Got any suggestions?

We want to hear from you! Send us a message and help improve Slidesgo

Top searches

Trending searches

15 templates

26 templates

49 templates

american history

76 templates

great barrier reef

17 templates

39 templates

How to Save Money Infographics

It seems that you like this template, free google slides theme, powerpoint template, and canva presentation template.

"Oh, it's the electricity bill again. How do other families manage to save money?". This question might sound familiar, so if you have tips and recommendations on how to save money each month, it'll be great if you used these editable infographics to represent that data visually in front of your audience. There are all kinds of designs and diagrams, including tables and graphs, and you'll find lots of illustrations related to money, such as wallets or even piggy banks. Everything is very colorful, helping your information stand out even more.

Features of these infographics

- 100% editable and easy to modify

- 31 different infographics to boost your presentations

- Include icons and Flaticon’s extension for further customization

- Designed to be used in Google Slides, Canva, and Microsoft PowerPoint and Keynote

- 16:9 widescreen format suitable for all types of screens

- Include information about how to edit and customize your infographics

How can I use the infographics?

Am I free to use the templates?

How to attribute the infographics?

Attribution required If you are a free user, you must attribute Slidesgo by keeping the slide where the credits appear. How to attribute?

Related posts on our blog.

How to Add, Duplicate, Move, Delete or Hide Slides in Google Slides

How to Change Layouts in PowerPoint

How to Change the Slide Size in Google Slides

Related presentations.

Premium template

Unlock this template and gain unlimited access

What are your financial priorities?

Answer a few simple questions, and we’ll direct you to the right resources for every stage of life.

Welcome back. Your personalized solutions are waiting.

Welcome back. Here's where you left off.

You might also be interested in:

Related content

Read more , 4 minutes

Read more , 3 minutes

View infographic , 2 minutes

Read more , 2 minutes

8 simple ways to save money

Saving is easier when you have a plan—follow these steps to create one

Read, 4 minutes

Sometimes the hardest thing about saving money is just getting started. This step-by-step guide can help you develop a simple and realistic strategy, so that you can save for all your short- and long-term goals.

Record your expenses

The first step to start saving money is figuring out how much you spend. Keep track of all your expenses—that means every coffee, household item and cash tip as well as regular monthly bills. Record your expenses however is easiest for you—a pencil and paper, a simple spreadsheet or a free online spending tracker or app. Once you have your data, organize the numbers by categories, such as gas, groceries and mortgage, and total each amount. Use your credit card and bank statements to make sure you’ve included everything.

Bank of America clients can access the Spending & Budgeting tool in Mobile and Online Banking to automatically categorize transactions for easier budgeting.

Include saving in your budget

Now that you know what you spend in a month, you can begin to create a budget . Your budget should show what your expenses are relative to your income, so that you can plan your spending and limit overspending. Be sure to factor in expenses that occur regularly but not every month, such as car maintenance. Include a savings category in your budget and aim to save an amount that initially feels comfortable to you. Plan on eventually increasing your savings by up to 15 to 20 percent of your income.

Find ways to cut spending

If you can’t save as much as you’d like, it might be time to cut back on expenses. Identify nonessentials, such as entertainment and dining out, that you can spend less on. Look for ways to save on your fixed monthly expenses, such as your car insurance or cell phone plan, as well. Other ideas for trimming everyday expenses include:

Search for free activities

Use resources, such as community event listings, to find free or low-cost entertainment.

Review recurring charges

Cancel subscriptions and memberships you don’t use—especially if they renew automatically.

Examine the cost of eating out vs. cooking at home

Plan to eat most of your meals at home, and research local restaurant deals for nights that you want to treat yourself.

Wait before you buy

When tempted by a nonessential purchase, wait a few days. You may realize the item was something you wanted rather than needed—and you can develop a plan to save for it.

Set savings goals

One of the best ways to save money is to set a goal . Start by thinking about what you might want to save for—both in the short term (one to three years) and the long term (four or more years). Then estimate how much money you’ll need and how long it might take you to save it.

Common short-term goals: Emergency fund (three to nine months of living expenses), vacation or down payment for a car

Common long-term goals: Down payment on a home or a remodeling project, your child’s education or retirement

Set a small, achievable short-term goal for something that’s fun and goes beyond your monthly budget, such as a new smartphone or holiday gifts. Reaching smaller goals—and enjoying the reward you’ve saved for—can give you a psychological boost, making the payoff of saving more immediate and reinforces the habit.

Determine your financial priorities

After your expenses and income, your goals are likely to have the biggest impact on how you allocate your savings. For example, if you know you’re going to need to replace your car in the near future, you could start putting away money for one now. But be sure to remember long-term goals—it’s important that planning for retirement doesn’t take a back seat to shorter-term needs. Learning how to prioritize your savings goals can give you a clear idea of how to allocate your savings.

Pick the right tools

There are many savings and investment accounts suitable for short- and long-term goals. And you don’t have to pick just one. Look carefully at all the options and consider balance minimums, fees, interest rates, risk and how soon you’ll need the money so you can choose the mix that will help you best save for your goals.

Short-term goals

If you’ll need the money soon or need to be able to access it quickly, consider using these FDIC-insured deposit accounts:

- A savings account

- A certificate of deposit (CD) , which locks in your money for a fixed period of time at a rate that is typically higher than that of a savings account

Long-term goals

If you’re saving for retirement or your child’s education, consider:

- FDIC-insured individual retirement accounts (IRAs) or 529 plans, which are tax-efficient savings accounts

- Securities, such as stocks or mutual funds. These investment products are available through investment accounts with a broker-dealer 1

Make saving automatic

Almost all banks offer automated transfers between your checking and savings accounts. You can choose when, how much and where to transfer money or even split your direct deposit so that a portion of every paycheck goes directly into your savings account. The advantage: You don’t have to think about it, and you’re less likely to spend the money instead. Other easy savings tools include credit card rewards and spare change programs, which round up transactions to the nearest dollar and transfer the difference into a savings or investment account.

With Mobile & Online Banking, Bank of America clients can easily set up automatic transfers between accounts.

Watch your savings grow

Review your budget and check your progress every month. That will help you not only stick to your personal savings plan, but also identify and fix problems quickly. Understanding how to save money may even inspire you to find more ways to save and hit your goals faster.

1 Remember that securities are not insured by the FDIC, are not deposits or other obligations of a bank and are not guaranteed by a bank. They are subject to investment risks, including the possible loss of your principal.

The material provided on this website is for informational use only and is not intended for financial or investment advice. Bank of America Corporation and/or its affiliates assume no liability for any loss or damage resulting from one’s reliance on the material provided. Please also note that such material is not updated regularly and that some of the information may not therefore be current. Consult with your own financial professional when making decisions regarding your financial or investment management. ©2024 Bank of America Corporation.

What to read next

More from bank of america, bank of america life plan® helps you create a plan that’s tailored to your goals..

We're here to help. Reach out by visiting our Contact page or schedule an appointment today.

Mobile Banking requires that you download the Mobile Banking app and is only available for select mobile devices. Message and data rates may apply.

The Spending & Budgeting tool is currently available to clients with a personal checking or savings account, credit card, a linked Merrill investment account, as well as a Small Business checking or savings account.

Fees apply to wires and certain transfers. See the Online Banking Service Agreement for details. Data connection required. Carrier fees may apply.

You're continuing to another website

You're continuing to another website that Bank of America doesn't own or operate. Its owner is solely responsible for the website's content, offerings and level of security, so please refer to the website's posted privacy policy and terms of use. It's possible that the information provided in the website is available only in English.

Va a ir a una página que podría estar en inglés

Es posible que el contenido, las solicitudes y los documentos asociados con los productos y servicios específicos en esa página estén disponibles solo en inglés. Antes de escoger un producto o servicio, asegúrese de haber leído y entendido todos los términos y condiciones provistos.

Advertising Practices

We strive to provide you with information about products and services you might find interesting and useful. Relationship-based ads and online behavioral advertising help us do that.

Bank of America participates in the Digital Advertising Alliance ("DAA") self-regulatory Principles for Online Behavioral Advertising and uses the Advertising Options Icon on our behavioral ads on non-affiliated third-party sites (excluding ads appearing on platforms that do not accept the icon). Ads served on our behalf by these companies do not contain unencrypted personal information and we limit the use of personal information by companies that serve our ads. To learn more about ad choices, or to opt out of interest-based advertising with non-affiliated third-party sites, visit YourAdChoices powered by the DAA or through the Network Advertising Initiative's Opt-Out Tool . You may also visit the individual sites for additional information on their data and privacy practices and opt-out options.

To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review the Bank of America Online Privacy Notice and our Online Privacy FAQs .

Connect with us

Your Privacy Choices

Some materials and online content may be available in English only.

Bank of America, N.A. Member FDIC. Equal Housing Lender

© 2023 Bank of America Corporation. All rights reserved.

Investment products:

Bank of America and its affiliates do not provide legal, tax or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.

Get expert advice delivered straight to your inbox.

How to Save Money: 23 Ways to Start Today

11 Min Read | May 28, 2024

Here’s your crash course on how to start saving money. Like right now. And listen, even small changes can make a big difference. So jump in and take these 23 simple tips to the bank. Literally.

How to Save Money

How to Save Money on Food How to Save Money on Housing and Utilities How to Save Money on Transportation How to Save Money on Entertainment and Fun Other Ways to Save Money

How to Save Money on Food

1. meal plan..

The hardest budget line to keep in line? Food. The best way to save money on food ? Meal plan. (Every breakfast, lunch, dinner and even snack!)

Build your meal plan based on:

- What’s already in the fridge, freezer and pantry (Don’t waste food!)

- What’s on your schedule (Need quick dinners for busy nights?)

- What’s on sale (Pick recipes with those sale ingredients.)

- What needs just a few ingredients (Less is more here—more savings, that is.)

Then make a grocery list—and stick to it. For real. Say goodbye to wasted food and drive-thru temptations and hello to legit money savings.

Here's A Tip

Download my girl Rachel Cruze’s free Meal Planner & Grocery Savings Guide for more tips, tricks and even printables to help you here.

2. Buy generic.

Hey, I don’t mind if you’re a brand snob about a few things. I won’t sit up here and tell you that Great Value Twist & Shouts taste the same as Nabisco Oreos. But please know, a ton of name brands are exactly the same as the generic—except the brand name paid more for marketing. And that means you’re paying more for a fancy logo.

Try out generic brands of staple food items—plus, go ahead and go generic on nonfood basics like medicines, cleaning supplies and paper products. (That’s a little bonus tip for you right there.)

3. Pack your lunch.

Get this—the average household spends about $3,639 on food outside of the home each year. 1 That’s $303 a month! And you know some of that is spent going out for lunch during the workday. Learn some cheap lunch ideas and pack your midday meal instead—it’s a great way to save money and eat healthier.

4. Stop eating out.

Are y’all ready for me to level up that last challenge? What if you stopped eating out completely ? I know, I’m trying your life right now. But look—it’s not for the rest of your life. It’s just for a season. You could pack that $303 into your savings each month and hit your money goals way quicker.

Also, if you’re in debt, this is the first luxury I need you to cut. And you won’t even have to skip out on your favorites. You know you can make more—and better —pizza at the house for way less anyway.

5. Skip the coffee shop.

This one gets said so much some of you are rolling your eyes—but if you’ve got a big coffee shop habit, you can save big by becoming your own barista. And when you do go out for a treat, learn some coffee shop hacks so you aren’t paying full price for your fancy caffeine fix.

How to Save Money on Housing and Utilities

6. switch your cell phone plan..

When was the last time you shopped around for better cell phone deals ? It’s time.

See what other providers offer. Then take what you learn to your provider and see if they’ll give you a deal to stick with them. If not, and you aren’t in a contract with a time frame, go ahead and make that switch.

7. Reduce energy costs.

If you’re looking for easy ways to save money on your electric bill , make a few tweaks at home.

Start with some simple things like taking shorter showers (notice I didn’t say fewer showers), fixing that toilet that runs continuously, washing your clothes in cold water, and turning the lights off when you leave a room. You’ll be shocked at how these small changes can really add up.

8. DIY . . . everything!

Before you shell out the cash to pay for a new backsplash, bench or fancy light fixture, think about doing it yourself. Usually, the cost of materials and a simple YouTube search will save you a ton of money here.

I’ll be honest—your girl is not crafty in any way, shape or form, so I’ll probably just wait until I can afford to pay a pro. But if projects are your thing, check out this list of 10 home projects you can probably tackle yourself.

How to Save Money on Transportation

9. try carpooling..

Okay, I know the idea of carpooling might make your skin crawl, but if you’ve got some trustworthy coworkers who live close to you, you can save a lot of gas money—and wear and tear on your car—by taking turns driving each other to work.

10. Find ways to save on gas.

Some grocery stores offer gas rewards programs. Um, a discount on gas for buying groceries you have to buy anyway? Say less. Just make sure you’re not signing up for any rewards programs linked to a credit card. You’re trying to save money—not go into debt, okay?

Save more. Spend better. Budget confidently.

Get EveryDollar: the free app that makes creating—and keeping—a budget simple . (Yes, please.)

How to Save Money on Entertainment and Fun

11. cancel some subscriptions and memberships..

If you want to save money each month, pick one TV streaming service to cancel. Just one.

Then do a quick audit and see what else you can cut. If that subscription or membership isn’t changing your life and you’d rather have that money in your bank account, cancel it. Remember, most of these cuts are just temporary while you get that cash stacked.

12. Try a no-spend month.

Let’s be honest: If you’re in the midst of trying to pay off debt or save money, every month should be a no-spend month . Keeping a needs-based, no-fluff budget for 30 days at a time can save hundreds if not thousands for some!

Because that’s what a no-spend month is—you commit to cutting out those nonessentials for one month.

Just make sure you know your parameters from day one (what you will and won’t buy). And do yourself a favor: Get an accountability partner or have a friend take the challenge with you. It seriously helps.

13. Get a library card.

Before you click Add to Cart on that brand-new book, get yourself a library card. And if you’re more into audiobooks or e-books, download an app like Libby that connects to your library so you can check out those versions on your phone or tablet.

Other Ways to Save Money

14. adjust your tax withholdings..

Listen, if you’re getting huge tax refunds each year, that means you’ve been loaning the government money every month without interest . I don’t think so—homey don’t play that. It’s time to adjust your tax withholding s. Put that money back into your monthly budget.

15. Check your insurance rates.

Why is this a money-saving tip? You could be overpaying or be underinsured. Both of those can cost you big. This isn’t an excuse to cut insurances, but it is an excuse to take our 5-Minute Coverage Checkup to make sure you’ve got the exact coverage you need.

16. Stuff your cash envelopes.

Step away from the plastic. In fact, go ahead and take the credit and debit cards out of your wallet. If you really want to get serious about saving, start using the cash envelope system to practice mindful spending.

When you use cash, it activates the pain centers of your brain, creating more friction for every purchase. Simply put, when you spend cash, you feel it. And that helps you spend less—which means you save more.

17. Stay out of “that store.”

When you’re learning how to save money, don’t even think about putting yourself in a tempting environment. We all have “that store”—the one that encourages us to get all spendy and stuff. For me, it’s Home Goods. For you, it’s (fill in the blank).

Know it. Own it. Avoid it! And then, replace that shopping trip with something else fun, like baking cookies with the family. That way you still enjoy yourself without risking those pricey purchases.

18. Use cash-back apps and coupons.

Use coupons. You can clip them from actual paper or click them in an app, but this is money just waiting to be saved. Don’t sleep on it.

Then go one step further and check out cash-back apps to save even more on stuff you’re already going to buy. (Just don’t get talked into buying things you don’t need because of a deal—that’s not a deal. At all.)

19. Learn the power of no (or not now ).

We live in a world of instant gratification. Food from our favorite restaurants— boom! At our door in an hour or less. The show you want to binge—ready for you to hit play, now . The ads on social media say you need this, that and the other. And with the swipe of your finger, it’s at your doorstep. We’re just a couple clicks away from nearly instantly satisfying our desires for anything.

But if you’ll delay some of that gratification by using the magic of no —or, in some cases, not now —you’ll save so much money, build better spending habits, and feel more contentment overall. Savings with a side of mental and emotional health? Yes, please.

20. Say goodbye to debt.

I’m not the only one who says ditching your debt is a top tip for saving money. But even if I was, I’d still shout it from the rooftops because I’ve lived this.

My husband and I paid off $460,000 in debt. (You read that right.) And getting that weight off our backs and out of our lives meant first deciding to stop borrowing money. Because borrowed money, aka debt, straight up steals your income.

I mean, look at how much money debt is taking from the average American each month:

- Average student loan payment: $393 2

- Average credit card payment (based on a 2% minimum payment): $116.10 3

- Average new car payment: $726 4

- Total: $1,235.10

Imagine throwing $1,235.10 toward your savings goals instead of toward your past. Every month.

And that's just three kinds of debt and some national averages there. Now look at your debt. What would you get back in the budget if it was gone ? Paying off debt takes time and effort—but keep your eye on how much you’ll save and the freedom you’ll feel when you finally get to pay yourself instead of paying debt.

21. Set a savings goal.

Sometimes the best way to save money is by setting a savings goal—a specific dollar amount with a set deadline. You can try the 100 Envelope Challenge and hit a $5,050 goal or use the our Savings Tracker and fill in whatever amount you want.

Bonus tip: Be sure you know why this money is so important for you to save. Because remember—the stronger the why , the stronger the try.

22. Save money automatically.

Set up your direct deposit so some of each paycheck goes straight to your savings account. That way, you don’t have to put in a lot of effort to save money—you’re just saving.

23. Make a budget.

A budget is a plan for your money. Think of it as a map to get you to your money goals. And you need a budget.

Because here’s the thing—if you follow every single one of these tips on how to save money but you don’t have a budget . . . you’re playing yourself. You’ll end up accidentally spending everything you intentionally saved. Simply because you didn’t have a plan!

We’ve all been there , so let’s level up.

I need you to make a budget today to see where you are with your money—and then keep making one every single month to get where you want to be.

Whether you budget already or not, check out EveryDollar . This is the budgeting app my family uses. EveryDollar played a huge role in helping us get out of debt, and it helps us set and stick to our money goals—one monthly budget at a time.

You can do this! Starting today, you can save more and spend less by using these 23 tips.

Did you find this article helpful? Share it!

About the author

Jade Warshaw

Jade Warshaw is a personal finance coach, bestselling author of Money’s Not a Math Problem, and regular co-host on The Ramsey Show, the second-largest talk radio show in America. Jade and her husband paid off nearly half a million dollars of debt, and now she’s a six-figure debt elimination expert who uses her journey to help others get out of debt and take control of their money. She’s appeared on CNBC, Fox News and Cheddar News and been featured in Fortune and POLITICO magazines. Through her social content, recent book, syndicated columns and speaking events, Jade is on a mission to change the typical American money mindset. Learn More.

19 Cable Alternatives to Save You Money in 2023

One quick way to free up extra cash is to cut the cable cord. And with all the cable alternatives out there, you won't even have to sacrifice the fun to save a ton. Let's start with 19 of the best.

How to Save Money on Your Electric Bill

With this list of tips, you’ll learn how to save on your electric bill so you can stay comfortable in your home—and with your wallet.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Save Money Now (Before You Really Need It)

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

You've been meaning to save more money. It's been on your mind for a while. But now — right now — feels like the time to get serious.

To save a big chunk of cash before you really need it.

When it comes to saving money, small changes can add up quickly. Here are some of the best ways to save money right away.

Interest rates are on the rise for savings accounts , thanks to the Federal Reserve’s actions this year.

28 ways to save money

1. Automate transfers .

2. Count your coins and bills .

3. Prep for grocery shopping .

4. Minimize restaurant spending .

5. Get discounts on entertainment .

6. Map out major purchases .

7. Restrict online shopping .

8. Delay purchases with the 30-day rule .

9. Get creative with gifts .

10. Lower your car costs .

11. Reduce your gas usage .

12. Bundle cable and internet .

13. Switch your cell phone plan .

14. Reduce your electric bill .

15. Lower your student loan payments .

16. Cancel unnecessary subscriptions .

17. Refinance your mortgage .

18. Set savings goals .

19. Track spending .

20. Pay off high-interest debt .

21. Keep savings in a high-yield savings account .

22. Create a 50/30/20 budget .

23. Shop consignment and thrift stores.

24. Join initiatives to get free items.

25. Use car sharing services.

26. Stock up on household supplies when they're cheap.

27. Enjoy community events.

28. Cash in on your birthday.

1. Automate transfers

By setting up automatic transfers from your checking account to your savings account each month, the money will accumulate over time without any additional work on your part. This technique can be especially useful when your savings accounts are dedicated to specific goals, such as establishing an emergency fund, going on a vacation or building a down payment.

You can also let apps like Digit or Qapital do some of the work for you. After you sign up, they'll transfer small amounts from your checking account to a separate savings account for you. That way, you don’t have to spend time or energy thinking about making a transfer. You can learn more about apps that automate savings and decide if they’re a good fit for you.

2. Count your coins and bills

Another option is saving your change manually by setting it aside each night. After you have a sizable amount, you can deposit it directly into your savings and watch your account grow from there. In fact, when you want to watch your spending, it’s a good idea to use cash instead of credit cards because it can be harder to part with physical money. While this strategy doesn’t build savings overnight, it's a solid approach for slow-and-steady savings growth.

3. Prep for grocery shopping

A little work before you go to the grocery store can go a long way toward helping you save money on groceries . Check your pantry and make a shopping list to avoid impulse buying something you don't need. Learn how to get coupons and join loyalty programs to maximize your savings as you shop. In exchange for sharing your phone number or email address, your local store’s loyalty program might offer additional discounts.

If you use a cash-back credit card, you could earn extra cash back on grocery purchases . Some cards offer as much as 5% or 6% cash back, but you’ll want to be sure to pay off your bill each month to avoid paying interest and fees.

If you shop for groceries at a large retailer like Target, Amazon or Walmart, you can often find additional savings by downloading the store’s app. And apps like Flipp help you sort through sales flyers and coupons from local stores when you enter your ZIP code.

4. Minimize restaurant spending

One of the easiest expenses to cut when you want to save more is restaurant meals, since eating out tends to be pricier than cooking at home. If you do still want to eat at restaurants, try to reduce the frequency and take advantage of credit cards that reward restaurant spending .

You can also opt for appetizers or split an entree with your dining companion to save money when you eat out . Skipping drinks and dessert or indulging in both at home post-dinner can help stretch your budget as well.

5. Get discounts on entertainment

You can take advantage of free days at museums and national parks to save on entertainment costs . Your local community might offer free concerts and other in-person or virtual events; check your local calendar before splurging on pricey tickets to private events. You can also ask about discounts for older adults, students, military members or veterans, first responders and more.

6. Map out major purchases

You can save by timing your purchases of appliances, furniture, cars, electronics and more according to annual sale periods . It’s also worth confirming a deal is actually a deal by tracking prices over time . You can let tools do this step for you; the Camelizer browser extension tracks prices on Amazon and can alert you of price drops. The Honey browser extension pulls in coupon codes and checks for lower prices elsewhere.

When you're shopping in person, make sure you get the best deal by using the ShopSavvy app. It lets you scan bar codes and alerts you of better prices elsewhere.

7. Restrict online shopping

You can make it more difficult to shop online to stop spending money on things you may not need. Instead of saving your billing information, opt to input your shipping address and credit card number each time you order. You’ll probably make fewer impulse purchases because of the extra work involved. You may even consider deleting any shopping apps from your phone for the time being.

8. Delay purchases with the 30-day rule

One way to avoid overspending is to give yourself a cooling-off period between the time an item catches your eye and when you actually make the purchase. If you’re shopping online, consider putting the item in your shopping cart and then walking away until you’ve had more time to think it over. (In some cases, you might even get a coupon code when the retailer notices you abandoned the cart.) If 30 days seems like too long to wait, you can try shorter periods like a 24- or 48-hour delay.

9. Get creative with gifts

You can save money with affordable gift ideas, like herb gardens and books, or go the do-it-yourself route. Baking cookies, creating art or preparing someone dinner can demonstrate that you care just as much as making an expensive purchase, and perhaps even more so. You can also shower someone with the gift of your time by offering to take them to a local (free) museum or other event.

To plan for costs, create a calendar for all the important gift-giving events for the year. Then create a savings bucket or " sinking fund " specifically for gifts, and buy the items during major sale periods like Independence Day, Labor Day or Black Friday.

10. Lower your car costs

Refinancing your auto loan and taking advantage of lower interest rates could save you considerably over the life of your loan. Shopping around for car insurance regularly can also help you cut costs compared with simply letting your current policy auto-renew. You can cut ongoing car maintenance costs by driving less, removing heavy items from your trunk and avoiding unnecessary rapid acceleration.

11. Reduce your gas usage

You can't control prices at the pump, but you can do several things to cut your gas usage and save money . Try using a gas app to pinch pennies when you do fill up.

12. Bundle cable and internet

You could lower your cable bill by as much as $40 per month by downsizing your cable package. And you could save more than $1,000 over two years by bundling your cable and internet service, depending on your carrier. Another option to consider is cutting cable or at least cutting some of your additional streaming services or premium subscriptions.

13. Switch your cell phone plan

Changing your plan is one way to save money on your cell phone bill , but it’s not the only way. Signing up for autopay and paperless statements can save you an additional $5 to $10 per month, per line. Removing insurance from your plan could save you $80 to $300 per year, depending on your plan. We compared different cell phone plans to help you find the best match.

14. Reduce your electric bill

Big and small changes in your energy usage can help you save hundreds annually on your electric bill . Consider plugging any insulation leaks in your home, using smart power strips, swapping in more energy-efficient appliances and switching to a smart thermostat. Even incremental drops in your monthly electricity usage can add up to big savings in the long term.

15. Lower your student loan payments

Enrolling in income-driven repayment could lower your monthly payments to a manageable level since the amount you pay is tied to your earnings. Other options include refinancing , enrolling in autopay to trigger a discount and making extra payments so you can unload the debt faster, which cuts the overall interest you’ll pay.

16. Cancel unnecessary subscriptions

You might be paying for subscriptions you no longer use or need. Reviewing your credit card or bank statement carefully can help you flag any recurring expenses you can eliminate. And avoid signing up for free trials that require payment information, or at least make a note or set a calendar reminder to cancel before the free period ends.

17. Refinance your mortgage

If you’re able to snag a lower interest rate, refinancing your mortgage can save you several hundred dollars each month. Use our mortgage refinance calculator to find out how much you could save. While refinancing comes with some initial costs upfront, they can be recouped over time, once you start paying less each month.

18. Set savings goals

Set a specific but realistic goal. It may be “save $5,000 in an individual retirement account this year” or “pay off my credit card debt faster.”

Use a savings goal calculator to see how much you’d have to save each month or year to reach your goal.

19. Track spending

Keep track of your monthly cash flow — your income minus your expenditures. This step will also make it easier to mark progress toward your savings goal. Try a budget app that tracks your spending. (NerdWallet has a free app that does just that.) Or you can follow these five steps to help track your monthly expenses .

Get a custom financial plan and unlimited access to a Certified Financial Planner™

NerdWallet Advisory LLC

20. Pay off high-interest debt

Debt payments can be a huge burden on your overall budget. If you can pay off high-interest debt more quickly through extra payments using the snowball or avalanche methods, you’ll save on total interest paid and free yourself from that burden sooner. Then, start putting the money into savings instead. If you don’t have disposable income to make extra payments, consider picking up a side hustle to make money to put toward your debt.

21. Keep savings in a high-yield savings account

As you work toward your financial goals , make sure to put your accumulating funds in a high-yield online savings account to maximize your money. Some of the best online accounts pay interest rates that are higher than the ones at large traditional banks.

22. Create a 50/30/20 budget

One smart way to manage your money — and hopefully hold on to more of it — is to follow a budget, which means setting priorities for your spending.

At NerdWallet, we recommend the 50/30/20 budget for money management. This approach means devoting 50% of your after-tax income to necessities, 30% to wants and 20% to savings and any debt payments. If one of your allocations exceeds these percentages, you can make some adjustments elsewhere.

23. Shop consignment and thrift stores

Shopping at thrift or consignment stores is a way to save money. Consignment stores sell items for you, giving you a cut of the money, whereas at thrift stores you shop used items. Platforms like ThredUp, an online consignment and thrift store, do both. You can buy used clothes as well as donate old clothes you don’t want and earn money or shopping credits.

Whether buying at a consignment or thrift store, compare prices to ensure you’re getting a reasonable discount.

Consider buying hobby supplies at a thrift store. That way, if you decide you want to drop the hobby, you haven’t spent tons on equipment.

24. Join initiatives to get free items

Initiatives like The Freecycle Network and Buy Nothing groups make it possible to get items you need for free. You can exchange items locally for free with the goal of reducing waste and helping the environment. If you're looking for free clothing , check out community swap events.

25. Use car sharing services

If you need to rent a car, consider nontraditional car-sharing services like Turo or Getaround. Look at these services as the Airbnbs of cars. Do your homework to see if car-sharing services work out cheaper than large, well-known rental services. If you don’t drive much because you work remotely or just choose not to have a car, you may also find using car-sharing services works out cheaper than owning a car or using taxis.

26. Stock up on household supplies when they’re cheap

It can feel like you’re constantly buying items like dishwashing soap, paper towels or toiletries. Track your inventory of household supplies and consider buying these items in bulk when they’re on sale. It may work out cheaper than rushing to buy them last-minute when they’re selling at full price. Amazon’s Subscribe & Save program can also be a way to get regular shipments of household supplies at a discount.

27. Enjoy community events

Getting out and having new experiences can be expensive. Find low-cost or free events in your community by checking listings at libraries, churches and websites like Eventbrite. Or enter your city and "events" in a search engine to find some things to do.

Community events can be an inexpensive way to keep kids engaged and spend quality time together. For outdoor events, pack snacks and water to minimize the amount you spend on food.

28. Cash in on your birthday

Once a year, set aside extra money by getting freebies and discounts on your birthday. You could get free food or rewards to redeem on clothing purchases. We compiled a list of dozens of companies that offer birthday freebies .

Saving from 10% to 20% of your paycheck is a solid goal, but the details can get more complicated. Learn how to determine the right amount of savings for you .

Saving money more quickly often starts with making sure your money is working for you by placing it in a high-yield savings account. Learn more about making your money work harder for you .

An emergency fund can be there for you when you face an unexpected cost or income loss. Building one starts with setting a savings goal and working toward it. Get more ideas about how to build an emergency fund of your own.

Saving from 10% to 20% of your paycheck is a solid goal, but the details can get more complicated. Learn how to determine the

right amount of savings for you

Saving money more quickly often starts with making sure your money is working for you by placing it in a high-yield savings account. Learn more about

making your money work harder for you

An emergency fund can be there for you when you face an unexpected cost or income loss. Building one starts with setting a savings goal and working toward it. Get more ideas about

how to build an emergency fund

of your own.

» Learn more: How to save money in Canada

on Capitalize's website

Get a custom financial plan and unlimited access to a Certified Financial Planner™ for just $49/month.

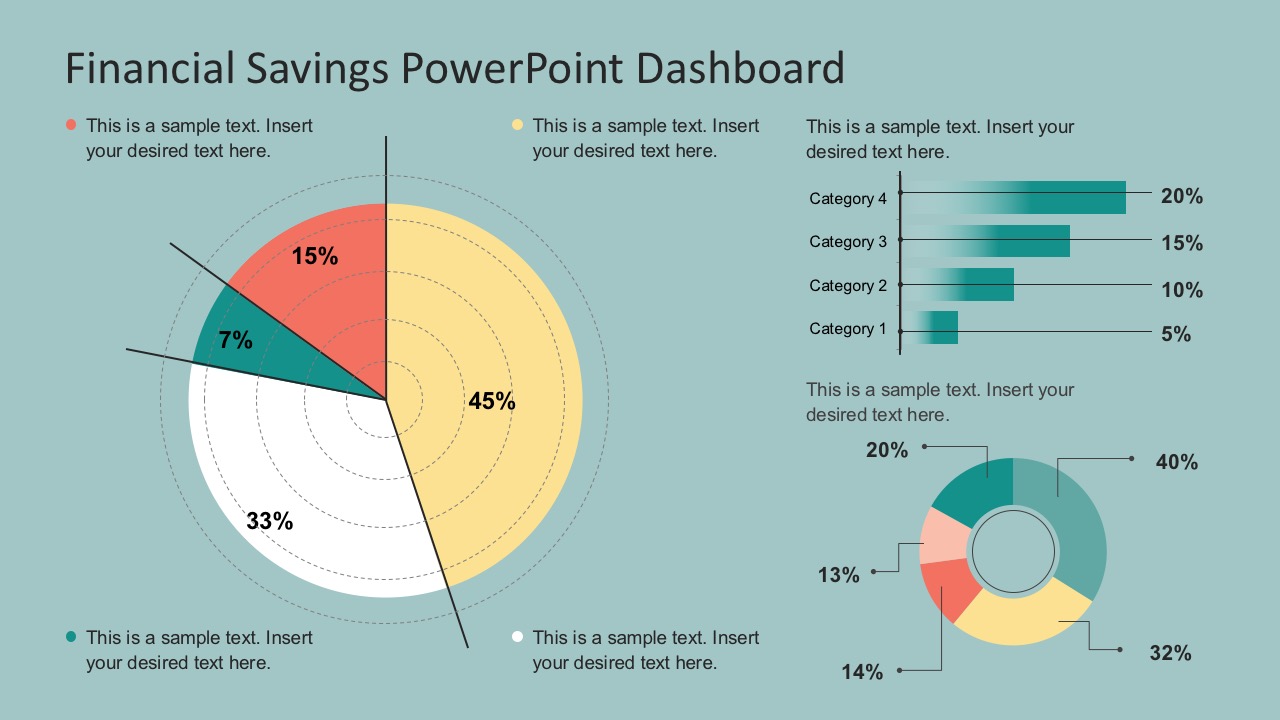

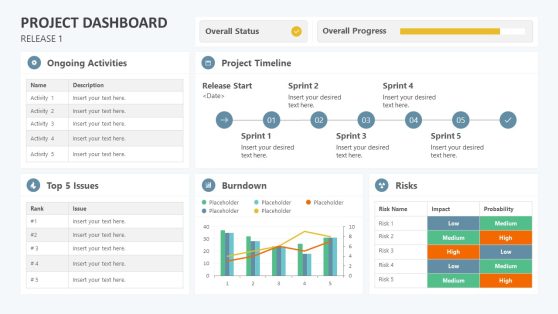

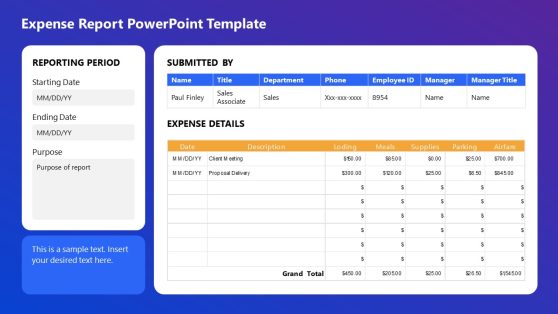

Home PowerPoint Templates Data & Charts Financial Savings PowerPoint Infographics

Financial Savings PowerPoint Infographics

Financial Savings PowerPoint Infographics is a 7-slide presentation template. The PowerPoint consists of charts, diagrams, clip arts, icons, and tons of high-quality graphics. The PowerPoint comes with dashboards and infographics that give direct analysis comparison. Hence, suitable for any savings and budget allocation purposes.

The financial presentation is usually uninteresting, but this template elevates from the standard. Because it includes flat colored icons and infographics, informative lists, numbers, definitions, and artsy clip arts in PowerPoint.

This Financial Savings PowerPoint Infographics gives a cool and interesting layout style. It contains numerous hand drawn icons on a nice light blue background. This gives the template a subtle approach that makes it easier to understand. Nonetheless, the slides are 100% vectors in PowerPoint. Thus, making the PowerPoint entirely editable and reconstructible.

Obviously, the PowerPoint presentation may be used for any financial project. For instance, report making and banking strategies. The users may add information concerning cash flow, personal banking, currency exchange, compensatory, currency rates, credits, budget allocation, deposits and many others of that kind.

Alternatively, subscribe and enjoy full access to our entire graphic design template gallery for PowerPoint and Google Slides. Use the slides to leverage resources and save hours of work.

You must be logged in to download this file.

Favorite Add to Collection

Details (7 slides)

Supported Versions:

Subscribe today and get immediate access to download our PowerPoint templates.

Related PowerPoint Templates

Retirement Planning PowerPoint Template

Project Management Dashboard PowerPoint Template

Expense Report PowerPoint Template

PowerPoint Car Dashboard Template

Money Powerpoint Templates and Google Slides Themes

Discover a wide range of professionally designed presentation templates tailored to help you effectively communicate financial data and strategies.

Explore Free Money Presentation Templates

Modern Illustrated Introduction to Taxation

Get ready to jazz up your finance meetings with our peach-toned, illustrated slideshow template, tailor-made for finance professionals. Whether you’re ... Read more

Minimal Intro to Investing Slides

Catch your audience’s attention with our vibrant Teal and White Minimal Corporate Powerpoint and Google Slides template. Ideal for career ... Read more

Geometric Cryptocurrency Slides

Elevate your financial presentations with this bold and modern PowerPoint and Google Slides template designed for businesses focusing on cryptocurrency ... Read more

Grey and Neon Yellow Minimalistic Modern Blockchain Company Pitch Deck

Make a lasting impression with these blockchain company pitch deck slides, simple to use as a Google Slides template, PowerPoint ... Read more

Green Finance Slides

This template is specifically designed for finance and professional lectures. With its dark style and daring decoration you'll impress your audience with your slides. Who says finance and economics have to be boring?. ... Read more

Professional designs for your presentations

SlidesCarnival templates have all the elements you need to effectively communicate your message and impress your audience.

Suitable for PowerPoint and Google Slides

Download your presentation as a PowerPoint template or use it online as a Google Slides theme. 100% free, no registration or download limits.

- Google Slides

- Editor’s Choice

- All Templates

- Frequently Asked Questions

- Google Slides Help

- PowerPoint help

- Who makes SlidesCarnival?

- Logged (Mobile/Tablet) Your Investments My Account Messages Settings History Log Out

- PRODUCTS Personal Loans Apply Now Debt Consolidation Loans Home Improvement Loans Medical Loans Dental Loans Special Occasion Loans Credit Card Apply Now Business Loans Get Started Student Loans Get Started with Sparrow Home Equity Apply Now Home Equity Line of Credit Home Equity Loans Invest Get Started

Calculators

- User (FirstName)

- Logged In (Desktop) Your Investments My Account Messages Settings History Log Out

How to Save Money: 20 Simple Ways

Whether you’re trying to pay off debt, save for a big purchase, or simply make ends meet, actively saving money should be a top priority. It’s the foundation for building long-term wealth and financial security.

But let’s be real—saving money can be a struggle sometimes, especially if you’re living paycheck to paycheck.

The good news is that there are plenty of strategies and small lifestyle adjustments you can make to stretch every dollar further. Use these tips to save more money each month:

In This Article

20 tips for maximizing savings

1. create a budget plan .

Creating a budget is the first and most important step toward figuring out how to save money. It helps you track your expenses, identify unnecessary discretionary spending, and prioritize your financial goals.

As you create your monthly budget, make saving a priority. Put down the amount you want to save each month before listing your rent or mortgage, the car payment and streaming services, and even before the amount you plan to spend on groceries.

This way, instead of saving only if there’s money left at the end of the month, you’ll do it consistently.

2. Set savings goals

It may sound like an easy step to skip, but setting savings goals can do wonders in helping you actually save money.

Because when you have a clear savings plan, you’re much more motivated to stash money away. This is one money mistake people often skip—not slowing down long enough to plan out some goals.

If you don’t already have an emergency fund , start there. In total, experts suggest having at least six months of living expenses tucked away in case you lose a job.

For example, when you need $3,000 monthly for essential expenses, you should put $18,000 away for a rainy day. However, you should adjust that goal based on job security. Self-employed workers, for example, might want to save more due to inconsistent income.

Once you reach the amount of emergency savings you’re comfortable with, you could devote a larger portion of that category to other goals like paying off a debt or saving for retirement.

3. Try a roundup program

Using a round-up savings tool can be a clever way to save money without even realizing it. Often called microsaving, it involves rounding your purchases up to the nearest whole dollar and having the spare change swept into your savings account.

While a few third-party savings apps have round-up programs, such as Acorns and Qapital, banks like Ally Bank and Bank of America also include them in their service offerings.

4. Turn saving into a game

Saving money doesn’t have to be a chore – in fact, turning it into a game can make the process fun and engaging. One way to do this is to set specific savings challenges for yourself or your family.

For example, you could try a “no-spend month” where you commit to buying only essentials, or you could compete with friends or family members to see who can save the most in a certain time period with a prize for the winner.

5. Cut down on some of your small daily expenses

While a $5 coffee or $10 lunch might not seem like much, these small daily expenses can add up quickly over time. If you spend just $20 per day on random purchases, that’s $7,300 per year that could be going towards your savings instead.

You shouldn’t cut out all of life’s daily luxuries–treating yourself to that weekly latte is fun and can bring you joy. But try to identify and reduce these types of expenditures where you can, if possible.

6. Refinance debt if you’re struggling to pay it off

If you are struggling with debt and finding it difficult to manage your monthly payments, refinancing or consolidating with a debt consolidation loan can provide some much-needed relief.

Refinancing involves obtaining a new loan to pay off your existing debt, which is usually at a lower interest rate. Alternatively, you can consolidate your debts through a credit card balance transfer .

7. Use cashback apps

Cashback apps can be a great way to stretch your budget further and earn rewards for purchases you already planned to make. Most cashback apps allow you to earn money back on your purchases, either in cash or gift cards, simply by using the app to shop at participating stores.

There are a variety of cashback apps available, such as Rakuten, Ibotta, and Dosh, and they each have unique features and rewards.

For example, Rakuten offers cashback on purchases made through its app, as well as exclusive deals and discounts. In contrast, Ibotta offers cashback on grocery purchases, and Dosh offers cashback on travel and hotel bookings.

8. Consider your streaming subscriptions

One of the ways to learn how to live on a budget and save money is to consider your stream subscriptions. 95% of people now pay for more than one streaming service each month, according to a Forbes Home survey

Evaluate what you actually watch and which streaming services can be canceled or at least paused while you focus on your financial goals, such as building up an emergency fund or paying off your credit card debt.

9. Adjust the temperature

Small tweaks to your home’s temperature can dramatically reduce your utility bill. According to the U.S. Department of Energy , you can save as much as 10% yearly on heating and cooling by simply turning your thermostat back 7° to 10°F for eight hours a day from its normal setting.

10. Save your tax refund

If you’re getting a tax refund this year , make a plan to put it directly into a high-yield savings account. Even if you need to use some of it to pay down debt or buy a new car, ensure it goes into savings first.

This is because simply seeing that account balance rise and feeling the emotional satisfaction of having money saved may just be the momentum for a continued commitment to making saving money a part of your everyday life.

11. Shop around for insurance

Most experts recommend shopping around for insurance at least once a year to ensure you’re still getting the best deal. Whether it’s a car or home, research different insurance companies online and request quotes from a few of them.

Look into any discounts or special offers that may be available–and don’t be afraid to negotiate with providers to try and get a better rate or coverage package that works for you.

12. Increase your income

If your expenses are about as low as they can go, and you’re still struggling to make ends meet, it may be time to look for ways to increase your income. This can be done in several ways, depending on your skills, interests, and resources.

One approach is to look for ways to earn extra money on the side. This might include picking up a part-time job, starting a small business, or freelancing in your area of expertise.

Another option is to consider ways to boost your earning potential in your current job. This could involve investing in training to develop new skills, networking with colleagues or industry professionals, or taking on additional responsibilities to demonstrate your value to your employer.

13. Reward yourself along the way

Saving money doesn’t mean you have to deprive yourself of all the things you enjoy. It’s important to leave some room in your budget for fun and relaxation so you don’t get burnt out or discouraged.

Think of saving as a healthy lifestyle change rather than a strict diet. Celebrate your progress along the way by treating yourself to small rewards when you reach important milestones.

14. Follow the 50/30/20 budget rule

The 50/30/20 rule is a budgeting method that states you should spend 50% of your income on living expenses, 30% on nonessential spending and 20% on saving or paying off debt.

For example, if you earn $3,000 after-tax per biweekly paycheck, here’s how the budget would play out:

- 50% (needs): $1,500 for housing, food, gas, insurance, cable, wireless, minimum payments for loans or credit cards and other essential bills.

- 30% (wants): $900 for nonessentials like takeout, entertainment and more.

- 20% (saving and debt): $600 for emergency and retirement savings or debt repayment.

Notice that you have some flexibility to split up the 20% saving percentage category based on your goals. If your emergency fund is running low, you might decide to focus a larger portion of that 20% on growing your rainy-day fund.

And if saving a full 20% is difficult, you can work up to that amount as you get raises, promotions, or grow your income through different side hustles.

15. Decide where to put your savings

The right place to put your savings will depend on what the savings are for. When it comes to spare cash, it’s a good idea to keep a bit of emergency savings in an account where you can draw money quickly in a pinch without penalty.

For money you don’t need regular access to, investment accounts may provide you with a higher return on your money—but also note that investments in stocks, bonds or funds can lose value if the market goes through a downturn.

Here are the types of accounts to consider:

- High-yield savings accounts: Offer a higher-than-average Annual Percentage Yield (APY) than traditional savings accounts.

- Tiered savings accounts: Offer an APY that increases incrementally as your balance grows.

- Certificates of deposit (CDs): Offer a fixed interest rate for a fixed term. CDs are good for savings you don’t need because withdrawing money early could result in a penalty fee.

- Retirement accounts: Tax-advantaged accounts like 401(k)s, IRAs or Roth IRAs are places to park long-term retirement savings and earn a return on money invested.

- Brokerage accounts: Taxable accounts don’t offer the same tax advantages as retirement accounts but could be another place to invest long-term savings for wealth building and other goals.

16. Avoid bank fees

Do you know if you’re paying any bank fees? If you’re not sure, take a moment to log into your account.

Many traditional banks charge fees for monthly maintenance, overdrafts and ATMs—and you may not even realize they’re draining your account until you review your transactions.

If you check your account and you’re paying fees, consider switching banks. Many online banks offer accounts with low or no fees. Even if you avoid a $10 charge per month, that’s $120 you can put in savings.

17. Automate your savings

Saving money in an account that’s connected to your checking account can be convenient—but you may also be tempted to transfer money out for non-emergencies.

Setting up automatic transfers from your checking account into a high-yield savings account could help you earn a greater return on your money. And when money is in an account that’s less accessible, it could be easier to save without dipping into your cash.

18. Save for retirement

If your employer offers a 401(k) or similar retirement plan with a matching contribution, make sure you’re contributing enough to take full advantage of this benefit. Employer matching is essentially free money that can boost your retirement savings over time.

For example, if your employer matches 50% of your contributions up to 6% of your salary, and you earn $50,000 annually, you could receive an additional $1,500 in your retirement account each year just by contributing $3,000 of your own money.

It’s recommended to devote 10% to 15% of your pre-tax income to retirement (including employer contributions) each year. You can work up to that amount if you can’t save that much for retirement immediately.

19. Take advantage of community resources

Before paying full price for any activity or event, always check with your local library, community center, or tourism office to see if they offer any discounts or free passes.

Many cities have free events and activities to enjoy without spending a dime. Even for attractions that typically cost money, such as museums, aquariums, and zoos, you can often find coupons, discounts, or free days throughout the year.

For example, national parks across the United States offer several fee-free days each year, allowing you to explore these beautiful natural wonders without paying the usual entrance fees.

Some libraries can also get you free access to the area’s top attractions. For instance, if you have a Seattle Public Library card, you can access the Museum Pass program, which provides free tickets to popular attractions like the Seattle Aquarium, Woodland Park Zoo, and various museums that typically cost $25 or more per person.

20. Research government programs

In addition to finding ways to increase your income, it’s also worth exploring government programs that can help alleviate financial strain. Depending on your circumstances, there may be various federal or state programs that can provide financial assistance or other types of support.

For example, if you’re struggling to pay for basic needs like food or housing, you may be eligible for programs like SNAP (Supplemental Nutrition Assistance Program) or the Housing Choice Voucher Program (previously Section 8).

If you’re unemployed or underemployed, you may be able to receive benefits through programs like unemployment insurance or job training programs.

Learning how to save money is a cornerstone of any financial plan

The road to building wealth and financial freedom starts with consistently saving money, even if it’s a small amount initially.

By developing smart money habits, cutting costs where you can, and making savings a priority, you’re setting yourself up for long-term success.

Frequently asked questions on how to save money

How can i save money on a tight budget .

Living on a tight budget doesn’t mean you can’t save money. The key is creating a monthly budget, identifying any areas where you can cut back on discretionary spending, and making savings a top priority.

Even saving just $25-$50 per paycheck can make a difference over time. Other tips include reducing energy costs, cutting daily expenses like coffee runs, and taking advantage of cashback offers.

What is an emergency fund?

An emergency fund is a stash of easily accessible cash reserves that can cover your essential living expenses in case of job loss, medical emergency, home repair, or another unexpected event.

Most experts recommend saving three to six months’ worth of living expenses for this rainy-day fund to give you a proper safety net.

How much of my paycheck should I save each month?

The 50/30/20 budgeting method recommends setting aside 20% of your monthly after-tax income for savings and debt repayment.

If that’s not feasible, start with a percentage you can commit to and aim to increase it by 1% to 2% annually until you hit the 20% goal. Factors like your current savings, future goals, and job security may impact how much you should target.

Written by Cassidy Horton | Edited by Rose Wheeler

Cassidy Horton is a finance writer who’s passionate about helping people find financial freedom. With an MBA and a bachelor’s in public relations, her work has been published over a thousand times online by finance brands like Forbes Advisor, The Balance, PayPal, and more. Cassidy is also the founder of Money Hungry Freelancers, a platform that helps freelancers ditch their financial stress.

- How to Make a Financial Plan

- The Ultimate Guide to Budgeting and Saving

- How to Handle Unexpected Expenses

- 3 Tips for Your Financial Spring Cleaning

How to Teach Kids About Money and Finances

All personal loans made by WebBank.

RELATED ARTICLES

How to Build an Emergency Fund on a Tight Budget

Self-Employed Retirement Plans: How to Build Your Nest Egg

JOIN OUR MAILING LIST

Get the latest news & trends delivered to your inbox.

Please enter a valid email

Back to top

What to Do if You Can’t Pay Your Credit Card

How Does Debt Impact Your Ability to Buy a House?

The Pros and Cons of a Joint Personal Loan

Explore topics

Home ownership, credit management, financial wellness, investor center, investor center.

- Preferences

8 Best Strategies To Save Money Every Month Like a Pro

Saving money is a skill that everyone should learn and practice. Whether you are looking to build an emergency fund, save for a big purchase, or just want to have some extra cash, there are many ways to save money. In this article, we will discuss some strategies to save money. In this article, you will discover why saving money is crucial and how to start saving for enhanced financial security. – PowerPoint PPT presentation

- Saving money is a skill that everyone should learn and practice. Whether you are looking to build an emergency fund, save for a big purchase, or just want to have some extra cash, there are many ways to save money. In this article, we will discuss some strategies to save money. In this article, you will discover why saving money is crucial and how to start saving for enhanced financial security.

- Why Should You Focus On Saving Money?

- Saving money is essential in the modern world for several reasons. In todays economy, where the cost of living is constantly rising, its becoming challenging for many people to make ends meet. Saving money helps individuals and families plan for the future, reduce financial stress, and achieve long-term goals. Here are some of the benefits of saving money

- Building Financial Security

- Saving money is a critical step toward building financial security. By having a savings account, you can prepare for unexpected expenses such as medical emergencies or car repairs. An emergency fund can help you avoid high-interest credit card debt or the need to borrow money from family and friends. Furthermore, a nest egg can help you feel more secure about your financial future and reduce stress levels.

- Achieving Long-Term Goals

- Saving money also helps you achieve your long-term goals. Whether saving for a down payment on a home, starting a business, or planning for retirement, saving money is a crucial step toward achieving these goals. Setting aside a portion of your monthly income allows you to gradually build up the funds you need to accomplish your objectives.

- Planning for Retirement

- Saving for retirement is becoming increasingly important as people live longer, and government- funded retirement programs are becoming less generous. By saving money regularly, you can accumulate a significant nest egg to help you retire comfortably. Furthermore, by investing your savings in retirement accounts such as 401(k) plans or individual retirement accounts (IRAs), you can use compound interest to help your money grow over time.

- Reducing Financial Stress

- Saving money can also help reduce financial stress. Many people experience anxiety and worry about their financial situation, negatively impacting their mental health and overall well-being. A savings account can provide a sense of security and peace of mind, knowing you have money set aside for unforeseen circumstances.

- Managing Debt

- Saving money can also help you manage your debt. By having an emergency fund, you can avoid taking on high-interest credit card debt to cover unexpected expenses. Additionally, by saving money, you can pay off debt more quickly, as youll have extra funds available to make larger paymentsthis can help you get out of debt faster and reduce the amount of interest you pay over time.

- Set a Budget

- The first step to saving money is to set a budget. A budget will help you track your expenses and determine where to cut back. Start by listing all your monthly payments, including rent or mortgage, utilities, groceries, transportation, and other bills. Then, remove your expenses from your income to determine how much money you have left over. If your expenses exceed your income, its time to make some changes.

- Cut Back on Unnecessary Expenses

- Once your budget is set, its time to look for areas where you can cut back. For example, you can save money by eating at home instead of going out to eat, canceling subscriptions you dont use, or shopping for sales at the grocery store. You might also consider downgrading your cable or internet plan or using public transportation instead of driving. Every little bit helps, so look for opportunities to save wherever possible.

- When it comes to shopping, there are many ways to save money. Start by listing what you need before you go to the store, and stick to it. Avoid impulse buys and try to shop for sales and discounts. Consider buying in bulk, as this can save you money in the long run. When shopping for clothes or household items, consider buying used or shopping at thrift stores.

- One of the biggest obstacles to saving money is debt. If you have credit card debt or other loans, paying them off as quickly as possible is essential. Make a plan to pay off your debt, and stick to it. Consider consolidating your debt or negotiating with creditors to reduce interest ratesby avoiding debt, you will have more money to put toward savings.

- Build an Emergency Fund

- An emergency fund is money set aside for unexpected expenses, such as car repairs or medical bills. Without an emergency fund, you might have to rely on credit cards or loans to pay for these expenses, which can quickly add up. Try saving at least 3-6 months expenses in your emergency fund. Start by setting aside a small amount each month, and gradually increase your contributions as you can.

- Automate Your Savings

- One of the easiest ways to save money is to automate your savings. Set up automatic monthly transfers from your checking account to your savings account. This way, you wont have to remember to save money and will be less likely to spend it. You might also consider setting up a direct deposit from your paycheck to your savings account.

- Plan for the Future

- Saving money isnt just about the present its also about planning for the future. Start by setting long-term goals, such as saving for a down payment on a house or retirement. Then, create a plan to achieve these goals. Consider opening a retirement account or investing in stocks or mutual funds. The earlier you start saving for the future, the more time your money will have to grow.

- Find Ways to Earn More Money

- If you are struggling to save money, consider finding ways to earn more money. You might take on a part-time job, sell items you no longer need, or start a side hustle. Look for opportunities to make extra money that fits your schedule and interests.

8 Simple ways to save money

The content is not mine. This is just a sample Powerpoint presentation for my client to appreciate. Read less

Recommended

More related content, what's hot, what's hot ( 20 ), viewers also liked, viewers also liked ( 18 ), similar to 8 simple ways to save money, similar to 8 simple ways to save money ( 20 ), recently uploaded, recently uploaded ( 20 ).

- 1. Simple Ways To Save Money Source of Article: https://www.bankofamerica.com/deposits/manage/ways-to-save-money.go

- 2. Record your expenses Source of Article: https://www.bankofamerica.com/deposits/manage/ways-to-save-money.go

- 3. That means every coffee, every newspaper and every snack you purchase for the entire month. Source of Article: https://www.bankofamerica.com/deposits/manage/ways-to-save-money.go

- 4. For example, gas, groceries, mortgage and so on. Get the total amount for each. Source of Article: https://www.bankofamerica.com/deposits/manage/ways-to-save-money.go

- 5. Make a budget Source of Article: https://www.bankofamerica.com/deposits/manage/ways-to-save-money.go

- 6. Remember to include expenses that happen regularly, but not every month, like car maintenance check-ups. Source of Article: https://www.bankofamerica.com/deposits/manage/ways-to-save-money.go

- 7. Plan on saving money Source of Article: https://www.bankofamerica.com/deposits/manage/ways-to-save-money.go

- 8. Source of Article: https://www.bankofamerica.com/deposits/manage/ways-to-save-money.go Taking into consideration your monthly expenses and earnings, create a savings category within your budget and try to make it at least 10-15 percent of your income.

- 9. Source of Article: https://www.bankofamerica.com/deposits/manage/ways-to-save-money.go If your expenses won't let you save that much, it might be time to cut back. Look for non-essentials that you can spend less on—for example, entertainment and dining out—before thinking about saving money on essentials such as your vehicle or home.

- 10. Set savings goals Source of Article: https://www.bankofamerica.com/deposits/manage/ways-to-save-money.go

- 11. Setting savings goals makes it much easier to get started. Begin by deciding how long it will take to reach each goal. Source of Article: https://www.bankofamerica.com/deposits/manage/ways-to-save-money.go Some short-term goals (which can usually take 1-3 years) include: • Starting an emergency fund to cover 6 months to a year of living expenses (in case of job loss or other emergencies) • Saving money for a vacation • Saving to buy a new car • Saving to pay taxes (if they are not already deducted by your employer)

- 12. Decide on your priorities Source of Article: https://www.bankofamerica.com/deposits/manage/ways-to-save-money.go

- 13. Different people have different priorities when it comes to saving money, so it makes sense to decide which savings goals are most important to you. Source of Article: https://www.bankofamerica.com/deposits/manage/ways-to-save-money.go

- 14. Source of Article: https://www.bankofamerica.com/deposits/manage/ways-to-save-money.go Part of this process is deciding how long you can wait to save up for a goal and how much you want to put away each month to help you reach it.

- 15. Source of Article: https://www.bankofamerica.com/deposits/manage/ways-to-save-money.go Remember that setting priorities means making choices. If you want to focus on saving for retirement, some other goals might have to take a back seat while you make sure you're hitting your top targets.

- 16. Different savings and investment strategies for different goals Source of Article: https://www.bankofamerica.com/deposits/manage/ways-to-save-money.go

- 17. If you're saving for short-term goals, consider using these FDIC-insured deposits accounts: Source of Article: https://www.bankofamerica.com/deposits/manage/ways-to-save-money.go • A regular savings account, which is easily accessible • A high-yield savings account, which often has a higher interest rate than a standard savings account • A bank, which money market savings account as a variable interest rate that could increase as your savings grow • A CD (certificate of deposit), which locks in your money at a specific interest rate for a specific period of time

- 18. For long term goals consider: Source of Article: https://www.bankofamerica.com/deposits/manage/ways-to-save-money.go • FDIC-insured IRAs, which are built for purposes such as retirement savings. If you’re not sure how much money you should set aside for retirement, give the Merrill Edge retirement calculator a try. • Securities, like stocks and mutual funds. These investment products are available through investment accounts with a broker-dealer (e.g. Merrill Edge). Remember that securities, such as stocks and mutual funds, are not insured by the FDIC, are not deposits or other obligations of a bank and are not guaranteed by a bank, and are subject to investment risks including the possible loss of principal invested.

- 19. Make saving money easier with automatic transfers Source of Article: https://www.bankofamerica.com/deposits/manage/ways-to-save-money.go

- 20. Source of Article: https://www.bankofamerica.com/deposits/manage/ways-to-save-money.go Automatic transfers to your savings account can make saving money much easier. By moving money out of your checking account, you'll be less likely to spend money you wanted to use for savings.

- 21. Source of Article: https://www.bankofamerica.com/deposits/manage/ways-to-save-money.go There are many options for setting up transfers. You choose how often you want to transfer money and which accounts you want to use for the transfers.

- 22. Source of Article: https://www.bankofamerica.com/deposits/manage/ways-to-save-money.go Thinking of saving as a regular expense is a great way to keep on target with your savings goals.

- 23. Watch your savings grow Source of Article: https://www.bankofamerica.com/deposits/manage/ways-to-save-money.go

- 24. Source of Article: https://www.bankofamerica.com/deposits/manage/ways-to-save-money.go Check your progress every month. Not only will this help you stick to your personal savings plan, but it also helps you identify and fix problems quickly. With these simple ways to save money, it may even inspire you to save more and hit your goals faster.

- 25. Source of Article: https://www.bankofamerica.com/deposits/manage/ways-to-save-money.go END OF PRESENTATION. THANK YOU. POWERPOINT DESIGN BY JENY LYN RUELO

For Teachers

Home » Teachers

Teaching by Topic: Saving

Here are a bunch of tips, learning objectives, worksheets, and pre-built lesson plans to help you build your curriculum to teach students how to save money!

Saving money can be the difference between having financial success and not. The earlier students learn about saving, the better. Teachers and homeschoolers can help students reach their potential through direct instruction, engaging activities, and reliable assessments.

You can find the materials you need to teach saving, regardless of your students’ levels. Here are saving-related lessons, worksheets, activities and games, and tips for each grade. We also include saving learning objectives for each grade, which are pulled straight from the National Standards for Personal Finance Education.

National Standards for Personal Finance Education

Download our free teachers' cheat sheet.

Our free cheat sheet covers every learning objective in the National Standards for Personal Finance Education and the corresponding Kids' Money Lesson Plans - we cover each and every standard!

Learning Objectives

Pre-K students understand how saving can benefit them, and they learn about the value of money. They should be able to:

- Describe ways that people can decrease expenses to save more of their money.

- Map out a savings plan.

Pre-K Saving Lesson Plans

- KMLP Pre-K – Ways to Use Money : Students get to decorate their very own Save, Spend, Give jars to get an idea of where to put money, with goal-setting charts for their savings objectives. They complete class tasks, receive play money as income and choose what to spend it on at the classroom store.

Pre-K Saving Worksheets

- Money Name Matching

- Color the Money

- Money Value Match

- Make Your Own Play Money

Pre-K Saving Games and Activities

- Peter Pig’s Money Counter

- Wise Pockets

- Fruit Shoot Coins

- U.S. Mint games

Tips for Teaching Saving to Pre-K Students

- Every exposure to saving counts, from coloring to cartoons.

- Give your pre-K students ownership and choice in their learning.

- Don’t be afraid to use technology, even at this age.

For more resources on other topics, check out our Pre-K Money Lesson Plans Center .

Kindergarten