percent more likely, on average, to be promoted than their female colleagues, a trend that persists across all levels in investing roles (Exhibit 3).

The largest gap affects promotions into the principal level (L3), with men 2.75 times more likely than women to be promoted. One contributor to this disparity may be limited sponsorship and mentorship for women at the vice president (VP) level. As the head of talent for a North American PE fund put it, “At that [middle] level is where we find a number of ethnic minorities and women who have really felt like the levels they are at have a sticky floor. They found that it’s really hard to get that next promotion. They feel left out. They haven’t received the kind of mentorship and the kind of apprenticeship that they’re really going to need or the sponsorship to get promoted.”

The road to meaningful progress will likely be long. However, there’s a bright spot: the promotion gap at the managing-director level (L2) shrank in 2022.

Globally, men in investing roles are about 50 percent more likely, on average, to be promoted than their female colleagues.

Significant differences in representation between leading and lagging firms

Some firms have made noteworthy strides on the diversity of their talent pool, so much so that the industry’s global average of women in 15 percent of investing managing-director roles looks paltry by comparison. Leading firms had women in 45 percent of managing-director (L2) roles as the end of 2022. These firms also had significantly higher proportions of women at every level and overall had women in 38 percent of their investing roles, compared with the global average of 25 percent.

Interestingly, firms that were leaders in gender diversity (as indicated by relatively high proportions of women in managing-director roles) also retained women at higher rates than the industry average. However, firms that lagged on gender diversity showed significantly higher attrition in 2022 among women in investing. These firms in our sample did not have women in managing-director (L2) investing roles and had only 17 percent women in investing roles overall compared to the 25 percent global benchmark. Furthermore, these firms’ attrition rates for women in investing were 1.7 times higher, at 27 percent, than the global average over the course of 2022 (Exhibit 4).

For investing roles, our findings suggest a correlation between the representation of women at the top and higher overall gender representation, as well as between lack of women at the top and their ability to retain women at all levels of investing roles.

Our findings on gender diversity over time also highlight the feasibility of substantial progress when decision makers deploy effective strategies. Indeed, the results of our study show that not all PE firms are equal when it comes to cultures that support diverse talent.

Different regions have different timelines to gender parity

The timelines to achieving gender parity vary by region. For instance, despite advances, Europe still faces significant challenges related to women’s representation at senior levels. At its current pace, Europe would require more than six decades to reach gender parity at senior levels.

By contrast, based on the rate of recent progress, the Americas are the furthest from achieving gender parity at middle and junior levels for investing roles. The situation is notably different in the Asia–Pacific region, which has done the most to close the gender gap at middle and senior levels recently (Exhibit 5).

A concerning trend has emerged over the past two years: gender representation has seen a minor decrease in the Asia–Pacific region at the associate level (L5). Although this decline starts from a relatively high base, it indicates the need for ongoing efforts to maintain a diverse talent pipeline that can help the industry achieve gender parity.

Ethnic and racial diversity in private equity

Consistent with our past findings, ethnic and racial minorities in PE face similar underrepresentation as women. At nearly every level, investing roles have lower ethnic and racial diversity than noninvesting and operating-partner roles.

Our research data from the United States and Canada shows that ethnic and racial minorities represent only 20 percent of managing-director-level investing professionals (Exhibit 6). For context, people who identify as ethnic and racial minorities account for 30 percent of the Canadian population and 41 percent of the US population. 2 “QuickFacts: United States population estimates,” US Census Bureau, July 1, 2022; “The Canadian census: A rich portrait of the country's religious and ethnocultural diversity,” Statistics Canada, October 26, 2022. However, we found positive progress in ethnic and racial diversity in ICs in 2022. Ethnic and racial minorities represented 18 percent of investment committee members, nearly matching the ethnic and racial diversity of managing directors (L2) that year.

The improvement in the diversity of talent in investment committees over the course of 2022 may be the result of new requirements for PE firms to disclose C-suite- and investment-committee-level diversity data to prospective investors. The chief HR officer of a midsize PE firm headquartered in North America referred to this as “a standard part of the due diligence questionnaire these days.”

Investment professionals who identify as White held 70 percent of all investing roles and 80 percent of managing-director roles. As of 2022, White men made up the majority of White PE professionals at 79 percent, with 86 percent at the managing-director level. By contrast, women who identify as ethnic and racial minorities were the least represented group among investment professionals across all levels. White professionals lead promotion rates into every level except principal (L3). The difference in promotion is most drastic at the managing-director level (L2), in which White professionals were more than 2.3 times more likely to be promoted than any other race or ethnicity. And once they make it to the top, White professionals has the lowest rates of attrition, trailing only Hispanic and Latino investing professionals in attrition rates at the principal level (L3) and managing-director level (L2).

Firms with more ethnic and racial diversity at the top tend to have more-diverse talent pools

Not all PE firms have struggled to attract and develop talent from ethnic and racial minorities. Leading firms have reached or are nearing representative levels, with 42 percent of investing talent identifying as ethnic or racial minorities, compared with 30 percent of the Canadian population and 41 percent of the US population.

Lagging firms, on the other hand, have almost no ethnic and racial diversity at senior levels. These challenges at the top are reflected throughout the organization, with only 23 percent of investing professionals at lagging firms identifying as ethnic and racial minorities.

Firms that lead the industry in ethnic and racial diversity have demonstrated that significant progress is possible, but there is still work to be done to make PE offices in the United States and Canada more representative. Black and Hispanic professionals remain underrepresented, even at firms that lead on ethnic and racial diversity. Fourteen percent of the US population is Black, and 19 percent is Hispanic, 3 “QuickFacts: United States population estimates,” US Census Bureau, July 1, 2022. but even at leading firms, only 8 percent of managing directors are Black, and 9 percent are Hispanic.

Institutional investors are asking more about DEI metrics

When making funding decisions, institutional investors increasingly take PE firms’ DEI practices into account.

Institutional investors are broadening their view of DEI beyond the investment team and institutional investors now increasingly ask about DEI metrics within portfolio companies and their boards (Exhibit 7). This growing interest from institutional investors has encouraged PE firms to systematically track and report on these metrics, fueling momentum toward diversity and inclusion in the industry. As a partner at a North American PE fund put it, “Data requests from LPs [limited partners] on diversity and inclusion have gone from zero in the 2000s to everyone asking about it today.”

Notably, some institutional investors track PE firms’ year-over-year improvements in diversity and inclusion as part of their DEI assessments. Forward-looking institutional investors have started to move beyond simply tracking DEI metrics and are beginning to set minimum thresholds on some metrics. For instance, one institutional investor in our sample requires PE firms to meet minimum racial- and gender-diversity thresholds before the institutional investor considers making an investment.

Structural barriers for PE firms owned by ethnic and racial minorities and women

Institutional investors are continuing to gather data on diversity inclusion. But are their allocations consistent with their stated priorities?

Institutional investors that participated in last year’s study said they would be willing to give more capital to more-diverse deal teams. 4 “QuickFacts: United States population estimates,” US Census Bureau, July 1, 2022. However, institutional investors face challenges in making that promise a reality. As of 2021, PE firms owned by ethnic and racial minorities and women managed only 6 percent of total AUM in PE. 5 Knight diversity of asset managers research series: Industry , Knight Foundation, December 2021. If diversity is high on institutional investors’ priority list, why don’t minority-owned funds receive more capital?

The hurdle for minority- and women-owned funds is not their track record or the investing team’s experience. The challenges are structural and make it harder for institutional investors to allocate to these firms. For instance, compared with their competitors, minority- and women-owned firms are smaller and newer on average. In the current macroeconomic environment, institutional investors are relying more on existing long-term relationships with general partners to weather the cycle, leaving even fewer slots for these firms to compete over. To connect with these firms, institutional investors would have to go through brokers or adjust their minimum allocation rules to directly invest in smaller raises.

As institutional investors continue to shape the future of private equity, their influence will be vital in ensuring that DEI remains top of mind. Through thoughtful capital allocation and continued focus on DEI metrics, institutional investors have the power to drive meaningful change in the sector, making PE more inclusive, more diverse, and ultimately more successful.

From aspiration to action: Tangible steps toward a more diverse future

Our study highlights that to achieve a more diverse, equitable, and inclusive industry, firms require additional internal actions and practices as well as external pressures. Strategies to retain and promote diverse talent within PE firms would need to coexist with a collaborative commitment from institutional investors to demand DEI metrics and support women- and minority-owned funds. Our discussion focuses on specific actions and regional considerations that can accelerate the path to greater diversity of talent within investing roles in private markets globally.

Must-haves: A focus on retaining diverse talent and practices that accelerate the path to equity

PE firms have made initial progress in diversifying their entry-level talent pipelines. To establish a more inclusive culture and move toward gender parity, those efforts would need to extend to the senior ranks. It’s important for practices that promote diversity and inclusion to be embedded in every level of the organization. DEI should not be seen as just a recruitment initiative.

Key practices to implement include the following:

- analyzing attrition and promotion rates by gender, ethnicity, and race where possible, along with other measures of diversity, to shed light on firms’ effectiveness in retaining and promoting diverse talent

- developing intentional sponsorship and mentorship programs that can guide diverse talent, especially in midlevel roles

- establishing employee resource groups (ERGs) for diverse talent to offer safe spaces for interaction, discussion, and mutual support

- implementing more flexible HR policies, such as remote work, to cast a wider net for talent and improve inclusion for professionals from diverse backgrounds

- hosting unconscious-bias and conscious-inclusion training to minimize the impact of unconscious prejudices on decision-making processes

- creating intentional on-ramps and off-ramps for employees as they transition to and from parental leave or extended time off to help normalize these journeys

These initiatives go beyond recruitment and are crucial in building an inclusive environment that not only welcomes diverse team members but also enables them to flourish and ascend the ranks. By committing to these practices, PE firms can nurture diversity throughout their organizations, from the entry level to top leadership.

The road toward equity in PE is long, but a continued focus on actions that could accelerate progress can put the industry’s aspirations within reach. Institutional investors can continue to reinforce the industry’s commitment to DEI, and by acting on these commitments, PE firms can hone the edge that comes with diversity.

Pontus Averstad and Fredrik Dahlqvist are senior partners in McKinsey’s Stockholm office; Eitan Lefkowitz is a consultant in the New Jersey office; Alexandra Nee is a partner in the Washington, DC, office, where Mohammed Shafi is a consultant; Gary Pinshaw is a senior partner in the Sydney office; and David Quigley is a senior partner in the New York office.

The authors wish to thank Alejandro Beltrán, Diana Ellsworth, Carlos Esber, Tim Ewing, Catherine Falls, James Gannon, Chris Gorman, Kori Hill, Alexis Howard, Gil Sander Joseph, Claudy Jules, Bruck Kebede, Drew Knapp, Connor Kramer, Alexis Krivkovich, Ju-Hon Kwek, Bola Lawrence, Robin Lore, Tess Mandoli, Emma Moriarty, Andrew Mullin, Suraya Narayan, Margret-Ann Natsis, Hilary Nguyen, Daniel Obed, Vivek Pandit, David Pinski, Luis Rivera, Nicole Robinson, Elise Sauve, Jennifer Schmidt, Jeanette Stock, Neha Verma, Monne Williams, Jackie Wong, and Lareina Yee for their contributions to this report.

The authors also wish to thank all the participating private equity firms and institutional investors, without whose participation these industry-wide benchmarks would not be possible.

We are appreciative of McKinsey and LeanIn.org’s Women in the Workplace study, which has informed the creation of this work.

Explore a career with us

Related articles.

The state of diversity in global private markets: 2022

The state of diversity in US private equity

Tracking diversity, equity, and inclusion data in private markets

- e-ATM Order

- Share Market News

- FindYourMojo

- Live Webinar

- Relax For Tax

- Budget 2024

- One Click Mutual Fund

- Retirement Solutions

- Execution Algos

- One Click F&O

- Apply IPO through UPI

- Life Insurance

- Health Insurance

- Group Health Insurance

- Bike Insurance

- SME Insurance

- Car insurance

- Home Insurance

- Sovereign Gold Bonds

- New Bonds on Offer

- Government Securities

- Exchange Traded Bonds

- ICICI Bank FD

- Top Performing NPS Schemes

- NPS Calculator

- NPS Important FAQ and Disclosures

- Equity Trending News

- Self learning

- Customer Service

- Corporate Services

- Open Account

- Masters of the Street

- Features and Products

- Will Drafting

- Goal Planner

- Retirement Planning

- Brokerage Fees and Charges

- Business Partner

- Business Partner Opportunity

- Business Partner Earning Calculator

- Business Partner App

- Partner Universe

- Insurance – POSP

- Equity Research

- Investing-Ideas

- Infosys Ltd

Infosys Ltd IT - Software | NSE : INFY

- Target : 1,760.0 (17.33%)

- Target Period : 12-18 Month

26 Jul 2022

Particulars

Shareholding pattern, price chart, research analyst, key financial summary, financial summary, profit and loss statement ₹ crore, key ratios ₹ crore, balance sheet ₹ crore, cash flow statement ₹ crore, previous reports pdf:.

Copyright© 2022. All rights Reserved. ICICI Securities Ltd. ®trademark registration in respect of the concerned mark has been applied for by ICICI Bank Limited

Higher rates of cancer in minoritized communities across Chicago and U.S. driven by disparities

Despite the overall death rate from cancer in the U.S. falling by 33% between 1991 and 2020, many segments of the U.S. population experience a disproportionate cancer burden, according to the 2024 American Association for Cancer Research (AACR) Cancer Disparities Progress Report .

Communities in Chicago suffer from multiple health disparities, particularly for cancer. The South Side’s 800,000 residents, the majority of whom are Black and historically marginalized, face significantly higher rates of cancer.

“Cancer affects everyone, but advances in cancer prevention, early detection and treatment have not benefited everyone equally,” said Kunle Odunsi, MD, PhD , who served on the steering committee responsible for issuing the report. He is the director of the National Cancer Institute-designated University of Chicago Medicine Comprehensive Cancer Center (UCCCC), one of two such centers in Illinois.

Black communities suffer worse disparities

Cancer disparities are most stark in Black and Indigenous populations, which have the highest overall cancer death rates of all U.S. racial or ethnic groups. Black men are twice as likely to die from prostate cancer compared to white men. Even though the incidence of breast cancer is similar in Black and white women, Black women have a 40% higher likelihood of dying from it. Similarly, Black individuals are twice as likely to be diagnosed with and die from multiple myeloma.

Many of these inequities are rooted in a long history of racism, segregation and discrimination against marginalized population groups in the U.S. — especially in large cities like Chicago. For example, as noted in the report, an analysis of U.S. cancer deaths in the context of residential segregation caused by decades of redlining (discriminatory housing practices) found that between 2015 and 2019, residents of disadvantaged neighborhoods had a 22% higher mortality rate for all cancers combined compared to other residents.

On Chicago's South Side, cancer is the second leading cause of death, with cancer death rates nearly twice the national average. Because of a lack of information, resources and access to care, South Side residents are frequently diagnosed with cancer later and have more issues getting treatment than those who live on the North Side.

Examining drivers of cancer disparities

Researchers are trying to better understand the major drivers of cancer disparities in order to identify ways to reduce them. The AACR report discussed biological, social and structural factors that adversely affect racial and ethnic minority groups and medically underserved populations.

Social drivers of health include factors such as place of residence, education, work opportunities, healthcare access, housing, transportation, exposure to racism, language and literacy, and access to healthy food, clean air, water and community resources.

Disparities between populations are also driven by biological factors related to ancestry and environmental exposures. These factors include not only inherited genetics and our bodies’ immune responses, but also contaminants in the air, water and food we consume and the settings in which we live and work.

Other major contributing factors discussed in the report are the lack of diversity in existing cancer genomics datasets; the underrepresentation of minority groups in clinical trials; and the lack of diversity in the cancer research and care workforce.

Pursuing equitable solutions

The AACR report emphasizes the complex and multifaceted nature of cancer disparities, which necessitates multidisciplinary and collaborative approaches to identify effective solutions.

“The UCCCC joins AACR in its commitment to prioritize cancer disparities research and ensure that no populations or communities are left behind,” Odunsi said.

Below are examples of how the UCCCC is putting research, education and community resources in place to address the critical challenges of cancer disparities and achieve health equity for all patients.

- UChicago Medicine is one of nine healthcare sites across the country enrolling hundreds of thousands of people from all racial, ethnic and socioeconomic backgrounds in the Connect for Cancer Prevention study . Over time, the data generated by study participants will allow researchers to gain insights into how cancer develops and what can be done to prevent it. Bringing the Connect study to Hyde Park and surrounding communities enables underrepresented groups to participate in — and benefit from — biomedical research.

- The UCCCC launched The Center to Eliminate Cancer Inequity ( CinEQUITY ) in February 2024 to serve as a hub to catalyze research aimed at eliminating cancer inequities.

- In September 2023, UChicago Medicine began construction on Chicago’s first freestanding center dedicated to cancer care and research. The new pavilion, slated to open in 2027, will provide patients and the South Side community access to the newest diagnostic innovations and leading-edge therapies.

- Odunsi was recently selected by the National Cancer Institute Center to Reduce Cancer Health Disparities to join the Cancer Equity Leaders group , a diverse team of premier cancer research leaders who will reimagine and transform the future of cancer health equity. This group will help guide NCI’s diversity training, biomedical workforce development, and community outreach and engagement initiatives.

- UChicago Medicine researchers received a grant from Stand Up To Cancer® (SU2C) in 2023 to determine if employing new methods of patient outreach — with or without engagement of a community ambassador — increase clinical trial participation among the underserved community on Chicago’s South Side.

- The UCCCC’s Office of Community Engagement and Cancer Health Equity forms strategic alliances with UChicago units and other healthcare organizations, as well as community, ethnic and faith-based groups, to create innovative programs that will increase access to care, reduce risk factors for cancer, reduce tobacco use, increase participation in cancer research and improve the quality of life for cancer patients and survivors.

- In the fall, the UCCCC will be holding its sixth Annual Cancer Disparities and Health Equity Symposium to foster science and discussion about advances in cancer health disparities research which are driving health equity locally and globally. The theme will center on environmental factors.

- At the UCCCC, many programs and pathways have been established to reduce cancer disparities by building a more diverse and inclusive cancer research and care workforce. These programs allows young people, the majority of whom are women or from backgrounds otherwise underrepresented in the sciences — to gain hands-on experience in the laboratories of established cancer researchers at the University of Chicago.

- The UCCCC created a unique internship with City Colleges of Chicago with the goals of providing introductory education about--and increasing the diversity of--the cancer clinical research workforce.

- Representatives from the UCCCC regularly visit lawmakers in Springfield, Illinois and Washington, D.C., to advocate for legislation that increases diversity in clinical trials and expands access to lifesaving cancer screening.

- The UCCCC established working groups to increase the recruitment and accrual of under-represented populations and individuals across the lifespan to cancer clinical trials.

About the UCCCC

The University of Chicago Medicine Comprehensive Cancer Center (UCCCC) celebrates 50 years as a National Cancer Institute-designated cancer center. NCI-Designated Cancer Centers are characterized by scientific excellence and the capability to integrate a diversity of research approaches to focus on the problem of cancer. In addition to the depth and breadth of their cancer research, they are recognized for their care, education and community outreach programs.

- Election 2024

- Entertainment

- Newsletters

- Photography

- Personal Finance

- AP Investigations

- AP Buyline Personal Finance

- AP Buyline Shopping

- Press Releases

- Israel-Hamas War

- Russia-Ukraine War

- Global elections

- Asia Pacific

- Latin America

- Middle East

- Election Results

- Delegate Tracker

- AP & Elections

- Auto Racing

- 2024 Paris Olympic Games

- Movie reviews

- Book reviews

- Personal finance

- Financial Markets

- Business Highlights

- Financial wellness

- Artificial Intelligence

- Social Media

The larger the nonprofit, the more likely it is run by a white man, says new Candid diversity report

Candid CEO Ann Mei Chang poses for a photo at the nonprofit’s headquarters on Wednesday, Jan. 31, 2024, in New York. Chang, CEO since 2021, believes her organization can help the philanthropic sector work more efficiently by making more data from donors and grantees available to the public.(AP Photo/Peter K. Afriyie)

Candid CEO Ann Mei Chang poses for a photo at the nonprofits’s headquarters on Wednesday, Jan. 31, 2024, in New York. Chang, CEO since 2021, believes her organization can help the philanthropic sector work more efficiently by making more data from donors and grantees available to the public. (AP Photo/Peter K. Afriyie)

- Copy Link copied

NEW YORK (AP) — White men are most likely to lead the largest, best-funded nonprofits, while women of color tend to lead the organizations with the fewest financial resources, according to a study from the nonprofit data research organization Candid.

“ The State of Diversity in the U.S. Nonprofit Sector ” report released by Candid on Thursday is the largest demographic study of the nonprofit sector, based on diversity information provided by nearly 60,000 public charities.

According to the study, white CEOs lead 74% of organizations with more than $25 million in annual revenue, with white men heading 41% of those nonprofits, despite being only about 30% of the population. Women of color, who make up about 20% of the U.S. population, lead 14% of the organizations with more than $25 million in revenue and 28% of the smallest nonprofits — those with less than $50,000 in revenue.

The Candid report provides data for nonprofits who have complained for years that minority-led nonprofits attract fewer donations, government resources and sales, even after the racial reckoning following the murder of George Floyd and promises from funders of all sizes seeking change. Many groups argue that when the leadership of a charity comes from the community it is serving, its needs are met more effectively. According to a report from the Ms. Foundation for Women and the consulting group Strength in Numbers, less than 1% of the $67 billion that foundations donated in 2017 was earmarked specifically for minority women and girls.

“Our mission is to use data to help make the whole sector more efficient, effective and equitable,” Candid CEO Ann Mei Chang told The Associated Press. “We think that data is a force for good and can help everybody trying to do good, to do good better.”

The report’s findings are based on data gathered from the Demographics via Candid initiative, where nonprofits voluntarily report the diversity numbers of their organizations. Cathleen Clerkin, Candid’s associate vice president of research, said authors of the report compared its findings to other sector-wide data and found them to be consistent.

Because the diversity information was self-reported, Clerkin said Candid studied whether nonprofits would be more likely to share their information because they were more diverse, but found that was not the case. What was more likely to determine whether a nonprofit reported its diversity information was how much they depended on outside donations, said Clerkin, adding that Candid hopes the report will encourage more charities to provide its organization’s information.

The report found that environmental and animal welfare groups were least likely to have diverse leadership, with 88% having a white CEO. Nearly three-quarters of religious nonprofits had white CEOs, according to the report.

Portia Allen-Kyle, chief of staff and interim head of external affairs at the racial justice nonprofit Color of Change, said the report’s findings were not surprising. “The backsliding of Black leadership and other underrepresented populations is exactly what we unfortunately expect to see in an era of attacks on the tools of Black power like affirmative action, like DEI (diversity, equity and inclusion), et cetera,” she said. ”It’s a nonprofit space where disproportionately white leaders disproportionately receive resources from these white, ultrawealthy donors, while Black leaders from the most impacted communities are expected to often turn water into wine, using nothing but pennies on the dollar.”

Allen-Kyle said the fact that the report also finds that women of color are overrepresented as leaders of the smallest charities is also not a surprise. “With these small nonprofits, especially with advocacy, Black women are going to be doing this work regardless and they’re doing it on nothing and whether or not they get paid because they believe in it,” she said.

The report also found that Latinos were underrepresented as nonprofit CEOs in nearly every state.

“We have been talking about that for decades,” said Frankie Miranda, president and CEO of the Hispanic Federation, which supports Latino communities and nonprofits. “It’s the reason the Hispanic Federation was created in 1990 — to advocate for Latino-led, Latino-serving providers because we were not part of the conversation when decision-making around funding and support was happening.”

That has led to Hispanic Federation becoming one of the nation’s largest grantmakers for Latino nonprofits. However, even though its findings are not unexpected, the Candid study is still extraordinarily valuable, Miranda said.

“This study will validate our argument,” he said. “This is critically important for us to be able to say, ‘Here’s the proof.’ It’s proof for major donors that you need to do better when it comes to diversity within your organization. Your institution needs to have the cultural competency to understand the importance of investing in our organizations, the importance of getting to know these organizations. They know how to serve these communities.”

Associated Press coverage of philanthropy and nonprofits receives support through the AP’s collaboration with The Conversation US, with funding from Lilly Endowment Inc. The AP is solely responsible for this content. For all of AP’s philanthropy coverage, visit https://apnews.com/hub/philanthropy .

You are using an outdated browser. Please upgrade your browser to improve your experience.

Find Posts By Topic

- Broadband and Cable

- Cybersecurity

- Digital Equity

- Digital Government

You’re invited to our virtual event! Digital Equity/Inequity in Seattle: Learning from 2024 Seattle Technology Access & Adoption Study community research

Join us for a data discovery and discussion session as Seattle IT presents Digital Equity/Inequity in Seattle: Learning from 2024 Seattle Technology Access & Adoption Study presentation and discussion on Tuesday, May 21, from 3-4 p.m. with an optional extended conversation from 4-4:30 p.m. This virtual Webex event is an opportunity for us to share what we’ve learned from the report released this year. We will share the survey and focus group results, what this means for our community, and how to explore our dashboards and data. We’ll be joined by the City’s Interim Chief Technology Officer Jim Loter, Community Technology Advisory Board members, Digital Equity Advisor David Keyes, and research partners at Olympic Research and Strategy and Inclusive Data.

The study, conducted every five years, provides valuable data and insight on internet access and use, devices, digital skills, civic participation, training needs, and safety and security concerns. Results help guide City and community programs to better serve residents and close the digital divide. This study received input from 4,600 diverse Seattle residents, including Native community members, in eight languages.

Some of the results include:

- One in 20 households have fewer than one internet device per household member.

- 1 in 6 Native households dealt with internet outages of a month or more.

- Nearly 44,000 households have significant needs for improvement in access, devices, uses, and skills using a new digital connectedness index.

- 11% of BIPOC households do not have internet access both at home and on-the-go.

To learn more about the survey, including the full summary report, Tableau data dashboards, focus group results, and more, visit Seattle.gov/tech .