- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Premium News

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Personal Loans

- Student Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Asking for a Trend

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Recap: meta reports strong q3 earnings beat, mark zuckerberg talks ai, threads, and hiring faster next year.

Meta Platforms reported third-quarter earnings that beat analysts' revenue and profit estimates.

In the earnings call, Mark Zuckerberg discussed AI, how Threads is doing, and plans to hire faster in 2024.

Meta's CFO said the company is seeing "softer" ad spend in the fourth quarter coinciding with the Israel-Hamas war.

Meta Platforms reported third-quarter earnings after the closing bell Wednesday that beat analysts' revenue and profit estimates.

The beat was driven by a continued rebound in Meta's advertising business following a sharp slowdown throughout 2022. Meta's guidance on its 2023 and 2024 expenses also hit the sweet spot for investors, as it signaled that it can balance its "year of efficiency" cost cutting efforts while it continues to invest in the metaverse and artificial intelligence.

Shares initially jumped in after-hours trading, but dipped into the red as the earnings call progressed. Meta's stock was trading down more than 3% following the end of the call. Meta CFO Susan Li said the company has seen "softer" ad spend so far in the fourth quarter coinciding with the Israel-Hamas war. Li warned that 2024 will be volatile in terms of the broader economy, and the company is exposed to that as an advertising giant.

Zuckerberg closes out the call saying AI will 'transform' how people use Meta's apps.

The executive says that, over time, Meta will be able to use artificial intelligence to create content for people on its family of apps based on their interests.

Meta's stock dips into red in after-hours trading near the end of the call.

The stock was trading down nearly 1% going into the last analyst question after initially popping on Meta's earnings results.

Meta CFO says Meta is seeing more volatility early in Q4, including softer ad spend.

Susan Li says the company is seeing less ad spending in part due to the Israel-Hamas war. The executive says the company saw a similar impact from the war in Ukraine.

Snap issued a similar warning in its earnings on Tuesday.

Zuckerberg pitches his open-source strategy for AI models.

The Meta CEO says that when his engineers create open AI models that are used by other engineers, it works as free advertising for bringing in top talent in the field.

Meta CFO lays out 4 hiring priorities for 2024.

Next year, the company will be hiring most in AI, monetization, metaverse and reality labs, and regulatory compliance needs.

Much of the hiring budgeted for in 2023 will happen in 2024, Susan Li says.

Zuckerberg is still happy with Threads.

"From what we can tell, people love it so far," Zuckerberg says.

The Meta CEO says the app has just under 100 million monthly active users and he hopes to create an app that would encompass one billion users.

Threads was launched earlier this year and has become an alternative to X, formerly known as Twitter.

Zuckerberg says Meta is deprioritizing some non-AI projects to focus on the big prize.

The CEO said AI will be one of the company's biggest investment areas. Meta is racing to compete in the AI arms race with Google and Microsoft.

Meta might be hiring faster next year to work through a sizable 'hiring backlog,' Zuckerberg says.

The company executed a series of layoffs this year, eliminating tens of thousands of roles.

Mark Zuckerberg's Year of Efficiency 'is morphing into the Years of Efficiency,' ISI Evercore analyst Mark Mahaney says.

The company has made a series of cutbacks, including layoffs and cutbacks on office space and perks, since Zuckerberg announced the "year of efficiency" earlier this year.

In an overall positive third quarter earnings report, Meta notes it is currently in a fight with the Federal Trade Commission.

The FTC "is seeking to substantially modify our existing consent order and impose additional restrictions on our ability to operate," Meta says.

The company in 2020 entered into a consent decree with the FTC and agreed to pay a $5 billion civil penalty related to charges first made in 2012 over user privacy and data. Earlier this year , the FTC said it wanted Meta to expand its privacy protections for underage users of its virtual reality products, while limiting the company's use of facial recognition technology.

"We are contesting this matter, but if we are unsuccessful it would have an adverse impact on our business," Meta says Wednesday.

Mark Zuckerberg will speak for the first time since 33 states sued the company.

A bipartisan group of US state attorneys general announced on Tuesday that they are suing Meta, alleging Facebook and Instagram are harming young people's mental health by designing intentionally addictive features on the platforms.

At the time, a Meta spokesperson said the company has introduced dozens of tools to help support teens.

"We're disappointed that instead of working productively with companies across the industry to create clear, age-appropriate standards for the many apps teens use, the attorneys general have chosen this path," the company said.

Zuckerberg could be asked about the lawsuit during the earnings call.

Meta 'may be starting to come out of the woods,' Investing.com's Jesse Cohen says.

"All in all, it was a blowout quarter with Meta reporting its most profitable quarter in years," Cohen says in a note following the earnings release. "Investors have been encouraged by aggressive cost-cutting initiatives implemented by CEO Mark Zuckerberg in recent months."

Meta stock pops 4% after earnings beat.

Meta stock popped about 4% after it reported better than expected third-quarter earnings results. The gain essentially wiped out the stock's loss of about 4% during Wednesday's regular trading session. That rise has since been whittled down to about 2% as investors await the earnings conference call.

Meta reports profit and revenue that beat estimates.

3rd quarter results

Revenue: $34.15 billion, vs $33.52 billion estimate

Earnings per share: $4.39, vs $3.70 estimate

Facebook daily active users: 2.09 billion, vs 2.07 billion estimate

Facebook monthly active users: 3.05 billion, vs 3.05 billion estimate

Family of apps revenue: $33.94 billion, vs $33.08 billion estimate

4th quarter guidance

Revenue: $36.5 billion to $40 billion, vs estimate of $38.76 billion

Full-year 2023 guidance

Total expenses: $87 billion to $89 billion, vs $89.76 billion estimate

Full-year 2024 guidance

Total expenses: $94 billion to $99 billion

Estimate Source: Bloomberg

Goldman Sachs says Meta stock is a buy before earnings

Meta offers a positive risk/reward profile heading into earnings, and its "revenue growth remains on a re-acceleration trajectory," according to a recent note from Goldman Sachs.

"The stock is inexpensive on forward price-to-earnings multiples and management has reset the cost base to align with a mixture of compounded earnings growth while also maintaining a robust investment cadence in long-term initiatives such as AI and the metaverse," it said.

The bank rates Meta at "Buy" with a $384 price target, representing potential upside of 22%.

Meta stock slides 4% heading into earnings.

Meta stock is down about 4% heading into its third-quarter earnings report this afternoon.

The decline is nearly double the Nasdaq 100's decline of about 2.2% and is in-line with the 4% decline seen in the communications sector, of which Meta and Alphabet are the biggest components.

Alphabet's 10% decline today after its earnings results has dragged down the entire sector. But Deepwater Asset Management managing partner Gene Munster said Alphabet's solid advertising results are a "slight positive" for Meta heading into its earnings report.

Despite today's decline, Meta stock is still up 151% year-to-date and is up 243% from its 52-week low, making it one of the best-performing mega-cap stocks since the bear market bottom in October 2022.

All eyes on Meta's 2024 expense guidance as Wall Street sees $100 billion.

Analysts at Bank of America said in a recent note that Meta's 2024 forecast for its expenses will be closely watched by investors.

The bank expects the social media company to guide expenses at $100 billion, which is in line with JPMorgan's 2024 estimate of $96 billion-$102 billion.

Additionally, Bank of America said that solid fourth-quarter guidance and positive management commentary on Reels could drive further upside to Meta's stock.

"Our checks suggest Meta is benefitting from improving digital ad market, ramping Reels monetization and improving AI driven ad measurement," analysts said. "Reels and AI should fuel third-quarter growth."

JPMorgan says advertising trends have been improving.

Solid advertising revenues should enable Meta to beat analysts' revenue and profit estimates, according to a recent note from JPMorgan.

The bank expects third-quarter revenue to jump 22% year over year to $33.8 billion, and for the company to forecast 2024 total expenses at $96 billion-$102 billion.

"We like Meta and believe valuation remains compelling... For Q3 specifically, ad checks have been positive, both from a macro perspective and in terms of Meta-specific initiatives like Advantage+, Reels, and Click-to-Message ads," JPMorgan said.

JPMorgan rates Meta at "Overweight" with a $324 price target, representing potential upside of 7% from current levels.

Meta has to delicately balance its 'year of efficiency' with investments in AI.

Meta's disastrous 2022, in which its stock price plunged more than 70%, led CEO Mark Zuckerberg to announce a "year of efficiency," in which the company would significantly cut back on costs.

But with the arrival of generative artificial intelligence, Meta has to increase its investments in order to remain competitive.

According to Morningstar, management has to delicately balance its cost cutting plans with the need to invest heavily in AI.

"We'd like the firm to discuss its latest plans for the metaverse , and whether it will relaunch with its aggressive investments on that front. We think artificial intelligence is an important component of the metaverse," Morningstar said in a recent note.

UBS says Reels on Instagram is outperforming TikTok.

According to a recent note from UBS, channel checks by the bank indicate that "Reels is outperforming TikTok with lower CPMs and much improved engagement."

That's great news for Meta, given that TikTok has been viewed as one of the company's top risks in the competition for more eyeballs.

The bank said the apps' share of downloads have been rising for Instagram and Facebook , to 18% and 19% respectively, while TikTok has seen its download share fall to 22% from above 25% last year.

In Meta's post-earnings conference call, UBS also wants the social media giant to offer more details about its initiatives in artificial intelligence, including how and when it plans to make money off of the new technology.

"We think the GenAI consumer app bull case is still under-appreciated and not priced into shares. We think more disclosure on GenAI product uptake and eventual monetization could bolster confidence in the durability of top line growth, driving multiple expansion," UBS said.

Meta's consensus third-quarter revenue estimate is $33.52 billion.

3rd quarter

Revenue estimate $33.52 billion (Bloomberg Consensus)

Advertising rev. estimate $32.94 billion

Family of Apps revenue estimate $33.08 billion

Reality Labs revenue estimate $313.4 million

Other revenue estimate $211.7 million

Facebook daily active users estimate 2.07 billion

Facebook monthly active users estimate 3.05 billion

Ad impressions estimate +29.6%

Average price per ad estimate -8.94%

Family of Apps operating income estimate $15.23 billion

Reality Labs operating loss estimate $3.94 billion

Average Family service users per day estimate 3.09 billion

Average Family service users per month estimate 3.88 billion

EPS estimate $3.60

Operating margin estimate 33.9%

Full-year 2023

Total expenses estimate $89.76 billion

Capital expenditure estimate $29.31 billion

Source: Bloomberg

Read the original article on Business Insider

- Share full article

Advertisement

Supported by

Meta’s Profit Slides by More Than 50 Percent as Challenges Mount

The social networking company, which is trying to shift into the so-called metaverse, posted falling sales and said it was “making significant changes” to operate more efficiently.

By Ryan Mac

Ryan Mac is a technology reporter in Los Angeles.

A year ago, Mark Zuckerberg changed Facebook’s name to Meta and said he was going all in on the immersive digital world of the so-called metaverse.

Since then, Meta has plowed billions of dollars into, and restructured itself around, the emerging technology — just as the global economy has slowed, inflation has soared and investors have begun paying more attention to costs.

The combination has been nothing short of disastrous . This year, Meta’s earnings have been hit hard by its spending on the metaverse and its slowing growth in social networking and digital advertising. In July, the Silicon Valley company posted its first sales decline as a public company. Its stock has plunged more than 60 percent this year.

On Wednesday, Meta continued that trajectory and indicated that the decline would not end anytime soon. It said it would be “making significant changes across the board to operate more efficiently,” including by shrinking some teams and by hiring only in its areas of highest priority.

The company reported a 4 percent drop in revenue for its third quarter — to $27.7 billion, from $29 billion a year earlier. Net income was $4.4 billion, down 52 percent from a year earlier. Spending soared by 19 percent.

The company’s metaverse investments remained troubled. Meta said its Reality Labs division, which is responsible for the virtual reality and augmented reality efforts that are central to the metaverse, had lost $3.7 billion compared with $2.6 billion a year earlier. It said operating losses for the division would grow “significantly” next year.

For the current quarter, Meta forecast revenue of $30 billion to $32.5 billion, which would be down from a year ago. The company’s shares fell more than 19 percent in after-hours trading.

The results exacerbate what has been one of the most tumultuous years for Mr. Zuckerberg and his company since Facebook remade itself as a mobile-oriented company a decade ago. Over the past few months, Meta has frozen most hiring , reduced budgets and begun identifying low-performing employees, indicating the possibility of layoffs. In June, Mr. Zuckerberg said on a call with employees that “there are probably a bunch of people at the company who shouldn’t be here.” Meta had 87,314 employees at the end of September, up 28 percent from a year ago.

Mr. Zuckerberg has had trouble getting even his own employees to buy into his metaverse vision. The company’s new focus has been confusing , employees have said, with disagreements between executives, frequent strategy shifts and a little-used flagship virtual reality game, Horizon Worlds.

Mr. Zuckerberg was defiant on a call with analysts on Wednesday. He said people would “look back decades from now” and “talk about the importance of the work that was done here” regarding the metaverse, virtual reality and augmented reality.

“Look I get that a lot of people might disagree with this investment,” he said. “But from what I can tell, I think this is going to be a very important thing and I think it would be a mistake for us to not focus on any of these areas, which I think are going to be fundamentally important to the future.”

Meta’s financial difficulties stand out because of its size and its position as one of the world’s foremost tech companies. Its woes also reflect a difficult environment that has engulfed other social media companies. Digital advertising has been hurt by global economic jitters as brands reassess their budgets. The companies are also continuing to deal with privacy changes by Apple that have made it harder for them to target their digital advertising.

Last week, Snap, the maker of Snapchat, reported its slowest-ever quarterly growth , and its stock has fallen more than 75 percent this year. Twitter is in what may be the final throes of an acquisition by Elon Musk, the world’s richest man, which is likely to radically change the company as it goes private.

Meta faces other challenges, including tough regulatory scrutiny. This month, the company said it would sell Giphy , an online repository of animated clips known as GIFs, after British antitrust regulators said Meta’s $315 million deal for the company had reduced competition in social media and digital advertising. Meta’s acquisition of Within, the maker of a virtual reality fitness app, has also been halted by the Federal Trade Commission over antitrust concerns.

It’s unclear how Meta’s metaverse investment will pan out given low user numbers, said Mike Proulx, a research director at Forrester, even as the company cedes young users to rivals like TikTok.

“It truly warrants a conversation around what is Meta’s core business at present,” he said.

Despite the challenges, Meta increased its numbers of users. The number of people who use its apps such as Facebook, Instagram, WhatsApp or Messenger daily increased to 2.93 billion users in the quarter, up 4 percent from a year earlier.

On Wednesday’s earnings call, Mr. Zuckerberg praised the user growth for Facebook and WhatsApp and talked about how people were spending more time on Instagram’s Reels. But he spent much of the call focused on his vision for the metaverse.

“It’s just not clear, if we weren’t driving this forward that anyone else would be,” he said.

Ryan Mac is a technology reporter focused on corporate accountability across the global tech industry. He won a 2020 George Polk award for his coverage of Facebook and is based in Los Angeles. More about Ryan Mac

New to Shacknews? Signup for a Free Account

Already have an account? Login Now

- Subscribe

- Latest Pets

- Forum: Posts today 999

Facebook (META) Q3 2022 earnings results beat revenue expectations, miss on EPS

Meta came out ahead of expectations on total revenue, but it fell short on EPS as the company continues to invest deeply in VR and the metaverse.

As we continue to move through the latest season of fiscal quarterly closes, Meta (formerly known as Facebook) is the latest major company on the block reporting its Q3 2022 finish. The company shared its earnings results today and came out just ahead of expectations on total revenue. Unfortunately, it looks like Meta was not able to overcome either consensus or whisper number expectations on earnings-per-share (EPS).

Meta shared the full report of its Q3 2022 earnings results on its investor relations website on October 26, 2022. In said report, Meta reported a total revenue of $27.7 billion. This was up against expectation of around $27.38 billion, as estimated by Refinitiv . However, the company’s EPS for Q3 2022 only landed at $1.64 per share. This was down against the consensus expectation of $1.89 per share and whisper number expectation of $1.74 per share.

Meta has poured a massive amount of money into the advancement of virtual reality technology, as well as software and networking endeavors in metaverse applications such as the Meta Quest Pro and Horizon Worlds . That said, there is arguably still a lot of work to be done from software and hardware standpoints before any of it is practical. Oculus founder and former developer Palmer Luckey shared that he believes the current Horizon Worlds is “terrible today,” but it has the potential to be something amazing in the future.

Nonetheless, it looks like Instagram and Facebook are still driving enough business to make Meta the money it needs to keep moving forward with these projects. With Meta’s Q3 2022 in the books, stay tuned for more major tech companies reporting on their fiscal quarter finishes throughout the weeks ahead.

TJ Denzer is a player and writer with a passion for games that has dominated a lifetime. He found his way to the Shacknews roster in late 2019 and has worked his way to Senior News Editor since. Between news coverage, he also aides notably in livestream projects like the indie game-focused Indie-licious, the Shacknews Stimulus Games, and the Shacknews Dump. You can reach him at [email protected] and also find him on Twitter @JohnnyChugs .

- Stock Market

- Facebook Reality Labs

- Horizon Worlds

- Earnings Report

- Market News

TJ Denzer posted a new article, Facebook (META) Q3 2022 earnings results beat revenue expectations, miss on EPS

- Search Search Please fill out this field.

- Company News

- Tech Sector News

Meta (Facebook) Shares Slammed as Earnings, Spending Disappoint

Revenue fell in Q3; investment in AI, VR to grow next year

:max_bytes(150000):strip_icc():format(webp)/igorphoto5-6a932ba1c8de428db5b61eaba712addd.jpg)

Key Takeaways

- Meta's Q3 FY 2022 earnings per share (EPS) of $1.64 fell short of expectations.

- Revenue for Meta slipped year-over-year, while spending soared in Q3.

- Meta's shares plummeted 20% their lowest price since early 2016 in after-hours trading Oct. 26; they remained down more than 20% in pre-market trading Oct. 27.

- Meta says it's making essential long-term investments in artificial intelligence, data centers, and virtual reality.

- Mark Zuckerberg's control of the company through a special class of supervoting shares leaves the founder free to ignore calls to cut costs quickly.

Source: Predictions based on analysts’ consensus from Visible Alpha

Meta (Facebook) Financial Results: Analysis

Meta Platforms Inc. ( META ) shares plunged 20% to their lowest in almost seven years in after-hours trading on Oct. 26 after the social media giant's third-quarter results fell short of expectations amid mounting spending. The shares remained down more than 20% in pre-market trading Oct. 27.

The operator of Facebook , Instagram, WhatsApp, and Messenger posted Q3 diluted earnings of $1.64 per share. Analysts tracked by Visible Alpha had estimated $1.87 per share on average. While revenue topped the consensus estimate by 1%, it was down 4% year-over-year. Meta's expenses rose 19% from a year earlier, and its headcount increased 28% over the same span. As a result, free cash flow has all but evaporated: Over the past four quarters it has ebbed from $12.6 billion to $8.5 billion, $4.5 billion, and finally to $173 million in the most recent period.

Meta's Revenue, Spending Outlook

Meta projected Q4 revenue of $30 billion to $32.5 billion, compared with analyst expectations of $32.2 billion. CEO Mark Zuckerberg acknowledged "near-term challenges on revenue" in the statement reporting the results. European advertising revenue weakened notably, declining 10% sequentially from Q2.

Despite the downbeat results and outlook, the company is proceeding with investments in infrastructure and virtual reality (VR) hardware. In FY 2023, expenses are expected to rise another 15% or so from FY 2022, based on the midpoints of the ranges the company provided. Capital spending is set to increase as well, from about $32.5 billion in this fiscal year to a range of $34 billion to $39 billion in FY 2023.

Investments Under Fire as Stock Slumps

One widely followed observer on Twitter noted that over the last two quarters, Meta's capital spending has eclipsed that of Alphabet Inc. ( GOOGL , GOOG ) and Microsoft Corp. ( MSFT ). "You're spending 30% more in capex than the folks building self-driving cars, beaming internet to penguins in the Galapagos, and also doing Youtube Shorts as a side hustle. It's breathtaking," tweeted @modestproposal1. Google parent Alphabet shut down Loon, a project to provide Internet connectivity from balloons in the stratosphere, in 2021.

Investors' unease with Meta's heavy spending plans as revenue declines had already left the stock down more than 61% in 2022 before the Q3 earnings report. Earlier in the week, a fund manager published an open letter calling on the company to curb costs and capital spending.

Zuckerberg can ignore such criticism without fear of a shareholder revolt . Facebook's founder controls Meta because he owns a special class of shares , with each Class B share conferring 10 votes versus 1 for Meta's common stock.

Meta (Facebook) Earnings Call Recap

The company's rapidly growing spending drew the most questions from the analysts on the Q3 conference call, with some seeking details on the investments' potential returns and others asking whether Meta is neglecting competitive threats to its core business in prioritizing metaverse development.

" I think kind of summing up how investors are feeling right now is that there are just too many experimental bets versus proven bets on the core," said Jefferies analyst Brent Thill on the call. "I think everyone would love to hear why you think this pays off."

Zuckerberg said Meta faces so many challenges it can't afford to focus on just one. "Look, there are a lot of things going on right now in the business and in the world," he responded. "And so it's hard to have, like, a simple 'We're going to do this one thing, and that's going to solve all the issues.' I mean, there's macroeconomic issues. There's a lot of competition. There's ads challenges, especially coming from Apple. And then there's some of the longer-term things that we're taking on expenses because we believe that they're going to provide greater returns over time. And I think we're going to resolve each of these things over different periods of time. And I appreciate the patience. And I think that those who are patient and invest with us will end up being rewarded."

Zuckerberg and other Meta executives on the call said the planned 2023 spending increases will go primarily toward expanding the artificial intelligence (AI) capacity powering Meta's customized content recommendations engine, including for its Reels feature designed to compete against TikTok's videos. The hardware required to run the AI algorithms is leading Meta to upgrade its data centers as well, they said. At the same time, the planned launch of a new Quest virtual reality headset for consumers will cause the loss at Meta's Reality Labs unit to widen significantly next year, according to the company.

Meta. " Meta Reports Third Quarter 2022 Results ," Page 1.

Meta. " Meta Earnings Presentation Q3 2022 ," Page 17.

Meta. " Meta Reports Third Quarter 2022 Results ," Page 2.

Meta. " Meta Earnings Presentation Q3 2022 ," Page 2.

@modestproposal1 on Twitter. " Tweet ."

X Company Blog. " Loon’s Final Flight ."

Brad Gerstner on Medium. " Time to Get Fit—an Open Letter From Altimeter to Mark Zuckerberg (and the Meta Board of Directors) ."

Meta. " Q3 2022 Earnings Call Transcript ," Page 17.

Meta. " Q3 2022 Earnings Call Transcript ," Page 18.

Meta. " Q3 2022 Earnings Call Transcript ," pp. 6-7.

:max_bytes(150000):strip_icc():format(webp)/GettyImages-2151427538-3671b1532e38441391741ad75d8dbfd8.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

We couldn’t find any results matching your search.

Please try using other words for your search or explore other sections of the website for relevant information.

We’re sorry, we are currently experiencing some issues, please try again later.

Our team is working diligently to resolve the issue. Thank you for your patience and understanding.

Earnings Date

Latest press release, earnings per share, quarterly earnings surprise amount, yearly earnings forecast, quarterly earnings forecast, change in consensus, number of estimates changed.

- After-Hours

- Press Releases

- Analyst Research

- Dividend History

- Historical Quotes

- Historical NOCP

- P/E & PEG Ratios

- Option Chain

- Short Interest

- Institutional Holdings

- Insider Activity

- SEC Filings

- Revenue EPS

Symbol Search

Recently viewed.

Analyze your stocks, your way

Leverage the Nasdaq+ Scorecard to analyze stocks based on your investment priorities and our market data.

About Earnings Date

Nasdaq provides visual representation of analyst expected earnings growth. Read our earnings report guide before you consider the forecast information when making investment decisions. Visit the Earnings Calendar to see dates for upcoming earnings announcements.

Trending Stocks

Trending etfs, trending indexes.

- Type a symbol or company name. When the symbol you want to add appears, add it to My Quotes by selecting it and pressing Enter/Return.

These symbols will be available throughout the site during your session.

Your symbols have been updated

Edit watchlist.

- Type a symbol or company name. When the symbol you want to add appears, add it to Watchlist by selecting it and pressing Enter/Return.

Opt in to Smart Portfolio

Smart Portfolio is supported by our partner TipRanks. By connecting my portfolio to TipRanks Smart Portfolio I agree to their Terms of Use .

English (USA)

English (UK)

English (Canada)

English (India)

Deutsch (Deutschland)

Deutsch (Österreich)

Deutsch (Schweiz)

Français (France)

Français (Suisse)

Nederlands (Nederland)

Nederlands (België)

- Top Capitalization

- United States

- North America

- Middle East

- Sector Research

- Earnings Calendar

- Equities Analysis

- Most popular

- NVIDIA CORPORATION

- AMD (ADVANCED MICRO DEVICES)

- MICROSOFT CORPORATION

- SINGAPORE AIRLINES LIMITED

- NIPPON ACTIVE VALUE FUND PLC

- Index Analysis

- Indexes News

- EURO STOXX 50

- Currency Cross Rate

- Currency Converter

- Forex Analysis

- Currencies News

- Precious metals

- Agriculture

- Industrial Metals

- Livestock and Cattle

- CRUDE OIL (WTI)

- CRUDE OIL (BRENT)

- Developed Nations

- Emerging Countries

- South America

- Analyst Reco.

- Capital Markets Transactions

- New Contracts

- Profit Warnings

- Appointments

- Press Releases

- Security Transactions

- Earnings reports

- New markets

- New products

- Corporate strategies

- Legal risks

- Share buybacks

- Mergers and acquisitions

- Call Transcripts

- Currency / Forex

- Commodities

- Cryptocurrencies

- Interest Rates

- Asset Management

- Climate and ESG

- Cybersecurity

- Geopolitics

- Central Banks

- Private Equity

- Business Leaders

- All our articles

- Most Read News

- All Analysis

- Satirical Cartoon

- Today's Editorial

- Crypto Recap

- Behind the numbers

- All our investments

- Asia, Pacific

- Virtual Portfolios

- USA Portfolio

- European Portfolio

- Asian Portfolio

- My previous session

- My most visited

- Quality stocks

- Dividend Aristocrats

- Growth stocks

- Undervalued stocks

- The Cannabis Industry

- The Internet of Things

- Biotechnology

- Unusual volumes

- New Historical Highs

- New Historical Lows

- Top Fundamentals

- Sales growth

- Earnings Growth

- Profitability

- Rankings Valuation

- Enterprise value

- Top Consensus

- Analyst Opinion

- Target price

- Estimates Revisions

- Top ranking ESG

- Environment

- Visibility Ranking

- Stock Screener Home

- Cannibal companies

- The genomic revolution

- Europe's family businesses

- Oversold stocks

- Overbought stocks

- Close to resistance

- Close to support

- Accumulation Phases

- Most volatile stocks

- Top Investor Rating

- Top Trading Rating

- Top Dividends

- Low valuations

- All my stocks

- Stock Screener

- Stock Screener PRO

- Portfolio Creator

- Event Screener

- Dynamic Chart

- Economic Calendar

- Our subscriptions

- Our Stock Picks

- Thematic Investment Lists

Meta Platforms, Inc.

Us30303m1027, internet services.

This article is reserved for subscribers

Signed up already?

Not subscribed yet?

Latest news about Meta Platforms, Inc.

Chart meta platforms, inc..

Company Profile

Income statement evolution, analysis / opinion.

Why Shares of Meta Are Sinking After Earnings Report

April 24, 2024 at 05:14 pm EDT

Ratings for Meta Platforms, Inc.

Analysts' consensus, eps revisions, quarterly earnings - rate of surprise, sector social media & networking.

- Stock Market

- News Meta Platforms, Inc.

- Transcript : Meta Platforms, Inc., Q3 2022 Earnings Call, Oct 26, 2022

Tracking Terry Smith's Fundsmith 13F Portfolio - Q1 2024 Update

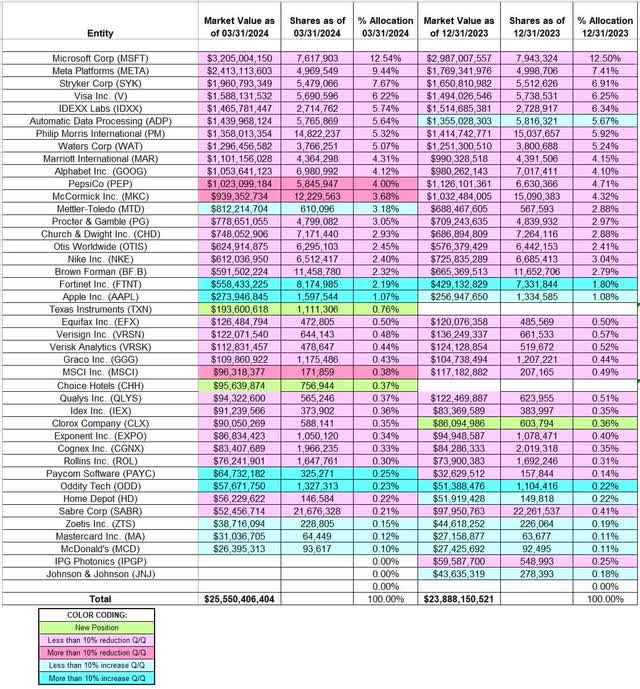

- Fundsmith's 13F portfolio value increased from $23.89B to $25.55B this quarter.

- The top three holdings in the portfolio are Microsoft, Meta Platforms, and Stryker Corp.

- New stakes were established in Texas Instruments and Choice Hotels, while stakes in IPG Photonics and Johnson & Johnson were disposed of.

ZoltanGabor

This article is part of a series that provides an ongoing analysis of the changes made to Fundsmith's 13F portfolio on a quarterly basis. It is based on their regulatory 13F Form filed on 5/15/2024. Please visit our Tracking Terry Smith's Fundsmith 13F Portfolio series to get an idea of their investment philosophy and our last update for the fund's moves during Q4 2023.

This quarter, Fundsmith's 13F portfolio value increased $23.89B to $25.55B. The number of holdings remained steady at 40. The top three holdings are at ~30% while the top five are close to ~42% of the 13F assets: Microsoft, Meta Platforms, Stryker Corp, Visa, and IDEXX Labs.

Note: Their flagship Fundsmith Equity Fund (2010 inception) has returned 15.4% annualized compared to 11.7% for the MSCI World Index. 2022 was their first down year since inception - negative 13.8%. The following top holdings are not in the 13F report: Novo Nordisk ( NVO ), L'Oreal ( OTCPK:LRLCF ), and LVMH Moet Hennessy Louis Vuitton ( OTCPK:LVMUY ).

New Stakes:

Texas Instruments ( TXN ) and Choice Hotels ( CHH ): TXN is a small 0.76% of the portfolio position established at prices between ~$156 and ~$174. The stock currently trades well above that range at ~$199. The very small 0.37% of the portfolio stake in CHH was established at prices between ~$109 and ~$130 and it is now at ~$115.

Stake Disposals:

IPG Photonics ( IPGP ) and Johnson & Johnson ( JNJ )( JNJ:CA ): These two very small (less than ~0.25% of the portfolio each) stakes were disposed during the quarter.

Stake Increases:

Mettler-Toledo ( MTD ) : The 3.18% MTD stake was purchased during H1 2022 at prices between ~$1098 and ~$1675 and the stock currently trades at ~$1480. The last few quarters saw only minor adjustments. This quarter saw a ~7% stake increase at prices between ~$1132 and ~$1350.

Fortinet Inc. ( FTNT ) : The small 2.19% stake in FTNT was more than doubled during Q3 2023 at prices between ~$57 and ~$80. That was followed by a ~50% stake increase in the last quarter at prices between ~$49.50 and ~$60. The position was increased by 11% this quarter at prices between $57.78 and $73.07. The stock is now at $61.35.

Apple Inc. ( AAPL )( AAPL:CA ) : AAPL is a ~1% of the portfolio position built during Q1 2023 at prices between ~$125 and ~$166 and the stock currently trades above that range at ~$190. The position was increased by 20% this quarter at prices between ~$169 and ~$195.

Mastercard Inc. ( MA )( MA:CA ), McDonald's ( MCD ), Oddity Tech ( ODD ), Paycom Software ( PAYC ), and Zoetis Inc. ( ZTS ) : These very small (less than ~0.25% of the portfolio each) stakes were increased during the quarter.

Stake Decreases:

Microsoft Corp. ( MSFT )( MSFT:CA ) : MSFT is currently the largest position at 12.54% of the portfolio. The stake was built during the five-year period from 2013 to 2018 at prices between ~$27 and ~$115. There was a ~23% selling in Q1 2022 at prices between ~$276 and ~$335. The stock currently trades at ~$430. The last several quarters have seen trimming. They are harvesting gains.

Meta Platforms ( META )( META:CA ) : The 9.44% META stake was built in 2018 at prices between ~$125 and ~$210. The stake remained steady since, although adjustments were made in most quarters. There was a ~20% reduction in Q1 2022 at prices between ~$187 and ~$339. That was followed by a ~11% selling during Q3 2023 at prices between ~$283 and ~$326. The stock currently trades at ~$478. There was marginal trimming in the last two quarters.

Stryker Corp. ( SYK ) : SYK is a 7.67% of the portfolio position purchased during the decade that ended in 2021 through consistent buying every quarter at prices between ~$50 and ~$275. There was a ~20% reduction in Q1 2022 at prices between ~$245 and ~$278. The stock currently trades at ~$336. The last several quarters only saw minor adjustments.

Visa Inc. ( V )( VISA:CA ) : Visa is a 6.22% of the portfolio position established over the decade that ended in 2021 through consistent buying in most years. The build-up happened at prices between ~$30 and ~$245. Q1 2022 saw a ~18% selling at prices between ~$191 and ~$235. The stock currently trades at ~$275. The last several quarters have seen only minor adjustments.

IDEXX Labs ( IDXX ) : IDXX is a 5.74% of the portfolio position established during the 2015-16 timeframe at prices between ~$63 and ~$120. Since then, the position remained relatively steady although adjustments were made in most quarters. There was a ~15% trimming in Q1 2022 at prices between ~$466 and ~$631. That was followed by a similar reduction during Q1 2023 at prices between ~$406 and ~$515. The stock currently trades at ~$517. The last four quarters saw only minor adjustments.

Automatic Data Processing ( ADP ) : The 2013-19 timeframe saw consistent buying in ADP at prices between ~$52 and ~$173. Q1 2020 saw a ~40% selling at prices between ~$112 and ~$181 while in the next quarter there was a ~70% increase at prices between ~$128 and ~$160. Since then, the activity had been minor. Q1 2022 saw a ~22% reduction at prices between ~$196 and ~$245. The stock is now at ~$249 and the stake is at 5.64% of the portfolio. The last two years saw only minor adjustments.

Philip Morris International ( PM ) : The 5.32% PM stake was established during the decade that ended in 2021 through consistent buying every quarter. Pricing ranged between ~$60 and ~$120. Q1 2022 saw a ~20% selling at prices between ~$89 and ~$112. The stock is now at ~$100. The last several quarters have seen minor trimming.

Waters Corp. ( WAT ) : WAT is a ~5% of the portfolio stake built during the 2015-2017 timeframe at prices between ~$115 and ~$200. Next two years also saw incremental buying. There was a ~23% selling in H1 2020 at prices between ~$175 and ~$240. Since then, the activity had been minor. There was a ~18% reduction in Q1 2022 at prices between ~$307 and ~$365. The stock currently trades at ~$337. The last several quarters have seen only minor adjustments.

Note: they have a ~7.6% ownership stake in Waters Corp.

Marriott International ( MAR ) : The 4.31% stake in MAR was primarily built during Q3 2023 at prices between ~$182 and ~$208. The stock currently trades at ~$237. There was marginal trimming in the last two quarters.

Alphabet Inc. ( GOOG )( GOOG:CA ) : GOOG is a 4.12% of the portfolio position purchased in Q4 2021 at prices between ~$133 and ~$151. There was a ~9% trimming in the next quarter. The stock currently trades at ~$176. The last quarter saw a ~8% selling and that was followed by marginal trimming this quarter.

PepsiCo ( PEP ) : The ~4% PEP stake was built over the decade that ended in 2021 through consistent buying during most quarters. The buying happened at prices between ~$65 and ~$170. There was a ~25% reduction in Q1 2022 at prices between ~$154 and ~$176. The stock is now at ~$178. There was a ~12% trimming this quarter.

McCormick ( MKC ) : MKC is a large 3.68% of the portfolio position built during the 2018-19 timeframe at prices between ~$50 and ~$86. There was a ~18% reduction in Q1 2022 at prices between ~$92 and ~$104. The stake was decreased by 19% this quarter at prices between $64.25 and $76.88. The stock currently trades at $72.21.

Note: they have a ~6.2% ownership stake in the business.

Procter & Gamble ( PG ) : The ~3% PG stake was built during Q1 2023 at prices between ~$137 and ~$154 and it now goes for ~$165. There was a ~180% stake increase during Q2 2023 at prices between ~$143 and ~$157. There was marginal trimming in the last three quarters.

Church & Dwight ( CHD ) : The 2.93% CHD position was built during the three quarters through Q2 2021 at prices between ~$72 and ~$93. There was a ~28% selling in Q1 2022 at prices between ~$95 and ~$104. That was followed by a ~20% reduction during Q2 2023 at prices between ~$88 and ~$100. The stock currently trades at ~$107. Q3 2023 saw a ~9% increase while the last two quarters saw marginal trimming.

Otis Worldwide ( OTIS ) : OTIS is a 2.45% of the portfolio stake established during Q3 2022 at prices between ~$64 and ~$82 and the stock currently trades at ~$98. The last few quarters have seen minor trimming.

Nike, Inc. ( NKE )( NKE:CA ) : The 2.40% NKE stake was built in H1 2020 at prices between ~$67 and ~$105. There was minor buying in most quarters since. Q1 2022 saw a ~23% reduction at prices between ~$118 and ~$166. The stock is now at $91.75. The last several quarters saw only minor adjustments.

Brown Forman ( BF.B ) : BF.B is a 2.32% of the portfolio stake built in 2019 at prices between ~$45 and ~$68. 2021 saw a ~50% stake increase at prices between ~$67 and ~$81 while in Q1 2022 there was a ~28% selling at prices between ~$62 and ~$72. The stock is now at $45.76. The last several quarters saw minor trimming.

Note: They own ~5% of the business.

Clorox Company ( CLX ) : CLX is a very small 0.35% of the portfolio position purchased last quarter at prices between ~$115 and ~$146 and the stock currently trades at ~$132. There was a minor ~3% trimming this quarter.

Cognex Inc. ( CGNX ), Exponent, Inc. ( EXPO ), Equifax Inc. ( EFX ), Graco Inc. ( GGG ), Home Depot ( HD ), IDEX Inc. ( IEX ), MSCI Inc. ( MSCI ), Qualys, Inc. ( QLYS ), Rollins, Inc. ( ROL ), Sabre Corp. ( SABR ), VeriSign Inc. ( VRSN ), and Verisk Analytics ( VRSK ): These very small (less than ~0.5% of the portfolio each) positions were reduced during the quarter.

The spreadsheet below highlights changes to Fundsmith's 13F holdings in Q1 2024:

Terry Smith - FundSmith Portfolio - Q1 2024 13F Report Q/Q Comparison (John Vincent (author))

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, GOOGL, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Related stocks, related analysis, trending analysis, trending news.

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

IMAGES

VIDEO

COMMENTS

In Millions, Except for Percentages. (1) Reflects a one-time income tax benefit of $913 million related to the effects of a tax election to capitalize and amortize certain research and development expenses for U.S. income tax purposes. Excluding this tax benefit, our effective tax rate would have been 11 percentage points higher in Q3 2020.

Q3 2022 Earnings. October 26, 2022 02:00 PM PT. Listen to Webcast. Earnings Release ( PDF ) Slides ( PDF ) Earnings Call Transcript ( PDF ) Follow Up Call Transcript ( PDF )

Meta Platforms, Inc. (Nasdaq: META) today reported financial results for the quarter ended September 30, 2022. "Our community continues to grow and I'm pleased with the strong engagement we're seeing driven by progress on our discovery engine and products like Reels," said Mark Zuckerberg, Meta founder and CEO. "While we face near-term challenges on revenue, the fundamentals are there for a ...

Meta will host a conference call to discuss its results at 2 p.m. PT / 5 p.m. ET the same day. The live webcast of the call can be accessed at the Meta Investor Relations website at investor.fb.com, along with the company's earnings press release, financial tables, and slide presentation. Following the call, a replay will be available at the same website.

Meta's Q3 earnings report was strong, and Mark Zuckerberg talked with analysts about the company's key priorities going into 2024. ... business following a sharp slowdown throughout 2022. Meta's ...

Meta Platforms, Inc. 2022 Q1 - Results - Earnings Call Presentation SA Transcripts Thu, Apr. 28, 2022 Meta Platforms, Inc.'s (FB) CEO Mark Zuckerberg on Q1 2022 Results - Earnings Call Transcript

147.01K Follower s. Meta Platforms, Inc. ( NASDAQ: META) Q3 2022 Earnings Conference Call October 26, 2022 5:00 PM ET. Company Participants. Deborah Crawford - Vice President, Investor Relations ...

Win McNamee | Getty Images. While revenue fell 4% in the third quarter, Meta's costs and expenses rose 19% year over year to $22.1 billion. Operating income declined 46% from the previous year ...

Oct. 26, 2022. A year ago, ... This year, Meta's earnings have been hit hard by its spending on the metaverse and its slowing growth in social networking and digital advertising.

In said report, Meta reported a total revenue of $27.7 billion. This was up against expectation of around $27.38 billion, as estimated by Refinitiv. However, the company's EPS for Q3 2022 only ...

Q3: 2022-10-26 Earnings Summary. EPS of $1.64 misses by $0.21 | Revenue of $27.71B (-4.47% Y/Y) beats by $313.82M. The following slide deck was published by Meta Platforms, Inc. in conjunction ...

Meta's Q3 FY 2022 earnings per share (EPS) of $1.64 fell short of expectations. Revenue for Meta slipped year-over-year, while spending soared in Q3. Meta's shares plummeted 20% their lowest price ...

Share repurchases - We repurchased $6.55 billion of our Class A common stock in the third quarter of 2022. As of September 30, 2022, we had $17.78 billion available and authorized for ...

Data as of Apr 26, 2024. Data as of Apr 30, 2024. Data as of May 1, 2024. Find annual and quearterly earnings data for Meta Platforms, Inc. Class A Common Stock (META) including earnings per share ...

News Meta Platforms, Inc. Transcript : Meta Platforms, Inc., Q3 2022 Earnings Call, Oct 26, 2022. Presentation Operator MessageOperator Good afternoon. My name is Martin, and I will be your conference operator today. At this time, I would like to welcome everyone to the Meta Third Quarter Earnings...

Meta Platforms last issued its earnings data on April 24th, 2024. The social networking company reported $4.71 earnings per share (EPS) for the quarter, beating the consensus estimate of $4.32 by $0.39. The company earned $36.46 billion during the quarter, compared to analyst estimates of $36.28 billion.

Q3 2023 Earnings. October 25, 2023 02:00 PM PT. Listen to Webcast. Earnings Release ( PDF ) Slides ( PDF ) Earnings Call Transcript ( PDF )

Investor Relations Contact. Starbucks Coffee Company Investor Relations Department 2401 Utah Avenue South, Mailstop IR Seattle, WA 98134. [email protected]

When is Meta Materials' next earnings announcement? View the latest MMAT earnings date, analysts forecasts, earnings history, and conference call transcripts. ... August 14th, 2024 based off prior year's report dates. Read More . Meta Materials Earnings History by Quarter Time Frame * Start Date * End Date. Export to Excel ... Q3 2022 ($0.0250 ...

Revenue - Revenue was $32.17 billion and $116.61 billion, a decrease of 4% and 1% year-over-year for the fourth quarter and full year 2022, respectively. Had foreign exchange rates remained constant with the same periods of 2021, revenue would have been $2.01 billion and $5.96 billion higher, an increase of 2% and 4% on a constant currency ...

Earnings for Micron Technology are expected to grow by 2,306.90% in the coming year, from $0.29 to $6.98 per share. Micron Technology has not formally confirmed its next earnings publication date, but the company's estimated earnings date is Wednesday, June 26th, 2024 based off prior year's report dates.

Meta Platforms, Inc. (Nasdaq: META) today reported financial results for the quarter ended June 30, 2022. "It was good to see positive trajectory on our engagement trends this quarter coming from products like Reels and our investments in AI," said Mark Zuckerberg, Meta founder and CEO. "We're putting increased energy and focus around our key company priorities that unlock both near and long ...

Fundsmith's 13F portfolio value increased from $23.89B to $25.55B this quarter. The top three holdings in the portfolio are Microsoft, Meta Platforms, and Stryker Corp. New stakes were established ...

Snowflake Inc.'s talks to acquire startup Reka AI for more than $1 billion have broken down, dashing an effort by the software company to bring more generative AI muscle in-house.

View the latest TSLA earnings date, analysts forecasts, earnings history, and conference call transcripts. ... July 17th, 2024 based off prior year's report dates. Read More . Tesla Earnings History by Quarter Time Frame * Start Date * End Date. Export to Excel. Date Quarter ... 10/19/2022: Q3 2022: $0.87: $0.95 +$0.08: $0.95: $21.96 billion ...