How to start a medical billing company [2024 guide]

Want to start a home-based medical billing business but not sure of the process?

Don’t worry, we’ve got you covered.

There are numerous benefits to running your own home-based business. Working in comfort, building your schedule, being your boss, ditching the daily commute; the list goes on.

However, before investing money, effort, and time into establishing a medical billing business, you should determine if coding and billing is a good fit for you. It takes a lot to get up and running, including a rigorous certification course.

Rest assured, however, the returns of a well-run medical billing business are fantastic. With independence and a steady income, you’ll have a healthier work-life balance and the ability to decide how large you want your company to grow.

Here’s what we will cover in this article

Click on the links below to jump to a particular section.

- What is a Medical Billing Business?

- Is a Home-Run Medical Billing Business Right For You?

- Is There a Need For Your Service?

- What Are the Startup Costs Involved?

- Get Hands-On Experience in a Medical Role

- Apply For Medical Billing Training

- Watch Out For Scams

- Create a Business Plan

- Other Necessities

- A Clearinghouse

- A Medical Billing Software

- Other Equipment & Forms

- Choosing a Billing Software

- How to Charge Clients

- Income Potential

- Specialize Yourself

- Construct a Strong Marketing Plan

- Network & Grow

- Bonus: An Alternative Business Opportunity

Ready to get started? Let’s go!

What is a medical billing business?

Medical centers, hospitals, and private care professionals bill patients for appointments and services. These services can include check-ups, procedures, testing, treatments, and so on.

Medical coding and billing businesses translate these patient services into a bill, and then send and follow up on such medical claims with insurance companies.

Why do doctors and healthcare providers use outsourced billing methods in their revenue cycle management procedures?

Health insurance companies, Medicare, and Medicaid require billing departments to process medical bills through extensive software under strict rules and provisions.

These rules state that billers and coders submit claims with a series of particular codes specific to the medical procedure performed by the health provider. This makes the medical claims billing process far more streamlined and organized.

However, that isn’t all.

Revenue Cycle Management is the administration of medical financial transactions resulting from patient-provider encounters. These transactions include:

- Collections

- Payer contracting

- Provider enrollment

- Data analytics

Medical billers and coders play a significant role in carrying out these revenue cycle procedures. They follow the patient’s payment actions from the initial appointment or interaction with a medical provider to the final payment of the bill.

Billers and coding specialists help doctors earn revenue promptly through their coding and billing abilities and extensive knowledge of the requirements of insurance companies.

Through patient medical records and medical reports, billers and coding specialists can create and process accurate bills far quicker than health professionals.

Faster processing means more cash flow and decreased accounts receivables for care providers.

Is a home-run medical billing business right for you?

Running any business requires:

- Organization

- Data entry skills

- Management skills

If you want to run a successful medical billing service from home, nurture these qualities and skills within yourself.

If this is the first time you are starting a new business, check out our 10 entrepreneurial skills you need .

Next, determine if the healthcare industry interests you.

- Would you enjoy going through medical records and generating claims codes?

- Would you like working with both care providers and insurance companies to receive payment for services rendered?

- Would rejected claims and complications frustrate you? What about uncollectibles?

- Do you have an interest in learning more about medical procedures?

- Did you enjoy working in the medical field in the past?

The medical billing process in the United States can be very complicated. Be sure that you have a passion for the work.

Is there a need for your service?

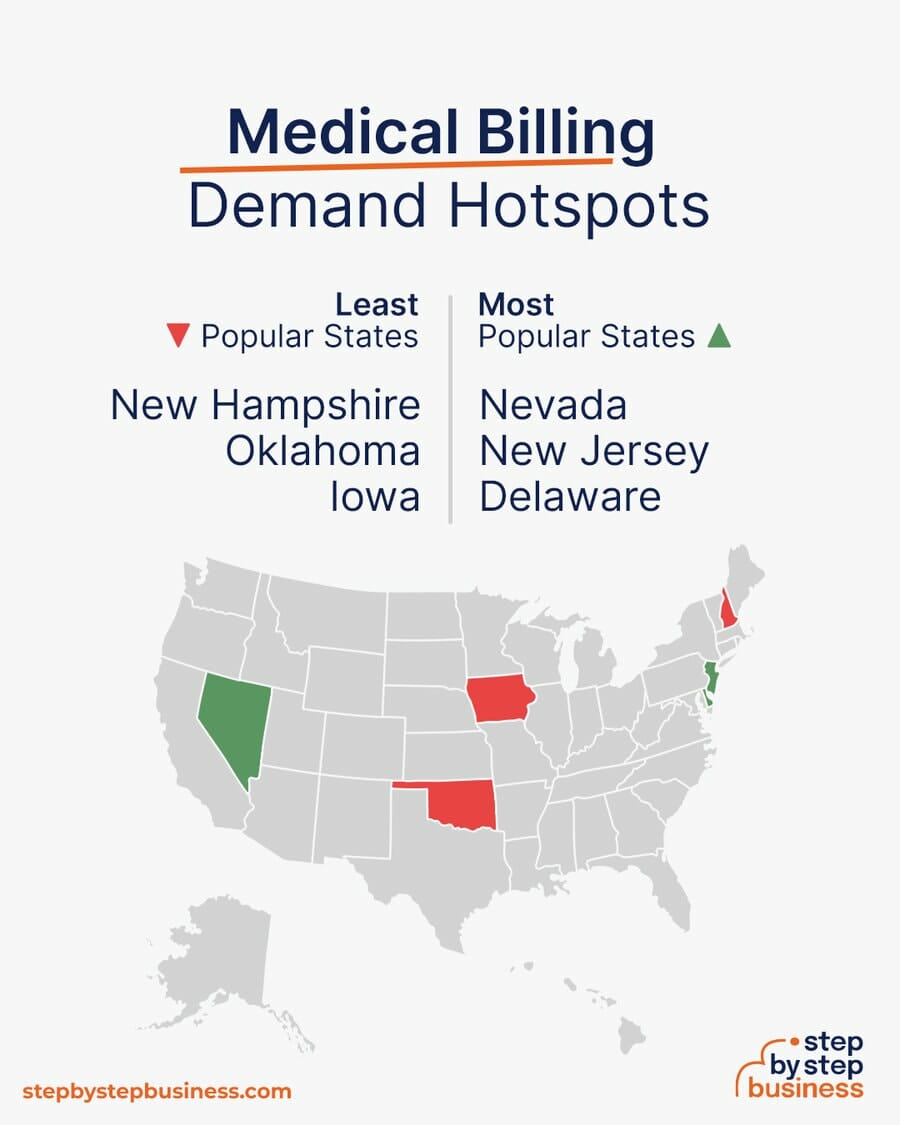

Before putting time and money in your home business, first research if there is a need for third-party billing in your area.

Contact doctors and healthcare providers and ask them these questions:

- Does an outside company handle your billing or do you do it yourself?

- What software programs do you use/recommend?

- If you use an outside provider, what processes do you outsource?

- How many patients do you see and bill daily?

Tip – Nursing homes and hospitals also use medical billing services and can be a lucrative area of specialization.

The questions listed above will:

- Provide a clear idea of the need for your services in the area

- Give you tips on which software is the best

- Indicate what volume of claims you can expect from your prospective clients.

What are the startup costs involved?

Fortunately, a solo-run medical billing business is easy to start and requires a minimal investment of money. Startup costs typically range between $2,000-$10,000 .

Running a home-based small business lets you avoid overheads like renting out an office space and hiring and training employees.

The most expensive cost in starting your billing service is billing software . Prices can range from $100 to $10,000 based on the size of the company, the number of employees, the number of providers, and software features.

You will also need office supplies, including:

- A reliable computer ($500 – $3000)

- A printer and fax machine ($150+)

- Software licensing ($1500-$3500 per user)

Other costs you may need to consider are:

- Software upgrades ($500-$3500 per year)

- Backup hard drives ($50-$150 per drive)

- Ethernet switches and wires ($50-$100 per wire)

- IT support ($100+ per hour)

If you grow your business into a medium/large company, professional, in-house systems are required and can cost up to $50,000 to purchase and install. Servers will further cost another $3,000-$5,000, and training can cost $3,000+.

A. First steps to starting your own medical billing business

The multi-step process of starting your own medical billing home business can be extensive. We advise that you follow each step thoroughly and obtain every license and certificate required to be in legal standing and risk no chance of being shut down.

Here’s how to start.

1. Get hands-on experience in a medical role

If you are new to the medical industry, it is highly beneficial to work in the medical field for at least a few months before starting your business.

A great way to do this is by working in the billing department of a medical office or a hospital. You will experience the medical industry and billing process first hand, and will also gain an improved understanding of the average volume of patients that visit doctors daily.

Working in a doctor’s office will help you network and source potential clients for your business. You will handle a variety of medical records and insurance claims, and may even get to learn the electronic billing process if the practice supports it.

2. Apply for medical billing training

Why do you need medical billing training?

Medical billing differs from other types of invoices for two reasons:

- Medical bills go through an insurer before being sent to a patient.

- Medical bills require highly specialized codes and descriptions when sent to insurers.

Also, many medical procedures have similar names; therefore, billing specialists must have in-depth knowledge about anatomy, physiology, pharmacology, and health insurance terms.

A variety of colleges offer billing certification courses, both online and in-person. The completion of most billing certifications takes 9 to 18 months and requires 18 credits.

The Primary Coding Manuals & Certification Exams

When choosing a certification program, pick a course that includes all necessary code manuals and exam preparations.

Medical billing certificate programs should cover three primary code manuals:

- CPT: Current Procedural Terminology (set by the American Medical Association)

- ICD-10-CM: International Statistical Classification of Diseases and Related Health Problems (Maintained by the World Health Organization)

- HCPCS: Healthcare Common Procedure Coding System

Following the course, you should be prepared to take exams offered by the three medical billing and coding businesses listed below:

- Certified Medical Reimbursement Specialist exam – American Medical Billing Association (AMBA)

- Certified Coding Associate – American Health Information Management Association (AHIMA)

- Certified Professional Coder’s board exam – American Academy of Professional Coder’s (AAPC)

3. Watch out for scams

There are a plethora of medical billing opportunities that aid entrepreneurs in starting their own third-party billing business.

For example, a company may offer to set the entrepreneur up with training, the perfect electronic billing tools, and a list of potential clients that need outsourced billing services.

Sounds too good to be true, right?

Reliable services like this surely exist, however many of them are scams. The Federal Trade Commission has created a guide for how to detect and avoid scams.

It is crucial that you do thorough research on service providers if you choose to take this route.

The FTC suggests that you, “check with the state Attorney General’s office , consumer protection agency and the Better Business Bureau in your area and the area where the promoter is based to learn whether there are any unresolved complaints about the business opportunity or the promoter.”

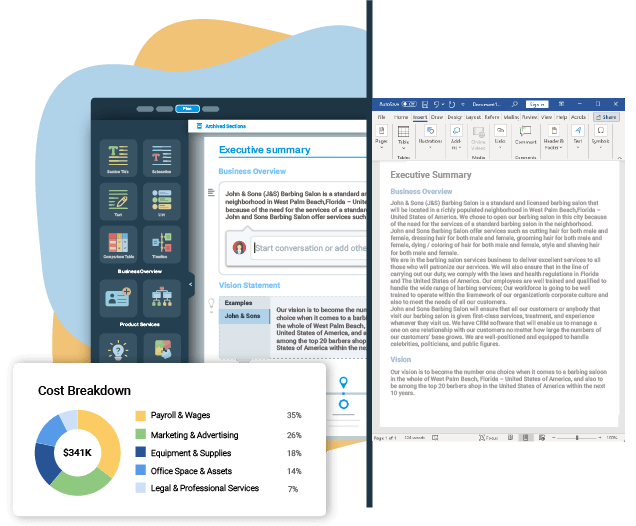

4. Create a business plan

Determining what kind of business you want to run is the first step in creating an airtight business plan.

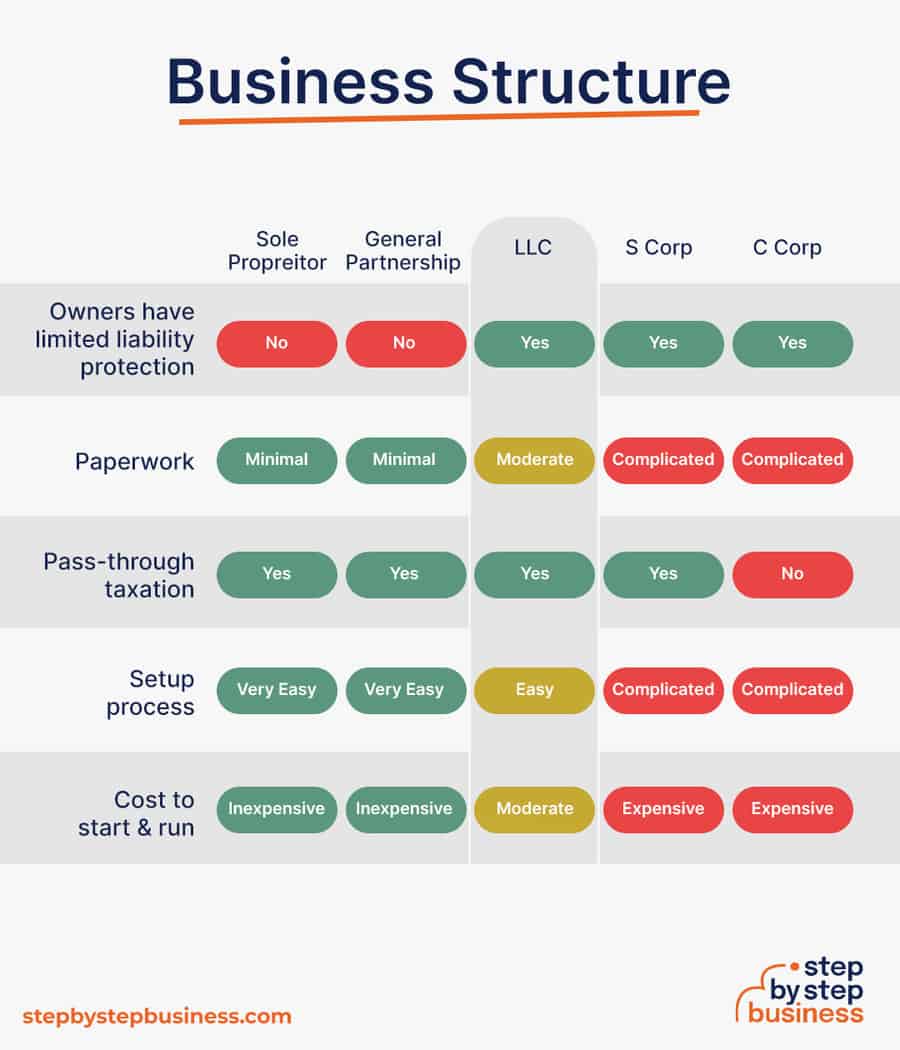

Do you want to run a sole proprietorship or a partnership with another person? Will your business be an LLC ? Will it be a large corporation?

Meet with a certified public accountant to understand which option suits your personal and tax needs.

Next, ask yourself a few questions:

- Who is your target audience?

- What are the initial costs?

- What kind of income can you expect?

- What is the name of the business?

- What do you need to get started?

5. Other necessities

Here are a few more things you will need to accomplish before starting your medical billing company:

- Apply for a business license

- Register for taxes

- Set up a business bank account

- Set up accounting

- Obtain necessary permits and licenses

- Get business insurance

- Start an LLC. Here are some free guides .

B. What you need to get up and running

Here are the essential items you will need to run a medical billing business smoothly:

1. A clearinghouse

A clearinghouse is a financial institution that processes and facilitates the exchange of payments, securities, or derivatives transactions. In your case, it is a company that electronically receives and transmits medical claims billing.

How much does this service cost?

The cost of a clearinghouse can range from below $100 to several hundred dollars depending on the bells and whistles. Some clearinghouses also demand additional fees for each new medical care provider or account you add.

2. A medical billing software

As mentioned earlier, the most expensive part of setting up your in-house company is medical billing software.

If you want some specific features of your choice and a billing software specifically made for your business, you can get a bespoke medical billing software developed for you.

Otherwise, billing software can range anywhere from a couple of hundred dollars to $10,000. While some are basic, others include features like marketing plans and lead generation.

Fortunately, many software companies provide free trials. Give your top choices a try before investing heavily in the most critical part of your business.

3. Other equipment & forms

There are a few other necessities you will need to have:

- A reliable computer with an internet connection

- A phone, printer, and fax machine

- Medical insurance forms

- Reference books (ICD-10, CPT, and HCPCS Expert 2000 coding books)

- A productive work environment

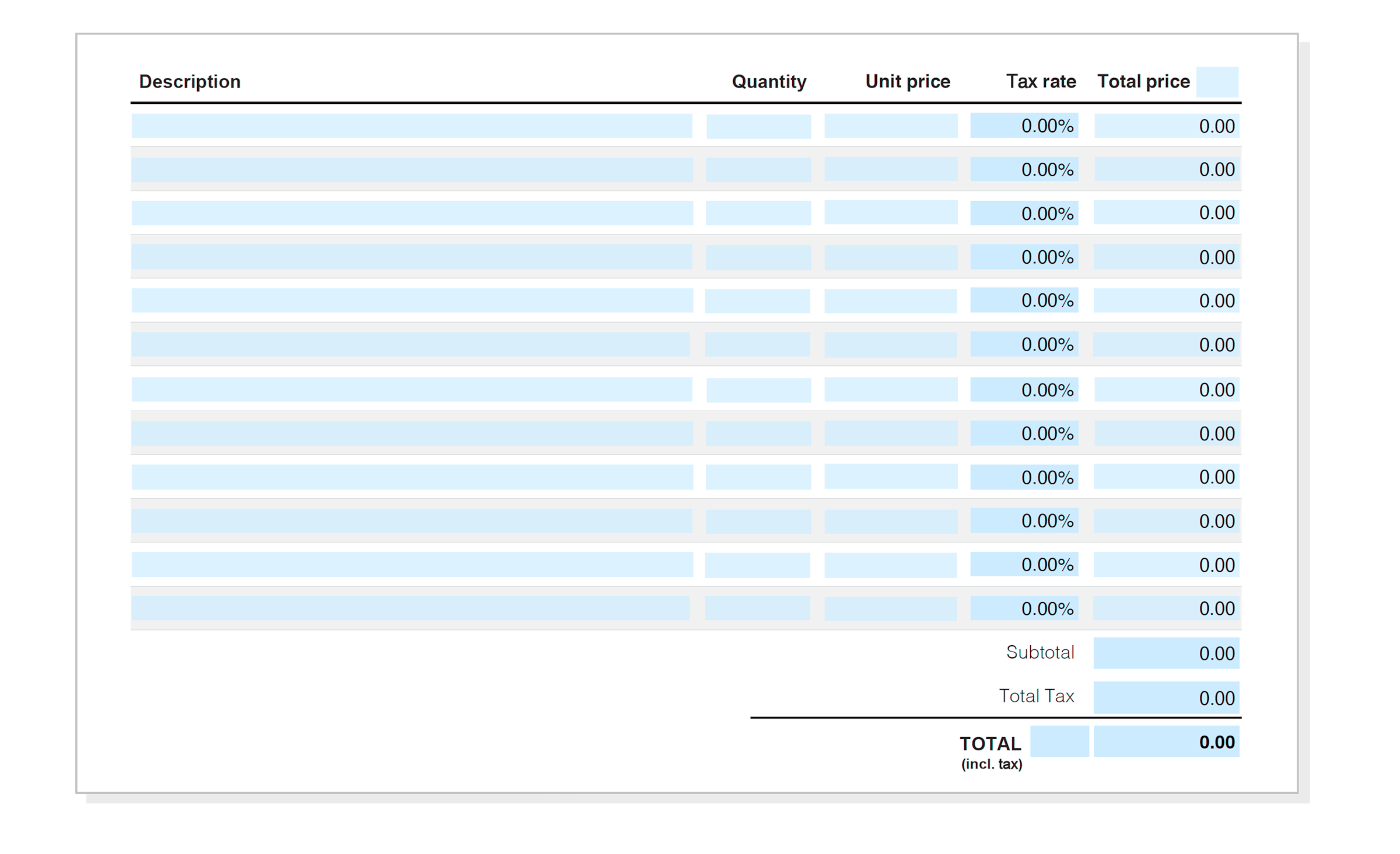

If you gain a plethora of clients, you can also use invoicing software to remain organized. If you run a high-volume business, electronic billing may be of use to you.

C. Choosing a billing software

As mentioned earlier, medical billing software pricing can vary widely based on software features and the size of your business.

Here are some of the most popular billing software of 2021:

A cloud-based medical practice management system that includes billing features like medical claims processing, claims scrubbing, code & charge entry, health insurance verification, and more.

- Solo Practice: $499 per month

- Mid-Sized: $4,990 per month

- Large Practice: $12,425 per month

Capterra rating: 4/5

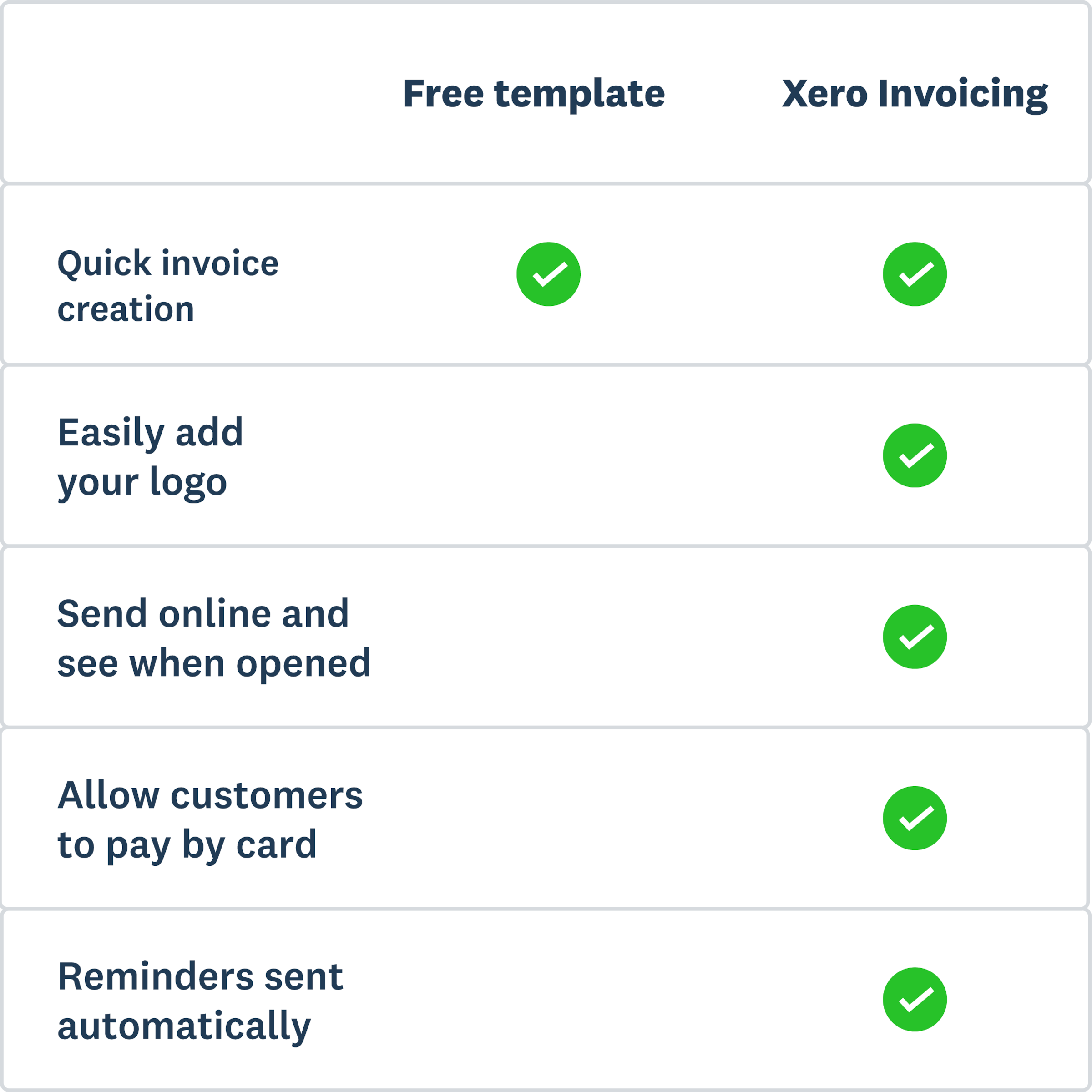

A cloud-based medical practice management software with built-in billing and EHR capabilities. The billing feature is integrated with Xero accounting software and includes payment processing, invoice generation, claims management, and financial reporting tools.

- Solo Practice: $23 – $93 per month

- Mid-Sized: $102 – $139 per month

- Large Practice: $150 – $270 per month

Capterra rating : 5/5

CareCloud EHR

A cloud-based medical practice management system with an integrated billing app that features claims processing, claims scrubbing, code & charge entry, health insurance verification, invoice history, and more.

- Solo Practice: $349 – $649 per month

- Mid-Sized: $3,490 – $6,290 per month

- Large Practice: $8,725 – $15,725

A web and mobile-available software that manages patient billing through cloud technology. Billing features include claims processing & scrubbing, health insurance verification, dunning management, and more.

- Solo Practice: $300 per month

- Mid-Sized: $3,000 per month

- Large Practice: $7,500 per month

CollaborateMD

A simple, efficient, and affordable cloud-based medical practice management and medical billing solution for your third-party billing needs. Billing features include claims processing, claims scrubbing, health insurance verification, remittance advice, and more.

- Solo Practice: $165 – $345 per month

- Mid-Sized: $1,650 – $3,450

- Large Practice: $4,125 – $8,625

Note – Pricing for billers and coders may vary based on the number of users, features, and number of clients.

For more options, check out Capterra’s list of the best medical billing software .

D. How to charge clients

There are a few ways to charge your clients in the medical billing process:

A percentage of collections – The most popular method, as it often lends the highest return and revenue.

A per-claim fee – This method includes charging a set fee for each claim that is submitted, whether paid or unpaid.

An hourly fee – Hourly fees are useful for medical billing businesses that provide complementary services. The current average hourly rate of a medical billing clerk employee in the U.S. is $18/hour . As an independent contractor, you will likely earn more.

The option you choose depends on the healthcare providers you partner with, as well as the billing and medical coding you perform.

Tracking billing hours

If you opt for charging hourly fees, try using Time Doctor to track your working hours.

If you have a team, Time Doctor follows the websites that they visit while clocked-in and will send reminders when it thinks they are visiting a site that is unrelated to work.

E. Income potential

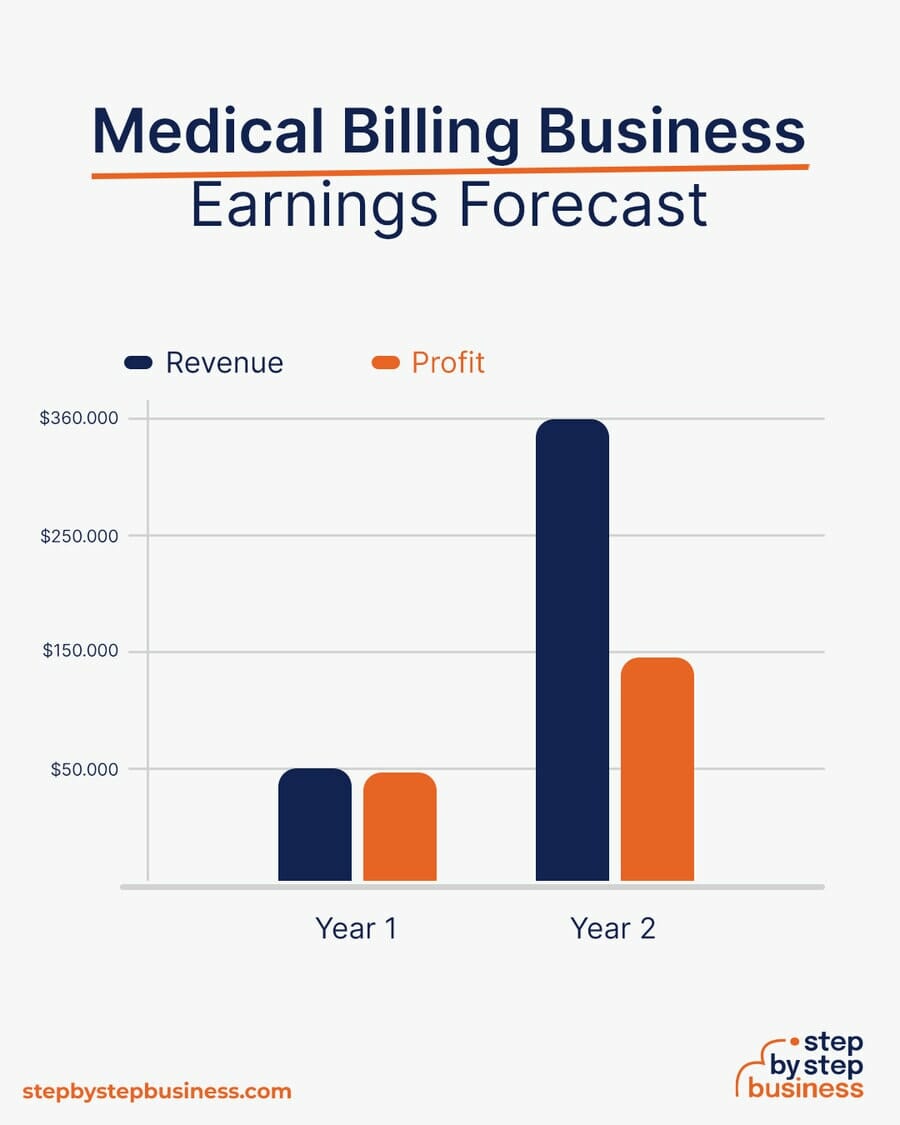

As with all businesses, the income you earn largely depends on the success and size of the company. Whether you earn $20k or $100k per year will depend on the care providers you partner up with, as well as if you specialize yourself and run an efficient business.

F. Specialize yourself

Specializing yourself in one or two fields of healthcare can significantly benefit your knowledge and income in this business.

For one, you will eliminate the number of billing codes you need to use regularly. More importantly, much of your credibility as a medical billing clerk will depend on your knowledge of the industry and medical services at hand.

The more you speak their language, the more care providers will hire you for outsourced billing. Here are a few areas of specialty to consider:

- Cardiologists

- Veterinarians

- Chiropractors

- Family practitioners

- Psychiatrists

Note – A healthcare provider that charges a high copay doesn’t necessarily mean more income for you. Doctors with a low copay often require a higher patient billing volume to succeed, sending more insurance claims your way.

G. Construct a strong marketing plan

Your business, like all businesses, won’t grow itself.

Medical billing is a heavily saturated industry. You must create a rigorous marketing plan if you want to hit the ground running.

Getting your first client can be the biggest challenge. You have a head start if you have experience in the medical care industry and have maintained positive relations with healthcare providers in the past.

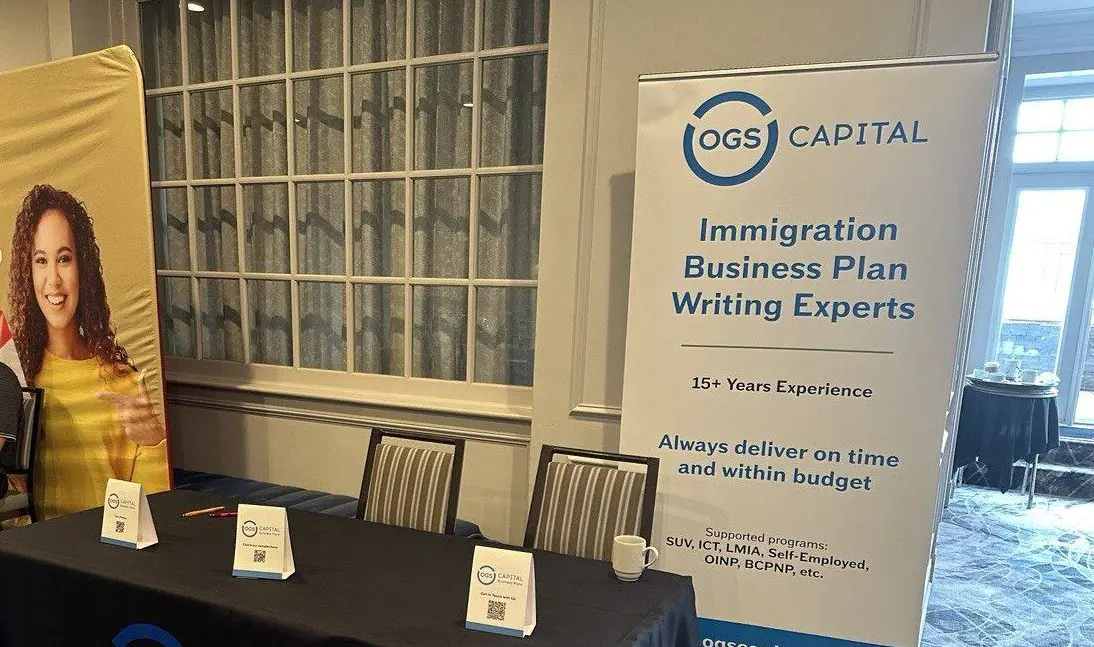

One of the best ways to market yourself in the medical billing industry is through in-person visits where you drop off marketing material and create relationships with providers.

Moreover, creating a website and business cards or vCards for your service, as well as offering incentives will stimulate growth and lead opportunities.

While generating leads, consider providing these free incentives to lure in prospects:

- An analysis of the benefits of outsourcing billing services for their specific medical practice.

- A code review. Analyze which codes are out-of-date or incorrect, and estimate the amount of lost revenue that has resulted from these codes.

- A free claim process and an estimate of the time your services saved them.

- An analysis of their Superbill and accounts receivable, and an estimate of why some of their medical claims are rejected.

- A consultation to evaluate if they comply with HIPAA and OIG.

If you struggle to bag your first client, you can also offer discounts and other incentives for some time. For instance, you could offer twenty percent off for the first month of your services.

Whatever route of marketing you choose to pursue, create a strategic plan ahead of time so that you are ready to go when it’s time to grow your business.

H. Network & grow

Knowing the right people can always help achieve your goals.

What’s more?

Word of mouth referrals and positive personal testimonies are fantastic for your business.

Embed yourself in the network of medical professionals and make a name for your business. Involving yourself can be done through joining professional organizations, getting in touch with your own family’s medical providers, and working in a medical office that allows you to come in contact with a variety of providers.

Expanding your network will increase your chances of obtaining new clients and growing your business.

I. Bonus: An alternative business opportunity

There is an alternative option for starting your own third-party billing business that can be fruitful if done well.

What is it?

Buying an already existing medical business.

Purchasing an already existing billing company can be done privately or through a broker and can help you avoid a few startup fees and client roundups.

Acquiring a successful business can also lead to high returns with less initial work.

However, before acquiring an already-existing business, ask a few critical questions:

- How many clients does the company have?

- How long have they been customers?

- Are they under contract?

- What method of payment do they use?

- What prices do they pay?

Establishing your own billing business can be both lucrative and enjoyable.

Keep in mind that a work-at-home business requires commitment, dedication, and organization. We at Time Doctor would know. Our team is made up of 80+ remote workers!

For tips on how to be more productive in your remote work, check out the Top 10 secrets to maximize remote work productivity .

With that said, there are numerous benefits to being your boss, including a flexible schedule and the freedom to make your own business decisions.

Furthermore, running a medical billing service out of your home avoids overhead costs and requires little capital to establish.

When done well, a medical billing business can give you the steady income and flexible schedule you have been desperately seeking!

View a free demo of Time Doctor

Andy is a technology & marketing leader who has delivered award-winning and world-first experiences.

Is medical billing outsourcing the best option for my medical practice?

Process documentation best practices (and why you’ll fail without it), related posts, enhancing support agent productivity: the impact of ui/ux on customer support tools, boosting retention and engagement through employee stock options, track employee hours effectively: 10 best apps in 2024, 10 effective strategies on how to reduce stress at work and stay..., analyzing 12 million support tickets: insights from time doctor’s webinar, work-life harmony: keep employees happy and business thriving.

- Sample Business Plans

- Medical & Health Care

Medical Billing Business Plan

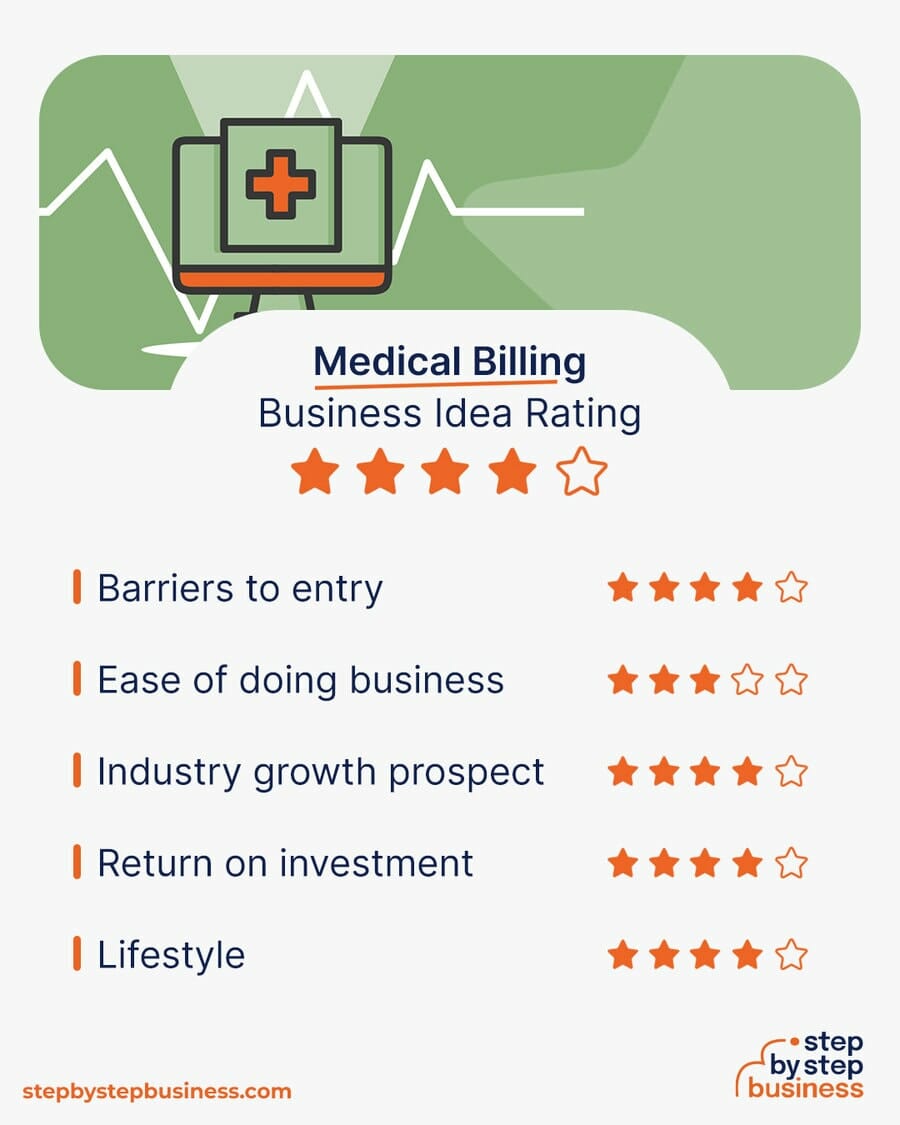

High demand, low startup costs, and a recurring revenue model make starting a medical billing business a lucrative and rewarding profession.

Anyone can start a new business, but you need a detailed business plan when it comes to raising funding, applying for loans, and scaling it like a pro!

Need help writing a business plan for your medical billing business? You’re at the right place. Our medical billing business plan template will help you get started.

Free Business Plan Template

Download our free business plan template now and pave the way to success. Let’s turn your vision into an actionable strategy!

- Fill in the blanks – Outline

- Financial Tables

How to Write A Medical Billing Business Plan?

Writing a medical billing business plan is a crucial step toward the success of your business. Here are the key steps to consider when writing a business plan:

1. Executive Summary

An executive summary is the first section planned to offer an overview of the entire business plan. However, it is written after the entire business plan is ready and summarizes each section of your plan.

Here are a few key components to include in your executive summary:

Introduce your Business:

Start your executive summary by briefly introducing your business to your readers.

Market Opportunity:

Medical billing services:.

Highlight the medical billing services you offer your clients. The USPs and differentiators you offer are always a plus.

Marketing & Sales Strategies:

Financial highlights:, call to action:.

Ensure your executive summary is clear, concise, easy to understand, and jargon-free.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

2. Business Overview

The business overview section of your business plan offers detailed information about your company. The details you add will depend on how important they are to your business. Yet, business name, location, business history, and future goals are some of the foundational elements you must consider adding to this section:

Business Description:

Describe your business in this section by providing all the basic information:

Describe what kind of medical billing company you run and the name of it. You may specialize in one of the following medical billing businesses:

- Third-party medical billing

- Medical coding services

- Medical billing software companies

- Medical billing consulting services

- Specialty-specific medical billing business

- Describe the legal structure of your medical billing company, whether it is a sole proprietorship, LLC, partnership, or others.

- Explain where your business is located and why you selected the place.

Mission Statement:

Business history:.

If you’re an established medical billing service provider, briefly describe your business history, like—when it was founded, how it evolved over time, etc.

Future Goals

This section should provide a thorough understanding of your business, its history, and its future plans. Keep this section engaging, precise, and to the point.

3. Market Analysis

The market analysis section of your business plan should offer a thorough understanding of the industry with the target market, competitors, and growth opportunities. You should include the following components in this section.

Target market:

Start this section by describing your target market. Define your ideal customer and explain what types of services they prefer. Creating a buyer persona will help you easily define your target market to your readers.

Market size and growth potential:

Describe your market size and growth potential and whether you will target a niche or a much broader market.

Competitive Analysis:

Market trends:.

Analyze emerging trends in the industry, such as technology disruptions, changes in customer behavior or preferences, etc. Explain how your business will cope with all the trends.

Regulatory Environment:

Here are a few tips for writing the market analysis section of your medical billing business plan::

- Conduct market research, industry reports, and surveys to gather data.

- Provide specific and detailed information whenever possible.

- Illustrate your points with charts and graphs.

- Write your business plan keeping your target audience in mind.

4. Products And Services

The product and services section should describe the specific services and products that will be offered to customers. To write this section should include the following:

Describe your services:

Mention the medical billing services your business will offer. This list may include services like,

- Claims processing

- Medical coding

- Insurance verification

- Accounts receivable management

- Patient billing & collections

- Practice management software

- Compliance & regulatory assistance

- Consulting & advisory services

Quality measures:

Additional services.

In short, this section of your medical billing plan must be informative, precise, and client-focused. By providing a clear and compelling description of your offerings, you can help potential investors and readers understand the value of your business.

5. Sales And Marketing Strategies

Writing the sales and marketing strategies section means a list of strategies you will use to attract and retain your clients. Here are some key elements to include in your sales & marketing plan:

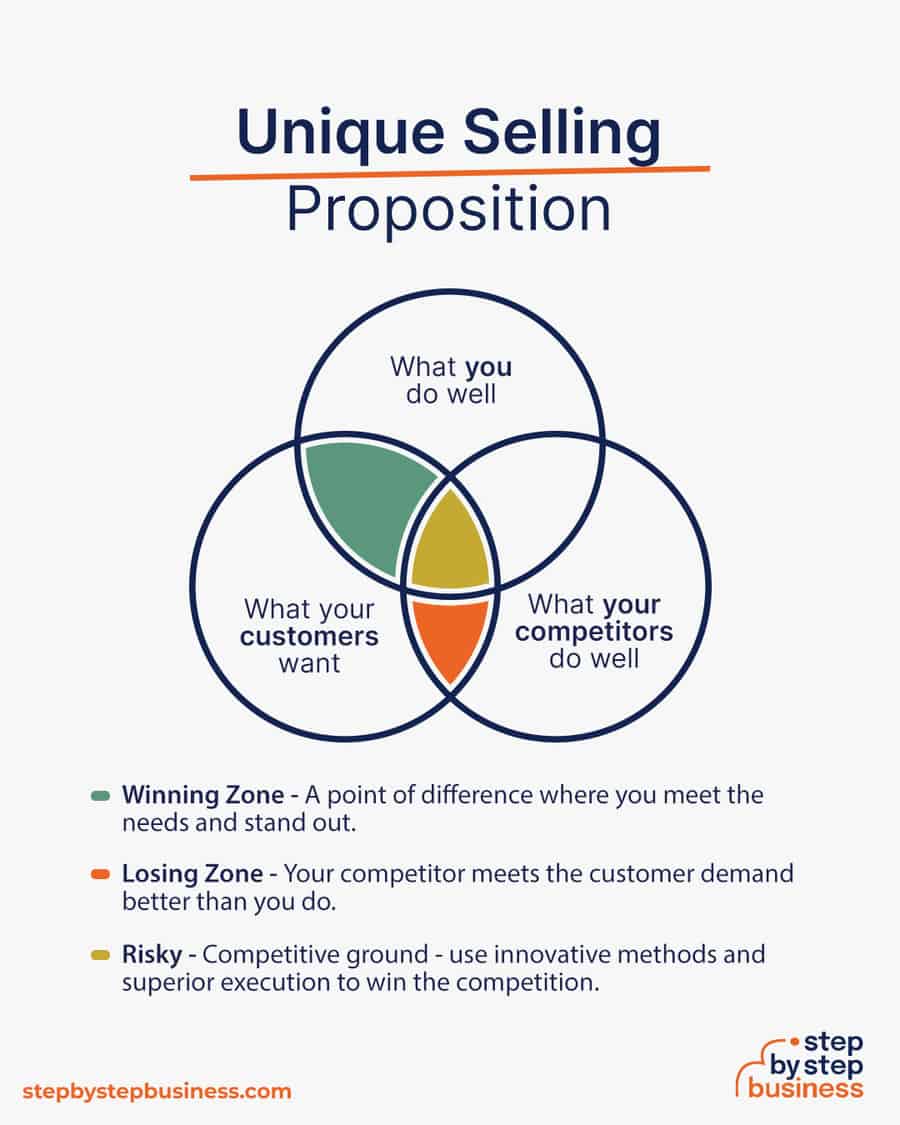

Unique Selling Proposition (USP):

Define your business’s USPs depending on the market you serve, the equipment you use, and the unique services you provide. Identifying USPs will help you plan your marketing strategies.

Pricing Strategy:

Marketing strategies:, sales strategies:, customer retention:.

Overall, this section of your medical billing company business plan should focus on customer acquisition and retention.

Have a specific, realistic, and data-driven approach while planning sales and marketing strategies for your medical billing business, and be prepared to adapt or make strategic changes in your strategies based on feedback and results.

6. Operations Plan

The operations plan section of your business plan should outline the processes and procedures involved in your business operations, such as staffing requirements and operational processes. Here are a few components to add to your operations plan:

Staffing & Training:

Operational process:, equipment & software:.

Include the list of equipment and software required for medical billing, such as computers, printers & scanners, telephone systems, medical billing software, practice management system, data security measures, etc.

Adding these components to your operations plan will help you lay out your business operations, which will eventually help you manage your business effectively.

7. Management Team

The management team section provides an overview of your medical billing business’s management team. This section should provide a detailed description of each manager’s experience and qualifications, as well as their responsibilities and roles.

Founders/CEO:

Key managers:.

Introduce your management and key members of your team, and explain their roles and responsibilities.

Organizational structure:

Compensation plan:, advisors/consultants:.

Mentioning advisors or consultants in your business plans adds credibility to your business idea.

This section should describe the key personnel for your medical billing services, highlighting how you have the perfect team to succeed.

8. Financial Plan

Your financial plan section should provide a summary of your business’s financial projections for the first few years. Here are some key elements to include in your financial plan:

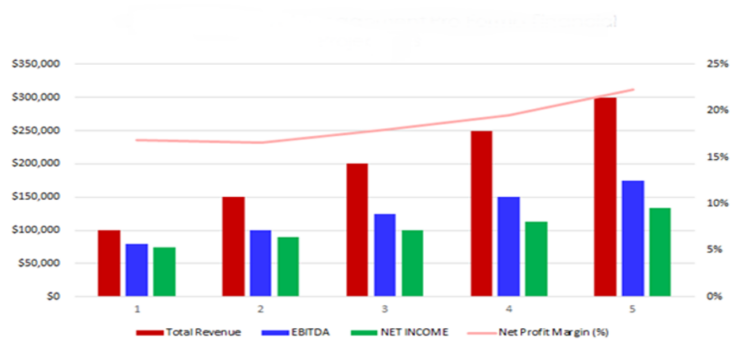

Profit & loss statement:

Cash flow statement:, balance sheet:, break-even point:.

Determine and mention your business’s break-even point—the point at which your business costs and revenue will be equal.

Financing Needs:

Be realistic with your financial projections, and make sure you offer relevant information and evidence to support your estimates.

9. Appendix

The appendix section of your plan should include any additional information supporting your business plan’s main content, such as market research, legal documentation, financial statements, and other relevant information.

- Add a table of contents for the appendix section to help readers easily find specific information or sections.

- In addition to your financial statements, provide additional financial documents like tax returns, a list of assets within the business, credit history, and more. These statements must be the latest and offer financial projections for at least the first three or five years of business operations.

- Provide data derived from market research, including stats about the industry, user demographics, and industry trends.

- Include any legal documents such as permits, licenses, and contracts.

- Include any additional documentation related to your business plan, such as product brochures, marketing materials, operational procedures, etc.

Use clear headings and labels for each section of the appendix so that readers can easily find the necessary information.

Remember, the appendix section of your medical billing service business plan should only include relevant and important information supporting your plan’s main content.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

This sample medical billing business plan will provide an idea for writing a successful medical billing plan, including all the essential components of your business.

After this, if you still need clarification about writing an investment-ready business plan to impress your audience, download our medical billing business plan pdf .

Related Posts

Medical Lab Business Plan

Medical Transport Business Plan

400+ Free Business Plan Example

Business Plan Cover Page Guide

AI-Powered Business Plan Generators

Steps for Preparing Business Plan

Frequently asked questions, why do you need a medical billing business plan.

A business plan is an essential tool for anyone looking to start or run a successful medical billing business. It helps to get clarity in your business, secures funding, and identifies potential challenges while starting and growing your business.

Overall, a well-written plan can help you make informed decisions, which can contribute to the long-term success of your medical billing company.

How to get funding for your medical billing business?

There are several ways to get funding for your medical billing business, but self-funding is one of the most efficient and speedy funding options. Other options for funding are:

- Bank loan – You may apply fora loan in government or private banks.

- Small Business Administration (SBA) loan – SBA loans and schemes are available at affordable interest rates, so check the eligibility criteria before applying for it.

- Crowdfunding – The process of supporting a project or business by getting a lot of people to invest in your business, usually online.

- Angel investors – Getting funds from angel investors is one of the most sought startup options.

Apart from all these options, there are small business grants available, check for the same in your location and you can apply for it.

Where to find business plan writers for your medical billing business?

There are many business plan writers available, but no one knows your business and ideas better than you, so we recommend you write your medical billing business plan and outline your vision as you have in your mind.

What is the easiest way to write your medical billing business plan?

A lot of research is necessary for writing a business plan, but you can write your plan most efficiently with the help of any medical billing business plan example and edit it as per your need. You can also quickly finish your plan in just a few hours or less with the help of our business plan software .

How do I write a good market analysis in a medical billing business plan?

Market analysis is one of the key components of your business plan that requires deep research and a thorough understanding of your industry. We can categorize the process of writing a good market analysis section into the following steps:

- Stating the objective of your market analysis—e.g., investor funding.

- Industry study—market size, growth potential, market trends, etc.

- Identifying target market—based on user behavior and demographics.

- Analyzing direct and indirect competitors.

- Calculating market share—understanding TAM, SAM, and SOM.

- Knowing regulations and restrictions

- Organizing data and writing the first draft.

Writing a marketing analysis section can be overwhelming, but using ChatGPT for market research can make things easier.

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

Medical Billing Business Plan Template

Written by Dave Lavinsky

Medical Billing Business Plan

You’ve come to the right place to create your Medical Billing business plan.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Medical Billing businesses.

Below is a template to help you create each section of your Medical Billing business plan.

Executive Summary

Business overview.

TriMountain Medical Billing is a startup business located in Denver, Colorado. The company is founded by two friends, Nancy Linninger and Lacy Patton, both of whom have over 10 years of experience in the medical billing industry. They were team members in a large medical billing firm that was part of a national chain business and each has garnered a reputation for accuracy, excellent customer service, and offering the extra effort sometimes needed to assist in complex billing circumstances. Both Nancy and Lacy have been award recipients by associations for outstanding service to physician groups and individual physicians within their sphere of service and both partners have been awarded for their consistent care and devotion to “getting the job done correctly.”

With their outstanding reputations to carry their new business forward, the partners are talking with former customers about joining their new business and they are also gathering information to join industry events and citywide associations that will help spread the word of their new business.

Product Offering

The following are the services that TriMountain Medical Billing will provide:

- End-to-end revenue cycle management services

- Patient data entry

- Insurance verification

- Claim submission

- Denial management

- Payment posting

- Day to day client management

Customer Focus

TriMountain Medical Billing will primarily target the offices of physicians and various other healthcare providers. Secondarily, they will target the specialty and often unique billing needs of offices of cardiology, orthopedics, dermatology, and radiology.

Management Team

TriMountain Medical Billing is a startup company formed as a legal partnership. The partners, Nancy Linninger and Lacy Patton, carry an extensive background portfolio of accomplishments and awards within the medical billing industry. They are each known for stellar performance in complex medical billing issues and for their outstanding customer service in each medical billing case received. The partners have over 10 years of billing experience combined and have already determined from former clients that they will move to the new company as soon as it is open for business.

Nancy Linninger holds a bachelor of arts degree in Accounting, which she acquired from the University of Colorado. Her medical billing experience began before she attended the university, having started working at a small medical billing office while she was in high school.

Lacy Patton holds a bachelor of arts degree in Business, which she acquired from the College of the Redwoods. Her medical billing experience consisted of six years at her former employment, where as a Medical Billing Clerk III, she learned all aspects of medical billing, along with customer service and management of the newest software available for use in medical billing.

Success Factors

TriMountain Medical Billing will be able to achieve success by offering the following competitive advantages:

- Friendly, knowledgeable, and highly-qualified team of TriMountain Medical Billing.

- Exceptional customer service is the highest priority for the team at TriMountain Medical Billing and the staff will be trained to meet or exceed this service level.

- All billing is open to communication and discussion, with mediation set for any disputes that may arise. The phrase, “The customer is always right,” is one that TriMountain Medical Billing takes seriously.

- Comprehensive menu of services and an accurate and complete record and descriptions for the records that are delivered to the [physician groups every month.

- TriMountain Medical Billing offers the best pricing in the city. Their pricing structure is the most cost-effective when compared to the competition.

Financial Highlights

TriMountain Medical Billing is seeking $200,000 in debt financing to launch its TriMountain Medical Billing offices. The funding will be dedicated toward securing the office space and purchasing office equipment and supplies. Funding will also be dedicated toward three months of overhead costs to include payroll of the staff, rent, and marketing costs for the print ads and marketing costs. The breakout of the funding is below:

- Office space build-out: $20,000

- Office equipment, supplies, and materials: $10,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $10,000

- Working capital: $10,000

The following graph outlines the financial projections for TriMountain Medical Billing.

Company Overview

Who is trimountain medical billing.

TriMountain Medical Billing is a newly established, full-service medical billing business in Denver, Colorado. TriMountain Medical Billing will be the most reliable, cost-effective, and efficient choice for healthcare providers in Denver and the surrounding communities. TriMountain Medical Billing will provide a comprehensive menu of medical billing services for any physicians group or clinic to utilize. Their full-service approach includes a comprehensive array of services and the latest software to support them.

TriMountain Medical Billing will be able to manage every client with speed and accuracy. The team of professionals are highly qualified and experienced in medical billing and, more importantly, in customer service that is superior to all others. TriMountain Medical Billing removes all the headaches and issues of medical billing and ensures a reliable, fast and efficient medical billing system will support every client’s customer service needs.

TriMountain Medical Billing History

Since incorporation, TriMountain Medical Billing has achieved the following milestones:

- Registered TriMountain Medical Billing, LLC to transact business in the state of Colorado.

- Has a contract in place for a 10,000 square foot office at one of the midtown buildings

- Reached out to numerous contacts to include TriMountain Medical Billing as new partners in billing.

- Began recruiting a staff of two and three office personnel to work at TriMountain Medical Billing.

TriMountain Medical Billing Services

The following will be the services TriMountain Medical Billing will provide:

Industry Analysis

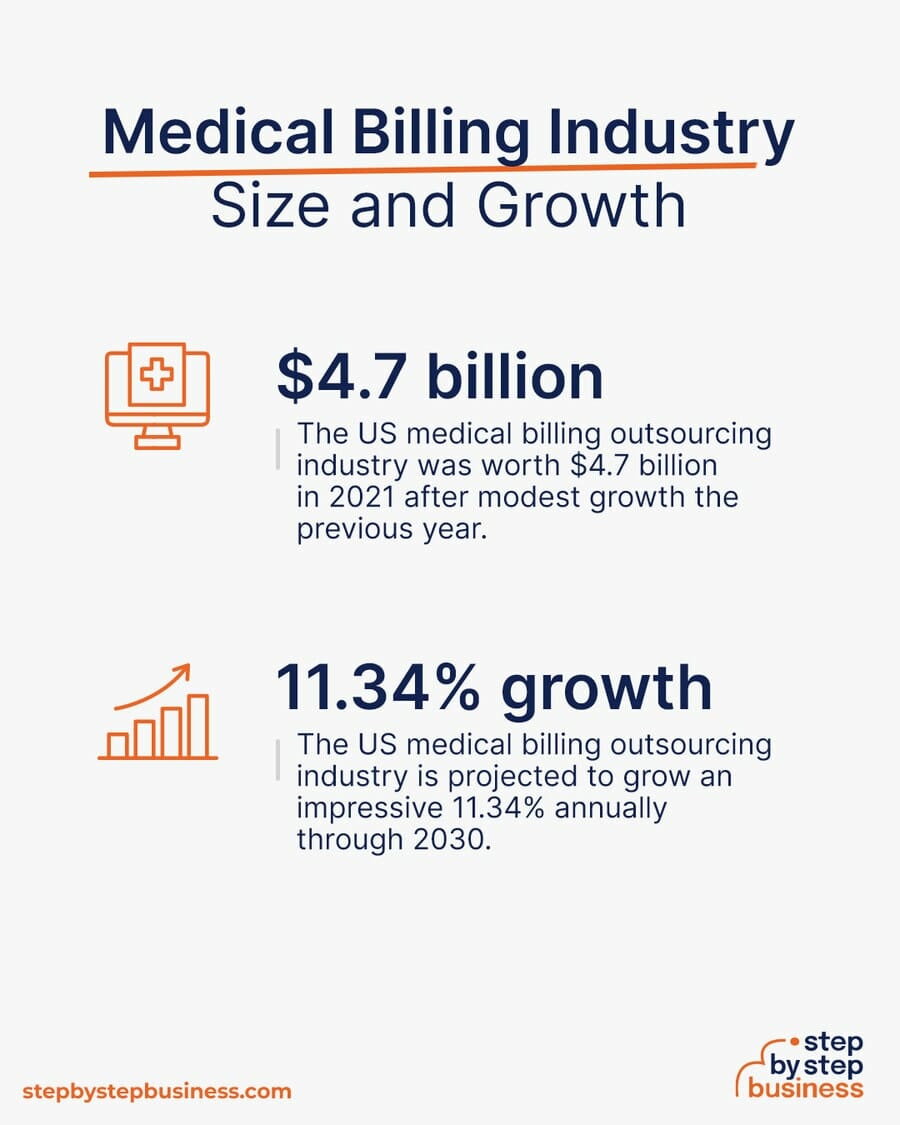

The medical billing industry is expected to surge in growth over the next five years to over $24 billion. The fast rate of growth will be driven by the increasing demand to outsource billing from healthcare providers to medical billing companies who specialize in services and accuracy. This allows practitioners to focus on patients rather than on billing. Additionally, the growth in the industry will be exponentially fast as a result of governmental programs and policies that are currently in motion to change. More services by medical billing companies, especially with the use of AI, will be required.

Costs will likely be reduced as AI is integrated into medical billing systems and input becomes less timely, which will lower costs. Additionally, costs will be reduced as software and other formats and systems continue to evolve to make time-consuming tasks easier and more efficient for medical billing processes and their requirements.

Customer Analysis

Demographic profile of target market.

TriMountain Medical Billing will target the offices of physicians and various other healthcare providers. Secondarily, they will target the specialty and often unique billing needs of offices of cardiology, orthopedics, dermatology, and radiology.

Customer Segmentation

TriMountain Medical Billing will primarily target the following customer profiles:

- Physician offices

- Medical groups that service physicians

- Specialty medical groups, such as cardiology, orthopedics, dermatology and radiology, each of which has unique medical billing requirements

Competitive Analysis

Direct and indirect competitors.

TriMountain Medical Billing will face competition from other companies with similar business profiles. A description of each competitor company is below.

MedBill of Colorado

MedBill of Colorado is owned by a physician’s group located in Provo, Utah. The focus of the medical billing company is on medical coding and the documentation that must accurately accompany coding. MedBill of Colorado offers physician groups an assurance that medical records are coded accurately and in compliance with coding guidelines, which is crucial for accurate billing and reimbursement.

The physician’s group that owns MedBill of Colorado is currently seeking a sizable loan in order to obtain software and AI-assisted programs that will speed the billing process for certain physician groups and individual clients. The cutting-edge technology, when placed into use, will reduce the time and effort spent in accurately coding.

Colorado Medical Claim Services

The Colorado Medical Claim Services group has a primary focus on claims submission, tracking, and follow-up. They work to speed the processing of claims, which ensure physician groups receive timely payments. They also work to accurately reduce claim denials, which removes the time-consuming tasks from the physician’s group. Colorado Medical Claim Services also works to maximize reimbursements for healthcare providers by cross-checking and verifying expenditures and allowable reimbursements.

Colorado Medical Claim Services was started in 2019 by a physician, Neil Baker, who saw the opportunity to garner profit in a fast-rising area of medical billing. The coding portion of the service is just the beginning for the Colorado Medical Claim Services business.

Denver Doctors Collection Group

Denver Doctors Collection Group has a primary concentration on accurate patient billing and the collection due to doctors as a result of those billings. The six employees within the company handle patient statements, payment plans, and collections to ensure that patients pay their bills promptly. If patients are unable to pay, the Denver Doctors Collection Group sets up efficient and effective repayment programs that ensure doctors are able to maintain a reasonable cash flow even as repayment plans often take a longer period of time to collect. The owner of the company, Dan Dorsee, started the company in 1999 and has maintained the company through sustained growth within this segment of medical billing.

Competitive Advantage

TriMountain Medical Billing will be able to offer the following advantages over their competition:

Marketing Plan

Brand & value proposition.

TriMountain Medical Billing will offer the unique value proposition to its clientele:

- Highly-qualified team of skilled employees who believe customer service is the highest priority for the team at TriMountain Medical Billing.

- The staff of TriMountain Medical Billing are fully trained to meet and exceed the requirements of each physician group in accuracy and reliability of their work.

- Billing questions are always open to communication and discussion, with mediation set for any disputes that may arise. The phrase, “The customer is always right,” is one that TriMountain Medical Billing takes seriously.

- Compared to other medical billing companies in the area, TriMountain Medical Billing offers comprehensive services at lower rates than other providers.

Promotions Strategy

The promotions strategy for TriMountain Medical Billing is as follows:

Word of Mouth/Referrals

Nancy Linninger and Tracy Patton have built up an extensive list of contacts over the years by providing exceptional service and expertise to former medical billing clients. The contacts and clients will follow them to their new company and help spread the word of TriMountain Medical Billing.

Professional Associations and Networking

National trade shows and regional networking events will be attended and the new company will be offered in sales and business development efforts. Physician conferences and medical coding conferences will be attended, as well, with similar goals.

Print Advertising

Printed brochures will be offered to all physician groups and clinics within the Denver region. Discounted pricing for one-year contracts will be offered during the first month of business. From time to time, additional messaging will be sent to physician groups to consider the services of TriMountain Medical Billing.

Website/SEO Marketing

TriMountain Medical Billing will fully utilize their website. The website will be well organized, informative, and list all the services that TriMountain Medical Billing provides. The website will also list their contact information. The website will engage in SEO marketing tactics so that anytime someone types in the Google or Bing search engine “medical billing company” or “medical billing near me,” TriMountain Medical Billing will be listed at the top of the search results.

The pricing of TriMountain Medical Billing will be moderate and on par with competitors so customers feel they receive excellent value when purchasing their services.

Operations Plan

The following will be the operations plan for TriMountain Medical Billing. Operation Functions:

- Nancy Linninger will be the owner and president of the company. She will oversee all business development and manage the accounting needs of the company.

- Nancy Linninger will seek investor funding to fully develop two additional locations of the company within outlying regions of Denver in areas of fastest population growth.

- Tracy Patton will direct programs and oversee client relations with resolution or conflict negotiation needs. She will also manage non-payment issues and repayment plans.

- Tracy Patton will be the owner and vice president of the company. She will assume the role of administrative director, overseeing all staff and operations within the company. She will also direct the software programs and other innovations within the company.

- Daniel Peterson will be the senior manager of billing processes. He will work directly with staff to train, conduct checks, supervise accuracy and oversee client relations.

Milestones:

TriMountain Medical Billing will have the following milestones completed in the next six months.

- 5/1/202X – Finalize contract to lease office space

- 5/15/202X – Finalize personnel and staff employment contracts for the TriMountain Medical Billing

- 6/1/202X – Finalize contracts for TriMountain Medical Billing clients

- 6/15/202X – Begin networking at industry events

- 6/22/202X – Begin moving into the TriMountain Medical Billing office

- 7/1/202X – TriMountain Medical Billing opens its doors for business

Daniel Peterson has been recruited as the senior manager of billing processes. He will work directly with staff to train, conduct checks, supervise accuracy and oversee client relations.

Financial Plan

Key revenue & costs.

The revenue drivers for TriMountain Medical Billing are the fees they will charge to physicians and specialty medical groups for their services. .

The cost drivers will be the overhead costs required in order to staff at TriMountain Medical Billing. The expenses will be the payroll cost, rent, utilities, office supplies, and marketing materials.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and in order to pay off the startup business loan.

- Number of clients per Month: 100

- Average revenue per Month: $150,500

- Office Lease per Year: $100,000

Financial Projections

Income statement, balance sheet, cash flow statement, medical billing business plan faqs, what is a medical billing business plan.

A medical billing business plan is a plan to start and/or grow your medical billing business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Medical Billing business plan using our Medical Billing Business Plan Template here .

What are the Main Types of Medical Billing Businesses?

There are a number of different kinds of medical billing businesses , some examples include: Light, Full Service, and Boutique.

How Do You Get Funding for Your Medical Billing Business Plan?

Medical Billing businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start a Medical Billing Business?

Starting a medical billing business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

- Develop A Medical Billing Business Plan - The first step in starting a business is to create a detailed medical billing business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

- Choose Your Legal Structure - It's important to select an appropriate legal entity for your medical billing business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your medical billing business is in compliance with local laws.

- Register Your Medical Billing Business - Once you have chosen a legal structure, the next step is to register your medical billing business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

- Identify Financing Options - It’s likely that you’ll need some capital to start your medical billing business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

- Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

- Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

- Acquire Necessary Medical Billing Equipment & Supplies - In order to start your medical billing business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

- Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your medical billing business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful medical billing business:

- How to Start a Medical Billing Company

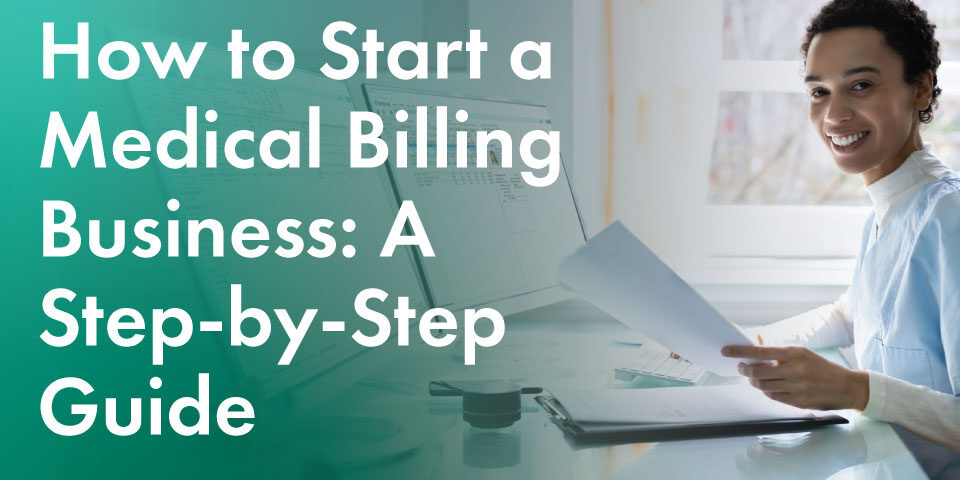

How to Start a Medical Billing Business: A Step-by-Step Guide

Starting a medical billing business can be a lucrative venture, offering you the opportunity to provide essential services to healthcare providers while enjoying the benefits of running your own business. In this comprehensive guide, we’ll walk you through the step-by-step process of launching your own medical billing business, from understanding the industry to setting up operations and attracting clients.

Why Start a Medical Billing Business?

The medical billing outsourcing market is a fast-growing industry. According to Grand View Research , the U.S. market size was valued at 5.2 billion dollars in 2022, and is expected to grow to 12.3 billion by 2030.

This is mainly because healthcare providers are increasingly relying on outsourced medical billing services due to complex coding systems, growing healthcare costs and federal mandates for electronic health records, or EHR. More and more, doctors are looking to outsource time-consuming administrative functions such as revenue management.

Understand the Medical Billing Industry

Before diving into the business, it’s crucial to have a solid understanding of the medical billing industry. Research the latest industry trends, regulations, and best practices to ensure you’re well-prepared to provide accurate and up-to-date services.

Gain Relevant Education and Training

While formal education isn’t always mandatory, obtaining relevant training and certifications will significantly enhance your credibility. Consider enrolling in medical billing and coding courses, obtaining certifications such as Certified Professional Biller (CPB), and staying informed about changes in healthcare laws.

In order to bill appropriately, a medical biller and coder should also have a basic understanding of anatomy, physiology and pharmacology. They should also understand medical and insurance terminology. There are three basic types of coding that a biller must be familiar with:

- CPT : Current Procedural Terminology

- HCPCS: Healthcare Common Procedure Coding System, produced by the Centers for Medicare and Medicaid Services

- ICD-11 : International Classification of Diseases

Programs are available ranging from one to four years, from certifications and Associates Degrees to Bachelor’s, Master’s and even Doctorate’s in the field. Shorter programs are often available at community colleges and technical/vocational schools, whereas higher level degrees come from in-person and on-line schools. There is financial aid available for many of these programs.

Once you have completed your education, you will need to pay and sit for the exam from your chosen organization to become credentialed:

- American Medical Billing Association (AMBA)

- American Academy of Professional Coder’s (AAPC)

- American Health Information Management Association (AHIMA)

These organizations offer a range of certifications from Certified Coding Associate to Registered Health Information Administrator, depending on the level of education you choose to obtain. The costs for these tests range from $300 and up.

Develop a Business Plan

Creating a well-thought-out business plan is essential for the success of your venture. Outline your business goals, target market, services offered, pricing strategy, and marketing approach. A comprehensive business plan will guide your decisions and attract potential investors or partners.

Choose a Legal Structure

Decide on the legal structure of your business, such as sole proprietorship, partnership, LLC, or corporation. Each structure has its own implications for liability, taxes, and management, so consult a legal professional to determine the best fit for your business.

Secure Necessary Licenses and Permits

Depending on your location and the nature of your medical billing business, you may need to obtain specific licenses and permits. Research the requirements in your area and ensure compliance before launching your business.

Set Up Your Office and Equipment

Create a functional workspace equipped with the necessary tools, such as computers, medical billing software , and office supplies. Invest in reliable software that can handle the complexity of medical billing tasks and ensure data security, such as TotalMD.

Look for medical billing software that is catered for medical billers and not just for healthcare providers. This will save you a lot of money because most medical software programs are priced per provider, not per user. TotalMD has a great pricing structure specifically for medical billers.

Develop Pricing and Services

Determine the pricing structure for your services. Research competitors’ rates and consider the complexity of the tasks you’ll be handling. Offer a range of services, including insurance claims submission, reimbursement tracking, and patient billing, to cater to different client needs.

There are three ways that billing is done through a billing service:

- Per-Claim Billing: a set amount is charged for each claim, regardless of the amount of work it takes to get it ready to bill. If the claim is rejected on the front-end, those corrections are included in the price. If the claim denies on the backend, an additional fee can be charged for the resubmission. These fees can range from between $1 to $8 per claim.

- Hourly: Hourly may be the best way to go if you are also doing practice management for the providers. The Bureau of Labor Statistics shows that an average hourly wage for a medical billing clerk is $16.50 per hour. Providers can expect to pay more to an independent contractor.

- Percentage of Collections: This is popular as it encourages the biller to maximize reimbursement for their providers. These percentages can range from 4% – 10% depending on many different factors.

Establish Billing Processes

Design efficient billing processes to ensure accuracy and timely submissions. Implement systems for verifying patient information, coding procedures correctly, and communicating with healthcare providers and insurers. This is where reliable medical billing software comes in.

Build a Strong Online Presence

In today’s digital age, having a professional website and active social media profiles is crucial for reaching potential clients. Optimize your website with relevant keywords, clear service descriptions, and client testimonials to boost your online visibility.

Network and Market Your Services

Network with local healthcare providers, clinics, and medical offices to build relationships and gain referrals. Attend industry events, join medical associations, and leverage online platforms to showcase your expertise and establish credibility.

Conclusion:

Starting a medical billing business requires careful planning, dedication, and a commitment to staying informed about industry changes. By following this step-by-step guide, you’ll be well-equipped to launch your business, provide valuable services to healthcare providers, and carve out a successful niche in the medical billing industry. Remember that persistence and a focus on delivering accurate and efficient billing services will be key to your business’s long-term success.

Andrea Jaramillo

Related posts.

Navigating Increased Patient Financial Responsibility

6 Effective Ways to Ask Your Patients for Payment

Using Fax Machines in the Medical World

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

How to Start a Medical Billing Company

Starting a medical billing company can be very profitable. With proper planning, execution and hard work, you can enjoy great success. Below you will learn the keys to launching a successful medical billing company.

Importantly, a critical step in starting a medical billing company is to complete your business plan. To help you out, you should download Growthink’s Ultimate Business Plan Template here .

Download our Ultimate Business Plan Template here

14 Steps To Start a Medical Billing Company :

- Choose the Name for Your Medical Billing Company

- Develop Your Medical Billing Company Business Plan

- Choose the Legal Structure for Your Medical Billing Company

- Secure Startup Funding for Your Medical Billing Company (If Needed)

- Secure a Location for Your Business

- Register Your Medical Billing Company with the IRS

- Open a Business Bank Account

- Get a Business Credit Card

- Get the Required Business Licenses and Permits

- Get Business Insurance for Your Medical Billing Company

- Buy or Lease the Right Medical Billing Company Equipment

- Develop Your Medical Billing Company Marketing Materials

- Purchase and Setup the Software Needed to Run Your Medical Billing Company

- Open for Business

1. Choose the Name for Your Medical Billing Company

The first step to starting a medical billing company is to choose your business’ name.

This is a very important choice since your company name is your brand and will last for the lifetime of your business. Ideally you choose a name that is meaningful and memorable. Here are some tips for choosing a name for your medical billing company:

- Make sure the name is available . Check your desired name against trademark databases and your state’s list of registered business names to see if it’s available. Also check to see if a suitable domain name is available.

- Keep it simple . The best names are usually ones that are easy to remember, pronounce and spell.

- Think about marketing . Come up with a name that reflects the desired brand and/or focus of your medical billing company.

2. Develop Your Medical Billing Company Business Plan

One of the most important steps in starting a medical billing company is to develop your medical billing company business plan . The process of creating your plan ensures that you fully understand your market and your business strategy. The plan also provides you with a roadmap to follow and if needed, to present to funding sources to raise capital for your business.

Your business plan should include the following sections:

- Executive Summary – this section should summarize your entire business plan so readers can quickly understand the key details of your medical billing company.

- Company Overview – this section tells the reader about the history of your medical billing company and what type of medical billing company you operate. For example, are you an in-house medical billing company, outsourced, third-party medical, hybrid, medical billing software, web-based, medical billing franchise, or a self-employed medical billing consultant?

- Industry Analysis – here you will document key information about the healthcare industry. Conduct market research and document how big the industry is and what trends are affecting it.

- Customer Analysis – in this section, you will document who your ideal or target customers are and their demographics. For example, how old are they? Where do they live? What do they find important when purchasing services like the ones you will offer?

- Competitive Analysis – here you will document the key direct and indirect competitors you will face and how you will build competitive advantage.

- Marketing Plan – your marketing plan should address the 4Ps: Product, Price, Promotions and Place.

- Product : Determine and document what products/services you will offer

- Prices : Document the prices of your products/services

- Place : Where will your own business be located and how will that location help you increase sales?

- Promotions : What promotional methods will you use to attract customers to your medical billing company? For example, you might decide to use pay-per-click advertising, public relations, search engine optimization and/or social media marketing.

- Operations Plan – here you will determine the key processes you will need to run your day-to-day operations. You will also determine your staffing needs. Finally, in this section of your plan, you will create a projected growth timeline showing the milestones you hope to achieve in the coming years.

- Management Team – this section details the background of your company’s management team.

- Financial Plan – finally, the financial plan answers questions including the following:

- What startup costs will you incur?

- How will your medical billing company make money?

- What are your projected sales and expenses for the next five years?

- Do you need to raise funding to launch your business?

Finish Your Business Plan Today!

3. choose the legal structure for your medical billing company.

Next you need to choose a legal structure for your own medical billing company and register it and your business name with the Secretary of State in each state where you operate your business.

Below are the five most common legal structures:

1) Sole proprietorship

A sole proprietorship is a business entity in which the owner of the medical billing company and the business are the same legal person. The owner of a sole proprietorship is responsible for all debts and obligations of the business. There are no formalities required to establish a sole proprietorship, and it is easy to set up and operate. The main advantage of a sole proprietorship is that it is simple and inexpensive to establish. The main disadvantage is that the owner is liable for all debts and obligations of the business.

2) Partnerships

A partnership is a legal structure that is popular among small businesses. It is an agreement between two or more people who want to start a medical billing company together. The partners share in the profits and losses of the business.

The advantages of a partnership are that it is easy to set up, and the partners share in the profits and losses of the business. The disadvantages of a partnership are that the partners are jointly liable for the debts of the business, and disagreements between partners can be difficult to resolve.

3) Limited Liability Company (LLC)

A limited liability company, or LLC, is a type of business entity that provides limited liability to its owners. This means that the owners of an LLC are not personally responsible for the debts and liabilities of the business. The advantages of an LLC for a medical billing company include flexibility in management, pass-through taxation (avoids double taxation as explained below), and limited personal liability. The disadvantages of an LLC include lack of availability in some states and self-employment taxes.

4) C Corporation

A C Corporation is a business entity that is separate from its owners. It has its own tax ID and can have shareholders. The main advantage of a C Corporation for a medical billing company is that it offers limited liability to its owners. This means that the owners are not personally responsible for the debts and liabilities of the business. The disadvantage is that C Corporations are subject to double taxation. This means that the corporation pays taxes on its profits, and the shareholders also pay taxes on their dividends.

5) S Corporation

An S Corporation is a type of corporation that provides its owners with limited liability protection and allows them to pass their business income through to their personal income tax returns, thus avoiding double taxation. There are several limitations on S Corporations including the number of shareholders they can have among others.

Once you register your medical billing company, your state will send you your official “Articles of Incorporation.” You will need this among other documentation when establishing your banking account (see below). We recommend that you consult an attorney in determining which legal structure is best suited for your company.

Incorporate Your Business at the Guaranteed Lowest Price

We are proud to have partnered with Business Rocket to help you incorporate your business at the lowest price, guaranteed.

Not only does BusinessRocket have a 4.9 out of 5 rating on TrustPilot (with over 1,000 reviews) because of their amazing quality…but they also guarantee the most affordable incorporation packages and the fastest processing time in the industry.

4. Secure Startup Funding for Your Medical Billing Company (If Needed)

In developing your own medical billing business plan , you might have determined that you need to raise funding to launch your business.

If so, the main sources of funding for a medical billing company to consider are personal savings, family and friends, credit card financing, bank loans, crowdfunding and angel investors. Angel investors are individuals who provide capital to early-stage businesses. Angel investors typically will invest in a medical billing company that they believe has high potential for growth.

5. Secure a Location for Your Business

When you’re starting a medical billing company, the first thing you need to do is find a location. There are a few things to keep in mind when choosing a location:

– Cost: You’ll want to find a location that is affordable, both in terms of rent and utilities.

– Accessibility: The location should be easy to get to, both for your employees and your clients.

– Space: You’ll need enough space to set up your office and equipment.

Once you’ve narrowed down your options, it’s important to take a look at the surrounding businesses and see if there is potential for collaboration. You may also want to consider whether the area is growing, as this could mean more business for you in the future.

6. Register Your Medical Billing Company with the IRS

Next, you need to register your business with the Internal Revenue Service (IRS) which will result in the IRS issuing you an Employer Identification Number (EIN).

Most banks will require you to have an EIN in order to open up an account. In addition, in order to hire employees, you will need an EIN since that is how the IRS tracks your payroll tax payments.

Note that if you are a sole proprietor without employees, you generally do not need to get an EIN. Rather, you would use your social security number (instead of your EIN) as your taxpayer identification number.

7. Open a Business Bank Account

It is important to establish a bank account in your medical billing company’s name. This process is fairly simple and involves the following steps:

- Identify and contact the bank you want to use

- Gather and present the required documents (generally include your company’s Articles of Incorporation, driver’s license or passport, and proof of address)

- Complete the bank’s application form and provide all relevant information

- Meet with a banker to discuss your business needs and establish a relationship with them

8. Get a Business Credit Card

You should get a business credit card for your medical billing company to help you separate personal and business expenses.

You can either apply for a business credit card through your bank or apply for one through a credit card company.

When you’re applying for a business credit card, you’ll need to provide some information about your business. This includes the name of your business, the address of your business, and the type of business you’re running. You’ll also need to provide some information about yourself, including your name, Social Security number, and date of birth.

Once you’ve been approved for a business credit card, you’ll be able to use it to make purchases for your business. You can also use it to build your credit history which could be very important in securing loans and getting credit lines for your business in the future.

9. Get the Required Business Licenses and Permits

A medical billing company needs to have a business license and a permit to operate as a medical billing company. The business license can be obtained from the local city or county government. The permit to operate as a medical billing company can be obtained from the state government.

10. Get Business Insurance for Your Medical Billing Company

The type of insurance you need to operate a medical billing company will depend on the type of business.

Some business insurance policies you should consider for your medical billing company include:

- General liability insurance : This covers accidents and injuries that occur on your property. It also covers damages caused by your employees or products.

- Auto insurance : If a vehicle is used in your business, this type of insurance will cover if a vehicle is damaged or stolen.

- Workers’ compensation insurance : If you have employees, this type of policy works with your general liability policy to protect against workplace injuries and accidents. It also covers medical expenses and lost wages.

- Commercial property insurance : This covers damage to your property caused by fire, theft, or vandalism.

- Business interruption insurance : This covers lost income and expenses if your business is forced to close due to a covered event.

- Professional liability insurance : This protects your business against claims of professional negligence.

Find an insurance agent, tell them about your business and its needs, and they will recommend policies that fit those needs.

11. Buy or Lease the Right Medical Billing Company Equipment

To start a medical billing company, you will need some basic equipment such as a computer, phone, scanner, and internet access. You might also want to invest in some office furniture.

12. Develop Your Medical Billing Company Marketing Materials

- Logo : Spend some time developing a good logo for your medical billing company. Your logo will be printed on company stationery, business cards, marketing materials and so forth. The right logo can increase customer trust and awareness of your brand.