- Free Debt Assessment

- Individual Voluntary Arrangement

- Debt Management Plan

- Debt Consolidation

- Private Parking Fines

- Council & Police Fines

- Convicted Driver Insurance

- Equity Release

- Secured Loans

- Customer Stories

- Free Debt Assessment Back

- Knowledge Base

- Customer Stories Back

- About Us Back

- Contact Us Back

Deed of Assignment of Debt – Everything You Need to Know

Scott Nelson

Debt Expert

Scott Nelson is a renowned debt expert who supports people in debt with debt management and debt solution resources.

Janine Marsh

Financial Expert

Janine is a financial expert who supports individuals with debt management, cost-saving resources, and navigating parking tickets.

Total amount of debt?

For free & impartial money advice you can visit MoneyHelper . We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper . We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you facing a ‘deed of assignment of debt’? Are you worried about a debt collector knocking on your door?

You’re in the right place. Each month, over 170,000 people visit our site looking for guidance on debt issues, just like this one.

In this article, we’ll explain:

- What a ‘deed of assignment’ is

- What it means for your debts

- Different types of assignment

- Why companies sell their debts

- Ways to handle your debt situation

We know how scary it can be when debt collectors get involved; some of our team have faced similar situations. We’re here to help you understand your situation and make the best choices.

There are several debt solutions in the UK, choosing the right one for you could write off some of your unaffordable debt , but the wrong one may be expensive and drawn out.

Answer below to get started.

How much debt do you have?

This isn’t a full fact find. MoneyNerd doesn’t give advice. We work with The Debt Advice Service who provide information about your options.

Deed of Assignment of Debt – the basics

Being in debt is confusing enough as it is. And it can get even more complicated when you get a letter through the door from a company you may never have heard of demanding (often in quite a strongly-worded way) that you make your payments to them instead.

What’s going on, you might ask yourself?

At the end of the day, the creditor will want the money that you owe back.

However, sometimes when an account falls into arrears , they won’t have the capabilities or resources to claim it back . This is when the original company you owe money might ‘ assign’ your debt .

What is a Deed of Assignment of Debt?

This is notice that tells you that you now owe a debt collection agency or another collection service the money you originally owed to the creditor .

Instead of paying the company you might have originally owed money to, you now owe a third party company.

A deed of assignment of debt is a legal documen t alerting you of the transfer of ownership of your debt to another person. The right to receive payment from the debt you owe is transferred over to this new party as well.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Monthly debt repayments

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What does it mean?

A deed of assignment of debt is used to transfer or sell the right to recover a debt .

Without a deed of assignment of debt, the two companies are not able to do this – you need a written transfer document.

Once the transfer document, or deed of assignment of debt, has been signed by the assignee (the party transferring the debt) and the party receiving the debt ( assignor ), they must give notice to the debtor (the person that owes the company the sum of money).

Notice must be given within 7 days of assigning the debt. Unless someone gives notice to the debtor, then the new owner of the debt can’t enforce the debt by suing in court.

Is there more than one type of assignment?

Confusingly, there are actually two different sorts of assignment that a creditor can make. These are Legal and Equitable.

Both types of assignment fall under the Law of Property Act 1925 , and both require the creditor to inform you of the change in writing – this is known as a notice of assignment of debt .

1. Legal Assignment

Legal assignment of debt gives the company who are purchasing the debt the power to enforce it .

Basically it means that you make payments to this company instead of the original creditor, and they can send you letters and make calls to your home.

2. Equitable

If a debt is an equitable assignment, only the amount you owe is transferred , and the original creditor will still retain the original rights and responsibilities .

The purchasing company will not be able to enforce the debt either.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Why do companies sell their debts?

A deed of assignment of debt can be a real headache, as you now have another layer of money owed. You will probably rightly ask yourself – why? And how can they sell it?

It may seem strange and confusing, but it’s actually completely legal for them to sell your debt . When you sign a credit agreement, there is almost always a clause in fine print that states that the original creditor has the power to assign their rights to a third party.

As you have signed this agreement, they don’t actually need to ask for your permission to assign your debt.

This also means that you cannot dispute it or make a complaint about it either. The only exception to this rule is if you have given evidence of mental health issues .

» TAKE ACTION NOW: Fill out the short debt form

What are the next steps?

So that’s the basics about a Deed of Assignment of Debt. But what does this mean for you?

If your creditor passes one of your debts onto a third party company or debt collection agency, it will be officially noted that this new company is now responsible for collection .

You will be able to see this change on your credit report , and any defaults will also be registered in their name too.

While it certainly adds another layer of confusion to proceedings and you may be unsure of what’s going on when you find out about a deed of assignment of debt, it can occasionally be a bit of a blessing in disguise.

You may find it much easier dealing with the new company, as they could be more flexible when it comes to discussing interest and additional charges.

There is also the likelihood that these companies actually specialise in collecting debts , and so know how to approach you as the customer with more tact and delicacy than the original creditor.

Is there something missing? We’re all ears and eager to improve. Send us a message and let us know how we can make our article more useful for you.

You can email us directly at [email protected] to share your feedback.

- Property News

- Home Improvement

- Advertise with us

- Resources & Guides

Free Deed of Assignment Tenancy Agreement Sample Form and Template

A Deed of Assignment is a legal document that transfers the ownership rights and interests of a property or asset from one party, known as the assignor, to another party, known as the assignee. It is commonly used in real estate transactions but can also apply to other types of assets, such as intellectual property rights, stocks, or contractual rights.

The Deed of Assignment serves as evidence of the transfer of ownership and provides a clear transaction record. It outlines the terms and conditions of the assignment, including the details of the parties involved, a description of the property or asset being assigned, and any applicable terms or conditions.

Key elements typically included in a Deed of Assignment are:

- Parties: The document identifies the assignor (current owner) and the assignee (new owner) involved in the transaction. It is essential to provide accurate and complete information about both parties.

- Description of the property or asset: The Deed of Assignment should include a detailed description of the property or asset being transferred. This includes the physical address, boundaries, and any relevant identifying information for real estate. For other assets, it may include specific details such as patent numbers or stock certificates.

- Consideration: Consideration refers to the value or payment exchanged in return for the assignment. It can be in the form of money, goods, services, or any other agreed-upon consideration. The Deed of Assignment should clearly state the consideration provided by the assignee to the assignor.

- Terms and conditions: This section outlines the specific terms and conditions of the assignment. It may include any restrictions, warranties, or obligations that the assignee must adhere to after the transfer of ownership. These terms are mutually agreed upon by both parties and are legally binding.

- Signatures and witnessing: The Deed of Assignment requires the signatures of both the assignor and the assignee to make it legally enforceable. Additionally, witnesses are often present during the document’s signing to validate its authenticity.

Once the Deed of Assignment is signed and executed, it becomes a legally binding agreement between the assignor and the assignee. It ensures that the assignee acquires the rightful ownership of the property or asset, and the assignor relinquishes their ownership rights.

It is important to note that the requirements and legal implications of a Deed of Assignment can vary depending on the jurisdiction. Consulting with legal professionals or experts in the relevant field is recommended to ensure compliance with local laws and regulations.

When Can A Contract Be Signed As A Deed?

Under certain circumstances, a contract can be signed as a deed, distinguishing it from a standard contract. This is typically the case when the parties involved agree that no consideration, or payment, is necessary for the agreement to be valid.

As a more formal document, a deed follows a specific execution process. It requires the presence of a witness during the signing and in some cases, the use of a seal to authenticate the deed.

Is it Possible to Reverse a Deed of Assignment?

Once a deed of assignment has been executed and dated, it remains legally binding and enforceable until specific actions are taken. These actions include varying the deed using a deed of variation, surrendering it using a deed of surrender, or selling the property involved. If you intend to make changes to the original deed, it is more common to surrender the entire deed and then create a new deed with the desired modifications.

Which document do I require, a deed of assignment or a deed of trust?

When it comes to transferring the beneficial interest in land or property from one party to another, a deed of assignment is typically utilized. This document focuses solely on the assignment of the beneficial interest. On the other hand, a deed of trust can serve the same purpose but includes additional clauses that outline procedures for selling the property, among other things.

A deed of assignment is suitable for most married couples seeking to assign their beneficial interest in an investment property.

Download a Deed of Assignment Tenancy Agreement Template

If you like a custom, completely personalised assignment agreement, use the link below. It takes about 5 min to create and you will end up with an agreement, tailored to your specific property.

Download CUSTOM Assignment Agreement

Alternatively, if you just want to download a generic deed of assignment of tenancy template, use the link below.

Download GENERIC Deed of Assignment of Tenancy Agreement

All content on this form and other forms for landlords published by Property Division are provided “as is”, with no guarantees of completeness, accuracy or timeliness, and without representations, warranties or other contractual terms of any kind, express or implied. Property Division does not represent or warrant that this letter or other material supplied by Property Division will be accurate, current, uninterrupted, error-free or omission-free.

Can a landlord refuse to assign a lease in the UK?

In the United Kingdom, a landlord’s ability to refuse to assign a lease is governed by the terms of the lease agreement and relevant landlord and tenant laws. The Landlord and Tenant Act 1988 (as amended) provides certain protections and guidelines for both landlords and tenants regarding the assignment of leases.

Here are some key points to consider:

- Lease Agreement Terms: The terms of the lease agreement will typically outline the conditions and requirements for assigning the lease. Some leases may include provisions that require the tenant to obtain the landlord’s consent before assigning the lease.

- Reasonable Refusal: The Landlord and Tenant Act 1988 limits a landlord’s ability to unreasonably withhold consent to an assignment. Generally, the landlord’s refusal must be reasonable, and they cannot arbitrarily deny permission. Common reasons for refusal may include concerns about the proposed assignee’s financial stability or if the assignee’s intended use of the property violates the terms of the lease.

- Landlord’s Costs: The landlord may be entitled to recover reasonable costs incurred in considering the request for assignment. These costs should be outlined in the lease agreement.

- Procedure for Seeking Consent: The lease agreement may specify the procedure that the tenant must follow when seeking the landlord’s consent for an assignment. It is important for tenants to adhere to these procedures to ensure compliance with the terms of the lease.

- Landlord’s Remedies: If the landlord believes there are valid reasons to refuse consent, they may have remedies available under the lease agreement or applicable law. However, these reasons must typically be specified in the lease.

It’s important for both landlords and tenants to be aware of the lease agreement’s specific terms and understand their rights and responsibilities under the Landlord and Tenant Act 1988. If disputes arise, seeking legal advice is recommended to ensure compliance with the law and the terms of the lease. Additionally, the laws and regulations may be subject to change, so staying informed about any updates is advisable.

RELATED ARTICLES MORE FROM AUTHOR

Change of tenancy agreement, free holiday let tenancy agreement template uk, free assured shorthold tenancy agreement template uk.

- Blog for us

- Privacy Policy

- Terms and Conditions

What is an Assignment of Debt?

By Sej Lamba

Updated on 26 February 2024 Reading time: 5 minutes

This article meets our strict editorial principles. Our lawyers, experienced writers and legally trained editorial team put every effort into ensuring the information published on our website is accurate. We encourage you to seek independent legal advice. Learn more .

When Could an Assignment of Debt Happen?

Key issues on assignment of debt, drafting the correct documentation, giving notice, key takeaways.

Debts are increasingly common in today’s financial climate, and unfortunately, many people struggle to repay what they owe. Debts owed can be sold to third parties and a lot of companies in the UK purchase debts. However, this can be complicated as specific legal formalities apply when assigning debts. This article will explain some of the critical issues around the assignment of debt.

Debt collection can be a complex process. There are various reasons as to why debt is assigned. For example, a company owed debt may want to avoid putting in time and effort to chase it or want to take legal action to recover it.

To picture a scenario, imagine this:

- Joe Bloggs gets a brand-new shiny credit card. Joe purchases lots of nice things for his family with the credit card. Usually, he can keep up with payments as he keeps track of them and earns enough to pay them back;

- suddenly, Joe has an injury and cannot work anymore. He has to give up his job and now can’t afford to pay the credit card company back;

- Joe ignores various letters chasing the debt and hopes the problem will disappear. Ultimately, after months, the credit card company gives up and sells Joe’s debt to a debt collection agency.

So, in summary – after the debt sale, Joe now owes money to a different company.

In practice, debt assignments can be complex, and the parties must follow the relevant legal rules and draft the correct documentation.

An assignment of debt essentially transfers the debt from one party (the assignor) to a third party (an assignee).

In practice, this will mean the original debtor (e.g. Joe Bloggs) will now owe the debt to a new third-party creditor (e.g. the debt collection business). Therefore, in the scenario above, Joe must now repay the debt to the third-party debt collection business.

This process can be complex. There have been several legal cases in the courts where this process has given rise to disputes.

There are two different types of assignment of debt – a legal assignment of debt and an equitable assignment of debt.

In simple terms:

- a legal assignment of debt will transfer the right for enforcement of the debt; and

- an equitable assignment of debt will transfer only the benefit of the debt without the right to enforce it.

Let us explore each type below.

Legal Assignment of Debt

If the assignment complies with specific legal requirements under the Law of Property Act 1925, it will be a ‘legal assignment’. This means that the assignee will be the new owner of the debt.

A legal assignment requires various formalities to be effective. For example, it must:

- be in writing and signed by the assignor;

- the debtor must be given written notice of the assignment;

- be absolute with no conditions attached to it;

- relate to the whole of the debt and not just part of it; and

- not be a charge.

After the transfer of the debt, the assignor can sue the debtor in its own name.

Equitable Assignment of Debt

It is also possible to have an equitable debt transfer – the requirements for this are much less strict. For example, this can be done informally by the assignor informing the assignee that the rights are transferred to them.

Download this free Commercial Contracts Checklist to ensure your contracts will meet your business’ needs.

For an equitable assignment, giving notice is not essential, but still always highly advisable.

Where an equitable assignment is made, the assignee won’t have the right to pursue court action for the debt. In this case, the assignee will have to join forces with the assignor to sue for the debt to sue for the debt.

The debtor should receive notice of any debt transfer so they know to whom the money is owed. Following notice, the new debt owner can pursue the debt owed.

A legal assignment is the best option for an assignee of debt – this will give them full rights to enforce the debt.

Assignments of debts can be very complex. For a legal assignment of debt, you need to follow various formalities. Otherwise, it may be unenforceable and lead to disputes. If you need help executing a debt assignment correctly, you should seek legal advice from an experienced lawyer.

If you need help with an assignment of debt, LegalVision’s experienced business lawyers can assist as part of our LegalVision membership. You will have unlimited access to lawyers to answer your questions and draft and review your documents for a low monthly fee. Call us today on 0808 196 8584 or visit our membership page .

We appreciate your feedback – your submission has been successfully received.

Register for our free webinars

A roadmap to business success: how to franchise in the uk, corporate governance 101: responsibilities for directors, business divorces: exiting directors and shareholders from your company, contact us now.

Fill out the form and we will contact you within one business day

Related articles

3 Key Considerations to Manage Contract Risks

3 Business Benefits of Working With a Specialist Commercial Contracts Lawyer

What Are the Risks of a Verbal Contract With Your Customers?

3 Points Your Business Should Consider to Minimise Risk Before Signing a New Contract

We’re an award-winning law firm

2023 Economic Innovator of the Year Finalist - The Spectator

2023 Law Company of the Year Finalist - The Lawyer Awards

2023 Future of Legal Services Innovation - Legal Innovation Awards

2021 Fastest Growing Law Firm in APAC - Financial Times

Solutions only available in England, Wales and Northern Ireland

Assignment of Debt UK – Everything You Need To Know

Get confidential debt help for your situation.

- Expert debt help to find the right solution for you

- We give you full support

- Together we can manage your debt

Get started

Struggling with debt? we can help you look at the available solutions.

If you have debts of over £5,000, and you're struggling to repay them, get in touch today!

In the complex financial landscape of the United Kingdom, understanding the nuances of ‘Assignment of Debt’ is essential for both creditors and debtors. This concept, often encountered but not always fully understood, involves the transfer of a debt obligation from the original creditor (the assignor) to a third party (the assignee).

This article aims to demystify the intricacies of debt assignment, explaining its types, legal implications, and impact on individuals’ financial standings.

Whether it’s about navigating through the differences between legal and equitable assignments, understanding the role of deeds, or grasping how such transactions affect your credit report and legal rights, this guide provides a comprehensive overview, ensuring that you are well informed about this critical aspect of financial management in the UK.

Table of Contents

What Does ‘Assignment of Debt’ Mean?

Assignment of Debt: a term that might sound complex, but it’s really quite straightforward. Let’s dive into what this means for you.

Simply put, your original creditor, known as the assignor, transfers your debt to another party, the assignee. This could change who you deal with regarding your debt. The assignee can now take legal steps to recover the debt from you. Thus, this might include court action.

How Debt Assignments Work

When a creditor offers credit to a borrower, they do so believing that the money they lend, along with the interest, is repaid on time. So, the lender waits to recover the money owed according to the timeframe stated in the contract.

In some situations, the lender might decide that they want to sell the debt to a third party because they no longer want to assume responsibility for servicing the loan. In this case, the debtor should be sent a Notice of Assignment (NOA). This should state that someone else is now responsible for collecting the outstanding debt. This is called a debt assignment.

It’s mandatory to inform the debtor when the debt is assigned to a third party so that they are aware of who they should pay the debt to. The payments won’t be accepted if the debtor ends up sending payments to the old creditor after they’re assigned. This might result in the debtor unintentionally defaulting.

Also, once the debtor receives this notice, it’s best that they verify that the new creditor has recorded the correct monthly payment and total balance. In some situations, the new assignee might even decide to make changes to the original terms of the loan. In this case, the creditor should notify the debtor without delay and give them sufficient time to respond.

Need more help to deal with your Debt issue?

There are a number of alternative debt solutions available in the UK that you could use to write off some of your priority debts. But keep in mind that choosing the right solution will aid you in writing off some of your debt, while choosing the wrong one will worsen your debt situation.

Are you struggling with unaffordable debt?

- Affordable repayments

- Reduce Pressure from people you owe

- One simple monthly payment

Legal Assignment vs Equitable Assignment

A legal assignment is when another company takes over the following from a creditor:

- Benefit of a debt

- The right to enforce the debt

This indicates that they have the right to seek court action over the loan.

However, when it comes to equitable assignment, it only transfers the benefit of the loan to a third party. In this case, there is no right to seek court action over the loan. Thus, in a situation where the assignee wants to take the debtor to court, they only have the right to work with the original creditor after the original creditor decides to take the debtor to court.

So, simply said, they don’t have the power to initiate court action themselves. Also, note that in order for the assignment to be effective, the debtor must be notified regarding the assignment. The debtor is obligated to make the payment to the assignee only after they get the notice.

Assignment vs Novation

When it comes to the assignment, the party that assigns will continue performing the obligation associated with the loan. However, the assignee is now entitled to the loan benefits.

For example, assume that you assign a debt, that a debtor owes to you, to another organisation. In this situation, you have some rights and obligations over the loan. But particularly the right to pursue legal action in court.

Meanwhile, when it comes to novation, it consists of a full transfer of both rights and obligations. For example, as per the previous scenario, the creditor would give the assignee company full power when it comes to both the obligations and the rights associated with the loan.

Assignment vs Selling

As mentioned before, the assignment of debt means that the right of an individual to collect a debt has been transferred legally from the assignor (original creditor) to the assignee (third party). Then, the debtors are informed regarding the assignment. They should then make the payments to the assignee.

However, keep in mind that the conditions and terms of the contract do not change.

When it comes to selling debt, this is where a lender sells their loan to another, usually for a lesser amount than what it’s worth. The buyer (most of the time a debt collection company) tries to collect the whole amount from the debtor.

Does an Assignment Need to be a Deed?

When delving into the law of assignment, a crucial question often pops up: is a formal deed essential to make the transfer of debt legitimate? The answer isn’t as straightforward as you might think. Let’s unpack this:

Often, a less formal agreement can do the job. However, in some cases, particularly when the original loan agreement was a deed, a deed for the assignment becomes necessary.

Understanding the importance of deeds in this context is key. If your original loan agreement was signed as a deed, the assignment might also need to be a deed. This adds a layer of formality and legal binding. A deed indicates a more serious commitment, making everyone involved fully aware of the transfer’s details.

Knowing your rights in these situations is non-negotiable:

- Whether it’s through a deed or an agreement, you’re entitled to be informed about the assignment. This ensures the process is fair and transparent.

- This notification is more than just a formality; it validates the transfer and helps you understand the change in your debt obligations.

- The use of a deed or agreement provides legal clarity. This helps in understanding your position in the new arrangement.

- In such situations, seeking legal or financial advice can be a wise move.

In the complex world of debt assignments, whether a deed is necessary depends on various factors. Understanding the role of deeds and your rights is essential in navigating these financial waters.

Benefits of Assignment of Debt

There are multiple reasons why a creditor might decide to assign the debt to another person. One of the main reasons for this is to improve liquidity or to reduce the risk. In some cases, the lender might also be wanting some capital urgently. Also, they might have accumulated a large amount of high-risk loans and be wary that most of them could default.

In such situations, lenders may be willing to assign them to another person swiftly, even for a very small amount. They are open to doing this as long as it will help to improve their financial outlook and appease worried investors.

In other cases, the creditor might decide the debt is too old to spend resources trying to collect it. They might even assume that since it’s old, it’s not worth assigning it to a third party to pick up the collection activity. In such an instance, a company will decide not to assign their debt to a third party.

Criticisms of Assignment of Debt

Even though the assignment of debt may seem like a good option for lenders, it also has a fair bit of criticism.

Over the past, debt buyers have been known to use various unethical practices in order to get paid. This includes constantly harassing debtors and issuing threats. In some situations, they have also been accused of chasing debts that have already been paid.

Additional Advice and Guidance

If you’re struggling with debt, note that there are many debt solutions available in the UK that you can consider taking up. Some of these include:

- Individual Voluntary Arrangement (IVA)

- Debt Management Plan (DMP)

- Debt Relief Orders (DRO)

However, note that while the right debt solutions will help to write off debt, choosing the wrong one might worsen your situation. So, we recommend you reach out to a debt charity for advice before you make the decision. Some debt charities you can reach out to include:

- National Debtline

- Citizens Advice

Alternatively, feel free to fill out our online form , and our MoneyAdvisor team will guide you.

- It refers to the transfer of a debtor’s obligation from the original creditor (assignor) to a third party (assignee).

- Legal Assignment: Transfers both the right to collect the debt and the right to enforce it legally, including court action.

- Equitable Assignment: Only the benefits of the loan are transferred, not the legal right to enforce it.

- Assignment maintains the original terms of the loan with a new creditor, whereas novation transfers all rights and obligations to a new party.

- In assignment, the right to collect the debt is transferred, while selling involves a financial transaction where the lender sells the loan, often at a lower price.

- Generally, a deed is not required for debt assignment, but it may be necessary when the original loan agreement is signed as a deed.

- Assignment of debt will be reflected in the credit report, including any updates on the loan terms and the new lender’s name.

- A formal notice is required, especially in legal assignments, to inform the borrower about the transfer of their debt.

- Once a notice is issued, the new creditor assumes the rights and obligations of the debt and may engage in various debt collection methods.

- Common reasons include avoiding the hassle of debt collection, lacking resources for legal action, or efficiency in debt collection through a third party like a collection agency.

- Under UK law, most debts have a limitation period of six years (twelve for mortgage loans), after which they might be written off if there’s no contact from the creditor.

Under UK law, the limitation period for most debts is six years. For mortgage loans, it extends to twelve years. If your creditor hasn’t contacted you within these time frames, you may have legal grounds to have the debt written off. This includes personal loans, credit cards, payday loans, and others.

The new lender takes on both the obligations and rights of the mortgage loan. Though rare, borrowers can also assign their mortgage to someone else. These assignments are recorded with the county recorder’s office for legal purposes.

Your credit report will reflect the change in lender and any new loan terms. You’ll see the new lender’s name instead of the old one. If you default under the new lender, they will report this to Credit Reference Agencies.

Under the Property Act 1925, it’s a formal notification to the borrower that their debt has been acquired by a new company. This notice is required in cases of legal assignment.

The new creditor assumes the benefits and obligations of the debt. They may hire a collection agency or use other methods to recover the debt, often avoiding court action to minimise costs.

Assigning debt is often done to avoid the trouble of collecting it. Some may lack the resources to take legal action against debtors. If a third party, like a debt collection agency, can handle repayment collection more efficiently, it’s a preferred choice.

Could you write off some debt?

We offer free advice. May not be suitable in all circumstances. Fees apply. Your credit rating may be affected.

Related Post

N244 Form for CCJ: What You Need to Know

Is Clearscore Accurate? The Truth About Your Credit Score

Car Finance Debt – New 2024 Laws & Your Rights

Mortgages and Remortgaging with Existing Debt

Start reducing your debt repayments and regain control..., struggling with your debt you don’t need to do it alone. click here.

Feel free to visit our Complaints Policy and Privacy Policy

DEBT SOLUTIONS

- Debt Management Plan

- Debt Consolidation

- Debt Arrangement Scheme (DAS)

- Sequestration

- 0800 056 6820 (Free Phone)

- Crescent House, Lever Street, Bolton, BL3 6NN

Feel free to visit our Complaints Policy and Privacy Policy Customer Charter

Money Advisor and Moneyadvisor.co.uk are trading styles of Debt Correct; Debt Correct are authorised and regulated by the Financial Conduct Authority FRN: 663034 and can be found on the FCA register. Debt Correct is also licensed by the Information Commissioners Office (ICO). Licence No: ZA277704. Our registered office is 6 Hind Hill St, Heywood, OL10 1JZ.

Debt solutions such as IVA, Debt Management, DRO and Bankruptcy will have a negative impact on your credit rating. As part of our free service, we’ll look at your financial situation, explain the available options, and then recommend a debt solution which could be suitable for you. Depending on the solution, fees may be involved, which would be fully explained, and details provided in writing.

Should we determine an IVA is the most appropriate solution for you, we will pass your case to The Insolvency Group. Tracey Howarth (IP No: 16410), Mike Reeves (IP No: 7882) and Donald Harper (IP No: 9296) are licensed as insolvency practitioners in the UK with the Insolvency Practitioners Association.

*As an example, debt write-off of 85% has been achieved by 14.32% of our customers on approved IVAs in the last 12 months. (Dated 07/11/2023)

Learn about how I can check my credit score UK .

- Insights & events

Assigning debts and other contractual claims - not as easy as first thought

Harking back to law school, we had a thirst for new black letter law. Section 136 of the Law of the Property Act 1925 kindly obliged. This lays down the conditions which need to be satisfied for an effective legal assignment of a chose in action (such as a debt). We won’t bore you with the detail, but suffice to say that what’s important is that a legal assignment must be in writing and signed by the assignor, must be absolute (i.e. no conditions attached) and crucially that written notice of the assignment must be given to the debtor.

When assigning debts, it’s worth remembering that you can’t legally assign part of a debt – any attempt to do so will take effect as an equitable assignment. The main practical difference between a legal and an equitable assignment is that the assignor will need to be joined in any legal proceedings in relation to the assigned debt (e.g. an attempt to recover that part of the debt).

Recent cases which tell another story

Why bother telling you the above? Aside from our delight in remembering the joys of debating the merits of legal and equitable assignments (ehem), it’s worth revisiting our textbooks in the context of three recent cases. Although at first blush the statutory conditions for a legal assignment seem quite straightforward, attempts to assign contractual claims such as debts continue to throw up legal disputes:

- In Sumitomo Mitsui Banking Corp Europe Ltd v Euler Hermes Europe SA (NV) [2019] EWHC 2250 (Comm), the High Court held that a performance bond issued under a construction contract was not effectively assigned despite the surety acknowledging a notice of assignment of the bond. Sadly, the notice of assignment failed to meet the requirements under the bond instrument that the assignee confirm its acceptance of a provision in the bond that required the employer to repay the surety in the event of an overpayment. This case highlights the importance of ensuring any purported assignment meets any conditions stipulated in the underlying documents.

- In Promontoria (Henrico) Ltd v Melton [2019] EWHC 2243 (Ch) (26 June 2019) , the High Court held that an assignment of a facility agreement and legal charges was valid, even though the debt assigned had to be identified by considering external evidence. The deed of assignment in question listed the assets subject to assignment, but was illegible to the extent that the debtor’s name could not be deciphered. The court got comfortable that there had been an effective assignment, given the following factors: (i) the lender had notified the borrower of its intention to assign the loan to the assignee; (ii) following the assignment, the lender had made no demand for repayment; (iii) a manager of the assignee had given a statement that the loan had been assigned and the borrower had accepted in evidence that he was aware of the assignment. Fortunately for the assignee, a second notice of assignment - which was invalid because it contained an incorrect date of assignment - did not invalidate the earlier assignment, which was found to be effective. The court took a practical and commercial view of the circumstances, although we recommend ensuring that your assignment documents clearly reflect what the parties intend!

- Finally, in Nicoll v Promontoria (Ram 2) Ltd [2019] EWHC 2410 (Ch), the High Court held that a notice of assignment of a debt given to a debtor was valid, even though the effective date of assignment stated in the notice could not be verified by the debtor. The case concerned a debt assigned by the Co-op Bank to Promontoria and a joint notice given by assignor and assignee to the debtor that the debt had been assigned “on and with effect from 29 July 2016”. A subsequent statutory demand served by Promontoria on the debtor for the outstanding sums was disputed on the basis that the notice of assignment was invalid because it contained an incorrect date of assignment. Whilst accepting that the documentation was incapable of verifying with certainty the date of assignment, the Court held that the joint notice clearly showed that both parties had agreed that an assignment had taken place and was valid. This decision suggests that mistakes as to the date of assignment in a notice of assignment may not necessarily be fatal, if it is otherwise clear that the debt has been assigned.

The conclusion from the above? Maybe it’s not quite as easy as first thought to get an assignment right. Make sure you follow all of the conditions for a legal assignment according to the underlying contract and ensure your assignment documentation is clear.

Contact our experts for further advice

Search our site

⛪ Deed of assignment

A deed of assignment is a legal document that transfers the rights and obligations of one party to another. In most cases, a deed of assignment is used to transfer property or interests in property from one person to another.

Note: Working on a legal issue? Try our AI Legal Assistant - It's free while in beta 🚀

Deed of Assignment of Equitable Interest in Residential Land

England and Wales

Assignment Of Lease Deed

Deed of assignment of benefit of claim for the freehold or extended lease house under section 8 or section 14, deed of assignment of goodwill and intellectual property rights (transfer of a general partnership to an llp), arrears assignment deed, associated business activities, transfer partnership to llp, assign the benefit of a claim, assign lease, assign equitable interest, assign arrears, try the world's most advanced ai legal assistant, today.

English law assignments of part of a debt: Practical considerations

United Kingdom | Publication | December 2019

Enforcing partially assigned debts against the debtor

The increase of supply chain finance has driven an increased interest in parties considering the sale and purchase of parts of debts (as opposed to purchasing debts in their entirety).

While under English law part of a debt can be assigned, there is a general requirement that the relevant assignee joins the assignor to any proceedings against the debtor, which potentially impedes the assignee’s ability to enforce against the debtor efficiently.

This note considers whether this requirement may be dispensed with in certain circumstances.

Can you assign part of a debt?

Under English law, the beneficial ownership of part of a debt can be assigned, although the legal ownership cannot. 1 This means that an assignment of part of a debt will take effect as an equitable assignment instead of a legal assignment.

Joining the assignor to proceedings against the debtor

While both equitable and legal assignments are capable of removing the assigned asset from the insolvency estate of the assignor, failure to obtain a legal assignment and relying solely on an equitable assignment may require the assignee to join the relevant assignor as a party to any enforcement action against the debtor.

An assignee of part of a debt will want to be able to sue a debtor in its own name and, if it is required to join the assignor to proceedings against the debtor, this could add additional costs and delays if the assignor was unwilling to cooperate. 2

Kapoor v National Westminster Bank plc

English courts have, in recent years, been pragmatic in allowing an assignee of part of a debt to sue the debtor in its own name without the cooperation of the assignor.

In Charnesh Kapoor v National Westminster Bank plc, Kian Seng Tan 3 the court held that an equitable assignee of part of a debt is entitled in its own right and name to bring proceedings for the assigned debt. The equitable assignee will usually be required to join the assignor to the proceedings in order to ensure that the debtor is not exposed to double recovery, but the requirement is a procedural one that can be dispensed with by the court.

The reason for the requirement that an equitable assignee joins the assignor to proceedings against the debtor is not that the assignee has no right which it can assert independently, but that the debtor ought to be protected from the possibility of any further claim by the assignor who should therefore be bound by the judgment.

Application of Kapoor

It is a common feature of supply chain finance transactions that the assigned debt (or part of the debt) is supported by an independent payment undertaking. Such independent payment undertaking makes it clear that the debtor cannot raise defences and that it is required to pay the relevant debt (or part of a debt) without set-off or counterclaim. In respect of an assignee of part of an independent payment undertaking which is not disputed and has itself been equitably assigned to the assignee, we believe that there are good grounds that an English court would accept that the assignee is allowed to pursue an action directly against the debtor without needing the assignor to be joined, as this is likely to be a matter of procedure only, not substance.

This analysis is limited to English law and does not consider the laws of any other jurisdiction.

Notwithstanding the helpful clarifications summarised in Kapoor, as many receivables financing transactions involve a number of cross-border elements, assignees should continue to consider the effect of the laws (and, potentially court procedures) of any other relevant jurisdictions on the assignment of part of a debt even where the sale of such partial debt is completed under English law.

Legal title cannot be assigned in respect of part of a debt. A partial assignment would not satisfy the requirements for a legal assignment of section 136 of the Law of Property Act 1925.

If an assignor does not consent to being joined as a plaintiff in proceedings against the debtor it would be necessary to join the assignor as a co-defendant. However, where an assignor has gone into administration or liquidation, there may be a statutory prohibition on joining such assignor as a co-defendant (without the leave of the court or in certain circumstances the consent of the administrator).

[2011] EWCA Civ 1083

- Financial institutions

Recent publications

Publication

Stephanie Hamon on managing change and tech implementation at a panel session of the Legal Tech Talk conference

Head of Legal Operations, Stephanie Hamon, will be joining the panel discussion on "Simplifying Legal Tech Adoption and Implementation" at the Legal Tech Talk conference on June 13th (3:30 - 4:15 PM).

Global | June 07, 2024

AI regulation in the UK: Will the next government introduce AI legislation?

The current government’s approach to AI regulation draws on non-binding, cross-sectoral principles.

United Kingdom | June 07, 2024

Now in effect: New enrollment and renewal requirements for Medicaid, CHIP

Our healthcare lawyers comment on healthcare providers and MCOs that are beginning to experience the financial impacts of the end of continuous Medicaid enrollment and the reductions associated with the enhanced FMAP.

United States | June 06, 2024

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2023

- Canada (English)

- Canada (Français)

- United States

- Deutschland (Deutsch)

- Germany (English)

- The Netherlands

- Türkiye

- United Kingdom

- South Africa

- Hong Kong SAR

- Marshall Islands

- Nordic region

- Practical Law

Assignment of debt

Practical law uk legal update 1-100-2291 (approx. 2 pages), get full access to this document with a free trial.

Try free and see for yourself how Practical Law resources can improve productivity, efficiency and response times.

About Practical Law

This document is from Thomson Reuters Practical Law, the legal know-how that goes beyond primary law and traditional legal research to give lawyers a better starting point. We provide standard documents, checklists, legal updates, how-to guides, and more.

650+ full-time experienced lawyer editors globally create and maintain timely, reliable and accurate resources across all major practice areas.

83% of customers are highly satisfied with Practical Law and would recommend to a colleague.

81% of customers agree that Practical Law saves them time.

- General Contract and Boilerplate

- United Kingdom

IMAGES

VIDEO

COMMENTS

4. Sign. Use our Deed of Assignment of Debt template in order to transfer (or sell) the right to recover a debt. To transfer a debt legally between parties, it is necessary to enter into a written transfer document. Once the transfer document has been signed by the Assignee (the party transferring the debt) and the Assignee (the party receiving ...

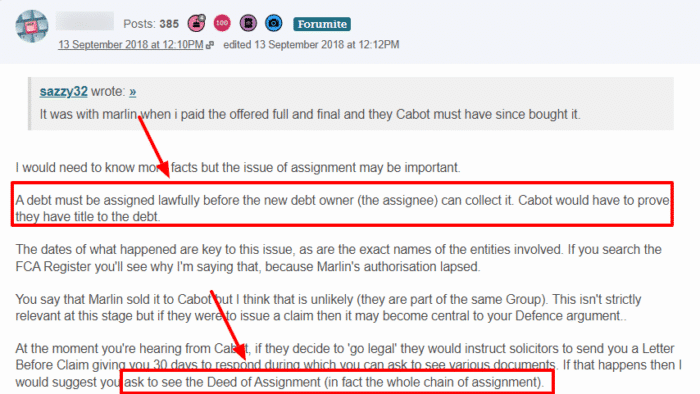

A deed of assignment of debt is used to transfer or sell the right to recover a debt. Without a deed of assignment of debt, the two companies are not able to do this - you need a written transfer document. Source: MSE Forum. Once the transfer document, or deed of assignment of debt, has been signed by the assignee (the party transferring the ...

A standard form deed of assignment under which a lender (the assignor) assigns its rights relating to a facility agreement (also known as a loan agreement) to a new lender (the assignee). Only the assignor's rights under the facility agreement (such as to receive repayment of the loan and to receive interest) are assigned. The assignor will still have to perform any obligations it may have ...

But you need to do so in writing. A deed of assignment of a debt is the document to use for this. You would need to assign the whole of a debt, as you cannot assign only part of it. The debtor cannot assign the debt to someone else unless the creditor agrees and you would then do this via a deed of novation. 2.

Now armed with knowledge about debt assignment types, legal implications, and credit impacts, it's time to take action. If you find yourself facing a Deed of Assignment of Debt, don't panic. Instead, explore the various debt solutions available, such as Debt Management Plans, Individual Voluntary Arrangements, Debt Relief Orders, or bankruptcy.

10 February, 2024. A Deed of Assignment is a legal document that transfers the ownership rights and interests of a property or asset from one party, known as the assignor, to another party, known as the assignee. It is commonly used in real estate transactions but can also apply to other types of assets, such as intellectual property rights ...

Summary. This new Standard document is for use on an assignment of an unregistered lease. It is suitable for use where: The assignor is assigning the whole of the property demised by the lease. The property is not subject to any underlease (s). The Standard document contains optional clauses that are appropriate in the following circumstances:

An assignment of debt essentially transfers the debt from one party (the assignor) to a third party (an assignee). In practice, this will mean the original debtor (e.g. Joe Bloggs) will now owe the debt to a new third-party creditor (e.g. the debt collection business). Therefore, in the scenario above, Joe must now repay the debt to the third ...

A legal assignment is when another company takes over the following from a creditor: Benefit of a debt. The right to enforce the debt. This indicates that they have the right to seek court action over the loan. However, when it comes to equitable assignment, it only transfers the benefit of the loan to a third party.

A deed for use when a party to an agreement wishes to assign its rights and benefits under that agreement to another person. Get full access to this document with a free trial Try free and see for yourself how Practical Law resources can improve productivity, efficiency and response times.

Assigning debts and other contractual claims - not as easy as first thought. Harking back to law school, we had a thirst for new black letter law. Section 136 of the Law of the Property Act 1925 kindly obliged. This lays down the conditions which need to be satisfied for an effective legal assignment of a chose in action (such as a debt).

1. If someone is behind on payments for a debt, they may want to assign the arrears to another party. This can help to make sure that the debt is paid and can also help to protect the original creditor's credit score. 2. Another reason someone might want to assign arrears is if they are no longer able to make the payments themselves.

Re: Assignment of the rights under contract: Introduction. The Assignor (as defined below) is party to a contract with for dated (Contract). The Assignor has agreed to assign the Contract to the Assignee (as defined below). The purpose of this letter is to immediately assign the rights and benefits of the Contract by this Deed of Assignment.

What is a notice of assignment. A Notice of Assignment, in relation to debt, is a document used to inform debtors that their debt has been 'purchased' by a third party. The notice serves to notify the debtor that a new company (known as the assignee) has taken over the responsibility of collecting the debt.

A deed of assignment can be used by property owners to assign their beneficial interest to another party; either a legal owner or a non-legal owner. Most commonly the transfer is between husband and wife for tax purposes on a buy to let. Where a property is held as joint tenants and the parties want to assign beneficial interest, then they must ...

Please contact Technical Support at +44 345 600 9355 for assistance. Assignment of a Judgment debt. On review of your other notes I understand that it is possible to assign a Judgment debt. Depending upon the enforcement mechanism a further application may need to be made to the Court to substitute the Claimant.

While under English law part of a debt can be assigned, there is a general requirement that the relevant assignee joins the assignor to any proceedings against the debtor, which potentially impedes the assignee's ability to enforce against the debtor efficiently. ... although the legal ownership cannot. 1 This means that an assignment of part ...

A Deed of Assignment is a legal document that transfers or assigns the legal rights and obligations to another party. And it varies depending on your situation. For example, an assignment could work for simple things like intellectual property. When a graphic designer creates a logo for you, you might want to make sure that logo is owned by you.

An Assignment is a document that transfers ownership of a contract, property, or asset from one party to another. The Assignment moves any rights, responsibilities, pending interest, and benefits from the original owner to the recipient. An Assignment can also be called a/an: Contract assignment. Deed of assignment.

Trust. 83% of customers are highly satisfied with Practical Law and would recommend to a colleague. Improve Response Time. 81% of customers agree that Practical Law saves them time. End of Document. Resource ID 1-100-2291. The assignment of debt in good faith is not invalid even if the necessity for litigation to recover it is contemplated by ...

This agreement must clearly establish the calendar date when the assignment of the debt to the Assuming Party becomes active. (2) Debtor Name And Mailing Address. The current Holder of the debt should be identified as the Debtor in this agreement. To this end, record the Debtor's name and address. (3) Assuming Party.