Letter Templates

application letter sample for microfinance

If you are seeking financial support to start or expand your small business, a well-written application letter is essential. In this article, we provide six different examples of an application letter sample for microfinance. You can use these samples as a reference and edit them as needed to create your own effective letter.

As a small business owner, you may face difficulties in obtaining the necessary funds to run your business. Microfinance institutions offer financial assistance to small businesses and entrepreneurs who face such difficulties. An application letter is your first step towards obtaining financial support from a microfinance institution. It is important to write a well-crafted letter that highlights your business’s strengths and financial needs.

An application letter is a formal letter written to request financial support from a microfinance institution. The letter should clearly state the amount of funding required and the purpose for which it will be used. It should also include a brief description of your business, its strengths, and the potential for growth. A well-crafted application letter can increase your chances of obtaining the necessary funds to start or expand your business.

Request for Working Capital

Dear Sir/Madam,

I am writing to request a working capital loan of $10,000 for my small business. We are a new company that provides marketing services to small businesses in the local area. We have experienced significant growth in the past year and have secured contracts with several new clients. However, we require additional funds to meet the demands of our clients.

Thank you for considering our application. We look forward to hearing from you soon.

Request for Equipment Financing

I am writing to request a $15,000 equipment financing loan for my small manufacturing business. We are in the process of expanding our production capacity to meet the increasing demand for our products. However, we require additional funds to purchase new equipment that will help us increase production and maintain quality.

Thank you for your consideration. I look forward to hearing from you soon.

Request for Inventory Financing

I am writing to request $20,000 in inventory financing for my small retail business. We are a new company that sells handmade products online and in-store. We have experienced significant growth in the past year and need additional funds to purchase inventory to meet the increasing demand for our products.

Thank you for considering our application. I look forward to hearing from you soon.

Mary Johnson

Request for Business Expansion Loan

I am writing to request a $50,000 business expansion loan for my small business. We have been in the market for the past five years and have served several clients in the local area. We plan to expand our services to other cities and require additional funds to set up new offices and hire new staff.

David Brown

Request for Marketing and Advertising Loan

I am writing to request a $10,000 marketing and advertising loan for my small business. We are a new company that provides digital marketing services to small businesses in the local area. We require additional funds to create and implement a marketing campaign that will help us attract new clients.

Samantha Green

Request for Trade Finance

I am writing to request a $30,000 trade finance loan for my small export business. We export handmade products to several countries in Europe and require additional funds to meet the increasing demand for our products. The loan will be used to purchase raw materials and pay for shipping costs.

Michael Lee

Related Tips

How to write an effective application letter for microfinance.

1. Research the microfinance institution and understand its requirements before writing the letter.

2. Clearly state the purpose for which you require the funds and how you plan to use them.

3. Highlight your business’s strengths and potential for growth.

4. Provide accurate financial data to support your request.

5. Use a professional tone and format the letter correctly.

6. Edit and proofread the letter to ensure it is free of errors and presents a clear picture of your business to the reader.

Frequently Asked Questions

How long should an application letter be.

The letter should be one to two pages long and not more than 500 words.

What information should I include in the letter?

You should clearly state the purpose for which you require the funds, provide a brief description of your business, highlight its strengths, and explain how the loan will help you achieve your business goals.

How long does it take to get a response to an application letter?

The response time varies depending on the microfinance institution. It could take anywhere from a few days to several weeks to receive a response.

What documents should I attach to the letter?

You may need to attach financial statements, a business plan, and other relevant documents to support your request. Check with the microfinance institution to find out what documents are required.

Can I apply for a loan if my business is not registered?

Most microfinance institutions require businesses to be registered before they can apply for a loan. Check with the institution to find out its requirements.

What happens if my application is rejected?

If your application is rejected, you can ask for feedback on why it was rejected and try to address the issues in your next application. You may also consider applying to other microfinance institutions.

An application letter is an important document that can help you obtain the necessary funds to start or expand your small business. By following the tips provided in this article and using the sample letters as a guide, you can create a well-crafted letter that highlights your business’s strengths and financial needs. Remember to research the microfinance institution and its requirements before submitting the letter.

- sample letter of request for financial assistance

- request letter for loan approval from company

- application letter sample for loan

- simple application letter for the post of a secretary

- application letter for hra allowance

- request letter sample for tuition

7 Finance Officer Cover Letter Examples

Finance officer cover letter examples.

In today's competitive job market, it is crucial for finance officers to have a well-tailored cover letter that effectively highlights their skills and experiences. A cover letter serves as a first impression and can greatly influence a hiring manager's decision to invite a candidate for an interview. Therefore, it is essential to craft a cover letter that stands out from the crowd and showcases why you are the best fit for the finance officer position.

A well-written cover letter can demonstrate your qualifications and convey your enthusiasm for the role. It provides an opportunity to expand upon your resume and explain how your skills and experiences make you a strong candidate. In this article, we will provide you with examples of effective finance officer cover letters to help you create your own compelling document. By following these examples and incorporating the key takeaways, you can increase your chances of securing an interview and ultimately landing your dream job as a finance officer.

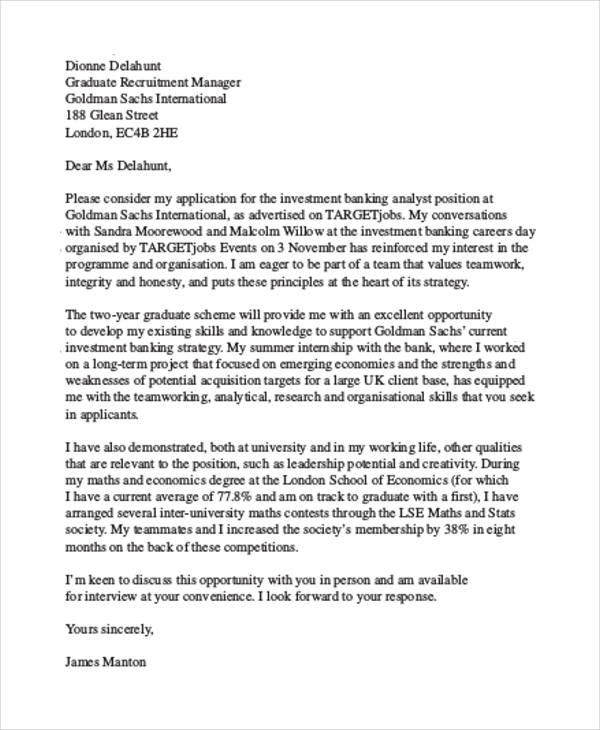

Example 1: Senior Finance Officer Cover Letter Example

Key takeaways.

Emily's cover letter effectively showcases her relevant experience and highlights her achievements in financial analysis, management, and leadership.

To stand out as a finance professional, it is crucial to emphasize your accomplishments and the impact of your work. Quantify your achievements whenever possible to demonstrate your value to potential employers.

She highlights her success in improving forecasting accuracy by 20% through the development of financial models, as well as leading a team in implementing cost-saving strategies that resulted in a 15% reduction in operational expenses.

Highlighting specific accomplishments and the quantifiable results you achieved demonstrates your ability to deliver tangible results and contribute to the financial success of an organization.

Emily could further strengthen her cover letter by aligning her experience and skills with J.P. Morgan Chase & Co's specific goals and values.

Research the company thoroughly to understand its mission, values, and strategic priorities. Tailor your cover letter to demonstrate how your skills and experience align with what the company is looking for in a Senior Finance Officer.

Example 2: Financial Planning and Analysis Cover Letter

Michael's cover letter effectively showcases his experience and skills in financial planning and analysis, positioning him as an ideal candidate for the role at Goldman Sachs Group Inc.

When applying for a financial planning and analysis position, it's crucial to highlight your expertise in financial modeling, budgeting, forecasting, and data analysis. These skills are highly valued in the industry and demonstrate your ability to contribute to the company's financial success.

He emphasizes his achievements in previous roles, such as improving decision-making and financial performance through effective financial analysis and reporting.

Quantify your achievements whenever possible. Highlight specific examples where your financial analysis skills have had a measurable impact on business outcomes. This demonstrates your ability to provide valuable insights and drive positive results.

Michael also mentions his experience in collaborating with cross-functional teams and implementing new systems, showcasing his ability to work effectively in a team and contribute to process improvements.

In addition to technical skills, emphasize your ability to collaborate and communicate effectively with stakeholders at all levels. This demonstrates your potential to work seamlessly with different teams and drive organizational success.

To further strengthen his cover letter, Michael could have specifically mentioned how his skills and experience align with the requirements and values of Goldman Sachs Group Inc.

Research the company's financial planning and analysis practices and values, and tailor your cover letter to show how your expertise aligns with their specific needs. This demonstrates your commitment and understanding of the company's goals.

Example 3: Treasury Analyst Cover Letter Example

Jennifer's cover letter effectively highlights her relevant experience and demonstrates her strong qualifications for the Treasury Analyst position at Bank of New York Mellon Corporation.

When applying for a position as a Treasury Analyst, it's crucial to showcase your expertise in financial analysis and treasury operations. This demonstrates your ability to analyze financial data and make informed decisions to optimize financial performance.

Jennifer emphasizes her experience as a Financial Analyst, where she developed strong analytical skills and provided valuable insights to senior management. This showcases her ability to identify risks and opportunities and make data-driven decisions.

Highlight your experience in financial analysis and your ability to provide strategic recommendations based on your analysis. This demonstrates your ability to contribute to the organization's financial success.

She also highlights her role as a Senior Treasury Analyst, where she successfully implemented cash management strategies and improved operational efficiency. This demonstrates her ability to manage liquidity and optimize working capital.

Showcase your experience in implementing cash management strategies and improving operational efficiency. This highlights your ability to effectively manage treasury operations and contribute to cost savings and operational effectiveness.

Overall, Jennifer's cover letter effectively positions her as a qualified candidate with the necessary skills and experience to excel in the Treasury Analyst role at Bank of New York Mellon Corporation.

Example 4: Risk Management Officer Cover Letter

Robert's cover letter effectively showcases his extensive experience and expertise in risk management, positioning him as a strong candidate for the Risk Management Officer position at BlackRock Inc.

When applying for a risk management role, it is crucial to highlight your experience in identifying, assessing, and mitigating risks. This demonstrates your ability to protect the company's assets and ensure compliance with regulatory requirements.

Robert emphasizes his accomplishments in previous roles, such as successfully implementing risk management frameworks and policies, leading cross-functional teams, and conducting risk assessments. These achievements demonstrate his ability to develop and execute effective risk management strategies.

Highlight specific achievements and responsibilities relevant to risk management. This shows your practical application of risk management principles and your ability to drive positive outcomes for the organization.

To further enhance his application, Robert could consider mentioning any industry-specific certifications or training he has acquired, as well as his knowledge of relevant regulations and compliance standards.

Highlighting relevant certifications and industry knowledge can reinforce your qualifications and demonstrate your commitment to staying up-to-date with industry best practices.

Overall, Robert's cover letter effectively communicates his qualifications and demonstrates his ability to contribute to BlackRock Inc.'s risk management efforts.

Example 5: Financial Compliance Cover Letter

Samantha's cover letter effectively showcases her extensive experience in financial compliance and highlights her strong track record of success in managing compliance programs, mitigating risks, and ensuring adherence to regulations.

As a financial compliance professional, it is crucial to demonstrate your experience in conducting risk assessments, implementing effective controls, and overseeing compliance programs. This establishes your credibility and ability to navigate complex regulatory landscapes.

Samantha quantifies her accomplishments by mentioning specific results, such as a 20% reduction in compliance violations and a 30% decrease in compliance incidents. This demonstrates her ability to deliver tangible results and drive positive change.

Whenever possible, include quantifiable achievements in your cover letter to demonstrate the impact of your work. This adds credibility to your claims and highlights your ability to make a measurable difference.

While Samantha mentions her experience at leading financial institutions, she could further strengthen her pitch by highlighting any relevant certifications or specialized training she has completed in the field of financial compliance.

Don't forget to emphasize any certifications or specialized training you have received in financial compliance. This demonstrates your commitment to professional development and reinforces your expertise in the field.

Example 6: Investment Banking Cover Letter Example

Christopher's cover letter effectively highlights his extensive experience and achievements in the investment banking industry, positioning him as a strong candidate for the Investment Banking position at Morgan Stanley.

When applying for a highly competitive role in investment banking, it is crucial to emphasize your experience and track record in executing complex transactions. This demonstrates your ability to handle the demands of the industry and generate value for clients.

Christopher showcases his expertise in financial modeling, valuation, and due diligence, which are essential skills for investment banking professionals. He also emphasizes his experience in managing key client relationships and executing capital raising and M&A transactions.

Highlighting your proficiency in financial modeling, valuation, due diligence, and relationship management can significantly enhance your application for an investment banking role. These skills are highly sought after in the industry and demonstrate your ability to contribute to the success of the organization.

While Christopher's cover letter effectively highlights his experience and achievements, he could further emphasize his specific contributions to deals and transactions, showcasing his individual impact on the success of projects.

When discussing your experience, be sure to provide specific examples of deals or transactions where you made a significant contribution. This demonstrates your ability to drive results and adds credibility to your application.

Example 7: Financial Controller Cover Letter Example

Jessica's cover letter effectively highlights her experience and achievements in financial management, positioning her as a strong candidate for the Financial Controller position at Bank of America.

Emphasize your experience and accomplishments in financial management, including financial planning, analysis, reporting, and controls. This demonstrates your ability to effectively oversee financial operations and drive strategic decision-making.

She quantifies her achievements, such as a 20% reduction in reporting time and successful implementation of a new financial software system. These tangible results showcase her ability to drive efficiency and improve accuracy in financial processes.

Whenever possible, include quantifiable achievements that demonstrate the impact of your work. This provides concrete evidence of your abilities and sets you apart from other candidates.

Jessica also highlights her experience in leading high-performing teams and mentoring finance professionals. This showcases her leadership skills and ability to motivate and develop talent.

Highlight your experience in leading and managing teams, as well as any mentoring or coaching experience. This demonstrates your ability to effectively lead and develop finance professionals, which is crucial for the Financial Controller role.

Overall, Jessica's cover letter effectively showcases her expertise in financial management and leadership, making her a strong candidate for the Financial Controller position at Bank of America.

Skills To Highlight

As a finance officer, your cover letter should highlight the unique skills that make you a strong candidate for the role. These key skills include:

Financial Analysis : Showcase your ability to analyze financial data and make informed decisions based on your analysis. Highlight any experience you have in conducting financial forecasting, budgeting, or variance analysis. Employers are looking for candidates who can provide valuable insights and recommendations based on their financial analysis.

Financial Planning and Analysis : Demonstrate your expertise in financial planning and analysis, including your ability to create financial models, perform financial forecasting, and conduct scenario analysis. Emphasize your proficiency in using financial planning software and tools to support strategic decision-making.

Treasury Management : Highlight your knowledge and experience in managing cash flow, liquidity, and funding for an organization. Showcase your ability to optimize working capital, manage foreign exchange risk, and develop effective cash management strategies. Employers are looking for finance officers who can efficiently manage the organization's financial resources.

Risk Management : Illustrate your understanding of financial risks and your ability to develop and implement risk management strategies. Discuss any experience you have in identifying and assessing financial risks, such as credit risk, market risk, or operational risk. Emphasize your ability to develop risk mitigation plans and monitor risk exposures.

Financial Compliance : Highlight your knowledge of financial regulations and your ability to ensure compliance with relevant laws and standards. Showcase your experience in conducting internal audits, implementing internal controls, and preparing financial statements in accordance with accounting principles. Employers value finance officers who can maintain financial integrity and adhere to regulatory requirements.

Investment Banking : If you have experience in investment banking, emphasize your expertise in financial modeling, valuation, and deal structuring. Highlight any successful transactions or deals you have been involved in and showcase your ability to analyze investment opportunities and provide strategic advice.

Financial Control : Showcase your ability to establish and maintain financial controls to safeguard the organization's assets. Discuss your experience in conducting financial audits, monitoring financial performance, and implementing corrective actions. Employers are looking for finance officers who can ensure the accuracy and reliability of financial information.

By highlighting these key skills in your cover letter, you can demonstrate your qualifications and suitability for a finance officer position. Tailor your examples and experiences to align with the specific requirements of the job you are applying for, and emphasize how your skills can contribute to the success of the organization.

Common Mistakes To Avoid In Cover Letters

When crafting your cover letter for a finance officer position, it's important to avoid these common mistakes:

Being Too Generic : Your cover letter should be tailored to the specific finance officer role and company to which you're applying. Avoid using a generic cover letter template and instead, customize it to showcase your relevant skills and experiences that align with the job requirements. Show that you've done your research on the company and understand its financial goals and objectives.

Failing to Highlight Specific Achievements : Don't simply restate the information from your resume in your cover letter. Instead, use it as an opportunity to highlight specific achievements and successes that demonstrate your expertise in finance. Focus on quantifiable results and provide examples of how you have positively impacted financial processes, improved financial performance, or implemented cost-saving measures in your previous roles.

Neglecting to Showcase Alignment with Company's Financial Goals : A strong finance officer cover letter should not only highlight your skills and experiences but also demonstrate how your expertise aligns with the company's financial goals and objectives. Research the company's financial standing, industry trends, and any recent financial developments. Use this information to explain how your skills and experience can contribute to the company's financial success.

Lack of Attention to Detail : Finance is a field that requires attention to detail, and your cover letter should reflect this. Avoid any spelling or grammatical errors, as they can create a negative impression of your attention to detail. Take the time to proofread your cover letter carefully, and consider asking a trusted friend or family member to review it as well.

Using Jargon or Acronyms Without Explanation : While it's important to showcase your knowledge and expertise in finance, avoid using excessive jargon or acronyms that may not be familiar to the reader. If you do use technical terms, be sure to provide explanations or context to ensure that the reader understands your message clearly.

Failing to Demonstrate Strong Communication Skills : As a finance officer, effective communication is essential. Your cover letter should demonstrate your ability to communicate clearly and concisely. Avoid lengthy paragraphs and use bullet points or short sentences to convey your key points. Additionally, make sure your cover letter is well-organized and easy to read, with a professional tone throughout.

By avoiding these common mistakes, you can create a strong and compelling cover letter that showcases your qualifications as a finance officer and increases your chances of landing an interview.

In conclusion, a well-crafted cover letter is essential for a finance officer's successful job application. It serves as a personalized introduction to the potential employer and highlights the candidate's qualifications and skills that make them a perfect fit for the position. A strong cover letter demonstrates professionalism, attention to detail, and a genuine interest in the company.

By showcasing specific achievements and experiences, the cover letter helps the finance officer stand out from other applicants and leaves a lasting impression on the hiring manager. It is an opportunity to present oneself as a strong candidate who can contribute to the organization's success.

Remember to tailor the cover letter to each specific job application, addressing the company's needs and requirements. Research the company beforehand to understand its values, goals, and culture, and incorporate this knowledge into the cover letter. This shows the employer that the candidate has taken the time and effort to understand the organization and is genuinely interested in becoming a part of it.

In summary, a well-written cover letter can greatly enhance a finance officer's chances of securing a rewarding position in the competitive field of finance. It is a powerful tool that should not be underestimated. So, take the time to create a unique and compelling cover letter that showcases your skills, experiences, and passion for the finance industry. Good luck with your job application!

Business Loan Application Letter Sample: Free & Effective

In this article, I’ll guide you through the process step-by-step, drawing from my personal experiences, and provide you with a handy template to get you started. Whether you’re a seasoned business owner or just starting out, these insights will help you craft a compelling letter that stands out to lenders.

Key Takeaways

- Understand Your Audience: Know the lender’s requirements and tailor your letter accordingly.

- Be Clear and Concise: Communicate your business’s needs and how the loan will be used in a straightforward manner.

- Provide Detailed Information: Include pertinent details about your business and your plan for the loan.

- Use a Professional Tone: Maintain a formal tone throughout the letter to convey seriousness and professionalism.

- Follow a Structured Format: Use a clear and logical structure to make your letter easy to read and understand.

- Include Supporting Documents: Attach essential documents that can vouch for your business’s credibility and financial health.

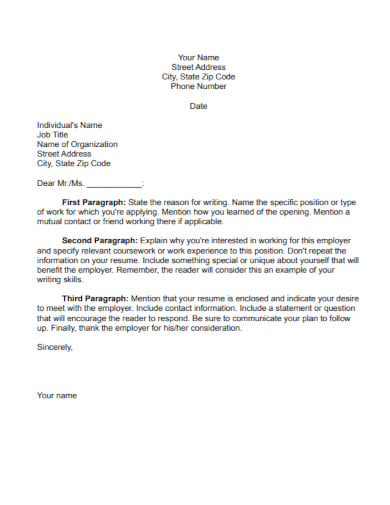

Step-by-Step Guide to Writing a Business Loan Application Letter

Step 1: understand the lender’s requirements.

Before you begin writing, it’s crucial to understand the lender’s criteria. Each financial institution has its unique set of requirements for loan applications. Familiarize yourself with these to tailor your letter effectively.

Step 2: Start with Your Contact Information

Begin your letter with your contact information at the top, followed by the date and the lender’s details. This establishes a professional tone from the outset.

Your Name Your Business Name Your Business Address City, State, Zip Code Date Lender’s Name Lender’s Institution Lender’s Address City, State, Zip Code

Step 3: Craft a Compelling Introduction

Trending now: find out why.

In the opening paragraph, introduce yourself and your business. Clearly state the purpose of your letter – to apply for a business loan – and the amount you are requesting. This sets the stage for the details that follow.

Step 4: Detail Your Business Plan

This is where you shine. Outline your business plan, emphasizing how the loan will contribute to your business’s growth. Be specific about how you intend to use the funds. Will they be used for expanding operations, purchasing equipment, or maybe for bolstering your working capital? Lenders want to see that you have a clear plan in place.

Step 5: Showcase Your Business’s Financial Health

Include a brief overview of your business’s financial status. Highlight your revenue, profit margins, and financial projections. This demonstrates to lenders that you have a viable business capable of repaying the loan.

Step 6: Mention Collateral (If Applicable)

If you’re offering collateral against the loan, specify what it is. This could be equipment, real estate, or inventory. Detailing the collateral reassures lenders about the security of their investment.

Step 7: Conclude with a Call to Action

End your letter by thanking the lender for considering your application and expressing your willingness to provide further information if needed. Include a polite request for a meeting or a conversation to discuss the application further.

Step 8: Professional Sign-Off

Sign off your letter with a professional closing, such as “Sincerely,” followed by your name and position within the company.

Template for a Business Loan Application Letter

[Your Name] [Your Business Name] [Your Business Address] [City, State, Zip Code] [Date]

[Lender’s Name] [Lender’s Institution] [Lender’s Address] [City, State, Zip Code]

Dear [Lender’s Name],

I am writing to apply for a business loan of [Loan Amount] for [Your Business Name]. As [Your Position] of the company, I am committed to guiding our business to new heights, and this loan is a crucial step in our growth strategy.

Our plan is to allocate the loan towards [Specific Use of Loan]. This investment is projected to [Expected Outcome of Loan Investment], enhancing our profitability and ensuring our ability to repay the loan.

Enclosed with this letter, you will find our business plan, financial statements, and cash flow projections, providing a comprehensive view of our business’s financial health and growth potential.

Thank you for considering our loan application. I am looking forward to the opportunity to discuss this further and am happy to provide any additional information required.

[Your Name] [Your Position] [Your Contact Information]

Tips from Personal Experience

- Personalize Your Letter: While using a template is helpful, adding personal touches that reflect your business’s unique aspects can make your letter stand out.

- Be Transparent: Honesty about your business’s current financial situation and how you plan to use the loan builds trust with lenders.

- Proofread: A letter free from grammatical errors and typos shows attention to detail and professionalism.

I’d love to hear your thoughts or experiences with writing business loan application letters. Do you have any tips to share or questions about the process? Feel free to leave a comment below.

Frequently Asked Questions (FAQs)

Q: What is a business loan request?

Answer: A business loan request is a formal request made by a business to a lender or financial institution for a loan to finance business operations or expansion.

Q: What information is typically included in a business loan request?

Answer: A business loan request typically includes information about the business, including its financial history, plans for the loan proceeds, and a projected financial statement.

It may also include personal financial information about the business owner or owners.

Q: How is a business loan request typically made?

Answer: A business loan request is typically made in writing, through a loan application or business plan submitted to a lender or financial institution.

Q: What documentation is required to support a business loan request?

Answer: Documentation that may be required to support a business loan request can include financial statements, tax returns, and personal financial information.

It may also include business plan, projected financial statement, and any collateral that the business can offer.

Q: What are the potential outcomes of a business loan request?

Answer: The potential outcomes of a business loan request can include the lender or financial institution approving the loan, denying the loan, or offering a modified loan amount or terms.

The interest rate, repayment period, and other terms of the loan will be based on the creditworthiness of the business and the lender’s lending policies.

Q: What is a business loan request letter?

Answer : A business loan request letter is a formal written document submitted by an individual or a business to a financial institution or lender, seeking financial assistance in the form of a loan.

It outlines the purpose of the loan, the amount requested, and provides supporting information to convince the lender of the borrower’s creditworthiness.

Q: How do I start a business loan request letter?

Answer : To start a business loan request letter, begin by addressing it to the appropriate person or department at the lending institution.

Use a formal salutation such as “Dear [Lender’s Name]” or “To Whom It May Concern.” Introduce yourself or your business and clearly state the purpose of the letter, which is to request a loan.

Q: How should I structure a business loan request letter?

Answer : A business loan request letter should follow a professional and organized structure. It typically includes an introduction, a body, and a conclusion.

The introduction should clearly state the purpose of the letter and provide essential details about yourself or your business.

The body of the letter should elaborate on the loan request, including the amount needed, the purpose of the loan, and any supporting information or documents.

Finally, the conclusion should express appreciation for the lender’s time and consideration, while offering your contact information for further communication.

Q: What tone should I use in a business loan request letter?

Answer : A loan request letter should maintain a formal and professional tone throughout. It should be respectful, concise, and polite. Avoid using overly technical jargon or informal language.

It is important to demonstrate professionalism and credibility to increase your chances of a favorable response.

Q: How long should a business loan request letter be?

Answer : A business loan request letter should be concise and to the point, typically ranging from one to two pages.

Avoid excessive details or unnecessary information that may distract from the main purpose of the letter. Keep the content focused, clear, and persuasive.

Q: What is the purpose of a business loan request letter?

Answer : The purpose of a business loan request letter is to formally request financial assistance from a lender or financial institution.

It serves as a written proposal, outlining the borrower’s need for funds, the purpose of the loan, and the borrower’s ability to repay.

The letter aims to persuade the lender that the loan is a viable investment with a solid repayment plan and potential for positive outcomes.

Q: How important is a business loan request letter?

Answer : A business loan request letter is crucial when seeking a loan from a lender or financial institution.

It acts as a formal request, providing essential information about the borrower, the purpose of the loan, and the borrower’s ability to repay.

A well-written and persuasive loan request letter increases the likelihood of the loan being approved, as it demonstrates professionalism, credibility, and a clear understanding of the borrower’s financial needs.

Related Articles

Personal loan request letter sample: free & effective, request letter for working capital loan: the simple way, personal loan paid in full letter sample: free & effective, sample letter to bank requesting extension of time for loan payment: free & effective, ask someone for money in a letter sample: free & effective, business loan request letter sample: free & customizable, leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Start typing and press enter to search

How To Write A Letter Of Application For A Loan

Advertisement

Are you asking “how do I write a letter of loan request for a company?” or wondering “how to write an application letter for a loan in a microfinance bank?” Search no further, this guide is specially made for you to get the financial help you need, using our free loan application letter sample.

When requesting a loan from a bank, lender, or other financial institution, a letter of application is frequently required. You must include this letter in your loan application. If you describe your company’s background and current financial situation, as well as how you intend to use the loan funds and how you will repay them, the bank is more likely to approve your loan application.

Let’s take a look at the components of a loan application letter, explain how to write one, and walk you through writing a sample letter of your own. A formal letter of application for a loan is delivered to the lender at the time the loan is requested. Why you require the loan should be stated in the letter, as how you intend to spend the funds, and how you intend to pay back the loan.

A crucial step in the loan application process is the application letter. The lender will have the opportunity to find out more about you and how you’re doing financially. You can increase your chances of having a loan approved by writing a strong application letter.

Tips for creating a strong loan application letter:

- Be succinct and clear.

Lenders shouldn’t have to read through a lot of extraneous details in order to understand your loan request.

- Be precise.

Describe your reasons for needing the loan, the amount you require, and your intended use for the funds.

- Be sensible.

Asking for more money than you need is improper. Tailoring your cloth according to your size is one proverb that should be strictly applied when applying for a loan.

- Be truthful.

Don’t misrepresent anything or make any false claims and before sending your letter, carefully proofread it.

Here is an example of an application letter for a loan:

[Your Name]

[Your Address]

[City, State ZIP Code]

[Your Phone Number]

[Your Email Address]

To Whom It May Concern

I am writing to apply for a loan in the amount of #50,000 from your bank. I have been a customer of your bank for 5 years and have always been satisfied with your services.

I am requesting this loan to consolidate my credit card debt. I have been carrying a balance on my credit cards for the past few years and I am now paying over 20% interest on my debt. I am hoping to refinance my debt with a lower interest rate and save money on my monthly payments.

I am currently employed as a software engineer at XYZ. I have been with this company for 3 years and have a good performance record. I have a solid credit history and am a member of the National Institute of Finance Management.

A copy of my most recent pay stub, a credit report, and a letter from my employer attesting to my employment and salary are all enclosed. I would appreciate the chance to go over my loan application with you in more detail. I appreciate your consideration and time.

[Your Name ]

The first step in obtaining the financial assistance you require is to prepare an efficient and extensively reported loan proposal, which calls for knowledge of how to write a loan application letter. While an enterprise loan requires a strong credit history and receivables, personal loan approval is primarily based on your credit score and prudent financial planning.

Related posts:

- Loanspot Africa Loan Application Requirements And How To Apply

- How To Use GTBank Loan Code

- How To Apply For a Loan Using The Branch Loan App

- How To Use The Renmoney Ussd Code

- Loans For Unemployed In Nigeria

- How To Use Palmcredit Ussd Code

- Types Of Lapo Loans You Can Get

- How To Apply For Loan On Bg Loan App

- How To Apply For A Loan Using 9money

- Specta Loan: Requirements And How To Apply

Privacy preference center

We care about your privacy

When you visit our website, we will use cookies to make sure you enjoy your stay. We respect your privacy and we’ll never share your resumes and cover letters with recruiters or job sites. On the other hand, we’re using several third party tools to help us run our website with all its functionality.

But what exactly are cookies? Cookies are small bits of information which get stored on your computer. This information usually isn’t enough to directly identify you, but it allows us to deliver a page tailored to your particular needs and preferences.

Because we really care about your right to privacy, we give you a lot of control over which cookies we use in your sessions. Click on the different category headings on the left to find out more, and change our default settings.

However, remember that blocking some types of cookies may impact your experience of our website. Finally, note that we’ll need to use a cookie to remember your cookie preferences.

Without these cookies our website wouldn’t function and they cannot be switched off. We need them to provide services that you’ve asked for.

Want an example? We use these cookies when you sign in to Kickresume. We also use them to remember things you’ve already done, like text you’ve entered into a registration form so it’ll be there when you go back to the page in the same session.

Thanks to these cookies, we can count visits and traffic sources to our pages. This allows us to measure and improve the performance of our website and provide you with content you’ll find interesting.

Performance cookies let us see which pages are the most and least popular, and how you and other visitors move around the site.

All information these cookies collect is aggregated (it’s a statistic) and therefore completely anonymous. If you don’t let us use these cookies, you’ll leave us in the dark a bit, as we won’t be able to give you the content you may like.

We use these cookies to uniquely identify your browser and internet device. Thanks to them, we and our partners can build a profile of your interests, and target you with discounts to our service and specialized content.

On the other hand, these cookies allow some companies target you with advertising on other sites. This is to provide you with advertising that you might find interesting, rather than with a series of irrelevant ads you don’t care about.

Credit Officer Cover Letter Example

Increase your chances of scoring a job and learn to perfect your own cover letter with our free, modifiable Credit Officer cover letter example. Use this cover letter example for free or customize it inside our easy-to-use cover letter maker.

Related resume guides and samples

How to write an appealing accountant resume

How to build the perfect auditor resume

How to build a great bookkeeper resume

Ultimate tips for the perfect finance analyst resume

Five great tips for your insurance agent resume

How to write an appealing investment advisor resume?

Create the perfect resume for a role in tax services

Credit Officer Cover Letter Example (Full Text Version)

Sophie schiele.

Dear Hiring Managers,

I am a results-oriented and self-driven finance professional with a proven track record of success in both independent and team environments. I am very interested in the opportunity to join your firm, as I believe I could make a valuable contribution to your team and organization. Furthermore, I see this as a chance to further develop my expertise and advance my career.

My strengths include exceptional communication and negotiation skills, as well as the ability to lead projects to successful completion. During my time at Yavapai & Co., Ltd. as a Credit Officer, I demonstrated a proactive approach and strong determination to achieve goals. I was responsible for various tasks, such as reviewing loan applications, organizing promotional events, and conducting financial analysis, always prioritizing client satisfaction.

I possess a strong work ethic and proficiency in industry software programs necessary for this role. Additionally, I am a native German speaker with proficiency in English and basic knowledge of Spanish. With attention to detail, analytical skills, and the ability to remain composed under pressure, I am confident that my qualifications align with your current needs.

I have enclosed my resume for your review and am available for further information. Thank you for considering my application for the Credit Officer position within your company. I look forward to the opportunity to discuss my candidacy with you.

Sincerely, Sophie Schiele

Milan Šaržík, CPRW

Milan’s work-life has been centered around job search for the past three years. He is a Certified Professional Résumé Writer (CPRW™) as well as an active member of the Professional Association of Résumé Writers & Careers Coaches (PARWCC™). Milan holds a record for creating the most career document samples for our help center – until today, he has written more than 500 resumes and cover letters for positions across various industries. On top of that, Milan has completed studies at multiple well-known institutions, including Harvard University, University of Glasgow, and Frankfurt School of Finance and Management.

Edit this sample using our resume builder.

Don’t struggle with your cover letter. artificial intelligence can write it for you..

Similar job positions

Front Desk Receptionist Investment Advisor Auditor Tax Services Insurance Agent Facilities Manager Personal Assistant Finance Analyst Administration Bookkeeper Accountant Office Staff

Related accounting / finance resume samples

Related accounting / finance cover letter samples

Let your resume do the work.

Join 5,000,000 job seekers worldwide and get hired faster with your best resume yet.

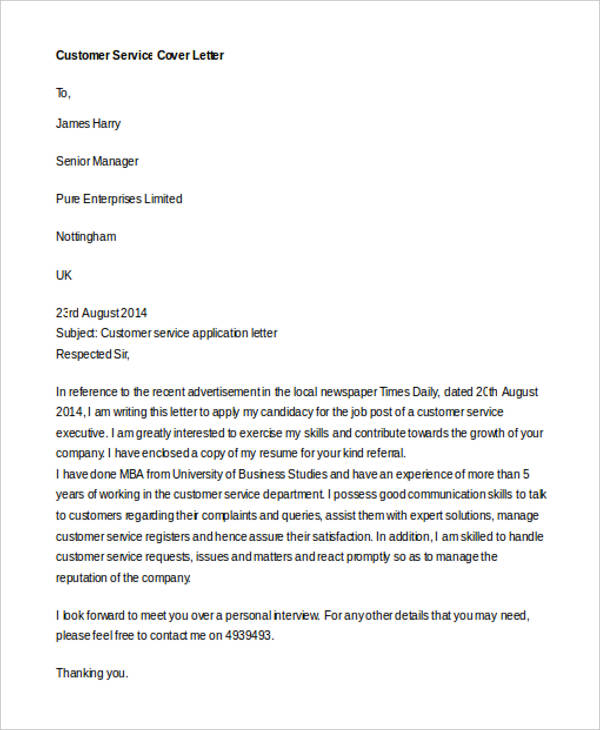

Finance Officer Cover Letter Example

A cover letter gives you an opportunity to persuade the employer to go through your resume. It doubles the chances of you getting a face-to-face interview with the hiring manager. Roll out your skills that mimic the job summary but with little word variations in your Finance Officer Cover Letter.

Our Finance Officer Cover Letter Sample will help you set yourself apart from other candidates in the pool.

- Cover Letters

- Accounting & Finance

What to Include in a Finance Officer Cover Letter?

Roles and responsibilities.

Finance Officer Roles and Responsibilities:

The role of a Finance Officer is to look after every fiscal matter of the organization. He is a forward-looking professional responsible for raising the financial status of the company by supervising its financial and accounting processes . His primary responsibilities consist of conducting internal audits, processing invoices and receipts, and developing budgets.

The significant responsibilities of a Finance Officer are penned down below:

- Prepare budgets and allocate them to each department of the organization.

- Formulate fiscal policies for the smooth functioning of the company.

- Provide assistance to the accounting department in the preparation of the company’s final accounts.

- Oversee the cash inflows and cash outflows.

- Act as a point of contact between the auditor and the company.

- Develop reconciliation statements.

- Perform gap analysis to assess the discrepancies.

- Make sure that the account records management is well organized.

- Complete the month-end closing formalities.

Education & Skills

Finance Officer Skills :

- Excellent analytical skills to analyze the financial health of the organization.

- Financial savviness to spot the inconsistency in the transactions.

- Outstanding interpersonal ability to offer assistance to colleagues in resolving financial issues.

- Innovative thinking to suggest effective monetary policies for the company.

- Ability to determine and cut non-essential expenditures.

- Capable of applying a combination of different financial strategies and different situations.

Finance Officer Educational Requirements:

- Graduation in accounting, finance, economics, or a related stream.

- 3-5 years of prior experience.

- Proficiency with accounting software.

- Excellent knowledge of GAAP and other accounting principles.

Finance Officer Cover Letter Example (Text Version)

Dear Mr./Ms.,

I want to apply for the role of Finance Officer open in your company. This application will showcase my current responsibilities in 1 year of professional experience and a set of unique talents in the finance field that make me best-suited for the role.

Below is the sample of my daily tasks in the current firm:

- Review and execute financial policies.

- Prepare balance sheets and P&L statements.

- Import transaction records from the bank statement to generate reconciliation statements.

- Oversee all the bank deposits and payments.

- Assist in audits and completion of required paperwork.

Furthermore, I keep myself updated with the latest development in the finance market in order to alter the financial policies of the company in accordance with the protocols. My remarkable regularity in fulfilling the role responsibilities will prove me an ideal asset to your finance department.

Please refer to the attached resume to get an overview of my academic qualifications and career breakthroughs. I’d hope to get a chance and have a further conversation to prove my fitness for the required role.

Sincerely, [Your Name]

Quick Tips for Finance Officer Cover Letter for Experienced Applicants:

The key selling point of your cover letter could be the examples to showcase what skills you possess. Therefore, mindfully highlight your field expertise.

You can deliver your worthiness with the help of a well-informed resume. Highlight your academic scores in the relevant coursework and to date essential role responsibilities throughout your professional journey for the employer to imagine you as the next in line.

Our Finance Officer Resume Sample will impart the essential takeaways for you to compose your resume.

Customize Finance Officer Cover Letter

Get hired faster with our free cover letter template designed to land you the perfect position.

Related Accounting & Finance Cover Letters

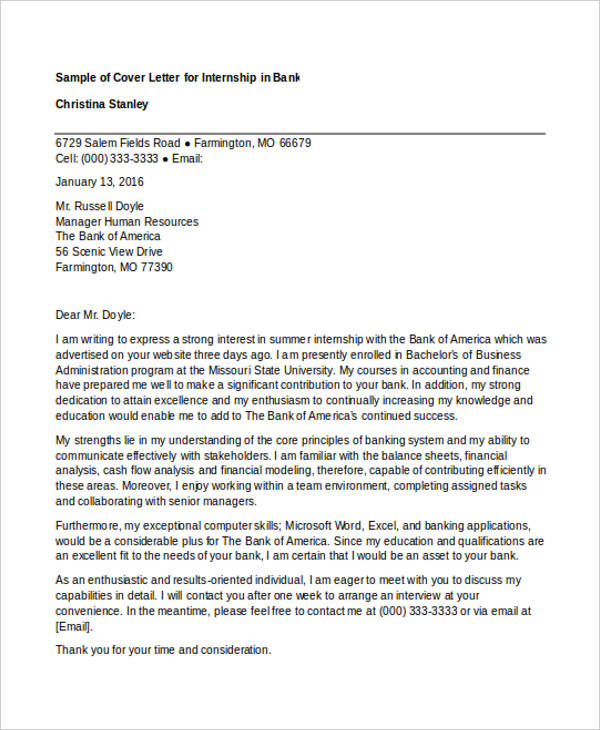

Loan Officer Cover Letter Examples

Use these Loan Officer cover letter examples to help you write a powerful cover letter that will separate you from the competition.

Loan officers work with clients to identify and assess their borrowing needs. They also work with lending institutions to get the best rates for their clients.

In order to be a successful loan officer, you need to be able to build relationships with clients and have a strong knowledge of the lending industry.

Use these examples to write a cover letter that will help you get the job you want.

Formal/Professional Writing Style Example

With a strong background in finance and over five years of experience in the banking industry, I am confident in my ability to excel as a Loan Officer at [Company Name]. My passion for providing excellent customer service and my expertise in analyzing financial data make me a strong candidate for this position.

In my current role as a Loan Officer at [Current Company], I have demonstrated exceptional skills in understanding clients’ financial needs and providing tailored solutions to meet their requirements. My ability to develop and maintain relationships with both colleagues and clients has proven invaluable in facilitating efficient loan processing and approvals.

My accomplishments in this role include:

– Successfully managing a loan portfolio worth $10 million, resulting in a 98% repayment rate and consistently exceeding target goals. – Implementing new risk assessment strategies, which reduced loan delinquency rates by 15% over a 12-month period. – Training and mentoring junior loan officers, fostering their professional growth and increasing team productivity.

Alongside my excellent communication and interpersonal skills, I have a Bachelor’s degree in Finance from [University Name] and possess sound knowledge of lending regulations and compliance. I am confident that my ability to accurately analyze clients’ financial positions and deliver personalized loan strategies will make me an asset to your team at [Company Name].

I am excited about the opportunity to contribute to your company’s ongoing success and be part of your dynamic Loan Officer team. I am available to discuss my qualifications further at your earliest convenience. Thank you for considering my application, and I look forward to speaking with you.

[Your Name]

Entry-Level Writing Style Example

As a recent finance graduate and a highly motivated individual, I believe my academic background and eagerness to learn make me an ideal candidate for this role.

I recently obtained my Bachelor’s Degree in Finance from XYZ University, where I gained a strong understanding of financial principles, risk management, and credit analysis. Throughout my coursework, I have developed a keen interest in mortgage lending and was particularly drawn to your company’s commitment to helping clients achieve their homeownership dreams.

While completing my degree, I had the opportunity to intern at a local credit union, where I provided exceptional customer service and assisted in processing loan applications. This experience allowed me to see first-hand how the lending process works and solidified my passion for pursuing a career as a Loan Officer. I also honed my communication and problem-solving skills, which I believe are integral to succeeding in this position.

I am excited about the opportunity to join your team and contribute to XYZ Company’s continued growth and success. I am eager to apply my educational background and enthusiasm for this industry in a role such as this, where I can further develop my skills and grow within the company.

Thank you for considering my application. I look forward to the opportunity to discuss my qualifications further and am available for an interview at your convenience.

Networking/Referral Writing Style Example

I was recently referred to your company by Mr. James Smith, a valued colleague and long-time friend of mine at XYZ Bank. Mr. Smith impressed upon me the high standards of professionalism and customer service that your organization maintains, and I am confident that my background and experience make me a strong fit for this role.

Having worked in the financial industry for more than five years, I have gained extensive knowledge of loan products, credit risk assessments, and regulatory requirements. I pride myself on my ability to devise tailored solutions to meet the varied financial needs of clients, ensuring a positive customer experience.

In my previous role as a Loan Officer at ABC Bank, I was responsible for managing a portfolio of 200 clients with an overall loan value exceeding $50 million. I earned a reputation for excellent customer service and maintained a 95% loan approval rate, contributing significantly to the growth of the bank.

Furthermore, my strong analytical skills and attention to detail enable me to excel in assessing the creditworthiness of potential borrowers, minimizing risk, and ensuring compliance with all relevant regulations.

In closing, I am eager to contribute my expertise to your team as a Loan Officer and am confident in my ability to make a significant impact at your organization. Thank you for considering my application, and I look forward to the opportunity to discuss my suitability for this role in greater detail.

Enthusiastic/Passionate Writing Style Example

As a highly motivated and dedicated individual, it has always been my dream to contribute my expertise to a renowned financial institution such as yours. It is your company’s commitment to clients and dedication to responsible lending that has always resonated with me and aligns with my professional vision. It would be an incredible honor to be a part of your team and help individuals and businesses alike achieve their financial goals.

With a strong academic background in finance, years of experience in customer service, and a track record of successful loan management, I am confident that I possess the necessary skillset and passion to excel in this position. My experience has thoroughly equipped me to assist clients in a empathetic and knowledgeable manner, guiding them through the lending process and ensuring that they can make well-informed decisions.

What sets me apart from other candidates is my unrelenting enthusiasm and love for my work. It is my belief that great Loan Officers not only possess strong analytical skills and financial knowledge, but also a deep understanding of their clients’ needs and a genuine excitement to help them achieve success. As a driven and proactive problem solver, I eagerly seek out creative solutions and never shy away from challenges.

I am confident that my passion, dedication, and skills will be assets to your company and contribute to its continued success in the community. I look forward to the opportunity to speak with you further about how my expertise aligns with your goals and how, together, we can make a tangible impact in people’s lives.

Thank you for considering my application, and I hope to join your exceptional team of Loan Officers soon.

Problem-Solving Writing Style Example

As an experienced banking professional with a solid understanding of the industry, I am aware that one of the key challenges facing financial institutions today is effectively managing risk while maintaining customer satisfaction. With my strong background in assessing credit, efficient decision-making, and my ability to build long-lasting relationships, I am confident that I can help address these challenges and contribute positively to your company.

Throughout my career, I have consistently demonstrated a keen ability to scrutinize borrowers’ financial profiles and accurately evaluate their creditworthiness. This has not only allowed me to protect my employer’s interests but also resulted in dynamic growth in loan portfolios. I understand that a high level of financial integrity is essential in the current banking climate, and I am prepared to utilize my expertise to manage the risk to your business while ensuring customers receive the best possible service.

Furthermore, I recognize the importance of engaging with customers in today’s increasingly competitive market effectively. As a Loan Officer, I have maintained excellent customer satisfaction rates by promptly addressing concerns, providing targeted solutions, and nurturing valuable relationships. My strong communication skills have allowed me to work efficiently with both customers and colleagues, helping to streamline processes and create an environment of trust and cooperation.

To support my application, I have enclosed my resume that outlines my relevant experiences and achievements. I am excited about the opportunity to contribute positively to your organization as a Loan Officer and am eager to discuss my qualifications further at your earliest convenience.

Thank you for considering my application. I look forward to the possibility of working with you.

Storytelling/Narrative Writing Style Example

I recall the day when my parents’ small business encountered financial difficulties and they needed a loan to keep it afloat. I accompanied them to the bank, where we were greeted by a loan officer who treated us with empathy and guided us through the entire process. His professionalism and expertise not only helped my parents secure the loan they needed but also left a lasting impression on me. From that day on, I knew I wanted to be in a position where I could make a positive impact on people’s lives by helping them navigate through financial challenges.

As a graduate in finance and with over five years of experience in the banking sector, I believe that my background in financial analysis and customer service have prepared me well to excel as a Loan Officer. In my previous role at XYZ Bank, I successfully processed over 200 loan applications, resulting in a 95% approval rate. Maintaining strong relationships with clients and ensuring their satisfaction was always my top priority. I was recognized for my commitment to excellence and awarded the “Employee of the Year” in 2019.

I am confident that my passion for helping others, combined with my strong financial background and customer service skills, make me the ideal candidate for the Loan Officer position at your organization. I am excited about the opportunity to contribute to your team and support your clients in achieving their financial goals.

Thank you for considering my application. I look forward to the opportunity to discuss my qualifications further and demonstrate my enthusiasm for this role.

Technical Director Cover Letter Examples

Digital strategist cover letter examples, you may also be interested in..., summer camp counselor cover letter examples & writing tips, banker cover letter examples, shop assistant cover letter examples, pharmacy supervisor cover letter examples.

Professional Loan Officer Cover Letter Examples for 2024

Your loan officer cover letter must immediately capture the hiring manager’s attention. Demonstrate your expertise in analyzing financial information with clarity. Highlight your proficiency in determining clients' creditworthiness and your impeccable record of managing loan portfolios. Show them your commitment to fostering trusting relationships with clients, ensuring you stand out.

Cover Letter Guide

Loan Officer Cover Letter Sample

Cover Letter Format

Cover Letter Salutation

Cover Letter Introduction

Cover Letter Body

Cover Letter Closing

No Experience Loan Officer Cover Letter

Key Takeaways

Embarking on a job hunt, you've likely discovered that a standout loan officer cover letter is your golden ticket. As tempting as it is to reiterate your resume, your cover letter’s true charm lies in narrating your proudest professional victory. It's a delicate dance of formality and personal touch—dodging cliches while keeping it concise. Aim for a one-page wonder that opens the door to your career dreams without sounding like everyone else’s tune. Let's craft that impressive narrative together.

- Personalize your loan officer cover letter and get inspired by other professionals to tell a compelling story;

- Format and design your loan officer cover letter to make an excellent first impression;

- Introduce your best achievement in your loan officer cover letter to recruiters;

- How to make sure recruiters get in touch with you, using your loan officer cover letter greeting and closing paragraphs.

What is more, did you know that Enhancv's AI can write your cover letter for you? Just upload your loan officer resume and get ready to forward your job application in a flash.

If the loan officer isn't exactly the one you're looking for we have a plethora of cover letter examples for jobs like this one:

- Loan Officer resume guide and example

- External Auditor cover letter example

- Audit Director cover letter example

- Finance Executive cover letter example

- Financial Analyst cover letter example

- Public Accounting Auditor cover letter example

- Financial Professional cover letter example

- Financial Risk Analyst cover letter example

- Accounts Clerk cover letter example

- Financial Operations Manager cover letter example

- Accounts Payable Manager cover letter example

Loan Officer cover letter example

Madison Taylor

Philadelphia, Pennsylvania

+1-(234)-555-1234

- Illustrating quantifiable achievements (e.g., "closing an average of 25 loans per month") is essential in demonstrating the candidate's effectiveness and results-driven mindset, which is particularly valuable in a sales-oriented role within the financial sector.

- Emphasizing strong relationship-building skills and partnerships with industry professionals showcases the candidate's network and ability to generate business, which is crucial for roles reliant on referrals and collaborations in the mortgage industry.

- Mentioning personal alignment with the company's core values (e.g., "Homeward Financial's emphasis on integrity and customer satisfaction resonates deeply with my professional philosophy") helps to establish a cultural fit, important for both the applicant and employer.

The must-have sections and format of your loan officer cover letter

When writing your loan officer cover letter, keep in mind that it'll only be read by the recruiters and not the Applicant Tracker System (or software used to assess your profile). That's why you should structure your content with a/an:

- Header (apart from your contact information, include your name, the role you're applying for, and the date);

- Personalized salutation;

- Opening paragraph to win the recruiters over;

- Middle paragraph with key details;

- Closing that starts from clichés;

- Sign off (that's not mandatory).

Industry standards dictate your paragraphs to be single-spaced and to wrap your content in a one-inch margin. Designing your loan officer cover letter, refer to one of our templates , which automatically takes care of the spacing and margins.

Choose the same font for your loan officer cover letter as you did for your resume : the likes of Lato and Bitter would help you to stand out in a sea of cover letters in Arial or Times New Roman.

Export your whole loan officer cover letter from our builder in PDF to keep the same formatting and image quality.

The top sections on a loan officer cover letter

- Header: This should include the candidate's contact information and the date to ensure the recruiter knows who the letter is from and can easily get in touch for follow-up discussions specific to loan officer opportunities.

- Greeting: A personalized salutation addressing the hiring manager by name demonstrates the candidate's attention to detail and professionalism, which are crucial traits for a loan officer.

- Introduction: This brief section should capture the recruiter’s attention by outlining the candidate's relevant experience in finance or customer service, showcasing their suitability for the loan officer role.

- Body: The body should contain specific examples of past successes in financial analysis or customer relationship management, emphasizing skills and experiences that directly align with the loan officer position.

- Closing: Here, the candidate should reiterate their enthusiasm for the position, mention their availability for an interview, and include a courteous thank-you to the recruiter for considering their application for such a pivotal role within the financial industry.

Key qualities recruiters search for in a candidate’s cover letter

- In-depth understanding of lending procedures and regulations: Being knowledgeable about current lending laws ensures compliance and protects both the lender and borrower.

- Strong analytical skills: Loan officers must analyze applicants' financial data to assess creditworthiness and the risk involved in offering them a loan.

- Excellent interpersonal and communication skills: Building relationships with clients and effectively communicating loan terms and financial advice is crucial for client satisfaction and retention.

- Proven sales experience: Demonstrating the ability to sell financial products successfully is important since loan officers must persuade clients to choose their institution's offerings.

- Detail-oriented approach: Attention to detail ensures accuracy in loan processing, which is essential for maintaining legal compliance and avoiding costly errors.

- Customer service orientation: Offering exceptional customer service can differentiate a loan officer in a competitive market and lead to increased referrals and repeat business.

How to address hiring managers in your loan officer cover letter greeting

Goodbye, "Dear Sir/Madam" or "To whom it may concern!"

The salutation of your loan officer cover letter is how you kick off your professional communication with the hiring managers.

And you want it to start off a bit more personalized and tailored, to catch the recruiters' attention.

Take the time to find out who's recruiting for the role (via LinkedIn or the company page).

If you have previously chatted or emailed the hiring managers, address them on a first or last name basis.

The alternative is a "Dear HR team" or "Dear Hiring Manger", but remember that a "Dear Ms. Simmons" or "Dear Simon," could get you farther ahead than an impersonal greeting.

List of salutations you can use

- Dear Hiring Manager,

- Dear [Company Name] Team,

- Dear [Specific Department] Team,

- Dear Mr./Ms. [Last Name],

- Dear [First Name] [Last Name],

- Dear [Job Title],

Your loan officer cover letter introduction and the value you bring

Moving on from the "Dear Recruiter" to your professional introduction .

Use those first two sentences of your loan officer cover letter to present the biggest asset you'd bring to the organization.

Don't go into too much detail about your achievement or the skill set, but instead - go straight for the win.

That is - what is your value as a professional?

Would you be able to build stronger, professional relationships in any type of communication? Or, potentially, integrate seamlessly into the team?

What comes next: your loan officer cover letter middle paragraphs

In the next three to six paragraphs (or the body of your loan officer cover letter) you have to prove your unique value .

Most candidates tend to mess up at this stage. They tend to just copy-paste information from their resume.

That's one big no-no.

Remember that when writing your loan officer cover letter, it has to be personalized. And, your ultimate aim is to catch the recruiter's eye.

So, look back on key job requirements and write down a list that includes the ones you cover.

Next, select just one key achievement from your professional (or personal) history that meets those advert keywords.

Narrate a story around how you've grown your skill set and knowledge. Also, aim to show the unique understanding or soft skills you bring about, thanks to your past success.

Thinking about the closing paragraph of your loan officer cover letter

Before your signature, you have extra space to close off your loan officer cover letter .

Use it to either make a promise or look to the future.

Remind recruiters how invaluable of a candidate you are by showing what you plan to achieve in the role.

Also, note your availability for a potential next meeting (in person or over the telephone).

By showing recruiters that you're thinking about the future, you'd come off as both interested in the opportunity and responsible.

What to write on your loan officer cover letter, when you have zero experience

The best advice for candidates, writing their loan officer cover letters with no experience , is this - be honest.

If you have no past professional roles in your portfolio, focus recruiters' attention on your strengths - like your unique, transferrable skill set (gained as a result of your whole life), backed up by one key achievement.

Or, maybe you dream big and have huge motivation to join the company. Use your loan officer cover letter to describe your career ambition - that one that keeps you up at night, dreaming about your future.

Finally, always ensure you've answered why employers should hire precisely you and how your skills would benefit their organization.

Key takeaways

Your loan officer cover letter is your best shot at standing out by showing your motivation and the unique skills you'd bring to the job:

- Chose no more than one achievement, which you'd be talking about in the body of your loan officer cover letter, by focusing on skills and outcomes;

- Address recruiters with their first or last name, or "Dear Hiring Manager" in your loan officer cover letter greeting;

- Introduce in no more than two sentences what makes your profile unique (perhaps it's your motivation, enthusiasm, or appreciation of the company you're applying for);

- Select the same font you have used in your resume (avoid Times New Roman and Arial, as most candidates tend to invest in them);

- Close your loan officer cover letter with a promise of how you see yourself growing in the company and the benefits you'd bring about.

Cover letter examples by industry

AI cover letter writer, powered by ChatGPT

Enhancv harnesses the capabilities of ChatGPT to provide a streamlined interface designed specifically focused on composing a compelling cover letter without the hassle of thinking about formatting and wording.

- Content tailored to the job posting you're applying for

- ChatGPT model specifically trained by Enhancv

- Lightning-fast responses

How to Write a Modern Resume

How to write an effective resume profile (with examples), how to write a cover letter – writing guide + examples & downloadable templates, how to list projects on a resume: a concise approach, how to respond to an interview request email – email examples and templates included, how to start a resume (5+ examples of resume introductions).

- Create Resume

- Terms of Service

- Privacy Policy

- Cookie Preferences

- Resume Examples

- Resume Templates

- AI Resume Builder

- Resume Summary Generator

- Resume Formats

- Resume Checker

- Resume Skills

- How to Write a Resume

- Modern Resume Templates

- Simple Resume Templates

- Cover Letter Builder

- Cover Letter Examples

- Cover Letter Templates

- Cover Letter Formats

- How to Write a Cover Letter

- Resume Guides

- Cover Letter Guides

- Job Interview Guides

- Job Interview Questions

- Career Resources

- Meet our customers

- Career resources

- English (UK)

- French (FR)

- German (DE)

- Spanish (ES)

- Swedish (SE)

© 2024 . All rights reserved.

Made with love by people who care.

All Formats

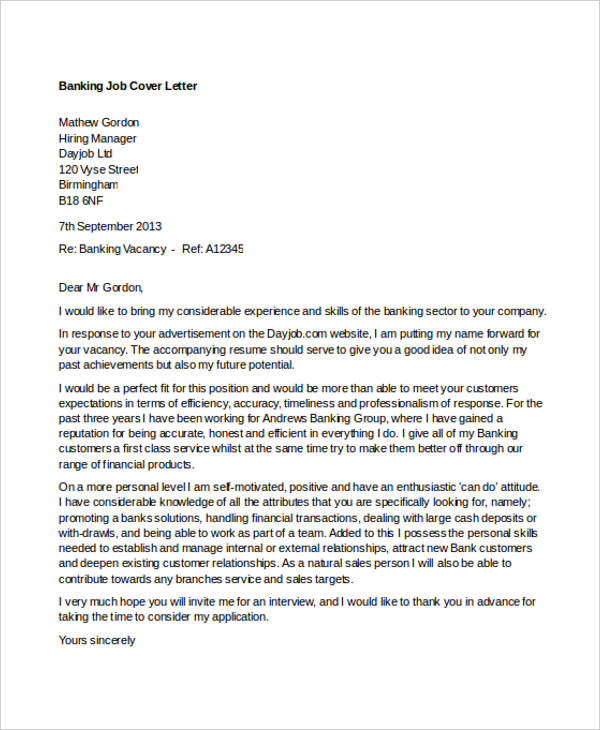

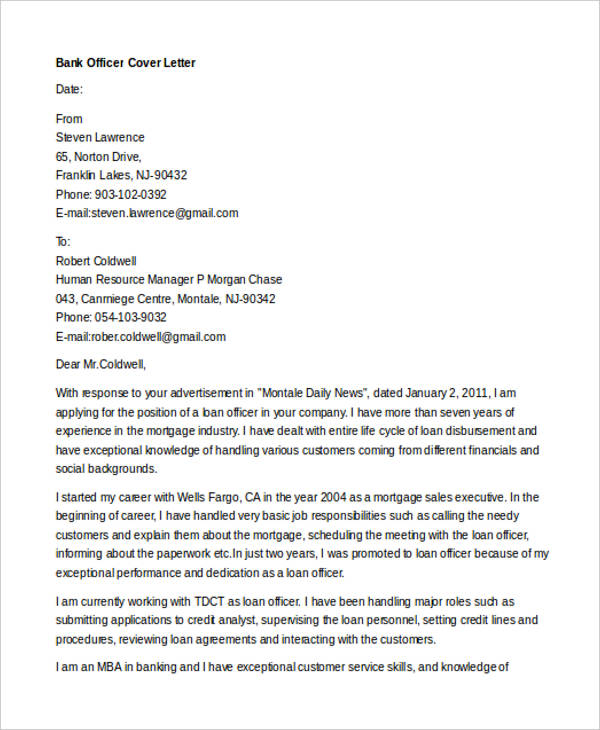

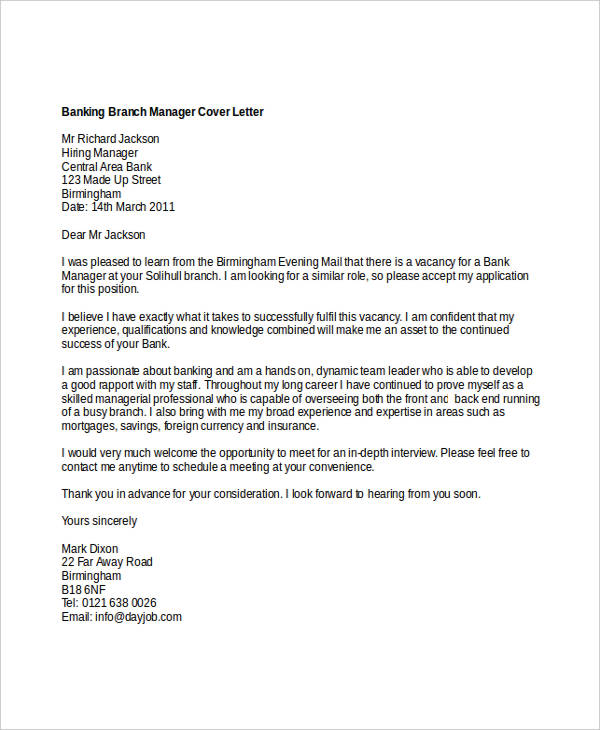

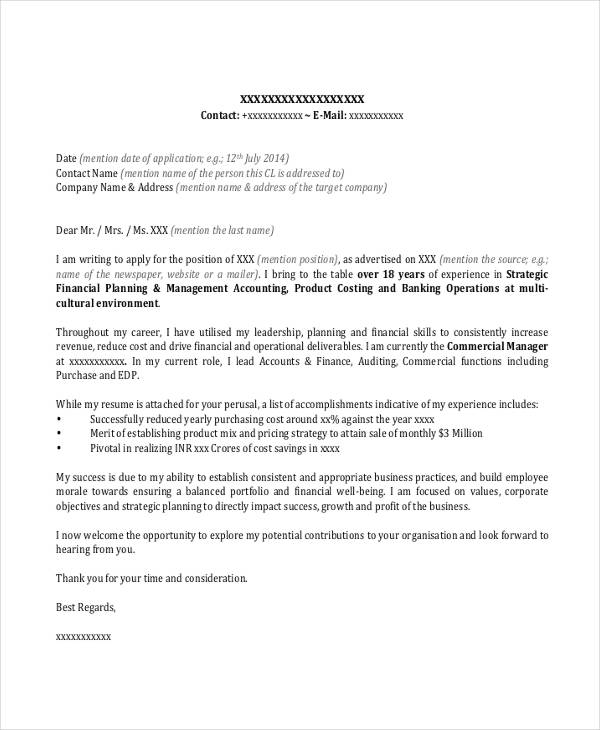

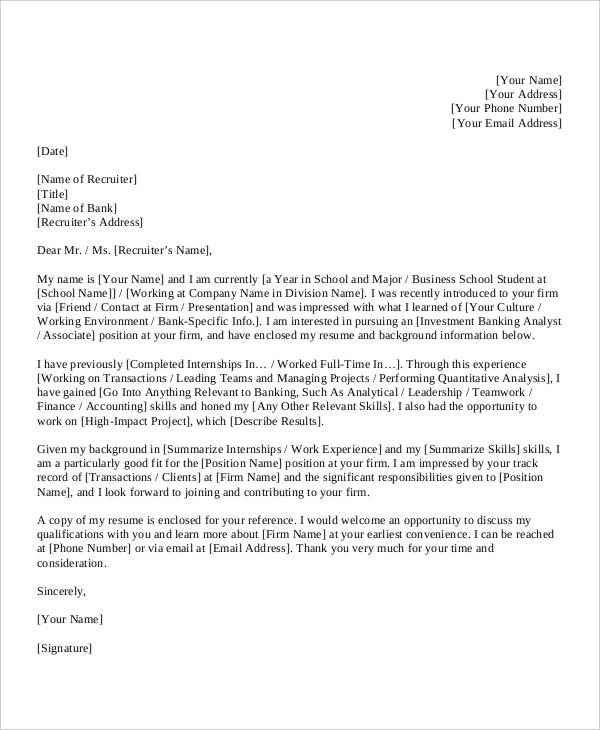

16+ Banking Cover Letter Templates – Sample, Example

Job seeking is one of the most challenging events that every individual must take. It surely is not an easy task to do as well—from endless sample resumes and cover letter making, looking for prospective employers, to repetitive questions from recruiters. It is essential to always create a good first impression toward hiring managers, and this should mirror, apart from your resume, through your cover letter templates.

Free Cover Letter For Bank Job

- Google Docs

Bank Job Application Letter

Cover Letter Sample For Bank Job Application In Word Format

Banking Cover Letter Templates

- Address your printable letter directly to the employer

- You can write about your interest in the banking position

- Write about your personal, educational, and experience detail(s)

- Your personal detail(s) should have your name, address, and contact detail(s) for communication

- Make sure you write your area of study in your educational detail(s)

- Write about your skills and experiences(if any). It will help you to get the job you are interested in.

Application Letter For Bank Job With Experience

Cover Letter For Bank Job Fresher

Application For Employment As A Mobile Banker

Simple Job Application Letter For Bank

Sample Bank Job Application Letter Format

Bank Cover Letter Sample

Letter For Internship In Bank

Application Letter For Bank Job

How to Write a Banking Cover Letter

- You should write your necessary details at the top portion. The name and contact information should be on the right side, and the hiring manager’s name and contact details are on the left side. In case you don’t have the name, make use of the company name and address. You can also see more on Professional Banking Resume in Word .

- Make a clear and concise introduction. This is the part where you should state who you are and how you learned of the job vacancy. You also include what attracts you to the position and the company. Write at most 2 to 3 sentences.

- Write down your background. This part is where the lengthy paragraph starts. Begin by writing what you are currently doing and give relevant experiences you’ve had. Highlight the relevant skills applicable to banking.

- Conclusion section. This is the area where you write down your contact information and include that you look forward to hearing from them. This should be in short sentences. You can also see more on Banking Cover Letters in Word.

Branch Manager Cover Letter

Job Letter Sample For Bank

Cover Letter For Bank Job PDF

Cover Letter For Banking Position

Short Cover Letter Sample For Bank Job

Sample Cover Letter For Bank Job

Guidelines for Cover Letter Making

- Your cover letter formal should consist of contact information, a salutation, the content, and suitable closing.

- When it comes to salutations, it is necessary to include an appropriate salutation at the start of the basic cover letter .

- For closings, ensure to make use of a professional close statement to your cover letter professional .