Check your browser settings and network. This website requires JavaScript for some content and functionality.

The Global Financial Crisis

The global financial crisis (GFC) refers to the period of extreme stress in global financial markets and banking systems between mid 2007 and early 2009. During the GFC, a downturn in the US housing market was a catalyst for a financial crisis that spread from the United States to the rest of the world through linkages in the global financial system. Many banks around the world incurred large losses and relied on government support to avoid bankruptcy. Millions of people lost their jobs as the major advanced economies experienced their deepest recessions since the Great Depression in the 1930s. Recovery from the crisis was also much slower than past recessions that were not associated with a financial crisis.

Main Causes of the GFC

As for all financial crises, a range of factors explain the GFC and its severity, and people are still debating the relative importance of each factor. Some of the key aspects include:

1. Excessive risk-taking in a favourable macroeconomic environment

In the years leading up to the GFC, economic conditions in the United States and other countries were favourable. Economic growth was strong and stable, and rates of inflation, unemployment and interest were relatively low. In this environment, house prices grew strongly.

Expectations that house prices would continue to rise led households, in the United States especially, to borrow imprudently to purchase and build houses. A similar expectation on house prices also led property developers and households in European countries (such as Iceland, Ireland, Spain and some countries in Eastern Europe) to borrow excessively. Many of the mortgage loans, especially in the United States, were for amounts close to (or even above) the purchase price of a house. A large share of such risky borrowing was done by investors seeking to make short-term profits by ‘flipping’ houses and by ‘subprime’ borrowers (who have higher default risks, mainly because their income and wealth are relatively low and/or they have missed loan repayments in the past).

Banks and other lenders were willing to make increasingly large volumes of risky loans for a range of reasons:

- Competition increased between individual lenders to extend ever-larger amounts of housing loans that, because of the good economic environment, seemed to be very profitable at the time.

- Many lenders providing housing loans did not closely assess borrowers’ abilities to make loan repayments. This also reflected the widespread presumption that favourable conditions would continue. Additionally, lenders had little incentive to take care in their lending decisions because they did not expect to bear any losses. Instead, they sold large amounts of loans to investors, usually in the form of loan packages called ‘mortgage-backed securities’ (MBS), which consisted of thousands of individual mortgage loans of varying quality. Over time, MBS products became increasingly complex and opaque, but continued to be rated by external agencies as if they were very safe.

- Investors who purchased MBS products mistakenly thought that they were buying a very low risk asset: even if some mortgage loans in the package were not repaid, it was assumed that most loans would continue to be repaid. These investors included large US banks, as well as foreign banks from Europe and other economies that sought higher returns than could be achieved in their local markets.

2. Increased borrowing by banks and investors

In the lead up to the GFC, banks and other investors in the United States and abroad borrowed increasing amounts to expand their lending and purchase MBS products. Borrowing money to purchase an asset (known as an increase in leverage) magnifies potential profits but also magnifies potential losses. [1] As a result, when house prices began to fall, banks and investors incurred large losses because they had borrowed so much.

Additionally, banks and some investors increasingly borrowed money for very short periods, including overnight, to purchase assets that could not be sold quickly. Consequently, they became increasingly reliant on lenders – which included other banks – extending new loans as existing short-term loans were repaid.

3. Regulation and policy errors

Regulation of subprime lending and MBS products was too lax. In particular, there was insufficient regulation of the institutions that created and sold the complex and opaque MBS to investors. Not only were many individual borrowers provided with loans so large that they were unlikely to be able to repay them, but fraud was increasingly common – such as overstating a borrower's income and over-promising investors on the safety of the MBS products they were being sold.

In addition, as the crisis unfolded, many central banks and governments did not fully recognise the extent to which bad loans had been extended during the boom and the many ways in which mortgage losses were spreading through the financial system.

How the GFC Unfolded

Us house prices fell, borrowers missed repayments.

The catalysts for the GFC were falling US house prices and a rising number of borrowers unable to repay their loans. House prices in the United States peaked around mid 2006, coinciding with a rapidly rising supply of newly built houses in some areas. As house prices began to fall, the share of borrowers that failed to make their loan repayments began to rise. Loan repayments were particularly sensitive to house prices in the United States because the proportion of US households (both owner-occupiers and investors) with large debts had risen a lot during the boom and was higher than in other countries.

Stresses in the financial system

Stresses in the financial system first emerged clearly around mid 2007. Some lenders and investors began to incur large losses because many of the houses they repossessed after the borrowers missed repayments could only be sold at prices below the loan balance. Relatedly, investors became less willing to purchase MBS products and were actively trying to sell their holdings. As a result, MBS prices declined, which reduced the value of MBS and thus the net worth of MBS investors. In turn, investors who had purchased MBS with short-term loans found it much more difficult to roll over these loans, which further exacerbated MBS selling and declines in MBS prices.

Spillovers to other countries

As noted above, foreign banks were active participants in the US housing market during the boom, including purchasing MBS (with short-term US dollar funding). US banks also had substantial operations in other countries. These interconnections provided a channel for the problems in the US housing market to spill over to financial systems and economies in other countries.

Failure of financial firms, panic in financial markets

Financial stresses peaked following the failure of the US financial firm Lehman Brothers in September 2008. Together with the failure or near failure of a range of other financial firms around that time, this triggered a panic in financial markets globally. Investors began pulling their money out of banks and investment funds around the world as they did not know who might be next to fail and how exposed each institution was to subprime and other distressed loans. Consequently, financial markets became dysfunctional as everyone tried to sell at the same time and many institutions wanting new financing could not obtain it. Businesses also became much less willing to invest and households less willing to spend as confidence collapsed. As a result, the United States and some other economies fell into their deepest recessions since the Great Depression.

Policy Responses

Until September 2008, the main policy response to the crisis came from central banks that lowered interest rates to stimulate economic activity, which began to slow in late 2007. However, the policy response ramped up following the collapse of Lehman Brothers and the downturn in global growth.

Lower interest rates

Central banks lowered interest rates rapidly to very low levels (often near zero); lent large amounts of money to banks and other institutions with good assets that could not borrow in financial markets; and purchased a substantial amount of financial securities to support dysfunctional markets and to stimulate economic activity once policy interest rates were near zero (known as ‘quantitative easing’).

Increased government spending

Governments increased their spending to stimulate demand and support employment throughout the economy; guaranteed deposits and bank bonds to shore up confidence in financial firms; and purchased ownership stakes in some banks and other financial firms to prevent bankruptcies that could have exacerbated the panic in financial markets.

Although the global economy experienced its sharpest slowdown since the Great Depression, the policy response prevented a global depression. Nevertheless, millions of people lost their jobs, their homes and large amounts of their wealth. Many economies also recovered much more slowly from the GFC than previous recessions that were not associated with financial crises. For example, the US unemployment rate only returned to pre-crisis levels in 2016, about nine years after the onset of the crisis.

Stronger oversight of financial firms

In response to the crisis, regulators strengthened their oversight of banks and other financial institutions. Among many new global regulations, banks must now assess more closely the risk of the loans they are providing and use more resilient funding sources. For example, banks must now operate with lower leverage and can’t use as many short-term loans to fund the loans that they make to their customers. Regulators are also more vigilant about the ways in which risks can spread throughout the financial system, and require actions to prevent the spreading of risks.

Australia and the GFC

Relatively strong economic performance.

Australia did not experience a large economic downturn or a financial crisis during the GFC. However, the pace of economic growth did slow significantly, the unemployment rate rose sharply and there was a period of heightened uncertainty. The relatively strong performance of the Australian economy and financial system during the GFC, compared with other countries, reflected a range of factors, including:

- Australian banks had very small exposures to the US housing market and US banks, partly because domestic lending was very profitable.

- Subprime and other high-risk loans were only a small share of lending in Australia, partly because of the historical focus on lending standards by the Australian banking regulator (the Australian Prudential Regulation Authority (APRA)).

- Australia's economy was buoyed by large resource exports to China, whose economy rebounded quickly after the initial GFC shock (mainly due to expansionary fiscal policy).

Also a large policy response

Despite the Australian financial system being in a much better position before the GFC, given the magnitude of the shock to the global economy and to confidence more broadly, there was also a large policy response in Australia to ensure that the economy did not suffer a major downturn. In particular, the Reserve Bank lowered the cash rate target significantly, and the Australian Government undertook expansionary fiscal policy and provided guarantees on deposits at and bonds issued by Australian banks.

Following the crisis, APRA implemented the stronger global banking regulations in Australia. Together, APRA and the financial market and corporate regulator, the Australian Securities and Investments Commission, have also strengthened lending standards to make the financial and private sectors more resilient.

Imagine that Jane buys an asset for $100,000 using $10,000 of her own money and $90,000 of borrowed money. If the asset price increases to $110,000, then Jane's own money after paying back the loan has doubled to $20,000 (ignoring interest costs). However, if the asset price falls to $90,000, then Jane would have lost all of the money she initially had. And if the asset price were to fall to less than $90,000, then Jane would owe money to her lender. [1]

Newly Launched - World's Most Advanced AI Powered Platform to Generate Stunning Presentations that are Editable in PowerPoint

Powerpoint Templates

Icon Bundle

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

Global Financial Crisis Powerpoint Presentation Slides

Grab this visually appealing Financial Crisis PowerPoint Presentation Slides to showcase the economic slump of the 20th century. This economic crisis PPT slides deck contains graphical layouts which will help you elucidate vital facts with ease. This economic recession PPT slideshow provides you appropriate graphics to showcase key statistics of past financial crunches. Our financial depression PowerPoint theme gives you impeccable layouts from infographics and flowcharts to pie charts and timeline diagrams. Our content-driven economic decline PowerPoint theme gives you a tabular format to represent the impact of the great depression on investment banks. Use professionally designed fiscal crisis PowerPoint presentation to discuss the spread and the events that ensued. So, download our financial turmoil PPT to obtain professional layouts such as the subprime effect, fed tapering, and current situation.

- Add a user to your subscription for free

You must be logged in to download this presentation.

Do you want to remove this product from your favourites?

PowerPoint presentation slides

Presenting Global Financial Crisis Powerpoint Presentation Slides. This slideshow completely customizable and can be altered as per your needs. You can easily modify the colors, font type, font size, and background of the slide deck and save it in formats like JPG, PNG, and PDF. It can be projected on a standard screen and widescreen size without any fear of pixelation. It is compatible with Google slides.

People who downloaded this PowerPoint presentation also viewed the following :

- Business Slides , Financials , Flat Designs , Concepts and Shapes , Complete Decks , All Decks , Finance and Accounting , General

- Global Financial Crisis ,

- Investment ,

Content of this Powerpoint Presentation

Slide 1 : This slide introduces Global Financial Crisis. State your Company name and begin. Slide 2 : In this slide, 2008 Financial Crisis Impact Explained in Numbers. Slide 3 : This slide showcases Major Financial Bubble Burst of all times Slide 4 : This slide displays Impact of The Great Recession on Investment Banks Slide 5 : This slide shows 2008 Financial Crisis Cost. Slide 6 : This slide presents Key Figures of the Crisis Slide 7 : This slide shows Before the Beginning. In 2001, the U.S. economy underwent a minor, short-lived recession. Slide 8 : This slide explains What Happened after crisis. Slide 9 : This slide explains How did it Spread? Slide 10 : This slide explains How did those who bought CDOs protect themselves? Slide 11 : This slide displays Beginning of the End. Slide 12 : This slide showcases Subprime Effect Slide 13 : This slide displays Major Bailout Packages Slide 14 : This slide shows Recipients of Penalties Slide 15 : This slide showcases After a Decade- Current Scenario Slide 16 : This slide describes Fed Tapering Slide 17 : This slide shows Quantitative Easing Slide 18 : This is Global Financial Crisis Icons Slide. Slide 19 : This slide is titled as Additional Slides for moving forward. Slide 20 : This slide displays Our Mission, Vision and Goals. Slide 21 : This is 30 60 90 Days plan slide. Slide 22 : This is Our team slide with names and designations. Slide 23 : This slide displays Comparison. Slide 24 : This is Financial slide. Slide 25 : This slide displays Targets. Slide 26 : This slide shows Timeline Slide 27 : This is Thank you slide with Contact details.

Global Financial Crisis Powerpoint Presentation Slides with all 27 slides:

Use our Global Financial Crisis Powerpoint Presentation Slides to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

Ratings and Reviews

by Dane Harrison

December 27, 2021

by Darius Webb

by Smith Flores

by Charlie Jackson

September 30, 2020

by Alexander Ramirez

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

What We’ve Learned from the Financial Crisis

Five years later, how has theory adjusted?

Reprint: R1311G

For decades, the basic idea that governed economic thinking was that markets work: The right price will always find a buyer and a seller, and millions of buyers and sellers are far better than a few government officials at determining the right price. But then came the Great Recession, when the global financial system seemed on the verge of collapse—as did prevailing notions about how the economic and financial world is supposed to function.

The author has followed academic economics and finance as a journalist since the mid-1990s. To him, three shifts in thinking stand out: (1) Macroeconomists are realizing that it was a mistake to pay so little attention to finance. (2) Financial economists are beginning to wrestle with some of the broader consequences of what they’ve learned over the years about market misbehavior. (3) Economists’ extremely influential grip on a key component of the economic world—the corporation—may be loosening.

In the early 1930s, he concludes, policy errors by governments and central banks turned a financial crisis into a global economic disaster. In 2008 the financial shock was at least as big, but the reaction was smarter and the economic fallout less severe.

Five years ago the global financial system seemed on the verge of collapse. So did prevailing notions about how the economic and financial worlds are supposed to function.

- Justin Fox , a former editorial director of Harvard Business Review , is a columnist for Bloomberg View . He is the author of The Myth of the Rational Market . Follow him on Twitter @foxjust .

Partner Center

- Economy & Politics ›

The Global Financial Crisis - Statistics & Facts

Wall Street and the ‘Great Moderation’

U.s. housing bubble, escalating crisis and the collapse of lehman brothers, policy responses and legacies of the crisis, key insights.

Detailed statistics

Great Recession: delinquency rate by loan type in the U.S. 2007-2010

Residential mortgage backed security issuance in the U.S. 2003-2023

Largest bankruptcies in the U.S. as of February 2024, by assets

Editor’s Picks Current statistics on this topic

Financial Institutions

Global Financial Crisis: Lehman Brothers stock price and percentage gain 1995-2008

Mortgages & Financing

Key Economic Indicators

Further recommended statistics

Real estate and financial bubbles.

- Premium Statistic Value of CMBS originations in the U.S. 2000-2022

- Premium Statistic Residential mortgage backed security issuance in the U.S. 2003-2023

- Basic Statistic Total debt securities of U.S. agency- and GSE-backed mortgage pools sector 2000-2018

- Basic Statistic Great Recession: real house price index in Europe's weakest economies 2005-2011

Value of CMBS originations in the U.S. 2000-2022

Value of commercial mortgage-backed securities (CMBS) originations in the United States from 2000 to 2022 (in billion U.S. dollars)

Residential mortgage backed security issuance in the United States from 2003 to 1st half 2023 (in billion U.S. dollars)

Total debt securities of U.S. agency- and GSE-backed mortgage pools sector 2000-2018

Total debt securities of the agency- and government sponsored enterprise backed mortgage pools sector in the United States from 2000 to 2018 (in billion U.S. dollars)

Great Recession: real house price index in Europe's weakest economies 2005-2011

Real house price index in Portugal, Italy, Ireland, Greece, and Spain before and during the Great Recession from 2005 to 2011 (where 2015=100)

Wall Street crisis and global shockwaves

- Basic Statistic Great Recession: delinquency rate by loan type in the U.S. 2007-2010

- Premium Statistic Financial crisis - credit losses and writedowns of insurances 2008

- Basic Statistic Global Financial Crisis: Lehman Brothers stock price and percentage gain 1995-2008

- Basic Statistic Global Financial Crisis: Fannie Mae stock price and percentage change 2000-2010

- Basic Statistic Global Financial Crisis: Freddie Mac monthly closing stock price 2000-2010

Quarterly delinquency rate on all commercial bank loans, single-family residential mortgages and business loans in the United States from 2007 to 2010

Financial crisis - credit losses and writedowns of insurances 2008

Credit losses and writedowns at insurance companies during the financial crisis since January 2007 (in billion U.S. dollars)

Annual year end stock price and percentage gain or loss in stock price for Lehman Brothers from 1995 to 2008 (in U.S. dollars)

Global Financial Crisis: Fannie Mae stock price and percentage change 2000-2010

Annual year end stock price and percentage gain or loss in stock price for the Federal National Mortgage Association (Fannie Mae) from 2000 to 2010 (in U.S. dollars and percent)

Global Financial Crisis: Freddie Mac monthly closing stock price 2000-2010

Monthly closing stock price of the Federal Home Loan Mortgage Corporation (Freddie Mac) from January 2000 to December 2010 (in U.S. dollars)

The global recession

- Basic Statistic Great Recession: global gross domestic product (GDP) growth from 2007 to 2011

- Basic Statistic Great Recession: annual value of global exports of merchandise from 2007 to 2011

- Basic Statistic Global unemployment rate 2004-2023

- Basic Statistic Great Recession: GDP growth rates for G7 countries from 2007 to 2011

- Basic Statistic Great Recession: unemployment rate in the G7 countries 2007-2011

- Basic Statistic Great Recession: monthly industrial production in the U.S. from 2007 to 2010

- Basic Statistic Great Recession: consumer confidence level in the U.S. 2007-2010

- Basic Statistic Great Recession: GDP growth for the E7 emerging economies 2007-2011

- Basic Statistic Great Recession: GDP growth in less affected regions 2007-2011

Great Recession: global gross domestic product (GDP) growth from 2007 to 2011

Annual global gross domestic product (GDP) growth rate during the Great Recession from 2007 to 2011

Great Recession: annual value of global exports of merchandise from 2007 to 2011

Total value of annual global merchandise exports during the Great Recession from 2007 to 2011 (in millions of U.S. dollars)

Global unemployment rate 2004-2023

Global unemployment rate from 2004 to 2023 (as a share of the total labor force)

Great Recession: GDP growth rates for G7 countries from 2007 to 2011

Annual Gross Domestic Product growth rates for the G7 countries during and after the Great Recession from 2007 to 2011

Great Recession: unemployment rate in the G7 countries 2007-2011

Annual unemployment rate for the countries of the Group of Seven (G7) during and after the Great Recession from 2007 to 2011

Great Recession: monthly industrial production in the U.S. from 2007 to 2010

Monthly industrial production during the Great Recession in the United States from 2007 to January 2010 (where 2017 = 100)

Great Recession: consumer confidence level in the U.S. 2007-2010

Monthly Consumer Confidence Index (CCI) level during the Great Recession in the United States from January 2007 to January 2010

Great Recession: GDP growth for the E7 emerging economies 2007-2011

Annual Gross Domestic Product growth rates for the E7 emerging economies during the Great Recession from 2007 to 2011

Great Recession: GDP growth in less affected regions 2007-2011

Annual GDP growth in regions that experienced less severe crises during the Great Recession from 2007 to 2011

Policy interventions

- Basic Statistic Annual Fed funds effective rate in the U.S. 1990-2023

- Basic Statistic Great Recession: total U.S. government expenditure on TARP program 2008-2012

- Basic Statistic Great Recession: distribution of U.S. government spending on TARP program 2008-2012

- Basic Statistic Great Recession: U.S. public opinion on government support of financial system 2008

- Basic Statistic Great Recession: U.S government spending on ARRA by department or agency 2009-2011

- Basic Statistic Great Recession: UK government bailout of banking system in October 2008, by bank

- Basic Statistic Great Recession: general government debt as a percentage of GDP for the G7

- Basic Statistic Great Recession: major economy government expenditure as a share of GDP 2007-2011

Annual Fed funds effective rate in the U.S. 1990-2023

Federal funds rate level in the United States from 1990 to 2023

Great Recession: total U.S. government expenditure on TARP program 2008-2012

Total funds disbursed, total returns, and losses from the United States government's Troubled Asset Relief Program (TARP) from 2008 to 2012 (in billions of U.S. dollars)

Great Recession: distribution of U.S. government spending on TARP program 2008-2012

Distribution of United States government expenditure on Troubled Asset Relief Program (TARP) by program from 2008 to 2012

Great Recession: U.S. public opinion on government support of financial system 2008

Public opinion on the Unite States government's intervention to support the financial system by political affiliation in September 2008

Great Recession: U.S government spending on ARRA by department or agency 2009-2011

Total spending by the United States government on the American Recovery and Reinvestment Act (ARRA) by department or agency from 2009 to 2011 (in billions of U.S. dollars)

Great Recession: UK government bailout of banking system in October 2008, by bank

Total value of largest U.K. banks bailed out in October 2008 and the value of bailout from UK government or private investors (in billions of British pounds)

Great Recession: general government debt as a percentage of GDP for the G7

Annual general government debt as a percentage of gross domestic product (GDP) for each of the G7 countries during the Great Recession from 2007 to 2011

Great Recession: major economy government expenditure as a share of GDP 2007-2011

Annual general government expenditure as a percentage of gross domestic product (GDP) for selected major economies during the Great Recession from 2007 to 2011

Legacies of the crises

- Basic Statistic Long-term unemployment as a share of total unemployment in the U.S. 2002-2022

- Basic Statistic Share of young adults living with their parents in the U.S. 2015

- Premium Statistic Alcohol, drug, and suicide death rates in the U.S. in 1999 to 2021

- Basic Statistic Employment rate in the European Union 2017

- Basic Statistic Youth unemployment rate in the European Union and the euro area 2021

- Basic Statistic Opinion on cause of EU economic problems, by country 2012

- Premium Statistic Public opinion on further regulation on Wall Street U.S. 2019

Long-term unemployment as a share of total unemployment in the U.S. 2002-2022

Share of long-term unemployed workers in the monthly total unemployment rate in the United States from 2002 to 2022

Share of young adults living with their parents in the U.S. 2015

Share of young adults who live with their parents in the United States from 2007 to 2015

Alcohol, drug, and suicide death rates in the U.S. in 1999 to 2021

Rate of alcohol, drug, and suicide deaths in the U.S. from 1999 to 2021 (per 100,000 population)

Employment rate in the European Union 2017

Employment rate in the European Union from 2007 to 2017

Youth unemployment rate in the European Union and the euro area 2021

Youth unemployment rate in the European Union and the euro area from 2011 to 2021

Opinion on cause of EU economic problems, by country 2012

Who is most to blame for your countries current economic problems?

Public opinion on further regulation on Wall Street U.S. 2019

Share of Americans who believe further regulation should be imposed on Wall Street due to their role in the 2008 financial crisis as of July 2019

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

- Program on Financial Stability

- Other Projects

- Global Financial Crisis

The Global Financial Crisis

Examining the u.s. government's interventions.

The global financial crisis was the most significant world economic event since the Great Depression. The materials presented here are designed to help anyone interested in the crisis explore it in greater detail. At this time, our focus is on how the United States government intervened to prevent the total collapse of the financial system and the effects of those actions.

The Global Financial Crisis of 2008

Jul 14, 2014

170 likes | 510 Views

The Global Financial Crisis of 2008. Chandra Athukorala Arndt-Corden Division of Economics Research School of Pacific and Asian Studies. Preview. Financial Crisis: A ‘hardy perennial’ - ‘[A] subject that does not appear to be going out of fashion’

Share Presentation

- home owners

- global financial crisis

- economic expansion

- credit risk

- low inflation

Presentation Transcript

The Global Financial Crisis of 2008 Chandra Athukorala Arndt-Corden Division of Economics Research School of Pacific and Asian Studies

Preview • Financial Crisis: A ‘hardy perennial’ - ‘[A] subject that does not appear to be going out of fashion’ (Robert M Solow, in the Foreword to Kindleberger and Aliber 2005)

Financial crisis results from the implosion of asset price bubbles (or from the sharp depreciation of national currencies) (A bubble; a non-sustainable pattern of price changes or cash flows) Bubbles are generally associated with a robust, prolong economic expansion : manias associated with growth euphoria rational behaviour morphs into irrational exuberance A certain event, perhaps a change in government policy, an unexplained failure of a firm/bank previously thought to have been successful leads to bursting of the bubble. Bubbles always implore, but this does not always lead to a crisis (a soft landing is possible) – depends very much on the money and capital market institutions of the time.

Financial crises have been more extensive and pervasive in the last four decades than in any previous period. (An outcome of ‘financial globalization’?) • We are now witnessing the third global crisis in a decade (1997-98 Asian crisis; dot-com crisis in 2001; the US housing market crisis 2007 - ) • The ‘mother of all crises’ (so far!) in recorded history has been the Great Depression following the crash of the stock market bubble in the US in the late 1920s. • The current unfolding crisis is similar in the source of origin (US, the largest economy) and global spread. The number of bank failures are going to be larger.

Could it usher in the Second Great Depression? Unlikely • The global economy is much more ‘diversified’ than in the thirties. • All major countries have central banks which are ready to act as ‘lenders of last resort’ • Floating exchange rate regimes (attempt to stick to the ‘gold standard’ was a major factor in deepening crisis in the 1930s)

The US Housing Boom and Bubble Three key factors provided the setting: • Surge in capital flows to the US (A reflection of the on-going process of financial globalization. implosion of the real state and stock bubble in Japan in the early 1990s, the Asian crisis 1997-98, China’s meteoric economic rise played a role) • Robust growth propelled by productivity growth since the mid- 1990. (productivity growth: 1974-95: 1.4%, 1996-2007 2.5% Rapid productivity growth means the economy could grow faster without exacerbating inflation) • Historically low interest rates in the aftermaths of the dot.com collapse and the terrorist attack of September 11, 2001, FED lowered federal fund rates to 1 percent and kept until June 2004. The subsequent hikes were marginal)

The house price inflation began to exceed consumption price inflation as early as 1998. (Shiller 2000) The rate of expansion of house prices began to exceed household income growth staring in 2004 (a clear sign of a bubble) (Harris 2008) Housing stock value increased from about 4% of GDP in the 1990s to 6% in 2006. Almost two thirds of house owners had a mortgage by 2007 (compared to 50% in the 1990s) Home-loans as percentage of consumption: 1990s: 26%; 2006: 36%

Signs of aggressive speculative behaviour • Surge in the use of hybrid (sub-prime) mortgages, which required no down payment, demanded little documentation of income or assts, or offered low initial ‘teaser’ rates of payments. (by 2006 sub prime mortgages accented for 15% of the mortgage market) • A surge in the number of buyers who were self identified speculators (‘flippers’) • Markets in ‘hot areas’ were getting hotter (home price increases: Metro areas: 5% in 2004 to 7% in 2006 Cities: 20% to 28%)

Linkages to the rest of the economy • Housing sector boom was accompanied by a stock market boon • New financial derivatives based on to mortgages contributed to massive expansion in overall financial systems • Thus, there was a high risk of a synchronized price declines across many speculative markets. • ‘regulatory failure’ amplified the potential risk. - There was no regulatory reforms to match new financial innovations - New innovations made it hard for regulators to keep track of firms’/banks’ exposure to credit risk.

Was Greenspan part of the problem? (Shiller 2000, Soros 2008, Harriss 2008, Rubin 2003) • Greenspan was an ‘easy-money dove’ (A an easy money dove tends to be soft on inflation and less inclined to hike interest rate. A hawk is tough on inflation and inclined to hike interest rates (and inflict pain on capital markets)) • He inadvertently encouraged the bubbles through talks of higher trend growth propelled by productivity growth and persistent low inflation 9in this he exaggerated the China factor. • He ignored the signs of housing bubble and kept short-term interest rates too low for too long.

Bursting of the Bubble and Onset of the Crisis Rumbling of the housing bubble from third quarter of 2007 Trigger: sub-prime credit defaults. Feedback loop in the housing sector) • The sharp pull back in lending to supreme borrows cased a sharp drop in demand for homes (over 1 million homes on sale by mid 2008) • Falling house prices • Negative household equity (i.e the value of the home is less than the value of the mortgage) creating an incentive for defaulting loans. • More houses are being sold at bargain prices, pushing home process lower.

Falling home construction and weaker demand, results in further contraction in demand for houses In addition • Economy wide concretionary effects arising from collapsing credit and share markets.

Unfolding crisis Nov/Dec 2007: The market for inter-bank lending tightened up dramatically January/February 2008: The auction rate market (where state and local governments borrowing is rolled over) ran into serious problems March 2008; Bear sterns, a major investment bank, was absorbed by JP Morgan September 2008: Lehman Brothers collapsed - a bellwether event which lead to virtual drying-up of the commercial papers market seized.

Policy Response Greenspan-style gradualism in 2006 and 2007: the FED continued to focus on inflation Gradualism ended in January 2008: Bernanke announced that recession, not inflation, was the main concern. Late January 2008: 125 basic point cuts in fund rate accompanied by array of new programs to directly add liquidity to credit market September 2008: 700 billion rescue package Recapitalization of back has become part of the policy package (following the British move in October)

Current state of the US economy The US economy may well be in recession already. Economic collapse is likely to continue well into 2009 (and beyond?) Retail sales dropped by 1.35% in 3rd quarter 2008 Almost a quarter of home owners with mortgages have zero or negative equity. Because of the collapse of the commercial paper market, companies are facing straining balance-sheet capacity

Global Spread • In the second half of 2007, banks and hedge funds around the world reported major losses from sub-prime mortgages • September 2007: Northern Rock, a major bank, was rescued by the UK government • Widespread bank failures in the second and third quarter of 2008 in a number of countries: UK, Belgium, Sweden, Iceland • In the 2nd week of October, Britain ‘nationalized’ much of its banking industry • The impact on Asian countries? No signs of significant ripple effects of the financial crisis, but bound to be affected by the second-round (real-sector contrition in the US and other developed countries) effects)

Reference Harris, Ethan S. (2008), Ben Bernanke’s FED: The Federal Reserve After Greemspan, Cambridge, AMS: Harvard Business Press. Hartcher, Peter (2006), Bubble Man: Allan Greenspan & the Missing 7 Trilliona Dollars, Melbourne: Black Ink. Kindleberger, Charls P. and Robert Aliber (2005), Manias, Panics, and Crashes: A History of the Financial Crises, Ney York: john Wiley and Sons. Rubin, Robert E. and Jacob Weisberg (2003), In a Uncertain World,New York: Random House. Shiller, Robert I. (2000), Irrational Exuberance, Priceton, NJ, Priceton University Press. Soros, George (2008), The Credit Crisis of 2008 and what it Means, New York: Foreign Affairs

- More by User

The Global Financial Crisis

375 views • 17 slides

Global Financial Crisis

Subprime mortgage crisis . The subprime mortgage crisis is an ongoing financial crisis triggered by a significant decline in housing prices and related mortgage payment delinquencies and foreclosures in the United States.This caused a ripple effect across the financial markets and global banking sy

467 views • 22 slides

THE GLOBAL FINANCIAL CRISIS

THE GLOBAL FINANCIAL CRISIS. Dr Tony Stokes Senior Lecturer in Economics AUSTRALIAN CATHOLIC UNIVERSITY Strathfield. The Global Financial Crisis. www.nicholsoncartoons.com.au. How did the financial crisis begin?. The financial crisis began in the US in the middle of 2007.

749 views • 18 slides

GLOBAL FINANCIAL CRISIS

GLOBAL FINANCIAL CRISIS. ISHRAT HUSAIN July 12, 2012. AGENDA . CONTEXT AND BACKGROUND BRIEF CHRONOLOGY OF KEY EVENTS CONTRIBUTORY FACTORS WHAT WENT WRONG RESPONSE TO THE CRISIS IMPACT OF CRISIS IN PAKISTAN SALIENT FEATURES AND LESSONS LEARNT

538 views • 34 slides

The Global Financial Crisis of 2008. “The global pool of money”. Subprime crisis housing bust credit crunch global financial crisis Great Recession ¼ of residential mortgages “underwater” (w/negative equity)

429 views • 16 slides

Is the global financial crisis of 2008 truly over?

Is the global financial crisis of 2008 truly over?. V. Anantha Nageswaran June 2011. The US remains steeped in denial. Negative interest rate gap – to persist.

495 views • 40 slides

Global Financial Crisis. Don Kopka , PhD Management Dept Towson University. Types of Financial Crises. Currency – Sharp currency depreciation Banking – Loss of confidence in banking system Foreign Debt – Country unable to service foreign debt obligations. Previous Financial Crises.

149 views • 0 slides

Global Financial Crisis. Globalization Lesson 3. Objectives. Review events leading up to financial crisis that struck the US in 2008. Explore the reverberations of said crisis on Europe and the global economy. Identify if we have learned any lessons in the past 5 years. Warm Up.

338 views • 9 slides

Global Financial Crisis. Globalization Unit Lesson 3. Objectives. Explore events leading up to financial crisis that struck the US and the world in 2008. Interpret political cartoons relating to global economic crisis.

493 views • 15 slides

The global financial crisis

The global financial crisis. A bank run. Financial panic in “Mary Poppins ” http://www.youtube.com/watch?v=C6DGs3qjRwQ (via LoseTheNameOfAction ). A fatal combination. Financial globalization Great increase in (two-way) capital flows across national borders

360 views • 24 slides

Financial Crisis of 2008

Financial Crisis of 2008. Econ 102 2014. Worst recession in 80 years. How did it happen? How was the situation before the crisis? ‘ Great Moderation’ Stable growth and low inflation. Worst recession in 80 years. How did it happen? How was the situation before the crisis?

522 views • 27 slides

Global Financial Crisis . Deepak Prakash Bhatt, PhD. Criticism . Joseph E. Stiglitz - Senior Vice-President of WB Chairperson of Council of Economic Advisors Raised discontents about world bank policies Critical views about globalization, free market fundamentalists and IMF

413 views • 23 slides

Global Financial Crisis. Outline. What lead us to the crisis? Background (How it started) Parties/Players End result What can we learn from this? . How it started. Late 1990’s – internet bubble bursts US economy in trouble

210 views • 12 slides

Global Financial Imbalances: The Role of the Financial Crisis

Global Financial Imbalances: The Role of the Financial Crisis. G. (Tassos) Malliaris Mary Malliaris LOYOLA UNIVERSITY CHICAGO 19 th Multinational Finance Conference Krakow, Poland June 24 -27, 2012. Focus of the Paper. Trace Rapidly the Evolution of the Global Monetary System

600 views • 40 slides

BIS “The Global Financial Crisis”

BIS “The Global Financial Crisis”. Vaughan / Economics 639.

78 views • 2 slides

Financial Crisis of 2007-2008

Financial Crisis of 2007-2008. [i.e. what we’re going to discuss, teach and write about during the next 1 0 years]. Prof. Marian Moszoro, PhD November 12th , 2008. Origin. real estate prices had NEVER fallen all bad debts CAN’T default at the same time

593 views • 21 slides

An Overview of the 2008 Financial Crisis

An Overview of the 2008 Financial Crisis. (the perspective of an electrical engineer on Wall Street). Samir Padalkar PhD, [email protected]. Roadmap. Real Estate Bubble Security Definitions CDO Issues Rating Agencies, FNMA, FHLMC, AIG Federal Reserve 2000 Internet Bubble Comparison

436 views • 25 slides

The Global Financial Crisis. History & Context. 1990s – rapid expansion Unsustainable levels of gearing Benign economic conditions & policies favoring low and long-term interest rates Financial Innovation Increased investors participating in the global market. Credit Crunch.

359 views • 19 slides

Global Financial Crisis. subprime mortgage crisis. The World Cheers for China in 2009. Economy. China’s ambition to guarantee an economic growth rate of 8 percent a pipe dream. ?. BRICS. (金砖国家). 2001. 2009. China since the Reform & Opening-up in 1978.

436 views • 23 slides

Global Financial Crisis: The Aftermath

Global Financial Crisis: The Aftermath. Kenneth Matziorinis, Ph.D., CMC Canbek Economics & McGill University www.canbekeconomics.com. AHEPA, Ottawa, January 27, 2010. What Happened?. Low interest rates, high leverage and overconfidence led to the creation of bubbles which then burst.

363 views • 23 slides

2008+ GLOBAL CRISIS

2008+ GLOBAL CRISIS. Hasan Ersel HSE May 25, 2011. MARKET SYSTEM IS NOT MANNA FROM HEAVEN. Market system is a human product. If it is well designed it works well, otherwise it doesn’t...

290 views • 27 slides

408 views • 40 slides

Global Financial Development Report 2019/2020: Bank Regulation and Supervision a Decade after the Global Financial Crisis

Regulatory arbitrage

A majority of financial sector practitioners surveyed in a global poll believe that post-crisis financial regulation has led to an increase in regulatory arbitrage.

Financial safety nets are spreading worldwide

Approximately 2 in 3 low-income countries have explicit deposit insurance.

Regulatory capital ratios are at their highest since the GFC

Banking reforms have led to increased regulatory capital (capital to risk-weighted assets), especially in high-income countries.

Banks are shifting assets into lower risk-weighted categories

Banks have increased their regulatory capital ratios partly by shifting toward lower risk-weighted assets.

Developing countries have been selective in adopting Basel II/III provisions

Many developing countries still use the simple standardized approach to computing risk weights.

- 🠞 Chapter 1

Systemically Important Banks are subject to new resolution rules

SIBs are required to hold more capital and bail-in debt. New rules for resolution and orderly liquidation have yet to be tested.

- 🠞 Chapter 3

Minimum leverage ratio requirements are still not widely imposed

Few Basel III countries had implemented a leverage ratio requirement as of 2016

The quality of bank capital matters

High-quality capital can help cushion banks during times of crisis

This site uses cookies to optimize functionality and give you the best possible experience. If you continue to navigate this website beyond this page, cookies will be placed on your browser. To learn more about cookies, click here .

- Search Search Please fill out this field.

What Is a Financial Crisis?

What causes a financial crisis, financial crisis examples, the 2008 global financial crisis, the 2020 financial crisis, the bottom line.

- Investing Basics

Financial Crisis: Definition, Causes, and Examples

:max_bytes(150000):strip_icc():format(webp)/wk_headshot_aug_2018_02__william_kenton-5bfc261446e0fb005118afc9.jpg)

Gordon Scott has been an active investor and technical analyst or 20+ years. He is a Chartered Market Technician (CMT).

:max_bytes(150000):strip_icc():format(webp)/gordonscottphoto-5bfc26c446e0fb00265b0ed4.jpg)

- Guide to Stock Market Crashes

- October: The Month of Market Crashes?

- How Do Investors Lose Money When the Stock Market Crashes?

- Timeline of U.S. Stock Market Crashes

- October Effect

- Financial Crisis CURRENT ARTICLE

- Circuit Breaker

- Plunge Protection Team

- Dutch Tulip Bulb Market Bubble

- Black Friday

- Bank Panic of 1907

- Stock Market Crash of 1929

- What Caused the Stock Market Crash of 1929

- Black Tuesday

- Black Thursday

- Stock Market Crash of 1987

- Black Monday

- What Caused Black Monday: The Stock Market Crash of 1987

- The 2007-2008 Financial Crisis in Review

- The Fall of the Market in the Fall of 2008

- Components of the 2008 Bubble

- Financial Regulations: Glass-Steagall to Dodd-Frank

- Consequences of the Glass-Steagall Act Repeal

- Lessons from the 2008 Financial Crisis

- Major Players in the 2008 Financial Crisis: Where Are They Now?

- Too Big to Fail Banks: Where Are They Now?

Investopedia / Jiaqi Zhou

In a financial crisis, asset prices see a steep decline in value, businesses and consumers are unable to pay their debts, and financial institutions experience liquidity shortages. A financial crisis is often associated with a panic or a bank run during which investors sell off assets or withdraw money from savings accounts because they fear that the value of those assets will drop if they remain in a financial institution.

Other situations that may be labeled a financial crisis include the bursting of a speculative financial bubble , a stock market crash , a sovereign default , or a currency crisis . A financial crisis may be limited to banks or spread throughout a single economy, the economy of a region, or economies worldwide.

Key Takeaways

- Banking panics were at the genesis of several financial crises of the 19th, 20th, and 21st centuries, many of which led to recessions or depressions.

- Stock market crashes, credit crunches, the bursting of financial bubbles, sovereign defaults, and currency crises are all examples of financial crises.

- A financial crisis may be limited to a single country or one segment of financial services, but is more likely to spread regionally or globally.

A financial crisis may have multiple causes. Generally, a crisis can occur if institutions or assets are overvalued and can be exacerbated by irrational or herd-like investor behavior. For example, a rapid string of selloffs can result in lower asset prices, prompting individuals to dump assets or make huge savings withdrawals when a bank failure is rumored.

Contributing factors to a financial crisis include systemic failures, unanticipated or uncontrollable human behavior, incentives to take too much risk, regulatory absence or failures, or contagions that amount to a virus-like spread of problems from one institution or country to the next . If left unchecked, a crisis can cause an economy to go into a recession or depression. Even when measures are taken to avert a financial crisis, they can still happen, accelerate, or deepen.

Financial crises are not uncommon; they have happened for as long as the world has had currency. Some well-known financial crises include:

- Tulip Mania (1637). Though some historians argue that this mania did not have so much impact on the Dutch economy, and therefore shouldn't be considered a financial crisis, it did coincide with an outbreak of bubonic plague which had a significant impact on the country. With this in mind, it is difficult to tell if the crisis was precipitated by over-speculation or by the pandemic.

- Credit Crisis of 1772. After a period of rapidly expanding credit, this crisis started in March/April in London. Alexander Fordyce, a partner in a large bank, lost a huge sum shorting shares of the East India Company and fled to France to avoid repayment. Panic led to a run on English banks that left more than 20 large banking houses either bankrupt or stopping payments to depositors and creditors. The crisis quickly spread to much of Europe. Historians draw a line from this crisis to the cause of the Boston Tea Party—unpopular tax legislation in the 13 colonies—and the resulting unrest that gave birth to the American Revolution.

- Stock Crash of 1929 . This crash, starting on Oct. 24, 1929, saw share prices collapse after a period of wild speculation and borrowing to buy shares. It led to the Great Depression , which was felt worldwide for over a dozen years. Its social impact lasted far longer. One trigger of the crash was a drastic oversupply of commodity crops, which led to a steep decline in prices. A wide range of regulations and market-managing tools were introduced as a result of the crash.

- 1973 OPEC Oil Crisis. OPEC members started an oil embargo in October 1973 targeting countries that backed Israel in the Yom Kippur War. By the end of the embargo, a barrel of oil stood at $12, up from $3. Given that modern economies depend on oil, the higher prices and uncertainty led to the stock market crash of 1973–74, when a bear market persisted from January 1973 to December 1974 and the Dow Jones Industrial Average lost about 45% of its value.

- Asian Crisis of 1997–1998. This crisis started in July 1997 with the collapse of the Thai baht . Lacking foreign currency, the Thai government was forced to abandon its U.S. dollar peg and let the baht float. The result was a huge devaluation that spread to much of East Asia, also hitting Japan, as well as a huge rise in debt-to-GDP ratios. In its wake, the crisis led to better financial regulation and supervision.

- The 2007-2008 Global Financial Crisis. This financial crisis was the worst economic disaster since the Stock Market Crash of 1929. It started with a subprime mortgage lending crisis in 2007 and expanded into a global banking crisis with the failure of investment bank Lehman Brothers in September 2008. Huge bailouts and other measures meant to limit the spread of the damage failed and the global economy fell into recession.

- COVID19 Pandemic . A global stock market crash began in February 2020. From February 20 until March 23, 2020 the S&P 500 lost over 30% of its value. This was a result of the COVID-19 pandemic, which caused widespread panic and uncertainty about the future of the global economy. Despite being severe and with global reach, markets and national economies rebounded quickly and by early April 2020, the S&P 500 had began a decisive rise, surpassing its pre-pandemic high in August 2020.

The 2008 Global Financial Crisis remains one of the deepest economic downturns in modern history and deserves special attention, as its causes, effects, response, and lessons are still relevant to the current financial landscape.

Loosened Lending Standards

The crisis was the result of a sequence of events, each with its own trigger and culminating in the near-collapse of the banking system. It has been argued that the seeds of the crisis were sown as far back as the 1970s with the Community Development Act, which required banks to loosen their credit requirements for lower-income consumers, creating a market for subprime mortgages .

The amount of subprime mortgage debt, which was guaranteed by Freddie Mac and Fannie Mae , continued to expand into the early 2000s when the Federal Reserve Board began to cut interest rates drastically to avoid a recession. The combination of loose credit requirements and cheap money spurred a housing boom, which drove speculation, pushing up housing prices and creating a real estate bubble.

A financial crisis can take many forms, including a banking/credit panic or a stock market crash, but differs from a recession, which is often the result of such a crisis.

Complex Financial Instruments

In the meantime, the investment banks, looking for easy profits in the wake of the dot-com bust and 2001 recession, created collateralized debt obligations (CDOs) from the mortgages purchased on the secondary market. Because subprime mortgages were bundled with prime mortgages, there was no way for investors to understand the risks associated with the product. When the market for CDOs began to heat up, the housing bubble that had been building for several years had finally burst. As housing prices fell, subprime borrowers began to default on loans that were worth more than their homes, accelerating the decline in prices.

Failures Begin, Contagion Spreads

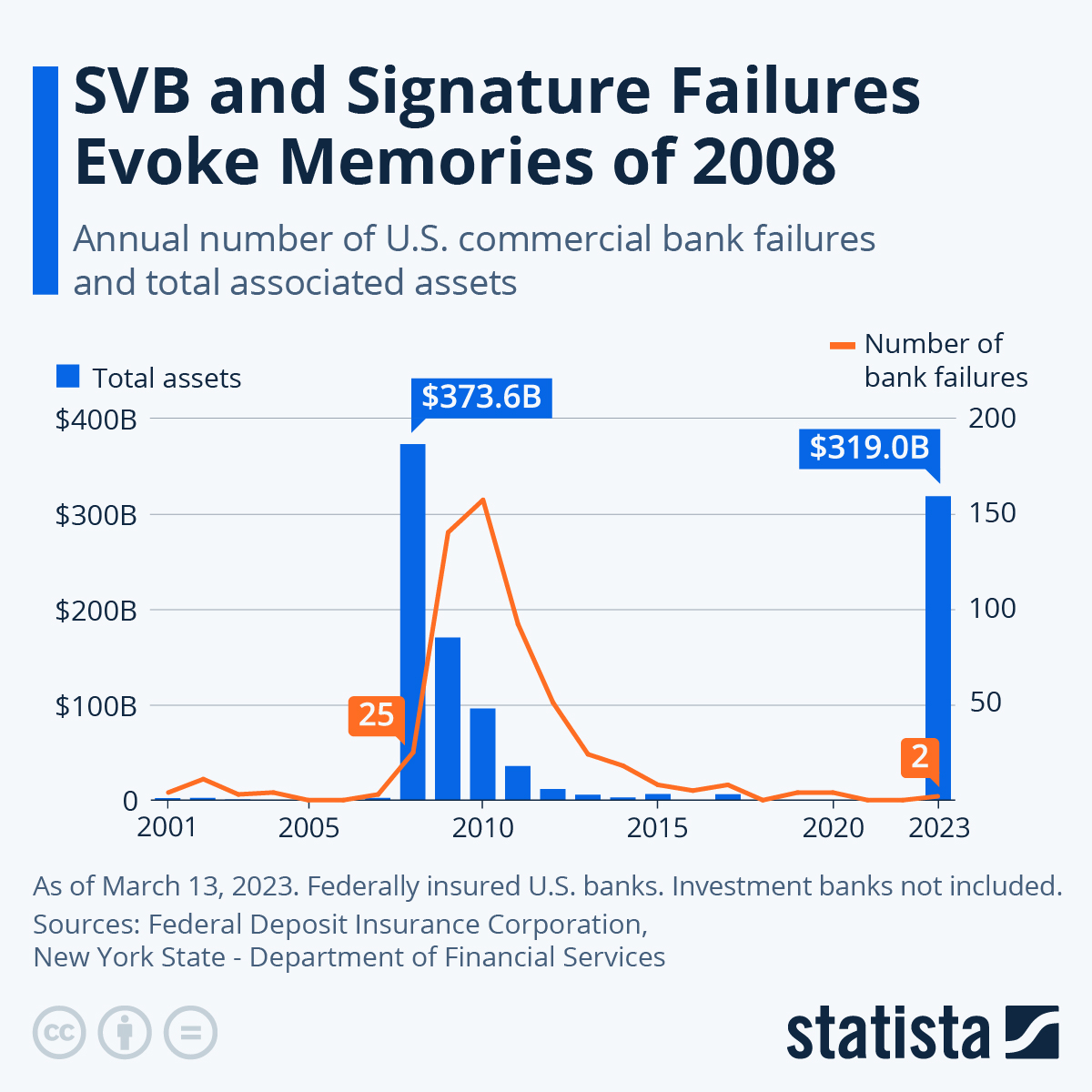

When investors realized the CDOs were worthless due to the toxic debt they represented, they attempted to unload the obligations. However, there was no market for the CDOs. The subsequent cascade of subprime lender failures created liquidity contagion that reached the upper tiers of the banking system. Two major investment banks, Lehman Brothers and Bear Stearns, collapsed under the weight of their exposure to subprime debt, and more than 450 banks failed over the next five years. Several of the major banks were on the brink of failure and were rescued by a taxpayer-funded bailout.

The U.S. Government responded to the Financial Crisis by lowering interest rates to nearly zero, buying back mortgage and government debt, and bailing out some struggling financial institutions. With rates so low, bond yields became far less attractive to investors when compared to stocks. The government response ignited the stock market. By March 2013, the S&P bounced back from the crisis and continued on its 10-year bull run from 2009 to 2019 to climb to about 250%. The U.S. housing market recovered in most major cities, and the unemployment rate fell as businesses began to hire and make more investments.

New Regulations

One big upshot of the crisis was the adoption of the Dodd-Frank Wall Street Reform and Consumer Protection Act , a massive piece of financial reform legislation passed by the Obama administration in 2010. Dodd-Frank brought wholesale changes to every aspect of the U.S. financial regulatory environment, which touched every regulatory body and every financial services business. Notably, Dodd-Frank had the following effects:

- More comprehensive regulation of financial markets, including more oversight of derivatives, which were brought into exchanges.

- Regulatory agencies, which had been numerous and sometimes redundant, were consolidated.

- A new body, the Financial Stability Oversight Council , was devised to monitor systemic risk.

- Greater investor protections were introduced, including a new consumer protection agency (the Consumer Financial Protection Bureau ) and standards for "plain-vanilla" products.

- The introduction of processes and tools (such as cash infusions) is meant to help with the winding down of failed financial institutions.

- Measures meant to improve standards, accounting, and regulation of credit rating agencies.

In February of 2020, the COVID19 virus was discovered in China. The disease soon made its way around the world, killing millions and stoking fear. This, in turn, caused markets to fall and credit to the financial system to grind to a halt.

The pandemic resulted in strict lockdowns and travel restrictions, which had a significant impact on global supply chains, consumer demand, and financial markets. Investors became increasingly concerned about the economic consequences of the pandemic, leading to a rapid sell-off in stock markets around the world. The crash was particularly severe in March 2020, when the Dow Jones Industrial Average (DJIA) experienced its worst day since 1987, falling over 2,000 points in a single day. Other major stock indexes, such as the S&P 500 and the FTSE 100, also experienced significant losses. From February 12 through March 23, 2020, the DJIA lost 37% of its value.

Central banks and governments around the world responded with various measures to stabilize the financial system and support the economy, including monetary stimulus and fiscal policies such as government spending and tax breaks.

Despite the severity of the initial crash, the markets rebounded somewhat in the following months, and many investors saw significant gains toward the end of 2020 and into 2021, where markets hit new all-time highs. However, the long-term economic consequences of the pandemic are still unclear, and many industries and countries are still struggling to recover fully.

A financial crisis is when financial instruments and assets decrease significantly in value. As a result, businesses have trouble meeting their financial obligations, and financial institutions lack sufficient cash or convertible assets to fund projects and meet immediate needs. Investors lose confidence in the value of their assets and consumers' incomes and assets are compromised, making it difficult for them to pay their debts.

A financial crisis can be caused by many factors, maybe too many to name. However, often a financial crisis is caused by overvalued assets, systemic and regulatory failures, and resulting consumer panic, such as a large number of customers withdrawing funds from a bank after learning of the institution's financial troubles. Some believe that financial crises are an inherent feature in how modern capitalist economies function, where the business cycle fuels speculative growth during economic booms, only to be met by contractions and recession. During these contractions, borrowers default on their loans and creditors tighten their lending criteria.

What Are the Stages of a Financial Crisis?

The financial crisis can be segmented into three stages, beginning with the launch of the crisis. Financial systems fail, generally caused by system and regulatory failures, institutional mismanagement of finances, and more. The next stage involves the breakdown of the financial system, with financial institutions, businesses, and consumers unable to meet obligations. Finally, assets decrease in value, and the overall level of debt increases.

What Was the Cause of the 2008 Financial Crisis?

Although the crisis was attributed to many breakdowns, it was largely due to the bountiful issuance of sub-prime mortgages, which were frequently sold to investors on the secondary market. Bad debt increased as sub-prime mortgagors defaulted on their loans, leaving secondary market investors scrambling. Investment firms, insurance companies, and financial institutions slaughtered by their involvement with these mortgages required government bailouts as they neared insolvency. The bailouts adversely affected the market, sending stocks plummeting. Other markets responded in tow, creating global panic and an unstable market.

What Was the Worst Financial Crisis Ever?

Arguably, the worst financial crisis in the last 90 years was the 2008 Global Financial Crisis, which sent stock markets crashing, financial institutions into ruin, and consumers scrambling.

A financial crisis occurs when asset prices drop steeply, businesses and consumers cannot pay their debts, and financial institutions experience liquidity shortages. Various factors contribute to a financial crisis, including systemic failures, unanticipated or uncontrollable human behavior, incentives to take excessive risks, regulatory absence or failures, or natural disasters such as pandemic viruses. Some of the historical examples of financial crises include Tulip Mania, the Credit Crisis of 1772, the Stock Crash of 1929, the 1973 OPEC Oil Crisis, the Asian Crisis of 1997-1998, and the 2008 Global Financial Crisis.

Barron's. " The Real Story of the Dutch Tulip Bubble Is Even More Fascinating Than the Myth You’ve Heard ."

Open Educational Resources, City University of New York. " The Destruction of the Tea and the Coercive Acts ."

Academia. " Chapter Twenty-Seven, The Credit Crisis of 1772/3 in the Atlantic World ," Pages 491-492.

Economic History Association. " The 1929 Stock Market Crash ."

Federal Reserve History. " Stock Market Crash of 1929 ."

Macrotrends. " Dow Jones - DJIA - 100 Year Historical Chart ."

Georgetown University Library. " Oil as a Stragetic Resource: Impact of the 1973 Oil Crisis on the Korean Peninsula ," Page 6.

Federal Reserve History. " Asian Financial Crisis: July 1997–December 1998 ."

Federal Deposit Insurance Corporation. " Crisis and Response: An FDIC History, 2008-2013: Overview ," Pages xiv, xxii

U.S. Congress. " S.3066 - Housing and Community Development Act of 1974 ."

Federal Reserve Bank of St. Louis, FRED Economic Data. " Federal Funds Effective Rate (FEDFUNDS) ," Select Date "December 2000 to August 2004."

ResearchGate. " Housing Policy, Subprime Markets and Fannie Mae and Freddie Mac: What We Know, What We Think We Know and What We Don’t Know ," Page 3.

U.S. Financial Crisis Inquiry Commission. " The Financial Crisis Inquiry Report ," Pages 127-129, 142.

Federal Deposit Insurance Corporation. " Bank Failures in Brief – Summary 2001 Through 2022 ."

U.S. Financial Crisis Inquiry Commission. " The Financial Crisis Inquiry Report ," Pages 8, 256, 325, 339-340, 435.

Federal Reserve Bank of St. Louis, FRED Economic Data. " Federal Funds Effective Rate (FEDFUNDS) ," Select Date "February 2007 to December 2009."

Federal Reserve Bank of St. Louis, FRED Economic Data. " S&P 500 (SP500) ," Select Date "June 8, 2013 to December 31, 2019."

Russell Sage Foundation Journal of the Social Sciences. " The Impact of the Dodd-Frank Act on Financial Stability and Economic Growth ."

Marketwatch. " S&P 500 Index ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-82880373-59f3f0a6c412440011f19240.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

IMAGES

VIDEO

COMMENTS

The document provides an overview of the global financial crisis of 2008. It discusses several key points: - The US housing market boom from 2002-2006 led to a housing price bubble that eventually burst, contributing to the crisis. As housing prices declined sharply from their 2006 peak, foreclosures and defaults increased substantially.

The 2007-09 global financial crisis has been a painful reminder of the multifaceted nature of crises. They hit small and large countries as well as poor and rich ones. As fittingly described by Reinhart and Rogoff (2009a), "financial crises are an equal opportunity menace." They

The Global Financial Crisis. The global financial crisis (GFC) refers to the period of extreme stress in global financial markets and banking systems between mid 2007 and early 2009. During the GFC, a downturn in the US housing market was a catalyst for a financial crisis that spread from the United States to the rest of the world through ...

By now, the tectonic damage left by the global financial crisis of 2007-09 has been well documented. World per capita output, which typically expands by about 2.2 percent annually, contracted by 1.8 percent in 2009, the largest contraction the global economy experienced

The Global Financial Crisis. Download the complete Explainer 117KB. The global financial crisis (GFC) refers to the period of extreme stress in global financial markets and banking systems between mid 2007 and early 2009. During the GFC, a downturn in the US housing market was a catalyst for a financial crisis that spread from the United States ...

Angelica Joyce Zamora. [SERIES 4/4] The Global Financial Crisis (2007 - 2009) from the Frederic Mishkin's The Economics of Money, Banking, and Financial Markets Financial Crises on Advanced Economies Chapter Outline: SERIES 1: Factors Causing Financial Crises SERIES 2: Dynamics of Financial Crises in Advanced Economies Series 3: The Great ...

Global financial crisis 2008.pptx - Free download as Powerpoint Presentation (.ppt / .pptx), PDF File (.pdf), Text File (.txt) or view presentation slides online. On September 15, 2008, Lehman Brothers filed for bankruptcy, becoming the largest bankruptcy filing in US history. Lehman had $639 billion in assets but $619 billion in debt. Its collapse made it the largest victim of the subprime ...

Slide 1: This slide introduces Global Financial Crisis.State your Company name and begin. Slide 2: In this slide, 2008 Financial Crisis Impact Explained in Numbers. Slide 3: This slide showcases Major Financial Bubble Burst of all times Slide 4: This slide displays Impact of The Great Recession on Investment Banks Slide 5: This slide shows 2008 Financial Crisis Cost.

The Global Financial Crisis of 2008 - Free download as Powerpoint Presentation (.ppt / .pptx), PDF File (.pdf), Text File (.txt) or view presentation slides online. The document summarizes the key causes and events of the 2008 Global Financial Crisis in 3 sentences: The crisis was precipitated by a real estate bubble fueled by extremely low interest rates set by the Federal Reserve in response ...

In the early 1930s, he concludes, policy errors by governments and central banks turned a financial crisis into a global economic disaster. In 2008 the financial shock was at least as big, but the ...

Both global and regional cooperation are important to mitigate economic and financial risks during crises. This session will discuss how best to leverage such cooperation during the COVID-19 crisis to manage risks, including by drawing on lessons from the past. 10:25-11:10 pm: Adapting crisis tools to a changing financial landscape. Moderator:

Presentation Design; Animated videos; Whitepapers, E-Books, etc. ... The Financial Crisis of 2007-2009, or the Global Financial Crisis, came as a shock to many bankers, policymakers, and ...

The global financial crisis was the most significant world economic event since the Great Depression. The materials presented here are designed to help anyone interested in the crisis explore it in greater detail. At this time, our focus is on how the United States government intervened to prevent the total collapse of the financial system and ...

The Global Financial Crisis of 2008. Chandra Athukorala Arndt-Corden Division of Economics Research School of Pacific and Asian Studies. Preview. Financial Crisis: A 'hardy perennial' - ' [A] subject that does not appear to be going out of fashion'. Download Presentation.

Paper prepared for presentation at the ILO Caribbean Tripartite Conference on Promoting Human Prosperity Beyond the Global Financial Crisis, 1-2 April, 2009, Kingston, Jamaica. HOW DID WE GET HERE. In trying to answer this question, we shall refer to the significance of the following issues: Systemic weakness in the global financial system;

Starting in mid-2007, the global financial crisis quickly metamorphosed from the bursting of the housing bubble in the US to the worst recession the world has witnessed for over six decades. Through an in-depth review of the crisis in terms of the causes, consequences and policy responses, this paper identifies four key messages.

Much lower capital flows to and from advanced economies and financial centers. Retrenchment in global banking Euro area crisis. Increased weight of EMDEs in global GDP. These economies have lower ...

The crisis revealed major shortcomings in market discipline, regulation, and supervision. The Global Financial Development Report 2019/2020 provides new data and evidence on the regulatory remedies adopted to prevent future financial instability and sheds light on ongoing policy debates. Developing countries have increased their minimum capital ...

An objective of the series is to get the ndings out quickly, even if the presentations are less than fully polished. e papers carry the names of the authors and should be cited accordingly. e ndings, interpretations, and conclusions expressed in this paper are entirely those ... Since the global financial crisis, global debt has reached an all ...

Financial Crisis: A financial crisis is a situation in which the value of financial institutions or assets drops rapidly. A financial crisis is often associated with a panic or a run on the banks ...

Global Financial Stability Report, October 2021. October 6, 2021. Description: Financial stability risks have been contained so far, reflecting ongoing policy support and a rebound in the global economy earlier this year. Chapter 1 explains that financial conditions have eased further in net in advanced economies but changed little in emerging ...

Waste Management & Climate Conference 2024 #WorldEnvironmentDay